Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Sonos Inc | a8-kq4fy18.htm |

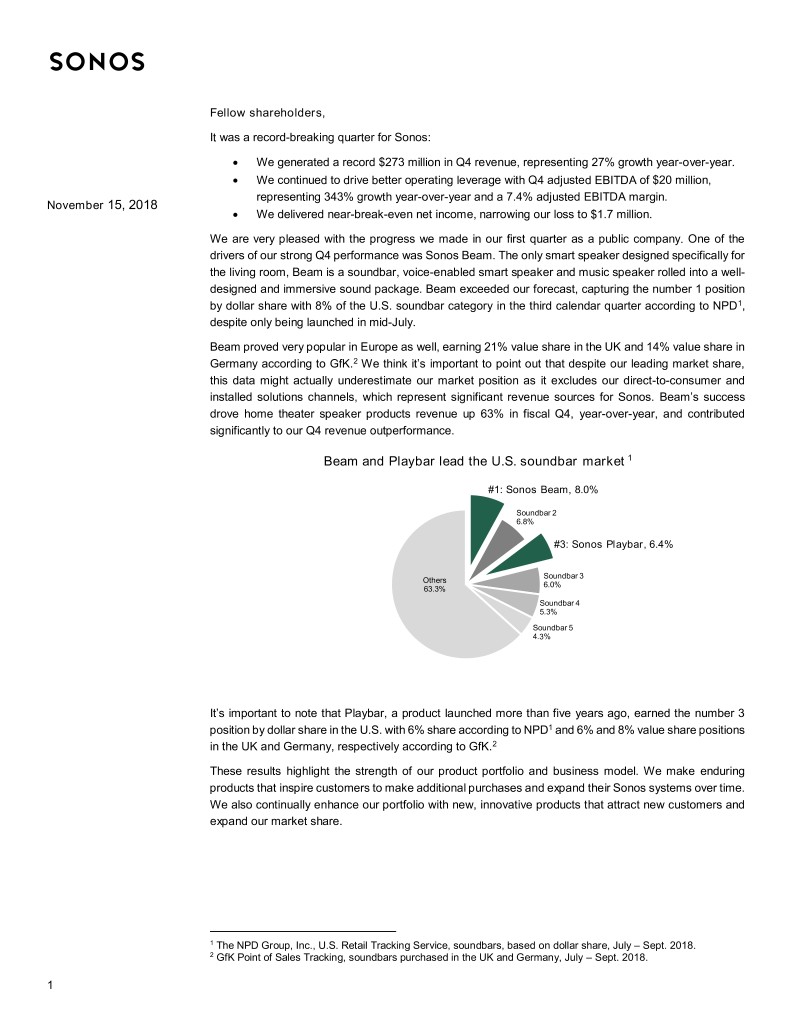

Fellow shareholders, It was a record-breaking quarter for Sonos: • We generated a record $273 million in Q4 revenue, representing 27% growth year-over-year. • We continued to drive better operating leverage with Q4 adjusted EBITDA of $20 million, representing 343% growth year-over-year and a 7.4% adjusted EBITDA margin. November 15, 2018 • We delivered near-break-even net income, narrowing our loss to $1.7 million. We are very pleased with the progress we made in our first quarter as a public company. One of the drivers of our strong Q4 performance was Sonos Beam. The only smart speaker designed specifically for the living room, Beam is a soundbar, voice-enabled smart speaker and music speaker rolled into a well- designed and immersive sound package. Beam exceeded our forecast, capturing the number 1 position by dollar share with 8% of the U.S. soundbar category in the third calendar quarter according to NPD1, despite only being launched in mid-July. Beam proved very popular in Europe as well, earning 21% value share in the UK and 14% value share in Germany according to GfK.2 We think it’s important to point out that despite our leading market share, this data might actually underestimate our market position as it excludes our direct-to-consumer and installed solutions channels, which represent significant revenue sources for Sonos. Beam’s success drove home theater speaker products revenue up 63% in fiscal Q4, year-over-year, and contributed significantly to our Q4 revenue outperformance. Beam and Playbar lead the U.S. soundbar market 1 #1: Sonos Beam, 8.0% Soundbar 2 6.8% #3: Sonos Playbar, 6.4% Soundbar 3 Others 6.0% 63.3% Soundbar 4 5.3% Soundbar 5 4.3% It’s important to note that Playbar, a product launched more than five years ago, earned the number 3 position by dollar share in the U.S. with 6% share according to NPD1 and 6% and 8% value share positions in the UK and Germany, respectively according to GfK.2 These results highlight the strength of our product portfolio and business model. We make enduring products that inspire customers to make additional purchases and expand their Sonos systems over time. We also continually enhance our portfolio with new, innovative products that attract new customers and expand our market share. 1 The NPD Group, Inc., U.S. Retail Tracking Service, soundbars, based on dollar share, July – Sept. 2018. 2 GfK Point of Sales Tracking, soundbars purchased in the UK and Germany, July – Sept. 2018. 1

Fiscal year 2018 FY2018 was a pivotal year for Sonos, and our thirteenth consecutive year of revenue growth. We successfully achieved our goal of increasing our product velocity by launching two new products during the year, which helped us achieve our highest annual revenue growth rate since FY2014, and we made significant progress on our long-term goal of driving sustainable, profitable growth. In FY2018, we: • Generated $1,137 million in revenue and $69 million in adjusted EBITDA, representing 15% and 24% year-over-year growth, respectively • Incurred a net loss of $15.6 million • Added over 1.5 million new homes, which represents 21% more new homes than we added in FY2017 • Sold over 5 million products, representing 29% growth year-over-year • Registered 37% of products to existing customers, underscoring the power of our system as customers continue to add more Sonos to their homes year after year • Grew our direct-to-consumer revenue 26% year-over-year Revenue New households in millions, % growth millions of households, % growth $1,137 1.5 $993 14.6% $901 21.3% 10.1% 1.3 1.2 6.8% 2.1% -0.4% 2016 2017 2018 2016 2017 2018 2

Sonos remains unique We’re proud of our progress over the last 16 years. However, we believe this is only the beginning as we work to become the world’s leading sound experience company. With Sonos in over 7.4 million homes today, we are off to a great start, but we believe we are just scratching the surface considering that approximately 200 million subscribers are paying for streaming music, a number that is expected to grow to 333 million over the next three years.3 As we gear up for the holiday season, we want to offer our perspective on what it means to deliver a world-class sound experience within the current consumer electronics landscape. From a consumer’s perspective, the sheer volume of new product releases during this season must be overwhelming. From our vantage point, while the number of product releases seems to be increasing, the strategic intentions remain the same. Big tech companies continue to release hardware as entry points to service offerings like search, e-commerce and music services. These lower-priced, commodity devices seem to flood the market over the holiday season and tend to find their way into drawers or closets by the next year. While some of these devices introduce customers to new experiences like voice, the products lack staying power because of gaps in quality, design or sound experience. These products were not developed to deliver premium sound experiences and lasting design and ultimately do not meet the needs of our target customers. We view the proliferation of big tech devices as stepping stones to Sonos and believe that over time consumers will transition from gadgets that make sound to the enduring sound experience that is uniquely Sonos. 3 Futuresource Consulting, Audio Market Review, September 10, 2018 3

At Sonos, we chose a different approach. We invented wireless multi-room home audio and developed a portfolio of products that look and sound great and work together as a system to deliver a simple but compelling customer experience. Our products clearly stand Season after season, our customers use our products and continue to add more apart. Our recent products as they add more rooms and transform the sound in their homes. In fact, partnership with HAY explores 94% of the 21 million Sonos products registered since 2005 are still in use today. the relationship between sound As we continue to bring innovative audio products to the market, we will use the and design in the home. same approach: create easy-to-use products that work together and work with everything. Fiscal year 2019 We are hard at work delivering on everything we have planned for FY2019, including: • The recently announced Sonos Amp is the first step in a multi-faceted plan to accelerate our installed solutions channel. The opening of our developer portal and future launch of in-wall, in- ceiling and outdoor wired speakers in partnership with Sonance enables our installer partners to deliver seamless Sonos integrations to their customers. • Our recent launch in Japan, the world’s second largest music market, presents a significant opportunity to bring the Sonos experience to consumers who value design and fidelity of sound. • Our partnership with IKEA will deliver products that reimagine what sound looks like in the home and potentially introduce millions of new households to the Sonos app and experience. • We expect Google Assistant to join our platform alongside Amazon Alexa, giving customers the freedom of choice when it comes to voice assistants. Each of these initiatives, plus strong momentum from our existing portfolio and our product roadmap sets the stage for an exciting FY2019. Additionally, we realize that while approximately 50% of listening happens in the home, the other 50% happens outside the home. So, to be the leading sound experience company, we need to continue to offer differentiated listening experiences in the home while extending our platform and products to all the places and spaces our customers listen to the fantastic breadth of audio content available on demand today. In FY2019, we plan to push our boundaries by investing resources to make the experience of Sonos outside the home a reality. 4

FY 2019 outlook To provide better visibility for investors, we are providing full-year FY2019 (FY ending September 28, 2019) and Q1 FY2019 (ending December 29, 2018) guidance below. Our outlook highlights revenue and adjusted EBITDA growth ranges as these are the metrics we focus on to deliver sustainable, profitable growth. Long-term FY2018 FY2019 Q1 target actual outlook outlook (dollars in millions) Revenue growth 10%+ 15% 10 - 12% 3 - 6% Revenue range $1,250 - $1,275 $485 - $495 Adjusted EBITDA growth 20% 24% 20 - 27% 1 - 6% Adjusted EBITDA range $83 - $88 $66 - $69 Revenue. Our recently completed FY2018 illustrates the variability in our quarterly revenue performance due to product launch cadence. In FY2018, we generated 26%, 2%, -7% and 27% year-over-year quarterly revenue growth in Q1 through Q4, respectively. It is important to keep this variability in mind when putting our annual outlook into a quarterly context. For the full fiscal year 2019, we expect annual revenue in the range of $1,250 million to $1,275 million, or 10 to 12% growth year-over-year. For Q1 FY2019, we expect revenue in the range of $485 million to $495 million, or 3 to 6% growth year-over- year. Gross margin. Our long-term target continues to be 42-44%, a level we’ve achieved regularly over the past thirteen years. As previously discussed, we anticipate lower gross margins (40-41%) in FY2019 as a result of industry-wide component shortages (primarily multi-layer ceramic capacitors or MLCCs) and our new increased product cadence which shifts the product mix to those products earlier in their life cycle when the gross margin is lower. Due to normal holiday season promotional activities, we expect Q1 gross margin to be lower than the full year range. Adjusted EBITDA. We expect a modest increase to operating expenses in FY2019 from FY2018 as we benefit from $14 million of annualized savings we expect to realize from our reorganization efforts in Q3 FY2018. For the full fiscal year 2019, we expect annual adjusted EBITDA in the range of $83 million to $88 million, or 20 to 27% growth year-over-year. For Q1 FY2019, we expect adjusted EBITDA in the range of $66 million to $69 million, or 1 to 6% growth year-over-year. Capital expenditures. We intend to invest approximately 2.5% of FY2019 revenue in capital expenditures, primarily to fund tooling and production line test equipment required for new products. 5

Sonos is on a quest to become the world’s leading sound experience company. We revolutionized the experience of listening in the home. We’re not just making “smart speakers”, we’re making a premium smart system that’s open to all audio content and voice services, incredibly easy to use and always sounds amazing. Now we are focused on extending this system to meet the listening needs of every aspect of our customers’ lives, in the home and beyond. Patrick Spence CEO P.S. Everyone at Sonos comes to work to share their love of music. Enjoy some of our favorite new tracks from the last quarter. Now Playing at Sonos Track Artist Comeback kid Sharon Van Etten Nont for sale Sudan Archives Everybody loves you SOAK Bite the hand Julien Baker, Phoebe Bridgers, Lucy Dacus Shot clock Ella Mai Woman Cat Power, Lana Del Rey Deluxe Tender Age Accusations 070 Shake Scream whole Methyl Ethel symbol Adrianne Lenker One more Yaeji Body Julia Jacklin 6

Financial summary Q4 (three months ended September 29, 2018) and full-year fiscal 2018 results Revenue In Q4 FY2018 we sold 1,120,179 products, representing 47% growth year-over-year, and generated $273 million in revenue. This robust product growth translated into a 27% increase in revenue compared to Q4 of FY2017. In Q4 FY2018, the largest driver impacting our year-over-year revenue growth was the launch of Beam, which led to a 119% increase in home theater speakers products sold and a 63% increase in home theater speakers revenue. Wireless speakers products sold increased 35% due to the continued momentum of Sonos One. Despite the strong unit growth, wireless speaker revenue increased 4% as volume mix shifted from higher-priced Play:5 and Play:3 to lower-priced Sonos One and Play:1. In FY2018, products sold increased 29% and revenue increased 15% compared to FY2017. Wireless speakers continue to be our largest category and revenue in the category grew 14% on 35% unit growth compared to the same period in FY2017, driven by the introduction of Sonos One in Q1 FY2018. Home theater speakers revenue increased 20% on 30% unit growth compared to the same period in FY2017, driven by the introduction of Beam in Q4 FY2018. Revenue from components declined 1% on a 2% unit decrease, which reflects the maturity of these products that were launched 10 years ago. In September, we announced our new component product, Sonos Amp, which we expect to drive renewed consumer interest in this category during FY2019. Three months ended Fiscal year ended September 29, September 30, September 29, September 30, 2018 2017 2018 2017 (dollars in thousands) Wireless speakers $93,464 $90,299 $546,649 $480,977 Home theater speakers 134,464 82,610 418,416 348,899 Components 36,906 38,660 150,436 151,965 Other 8,106 2,526 21,507 10,685 Total revenue $272,940 $214,095 $1,137,008 $992,526 Gross margin Our Q4 FY2018 gross margin of 42.6% was 5.5 percentage points lower than Q4 FY2017. The year-over- year reduction in gross margin is consistent with our acceleration in new product cadence. We launched Sonos One in Q1 FY2018 and Beam in Q4 FY2018 with gross margins below the average gross margin of our product portfolio, thereby diluting our overall gross margin. Prior to FY2018, we launched two products over the previous four years. We have historically launched products below their long-term target gross margin and improved gross margin over time as we realize cost efficiencies and through the efforts of our engineering and supply chain teams to reduce per-unit production costs. In addition, our cost of goods sold was negatively impacted late in Q4 by price premiums on certain components including ceramic capacitors. As we have previously stated, we expect this impact to increase in FY2019. Operating expenses Our operating expenses in Q4 FY2018 were $116.1 million, representing 42.5% of revenue for the period. On a comparative basis, operating expenses declined $2.4 million, or 2.0%, compared to Q4 FY2017. Our operating expenses for FY2018 were $498.2 million, representing 43.8% of revenue for the period. On a comparative basis, operating expenses increased $26.5 million, or 5.6%, compared to FY2017. Growth in operating expenses was primarily driven by increasing headcount in R&D by approximately 20% and investing in personnel and professional fees to create the infrastructure necessary to support a public company. Importantly, we demonstrated considerable operating leverage in sales & marketing which increased modestly by 0.3% year-over-year, reducing FY2018 S&M as a percentage of FY2018 7

revenue by 3.4 percentage points. We grew revenue 14.6% despite holding S&M expenses essentially flat as we transitioned away from traditional paid media and adopted more effective direct-to-consumer and digital marketing techniques. Sales & marketing expense % of revenue 28.6% 27.2% 23.8% 2016 2017 2018 Q&A conference call webcast – 5 p.m. EDT on November 15, 2018 The Company will host a webcast of its conference call and Q&A related to Q4 2018 results on November 15, 2018 at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). Participants may access the live webcast in listen-only mode on the Sonos investor relations website at investors.sonos.com. An archived webcast of the conference call will also be available at investors.sonos.com following the call. The conference call may also be accessed by dialing (877) 683-0503, with conference ID 7086508. Participants outside the U.S. can dial toll-free (647) 689-5442. 8

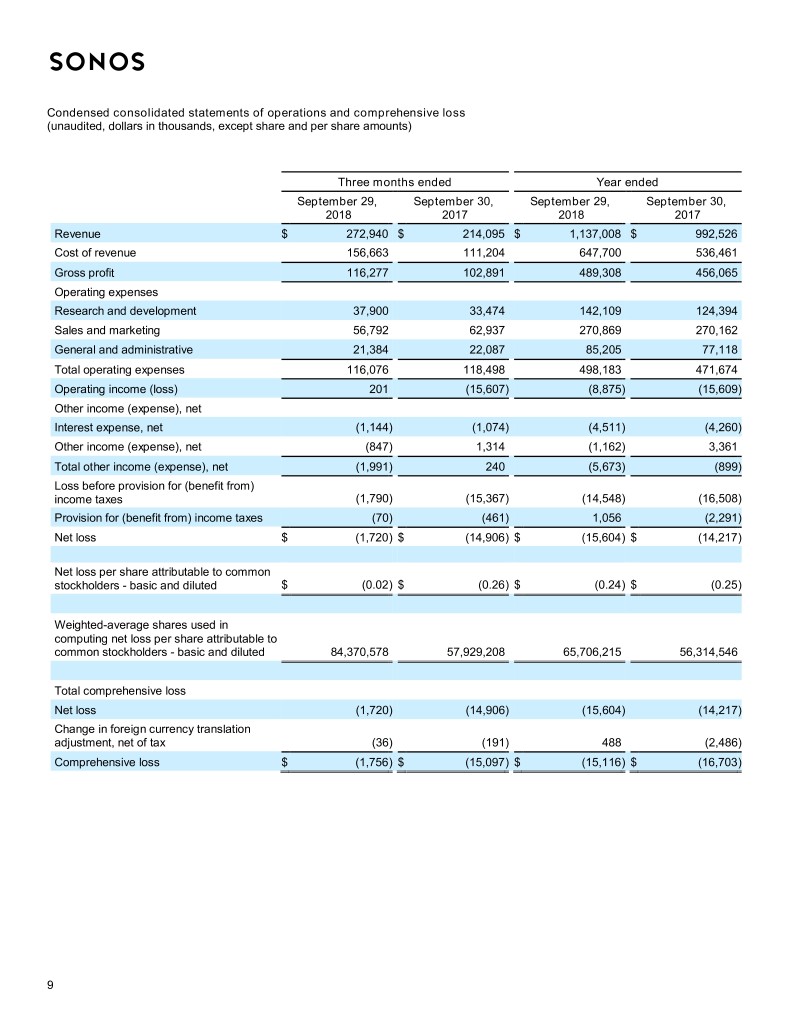

Condensed consolidated statements of operations and comprehensive loss (unaudited, dollars in thousands, except share and per share amounts) Three months ended Year ended September 29, September 30, September 29, September 30, 2018 2017 2018 2017 Revenue $ 272,940 $ 214,095 $ 1,137,008 $ 992,526 Cost of revenue 156,663 111,204 647,700 536,461 Gross profit 116,277 102,891 489,308 456,065 Operating expenses Research and development 37,900 33,474 142,109 124,394 Sales and marketing 56,792 62,937 270,869 270,162 General and administrative 21,384 22,087 85,205 77,118 Total operating expenses 116,076 118,498 498,183 471,674 Operating income (loss) 201 (15,607 ) (8,875 ) (15,609 ) Other income (expense), net Interest expense, net (1,144 ) (1,074 ) (4,511 ) (4,260 ) Other income (expense), net (847 ) 1,314 (1,162 ) 3,361 Total other income (expense), net (1,991 ) 240 (5,673 ) (899 ) Loss before provision for (benefit from) income taxes (1,790 ) (15,367 ) (14,548 ) (16,508 ) Provision for (benefit from) income taxes (70 ) (461 ) 1,056 (2,291 ) Net loss $ (1,720 ) $ (14,906 ) $ (15,604 ) $ (14,217 ) Net loss per share attributable to common stockholders - basic and diluted $ (0.02 ) $ (0.26 ) $ (0.24 ) $ (0.25 ) Weighted-average shares used in computing net loss per share attributable to common stockholders - basic and diluted 84,370,578 57,929,208 65,706,215 56,314,546 Total comprehensive loss Net loss (1,720 ) (14,906 ) (15,604 ) (14,217 ) Change in foreign currency translation adjustment, net of tax (36 ) (191 ) 488 (2,486 ) Comprehensive loss $ (1,756 ) $ (15,097 ) $ (15,116 ) $ (16,703 ) 9

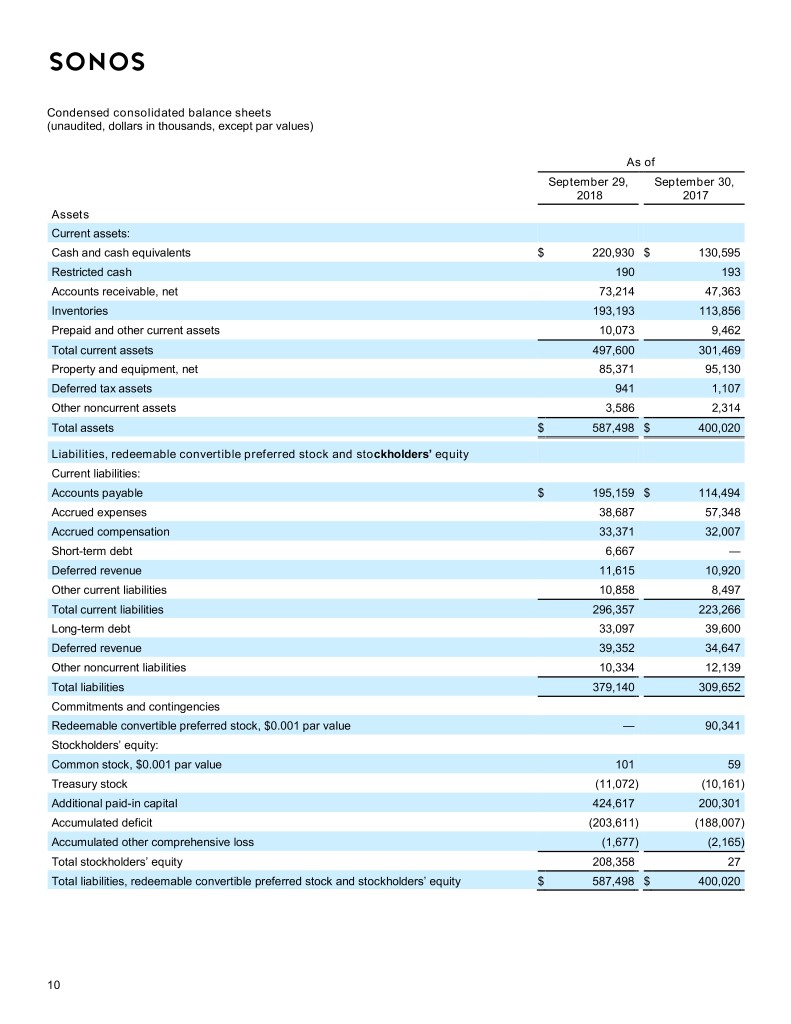

Condensed consolidated balance sheets (unaudited, dollars in thousands, except par values) As of September 29, September 30, 2018 2017 Assets Current assets: Cash and cash equivalents $ 220,930 $ 130,595 Restricted cash 190 193 Accounts receivable, net 73,214 47,363 Inventories 193,193 113,856 Prepaid and other current assets 10,073 9,462 Total current assets 497,600 301,469 Property and equipment, net 85,371 95,130 Deferred tax assets 941 1,107 Other noncurrent assets 3,586 2,314 Total assets $ 587,498 $ 400,020 Liabilities, redeemable convertible preferred stock and stockholders’ equity Current liabilities: Accounts payable $ 195,159 $ 114,494 Accrued expenses 38,687 57,348 Accrued compensation 33,371 32,007 Short-term debt 6,667 — Deferred revenue 11,615 10,920 Other current liabilities 10,858 8,497 Total current liabilities 296,357 223,266 Long-term debt 33,097 39,600 Deferred revenue 39,352 34,647 Other noncurrent liabilities 10,334 12,139 Total liabilities 379,140 309,652 Commitments and contingencies Redeemable convertible preferred stock, $0.001 par value — 90,341 Stockholders’ equity: Common stock, $0.001 par value 101 59 Treasury stock (11,072 ) (10,161 ) Additional paid-in capital 424,617 200,301 Accumulated deficit (203,611 ) (188,007 ) Accumulated other comprehensive loss (1,677 ) (2,165 ) Total stockholders’ equity 208,358 27 Total liabilities, redeemable convertible preferred stock and stockholders’ equity $ 587,498 $ 400,020 10

Condensed consolidated statements of cash Flows (unaudited, dollars in thousands) Year ended September 29, September 30, 2018 2017 Cash flows from operating activities Net loss $ (15,604 ) $ (14,217 ) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation 39,358 35,014 Stock-based compensation expense 38,645 36,550 Other 1,676 713 Deferred income taxes 152 1,443 Foreign currency transaction (gain) loss 941 (3,568 ) Changes in operating assets and liabilities: Accounts receivable, net (26,505 ) (2,727 ) Inventories, net (80,107 ) (60,270 ) Other assets (2,140 ) 36 Accounts payable and accrued expenses 66,473 54,895 Accrued compensation 1,625 5,123 Deferred revenue 5,566 9,411 Other liabilities 490 1,557 Net cash provided by operating activities 30,570 63,960 Cash flows from investing activities Purchases of property and equipment (35,747 ) (33,553 ) Net cash used in investing activities (35,747 ) (33,553 ) Cash flows from financing activities Proceeds from initial public offering, net of underwriting discounts and commissions 90,562 — Payments of offering costs (3,950 ) — Proceeds from issuance of common stock, net of issuance costs — 10,078 Proceeds from exercise of stock options 9,345 8,906 Payments for purchase of treasury stock (911 ) (10,016 ) Proceeds from borrowings, net of borrowing costs 69,748 14,987 Repayments of borrowings (70,000 ) — Payments for debt extinguishment costs (420 ) — Net cash provided by financing activities 94,374 23,955 Effect of exchange rate changes on cash and cash equivalents 1,138 1,320 Net increase in cash and cash equivalents 90,335 55,682 Cash and cash equivalents Beginning of period 130,595 74,913 End of period $ 220,930 $ 130,595 Supplemental disclosure Cash paid for interest 3,750 4,114 Cash paid for taxes, net of refunds 1,430 461 Supplemental disclosure of non-cash investing and financing activities Conversion of redeemable convertible preferred stock 90,341 — Purchases of property and equipment, accrued but not paid 4,075 9,665 Deferred offering costs in accounts payable and accrued expenses 585 — 11

Non-GAAP reconciliation (unaudited, in thousands) Three months ended Year ended September 29, September 30, September 29, September 30, 2018 2017 2018 2017 (dollars in thousands) Net loss $ (1,720 ) $ (14,906 ) $ (15,604 ) $ (14,217 ) Depreciation 10,712 10,567 39,358 35,014 Stock-based compensation expense 9,247 9,589 38,645 36,550 Interest expense, net 1,144 1,074 4,511 4,260 Other (income) expense, net 847 (1,314 ) 1,162 (3,361 ) Provision for (benefit from) income taxes (70 ) (461 ) 1,056 (2,291 ) Adjusted EBITDA $ 20,160 $ 4,549 $ 69,128 $ 55,955 Revenue $ 272,940 $ 214,095 $ 1,137,008 $ 992,526 Adjusted EBITDA margin 7.4 % 2.1 % 6.1 % 5.6 % 12

Use of Non-GAAP Measures We have provided in this letter financial information that has not been prepared in accordance with generally accepted accounting principles (“U.S. GAAP”). These non-GAAP financial measures are not based on any standardized methodology prescribed by U.S. GAAP and are not necessarily comparable to similarly titled measures presented by other companies. We use these non-GAAP financial measures to evaluate our operating performance and trends and make planning decisions. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses and other items that we exclude in these non-GAAP financial measures. Accordingly, we believe that these non- GAAP financial measures provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects, and allowing for greater transparency with respect to a key financial metric used by our management in its financial and operational decision-making. Non-GAAP financial measures should not be considered in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their nearest U.S. GAAP financial equivalents provided in the financial statement tables below. We define adjusted EBITDA as net income (loss) adjusted to exclude the impact of depreciation, stock-based compensation expense, interest expense, net, other income (expense), net and provision for (benefit from) income taxes. We define adjusted EBITDA margin as adjusted EBITDA divided by revenue. We do not provide a reconciliation of forward-looking non-GAAP financial measures to their comparable GAAP financial measures because we cannot do so without unreasonable effort due to unavailability of information needed to calculate reconciling items and due to the variability, complexity and limited visibility of the adjusting items that would be excluded from the non-GAAP financial measures in future periods. When planning, forecasting and analyzing future periods, we do so primarily on a non-GAAP basis without preparing a GAAP analysis as that would require estimates for items such as stock-based compensation, which is inherently difficult to predict with reasonable accuracy. Stock-based compensation expense is difficult to estimate because it depends on our future hiring and retention needs, as well as the future fair market value of our common stock, all of which are difficult to predict and subject to constant change. In addition, for purposes of setting annual guidance, it would be difficult to quantify stock-based compensation expense for the year with reasonable accuracy in the current quarter. As a result, we do not believe that a GAAP reconciliation would provide meaningful supplemental information about our outlook. Forward Looking Statements This letter contains forward-looking statements that involve risks and uncertainties. These forward-looking statements include statements regarding our outlook for the fiscal year ending September 28, 2019, long-term focus, financial, growth and business strategies, growth metrics, product launches, new partnerships and platform features, direct-to-consumer channel expansion, seasonality, brand awareness efforts, our expansion into Japan, total market growth, component shortages and other factors affecting variability in our financial results. These forward-looking statements are only predictions and may differ materially from actual results due to a variety of factors, including, but not limited to our ability to successfully introduce new products and maintain the success of our existing products; the success of our financial, growth and business strategies; the success of new partnerships and additions to our platform; our ability to meet growth targets; the success of our efforts to expand our direct-to-consumer channel and improve brand awareness; our expectations of seasonality and other factors variability in our financial results; our ability to manage our international expansion; the expansion of streaming music use; the occurrence of component shortages and price premiums; and the other risk factors set forth under the caption “Risk Factors” in our final prospectus filed pursuant to Rule 424(b)(4) on August 2, 2018, a copy of which is available free of charge at the Securities and Exchange Commission’s website at www.sec.gov or upon request from our investor relations department. Additional information will also be set forth in our Annual Report on Form 10-K for the fiscal year ended September 29, 2018. All forward-looking statements herein reflect our opinions only as of the date of this letter, and we undertake no obligation, and expressly disclaim any obligation, to update forward-looking statements herein in light of new information or future events. 13