Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LINDSAY CORP | d691716d8k.htm |

Investor Presentation January 2019 Exhibit 99.1

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions, and the Company’s actual financial condition and results of operations, to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include those outlined in the “Risk Factors” section of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

THE LINDSAY STORY We are Transforming Lindsay… Irrigation and infrastructure products From: A cyclical manufacturer

THE LINDSAY STORY …To an Innovative Market Leader Driven by a new culture and technological innovation Higher margin Innovative Leverage Less cyclical

THE NEW LINDSAY CORPORATION Driving Margin Expansion and Growth through Technology Differentiation 1 2 3 STRONG PLATFORMS Executing NEW STRATEGY CLEAR PRIORITIES / GOALS

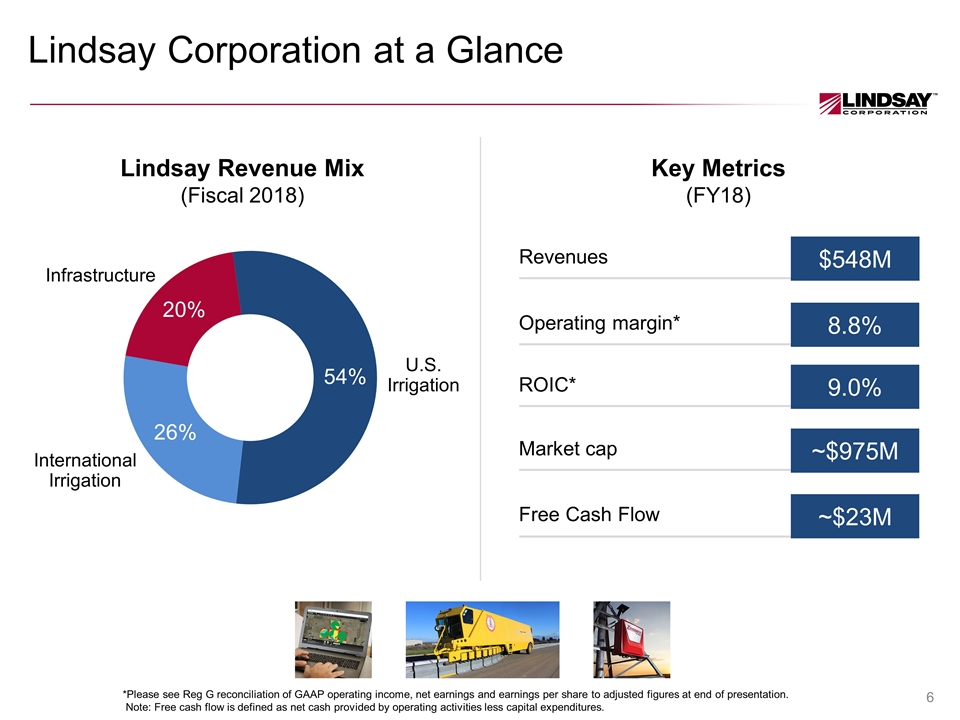

Revenues Operating margin* Lindsay Corporation at a Glance Key Metrics (FY18) Lindsay Revenue Mix (Fiscal 2018) U.S. Irrigation International Irrigation Infrastructure ROIC* $548M 8.8% 9.0% Market cap ~$975M Free Cash Flow ~$23M *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation. Note: Free cash flow is defined as net cash provided by operating activities less capital expenditures.

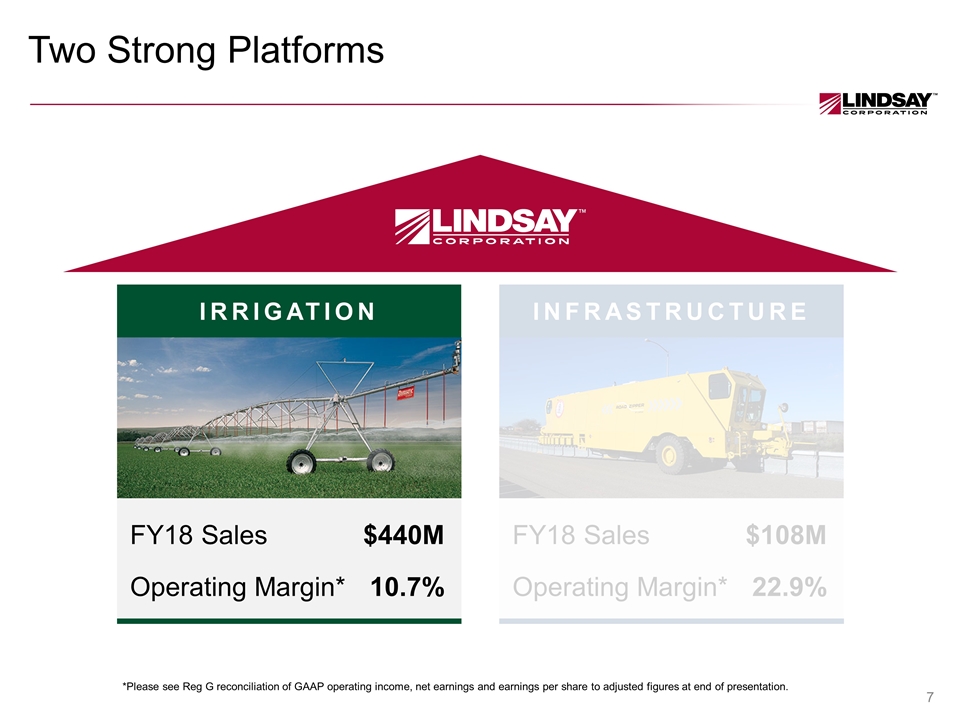

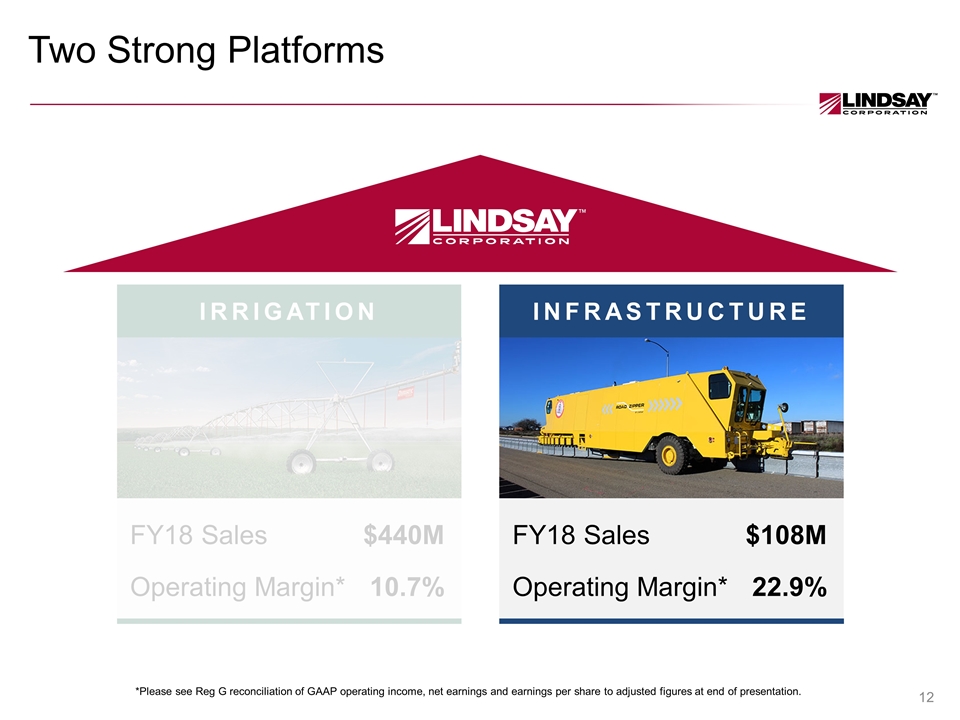

Two Strong Platforms INFRASTRUCTURE IRRIGATION FY18 Sales $440M Operating Margin* 10.7% FY18 Sales $108M Operating Margin* 22.9% *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

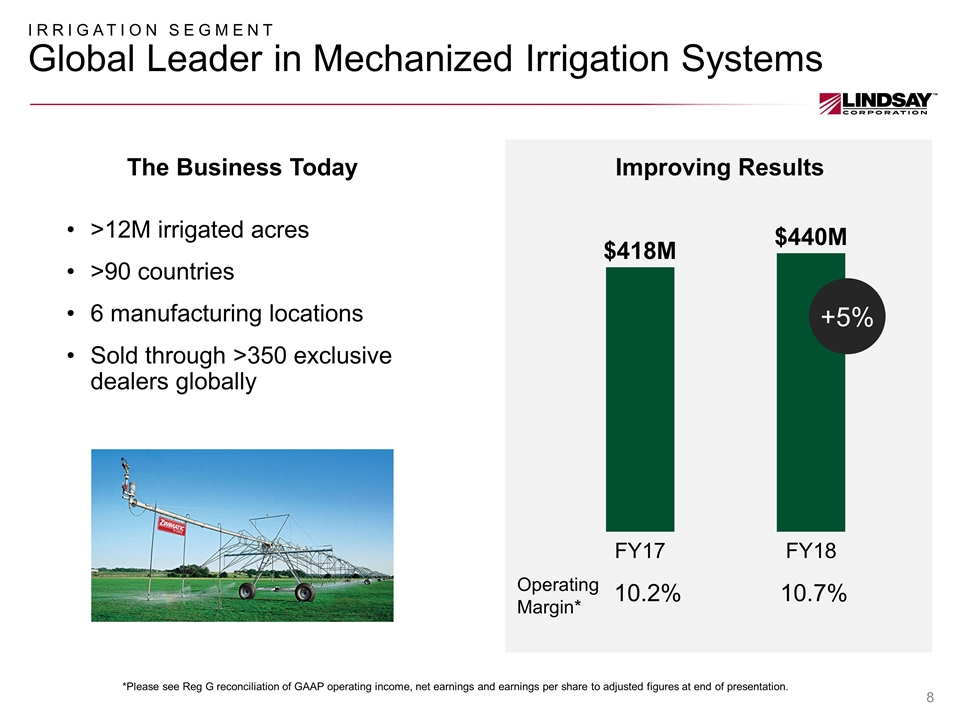

IRRIGATION SEGMENT Global Leader in Mechanized Irrigation Systems >12M irrigated acres >90 countries 6 manufacturing locations Sold through >350 exclusive dealers globally Improving Results The Business Today +5% 10.2% 10.7% Operating Margin* *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

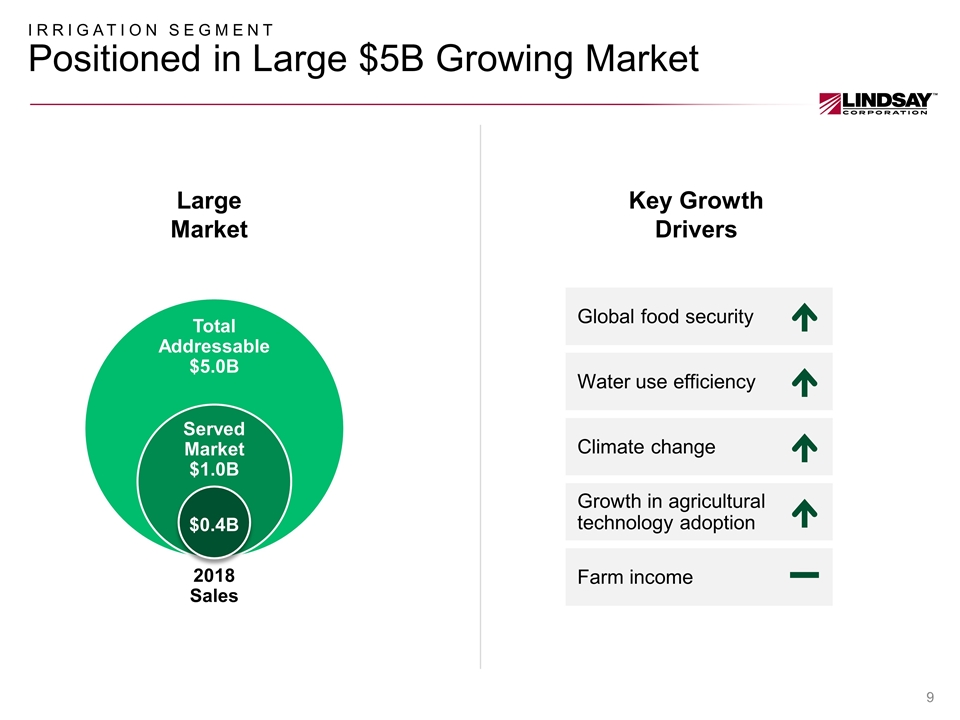

IRRIGATION SEGMENT Positioned in Large $5B Growing Market Large Market Key Growth Drivers Served Market $1.0B Total Addressable $5.0B $0.4B Global food security Water use efficiency Climate change Growth in agricultural technology adoption Farm income 2018 Sales

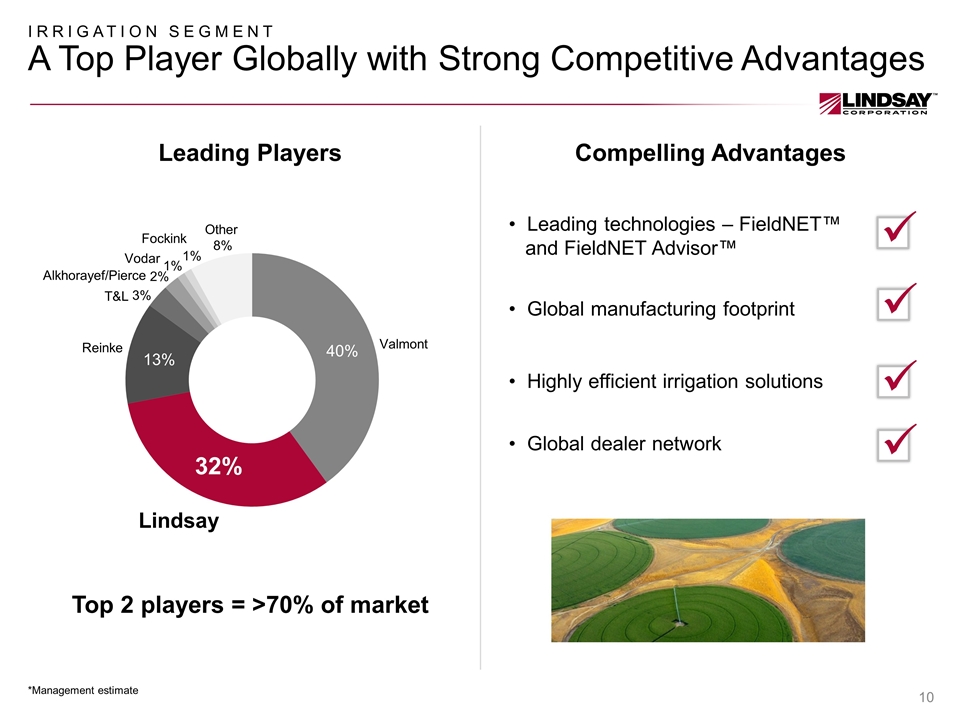

Leading technologies – FieldNET™ and FieldNET Advisor™ Global manufacturing footprint Highly efficient irrigation solutions IRRIGATION SEGMENT A Top Player Globally with Strong Competitive Advantages Compelling Advantages Leading Players Valmont Lindsay Reinke T&L Alkhorayef/Pierce Vodar Fockink Other ü ü ü ü Top 2 players = >70% of market Global dealer network *Management estimate

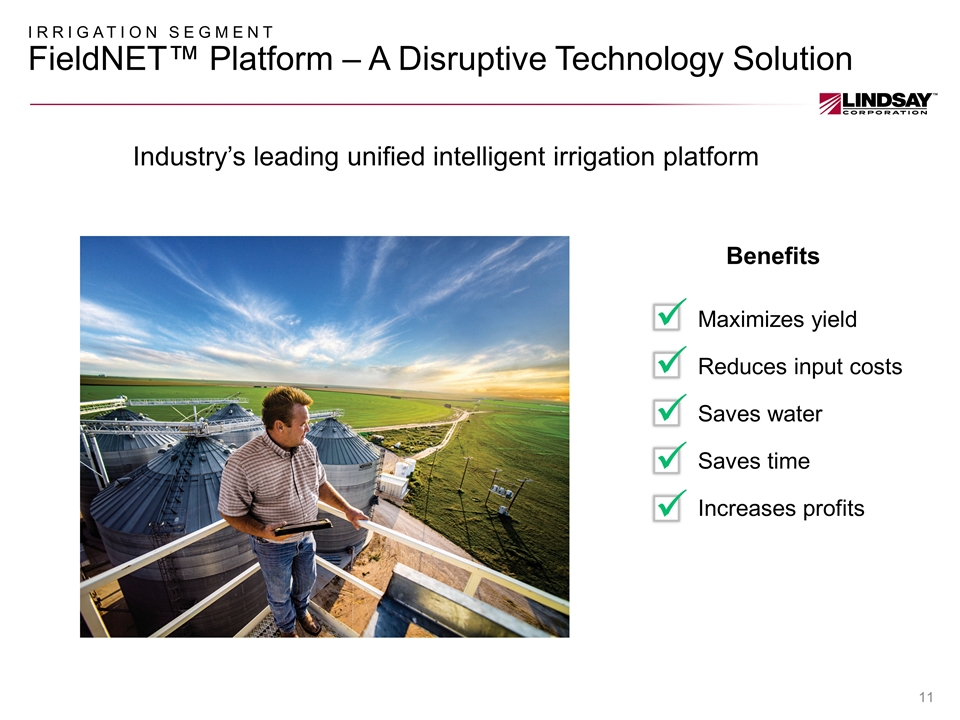

IRRIGATION SEGMENT FieldNET™ Platform – A Disruptive Technology Solution Benefits Industry’s leading unified intelligent irrigation platform ü Maximizes yield Reduces input costs Saves water Saves time Increases profits ü ü ü ü

Two Strong Platforms IRRIGATION FY18 Sales $440M INFRASTRUCTURE FY18 Sales $108M Operating Margin* 10.7% Operating Margin* 22.9% *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

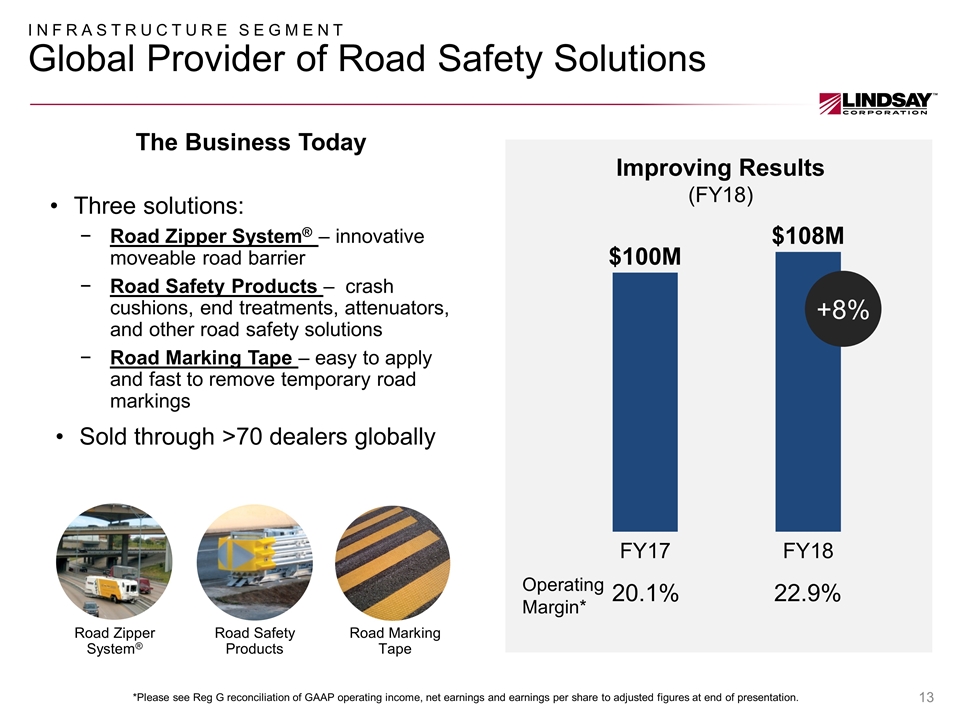

INFRASTRUCTURE SEGMENT Global Provider of Road Safety Solutions Three solutions: Road Zipper System® – innovative moveable road barrier Road Safety Products – crash cushions, end treatments, attenuators, and other road safety solutions Road Marking Tape – easy to apply and fast to remove temporary road markings Sold through >70 dealers globally Improving Results (FY18) The Business Today +8% 20.1% 22.9% Operating Margin* Road Zipper System® Road Safety Products Road Marking Tape *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

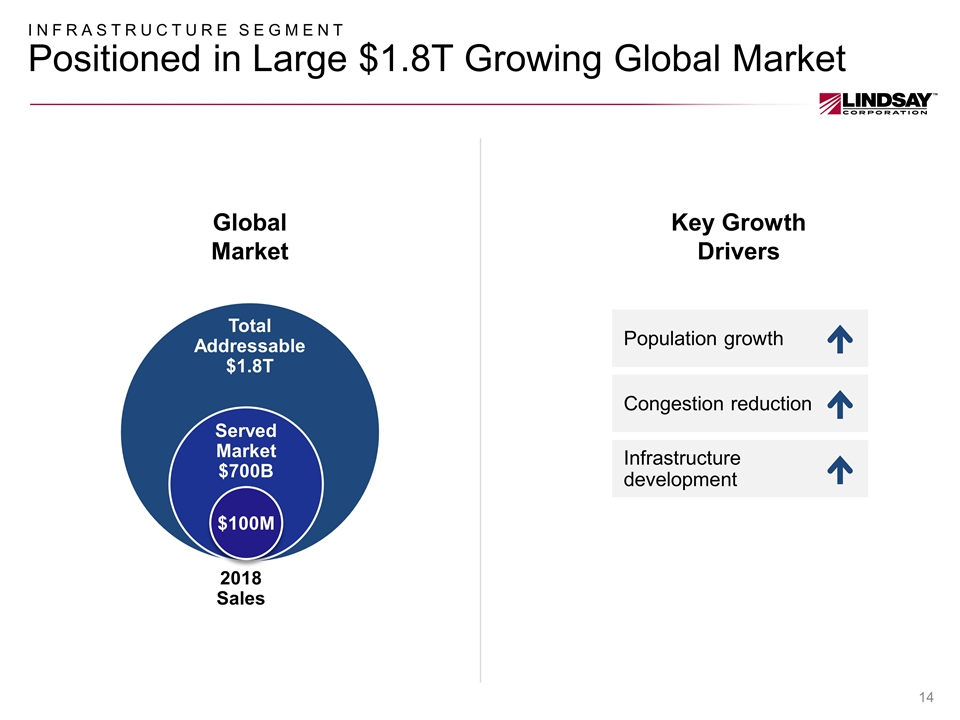

INFRASTRUCTURE SEGMENT Positioned in Large $1.8T Growing Global Market Key Growth Drivers Population growth Congestion reduction Infrastructure development Served Market $700B Total Addressable $1.8T $100M 2018 Sales $100M Global Market

INFRASTRUCTURE SEGMENT Road Zipper System® – One-of-a-Kind Innovative Solution Key Advantages Solving Traffic Congestion Globally ü Mitigates congestion Improves road safety Reduces pollution ü ü Creates managed lanes at a fraction of the cost of new construction Completed Road Zipper projects Purchasing options available Miles of barriers in use 200+ Buy or Lease 200+

THE NEW LINDSAY CORPORATION Driving Margin Expansion and Growth through Technology Differentiation 1 2 3 STRONG PLATFORMS Executing NEW STRATEGY CLEAR PRIORITIES / GOALS

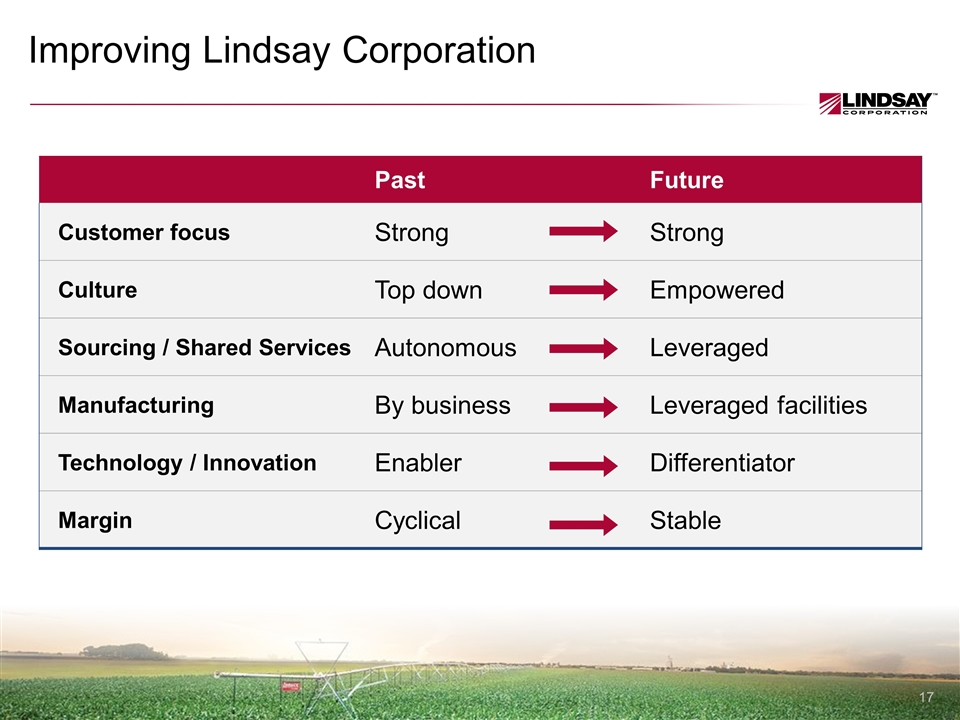

Improving Lindsay Corporation Past Future Customer focus Strong Strong Culture Top down Empowered Sourcing / Shared Services Autonomous Leveraged Manufacturing By business Leveraged facilities Technology / Innovation Enabler Differentiator Margin Cyclical Stable

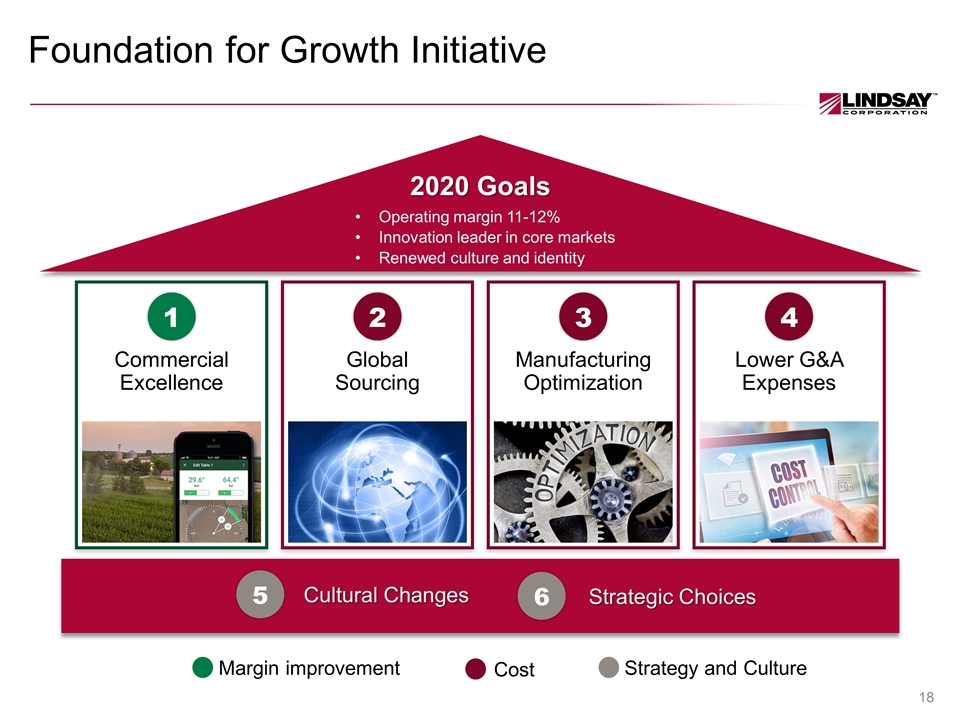

Foundation for Growth Initiative Margin improvement Cost Strategy and Culture 2020 Goals Operating margin 11-12% Innovation leader in core markets Renewed culture and identity 1 2 3 4 5 6 Commercial Excellence Global Sourcing Manufacturing Optimization Lower G&A Expenses Cultural Changes Strategic Choices

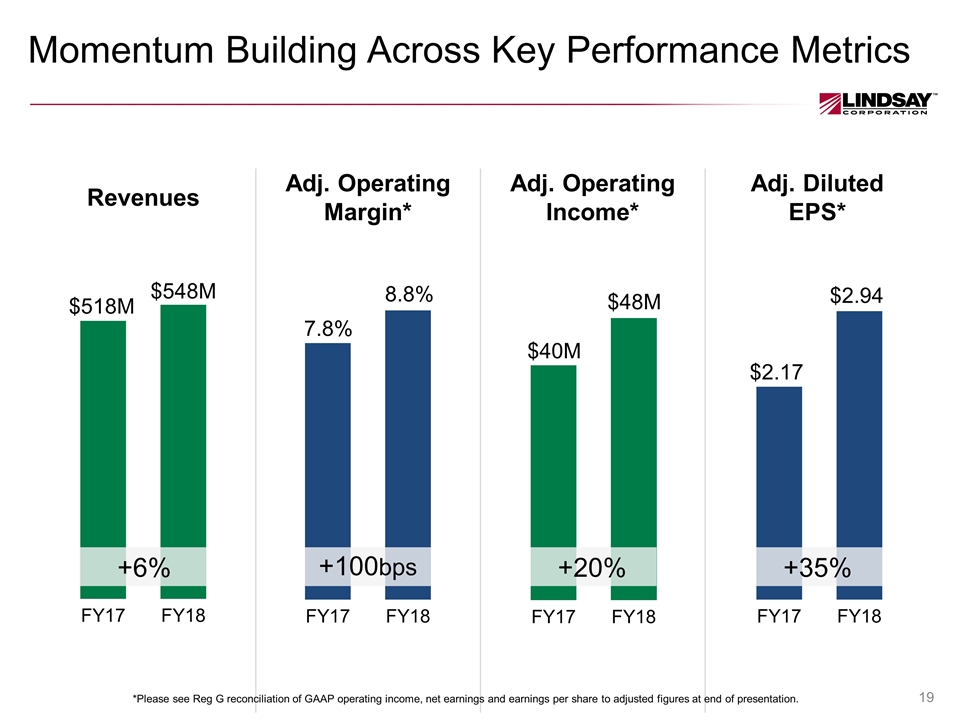

Momentum Building Across Key Performance Metrics Revenues Adj. Operating Margin* Adj. Operating Income* Adj. Diluted EPS* $548M $518M 8.8% 7.8% $48M $40M $2.94 $2.17 +6% +100bps +20% +35% *Please see Reg G reconciliation of GAAP operating income, net earnings and earnings per share to adjusted figures at end of presentation.

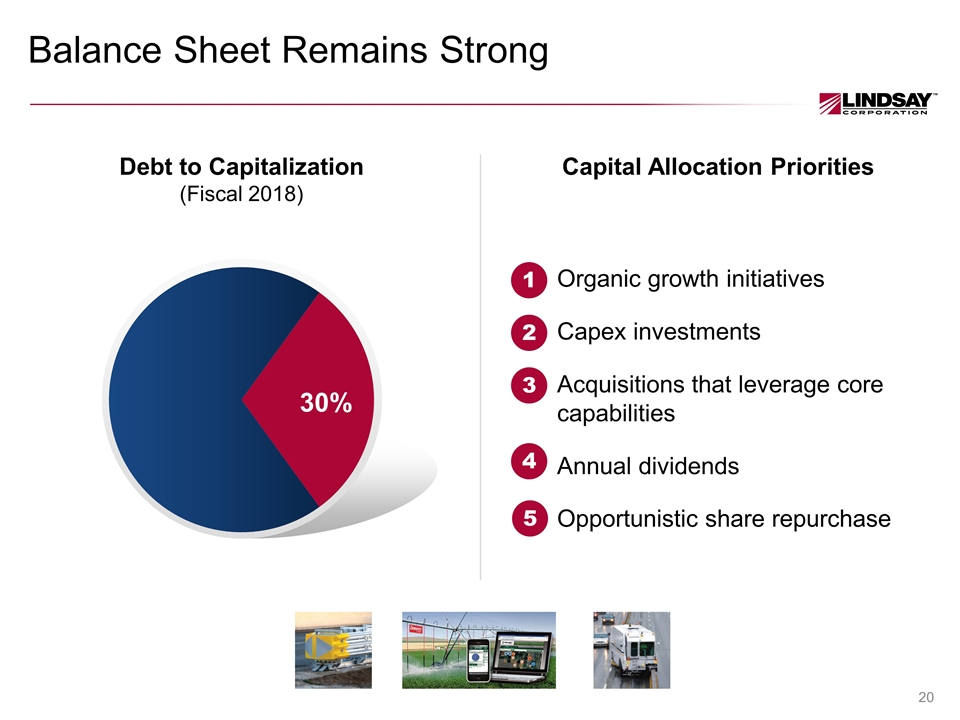

Balance Sheet Remains Strong Debt to Capitalization (Fiscal 2018) Capital Allocation Priorities Organic growth initiatives Capex investments Acquisitions that leverage core capabilities Annual dividends Opportunistic share repurchase 1 2 3 4 5

THE NEW LINDSAY CORPORATION Driving Margin Expansion and Growth through Technology Differentiation 1 2 3 STRONG PLATFORMS Executing NEW STRATEGY CLEAR PRIORITIES / GOALS

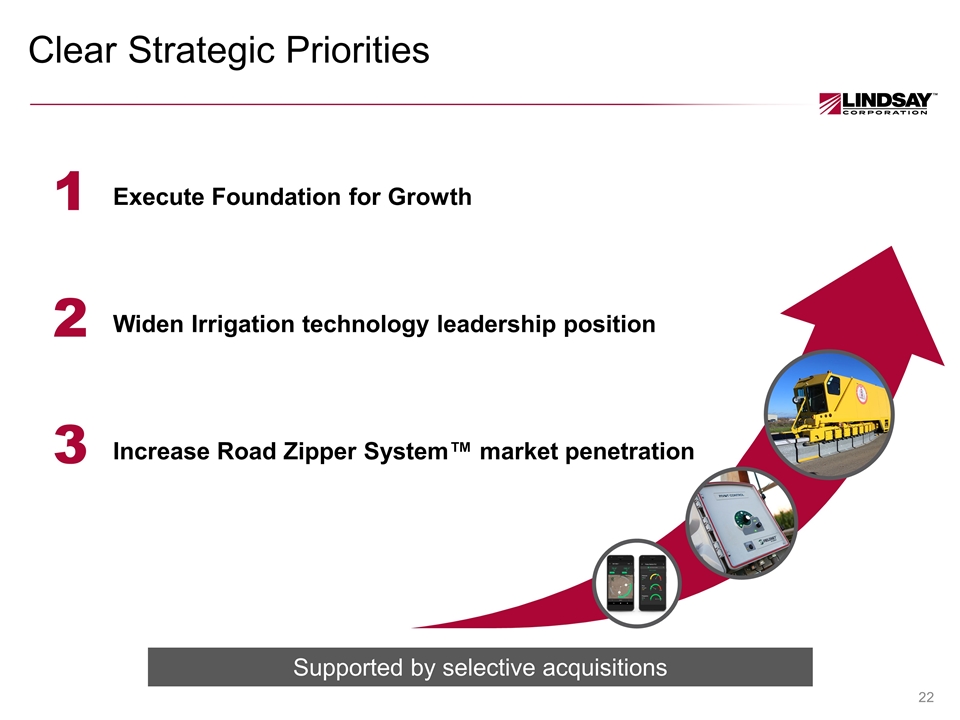

Clear Strategic Priorities Execute Foundation for Growth Widen Irrigation technology leadership position Increase Road Zipper System™ market penetration 1 2 3 Supported by selective acquisitions

1. Execute Foundation for Growth Execution is on track Recent Achievements Divested non-core businesses – Watertronics, LAKOS, SPF and Irrigation Specialists ü Expanded FieldNET Advisor to be a global platform ü Manufacturing facilities – Closed an Infrastructure facility, consolidated activity into Lindsay, NE facility ü Shared Services – Initiated centralization of shared services activities ü Workstream initiatives moving to implementation stage ü

2. Widen Irrigation Technology Leadership Position Broaden technology leadership Innovation Collaboration More countries More crops New products Strategic data partners John Deere Operations Center Farmers Edge DTN – weather data/forecasts

3.Increase Road Zipper System™ Market Penetration Increase leasing business Sustainable business results Shift target stakeholders from “relieving traffic congestion” to “designed into project” Innovation supporting alternate zipper configurations and applications Initiatives Road Zipper System™ making roadways flexible, adaptable and safe Path toward expansion Permanent solution Flexible capacity without adding a permanent lane Improved commuter safety Long-term solution for high traffic directionality Lease solution Expedited construction Improves work zone safety Reduces construction cost

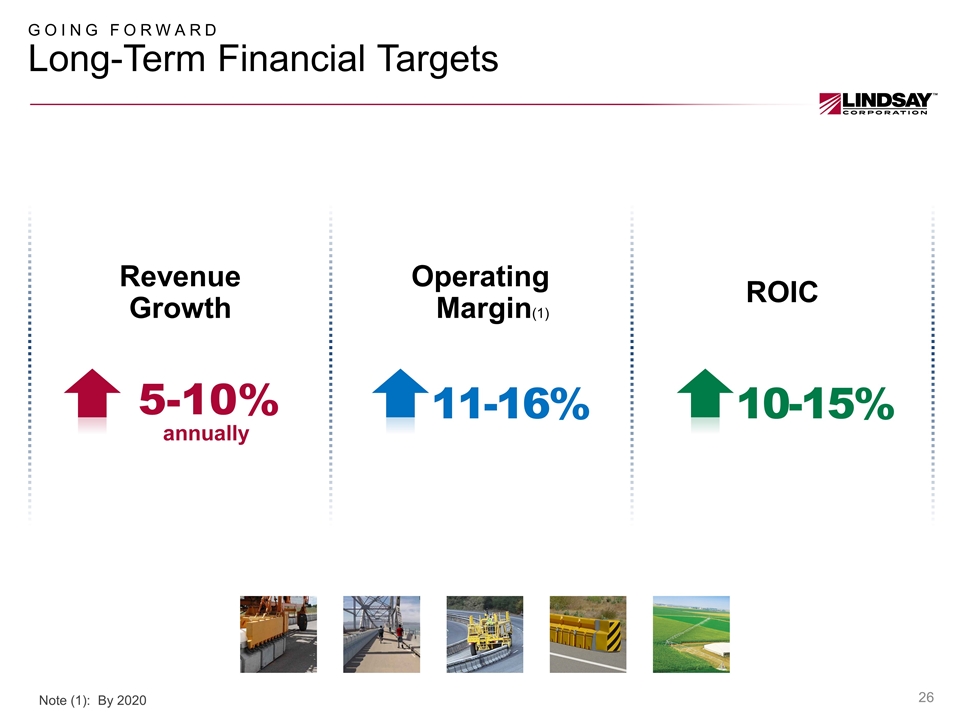

GOING FORWARD Long-Term Financial Targets 5-10% annually 11-16% Revenue Growth Operating Margin(1) ROIC Note (1): By 2020 10-15%

IN SUMMARY Driving Margin Expansion and Growth through Technology Differentiation 1 2 3 STRONG PLATFORMS Executing NEW STRATEGY CLEAR PRIORITIES / GOALS Both segments leaders in growing markets Plan on track, momentum building Extending technology leadership, expanding margins

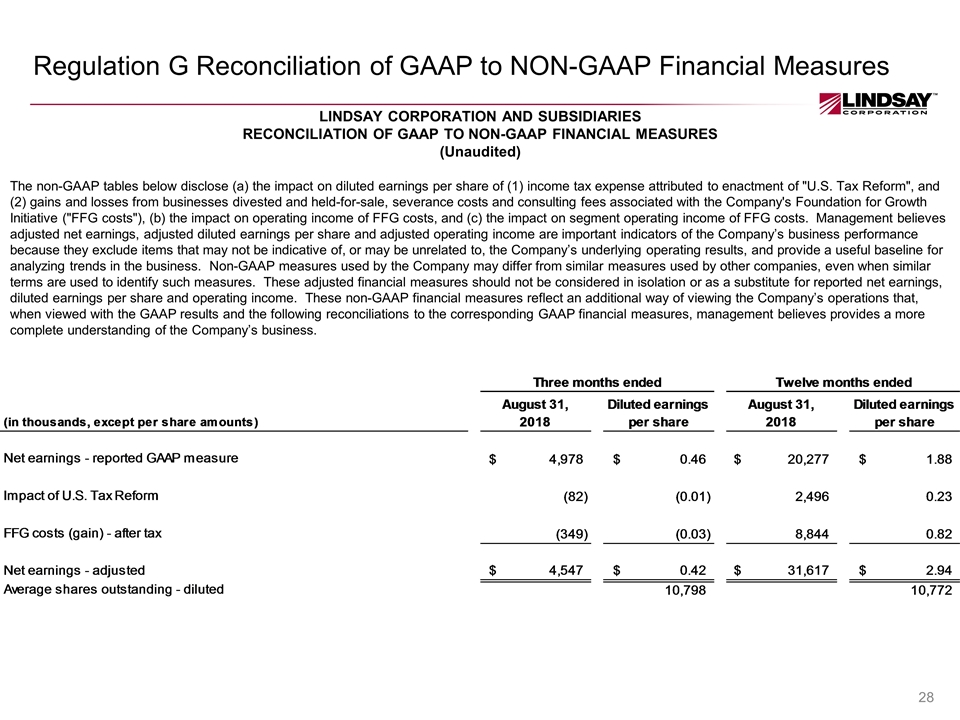

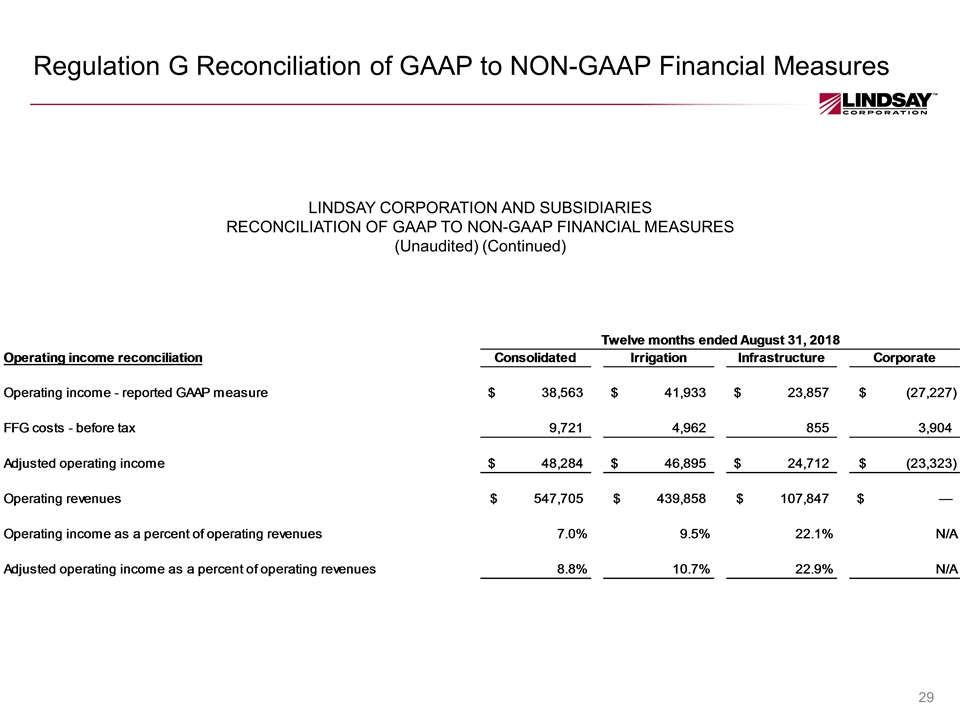

Regulation G Reconciliation of GAAP to NON-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) The non-GAAP tables below disclose (a) the impact on diluted earnings per share of (1) income tax expense attributed to enactment of "U.S. Tax Reform", and (2) gains and losses from businesses divested and held-for-sale, severance costs and consulting fees associated with the Company's Foundation for Growth Initiative ("FFG costs"), (b) the impact on operating income of FFG costs, and (c) the impact on segment operating income of FFG costs. Management believes adjusted net earnings, adjusted diluted earnings per share and adjusted operating income are important indicators of the Company’s business performance because they exclude items that may not be indicative of, or may be unrelated to, the Company’s underlying operating results, and provide a useful baseline for analyzing trends in the business. Non-GAAP measures used by the Company may differ from similar measures used by other companies, even when similar terms are used to identify such measures. These adjusted financial measures should not be considered in isolation or as a substitute for reported net earnings, diluted earnings per share and operating income. These non-GAAP financial measures reflect an additional way of viewing the Company’s operations that, when viewed with the GAAP results and the following reconciliations to the corresponding GAAP financial measures, management believes provides a more complete understanding of the Company’s business.

Regulation G Reconciliation of GAAP to NON-GAAP Financial Measures LINDSAY CORPORATION AND SUBSIDIARIES RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited) (Continued)