Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STAAR SURGICAL CO | tv510384_8k.htm |

Exhibit 99.1

STAAR Surgical Company NASDAQ: STAA Investor Presentation | January 7, 2019

Forward Looking Statements All statements in this presentation that are not statements of historical fact are forward - looking statements, including statements about any of the following: any financial projections, including those relating to the plans, strategies, and objectives of management for future operations or prospects for achieving such plans, expectations for sales, revenue, earnings, marketing, addressable markets and clinical initiatives, regulatory approvals, quality, operations and other expense, or expense timing, success and timing of new or improved products, clinical trials, research and development activities, investment imperatives, and any statements of assumptions underlying any of the foregoing. Important factors that could cause actual results to differ materially from those indicated by such forward - looking statements are set forth in the Company’s Annual Report on Form 10 - K for the year ended December 29, 2017 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings.” We disclaim any intention or obligation to update or revise any financial projections or forward - looking statement due to new information or events. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties include the following: global economic conditions; changes in currency exchange rates; the discretion of regulatory agencies to approve or reject existing, new or improved products, or to require additional actions before approval (including but not limited to FDA requirements regarding the EVO Visian ICL family of lenses and international regulatory requirements to obtain a presbyopia correction claim for the EVO Visian ICL with EDOF), or to take enforcement action; research and development efforts; potential international trade disputes; the purchasing patterns of our distributors carrying inventory in the market; and the willingness of surgeons and patients to adopt a new or improved product and procedure. The Visian ICL with CentraFLOW, now known as EVO Visian ICL, is not approved for sale in the United States. 2

» ICL Overview » Current Market Opportunity » Roadmap to Expanded Opportunity » Strong 2018 Financial Performance - Anticipate Achieving Previously Provided Outlook, Reporting on 2/21/2019 » 2019 Outlook: Continued Growth 3 Agenda

99.4% of Patients Would Elect STAAR’s Implantable Collamer Lens (ICL) Again* 4 We transform lives by providing visual freedom through premium lens - based surgical correction of refractive error. *Patient Registry Survey Data on File ICL Patients ICL Ambassadors

ICL™ Patient Testimonials “Upgradeable, Replaceable”… I feel like a big part of health is using what your body already has. Visian ICL is in line with that because it’s keeping your eye completely intact. My eye is still my eye. EVE TORRES GRACIE JIU JITSU INSTRUCTOR, FORMER WWE DIVA, MOM I had my first opportunity to put my Visian ICL eyes to the test recently in the Brazilian Rainforest, and it couldn’t have been more exciting to be able to spot rare species better than ever. 5 PHIL TORRES ENTOMOLOGIST, TV SHOW HOST

ICL Metrics *STAAR sells directly in the U.S., Canada, the U.K., Spain, Germany & Japan and through a Hybrid sales model along with distributors in China, South Korea, and India, and through distributors in the remaining countries. 900K+ ICLs™ Implanted Globally 75+ Countries* 84% ICL Revenue Mix Preliminary Q4 2018 54% ICL™ Unit Growth Preliminary Q4 2018 Y/Y 6

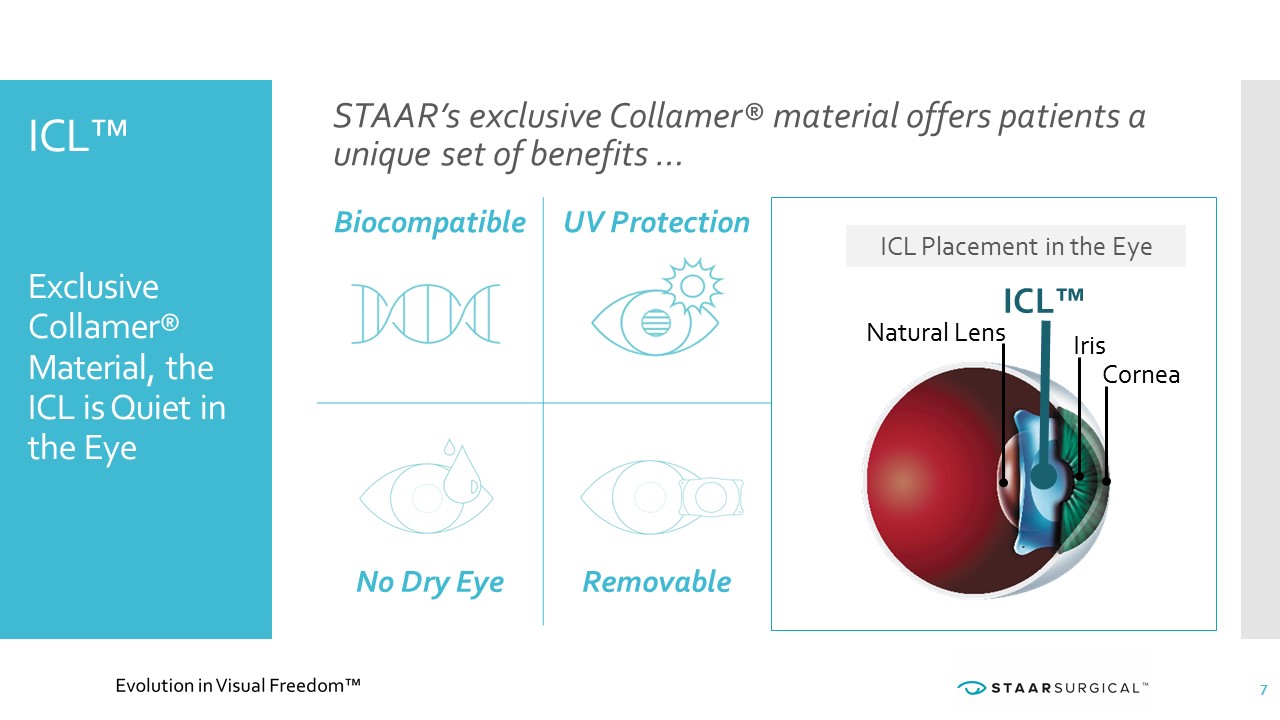

Biocompatible UV Protection No Dry Eye Removable ICL™ Exclusive Collamer® Material, the ICL is Quiet in the Eye Iris Cornea ICL™ Natural Lens 7 STAAR’s exclusive Collamer® material offers patients a unique set of benefits … ICL Placement in the Eye

EVO ICL™ Safety and Effectiveness Outcomes Reported in Literature 8 Stellar Safety and Effectiveness of STAAR’s EVO Lens 2018 Literature Review authored by Dr. Mark Packer is a review of 67 papers from 10 countries* Review covers over 6,000 Eyes of data with up to 5 years of Follow - Up Outstanding outcomes for Safety and Effectiveness Conclusion: “Improved safety and effectiveness across a broad range of refractive errors make EVO an attractive option for surgeons and patients”. *Published in Clinical Ophthalmology, December 2018

9 The Market Opportunity Myopia, Presbyopia and Growth

Myopia An Inability to Focus at Distance due to Genetic and/or Environmental Factors • More screen use and near vision work • Less time spent outdoors • Positive correlation between education level and myopia • ICL™ Label Approved Use is - 3 to - 20 diopters of vision correction *“Ophthalmology 2016;123:1036 - 1042 © 2016 by the American Academy of Ophthalmology;” Myopia incidence was estimated at 1.4B people globally at time of study growing to 4.8B people by 2050 or predicted 50% of global pop. Singapore Health Board 10 Predicted to Impact 50% of Global Population by 2050…

Existing Market Annual Refractive Procedures* Procedures by Geography Top 10 Markets 82,722 84,500 86,860 87,360 93,631 139,360 161,044 229,262 733,850 944,330 U.K. Italy Japan Spain Canada Germany South Korea India US China 4.0 million procedures annually LASIK ~90% market share, but U.S. LASIK procedures down 50% from 10 years ago indicating a significant growth opportunity for premium ICL Existing market primarily addresses Myopia (distance) vision correction and Myopia with astigmatism (curvature of eye) Procedures include LASIK, SMILE, ICL, RLE and PRK ICL is taking market share! 11 * Company internal estimates and December 2018 Market Scope Report data.

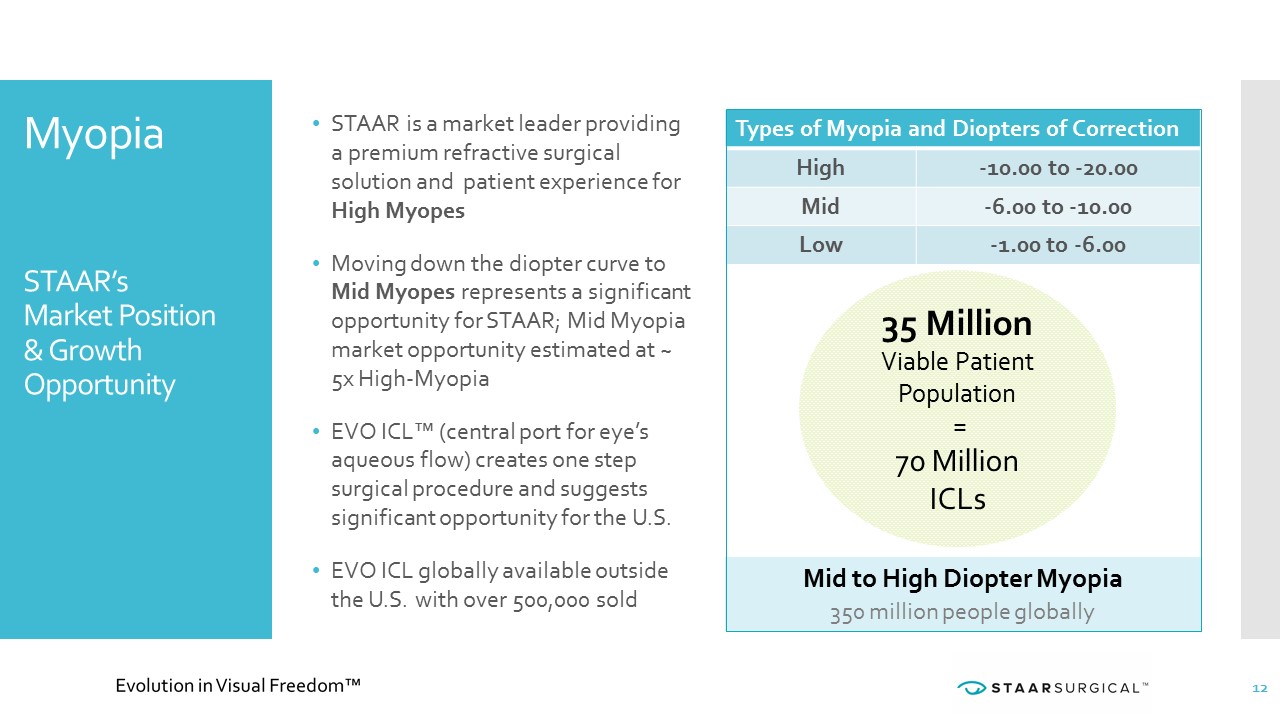

Myopia STAAR’s Market Position & Growth Opportunity • STAAR is a market leader providing a premium refractive surgical solution and patient experience for High Myopes • Moving down the diopter curve to Mid Myopes represents a significant opportunity for STAAR; Mid Myopia market opportunity estimated at ~ 5x High - Myopia • EVO ICL™ (central port for eye’s aqueous flow) creates one step surgical procedure and suggests significant opportunity for the U.S. • EVO ICL globally available outside the U.S. with over 500,000 sold. 12 Types of Myopia and Diopters of Correction High - 10.00 to - 20.00 Mid - 6.00 to - 10.00 Low - 1.00 to - 6.00 Mid to High Diopter Myopia 350 million people globally 35 Million Viable Patient Population = 70 Million ICLs

Presbyopia An Inability to Focus on Near Objects due to an Age Related Loss of Lens Accommodation • Current refractive options for presbyopia are Monocular/LASIK/RLE • ICL could be a more desirable solution to patients seeking Visual Freedom • ICL Not laser/equipment dependent; no large capital investment required • ICL Bilateral placement - no emmetropia qualifier • ICL targets each eye for desired correction Impacts 1.7 Billion People Globally… Reading Glasses 13

Presbyopia 14 Early Presbyopia 550 million people globally 55 Million Viable Patient Population = 110 Million ICLs * Company internal estimates; refract ive market is currently approximately 3.6 million procedures (eyes) annually based on Marketscope Report data. • STAAR aims to become a market leading refractive surgical solution and patient experience for the 550 million Early Presbyopes, ages 45 to 55 • Multi - site European clinical trial for EVO ICL with EDOF { presby lens } currently underway • Initially targeting CE Mark approval (31+ countries) TAM variables include Epidemiological Data; Distribution of Uncorrected Refractive; Error by Age; Patient Ability to Pay; Proximity to Qualified Surgeon; Willingness to Undergo a Refractive Procedure; and Surgeon Input.

Growth Opportunities Current and Potential Future Drivers of Growth • ICL capturing vision correction (refractive surgery) market share drives base business growth • ICL Premium and Primary product positioning supported by clinical data and industry - leading patient satisfaction • Myopia • Moving down the diopter curve expands STAAR’s Myopia market opportunity • EVO in the U.S. represents game - changing market opportunity for the ICL • Presbyopia • EVO with EDOF (Presby Lens) in CE Mark Countries • The only bilateral intraocular custom solution for Presby treatment • ICL advantages supported by clinical studies and strategic cooperation agreements with committed growth create barriers to entry 15

720,000 1,500,000 Mid to High Myopia Early Presbyopia 16 * Company internal estimates updated October 31, 2018 STAAR is targeting 2.22 million eyes annually, which would represent an annual revenue opportunity > $1 Billion * Significant Visual Freedom Market Opportunity for Premium Refractive Procedures with EVO

17 Financial Overview Recent Results, Outlook and Growth Drivers

Growth Results STAAR’s Revenue Growth Leads Sector 18

19.3 21.0 20.1 22.1 20.4 21.9 23.5 24.9 27.1 33.9 31.8 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 68.4% 70.8% 70.9% 71.7% 74.4% 75.1% 2015 2016 2017 Q1 2018 Q2 2018 Q3 2018 $82.4 2016 $90.6 2017 $ Millions Revenue Gross Margin YTD $92.8 2018 19 Business Results 2016 – 2018 As Reported, YTD Volume Increases Fuel Gross Margin: - Nidau Production - Presbyopia Clinicals - Presbyopia Production - Commercial Buildout - Digital Marketing - Surgeon Support - Patient Outreach +7% Y/Y Growth +10% Y/Y Growth +41% Y/Y Growth

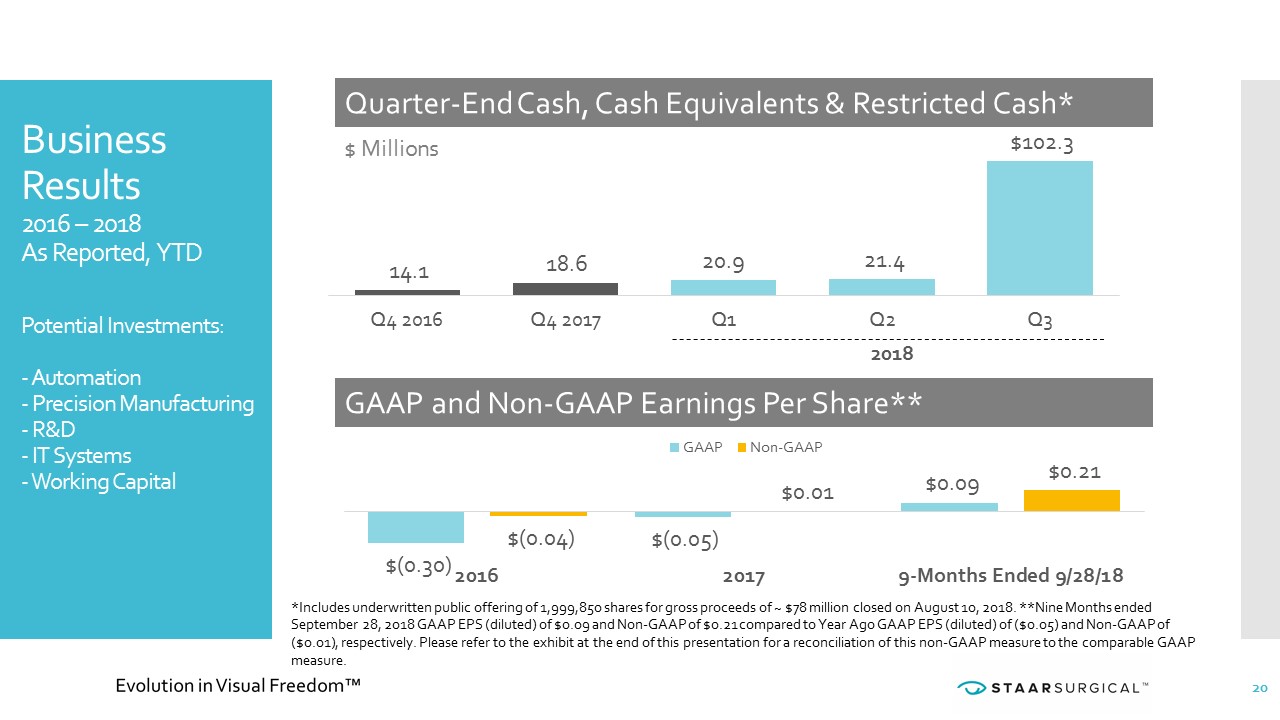

2018 Business Results 2016 – 2018 As Reported, YTD Potential Investments: - Automation - Precision Manufacturing - R&D - IT Systems - Working Capital Quarter - End Cash, Cash Equivalents & Restricted Cash* GAAP and Non - GAAP Earnings Per Share** 14.1 18.6 20.9 21.4 $102.3 Q4 2016 Q4 2017 Q1 Q2 Q3 $ Millions $(0.30) $(0.05) $0.09 $(0.04) $0.01 $0.21 2016 2017 9-Months Ended 9/28/18 GAAP Non-GAAP *Includes underwritten public offering of 1,999,850 shares for gross proceeds of ~ $78 million closed on August 10, 2018. **N ine Months ended September 28, 2018 GAAP EPS (diluted) of $0.09 and Non - GAAP of $0.21 compared to Year Ago GAAP EPS (diluted) of ($0.05) and Non - GAAP of ($0.01), respectively. Please refer to the exhibit at the end of this presentation for a reconciliation of this non - GAAP measure to the comparable GAAP measure. 20

2018 Business Outlook Outlook provided as updated on October 31, 2018 Revenue Growth Percentage Target Increase Should Exceed 30% Full Year 2018 Over 2017 GAAP Net Income Fully expect to maintain GAAP Net Income profitability for the year • Achieve Full Year Positive Cash Flow • Cash Balance Increase Full Year 2018 over 2017 We are announcing today, January 7, 2019, that we anticipate achieving the outlook above when we report Fiscal 2018 full year results on or about February 21 st 21

Introducing 2019 Business Outlook* January 7, 2019 Revenue Growth Percentage Target Increase 20% Full Year 2019 Over 2018 (Includes $2.6M reduction in sales of low margin injector parts) ICL Unit Growth Percentage Target Increase 30% Full Year 2019 Over 2018 GAAP Net Income Expect to increase GAAP Net Income Profitability for the Year Achieve Full Year Positive Cash Flow • Cash Balance Increase Full Year 2019 over 2018 * Note that STAAR may incur charges, realize gains or losses, incur financing costs or interest expense, or experience other ev ent s in 2019 that could cause actual results to vary materially from this outlook. 22

Growth Drivers 2019 » Continued market penetration in China where share has increased 5x in less than three years » U.S. market returns to growth with introduction of the Toric ICL for astigmatism in Q4’18 » EU market upside with potential Presbyopia approval 23 » Continued market share gains in Mid - to - lower diopter ( - 6 to - 10) lenses » Increasing investment in DTC marketing and patient education » Strategic cooperation agreements and alliances w/ global partners at contracted unit volumes and price

STAAR Surgical Company 2018 - 2020 24 Millions of Eyes “Millions of Eyes” Global Opportunity – Myopia and Presbyopia Revenue Growth 20%+ Annual Revenue Growth Goal Profitability Targets Targeting Achievement of Sustained Profitability Margin Expansion Gross Margin Improvement & Cash Generation Growth Continues Product Expansion EVO ICL Product Family Expansion – Myopia and Presbyopia EDOF Global Partners Growing Global Partners – Strategic Agreements Secure Base We Believe There is Substantial Growth Opportunity…

STAAR Surgical Company NASDAQ: STAA Investor Presentation | January 7, 2019