Attached files

| file | filename |

|---|---|

| EX-32.1 - RCI HOSPITALITY HOLDINGS, INC. | ex32-1.htm |

| EX-31.2 - RCI HOSPITALITY HOLDINGS, INC. | ex31-2.htm |

| EX-31.1 - RCI HOSPITALITY HOLDINGS, INC. | ex31-1.htm |

| EX-23.2 - RCI HOSPITALITY HOLDINGS, INC. | ex23-2.htm |

| EX-23.1 - RCI HOSPITALITY HOLDINGS, INC. | ex23-1.htm |

| EX-21.1 - RCI HOSPITALITY HOLDINGS, INC. | ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2018

| [ ] | Transition report under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission file number: 001-13992

RCI HOSPITALITY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Texas

State or other jurisdiction of (I.R.S. Employer incorporation or organization Identification No.)

10737 Cutten Road, Houston, Texas 77066

(Address of principal executive offices)

(281) 397-6730

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $0.01 Par Value

(Title of class)

NASDAQ Stock Market LLC

Name of each exchange on which registered

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [X]

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ] Smaller reporting company [ ] Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $254,986,999.

As of November 30, 2018, there were approximately 9,704,600 shares of common stock outstanding.

NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, among other things, statements regarding plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements, which are other than statements of historical facts. Forward-looking statements may appear throughout this report, including without limitation, the following sections: Item 1 – “Business,” Item 1A – “Risk Factors,” and Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report on Form 10-K, and, in particular, the risks discussed under the caption “Risk Factors” in Item 1A and those discussed in other documents we file with the Securities and Exchange Commission (“SEC”). Important factors that in our view could cause material adverse effects on our financial condition and results of operations include, but are not limited to, the risks and uncertainties associated with operating and managing an adult business, the business climates in cities where it operates, the success or lack thereof in launching and building the company’s businesses, risks and uncertainties related to cyber security, conditions relevant to real estate transactions, and numerous other factors such as laws governing the operation of adult entertainment businesses, competition and dependence on key personnel. We undertake no obligation to revise or publicly release the results of any revision to any forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

| 2 |

TABLE OF CONTENTS

| 3 |

INTRODUCTION

RCI Hospitality Holdings, Inc. (sometimes referred to as “RCIHH” herein) is a holding company engaged in a number of activities in the hospitality and related businesses. All services and management operations are conducted by subsidiaries of RCIHH, including RCI Management Services, Inc.

Through our subsidiaries, as of September 30, 2018, we operate a total of 43 establishments that offer live adult entertainment, and/or restaurant and bar operations. We also operate a leading business communications company (the “Media Group”) serving the multibillion-dollar adult nightclubs industry. We have two principal reportable segments: Nightclubs and Bombshells. The terms “Company,” “we,” “our,” “us” and similar terms used in this Form 10-K refer to RCIHH and its subsidiaries. Excepting executive officers of RCIHH, any employment referenced in this document is not with RCIHH but solely with one of its subsidiaries. RCIHH was incorporated in the State of Texas in 1994.

Our fiscal year ends on September 30. References to years 2018, 2017, and 2016 are for fiscal years ended September 30, 2018, 2017, and 2016, respectively. Our fiscal quarters chronologically end on December 31, March 31, June 30 and September 30.

Our website address is www.rcihospitality.com. Upon written request, we make available free of charge our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the SEC under the Securities Exchange Act of 1934, as amended. Information contained in the website shall not be construed as part of this Form 10-K.

OUR BUSINESS

We operate several businesses, which we aggregate for financial reporting into two reportable segments – Nightclubs and Bombshells – and combine other operating segments into “Other.”

Nightclubs

We operate our nightclubs through the following brands that target many different demographics of customers by providing a unique, quality entertainment environment. Our adult entertainment clubs do business as Rick’s Cabaret, Jaguar’s Club, Tootsie’s Cabaret, XTC Cabaret, Club Onyx, Hoops Cabaret and Sports Bar, Scarlett’s Cabaret, Temptations Adult Cabaret, Foxy’s Cabaret, Vivid Cabaret, Downtown Cabaret, Cabaret East, The Seville, Silver City Cabaret, and Kappa Men’s Club. We also operate dance clubs under the brand name Studio 80.

We generate revenue on our nightclubs through the sale of alcoholic beverages, food and merchandise items; service in the form of cover charge, dance fees, and room rentals; and through other related means such as ATM commissions and vending income, among others.

During fiscal 2018, Nightclub segment sales mix was 46% service revenue; 39% alcoholic beverages; and 15% food, merchandise and other, which had a segment gross margin (revenues less cost of goods sold) of approximately 88%.

| 4 |

In May 2018, we acquired a club in Kappa, Illinois for $1.5 million, financed by a $1.0 million seller note with interest at 8%. The acquisition included real estate valued at $825,000, other non-real-estate business assets worth $180,000, with goodwill from the acquisition amounting to $495,000. See Note 13 to our consolidated financial statements for details of the transaction.

In September 2018, we acquired the remaining 49% interest in our joint venture partner for $1.55 million. See Note 13 to our consolidated financial statements for details of the transaction.

In November 2018, subsequent to our fiscal year ended September 30, 2018, we closed on the acquisition of one club in Chicago, Illinois and another club in Pittsburgh, Pennsylvania. The club in Chicago was acquired for a total consideration of $10.5 million with $6.0 million cash paid at closing and $4.5 million in a 6-year seller financed note with interest at 7%. The Pittsburgh club was acquired for a total consideration of $15.1 million, with $7.6 million cash paid at closing and two seller notes payable. The first note is a 2-year 7% note for $2.0 million, and the second is a 10-year 8% note for $5.5 million. See Note 19 to our consolidated financial statements for details of the transactions.

A list of our nightclub locations is in Item 2— “Properties.”

Bombshells

As of September 30, 2018, we operated six Bombshells, all in Texas with one in Dallas, one in Austin and four in the Houston area. The restaurant concept sets itself apart with décor that pays homage to all branches of the U.S. military. Locations feature local DJs, large outdoor patios, and more than 75 state-of-the-art flat screen TVs for watching your favorite sports. All food and drink menu items have military names. Bombshell Girls, with their military-inspired uniforms, are a key attraction. Their mission, in addition to waitressing, is to interact with guests and generate a fun atmosphere. Bombshells is also open to franchising as our subsidiary, BMB Franchising Services, Inc. has received approval to sell franchises in all 50 states.

We opened the first Bombshells in March 2013 in Dallas, quickly becoming one of the most popular restaurant destinations in the area. Within five years, six more opened in the Austin and Houston, Texas areas. In September 2016, we closed one Bombshells location in Webster, Texas. Of the six currently active Bombshells, four are freestanding pad sites and two are inline locations.

During fiscal 2018, sales mix was 60% alcoholic beverages and 40% food, merchandise and other, which had a segment gross margin (revenues less cost of goods sold) of 75%.

For a list of our Bombshells locations, refer to Item 2—“Properties.”

Media Group

The Media Group, made up of wholly-owned subsidiaries, is the leading business communications company serving the multibillion-dollar adult nightclubs industry and the adult retail products industry. It owns a national industry convention and tradeshow; two national industry trade publications; two national industry award shows; and more than a dozen industry and social media websites. Included in the Media Group is ED Publications, publishers of the bimonthly ED Club Bulletin, the only national business magazine serving the 2,200-plus adult nightclubs in North America, which collectively have annual revenues in excess of $5 billion, according to the Association of Club Executives. ED Publications, founded in 1991, also publishes the Annual VIP Guide of adult nightclubs, touring entertainers and industry vendors; produces the Annual Gentlemen’s Club Owners EXPO, a national convention and tradeshow; and offers the exclusive ED VIP Club Card, honored at more than 850 adult nightclubs. The Media Group produces two nationally recognized industry award shows for the readers of both ED Club Bulletin and StorErotica magazines, and maintains a number of B-to-B and consumer websites for both industries.

| 5 |

OUR STRATEGY

Our overall objective is to create value for our shareholders by developing and operating profitable businesses in the hospitality and related space. We strive to achieve that by providing an attractive price-value entertainment and dining experience; by attracting and retaining quality personnel; and by focusing on unit-level operating performance. Aside from our operating strategy, we employ a capital allocation strategy.

Capital Allocation Strategy

Our capital allocation strategy provides us with disciplined guidelines on how we should use our free cash flows; provided however, that we may deviate from this strategy if the circumstances warrant. We calculate free cash flow as net cash flows from operating activities minus maintenance capital expenditures. Using the after-tax yield of buying our own stock as baseline, we believe we are able to make better investment decisions unless there is another strategic rationale, in management’s opinion.

Based on our current capital allocation strategy:

| ● | We consider buying back our own stock if the after-tax yield on free cash flow climbs over 10%; | |

| ● | We consider disposing of underperforming units to free up capital for more productive use; | |

| ● | We consider acquiring or developing our own clubs or restaurants that we believe have the potential to provide a minimum cash on cash return of 25%-33%, absent an otherwise strategic rationale; | |

| ● | We consider paying down our most expensive debt if it makes sense on a tax adjusted basis, or there is an otherwise strategic rationale. |

COMPETITION

The adult entertainment and the restaurant/sports bar businesses are highly competitive with respect to price, service and location. All of our nightclubs compete with a number of locally owned adult clubs, some of whose brands may have name recognition that equals that of ours. The names “Rick’s” and “Rick’s Cabaret,” “Tootsie’s Cabaret,” “XTC Cabaret,” “Scarlett’s,” “Silver City,” “Club Onyx,” “Downtown Cabaret,” “Temptations,” “The Seville,” “Jaguars,” “Hoops Cabaret,” and “Foxy’s Cabaret” are proprietary. In the restaurant/sports bar business, “Bombshells” is also proprietary. We believe that the combination of our existing brand name recognition and the distinctive entertainment environment that we have created allows us to compete effectively in the industry and within the cities where we operate. Although we believe that we are well positioned to compete successfully, there can be no assurance that we will be able to maintain our high level of name recognition and prestige within the marketplace.

GOVERNMENTAL REGULATIONS

We are subject to various federal, state and local laws affecting our business activities. Particularly in Texas, the authority to issue a permit to sell alcoholic beverages is governed by the Texas Alcoholic Beverage Commission (“TABC”), which has the authority, in its discretion, to issue the appropriate permits. We presently hold a Mixed Beverage Permit and a Late Hour Permit at numerous Texas locations. Minnesota, North Carolina, Louisiana, Arizona, Pennsylvania, Florida, New York, and Illinois have similar laws that may limit the availability of a permit to sell alcoholic beverages or that may provide for suspension or revocation of a permit to sell alcoholic beverages in certain circumstances. It is our policy, prior to expanding into any new market, to take steps to ensure compliance with all licensing and regulatory requirements for the sale of alcoholic beverages, as well as the sale of food.

| 6 |

In addition to various regulatory requirements affecting the sale of alcoholic beverages, in many cities where we operate, the location of an adult entertainment cabaret is subject to restriction by city, county or other governmental ordinance. The prohibitions deal generally with distance from schools, churches and other sexually oriented businesses, and contain restrictions based on the percentage of residences within the immediate vicinity of the sexually oriented business. The granting of a sexually oriented business permit is not subject to discretion; the permit must be granted if the proposed operation satisfies the requirements of the ordinance. In all states where we operate, management believes we are in compliance with applicable city, county, state or other local laws governing the sale of alcohol and sexually oriented businesses.

TRADEMARKS

Our rights to the trade names “RCI Hospitality Holdings, Inc.,” “Rick’s,” “Rick’s Cabaret,” “Tootsie’s Cabaret,” “Club Onyx,” “XTC Cabaret,” “Temptations,” “Jaguars,” “Downtown Cabaret,” “Cabaret East,” Bombshells Restaurant and Bar,” and “Vee Lounge” are established under common law, based upon our substantial and continuous use of these trade names in interstate commerce, some of which have been in use at least as early as 1987. We have registered our service mark, “RICK’S AND STARS DESIGN,” and the “BOMBSHELLS RESTAURANT & BAR” logo design with the United States Patent and Trademark Office. We have also obtained service mark registrations from the Patent and Trademark Office for “RICK’S AND STARS DESIGN” logo, “RCI HOSPITALITY HOLDINGS, INC.,” “RICKS,” “RICK’S CABARET,” “CLUB ONYX,” “XTC CABARET,” “SCARLETT’S CABARET,” “SILVER CITY CABARET,” “BOMBSHELLS RESTAURANT AND BAR”, “THE SEVILLE CLUB”, “DOWN IN TEXAS SALOON”, “CLUB DULCE”, “THE BLACK ORCHID”, “HOOPS CABARET”, “VEE LOUNGE,” “STUDIO 80”, “FOXY’S CABARET,” and “EXOTIC DANCER” are registered through service mark registrations issued by the United States Patent and Trademark Office. As of this date, we have pending registration applications for the name “TOOTSIES CABARET” We also own the rights to numerous trade names associated with our media division. There can be no assurance that these steps we have taken to protect our service marks will be adequate to deter misappropriation of our protected intellectual property rights.

EMPLOYEES AND INDEPENDENT CONTRACTORS

As of September 30, 2018, we had approximately 2,050 employees, of which approximately 200 are in management positions, including corporate and administrative operations, and approximately 1,850 are engaged in entertainment, food and beverage service, including bartenders, waitresses, and certain entertainers. None of our employees are represented by a union. We consider our employee relations to be good. Additionally, as of September 30, 2018, we had independent contractor entertainers, who are self-employed and conduct business at our locations on a non-exclusive basis. Our entertainers at Rick’s Cabaret in Minneapolis, Minnesota and at Jaguars Club in Phoenix, Arizona act as commissioned employees. All employees and independent contractors sign arbitration non-class action participation agreements.

We believe that the adult entertainment industry standard of treating entertainers as independent contractors provides us with safe harbor protection to preclude payroll tax assessment for prior years. We have prepared plans that we believe will protect our profitability in the event that the sexually oriented business industry is required in all states to convert entertainers, who are now independent contractors, into employees. See related discussion in “Risk Factors.”

| 7 |

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below before deciding to purchase shares of our common stock. If any of the events, contingencies, circumstances or conditions described in the risks below actually occurs, our business, financial condition or results of operations could be seriously harmed. The trading price of our common stock could, in turn, decline and you could lose all or part of your investment.

Our business operations are subject to regulatory uncertainties which may affect our ability to continue operations of existing nightclubs, acquire additional nightclubs, or be profitable.

Adult entertainment nightclubs are subject to local, state and federal regulations. Our business is regulated by local zoning, local and state liquor licensing, local ordinances, and state and federal time place and manner restrictions. The adult entertainment provided by our nightclubs has elements of speech and expression and, therefore, enjoys some protection under the First Amendment to the United States Constitution. However, the protection is limited to the expression, and not the conduct of an entertainer. While our nightclubs are generally well established in their respective markets, there can be no assurance that local, state and/or federal licensing and other regulations will permit our nightclubs to remain in operation or profitable in the future.

Our business has been, and may continue to be, adversely affected by conditions in the U.S. financial markets and economic conditions generally.

Our nightclubs are often acquired with a purchase price based on historical EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization). This results in certain nightclubs carrying a substantial amount of intangible asset value, mostly allocated to licenses and goodwill. Generally accepted accounting principles require an annual impairment review of these indefinite-lived intangible assets. As a result of our annual impairment review, we recorded impairment charges of $4.7 million in 2018 (representing a $1.6 million of property and equipment impairment on one club and one Bombshells, and $3.1 million of license impairment on three clubs), $7.6 million in 2017 (including $4.7 million of goodwill impairment on three operating clubs and one property held for sale, $385,000 of property and equipment impairment on one operating club, $1.4 million of license impairment on two clubs, and $1.2 million of other-than-temporary impairment recognized on our cost method investment in Robust), and $3.5 million in 2016 (including $1.4 million in one of our properties held for sale and $2.1 million of license impairment on one club). If difficult market and economic conditions materialize over the next year and/or we experience a decrease in revenue at one or more nightclubs or restaurants, we could incur a decline in fair value of one or more of our nightclubs or restaurants. This could result in future impairment charges of up to the total value of the indefinite-lived intangible assets. We actively monitor our clubs and restaurants for any indication of impairment.

We may deviate from our present capital allocation strategy.

We believe that our present capital allocation strategy will provide us with optimized returns. However, implementation of our capital allocation strategy depends on the interplay of different factors such as our stock price, our outstanding common shares, the interest rates on our debt, and the rate of return on available investments. If these factors are not conducive to implementing our present capital allocation strategy, or we determine that adopting a different capital allocation strategy is in the best interest of shareholders, we reserve the right to deviate from this approach. There can be no assurance that we will not deviate from or adopt an alternative capital allocation strategy moving forward.

We may need additional financing, or our business expansion plans may be significantly limited.

If cash generated from our operations is insufficient to satisfy our working capital and capital expenditure requirements, we will need to raise additional funds through the public or private sale of our equity or debt securities. The timing and amount of our capital requirements will depend on a number of factors, including cash flow and cash requirements for nightclub acquisitions and new restaurant development. If additional funds are raised through the issuance of equity or convertible debt securities, the ownership percentage of our then-existing shareholders will be reduced. We cannot ensure that additional financing will be available on terms favorable to us, if at all. Any future equity financing, if available, may result in dilution to existing shareholders; and debt financing, if available, may include restrictive covenants. Any failure by us to procure timely additional financing, if needed, will have material adverse consequences on our business operations.

| 8 |

There is substantial competition in the nightclub entertainment industry, which may affect our ability to operate profitably or acquire additional clubs.

Our nightclubs face substantial competition. Some of our competitors may have greater financial and management resources than we do. Additionally, the industry is subject to unpredictable competitive trends and competition for general entertainment dollars. There can be no assurance that we will be able to remain profitable in this competitive industry.

The adult entertainment industry standard is to classify adult entertainers as independent contractors, not employees. If federal or state law mandates that they be classified as employees, our business could be adversely impacted.

The adult entertainment industry standard is to classify adult entertainers as independent contractors, not employees. The Internal Revenue Service regulations and applicable state law guidelines regarding independent contractor classification are subject to judicial and agency interpretation, and it could be determined that the independent contractor classification is inapplicable. Further, if legal standards for classification of independent contractors change, it may be necessary to modify our compensation structure for these adult entertainers, including by paying additional compensation or reimbursing expenses. While we take steps to ensure that our adult entertainers are deemed independent contractors, if our adult entertainers are determined to have been misclassified as independent contractors, we would incur additional exposure under federal and state law, workers’ compensation, unemployment benefits, labor, employment and tort laws, including for prior periods, as well as potential liability for employee benefits and tax withholdings. Any of these outcomes could result in substantial costs to us, could significantly impair our financial condition and our ability to conduct our business as we choose, and could damage our ability to attract and retain other personnel.

The adult entertainment industry is extremely volatile.

Historically, the adult entertainment, restaurant and bar industry has been an extremely volatile industry. The industry tends to be extremely sensitive to the general local economy, in that when economic conditions are prosperous, entertainment industry revenues increase, and when economic conditions are unfavorable, entertainment industry revenues decline. Coupled with this economic sensitivity are the trendy personal preferences of the customers who frequent adult cabarets. We continuously monitor trends in our customers’ tastes and entertainment preferences so that, if necessary, we can make appropriate changes which will allow us to remain one of the premiere adult cabarets. However, any significant decline in general corporate conditions or uncertainties regarding future economic prospects that affect consumer spending could have a material adverse effect on our business. In addition, we have historically catered to a clientele base from the upper end of the market. Accordingly, further reductions in the amounts of entertainment expenses allowed as deductions from income under the Internal Revenue Code of 1954, as amended, could adversely affect sales to customers dependent upon corporate expense accounts.

Private advocacy group actions targeted at the kind of adult entertainment we offer could result in limitations and our inability to operate in certain locations and negatively impact our business.

Our ability to operate successfully depends on the protection provided to us under the First Amendment to the U.S. Constitution. From time to time, private advocacy groups have sought to target our nightclubs by petitioning for non-renewal of certain of our permits and licenses. Furthermore, private advocacy groups which have influences on certain financial institutions have managed to sway these financial institutions into not doing business with us. In addition to possibly limiting our operations and financing options, negative publicity campaigns, lawsuits and boycotts could negatively affect our businesses and cause additional financial harm by discouraging investors from investing in our securities or requiring that we incur significant expenditures to defend our business.

| 9 |

Our revenues could be significantly affected by limitations relating to permits to sell alcoholic beverages.

We derive a significant portion of our revenues from the sale of alcoholic beverages. States in which we operate may have laws which may limit the availability of a permit to sell alcoholic beverages, or which may provide for suspension or revocation of a permit to sell alcoholic beverages in certain circumstances. The temporary or permanent suspension or revocations of any such permits would have a material adverse effect on our revenues, financial condition and results of operations. In all states where we operate, management believes we are in compliance with applicable city, county, state or other local laws governing the sale of alcohol.

Activities or conduct at our nightclubs may cause us to lose necessary business licenses, expose us to liability, or result in adverse publicity, which may increase our costs and divert management’s attention from our business.

We are subject to risks associated with activities or conduct at our nightclubs that are illegal or violate the terms of necessary business licenses. Some of our nightclubs operate under licenses for sexually oriented businesses and are afforded some protection under the First Amendment to the U.S. Constitution. While we believe that the activities at our nightclubs comply with the terms of such licenses, and that the element of our business that constitutes an expression of free speech under the First Amendment to the U.S. Constitution is protected, activities and conduct at our nightclubs may be found to violate the terms of such licenses or be unprotected under the U.S. Constitution. This protection is limited to the expression and not the conduct of an entertainer. An issuing authority may suspend or terminate a license for a nightclub found to have violated the license terms. Illegal activities or conduct at any of our nightclubs may result in negative publicity or litigation. Such consequences may increase our cost of doing business, divert management’s attention from our business and make an investment in our securities unattractive to current and potential investors, thereby lowering our profitability and our stock price.

We have developed comprehensive policies aimed at ensuring that the operation of each of our nightclubs is conducted in conformance with local, state and federal laws. We have a “no tolerance” policy on illegal drug use in or around our facilities. We continually monitor the actions of entertainers, waitresses and customers to ensure that proper behavior standards are met. However, such policies, no matter how well designed and enforced, can provide only reasonable, not absolute, assurance that the policies’ objectives are being achieved. Because of the inherent limitations in all control systems and policies, there can be no assurance that our policies will prevent deliberate acts by persons attempting to violate or circumvent them. Notwithstanding the foregoing limitations, management believes that our policies are reasonably effective in achieving their purposes.

We rely heavily on information technology in our operations and any material failure, weakness, interruption or breach of security could prevent us from effectively operating our business.

Our operations and corporate functions rely heavily on information systems, including point-of-sale processing, management of our supply chain, payment of obligations, collection of cash, electronic communications, data warehousing to support analytics, finance and accounting systems, mobile technologies to enhance the customer experience, and other various processes and procedures, some of which are handled by third parties. Our ability to efficiently and effectively manage our business depends significantly on the reliability and capacity of these systems. The failure of these systems to operate effectively, maintenance problems, upgrading or transitioning to new platforms, or a breach in security relating to these systems could result in delays in consumer service and reduce efficiency in our operations. These problems could adversely affect our results of operations, and remediation could result in significant, unplanned capital investments.

| 10 |

Security breaches of confidential customer information or personal employee information may adversely affect our business.

A significant portion of our revenues are paid through debit and credit cards. Other restaurants and retailers have experienced significant security breaches in which debit and credit card information or other personal information of their customers have been stolen. We also maintain certain personal information regarding our employees. Although we aim to safeguard our technology systems, they could potentially be vulnerable to damage, disability or failures due to physical theft, fire, power outage, telecommunication failure or other catastrophic events, as well as from internal and external security breaches, employee error or malfeasance, denial of service attacks, viruses, worms and other disruptive problems caused by hackers and cyber criminals. A breach in our systems that compromises the information of our customers or employees could result in widespread negative publicity, damage to our reputation, a loss of customers, and legal liabilities. We may in the future become subject to lawsuits or other proceedings for purportedly fraudulent transactions arising from the actual or alleged theft of our customers’ debit and credit card information or if customer or employee information is obtained by unauthorized persons or used inappropriately. Any such claim or proceeding, or any adverse publicity resulting from such an event, may have a material adverse effect on our business.

Our acquisitions may result in disruptions in our business and diversion of management’s attention.

We have made and may continue to make acquisitions of complementary nightclubs, restaurants or related operations. Any acquisitions will require the integration of the operations, products and personnel of the acquired businesses and the training and motivation of these individuals. Such acquisitions may disrupt our operations and divert management’s attention from day-to-day operations, which could impair our relationships with current employees, customers and partners. We may also incur debt or issue equity securities to pay for any future acquisitions. These issuances could be substantially dilutive to our stockholders. In addition, our profitability may suffer because of acquisition-related costs or amortization, or impairment costs for acquired goodwill and other intangible assets. If management is unable to fully integrate acquired business, products or persons with existing operations, we may not receive the benefits of the acquisitions, and our revenues and stock trading price may decrease.

The impact of new club or restaurant openings could result in fluctuations in our financial performance.

Performance of any new club or restaurant location will usually differ from its originally targeted performance due to a variety of factors, and these differences may be material. New clubs and restaurants typically encounter higher customer traffic and sales in their initial months, which may decrease over time. Accordingly, sales achieved by new or reconcepted locations may not be indicative of future operating results. Additionally, we incur substantial pre-opening expenses each time we open a new establishment, which expenses may be higher than anticipated. Due to the foregoing factors, results for any one fiscal quarter are not necessarily indicative of results to be expected for any other fiscal quarter or for a full fiscal year.

We must continue to meet NASDAQ Global Market Continued Listing Requirements, or we risk delisting.

Our securities are currently listed for trading on the NASDAQ Global Market. We must continue to satisfy NASDAQ’s continued listing requirements or risk delisting which would have an adverse effect on our business. If our securities are ever delisted from NASDAQ, they may trade on the over-the-counter market, which may be a less liquid market. In such case, our shareholders’ ability to trade or obtain quotations of the market value of shares of our common stock would be severely limited because of lower trading volumes and transaction delays. These factors could contribute to lower prices and larger spreads in the bid and ask prices for our securities. There is no assurance that we will be able to maintain compliance with the NASDAQ continued listing requirements.

| 11 |

We incur significant costs as a result of operating as a public company, and our management devotes substantial time to new compliance initiatives.

We will incur significant legal, accounting and other expenses that our non-public competition does not incur. The Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), as well as new rules subsequently implemented by the SEC, have imposed various requirements on public companies, including requiring certain corporate governance practices. Our management and other personnel devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations increase our legal and financial compliance costs, and will make some activities more time-consuming and costly.

In addition, the Sarbanes-Oxley Act requires, among other things, that we maintain effective internal control over financial reporting and effective disclosure controls and procedures. In particular, under Section 404 of the Sarbanes-Oxley Act, we are required to perform system and process evaluation and testing on the effectiveness of our internal control over financial reporting, and our independent registered public accounting firm is required to report on the effectiveness of our internal control over financial reporting. In performing this evaluation and testing, both our management and our independent registered public accounting firm concluded that our internal control over financial reporting is not effective as of September 30, 2018 because of certain material weaknesses. We are, however, addressing these issues and updating our policies and procedures. Upon finalizing these policies and procedures and ensuring they are effectively applied, we believe our internal control will be deemed effective. Correcting this issue, and thereafter our continued compliance with Section 404 will require that we incur substantial accounting expense and expend significant management efforts. Moreover, if we are not able to correct our internal control issues and comply with the requirements of Section 404 in a timely manner, or if in the future we or our independent registered public accounting firm identifies deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

We have identified material weaknesses in our internal control over financial reporting

Management, including our Chief Executive Officer and our Chief Financial Officer, assessed the effectiveness of our internal control over financial reporting as of September 30, 2018 and concluded that we did not maintain effective internal control over financial reporting. Specifically, management identified material weaknesses over (1) revenues, (2) complex accounting matters related to assets held for sale, business combinations, income taxes, debt modifications, useful lives of leasehold improvements, and the impairment analyses for indefinite-lived intangible assets, goodwill, and property and equipment, (3) financial statement close and reporting, (4) information technology, and (5) segregation of duties—see Item 9A, “Controls and Procedures,” below. While certain actions have been taken to implement a remediation plan to address these material weaknesses and to enhance our internal control over financial reporting, if these material weaknesses are determined to have not been remediated, it could adversely affect our ability to report our financial condition and results of operations in a timely and accurate manner, which could negatively affect investor confidence in our company, and, as a result, the value of our common stock could be adversely affected.

Our quarterly operating results may fluctuate and could fall below the expectations of securities analysts and investors due to seasonality and other factors, some of which are beyond our control, resulting in a decline in our stock price.

Our nightclub operations are affected by seasonal factors. Historically, we have experienced reduced revenues from April through September with the strongest operating results occurring from October through March. As a result, our quarterly and annual operating results and comparable restaurant sales may fluctuate significantly as a result of seasonality and the factors discussed above. Accordingly, results for any one fiscal quarter are not necessarily indicative of results to be expected for any other fiscal quarter or for any fiscal year and same-store sales for any particular future period may decrease. In the future, operating results may fall below the expectations of securities analysts and investors. In that event, the price of our common stock would likely decrease.

| 12 |

We may have uninsured risks in excess of our insurance coverage.

We maintain insurance in amounts we consider adequate for personal injury and property damage to which the business of the Company may be subject. However, there can be no assurance that uninsured liabilities in excess of the coverage provided by insurance, which liabilities may be imposed pursuant to the Texas “dram shop” statute or similar “dram shop” statutes or common law theories of liability in other states where we operate or expand. For example, the Texas “dram shop” statute provides a person injured by an intoxicated person the right to recover damages from an establishment that wrongfully served alcoholic beverages to such person if it was apparent to the server that the individual being sold, served or provided with an alcoholic beverage was obviously intoxicated to the extent that he presented a clear danger to himself and others. An employer is not liable for the actions of its employee who over-serves if (i) the employer requires its employees to attend a seller training program approved by the TABC; (ii) the employee has actually attended such a training program; and (iii) the employer has not directly or indirectly encouraged the employee to violate the law. It is our policy to require that all servers of alcohol working at our clubs in Texas be certified as servers under a training program approved by the TABC, which certification gives statutory immunity to the sellers of alcohol from damage caused to third parties by those who have consumed alcoholic beverages at such establishment pursuant to the TABC. There can be no assurance, however, that uninsured liabilities may not arise in the markets in which we operate which could have a material adverse effect on the Company.

Our previous liability insurer may be unable to provide coverage to us and our subsidiaries.

As previously reported, the Company and its subsidiaries were insured under a liability policy issued by Indemnity Insurance Corporation, RRG (“IIC”) through October 25, 2013. The Company and its subsidiaries changed insurance companies on that date.

On November 7, 2013, the Court of Chancery of the State of Delaware entered a Rehabilitation and Injunction Order (“Rehabilitation Order”), which declared IIC impaired, insolvent and in an unsafe condition and placed IIC under the supervision of the Insurance Commissioner of the State of Delaware (“Commissioner”) in her capacity as receiver (“Receiver”). The Rehabilitation Order empowered the Commissioner to rehabilitate IIC through a variety of means, including gathering assets and marshaling those assets, as necessary. Further, the order stayed or abated pending lawsuits involving IIC as the insurer until May 6, 2014.

On April 10, 2014, the Court of Chancery of the State of Delaware entered a Liquidation and Injunction Order With Bar Date (“Liquidation Order”), which ordered the liquidation of IIC and terminated all insurance policies or contracts of insurance issued by IIC. The Liquidation Order further ordered that all claims against IIC must have been filed with the Receiver before the close of business on January 16, 2015 and that all pending lawsuits involving IIC as the insurer were further stayed or abated until October 7, 2014. As a result, the Company and its subsidiaries no longer had insurance coverage under the liability policy with IIC. Currently, there are several civil lawsuits pending against the Company and its subsidiaries. The Company has retained counsel to defend against and evaluate these claims and lawsuits. We are funding 100% of the costs of litigation and will seek reimbursement from the bankruptcy receiver. The Company filed the appropriate claims against IIC with the Receiver before the January 16, 2015 deadline and has provided updates as requested; however, there are no assurances of any recovery from these claims. It is unknown at this time what effect this uncertainty will have on the Company. As previously stated, since October 25, 2013, the Company obtained general liability coverage from other insurers, which have covered and/or will cover any claims arising from actions after that date. As of September 30, 2018, we have 2 remaining unresolved claims out of the original 71 claims.

| 13 |

The protection provided by our service marks is limited.

Our rights to the trade names “RCI Hospitality Holdings, Inc.,” “Rick’s,” “Rick’s Cabaret,” “Tootsie’s Cabaret,” “Club Onyx,” “XTC Cabaret,” “Temptations,” “Jaguars,” “Downtown Cabaret,” “Cabaret East,” “Foxy’s Cabaret,” “Bombshells Restaurant and Bar,” “Vee Lounge,” and “Studio 80” are established under common law, based upon our substantial and continuous use of these trade names in interstate commerce, some of which have been in use at least as early as 1987. “RICK’S AND STARS DESIGN” logo, “RCI HOSPITALITY HOLDINGS, INC.,” “RICKS,” “RICK’S CABARET,” “CLUB ONYX,” “XTC CABARET,” “SCARLETT’S CABARET,” “SILVER CITY CABARET,” “BOMBSHELLS RESTAURANT AND BAR,” “THE SEVILLE CLUB,” “DOWN IN TEXAS SALOON,” “THE BLACK ORCHID,” “HOOPS CABARET,” “STUDIO 80,” “FOXY’S CABARET,” “CLUB DULCE” and “EXOTIC DANCER” are registered through service mark registrations issued by the United States Patent and Trademark Office. As of this date, we have pending registration application for the name “TOOTSIE’S CABARET.” We also own the rights to numerous trade names associated with our media division. There can be no assurance that the steps we have taken to protect our service marks will be adequate to deter misappropriation of our protected intellectual property rights. Litigation may be necessary in the future to protect our rights from infringement, which may be costly and time consuming. The loss of the intellectual property rights owned or claimed by us could have a material adverse effect on our business.

Anti-takeover effects of the issuance of our preferred stock could adversely affect our common stock.

Our Board of Directors has the authority to issue up to 1,000,000 shares of preferred stock in one or more series, to fix the number of shares constituting any such series, and to fix the rights and preferences of the shares constituting any series, without any further vote or action by the stockholders. The issuance of preferred stock by the Board of Directors could adversely affect the rights of the holders of our common stock. For example, such issuance could result in a class of securities outstanding that would have preferences with respect to voting rights and dividends and in liquidation over the common stock, and could (upon conversion or otherwise) enjoy all of the rights appurtenant to common stock. The Board’s authority to issue preferred stock could discourage potential takeover attempts and could delay or prevent a change in control of the Company through merger, tender offer, proxy contest or otherwise by making such attempts more difficult to achieve or costlier. There are no issued and outstanding shares of preferred stock; there are no agreements or understandings for the issuance of preferred stock; and the Board of Directors has no present intention to issue preferred stock.

Future sales or the perception of future sales of a substantial amount of our common stock may depress our stock price.

The market price of our common stock could decline as a result of sales of substantial amounts of our common stock in the public market, or as a result of the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of common stock.

| 14 |

Our stock price has been volatile and may fluctuate in the future.

The trading price of our securities may fluctuate significantly. This price may be influenced by many factors, including:

| ● | our performance and prospects; | |

| ● | the depth and liquidity of the market for our securities; | |

| ● | investor perception of us and the industry in which we operate; | |

| ● | changes in earnings estimates or buy/sell recommendations by analysts; | |

| ● | general financial and other market conditions; and | |

| ● | domestic economic conditions. |

Public stock markets have experienced, and may experience, extreme price and trading volume volatility. These broad market fluctuations may adversely affect the market price of our securities.

We are dependent on key personnel.

Our future success is dependent, in a large part, on retaining the services of Eric Langan, our President and Chief Executive Officer. Mr. Langan possesses a unique and comprehensive knowledge of our industry. While Mr. Langan has no present plans to leave or retire in the near future, his loss could have a negative effect on our operating, marketing and financial performance if we are unable to find an adequate replacement with similar knowledge and experience within our industry. We maintain key-man life insurance with respect to Mr. Langan. Although Mr. Langan is under an employment agreement (as described herein), there can be no assurance that Mr. Langan will continue to be employed by us.

Cumulative voting is not available to our stockholders.

Cumulative voting in the election of Directors is expressly denied in our Articles of Incorporation. Accordingly, the holder or holders of a majority of the outstanding shares of our common stock may elect all of our Directors.

Our directors and officers have limited liability and have rights to indemnification.

Our Articles of Incorporation and Bylaws provide, as permitted by governing Texas law, that our directors and officers shall not be personally liable to us or any of our stockholders for monetary damages for breach of fiduciary duty as a director or officer, with certain exceptions. The Articles further provide that we will indemnify our directors and officers against expenses and liabilities they incur to defend, settle, or satisfy any civil litigation or criminal action brought against them on account of their being or having been its directors or officers unless, in such action, they are adjudged to have acted with gross negligence or willful misconduct.

The inclusion of these provisions in the Articles may have the effect of reducing the likelihood of derivative litigation against directors and officers and may discourage or deter stockholders or management from bringing a lawsuit against directors and officers for breach of their duty of care, even though such an action, if successful, might otherwise have benefited us and our stockholders.

| 15 |

The Articles provide for the indemnification of our officers and directors, and the advancement to them of expenses in connection with any proceedings and claims, to the fullest extent permitted by Texas law. The Articles include related provisions meant to facilitate the indemnitee’s receipt of such benefits. These provisions cover, among other things: (i) specification of the method of determining entitlement to indemnification and the selection of independent counsel that will in some cases make such determination, (ii) specification of certain time periods by which certain payments or determinations must be made and actions must be taken, and (iii) the establishment of certain presumptions in favor of an indemnitee.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, we have been advised that in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

A failure to maintain food safety throughout the supply chain and food-borne illness concerns may have an adverse effect on our business.

Food safety is a top priority, and we dedicate substantial resources to ensuring that our guests enjoy safe, quality food products. However, food safety issues could be caused at the point of source or by food suppliers or distributors and, as a result, be out of our control. In addition, regardless of the source or cause, any report of food-borne illnesses such as E. coli, hepatitis A, trichinosis or salmonella, and other food safety issues including food tampering or contamination, at one of our restaurants or clubs could adversely affect the reputation of our brands and have a negative impact on our sales. Even instances of food-borne illness, food tampering or food contamination occurring solely at restaurants of our competitors could result in negative publicity about the food service industry generally and adversely impact our sales. The occurrence of food-borne illnesses or food safety issues could also adversely affect the price and availability of affected ingredients, resulting in higher costs and lower margins.

Recently enacted legislation may significantly affect our results of operations, cash flows and financial condition.

On December 22, 2017, the Tax Cuts and Jobs Act (“Tax Act”) was signed into law. The Tax Act contains significant changes to corporate taxation, including reduction of the corporate tax rate from 35% to 21%, additional limitations on the tax deductibility of interest, immediate deductions for certain new investments instead of deductions for depreciation expense over time, and modification or repeal of many business deductions and credits. Notwithstanding the reduction in the corporate income tax rate, the overall impact of the Tax Act is uncertain, and our results of operations, cash flows, financial condition, and first-covered-year income tax return filings, as well as the trading price of our common stock, could be adversely affected.

Other risk factors may adversely affect our financial performance.

Other risk factors that could cause our actual results to differ materially from those indicated in the forward-looking statements by affecting, among many things, pricing, consumer spending and consumer confidence, include, without limitation, changes in economic conditions and financial and credit markets, credit availability, increased fuel costs and availability for our employees, customers and suppliers, health epidemics or pandemics or the prospects of these events (such as reports on avian flu), consumer perceptions of food safety, changes in consumer tastes and behaviors, governmental monetary policies, changes in demographic trends, terrorist acts, energy shortages and rolling blackouts, and weather (including, major hurricanes and regional snow storms) and other acts of God.

Item 1B. Unresolved Staff Comments.

None.

As of September 30, 2018, we own 51 real estate properties. On 31 of these properties, we operate clubs or restaurants. We lease multiple other properties to third-party tenants.

Four of our owned properties are locations where we previously operated clubs but now lease the buildings to third parties. Six are non-income-producing properties for corporate use, including our corporate office. Five other properties are currently offered for sale. The remaining five properties are under-construction future Bombshells sites, with one adjacent property that may be offered for sale in the future. Twelve of our clubs and restaurants are in leased locations.

Our principal corporate office is located at 10737 Cutten Road, Houston, Texas 77066, consisting of a 21,000-square foot corporate office and an 18,000-square foot warehouse facility.

| 16 |

Below is a list of locations we operated as of September 30, 2018:

| Name of Establishment | Year Acquired/Opened | |||

| Club Onyx, Houston, TX | 1995 | |||

| Rick’s Cabaret, Minneapolis, MN | 1998 | |||

| XTC Cabaret, Austin, TX | 1998 | |||

| XTC Cabaret, San Antonio, TX | 1998 | |||

| Rick’s Cabaret, New York City, NY | 2005 | |||

| Club Onyx, Charlotte, NC | 2005 | (1) | ||

| Rick’s Cabaret, San Antonio, TX | 2006 | |||

| XTC Cabaret, South Houston, TX | 2006 | (1) | ||

| Rick’s Cabaret, Fort Worth, TX | 2007 | |||

| Tootsie’s Cabaret, Miami Gardens, FL | 2008 | |||

| XTC Cabaret, Dallas, TX | 2008 | |||

| Rick’s Cabaret, Round Rock, TX | 2009 | |||

| Cabaret East, Fort Worth, TX | 2010 | |||

| Rick’s Cabaret DFW, Fort Worth, TX | 2011 | |||

| Downtown Cabaret, Minneapolis, MN | 2011 | |||

| Temptations, Aledo, TX | 2011 | (1) | ||

| Silver City Cabaret, Dallas, TX | 2012 | |||

| Jaguars Club, Odessa, TX | 2012 | |||

| Jaguars Club, Phoenix, AZ | 2012 | |||

| Jaguars Club, Lubbock, TX | 2012 | |||

| Jaguars Club, Longview, TX | 2012 | |||

| Jaguars Club, Tye, TX | 2012 | |||

| Jaguars Club, Edinburg, TX | 2012 | |||

| Jaguars Club, El Paso, TX | 2012 | |||

| Jaguars Club, Harlingen, TX | 2012 | |||

| Studio 80, Fort Worth, TX | 2013 | (1) | ||

| Bombshells, Dallas, TX | 2013 | |||

| Temptations, Sulphur, LA | 2013 | |||

| Temptations, Beaumont, TX | 2013 | |||

| Vivid Cabaret, New York, NY | 2014 | (1) | ||

| Bombshells, Austin, TX | 2014 | (1) | ||

| Rick’s Cabaret, Odessa, TX | 2014 | |||

| Bombshells, Spring TX | 2014 | (1) | ||

| Bombshells, Houston, TX | 2014 | (1) | ||

| Foxy’s Cabaret, Austin TX | 2015 | |||

| The Seville, Minneapolis, MN | 2015 | |||

| Hoops Cabaret and Sports Bar, New York, NY | 2016 | (1) | ||

| Studio 80, Webster, TX | 2017 | (1) | ||

| Bombshells, Highway 290 Houston, TX | 2017 | (1) | ||

| Scarlett’s Cabaret, Washington Park, IL | 2017 | |||

| Scarlett’s Cabaret, Miami, FL | 2017 | (1) | ||

| Bombshells, Pearland, TX | 2018 | |||

| Kappa Men’s Club, Kappa, IL | 2018 | |||

(1) Leased location.

| 17 |

Our property leases are typically for a fixed rental rate without revenue percentage rentals. The lease terms generally have initial terms of 10 to 20 years with renewal terms of 5 to 20 years. At September 30, 2018, certain of our owned properties were collateral for mortgage debt amounting to approximately $94.5 million. Also, see more information in Notes 4, 7 and 10 to our consolidated financial statements.

See the “Legal Matters” section within Note 10 to our consolidated financial statements within this Annual Report on Form 10-K for the requirements of this Item, which section is incorporated herein by reference.

Item 4. Mine Safety Disclosures.

Not applicable.

| 18 |

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is quoted on the NASDAQ Global Market under the symbol “RICK.” The following table sets forth the quarterly high and low of sales prices per share for the common stock for the last two fiscal years.

| COMMON STOCK PRICE RANGE | High | Low | ||||||

| Fiscal Year Ended September 30, 2018 | ||||||||

| First Quarter | $ | 33.78 | $ | 24.31 | ||||

| Second Quarter | $ | 32.36 | $ | 26.22 | ||||

| Third Quarter | $ | 32.96 | $ | 26.82 | ||||

| Fourth Quarter | $ | 34.84 | $ | 28.22 | ||||

| Fiscal Year Ended September 30, 2017 | ||||||||

| First Quarter | $ | 17.99 | $ | 10.92 | ||||

| Second Quarter | $ | 18.00 | $ | 16.02 | ||||

| Third Quarter | $ | 25.47 | $ | 16.32 | ||||

| Fourth Quarter | $ | 26.85 | $ | 21.91 | ||||

On November 30, 2018, the closing stock price for our common stock as reported by NASDAQ was $25.02. On November 30, 2018, there were approximately 160 stockholders of record of our common stock (excluding broker held shares in “street name”). We estimate that there are approximately 7,500 stockholders having beneficial ownership in street name.

TRANSFER AGENT AND REGISTRAR

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, 6201 15th Avenue, Brooklyn, New York 11219.

DIVIDEND POLICY

Prior to 2016, we have not paid cash dividends on our common stock. Starting in March 2016, in conjunction with our share buyback program (see discussion below), our Board of Directors has declared quarterly cash dividends of $0.03 per share ($0.12 per share on an annual basis). During fiscal 2018, 2017, and 2016, we paid an aggregate amount of $1.2 million, $1.2 million, and $862,000, respectively, for cash dividends.

PURCHASES OF EQUITY SECURITIES BY THE ISSUER

We did not repurchase shares of the Company’s common stock during the three months and fiscal year ended September 30, 2018. As of September 30, 2018, we have $3.1 million remaining to purchase additional shares under our previously approved stock repurchase plan.

| 19 |

EQUITY COMPENSATION PLAN INFORMATION

We have no stock options nor any other equity award outstanding under equity compensation plans as of September 30, 2018.

| Equity Compensation Plan Information | ||||||||||||

| (a) | (b) | (c) | ||||||||||

| Number of Securities | ||||||||||||

| Weighted- | Remaining Available | |||||||||||

| Average | for Future Issuance | |||||||||||

| Number of Securities | Exercise Price | Under Equity | ||||||||||

| to be Issued Upon | of Outstanding | Compensation | ||||||||||

| Exercise of | Options, | Plans [Excluding | ||||||||||

| Outstanding Options, | Warrants and | Securities Reflected | ||||||||||

| Plan Category | Warrants and Rights | Rights | in Column (a)] | |||||||||

| Equity compensation plans approved by security holders | - | - | 429,435 | (1) | ||||||||

| Equity compensation plans not approved by security holders | - | - | - | |||||||||

| Total | - | - | 429,435 | |||||||||

| (1) | Includes shares that may be granted in the form of either incentive stock options or non-qualified stock options under the 2010 Stock Option Plan (the “2010 Plan”). The 2010 Plan is administered by the Board of Directors or by a compensation committee of the Board of Directors. The Board of Directors has the exclusive power to select individuals to receive grants, to establish the terms of the options granted to each participant, provided that all options granted shall be granted at an exercise price not less than the fair market value of the common stock covered by the option on the grant date and to make all determinations necessary or advisable under the 2010 Plan. |

STOCK PERFORMANCE GRAPH

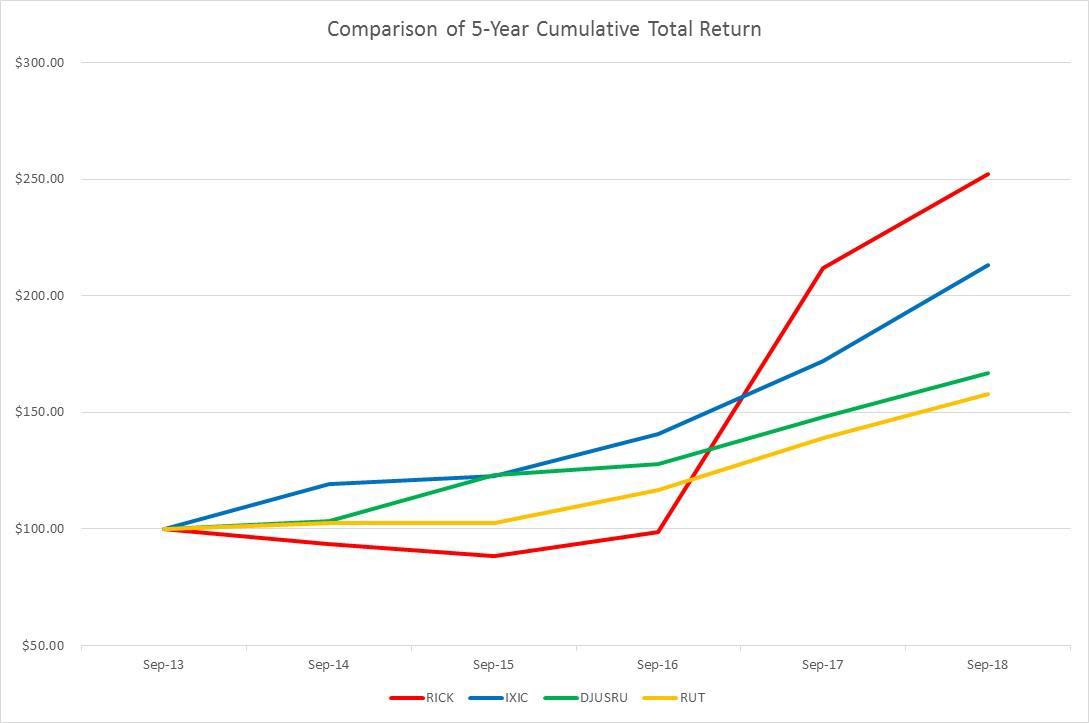

The following chart compares the 5-year cumulative total stock performance of our common stock; the NASDAQ Composite Index (IXIC); the Russell 2000 Index (RUT) and the Dow Jones U.S. Restaurant & Bar Index (DJUSRU), our peer index. The graph assumes a hypothetical investment of $100 on September 30, 2013 in each of our common stock and each of the indices, and that all dividends were reinvested. The measurement points utilized in the graph consist of the last trading day as of September 30 each year, representing the last day of our fiscal year. The calculations exclude trading commissions and taxes. We have selected the Dow Jones U.S. Restaurant & Bar Index as our peer index since it represents a broader group of restaurant and bar operators that are more aligned to our core business operations. RICK is a component of both the NASDAQ Composite Index and the Russell 2000 Index. The historical stock performance presented below is not intended to and may not be indicative of future stock performance.

| 20 |

Item 6. Selected Financial Data.

The following tables set forth certain of the Company’s historical financial data. The selected historical consolidated financial position data as of September 30, 2018 and 2017 and results of operations data for the years ended September 30, 2018, 2017, and 2016 have been derived from the Company’s audited consolidated financial statements and related notes included elsewhere in this Annual Report on Form 10-K. The selected historical consolidated financial data as of September 30, 2016, 2015, and 2014 and for the years ended September 30, 2015 and 2014 have been derived from the Company’s audited financial statements for such years, which are not included in this Annual Report on Form 10-K. The selected historical consolidated financial data set forth are not necessarily indicative of the results of future operations and should be read in conjunction with the discussion under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the historical consolidated financial statements and accompanying notes included herein. The historical results are not necessarily indicative of the results to be expected in any future period.

Please read the following selected consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this Annual Report on Form 10-K for a discussion of information that will enhance understanding of these data (in thousands, except per share data and percentages).

Financial Statement Data:

| Years Ended September 30, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Revenue | $ | 165,748 | $ | 144,896 | $ | 134,860 | $ | 135,449 | $ | 121,432 | ||||||||||

| Income from operations | $ | 28,396 | $ | 23,139 | $ | 20,693 | $ | 20,727 | $ | 18,754 | ||||||||||

| Net income attributable to RCIHH | $ | 21,713 | $ | 8,259 | $ | 11,218 | $ | 9,214 | $ | 11,161 | ||||||||||

| Diluted earnings per share | $ | 2.23 | $ | 0.85 | $ | 1.11 | $ | 0.89 | $ | 1.13 | ||||||||||

| Capital expenditures | $ | 25,263 | $ | 11,249 | $ | 28,148 | $ | 19,259 | $ | 16,034 | ||||||||||

| Dividends declared per share | $ | 0.12 | $ | 0.12 | $ | 0.09 | $ | - | $ | - | ||||||||||

| September 30, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Cash and cash equivalents | $ | 17,726 | $ | 9,922 | $ | 11,327 | $ | 8,020 | $ | 9,964 | ||||||||||

| Total current assets | $ | 36,802 | $ | 26,242 | $ | 29,387 | $ | 16,935 | $ | 17,973 | ||||||||||

| Total assets | $ | 330,566 | $ | 299,884 | $ | 276,061 | $ | 266,527 | $ | 233,383 | ||||||||||

| Total current liabilities (excluding current portion of long-term debt) | $ | 14,798 | $ | 13,671 | $ | 17,087 | $ | 15,580 | $ | 28,527 | ||||||||||

| Long-term debt (including current portion) | $ | 140,627 | $ | 124,352 | $ | 105,886 | $ | 94,349 | $ | 70,092 | ||||||||||

| Total liabilities | $ | 176,400 | $ | 164,659 | $ | 146,722 | $ | 138,973 | $ | 120,918 | ||||||||||

| Total RCIHH stockholders’ equity | $ | 154,269 | $ | 132,745 | $ | 126,755 | $ | 121,691 | $ | 109,455 | ||||||||||

| Common shares outstanding | 9,719 | 9,719 | 9,808 | 10,285 | 10,067 | |||||||||||||||

Non-GAAP Measures and Other Data:

| Years Ended September 30, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Adjusted EBITDA(1) | $ | 44,387 | $ | 37,348 | $ | 34,531 | $ | 34,125 | $ | 31,703 | ||||||||||

| Non-GAAP operating income(1) | $ | 37,000 | $ | 30,668 | $ | 27,566 | $ | 27,974 | $ | 25,641 | ||||||||||

| Non-GAAP operating margin(1) | 22.3 | % | 21.2 | % | 20.4 | % | 20.7 | % | 21.1 | % | ||||||||||

| Non-GAAP net income(1) | $ | 21,160 | $ | 13,953 | $ | 13,302 | $ | 13,873 | $ | 11,882 | ||||||||||

| Non-GAAP diluted net income per share(1) | $ | 2.18 | $ | 1.43 | $ | 1.32 | $ | 1.34 | $ | 1.19 | ||||||||||

| Free cash flow(1) | $ | 23,242 | $ | 19,281 | $ | 20,513 | $ | 14,889 | $ | 18,734 | ||||||||||

| Same-store sales | 4.6 | % | 4.9 | % | -1.3 | % | -1.5 | % | 2.8 | % | ||||||||||

| (1) | Reconciliation and discussion of non-GAAP financial measures are included under the “Non-GAAP Financial Measures” section of Item 7 – “Management’s Discussion and Analysis of Financial Condition and Results of Operations” that follows. These measures should be considered in addition to, rather than as a substitute for, U.S. GAAP measures. |

| 21 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

OVERVIEW

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader understand RCI Hospitality Holdings, Inc., our operations and our present business environment. MD&A is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes thereto contained in Item 8 – “Financial Statements and Supplementary Data” of this report. This overview summarizes the MD&A, which includes the following sections:

| ● | Our Business — a general description of our business and the adult nightclub industry, our objective, our strategic priorities, our core capabilities, and challenges and risks of our business. | |

| ● | Critical Accounting Policies and Estimates — a discussion of accounting policies that require critical judgments and estimates. | |

| ● | Operations Review — an analysis of our Company’s consolidated results of operations for the three years presented in our consolidated financial statements. | |

| ● | Liquidity and Capital Resources — an analysis of cash flows, aggregate contractual obligations, and an overview of financial position. |

OUR BUSINESS

The following are our operating segments:

| Nightclubs | Our wholly-owned subsidiaries own and/or operate upscale adult nightclubs serving primarily businessmen and professionals. These nightclubs are in Houston, Austin, San Antonio, Dallas, Fort Worth, Beaumont, Longview, Harlingen, Edinburg, Tye, Lubbock, El Paso and Odessa, Texas; Charlotte, North Carolina; Minneapolis, Minnesota; New York, New York; Miami Gardens and Pembroke Park, Florida; Pittsburgh, Pennsylvania; Phoenix, Arizona; and Washington Park, Kappa and Chicago, Illinois. No sexual contact is permitted at any of our locations. We also own and operate Studio 80 dance clubs in Fort Worth and Webster, Texas. | |

| Bombshells | Our wholly-owned subsidiaries own and operate restaurants, and sports bars in Houston, Dallas, Austin, Spring and Pearland, Texas under the brand name Bombshells Restaurant & Bar. | |

| Media Group | Our wholly-owned subsidiaries own a media division, including the leading trade magazine serving the multibillion-dollar adult nightclubs industry and the adult retail products industry. We also own an industry trade show, an industry trade publication and more than a dozen industry and social media websites. |

Our revenues are derived from the sale of liquor, beer, wine, food, merchandise; service revenues such as cover charges, membership fees, and facility use fees; and other revenues such as commissions from vending and ATM machines, real estate rental, valet parking, and other products and services for both nightclub and restaurant/sports bar operations. Media Group revenues include the sale of advertising content and revenues from our annual Expo convention. Our fiscal year-end is September 30.

| 22 |

We calculate same-store sales by comparing year-over-year revenues from nightclubs and restaurants/sports bars operating at least 12 full months. We exclude from a particular month’s calculation units previously included in the same-store sales base that have closed temporarily for more than 15 days until its next full month of operations. We also exclude from the same-store sales base units that are being reconcepted or are closed due to renovations or remodels. Acquired units are included in the same-store sales calculation as long as they qualify based on the definition stated above. Revenues outside of our Nightclubs and Bombshells reportable segments are excluded from same-store sales calculation.

Our goal is to use our Company’s assets—our brands, financial strength, and the talent and strong commitment of our management and employees—to become more competitive and to accelerate growth in a manner that creates value for our shareholders.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Management’s discussion and analysis of financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). The preparation of these consolidated financial statements requires our management to make assumptions and estimates about future events and apply judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. These estimates are based on management’s historical industry experience and on various other assumptions that are believed to be reasonable under the circumstances. On a regular basis, we evaluate these accounting policies, assumptions, estimates and judgments to ensure that our financial statements are presented fairly and in accordance with GAAP. However, because future events and their effects cannot be determined with certainty, actual results may differ from our estimates, and such differences could be material.

A full discussion of our significant accounting policies is contained in Note 2 to our consolidated financial statements, which is included in Item 8 – “Financial Statements and Supplementary Data” of this report. We believe that the following accounting estimates are the most critical to aid in fully understanding and evaluating our financial results. These estimates require our most difficult, subjective or complex judgments because they relate to matters that are inherently uncertain. We have reviewed these critical accounting policies and estimates and related disclosures with our Audit Committee.

Long-Lived Assets