Attached files

| file | filename |

|---|---|

| 8-K - 8-K - RGC RESOURCES INC | a8k4thquarterearningscall-.htm |

Fourth Quarter 2018 John S. D’Orazio, CEO Earnings conference call Paul W. Nester, CFO

Forward-Looking Statements The statements in this presentation by RGC Resources, Inc. (the "company") that are not historical facts constitute “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include the company's expectations regarding earnings per share, EBITDA, future expansion opportunities, natural gas reserves and potential discoverable natural gas reserves, technological advances in natural gas production, comparison of natural gas consumption and natural gas production, cost of natural gas, including relativity to other fuel sources, demand for natural gas, possibility of system expansion, general potential for customer growth, relationship of company with primary regulator, future capital expenditures, current and future economic growth, estimated completion dates for Mountain Valley Pipeline ("MVP") and MVP Southgate milestones, potential of MVP to provide additional source of natural gas, additional capacity to meet future demands, increased capital spending and area expansion opportunity, potential new customers and rate growth in potential expansion area. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results may differ materially from those expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, financial challenges affecting expected earnings per share and EBITDA, technical, political or regulatory issues with natural gas exploration, production or transportation, impact of increased natural gas demand on natural gas price, relative cost of alternative fuel sources, lower demand for natural gas, regulatory, legal, technical, political or economic issues frustrating system or area expansion, regulatory, legal, technical, political or economic issues that may affect MVP, delay in completion of MVP, increase in cost to complete MVP, including by an increase in cost of raw materials or labor to due economic factors or regulatory issues such as tariffs, economic challenges that may affect the service area generally and customer growth or demand and deterioration of relationship with primary regulator, and those risk factors described in the company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which is available at www.sec.gov and on the company’s website at www.rgcresources.com. The statements made in this presentation are based on information available to the company as of the first day of the month set forth on the cover of this presentation and the company undertakes no obligation to update any of the forward-looking statements after the date of this presentation. 1

Agenda Key Operational and Financial Highlights 2019 Outlook Questions 2

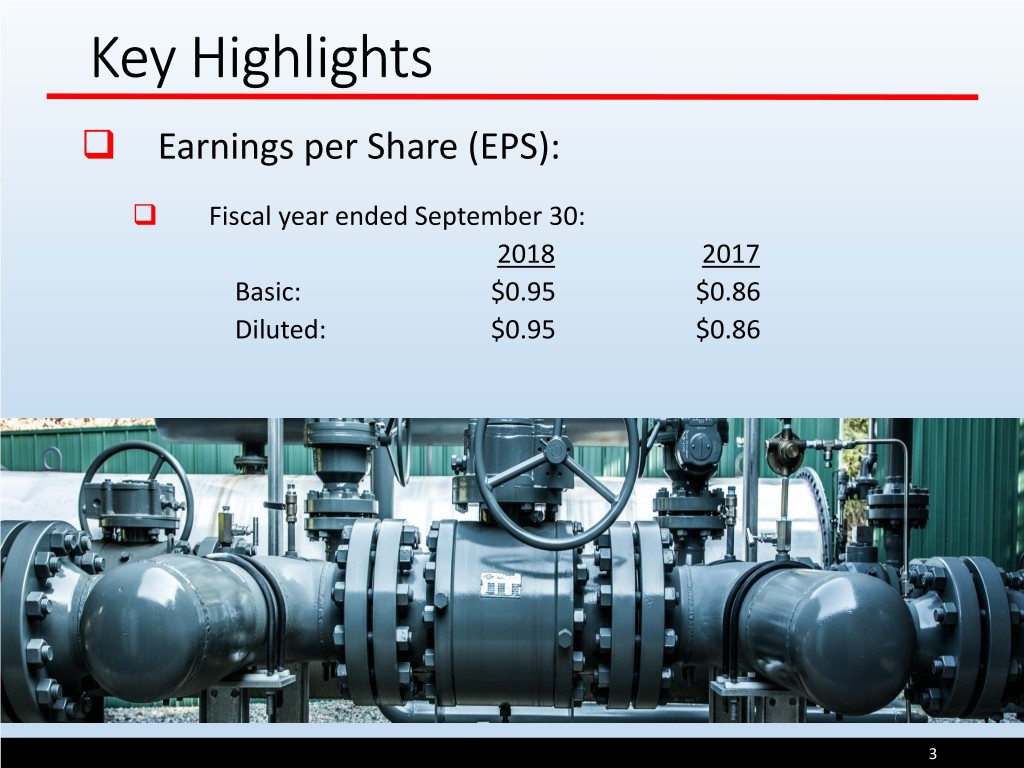

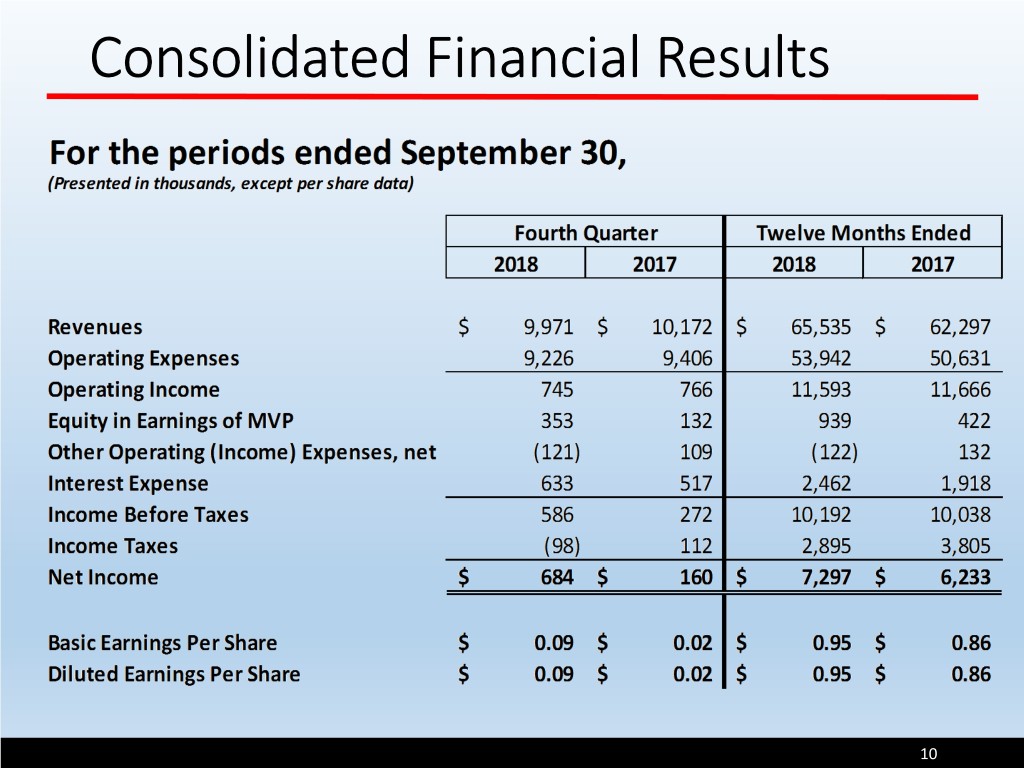

Key Highlights Earnings per Share (EPS): Fiscal year ended September 30: 2018 2017 Basic: $0.95 $0.86 Diluted: $0.95 $0.86 3

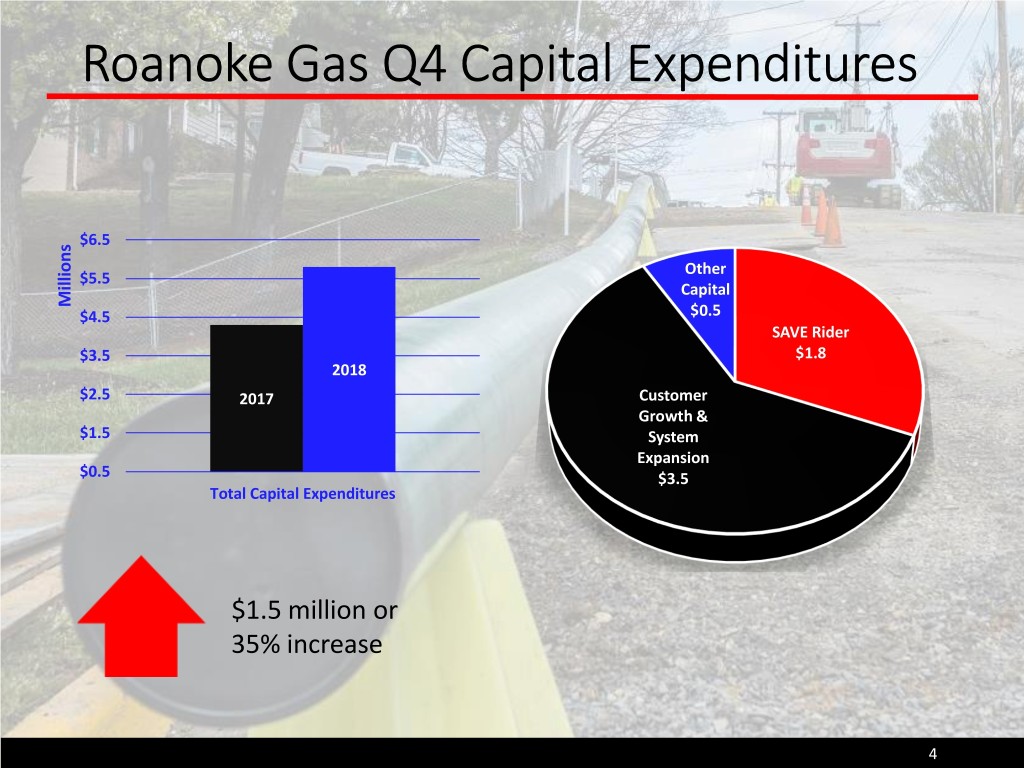

Roanoke Gas Q4 Capital Expenditures $6.5 Other $5.5 Capital Millions $4.5 $0.5 SAVE Rider $3.5 $1.8 2018 $2.5 2017 Customer Growth & $1.5 System Expansion $0.5 $3.5 Total Capital Expenditures $1.5 million or 35% increase 4

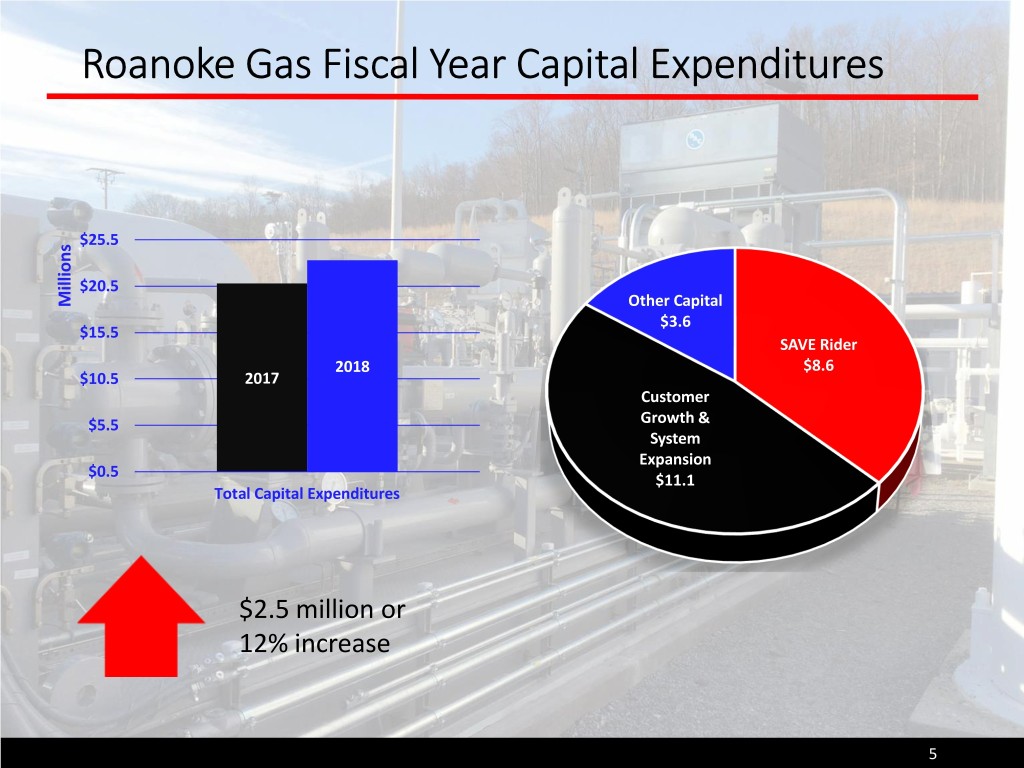

Roanoke Gas Fiscal Year Capital Expenditures $25.5 $20.5 Millions Other Capital $3.6 $15.5 SAVE Rider 2018 $8.6 $10.5 2017 Customer $5.5 Growth & System Expansion $0.5 $11.1 Total Capital Expenditures $2.5 million or 12% increase 5

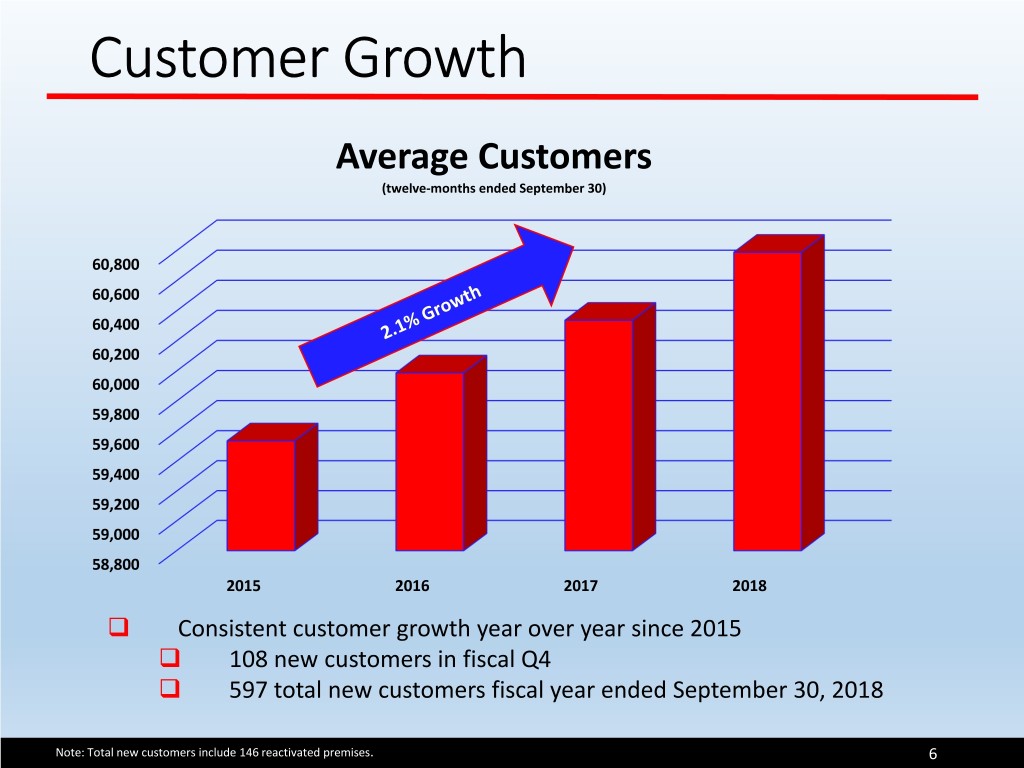

Customer Growth Average Customers (twelve-months ended September 30) 60,800 60,600 60,400 60,200 60,000 59,800 59,600 59,400 59,200 59,000 58,800 2015 2016 2017 2018 Consistent customer growth year over year since 2015 108 new customers in fiscal Q4 597 total new customers fiscal year ended September 30, 2018 Note: Total new customers include 146 reactivated premises. 6

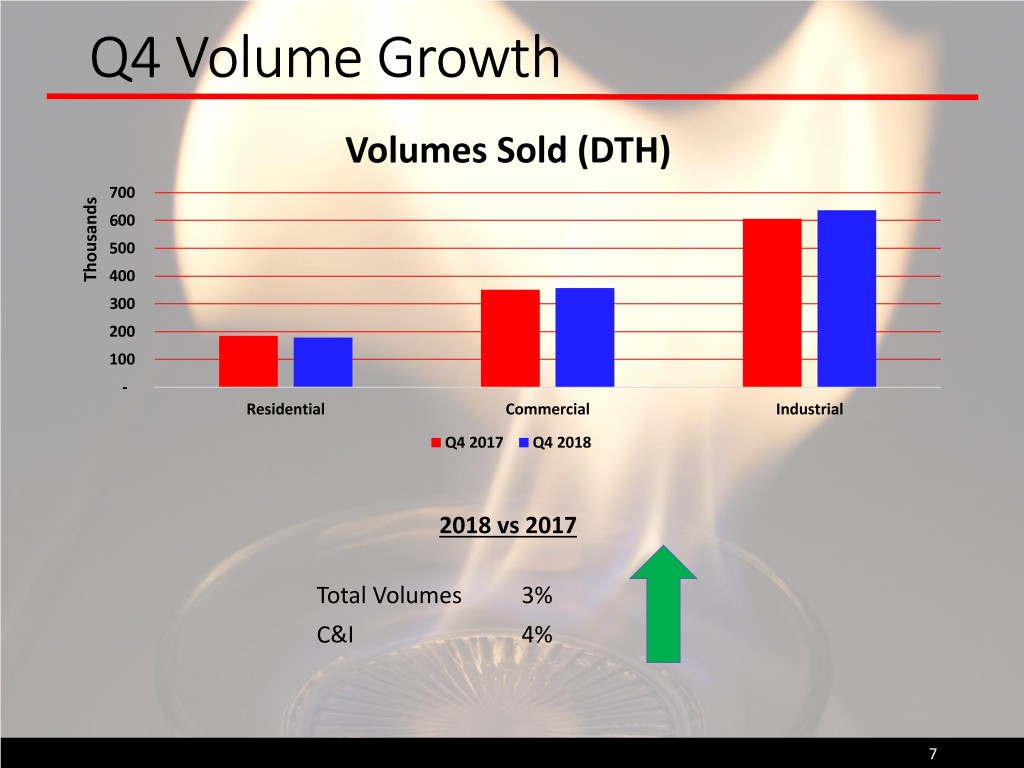

Q4 Volume Growth Volumes Sold (DTH) 700 600 500 Thousands 400 300 200 100 - Residential Commercial Industrial Q4 2017 Q4 2018 2018 vs 2017 Total Volumes 3% C&I 4% 7

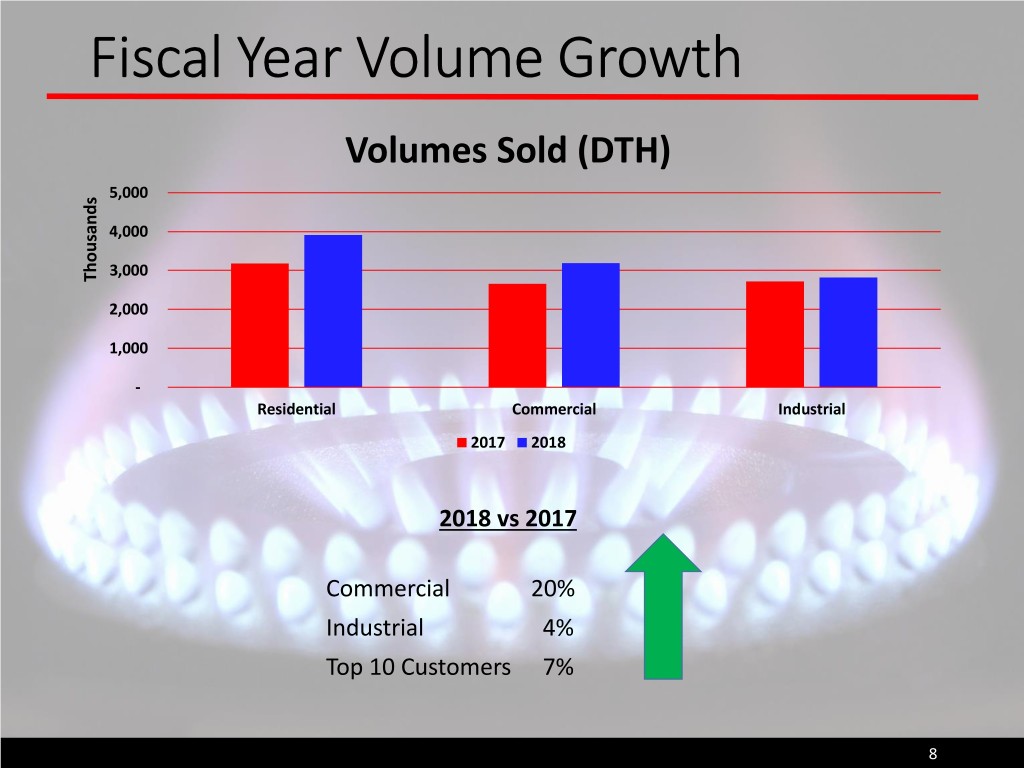

Fiscal Year Volume Growth Volumes Sold (DTH) 5,000 4,000 3,000 Thousands 2,000 1,000 - Residential Commercial Industrial 2017 2018 2018 vs 2017 Commercial 20% Industrial 4% Top 10 Customers 7% 8

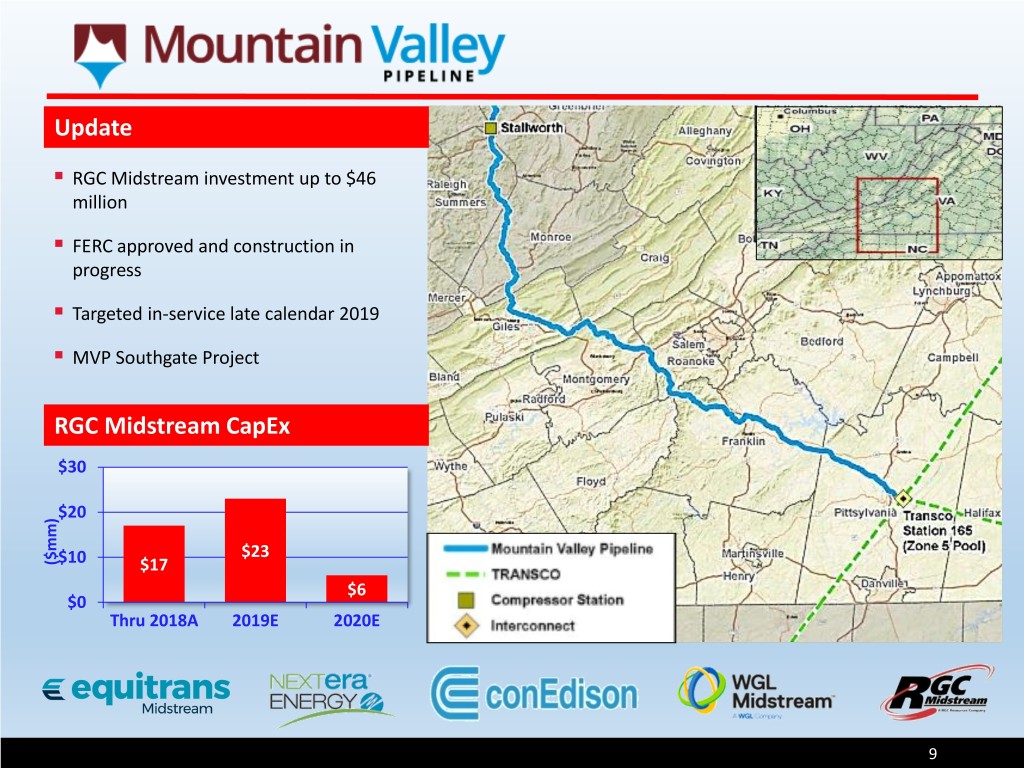

Update . RGC Midstream investment up to $46 million . FERC approved and construction in progress . Targeted in-service late calendar 2019 . MVP Southgate Project RGC Midstream CapEx $30 $20 $23 ($mm) $10 $17 $6 $0 Thru 2018A 2019E 2020E 9

Consolidated Financial Results 10

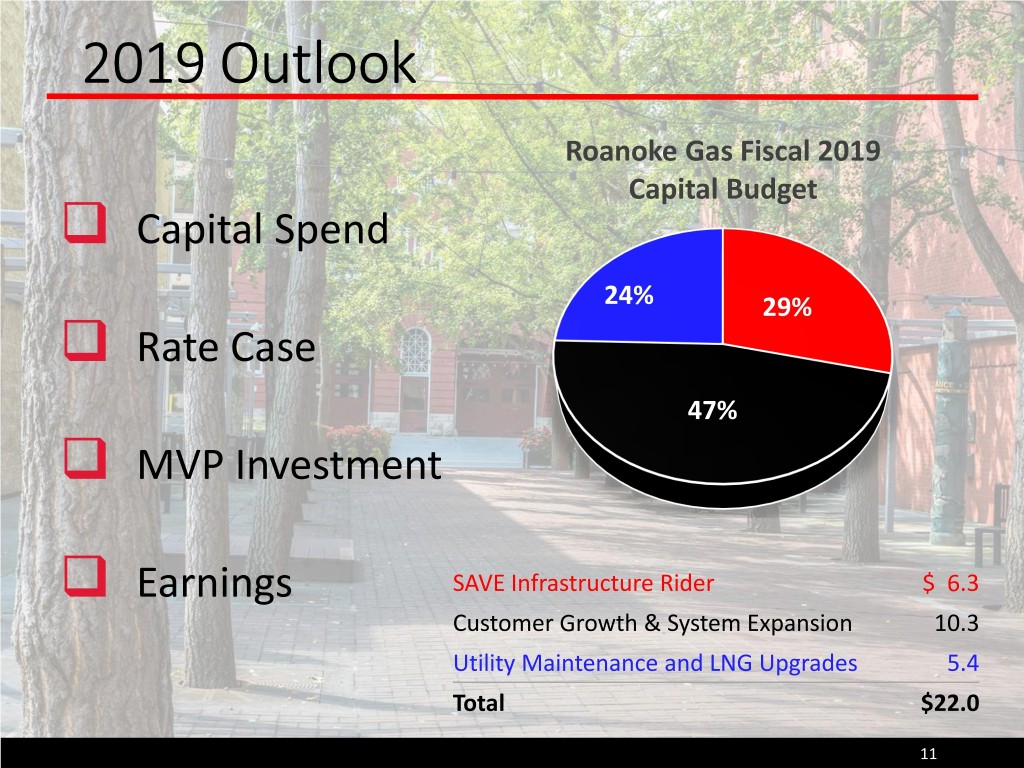

2019 Outlook Roanoke Gas Fiscal 2019 Capital Budget Capital Spend 24% 29% Rate Case 47% MVP Investment Earnings SAVE Infrastructure Rider $ 6.3 Customer Growth & System Expansion 10.3 Utility Maintenance and LNG Upgrades 5.4 Total $22.0 11

12