Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MERIDIAN BIOSCIENCE INC | d569042dex991.htm |

| 8-K - 8-K - MERIDIAN BIOSCIENCE INC | d569042d8k.htm |

Exhibit 99.2Exhibit 99.2

The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements accompanied by meaningful cautionary statements. Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, which may be identified by words such as“estimates”,“anticipates”,“projects”,“plans”,“seeks”,“may”,“will”,“expects”,“intends”,“believes”,“should” and similar expressions or the negative versions thereof and which also may be identified by their context. All statements that address operating performance or events or developments that Meridian expects or anticipates will occur in the future, including, but not limited to, statements relating to per share diluted earnings and revenue, are forward-looking statements. Such statements, whether expressed or implied, are based upon current expectations of the Company and speak only as of the date made. Specifically,Meridian’s forward-looking statements are, and will be, based onmanagement’s then-current views and assumptions regarding future events and operating performance. Meridian assumes no obligation to publicly update or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. These statements are subject to various risks, uncertainties and other factors that could cause actual results to differ materially, including, without limitation, the following: Meridian’s operating results, financial condition and continued growth depends, in part, on its ability to introduce into the marketplace enhancements of existing products or new products that incorporate technological advances, meet customer requirements and respond to products developed byMeridian’s competition, its ability to effectively sell such products and its ability to successfully expand and effectively manage increased sales and marketing operations. While Meridian has introduced a number of internally developed products and acquired products, there can be no assurance that it will be successful in the future in introducing such products on a timely basis or in protecting its intellectual property, and unexpected or costly manufacturing costs associated with its introduction of new products or acquired products could cause actual results to differ from expectations. Meridian relies on proprietary, patented and licensed technologies. As such, theCompany’s ability to protect its intellectual property rights, as well as the potential for intellectual property litigation, would impact its results. Ongoing consolidations of reference laboratories and formation of multi-hospital alliances may cause adverse changes to pricing and distribution. Recessionary pressures on the economy and the markets in which our customers operate, as well as adverse trends in buying patterns from customers, can change expected results. Costs, including legal expenses, and difficulties in complying with laws and regulations, including those administered by the United States Food and Drug Administration, can result in unanticipated expenses and delays and interruptions to the sale of new and existing products, as can the uncertainty of regulatory approvals and the regulatory process. The international scope ofMeridian’s operations, including changes in the relative strength or weakness of the U.S. dollar, compliance with anti-corruption laws, tariffs, trade wars, and general economic conditions in foreign countries, can impact results and make them difficult to predict. One ofMeridian’s growth strategies is the acquisition of companies and product lines. There can be no assurance that additional acquisitions will be consummated or that, if consummated, will be successful and the acquired businesses will be successfully integrated intoMeridian’s operations. There may be risks that acquisitions may disrupt operations and may pose potential difficulties in employee retention, and there may be additional risks with respect toMeridian’s ability to recognize the benefits of acquisitions, including potential synergies and cost savings or the failure of acquisitions to achieve their plans and objectives. Meridian cannot predict the outcome of goodwill impairment testing and the impact of possible goodwill impairments onMeridian’s earnings and financial results. Meridian cannot predict the possible impact of U.S. health care legislation enacted in 2010– the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act– and any modification or repeal of any of the provisions thereof initiated by Congress or the presidential administration, and any similar initiatives in other countries on its results of operations. Efforts to reduce the U.S. federal deficit, breaches ofMeridian’s information technology systems, trade wars, increased tariffs, and natural disasters and other events could have a materially adverse effect onMeridian’s results of operations and revenues. Meridian cannot predict the outcome of changes in business strategy or plans, legal proceedings or developments. In the past, the Company has identified a material weakness in our internal control over financial reporting, which has been remediated, but the Company can make no assurances that a material weakness will not be identified in the future, which if identified and if not properly corrected, could materially adversely affect our operations and result in material misstatements in our financial statements. In addition to the factors described in this paragraph, as well as those factors identified from time to time in our filings with the Securities and Exchange Commission, Part I, Item 1A Risk Factors of our most recent Annual Report on Form 10-K contains a list and description of uncertainties, risks and other matters that may affect the Company. Readers should carefully review these forward-looking statements and risk factors, and not place undue reliance on our forward-looking statements.The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements accompanied by meaningful cautionary statements. Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, which may be identified by words such as“estimates”,“anticipates”,“projects”,“plans”,“seeks”,“may”,“will”,“expects”,“intends”,“believes”,“should” and similar expressions or the negative versions thereof and which also may be identified by their context. All statements that address operating performance or events or developments that Meridian expects or anticipates will occur in the future, including, but not limited to, statements relating to per share diluted earnings and revenue, are forward-looking statements. Such statements, whether expressed or implied, are based upon current expectations of the Company and speak only as of the date made. Specifically,Meridian’s forward-looking statements are, and will be, based onmanagement’s then-current views and assumptions regarding future events and operating performance. Meridian assumes no obligation to publicly update or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. These statements are subject to various risks, uncertainties and other factors that could cause actual results to differ materially, including, without limitation, the following: Meridian’s operating results, financial condition and continued growth depends, in part, on its ability to introduce into the marketplace enhancements of existing products or new products that incorporate technological advances, meet customer requirements and respond to products developed byMeridian’s competition, its ability to effectively sell such products and its ability to successfully expand and effectively manage increased sales and marketing operations. While Meridian has introduced a number of internally developed products and acquired products, there can be no assurance that it will be successful in the future in introducing such products on a timely basis or in protecting its intellectual property, and unexpected or costly manufacturing costs associated with its introduction of new products or acquired products could cause actual results to differ from expectations. Meridian relies on proprietary, patented and licensed technologies. As such, theCompany’s ability to protect its intellectual property rights, as well as the potential for intellectual property litigation, would impact its results. Ongoing consolidations of reference laboratories and formation of multi-hospital alliances may cause adverse changes to pricing and distribution. Recessionary pressures on the economy and the markets in which our customers operate, as well as adverse trends in buying patterns from customers, can change expected results. Costs, including legal expenses, and difficulties in complying with laws and regulations, including those administered by the United States Food and Drug Administration, can result in unanticipated expenses and delays and interruptions to the sale of new and existing products, as can the uncertainty of regulatory approvals and the regulatory process. The international scope ofMeridian’s operations, including changes in the relative strength or weakness of the U.S. dollar, compliance with anti-corruption laws, tariffs, trade wars, and general economic conditions in foreign countries, can impact results and make them difficult to predict. One ofMeridian’s growth strategies is the acquisition of companies and product lines. There can be no assurance that additional acquisitions will be consummated or that, if consummated, will be successful and the acquired businesses will be successfully integrated intoMeridian’s operations. There may be risks that acquisitions may disrupt operations and may pose potential difficulties in employee retention, and there may be additional risks with respect toMeridian’s ability to recognize the benefits of acquisitions, including potential synergies and cost savings or the failure of acquisitions to achieve their plans and objectives. Meridian cannot predict the outcome of goodwill impairment testing and the impact of possible goodwill impairments onMeridian’s earnings and financial results. Meridian cannot predict the possible impact of U.S. health care legislation enacted in 2010– the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act– and any modification or repeal of any of the provisions thereof initiated by Congress or the presidential administration, and any similar initiatives in other countries on its results of operations. Efforts to reduce the U.S. federal deficit, breaches ofMeridian’s information technology systems, trade wars, increased tariffs, and natural disasters and other events could have a materially adverse effect onMeridian’s results of operations and revenues. Meridian cannot predict the outcome of changes in business strategy or plans, legal proceedings or developments. In the past, the Company has identified a material weakness in our internal control over financial reporting, which has been remediated, but the Company can make no assurances that a material weakness will not be identified in the future, which if identified and if not properly corrected, could materially adversely affect our operations and result in material misstatements in our financial statements. In addition to the factors described in this paragraph, as well as those factors identified from time to time in our filings with the Securities and Exchange Commission, Part I, Item 1A Risk Factors of our most recent Annual Report on Form 10-K contains a list and description of uncertainties, risks and other matters that may affect the Company. Readers should carefully review these forward-looking statements and risk factors, and not place undue reliance on our forward-looking statements.

Certain financial measures presented in this presentation, such as operating expenses, operating income, net earnings and diluted earnings per share, excluding as applicable the effects of restructuring costs, litigation costs, and certain one-time effects of the U.S. tax reform act, are not recognized under generally accepted accounting principles in the United States of America, or U.S. GAAP. Management believes this non-GAAP financial information is useful to an investor in evaluating our performance, as these measures (i) help investors to more meaningfully evaluate and compare the results of operations from period to period by removing the impacts of these non-routine items; and (ii) are used by management for various purposes, including evaluating performance from period to period in presentations to our board of directors, and as a basis for strategic planning and forecasting. While we believe these financial measures are commonly used by investors to evaluate our performance and that of our competitors, the non- GAAP measures in this presentation may be different from non-GAAP measures used by other companies and should not be considered as an alternative to performance measures derived in accordance with U.S. GAAP. In addition, the non-GAAP measures presented herein are not based on any comprehensive set of accounting rules or principles. These non-GAAP measures have limitations, in that they do not reflect all amounts associated with our results as determined in accordance with U.S. GAAP, and they should not be considered as alternatives to information attributable to Meridian Bioscience, Inc. determined in accordance with U.S. GAAP. See the consolidated financial statements included in our reports filed with the U.S. Securities and Exchange Commission for our U.S. GAAP results. Additionally, for reconciliations of the non-GAAP measures included herein to our closest reported U.S. GAAP measures, refer to the reconciliations included in the press release of Meridian Bioscience, Inc. dated January 24, 2019.Certain financial measures presented in this presentation, such as operating expenses, operating income, net earnings and diluted earnings per share, excluding as applicable the effects of restructuring costs, litigation costs, and certain one-time effects of the U.S. tax reform act, are not recognized under generally accepted accounting principles in the United States of America, or U.S. GAAP. Management believes this non-GAAP financial information is useful to an investor in evaluating our performance, as these measures (i) help investors to more meaningfully evaluate and compare the results of operations from period to period by removing the impacts of these non-routine items; and (ii) are used by management for various purposes, including evaluating performance from period to period in presentations to our board of directors, and as a basis for strategic planning and forecasting. While we believe these financial measures are commonly used by investors to evaluate our performance and that of our competitors, the non- GAAP measures in this presentation may be different from non-GAAP measures used by other companies and should not be considered as an alternative to performance measures derived in accordance with U.S. GAAP. In addition, the non-GAAP measures presented herein are not based on any comprehensive set of accounting rules or principles. These non-GAAP measures have limitations, in that they do not reflect all amounts associated with our results as determined in accordance with U.S. GAAP, and they should not be considered as alternatives to information attributable to Meridian Bioscience, Inc. determined in accordance with U.S. GAAP. See the consolidated financial statements included in our reports filed with the U.S. Securities and Exchange Commission for our U.S. GAAP results. Additionally, for reconciliations of the non-GAAP measures included herein to our closest reported U.S. GAAP measures, refer to the reconciliations included in the press release of Meridian Bioscience, Inc. dated January 24, 2019.

44

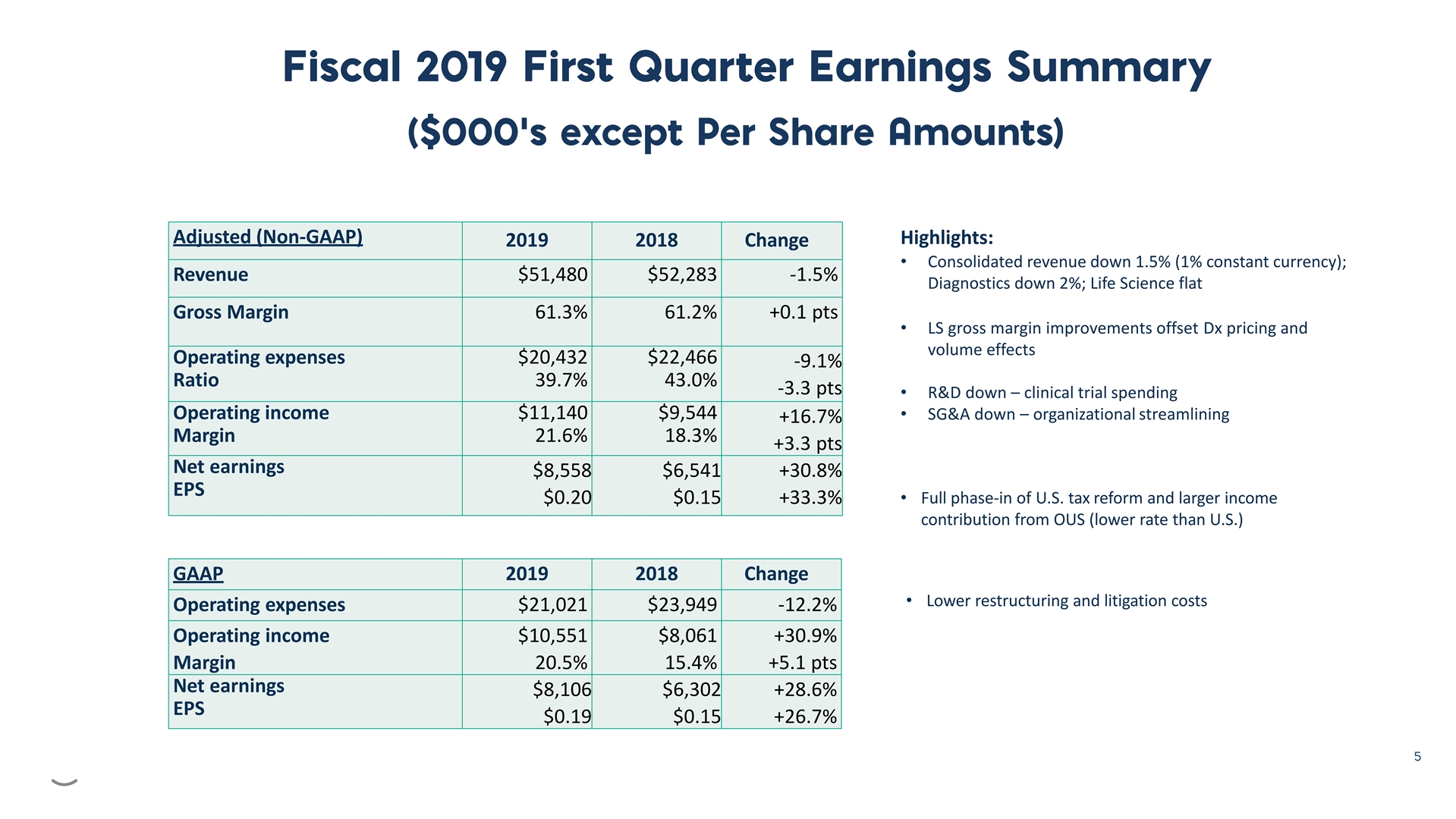

Adjusted (Non-GAAP) Highlights: 2019 2018 Change • Consolidated revenue down 1.5% (1% constant currency); Revenue $51,480 $52,283 -1.5% Diagnostics down 2%; Life Science flat Gross Margin 61.3% 61.2% +0.1 pts • LS gross margin improvements offset Dx pricing and volume effects Operating expenses $20,432 $22,466 -9.1% Ratio 39.7% 43.0% -3.3 pts • R&D down – clinical trial spending Operating income $11,140 $9,544• SG&A down– organizational streamlining +16.7% Margin 21.6% 18.3% +3.3 pts Net earnings $8,558 $6,541 +30.8% EPS • Full phase-in of U.S. tax reform and larger income $0.20 $0.15 +33.3% contribution from OUS (lower rate than U.S.) GAAP 2019 2018 Change • Lower restructuring and litigation costs Operating expenses $21,021 $23,949 -12.2% Operating income $10,551 $8,061 +30.9% Margin 20.5% 15.4% +5.1 pts Net earnings $8,106 $6,302 +28.6% EPS $0.19 $0.15 +26.7%Adjusted (Non-GAAP) Highlights: 2019 2018 Change • Consolidated revenue down 1.5% (1% constant currency); Revenue $51,480 $52,283 -1.5% Diagnostics down 2%; Life Science flat Gross Margin 61.3% 61.2% +0.1 pts • LS gross margin improvements offset Dx pricing and volume effects Operating expenses $20,432 $22,466 -9.1% Ratio 39.7% 43.0% -3.3 pts • R&D down – clinical trial spending Operating income $11,140 $9,544• SG&A down– organizational streamlining +16.7% Margin 21.6% 18.3% +3.3 pts Net earnings $8,558 $6,541 +30.8% EPS • Full phase-in of U.S. tax reform and larger income $0.20 $0.15 +33.3% contribution from OUS (lower rate than U.S.) GAAP 2019 2018 Change • Lower restructuring and litigation costs Operating expenses $21,021 $23,949 -12.2% Operating income $10,551 $8,061 +30.9% Margin 20.5% 15.4% +5.1 pts Net earnings $8,106 $6,302 +28.6% EPS $0.19 $0.15 +26.7%

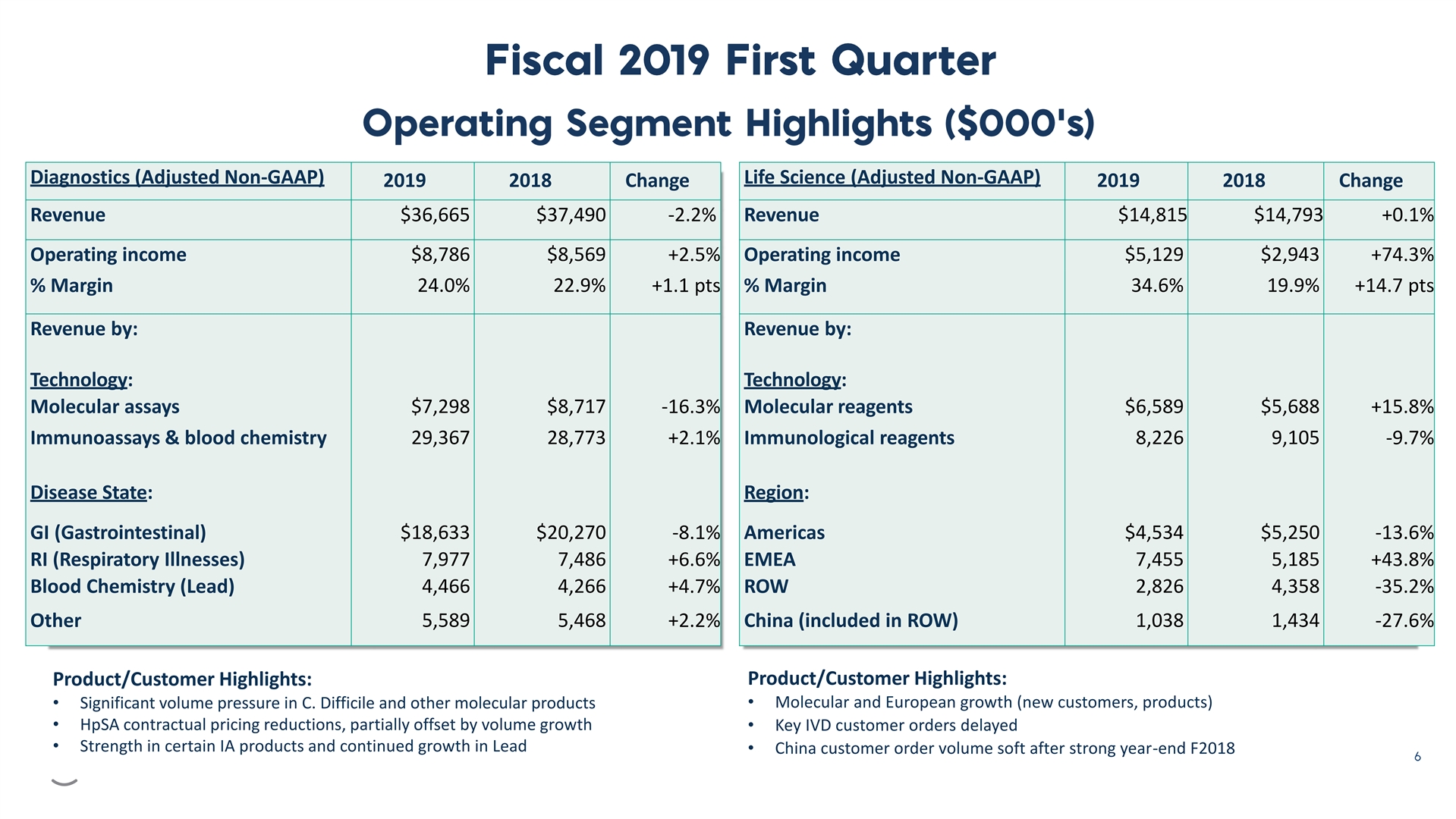

Diagnostics (Adjusted Non-GAAP) Life Science (Adjusted Non-GAAP) 2019 2018 Change 2019 2018 Change Revenue $36,665 $37,490 -2.2% Revenue $14,815 $14,793 +0.1% Operating income $8,786 $8,569 +2.5% Operating income $5,129 $2,943 +74.3% % Margin 24.0% 22.9% +1.1 pts % Margin 34.6% 19.9% +14.7 pts Revenue by: Revenue by: Technology: Technology: Molecular assays $7,298 $8,717 -16.3% Molecular reagents $6,589 $5,688 +15.8% Immunoassays & blood chemistry 29,367 28,773 +2.1% Immunological reagents 8,226 9,105 -9.7% Disease State: Region: GI (Gastrointestinal) $18,633 $20,270 -8.1% Americas $4,534 $5,250 -13.6% RI (Respiratory Illnesses) 7,977 7,486 +6.6% EMEA 7,455 5,185 +43.8% Blood Chemistry (Lead) 4,466 4,266 +4.7% ROW 2,826 4,358 -35.2% Other 5,589 5,468 +2.2% China (included in ROW) 1,038 1,434 -27.6% Product/Customer Highlights: Product/Customer Highlights: • Molecular and European growth (new customers, products) • Significant volume pressure in C. Difficile and other molecular products • HpSA contractual pricing reductions, partially offset by volume growth • Key IVD customer orders delayed • Strength in certain IA products and continued growth in Lead • China customer order volume soft after strong year-end F2018Diagnostics (Adjusted Non-GAAP) Life Science (Adjusted Non-GAAP) 2019 2018 Change 2019 2018 Change Revenue $36,665 $37,490 -2.2% Revenue $14,815 $14,793 +0.1% Operating income $8,786 $8,569 +2.5% Operating income $5,129 $2,943 +74.3% % Margin 24.0% 22.9% +1.1 pts % Margin 34.6% 19.9% +14.7 pts Revenue by: Revenue by: Technology: Technology: Molecular assays $7,298 $8,717 -16.3% Molecular reagents $6,589 $5,688 +15.8% Immunoassays & blood chemistry 29,367 28,773 +2.1% Immunological reagents 8,226 9,105 -9.7% Disease State: Region: GI (Gastrointestinal) $18,633 $20,270 -8.1% Americas $4,534 $5,250 -13.6% RI (Respiratory Illnesses) 7,977 7,486 +6.6% EMEA 7,455 5,185 +43.8% Blood Chemistry (Lead) 4,466 4,266 +4.7% ROW 2,826 4,358 -35.2% Other 5,589 5,468 +2.2% China (included in ROW) 1,038 1,434 -27.6% Product/Customer Highlights: Product/Customer Highlights: • Molecular and European growth (new customers, products) • Significant volume pressure in C. Difficile and other molecular products • HpSA contractual pricing reductions, partially offset by volume growth • Key IVD customer orders delayed • Strength in certain IA products and continued growth in Lead • China customer order volume soft after strong year-end F2018

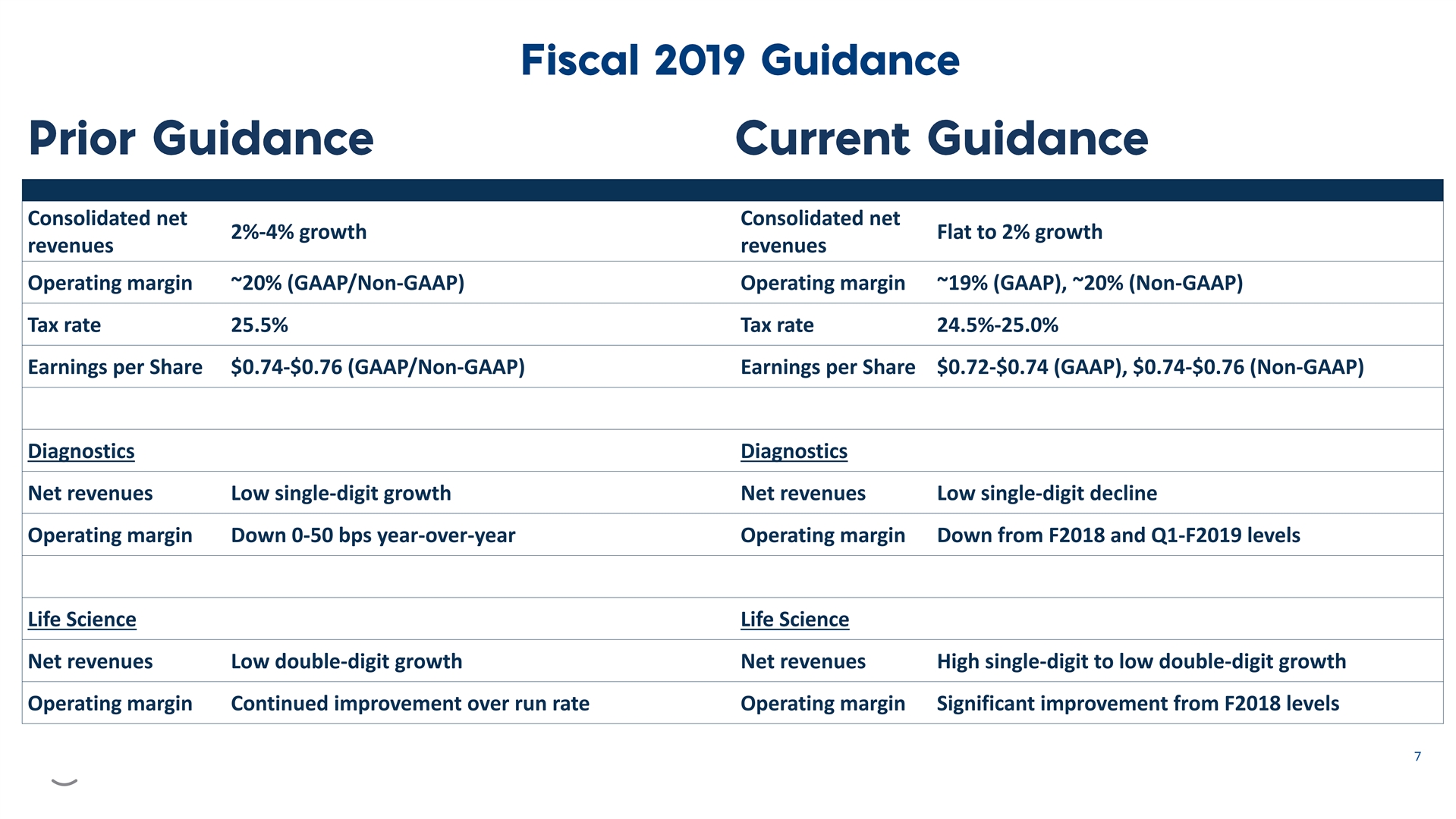

Consolidated net Consolidated net 2%-4% growth Flat to 2% growth revenues revenues Operating margin ~20% (GAAP/Non-GAAP) Operating margin ~19% (GAAP), ~20% (Non-GAAP) Tax rate 25.5% Tax rate 24.5%-25.0% Earnings per Share $0.74-$0.76 (GAAP/Non-GAAP) Earnings per Share $0.72-$0.74 (GAAP), $0.74-$0.76 (Non-GAAP) Diagnostics Diagnostics Net revenues Low single-digit growth Net revenues Low single-digit decline Operating margin Down 0-50 bps year-over-year Operating margin Down from F2018 and Q1-F2019 levels Life Science Life Science Net revenues Low double-digit growth Net revenues High single-digit to low double-digit growth Operating margin Continued improvement over run rate Operating margin Significant improvement from F2018 levelsConsolidated net Consolidated net 2%-4% growth Flat to 2% growth revenues revenues Operating margin ~20% (GAAP/Non-GAAP) Operating margin ~19% (GAAP), ~20% (Non-GAAP) Tax rate 25.5% Tax rate 24.5%-25.0% Earnings per Share $0.74-$0.76 (GAAP/Non-GAAP) Earnings per Share $0.72-$0.74 (GAAP), $0.74-$0.76 (Non-GAAP) Diagnostics Diagnostics Net revenues Low single-digit growth Net revenues Low single-digit decline Operating margin Down 0-50 bps year-over-year Operating margin Down from F2018 and Q1-F2019 levels Life Science Life Science Net revenues Low double-digit growth Net revenues High single-digit to low double-digit growth Operating margin Continued improvement over run rate Operating margin Significant improvement from F2018 levels

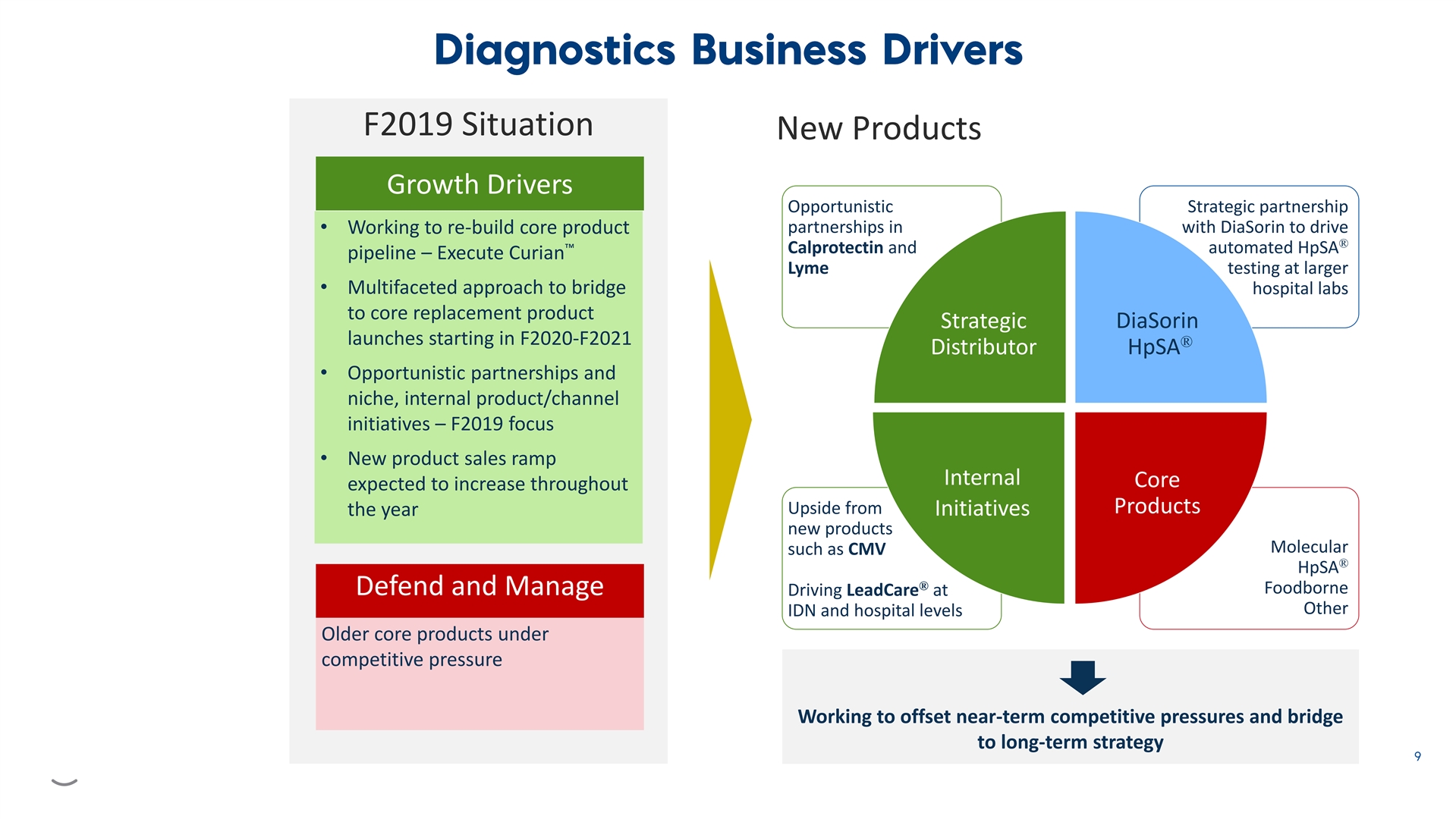

F2019 Situation New Products Growth Drivers Opportunistic Strategic partnership partnerships in with DiaSorin to drive • Working to re-build core product ® ™ Calprotectin and automated HpSA pipeline – Execute Curian Lyme testing at larger • Multifaceted approach to bridge hospital labs to core replacement product Strategic DiaSorin launches starting in F2020-F2021 ® Distributor HpSA • Opportunistic partnerships and niche, internal product/channel initiatives – F2019 focus • New product sales ramp Internal Core expected to increase throughout Products Upside from the year Initiatives new products Molecular such as CMV ® HpSA ® Foodborne Defend and Manage Driving LeadCare at Other IDN and hospital levels Older core products under competitive pressure Working to offset near-term competitive pressures and bridge to long-term strategy F2019 Situation New Products Growth Drivers Opportunistic Strategic partnership partnerships in with DiaSorin to drive • Working to re-build core product ® ™ Calprotectin and automated HpSA pipeline – Execute Curian Lyme testing at larger • Multifaceted approach to bridge hospital labs to core replacement product Strategic DiaSorin launches starting in F2020-F2021 ® Distributor HpSA • Opportunistic partnerships and niche, internal product/channel initiatives – F2019 focus • New product sales ramp Internal Core expected to increase throughout Products Upside from the year Initiatives new products Molecular such as CMV ® HpSA ® Foodborne Defend and Manage Driving LeadCare at Other IDN and hospital levels Older core products under competitive pressure Working to offset near-term competitive pressures and bridge to long-term strategy

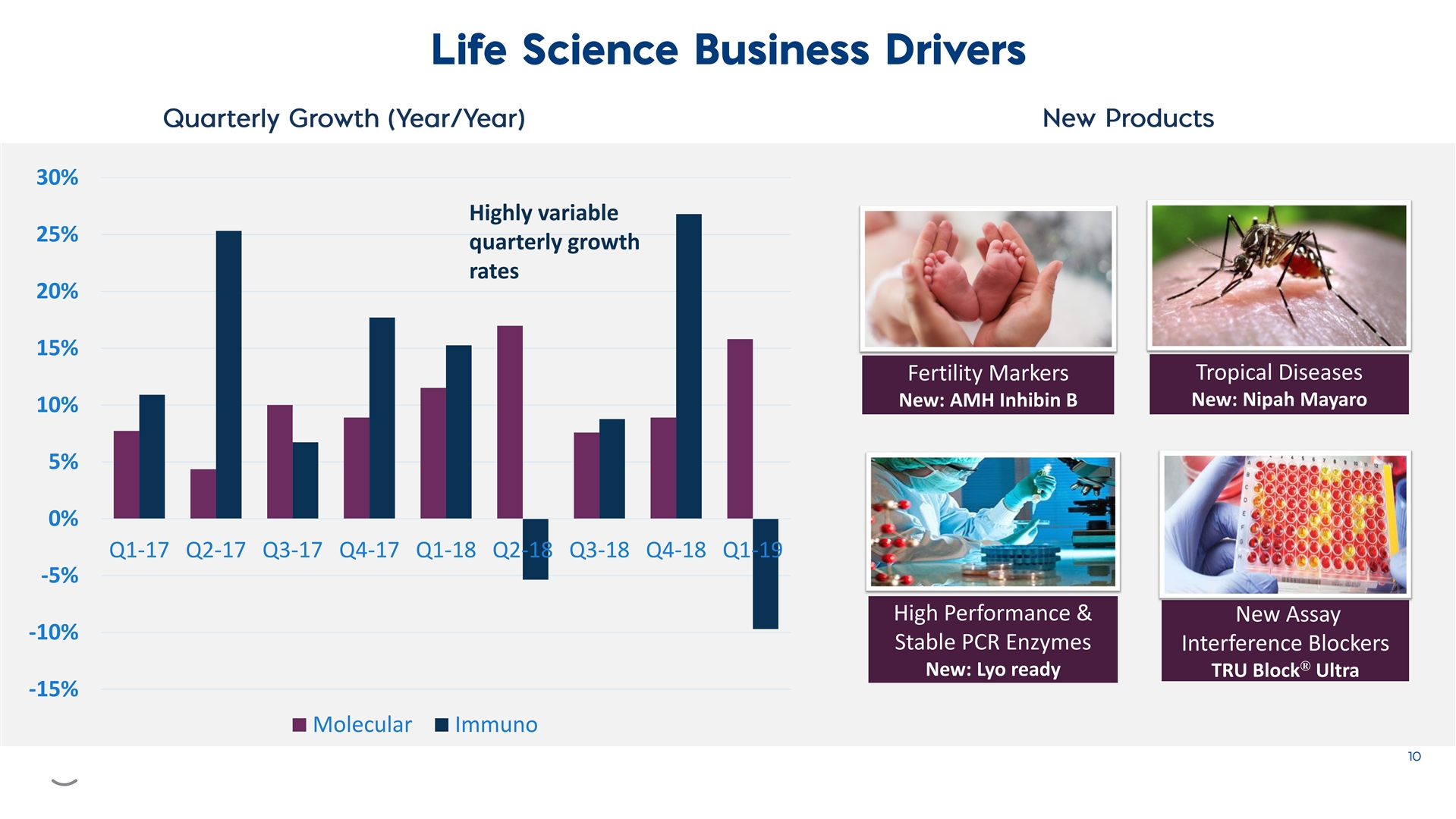

30% Highly variable 25% quarterly growth rates 20% 15% Tropical Diseases Fertility Markers New: Nipah Mayaro New: AMH Inhibin B 10% 5% 0% Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 -5% High Performance & New Assay -10% Stable PCR Enzymes Interference Blockers ® New: Lyo ready TRU Block Ultra -15% Molecular Immuno30% Highly variable 25% quarterly growth rates 20% 15% Tropical Diseases Fertility Markers New: Nipah Mayaro New: AMH Inhibin B 10% 5% 0% Q1-17 Q2-17 Q3-17 Q4-17 Q1-18 Q2-18 Q3-18 Q4-18 Q1-19 -5% High Performance & New Assay -10% Stable PCR Enzymes Interference Blockers ® New: Lyo ready TRU Block Ultra -15% Molecular Immuno

F2019 and Beyond • Early stages of strategy execution in Diagnostics amid increasing competitive pressures • Balancing near-term earnings with investment for future growth • Total R&D investment to increase over time and accelerate with more clinical trial activity • Commercial, product and cost initiatives underway in Diagnostics business • Growth prospects in Life Science business remain strongF2019 and Beyond • Early stages of strategy execution in Diagnostics amid increasing competitive pressures • Balancing near-term earnings with investment for future growth • Total R&D investment to increase over time and accelerate with more clinical trial activity • Commercial, product and cost initiatives underway in Diagnostics business • Growth prospects in Life Science business remain strong