Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LUMINEX CORP | a2019jpmpressreleaseexhibi.htm |

| 8-K - FORM 8-K - LUMINEX CORP | form8-k1719.htm |

JP Morgan Healthcare Conference Investor Presentation Nachum “Homi” Shamir President and Chief Executive Officer January 9, 2019 CONFIDENTIAL

Safe Harbor Statement Certain statements made during the course of this presentation may not be purely historical and consequently may be forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements made regarding: our Licensed Technologies Group model and the ability of our licensees and installed base to drive future growth; the ability of our technology to enhance productivity and efficiency; our financial position and long-term revenue growth; our ability to integrate our acquisition of MilliporeSigma flow cytometry business; our molecular diagnostic business model, the markets we are targeting, market segmentation, expected growth of such markets, and the ability of our products to address those markets; sales of our products, their technical capabilities, and the anticipated market size and acceptance, demand and regulatory environment and approvals therefor; our direct sales efforts; our system placements; our system and assay product pipeline and anticipated timelines for regulatory approvals and market releases, including for ARIES® and VERIGENE® instrumentation and assays; market opportunity for ARIES® and VERIGENE; functionality and benefits of ARIES® and VERIGENE and competitive position; reimbursement trends; our ability to drive growth through investment in R&D and next generation systems and focus on operating leverage and managing operating costs; our long-term financial targets; our key steps and strategies for growth; our strategic outlook and growth plan for our business for 2019 and beyond; operational trends, including those related to sales of systems, assays, consumables, and royalty revenues; competitive threats and products offered by other companies; our business outlook, financial targets and projections about revenues, cash flow, system shipments, expenses and market conditions, and their anticipated impact on Luminex for 2019 and beyond; and, any statements of the plans, strategies and objectives of management for future operations. These forward-looking statements speak only as of the date hereof and are based on our current beliefs and expectations and are subject to known or unknown risks and uncertainties some of which are beyond our control that could cause actual results or plans to differ materially and adversely from those anticipated in the forward-looking statements. Factors that could cause or contribute to such differences are detailed in our annual, quarterly, or other filings with the Securities and Exchange Commission. We undertake no obligation to update these forward- looking statements. Also, certain non-GAAP financial measures as defined by SEC Regulation G, may be covered in this presentation. To the extent that any non- GAAP financial measures are covered, a presentation of and reconciliation to the most directly comparable GAAP financial measures will be included in this presentation may be available on our website at www.luminexcorp.com in accordance with Regulation G. complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 2

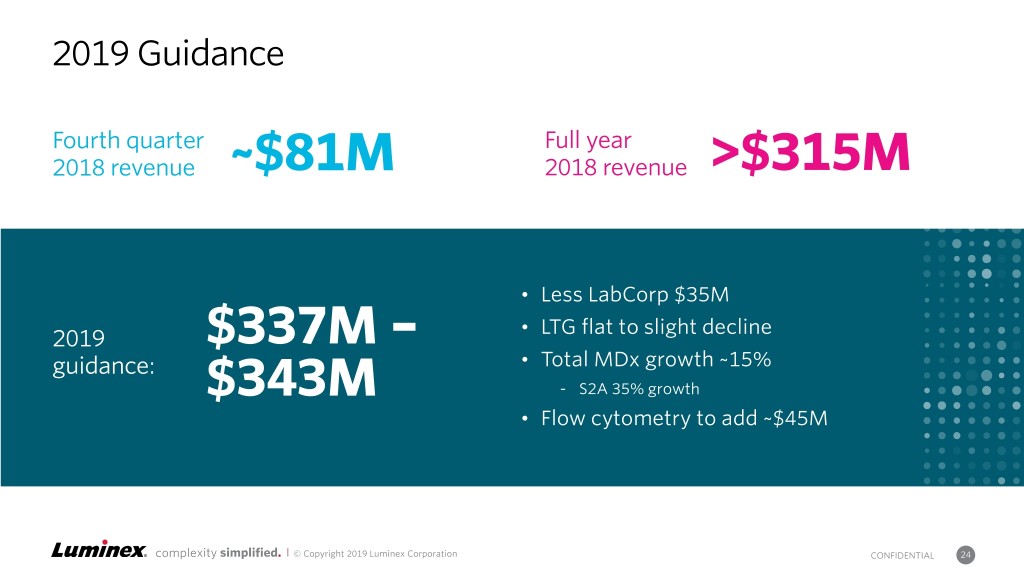

Preliminary Q4 and 2018 Revenue Fourth quarter Full year 2018 revenue ~$81M 2018 revenue >$315M • Total LTG revenue of over $41M, up 23% • Total LTG revenue of $149M, up 5% vs. the fourth quarter of 2017 vs. the full year 2017 • Total MDx revenue of ~$39M, a decline of • Total MDx revenue of ~$164M, up 1% 11% vs. the fourth quarter of 2017 vs. the full year 2017 ‒ Total MDx revenue was up ~21% excluding the ‒ Total MDx revenue was up ~13%, excluding the $11M departure of non-CF LabCorp revenue $13M departure of non-CF LabCorp revenue ‒ The MDx sample to answer portfolio generated ‒ MDx sample to answer portfolio generated $18M in the quarter, a 41% increase over the over $62M for the year, a 34% increase over the fourth quarter of 2017 full year 2017 complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 3

Introduction Molecular Diagnostics Group (MDx) Licensed Technologies Group (LTG) Flow Cytometry (IRIS) complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 4

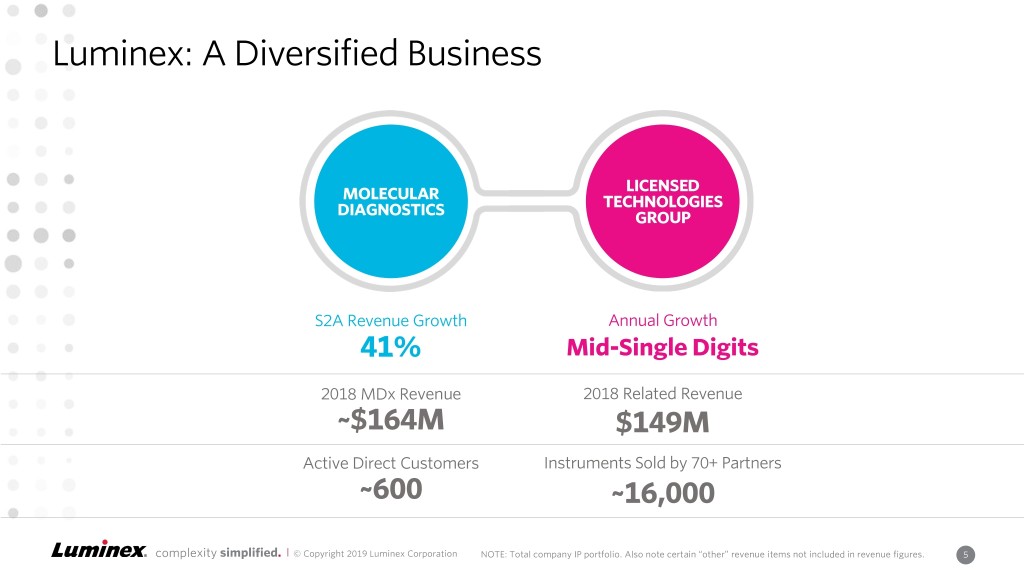

Luminex: A Diversified Business LICENSED MOLECULAR TECHNOLOGIES DIAGNOSTICS GROUP S2A Revenue Growth Annual Growth 41% Mid-Single Digits 2018 MDx Revenue 2018 Related Revenue ~$164M $149M Active Direct Customers Instruments Sold by 70+ Partners ~600 ~16,000 complexity simplified. | © Copyright 2019 Luminex Corporation NOTE: Total company IP portfolio. Also note certain “other” revenue items not included in revenueCONFIDENTIAL figures. 5

Luminex: Our Future Together LICENSED MOLECULAR FLOW TECHNOLOGIES CYTOMETRY DIAGNOSTICS GROUP S2A Revenue Growth Annual Growth Annual Growth 41% Mid-Single Digits High-Single Digits 2018 MDx Revenue 2018 Related Revenue 2018 Related Revenue ~$164M $149M ~$40M Active Direct Customers Instruments Sold by 70+ Partners Active Installed Base ~600 ~16,000 ~5,000 complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 6

Molecular Diagnostics

Quarterly S2A MDx Revenue* On Track to Achieve ~$100M >260 Run-Rate Target by YE19 VERIGENE® and ~$25M ARIES® Systems placed under contract in $18M 2018 $13M $10M $7M Entire VERIGENE® and ARIES® 4Q15 4Q16 4Q17 4Q18 4Q19E infectious disease test menu driving growth complexity simplified. | © Copyright 2019 Luminex Corporation *Approximate dollar amounts CONFIDENTIAL 8

Sample to Answer (S2A) VERIGENE® ARIES® Active ~600 $100,000 $55,000 Customers Avg Annual Revenue/ Avg Annual Revenue/ Active Customer* Active Customer* Syndromic Assays: Targeted Assays: BC-GN, BC-GP, Bordetella, C. diff, 360 EP, RP Flex Flu A/B/RSV, GAS, GBS, HSV 1&2, LDTs, MRSA (2019) 1Q17 4Q18 complexity simplified. | © Copyright 2019 Luminex Corporation NOTE: Active Customer = Purchases in rolling 12-month period. Figures approximate. CONFIDENTIAL 9

VERIGENE® Systems Comparison ® ® Key Characteristics: VERIGENE I VERIGENE II Chemistry Nanoparticles Nanoparticles Consumables 4 1 Shipping/Storage Refrigerator/Freezer Ambient Storage Automation Level Manual Set-up and Transfer to Reader Fully Automated, Sample to Result Throughput per System 1 Flexible: 1-6 LIS Capabilities Unidirectional Bidirectional Flex Capabilities Respiratory Only All Assays ~57”W ~18”W complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 10

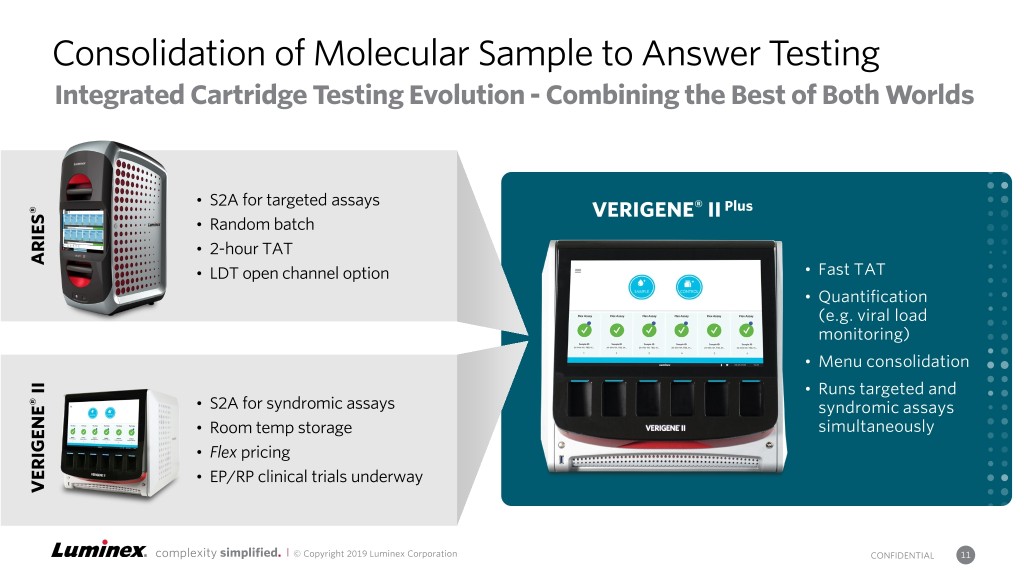

Consolidation of Molecular Sample to Answer Testing Integrated Cartridge Testing Evolution - Combining the Best of Both Worlds • S2A for targeted assays ® VERIGENE® II Plus • Random batch • 2-hour TAT ARIES • LDT open channel option • Fast TAT • Quantification (e.g. viral load monitoring) • Menu consolidation II • Runs targeted and ® • S2A for syndromic assays syndromic assays • Room temp storage simultaneously • Flex pricing • EP/RP clinical trials underway VERIGENE complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 11

Reimbursement Updates • Palmetto has changed its guidance on syndromic assay testing • Multiple Medicare Administrative Contractors Flex (MACs) expected to adopt the MolDx guidance Testing is • Some private payers have already issued the Path medical policy to explicitly cover panels Forward • Allows labs to be flexible in the face of reimbursement changes • Luminex likely to benefit from these changes complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 12

How We Win: Total Portfolio Selling Breadth of Solutions Superior Economic Value The Result • Platform ease of use; • Luminex well- • ~600 customers and throughput options positioned for shifting growing • Breadth of menu: reimbursement • MDx S2A revenue targeted and • Breadth/flexibility of $62M in 2018; syndromic tests test portfolio approaching $100M • Lab-developed test • Flex pricing option run rate by YE19 optionality complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 13

Licensed Technologies Group

Licensed Technologies Group: Overview Total Cumulative xMAP® LTG-Related Revenue, % of Total LTG-Related LTG: Systems Sold to Date* by Product Revenue, by Market >45% 16,000 of Total 14,900 Revenue 12,700 13% 32% 40% 40% 10,700 22% Mid- 33% Single 8,700 20% Digit Growth Long-Term 2011 2013 2015 2017 2018 FC NOTE: Our partners purchase and distribute the majority of the total complexity simplified. | © Copyright 2019 Luminex Corporation 15 number of multiplexing analyzers sold to date. CONFIDENTIAL

Licensed Technologies Group: Overview $350 Total Revenue* $1,200 Reported End-user Sales* $300 $1,000 $250 $800 $200 $600 $150 $400 $100 (Millions) (Millions) $50 $200 $- $- '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16 '17/'18 '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16 '17/'18 $120 $100 Consumables Royalties* $100 $80 $80 $60 $60 $40 $40 (Millions) (Millions) $20 $20 $- $- '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16 '17/'18 '03/'04 '05/'06 '07/'08 '09/'10 '11/'12 '13/'14 '15/'16 '17/'18 NOTE: Our partners purchase and distribute the majority of the total complexity simplified. | © Copyright 2019 Luminex Corporation 16 number of multiplexing analyzers sold to date. CONFIDENTIAL

Introducing the Newest Member of the xMAP® System Family Modern enhancements for the gold standard multiplexing platform ® SENSIPLEX™ System • 500-plex • 20 min read time • Full xMAP backwards- FLEXMAP 3D compatibility • Increased sensitivity & dynamic range 200 ™ ® • 100-plex • Improved automation • 45 min read time interface Luminex • Integrated Windows PC & large touchscreen ® • Robustness and • 50-plex serviceability • 60 min read time improvements MAGPIX complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 17

Licensed Technologies Group: Key Takeaways • 70+ partners investing in our technology; addressing large markets • Long-term contractual partnerships • Stable growth; highly profitable • Large and growing system base • SENSIPLEX™ on the horizon complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 18

Flow Cytometry

Strong financial outlook High quality differentiated Flow based on successful redesign flow cytometers with Cytometry and promising R&D pipeline strong brand recognition Strengths Strong R&D team Attractive growth focused on innovation market categories, & new product supported by development in strong market attractive markets fundamentals Experienced Broad geographic management team footprint, balanced supported by a highly between developed and engaged organization emerging markets complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 20

Portfolio: Balance of Performance and Affordability ® FlowSight ImageStream®X Cell Function & Mark II Mechanism Imaging FC Unique offering; combines high resolution imaging with flow cytometry easyCyte™ CellStream® easyCyte™ HT Advanced Phenotyping Phenotyping & Analysis Performance Muse® Analysis Cell Count, Product differentiation: ease of use, Viability, Cell automation, sensitivity & expandability Health, Phenotype Cell Counting & Vitality Entry portfolio Price complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 21

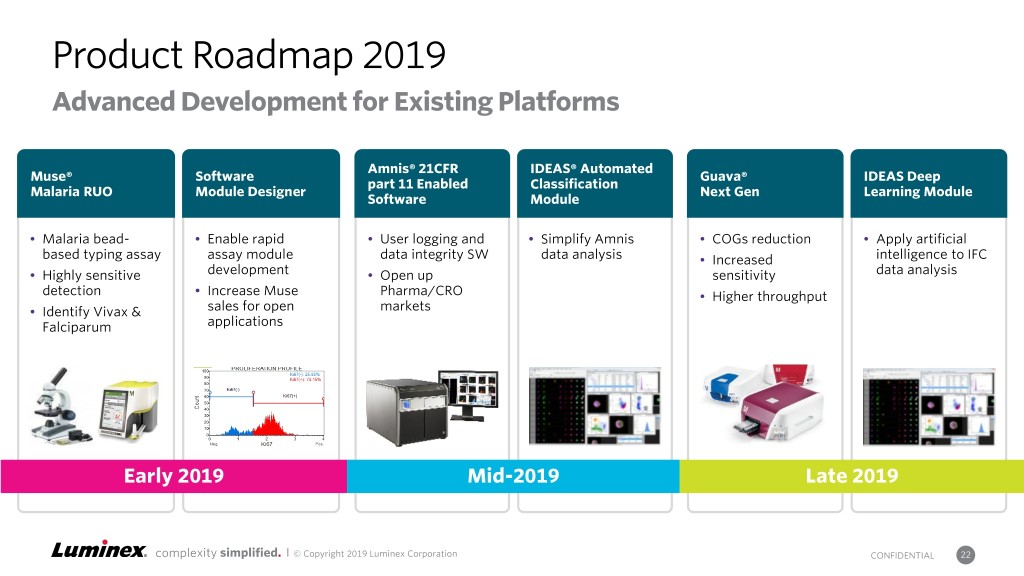

Product Roadmap 2019 Advanced Development for Existing Platforms Amnis® 21CFR IDEAS® Automated Muse® Software Guava® IDEAS Deep part 11 Enabled Classification Malaria RUO Module Designer Next Gen Learning Module Software Module Malaria bead- Enable rapid User logging and Simplify Amnis COGs reduction Apply artificial based typing assay assay module data integrity SW data analysis Increased intelligence to IFC Highly sensitive development Open up sensitivity data analysis detection Increase Muse Pharma/CRO Higher throughput Identify Vivax & sales for open markets Falciparum applications Early 2019 Mid-2019 Late 2019 complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 22

Financial Overview and Summary

2019 Guidance Fourth quarter Full year 2018 revenue ~$81M 2018 revenue >$315M • Less LabCorp $35M • LTG flat to slight decline 2019 $337M – guidance: • Total MDx growth ~15% $343M - S2A 35% growth • Flow cytometry to add ~$45M complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 24

Summary Molecular Diagnostics Group (MDx) Licensed Technologies Group (LTG) Flow Cytometry (IRIS) complexity simplified. | © Copyright 2019 Luminex Corporation CONFIDENTIAL 25

Thank You