Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BRINKS CO | a2018128kinvestorpresentat.htm |

Exhibit 99.1 Investor Presentation December 2018 NYSE: BCO

Safe Harbor Statement and Non-GAAP Results These materials contain forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," "predict," "intend," "plan," "believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials includes, but is not limited to information regarding: 2018 non-GAAP outlook, including revenue, operating profit, margin rate, earnings per share and adjusted EBITDA; 2018 and future years’ tax rates and payments; projected contributions for legacy liabilities; expected price increases in the Argentina business; 2019 revenue, operating profit, margin rate and adjusted EBITDA targets; closing of the Rodoban acquisition; 2018 -2020 capital expense outlook; 2018 and 2019 target cash flow; net debt and leverage outlook, maturity of outstanding debt, and future investment in and results of acquisitions. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated. These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to: our ability to improve profitability and execute further cost and operational improvement and efficiencies in our core businesses; our ability to improve service levels and quality in our core businesses; market volatility and commodity price fluctuations; seasonality, pricing and other competitive industry factors; investment in information technology and its impact on revenue and profit growth; our ability to maintain an effective IT infrastructure and safeguard confidential information; our ability to effectively develop and implement solutions for our customers; risks associated with operating in foreign countries, including changing political, labor and economic conditions, regulatory issues, currency restrictions and devaluations, restrictions on and cost of repatriating earnings and capital, impact on the Company’s financial results as a result of jurisdictions determined to be highly inflationary, and restrictive government actions, including nationalization; labor issues, including negotiations with organized labor and work stoppages; the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates; our ability to identify, evaluate and complete acquisitions and other strategic transactions and to successfully integrate acquired companies; costs related to dispositions and market exits; our ability to obtain appropriate insurance coverage, positions taken by insurers relative to claims and the financial condition of insurers; safety and security performance and loss experience; employee, environmental and other liabilities in connection with former coal operations, including black lung claims; the impact of the Patient Protection and Affordable Care Act on legacy liabilities and ongoing operations; funding requirements, accounting treatment, and investment performance of our pension plans, the VEBA and other employee benefits; changes to estimated liabilities and assets in actuarial assumptions; the nature of hedging relationships and counterparty risk; access to the capital and credit markets; our ability to realize deferred tax assets; the outcome of pending and future claims, litigation, and administrative proceedings; public perception of our business, reputation and brand; changes in estimates and assumptions underlying critical accounting policies; the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations. This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2017, and in our other public filings with the Securities and Exchange Commission. The forward-looking information discussed today and included in these materials is representative as of the specific date noted, and The Brink's Company undertakes no obligation to update any information contained in this document. These materials are copyrighted and may not be used without written permission from Brink's. Today’s presentation is focused primarily on non- GAAP results. Detailed reconciliations of non-GAAP to GAAP results are included in the appendix. 2 .

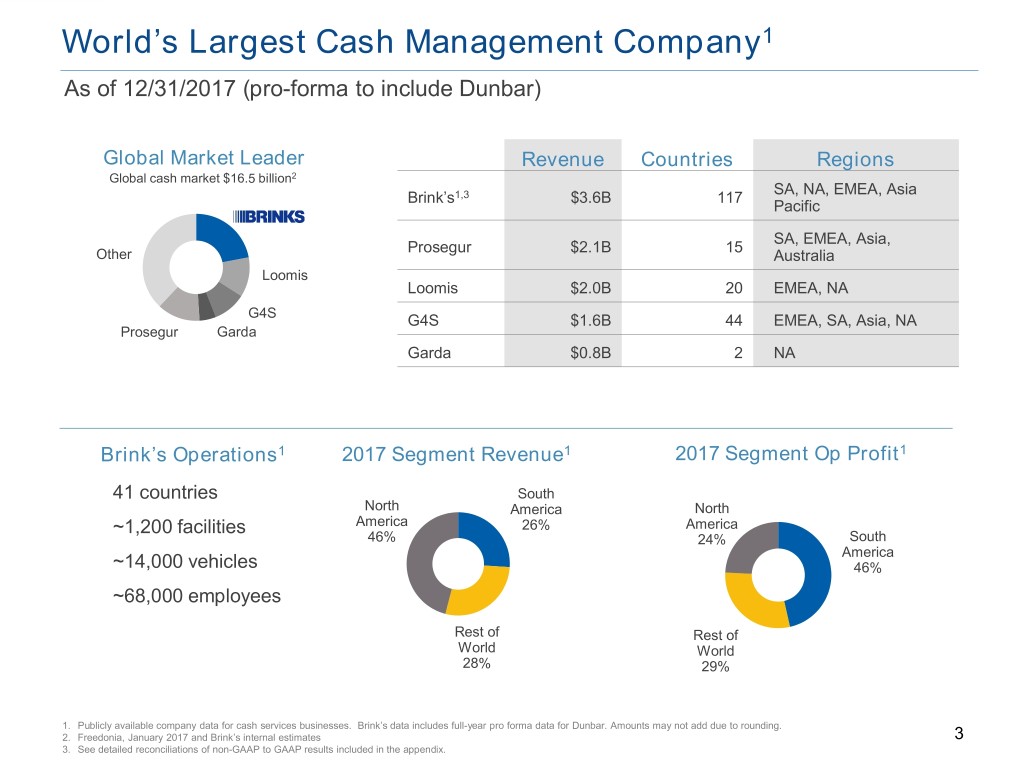

World’s Largest Cash Management Company1 As of 12/31/2017 (pro-forma to include Dunbar) Global Market Leader Revenue Countries Regions Global cash market $16.5 billion2 SA, NA, EMEA, Asia Brink’s1,3 $3.6B 117 Pacific SA, EMEA, Asia, Prosegur $2.1B 15 Other Australia Loomis Loomis $2.0B 20 EMEA, NA G4S G4S $1.6B 44 EMEA, SA, Asia, NA Prosegur Garda Garda $0.8B 2 NA Brink’s Operations1 2017 Segment Revenue1 2017 Segment Op Profit1 41 countries South North America North ~1,200 facilities America 26% America 46% 24% South America ~14,000 vehicles 46% ~68,000 employees Rest of Rest of World World 28% 29% 1. Publicly available company data for cash services businesses. Brink’s data includes full-year pro forma data for Dunbar. Amounts may not add due to rounding. 2. Freedonia, January 2017 and Brink’s internal estimates 3 3. See detailed reconciliations of non-GAAP to GAAP results included in the appendix.

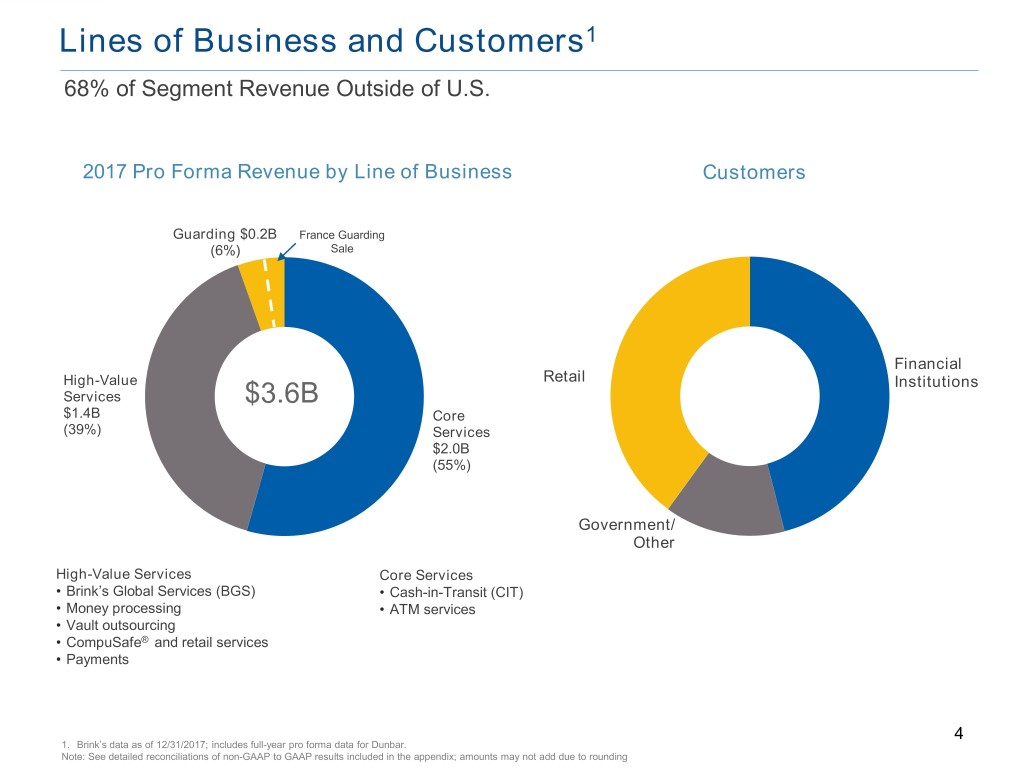

Lines of Business and Customers1 68% of Segment Revenue Outside of U.S. 2017 Pro Forma Revenue by Line of Business Customers Guarding $0.2B France Guarding (6%) Sale Financial High-Value Retail Institutions Services $3.6B $1.4B Core (39%) Services $2.0B (55%) Government/ Other High-Value Services Core Services • Brink’s Global Services (BGS) • Cash-in-Transit (CIT) • Money processing • ATM services • Vault outsourcing • CompuSafe® and retail services • Payments 4 1. Brink’s data as of 12/31/2017; includes full-year pro forma data for Dunbar. Note: See detailed reconciliations of non-GAAP to GAAP results included in the appendix; amounts may not add due to rounding

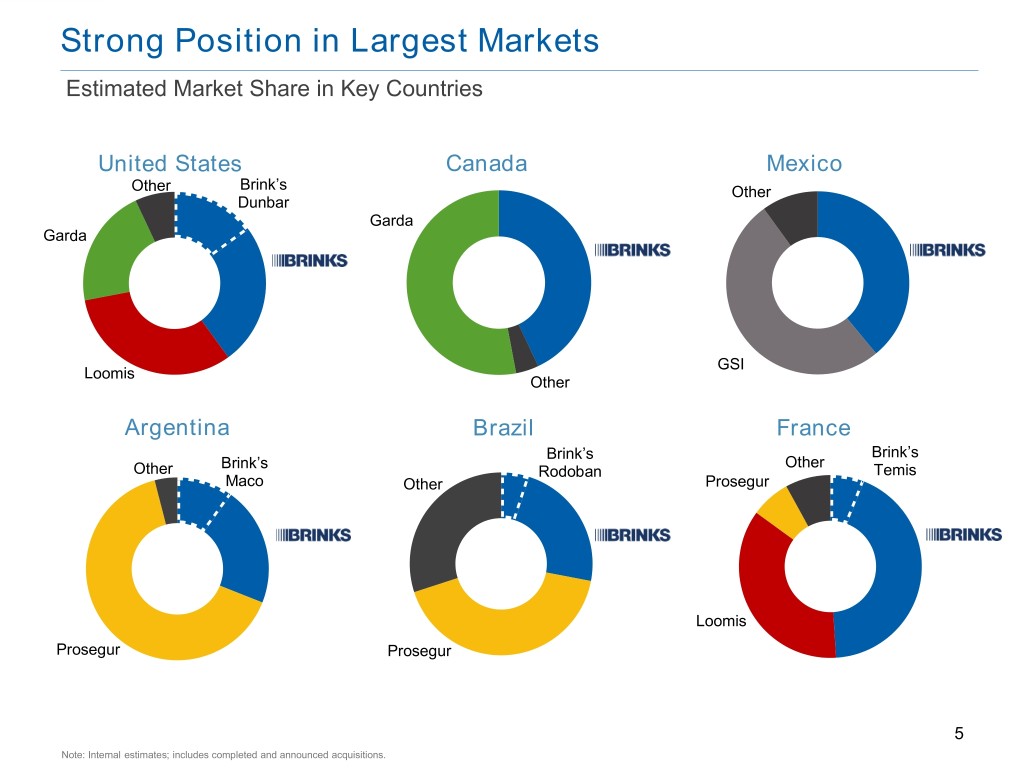

Strong Position in Largest Markets Estimated Market Share in Key Countries United States Canada Mexico Other Brink’s Other Dunbar Garda Garda GSI Loomis Other Argentina Brazil France Brink’s Brink’s Brink’s Other Other Rodoban Temis Maco Other Prosegur Loomis Prosegur Prosegur 5 Note: Internal estimates; includes completed and announced acquisitions.

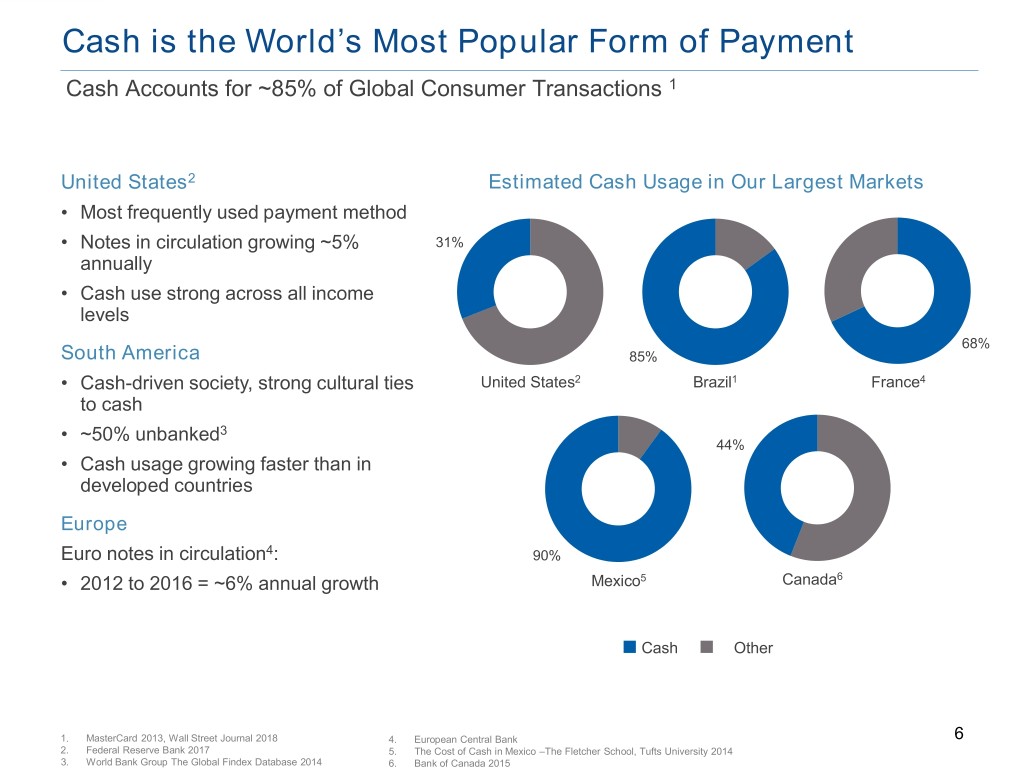

Cash is the World’s Most Popular Form of Payment Cash Accounts for ~85% of Global Consumer Transactions 1 United States2 Estimated Cash Usage in Our Largest Markets • Most frequently used payment method • Notes in circulation growing ~5% 31% annually • Cash use strong across all income levels 68% South America 85% • Cash-driven society, strong cultural ties United States2 Brazil1 France4 to cash • ~50% unbanked3 44% • Cash usage growing faster than in developed countries Europe Euro notes in circulation4: 90% • 2012 to 2016 = ~6% annual growth Mexico5 Canada6 Cash Other 1. MasterCard 2013, Wall Street Journal 2018 4. European Central Bank 6 2. Federal Reserve Bank 2017 5. The Cost of Cash in Mexico –The Fletcher School, Tufts University 2014 3. World Bank Group The Global Findex Database 2014 6. Bank of Canada 2015

Our Strategy Introduce Accelerate Differentiated Profitable Growth Services • Grow high-value services • Leverage uniform, best-in- • Grow account share class global technology base Introduce Accelerate with large FI customers for logistics and operating Differentiated Profitable systems Services Growth • Increase focus on (IDS) (APG) smaller FIs • Offer end-to-end cash supply chain managed Culture • Penetrate large, services unvended retail market • Launch customer portal and • Explore core and Close the Gap — adjacent acquisitions value-added, fee-based Operational services Excellence (CTG) Close the Gap • Operational excellence • Increase operational • Lead industry in safety productivity and security • Achieve industry-leading • Exceed customer margins expectations 7

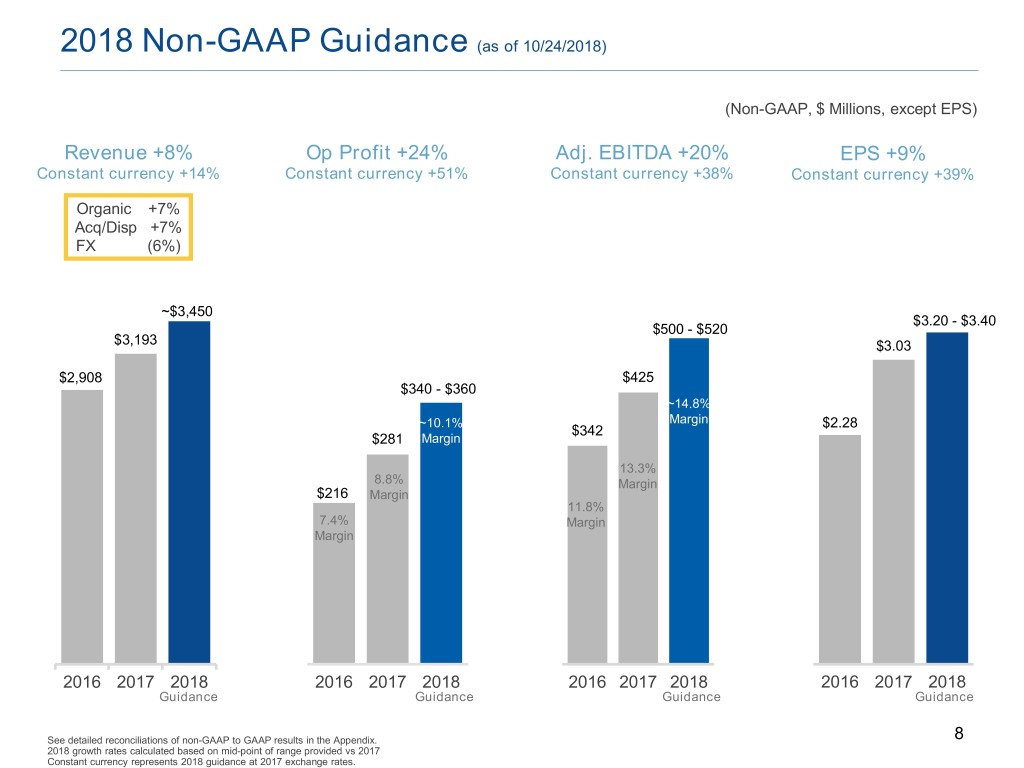

2018 Non-GAAP Guidance (as of 10/24/2018) (Non-GAAP, $ Millions, except EPS) Revenue +8% Op Profit +24% Adj. EBITDA +20% EPS +9% Constant currency +14% Constant currency +51% Constant currency +38% Constant currency +39% Organic +7% Acq/Disp +7% FX (6%) ~$3,450 $3.20 - $3.40 $500 - $520 $3,193 $3.03 $2,908 $425 $340 - $360 ~14.8% ~10.1% Margin $2.28 $342 $281 Margin 13.3% 8.8% Margin $216 Margin 11.8% 7.4% Margin Margin 2016 2017 2018 2016 2017 2018 2016 2017 2018 2016 2017 2018 Guidance Guidance Guidance Guidance See detailed reconciliations of non-GAAP to GAAP results in the Appendix. 8 2018 growth rates calculated based on mid-point of range provided vs 2017 Constant currency represents 2018 guidance at 2017 exchange rates.

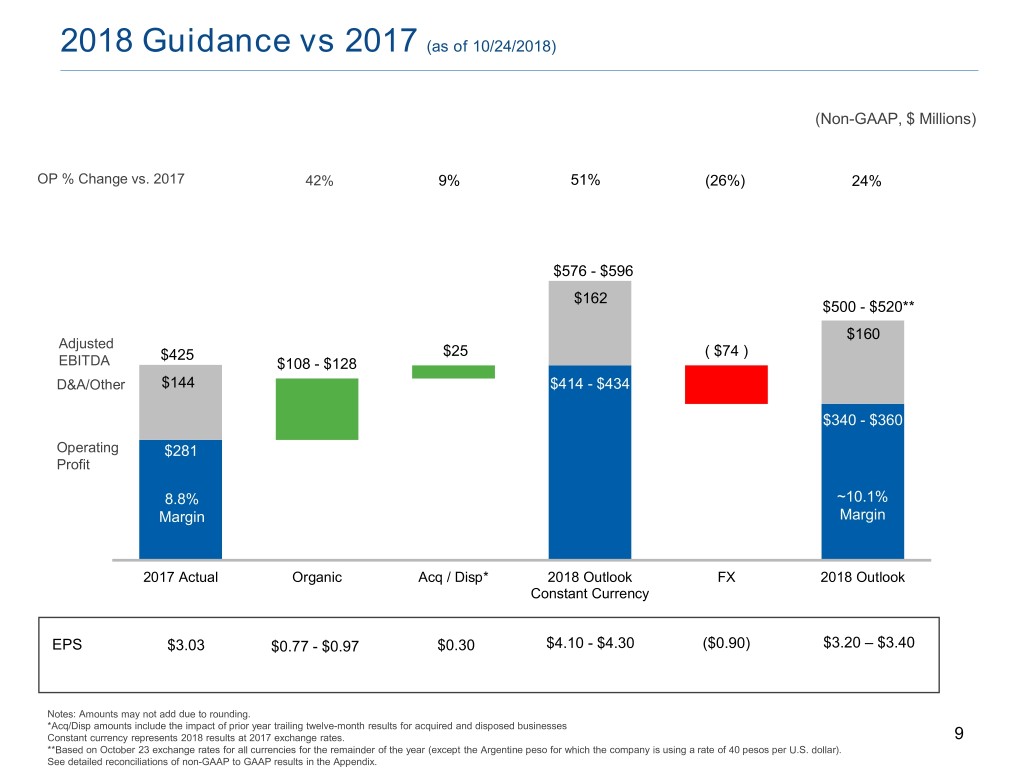

2018 Guidance vs 2017 (as of 10/24/2018) (Non-GAAP, $ Millions) OP % Change vs. 2017 42% 9% 51% (26%) 24% $576 - $596 $162 $500 - $520** $160 Adjusted $425 $25 ( $74 ) EBITDA $108 - $128 D&A/Other $144 $414 - $434 $340 - $360 Operating $281 Profit 8.8% ~10.1% Margin Margin 2017 Actual Organic Acq / Disp* 2018 Outlook FX 2018 Outlook Constant Currency EPS $3.03 $0.77 - $0.97 $0.30 $4.10 - $4.30 ($0.90) $3.20 – $3.40 Notes: Amounts may not add due to rounding. *Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses Constant currency represents 2018 results at 2017 exchange rates. 9 **Based on October 23 exchange rates for all currencies for the remainder of the year (except the Argentine peso for which the company is using a rate of 40 pesos per U.S. dollar). See detailed reconciliations of non-GAAP to GAAP results in the Appendix.

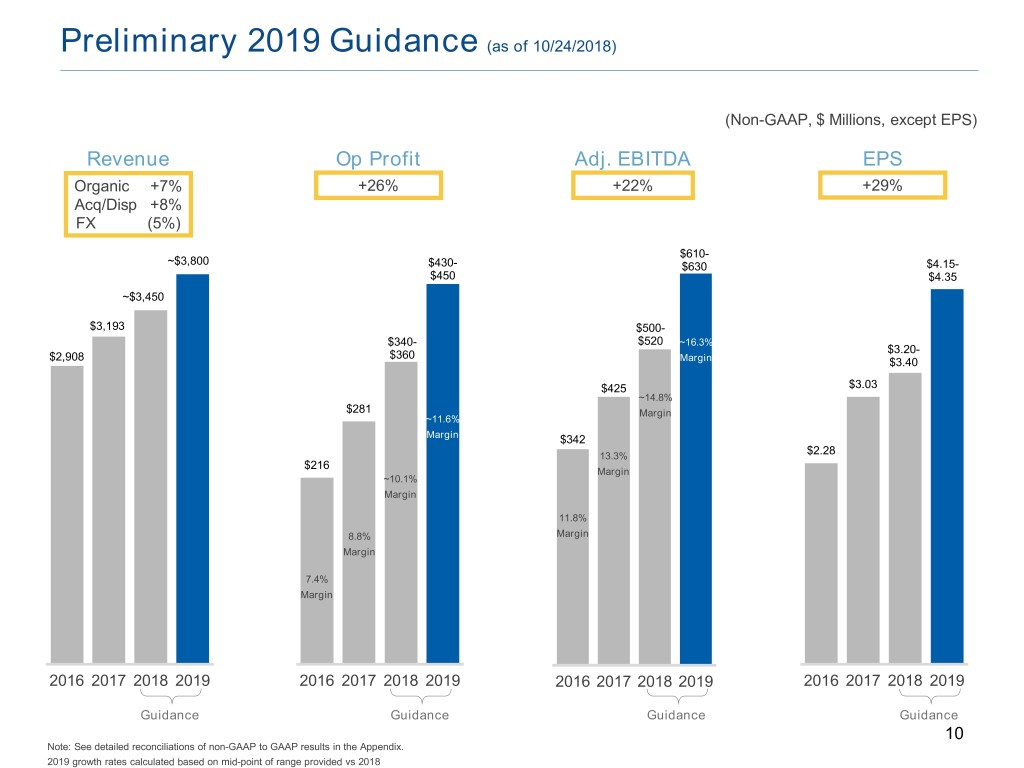

Preliminary 2019 Guidance (as of 10/24/2018) (Non-GAAP, $ Millions, except EPS) Revenue Op Profit Adj. EBITDA EPS Organic +7% +26% +22% +29% Acq/Disp +8% FX (5%) $610- ~$3,800 $430- $630 $4.15- $450 $4.35 ~$3,450 $3,193 $500- $340- $520 ~16.3%15.8% - $360 $3.20- $2,908 Margin16.3% $3.40 Margin 11.2%xx%- $425 $3.03 ~14.8%15.9% 11.7%Margin $281 MarginMargin ~11.6%Margin Margin $342 ~14.5% $2.28 13.3%13.5% Margin $216 MarginMargin ~10.1% 9.9%- Margin 10.4% 13.3% Margin 11.8%12.7% Margin 8.8% MarginMargin Margin8.8% 11.8% Margin Margin 7.4% Margin7.4% Margin 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 Guidance Guidance Guidance Guidance 10 Note: See detailed reconciliations of non-GAAP to GAAP results in the Appendix. 2019 growth rates calculated based on mid-point of range provided vs 2018

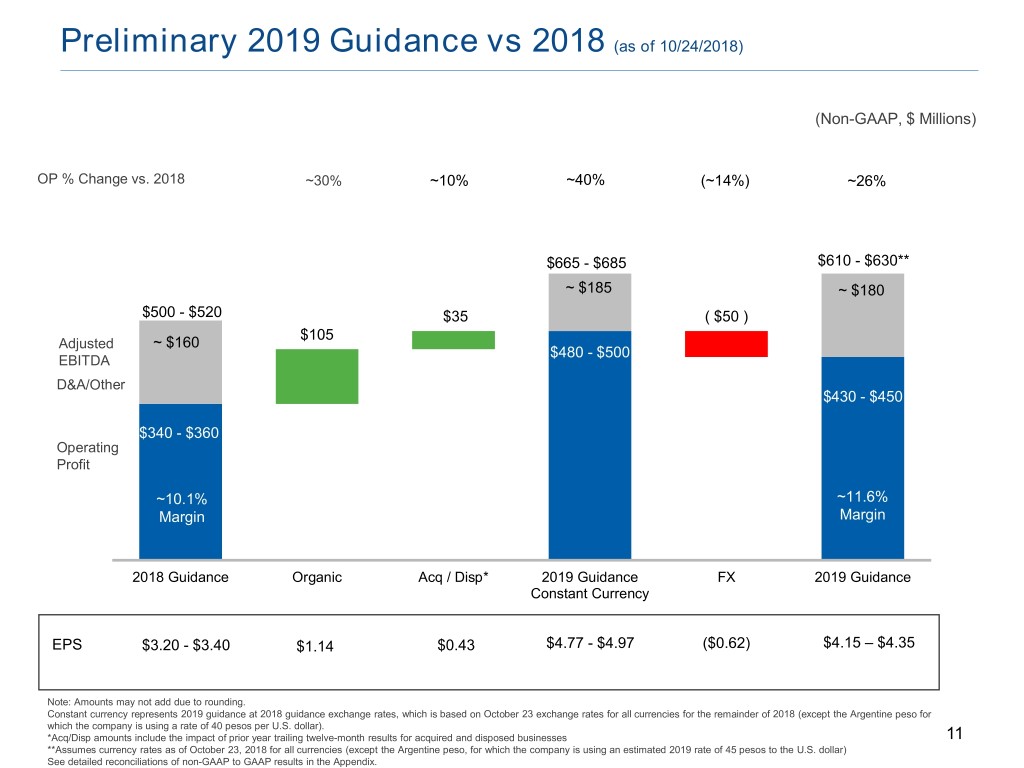

Preliminary 2019 Guidance vs 2018 (as of 10/24/2018) (Non-GAAP, $ Millions) OP % Change vs. 2018 ~30% ~10% ~40% (~14%) ~26% $665 - $685 $610 - $630** ~ $185 ~ $180 $500 - $520 $35 ( $50 ) $105 Adjusted ~ $160 $480 - $500 EBITDA D&A/Other $430 - $450 $340 - $360 Operating Profit ~10.1% ~11.6% Margin Margin 2018 Guidance Organic Acq / Disp* 2019 Guidance FX 2019 Guidance Constant Currency EPS $3.20 - $3.40 $1.14 $0.43 $4.77 - $4.97 ($0.62) $4.15 – $4.35 Note: Amounts may not add due to rounding. Constant currency represents 2019 guidance at 2018 guidance exchange rates, which is based on October 23 exchange rates for all currencies for the remainder of 2018 (except the Argentine peso for which the company is using a rate of 40 pesos per U.S. dollar). *Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses 11 **Assumes currency rates as of October 23, 2018 for all currencies (except the Argentine peso, for which the company is using an estimated 2019 rate of 45 pesos to the U.S. dollar) See detailed reconciliations of non-GAAP to GAAP results in the Appendix.

Three-Year Strategic Plan – Strategy 1.0 + 1.5 (as of 10/24/2018) Organic Growth + Acquisitions 2019 Adjusted EBITDA Target $620 Million – 3-yr CAGR ~22%* Strategy 1.5 • Focus on “core-core” & “core-adjacent” Acquisitions 13.3% • Capture synergies & improveMargin density 2019 EBITDA Target: $130 • ~$1.05B 2017-2018 investment…$115M in 2019 (Acquisitions announced/closed to date) Strategy 1.0 • Close the Gap Core Organic Growth • Accelerate Profitable Growth 2019 EBITDA Target: $490 • Introduce Differentiated Services – technology-driven 2017 2018 2019 Organic Growth + Acquisitions = Increased Value for Shareholders Note: See detailed reconciliations of non-GAAP to GAAP results included in the appendix. | 12 * Growth rates calculated based on the mid-point of the range

Strategy 1.5 – Core Acquisitions Synergistic, Accretive Acquisitions in Our Core Markets Acquisitions-to-Date • “Core/ Core” – Core businesses in core markets • 6 completed in 2017 France U.S. (Temis) (AATI) • 3 acquisitions in 2018 U.S. –Dunbar in U.S. closed in August (Dunbar) –Rodoban in Brazil expected to close by 2018 year-end –Colombia minority partner buyout Colombia (Minority • Closed and announced acquisitions Partner Buyout) Brazil expected to generate Adjusted (PagFacil) EBITDA of: $130 million in 2019 Brazil – Fully synergized ~$200 Chile (Rodoban) (LGS) • Pipeline of additional opportunities supports exceeding 2019 target Argentina (Maco Transportadora & Litoral) 13

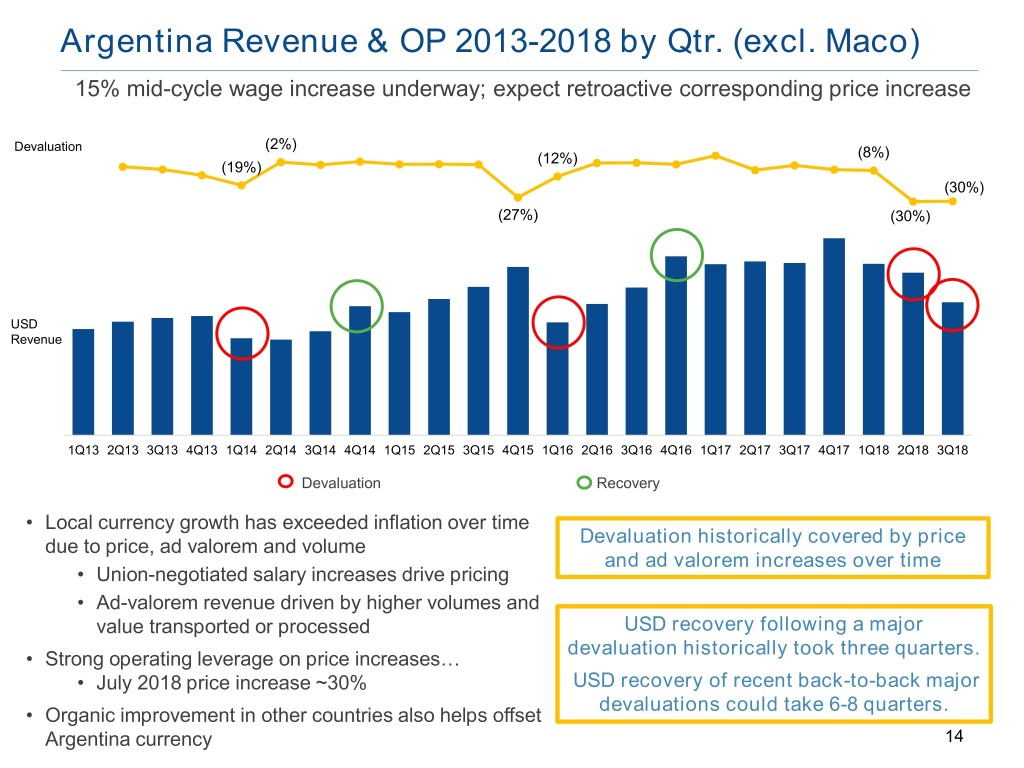

Argentina Revenue & OP 2013-2018 by Qtr. (excl. Maco) 15% mid-cycle wage increase underway; expect retroactive corresponding price increase Devaluation (2%) (12%) (8%) (19%) (30%) (27%) (30%) USD Revenue 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Devaluation Recovery • Local currency growth has exceeded inflation over time due to price, ad valorem and volume Devaluation historically covered by price and ad valorem increases over time • Union-negotiated salary increases drive pricing • Ad-valorem revenue driven by higher volumes and value transported or processed USD recovery following a major devaluation historically took three quarters. • Strong operating leverage on price increases… • July 2018 price increase ~30% USD recovery of recent back-to-back major devaluations could take 6-8 quarters. • Organic improvement in other countries also helps offset Argentina currency 14

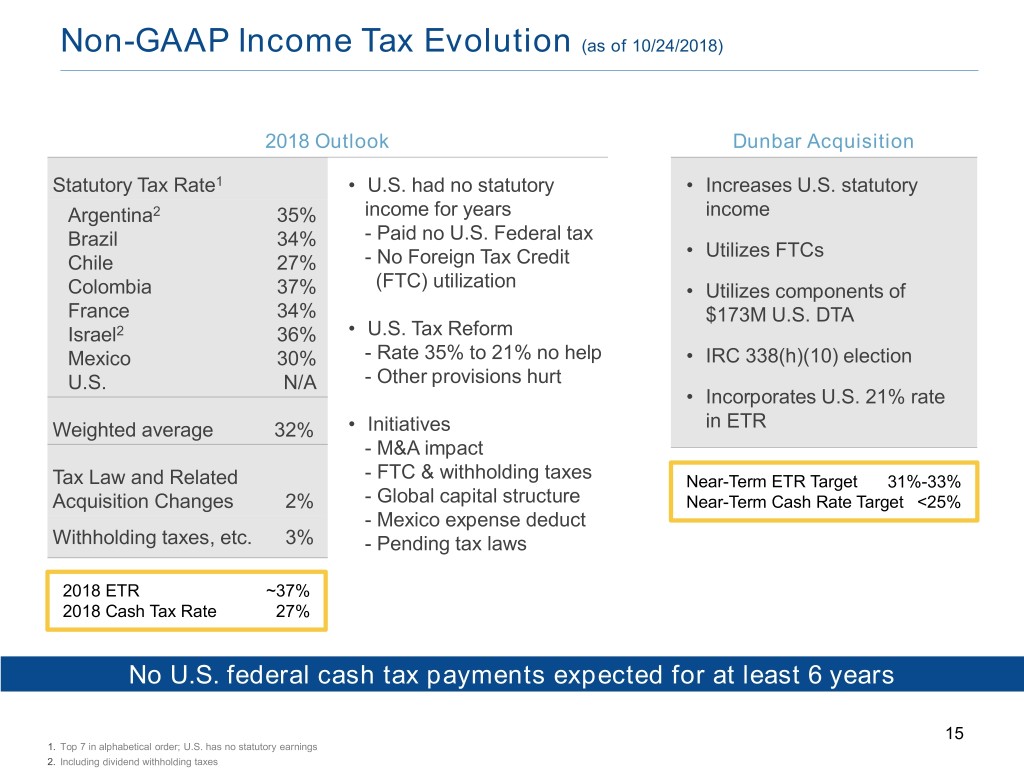

Non-GAAP Income Tax Evolution (as of 10/24/2018) 2018 Outlook Dunbar Acquisition Statutory Tax Rate1 • U.S. had no statutory • Increases U.S. statutory Argentina2 35% income for years income Brazil 34% - Paid no U.S. Federal tax • Utilizes FTCs Chile 27% - No Foreign Tax Credit (FTC) utilization Colombia 37% • Utilizes components of France 34% $173M U.S. DTA Israel2 36% • U.S. Tax Reform Mexico 30% - Rate 35% to 21% no help • IRC 338(h)(10) election U.S. N/A - Other provisions hurt • Incorporates U.S. 21% rate Weighted average 32% • Initiatives in ETR - M&A impact Tax Law and Related - FTC & withholding taxes Near-Term ETR Target 31%-33% Acquisition Changes 2% - Global capital structure Near-Term Cash Rate Target <25% - Mexico expense deduct Withholding taxes, etc. 3% - Pending tax laws 2018 ETR ~37% 2018 Cash Tax Rate 27% No U.S. federal cash tax payments expected for at least 6 years 15 1. Top 7 in alphabetical order; U.S. has no statutory earnings 2. Including dividend withholding taxes

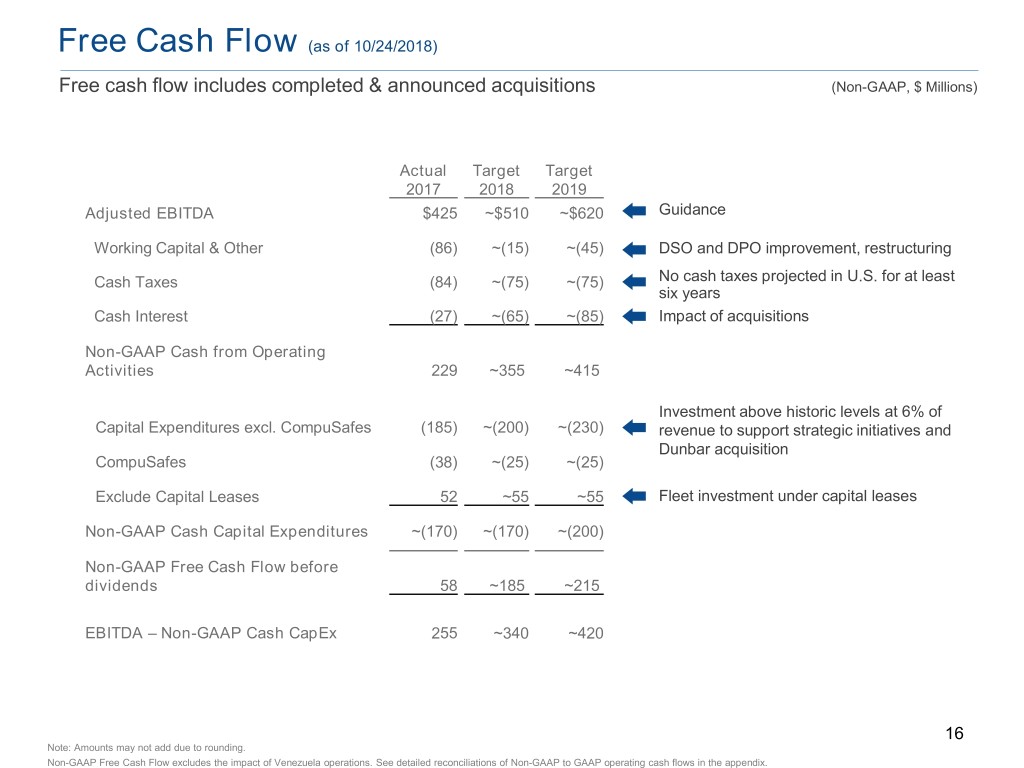

Free Cash Flow (as of 10/24/2018) Free cash flow includes completed & announced acquisitions (Non-GAAP, $ Millions) Actual Target Target 2017 2018 2019 Adjusted EBITDA $425 ~$510 ~$620 Guidance Working Capital & Other (86) ~(15) ~(45) DSO and DPO improvement, restructuring Cash Taxes (84) ~(75) ~(75) No cash taxes projected in U.S. for at least six years Cash Interest (27) ~(65) ~(85) Impact of acquisitions Non-GAAP Cash from Operating Activities 229 ~355 ~415 Investment above historic levels at 6% of Capital Expenditures excl. CompuSafes (185) ~(200) ~(230) revenue to support strategic initiatives and Dunbar acquisition CompuSafes (38) ~(25) ~(25) Exclude Capital Leases 52 ~55 ~55 Fleet investment under capital leases Non-GAAP Cash Capital Expenditures ~(170) ~(170) ~(200) Non-GAAP Free Cash Flow before dividends 58 ~185 ~215 EBITDA – Non-GAAP Cash CapEx 255 ~340 ~420 16 Note: Amounts may not add due to rounding. Non-GAAP Free Cash Flow excludes the impact of Venezuela operations. See detailed reconciliations of Non-GAAP to GAAP operating cash flows in the appendix.

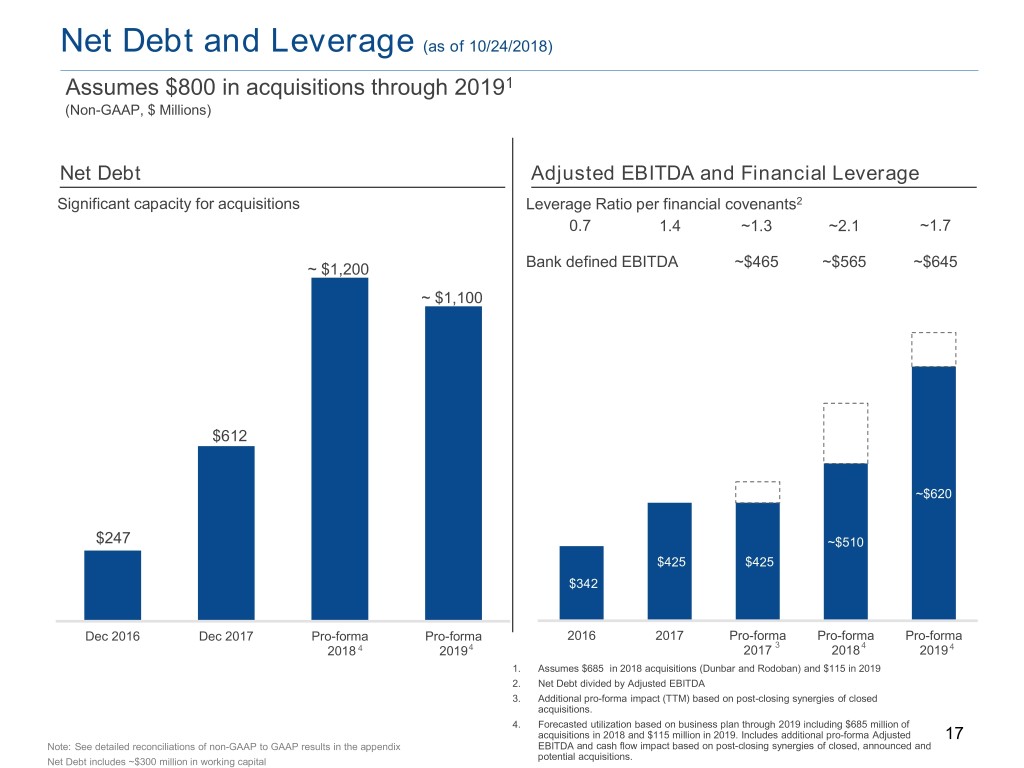

Net Debt and Leverage (as of 10/24/2018) Assumes $800 in acquisitions through 20191 (Non-GAAP, $ Millions) Net Debt Adjusted EBITDA and Financial Leverage Significant capacity for acquisitions Leverage Ratio per financial covenants2 0.7 1.4 ~1.3 ~2.1 ~1.7 ~ $1,200 Bank defined EBITDA ~$465 ~$565 ~$645 ~ $1,100 $612 ~$620 $247 ~$510 $425 $425 $342 Dec 2016 Dec 2017 Pro-forma Pro-forma 2016 2017 Pro-forma Pro-forma Pro-forma 3 2018 4 20194 2017 2018 4 2019 4 1. Assumes $685 in 2018 acquisitions (Dunbar and Rodoban) and $115 in 2019 2. Net Debt divided by Adjusted EBITDA 3. Additional pro-forma impact (TTM) based on post-closing synergies of closed acquisitions. 4. Forecasted utilization based on business plan through 2019 including $685 million of acquisitions in 2018 and $115 million in 2019. Includes additional pro-forma Adjusted 17 Note: See detailed reconciliations of non-GAAP to GAAP results in the appendix EBITDA and cash flow impact based on post-closing synergies of closed, announced and potential acquisitions. Net Debt includes ~$300 million in working capital

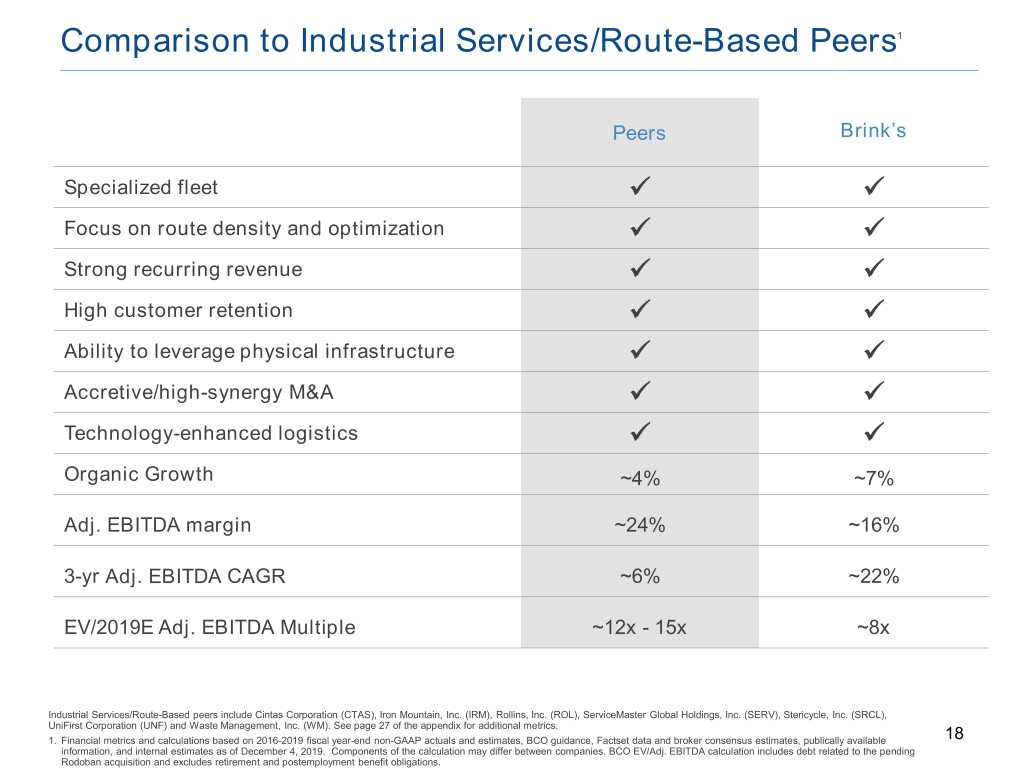

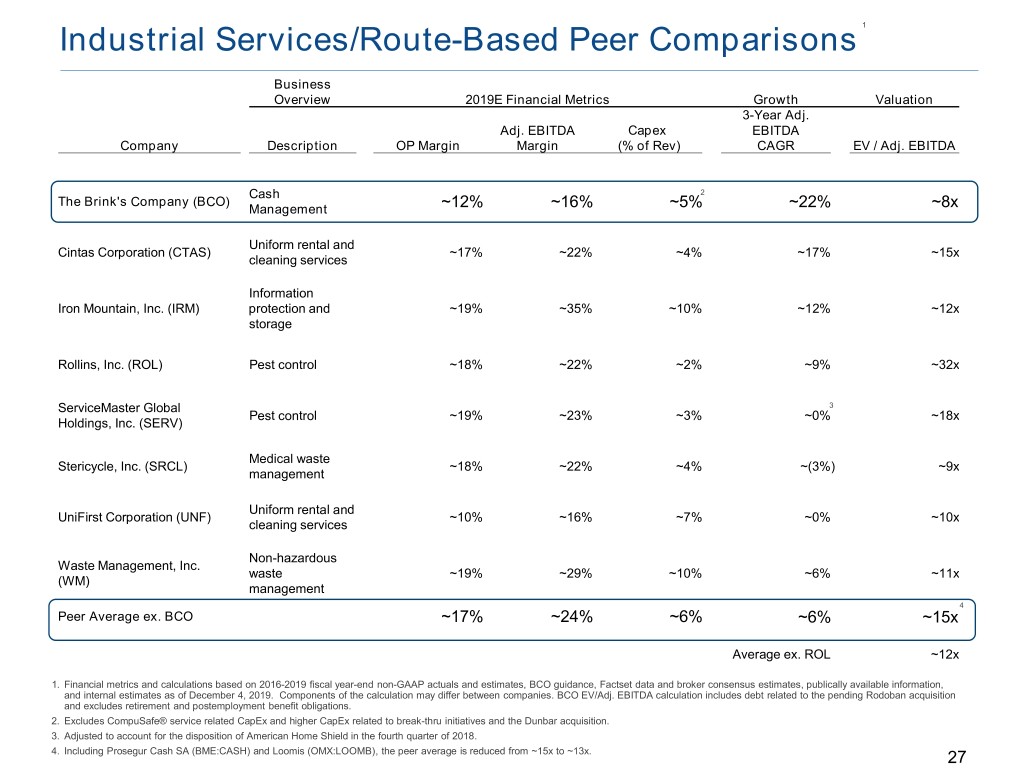

Comparison to Industrial Services/Route-Based Peers1 Peers Brink’s Specialized fleet Focus on route density and optimization Strong recurring revenue High customer retention Ability to leverage physical infrastructure Accretive/high-synergy M&A Technology-enhanced logistics Organic Growth ~4% ~7% Adj. EBITDA margin ~24% ~16% 3-yr Adj. EBITDA CAGR ~6% ~22% EV/2019E Adj. EBITDA Multiple ~12x - 15x ~8x Industrial Services/Route-Based peers include Cintas Corporation (CTAS), Iron Mountain, Inc. (IRM), Rollins, Inc. (ROL), ServiceMaster Global Holdings, Inc. (SERV), Stericycle, Inc. (SRCL), UniFirst Corporation (UNF) and Waste Management, Inc. (WM). See page 27 of the appendix for additional metrics. 1. Financial metrics and calculations based on 2016-2019 fiscal year-end non-GAAP actuals and estimates, BCO guidance, Factset data and broker consensus estimates, publically available 18 information, and internal estimates as of December 4, 2019. Components of the calculation may differ between companies. BCO EV/Adj. EBITDA calculation includes debt related to the pending Rodoban acquisition and excludes retirement and postemployment benefit obligations.

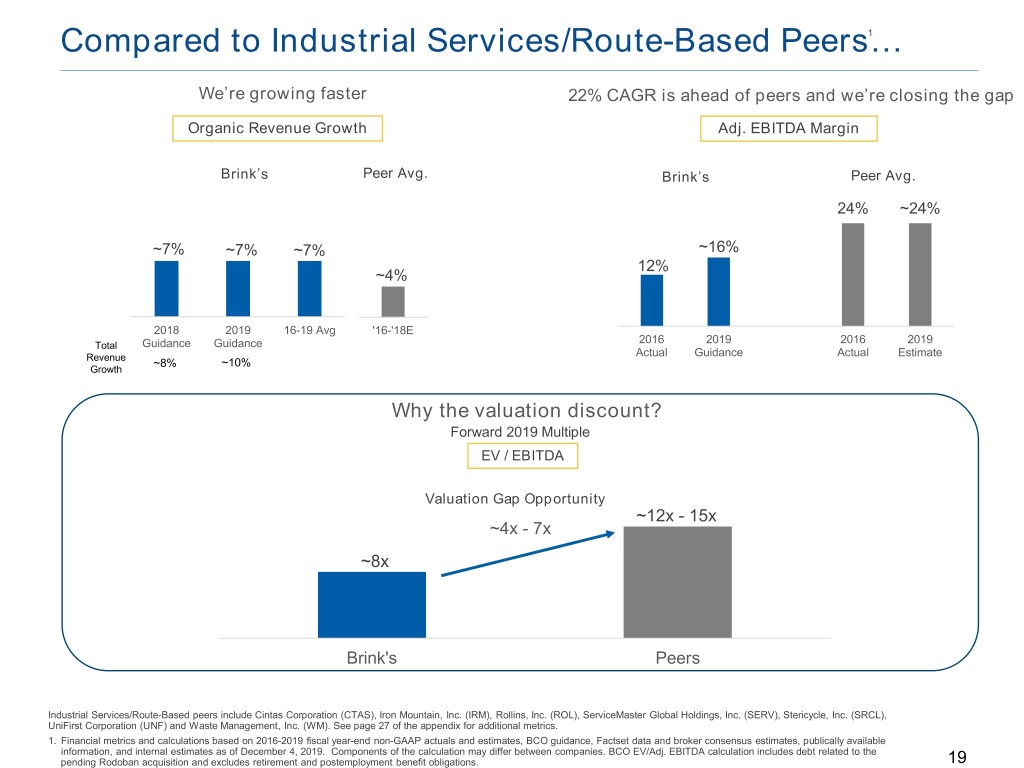

Compared to Industrial Services/Route-Based Peers…1 We’re growing faster 22% CAGR is ahead of peers and we’re closing the gap Organic Revenue Growth Adj. EBITDA Margin Brink’s Peer Avg. Brink’s Peer Avg. 24% ~24% ~7% ~7% ~7% ~16% 12% ~4% 2018 2019 16-19 Avg '16-'18E 2016 2019 2016 2019 Total Guidance Guidance Revenue Actual Guidance Actual Estimate ~8% ~10% Growth Why the valuation discount? Forward 2019 Multiple EV / EBITDA Valuation Gap Opportunity ~12x - 15x ~4x - 7x ~8x Brink's Peers Industrial Services/Route-Based peers include Cintas Corporation (CTAS), Iron Mountain, Inc. (IRM), Rollins, Inc. (ROL), ServiceMaster Global Holdings, Inc. (SERV), Stericycle, Inc. (SRCL), UniFirst Corporation (UNF) and Waste Management, Inc. (WM). See page 27 of the appendix for additional metrics. 1. Financial metrics and calculations based on 2016-2019 fiscal year-end non-GAAP actuals and estimates, BCO guidance, Factset data and broker consensus estimates, publically available information, and internal estimates as of December 4, 2019. Components of the calculation may differ between companies. BCO EV/Adj. EBITDA calculation includes debt related to the pending Rodoban acquisition and excludes retirement and postemployment benefit obligations. 19

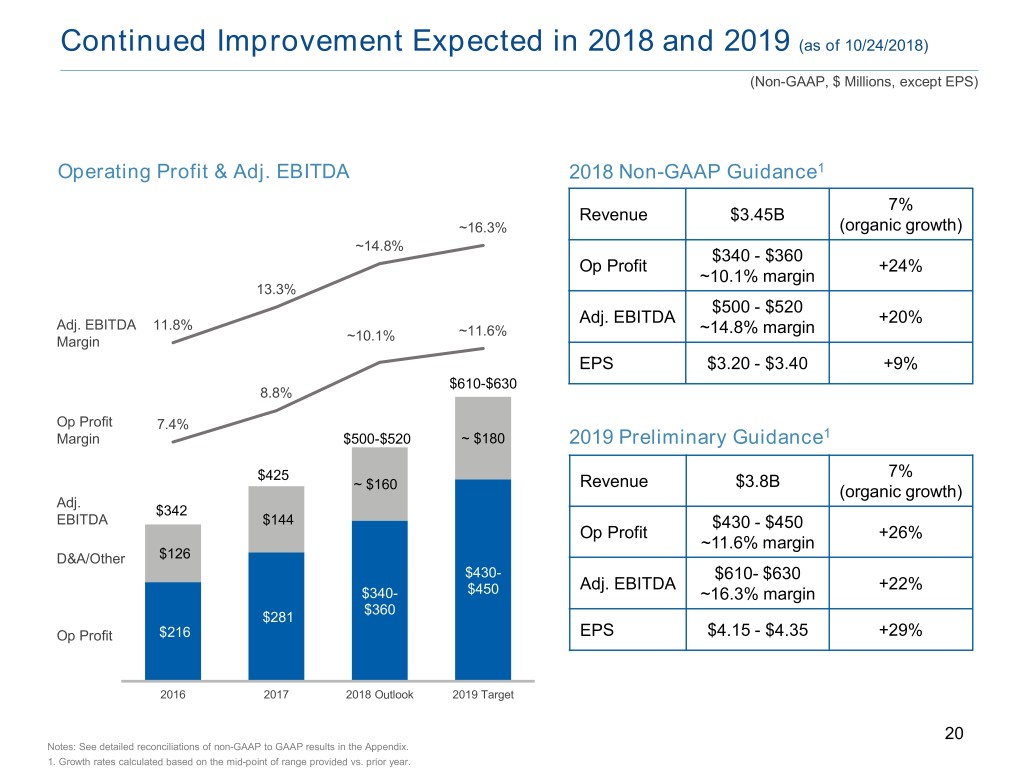

Continued Improvement Expected in 2018 and 2019 (as of 10/24/2018) (Non-GAAP, $ Millions, except EPS) Operating Profit & Adj. EBITDA 2018 Non-GAAP Guidance1 7% Revenue $3.45B ~16.3% (organic growth) ~14.8% $340 - $360 Op Profit +24% ~10.1% margin 13.3% $500 - $520 Adj. EBITDA +20% Adj. EBITDA 11.8% ~11.6% ~14.8% margin Margin ~10.1% EPS $3.20 - $3.40 +9% $610-$630 8.8% Op Profit 7.4% Margin $500-$520 ~ $180 2019 Preliminary Guidance1 7% $425 Revenue $3.8B ~ $160 (organic growth) Adj. $342 EBITDA $144 $430 - $450 Op Profit +26% ~11.6% margin D&A/Other $126 $430- $610- $630 Adj. EBITDA +22% $340- $450 ~16.3% margin $360 $281 Op Profit $216 EPS $4.15 - $4.35 +29% 2016 2017 2018 Outlook 2019 Target 20 Notes: See detailed reconciliations of non-GAAP to GAAP results in the Appendix. 1. Growth rates calculated based on the mid-point of range provided vs. prior year.

Questions? Brink’s Investor Relations 804-289-9709

Appendix

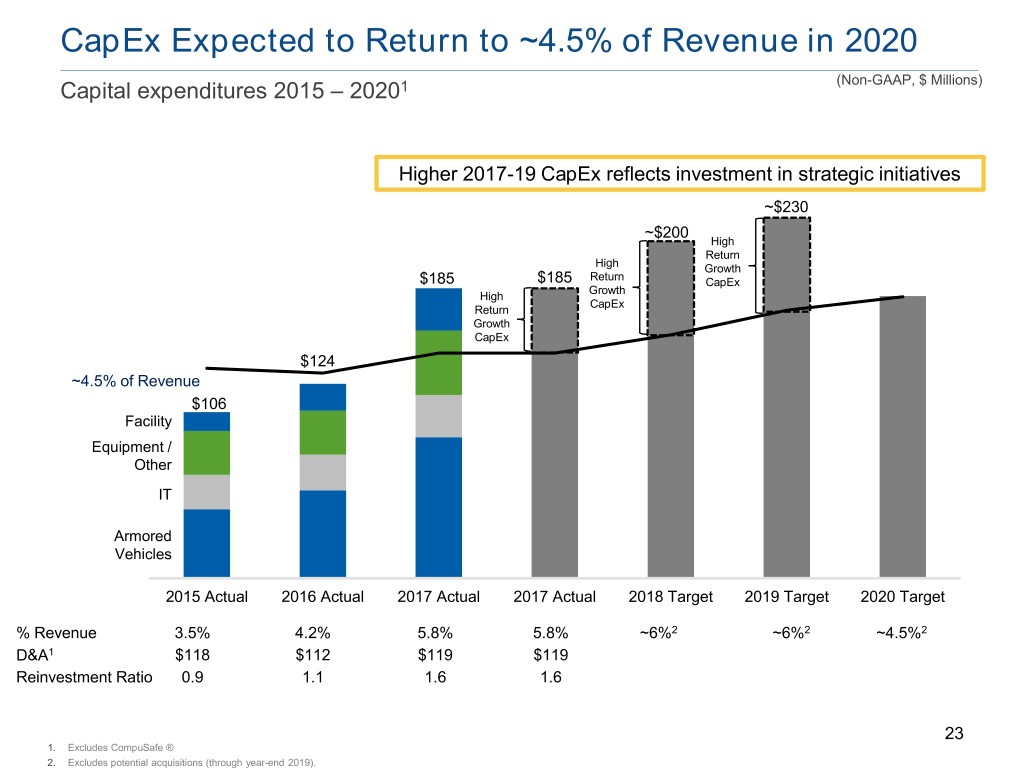

CapEx Expected to Return to ~4.5% of Revenue in 2020 (Non-GAAP, $ Millions) Capital expenditures 2015 – 20201 Higher 2017-19 CapEx reflects investment in strategic initiatives ~$230 ~$200 High Return High Growth $185 $185 Return CapEx Growth High CapEx Return Growth CapEx $124 ~4.5% of Revenue $106 Facility Equipment / Other IT Armored Vehicles 2015 Actual 2016 Actual 2017 Actual 2017 Actual 2018 Target 2019 Target 2020 Target % Revenue 3.5% 4.2% 5.8% 5.8% ~6%2 ~6%2 ~4.5%2 D&A1 $118 $112 $119 $119 Reinvestment Ratio 0.9 1.1 1.6 1.6 23 1. Excludes CompuSafe ® 2. Excludes potential acquisitions (through year-end 2019).

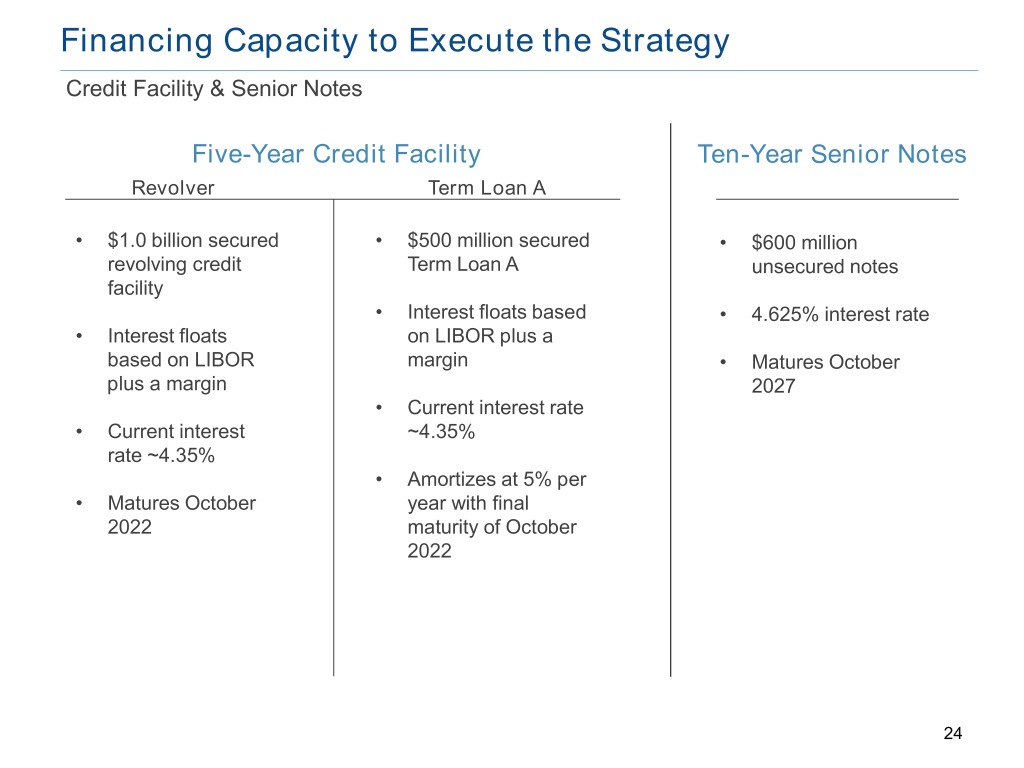

Financing Capacity to Execute the Strategy Credit Facility & Senior Notes Five-Year Credit Facility Ten-Year Senior Notes Revolver Term Loan A • $1.0 billion secured • $500 million secured • $600 million revolving credit Term Loan A unsecured notes facility • Interest floats based • 4.625% interest rate • Interest floats on LIBOR plus a based on LIBOR margin • Matures October plus a margin 2027 • Current interest rate • Current interest ~4.35% rate ~4.35% • Amortizes at 5% per • Matures October year with final 2022 maturity of October 2022 24

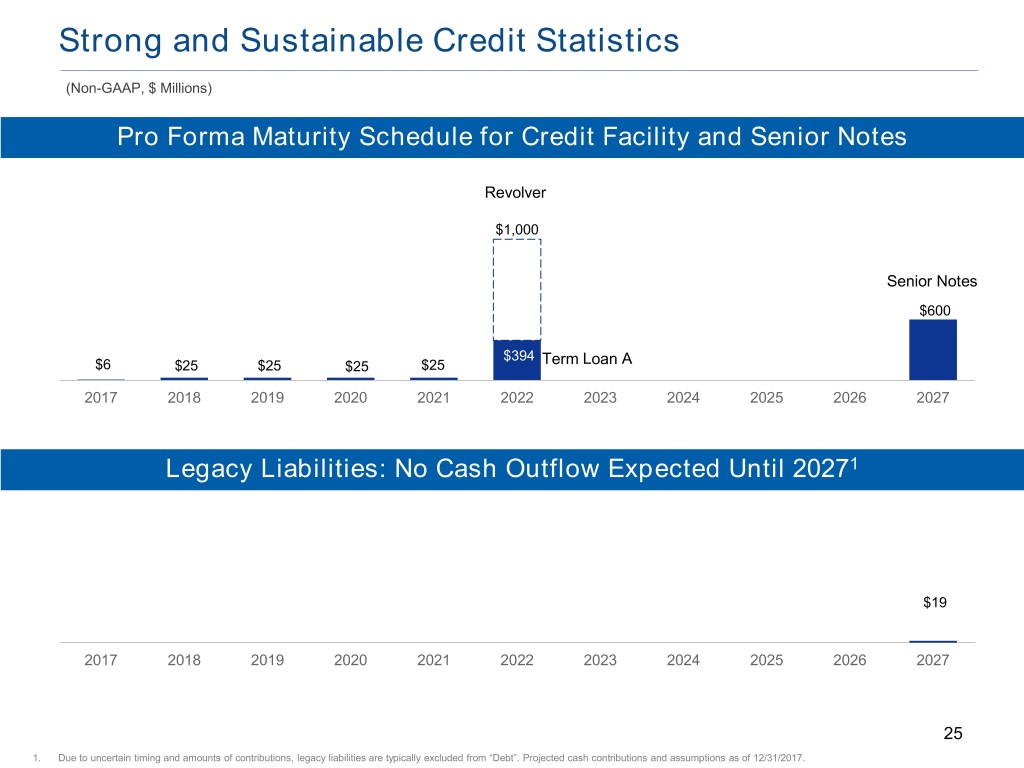

Strong and Sustainable Credit Statistics (Non-GAAP, $ Millions) Pro Forma Maturity Schedule for Credit Facility and Senior Notes Revolver $1,000 Senior Notes $600 $394 $6 $25 $25 $25 $25 Term Loan A 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 Legacy Liabilities: No Cash Outflow Expected Until 20271 $19 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 25 1. Due to uncertain timing and amounts of contributions, legacy liabilities are typically excluded from “Debt”. Projected cash contributions and assumptions as of 12/31/2017.

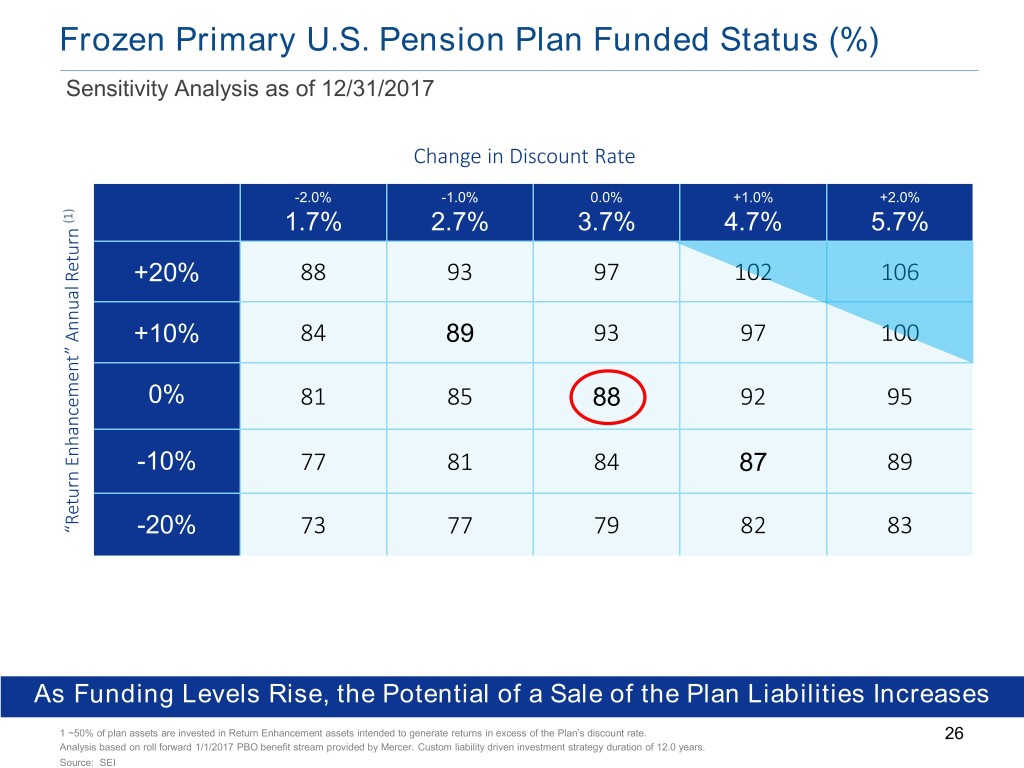

Frozen Primary U.S. Pension Plan Funded Status (%) Sensitivity Analysis as of 12/31/2017 Change in Discount Rate -2.0% -1.0% 0.0% +1.0% +2.0% (1) 1.7% 2.7% 3.7% 4.7% 5.7% Return Return +20% 88 93 97 102 106 +10% 84 89 93 97 100 0% 81 85 88 92 95 -10% 77 81 84 87 89 “Return Enhancement” Annual “Return -20% 73 77 79 82 83 As Funding Levels Rise, the Potential of a Sale of the Plan Liabilities Increases 1 ~50% of plan assets are invested in Return Enhancement assets intended to generate returns in excess of the Plan’s discount rate. 26 Analysis based on roll forward 1/1/2017 PBO benefit stream provided by Mercer. Custom liability driven investment strategy duration of 12.0 years. Source: SEI

1 Industrial Services/Route-Based Peer Comparisons Business Overview 2019E Financial Metrics Growth Valuation 3-Year Adj. Adj. EBITDA Capex EBITDA Company Description OP Margin Margin (% of Rev) CAGR EV / Adj. EBITDA Cash 2 The Brink's Company (BCO) Management ~12% ~16% ~5% ~22% ~8x Uniform rental and Cintas Corporation (CTAS) ~17% ~22% ~4% ~17% ~15x cleaning services Information Iron Mountain, Inc. (IRM) protection and ~19% ~35% ~10% ~12% ~12x storage Rollins, Inc. (ROL) Pest control ~18% ~22% ~2% ~9% ~32x ServiceMaster Global 3 Pest control ~19% ~23% ~3% ~0% ~18x Holdings, Inc. (SERV) Medical waste Stericycle, Inc. (SRCL) ~18% ~22% ~4% ~(3%) ~9x management Uniform rental and UniFirst Corporation (UNF) ~10% ~16% ~7% ~0% ~10x cleaning services Non-hazardous Waste Management, Inc. waste ~19% ~29% ~10% ~6% ~11x (WM) management 4 Peer Average ex. BCO ~17% ~24% ~6% ~6% ~15x Average ex. ROL ~12x 1. Financial metrics and calculations based on 2016-2019 fiscal year-end non-GAAP actuals and estimates, BCO guidance, Factset data and broker consensus estimates, publically available information, and internal estimates as of December 4, 2019. Components of the calculation may differ between companies. BCO EV/Adj. EBITDA calculation includes debt related to the pending Rodoban acquisition and excludes retirement and postemployment benefit obligations. 2. Excludes CompuSafe® service related CapEx and higher CapEx related to break-thru initiatives and the Dunbar acquisition. 3. Adjusted to account for the disposition of American Home Shield in the fourth quarter of 2018. 4. Including Prosegur Cash SA (BME:CASH) and Loomis (OMX:LOOMB), the peer average is reduced from ~15x to ~13x. 27

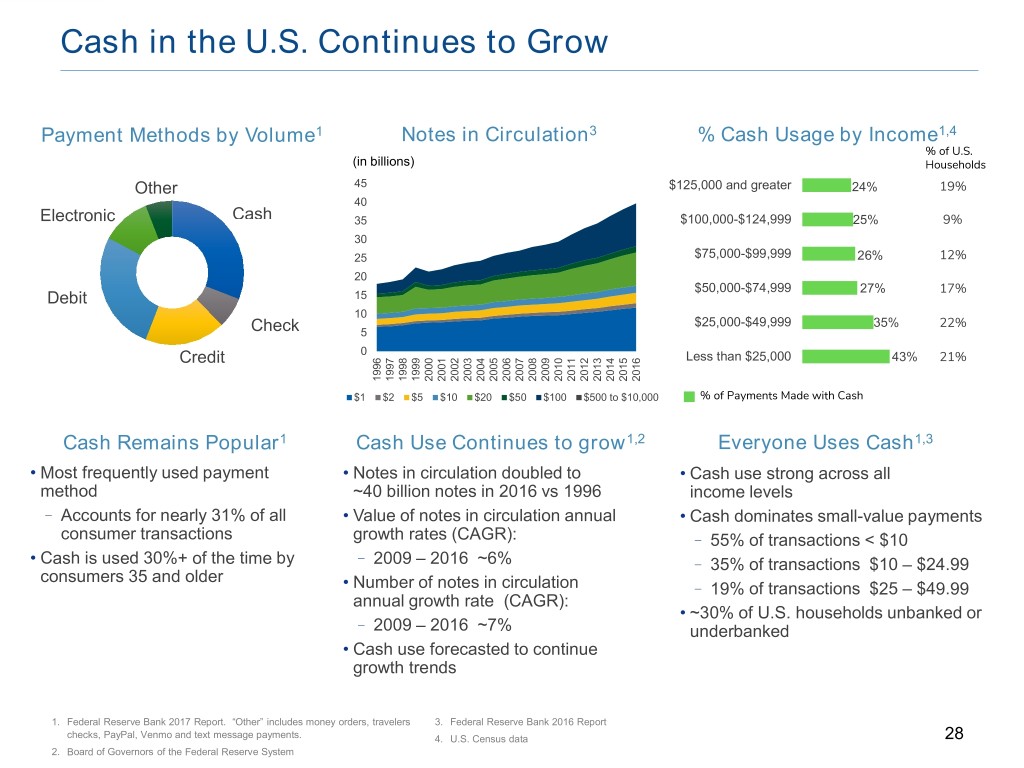

Cash in the U.S. Continues to Grow Payment Methods by Volume1 Notes in Circulation3 % Cash Usage by Income1,4 % of U.S. (in billions) Households Other 45 $125,000 and greater 24% 19% 40 Electronic Cash 35 $100,000-$124,999 25% 9% 30 25 $75,000-$99,999 26% 12% 20 $50,000-$74,999 27% 17% Debit 15 10 $25,000-$49,999 35% 22% Check 5 Credit 0 Less than $25,000 43% 21% 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 $1 $2 $5 $10 $20 $50 $100 $500 to $10,000 % of Payments Made with Cash Cash Remains Popular1 Cash Use Continues to grow1,2 Everyone Uses Cash1,3 • Most frequently used payment • Notes in circulation doubled to • Cash use strong across all method ~40 billion notes in 2016 vs 1996 income levels – Accounts for nearly 31% of all • Value of notes in circulation annual • Cash dominates small-value payments consumer transactions growth rates (CAGR): – 55% of transactions < $10 • Cash is used 30%+ of the time by – 2009 – 2016 ~6% – 35% of transactions $10 – $24.99 consumers 35 and older • Number of notes in circulation – 19% of transactions $25 – $49.99 annual growth rate (CAGR): • ~30% of U.S. households unbanked or – 2009 – 2016 ~7% underbanked • Cash use forecasted to continue growth trends 1. Federal Reserve Bank 2017 Report. “Other” includes money orders, travelers 3. Federal Reserve Bank 2016 Report checks, PayPal, Venmo and text message payments. 4. U.S. Census data 28 2. Board of Governors of the Federal Reserve System

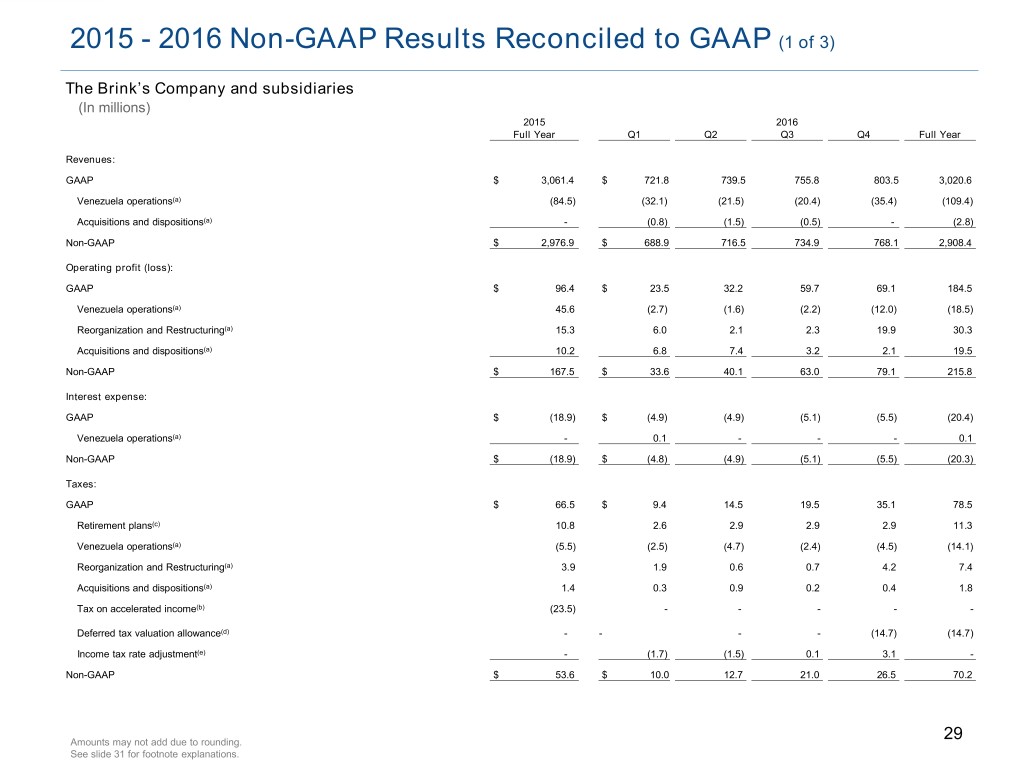

2015 - 2016 Non-GAAP Results Reconciled to GAAP (1 of 3) The Brink’s Company and subsidiaries (In millions) 2015 2016 Full Year Q1 Q2 Q3 Q4 Full Year Revenues: GAAP $ 3,061.4 $ 721.8 739.5 755.8 803.5 3,020.6 Venezuela operations(a) (84.5) (32.1) (21.5) (20.4) (35.4) (109.4) Acquisitions and dispositions(a) - (0.8) (1.5) (0.5) - (2.8) Non-GAAP $ 2,976.9 $ 688.9 716.5 734.9 768.1 2,908.4 Operating profit (loss): GAAP $ 96.4 $ 23.5 32.2 59.7 69.1 184.5 Venezuela operations(a) 45.6 (2.7) (1.6) (2.2) (12.0) (18.5) Reorganization and Restructuring(a) 15.3 6.0 2.1 2.3 19.9 30.3 Acquisitions and dispositions(a) 10.2 6.8 7.4 3.2 2.1 19.5 Non-GAAP $ 167.5 $ 33.6 40.1 63.0 79.1 215.8 Interest expense: GAAP $ (18.9) $ (4.9) (4.9) (5.1) (5.5) (20.4) Venezuela operations(a) - 0.1 - - - 0.1 Non-GAAP $ (18.9) $ (4.8) (4.9) (5.1) (5.5) (20.3) Taxes: GAAP $ 66.5 $ 9.4 14.5 19.5 35.1 78.5 Retirement plans(c) 10.8 2.6 2.9 2.9 2.9 11.3 Venezuela operations(a) (5.5) (2.5) (4.7) (2.4) (4.5) (14.1) Reorganization and Restructuring(a) 3.9 1.9 0.6 0.7 4.2 7.4 Acquisitions and dispositions(a) 1.4 0.3 0.9 0.2 0.4 1.8 Tax on accelerated income(b) (23.5) - - - - - Deferred tax valuation allowance(d) - - - - (14.7) (14.7) Income tax rate adjustment(e) - (1.7) (1.5) 0.1 3.1 - Non-GAAP $ 53.6 $ 10.0 12.7 21.0 26.5 70.2 Amounts may not add due to rounding. 29 See slide 31 for footnote explanations.

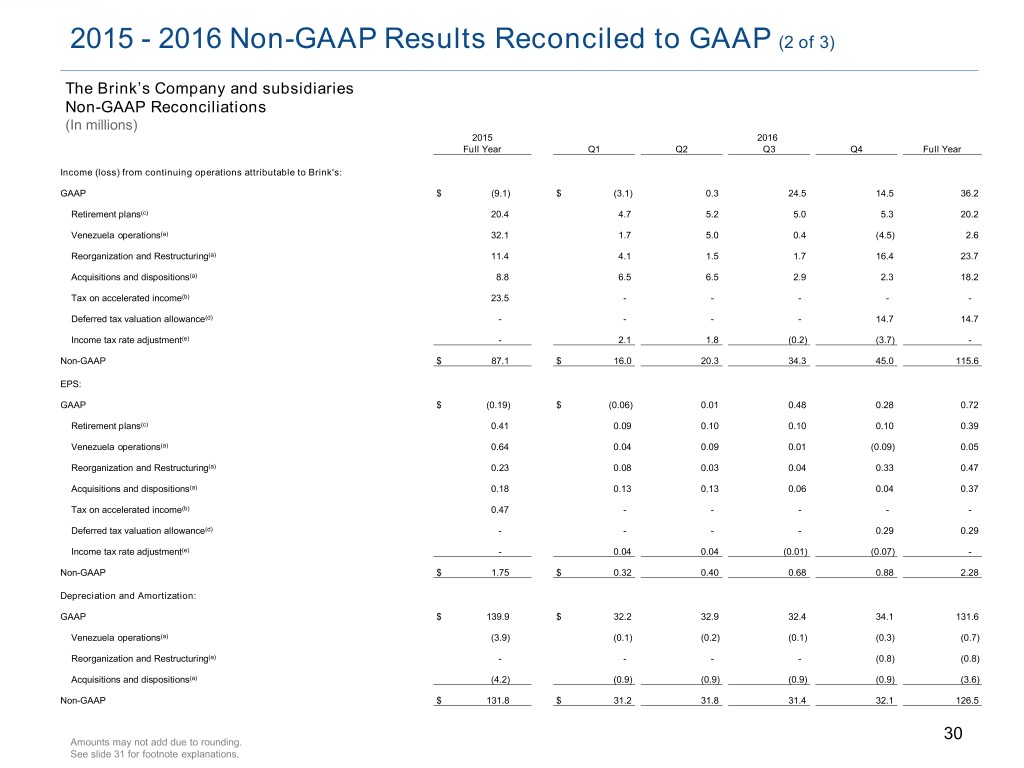

2015 - 2016 Non-GAAP Results Reconciled to GAAP (2 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2015 2016 Full Year Q1 Q2 Q3 Q4 Full Year Income (loss) from continuing operations attributable to Brink's: GAAP $ (9.1) $ (3.1) 0.3 24.5 14.5 36.2 Retirement plans(c) 20.4 4.7 5.2 5.0 5.3 20.2 Venezuela operations(a) 32.1 1.7 5.0 0.4 (4.5) 2.6 Reorganization and Restructuring(a) 11.4 4.1 1.5 1.7 16.4 23.7 Acquisitions and dispositions(a) 8.8 6.5 6.5 2.9 2.3 18.2 Tax on accelerated income(b) 23.5 - - - - - Deferred tax valuation allowance(d) - - - - 14.7 14.7 Income tax rate adjustment(e) - 2.1 1.8 (0.2) (3.7) - Non-GAAP $ 87.1 $ 16.0 20.3 34.3 45.0 115.6 EPS: GAAP $ (0.19) $ (0.06) 0.01 0.48 0.28 0.72 Retirement plans(c) 0.41 0.09 0.10 0.10 0.10 0.39 Venezuela operations(a) 0.64 0.04 0.09 0.01 (0.09) 0.05 Reorganization and Restructuring(a) 0.23 0.08 0.03 0.04 0.33 0.47 Acquisitions and dispositions(a) 0.18 0.13 0.13 0.06 0.04 0.37 Tax on accelerated income(b) 0.47 - - - - - Deferred tax valuation allowance(d) - - - - 0.29 0.29 Income tax rate adjustment(e) - 0.04 0.04 (0.01) (0.07) - Non-GAAP $ 1.75 $ 0.32 0.40 0.68 0.88 2.28 Depreciation and Amortization: GAAP $ 139.9 $ 32.2 32.9 32.4 34.1 131.6 Venezuela operations(a) (3.9) (0.1) (0.2) (0.1) (0.3) (0.7) Reorganization and Restructuring(a) - - - - (0.8) (0.8) Acquisitions and dispositions(a) (4.2) (0.9) (0.9) (0.9) (0.9) (3.6) Non-GAAP $ 131.8 $ 31.2 31.8 31.4 32.1 126.5 Amounts may not add due to rounding. 30 See slide 31 for footnote explanations.

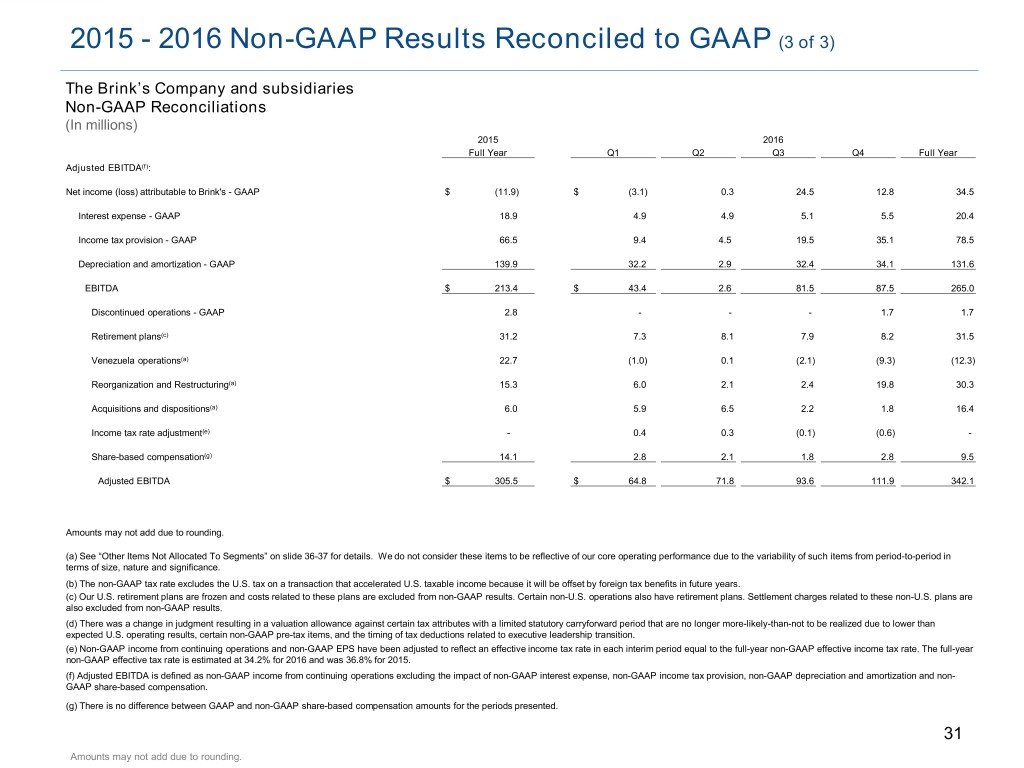

2015 - 2016 Non-GAAP Results Reconciled to GAAP (3 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2015 2016 Full Year Q1 Q2 Q3 Q4 Full Year Adjusted EBITDA(f): Net income (loss) attributable to Brink's - GAAP $ (11.9) $ (3.1) 0.3 24.5 12.8 34.5 Interest expense - GAAP 18.9 4.9 4.9 5.1 5.5 20.4 Income tax provision - GAAP 66.5 9.4 4.5 19.5 35.1 78.5 Depreciation and amortization - GAAP 139.9 32.2 2.9 32.4 34.1 131.6 EBITDA $ 213.4 $ 43.4 2.6 81.5 87.5 265.0 Discontinued operations - GAAP 2.8 - - - 1.7 1.7 Retirement plans(c) 31.2 7.3 8.1 7.9 8.2 31.5 Venezuela operations(a) 22.7 (1.0) 0.1 (2.1) (9.3) (12.3) Reorganization and Restructuring(a) 15.3 6.0 2.1 2.4 19.8 30.3 Acquisitions and dispositions(a) 6.0 5.9 6.5 2.2 1.8 16.4 Income tax rate adjustment(e) - 0.4 0.3 (0.1) (0.6) - Share-based compensation(g) 14.1 2.8 2.1 1.8 2.8 9.5 Adjusted EBITDA $ 305.5 $ 64.8 71.8 93.6 111.9 342.1 Amounts may not add due to rounding. (a) See “Other Items Not Allocated To Segments” on slide 36-37 for details. We do not consider these items to be reflective of our core operating performance due to the variability of such items from period-to-period in terms of size, nature and significance. (b) The non-GAAP tax rate excludes the U.S. tax on a transaction that accelerated U.S. taxable income because it will be offset by foreign tax benefits in future years. (c) Our U.S. retirement plans are frozen and costs related to these plans are excluded from non-GAAP results. Certain non-U.S. operations also have retirement plans. Settlement charges related to these non-U.S. plans are also excluded from non-GAAP results. (d) There was a change in judgment resulting in a valuation allowance against certain tax attributes with a limited statutory carryforward period that are no longer more-likely-than-not to be realized due to lower than expected U.S. operating results, certain non-GAAP pre-tax items, and the timing of tax deductions related to executive leadership transition. (e) Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate is estimated at 34.2% for 2016 and was 36.8% for 2015. (f) Adjusted EBITDA is defined as non-GAAP income from continuing operations excluding the impact of non-GAAP interest expense, non-GAAP income tax provision, non-GAAP depreciation and amortization and non- GAAP share-based compensation. (g) There is no difference between GAAP and non-GAAP share-based compensation amounts for the periods presented. 31 Amounts may not add due to rounding.

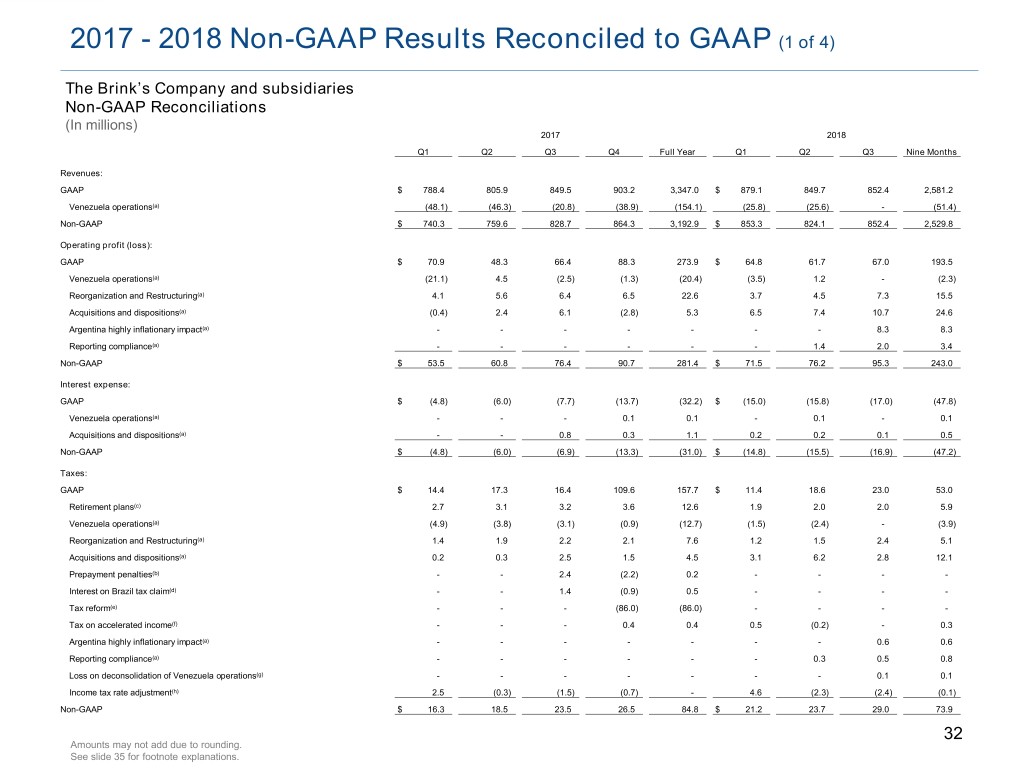

2017 - 2018 Non-GAAP Results Reconciled to GAAP (1 of 4) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2017 2018 Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Nine Months Revenues: GAAP $ 788.4 805.9 849.5 903.2 3,347.0 $ 879.1 849.7 852.4 2,581.2 Venezuela operations(a) (48.1) (46.3) (20.8) (38.9) (154.1) (25.8) (25.6) - (51.4) Non-GAAP $ 740.3 759.6 828.7 864.3 3,192.9 $ 853.3 824.1 852.4 2,529.8 Operating profit (loss): GAAP $ 70.9 48.3 66.4 88.3 273.9 $ 64.8 61.7 67.0 193.5 Venezuela operations(a) (21.1) 4.5 (2.5) (1.3) (20.4) (3.5) 1.2 - (2.3) Reorganization and Restructuring(a) 4.1 5.6 6.4 6.5 22.6 3.7 4.5 7.3 15.5 Acquisitions and dispositions(a) (0.4) 2.4 6.1 (2.8) 5.3 6.5 7.4 10.7 24.6 Argentina highly inflationary impact(a) - - - - - - - 8.3 8.3 Reporting compliance(a) - - - - - - 1.4 2.0 3.4 Non-GAAP $ 53.5 60.8 76.4 90.7 281.4 $ 71.5 76.2 95.3 243.0 Interest expense: GAAP $ (4.8) (6.0) (7.7) (13.7) (32.2) $ (15.0) (15.8) (17.0) (47.8) Venezuela operations(a) - - - 0.1 0.1 - 0.1 - 0.1 Acquisitions and dispositions(a) - - 0.8 0.3 1.1 0.2 0.2 0.1 0.5 Non-GAAP $ (4.8) (6.0) (6.9) (13.3) (31.0) $ (14.8) (15.5) (16.9) (47.2) Taxes: GAAP $ 14.4 17.3 16.4 109.6 157.7 $ 11.4 18.6 23.0 53.0 Retirement plans(c) 2.7 3.1 3.2 3.6 12.6 1.9 2.0 2.0 5.9 Venezuela operations(a) (4.9) (3.8) (3.1) (0.9) (12.7) (1.5) (2.4) - (3.9) Reorganization and Restructuring(a) 1.4 1.9 2.2 2.1 7.6 1.2 1.5 2.4 5.1 Acquisitions and dispositions(a) 0.2 0.3 2.5 1.5 4.5 3.1 6.2 2.8 12.1 Prepayment penalties(b) - - 2.4 (2.2) 0.2 - - - - Interest on Brazil tax claim(d) - - 1.4 (0.9) 0.5 - - - - Tax reform(e) - - - (86.0) (86.0) - - - - Tax on accelerated income(f) - - - 0.4 0.4 0.5 (0.2) - 0.3 Argentina highly inflationary impact(a) - - - - - - - 0.6 0.6 Reporting compliance(a) - - - - - - 0.3 0.5 0.8 Loss on deconsolidation of Venezuela operations(g) - - - - - - - 0.1 0.1 Income tax rate adjustment(h) 2.5 (0.3) (1.5) (0.7) - 4.6 (2.3) (2.4) (0.1) Non-GAAP $ 16.3 18.5 23.5 26.5 84.8 $ 21.2 23.7 29.0 73.9 32 Amounts may not add due to rounding. See slide 35 for footnote explanations.

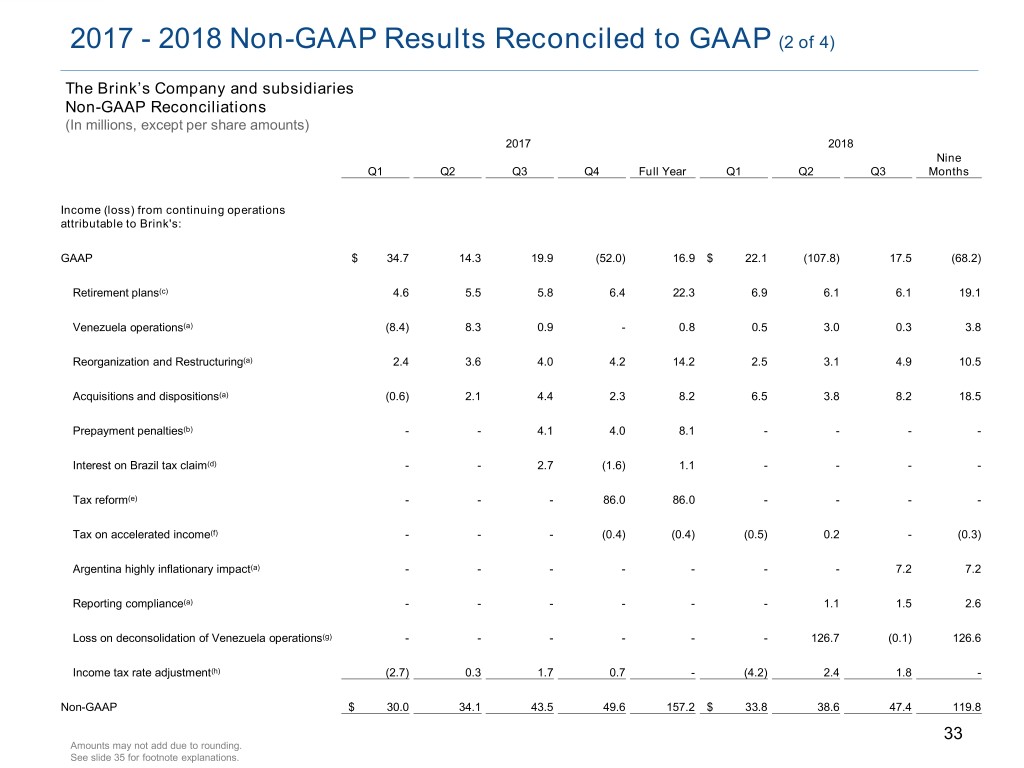

2017 - 2018 Non-GAAP Results Reconciled to GAAP (2 of 4) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions, except per share amounts) 2017 2018 Nine Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Months Income (loss) from continuing operations attributable to Brink's: GAAP $ 34.7 14.3 19.9 (52.0) 16.9 $ 22.1 (107.8) 17.5 (68.2) Retirement plans(c) 4.6 5.5 5.8 6.4 22.3 6.9 6.1 6.1 19.1 Venezuela operations(a) (8.4) 8.3 0.9 - 0.8 0.5 3.0 0.3 3.8 Reorganization and Restructuring(a) 2.4 3.6 4.0 4.2 14.2 2.5 3.1 4.9 10.5 Acquisitions and dispositions(a) (0.6) 2.1 4.4 2.3 8.2 6.5 3.8 8.2 18.5 Prepayment penalties(b) - - 4.1 4.0 8.1 - - - - Interest on Brazil tax claim(d) - - 2.7 (1.6) 1.1 - - - - Tax reform(e) - - - 86.0 86.0 - - - - Tax on accelerated income(f) - - - (0.4) (0.4) (0.5) 0.2 - (0.3) Argentina highly inflationary impact(a) - - - - - - - 7.2 7.2 Reporting compliance(a) - - - - - - 1.1 1.5 2.6 Loss on deconsolidation of Venezuela operations(g) - - - - - - 126.7 (0.1) 126.6 Income tax rate adjustment(h) (2.7) 0.3 1.7 0.7 - (4.2) 2.4 1.8 - Non-GAAP $ 30.0 34.1 43.5 49.6 157.2 $ 33.8 38.6 47.4 119.8 33 Amounts may not add due to rounding. See slide 35 for footnote explanations.

2017 - 2018 Non-GAAP Results Reconciled to GAAP (3 of 4) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions, except per share amounts) EPS: GAAP $ 0.67 0.28 0.38 (1.02) 0.33 $ 0.42 (2.11) 0.34 (1.34) Retirement plans(c) 0.09 0.11 0.11 0.12 0.43 0.13 0.12 0.12 0.37 Venezuela operations(a) (0.16) 0.15 0.02 - 0.02 0.01 0.06 0.01 0.07 Reorganization and Restructuring(a) 0.04 0.07 0.08 0.08 0.27 0.05 0.06 0.09 0.20 Acquisitions and dispositions(a) (0.01) 0.04 0.09 0.05 0.16 0.12 0.07 0.16 0.36 Prepayment penalties(b) - - 0.08 0.08 0.16 - - - - Interest on Brazil tax claim(d) - - 0.05 (0.03) 0.02 - - - - Tax reform(e) - - - 1.65 1.66 - - - - Tax on accelerated income(f) - - - (0.01) (0.01) (0.01) - - (0.01) Argentina highly inflationary impact(a) - - - - - - - 0.14 0.14 Reporting compliance(a) - - - - - - 0.02 0.03 0.05 Loss on deconsolidation of Venezuela operations(g) - - - - - - 2.43 - 2.43 Income tax rate adjustment(h) (0.05) 0.01 0.03 0.01 - (0.08) 0.05 0.03 - Share adjustment(i) - - - 0.02 - - 0.04 - 0.03 Non-GAAP $ 0.58 0.66 0.84 0.95 3.03 $ 0.65 0.74 0.91 2.30 Depreciation and Amortization: $ $ GAAP 33.9 34.6 37.9 40.2 146.6 38.8 39.1 41.6 119.5 Venezuela operations(a) (0.4) (0.4) (0.4) (0.5) (1.7) (0.5) (0.6) - (1.1) Reorganization and Restructuring(a) (0.9) (0.6) (0.5) (0.2) (2.2) (1.2) (0.2) (0.4) (1.8) Acquisitions and dispositions(a) (0.6) (1.1) (2.7) (4.0) (8.4) (3.8) (3.4) (4.5) (11.7) Non-GAAP $ 32.0 32.5 34.3 35.5 134.3 $ 33.3 34.9 36.7 104.9 34 Amounts may not add due to rounding. See slide 35 for footnote explanations.

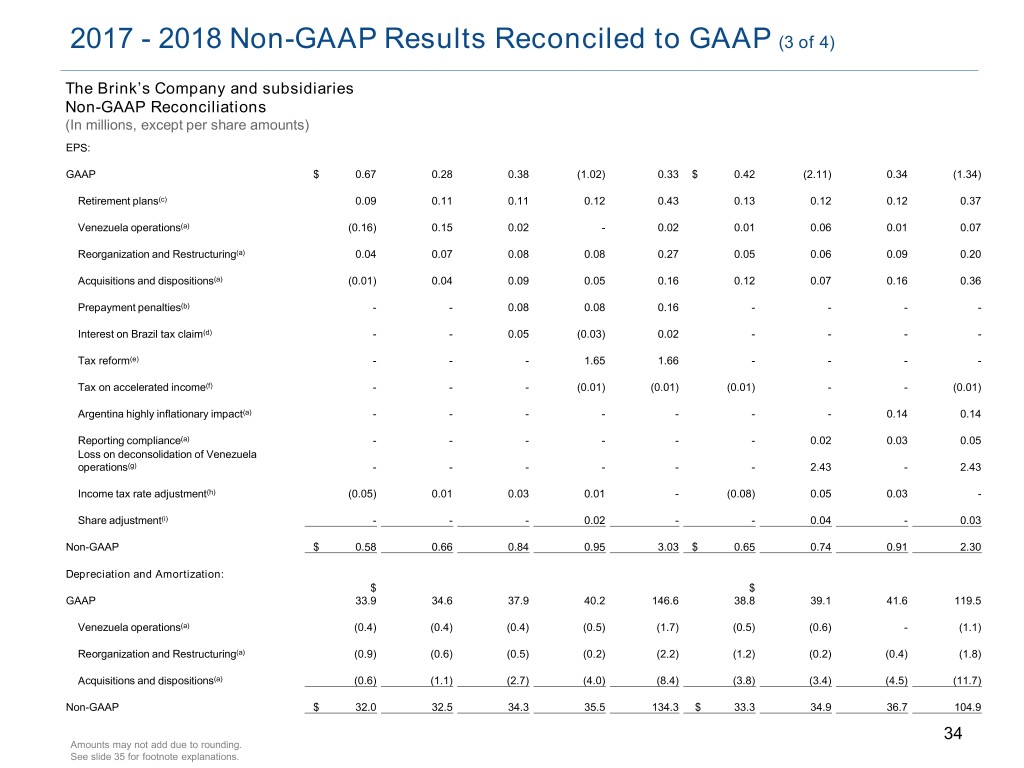

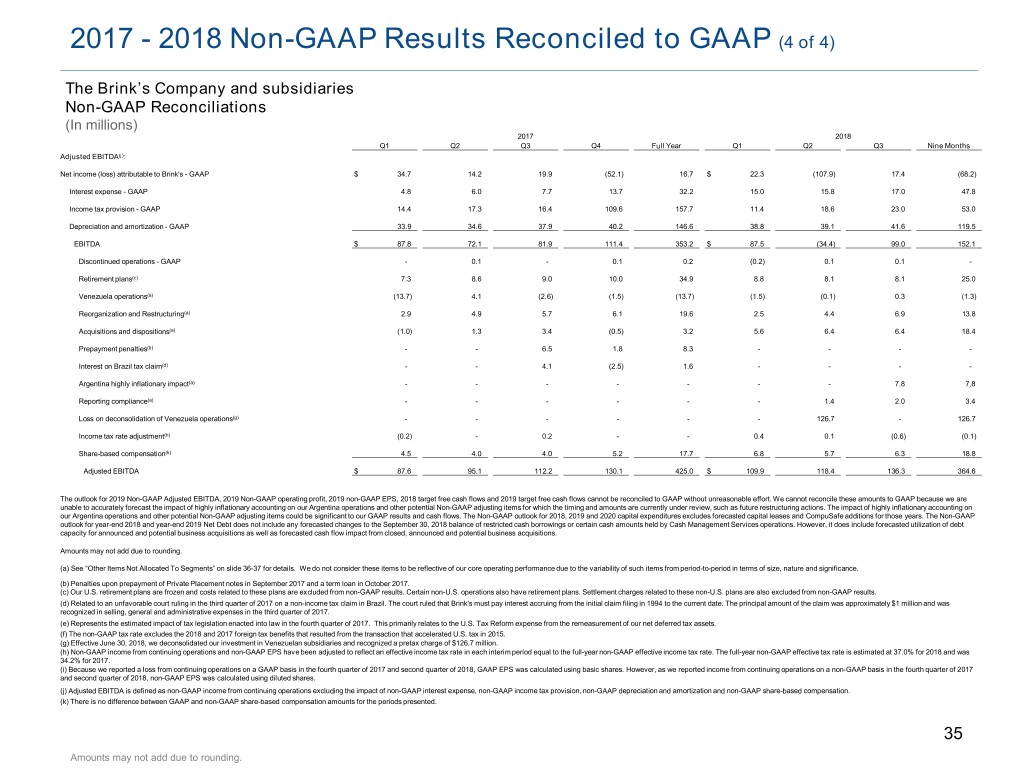

2017 - 2018 Non-GAAP Results Reconciled to GAAP (4 of 4) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2017 2018 Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Nine Months Adjusted EBITDA(j): Net income (loss) attributable to Brink's - GAAP $ 34.7 14.2 19.9 (52.1) 16.7 $ 22.3 (107.9) 17.4 (68.2) Interest expense - GAAP 4.8 6.0 7.7 13.7 32.2 15.0 15.8 17.0 47.8 Income tax provision - GAAP 14.4 17.3 16.4 109.6 157.7 11.4 18.6 23.0 53.0 Depreciation and amortization - GAAP 33.9 34.6 37.9 40.2 146.6 38.8 39.1 41.6 119.5 EBITDA $ 87.8 72.1 81.9 111.4 353.2 $ 87.5 (34.4) 99.0 152.1 Discontinued operations - GAAP - 0.1 - 0.1 0.2 (0.2) 0.1 0.1 - Retirement plans(c) 7.3 8.6 9.0 10.0 34.9 8.8 8.1 8.1 25.0 Venezuela operations(a) (13.7) 4.1 (2.6) (1.5) (13.7) (1.5) (0.1) 0.3 (1.3) Reorganization and Restructuring(a) 2.9 4.9 5.7 6.1 19.6 2.5 4.4 6.9 13.8 Acquisitions and dispositions(a) (1.0) 1.3 3.4 (0.5) 3.2 5.6 6.4 6.4 18.4 Prepayment penalties(b) - - 6.5 1.8 8.3 - - - - Interest on Brazil tax claim(d) - - 4.1 (2.5) 1.6 - - - - Argentina highly inflationary impact(a) - - - - - - - 7.8 7.8 Reporting compliance(a) - - - - - - 1.4 2.0 3.4 Loss on deconsolidation of Venezuela operations(g) - - - - - - 126.7 - 126.7 Income tax rate adjustment(h) (0.2) - 0.2 - - 0.4 0.1 (0.6) (0.1) Share-based compensation(k) 4.5 4.0 4.0 5.2 17.7 6.8 5.7 6.3 18.8 Adjusted EBITDA $ 87.6 95.1 112.2 130.1 425.0 $ 109.9 118.4 136.3 364.6 The outlook for 2019 Non-GAAP Adjusted EBITDA, 2019 Non-GAAP operating profit, 2019 non-GAAP EPS, 2018 target free cash flows and 2019 target free cash flows cannot be reconciled to GAAP without unreasonable effort. We cannot reconcile these amounts to GAAP because we are unable to accurately forecast the impact of highly inflationary accounting on our Argentina operations and other potential Non-GAAP adjusting items for which the timing and amounts are currently under review, such as future restructuring actions. The impact of highly inflationary accounting on our Argentina operations and other potential Non-GAAP adjusting items could be significant to our GAAP results and cash flows. The Non-GAAP outlook for 2018, 2019 and 2020 capital expenditures excludes forecasted capital leases and CompuSafe additions for those years. The Non-GAAP outlook for year-end 2018 and year-end 2019 Net Debt does not include any forecasted changes to the September 30, 2018 balance of restricted cash borrowings or certain cash amounts held by Cash Management Services operations. However, it does include forecasted utilization of debt capacity for announced and potential business acquisitions as well as forecasted cash flow impact from closed, announced and potential business acquisitions. Amounts may not add due to rounding. (a) See “Other Items Not Allocated To Segments” on slide 36-37 for details. We do not consider these items to be reflective of our core operating performance due to the variability of such items from period-to-period in terms of size, nature and significance. (b) Penalties upon prepayment of Private Placement notes in September 2017 and a term loan in October 2017. (c) Our U.S. retirement plans are frozen and costs related to these plans are excluded from non-GAAP results. Certain non-U.S. operations also have retirement plans. Settlement charges related to these non-U.S. plans are also excluded from non-GAAP results. (d) Related to an unfavorable court ruling in the third quarter of 2017 on a non-income tax claim in Brazil. The court ruled that Brink's must pay interest accruing from the initial claim filing in 1994 to the current date. The principal amount of the claim was approximately $1 million and was recognized in selling, general and administrative expenses in the third quarter of 2017. (e) Represents the estimated impact of tax legislation enacted into law in the fourth quarter of 2017. This primarily relates to the U.S. Tax Reform expense from the remeasurement of our net deferred tax assets. (f) The non-GAAP tax rate excludes the 2018 and 2017 foreign tax benefits that resulted from the transaction that accelerated U.S. tax in 2015. (g) Effective June 30, 2018, we deconsolidated our investment in Venezuelan subsidiaries and recognized a pretax charge of $126.7 million. (h) Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate is estimated at 37.0% for 2018 and was 34.2% for 2017. (i) Because we reported a loss from continuing operations on a GAAP basis in the fourth quarter of 2017 and second quarter of 2018, GAAP EPS was calculated using basic shares. However, as we reported income from continuing operations on a non-GAAP basis in the fourth quarter of 2017 and second quarter of 2018, non-GAAP EPS was calculated using diluted shares. (j) Adjusted EBITDA is defined as non-GAAP income from continuing operations excluding the impact of non-GAAP interest expense, non-GAAP income tax provision, non-GAAP depreciation and amortization and non-GAAP share-based compensation. (k) There is no difference between GAAP and non-GAAP share-based compensation amounts for the periods presented. 35 Amounts may not add due to rounding.

Non-GAAP Reconciliation — Other Items Not Allocated The Brink’s Company and subsidiaries Other Items Not Allocated to Segments (Unaudited) Brink’s measures its segment results before income and expenses for corporate activities and for certain other items. See below for a summary of the other items not allocated to segments. Venezuela operations Prior to the deconsolidation of our Venezuelan subsidiaries effective June 30, 2018, we excluded from our segment results all of our Venezuela operating results, due to the Venezuelan government's restrictions that have prevented us from repatriating funds. As a result, the Chief Executive Officer, the Company's Chief Operating Decision maker ("CODM"), has assessed segment performance and has made resource decisions by segment excluding Venezuela operating results. Reorganization and Restructuring 2016 Restructuring In the fourth quarter of 2016, management implemented restructuring actions across our global business operations and our corporate functions. As a result of these actions, we recognized $18.1 million in related 2016 costs, an additional $17.3 million in 2017 and $11.3 million in the first nine months of 2018. The actions under this program were substantially completed in the third quarter of 2018, with cumulative pretax charges of approximately $46.7 million. Executive Leadership and Board of Directors In 2015, we recognized $1.8 million in charges related to Executive Leadership and Board of Directors restructuring actions, which were announced in January 2016. We recognized $4.3 million in charges in 2016 related to the Executive Leadership and Board of Directors restructuring actions. 2015 Restructuring Brink's initiated a restructuring of its business in the third quarter of 2015. We recognized $11.6 million in related 2015 costs and an additional $6.5 million in 2016 related to this restructuring. The actions under this program were substantially completed by the end of 2016, with cumulative pretax charges of approximately $18 million. Other Restructurings Management routinely implements restructuring actions in targeted sections of our business. As a result of these actions, we recognized $4.2 million in the first nine months of 2018 and $4.6 million in 2017, primarily severance costs. For the current restructuring actions, we expect to incur additional costs between $2 and $4 million in future periods. Due to the unique circumstances around these charges, they have not been allocated to segment results and are excluded from non-GAAP results. 36

Non-GAAP Reconciliation — Other Items Not Allocated The Brink’s Company and subsidiaries Other Items Not Allocated to Segments (Unaudited) Acquisitions and dispositions Certain acquisition and disposition items that are not considered part of the ongoing activities of the business and are special in nature are consistently excluded from non-GAAP results. These items are described below: 2018 Acquisitions and Dispositions - Amortization expense for acquisition-related intangible assets was $11.7 million in the first nine months of 2018. - Severance costs related to our 2017 acquisitions in Argentina, France and Brazil were $3.7 million in the first nine months of 2018. - Transaction costs related to business acquisitions were $5.9 million in the first nine months of 2018. - Compensation expense related to the retention of key Dunbar employees was $1.3 million in the third quarter of 2018. 2017 Acquisitions and Dispositions - Amortization expense for acquisition-related intangible assets was $8.4 million in 2017. - Fourth quarter 2017 gain of $7.8 million related to the sale of real estate in Mexico. - Severance costs of $4.0 million related to our 2017 acquisitions in Argentina and Brazil. - Transaction costs of $2.6 million related to acquisitions of new businesses in 2017. - Currency transaction gains of $1.8 million related to acquisition activity. 2016 Acquisitions and Dispositions - Due to management's decision in the first quarter of 2016 to exit the Republic of Ireland, the prospective impacts of shutting down this operation were included in items not allocated to segments and were excluded from the operating segments effective March 1, 2016. This activity is also excluded from the consolidated non-GAAP results. Beginning May 1, 2016, due to management's decision to also exit Northern Ireland, the results of shutting down these operations were treated similarly to the Republic of Ireland. - Amortization expense for acquisition-related intangible assets was $3.6 million in 2016. - Brink's recognized a $2.0 million loss related to the sale of corporate assets in the second quarter of 2016. 2015 Acquisitions and Dispositions - These items related primarily to Brink's sale of its 70% interest in a cash management business in Russia in the fourth quarter of 2015 from which we recognized a $5.9 million loss on the sale. - Amortization expense for acquisition-related intangible assets was $4.2 million in 2015. Argentina highly inflationary impact Beginning in the third quarter of 2018, we designated Argentina's economy as highly inflationary for accounting purposes. As a result, Argentine peso-denominated monetary assets and liabilities are now remeasured at each balance sheet date to the currency exchange rate then in effect, with currency remeasurement gains and losses recognized in earnings. In addition, nonmonetary assets retain a higher historical basis when the currency is devalued. The higher historical basis results in incremental expense being recognized when the nonmonetary assets are consumed. Currency remeasurement losses were $8.1 million and incremental expense related to nonmonetary assets was $0.2 million in the third quarter of 2018. Reporting compliance Certain third party costs incurred related to the mitigation of material weaknesses ($1.2 million in the first nine months of 2018) and the implementation and adoption of ASU 2016-02, the new lease accounting standard effective for us January 1, 2019 ($2.2 million in the first nine months of 2018), are excluded from non-GAAP results. 37

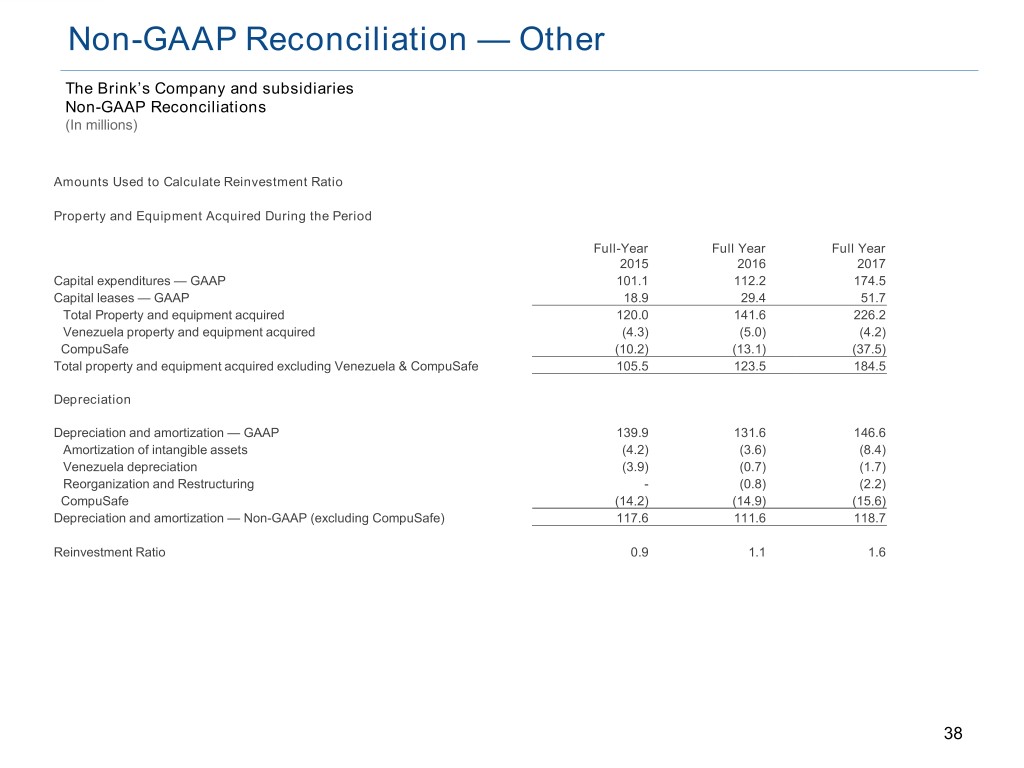

Non-GAAP Reconciliation — Other The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) Amounts Used to Calculate Reinvestment Ratio Property and Equipment Acquired During the Period Full-Year Full Year Full Year 2015 2016 2017 Capital expenditures — GAAP 101.1 112.2 174.5 Capital leases — GAAP 18.9 29.4 51.7 Total Property and equipment acquired 120.0 141.6 226.2 Venezuela property and equipment acquired (4.3) (5.0) (4.2) CompuSafe (10.2) (13.1) (37.5) Total property and equipment acquired excluding Venezuela & CompuSafe 105.5 123.5 184.5 Depreciation Depreciation and amortization — GAAP 139.9 131.6 146.6 Amortization of intangible assets (4.2) (3.6) (8.4) Venezuela depreciation (3.9) (0.7) (1.7) Reorganization and Restructuring - (0.8) (2.2) CompuSafe (14.2) (14.9) (15.6) Depreciation and amortization — Non-GAAP (excluding CompuSafe) 117.6 111.6 118.7 Reinvestment Ratio 0.9 1.1 1.6 38

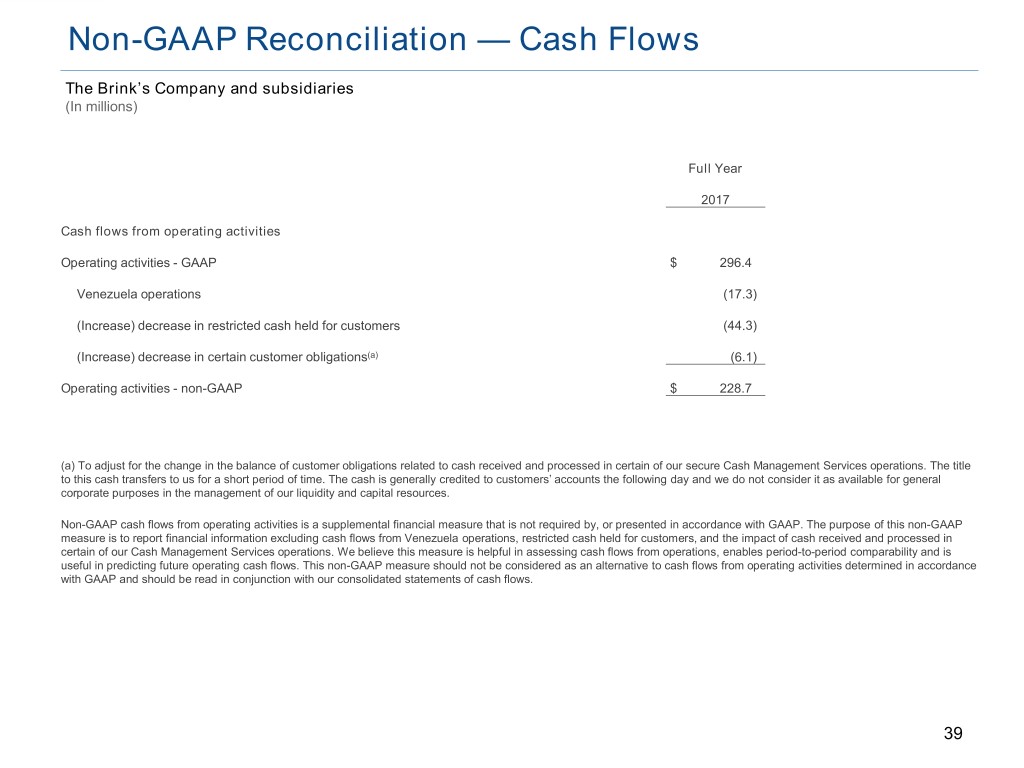

Non-GAAP Reconciliation — Cash Flows The Brink’s Company and subsidiaries (In millions) Full Year 2017 Cash flows from operating activities Operating activities - GAAP $ 296.4 Venezuela operations (17.3) (Increase) decrease in restricted cash held for customers (44.3) (Increase) decrease in certain customer obligations(a) (6.1) Operating activities - non-GAAP $ 228.7 (a) To adjust for the change in the balance of customer obligations related to cash received and processed in certain of our secure Cash Management Services operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources. Non-GAAP cash flows from operating activities is a supplemental financial measure that is not required by, or presented in accordance with GAAP. The purpose of this non-GAAP measure is to report financial information excluding cash flows from Venezuela operations, restricted cash held for customers, and the impact of cash received and processed in certain of our Cash Management Services operations. We believe this measure is helpful in assessing cash flows from operations, enables period-to-period comparability and is useful in predicting future operating cash flows. This non-GAAP measure should not be considered as an alternative to cash flows from operating activities determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows. 39

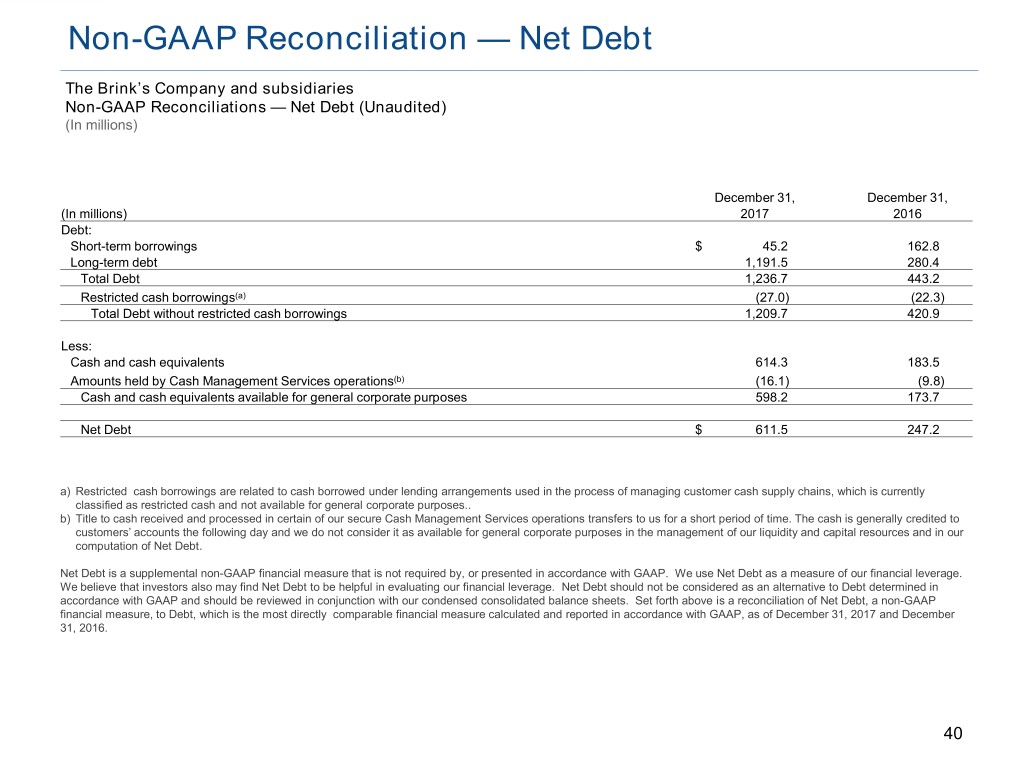

Non-GAAP Reconciliation — Net Debt The Brink’s Company and subsidiaries Non-GAAP Reconciliations — Net Debt (Unaudited) (In millions) December 31, December 31, (In millions) 2017 2016 Debt: Short-term borrowings $ 45.2 162.8 Long-term debt 1,191.5 280.4 Total Debt 1,236.7 443.2 Restricted cash borrowings(a) (27.0) (22.3) Total Debt without restricted cash borrowings 1,209.7 420.9 Less: Cash and cash equivalents 614.3 183.5 Amounts held by Cash Management Services operations(b) (16.1) (9.8) Cash and cash equivalents available for general corporate purposes 598.2 173.7 Net Debt $ 611.5 247.2 a) Restricted cash borrowings are related to cash borrowed under lending arrangements used in the process of managing customer cash supply chains, which is currently classified as restricted cash and not available for general corporate purposes.. b) Title to cash received and processed in certain of our secure Cash Management Services operations transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources and in our computation of Net Debt. Net Debt is a supplemental non-GAAP financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our condensed consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most directly comparable financial measure calculated and reported in accordance with GAAP, as of December 31, 2017 and December 31, 2016. 40