Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Oaktree Specialty Lending Corp | d657344dex991.htm |

| 8-K - 8-K - Oaktree Specialty Lending Corp | d657344d8k.htm |

Fourth Quarter Fiscal Year 2018 Earnings Presentation November 29, 2018 Nasdaq: OCSL Exhibit 99.2

Forward Looking Statements Some of the statements in this presentation constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this presentation may include statements as to: our future operating results and distribution projections; the ability of Oaktree Capital Management, L.P. (“Oaktree” or our “Investment Adviser”) to find lower-risk investments to reposition our portfolio and to implement our Investment Adviser’s future plans with respect to our business; our business prospects and the prospects of our portfolio companies; the impact of the investments that we expect to make; the ability of our portfolio companies to achieve their objectives; our expected financings and investments and additional leverage we may seek to incur in the future; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; and the cost or potential outcome of any litigation to which we may be a party. In addition, words such as “anticipate,” “believe,” “expect,” “seek,” “plan,” “should,” “estimate,” “project” and “intend” indicate forward-looking statements, although not all forward-looking statements include these words. The forward-looking statements contained in this presentation involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” and elsewhere in our annual report on Form 10-K for the fiscal year ended September 30, 2018. Other factors that could cause actual results to differ materially include: changes in the economy, financial markets and political environment; risks associated with possible disruption in our operations or the economy generally due to terrorism or natural disasters; future changes in laws or regulations (including the interpretation of these laws and regulations by regulatory authorities) and conditions in our operating areas, particularly with respect to business development companies or regulated investment companies; and other considerations that may be disclosed from time to time in our publicly disseminated documents and filings. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Although we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. Unless otherwise indicated, data provided herein are dated as of September 30, 2018.

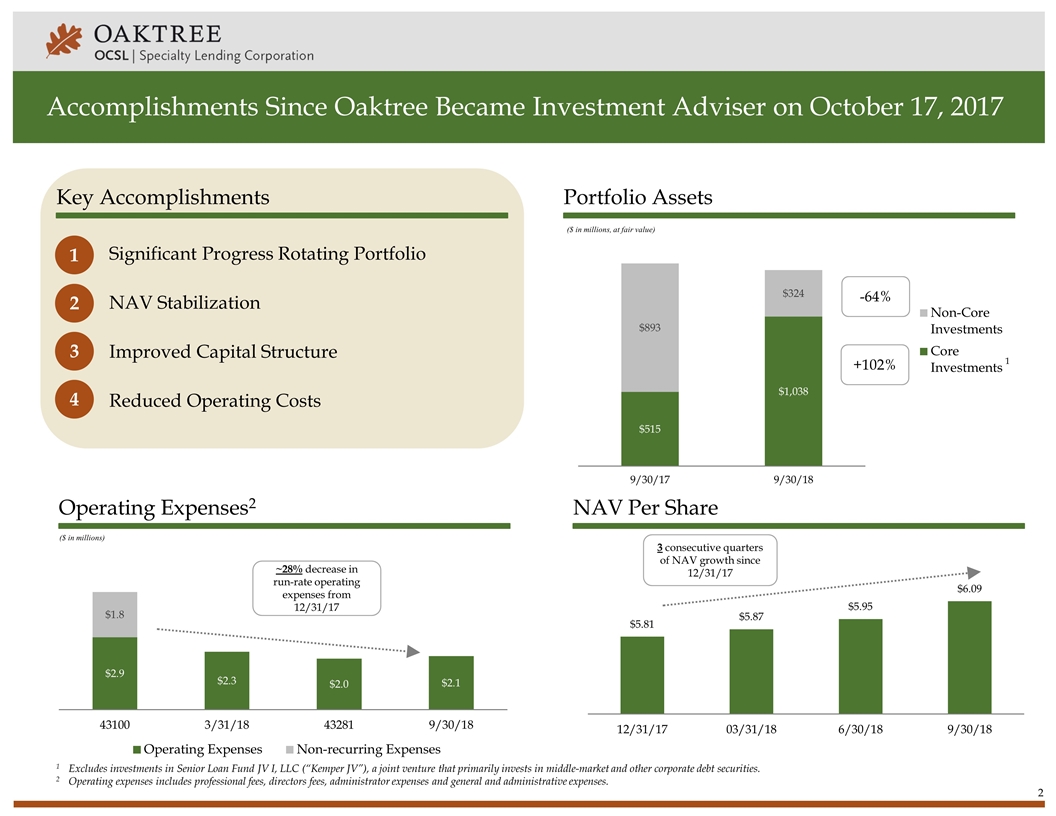

Accomplishments Since Oaktree Became Investment Adviser on October 17, 2017 Significant Progress Rotating Portfolio NAV Stabilization Improved Capital Structure Reduced Operating Costs ($ in millions, at fair value) 1 Operating Expenses2 Portfolio Assets NAV Per Share Key Accomplishments ($ in millions) ~28% decrease in run-rate operating expenses from 12/31/17 1 2 3 4 1Excludes investments in Senior Loan Fund JV I, LLC (“Kemper JV”), a joint venture that primarily invests in middle-market and other corporate debt securities. 2Operating expenses includes professional fees, directors fees, administrator expenses and general and administrative expenses. +102% -64% 3 consecutive quarters of NAV growth since 12/31/17

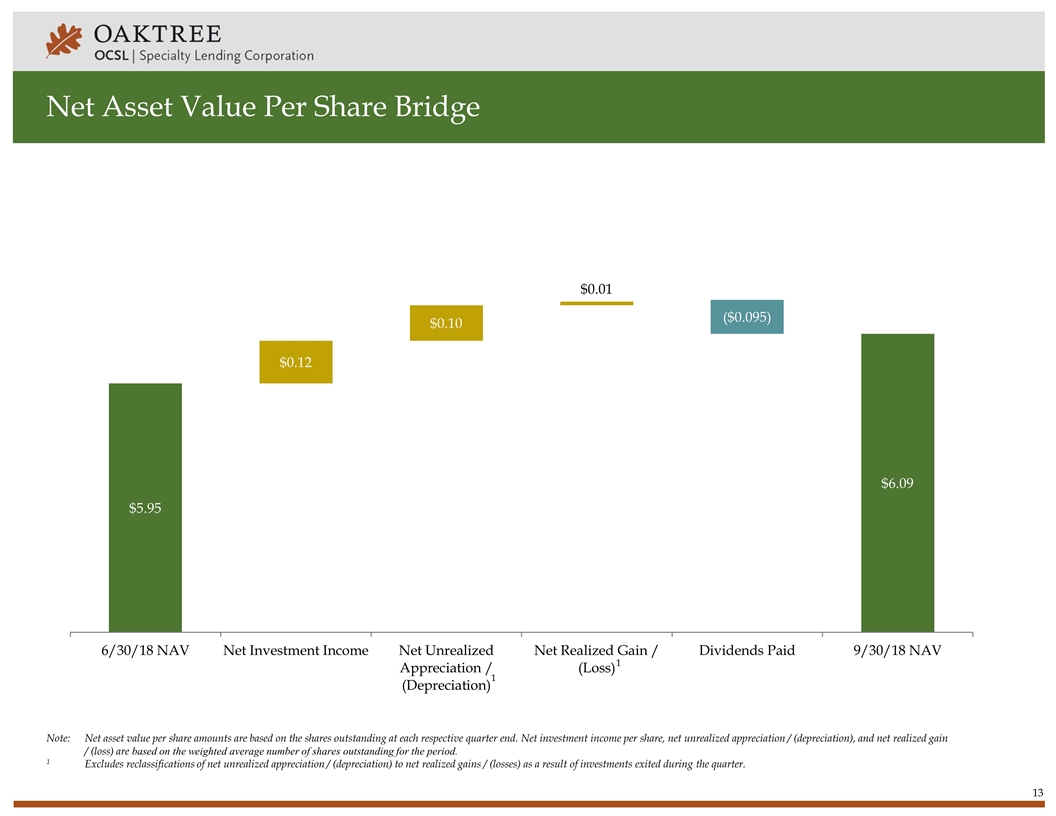

Q4 2018 Highlights Net asset value per share increased by $0.14 to $6.09 NAV continues to remain stable, increasing $0.28 per share or approximately 5% since December 31, 2017 Third consecutive quarter of NAV growth Realized gains resulting from monetizations of investments and unrealized write-ups of certain investments primarily contributed to the sequential NAV increase Net investment income per share increased by $0.02 to $0.12 Higher prepayment fees and OID acceleration on loan payoffs contributed to the increase Board of Directors declared a dividend of $0.095 per share, payable on December 28, 2018 to stockholders of record as of December 17, 2018 Monetized $32 million of non-core investments Exited one investment on non-accrual and monetized an aviation investment Core investments represented 76% of the portfolio as of September 30, 20181 Monetized approximately $20 million of non-core investments since October 1, 2018 Entered into $228 million of new investment commitments Senior secured originations represented 88% of new investment commitments Diversified across 12 industries 1Excludes investments in the Kemper JV. 1 2 3 4

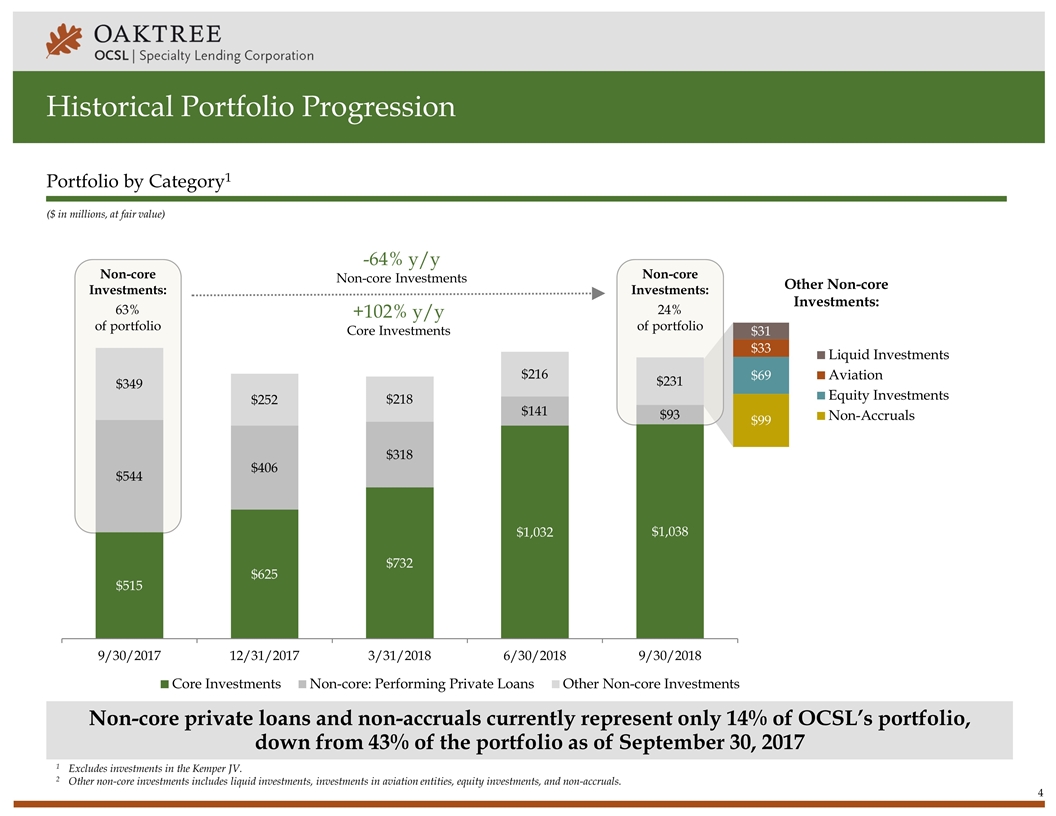

Non-core Investments: 24% of portfolio Non-core Investments: 63% of portfolio Historical Portfolio Progression Non-core private loans and non-accruals currently represent only 14% of OCSL’s portfolio, down from 43% of the portfolio as of September 30, 2017 ($ in millions, at fair value) Portfolio by Category1 -64% y/y Non-core Investments 1 Excludes investments in the Kemper JV. 2 Other non-core investments includes liquid investments, investments in aviation entities, equity investments, and non-accruals. +102% y/y Core Investments Other Non-core Investments:

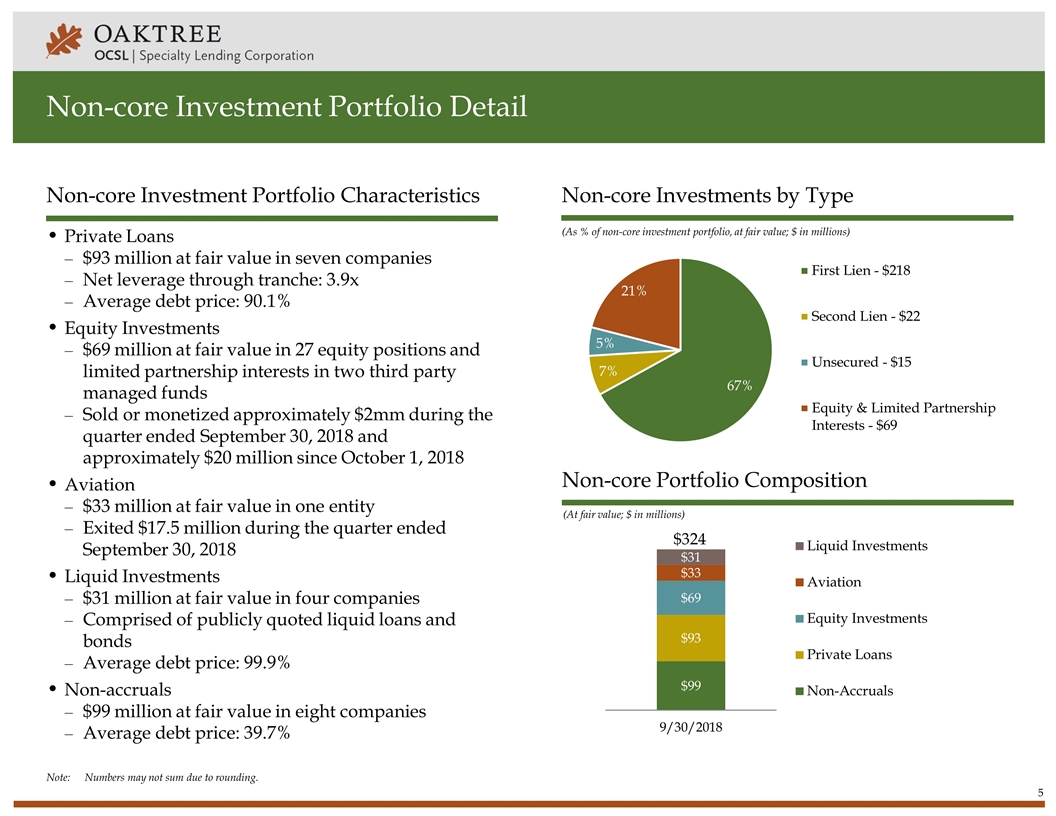

Note:Numbers may not sum due to rounding. Non-core Investment Portfolio Detail Non-core Investment Portfolio Characteristics Private Loans $93 million at fair value in seven companies Net leverage through tranche: 3.9x Average debt price: 90.1% Equity Investments $69 million at fair value in 27 equity positions and limited partnership interests in two third party managed funds Sold or monetized approximately $2mm during the quarter ended September 30, 2018 and approximately $20 million since October 1, 2018 Aviation $33 million at fair value in one entity Exited $17.5 million during the quarter ended September 30, 2018 Liquid Investments $31 million at fair value in four companies Comprised of publicly quoted liquid loans and bonds Average debt price: 99.9% Non-accruals $99 million at fair value in eight companies Average debt price: 39.7% (As % of non-core investment portfolio, at fair value; $ in millions) Non-core Investments by Type (At fair value; $ in millions) Non-core Portfolio Composition

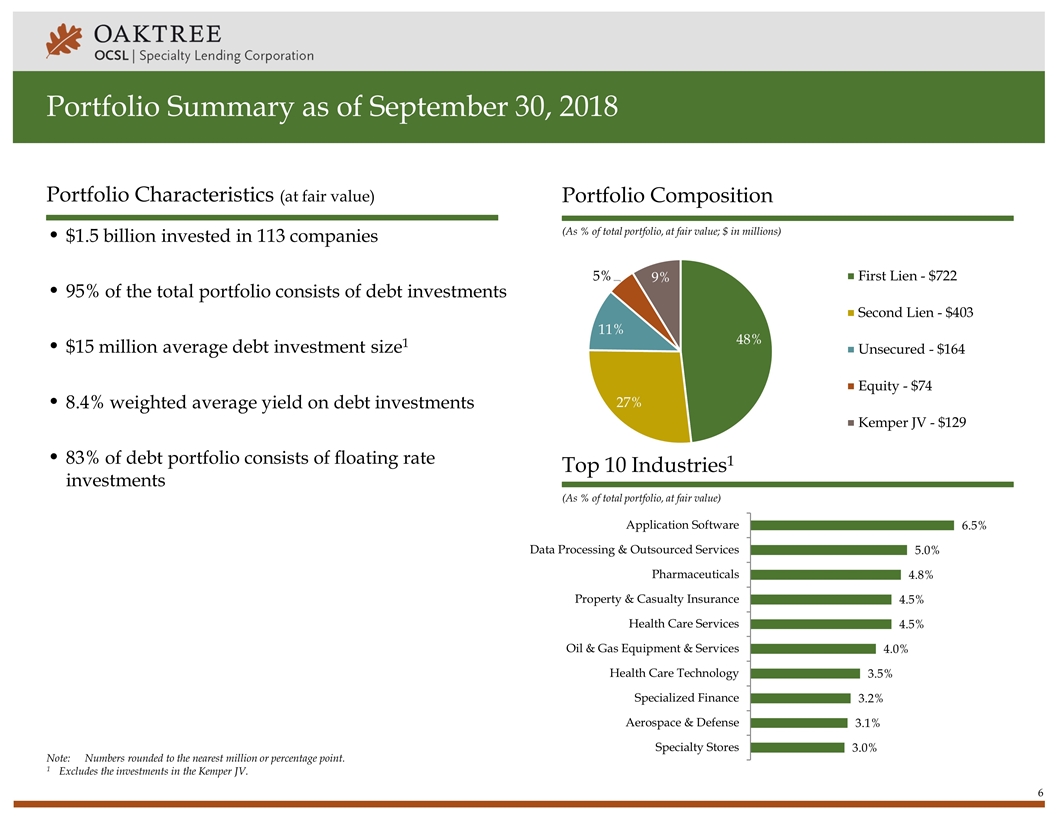

Portfolio Summary as of September 30, 2018 (As % of total portfolio, at fair value; $ in millions) (As % of total portfolio, at fair value) Portfolio Composition Top 10 Industries1 Portfolio Characteristics (at fair value) Note:Numbers rounded to the nearest million or percentage point. 1Excludes the investments in the Kemper JV. $1.5 billion invested in 113 companies 95% of the total portfolio consists of debt investments $15 million average debt investment size1 8.4% weighted average yield on debt investments 83% of debt portfolio consists of floating rate investments

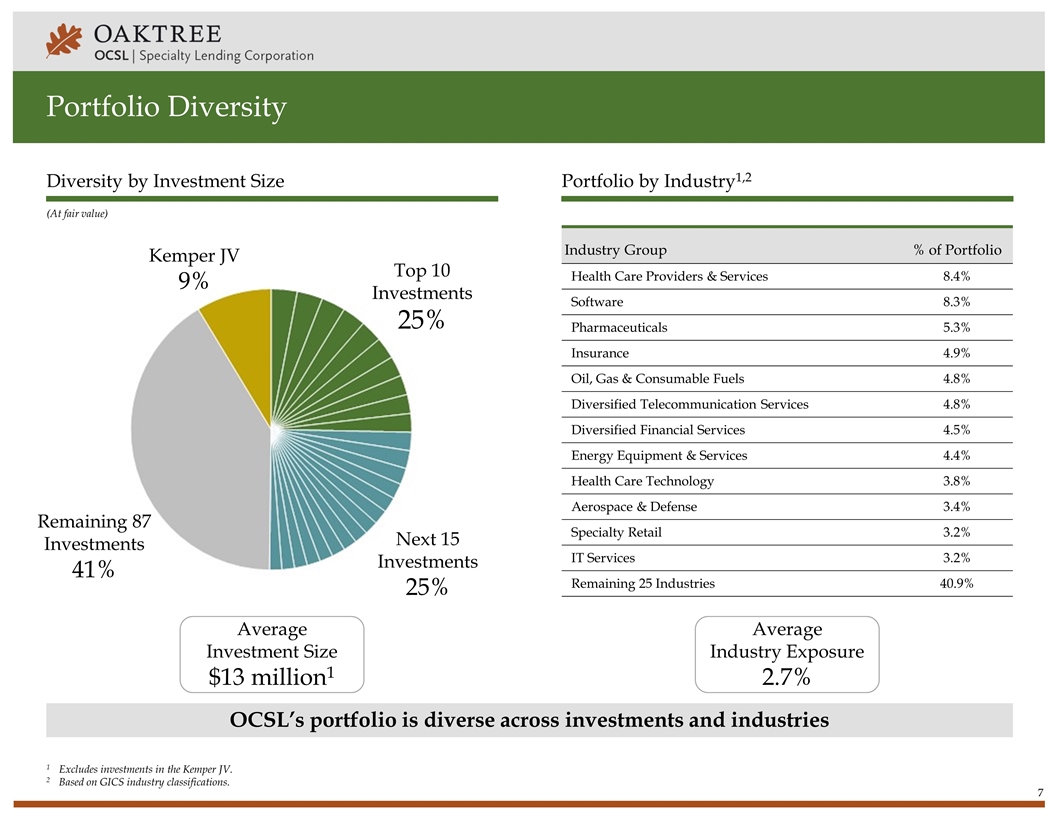

Portfolio Diversity OCSL’s portfolio is diverse across investments and industries (At fair value) Portfolio by Industry1,2 Diversity by Investment Size Top 10 Investments 25% Next 15 Investments 25% Remaining 87 Investments 41% Kemper JV 9% Average Investment Size $13 million1 1Excludes investments in the Kemper JV. 2Based on GICS industry classifications. Industry Group % of Portfolio Health Care Providers & Services 8.4% Software 8.3% Pharmaceuticals 5.3% Insurance 4.9% Oil, Gas & Consumable Fuels 4.8% Diversified Telecommunication Services 4.8% Diversified Financial Services 4.5% Energy Equipment & Services 4.4% Health Care Technology 3.8% Aerospace & Defense 3.4% Specialty Retail 3.2% IT Services 3.2% Remaining 25 Industries 40.9% Average Industry Exposure 2.7%

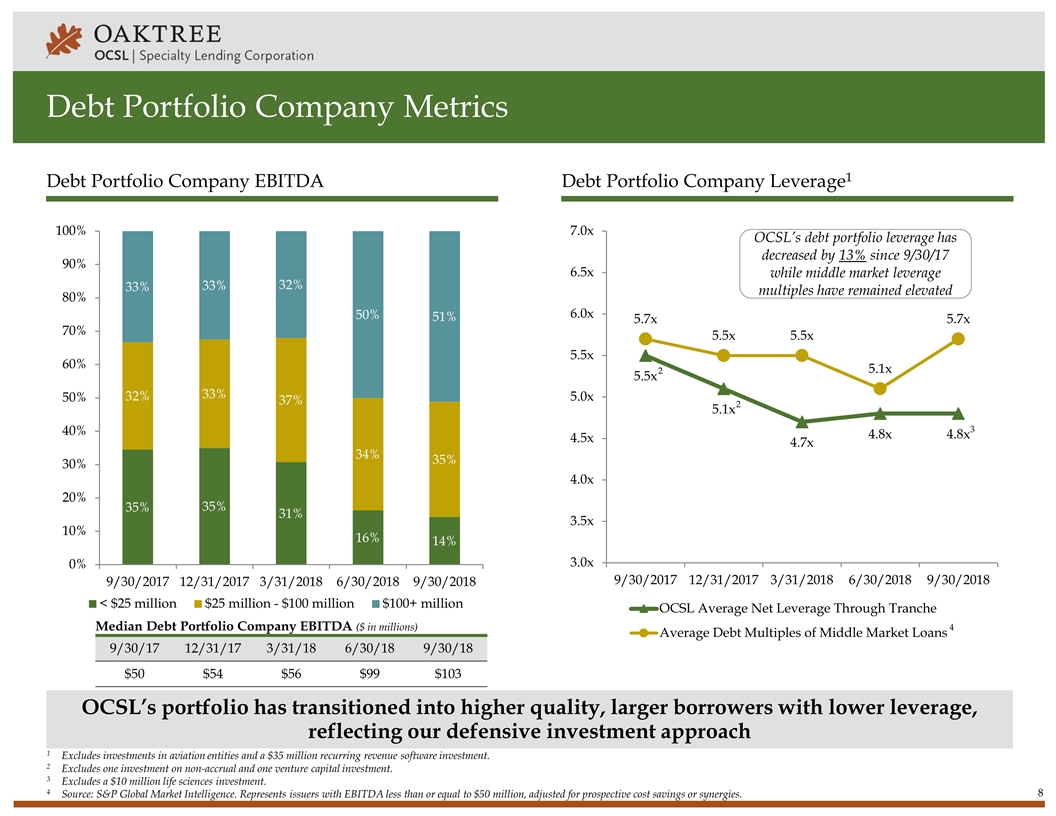

Debt Portfolio Company Metrics OCSL’s portfolio has transitioned into higher quality, larger borrowers with lower leverage, reflecting our defensive investment approach Debt Portfolio Company EBITDA Debt Portfolio Company Leverage1 Median Debt Portfolio Company EBITDA ($ in millions) OCSL’s debt portfolio leverage has decreased by 13% since 9/30/17 while middle market leverage multiples have remained elevated 1 Excludes investments in aviation entities and a $35 million recurring revenue software investment. 2 Excludes one investment on non-accrual and one venture capital investment. 3 Excludes a $10 million life sciences investment. 4 Source: S&P Global Market Intelligence. Represents issuers with EBITDA less than or equal to $50 million, adjusted for prospective cost savings or synergies. 4 9/30/17 12/31/17 3/31/18 6/30/18 9/30/18 $50 $54 $56 $99 $103 2 3 2

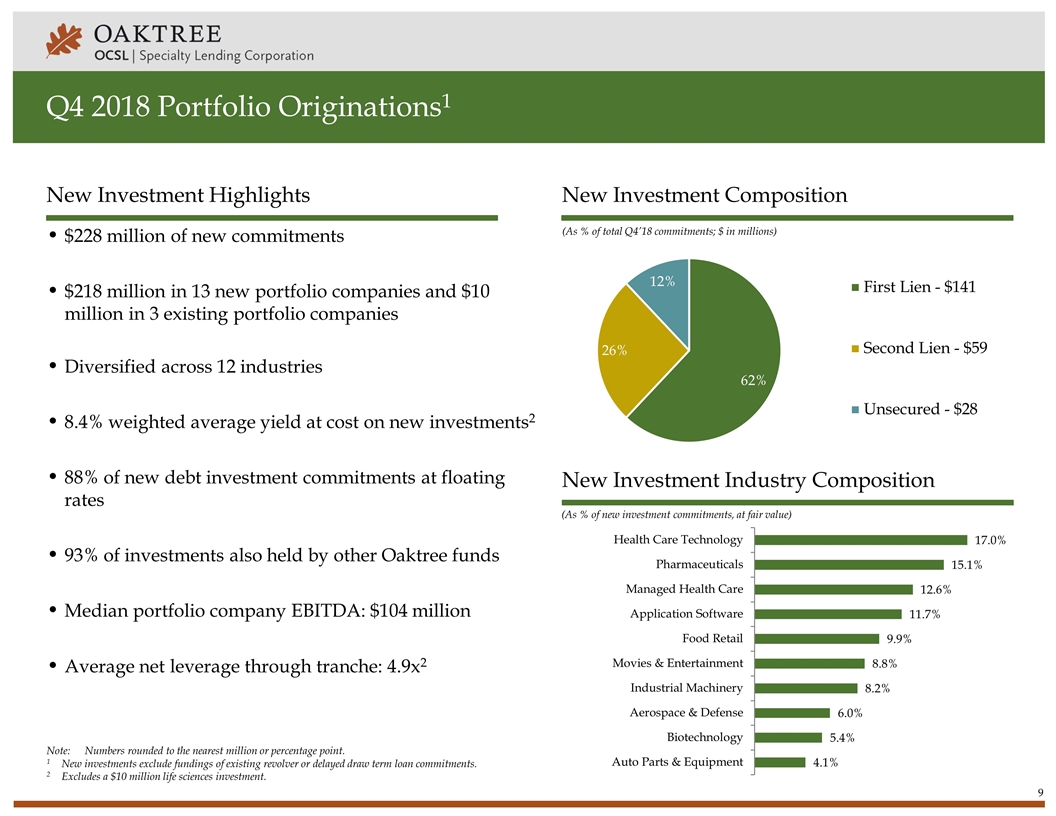

Q4 2018 Portfolio Originations1 $228 million of new commitments $218 million in 13 new portfolio companies and $10 million in 3 existing portfolio companies Diversified across 12 industries 8.4% weighted average yield at cost on new investments2 88% of new debt investment commitments at floating rates 93% of investments also held by other Oaktree funds Median portfolio company EBITDA: $104 million Average net leverage through tranche: 4.9x2 New Investment Highlights (As % of new investment commitments, at fair value) New Investment Industry Composition (As % of total Q4’18 commitments; $ in millions) New Investment Composition Note:Numbers rounded to the nearest million or percentage point. 1 New investments exclude fundings of existing revolver or delayed draw term loan commitments. 2 Excludes a $10 million life sciences investment.

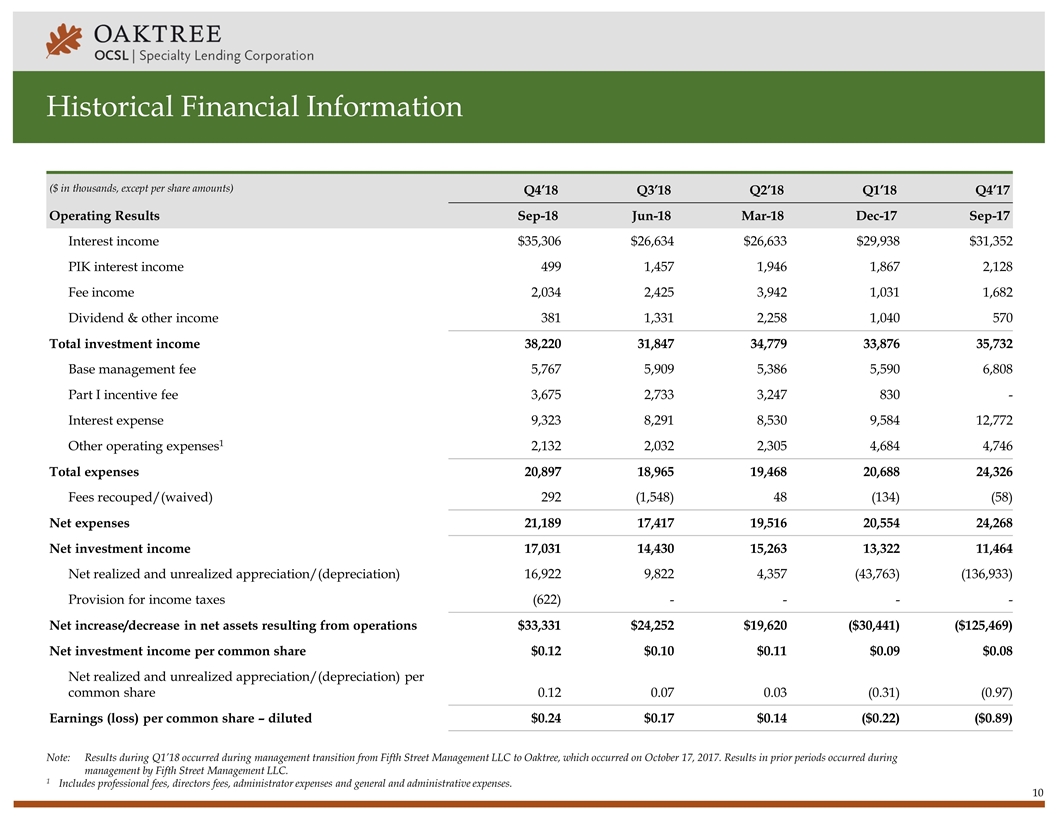

Historical Financial Information ($ in thousands, except per share amounts) Operating Results Q4’18 Q3’18 Q2’18 Q1’18 Q4’17 Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Interest income $35,306 $26,634 $26,633 $29,938 $31,352 PIK interest income 499 1,457 1,946 1,867 2,128 Fee income 2,034 2,425 3,942 1,031 1,682 Dividend & other income 381 1,331 2,258 1,040 570 Total investment income 38,220 31,847 34,779 33,876 35,732 Base management fee 5,767 5,909 5,386 5,590 6,808 Part I incentive fee 3,675 2,733 3,247 830 - Interest expense 9,323 8,291 8,530 9,584 12,772 Other operating expenses1 2,132 2,032 2,305 4,684 4,746 Total expenses 20,897 18,965 19,468 20,688 24,326 Fees recouped/(waived) 292 (1,548) 48 (134) (58) Net expenses 21,189 17,417 19,516 20,554 24,268 Net investment income 17,031 14,430 15,263 13,322 11,464 Net realized and unrealized appreciation/(depreciation) 16,922 9,822 4,357 (43,763) (136,933) Provision for income taxes (622) - - - - Net increase/decrease in net assets resulting from operations $33,331 $24,252 $19,620 ($30,441) ($125,469) Net investment income per common share $0.12 $0.10 $0.11 $0.09 $0.08 Net realized and unrealized appreciation/(depreciation) per common share 0.12 0.07 0.03 (0.31) (0.97) Earnings (loss) per common share – diluted $0.24 $0.17 $0.14 ($0.22) ($0.89) Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree, which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. 1Includes professional fees, directors fees, administrator expenses and general and administrative expenses.

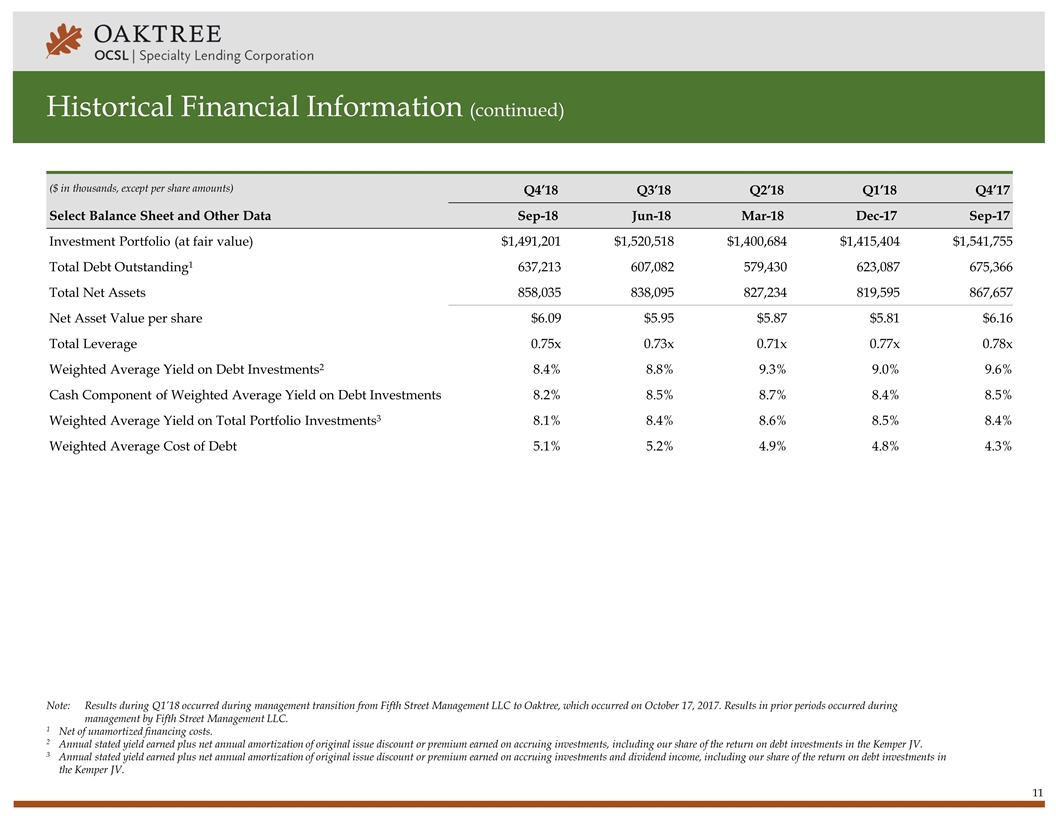

Historical Financial Information (continued) ($ in thousands, except per share amounts) Select Balance Sheet and Other Data Q4’18 Q3’18 Q2’18 Q1’18 Q4’17 Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Investment Portfolio (at fair value) $1,491,201 $1,520,518 $1,400,684 $1,415,404 $1,541,755 Total Debt Outstanding1 637,213 607,082 579,430 623,087 675,366 Total Net Assets 858,035 838,095 827,234 819,595 867,657 Net Asset Value per share $6.09 $5.95 $5.87 $5.81 $6.16 Total Leverage 0.75x 0.73x 0.71x 0.77x 0.78x Weighted Average Yield on Debt Investments2 8.4% 8.8% 9.3% 9.0% 9.6% Cash Component of Weighted Average Yield on Debt Investments 8.2% 8.5% 8.7% 8.4% 8.5% Weighted Average Yield on Total Portfolio Investments3 8.1% 8.4% 8.6% 8.5% 8.4% Weighted Average Cost of Debt 5.1% 5.2% 4.9% 4.8% 4.3% Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree, which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. 1Net of unamortized financing costs. 2Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments, including our share of the return on debt investments in the Kemper JV. 3Annual stated yield earned plus net annual amortization of original issue discount or premium earned on accruing investments and dividend income, including our share of the return on debt investments in the Kemper JV.

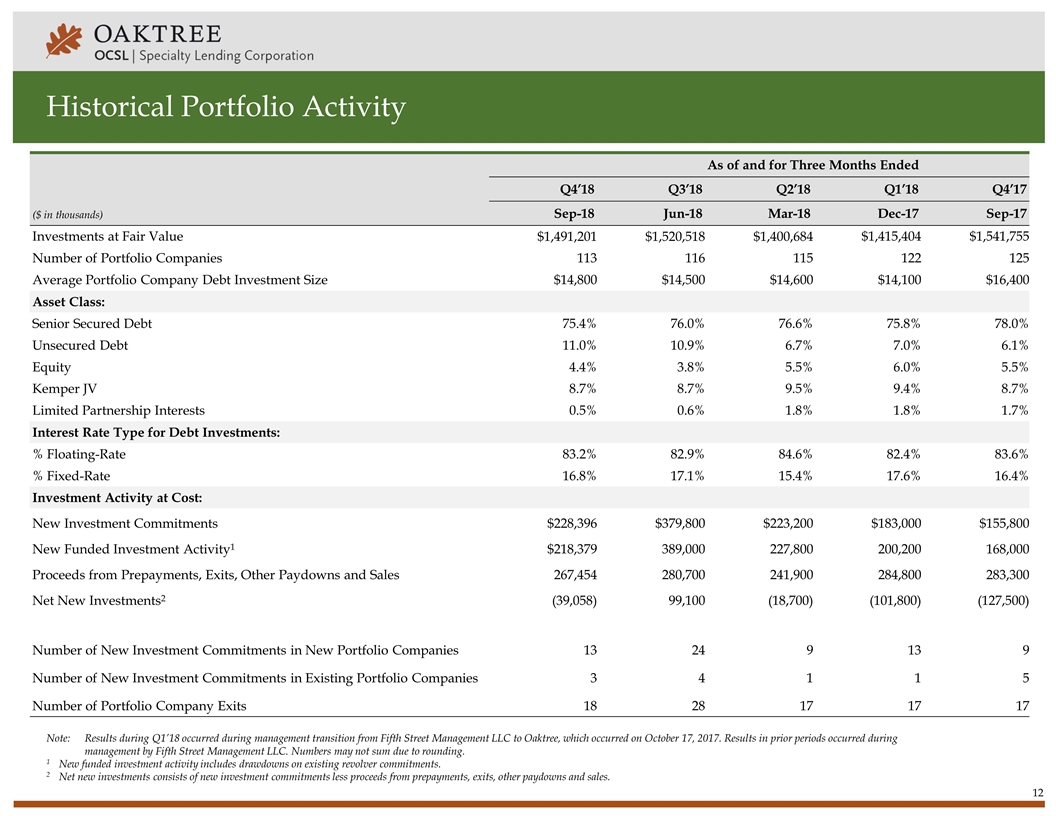

Historical Portfolio Activity ($ in thousands) As of and for Three Months Ended Q4’18 Q3’18 Q2’18 Q1’18 Q4’17 Sep-18 Jun-18 Mar-18 Dec-17 Sep-17 Investments at Fair Value $1,491,201 $1,520,518 $1,400,684 $1,415,404 $1,541,755 Number of Portfolio Companies 113 116 115 122 125 Average Portfolio Company Debt Investment Size $14,800 $14,500 $14,600 $14,100 $16,400 Asset Class: Senior Secured Debt 75.4% 76.0% 76.6% 75.8% 78.0% Unsecured Debt 11.0% 10.9% 6.7% 7.0% 6.1% Equity 4.4% 3.8% 5.5% 6.0% 5.5% Kemper JV 8.7% 8.7% 9.5% 9.4% 8.7% Limited Partnership Interests 0.5% 0.6% 1.8% 1.8% 1.7% Interest Rate Type for Debt Investments: % Floating-Rate 83.2% 82.9% 84.6% 82.4% 83.6% % Fixed-Rate 16.8% 17.1% 15.4% 17.6% 16.4% Investment Activity at Cost: New Investment Commitments $228,396 $379,800 $223,200 $183,000 $155,800 New Funded Investment Activity1 $218,379 389,000 227,800 200,200 168,000 Proceeds from Prepayments, Exits, Other Paydowns and Sales 267,454 280,700 241,900 284,800 283,300 Net New Investments2 (39,058) 99,100 (18,700) (101,800) (127,500) Number of New Investment Commitments in New Portfolio Companies 13 24 9 13 9 Number of New Investment Commitments in Existing Portfolio Companies 3 4 1 1 5 Number of Portfolio Company Exits 18 28 17 17 17 Note:Results during Q1’18 occurred during management transition from Fifth Street Management LLC to Oaktree, which occurred on October 17, 2017. Results in prior periods occurred during management by Fifth Street Management LLC. Numbers may not sum due to rounding. 1New funded investment activity includes drawdowns on existing revolver commitments. 2Net new investments consists of new investment commitments less proceeds from prepayments, exits, other paydowns and sales.

Net Asset Value Per Share Bridge ($0.095) Note:Net asset value per share amounts are based on the shares outstanding at each respective quarter end. Net investment income per share, net unrealized appreciation / (depreciation), and net realized gain / (loss) are based on the weighted average number of shares outstanding for the period. 1Excludes reclassifications of net unrealized appreciation / (depreciation) to net realized gains / (losses) as a result of investments exited during the quarter. 1 1

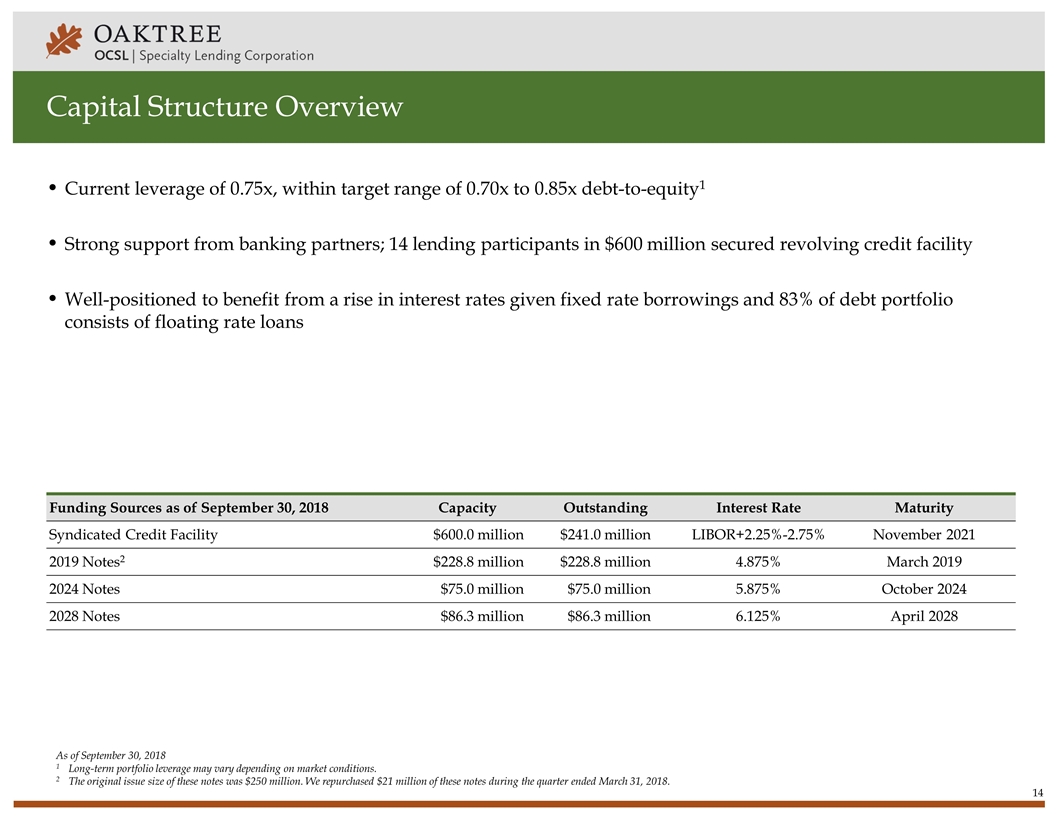

Capital Structure Overview Funding Sources as of September 30, 2018 Capacity Outstanding Interest Rate Maturity Syndicated Credit Facility $600.0 million $241.0 million LIBOR+2.25%-2.75% November 2021 2019 Notes2 $228.8 million $228.8 million 4.875% March 2019 2024 Notes $75.0 million $75.0 million 5.875% October 2024 2028 Notes $86.3 million $86.3 million 6.125% April 2028 As of September 30, 2018 1Long-term portfolio leverage may vary depending on market conditions. 2The original issue size of these notes was $250 million. We repurchased $21 million of these notes during the quarter ended March 31, 2018. Current leverage of 0.75x, within target range of 0.70x to 0.85x debt-to-equity1 Strong support from banking partners; 14 lending participants in $600 million secured revolving credit facility Well-positioned to benefit from a rise in interest rates given fixed rate borrowings and 83% of debt portfolio consists of floating rate loans

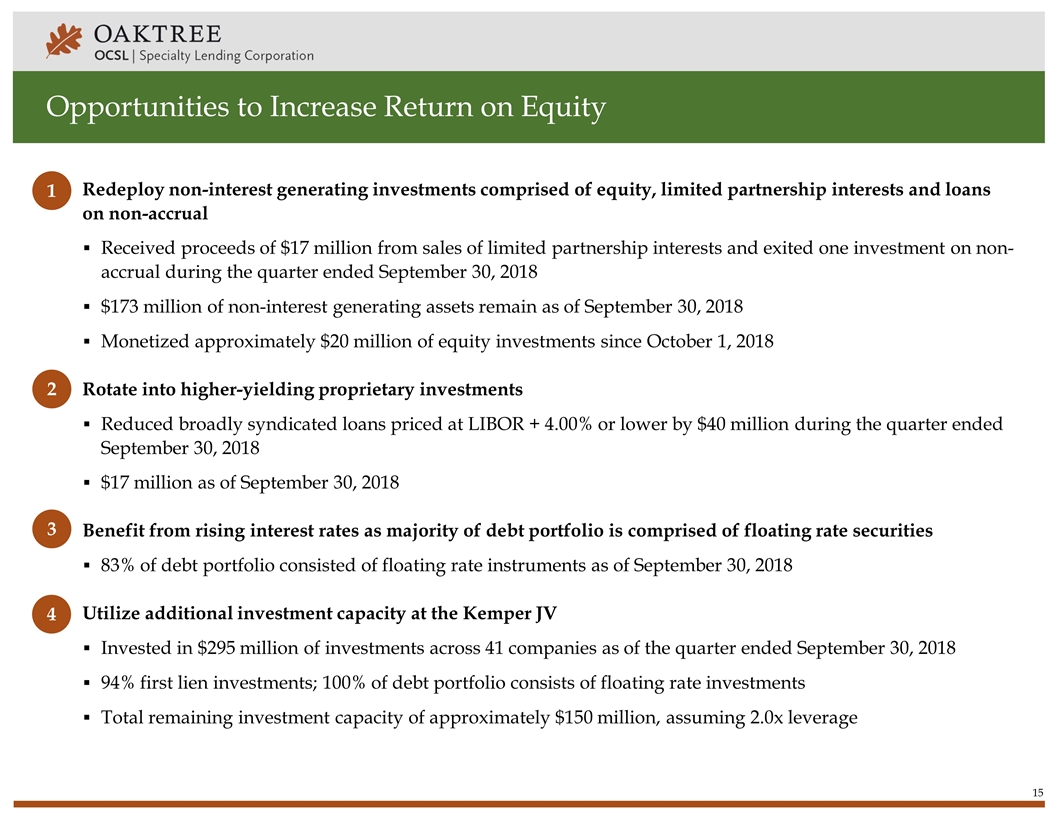

Opportunities to Increase Return on Equity Redeploy non-interest generating investments comprised of equity, limited partnership interests and loans on non-accrual Received proceeds of $17 million from sales of limited partnership interests and exited one investment on non-accrual during the quarter ended September 30, 2018 $173 million of non-interest generating assets remain as of September 30, 2018 Monetized approximately $20 million of equity investments since October 1, 2018 Rotate into higher-yielding proprietary investments Reduced broadly syndicated loans priced at LIBOR + 4.00% or lower by $40 million during the quarter ended September 30, 2018 $17 million as of September 30, 2018 Benefit from rising interest rates as majority of debt portfolio is comprised of floating rate securities 83% of debt portfolio consisted of floating rate instruments as of September 30, 2018 Utilize additional investment capacity at the Kemper JV Invested in $295 million of investments across 41 companies as of the quarter ended September 30, 2018 94% first lien investments; 100% of debt portfolio consists of floating rate investments Total remaining investment capacity of approximately $150 million, assuming 2.0x leverage 1 2 3 4

Appendix

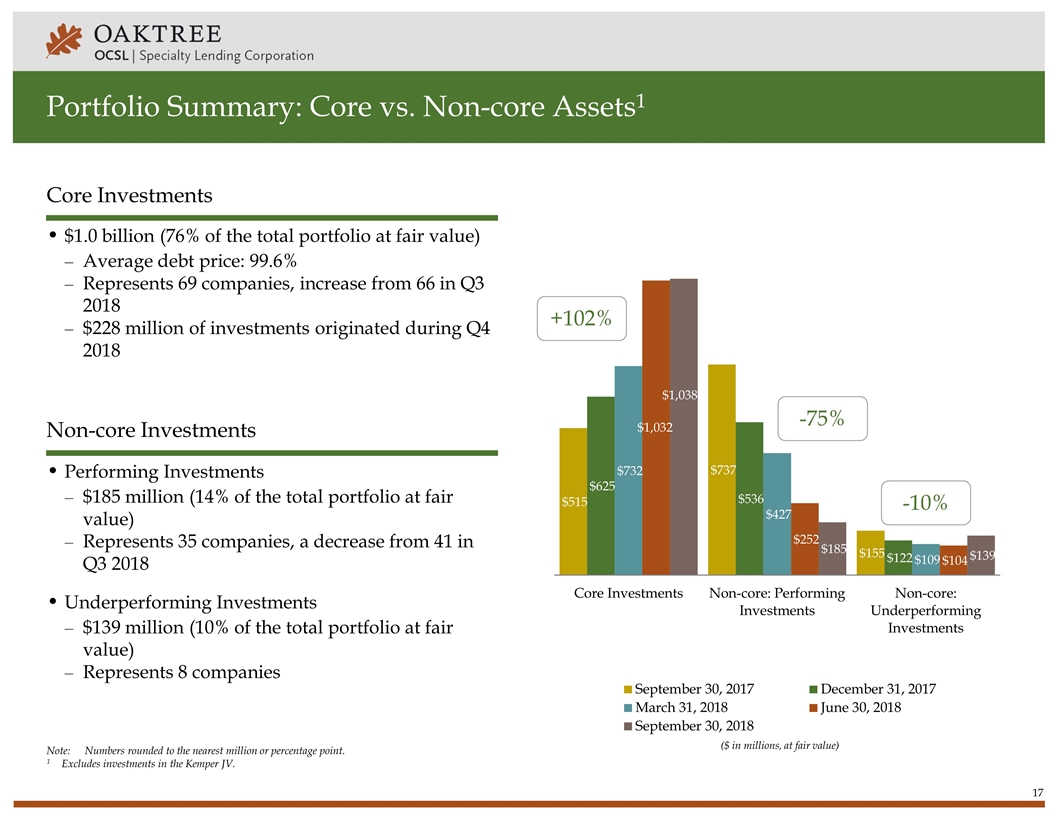

Portfolio Summary: Core vs. Non-core Assets1 $1.0 billion (76% of the total portfolio at fair value) Average debt price: 99.6% Represents 69 companies, increase from 66 in Q3 2018 $228 million of investments originated during Q4 2018 Non-core Investments Performing Investments $185 million (14% of the total portfolio at fair value) Represents 35 companies, a decrease from 41 in Q3 2018 Underperforming Investments $139 million (10% of the total portfolio at fair value) Represents 8 companies ($ in millions, at fair value) Note:Numbers rounded to the nearest million or percentage point. 1 Excludes investments in the Kemper JV. Core Investments +102% -75% -10%

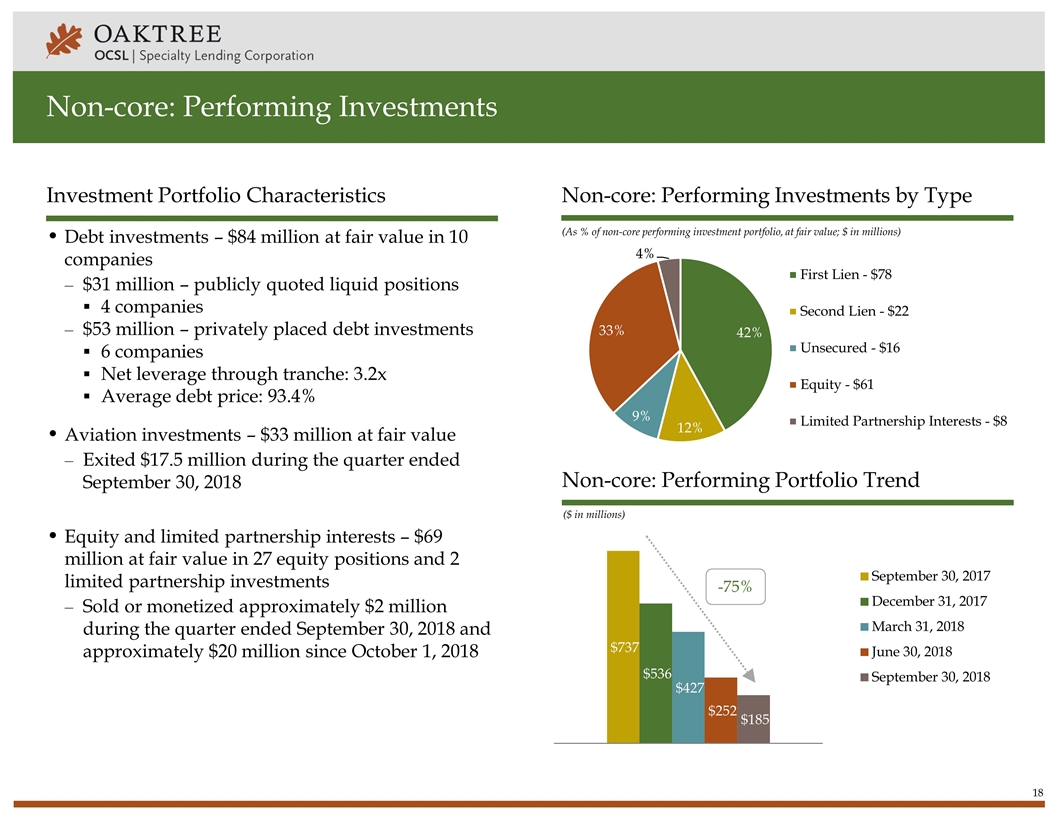

Non-core: Performing Investments Investment Portfolio Characteristics Debt investments – $84 million at fair value in 10 companies $31 million – publicly quoted liquid positions 4 companies $53 million – privately placed debt investments 6 companies Net leverage through tranche: 3.2x Average debt price: 93.4% Aviation investments – $33 million at fair value Exited $17.5 million during the quarter ended September 30, 2018 Equity and limited partnership interests – $69 million at fair value in 27 equity positions and 2 limited partnership investments Sold or monetized approximately $2 million during the quarter ended September 30, 2018 and approximately $20 million since October 1, 2018 (As % of non-core performing investment portfolio, at fair value; $ in millions) Non-core: Performing Investments by Type ($ in millions) Non-core: Performing Portfolio Trend -75%

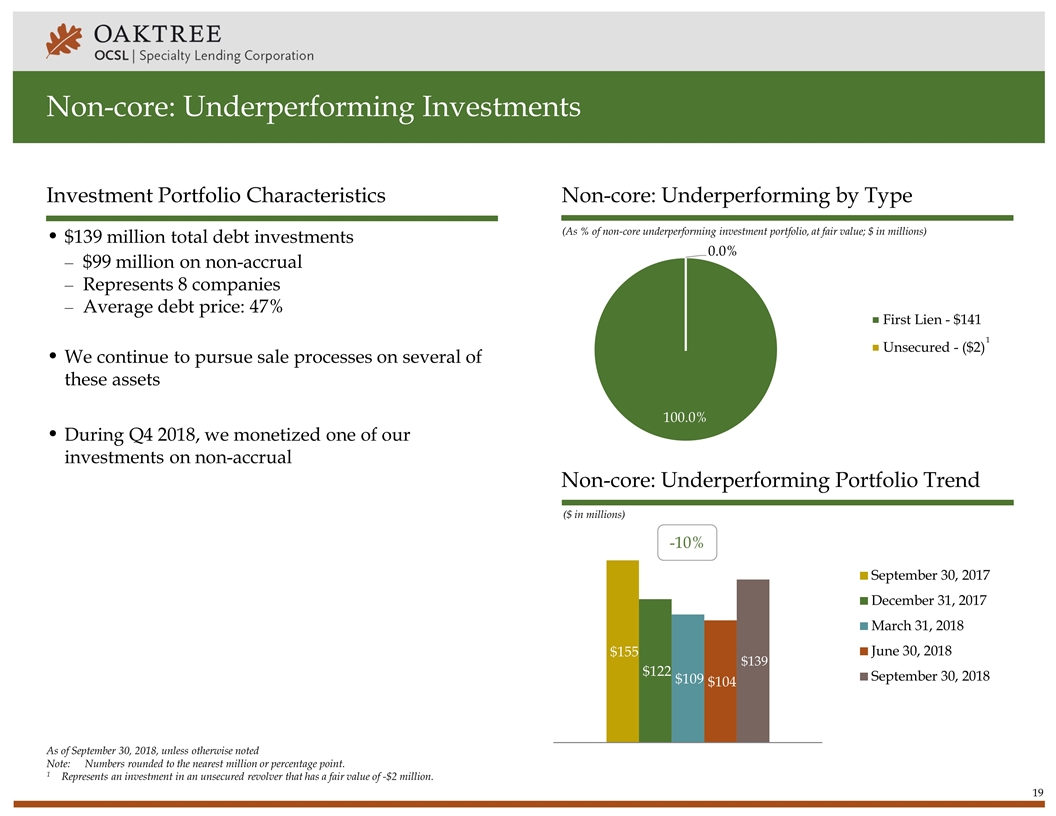

Non-core: Underperforming Investments Non-core: Underperforming by Type Investment Portfolio Characteristics (As % of non-core underperforming investment portfolio, at fair value; $ in millions) $139 million total debt investments $99 million on non-accrual Represents 8 companies Average debt price: 47% We continue to pursue sale processes on several of these assets During Q4 2018, we monetized one of our investments on non-accrual ($ in millions) Non-core: Underperforming Portfolio Trend -10% 1 As of September 30, 2018, unless otherwise noted Note:Numbers rounded to the nearest million or percentage point. 1 Represents an investment in an unsecured revolver that has a fair value of -$2 million.

Contact: Michael Mosticchio, Investor Relations ocsl-ir@oaktreecapital.com