Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - LendingTree, Inc. | ex231.htm |

| EX-99.4 - EXHIBIT 99.4 - LendingTree, Inc. | ex994.htm |

| EX-99.3 - EXHIBIT 99.3 - LendingTree, Inc. | quotewizardfs1718exhibit993.htm |

| 8-K/A - 8-K/A - LendingTree, Inc. | quartz8-ka.htm |

Exhibit 99.2 Audited Financial Statements of QuoteWizard

Independent Auditor’s Report Board of Directors QuoteWizard.com, LLC and Subsidiary Seattle, Washington Report on the Financial Statements We have audited the accompanying consolidated financial statements of QuoteWizard.com, LLC and Subsidiary (the Company), which comprise the consolidated balance sheets as of December 31, 2017 and 2016, the related consolidated statements of income, changes in members’ equity, and cash flows for the years then ended, and the related notes to the consolidated financial statements (collectively, the financial statements). Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. 1

Opinion In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of QuoteWizard.com, LLC and Subsidiary as of December 31, 2017 and 2016, and the results of their consolidated operations and their consolidated cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Seattle, Washington October 2, 2018, except as to Note 2, which is as of January 10, 2019. 2

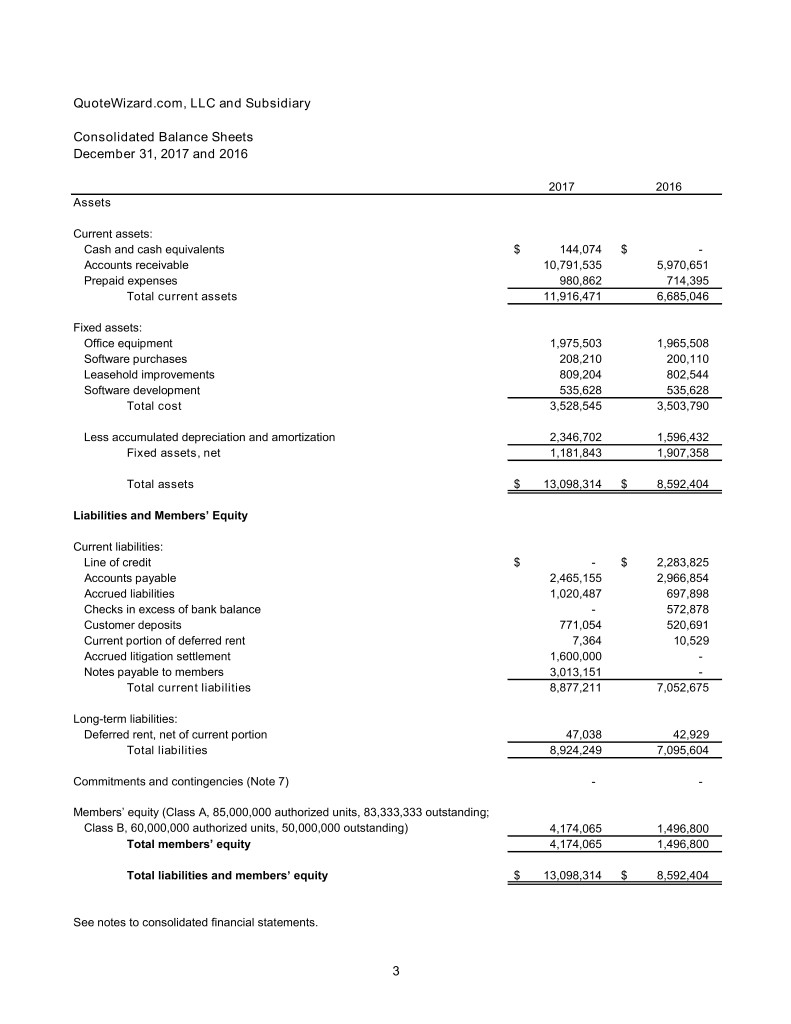

QuoteWizard.com, LLC and Subsidiary Consolidated Balance Sheets December 31, 2017 and 2016 2017 2016 Assets Current assets: Cash and cash equivalents $ 144,074 $ - Accounts receivable 10,791,535 5,970,651 Prepaid expenses 980,862 714,395 Total current assets 11,916,471 6,685,046 Fixed assets: Office equipment 1,975,503 1,965,508 Software purchases 208,210 200,110 Leasehold improvements 809,204 802,544 Software development 535,628 535,628 Total cost 3,528,545 3,503,790 Less accumulated depreciation and amortization 2,346,702 1,596,432 Fixed assets, net 1,181,843 1,907,358 Total assets $ 13,098,314 $ 8,592,404 Liabilities and Members’ Equity Current liabilities: Line of credit $ - $ 2,283,825 Accounts payable 2,465,155 2,966,854 Accrued liabilities 1,020,487 697,898 Checks in excess of bank balance - 572,878 Customer deposits 771,054 520,691 Current portion of deferred rent 7,364 10,529 Accrued litigation settlement 1,600,000 - Notes payable to members 3,013,151 - Total current liabilities 8,877,211 7,052,675 Long-term liabilities: Deferred rent, net of current portion 47,038 42,929 Total liabilities 8,924,249 7,095,604 Commitments and contingencies (Note 7) - - Members’ equity (Class A, 85,000,000 authorized units, 83,333,333 outstanding; Class B, 60,000,000 authorized units, 50,000,000 outstanding) 4,174,065 1,496,800 Total members’ equity 4,174,065 1,496,800 Total liabilities and members’ equity $ 13,098,314 $ 8,592,404 See notes to consolidated financial statements. 3

QuoteWizard.com, LLC and Subsidiary Consolidated Statements of Income Years Ended December 31, 2017 and 2016 2017 2016 Net revenue $ 83,448,360 $ 78,150,360 Cost of services 9,061,920 17,381,712 Gross profit 74,386,440 60,768,648 Selling, general and administrative expenses 65,931,715 59,433,292 Settlement expense (Note 7) 1,600,000 - Stock compensation for Quote Wizard EIP, LLC 4,301,562 482,189 Operating income 2,553,163 853,167 Other expense: Other expense 112,323 - Interest expense 115,426 28,116 Total other expense 227,749 28,116 Net income $ 2,325,414 $ 825,051 See notes to consolidated financial statements. 4

QuoteWizard.com, LLC and Subsidiary Consolidated Statements of Changes in Members’ Equity Years Ended December 31, 2017 and 2016 Balance, December 31, 2015 $ 4,502,554 Distributions (4,312,994) Stock compensation for Quote Wizard EIP, LLC 482,189 Net income 825,051 Balance, December 31, 2016 1,496,800 Distributions (4,127,663) Stock compensation for Quote Wizard EIP, LLC 4,301,562 Stock compensation for options 177,952 Net income 2,325,414 Balance, December 31, 2017 $ 4,174,065 See notes to consolidated financial statements. 5

QuoteWizard.com, LLC and Subsidiary Consolidated Statements of Cash Flows Years Ended December 31, 2017 and 2016 2017 2016 Cash flows from operating activities: Net income $ 2,325,414 $ 825,051 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 750,270 639,127 Stock compensation for Quote Wizard EIP, LLC 4,301,562 482,189 Stock compensation for options 177,952 - Changes in operating assets and liabilities: Accounts receivable (4,820,884) 569,793 Prepaid expenses (266,467) (90,247) Accounts payable (501,699) (1,039,867) Accrued liabilities and other current liabilities 1,935,740 (365,714) Customer deposits 250,363 (325,975) Deferred rent 944 (33,217) Net cash provided by operating activities 4,153,195 661,140 Cash flows from investing activities: Purchases of fixed assets (24,755) (1,253,970) Net cash used in investing activities (24,755) (1,253,970) Cash flows from financing activities: Distributions (4,127,663) (4,312,994) Checks in excess of bank balance (572,878) 572,878 Net (repayments) borrowings on line of credit (2,283,825) 1,283,825 Proceeds from member notes payable 3,000,000 - Net cash used in financing activities (3,984,366) (2,456,291) Net increase (decrease) in cash and cash equivalents 144,074 (3,049,121) Cash and cash equivalents: Beginning of year - 3,049,121 End of year $ 144,074 $ - Supplemental disclosure of cash flow information: Cash paid for interest $ 102,275 $ 28,116 See notes to consolidated financial statements. 6

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 1. Nature of Business and Summary of Significant Accounting Policies Nature of business: QuoteWizard.com, LLC (the Company) is an online marketing/advertising and lead generation company with operations in Seattle, Washington, and Denver, Colorado. The Company was organized June 5, 2007, as a Delaware limited liability company, upon the filing of its articles of organization with the Secretary of the State of the state of Delaware. The Company sells leads, online clicks and call transfers to independent insurance agents, corporate insurance customers, as well as competitors within the industry. Leads are primarily self-generated through the Company’s Search Engine Marketing/Search Engine Optimization initiatives which generate high-intent high-converting leads, online marketing channels as well as leads purchased through data mining companies or other competitors. In December 2017, the Company formed a wholly owned subsidiary, Wizard Enterprises, LLC, for the purpose of acquiring a business (as disclosed in Note 8). There was no activity in this subsidiary in 2017. Ownership: As of December 31, the respective ownership percentages were as follows: Class A Ownership (Voting) Class B Ownership (Nonvoting) 2017 2016 2017 2016 Quote Wizard EIP, LLC 40.60% 40.00% 0.00% 0.00% Scott Peyree 14.85% 15.00% 34.91% 25.00% John Anderson 14.85% 15.00% 18.52% 25.00% Rob Peyree 14.85% 15.00% 18.52% 25.00% Tom Peyree 14.85% 15.00% 18.52% 25.00% Scott and Michelle Peyree Children’s Irrevocable Trust 0.00% 0.00% 6.35% 0.00% Michelle Peyree 0.00% 0.00% 3.18% 0.00% 100.00% 100.00% 100.00% 100.00% Principles of consolidation: The consolidated financial statements include the accounts of the Company and its subsidiary. All significant intercompany accounts and transactions are eliminated in consolidation. Variable interest entities: The Company evaluates loans it guarantees for certain legal entities in which equity investors do not have (1) sufficient equity at risk for the legal entity to finance its activities without additional subordinated financial support, (2) as a group, the power, through voting or similar rights, to direct the activities of the legal entity that most significantly impact the entity’s economic performance, or (3) the obligation to absorb the expected losses of the legal entity or the right to receive expected residual returns of the legal entity. Such legal entities are referred to as variable interest entities (VIE). The Company would consolidate the results of any such entity in which it determined that it had a controlling financial interest, which would exist if the Company had both the power to direct the activities that most significantly affect the VIE’s economic performance and the obligation to absorb the losses of, or right to receive benefits from, the VIE that could be potentially significant to the VIE. Annually, the Company reassesses whether it has a controlling financial interest in any of these legal entities. The Company guaranteed two loans for QuoteWizard Holdings, LLC (Holdings), a related party with a bank, and outstanding balances on these loans totaled approximately $628,000 and $2,049,000 as of December 31, 2017 and 2016, respectively. The related party is current on required loan payments, and $182,000 matured and was paid off in February 2018, and approximately $446,000 is scheduled to mature in April 2019 (see Note 7). Subsequent to December 31, 2017, the loan scheduled to mature in April 2019 was also paid in full. Due to these guarantees and structure of the related party, the Company determined the related party is a VIE. Since the Company does not participate in the rights and obligations of this VIE, the Company determined that it is not the primary beneficiary and therefore has disclosed the Company’s guarantee of the loan agreements. The Company’s maximum exposure in its involvement with this VIE as of December 31, 2017 and 2016, is approximately $628,000 and $2,049,000, respectively. 7

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 1. Nature of Business and Summary of Significant Accounting Policies (Continued) Financial statement presentation: The consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (U.S. GAAP). Cash and cash equivalents: The Company considers all cash investment instruments with an original maturity of three months or less to be cash equivalents for purposes of consolidated balance sheet classification and the consolidated statements of cash flows. The Company maintains bank balances, which, at times, may exceed federally insured limits. Balances are monitored regularly, and no losses have been experienced in such accounts. Accounts receivable and allowance for doubtful accounts: Accounts receivable are carried at original invoice amount less an estimate made for doubtful accounts based on a review of all outstanding amounts at period-end. Management determines the allowance for doubtful accounts by identifying troubled accounts and by using historical experience with customers to determine which specific accounts need to be allowed for. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded when received. Accounts receivable are considered past due when outstanding longer than the contractual payment terms, which are generally between 30 and 75 days. Management does not believe an allowance is necessary for the years ended December 31, 2017 and 2016. Concentration of credit risk related to accounts receivable is limited to major customers, which are those that individually represent 10 percent or more of revenue. For the year ended December 31, 2017, three customers accounted for 66 percent of total revenue in the aggregate. Accounts receivable from these customers totaled approximately $6,978,000 as of December 31, 2017. Concentration of credit risk related to accounts receivable is limited to major customers, which are those that individually represent 10 percent or more of revenue. For the year ended December 31, 2016, two customers accounted for 25 percent of total revenue in the aggregate. Accounts receivable from these customers totaled approximately $2,600,000 as of December 31, 2016. Prepaid expenses: Prepaid expenses consist of insurance, licensing fees, subscriptions and various service agreements. The prepaid balances are expensed on the straight-line basis over the expense’s related service period. Fixed assets: Fixed assets are stated at historical cost less accumulated depreciation and amortization. Repairs and maintenance costs are expensed as incurred. Depreciation and amortization are computed utilizing the straight-line method over the assets’ estimated useful lives, which range from three to seven years. Leasehold improvements are amortized over the shorter of their lease terms or estimated useful lives. Software development includes internal and external costs capitalized after the preliminary project stage and during the application development stage of the software. Depreciation and amortization are recorded as selling, general and administrative expenses and totaled approximately $750,000 and $640,000 for the years ended December 31, 2017 and 2016, respectively. Revenue recognition: The Company generally recognizes revenue from product sales, net of any promotional and loyalty discounts, when leads are delivered to the customer. Discounts totaled approximately $1,481,000 and $616,000 at December 31, 2017 and 2016, respectively. Customer deposits: The Company instituted a policy requiring deposits for a new independent insurance agent to be used for future lead purchases. Deposits are recorded as a customer deposit liability when received and credited to revenue when leads are delivered to the customer. 8

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 1. Nature of Business and Summary of Significant Accounting Policies (Continued) Loyalty program: The Company provides independent agents with a loyalty program. The Company records loyalty expense and a corresponding liability as points are awarded to the independent agents. The estimated liability included in accrued liabilities are approximately $696,000 and $504,000 at December 31, 2017 and 2016, respectively, and represents the points available to be used and an estimate for breakage. Cost of services: The Company currently records all outside third-party costs related to delivering revenue as cost of services. Selling, general and administrative expenses: All internal costs as well as all outside third-party costs not directly related to delivering revenue are recorded as selling, general and administrative expenses. For the years ended December 31, 2017 and 2016, one vendor provided 64 percent of services to the Company, and two vendors provided approximately 32 percent of services to the Company, respectively. Those services relate to online marketing costs and the Company believes there are substantially the same services that could be provided by other vendors with no disruption to the Company’s operations. Online marketing and advertising costs: The Company charges advertising costs to expense as incurred. Advertising costs were approximately $43,483,000 and $35,375,000 for the years ended December 31, 2017 and 2016, respectively. Advertising costs consist primarily of list purchasing services, online marketing costs, industry-specific conferences, and promotional items to attract and obtain new agents. Share-based compensation: The majority owner, Quote Wizard EIP, LLC (EIP), offers compensation, in the form of EIP shares, to employees of the Company. As the awards vest, compensation expense is recognized in the Company’s consolidated financial statements given there are no employees in EIP. The vested unit value is accounted for as a liability or equity on EIP’s financial statements and a contribution to equity in the Company’s consolidated financial statements. Compensation cost is recorded on the Company’s consolidated statements of income for the EIP units vested. The Company has granted unit options to employees under its equity incentive plan. These options are accounted for as equity and compensation expense is recorded as the options vest based on the fair value at date of grant. Income taxes: The Company is a nontaxable entity, which provides that its members separately account for their shares of the Company’s income, deductions, losses and credits. Accordingly, no federal or state income tax expense or provision has been recognized in the accompanying consolidated financial statements. Management evaluated the Company’s tax positions and concluded that the Company had taken no uncertain tax positions that require adjustment to the consolidated financial statements to comply with the provisions of this guidance. The Company is no longer subject to tax examinations by the U.S. federal, state or local tax authorities for years before 2014. Use of estimates: Preparation of consolidated financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities, at the date of the consolidated financial statements, and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates. Significant estimates made by management, included in the consolidated financial statements, include loyalty point accrual and share-based compensation expense. 9

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 1. Nature of Business and Summary of Significant Accounting Policies (Continued) Recent accounting pronouncements: In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606), and subsequently updated it with ASU 2016-08, ASU 2016-10, ASU 2016-12 and ASU 2016-20. This standard and the related updates outline a single comprehensive model for companies to use in accounting for revenue arising from contracts with customers and supersede most current revenue recognition guidance, including industry-specific guidance. The core principle of the revenue model is that revenue is recognized when a customer obtains control of a good or service. A customer obtains control when it has the ability to direct the use of and obtain the benefits from the good or service. Transfer of control is not the same as transfer of risks and rewards as it is considered in current guidance. The Company will also need to apply new guidance to determine whether revenue should be recognized over time or at a point in time. ASU 2014-09, as deferred by ASU 2015-14, will be effective for annual reporting periods beginning after December 15, 2018, using either of two methods: (a) retrospective to each prior reporting period presented with the option to elect certain practical expedients, as defined within ASU 2014-09; or (b) retrospective with the cumulative effect of initially applying ASU 2014-09 recognized at the date of initial application and providing certain additional disclosures, as defined in ASU 2014-09. The Company has not yet selected a transition method and is currently evaluating the impact of the pending adoption of ASU 2014-09 on its consolidated financial statements. In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842). The guidance in this ASU supersedes the leasing guidance in Topic 840, Leases. Under the new guidance, lessees are required to recognize lease assets and lease liabilities on the consolidated balance sheet for all leases with terms longer than 12 months. Leases will be classified as either finance or operating, with classification affecting the pattern of expense recognition on the consolidated statement of income. The new standard is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years, with early application permitted. A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered into after, the beginning of the earliest comparative period presented in the consolidated financial statements, with certain practical expedients available. The Company is currently evaluating the impact of the pending adoption of the new standard on its consolidated financial statements. In May 2017, the FASB issued ASU 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting. ASU 2017-09 provides clarity when there are changes to the terms or conditions of a share-based payment award. The term modification is further defined by set criteria and the ASU provides guidance on how a modification should be accounted for if all the criteria are met. This guidance is effective for annual reporting periods beginning after December 15, 2017, and should be applied prospectively to an award modified on or after the adoption date. The Company is currently evaluating the impact of the pending adoption of the new standard on its consolidated financial statements. Note 2. Reclassification Approximately $43,100,000 and $34,600,000 of advertising costs for the years ended December 31, 2017 and 2016, respectively, were previously classified as cost of services on the consolidated statements of income have been reclassified to selling, general and administrative expenses. These costs are related to online marketing rather than direct cost of services. Both classifications are considered appropriate under U.S. GAAP, and the amounts have been reclassified as a matter of management preference. Changes are reflected in Note 1 above. 10

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 3. Operating Lease Agreements The Company leases office space under noncancellable lease agreements, with amendments, expiring in February 2021. Rent expense for operating leases totaled approximately $1,086,000 and $1,016,791 for the years ended December 31, 2017 and 2016, respectively. The Company opened a new office in Denver, Colorado, in the second quarter of 2016. Approximate future minimum rental payments under noncancellable operating lease agreements are as follows: Years ending December 31: 2018 $ 1,124,530 2019 1,161,937 2020 323,467 2021 14,238 $ 2,624,172 Note 4. Retirement and Compensation Plans The Company sponsors a 401(k) plan that covers all eligible employees. Employees are eligible to participate in the Company’s 401(k) plan on the first day of the month following their first 30 days of employment. Total compensation is eligible for deferral up to the Internal Revenue Service mandated maximum allowable limits. The plan allows for a Company match at a maximum rate of 4 percent of an employee’s compensation up to $265,000. Employer contributions to the plan totaled approximately $415,000 and $485,000 for the years ended December 31, 2017 and 2016, respectively. The Company is self-insured for dental for the years ended December 31, 2017 and 2016. The expense related to the dental insurance was approximately $71,000 and $91,000 for the years ended December 31, 2017 and 2016, respectively. On January 11, 2017, the Company granted 4,511,246 Class B member shares to a member, which were immediately fully vested. These shares will participate in distributions as defined in the LLC operating agreement only when the fair value of the Company is over $60 million. At the date of grant, the fair market value was insignificant, and as a result there was no compensation expense recorded for the year ended December 31, 2017. Under the Company’s option plan, there are 2,030,451 options available to grant and the Company granted 1,931,455 options on various dates during 2017, all of which are outstanding as of December 31, 2017. No options have been forfeited, exercised or expired during 2017 and none of the options are exercisable as of December 31, 2017. Options vest over four years, with 25 percent vested upon the one- year anniversary of the vesting commencement date and thereafter vest monthly. The options have a ten- year maturity, with an average remaining life of 9.7 years as of December 31, 2017. The weighted- average grant date fair value is $1.19 and the weighted-average exercise price is $0.44. Total compensation expense recorded in 2017 was approximately $178,000 and is included in selling, general and administrative expenses on the consolidated statement of income. Future compensation expense will be approximately $611,000 in 2018, 2019 and 2020 and approximately $433,000 in 2021. The fair value was determined based on an option-pricing model prepared by a valuation expert. 11

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 4. Retirement and Compensation Plans (Continued) One of the members of the Company, EIP, has issued EIP units to certain employees of the Company which are considered profit interest units. EIP has authorized 225,000 Class A EIP units and 250,000 Class B EIP units. The Board of Managers of EIP has the power and discretion to issue units and to determine the terms of the award, subject to the terms of the EIP’s amended and restated limited liability company agreement. The EIP Class A voting and Class B nonvoting units vest over a period of either 10 years or four years. A summary of the nonvested EIP employee units are as follows: Class A Fair Class B Fair Units Value Units Value Outstanding at December 31, 2015 101,612 $ 43.10 183,097 $ 4.44 Granted 23,391 13.54 73,500 1.27 Vested (33,468) 12.78 (34,348) 1.24 Forfeited (23,243) 12.78 (54,240) 1.24 Outstanding at December 31, 2016, restated 68,292 5.42 168,009 0.56 Granted 2,629 144.80 9,940 14.84 Vested (17,737) 97.11 (33,612) 11.11 Forfeited (2,322) 97.11 (10,256) 11.11 Outstanding at December 31, 2017 50,862 188.25 134,081 19.30 As of December 31, 2017, approximately $12,262,000, based on fair value at December 31, 2017, of unrecognized compensation expense related to the EIP employee unit grants are expected to be recognized over a weighted-average period of six years. The compensation expense recorded for vested units was recorded at either an average fair value or the fair value as of December 31, 2017, depending on whether the units vested were accounted for as equity or liabilities and totaled approximately $4,302,000 for the year ended December 31, 2017, which was recognized on the consolidated statement of income. As of December 31, 2016, approximately $464,000, based on fair value at December 31, 2016, of unrecognized compensation expense related to the EIP employee unit grants are expected to be recognized over a weighted-average period of 6.6 years. The compensation expense recorded for vested units was recorded at either an average fair value or the fair value as of December 31, 2016, depending on whether the units vested were accounted for as equity or liabilities and totaled approximately $482,000 for the year ended December 31, 2016, which was recognized on the consolidated statement of income. The EIP units vested by employees at December 31, 2017, were valued at approximately $5,500,000 and is made up of 71,813 Class A EIP vested units and 79,388 Class B EIP vested units. The fair value of the units is based on an estimate of the enterprise value of the Company, based on an option-pricing model, and unit holders will participate in distributions in a change in control only when the fair value of the Company is over $20,000,000. The EIP units vested by employees at December 31, 2016, were valued at approximately $1,300,000 and made up of 44,808 Class A EIP vested units and 50,926 Class B EIP vested units. The fair value of the units is estimated based on an estimate of the enterprise value of the Company, based on an option- pricing model, and unit holders will participate in distributions in a change in control only when the fair value of the Company is over $20,000,000. 12

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 5. Credit Facilities With Banks The Company has a revolving line of credit agreement with a bank. The agreement was amended in April 2017 to increase the maximum revolving balance of from $1,000,000 to $6,000,000, which was amended again in December 2017 to raise the maximum revolving balance to $8,000,000. The amendment requires that the maximum revolving balance be reduced back to $6,000,000 by May 2018. See Note 8 for additional amendments subsequent to December 31, 2017. The balances outstanding at December 31, 2017 and 2016, were $0 and $2,283,825, respectively. Interest is due monthly on the outstanding balance at the one-month LIBOR plus 1.85 percent (effective interest rate was 3.475 percent and 2.6625 percent at December 31, 2017 and 2016, respectively). As collateral, the Company has granted the bank a first lien security interest in all of its personal property assets and is guaranteed by the members. The line of credit agreement is set to expire on January 31, 2019. In association with the credit agreement, the Company has agreed to certain loan covenants. Requirements include the maintenance of a minimum asset coverage ratio and fixed charge coverage ratio as well as placing restrictions on the use of proceeds and the assumption of additional debt, among other things. Note 6. Notes Payable to Members In December 2017, the Company entered into unsecured subordinated notes payable with its partners totaling $3,000,000 with principal and interest of 10 percent compounded annually due upon maturity. The maturity date of the notes is December 1, 2019, and the notes contain prepayment penalties of 5 percent of the outstanding balances and acceleration of maturity date provisions in the event 15 percent or more of the Company’s assets or shares are sold to another company. The outstanding balances at December 31, 2017, were $3,013,151 and it is the intent of the Company that the notes to be repaid in 2018. Note 7. Commitments and Contingencies In March 2015, Holdings obtained a loan for the purpose of funding the purchase of the vested EIP units, as described in Note 4. The loan was for $3,150,000, has a 36-month term, an interest rate of 3.26 percent and monthly payments of principal and interest of $91,949. The loan matured in February 2018. The outstanding balance at December 31, 2017 and 2016, was approximately $181,900 and $1,259,900, respectively. The loan was secured by all assets of the Company and personally guaranteed by all of the individual members of the Company. In April 2016, Holdings obtained a loan for the purpose of funding the purchase of the vested EIP units as described in Note 4. The loan was for $1,040,000, has a 36-month term, an interest rate of 3.65 percent and monthly payments of principal and interest of $30,554. The loan matures in April 2019. The outstanding balance at December 31, 2017 and 2016, was approximately $446,000 and $788,900, respectively. The loan is secured by all assets of the Company and personally guaranteed by all of the individual members of the Company. In 2017, an unrelated entity filed a complaint against the Company for trademark infringement and unfair competition. In 2018, the Company reached a settlement with this entity whereby the Company has agreed to transfer certain domain names and has agreed to stipulations regarding future registrations. There were no additional costs incurred related to this complaint. 13

QuoteWizard.com, LLC and Subsidiary Notes to Consolidated Financial Statements Note 7. Commitments and Contingencies (Continued) In 2017, a trade secret and breach of contract lawsuit was filed against the Company. The parties agreed in 2018 to a cash settlement of $1,600,000, plus business guarantees that would entitle plaintiff to a 20 percent penalty on any revenue shortfall over the course of a three-year period (maximum penalty of $1,600,000). The cash settlement has been included in accrued liabilities at December 31, 2017, and is included in operating expenses at December 31, 2017. The 20 percent relates to future period, and as a result has not been recorded at December 31, 2017. Note 8. Subsequent Events Events that occurred subsequent to December 31, 2017, have been evaluated by the Company’s management through October 2, 2018, which is the date the consolidated financial statements were available to be issued. On January 5, 2018, Wizard Enterprises, LLC closed on its purchase agreement to acquire assets of Bantam Connect LLC, a Nevada limited liability company on the same date. No liabilities were assumed. The purchase price per the agreement required an initial cash payment of $3,000,000, to be adjusted for certain working capital adjustments required within the agreement and also requires issuance of 1,713,466 Class B units to be issued to sellers, valued at approximately $2,500,000. The Company is still in the process of allocating the net purchase price to the acquired assets, which included prepaid assets, fixed assets and intangible assets. In March 2018, the Company amended the line of credit. The amendment resulted in an increase in the maximum revolving balance of $15,000,000. At date of this report, the outstanding balance of the line of credit is approximately $9,300,000. On July 6, 2018, the loan set to mature in April 2019, held by Holdings and guaranteed by the Company, was paid in full by Holdings. In September 2018, the Company amended the line of credit agreement. The amendment resulted in an extension of the termination date to January 31, 2019. On July 3, 2018, the Company communicated to its customers that it would be discontinuing the loyalty program on August 1, 2018, and the rewards from that program would be redeemable through the end of July 2018. 14