Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PORTOLA PHARMACEUTICALS INC | d668991d8k.htm |

Charting Our Course Tuesday, January 8, 2019 Scott Garland President & CEO Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases you can identify these statements by forward-looking words, such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “potential,” “seek,” “expect,” “goal,” or the negative or plural of these words or similar expressions. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, and new risks emerge from time to time. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Please refer to our Annual Report on Form 10-K and our most recent Quarterly Report on Form 10-Q that we filed with the SEC for a description of risks and uncertainties that could impact future results. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update any forward-looking statements except as required by law. For investor discussions only. Not for promotional use.

Gaspar De Portola For investor discussions only. Not for promotional use.

For investor discussions only. Not for promotional use. Progress on our Journey to Success OCT NOV DEC JAN FEB MAR

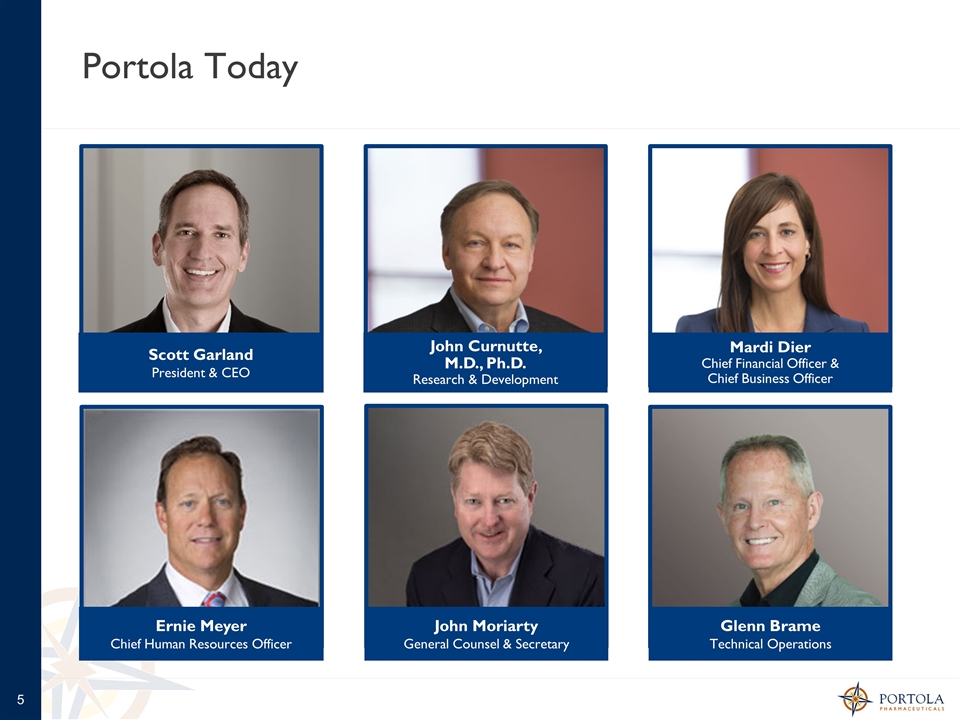

Portola Today Mardi Dier Chief Financial Officer & Chief Business Officer John Curnutte, M.D., Ph.D. Research & Development Scott Garland President & CEO Glenn Brame Technical Operations John Moriarty General Counsel & Secretary Ernie Meyer Chief Human Resources Officer

ANDEXXA For investor discussions only. Not for promotional use.

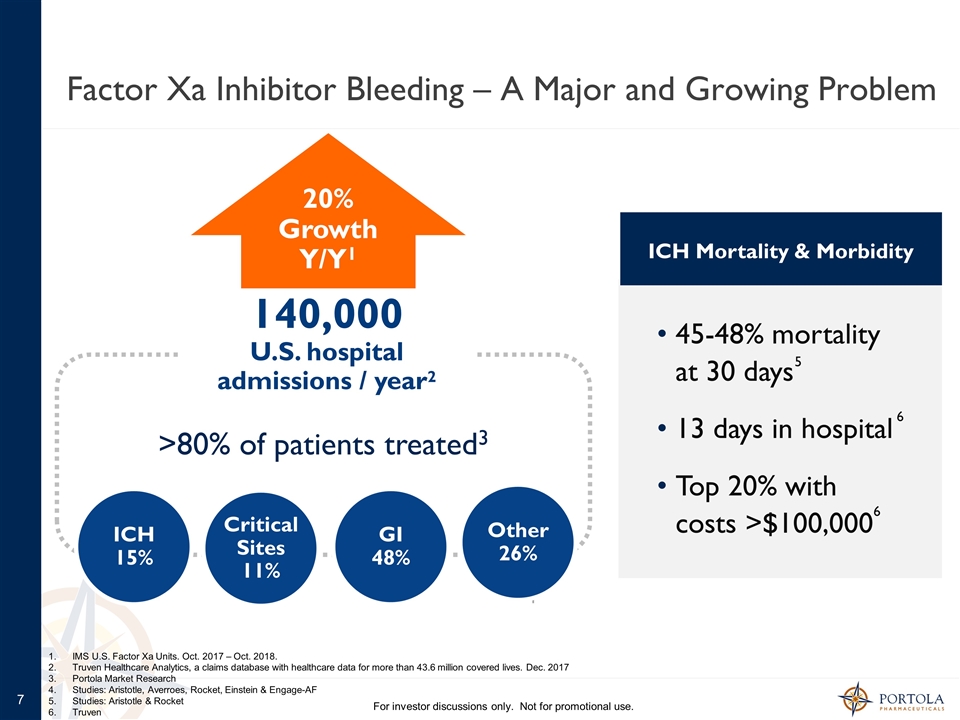

IMS U.S. Factor Xa Units. Oct. 2017 – Oct. 2018. Truven Healthcare Analytics, a claims database with healthcare data for more than 43.6 million covered lives. Dec. 2017 Portola Market Research Studies: Aristotle, Averroes, Rocket, Einstein & Engage-AF Studies: Aristotle & Rocket Truven Factor Xa Inhibitor Bleeding – A Major and Growing Problem For investor discussions only. Not for promotional use. 140,000 U.S. hospital admissions / year2 GI 48% ICH 15% Critical Sites 11% 20% Growth Y/Y1 >80% of patients treated3 45-48% mortality at 30 days 13 days in hospital Top 20% with costs >$100,000 ICH Mortality & Morbidity 4 5 6 6 Other 26%

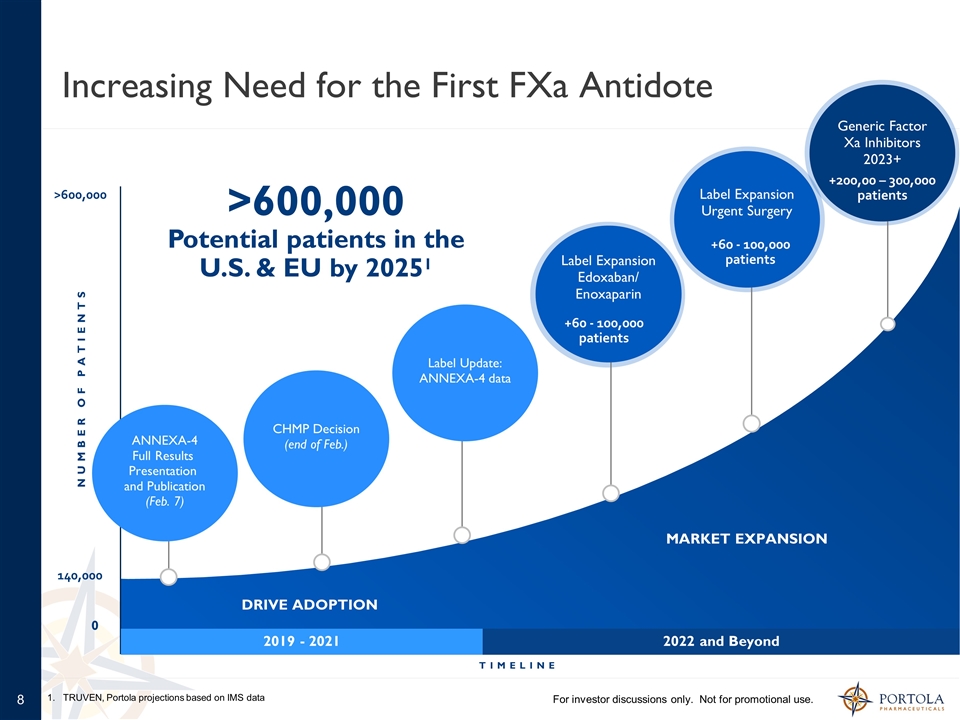

Increasing Need for the First FXa Antidote CHMP Decision (end of Feb.) 2019 - 2021 2022 and Beyond Label Update: ANNEXA-4 data ANNEXA-4 Full Results Presentation and Publication (Feb. 7) Label Expansion Edoxaban/ Enoxaparin Label Expansion Urgent Surgery Generic Factor Xa Inhibitors 2023+ +60 - 100,000 patients +60 - 100,000 patients +200,00 – 300,000 patients DRIVE ADOPTION MARKET EXPANSION TIMELINE NUMBER OF PATIENTS For investor discussions only. Not for promotional use. 1. TRUVEN, Portola projections based on IMS data 0 140,000 >600,000 >600,000 Potential patients in the U.S. & EU by 20251

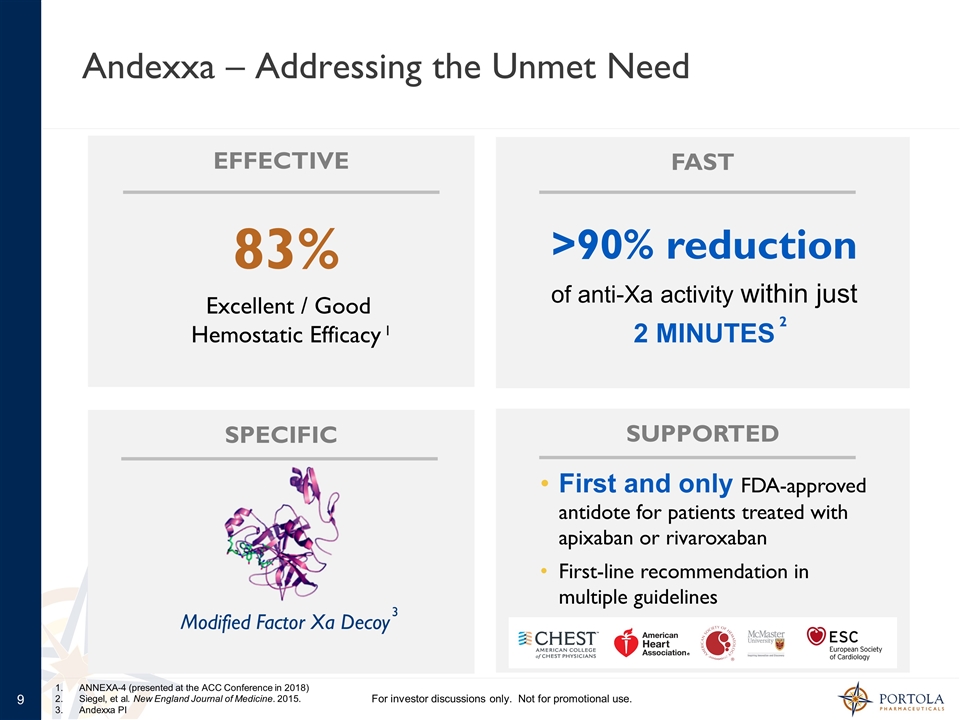

Andexxa – Addressing the Unmet Need 83% Excellent / Good Hemostatic Efficacy First and only FDA-approved antidote for patients treated with apixaban or rivaroxaban First-line recommendation in multiple guidelines Modified Factor Xa Decoy EFFECTIVE FAST SPECIFIC SUPPORTED >90% reduction of anti-Xa activity within just 2 MINUTES 1 2 3 ANNEXA-4 (presented at the ACC Conference in 2018) Siegel, et al. New England Journal of Medicine. 2015. Andexxa PI For investor discussions only. Not for promotional use.

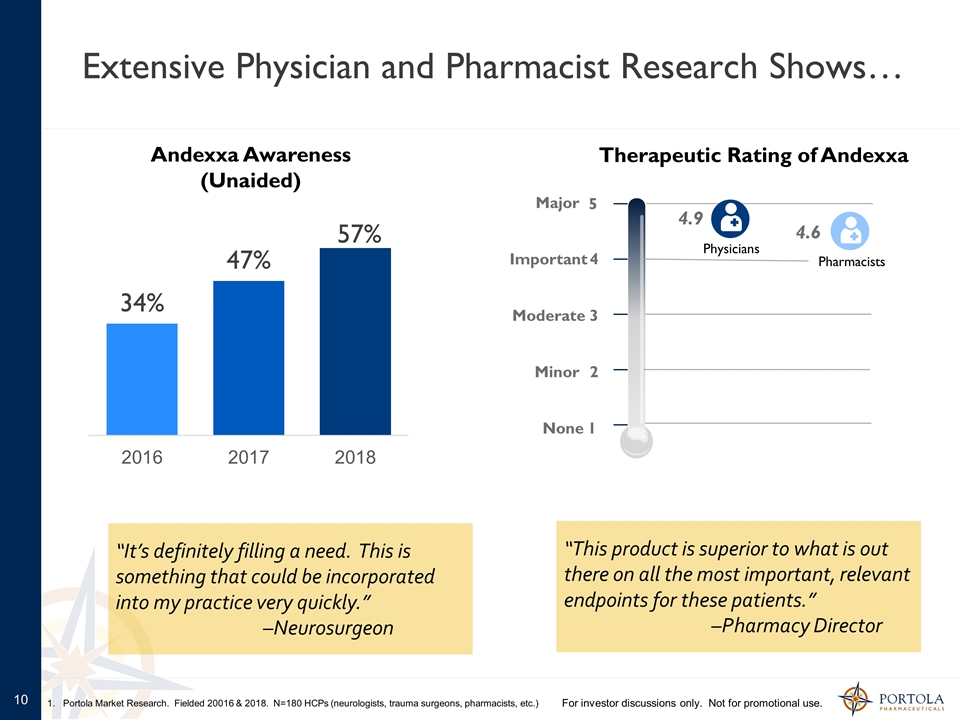

Extensive Physician and Pharmacist Research Shows… Andexxa Awareness (Unaided) Therapeutic Rating of Andexxa “This product is superior to what is out there on all the most important, relevant endpoints for these patients.” –Pharmacy Director For investor discussions only. Not for promotional use. 1. Portola Market Research. Fielded 20016 & 2018. N=180 HCPs (neurologists, trauma surgeons, pharmacists, etc.) 1 2 3 4 5 None Minor Moderate Important Major 4.6 Pharmacists Physicians 4.9 “It’s definitely filling a need. This is something that could be incorporated into my practice very quickly.” –Neurosurgeon

Broad Commercial Launch Underway GEN2 Approved Andexxa shipping this morning! Initiating Full Commercial Effort 78 reps on the ground, onboarding of 40 additional reps underway Launched comprehensive print/digital campaigns 60 HCPs trained for speakers bureau (75 by end of Q1) Ensuring Reimbursement & Access NTAP (up to $14k/claim from CMS) Specialty distributor consignment C- and J-Code HECON/Value proposition Establishing Andexxa as Standard of Care Inclusion in key clinical guidelines Increasing # of medical affairs liaisons Increasing medical congress presence Clarify limited data on PCCs Not approved, inconsistent, slow onset For investor discussions only. Not for promotional use.

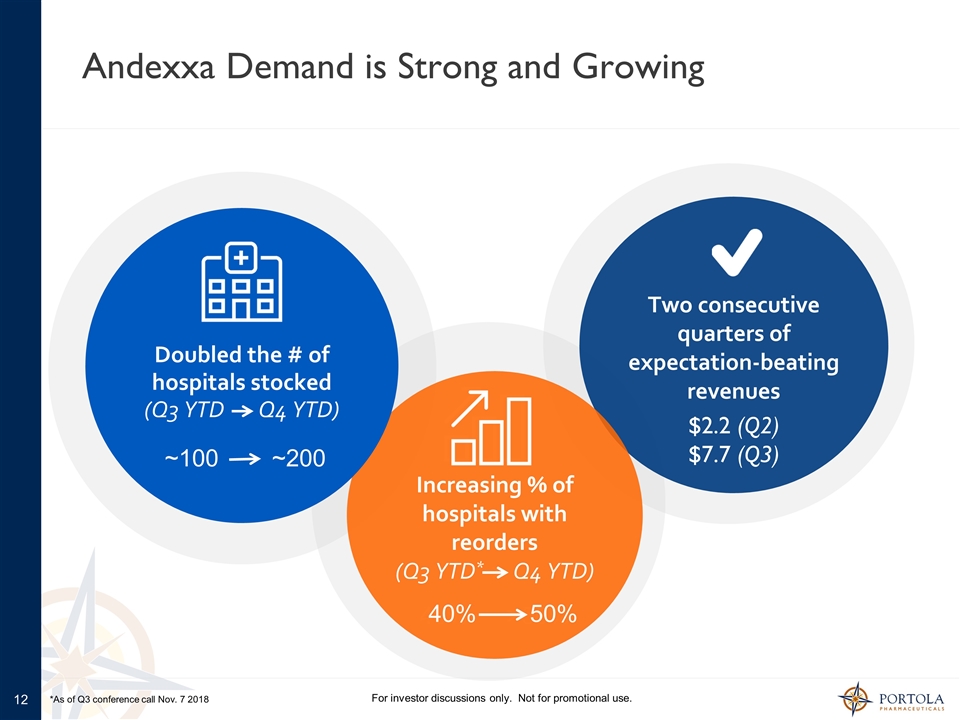

Andexxa Demand is Strong and Growing For investor discussions only. Not for promotional use. 40% 50% Two consecutive quarters of expectation-beating revenues $2.2 (Q2) $7.7 (Q3) 100 200 Increasing % of hospitals with reorders (Q3 YTD* Q4 YTD) Doubled the # of hospitals stocked (Q3 YTD Q4 YTD) ~100 ~200 40% 50% *As of Q3 conference call Nov. 7 2018

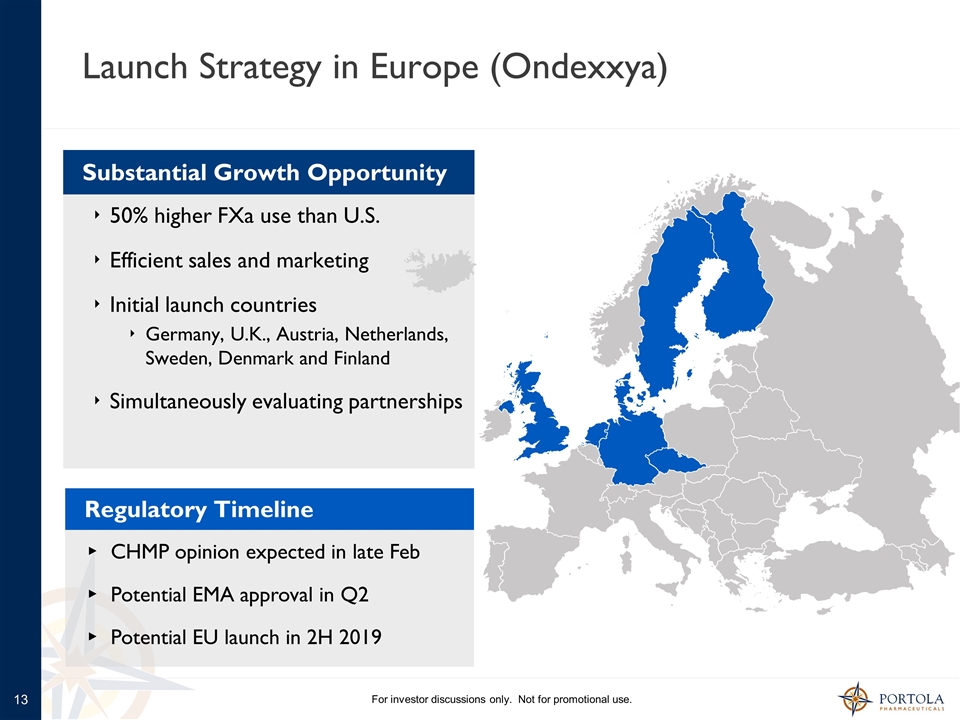

Launch Strategy in Europe (Ondexxya) For investor discussions only. Not for promotional use. Regulatory Timeline CHMP opinion expected in late Feb Potential EMA approval in Q2 Potential EU launch in 2H 2019 50% higher FXa use than U.S. Efficient sales and marketing Initial launch countries Germany, U.K., Austria, Netherlands, Sweden, Denmark and Finland Simultaneously evaluating partnerships Substantial Growth Opportunity

CERDULATINIB For investor discussions only. Not for promotional use.

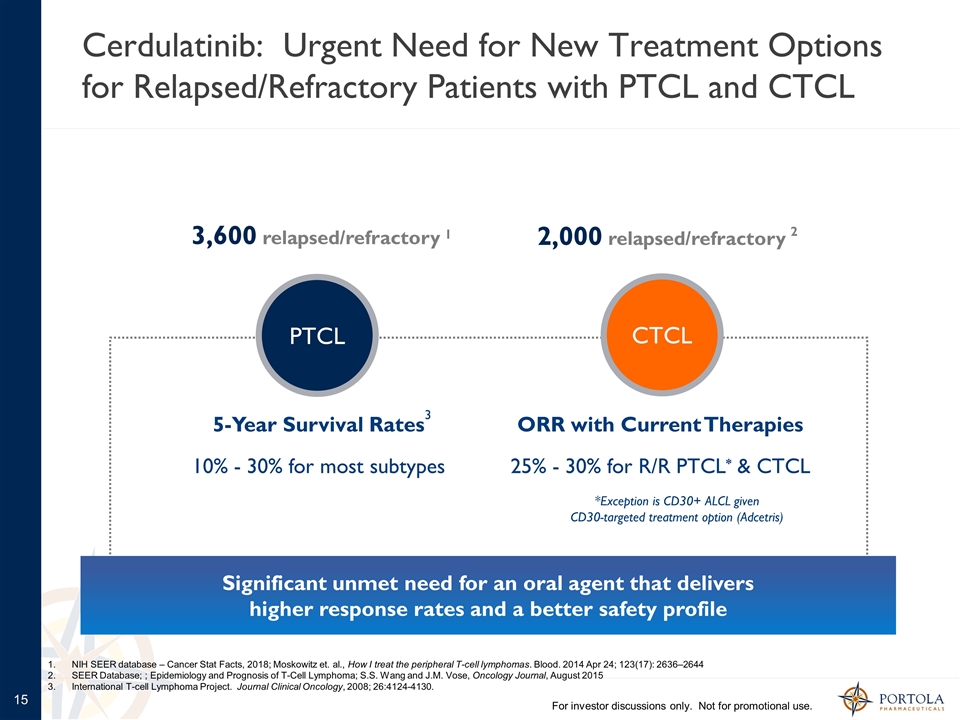

2,000 relapsed/refractory Cerdulatinib: Urgent Need for New Treatment Options for Relapsed/Refractory Patients with PTCL and CTCL For investor discussions only. Not for promotional use. Significant unmet need for an oral agent that delivers higher response rates and a better safety profile PTCL CTCL 3,600 relapsed/refractory ORR with Current Therapies 25% - 30% for R/R PTCL* & CTCL 5-Year Survival Rates 10% - 30% for most subtypes 1 2 3 *Exception is CD30+ ALCL given CD30-targeted treatment option (Adcetris) NIH SEER database – Cancer Stat Facts, 2018; Moskowitz et. al., How I treat the peripheral T-cell lymphomas. Blood. 2014 Apr 24; 123(17): 2636–2644 SEER Database; ; Epidemiology and Prognosis of T-Cell Lymphoma; S.S. Wang and J.M. Vose, Oncology Journal, August 2015 International T-cell Lymphoma Project. Journal Clinical Oncology, 2008; 26:4124-4130.

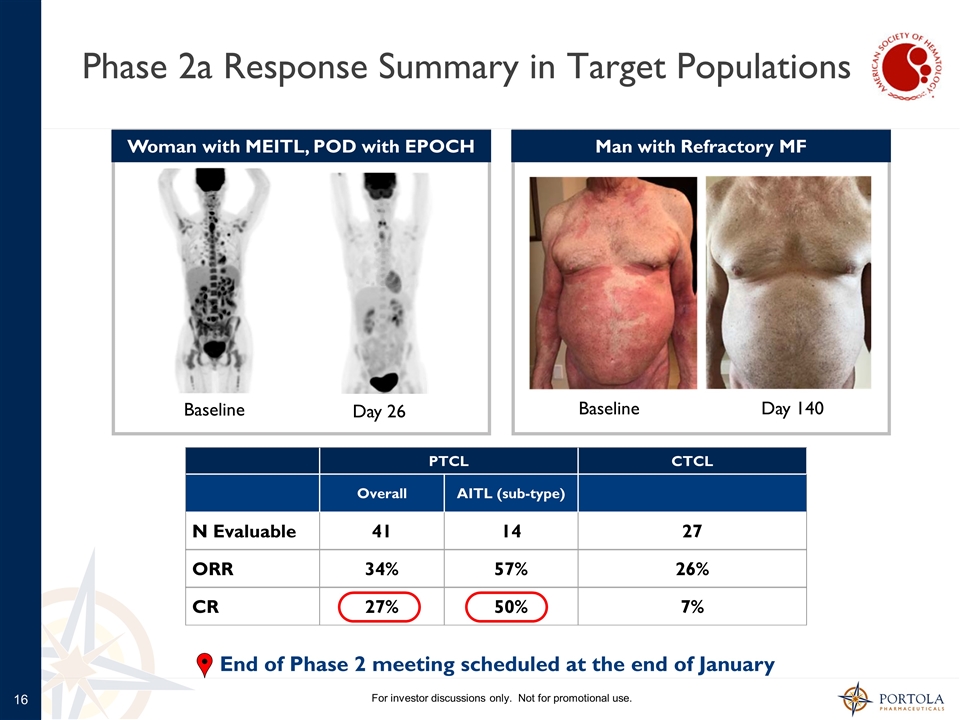

Phase 2a Response Summary in Target Populations For investor discussions only. Not for promotional use. PTCL CTCL Overall AITL (sub-type) N Evaluable 41 14 27 ORR 34% 57% 26% CR 27% 50% 7% Woman with MEITL, POD with EPOCH Baseline Day 26 Man with Refractory MF Baseline Day 140 End of Phase 2 meeting scheduled at the end of January

BEVYXXA For investor discussions only. Not for promotional use.

Focused Commercial Strategy on Centers Of Excellence For investor discussions only. Not for promotional use. Focused effort on a small number of high potential accounts Simultaneously exploring potential partnership opportunities

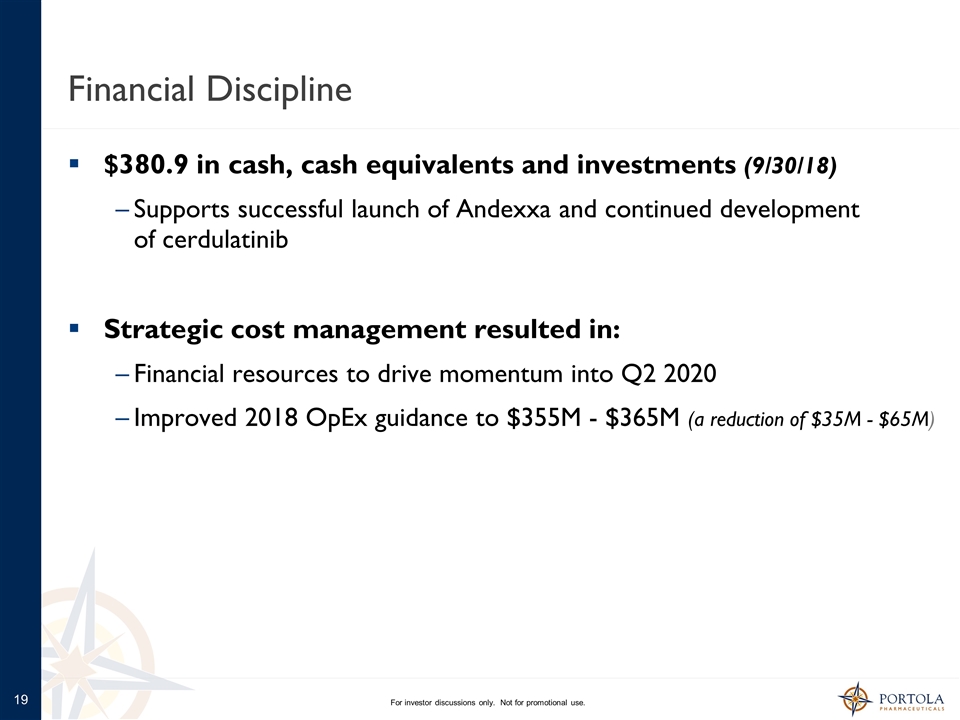

Financial Discipline $380.9 in cash, cash equivalents and investments (9/30/18) Supports successful launch of Andexxa and continued development of cerdulatinib Strategic cost management resulted in: Financial resources to drive momentum into Q2 2020 Improved 2018 OpEx guidance to $355M - $365M (a reduction of $35M - $65M) For investor discussions only. Not for promotional use.

For investor discussions only. Not for promotional use. Opportunity to impact millions of patient lives with Andexxa Progress and momentum in executing our plan We have the right team Portola in 2019…

NASDAQ: PTLA