Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Great Elm Capital Corp. | gecc-ex991_6.htm |

| 8-K - 8-K - Great Elm Capital Corp. | gecc-8k_20180930.htm |

Great Elm Capital Corp. (NASDAQ: GECC) Investor Presentation – Quarter Ended September 30, 2018 November 13, 2018 © 2018 Great Elm Capital Corp. Exhibit 99.2

© 2018 Great Elm Capital Corp. Disclaimer Statements in this communication that are not historical facts are “forward-looking” statements within the meaning of the federal securities laws. These statements are often, but not always, made through the use of words or phrases such as “believe,” “expect,” “anticipate,” “should,” “planned,” “will,” “may,” “intend,” “estimated,” “aim,” “target,” “opportunity,” “sustained,” “positioning,” “designed,” “create,” “seek,” “would,” “could”, “continue,” “ongoing,” “upside,” “increases,” and “potential,” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are: conditions in the credit markets, the price of Great Elm Capital Corp. (“GECC”) common stock, and performance of GECC’s portfolio and investment manager. Additional information concerning these and other factors can be found in GECC’s Form 10-K and other reports filed with the Securities and Exchange Commission (the “SEC”). GECC assumes no obligation to, and expressly disclaims any duty to, update any forward-looking statements contained in this communication or to conform prior statements to actual results or revised expectations, except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. You should consider the investment objective, risks, charges and expenses of GECC carefully before investing. GECC’s filings with the SEC contain this and other information about GECC and are available by contacting GECC at the phone number and address at the end of this presentation. The SEC also maintains a website that contains the aforementioned documents. The address of the SEC’s website is http://www.sec.gov. These documents should be read and considered carefully before investing. The performance, distributions and financial data contained herein represent past performance, distributions and results and neither guarantees nor is indicative of future performance, distributions or results. Investment return and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than the original cost. GECC’s market price and net asset value will fluctuate with market conditions. Current performance may be lower or higher than the performance data quoted. All information and data, including portfolio holdings and performance characteristics, is as of September 30, 2018, unless otherwise noted, and is subject to change. This presentation does not constitute an offer of any securities for sale.

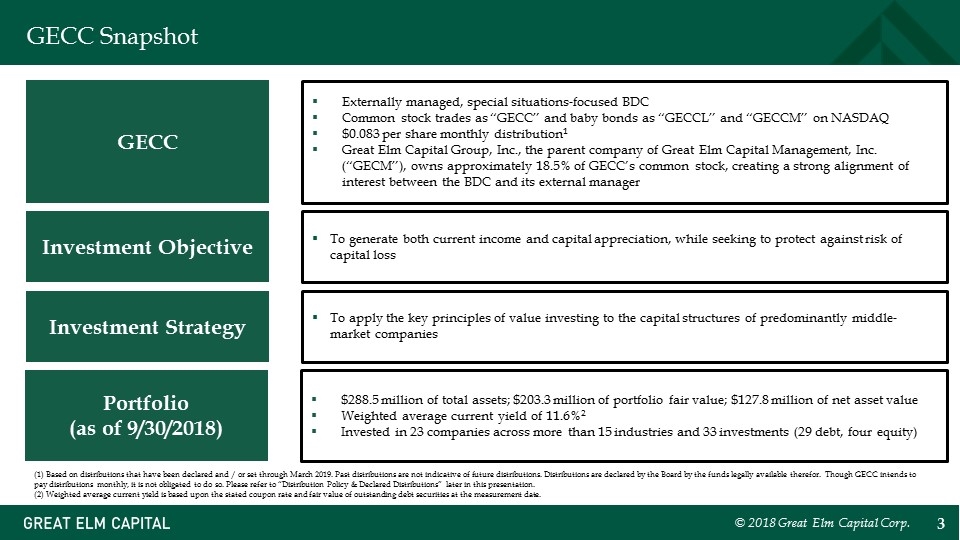

GECC Snapshot GECC Investment Objective Investment Strategy Externally managed, special situations-focused BDC Common stock trades as “GECC” and baby bonds as “GECCL” and “GECCM” on NASDAQ $0.083 per share monthly distribution1 Great Elm Capital Group, Inc., the parent company of Great Elm Capital Management, Inc. (“GECM”), owns approximately 18.5% of GECC’s common stock, creating a strong alignment of interest between the BDC and its external manager To generate both current income and capital appreciation, while seeking to protect against risk of capital loss To apply the key principles of value investing to the capital structures of predominantly middle-market companies Portfolio (as of 9/30/2018) $288.5 million of total assets; $203.3 million of portfolio fair value; $127.8 million of net asset value Weighted average current yield of 11.6%2 Invested in 23 companies across more than 15 industries and 33 investments (29 debt, four equity) (1) Based on distributions that have been declared and / or set through March 2019. Past distributions are not indicative of future distributions. Distributions are declared by the Board by the funds legally available therefor. Though GECC intends to pay distributions monthly, it is not obligated to do so. Please refer to “Distribution Policy & Declared Distributions” later in this presentation. (2) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. © 2018 Great Elm Capital Corp.

© 2018 Great Elm Capital Corp. Realized Investments (through November 9, 2018) Past performance is not indicative of future results. It should not be assumed that the realization of other positions will be profitable or equal the performance of the positions realized in the quarter ended September 30, 2018 and the partial quarter reported through November 9, 2018. Because we focus on a catalyst-driven, special situations investment approach, results will vary from period to period and it should not be assumed that results attained in any one period will be replicated. Please refer to “Disclaimer” at the beginning of this presentation.

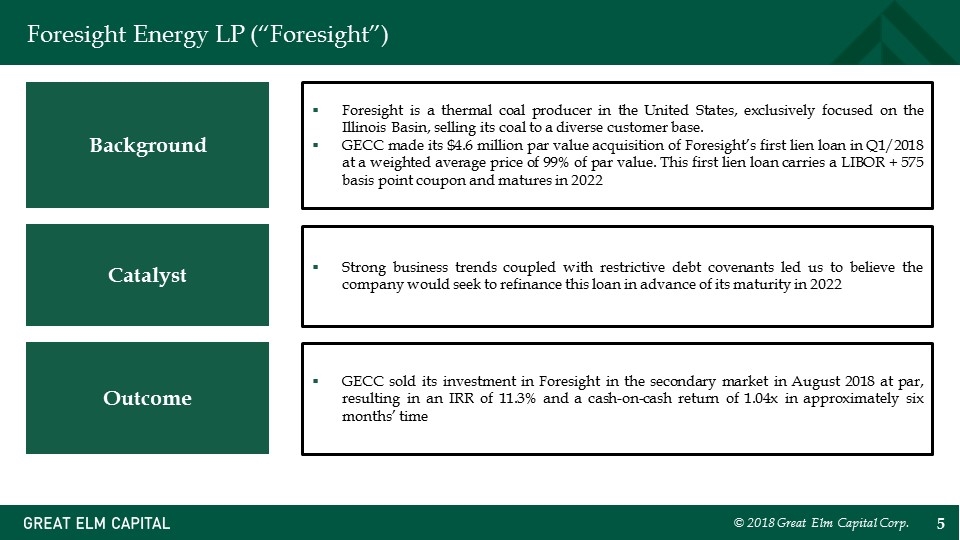

© 2018 Great Elm Capital Corp. Background Catalyst Outcome Foresight is a thermal coal producer in the United States, exclusively focused on the Illinois Basin, selling its coal to a diverse customer base. GECC made its $4.6 million par value acquisition of Foresight’s first lien loan in Q1/2018 at a weighted average price of 99% of par value. This first lien loan carries a LIBOR + 575 basis point coupon and matures in 2022 Strong business trends coupled with restrictive debt covenants led us to believe the company would seek to refinance this loan in advance of its maturity in 2022 GECC sold its investment in Foresight in the secondary market in August 2018 at par, resulting in an IRR of 11.3% and a cash-on-cash return of 1.04x in approximately six months’ time Foresight Energy LP (“Foresight”)

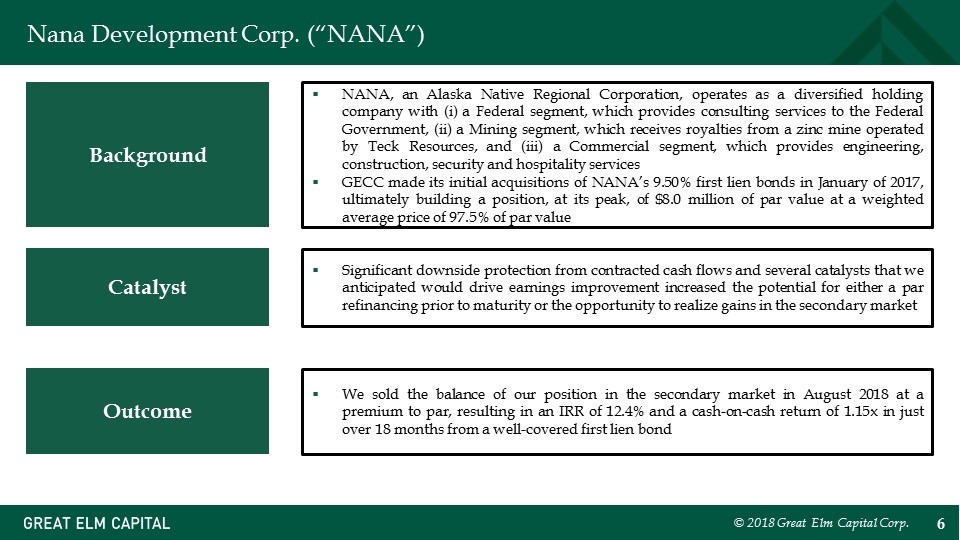

© 2018 Great Elm Capital Corp. Background Catalyst Outcome NANA, an Alaska Native Regional Corporation, operates as a diversified holding company with (i) a Federal segment, which provides consulting services to the Federal Government, (ii) a Mining segment, which receives royalties from a zinc mine operated by Teck Resources, and (iii) a Commercial segment, which provides engineering, construction, security and hospitality services GECC made its initial acquisitions of NANA’s 9.50% first lien bonds in January of 2017, ultimately building a position, at its peak, of $8.0 million of par value at a weighted average price of 97.5% of par value Significant downside protection from contracted cash flows and several catalysts that we anticipated would drive earnings improvement increased the potential for either a par refinancing prior to maturity or the opportunity to realize gains in the secondary market We sold the balance of our position in the secondary market in August 2018 at a premium to par, resulting in an IRR of 12.4% and a cash-on-cash return of 1.15x in just over 18 months from a well-covered first lien bond Nana Development Corp. (“NANA”)

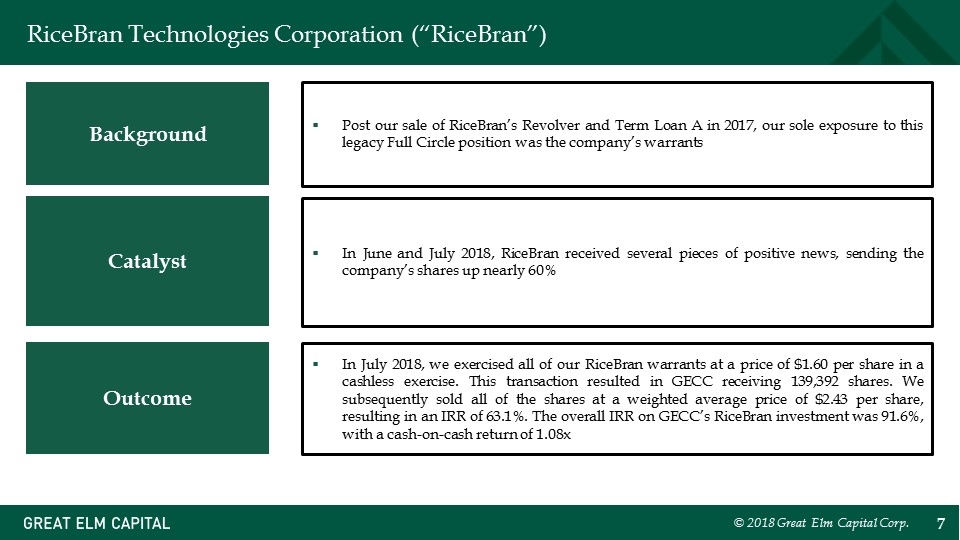

© 2018 Great Elm Capital Corp. Background Catalyst Outcome Post our sale of RiceBran’s Revolver and Term Loan A in 2017, our sole exposure to this legacy Full Circle position was the company’s warrants In June and July 2018, RiceBran received several pieces of positive news, sending the company’s shares up nearly 60% In July 2018, we exercised all of our RiceBran warrants at a price of $1.60 per share in a cashless exercise. This transaction resulted in GECC receiving 139,392 shares. We subsequently sold all of the shares at a weighted average price of $2.43 per share, resulting in an IRR of 63.1%. The overall IRR on GECC’s RiceBran investment was 91.6%, with a cash-on-cash return of 1.08x RiceBran Technologies Corporation (“RiceBran”)

© 2018 Great Elm Capital Corp. Financial & Portfolio Review (Quarter Ended 9/30/2018)

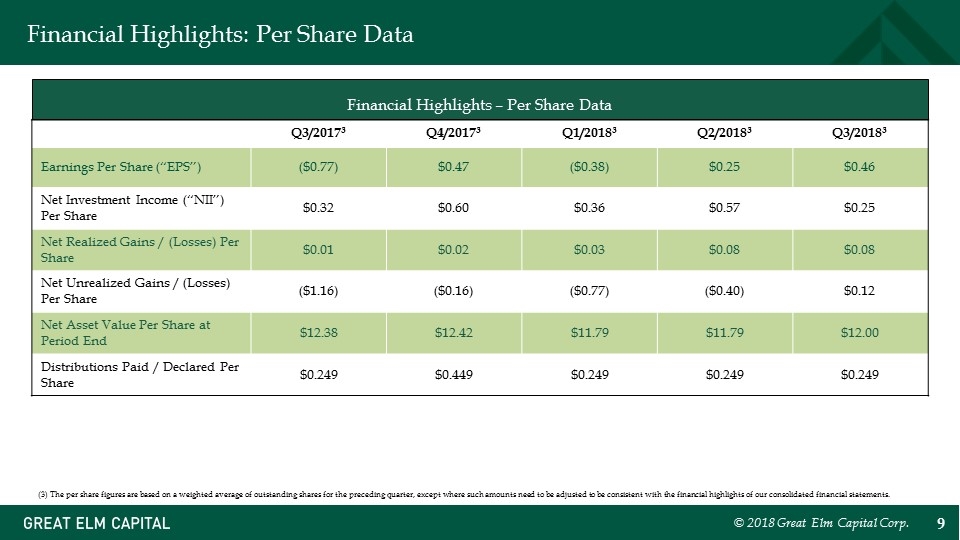

© 2018 Great Elm Capital Corp. Financial Highlights: Per Share Data Q3/20173 Q4/20173 Q1/20183 Q2/20183 Q3/20183 Earnings Per Share (“EPS”) ($0.77) $0.47 ($0.38) $0.25 $0.46 Net Investment Income (“NII”) Per Share $0.32 $0.60 $0.36 $0.57 $0.25 Net Realized Gains / (Losses) Per Share $0.01 $0.02 $0.03 $0.08 $0.08 Net Unrealized Gains / (Losses) Per Share ($1.16) ($0.16) ($0.77) ($0.40) $0.12 Net Asset Value Per Share at Period End $12.38 $12.42 $11.79 $11.79 $12.00 Distributions Paid / Declared Per Share $0.249 $0.449 $0.249 $0.249 $0.249 (3) The per share figures are based on a weighted average of outstanding shares for the preceding quarter, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. Financial Highlights – Per Share Data

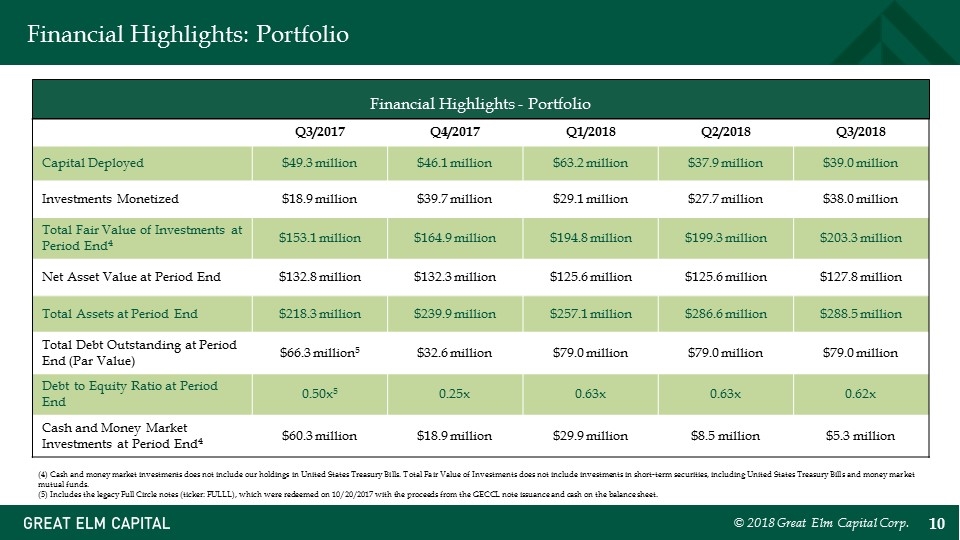

© 2018 Great Elm Capital Corp. Financial Highlights: Portfolio Q3/2017 Q4/2017 Q1/2018 Q2/2018 Q3/2018 Capital Deployed $49.3 million $46.1 million $63.2 million $37.9 million $39.0 million Investments Monetized $18.9 million $39.7 million $29.1 million $27.7 million $38.0 million Total Fair Value of Investments at Period End4 $153.1 million $164.9 million $194.8 million $199.3 million $203.3 million Net Asset Value at Period End $132.8 million $132.3 million $125.6 million $125.6 million $127.8 million Total Assets at Period End $218.3 million $239.9 million $257.1 million $286.6 million $288.5 million Total Debt Outstanding at Period End (Par Value) $66.3 million5 $32.6 million $79.0 million $79.0 million $79.0 million Debt to Equity Ratio at Period End 0.50x5 0.25x 0.63x 0.63x 0.62x Cash and Money Market Investments at Period End4 $60.3 million $18.9 million $29.9 million $8.5 million $5.3 million (4) Cash and money market investments does not include our holdings in United States Treasury Bills. Total Fair Value of Investments does not include investments in short-term securities, including United States Treasury Bills and money market mutual funds. (5) Includes the legacy Full Circle notes (ticker: FULLL), which were redeemed on 10/20/2017 with the proceeds from the GECCL note issuance and cash on the balance sheet. Financial Highlights - Portfolio

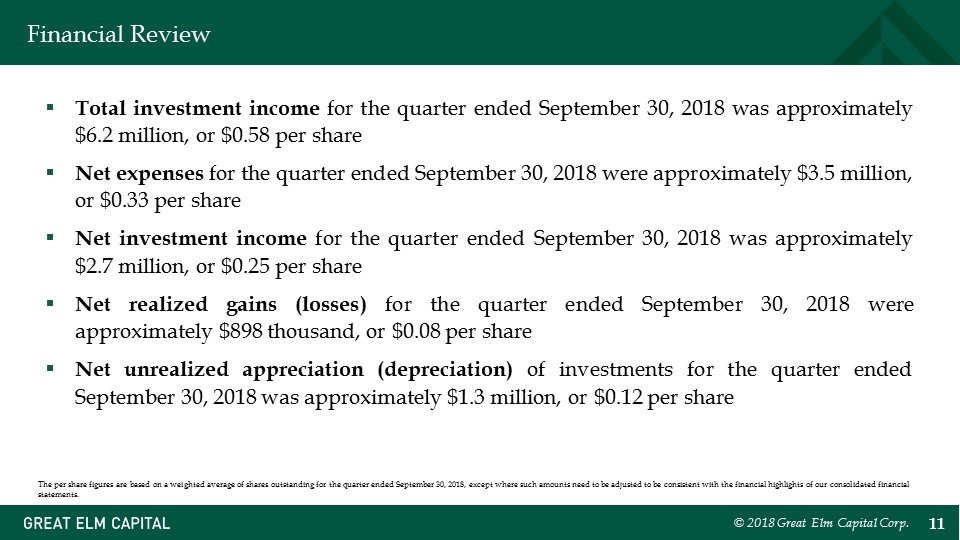

© 2018 Great Elm Capital Corp. Financial Review Total investment income for the quarter ended September 30, 2018 was approximately $6.2 million, or $0.58 per share Net expenses for the quarter ended September 30, 2018 were approximately $3.5 million, or $0.33 per share Net investment income for the quarter ended September 30, 2018 was approximately $2.7 million, or $0.25 per share Net realized gains (losses) for the quarter ended September 30, 2018 were approximately $898 thousand, or $0.08 per share Net unrealized appreciation (depreciation) of investments for the quarter ended September 30, 2018 was approximately $1.3 million, or $0.12 per share The per share figures are based on a weighted average of shares outstanding for the quarter ended September 30, 2018, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements.

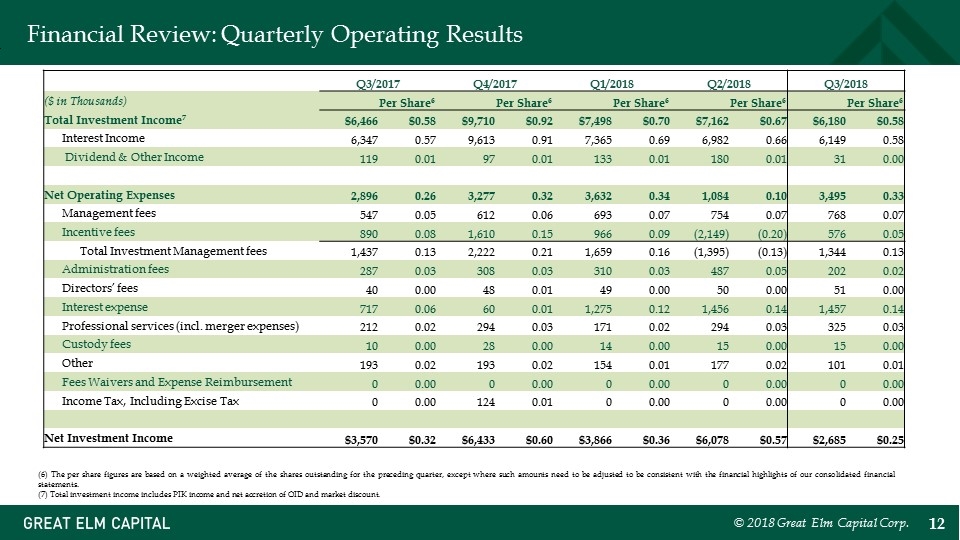

© 2018 Great Elm Capital Corp. Financial Review: Quarterly Operating Results (6) The per share figures are based on a weighted average of the shares outstanding for the preceding quarter, except where such amounts need to be adjusted to be consistent with the financial highlights of our consolidated financial statements. (7) Total investment income includes PIK income and net accretion of OID and market discount. Q3/2017 Q4/2017 Q1/2018 Q2/2018 Q3/2018 ($ in Thousands) Per Share6 Per Share6 Per Share6 Per Share6 Per Share6 Total Investment Income7 $6,466 $0.58 $9,710 $0.92 $7,498 $0.70 $7,162 $0.67 $6,180 $0.58 Interest Income 6,347 0.57 9,613 0.91 7,365 0.69 6,982 0.66 6,149 0.58 Dividend & Other Income 119 0.01 97 0.01 133 0.01 180 0.01 31 0.00 Net Operating Expenses 2,896 0.26 3,277 0.32 3,632 0.34 1,084 0.10 3,495 0.33 Management fees 547 0.05 612 0.06 693 0.07 754 0.07 768 0.07 Incentive fees 890 0.08 1,610 0.15 966 0.09 (2,149) (0.20) 576 0.05 Total Investment Management fees 1,437 0.13 2,222 0.21 1,659 0.16 (1,395) (0.13) 1,344 0.13 Administration fees 287 0.03 308 0.03 310 0.03 487 0.05 202 0.02 Directors’ fees 40 0.00 48 0.01 49 0.00 50 0.00 51 0.00 Interest expense 717 0.06 60 0.01 1,275 0.12 1,456 0.14 1,457 0.14 Professional services (incl. merger expenses) 212 0.02 294 0.03 171 0.02 294 0.03 325 0.03 Custody fees 10 0.00 28 0.00 14 0.00 15 0.00 15 0.00 Other 193 0.02 193 0.02 154 0.01 177 0.02 101 0.01 Fees Waivers and Expense Reimbursement 0 0.00 0 0.00 0 0.00 0 0.00 0 0.00 Income Tax, Including Excise Tax 0 0.00 124 0.01 0 0.00 0 0.00 0 0.00 Net Investment Income $3,570 $0.32 $6,433 $0.60 $3,866 $0.36 $6,078 $0.57 $2,685 $0.25

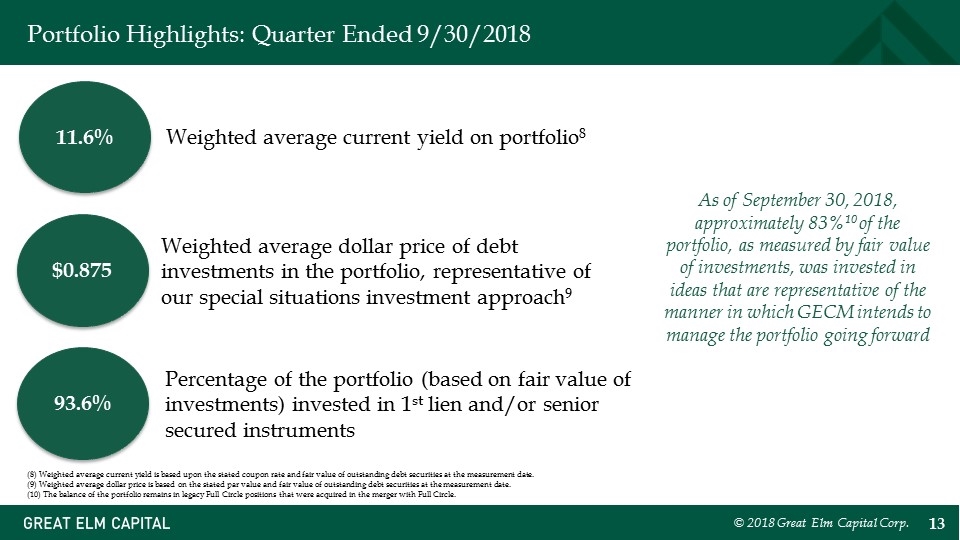

© 2018 Great Elm Capital Corp. Portfolio Highlights: Quarter Ended 9/30/2018 11.6% Weighted average current yield on portfolio8 93.6% Percentage of the portfolio (based on fair value of investments) invested in 1st lien and/or senior secured instruments $0.875 Weighted average dollar price of debt investments in the portfolio, representative of our special situations investment approach9 As of September 30, 2018, approximately 83%10 of the portfolio, as measured by fair value of investments, was invested in ideas that are representative of the manner in which GECM intends to manage the portfolio going forward (8) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. (9) Weighted average dollar price is based on the stated par value and fair value of outstanding debt securities at the measurement date. (10) The balance of the portfolio remains in legacy Full Circle positions that were acquired in the merger with Full Circle.

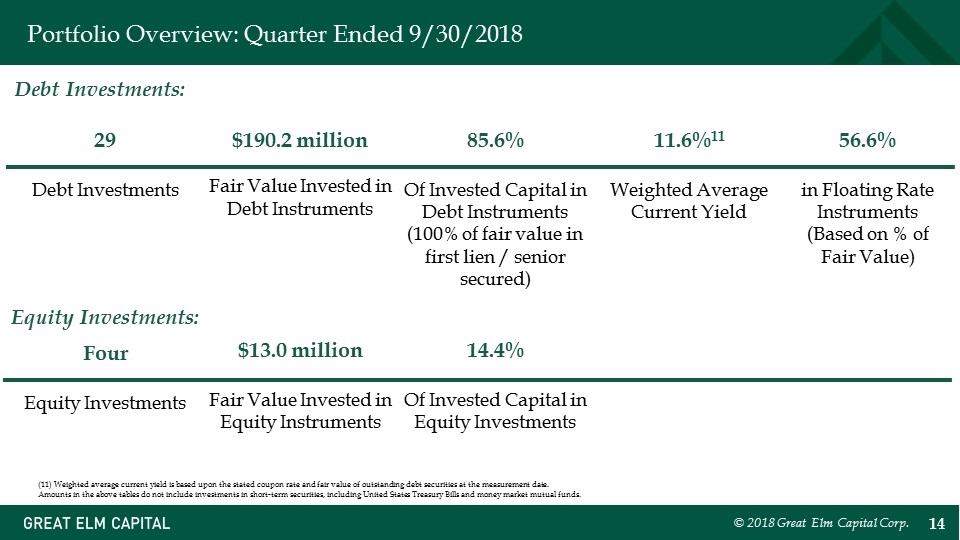

© 2018 Great Elm Capital Corp. Portfolio Overview: Quarter Ended 9/30/2018 29 Debt Investments $190.2 million Fair Value Invested in Debt Instruments 56.6% in Floating Rate Instruments (Based on % of Fair Value) 11.6%11 Weighted Average Current Yield 85.6% Of Invested Capital in Debt Instruments (100% of fair value in first lien / senior secured) Four Equity Investments $13.0 million Fair Value Invested in Equity Instruments Debt Investments: Equity Investments: 14.4% Of Invested Capital in Equity Investments (11) Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills and money market mutual funds.

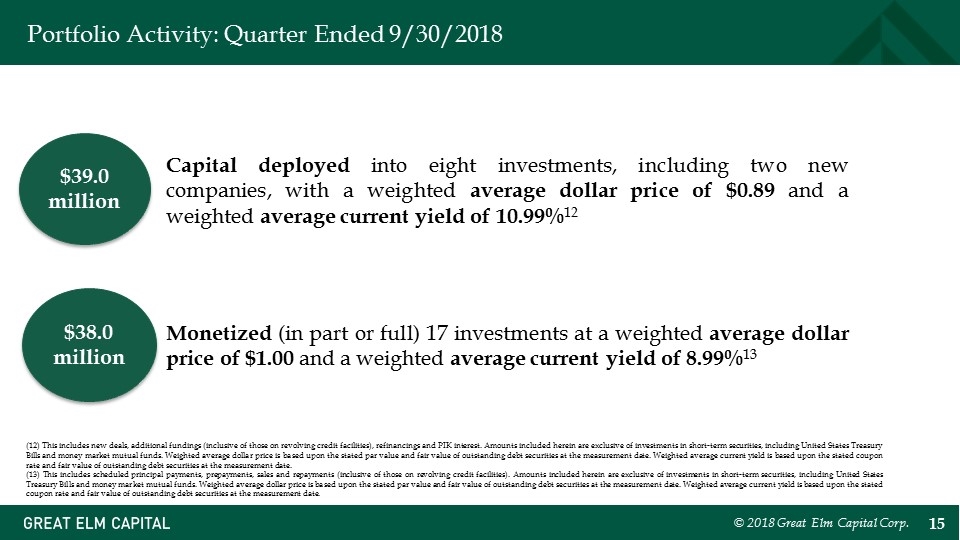

© 2018 Great Elm Capital Corp. Portfolio Activity: Quarter Ended 9/30/2018 $39.0 million Capital deployed into eight investments, including two new companies, with a weighted average dollar price of $0.89 and a weighted average current yield of 10.99%12 $38.0 million Monetized (in part or full) 17 investments at a weighted average dollar price of $1.00 and a weighted average current yield of 8.99%13 (12) This includes new deals, additional fundings (inclusive of those on revolving credit facilities), refinancings and PIK interest. Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills and money market mutual funds. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. (13) This includes scheduled principal payments, prepayments, sales and repayments (inclusive of those on revolving credit facilities). Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills and money market mutual funds. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date.

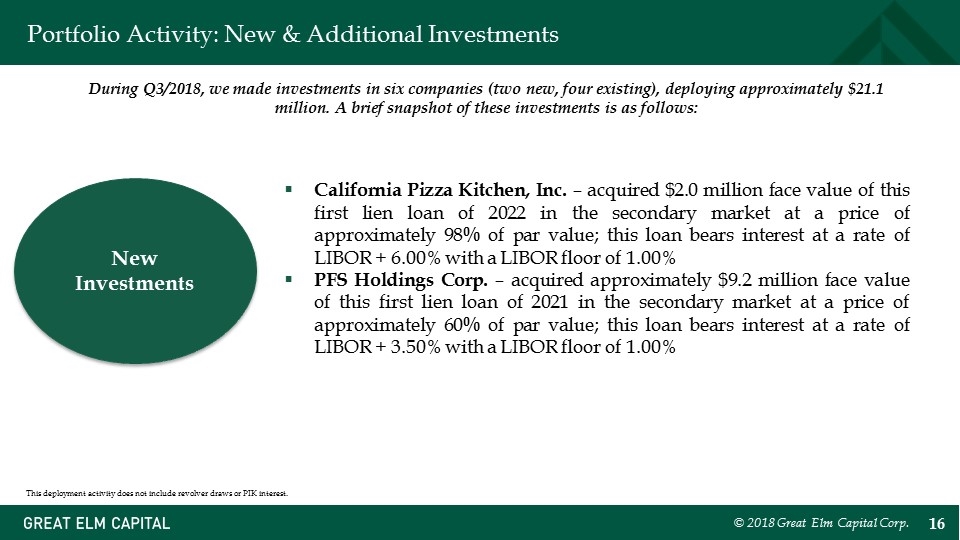

Portfolio Activity: New & Additional Investments © 2018 Great Elm Capital Corp. During Q3/2018, we made investments in six companies (two new, four existing), deploying approximately $21.1 million. A brief snapshot of these investments is as follows: This deployment activity does not include revolver draws or PIK interest. California Pizza Kitchen, Inc. – acquired $2.0 million face value of this first lien loan of 2022 in the secondary market at a price of approximately 98% of par value; this loan bears interest at a rate of LIBOR + 6.00% with a LIBOR floor of 1.00% PFS Holdings Corp. – acquired approximately $9.2 million face value of this first lien loan of 2021 in the secondary market at a price of approximately 60% of par value; this loan bears interest at a rate of LIBOR + 3.50% with a LIBOR floor of 1.00% New Investments

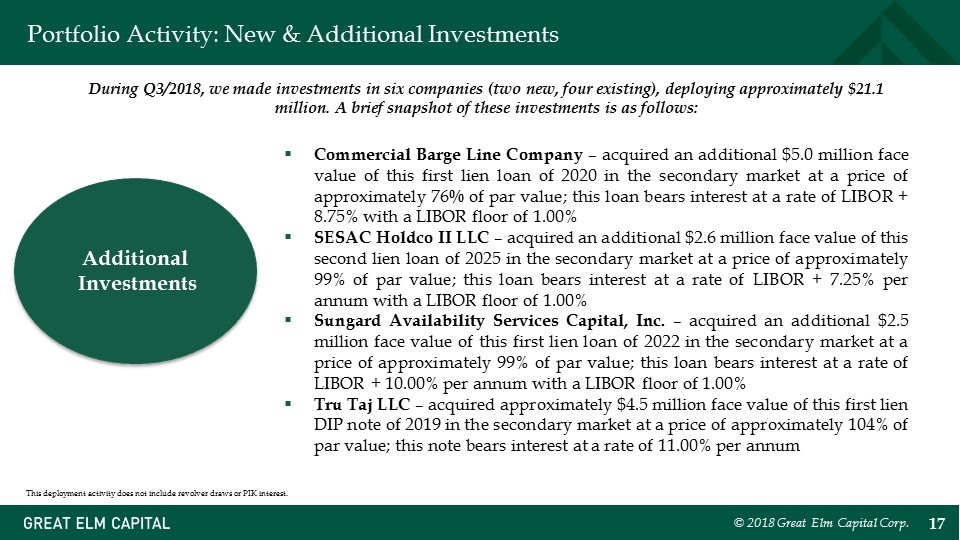

Portfolio Activity: New & Additional Investments © 2018 Great Elm Capital Corp. During Q3/2018, we made investments in six companies (two new, four existing), deploying approximately $21.1 million. A brief snapshot of these investments is as follows: This deployment activity does not include revolver draws or PIK interest. Commercial Barge Line Company – acquired an additional $5.0 million face value of this first lien loan of 2020 in the secondary market at a price of approximately 76% of par value; this loan bears interest at a rate of LIBOR + 8.75% with a LIBOR floor of 1.00% SESAC Holdco II LLC – acquired an additional $2.6 million face value of this second lien loan of 2025 in the secondary market at a price of approximately 99% of par value; this loan bears interest at a rate of LIBOR + 7.25% per annum with a LIBOR floor of 1.00% Sungard Availability Services Capital, Inc. – acquired an additional $2.5 million face value of this first lien loan of 2022 in the secondary market at a price of approximately 99% of par value; this loan bears interest at a rate of LIBOR + 10.00% per annum with a LIBOR floor of 1.00% Tru Taj LLC – acquired approximately $4.5 million face value of this first lien DIP note of 2019 in the secondary market at a price of approximately 104% of par value; this note bears interest at a rate of 11.00% per annum Additional Investments

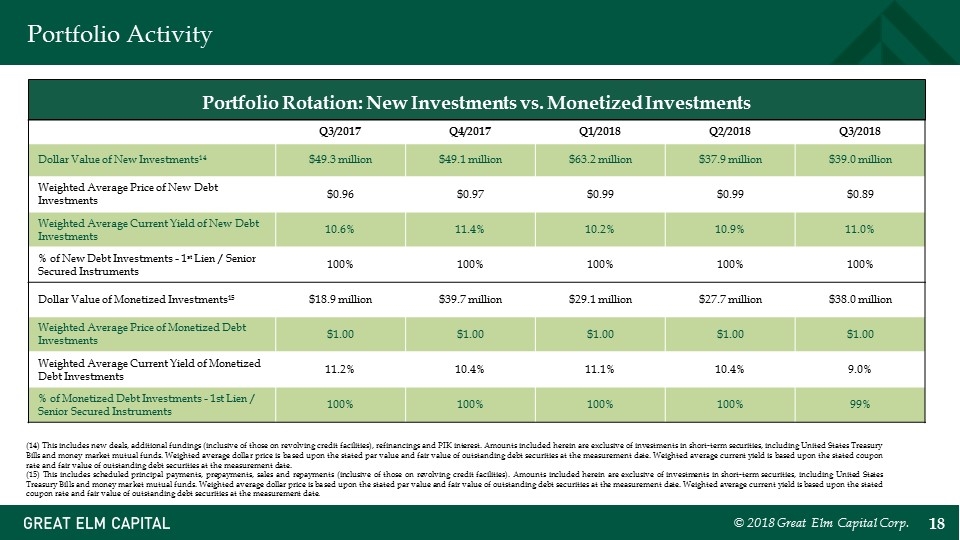

© 2018 Great Elm Capital Corp. Portfolio Activity Q3/2017 Q4/2017 Q1/2018 Q2/2018 Q3/2018 Dollar Value of New Investments14 $49.3 million $49.1 million $63.2 million $37.9 million $39.0 million Weighted Average Price of New Debt Investments $0.96 $0.97 $0.99 $0.99 $0.89 Weighted Average Current Yield of New Debt Investments 10.6% 11.4% 10.2% 10.9% 11.0% % of New Debt Investments - 1st Lien / Senior Secured Instruments 100% 100% 100% 100% 100% Dollar Value of Monetized Investments15 $18.9 million $39.7 million $29.1 million $27.7 million $38.0 million Weighted Average Price of Monetized Debt Investments $1.00 $1.00 $1.00 $1.00 $1.00 Weighted Average Current Yield of Monetized Debt Investments 11.2% 10.4% 11.1% 10.4% 9.0% % of Monetized Debt Investments - 1st Lien / Senior Secured Instruments 100% 100% 100% 100% 99% (14) This includes new deals, additional fundings (inclusive of those on revolving credit facilities), refinancings and PIK interest. Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills and money market mutual funds. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. (15) This includes scheduled principal payments, prepayments, sales and repayments (inclusive of those on revolving credit facilities). Amounts included herein are exclusive of investments in short-term securities, including United States Treasury Bills and money market mutual funds. Weighted average dollar price is based upon the stated par value and fair value of outstanding debt securities at the measurement date. Weighted average current yield is based upon the stated coupon rate and fair value of outstanding debt securities at the measurement date. Portfolio Rotation: New Investments vs. Monetized Investments

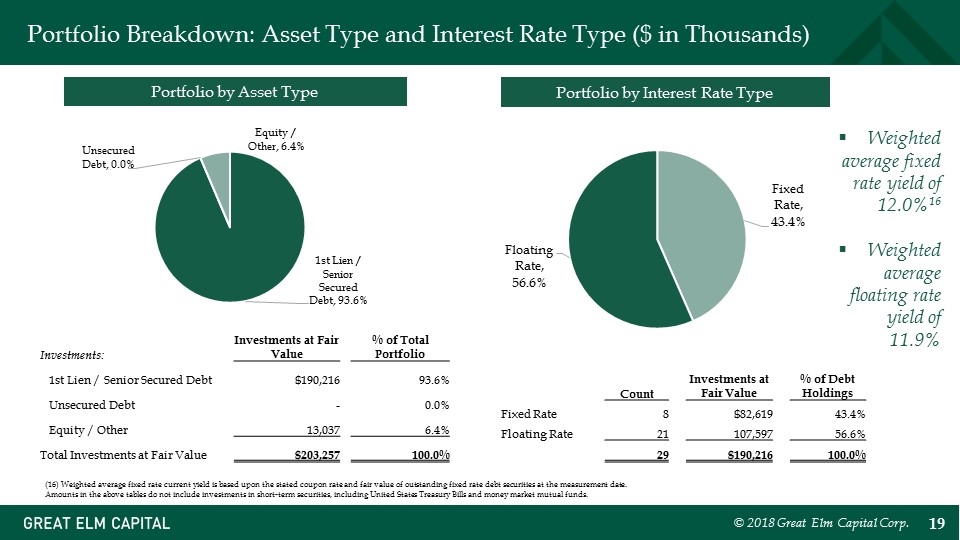

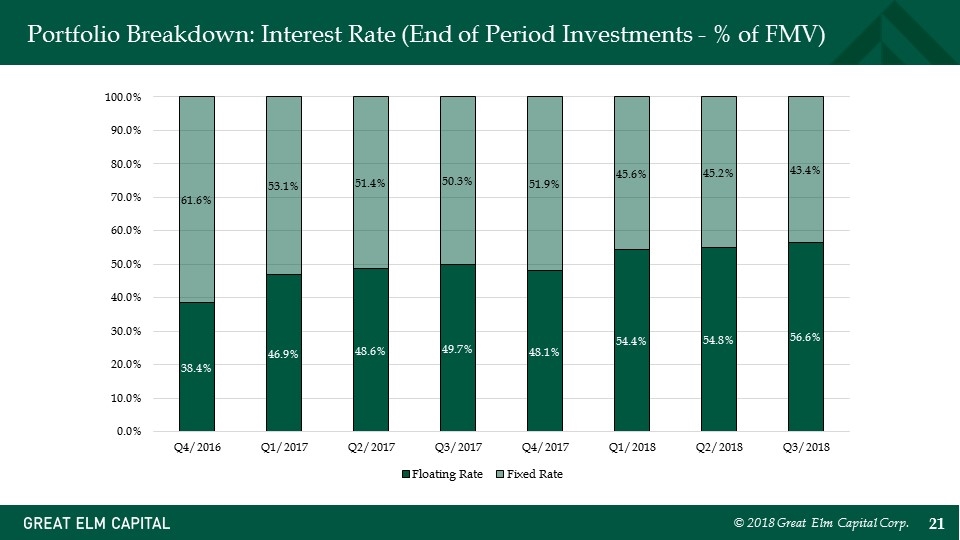

Portfolio Breakdown: Asset Type and Interest Rate Type ($ in Thousands) Portfolio by Asset Type Portfolio by Interest Rate Type Investments: Investments at Fair Value % of Total Portfolio 1st Lien / Senior Secured Debt $190,216 93.6% Unsecured Debt - 0.0% Equity / Other 13,037 6.4% Total Investments at Fair Value $203,257 100.0% Count Investments at Fair Value % of Debt Holdings Fixed Rate 8 $82,619 43.4% Floating Rate 21 107,597 56.6% 29 $190,216 100.0% Weighted average fixed rate yield of 12.0%16 Weighted average floating rate yield of 11.9% (16) Weighted average fixed rate current yield is based upon the stated coupon rate and fair value of outstanding fixed rate debt securities at the measurement date. Amounts in the above tables do not include investments in short-term securities, including United States Treasury Bills and money market mutual funds. © 2018 Great Elm Capital Corp.

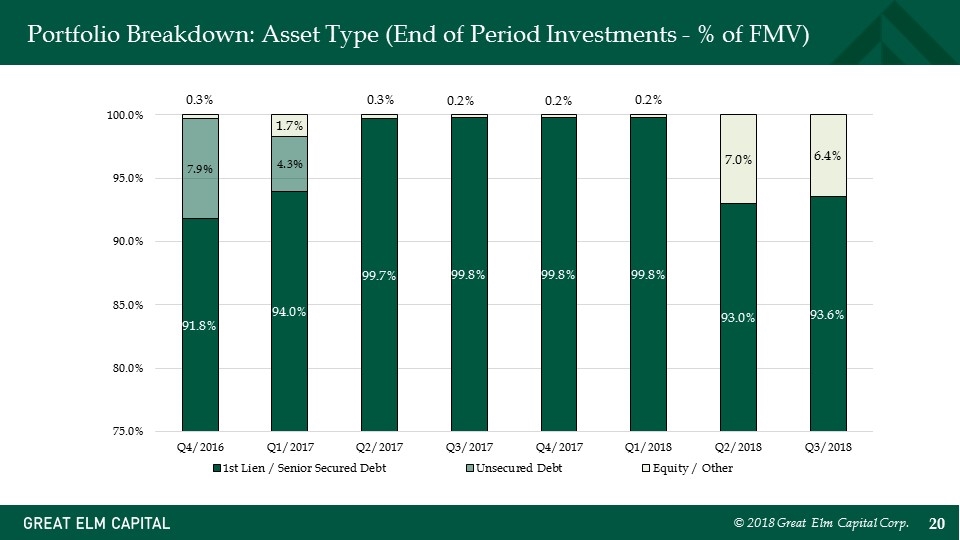

© 2018 Great Elm Capital Corp. Portfolio Breakdown: Asset Type (End of Period Investments - % of FMV)

© 2018 Great Elm Capital Corp. Portfolio Breakdown: Interest Rate (End of Period Investments - % of FMV)

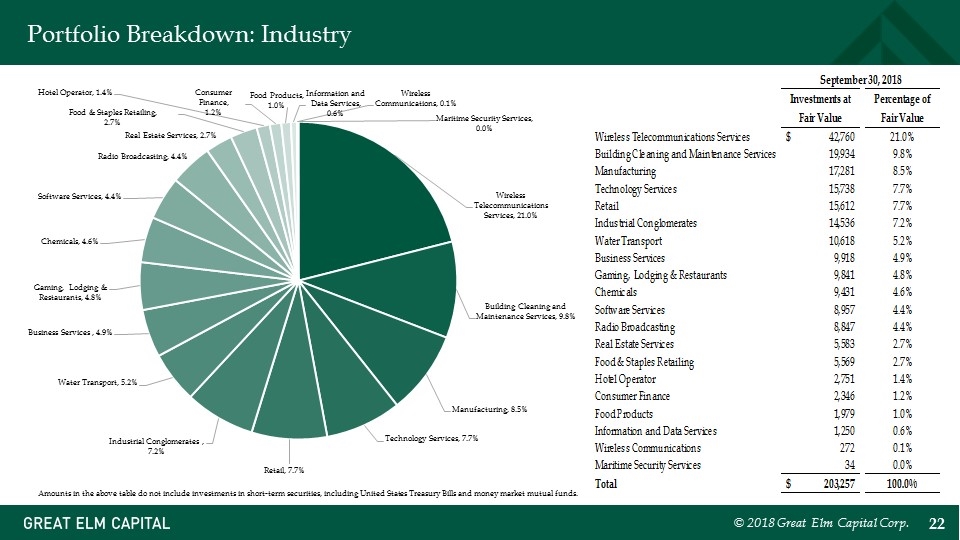

© 2018 Great Elm Capital Corp. Portfolio Breakdown: Industry Amounts in the above table do not include investments in short-term securities, including United States Treasury Bills and money market mutual funds.

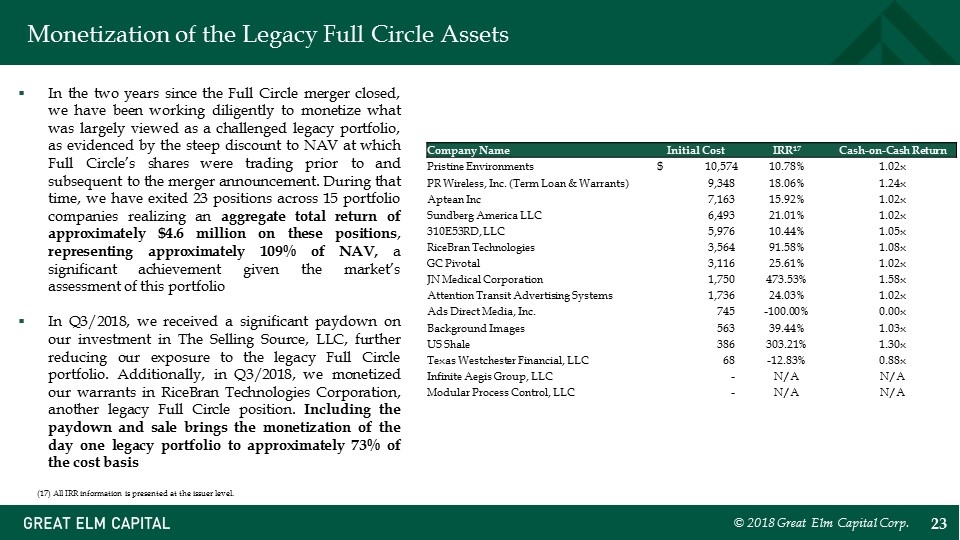

Monetization of the Legacy Full Circle Assets © 2018 Great Elm Capital Corp. In the two years since the Full Circle merger closed, we have been working diligently to monetize what was largely viewed as a challenged legacy portfolio, as evidenced by the steep discount to NAV at which Full Circle’s shares were trading prior to and subsequent to the merger announcement. During that time, we have exited 23 positions across 15 portfolio companies realizing an aggregate total return of approximately $4.6 million on these positions, representing approximately 109% of NAV, a significant achievement given the market’s assessment of this portfolio In Q3/2018, we received a significant paydown on our investment in The Selling Source, LLC, further reducing our exposure to the legacy Full Circle portfolio. Additionally, in Q3/2018, we monetized our warrants in RiceBran Technologies Corporation, another legacy Full Circle position. Including the paydown and sale brings the monetization of the day one legacy portfolio to approximately 73% of the cost basis Company Name Initial Cost IRR17 Cash-on-Cash Return Pristine Environments $ 10,574 10.78% 1.02x PR Wireless, Inc. (Term Loan & Warrants) 9,348 18.06% 1.24x Aptean Inc 7,163 15.92% 1.02x Sundberg America LLC 6,493 21.01% 1.02x 310E53RD, LLC 5,976 10.44% 1.05x RiceBran Technologies 3,564 91.58% 1.08x GC Pivotal 3,116 25.61% 1.02x JN Medical Corporation 1,750 473.53% 1.58x Attention Transit Advertising Systems 1,736 24.03% 1.02x Ads Direct Media, Inc. 745 -100.00% 0.00x Background Images 563 39.44% 1.03x US Shale 386 303.21% 1.30x Texas Westchester Financial, LLC 68 -12.83% 0.88x Infinite Aegis Group, LLC - N/A N/A Modular Process Control, LLC - N/A N/A (17) All IRR information is presented at the issuer level.

Avanti: Update About Avanti: Avanti is a leading provider of satellite-enabled data communications services in Europe, the Middle East and Africa. Avanti’s satellites utilize Ka-band frequencies, enabling higher speed and volume at lower cost. Avanti markets its services across the following six markets: consumer broadband, cellular backhaul, enterprise data networks, civil and military government and wholesale to other satellite operators GECC’s debt investment in Avanti is secured by a collateral package that consists of satellites in orbit (HYLAS 1, 2 and 4), one satellite under construction (HYLAS 3), ground earth stations, spectrum and orbital slots Recent Events: Since his hiring in April 2018, and despite a long sales cycle, new CEO Kyle Whitehill has signed three large, potentially highly profitable and long-term new contracts. Each of these would be among the largest contracts in the company's history In June 2018, Avanti announced that it had signed a $10 million contract with Viasat Inc. to provide Viasat with leased capacity on its newly launched HYLAS 4 satellite. This contract has an initial period of two years In August 2018, Avanti signed a seven-year Master Distribution Agreement for HYLAS 4 with COMSAT, providing Avanti with access to the US government In September 2018, Avanti announced the signing of a seven-year, wholesale capacity lease agreement for $84 million with a “major international satellite service provider” that is expected to commence in Q3/2019 As a result of these contract wins plus others in its pipeline, we are optimistic that Avanti will generate significant revenue growth going forward Since its operating costs are largely fixed, this revenue growth, if it were to be achieved, could ultimately translate into significant (and recurring) cash flow © 2018 Great Elm Capital Corp.

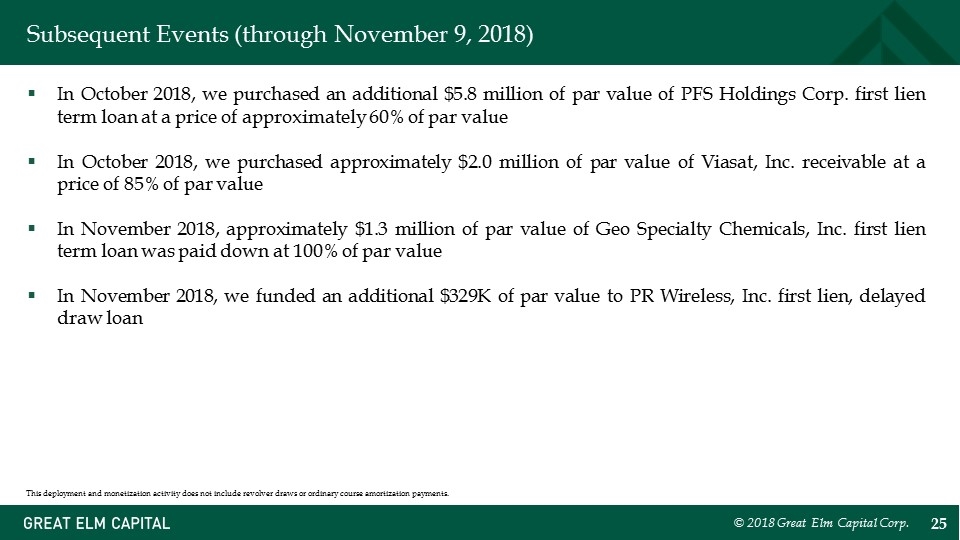

Subsequent Events (through November 9, 2018) © 2018 Great Elm Capital Corp. In October 2018, we purchased an additional $5.8 million of par value of PFS Holdings Corp. first lien term loan at a price of approximately 60% of par value In October 2018, we purchased approximately $2.0 million of par value of Viasat, Inc. receivable at a price of 85% of par value In November 2018, approximately $1.3 million of par value of Geo Specialty Chemicals, Inc. first lien term loan was paid down at 100% of par value In November 2018, we funded an additional $329K of par value to PR Wireless, Inc. first lien, delayed draw loan This deployment and monetization activity does not include revolver draws or ordinary course amortization payments.

© 2018 Great Elm Capital Corp. Capital Activity

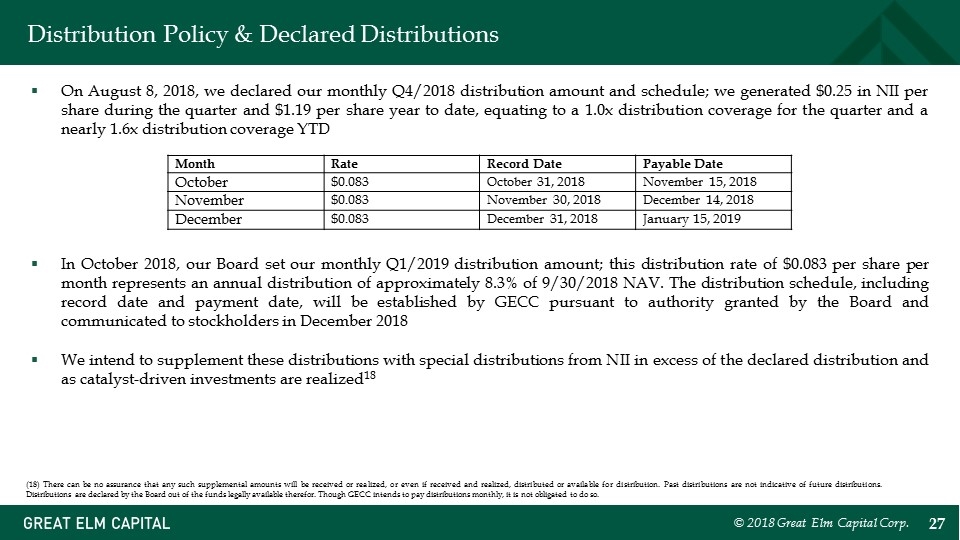

© 2018 Great Elm Capital Corp. Distribution Policy & Declared Distributions (18) There can be no assurance that any such supplemental amounts will be received or realized, or even if received and realized, distributed or available for distribution. Past distributions are not indicative of future distributions. Distributions are declared by the Board out of the funds legally available therefor. Though GECC intends to pay distributions monthly, it is not obligated to do so. On August 8, 2018, we declared our monthly Q4/2018 distribution amount and schedule; we generated $0.25 in NII per share during the quarter and $1.19 per share year to date, equating to a 1.0x distribution coverage for the quarter and a nearly 1.6x distribution coverage YTD In October 2018, our Board set our monthly Q1/2019 distribution amount; this distribution rate of $0.083 per share per month represents an annual distribution of approximately 8.3% of 9/30/2018 NAV. The distribution schedule, including record date and payment date, will be established by GECC pursuant to authority granted by the Board and communicated to stockholders in December 2018 We intend to supplement these distributions with special distributions from NII in excess of the declared distribution and as catalyst-driven investments are realized18 Month Rate Record Date Payable Date October $0.083 October 31, 2018 November 15, 2018 November $0.083 November 30, 2018 December 14, 2018 December $0.083 December 31, 2018 January 15, 2019

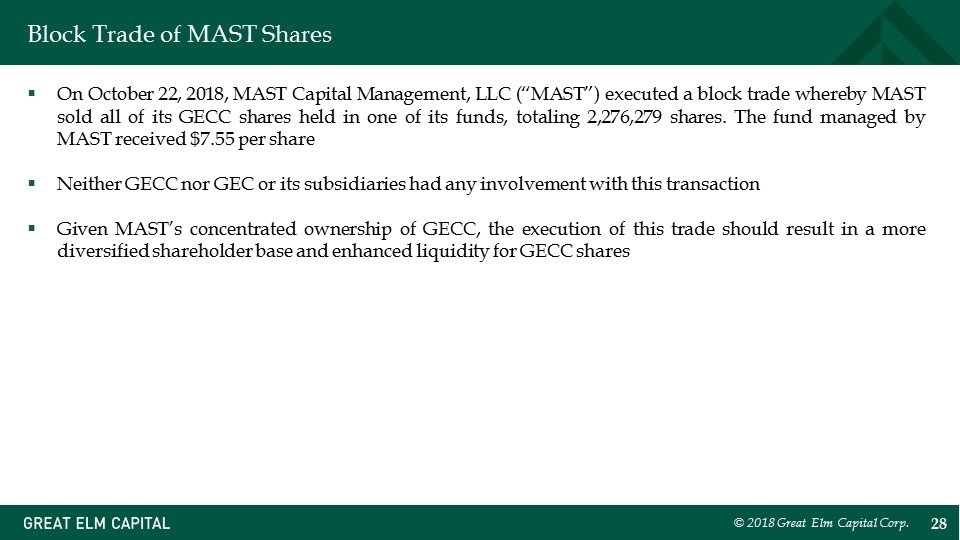

Block Trade of MAST Shares © 2018 Great Elm Capital Corp. On October 22, 2018, MAST Capital Management, LLC (“MAST”) executed a block trade whereby MAST sold all of its GECC shares held in one of its funds, totaling 2,276,279 shares. The fund managed by MAST received $7.55 per share Neither GECC nor GEC or its subsidiaries had any involvement with this transaction Given MAST’s concentrated ownership of GECC, the execution of this trade should result in a more diversified shareholder base and enhanced liquidity for GECC shares

© 2018 Great Elm Capital Corp. Appendix

Appendix: General Risks Debt instruments are subject to credit and interest rate risks. Credit risk refers to the likelihood that an obligor will default in the payment of principal or interest on an instrument. Financial strength and solvency of an obligor are the primary factors influencing credit risk. In addition, lack or inadequacy of collateral or credit enhancement for a debt instrument may affect its credit risk. Credit risk may change over the life of an instrument, and debt instruments that are rated by rating agencies are often reviewed and may be subject to downgrade. Our debt investments either are, or if rated would be, rated below investment grade by independent rating agencies. These “junk bonds” and “leveraged loans” are regarded as having predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may be illiquid and difficult to value and typically do not require repayment of principal before maturity, which potentially heightens the risk that we may lose all or part of our investment. Interest rate risk refers to the risks associated with market changes in interest rates. Interest rate changes may affect the value of a debt instrument indirectly (especially in the case of fixed rate obligations) or directly (especially in the case of an instrument whose rates are adjustable). In general, rising interest rates will negatively impact the price of a fixed rate debt instrument and falling interest rates will have a positive effect on price. Adjustable rate instruments also react to interest rate changes in a similar manner although generally to a lesser degree (depending, however, on the characteristics of the reset terms, including the index chosen, frequency of reset and reset caps or floors, among other factors). GECC utilizes leverage to seek to enhance the yield and net asset value of its common stock. These objectives will not necessarily be achieved in all interest rate environments. The use of leverage involves risk, including the potential for higher volatility and greater declines of GECC’s net asset value, fluctuations of dividends and other distributions paid by GECC and the market price of GECC’s common stock, among others. The amount of leverage that GECC may employ at any particular time will depend on, among other things, our Board’s and our adviser’s assessment of market and other factors at the time of any proposed borrowing. As part of our lending activities, we may purchase notes or make loans to companies that are experiencing significant financial or business difficulties, including companies involved in bankruptcy or other reorganization and liquidation proceedings. Although the terms of such financings may result in significant financial returns to us, they involve a substantial degree of risk. The level of analytical sophistication, both financial and legal, necessary for successful financing to companies experiencing significant business and financial difficulties is unusually high. We cannot assure you that we will correctly evaluate the value of the assets collateralizing our investments or the prospects for a successful reorganization or similar action. In any reorganization or liquidation proceeding relating to a portfolio company, we may lose all or part of the amounts advanced to the borrower or may be required to accept collateral with a value less than the amount of the investment advanced by us to the borrower. © 2018 Great Elm Capital Corp.

Appendix: Contact Information © 2018 Great Elm Capital Corp. Investor Relations Meaghan K. Mahoney Senior Vice President 800 South Street, Suite 230 Waltham, MA 02453 Phone: +1 (617) 375-3006 investorrelations@greatelmcap.com