Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MITEL NETWORKS CORP | d667526d8k.htm |

| EX-99.1 - EX-99.1 - MITEL NETWORKS CORP | d667526dex991.htm |

| EX-3.2 - EX-3.2 - MITEL NETWORKS CORP | d667526dex32.htm |

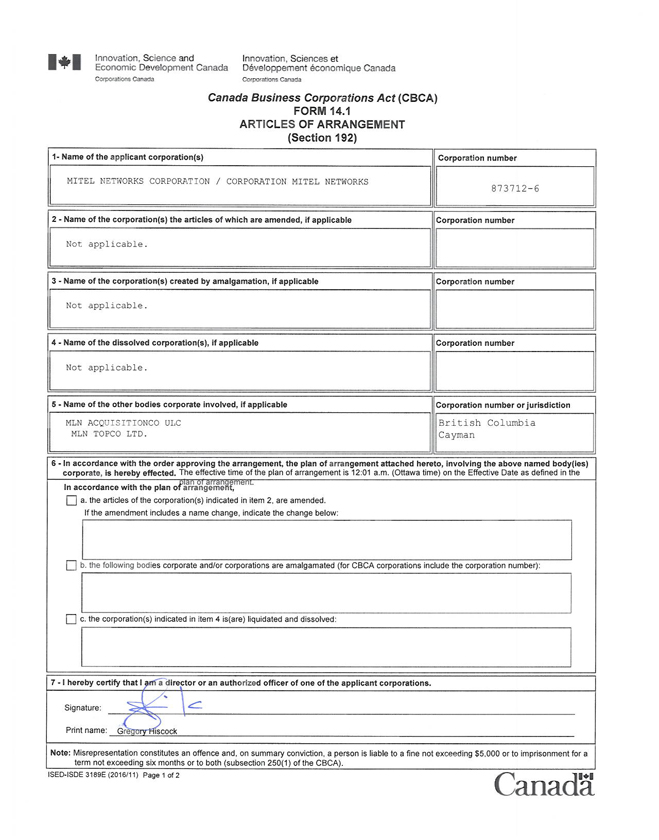

Exhibit 3.1

PLAN OF ARRANGEMENT

Under Section 192 of the Canada Business Corporations Act

concerning

MITEL NETWORKS CORPORATION

ARTICLE 1

INTERPRETATION

1.1 Definitions

For the purposes of this Plan of Arrangement, the following have the respective meanings set forth below:

“Affiliate” means, with respect to any Person, any other Person, directly or indirectly, controlling, controlled by, or under common control with, such Person. For purposes of this definition, the term “control” (including the correlative terms “controlling”, “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise; provided that, with respect to Parent and its Subsidiaries (including the Company and its Subsidiaries following the Closing), “Affiliate” shall not include any portfolio company or investment fund (excluding investment funds focused on private equity) affiliated with Searchlight Capital Partners, L.P.;

“Arrangement” means the arrangement under the provisions of Section 192 of the CBCA on the terms and conditions set out in this Plan of Arrangement subject to any amendments or variations hereto made in accordance with Section 6.1 of this Plan of Arrangement or made at the direction of the Court in accordance with the Final Order with the consent of the Company and Purchaser;

“Arrangement Agreement” means the Arrangement Agreement by and among Mitel Networks Corporation, Purchaser and Parent entered into as of the 23rd day of April, 2018;

“Arrangement Resolution” means the special resolution of the Company Shareholders approving the Plan of Arrangement, to be considered at the Company Meeting, substantially in the form and content of Exhibit A of the Arrangement Agreement;

“Articles of Arrangement” means the articles of arrangement of the Company in respect of the Arrangement, required by the CBCA to be filed with the Director after the Final Order is made in order for the Arrangement to become effective, which shall include the Plan of Arrangement and otherwise be in form and content satisfactory to the Purchaser, acting reasonably;

“Business Day” means any day other than the days on which banks in New York, New York or Ottawa, Ontario are required or authorized to close;

1

“Cashed-Out RSU” means each Company RSU (i) that has vested in accordance with its terms prior to the Effective Time but has not been settled in accordance with its terms prior to the Effective Time, (ii) that is held by a non-employee member of the Board, or (iii) the vesting of which is accelerated at the Effective Time pursuant to a Contract with the Holder thereof as a result of the consummation of the transactions contemplated by the Arrangement;

“CBCA” means the Canada Business Corporations Act;

“Certificate of Arrangement” means the certificate of arrangement issued by the Director pursuant to subsection 192(7) of the CBCA after the Articles of Arrangement have been filed;

“Code” means the United States Internal Revenue Code of 1986;

“Company” means Mitel Networks Corporation, a corporation existing under the CBCA;

“Company Debt” means the Indebtedness identified on the certificate that will be provided to the Company at least three (3) Business Days prior to the Effective Date (for purposes of the definition of “Company Debt”, “Indebtedness” shall have the meaning as used in the Arrangement Agreement);

“Company Meeting” has the meaning set forth in the Arrangement Agreement;

“Company Option” means any option, outstanding as of immediately prior to the Effective Time, exercisable to acquire one or more Shares from the Company;

“Company Proxy Statement” has the meaning set forth in the Arrangement Agreement;

“Company PSU” means any performance share unit outstanding as of immediately prior to the Effective Time that corresponds to one Share (or more or less than one Share);

“Company RSU” means any restricted share unit outstanding as of immediately prior to the Effective Time that corresponds to one Share;

“Company Securityholders” means Holders of Shares, Company Options, Company RSUs and Company Warrants;

“Company Shareholders” means Holders of Shares;

“Company Warrant Holder” means the Holder of Company Warrants.

“Company Warrants” means the warrants issued to the Company Warrant Holder, which upon exercise entitles the Company Warrant Holder to receive, for no consideration, one fifteenth (1/15) of a Share for each Company Warrant;

2

“Contract” means a binding agreement between the Company or one of its Subsidiaries, on the one hand, and a Holder of Company Options, Company PSUs or Company RSUs, on the other hand;

“Court” means the Ontario Superior Court of Justice (Commercial List) located in the City of Toronto;

“Debt Payoff Loan” has the meaning set forth in Section 3.1(a);

“Debt Repayment Notice” means a notice in writing provided by Purchaser to the Company at least three (3) Business Days prior to the Effective Time specifying (i) the portion of the Company Debt that the Company and/or one or more designated Subsidiaries of the Company shall repay pursuant to Section 3.1(b), and (ii) the manner in which the Company and/or one or more designated Subsidiaries of the Company shall be funded for the repayment;

“Depositary” means Computershare Investor Services Inc. or a bank or trust company selected by Purchaser in its reasonable discretion and reasonably acceptable to the Company, which Depositary will perform the duties described in the Plan of Arrangement pursuant to a depositary or paying agent agreement in form and substance reasonably acceptable to the parties;

“Director” means the Director appointed under Section 260 of the CBCA;

“Dissent Rights” has the meaning set forth in Section 5.1;

“Dissenting Shareholder” means any Company Shareholder as of the record date for the Company Meeting who has properly exercised its Dissent Rights and has not withdrawn or been deemed to have withdrawn such Dissent Rights;

“Effective Date” means the date shown on the Certificate of Arrangement;

“Effective Time” means 12:01 a.m. (Ottawa time) on the Effective Date, or such other time as specified in writing by Purchaser on the Effective Date;

“Final Order” means the final order of the Court approving the Arrangement as such order may be amended or varied by the Court at any time prior to the Effective Time or, if appealed, then, unless such appeal is withdrawn or denied, as affirmed or as amended on appeal at the direction of the Court;

“Holders” means (a) when used with reference to the Shares, the holders thereof shown from time to time in the register of holders of Shares maintained by or on behalf of the Company and, where the context so provides, includes joint holders of such Shares, (b) when used with reference to the Company Options, means the holders thereof shown from time to time in the register maintained by or on behalf of the Company in respect of Company Options, (c) when used with reference to the Company PSUs, means the holders thereof shown from time to time in the registers maintained by or on behalf of the Company in respect of the Company PSUs, (d) when used with reference to the Company RSUs, means the holders thereof shown from time to time in the registers maintained by or on behalf of the Company in respect of the

3

Company RSUs and (d) when used with reference to the Company Warrants, means the holder thereof;

“Interim Order” means the interim order of the Court, as the same may be amended, in respect of the Arrangement;

“ITA” means the Income Tax Act (Canada);

“Letter of Transmittal” means the letter of transmittal for use by the Company Shareholders, in the form accompanying the Company Proxy Statement (which shall be reasonably acceptable to Purchaser), which shall specify that delivery shall be effected, and risk of loss and title to the Share certificates shall pass, only upon proper delivery of the Share certificates (or effective affidavits of loss in lieu thereof) to the Depositary and which shall be in such form and have such other customary provisions as Purchaser and the Company may reasonably specify;

“Option Payment Loan” has the meaning set forth in Section 3.1(a);

“Parent” means MLN TopCo Ltd., a Cayman exempted company;

“Person” means any individual, corporation, company, limited liability company, partnership, association, trust, joint venture or any other entity or organization, including any government or political subdivision or any agency or instrumentality thereof;

“Plan of Arrangement”, “hereof”, “herein”, “hereunder”, and similar expressions refer to this Plan of Arrangement and not to any particular Article, Section or other portion hereof and includes any agreement or instrument supplementary or ancillary hereto;

“PSU Payment Loan” has the meaning set forth in Section 3.1(a);

“Purchase Price” has the meaning set forth in Section 3.1(f);

“Purchaser” means MLN AcquisitionCo ULC, a British Columbia unlimited liability company;

“RSU Payment Loan” has the meaning set forth in Section 3.1(a);

“Shares” means the common shares in the capital of the Company;

“Subsidiary”, with respect to any Person, means any other Person of which the first Person owns, directly or indirectly, (a) securities or other ownership interests having voting power to elect a majority of the board of directors or other persons performing similar functions or (b) more than 50% of the equity interests of the second Person; and

“Tax” and “Taxes” have the meanings ascribed thereto in the Arrangement Agreement.

4

1.2 Headings and References

The division of this Plan of Arrangement into Articles and sections and the insertion of headings are for convenience of reference only and do not affect the construction or interpretation of this Plan of Arrangement. Unless otherwise specified, references to Articles and sections are to Articles and sections of this Plan of Arrangement.

1.3 Time Periods

Unless otherwise specified, time periods within, or following, which any payment is to be made, or act is to be done, shall be calculated by excluding the day on which the period commences and including the day on which the period ends and by extending the period to the next Business Day following if the last day of the period is not a Business Day.

1.4 Currency

All sums of money which are referred to in this Plan of Arrangement are expressed in United States currency unless otherwise specified.

1.5 Time

Unless otherwise indicated, all times expressed herein or in any Letter of Transmittal are to local time, Ottawa, Ontario.

1.6 Construction

In this Plan of Arrangement:

(a) unless the context otherwise requires, words importing the singular include the plural and vice versa and words denoting any gender include all genders;

(b) the word “including” or “includes” shall mean “including (or includes) without limitation”; and

(c) any reference to a statute includes all rules and regulations made pursuant to such statute and, unless otherwise specified, the provisions of any statute or regulation or rule which amends, supplements or supersedes any such statute or any such regulation or rule.

1.7 Governing Law

This Plan of Arrangement shall be governed by and construed in accordance with the CBCA, and the laws of the Province of Ontario and other federal laws of Canada applicable therein.

5

ARTICLE 2

PURPOSE AND EFFECT OF THE PLAN OF ARRANGEMENT

2.1 Arrangement

This Plan of Arrangement is made pursuant to, is subject to the provisions of and forms part of, the Arrangement Agreement.

2.2 Effectiveness

This Plan of Arrangement, upon filing the Articles of Arrangement and the issuance of the Certificate of Arrangement, will become effective and will be binding without any further authorization, act or formality on the part of the Court, the Director, Purchaser (or its Affiliates), the Company, or the Company Securityholders, from and after the Effective Time and, other than as expressly provided in Article 3, no portion of this Plan of Arrangement shall take effect with respect to any Person until the Effective Time.

ARTICLE 3

THE ARRANGEMENT

3.1 Arrangement

Pursuant to the Arrangement, the following transactions shall occur and shall be deemed to occur in the order in which they appear without any further act or formality (unless otherwise specified):

(a) At the Effective Time, Purchaser will provide by wire transfer of immediately available funds (i) a loan (the “Debt Payoff Loan”) to the Company in an aggregate amount equal to all amounts required to repay and discharge the Company Debt in accordance with the Debt Repayment Notice, (ii) a loan to the Company equal to the aggregate amount payable under Section 3.1(c) (the “Option Payment Loan”), (iii) a loan to the Company equal to the aggregate amount payable under Section 3.1(d) (the “PSU Payment Loan”) and (iv) a loan to the Company equal to the aggregate amount payable under Section 3.1(e)(i) (the “RSU Payment Loan”). The Debt Payoff Loan, the Option Payment Loan, the PSU Payment Loan and the RSU Payment Loan will be evidenced by demand promissory notes issued by the Company to the lender thereof.

(b) Five (5) minutes following the step contemplated in Section 3.1(a), the Company and/or one or more of its Subsidiaries (as the case may be) will repay in full all amounts required to repay and discharge the portion of the Company Debt as set out in the Debt Repayment Notice.

(c) Five (5) minutes following the step contemplated in Section 3.1(b), each Company Option that has not been exercised prior to the Effective Time will be deemed to be assigned and transferred to the Company in consideration for the right to receive a cash payment from the Company at the time and in the manner set forth in Section 4.1(b) in an amount equal to the product of (i) the excess, if any, of (A) the Purchase Price over (B) the per Share exercise price of such Company Option as of the Effective Time multiplied by (ii) the total number of

6

Shares subject to such Company Option (and, for greater certainty, the Company shall withhold any required withholding Taxes pursuant to Section 4.5), and each such Company Option shall immediately be cancelled. For the avoidance of doubt, all Company Options outstanding as of the Effective Time that have a per Share exercise price equal to or exceeding the Purchase Price shall be cancelled by the Company for no consideration.

(d) Contemporaneously with the step contemplated in Section 3.1(c): each Company PSU will be deemed to be assigned and transferred to the Company in consideration for the right to receive a cash payment from the Company at the time and in the manner set forth in Section 4.1(b) in the amount equal to the product of (i) the Purchase Price multiplied by (ii) the total number of Shares subject to such Company PSU, which if not earned prior to the Effective Time shall be calculated in accordance with the following sentence (and, for greater certainty, the Company shall withhold any required withholding Taxes pursuant to Section 4.5), and each such Company PSU shall immediately be cancelled. With respect to each Company PSU for which the performance period has not been completed and/or performance has not yet been determined prior to the Effective Time, for purposes of this Section 3.1(d), the total number of Shares subject to such Company PSU shall be determined by multiplying (A) the number of Shares subject to such Company PSU at target as set forth in the applicable award agreement, by (B) in the case of a Company PSU granted in 2017, 120.83%, or in the case of a Company PSU granted in 2018, 117.11%.

(e) Contemporaneously with the step contemplated in Section 3.1(c): (i) each Cashed-Out RSU will be deemed to be assigned and transferred to the Company in consideration for the right to receive a cash payment from the Company at the time and in the manner set forth in Section 4.1(b) in an amount equal to the product of (A) the Purchase Price and (B) the total number of Shares subject to such Cashed-Out RSU (and, for greater certainty, the Company shall withhold any required withholding Taxes pursuant to Section 4.5), and each such Cashed-Out RSU shall immediately be cancelled, and (ii) each Company RSU that is not a Cashed-Out RSU will be deemed to be assigned and transferred to the Company in consideration for the right to receive a cash payment from the Company at the time and in the manner set forth in Section 4.1(b), but subject to the vesting conditions of such Company RSU, in an aggregate amount equal to the product of (x) the Purchase Price and (y) the total number of Shares subject to such Company RSU (and, for greater certainty, the Company shall withhold any required withholding Taxes pursuant to Section 4.5), and each such Company RSU shall immediately be cancelled.

(f) Five (5) minutes following the steps contemplated in Section 3.1(c), Section 3.1(d) and Section 3.1(e), each outstanding Share, other than Shares held by Dissenting Shareholders described in Section 3.1(g) will be transferred by the Holders thereof to Purchaser without any further authorization, act or formality by such Holders, in exchange for cash in the amount of $11.15 per Share (the “Purchase Price”) to be paid in accordance with the second sentence of Section 4.1(a), and Purchaser will be deemed to be the legal and beneficial owner thereof, free and clear of all liens, charges, claims and encumbrances (and, for greater certainty, the Depositary shall deduct and withhold any amounts required to be deducted or withheld in respect of Taxes pursuant to Section 4.5).

(g) Contemporaneously with the step contemplated in Section 3.1(f), the outstanding Shares held by Dissenting Shareholders shall be deemed to be transferred by the Holders thereof

7

to Purchaser without any further authorization, act or formality by such Holders, in consideration for the right to receive an amount determined and payable in accordance with Article 5 hereof, and the names of such Holders will be removed from the register of Holders, and Purchaser will be recorded as the registered Holder so transferred and will be deemed to be the legal and beneficial owner thereof, free and clear of all liens, charges, claims and encumbrances; such that following the transactions contemplated by Section 3.1(f) and Section 3.1(g), the Purchaser shall be the legal and beneficial owner of 100% of the Shares.

(h) Contemporaneously with the step contemplated in Section 3.1(f), each outstanding Company Warrant that has not been exercised prior to the Effective Time will be transferred by the Holder thereof to Purchaser without any further authorization, act or formality by such Holder, in exchange for cash in the amount equal to the Purchase Price for each whole Share issuable to such Holder upon the exercise of Company Warrants (such amount to be paid in accordance with the second sentence of Section 4.1(a)), and Purchaser will be deemed to be the legal and beneficial owner thereof, free and clear of all liens, charges, claims and encumbrances (and, for greater certainty, the Depositary shall deduct and withhold any amounts required to be deducted or withheld in respect of Taxes pursuant to Section 4.5).

ARTICLE 4

PAYMENT

4.1 Delivery of Cash

(a) At or immediately prior to the Effective Time, Purchaser shall deposit or cause to be deposited with the Depositary, for the benefit of each Company Shareholder and the Company Warrant Holder, the cash, in United States dollars, to which each such Company Shareholder and Company Warrant Holder is entitled pursuant to Section 3.1(f) or Section 3.1(h), as applicable, upon the transfer of the Shares or Company Warrants to Purchaser, as applicable. Upon surrender by a Company Shareholder or the Company Warrant Holder to the Depositary of a certificate which immediately prior to the Effective Time represented one or more Shares or Company Warrants, together with a duly completed and executed Letter of Transmittal and any other documents reasonably requested by Purchaser and the Depositary (or, if such Shares are held in book-entry or other uncertificated form, upon the entry through a book-entry transfer agent of the surrender of such Shares on a book-entry account statement, it being understood that any references herein to “certificates” shall be deemed to include references to book-entry account statements relating to the ownership of Shares), the Holder of such surrendered certificate(s) of Shares or Company Warrants shall be entitled to receive in exchange therefor, and the Depositary shall deliver to such Company Shareholder or the Company Warrant Holder, as soon as practicable after the Effective Time, by wire transfer or by a cheque issued by the Depositary (or other form of immediately available funds) representing that amount of cash which such Company Shareholder or the Company Warrant Holder has the right to receive pursuant to Section 3.1(f) or Section 3.1(h), as applicable, less any amounts withheld pursuant to Section 4.5.

(b) The Company shall deliver (or cause one of its Subsidiaries to deliver) to each Holder of Company Options, Company PSUs and Company RSUs, through the Company’s or one of its Subsidiary’s payroll systems (or by such other means as the Company may elect or as

8

otherwise directed by the Purchaser including with respect to the timing and manner of such delivery) that amount which such Holder of Company Options, Company PSUs and/or Company RSUs has the right to receive pursuant to Section 3.1(c), Section 3.1(d) or Section 3.1(e), as applicable, less any amounts withheld pursuant to Section 4.5, which (i) in the case of Company Options, Company PSUs and Cashed-Out RSUs, shall occur as soon as practicable after the Effective Time (but no later than the Company and its Subsidiaries second regular payroll payment after the Effective Time) and (ii) in the case of a Company RSU that is not a Cashed-Out RSU, shall occur within 15 Business Days after the date such Company RSU would have vested, subject to the vesting conditions of such Company RSU, including the Holder’s continued employment with the Company and its Subsidiaries through the applicable vesting date, except as otherwise provided by the terms of such Company RSU (and, for greater certainty, if such vesting conditions are not met, such Holder shall forfeit the right to receive any payment in respect of such Company RSU). Notwithstanding anything herein to the contrary, with respect to any Company Option, Company PSU, or Company RSU that constitutes nonqualified deferred compensation subject to Section 409A of the Code, to the extent that payment at the time described in this Section 4.1(b) would otherwise cause the imposition of a Tax or penalty under Section 409A of the Code, such payment shall instead be made at the earliest time permitted under the terms of the applicable Company Benefit Plan and applicable award agreement that will not result in the imposition of such Tax or penalty.

(c) Until surrendered as contemplated by this Section 4.1, each certificate of Shares and Company Warrants shall be deemed at all times after the Effective Time to represent only the right to receive upon such surrender a cash payment in the manner contemplated by this Section 4.1, less any amounts withheld pursuant to Section4.5.

(d) In the event of the surrender of a certificate of Shares or Company Warrants that is not registered in the transfer records of the Company under the name of the Person surrendering such certificate, the amount of cash to which the registered Holder is entitled pursuant to Section 3.1 shall be paid to such a transferee if such certificate is presented to the Depositary and such certificate is duly endorsed or is accompanied by all documents required to evidence and effect such transfer and to evidence that any applicable stock transfer Taxes or any other Taxes required by reason of such payments being made in a name other than the registered Holder have been paid.

(e) Any portion of the amount deposited with the Depositary (including any interest and other income resulting from any investment of the Depositary with respect to such amount) that remains unclaimed by the Holders and other eligible Persons in accordance with this Article 4 following 180 days after the Effective Time shall be delivered to the Company, and any Holder who has not previously complied with this Article 4 shall thereafter look only to the Company for, and, subject to Section 4.4, the Company shall remain liable for, payment of such Holder’s claim for payment under this Section 4.1.

4.2 Distributions with respect to Unsurrendered Certificates

No dividends or other distributions declared or made after the Effective Time with respect to Shares with a record date after the Effective Time shall be paid to the Holder of any unsurrendered certificate which immediately prior to the Effective Time represented outstanding

9

Shares that were transferred pursuant to Section 3.1. At the time of such surrender of any such certificate, there shall be paid to the Holder of the certificates representing Shares, without interest, the amount of cash to which such Holder is entitled pursuant to Section 3.1.

4.3 Lost Certificates

In the event any certificate which immediately prior to the Effective Time represented one or more outstanding Shares or Company Warrants that were transferred or cancelled pursuant to Section 3.1 is lost, stolen or destroyed, upon the making of an affidavit of that fact by the Person claiming such certificate to be lost, stolen or destroyed, the Depositary will issue in exchange for such lost, stolen or destroyed certificate, a cheque (or other form of immediately available funds) for the cash amount, deliverable in accordance with such Holder’s Letter of Transmittal. When authorizing such payment in exchange for any lost, stolen or destroyed certificate, the Person to whom cash is to be delivered shall, as a condition precedent to the payment thereof, give a bond satisfactory to Purchaser and the Company and their respective transfer agents in such sum as Purchaser and the Company may direct or otherwise indemnify Purchaser and the Company in a manner satisfactory to Purchaser and the Company against any claim that may be made against Purchaser or the Company with respect to the certificate alleged to have been lost, stolen or destroyed.

4.4 Extinction of Rights

Any certificate which immediately prior to the Effective Time represented outstanding Shares or Company Warrants that were transferred or cancelled pursuant to Section 3.1, and not deposited, with all other instruments required by Section 4.1, on or prior to the sixth anniversary of the Effective Date shall cease to represent a claim or interest of any kind or nature as a Holder of Shares or Company Warrants or for the receipt of cash. On such date, the cash to which the former Holder of the certificate referred to in the preceding sentence was ultimately entitled shall be deemed to have been surrendered for no consideration to Purchaser. None of Purchaser or the Company shall be liable to any Person in respect of any cash delivered to a public official pursuant to any applicable abandoned property, escheat or similar law.

4.5 Withholding Rights

Notwithstanding anything to the contrary contained herein, each of Purchaser, the Company, the Depositary and any other Person that has any withholding obligation with respect to any amount payable hereunder shall be entitled to deduct and withhold from any consideration payable or otherwise deliverable to any Person hereunder such amounts as are required to be deducted and withheld with respect to such payment under the ITA, the Code or any provision of any federal, provincial, territorial, state, local or other Tax Law. To the extent that amounts are so deducted or withheld, such deducted or withheld amounts shall be treated for all purposes hereof as having been paid to the Person to whom such amounts would otherwise have been paid, provided that such deducted or withheld amounts are timely remitted to the appropriate Governmental Authority.

10

4.6 No Liens

Any exchange or transfer of securities pursuant to this Plan of Arrangement shall be free and clear of any and all liens, charges, claims, encumbrances or other claims of third parties of any kind.

4.7 Paramountcy

From and after the Effective Time: (a) this Plan of Arrangement shall take precedence and priority over any and all Company Securities, including Shares, Company Options, Company RSUs, Company PSUs and the Company Warrant, issued or outstanding prior to the Effective Time; and (b) the rights and obligations of the holders (registered or beneficial) Company Securities, including Shares, Company Options, Company RSUs, Company PSUs and the Company Warrant, the Purchaser and its affiliates, the Depositary and any transfer agent or other depositary therefor in relation to this Plan of Arrangement shall be solely as provided for in this Plan of Arrangement.

ARTICLE 5

RIGHTS OF DISSENT

5.1 Rights of Dissent

Holders of Shares as of the record date for the Company Meeting may exercise rights of dissent with respect to such Shares pursuant to and in the manner set forth in Section 190 of the CBCA as modified by the Interim Order and this Article 5 (“Dissent Rights”) in connection with the Arrangement; provided that, notwithstanding Subsection 190(5) of the CBCA, the written objection to the Arrangement Resolution referred to in Subsection 190(5) of the CBCA must be received by the Company not later than 5:00 p.m. on the second (2nd) Business Day preceding the Company Meeting. Holders of Shares who duly exercise Dissent Rights and who:

(a) are ultimately determined to be entitled to be paid fair value for their Shares shall: (i) be deemed to have transferred such Shares to Purchaser as of the time stipulated in Section 3.1(g); (ii) in respect of such Shares be treated as not having participated in the transactions in Article 3 (other than Section 3.1(g)); (iii) be entitled to be paid, subject to Section 4.5, the fair value of such Shares by the Purchaser, which fair value shall be determined as of the close of business on the day before the Arrangement Resolution was adopted at the Company Meeting; and (iv) not be entitled to any other payment or consideration, including any payment that would be payable under the Arrangement had such Holders not exercised their Dissent Rights; or

(b) are ultimately determined not to be entitled, for any reason, to be paid fair value for their Shares shall be deemed to have participated in the Arrangement on the same basis and at the same time as non-Dissenting Shareholders;

but in no case shall the Company, Purchaser, the Depositary or any other Person be required to recognize such holders as holders of Shares after the time stipulated in Section 3.1(g), and the name of such holders of Shares shall be deleted from the register of holders of Shares at the time

11

stipulated in Section 3.1(g) and Purchaser shall be considered the holder of 100% of the Shares immediately following the completion of the transactions contemplated by Section 3.1. For the avoidance of doubt, in no circumstances shall the Purchaser, the Company, the Depositary or any other Person be required to recognize a Person exercising Dissent Rights: (A) unless, as of the deadline for exercising Dissent Rights (as set forth in Section 5.1), such Person is the registered holder of those Shares in respect of which such Dissent Rights are sought to be exercised, (B) if such Person has voted or instructed a proxy holder to vote such Shares in favor of the Arrangement Resolution, or (C) unless such Person has strictly complied with the procedures for exercising Dissent Rights and does not withdraw such dissent prior to the Effective Time. In addition to any other restrictions under section 190 of the CBCA, none of the following shall be entitled to exercise Dissent Rights: holders of Company Options, Company RSUs, Company PSUs or the Company Warrant (in their capacity as holders of Company Options, Company RSUs, Company PSUs or the Company Warrant, as applicable).

ARTICLE 6

AMENDMENTS

6.1 Amendments

(a) The Company reserves the right to amend, modify and/or supplement this Plan of Arrangement at any time and from time to time prior to the Effective Date provided that any such amendment, modification, and/or supplement must be (i) set out in writing, (ii) approved by Purchaser, (iii) filed with the Court and, if made following the Company Meeting, approved by the Court and (iv) communicated to Company Shareholders and the Company Warrant Holder if and as required by the Court.

(b) Any amendment, modification and/or supplement to this Plan of Arrangement may be proposed by the Company at any time prior to or at the Company Meeting (provided that Purchaser shall have consented thereto) with or without any other prior notice or communication and, if so proposed and accepted by the Persons voting at the Company Meeting (other than as required under the Interim Order), shall become part of this Plan of Arrangement for all purposes.

(c) Any amendment, modification and/or supplement to this Plan of Arrangement that is approved or directed by the Court following the Company Meeting shall be effective only if (i) it is consented to by each of the Company and Purchaser and (ii) if required by the Court, it is consented to by the Company Shareholders and the Company Warrant Holder voting in the manner directed by the Court. Any amendment, modification or supplement to this Plan of Arrangement may be made following the Company Meeting without filing such amendment, modification or supplement with the Court or seeking Court approval, provided that (A) it concerns a matter which, in the reasonable opinion of the Purchaser and the Company, is of an administrative nature required to better give effect to the implementation of this Plan of Arrangement and is not adverse to the interest of any holder of Shares, Company Options, Company RSUs, Company PSUs or the Company Warrant or (ii) is an amendment contemplated in Section 6.1(d).

12

(d) Any amendment, modification and/or supplement to this Plan of Arrangement may be made following the Effective Date unilaterally by Purchaser, provided that it concerns a matter which, in the reasonable opinion of Purchaser, is of an administrative nature required to better give effect to the implementation of this Plan of Arrangement and is not adverse to the financial or economic interests of any former Holder.

ARTICLE 7

FURTHER ASSURANCES

7.1 Assurances

Notwithstanding that the transactions and events set out herein shall occur and be deemed to occur in the order set out in this Plan of Arrangement without any further authorization, act or formality, each of the parties to the Arrangement Agreement shall make, do and execute, or cause to be made, done and executed, all such further acts, deeds, agreements, transfers, assurances, instruments or documents as may reasonably be required by any of them in order to further document or evidence any of the transactions or events set out herein.

13