Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRT Apartments Corp. | a8-kxinvestorpresentat.htm |

Mercer Crossing – Dallas, TX The Avenue – Lawrenceville, GA Pointe at Lenox Park – Atlanta, GA Investor Presentation January 2019

Safe Harbor Certain information contained in this presentation, together with other cause actual outcomes or other events to differ materially from any such statements and information publicly disseminated by BRT Apartments forward-looking statements appear in the Company’s Annual Report on Corp. (the “Company”), constitute forward-looking statements within the Form 10-K for the year ended September 30, 2018 filed with the SEC, meaning of Section 27A of the Securities Act of 1933, as amended, and and in particular the sections of such document entitled “Risk Factors” Section 21E of the Securities and Exchange Act of 1934, as amended. and “Management’s Discussion and Analysis of Financial Condition and These statements involve assumptions and forecasts that are based Results of Operations”. You should not rely on forward-looking upon our current assessments of certain trends, risks and uncertainties, statements since they involve known and unknown risks, uncertainties which assumptions appear to be reasonable to us at the time they are and other factors which are, in some cases, beyond our control and made. We intend such forward-looking statements to be covered by the which could materially affect actual results or performance referred to safe harbor provision for forward-looking statements contained in the above. We undertake no obligation to publicly update or revise any Private Securities Litigation Reform Act of 1995 and include this forward-looking statements included in this presentation, whether as a statement for the purpose of complying with these safe harbor result of new information, future events or otherwise. provisions. Information regarding certain important factors that could Our fiscal year begins on October 1st and ends on September 30th. Unless otherwise indicated or the context otherwise requires, all references to a year (e.g., 2019), refer to the applicable fiscal year ended September 30th.

BRT Apartments is an owner and operator of Class B value-add and select Class A multi-family assets primarily in superior Sun Belt locations. The Company uses its expert real estate and investment experience to maximize risk-adjusted return for its stockholders. 3 Parkway Grande – San Marcos, TX Vanguard Heights – Creve Coeur, MO Verandas at Alamo Ranch – San Antonio, TX

Investments Highlights Differentiated Strategy Stable Portfolio and Proven Management Scalable Growth ▪ Focused on growth Robust Pipeline team, closely aligned Opportunity markets, targeting ▪ Primarily acquire with Stockholders ▪ Target assets in the assets where we can properties with 90+% ▪ Management and Sun Belt with favorable create value using occupancy affiliates owns 39% of demographics repositioning and ▪ Strong deal flow from the Company’s total ▪ High job growth renovation programs equity existing network of ▪ Outsized population ▪ Extensive JV network partners and brokers ▪ Internalized growth mitigating risk and Management expanding our ability to ▪ Attractive annual grow into ideal markets dividend yield of 5.86%1 ▪ Purchase price between $20 million and $100 million with BRT’s equity contribution of between $2 million and $20 million PAGE 4 [1] As of January 23, 2019

Capitalizing on Favorable Multi-Family Trends ▪ Multi-family apartments have seen tremendous growth in recent years due to high demand, driven partially by millennial’s preference to rent rather than to buy ▪ Buying opportunities in Sun Belt markets with positive net migration in the millennial age group moving into the area ▪ Middle class renters drive demand in our markets, who are more likely to rent Class B apartments. Renters in these markets are a mix of working class, millennials, and seniors. ▪ We believe we can buy select Class A and Class B apartments that offer attractive yields and growth Job Growth and Population Growth by Market 20.0% 18.4% 18.0% 16.8% 16.0% 15.1% 14.6% 15.2% 14.0% 12.0% 9.7% 9.8% 9.3% 9.3% 10.0% 8.1% 8.0% 7.9% 7.7% 8.0% 6.8% 6.5% 5.6% 6.0% 3.6% 4.0% 2.8% 2.0% 0.0% Charleston, SC Dallas, TX San Antonio, Houston, TX Nashville, TN Atlanta, GA Columbia, SC United States Gateway TX Markets Employment Growth (2013-2018) Expected Population Growth (2018-2024) Source: SNL, Bureau of Labor Statistics PAGE 5 Note: Employment growth uses 12-month employment figures ending in November, 2018

Proven Senior Management Team More than 30 Years experience in Multi-family Jeffrey A. Gould, Ryan W. Baltimore, President and CEO Vice President President and CEO since 2002 Vice President Senior Vice President and Member of the Board Corporate Strategy and Portfolio Management of Directors of One Liberty Properties, Inc. (NYSE: OLP) since 1999 Vice President of Georgetown Partners, Inc., managing general partner of Gould Investors L.P. since 1996 George E. Zweier, Chief Financial Officer Vice President and CFO David W. Kalish, Senior Vice President, Finance Senior Vice President – Finance since 1990 Senior Vice President and CFO of One Liberty Properties Inc. since 1990 Mitchell K. Gould, Executive Vice President Senior Vice President and CFO of Georgetown Executive Vice President Partners, managing general partner of Gould Investors L.P. since 1990 Acquisitions and Asset Management PAGE 6

Decades of Demonstrated Success in Multi-Family Pre-2012 2014-2015 2018 ▪ ▪ ▪ Engaged in lending on commercial and Fully exited lending and servicing Acquired 6 assets, totaling 1,921 units mixed use properties business and acquired 17 properties with ▪ Sold 3 properties with 1,386 units 5,680 units ▪ Significant involvement in multi-family ▪ ▪ Increased dividend to $0.20 per share apartments and other real estate assets Started development of 621 units in Greenville, SC and North Charleston, SC ▪ Announced internalization of management 1983 – 2012 2012 – PRESENT 2012-2013 2016-2017 2019 ▪ Commenced multi-family investing ▪ Acquired 18 assets, totaling 5,064 units, ▪ Acquired 1 asset with 266 units strategy in 2012 and acquired 5 properties and sold 13 properties with 3,786 units ▪ Sold 2 properties totaling 691 units with 1,451 units ▪ Completed development of 350 units in ▪ In 2013, acquired 9 properties with Greenville, SC and acquired a 2,334 units development property with 402 units ▪ Announced dividend of $0.18 per share PAGE 7 Source: Company Filings Note: Some numbers reflect development/lease-up units

BRT’s Total Return Since 2017 ▪ Since January 1, 2017, BRT’s total return has been 84.3%, outperforming both the S&P 500 and the MSCI U.S. REIT Index over the same time period by 61.6% and 77.8%, respectively BRT RMZ S&P 500 100.0% 84.3% 80.0% 60.0% 40.0% 20.0% 22.7% 6.5% 0.0% (20.0%) 1/1/17 4/1/17 7/1/17 10/1/17 1/1/18 4/1/18 7/1/18 10/1/18 1/1/19 PAGE 8 Source: SNL Note: As of January 23, 2019

Differentiated Strategy Creating Meaningful Value ▪ Target assets with high NOI growth potential Focus on ▪ Create value through re-tenanting, repositioning, and value-add renovations Growth ▪ Markets Growth through active property management ▪ High barriers to entry; minimal new development; less institutional competition ▪ JV structure leverages local expertise of joint venture partner network JV-Centric Strategy ▪ Superior flexibility to grow or exit markets versus vertically-integrated REITs ▪ Significant access to buying opportunities from strong JV partner network Proven Access ▪ Broad network of third party management companies and partner relationships to Investment Opportunities ▪ Flexible acquisition and funding profile; focus on one-off opportunities where major institutional buyers are not active ▪ BRT’s niche is the less competitive properties worth up to $100 million PAGE 9

Joint Venture Strategy Creating Value through Strong Operating Partnerships ▪ Receive numerous opportunities from both existing partners and potential partners through a strong network built Strong Deal from the successful lending platform and equity partnerships in the past Flow ▪ Have never advertised publicly but continue to see strong deal flow ▪ Ability to enter and exit markets through a strong network ▪ High “hit-rate” and efficiencies on deals as we only review deals when under contract Flexibility ▪ Have the ability to choose best-in-class third party management companies where the partners do not have a vertically integrated platform ▪ Local operators with expertise in specific markets provide value-added opportunities through Value-Creation extensive market knowledge through Local Partners ▪ Able to get “off-market” deals through the partners’ years of relationships with local brokers and owners PAGE 10

Acquisition Approach and Strategy Harnessing Partner Network to Facilitate Capital Deployment ACTIVE CONSERVATIVE TYPICAL DEAL CAPITAL PARTNER UNDERWRITING METRICS ILLUSTRATIVE VALUE ADD DEAL CAPITALIZATION - $60mm Transaction Before Value Add After Value Add Actively involved in Efficient underwriting: $2 million to $20 million Program Program (1) operations and asset management primarily equity investment management considers deals already Generally provide 65% to JV Partner: JV Partner: under contract by $4mm $6mm Strong local partner 80% of equity expertise accelerates site JV Partner, resulting requirement, pari passu selection and enhances in a high “hit rate” BRT Equity: $16mm BRT Equity: $26mm diligence process 60% – 70% LTV first Leverages relationship mortgage financing with JV partner to enhance quality of due Targeted 6% to 8% cash- Debt: $40mm Debt: $40mm diligence on-cash yield day one Working with partner Targeted 10% to maximizes ability to hone 16% IRR in on best locations for investment Willing to take preferred / Equity Equity senior equity position to Breakdown Breakdown enhance returns and 80% / 20% 80% / 20% mitigate risk $60mm $72mm Transaction Value 67% Leverage 56% Leverage 1) Value based on pro forma NOI and stabilized cap rate PAGE 11

Focus on Growth Markets Strategically Concentrated in High Employment Markets KEY PORTFOLIO FIGURES 3 % of NOI Average Monthly Rental Rate $964 2 2 STATE PROPERTIES UNITS CONTRIBUTION3 Average Property Age (Years)2 22.5 Texas 11 3,096 27% Average Cost per Unit4 $122,298 Georgia 5 1,545 15% Florida 4 1,248 11% Mississippi 2 776 9% Geographically Diverse Portfolio Missouri 3 355 9% South Carolina 3 678 7% Alabama 2 412 3% Indiana 1 400 2% Tennessee 1 300 4% Ohio 1 264 3% Virginia 1 220 4% Other1 - - 2% TOTAL 34 9,294 96% Source: Company Filings [1] Primarily reflects amounts from properties included in the Company's other assets segment related to a commercial leasehold position in Yonkers, NY [2] As of January 18, 2019. Excludes 402 units under development in West Nashville, TN PAGE 12 [3] For the fiscal year ended September 30, 2018. Properties sold during fiscal 2018 contributed 4% to fiscal 2018 NOI. Excludes 402 units under development in West Nashville, TN. See reconciliation of NOI set forth in the supplemental financial information filed on December 10, 2018 as an exhibit to BRT’s Current Report on Form 8-K. [4] Average cost includes total capitalization for renovations

Partnering with Private Owner/Operators Strong partnerships with national operators who manage/own 100,000+ units PAGE 13 | Note: Select group of BRT partners

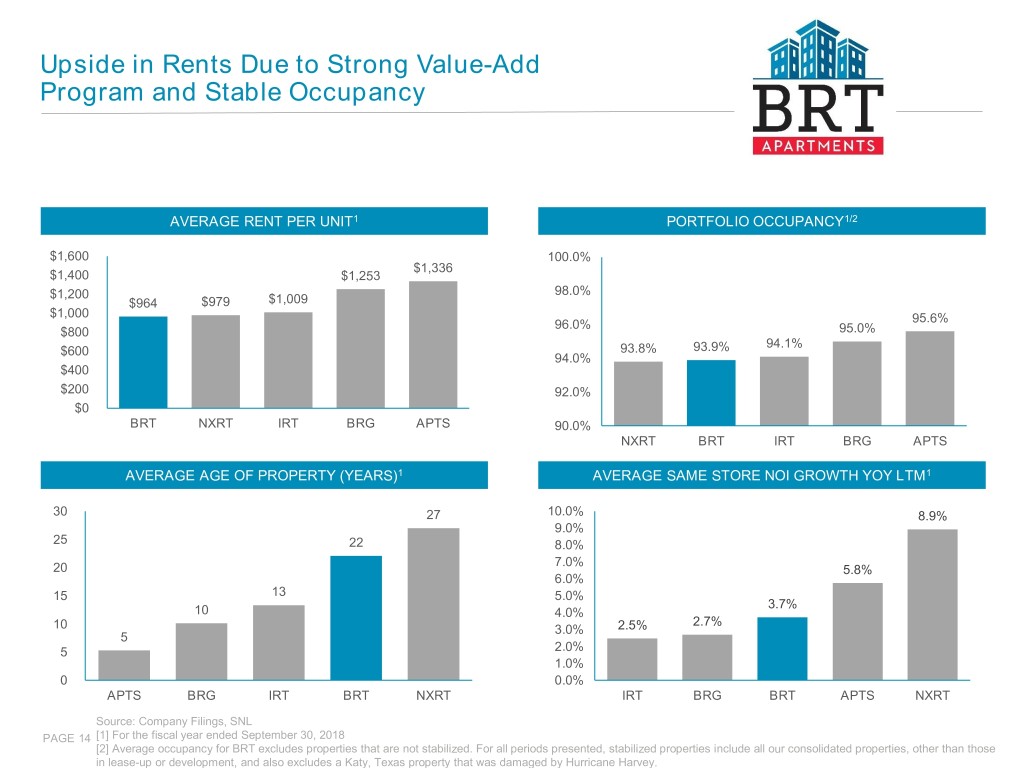

Upside in Rents Due to Strong Value-Add Program and Stable Occupancy AVERAGE RENT PER UNIT1 PORTFOLIO OCCUPANCY1/2 $1,600 100.0% $1,336 $1,400 $1,253 $1,200 98.0% $964 $979 $1,009 $1,000 95.6% 96.0% $800 95.0% 94.1% $600 93.8% 93.9% 94.0% $400 $200 92.0% $0 BRT NXRT IRT BRG APTS 90.0% NXRT BRT IRT BRG APTS AVERAGE AGE OF PROPERTY (YEARS)1 AVERAGE SAME STORE NOI GROWTH YOY LTM1 30 27 10.0% 8.9% 9.0% 25 22 8.0% 7.0% 20 5.8% 6.0% 15 13 5.0% 3.7% 10 4.0% 2.7% 10 3.0% 2.5% 5 5 2.0% 1.0% 0 0.0% APTS BRG IRT BRT NXRT IRT BRG BRT APTS NXRT Source: Company Filings, SNL PAGE 14 [1] For the fiscal year ended September 30, 2018 [2] Average occupancy for BRT excludes properties that are not stabilized. For all periods presented, stabilized properties include all our consolidated properties, other than those in lease-up or development, and also excludes a Katy, Texas property that was damaged by Hurricane Harvey. .

Recent Acquisitions PARC AT 980 ANATOLE APARTMENTS ▪ Stabilized cap rate: 5.5% ▪ Stabilized cap rate: 5.7% ▪ Purchase price: $77.3 million ▪ Purchase price: $20.5 million ▪ Location: Lawrenceville, GA ▪ Location: Daytona Beach, FL ▪ Number of units: 586 ▪ Number of units: 208 ▪ Value-Add, renovations have ▪ Value-Add already been completed at the property LANDINGS OF CARRIER PARKWAY CRESTMONT AT THORNBLADE ▪ Stabilized cap rate: 5.8% ▪ Stabilized cap rate: 5.71% ▪ Purchase price: $30.8 million ▪ Purchase price: $37.8 million ▪ Location: Grand Prairie, TX ▪ Location: Greenville, SC ▪ Number of units: 281 ▪ Number of units: 266 ▪ Value-Add ▪ Value-Add PAGE 15 | Source: Company Filings

History of Value Creation Dispositions DISPOSITION DATE PROPERTY NAME LOCATION # OF UNITS BRT SHARE OF IRR2 GAIN ON SALE1 Jul-15 Ivy Ridge Marietta, GA 207 $4.6mm 31.7% Mar-16 Grove at Trinity Pointe Cordova, TN 464 $4.5mm 21.2% Mar-16 Mountain Park Estates Kennesaw, GA 450 $6.3mm 26.0% Apr-16 Courtney Station Pooler, GA 300 $4.3mm 13.0% Jun-16 Madison at Schilling Farms Collierville, TN 324 $3.7mm 10.0% Jun-16 Village Green Little Rock, AK 172 $0.4mm 10.0% Sep-16 Sundance Wichita, KS 496 $5.4mm 32.0% Oct-16 Southridge Greenville, SC 350 $9.2mm 27.0% Oct-16 Spring Valley Panama City, FL 160 $3.9mm 37.0% Nov-16 Sandtown Vista Atlanta, GA 350 $4.7mm 40.2% Nov-16 Autum Brook Hixson, TN 156 $0.5mm -5.1% Jul-17 Meadowbrook Humble, TX 260 $4.6mm 23.5%3 Jul-17 Parkside Humble, TX 160 $2.8mm 23.5%3 Jul-17 Ashwood Park Pasadena, TX 144 $1.7mm 23.5%3 Oct-17 Waverly Place Apartments Melborune, FL 208 $10.0mm 25.0%4 Feb-18 Fountains Palm Beach Gardens, FL 542 $21.2mm 25.0%4 Feb-18 Apartments at the Venue Valley, AL 618 $5.2mm 15.7% Nov-18 The Factory at Garco Park North Charleston, SC 271 $6.2mm 20.0% Dec-18 Cedar Lakes Lake St. Louis, MO 420 $5.6mm 15.9% TOTAL WEIGHTED AVERAGE 6,052 $104.8mm [2] IRR to BRT after distributions paid to joint venture partners PAGE 16 [1] The total gain on the sale and BRT’s joint venture partner’s share of the total gain is set forth in our 2018 Annual Report or in press releases issued by BRT on November 12, 2018 and December [3] Represents IRR for portfolio of properties in a crossed joint venture 10, 2018 [4] Represents IRR for portfolio of properties in a crossed joint venture

Development Opportunities Superior Locations with Limited New Supply ▪ Pursue Class A / A+ new construction in emerging ▪ Garden style or mid-rise construction Southeast US markets ▪ Targeting unlevered stabilized return of at least 7% ▪ Willing to provide at least 50% of the required equity with well- capitalized development partners CURRENT DEVELOPMENT PROJECTS Canalside Sola, Columbia, SC Bells Bluff, Nashville, TN (rendering) (rendering) Location Estimated Capital Drawn Planned Units Status Development Cost ▪ Leasing is underway at the property, occupancy is Columbia, SC1 $60,697,000 $56,140,902 338 36% as of 1/22/2019 ▪ Occupancy on first buildings expected to begin in Nashville, TN $73,263,000 $52,985,797 402 Q1 2019 PAGE 17 | Source: Company Filings [1] The development deal in Columbia, SC is an unconsolidated property.

Development Case Study Greenville, SC PROPERTY DESCRIPTION ACQUISITION DATA DEVELOPMENT RETURN ON INVESTMENT ▪ Brand new construction ▪ Purchased land for ▪ Development was completed on time ▪ Property sold in October in downtown Greenville $7mm in January 2014 and budget 2016 for $68mm or $188,888 market per unit ▪ Development budget of ▪ Property was sold at the end of ▪ 360 unit mid-rise mixed $51.5mm, or $143,000 lease-up ▪ IRR of 27% to BRT use apartment complex per unit ▪ As the Greenville market became ▪ Built in 2016 oversaturated, we were able to sell and recycle capital effectively. PAGE 18

Value-Add Case Study: Houston Portfolio Houston, TX PROPERTY DESCRIPTION ACQUISITION DATA VALUE ADD UPGRADES ▪ ▪ 3 class B multi-family properties located Purchased for $22.66mm, or $40,177, per ▪ Upgraded interior units with new unit, in October 2013 in Humble, TX and Pasadena, TX refrigerators, range/ovens, and dishwashers ▪ Blended acquisition cap rate of 6.44% (based as well as new flooring in select units ▪ Built in 1982, 1983, 1984 on projected NOI and total cost) ▪ ▪ Targeted upgrades that result in the highest 564 units ▪ Capex budget of $1.2mm, or $2,100 return on investment per unit ▪ Sold the portfolio in July of 2017 for an IRR of 23.5% VALUE ADD PROGRAM RETURN ON INVESTMENT Before Renovation After Renovation Property Average Cost Per Unit Average Rent Increase ROI NOI CAGR over Hold Period Ashwood $2,638 $83 38% 18% Meadowbrook $2,593 $96 45% 13% Parkside $2,886 $86 36% 16% PAGE 19

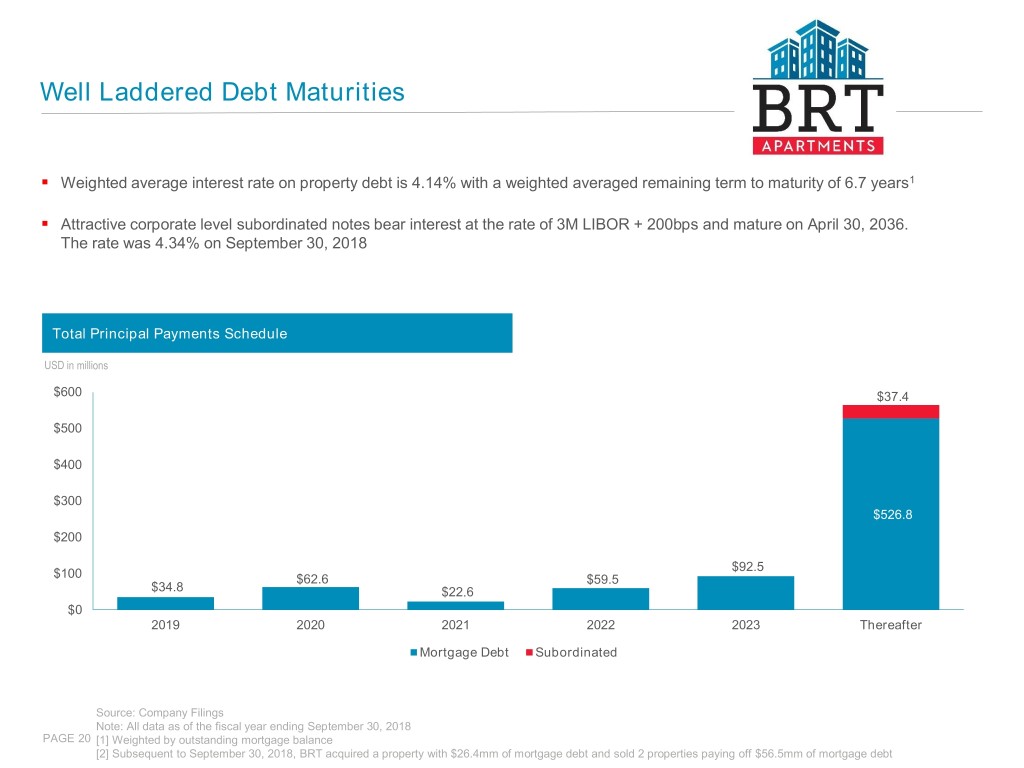

Well Laddered Debt Maturities ▪ Weighted average interest rate on property debt is 4.14% with a weighted averaged remaining term to maturity of 6.7 years1 ▪ Attractive corporate level subordinated notes bear interest at the rate of 3M LIBOR + 200bps and mature on April 30, 2036. The rate was 4.34% on September 30, 2018 Total Principal Payments Schedule USD in millions $600 $37.4 $500 $400 $300 $526.8 $200 $92.5 $100 $62.6 $59.5 $34.8 $22.6 $0 2019 2020 2021 2022 2023 Thereafter Mortgage Debt Subordinated Source: Company Filings Note: All data as of the fiscal year ending September 30, 2018 PAGE 20 [1] Weighted by outstanding mortgage balance [2] Subsequent to September 30, 2018, BRT acquired a property with $26.4mm of mortgage debt and sold 2 properties paying off $56.5mm of mortgage debt

Investment Highlights Differentiated Strategy Scalable Growth Opportunity Stable Portfolio and Robust Pipeline Proven Management with Close Alignment of Interests PAGE 21