Attached files

| file | filename |

|---|---|

| EX-10.F - EXHIBIT 10.F - RGC RESOURCES INC | ex10f-columbiagastransmiss.htm |

| EX-13 - EXHIBIT 13 - RGC RESOURCES INC | ex132017annualreportfina.htm |

| EX-10.II - EXHIBIT 10.II - RGC RESOURCES INC | ex10ii-amendedandrestatedr.htm |

| EX-32.1 - EXHIBIT 32.1 - RGC RESOURCES INC | rgco-ex321x9302017xq4.htm |

| EX-32.2 - EXHIBIT 32.2 - RGC RESOURCES INC | rgco-ex322x9302017xq4.htm |

| EX-23 - EXHIBIT 23 - RGC RESOURCES INC | rgco-ex23x9302017xq4.htm |

| EX-31.2 - EXHIBIT 31.2 - RGC RESOURCES INC | rgco-ex312x9302017xq4.htm |

| EX-21 - EXHIBIT 21 - RGC RESOURCES INC | rgco-ex21x9302017xq4.htm |

| EX-10.O - EXHIBIT 10.O - RGC RESOURCES INC | ex10o-saltvillegasstoragec.htm |

| EX-31.1 - EXHIBIT 31.1 - RGC RESOURCES INC | rgco-ex311x9302017xq4.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2017

Commission file number 000-26591

RGC RESOURCES, INC.

(Exact name of registrant as specified in its charter)

Virginia | 54-1909697 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

519 Kimball Avenue, N.E., Roanoke, VA | 24016 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (540) 777-4427

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $5 Par Value | NASDAQ Global Market | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ (Do not check if smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity as of the last business day of the registrant’s most recently completed second fiscal quarter: March 31, 2017. $147,136,528

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the last practicable date.

Class | Outstanding at November 30, 2017 | |

COMMON STOCK, $5 PAR VALUE | 7,250,093 SHARES | |

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the RGC Resources, Inc. Proxy Statement for the 2018 Annual Meeting of Shareholders are incorporated by reference into Part III hereof.

TABLE OF CONTENTS | ||||

Page Number | ||||

Item 1. | ||||

Item 1A. | ||||

Item 1B. | ||||

Item 2. | ||||

Item 3. | ||||

Item 4. | ||||

Item 5. | ||||

Item 6. | ||||

Item 7. | ||||

Item 7A. | ||||

Item 8. | ||||

Item 9. | ||||

Item 9A. | ||||

Item 9B. | ||||

Item 10. | ||||

Item 11. | ||||

Item 12. | ||||

Item 13. | ||||

Item 14. | ||||

Item 15. | ||||

Item 16. | ||||

Cautionary Note Regarding Forward Looking Statements

This report contains forward-looking statements that relate to future transactions, events or expectations. In addition, RGC Resources, Inc. (“Resources” or the “Company”) may announce or publish forward-looking statements relating to such matters as anticipated financial performance, business prospects, technological developments, new products, research and development activities and similar matters. These statements are based on management’s current expectations and information available at the time of such statements and are believed to be reasonable and are made in good faith. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. In order to comply with the terms of the safe harbor, the Company notes that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or expectations expressed in the Company’s forward-looking statements. The risks and uncertainties that may affect the operations, performance, development and results of the Company’s business include, but are not limited to those set forth in the following discussion and within Item 1A “Risk Factors” of this Annual Report on Form 10-K. All of these factors are difficult to predict and many are beyond the Company’s control. Accordingly, while the Company believes its forward-looking statements to be reasonable, there can be no assurance that they will approximate actual experience or that the expectations derived from them will be realized. When used in the Company’s documents or news releases, the words “anticipate,” “believe,” “intend,” “plan,” “estimate,” “expect,” “objective,” “projection,” “forecast,” “budget,” “assume,” “indicate” or similar words or future or conditional verbs such as “will,” “would,” “should,” “can,” “could” or “may” are intended to identify forward-looking statements.

Forward-looking statements reflect the Company’s current expectations only as of the date they are made. The Company assumes no duty to update these statements should expectations change or actual results differ from current expectations except as required by applicable laws and regulations.

2

PART I

Item 1. | Business. |

General and Historical Development

RGC Resources, Inc. ("Resources" or the "Company") was incorporated in the state of Virginia on July 31, 1998, for the primary purpose of becoming the holding company for Roanoke Gas Company (“Roanoke Gas”) and its subsidiaries. Effective July 1, 1999, Roanoke Gas and its subsidiaries were reorganized into the holding company structure. Resources is currently composed of the following subsidiaries: Roanoke Gas, Diversified Energy Company and RGC Midstream, LLC.

Roanoke Gas was organized as a public service corporation under the laws of the Commonwealth of Virginia in 1912. The principal service of Roanoke Gas is the distribution and sale of natural gas to residential, commercial and industrial customers within its service territory in Roanoke, Virginia and the surrounding localities. Roanoke Gas also provides certain non-regulated services which account for less than 2% of consolidated revenues.

In July 2015, the Company formed RGC Midstream, LLC, a limited liability company established for the purpose of becoming a 1% investor in Mountain Valley Pipeline, LLC. Mountain Valley Pipeline, LLC was created for the purpose of constructing a natural gas pipeline in West Virginia and Virginia. Additional information regarding this investment is provided under Note 4 of the Company's annual consolidated financial statements and under the Equity Investment in Mountain Valley Pipeline section of Item 7.

In March 2016, Resources dissolved its subsidiary, RGC Ventures of Virginia, Inc. ("Ventures"). Ventures contained the operations of Application Resources, Inc., which provided information technology consulting services, and The Utility Consultants, which provided utility and regulatory consulting services to other utilities. Both of these operations were insignificant when compared to the overall activities of Resources and represented less than 0.2% of total revenues and less than 6% of other non-utility revenues.

Diversified Energy Company currently has no active operations.

Services

Roanoke Gas maintains an integrated natural gas distribution system to deliver natural gas purchased from suppliers to residential, commercial and industrial users in its service territory. The schedule below is a summary of customers, delivered volumes (expressed in decatherms), revenues and margin as a percentage of the total for each category:

2017 | ||||||||||||||

Customers | Volume | Revenue | Margin | |||||||||||

Residential | 91.2 | % | 37 | % | 57 | % | 61 | % | ||||||

Commercial | 8.7 | % | 31 | % | 33 | % | 25 | % | ||||||

Industrial | 0.1 | % | 32 | % | 7 | % | 10 | % | ||||||

Other Utility | 0.0 | % | 0 | % | 1 | % | 2 | % | ||||||

Other Non-Utility | 0.0 | % | 0 | % | 2 | % | 2 | % | ||||||

Total Percent | 100.0 | % | 100 | % | 100 | % | 100 | % | ||||||

Total Value | 59,847 | 8,562,582 | $ | 62,296,870 | $ | 32,809,157 | ||||||||

2016 | ||||||||||||||

Customers | Volume | Revenue | Margin | |||||||||||

Residential | 91.2 | % | 38 | % | 57 | % | 60 | % | ||||||

Commercial | 8.7 | % | 31 | % | 33 | % | 25 | % | ||||||

Industrial | 0.1 | % | 31 | % | 7 | % | 11 | % | ||||||

Other Utility | 0.0 | % | 0 | % | 1 | % | 2 | % | ||||||

Other Non-Utility | 0.0 | % | 0 | % | 2 | % | 2 | % | ||||||

Total Percent | 100.0 | % | 100 | % | 100 | % | 100 | % | ||||||

Total Value | 59,635 | 8,842,605 | $ | 59,063,291 | $ | 31,564,914 | ||||||||

3

2015 | ||||||||||||||

Customers | Volume | Revenue | Margin | |||||||||||

Residential | 91.2 | % | 40 | % | 58 | % | 58 | % | ||||||

Commercial | 8.7 | % | 30 | % | 33 | % | 26 | % | ||||||

Industrial | 0.1 | % | 30 | % | 6 | % | 11 | % | ||||||

Other Utility | 0.0 | % | 0 | % | 1 | % | 3 | % | ||||||

Other Non-Utility | 0.0 | % | 0 | % | 2 | % | 2 | % | ||||||

Total Percent | 100.0 | % | 100 | % | 100 | % | 100 | % | ||||||

Total Value | 59,080 | 9,875,007 | $ | 68,189,607 | $ | 30,206,433 | ||||||||

Roanoke Gas’ regulated natural gas distribution business accounted for approximately 98% of Resources total revenues for fiscal years ending September 30, 2017, 2016 and 2015. The tables above indicates that residential customers represent over 91% of the Company’s customer total; however, they represent less than 50% of the total gas volumes delivered and more than half of the Company’s consolidated revenues and margin. Industrial customers include primarily transportation customers that purchase their natural gas requirements directly from a supplier other than the Company and utilize Roanoke Gas’ natural gas distribution system for delivery to their operations. Most of the revenue billed for these customers relates only to transportation service, and not to the purchase of natural gas, causing total revenues generated by these deliveries to be approximately 7% of total revenues, even though they represent 32% of total natural gas deliveries for the year ended September 30, 2017 and approximately 10% to 11% of gross margin for each of the years presented.

The Company’s revenues are affected by changes in gas costs as well as by changes in consumption volume due to weather and economic conditions and changes in the non gas portion of customer billing rates. Increases or decreases in the cost of natural gas are passed on to customers through the purchased gas adjustment mechanism as explained in further detail in Note 1 of the Company’s annual consolidated financial statements. Significant increases in gas costs may cause customers to conserve or, in the case of industrial customers, to switch to alternative energy sources.

The Company’s residential and commercial sales are seasonal and temperature-sensitive as the majority of the gas sold by Roanoke Gas to these customers is used for heating. For the fiscal year ended September 30, 2017, approximately 65% of the Company’s total DTH of natural gas deliveries and 73% of the residential and commercial deliveries were made in the five-month period of November through March. These percentages are comparable to the prior year but lower than fiscal 2015 due to lower volumes attributable to a much warmer heating season in fiscal 2016 and 2017. Total natural gas deliveries were 8.6 million DTH, 8.8 million DTH and 9.9 million DTH in fiscal 2017, 2016 and 2015, respectively.

Suppliers

Roanoke Gas relies on multiple interstate pipelines including those operated by Columbia Gas Transmission Corporation, LLC and Columbia Gulf Transmission Corporation, LLC (together “Columbia”), and East Tennessee Natural Gas, LLC (“East Tennessee”), Tennessee Gas Pipeline, Midwestern Gas Transmission Company and Saltville Gas Storage Company, LLC to transport natural gas from the production and storage fields to Roanoke Gas’ distribution system. Roanoke Gas is directly served by two pipelines, Columbia and East Tennessee. Columbia historically has delivered approximately 60% of the Company’s gas supply, while East Tennessee delivers the balance of the Company’s requirements. The rates paid for natural gas transportation and storage services purchased from the interstate pipeline companies are established by tariffs approved by the Federal Energy Regulatory Commission ("FERC"). These tariffs contain flexible pricing provisions, which, in some instances, authorize these transporters to reduce rates and charges to meet price competition. The current pipeline contracts expire at various times from 2018 to 2027. The Company anticipates being able to renew these contracts or enter into other contracts to meet customers’ continued demand for natural gas.

The Company manages its pipeline contracts and liquefied natural gas storage (“LNG”) facility in order to provide for sufficient capacity to meet the natural gas demands of its customers. The maximum daily winter capacity for delivery into Roanoke Gas’ distribution system under the interstate pipelines is 78,606 DTH per day. The LNG facility, which is capable of storing up to 200,000 DTH of natural gas in a liquid state for use during peak demand, has the capability of providing an additional 27,000 DTH per day. Combined, the pipelines and LNG facility can provide more than 105,000 DTH on a single winter day.

4

The Company uses multi-year contracts to meet its natural gas supply needs. The Company currently contracts with Sequent Energy Management, L.P. to manage its pipeline transportation, storage rights, gas supply inventories and deliveries and serve as the primary supplier of natural gas for Roanoke Gas. Natural gas purchased under the asset management agreement is priced at indexed-based market prices as reported in major industry pricing publications. The Company is currently in the process of soliciting proposals for a new asset management agreement to replace the current agreement which expires March 31, 2018.

The Company uses summer storage programs to supplement gas supply requirements during the winter months. During the summer months, the Company injects gas into its LNG facility. In addition, the Company has contracted for storage capacity from Columbia, Tennessee Gas Pipeline and Saltville Gas Storage Company, LLC for a combined total of more than 2.4 million DTH of storage capacity. The balance of the Company’s annual natural gas requirements are met primarily through market purchases made by its asset manager.

Competition

The Company’s natural gas utility operates in a regulated, monopolistic environment. Roanoke Gas currently holds the only franchises and/or certificates of public convenience and necessity to distribute natural gas in its Virginia service areas. These franchises generally extend for multi-year periods and are renewable by the municipalities, including exclusive franchises in the cities of Roanoke and Salem and the Town of Vinton, Virginia. All three franchise agreements were recently renewed for a term of 20 years and will expire December 31, 2035.

Management anticipates that the Company will be able to renew all of its franchises when they expire. There can be no assurance, however, that a given jurisdiction will not refuse to renew a franchise or will not, in connection with the renewal of a franchise, attempt to impose restrictions or conditions that could adversely affect the Company’s business operations or financial condition. Certificates of public convenience and necessity, issued by the Virginia State Corporation Commission (the “SCC”), are of perpetual duration and subject to compliance with regulatory standards.

Although Roanoke Gas has exclusive rights for the distribution of natural gas in its service area, the Company competes with suppliers of other forms of energy such as fuel oil, electricity, propane, coal and solar. Competition can be intense among the other energy sources with the primary driver being price in most instances. This is particularly true for those industrial applications that have the ability to switch to alternative fuels. The relationship between supply and demand has the greatest impact on the price of natural gas. Greater demand for natural gas for electric generation and other uses can provide upward pressure on the price of natural gas. Currently, a plentiful supply of natural gas, mostly due to improved drilling and extraction processes in shale formations, has served to maintain prices at lower levels. The Company continues to see a demand for its product. New construction activity has remained steady over the last few years and the Company continues to grow its customer base through a combination of extending service to new construction and converting existing alternative energy source users to natural gas.

Regulation

In addition to the regulatory requirements generally applicable to all companies, Roanoke Gas is also subject to additional regulation at the federal, state and local levels. At the federal level, the Company is subject to pipeline safety regulations issued by the Department of Transportation and the Pipeline and Hazardous Materials Safety Administration.

At the state level, the SCC performs regulatory oversight including the approval of rates and other charges for natural gas sold to customers, the approval of agreements between or among affiliated companies involving the provision of goods and services, pipeline safety, and certain other corporate activities of the Company, including mergers and acquisitions related to utility operations.

At the local level, Roanoke Gas is further regulated by the municipalities and localities that grant franchises for the placement of gas distribution pipelines and the operation of gas distribution networks within their jurisdictions.

Employees

At September 30, 2017, Resources had 106 full-time employees and 109 total employees. As of that date, 30 employees, or 28% of the Company’s full-time employees, belonged to the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied-Industrial International Union, Local No. 515 and were represented under a collective bargaining agreement. The union has been in place at the Company since 1952. The current collective bargaining agreement will expire on July 31, 2020. Management maintains an amicable relationship with the union.

5

Website Access to Reports

The Company’s website address is www.rgcresources.com. Information appearing on this website is not incorporated by reference in and is not a part of this annual report. The Company files reports with the Securities and Exchange Commission ("SEC"). A copy of this annual report, as well as other recent annual and quarterly reports are available on the Company's website. You may read and copy these filings with the SEC at the SEC public reference room at 100 F Street, NE, Washington, D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding the Company’s filings at www.sec.gov, which is hyper-linked on the Company's website and is where you may obtain other Company filings with the SEC.

Item 1A. | Risk Factors |

Please carefully consider the risks described below regarding the Company. These risks are not the only ones faced by the Company. Additional risks not presently known to the Company or that the Company currently believes are immaterial may also impair business operations and financial results. If any of the following risks actually occur, the Company’s business, financial condition or results of operations could be adversely affected. In such case, the trading price of the Company’s common stock could decline and investors could lose all or part of their investment. The risk factors below are categorized by operational, regulatory and financial:

OPERATIONAL RISKS

Availability of adequate and reliable pipeline capacity.

The Company is currently served directly by two interstate pipelines. These two pipelines carry 100% of the natural gas transported to the Company’s distribution system. Depending on weather conditions and the level of customer demand, failure of one or both of these interstate transmission pipelines could have a major impact on the Company’s ability to meet customer demand for natural gas and adversely affect the Company’s earnings as a result of lost revenue and the cost of service restoration and, if sufficiently frequent or prolonged, could lead customers to turn to alternative energy sources.

Risks associated with the operation of a natural gas distribution pipeline and LNG storage facility.

Numerous potential risks are inherent in the operation of a natural gas distribution system and LNG storage facility, including unanticipated or unforeseen events that are beyond the control of the Company. Examples of such events include adverse weather conditions, acts of terrorism or sabotage, accidents and damage caused by third parties, equipment failure, failure of upstream pipelines and storage facilities, as well as catastrophic events such as explosions, fires, earthquakes, floods, or other similar events. These risks could result in injury or loss of life, property damage, pollution and customer service disruption resulting in potentially significant financial losses. The Company maintains insurance policies with financially sound carriers to protect against many of these risks. If losses result from an event that is not fully covered by insurance, the Company’s financial condition could be significantly impacted if it were unable to recover such losses from customers through the regulatory rate making process. Even if the Company did not incur a direct financial loss as a result of any of the events noted above, it could encounter significant reputational damage from a reliability, safety, integrity or similar viewpoint, potentially resulting in a longer-term negative earnings impact.

Investment in Mountain Valley Pipeline.

The success of the Company's investment in Mountain Valley Pipeline, LLC (the "LLC") is predicated on several key factors including but not limited to the ability of all investors to meet their capital calls when due, the timely state and federal approvals and completing the construction of the pipeline within the targeted time frame and budget. Any significant delay, cost over-run or the failure to receive the requisite approvals on a timely basis, or at all, could have a significant effect on the Company's earnings and financial position.

In addition, there are also numerous risks facing the LLC over time, which in turn could adversely affect the Company's earnings and financial performance through its 1% investment. The LLC's ability to complete construction of, and capital improvement to, facilities on schedule and within budget may be adversely affected by escalating costs for materials and labor and regulatory compliance, inability to obtain or renew necessary licenses,

6

rights-of-way, permits or other approvals on acceptable terms or on schedule, disputes involving contractors, labor organizations, land owners, governmental entities, environmental groups, Native American and aboriginal groups, and other third parties, negative publicity, transmission interconnection issues, and other factors. If any development project or construction or capital improvement project is not completed, is delayed or is subject to cost overruns, certain associated costs may not be approved for recovery or be recovered through regulatory mechanisms that may otherwise be available, and the LLC could become obligated to make delay or termination payments or become obligated for other contractual damages, could experience the loss of tax credits or tax incentives, or delayed or diminished returns, and could be required to write-off all or a portion of its investment in the project. Any of these events could have a material adverse effect on the LLC’s business, financial condition, results of operations and prospects. The LLC may face risks related to project siting, financing, construction, permitting, governmental approvals and the negotiation of project development agreements that may impede its development and operating activities. The LLC must periodically apply for licenses and permits from various local, state, federal and other regulatory authorities and abide by their respective conditions. Should the LLC be unsuccessful in obtaining necessary licenses or permits on acceptable terms, should there be a delay in obtaining or renewing necessary licenses or permits or should regulatory authorities initiate any associated investigations or enforcement actions or impose related penalties or disallowances on the LLC, the LLC’s business, financial condition, results of operations and prospects could be materially adversely affected. Any failure to negotiate successful project development agreements for new facilities with third parties could have similar results.

The LLC’s gas infrastructure facilities and other facilities are subject to many operational risks. Operational risks could result in, among other things, lost revenues due to prolonged outages, increased expenses due to monetary penalties or fines for compliance failures, liability to third parties for property and personal injury damage, a failure to perform under applicable sales agreements and associated loss of revenues from terminated agreements or liability for liquidated damages under continuing agreements. The consequences of these risks could have a material adverse effect on the LLC’s business, financial condition, results of operations and prospects. Uncertainties and risks inherent in operating and maintaining the LLC's facilities include, but are not limited to, risks associated with facility start-up operations, such as whether the facility will achieve projected operating performance on schedule and otherwise as planned. The LLC’s business, financial condition, results of operations and prospects can be materially adversely affected by weather conditions, including, but not limited to, the impact of severe weather. Threats of terrorism and catastrophic events that could result from terrorism, cyber-attacks, or individuals and/or groups attempting to disrupt the LLC’s business, or the businesses of third parties, may materially adversely affect the LLC’s business, financial condition, results of operations and prospects.

Supply disruptions due to weather or other forces.

Hurricanes, floods and other natural or man-made disasters could damage or inhibit production and/or pipeline transportation facilities, which could result in decreased supplies of natural gas. Decreased supplies could result in an inability to meet customer demand or lead to higher prices or service disruptions. Disasters could also lead to additional governmental regulations that may limit production activity or increase production and transportation costs.

Security incident or cyber-attacks on the Company’s computer or information systems.

A cyber-security incident on the Company’s information systems could result in corruption of the Company’s financial information or the unauthorized release of confidential customer, employee or vendor information or result in the interruption of our ability to provide natural gas to our customer or compromise the safety of our distribution, transmission and storage systems. The Company takes reasonable precautions to safeguard its computer systems from attack; however, there are no guarantees that Company processes will adequately protect against unauthorized access to data. In the event of a successful attack, the Company could be exposed to material financial and reputational risks, possible disruptions in natural gas deliveries or a compromise of the safety of the natural gas distribution system, as well as be exposed to claims by persons harmed by such an attack and the attack could also materially increase the costs we incur to protect against such risks.

General downturn in the economy or prolonged period of slow economic recovery.

A weak or poorly performing economy can negatively affect the Company’s profitability. An economic downturn can result in loss of commercial and industrial customers due to plant closings, a loss of residential customers as well as slow or declining growth in new customer additions, all of which would result in reduced sales volumes and lower revenues. An economic downturn could also result in rising unemployment and other factors that could lead to a loss of customers and an increase in customer delinquencies and bad debt expense.

7

Inability to attract and retain professional and technical employees.

The ability to implement the Company’s business strategy and serve customers is dependent upon employing talented professionals and attracting, training, developing and retaining a skilled workforce. As the Company will be facing retirements of key personnel over the next several years, the failure to replace those departing employees with skilled and qualified employees could increase operating costs and expose the Company to other operational and financial risks.

Geographic concentration of business activities.

The Company's business activities are concentrated in the Roanoke Valley. Changes in the local economy, politics, regulations and weather patterns could negatively impact the Company's existing customer base, leading to declining usage patterns and financial condition of customers, both of which could adversely affect earnings.

Volatility in the price and availability of natural gas.

Natural gas purchases represent the single largest expense of the Company. Even with increasing demand from other areas, including electric generation, natural gas prices are currently expected to remain stable in the near term, although there can be no guarantee to that effect. If demand for natural gas increases at a rate in excess of current expectations, natural gas prices could face upward pressure. Increasing natural gas prices could result in declining sales as well as increases in bad debt expense.

Impact of varying weather conditions.

The Company’s revenues and earnings are dependent upon weather conditions, specifically winter weather. The Company’s rate structure currently has a weather normalization adjustment factor that results in either a recovery or refund of revenues due to any variation from the 30-year average for heating degree-days. If the provision for the weather normalization adjustment were removed from its rate structure, the Company would be exposed to a much greater risk related to weather variability resulting in earnings volatility. A colder than normal winter could cause the Company to incur higher than normal operating and maintenance costs.

Competition from other energy providers.

The Company competes with other energy providers in its service territory, including those that provide electricity, propane, coal, fuel oil and solar. Price is a significant competitive factor. Higher natural gas costs or decreases in the price of other energy sources may enhance competition and encourage customers to convert their gas-fired equipment to systems that use alternative energy sources, thus lowering natural gas deliveries and earnings. Price considerations could also inhibit customer and revenue growth if builders and developers do not perceive natural gas to be a better value than other energy options and elect to install heating systems that use an energy source other than natural gas.

Inability to complete necessary or desirable pipeline expansion or infrastructure development projects.

In order to serve new customers or expand service to existing customers, the Company needs to maintain, expand or upgrade its distribution, transmission and/or storage infrastructure, including new pipeline installation. Various factors may prevent or delay the completion of such projects or make them more costly, such as the inability to obtain required approval from local, state and/or federal regulatory and governmental bodies, public opposition to the projects, inability to obtain adequate financing, competition for labor and materials, construction delays, cost overruns, and an inability to negotiate acceptable agreements relating to rights-of-way, construction or other material development components. As a result, the Company may not be able to adequately serve existing customers or expand its distribution system to support customer growth, including any potential customer growth as a result of the construction of the MVP, which would negatively impact earnings.

REGULATORY RISKS

Increased compliance and pipeline safety requirements and fines.

The Company is committed to the safe and reliable delivery of natural gas to its customers. Working in concert with this commitment are numerous federal and state laws and regulations. Failure to comply with these laws and

8

regulations could result in the levy of significant fines. There are inherent risks that may be beyond the Company’s control, including third party actions, which could result in damage to pipeline facilities, injury and even death. Such incidents could subject the Company to lawsuits, large fines, increased scrutiny and loss of customers, all of which could have a significant effect on the Company’s financial position and results of operations.

Environmental laws or regulations.

The combustion of natural gas results in carbon related emissions. Passage of new environmental legislation or implementation of regulations that mandate reductions in greenhouse gas emissions or other similar restrictions could have a negative effect on the Company’s core operations and its investment in the LLC. Such legislation could impose limitations on greenhouse gas emissions, require funding of new energy efficiency objectives, impose new operational requirements or lead to other additional costs to the Company. Regulations restricting or prohibiting the use of coal as a fuel for electric power generation has increased the demand for natural gas, and could at some point potentially result in natural gas supply concerns and higher costs for natural gas. Legislation or regulations could limit the exploration and development of natural gas reserves, making the price of natural gas less competitive and less attractive as a fuel source for consumers, resulting in reduced deliveries and earnings.

Regulatory actions or failure to obtain timely rate relief.

The Company’s natural gas distribution operations are regulated by the SCC. The SCC approves the rates that the Company charges its customers. If the SCC did not allow rates that provided for the timely recovery of costs or a reasonable rate of return on investment in natural gas distribution facilities, earnings could be negatively impacted. Issuance of debt and equity by our subsidiaries are also subject to SCC regulation and approval. Delays or lack of approvals could inhibit the ability to access capital markets and negatively impact liquidity or earnings.

FINANCIAL RISKS

Access to capital to maintain liquidity.

The Company relies on a variety of capital sources to operate its business and fund capital expenditures, including internally generated cash from operations, short-term borrowings under its line-of-credit, proceeds from the issuance of additional shares of its common stock and other sources. Access to a line-of-credit is essential to provide seasonal funding of natural gas operations and provide capital budget bridge financing. Access to capital markets and other long-term funding sources is important for capital outlays and funding of the LLC investment. The ability of the Company to maintain and renew its line-of-credit and to secure longer-term financing is critical to operations. Adverse market trends, market disruptions or deterioration in the financial condition of the Company could increase the cost of borrowing, restrict the Company's ability to issue additional shares of its common stock or otherwise limit the Company’s ability to secure adequate funding.

Insurance coverage may not be sufficient.

The Company currently has liability and property insurance to cover a variety of exposures and perils. Although management considers the level of coverage to be appropriate, the insurance policies are subject to certain limits and deductibles. Insurance coverage for risks against which the Company and its industry peers typically insure may not be offered in the future or such policies may expand exclusions that limit the amount of coverage or remove certain risks completely as insured events. Furthermore, litigation awards continue to increase significantly and the limits of insurance may not keep pace accordingly. The proceeds received from any such insurance may not be paid in a timely manner. The occurrence of any of the foregoing could have a material adverse effect on the Company’s financial position, results of operations and cash flows.

Post-retirement benefits and related funding of obligations.

The costs of providing defined benefit pension and retiree medical plans are dependent on a number of factors such as the rates of return on plan assets, discount rates used in determining plan liabilities, the level of interest rates used to measure the required minimum funding levels of the plan, future government regulation, changes in life expectancy, and required or voluntary contributions made to the plan. Changes in actuarial assumptions and differences between the assumptions and actual results, as well as a significant decline in the value of investments that fund these plans, if not offset or mitigated by a decline in plan liabilities, could increase the expense of these plans and require significant

9

additional funding. Both funding obligations and increased expense could have a material impact on the Company's financial position, results of operation and cash flows.

Failure to comply with debt covenant requirements.

The Company's long-term debt obligations and bank line of credit contain financial covenants. Noncompliance with any of these covenants could result in an event of default which, if not cured or waived, could accelerate payment on outstanding debt obligations or cause prepayment penalties. In such an event, the Company may not be able to refinance or repay all of its indebtedness, pay dividends or have sufficient liquidity to meet operating and capital expenditure requirements. Any such acceleration would cause a material adverse change in our financial condition.

Item 1B. | Unresolved Staff Comments. |

Not applicable.

Item 2. | Properties. |

Included in “Utility Plant” on the Company’s consolidated balance sheet are storage plant, transmission plant, distribution plant and general plant of Roanoke Gas as categorized by natural gas utilities. The Company has approximately 1,135 miles of transmission and distribution pipeline with transmission and distribution plant representing more than 87% of the total investment in plant. The transmission and distribution pipelines are located on or under public roads and highways or private property for which the Company has obtained the legal authorization and rights to operate.

Roanoke Gas owns and operates eight metering stations through which it measures and regulates the gas being delivered by its suppliers. These stations are located at various points throughout the Company’s distribution system.

Roanoke Gas also owns a liquefied natural gas storage facility located in Botetourt County that has the capacity to store up to 220,000 DTH of natural gas.

The Company’s executive, accounting and business offices, along with its maintenance and service departments, are located on Kimball Avenue in Roanoke, Virginia.

Although the Company considers its present properties to be adequate, management continues to evaluate the adequacy of its current facilities as additional needs arise.

Item 3. | Legal Proceedings. |

The Company is not known to be a party to any pending legal proceedings.

Item 4. | Mine Safety Disclosures. |

Not applicable.

10

PART II

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Market Information

Resources' common stock is listed on the NASDAQ Global Market under the trading symbol RGCO. Payment of dividends is within the discretion of the Board of Directors and depends on, among other factors, earnings, capital requirements, and the operating and financial condition of the Company.

Range of Bid Prices | Cash Dividends | |||||||||||

Year Ending September 30, 2017 | High | Low | Declared | |||||||||

First Quarter | $ | 20.04 | $ | 15.81 | $ | 0.1450 | ||||||

Second Quarter | 22.51 | 16.60 | 0.1450 | |||||||||

Third Quarter | 31.99 | 21.00 | 0.1450 | |||||||||

Fourth Quarter | 29.95 | 23.65 | 0.1450 | |||||||||

Year Ending September 30, 2016 | ||||||||||||

First Quarter | $ | 15.96 | $ | 13.37 | $ | 0.1350 | ||||||

Second Quarter | 15.59 | 13.77 | 0.1350 | |||||||||

Third Quarter | 17.33 | 14.30 | 0.1350 | |||||||||

Fourth Quarter | 16.73 | 14.88 | 0.1350 | |||||||||

As of November 24, 2017, there were 1,159 holders of record of the Company’s common stock. This number does not include all beneficial owners of common stock who hold their shares in “street name.”

Comparisons of Cumulative Total Shareholder Returns

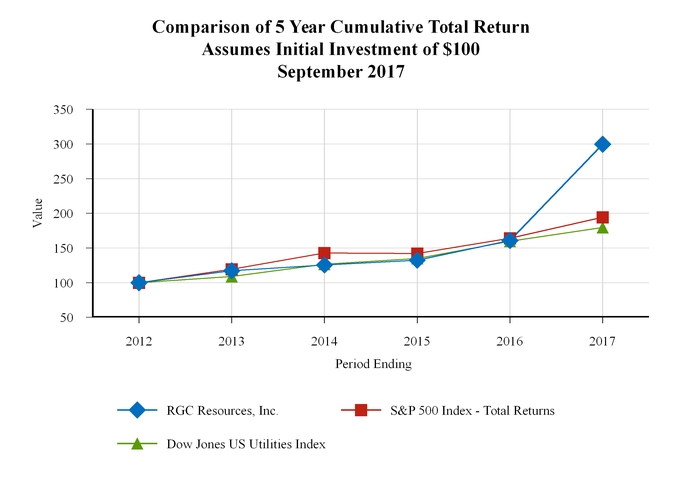

The following performance graph compares the Company’s total shareholder return from September 30, 2012 through September 30, 2017 with the Dow Jones US Utility Index, a utility based index, and the Standard & Poor’s 500 Stock Index (S&P 500 Index), a broad market index.

The graph below reflects the value of a hypothetical investment of $100 made September 30, 2012 in the Company’s common stock and in each index as of September 30, 2017, assuming the reinvestment of all dividends. Historical stock price performance as reflected on the graph is not indicative of future price performance. The total value at the end of the five years was $300 for the Company’s common stock, $180 for the Dow Jones US Utilities Index and $194 for the S&P 500 Index.

11

A summary of the Company’s equity compensation plans follows as of September 30, 2017:

(a) | (b) | (c) | |||||||

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||

Equity compensation plans approved by security holders | 101,575 | $14.31 | 576,018 | ||||||

Equity compensation plans not approved by security holders | — | — | — | ||||||

Total | 101,575 | $14.31 | 576,018 | ||||||

12

Item 6. | Selected Financial Data. |

Year Ending September 30, | ||||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

Operating Revenues | $ | 62,296,870 | $ | 59,063,291 | $ | 68,189,607 | $ | 75,016,134 | $ | 63,205,666 | ||||||||||

Gross Margin | 32,809,157 | 31,564,914 | 30,206,433 | 29,337,089 | 27,602,891 | |||||||||||||||

Operating Income | 11,666,309 | 11,212,092 | 10,006,192 | 9,681,868 | 8,795,055 | |||||||||||||||

Net Income | 6,232,865 | 5,806,866 | 5,094,415 | 4,708,440 | 4,262,052 | |||||||||||||||

Basic Earnings Per Share (1) | $ | 0.86 | $ | 0.81 | $ | 0.72 | $ | 0.67 | $ | 0.60 | ||||||||||

Cash Dividends Declared Per Share (1) | $ | 0.58 | $ | 0.54 | $ | 0.51 | $ | 0.49 | $ | 1.15 | ||||||||||

Book Value Per Share (1) | $ | 8.29 | $ | 7.75 | $ | 7.43 | $ | 7.35 | $ | 7.01 | ||||||||||

Average Shares Outstanding (1) | 7,218,686 | 7,149,906 | 7,092,315 | 7,073,218 | 7,048,091 | |||||||||||||||

Total Assets | $ | 183,135,071 | $ | 165,552,849 | $ | 145,847,194 | $ | 137,423,321 | $ | 121,658,797 | ||||||||||

Long-Term Debt (Less Unamortized Debt Expense) | $ | 61,312,011 | $ | 33,636,051 | $ | 30,316,573 | $ | 30,306,919 | $ | 12,984,169 | ||||||||||

Stockholders' Equity | 60,040,472 | 55,667,072 | 52,840,991 | 52,020,847 | 49,502,422 | |||||||||||||||

Shares Outstanding at Sept. 30(1) | 7,240,846 | 7,182,434 | 7,112,247 | 7,080,567 | 7,063,989 | |||||||||||||||

(1)Total shares and per share amounts for the prior years were revised to reflect the three-for-two stock split.

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

Forward-Looking Statements

This report contains forward-looking statements that relate to future transactions, events or expectations. RGC Resources, Inc. (“Resources” or the “Company”) may publish forward-looking statements relating to such matters as anticipated financial performance, business prospects, technological developments, new products, research and development activities and similar matters. These statements are based on management’s current expectations and information available at the time of such statements and are believed to be reasonable and are made in good faith. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. In order to comply with the terms of the safe harbor, the Company notes that a variety of factors could cause the Company’s actual results and experience to differ materially from the anticipated results or expectations expressed in the Company’s forward-looking statements. The risks and uncertainties that may affect the operations, performance, development and results of the Company’s business include, but are not limited to, those set forth in the following discussion and within Item 1A “Risk Factors” of this Annual Report on Form 10-K. All of these factors are difficult to predict and many are beyond the Company’s control. Accordingly, while the Company believes its forward-looking statements to be reasonable, there can be no assurance that they will approximate actual experience or that the expectations derived from them will be realized. When used in the Company’s documents or news releases, the words “anticipate,” “believe,” “intend,” “plan,” “estimate,” “expect,” “objective,” “projection,” “forecast,” “budget,” “assume,” “indicate” or similar words or future or conditional verbs such as “will,” “would,” “should,” “can,” “could” or “may” are intended to identify forward-looking statements.

Forward-looking statements reflect the Company’s current expectations only as of the date they are made. The Company assumes no duty to update these statements should expectations change or actual results differ from current expectations except as required by applicable laws and regulations.

13

Overview

Resources is an energy services company primarily engaged in the regulated sale and distribution of natural gas to approximately 59,800 residential, commercial and industrial customers in Roanoke, Virginia, and the surrounding localities, through its Roanoke Gas Company (“Roanoke Gas”) subsidiary. Roanoke Gas also provides certain unregulated services. Resources formed a wholly-owned subsidiary, RGC Midstream, LLC ("Midstream"), to invest in the Mountain Valley Pipeline, LLC (the "LLC"). Midstream is a 1% member in the LLC. More information is provided under the Equity Investment in Mountain Valley Pipeline section below. The unregulated operations represent less than 2% of revenues and margins of Resources.

The utility operations of Roanoke Gas are regulated by the Virginia State Corporation Commission (“SCC”), which oversees the terms, conditions, and rates to be charged to customers for natural gas service, safety standards, extension of service, accounting and depreciation. The Company is also subject to federal regulation from the Department of Transportation in regard to the construction, operation, maintenance, safety and integrity of its transmission and distribution pipelines. The Federal Energy Regulatory Commission ("FERC") regulates prices for the transportation and delivery of natural gas to the Company’s distribution system and underground storage services. The Company is also subject to other regulations which are not necessarily industry specific.

The Company is committed to the safe and reliable delivery of natural gas to its customers. Since 1991, the Company has placed an emphasis on the modernization of its distribution system through the renewal and replacement of its cast iron and bare steel natural gas distribution pipelines and other system improvements. The Company completed the replacement of all cast iron and bare steel pipe in the first quarter of fiscal 2017 and is continuing its renewal program with the replacement of first generation, pre-1973 plastic pipe to be completed over the next few years.

The Company is also dedicated to the safeguarding of its information technology systems. These systems contain confidential customer, vendor and employee information as well as important financial data. There is risk associated with the unauthorized access of this information with a malicious intent to corrupt data, cause operational disruptions, or compromise information. Management believes it has taken reasonable security measures to protect these systems from cyber attacks and other types of incidents; however, there can be no guarantee that an incident will not occur. In the event of a cyber incident, the Company will execute its Security Incident Response Plan to assist with managing the incident. The Company also maintains cyber-insurance coverage to mitigate financial implications resulting from a cyber incident.

More than 98% of the Company’s revenues are derived from the sale and delivery of natural gas to Roanoke Gas customers. The SCC authorizes the rates and fees the Company charges its customers for these services. These rates are designed to provide the Company with the opportunity to recover its gas and non-gas expenses and to earn a reasonable rate of return for shareholders based on normal weather. Normal weather refers to the average number of heating degree days (an industry measure by which the average daily temperature falls below 65 degrees Fahrenheit) over the most recent 30-year period.

As the Company’s business is seasonal in nature, volatility in winter weather and the commodity price of natural gas, can impact the effectiveness of the Company’s rates in recovering its costs and providing a reasonable return for its shareholders. In order to mitigate the effect of weather variations, the Company has certain approved rate mechanisms in place that help provide stability in earnings, adjust for volatility in the price of natural gas and provide a return on qualified infrastructure investment. These mechanisms include a purchased gas adjustment factor ("PGA"), weather normalization adjustment factor ("WNA"), inventory carrying cost revenue ("ICC") and a Steps to Advance Virginia Energy ("SAVE") adjustment rider.

The Company's approved billing rates include a component designed to allow for the recovery of the cost of natural gas used by its customers. The cost of natural gas is considered a pass-through cost and is independent of the non-gas rates of the Company. This rate component, referred to as the PGA clause, allows the Company to pass along to its customers increases and decreases in natural gas costs incurred by its regulated operations. On a quarterly basis, the Company files a PGA rate adjustment request with the SCC to adjust the gas cost component of its rates up or down depending on projected price and activity. Once administrative approval is received, the Company adjusts the gas cost component of its rates to reflect the approved amount. As actual costs will differ from the projections used in establishing the PGA rate, the Company will either over-recover or under-recover its actual gas costs during the period. The difference between actual costs incurred and costs recovered through the application of the PGA is recorded as a regulatory asset or liability. At the end of the annual deferral period, the balance is amortized over an ensuing 12-month period as amounts are reflected in customer billings.

14

The WNA reduces the volatility in earnings due to the variability in temperatures during the heating season. The WNA is based on the most recent 30-year temperature average and provides the Company with a level of earnings protection when weather is warmer than normal and provides its customers with price protection when the weather is colder than normal. The WNA allows the Company to recover from its customers the lost margin (excluding gas costs) from the impact of weather that is warmer than normal and correspondingly requires the Company to refund the excess margin earned for weather that is colder than normal. The WNA year runs from April through March. Any billings or refunds related to the WNA are completed following the end of the WNA year. For the fiscal year ended September 30, 2017, the Company recorded $1,839,000 in additional revenue from the WNA for weather that was approximately 18% warmer than normal. During the fiscal year ended September 30, 2016, the Company recorded $1,318,000 in additional revenue for the WNA for weather that was approximately 13% warmer than normal. During the fiscal year ended September 30, 2015, the Company reduced revenue by $609,000 due to the WNA for weather that was approximately 6.5% colder than normal. As normal weather is based on the most recent 30-year temperature average, the heating degree days used to determine normal will change each year as a new year is added to the 30-year period and the oldest year is removed. As a result of two consecutive years of significantly warmer winters, the number of heating degree days that defines normal has declined from 4,000 in fiscal 2013 to 3,959 in fiscal 2017. The Company's rates are designed on 4,000 heating degree days from its last non-gas rate filing; however, the WNA model is recovering on the current normal of 3,959 heating degree days, or about 1% less than for what the rates were designed to recover. The 30-year normal will not be reset in base rates until the next time the Company files for a non-gas rate increase, so until such time as normal is reset, the WNA may slightly under-recover for warmer weather.

The Company also has an approved rate structure in place that mitigates the impact of financing costs of its natural gas inventory. Under this rate structure, Roanoke Gas recognizes revenue for the financing costs, or “carrying costs”, of its investment in natural gas inventory. The ICC factor applied to average inventory is based on the Company’s weighted-average cost of capital including interest rates on short-term and long-term debt and the Company’s authorized return on equity.

During times of rising gas costs and rising inventory levels, the Company recognizes ICC revenues to offset higher financing costs associated with higher inventory balances. Conversely, during times of decreasing gas costs and declining inventory balances, the Company recognizes less carrying cost revenue as financing costs are lower. In addition, ICC revenues are impacted by changes in the weighted-average cost of capital. Although, the cost balance of storage gas at September 30, 2017 was higher than last year due to higher prices during the summer storage refill, the average balance during the year, which is the base used to calculate ICC revenues, was lower by 5%. Furthermore, increased borrowing levels in fiscal 2017 reduced the overall weighted average cost of capital, or ICC factor, as the debt to equity ratio increased. The combination of lower average storage balances and a reduction in the ICC factor resulted in a nearly $63,000 decline in ICC revenues. This trend in lower average storage balances and ICC factor in fiscal 2016 resulted in a $182,000 decline in ICC revenues from fiscal 2015. Based on the current storage balances and natural gas futures, the average dollar balance of gas in storage may increase next year; however, an expected increase in debt will potentially reduce the ICC factor and corresponding ICC revenues.

Generally, as investment in natural gas inventory increases so does the level of borrowing under the Company’s line-of-credit. However, as the carrying cost factor used in determining carrying cost revenues is based on the Company’s weighted-average cost of capital, carrying cost revenues do not directly correspond with incremental financing costs generally provided by the line-of-credit. Therefore, when inventory cost balances decline due to a reduction in commodity prices, net income will decline as carrying cost revenues decrease by a greater amount than the line-of-credit costs decrease. The inverse occurs when inventory costs increase.

The Company’s non-gas rates are designed to allow for the recovery of non-gas related expenses and provide a reasonable return to shareholders. These rates are determined based on the filing of a formal rate application with the SCC utilizing historical information including investment in natural gas facilities. Generally, investments related to extending service to new customers are recovered through the additional revenues generated by the non-gas rates currently in place. The investment in replacing and upgrading existing infrastructure is not recoverable until a formal rate application is made to include the additional investment, and new non-gas rates are approved. The SAVE Plan and Rider provides the Company with the ability to recover costs related to these investments on a prospective basis rather than on a historical basis. The SAVE Plan provides a mechanism to recover the related depreciation and expenses and provide a return on rate base of the additional capital investments related to improving the Company's infrastructure until such time a formal rate application is filed to incorporate this investment in the Company's non-gas rates. As the Company has not filed for an increase in non-gas rates since 2013, SAVE Plan revenues have increased each year corresponding to the level of SAVE qualifying capital investment. The Company recognized approximately $3,813,000,

15

$2,538,000 and $1,308,000 in SAVE Plan revenues for years ended September 30, 2017, 2016 and 2015, respectively. SAVE revenues will be included as part of the non-gas base rates the next time the Company files for a non-gas rate increase. Additional information regarding the SAVE Rider is provided under the Regulatory Affairs section.

The economic environment has a direct correlation with business and industrial production, customer growth and natural gas utilization. The local economy appears relatively stable and should continue to improve absent a major economic setback on a local, regional or national level.

Results of Operations

Fiscal Year 2017 Compared with Fiscal Year 2016

The table below reflects operating revenues, volume activity and heating degree-days.

Operating Revenues | ||||||||||||||

Year Ended September 30, | 2017 | 2016 | Increase | Percentage | ||||||||||

Gas Utilities | $ | 61,252,015 | $ | 58,079,990 | $ | 3,172,025 | 5 | % | ||||||

Other | 1,044,855 | 983,301 | 61,554 | 6 | % | |||||||||

Total Operating Revenues | $ | 62,296,870 | $ | 59,063,291 | $ | 3,233,579 | 5 | % | ||||||

Delivered Volumes | |||||||||||

Year Ended September 30, | 2017 | 2016 | Decrease | Percentage | |||||||

Regulated Natural Gas (DTH) | |||||||||||

Residential and Commercial | 5,840,883 | 6,088,108 | (247,225 | ) | (4 | )% | |||||

Transportation and Interruptible | 2,721,699 | 2,754,497 | (32,798 | ) | (1 | )% | |||||

Total Delivered Volumes | 8,562,582 | 8,842,605 | (280,023 | ) | (3 | )% | |||||

Heating Degree Days (Unofficial) | 3,250 | 3,484 | (234 | ) | (7 | )% | |||||

Total gas utility operating revenues for the year ended September 30, 2017 increased by 5% from the year ended September 30, 2016 primarily due to higher gas costs and increased SAVE Plan revenues more than offsetting a reduction in natural gas deliveries. The average commodity price of natural gas increased by 11% per decatherm sold due to higher commodity prices. Delivered volumes declined primarily due to weather, as reflected in the lower residential and commercial volumes. Industrial consumption was nearly unchanged. Residential and commercial deliveries tend to be more weather sensitive as reflected by a 4% decline in volumes on 7% fewer heating degree days. Transportation and interruptible volumes, which are primarily driven by production activities rather than weather, decreased by 1%. Other revenues experienced a 6% increase.

Gross Margin | ||||||||||||||

Year Ended September 30, | 2017 | 2016 | Increase / (Decrease) | Percentage | ||||||||||

Gas Utility | $ | 32,332,390 | $ | 31,070,660 | $ | 1,261,730 | 4 | % | ||||||

Other | 476,767 | 494,254 | (17,487 | ) | (4 | )% | ||||||||

Total Gross Margin | $ | 32,809,157 | $ | 31,564,914 | $ | 1,244,243 | 4 | % | ||||||

Regulated natural gas margins from utility operations increased by 4% from fiscal 2016, primarily as a result of increasing SAVE Plan revenues. Total SAVE Plan revenues increased by $1,275,000 as the Company continues to invest in qualified infrastructure projects. Since January 2014, the Company has invested more than $32,000,000 in qualified SAVE projects with fiscal 2018 projected to add an additional $8,000,000 in SAVE investment. Volumetric

16

margin declined by nearly $526,000 due to a reduction in total volumes delivered. Residential and commercial volumes declined due to warmer weather compared to the prior year. Interruptible and transportation volumes were nearly unchanged reflecting only a small decline. The impact of the warmer weather on volumetric margin was offset by the WNA, which provided approximately $522,000 in revenues. As discussed in more detail above, the WNA allowed the Company to recognize margin related to those natural gas volumes not delivered due to the warmer weather. ICC revenues declined by $63,000 due to lower average gas storage balance and a lower ICC factor.

Other margins, consisting of non-utility related services, decreased by $17,487 despite higher revenues. Higher operating costs made margin tighter in the non-utility services part of operations. The service contracts which generate the majority of the non-utility related revenues are subject to annual or semi-annual renewal provisions and the potential exists that these contracts may not be renewed or extended, which could negatively impact future revenues and margins.

The changes in the components of the gas utility margin are summarized below:

Twelve Months Ended September 30, | |||||||||||

2017 | 2016 | Increase / (Decrease) | |||||||||

Customer Base Charge | $ | 12,412,753 | $ | 12,364,811 | $ | 47,942 | |||||

SAVE Plan | 3,813,043 | 2,538,055 | 1,274,988 | ||||||||

Volumetric | 13,573,704 | 14,099,214 | (525,510 | ) | |||||||

WNA | 1,839,454 | 1,317,800 | 521,654 | ||||||||

Carrying Cost | 588,624 | 651,492 | (62,868 | ) | |||||||

Other | 104,812 | 99,288 | 5,524 | ||||||||

Total | $ | 32,332,390 | $ | 31,070,660 | $ | 1,261,730 | |||||

Operations and Maintenance Expense - Operations and maintenance expenses, in total, were nearly unchanged reflecting a net increase of $1,955 for the year. Expense declines in certain areas were offset by higher expenses in other categories. The most significant offsets pertain to labor, contracted services, employee benefit costs, corporate insurance, capitalized overheads and bad debt expense. Total operation and maintenance labor declined by $158,000 primarily as a result of the outsourcing of the Company's customer service, billing and credit and collection functions. Management made a strategic decision to transfer these operations to a provider that has significant experience in serving utility clients. In July 2017, the Company transitioned to the service provider, resulting in a reduction of 18 employees. The personnel savings from this work force reduction was offset by the fees paid to the service provider. Employee benefit costs increased by $195,000 due to higher health insurance premiums and higher actuarial determined costs on the post-retirement medical plan. The Company realized a $251,000 reduction in corporate property and liability insurance premiums due to favorable insurance renewals. Capitalized overheads, which include general and administrative, payroll and engineering costs, decreased by $179,000 from fiscal 2016 primarily due to a reduction in the general and administrative overhead rate and less LNG overheads due to a 46% reduction in the amount of LNG produced. The reduction in the LNG production was timing related as the facility was at near full capacity at September 30, 2016, while the balance at September 30, 2017 was at 79% capacity. Legal and other professional expenses were also lower due to reduced activity in those areas.

General Taxes - General taxes increased $122,944, or 7%, primarily due to higher property taxes associated with increases in utility property.

Depreciation - Depreciation expense increased by $665,127, or 12%, corresponding to 10% increase in utility plant investment.

Equity in Earnings of Unconsolidated Affiliate - The equity in earnings of the Mountain Valley Pipeline investment increased by $268,782 primarily consisting of the allowance for funds used during construction ("AFUDC") related to the increasing investment in the project. The investment in Mountain Valley Pipeline and the related AFUDC earnings are discussed further under the Equity Investment in Mountain Valley Pipeline section below.

Other Expense - Other expense, net, decreased by $123,139, or 48%, primarily due to lower pipeline assessments and charitable commitments.

17

Interest Expense - Total interest expense increased by $280,933, or 17%, due to a 24% increase in the average total debt outstanding. The combination of Mountain Valley Pipeline investments and the level of capital expenditures during fiscal 2017 generated the higher debt balances. The average interest rate declined during the current year from 3.76% to 3.56%. The $7,000,000 unsecured note issued on November 1, 2016 had a variable rate that ranged from 1.43% to 2.14% during the year, which was lower than the average rate on the outstanding debt during fiscal 2016.

Income Taxes - Income tax expense increased by $139,206, or 4%, on higher pre-tax earnings. The effective tax rate was 37.9% for fiscal 2017 compared to 38.7% for fiscal 2016. The lower effective tax rate was attributable to the exercise of stock options during the year, which resulted in additional tax deductions above the amount recorded at grant date due to the significant appreciation in stock price over the grant price.

Net Income and Dividends - Net income for fiscal 2017 was $6,232,865 compared to $5,806,866 for fiscal 2016. Basic and diluted earnings per share were $0.86 in fiscal 2017 compared to $0.81 in fiscal 2016. Dividends declared per share of common stock were $0.58 in fiscal 2017 compared to $0.54 in fiscal 2016. All per share amounts were restated for the three-for-two stock split effective March 1, 2017 as described in Note 2 to the Consolidated Financial Statements.

Fiscal Year 2016 Compared with Fiscal Year 2015

The table below reflects operating revenues, volume activity and heating degree-days.

Operating Revenues | ||||||||||||||

Year Ended September 30, | 2016 | 2015 | Decrease | Percentage | ||||||||||

Gas Utilities | $ | 58,079,990 | $ | 67,094,290 | $ | (9,014,300 | ) | (13 | )% | |||||

Other | 983,301 | 1,095,317 | (112,016 | ) | (10 | )% | ||||||||

Total Operating Revenues | $ | 59,063,291 | $ | 68,189,607 | $ | (9,126,316 | ) | (13 | )% | |||||

Delivered Volumes | |||||||||||

Year Ended September 30, | 2016 | 2015 | Decrease | Percentage | |||||||

Regulated Natural Gas (DTH) | |||||||||||

Residential and Commercial | 6,088,108 | 6,955,594 | (867,486 | ) | (12 | )% | |||||

Transportation and Interruptible | 2,754,497 | 2,919,413 | (164,916 | ) | (6 | )% | |||||

Total Delivered Volumes | 8,842,605 | 9,875,007 | (1,032,402 | ) | (10 | )% | |||||

Heating Degree Days (Unofficial) | 3,484 | 4,253 | (769 | ) | (18 | )% | |||||

Total gas utility operating revenues for the year ended September 30, 2016 declined by 13% from the year ended September 30, 2015 primarily due to a combination of lower gas costs and a reduction in natural gas deliveries more than offsetting revenues from the SAVE plan rider and WNA. The average commodity price of natural gas declined by 28% per decatherm sold. Delivered volumes declined primarily due to warmer weather, as reflected in the lower residential and commercial volumes. Industrial consumption also declined, causing a reduction in transportation and interruptible volumes. The more weather sensative residential and commercial deliveries declined by 12% on 18% fewer heating degree days. Transportation and interruptible volumes decreased by 6%. Other revenues experienced a 10% decrease. Approximately half of the decrease in other revenues was attributable to the cessation of operations for Utility Consultants during fiscal 2015 and Application Resources during fiscal 2016.

18

Gross Margin | ||||||||||||||

Year Ended September 30, | 2016 | 2015 | Increase / (Decrease) | Percentage | ||||||||||

Gas Utility | $ | 31,070,660 | $ | 29,656,975 | $ | 1,413,685 | 5 | % | ||||||

Other | 494,254 | 549,458 | (55,204 | ) | (10 | )% | ||||||||

Total Gross Margin | $ | 31,564,914 | $ | 30,206,433 | $ | 1,358,481 | 4 | % | ||||||

Regulated natural gas margins from utility operations increased by 5% from fiscal 2015, primarily as a result of WNA revenues, increasing SAVE Plan revenues and customer base charges related to customer growth more than offsetting lower volumetric margins and ICC revenues. SAVE Plan revenues increased by $1,230,000 as the Company was in the third year of the current SAVE Plan. The growth in SAVE Plan revenues has been fueled by the Company's pipeline renewal program and investment in eligible SAVE Plan infrastructure projects. As noted above, volumetric margin declined due to a reduction in total volumes delivered. Residential and commercial volumes declined due to much warmer weather compared to the prior year. Interruptible and transportation volumes declined due to a combination of reduced activity at one large customer, the closing of another industrial customer's operations during the prior fiscal year and a significant decrease in usage by another industrial customer that uses natural gas as its back up fuel source. The impact of the warmer weather on volumetric margin was offset by the WNA mechanism. ICC revenues continued to decline with a $182,000 reduction in fiscal 2016 compared to fiscal 2015 due to lower commodity prices and a lower ICC factor.

Other margins, consisting of non-utility related services, decreased by $55,204 on comparable activity. The Utility Consultants, which ceased activity in fiscal 2015, and Application Resources, which terminated in fiscal 2016, accounted for approximately $25,000 of the reduction in non-utility related margin. The remainder of the decrease in other margins is attributable to the level of activity under these contracts which fluctuates based on customer requirements.

The changes in the components of the gas utility margin are summarized below:

Twelve Months Ended September 30, | |||||||||||

2016 | 2015 | Increase / (Decrease) | |||||||||

Customer Base Charge | $ | 12,364,811 | $ | 12,240,580 | $ | 124,231 | |||||

SAVE Plan | 2,538,055 | 1,307,795 | 1,230,260 | ||||||||

Volumetric | 14,099,214 | 15,757,907 | (1,658,693 | ) | |||||||

WNA | 1,317,800 | (608,560 | ) | 1,926,360 | |||||||

Carrying Cost | 651,492 | 833,291 | (181,799 | ) | |||||||

Other | 99,288 | 125,962 | (26,674 | ) | |||||||

Total | $ | 31,070,660 | $ | 29,656,975 | $ | 1,413,685 | |||||

Operations and Maintenance Expense - Operations and maintenance expenses declined by $388,799, or 3%, from fiscal 2015 due to much higher overhead capitalization and lower bad debt expenses more than offsetting higher benefit and labor costs. Capitalized overheads increased by 30%, or nearly $873,000, over fiscal 2015 due to higher benefit costs, a 30% increase in capital expenditures and a 38% increase in the amount of LNG produced. In addition, bad debt expense declined by $77,000 due to the combination of reduced sales related to much warmer weather, lower gas costs and level of collections on previously written off accounts. Total benefit costs increased by $456,000 due to increased pension and postretirement medical costs related to the amortization of higher actuarial losses attributable to the adoption of a new mortality table that reflects extended life expectancies. Operating and maintenance labor costs increased by $141,000, or 2%, due to normal wage adjustments. The remaining decrease relates to a variety of areas, including the level of contracted and professional services, as the prior year included expenses related to the union contract negotiations and due diligence work related to the investment in the LLC.

General Taxes - General taxes increased $56,705, or 4%, primarily due to higher property taxes associated with increases in utility property.

19

Depreciation - Depreciation expense increased by $484,675, or more than 9%, corresponding to a similar increase in utility plant investment.

Equity in Earnings of Unconsolidated Affiliate - The investment in Mountain Valley Pipeline began in fiscal 2016 and the $152,864 equity in earnings is primarily attributed to AFUDC income. More information regarding the investment in Mountain Valley Pipeline is located under the Equity Investment in Mountain Valley Pipeline section below.

Other Expense - Other expense, net, increased by $26,789, or 12%, primarily due to higher pipeline assessments and multi-year charitable commitments.

Interest Expense - Total interest expense increased by $123,902, or 8%, due to a 15% increase in the average debt outstanding. The increase in average debt levels was attributable to financing the investments in Mountain Valley Pipeline and SAVE related projects and other capital improvements.

Income Taxes - Income tax expense increased by $495,622, or 16%, on higher pre-tax earnings. The effective tax rate was 38.7% for fiscal 2016 compared to 38.4% for fiscal 2015.

Net Income and Dividends - Net income for fiscal 2016 was $5,806,866 compared to $5,094,415 for fiscal 2015. Basic and diluted earnings per share were $0.81 in fiscal 2016 compared to $0.72 in fiscal 2015. Dividends declared per share of common stock were $0.54 in fiscal 2016 compared to $0.51 in fiscal 2015. All per share amounts were restated for the three-for-two stock split effective March 1, 2017.

Capital Resources and Liquidity

Due to the capital intensive nature of the utility business, as well as the related weather sensitivity, the Company’s primary capital needs are for the funding of its continuing construction program, the seasonal funding of its natural gas inventories and accounts receivables and payment of dividends. To meet these needs, the Company relies on its operating cash flows, line-of-credit agreement, long-term debt and capital raised through the Company’s stock plans.

Cash and cash equivalents decreased by $573,612 in fiscal 2017 and $341,982 in fiscal 2016 compared to an increase of $135,477 in fiscal 2015. The following table summarizes the categories of sources and uses of cash:

Cash Flow Summary | Year Ended September 30, | ||||||||||

2017 | 2016 | 2,015 | |||||||||

Net cash provided by operating activities | $ | 12,980,978 | $ | 14,921,640 | $ | 16,760,827 | |||||

Net cash used in investing activities | (23,492,555 | ) | (20,996,501 | ) | (13,750,274 | ) | |||||

Net cash provided by (used in) financing activities | 9,937,965 | 5,732,879 | (2,875,076 | ) | |||||||