Attached files

| file | filename |

|---|---|

| EX-32.2 - Patagonia Gold Corp. | exh322.htm |

| EX-32.1 - Patagonia Gold Corp. | exh321.htm |

| EX-31.2 - Patagonia Gold Corp. | exh312.htm |

| EX-31.1 - Patagonia Gold Corp. | exh311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

----------------------

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2018

Commission File Number: 333-182072

|

Hunt Mining Corp.

(Exact name of Registrant as specified in its charter)

|

British Columbia, Canada

|

1041 |

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number)

|

23800 East Appleway Ave. Liberty Lake, WA 99019 (509) 290-5659

(Address of principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Check whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large Accelerated Filer

|

☐

|

Accelerated Filer

|

☐

|

|

Non-accelerated Filer

|

☐

|

Smaller Reporting Company

|

☒

|

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date:

As of November 15, 2018, the registrant's outstanding common stock consisted of 63,588,798 shares.

Hunt Mining Corp.

Consolidated Interim financial statements

| Nine months ended September 30, 2018 and 2017 |

Page

|

|

|

|

|

Consolidated Balance Sheets

|

3

|

|

|

|

| Consolidated Statements of Operations and Comprehensive Income (Loss) |

4

|

|

|

|

| Consolidated Statement of Changes in Stockholders' Deficiency |

5

|

|

|

|

|

Consolidated Statements of Cash Flows

|

6

|

|

|

|

| Notes to the Consolidate d Interim financial statements |

7 - 23

|

- 2 -

|

Hunt Mining Corp.

|

||||||||||||

|

Expressed in U.S. Dollars

|

||||||||||||

|

Interim Consolidated Balance Sheets

|

||||||||||||

|

September 30,

|

December 31,

|

|||||||||||

|

NOTE

|

2018

|

2017

|

||||||||||

|

CURRENT ASSETS:

|

||||||||||||

|

Cash

|

17

|

$

|

60,240

|

$

|

78,145

|

|||||||

|

Accounts receivable

|

12,17,20

|

977,322

|

2,144,830

|

|||||||||

|

Prepaid expenses

|

7,054

|

13,750

|

||||||||||

|

Other deposit

|

-

|

55,092

|

||||||||||

|

Inventory

|

7

|

1,996,748

|

333,320

|

|||||||||

|

Total Current Assets

|

3,041,364

|

2,625,137

|

||||||||||

|

NON-CURRENT ASSETS:

|

||||||||||||

|

Mineral Properties

|

8

|

438,062

|

438,062

|

|||||||||

|

Property, plant and equipment

|

10

|

3,838,361

|

5,033,490

|

|||||||||

|

Performance bond

|

11,17

|

357,830

|

434,639

|

|||||||||

|

Total Non-Current Assets:

|

4,634,253

|

5,906,191

|

||||||||||

|

TOTAL ASSETS:

|

$

|

7,675,617

|

$

|

8,531,328

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||||||

|

Accounts payable and accrued liabilities

|

13,16,17

|

$

|

7,515,849

|

$

|

6,673,319

|

|||||||

|

Bank indebtedness

|

21

|

319,499

|

-

|

|||||||||

|

Interest payable

|

16,17

|

262,751

|

151,024

|

|||||||||

|

Transaction taxes payable

|

17

|

25,972

|

47,188

|

|||||||||

|

Loan payable and current portion of long-term debt

|

14,16,17

|

2,245,044

|

1,062,428

|

|||||||||

|

Total Current Liabilities:

|

10,369,115

|

7,933,959

|

||||||||||

|

NON-CURRENT LIABILITIES:

|

||||||||||||

|

Long-term debt

|

14,16,17

|

1,065,262

|

1,368,594

|

|||||||||

|

Asset retirement obligation

|

9

|

825,213

|

773,436

|

|||||||||

|

Total Non-Current Liabilities:

|

1,890,475

|

2,142,030

|

||||||||||

|

TOTAL LIABILITIES:

|

$

|

12,259,590

|

$

|

10,075,989

|

||||||||

|

STOCKHOLDERS' DEFICIENCY:

|

||||||||||||

|

Capital stock: Authorized- Unlimited No Par Value Issued and outstanding - 63,588,798 common shares (December 31, 2017 - 63,588,798 common shares)

|

15

|

$

|

24,695,186

|

$

|

24,695,186

|

|||||||

|

Additional paid in capital

|

9,696,520

|

9,696,520

|

||||||||||

|

Deficit

|

(39,196,246

|

)

|

(35,993,656

|

)

|

||||||||

|

Accumulated other comprehensive income (loss)

|

220,567

|

57,289

|

||||||||||

|

Total Stockholders' Deficiency:

|

(4,583,973

|

)

|

(1,544,661

|

)

|

||||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIENCY:

|

$

|

7,675,617

|

$

|

8,531,328

|

||||||||

|

Going Concern (Note 3)

|

||||||||||||

|

Commitments and Provision (Note 19)

|

||||||||||||

|

Subsequent Events (Note 22)

|

||||||||||||

|

Approved on behalf of the Board of Directors

|

||||||||||||

|

Signed CEO "Tim Hunt"

|

||||||||||||

|

Signed CFO "Ken Atwood"

|

||||||||||||

|

The accompanying notes are an integral part of these interim consolidated financial statements.

|

||||||||||||

- 3 -

|

Hunt Mining Corp.

|

||||||||||||||||||||

|

Expressed in U.S. Dollars

|

||||||||||||||||||||

|

Interim Consolidated Statements of Operations and Comprehensive Income (Loss)

|

||||||||||||||||||||

|

|

3 month period ended September 30,

|

9 month period ended September 30,

|

||||||||||||||||||

|

NOTE

|

2018

|

2017

|

2018

|

2017

|

||||||||||||||||

|

OPERATING EXPENSES:

|

||||||||||||||||||||

|

Professional fees

|

16

|

144,406

|

180,352

|

480,670

|

461,656

|

|||||||||||||||

|

Directors fees

|

762

|

787

|

2,351

|

2,291

|

||||||||||||||||

|

Exploration expenses

|

220,537

|

191,232

|

481,484

|

563,982

|

||||||||||||||||

|

Travel expenses

|

27,730

|

63,467

|

145,240

|

213,131

|

||||||||||||||||

|

Administrative and office expenses

|

16

|

42,191

|

13,649

|

135,195

|

213,404

|

|||||||||||||||

|

Payroll expenses

|

16

|

64,767

|

103,989

|

266,643

|

281,711

|

|||||||||||||||

|

Share based compensation

|

15,16

|

-

|

34,528

|

-

|

34,528

|

|||||||||||||||

|

Interest expense

|

16

|

142,309

|

134,748

|

371,137

|

323,657

|

|||||||||||||||

|

Banking charges

|

14,502

|

24,646

|

56,485

|

94,134

|

||||||||||||||||

|

Depreciation

|

10

|

403,022

|

37,999

|

1,208,688

|

635,337

|

|||||||||||||||

|

Total operating expenses:

|

$

|

1,060,226

|

$

|

785,397

|

$

|

3,147,893

|

$

|

2,823,831

|

||||||||||||

|

OTHER INCOME/(EXPENSE):

|

||||||||||||||||||||

|

Silver and gold recovery (loss), net of expenses

|

20

|

(96,162

|

)

|

$

|

340,480

|

$

|

106,452

|

$

|

3,200,226

|

|||||||||||

|

Interest income

|

2,316

|

4,206

|

9,854

|

12,042

|

||||||||||||||||

|

Miscellaneous expense

|

-

|

-

|

-

|

5,217

|

||||||||||||||||

|

Transaction taxes

|

(3,225

|

)

|

(6,147

|

)

|

(13,484

|

)

|

(23,977

|

)

|

||||||||||||

|

Gain (loss) on foreign exchange

|

42,077

|

296,056

|

(101,542

|

)

|

133,251

|

|||||||||||||||

|

Contingent liability recovery

|

-

|

-

|

-

|

(7,749

|

)

|

|||||||||||||||

|

Accretion expense

|

9

|

(18,659

|

)

|

(17,462

|

)

|

(55,977

|

)

|

(52,386

|

)

|

|||||||||||

|

Total other income (expense):

|

$

|

(73,653

|

)

|

$

|

617,133

|

$

|

(54,697

|

)

|

$

|

3,266,624

|

||||||||||

|

NET INCOME (LOSS) FOR THE PERIOD

|

$

|

(1,133,879

|

)

|

$

|

(168,264

|

)

|

$

|

(3,202,590

|

)

|

$

|

442,793

|

|||||||||

|

OTHER COMPREHENSIVE INCOME (LOSS), net of tax:

|

||||||||||||||||||||

|

Change in value of performance bond

|

11

|

14,616

|

(15,610

|

)

|

(76,809

|

)

|

13,751

|

|||||||||||||

|

Foreign currency translation adjustment

|

46,905

|

(221,390

|

)

|

240,087

|

(282,699

|

)

|

||||||||||||||

|

TOTAL NET INCOME (LOSS) AND COMPREHENSIVE

|

||||||||||||||||||||

|

INCOME (LOSS) FOR THE PERIOD:

|

$

|

(1,072,358

|

)

|

$

|

(405,264

|

)

|

$

|

(3,039,312

|

)

|

$

|

173,845

|

|||||||||

|

Weighted average shares outstanding - basic and diluted

|

63,588,798

|

63,588,798

|

63,588,798

|

63,588,798

|

||||||||||||||||

|

Weighted average shares outstanding - diluted

|

-

|

111,088,798

|

-

|

111,088,798

|

||||||||||||||||

|

NET INCOME (LOSS) PER SHARE - BASIC AND DILUTED:

|

$

|

(0.02

|

)

|

$

|

(0.01

|

)

|

$

|

(0.05

|

)

|

$

|

0.00

|

|||||||||

|

NET INCOME (LOSS) PER SHARE - DILUTED:

|

$

|

-

|

$

|

(0.00

|

)

|

$

|

-

|

$

|

0.00

|

|||||||||||

|

The accompanying notes are an integral part of these consolidated financial statements.

|

||||||||||||||||||||

- 4 -

|

Hunt Mining Corp.

|

||||||||||||||||||||

|

Expressed in U.S. Dollars

|

||||||||||||||||||||

|

Interim Consolidated Statement of Changes in Stockholders' Deficiency

|

||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||

|

Other

|

Additional

|

|||||||||||||||||||

|

Capital

|

Comprehensive

|

Paid in

|

||||||||||||||||||

|

|

Stock

|

Deficit

|

Income (Loss)

|

Capital

|

Total

|

|||||||||||||||

|

Balance -January 1, 2017

|

$

|

24,695,186

|

$

|

(37,649,570

|

)

|

$

|

(29,326

|

)

|

$

|

9,661,992

|

$

|

(3,321,718

|

)

|

|||||||

|

Net Income

|

-

|

1,655,914

|

-

|

-

|

1,655,914

|

|||||||||||||||

|

Other comprehensive income

|

-

|

-

|

86,615

|

-

|

86,615

|

|||||||||||||||

|

Share based compensation

|

-

|

-

|

-

|

34,528

|

34,528

|

|||||||||||||||

|

Balance - December 31, 2017

|

$

|

24,695,186

|

$

|

(35,993,656

|

)

|

$

|

57,289

|

$

|

9,696,520

|

$

|

(1,544,661

|

)

|

||||||||

|

Balance - January 1, 2018

|

$

|

24,695,186

|

$

|

(35,993,656

|

)

|

$

|

57,289

|

$

|

9,696,520

|

$

|

(1,544,661

|

)

|

||||||||

|

Net Income (loss)

|

-

|

(3,202,590

|

)

|

-

|

-

|

(3,202,590

|

)

|

|||||||||||||

|

Other comprehensive income

|

-

|

-

|

163,278

|

-

|

163,278

|

|||||||||||||||

|

Balance - September 30, 2018

|

$

|

24,695,186

|

$

|

(39,196,246

|

)

|

$

|

220,567

|

$

|

9,696,520

|

$

|

(4,583,973

|

)

|

||||||||

|

The accompanying notes are an integral part of these interim consolidated financial statements.

|

||||||||||||||||||||

- 5 -

|

Hunt Mining Corp.

|

||||||||||||

|

Expressed in U.S. Dollars

|

||||||||||||

|

Interim Consolidated Statements of Cash Flows

|

||||||||||||

|

9 month period ended September 30,

|

||||||||||||

|

NOTE

|

2018

|

2017

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net income (loss)

|

$

|

(3,202,590

|

)

|

$

|

442,793

|

|||||||

|

Items not affecting cash

|

||||||||||||

|

Depreciation

|

10

|

1,208,688

|

635,337

|

|||||||||

|

Gain (loss) on foreign exchange

|

(4,200

|

)

|

5,042

|

|||||||||

|

Realized gain on marketable securities

|

-

|

34,528

|

||||||||||

|

Accretion

|

9

|

55,977

|

52,386

|

|||||||||

|

Net change in non-cash working capital items

|

||||||||||||

|

Decrease (increase) in accounts receivable

|

1,167,508

|

(947,950

|

)

|

|||||||||

|

Decrease in prepaid expenses

|

6,355

|

(14,908

|

)

|

|||||||||

|

Decrease (increase) in inventory

|

(1,663,428

|

)

|

(541,803

|

)

|

||||||||

|

Increase (decrease) in accounts payable and accrued liabilities

|

1,186,056

|

2,763,843

|

||||||||||

|

Increase in interest payable

|

111,727

|

45,095

|

||||||||||

|

Increase (decrease) in transaction taxes payable

|

(21,216

|

)

|

12,049

|

|||||||||

|

(1,155,123

|

)

|

2,486,412

|

||||||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Purchases of property and equipment

|

10

|

(178,059

|

)

|

(1,667,596

|

)

|

|||||||

|

(178,059

|

)

|

(1,667,596

|

)

|

|||||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Change in bank line of credit (net)

|

21

|

319,499

|

50,000

|

|||||||||

|

Proceeds from loans

|

14,16

|

2,345,000

|

2,500,000

|

|||||||||

|

Repayment of loans

|

14,16

|

(1,460,006

|

)

|

(2,800,119

|

)

|

|||||||

|

1,204,493

|

(250,119

|

)

|

||||||||||

|

NET INCREASE IN CASH:

|

(128,689

|

)

|

568,697

|

|||||||||

|

EFFECT OF FOREIGN EXCHANGE ON CASH

|

110,784

|

(380,041

|

)

|

|||||||||

|

CASH, BEGINNING OF PERIOD:

|

78,145

|

108,272

|

||||||||||

|

CASH, END OF PERIOD:

|

$

|

60,240

|

$

|

296,928

|

||||||||

|

Taxes paid

|

$

|

16,546

|

$

|

-

|

||||||||

|

Interest paid

|

$

|

32

|

$

|

(312,385

|

)

|

|||||||

|

SUPPLEMENTAL NON-CASH INFORMATION

|

||||||||||||

|

Change in value of performance bond

|

$

|

(76,809

|

)

|

$

|

-

|

|||||||

|

PP&E included in AP

|

$

|

-

|

$

|

164,500

|

||||||||

|

The accompanying notes are an integral part of these interim consolidated financial statements.

|

||||||||||||

- 6 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

|

1.

|

Nature of Business

|

Hunt Mining Corp. (the "Company" or "Hunt Mining"), is a mineral exploration and processing company incorporated on January 10, 2006 under the laws of Alberta, Canada and, together with its subsidiaries, is engaged in the exploration of mineral properties in Santa Cruz Province, Argentina.

Effective November 6, 2013, the Company relocated from the Province of Alberta to the Province of British Columbia. The Company's registered office is located at 25th Floor, 700 West Georgia Street, Vancouver, B.C. V7Y 1B3. The Company's head office is located at 23800 E Appleway Avenue, Liberty Lake, Washington, 99019 USA.

The consolidated financial statements include the accounts of the following subsidiaries after elimination of intercompany transactions and balances:

|

Corporation

|

Incorporation

|

Percentage

ownership

|

Business Purpose

|

|

Cerro Cazador S.A. ("CCSA")

|

Argentina

|

100%

|

Holder of Assets and Exploration Company

|

|

Ganadera Patagonia(1)

|

Argentina

|

40%

|

Land Holding Company

|

|

1494716 Alberta Ltd.

|

Alberta

|

100%

|

Nominee Shareholder

|

|

Hunt Gold USA LLC

|

Washington, USA

|

100%

|

Management Company

|

(1) The Company has determined that the subsidiary is a variable interest entity because the Company is the primary beneficiary of the land the subsidiary holds, and therefore consolidates the subsidiary in its financial statements.

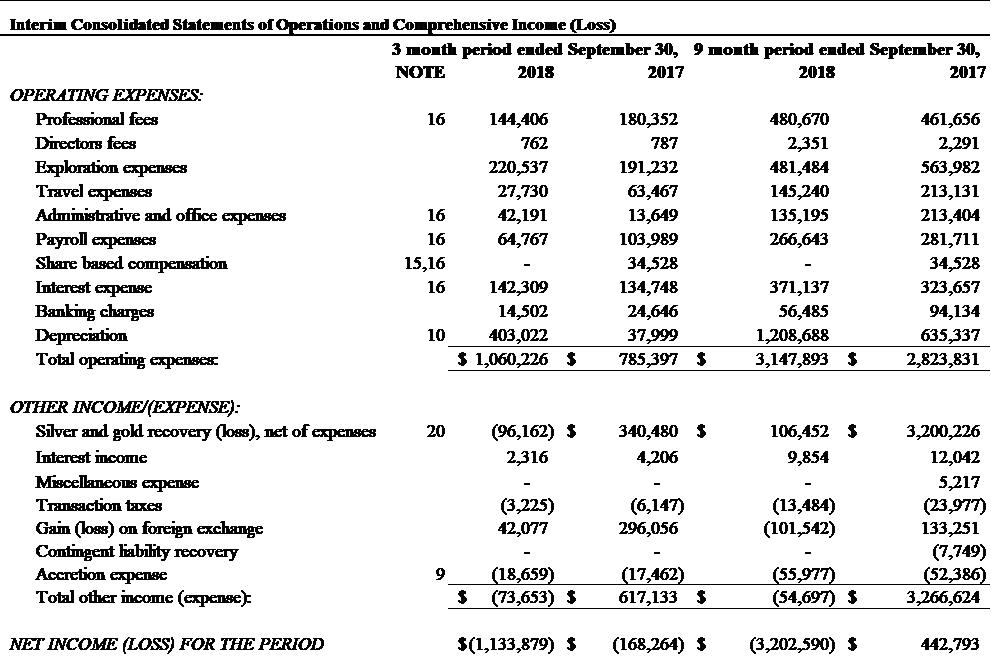

The Company's activities include the exploration and processing of minerals from properties in Argentina including the La Josefina project and the Mina Martha project (Note 8). On the basis of information to date, the Company has not yet determined whether the exploration properties contain economically recoverable ore reserves. The underlying value of the mineral properties is entirely dependent upon the existence of reserves, the ability of the Company to obtain the necessary financing to complete development and upon future profitable production or a sale of these properties. The Mina Martha project was purchased in the second quarter of 2016 and refurbishing activities began in late 2016. The Company finished all refurbishments to the Mina Martha project in the first quarter of 2017 and began selling concentrate in the second quarter of 2017.

Despite the sale of concentrate, the La Josefina and Mina Martha projects remains in the exploration stage because management has not established reserves as defined by SEC Industry Guide 7 required to be classified in either the development or production stage. As such, the sales of concentrate are classified as silver and gold recovery, net of expenses in profit and loss.

2. Basis of presentation

These consolidated financial statements have been prepared in conformity with generally accepted accounting principles of the United States of America ("US GAAP").

These consolidated financial statements have been prepared on a historical cost basis except for certain financial instruments measured at fair value. In addition, these consolidated financial statements have been prepared using the accrual basis of accounting, except for cash flow information.

The Company's presentation currency is the US Dollar.

- 7 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

The preparation of the consolidated financial statements requires management to make judgments, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. Actual results may differ from these estimates.

Judgments made by management in the application of US GAAP that have a significant effect on the consolidated financial statements and estimates with significant risk of material adjustment in the current and following periods are discussed in Note 6.

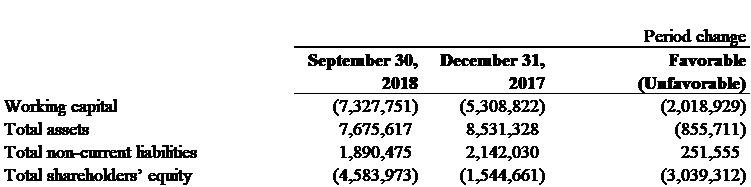

3. Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. During the nine months ended September 30, 2018, the Company had net loss of $3,202,590. As at September 30, 2018, the Company had an accumulated deficit of $39,196,246. The Company intends to continue funding operations through operation of the Martha Mine, La Josefina project and financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the year ending December 31, 2018.

These factors, among others, raise substantial doubt about the Company's ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

4. Significant Accounting Policies

The significant accounting policies used in the preparation of these consolidated financial statements are described below.

(a) Basis of measurement

The consolidated financial statements have been prepared under the historical cost convention, except for the revaluation of certain financial assets and financial liabilities to fair value.

(b) Consolidation

The Company's consolidated financial statements consolidate the accounts of the Company and its subsidiaries. All intercompany transactions, balances and unrealized gains or losses from intercompany transactions are eliminated on consolidation.

(c) Foreign currency translation

Monetary assets and liabilities denominated in foreign currencies are translated into the functional currency at the rates of exchange prevailing at the reporting date. Non-monetary assets and liabilities are translated at the exchange rate prevailing at the transaction date. Revenues and expenses are translated at average exchange rates throughout the reporting period. Gains and losses on translation of foreign currencies are included in the consolidated statement of operations.

The Company's functional currency is the Canadian dollar. All of the Company's subsidiaries have a US dollar functional currency. Financial statements are translated to their US dollar equivalents using the current rate method. Under this method, the statements of operations and comprehensive loss and cash flows for each period have been translated using the average exchange rates prevailing during each period. All assets and liabilities have been translated using the exchange rate prevailing at the balance sheet date. Translation adjustments are recorded as income or losses in other comprehensive income or loss. Transaction gains and losses resulting from fluctuations in currency exchange rates on transactions denominated in currencies other than the functional currency are recognized as incurred in the accompanying consolidated statement of loss and comprehensive loss.

- 8 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

(d) Financial instruments

The Company measures the fair value of financial assets and liabilities based on US GAAP guidance, which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements.

The Company classifies financial assets and liabilities as held-for-trading, available-for-sale, held-to-maturity, loans and receivables or other financial liabilities depending on their nature. Financial assets and financial liabilities are recognized at fair value on their initial recognition, except for those arising from certain related party transactions, which are accounted for at the transferor's carrying amount or exchange amount.

Financial assets and liabilities classified as held-for-trading are measured at fair value, with gains and losses recognized in net income. Financial assets classified as held-to-maturity, loans and receivables, and financial liabilities other than those classified as held-for-trading are measured at amortized cost, using the effective interest method of amortization. Financial assets classified as available-for-sale are measured at fair value, with unrealized gains and losses being recognized as other comprehensive income until realized, or if an unrealized loss is considered other than temporary, the unrealized loss is recorded in income.

See Note 17 to the Consolidated Financial Statements for fair value disclosures.

(e) Cash and equivalents

Cash and equivalents include cash on hand, deposits held with banks and other liquid short-term investments with original maturities of three months or less. The Company has no cash equivalents for all periods presented.

(f) Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses. Cost includes expenditures that are directly attributable to the acquisition of an asset.

Repairs and maintenance costs are charged to the consolidated statement of operations and comprehensive loss during the period in which they are incurred.

Depreciation is calculated to amortize the cost of the property, plant and equipment over their estimated useful lives using the straight-line method. Plant, buildings, equipment and vehicles are stated at cost and depreciated straight line over an estimated useful life of three to eight years. Depreciation begins once the asset is in the state intended for use by management.

The Company allocates the amount initially recognized in respect of an item of property and equipment to its significant parts and depreciates separately each such part. Residual values, method of depreciation and useful lives of the assets are reviewed annually and adjusted if appropriate.

Gains and losses on disposals of property, plant and equipment are determined by comparing the proceeds with the carrying amount of the asset and are included as part of other gains or losses in the consolidated statement of operations and comprehensive loss.

- 9 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

(g) Mineral properties and exploration and evaluation expenditures

All exploration expenditures are expensed as incurred. Expenditures to acquire mineral rights, to develop new mines, to define further mineralization in mineral properties which are in the development or operating stage, and to expand the capacity of operating mines, are capitalized and amortized on a units-of-production basis over proven and probable reserves.

Should a property be abandoned, its capitalized costs are charged to the consolidated statement of loss and comprehensive loss. The Company charges to the consolidated statement of loss and comprehensive loss the allocable portion of capitalized costs attributable to properties sold. Capitalized costs are allocated to properties sold based on the proportion of claims sold to the claims remaining within the project area.

(h) Long-lived assets

Long-lived assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For purposes of evaluating the recoverability of long-lived assets, the recoverability test is performed using undiscounted net cash flows related to the long-lived assets. If such assets are considered to be impaired, the impairment recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the assets. Assets to be disposed of are reported at the lower of their carrying amount or fair value less costs to sell.

(i) Asset retirement obligations

The Company records the fair value of an asset retirement obligation as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long-lived assets that result from the acquisition, construction, development, and/or normal use of the long-lived assets. The Company also records a corresponding asset, which is amortized over the life of the asset. Subsequent to the initial measurement of the asset retirement obligation, the obligation is adjusted at the end of each period to reflect the passage of time (accretion expense) and changes in the estimated future cash flows underlying the obligation (asset retirement cost).

(j) Income taxes

The Company accounts for income taxes under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under the asset and liability method, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is recognized if it is more likely than not that some portion or all of the deferred tax asset will not be recognized.

(k) Share-based compensation

The Company offers a share option plan for its directors, officers, employees and consultants. ASC 718 "Compensation – Stock Compensation" prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

- 10 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, "Equity Based Payments to Non-Employees." Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

(l) Earnings (loss) per share

The calculation of earnings (loss) per share ("EPS") is based on the weighted average number of shares outstanding for each period. The basic EPS is calculated by dividing the earnings or loss attributable to the equity owners of the Company by the weighted average number of common shares outstanding during the period.

The computation of diluted EPS assumes the conversion, exercise or contingent issuance of securities only when such conversion, exercise or issuance would have a dilutive effect on the earnings per share. The treasury stock method is used to determine the dilutive effect of the warrants and share options. When the Company reports a loss, the diluted net loss per common share is equal to the basic net loss per common share due to the anti-dilutive effect of the outstanding warrants and share options.

(m) Silver and gold recovery

Recovery of concentrate and other income is recognized when title and the risks and rewards of ownership to delivered concentrate and commodities pass to the buyer and collection is reasonably assured. Sale of concentrate is classified as silver and gold recovery, net of expenses in profit and loss because the Company has not established proven or probable ore reserves and remains in the exploration stage as defined by Industry guide 7.

Not all costs are applied against Silver and gold recovery. Since the Company has no established economically viable proven or probable ore reserves, the Company is treated as an exploration company and as such, only direct mining and milling costs are applied against silver and gold recovery. Other administrative, office, professional fees, and travel are disclosed separately.

From time to time, some of the Company's sales of concentrate are made under provisional pricing arrangements where the final sale prices are determined by quoted market prices in a period subsequent to the date of sale. In these circumstances, sales are recorded at period end based on latest information about prices and quantities available to management for the expected date of final settlement. Under such arrangements, the Company's receivable changes as the underlying commodity market price varies, this component of the contract is an embedded derivative which is recognized at fair value with changes in fair value recognized in profit and loss and receivables. Subsequent variations in prices and metal quantities are recognized as they occur.

(n) Inventories

Mineral concentrate and ore stockpiles are physically measured or estimated and valued at the lower of cost or net realizable value. Net realizable value is the estimated future sales price of the product the entity expects to realize when the product is processed and sold, less estimated costs to complete production and bring the product to sale. Where the time value of money is material, these future prices and costs to complete are discounted.

If the ore stockpile is not expected to be processed in 12 months after the reporting date, it is included in noncurrent assets and the net realizable value is calculated on a discounted cash flow basis.

Cost of silver concentrate and ore stockpiles is determined by using the first in first out method and comprises direct costs and a portion of fixed and variable overhead costs, including depreciation and amortization, incurred in converting materials into concentrate, based on the normal production capacity.

- 11 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

Materials and supplies are valued at the lower of cost or net realizable value. Any provision for obsolescence is determined by reference to specific items of stock. A regular review is undertaken to determine the extent of any provision for obsolescence.

5. Recently Issued Accounting Pronouncements

Restricted Cash

In November 2016, ASU No. 2016-18 was issued related to the inclusion of restricted cash in the statement of cash flows. This new guidance requires that a statement of cash flows explain the change during the period in the total of cash, cash equivalents and amounts generally described as restricted cash or restricted cash equivalents. This update is effective in fiscal years, including interim periods, beginning after December 15, 2017 and early adoption is permitted. The adoption of this guidance will result in the inclusion of the restricted cash balances within the overall cash balance and removal of the changes in restricted cash activities, which are currently recognized in other financing activities, on the Statements of Consolidated Cash Flows. Furthermore, an additional reconciliation will be required to reconcile cash and cash equivalents and restricted cash reported within the Consolidated Balance Sheets to sum to the total shown in the Statements of Consolidated Cash Flows. The adoption of this ASU had no material impact on the Company's consolidated financial statements.

Intra-Entity Transfers

In October 2016, ASU No. 2016-16 was issued related to the intra-entity transfers of assets other than inventory. This new guidance requires entities to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs. This update is effective in fiscal years, including interim periods, beginning after December 15, 2017 and early adoption is permitted. The adoption of this ASU had no material impact on the Company's consolidated financial statements.

Statement of Cash Flows

In August 2016, ASU No. 2016-15 was issued related to the statement of cash flows. This new guidance addresses eight specific cash flow issues with the objective of reducing the existing diversity in practice in how certain cash receipts and cash payments are presented and classified in the statement of cash flows. This update is effective in fiscal years, including interim periods, beginning after December 15, 2017 and early adoption is permitted. The adoption of this ASU had no material impact on the Company's consolidated financial statements.

Leases

In February 2016, ASU No. 2016-02 was issued related to leases. The new guidance modifies the classification criteria and requires lessees to recognize the assets and liabilities arising from most leases on the balance sheet. This update is effective in fiscal years, including interim periods, beginning after December 15, 2018 and early adoption is permitted. The Company is currently evaluating the updated guidance.

Investments

In January 2016, ASU No. 2016-01 was issued related to financial instruments. The new guidance requires entities to measure equity investments that do not result in consolidation and are not accounted for under the equity method at fair value and recognize any changes in fair value in net income. This new guidance also updates certain disclosure requirements for these investments. This update is effective in fiscal years, including interim periods, beginning after December 15, 2017 and early adoption is not permitted. The adoption of this ASU had no material impact on the Company's consolidated financial statements.

- 12 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

Revenue recognition

In May 2014, ASU No. 2014-09 was issued related to revenue from contracts with customers. This ASU was further amended in August 2015, March 2016, April 2016, May 2016 and December 2016 by ASU No. 2015-14, No. 2016-08, No. 2016-10, No. 2016-12 and No. 2016-20, respectively. The new standard provides a five-step approach to be applied to all contracts with customers and also requires expanded disclosures about revenue recognition. In August 2015, the effective date was deferred to reporting periods, including interim periods, beginning after December 15, 2017 and will be applied retrospectively. Early adoption is not permitted. The adoption of this ASU had no material impact on the Company's consolidated financial statements.

6. Critical accounting judgments and estimates

(a) Significant judgments

Preparation of the consolidated financial statements requires management to make judgments in applying the Company's accounting policies. Judgments that have the most significant effect on the amounts recognized in these consolidated financial statements relate to functional currency; income taxes; provisions and reclamation and closure cost obligations. These judgments have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year.

Functional Currency

Management determines the functional currency for each entity. This requires that management assess the primary economic environment in which each of these entities operates. Management's determination of functional currencies affects how the Company translates foreign currency balances and transactions. Determination includes an assessment of various indicators. In determining the functional currency of the Company's operations in Canada (Canadian dollar) and Argentina (U.S. dollar), management considered the indicators of ASC 830.

Income Taxes and value-added taxes receivable

Significant judgment is required in determining the provision for income taxes. There are many transactions and calculations undertaken during the ordinary course of business for which the ultimate tax determination is uncertain and subject to judgment. The Company recognizes liabilities and contingencies for anticipated tax audit issues based on the Company's current understanding of the tax law in the various jurisdictions in which it operates. For matters where it is probable that an adjustment will be made, the Company records its best estimate of the tax liability including the related interest and penalties in the current tax provision. Management believes they have adequately provided for the probable outcome of these matters; however, the final outcome may result in a materially different outcome than the amount included in the tax liabilities.

The Company has receivables due from the Argentinean government for value-added taxes. Significant estimates and judgments are involved in the assessment of recoverability of these receivables. Changes in management's impairment assumptions may result in an additional impairment provision, or a reduction to any previously recorded impairment provision, with the impact recorded in profit and loss.

Provisions

Management makes judgments as to whether an obligation exists and whether an outflow of resources embodying economic benefits of a liability of uncertain timing or amount is probable, not probable or remote. Management considers all available information relevant to each specific matter.

- 13 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

Reclamation and closure costs obligations

The Argentine mining regulations require that mine property be restored in accordance with specified standards and an approved reclamation plan. Significant reclamation activities include reclaiming refuse and slurry ponds, reclaiming the pit and support acreage at surface mines, and sealing portals at deep mines. The Company accrues for the cost of final mine closure reclamation over the estimated useful mining life of the property. At each period, the Company reviews the entire reclamation liability and makes necessary adjustments for revisions to cost estimates to reflect current experience.

The Company has adopted ASC 410, Asset Retirement and Environmental Obligations, which requires legal obligations associated with the retirement of long-lived assets to be recognized at their fair value at the time that the obligations are incurred. Upon initial recognition of a liability, that cost is capitalized as part of the related long-lived asset and allocated to expense over the useful life of the asset.

Title to Mineral Property Interests

Although the Company has taken steps to verify title to mineral properties in which it has an interest, these procedures do not guarantee the Company's title. Such properties may be subject to prior agreements or transfers and title may be affected by undetected defects.

(b) Estimation uncertainty

The preparation of the consolidated financial statements in conformity with US GAAP requires the Company to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. The Company also makes estimates and assumptions concerning the future. The determination of estimates requires the exercise of judgment based on various assumptions and other factors such as historical experience and current and expected economic conditions. Actual results could differ from those estimates.

The more significant areas requiring the use of management estimates and assumptions relate to title to mineral property interests; share-based payments, asset retirement obligations and inventories. These estimates have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the next financial year.

The Company is also exposed to legal risk. The outcome of future proceedings cannot be predicted with certainty. Thus, an adverse decision in a lawsuit could result in additional costs that are not covered, either wholly or partly, under insurance policies and that could significantly influence the business and results of operations.

Estimates and assumptions are continually evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances.

Share-based Payment Transactions

The Company measures the cost of equity-settled transactions with employees by reference to the fair value of the equity instruments at the date at which they are granted. Estimating fair value for share-based payment transactions is done by application of the Black-Scholes option-pricing model, which is dependent on the terms and conditions of the grant. This estimate also requires determining the most appropriate inputs to the Black-Scholes option-pricing model, including the expected life of the stock option, forfeiture rate, and volatility based on historical share prices and dividend yield and making assumptions about them.

- 14 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

Legal Proceedings

In the normal course of business, legal proceedings and other claims brought against the Company expose us to potential losses. Given the nature of these events, in most cases the amounts involved are not reasonably estimable due to uncertainty about the final outcome. In estimating the final outcome of litigation, management makes assumptions about factors including experience with similar matters, past history, precedents, relevant financial, scientific and other evidence, and facts specific to the matter. This determines whether management requires a provision or disclosure in the consolidated financial statements.

Asset retirement obligation

Upon retirement of the Company's mineral properties, retirement costs will be incurred by the Company. Estimates of these costs are subject to uncertainty associated with the method, timing and extent of future decommissioning activities. The liability, the related asset and the expense are affected by estimates with respect to the costs and timing of retiring the assets.

Inventories

Net realizable value tests are performed at each reporting date and represent the estimated future sales price of the product the Company expects to realize when the product is processed and sold, less estimated costs to complete production and bring the product to sale. Where the time value of money is material, these future prices and costs to complete are discounted.

Stockpiles are measured by estimating the number of tonnes added and removed from the stockpile, the number of contained ore ounces is based on assay data, and the estimated recovery percentage is based on the expected processing method.

Stockpile tonnages are verified by periodic surveys.

Silver and gold recovery

From time to time, some of the Company's sales of concentrate are made under provisional pricing arrangements where the final sale prices are determined by quoted market prices in a period subsequent to the date of sale. In these circumstances, sales are recorded at period end based on latest information about prices and quantities available to management for the expected date of final settlement.

7. Inventory

|

September 30, 2018

|

December 31, 2017

|

|||||||

|

Silver and gold concentrate

|

$

|

1,880,861

|

$

|

128,894

|

||||

|

Ore stockpiles

|

-

|

98,210

|

||||||

|

Materials and supplies

|

115,887

|

106,216

|

||||||

|

$

|

1,996,748

|

$

|

333,320

|

|||||

8. Mineral properties

(a) Acquisition of Mina Martha project

On May 6, 2016, the Company acquired the assets of the Mina Martha project from Coeur Mining Inc. ("Coeur"). The Mina Martha project consists of land, mineral rights, a mine camp, offices, a warehouse, maintenance shop, mining facilities including a flotation mill and a tailings retention facility.

- 15 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

As at September 30, 2018 this project has a carrying amount of $438,062 (2017 - $438,062) on the interim consolidated balance sheet.

(b) Acquisition of La Josefina project

In March 2007, the Company acquired the exploration and development rights to the La Josefina project from Fomento Minero de Santa Cruz Sociedad del Estado ("Fomicruz").

In July 2007, the Company entered into an agreement (subsequently amended) with Fomicruz which provides that, in the event that a positive feasibility study is completed on the La Josefina property, a Joint Venture Corporation ("JV Corporation") would be formed by the Company and Fomicruz. The Company would own 81% of the joint venture company and Fomicruz would own the remaining 19%. Fomicruz has the option to earn up to a 49% participating interest in the JV Corporation by reimbursing the Company an equivalent amount, up to 49%, of the exploration investment made by the Company. The Company has the right to buy back any increase in Fomicruz's ownership interest in the JV Corporation at a purchase price of USD$200,000 per each percentage interest owned by Fomicruz down to its initial ownership interest of 19%; the Company can also purchase 10% of the Fomicruz's initial 19% JV Corporation ownership interest by negotiating a purchase price with Fomicruz. Under the agreement, the Company has until the end of 2019 to complete cumulative exploration expenditures of $18 million and determine if it will enter into production on the property.

As at September 30, 2018 this project has a carrying amount of $Nil (2017 - $Nil) on the consolidated balance sheet.

(c) Acquisition of La Valenciana project

On November 1, 2012, the Company entered into an agreement for the exploration of the La Valenciana project in Santa Cruz province, Argentina. The agreement is for a total of 7 years, expiring on October 31, 2019. The agreement requires the Company to spend $5,000,000 in exploration on the project over 7 years. If the Company elects to exercise its option to bring the La Valenciana project into production, it must grant Fomicruz a 9% ownership in a new JV Corporation to be created by the Company to manage the project and the Company will have a 91% ownership interest in the JV Corporation.

As at September 30, 2018 this project has a carrying amount of $Nil (2017 - $Nil) on the consolidated balance sheet

9. Asset retirement obligation

On May 6, 2016, the Company purchased the Mina Martha project (Note 8). The Company is legally required to perform reclamation on the site to restore it to its original condition at the end of its useful life. In accordance with FASB ASC 410-20, Asset Retirement Obligations, the Company recognized the fair value of a liability for an asset retirement obligation in the amount of $678,032. The total amount of undiscounted cash flows required to settle the estimated obligation is $1,226,817 which has been discounted using a credit-adjusted rate of 10% (2017 – 10%) and an inflation rate of 2% (2017 – 2%).

The following table describes all of the changes to the Company's asset retirement obligation liability:

|

September 30,

|

December 31,

|

|||||||

|

2018

|

2017

|

|||||||

|

Asset retirement obligation at beginning of year

|

$

|

773,436

|

$

|

721,695

|

||||

|

Foreign exchange

|

(4,200

|

)

|

(16,327

|

)

|

||||

|

Accretion expense

|

55,977

|

68,068

|

||||||

|

Asset retirement obligation at end of period

|

$

|

825,213

|

$

|

773,436

|

||||

- 16 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

10. Property, Plant and Equipment

|

Land

|

Plant

|

Buildings

|

Vehicles and Equipment

|

Total

|

||||||||||||||||

|

Cost

|

||||||||||||||||||||

|

Balance at December 31, 2016

|

$

|

1,035,397

|

$

|

2,631,646

|

$

|

117,500

|

$

|

2,352,222

|

$

|

6,136,765

|

||||||||||

|

Additions

|

-

|

792,055

|

-

|

472,244

|

1,264,299

|

|||||||||||||||

|

Balance at December 31, 2017

|

1,035,397

|

3,423,701

|

117,500

|

2,824,466

|

7,401,064

|

|||||||||||||||

|

Additions

|

-

|

-

|

-

|

13,559

|

13,559

|

|||||||||||||||

|

Balance at September 30, 2018

|

$

|

1,035,397

|

$

|

3,423,701

|

$

|

117,500

|

$

|

2,838,025

|

$

|

7,414,623

|

||||||||||

|

Accumulated amortization

|

||||||||||||||||||||

|

Balance at December 31, 2016

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

1,201,982

|

$

|

1,201,982

|

||||||||||

|

Depreciation for the year

|

-

|

753,391

|

29,375

|

382,826

|

1,165,592

|

|||||||||||||||

|

Balance at December 31, 2017

|

-

|

753,391

|

29,375

|

1,584,808

|

2,367,574

|

|||||||||||||||

|

Depreciation for the year

|

-

|

753,391

|

29,375

|

425,922

|

1,208,688

|

|||||||||||||||

|

Balance at September 30, 2018

|

$

|

-

|

$

|

1,506,782

|

$

|

58,750

|

$

|

2,010,730

|

$

|

3,576,262

|

||||||||||

|

Net book value

|

||||||||||||||||||||

|

At December 31, 2017

|

$

|

1,035,397

|

$

|

2,670,310

|

$

|

88,125

|

$

|

1,239,658

|

$

|

5,033,490

|

||||||||||

|

At September 30, 2018

|

$

|

1,035,397

|

$

|

1,916,919

|

$

|

58,750

|

$

|

827,295

|

$

|

3,838,361

|

||||||||||

11. Performance bond

The performance bond, originally required to secure the Company's rights to explore the La Josefina property, is a step-up US dollar denominated 2.5% coupon bond, paying quarterly, issued by the Government of Argentina with a face value of $600,000 and a maturity date of 2035. The bond trades in the secondary market in Argentina. The bond was originally purchased for $247,487. As of the nine months ended September 30, 2018, the value of the bond decreased to $357,830 (December 31, 2017 - $434,639). The change in the face value of the performance bond of $76,809 for the nine months ended September 30, 2018 (December 31, 2017- $53,284) is recorded as other comprehensive loss in the Company's consolidated statement of operations and comprehensive loss.

Since Cerro Cazador S.A. ("CCSA") fulfilled its exploration expenditure requirement mandated by the agreement with Fomento Minero de Santa Cruz Sociedad del Estado ("Fomicruz"), the performance bond was no longer required to secure the La Josefina project. Therefore, in September 2010 the Company used the bond to secure the La Valenciana project, an additional Fomicruz exploration project.

12. Accounts receivable

|

September 30,

|

December 31,

|

|||||||

|

2018

|

2017

|

|||||||

|

Receivable from sale of concentrate

|

$

|

149,795

|

$

|

1,144,710

|

||||

|

Value added tax ("VAT") recoverable

|

780,930

|

1,000,120

|

||||||

|

Other receivables

|

46,597

|

-

|

||||||

|

Total accounts receivable

|

$

|

977,322

|

$

|

2,144,830

|

||||

- 17 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

13. Accounts payable

|

Note

|

September 30,

|

December 31,

|

||||||||||

|

2018

|

2017

|

|||||||||||

|

Accounts payables due to related parties

|

16

|

$

|

5,584,584

|

$

|

4,410,894

|

|||||||

|

Trade accounts payable and accrued liabilities

|

1,931,265

|

2,262,425

|

||||||||||

|

Total accounts payable and accrued liabilities

|

$

|

7,515,849

|

$

|

6,673,319

|

||||||||

14. Loan Payable and long-term debt

The Following is a summary of all loans.

|

Unsecured loan payable to related party at 8% interest per annum, due 20221 (Note 16)

|

$

|

1,615,445

|

$

|

1,731,022

|

||||

|

Unsecured loan payable to related party at 8% interest per annum, due on demand (Note 16)

|

994,861

|

700,000

|

||||||

|

Loan payable, repayable in monthly installments ranging between $3,000 and $15,000 per dry metric ton of concentrate, with interest at 6% per annum, secured by concentrate, due 20182

|

700,000

|

-

|

||||||

|

$

|

3,310,306

|

$

|

2,431,022

|

|||||

|

Less current portion

|

(2,245,044

|

)

|

(1,062,428

|

)

|

||||

|

Long-term debt

|

$

|

1,065,262

|

$

|

1,368,594

|

|

Principal payments on long-term debt are due as follows.

|

||||

|

Year ending December 31,

|

||||

|

2018

|

$

|

362,428

|

||

|

2019

|

$

|

375,510

|

||

|

2020

|

$

|

394,590

|

||

|

2021

|

$

|

414,910

|

||

|

2022

|

$

|

68,007

|

||

1During the year ended December 31, 2017, the maturity date of the loan payable was extended to May 9, 2022 and reclassified as long-term debt. The modification of the loan payable did not result in an extinguishment in accordance with ASC 470-50.

2 Subsequent to September 30, 2018, loan was repaid. (Note 22)

- 18 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

15. Capital Stock

Authorized:

Unlimited number of common shares without par value

Unlimited number of preferred shares without par value

Issued:

|

Common Shares

|

Nine months ended

|

Year ended

|

||||||||||||||

|

September 30, 2018

|

December 31, 2017

|

|||||||||||||||

|

Number

|

Amount

|

Number

|

Amount

|

|||||||||||||

|

Balance, beginning of period

|

63,588,798

|

$

|

24,695,186

|

63,588,798

|

$

|

24,695,186

|

||||||||||

|

Balance, end of period

|

63,588,798

|

$

|

24,695,186

|

63,588,798

|

$

|

24,695,186

|

||||||||||

|

Warrants

|

Nine months ended

|

Year ended

|

||||||||||||||

|

September 30, 2018

|

December 31, 2017

|

|||||||||||||||

|

Number

|

Amount

|

Number

|

Amount

|

|||||||||||||

|

Balance, beginning of period

|

48,862,500

|

$

|

735,152

|

48,862,500

|

$

|

735,152

|

||||||||||

|

Balance, end of period

|

48,862,500

|

$

|

735,152

|

48,862,500

|

$

|

735,152

|

||||||||||

Common share issuances:

No common shares were issued during the nine months ended September 30, 2018 (December 31, 2017 – None).

Stock options

Under the Company's share option plan, and in accordance with TSX Venture Exchange requirements, the number of common shares reserved for issuance under the option plan shall not exceed 10% of the issued and outstanding common shares of the Company, have a maximum term of 5 years and vest at the discretion of the Board of Directors. In connection with the foregoing, the number of common shares reserved for issuance to: (a) any individual director or officer will not exceed 5% of the issued and outstanding common shares; and (b) all consultants will not exceed 2% of the issued and outstanding common shares.

|

Range of Exercise prices (CAD)

|

Number outstanding

|

Weighted average life (years)

|

Weighted average exercise price (CAD)

|

Number exercisable on September 30, 2018

|

||||||||||||||||

|

Stock options

|

$

|

0.15 - $1.00

|

4,160,000

|

2.54

|

$

|

0.21

|

4,160,000

|

|||||||||||||

- 19 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

|

September 30, 2018

|

December 31, 2017

|

|||||||||||||||

|

Number of options

|

Weighted Average Price (CAD)

|

Number of options

|

Weighted Average Price (CAD)

|

|||||||||||||

|

Balance, beginning of period

|

4,380,000

|

$

|

0.21

|

4,225,000

|

$

|

0.24

|

||||||||||

|

Granted

|

-

|

$

|

0.00

|

200,000

|

$

|

0.20

|

||||||||||

|

Expiration of stock options

|

(220,000

|

)

|

$

|

1.00

|

(45,000

|

)

|

$

|

3.00

|

||||||||

|

Balance, end of period

|

4,160,000

|

$

|

0.21

|

4,380,000

|

$

|

0.24

|

||||||||||

No options were granted during the nine months ended September 30, 2018.

On June 14, 2017, 200,000 stock options were granted to the Company's controller with an exercise price of $CAD 0.20 and expiry date of June 14, 2022. The $34,528 fair value of the options granted were calculated using the Black-Scholes option pricing model and using the following assumptions:

|

Year ended

|

||||||||

|

December 31, 2017

|

||||||||

|

2017

|

2016

|

|||||||

|

Expected volatility

|

235.10

|

%

|

205.09

|

%

|

||||

|

Expected life (years)

|

5

|

5

|

||||||

|

Expected dividend yield

|

0

|

%

|

0

|

%

|

||||

|

Forfeiture rate

|

0

|

%

|

0

|

%

|

||||

|

Stock price

|

$CAD 0.23

|

$CAD 0.05

|

||||||

On February 27, 2017, 45,000 options with an exercise price of CAD 3.00 expired.

On April 23, 2018, 20,000 options with an exercise price of CAD 1.000 expired.

As at September 30, 2018, the Company's outstanding and exercisable stock options had an aggregate intrinsic value of $339,493 (December 31, 2017 - $316,717).

Warrants:

|

Range of Exercise prices (CAD)

|

Number outstanding

|

Weighted average life (years)

|

Weighted average exercise price (CAD)

|

|||||||||||||

|

Warrants

|

0.05 - 0.40

|

48,862,500

|

1.88

|

$

|

0.07

|

|||||||||||

|

September 30, 2018

|

December 31, 2017

|

|||||||||||||||

|

Number of warrants

|

Weighted Average Price (CAD)

|

Number of warrants

|

Weighted Average Price (CAD)

|

|||||||||||||

|

Balance, beginning of period

|

48,862,500

|

$

|

0.07

|

48,862,500

|

$

|

0.07

|

||||||||||

|

Warrants

|

-

|

-

|

-

|

$

|

0.00

|

|||||||||||

|

Balance, end of period

|

48,862,500

|

$

|

0.07

|

48,862,500

|

$

|

0.07

|

||||||||||

- 20 -

Hunt Mining Corp.

Notes to the Consolidated Interim Financial Statements (Unaudited)

(Expressed in US Dollars)

Nine month period ended September 30, 2018 and 2017

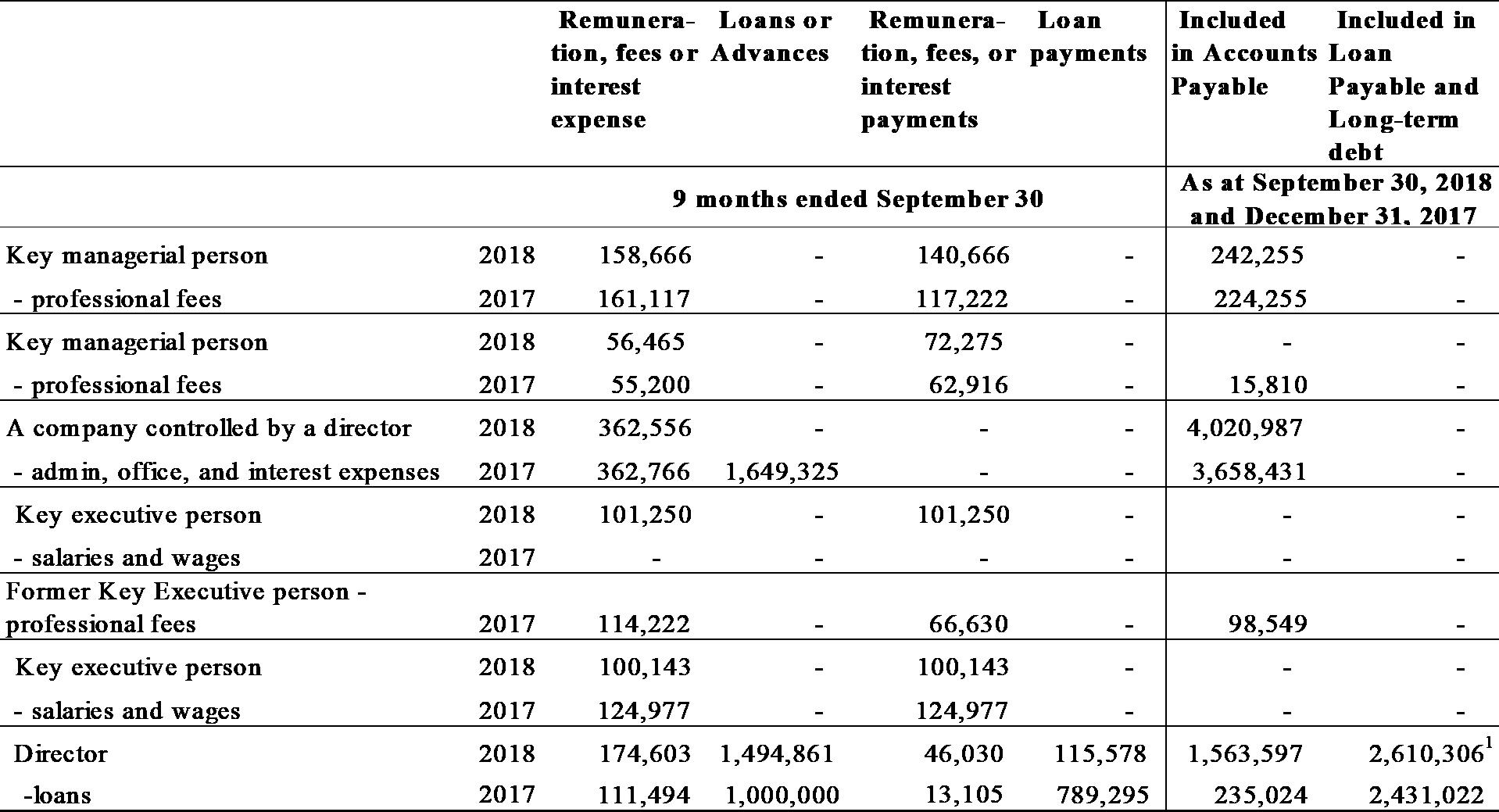

16. Related Party Transactions

Key management personnel include the members of the Board of Directors and executive officers of the Company. Related party transactions and balances not disclosed elsewhere in the Financial Statements are as follows:

|

Name and Principal Position

|

|

Remunera- tion, fees or interest expense

|

Loans or Advances

|

Remunera- tion, fees, or interest payments

|

Loan payments

|

Included in Accounts Payable

|

Included in Loan Payable and Long-term debt

|

||||||||||||||||||

|

|

|

9 months ended September 30

|

As at September 30, 2018 and December 31, 2017

|

||||||||||||||||||||||

|

Key managerial person

|

2018

|

158,666

|

-

|

140,666

|

-

|

242,255

|

-

|

||||||||||||||||||

|

- professional fees

|

2017

|

161,117

|

-

|

117,222

|

-

|

224,255

|

-

|

||||||||||||||||||

|

Key managerial person

|

2018

|

56,465

|

-

|

72,275

|

-

|

-

|

-

|

||||||||||||||||||

|

- professional fees

|

2017

|

55,200

|

-

|

62,916

|

-

|

15,810

|

-

|

||||||||||||||||||

|

A company controlled by a director

|

2018

|

-

|

-

|

-

|

-

|

3,658,431

|

-

|

||||||||||||||||||

|

- admin, office, and interest expenses

|

2017

|

362,766

|

1,649,325

|

-

|

-

|

3,658,431

|

-

|

||||||||||||||||||

|

Key executive person

|

2018

|

101,250

|

-

|

101,250

|

-

|

-

|

-

|

||||||||||||||||||

|

- salaries and wages

|

2017

|

-

|

-

|

-

|

-

|

-

|

-

|

||||||||||||||||||

|

Former Key Executive person - professional fees

|

2017

|

114,222

|

-

|

66,630

|

-

|

98,549

|

-

|

||||||||||||||||||

|

Key executive person

|

2018

|

100,143

|

-

|

100,143

|

-

|

-

|

-

|

||||||||||||||||||

|

- salaries and wages

|

2017

|

124,977

|

-

|

124,977

|

-

|

-

|

-

|

||||||||||||||||||

|

Director

|

2018

|

-

|

-

|

-

|

-

|

235,024

|

2,610,306

|

1

|

|||||||||||||||||

|

-loans

|

2017

|

111,494

|

1,000,000

|

13,105

|

789,295

|

235,024

|

2,431,022

|

||||||||||||||||||