Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CIVISTA BANCSHARES, INC. | d646826d8k.htm |

Investor Presentation Third Quarter 2018 Dennis G. Shaffer - President & Chief Executive Officer Richard J. Dutton - Senior Vice President, Chief Operating Officer NASDAQ: CIVB Exhibit 99.1

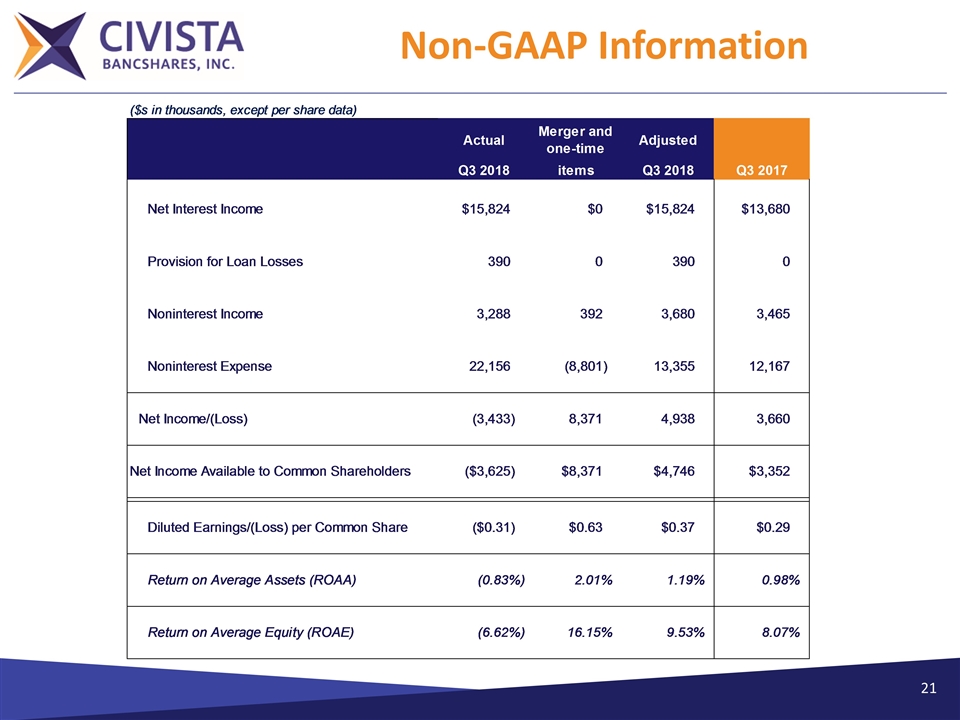

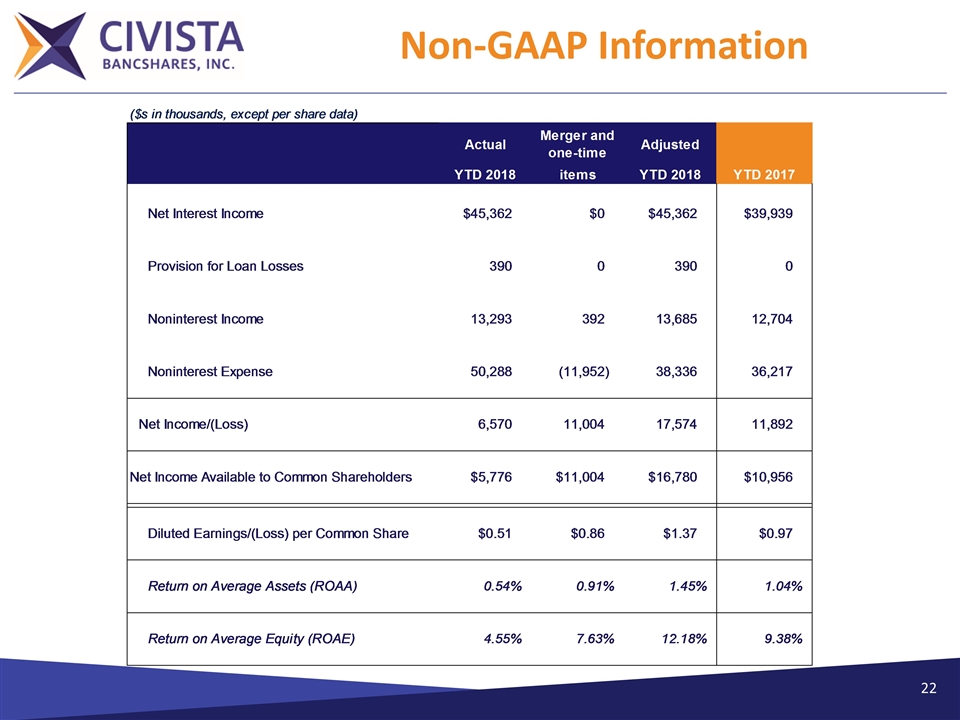

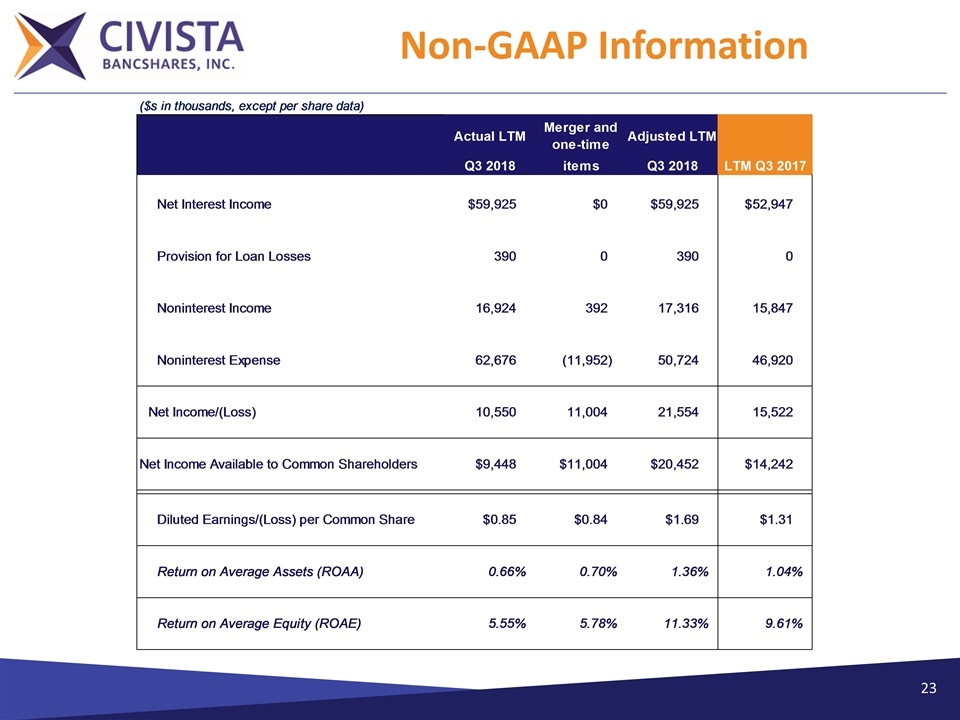

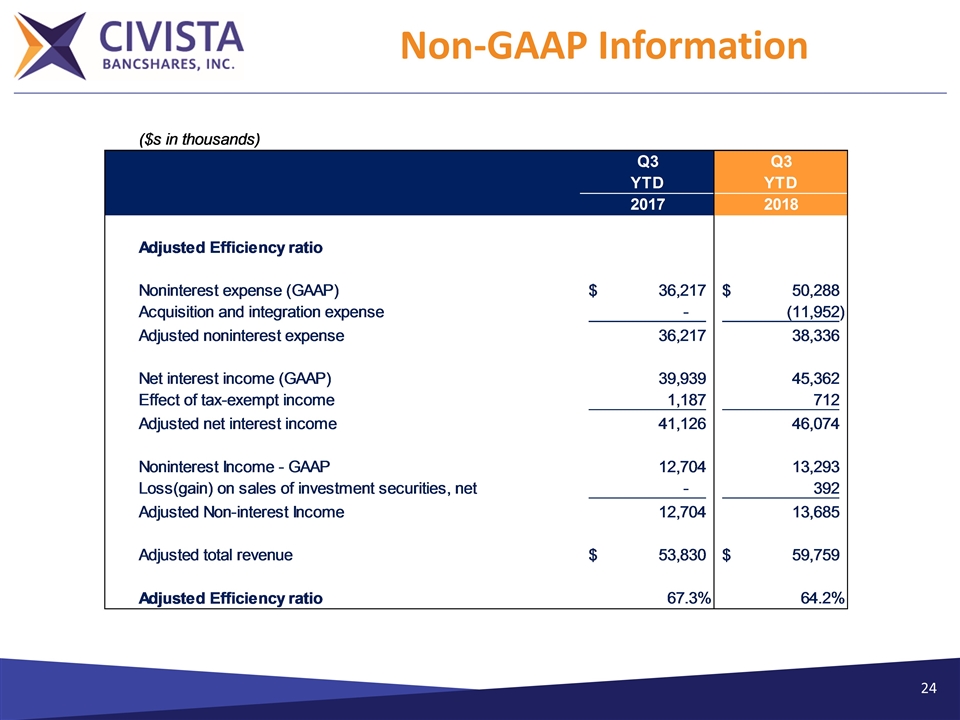

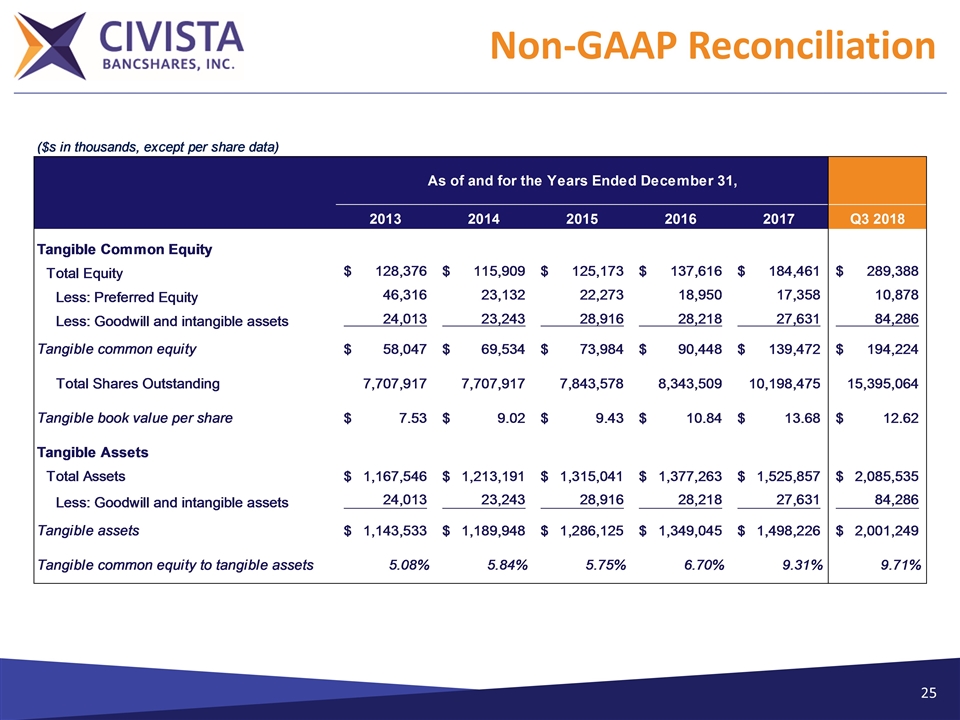

Forward-Looking Statements. This presentation may contain forward-looking statements within the meaning of such term in federal securities law. Forward-looking statements express management’s current expectations, forecasts of future events or long-term goals, and may be based upon beliefs, expectations and assumptions of the Company’s management are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. All statements in this material speak only as of the date they are made, and we undertake no obligation to update any statement. A number of factor, many of which are beyond the ability of the Company to control or predict, could cause the actual results to differ materially from those in its forward-looking statements. Additional information regarding such risks can be found in public documents on file with the SEC, including those risks identified in “Item 1A. Risk Factors” of Part I of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Use of Non-GAAP Financial Measures. This presentation contains certain financial information determined by methods other than in accordance with accounting principals generally accepted in the United States (“GAAP”). These non-GAAP financial measures include “Adjusted Noninterest Income”, “Adjusted Noninterest Expense”, “Adjusted Net Income”, “Adjusted Net Income Available to Common Shareholders”, “Adjusted Diluted Earnings per Common Share”, “Adjusted Return on Average Assets”, “Adjusted Return on Average Equity”, “Adjusted Efficiency ratio”, “Tangible Book Value per Share” and “Tangible Common Equity to Tangible Assets”. The Company believes that these non-GAAP financial measures provide both management and investors a more complete understanding of the Company’s profitability. These non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP Measures. Not all companies use the same calculation of these measures; therefore this presentation may not be comparable to other similarly titled measures as presented by other companies. Reconciliations of these non-GAAP measures are provided in the Appendix section of this presentation.

Contact Information Civista Bancshares, Inc.’s common shares are traded on the NASDAQ Capital Market under the symbol “CIVB.” The Company’s depository shares, each representing 1/40th ownership interest in a Series B Preferred Share, are traded on the NASDAQ Capital Market under the symbol “CIVBP.” Additional information can be found at: www.civb.com Dennis G Shaffer President & Chief Executive Officer dgshaffer@civb.com Telephone: 888.645.4121

Corporate Overview Bank originally founded in 1884 11th Largest Publicly Traded Commercial Bank Headquartered in Ohio Community Banking Focused Operations in 12 Ohio, 2 Indiana and 1 Kentucky Counties 35 Branches & 3 Loan Production Offices Operations in the 5 largest Ohio MSAs Franchise Poised for Acquisitions and Organic Growth Closed and converted the UCB transaction 9/14/18. Recognized integration and acquisition expenses of $12.0 million Full-Service Banking Organization with Diversified Revenue Streams Commercial Banking Retail Banking Wealth Management Mortgage Banking Tax Refund Processing Corporate Overview ¹ From American Banker Magazine, September 2017 © 2017 SourceMedia, Inc. All rights reserved. Used by permission and protected by the Copyright Laws of the United States. The printing, copying, redistribution, or retransmission of this Content without expressed written permission is prohibited. 1

Experienced Management Team Dennis G. Shaffer SVP & Chief Operating Officer 32 years of banking experience Joined in 2007 Richard J. Dutton SVP & Chief Lending Officer 30 years of banking experience Joined in 2016 Charles A. Parcher SVP & General Counsel 16 years of banking experience Joined in 2002 James E. McGookey SVP & Controller 30 years of banking experience Joined in 1988 Todd A. Michel SVP & Chief Risk Officer 22 years of banking experience Joined in 2013 John A. Betts SVP & Chief Credit Officer 33 years of banking experience Joined in 2010 Paul J. Stark Donna M. Jaskolski SVP & Customer Experience Officer 16 years of banking experience Joined in 2017 CEO & President President, Civista Bank 33 years of banking experience Joined in 2009

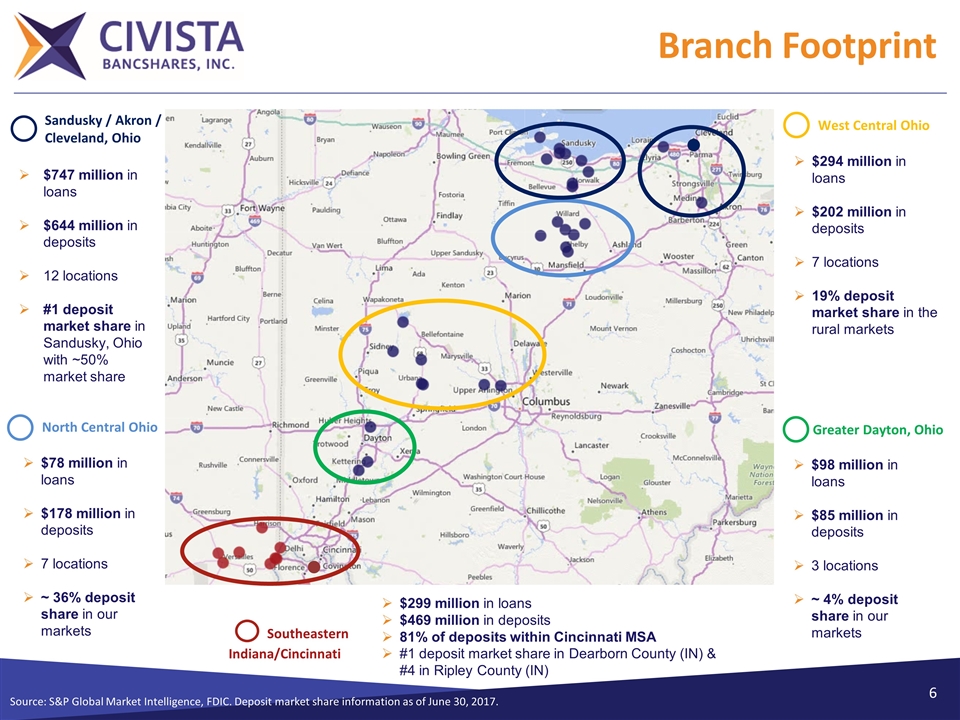

$299 million in loans $469 million in deposits 81% of deposits within Cincinnati MSA #1 deposit market share in Dearborn County (IN) & #4 in Ripley County (IN) Branch Footprint Source: S&P Global Market Intelligence, FDIC. Deposit market share information as of June 30, 2017. Sandusky / Akron / Cleveland, Ohio $747 million in loans $644 million in deposits 12 locations #1 deposit market share in Sandusky, Ohio with ~50% market share North Central Ohio $78 million in loans $178 million in deposits 7 locations ~ 36% deposit share in our markets $294 million in loans $202 million in deposits 7 locations 19% deposit market share in the rural markets West Central Ohio Greater Dayton, Ohio $98 million in loans $85 million in deposits 3 locations ~ 4% deposit share in our markets Southeastern Indiana/Cincinnati

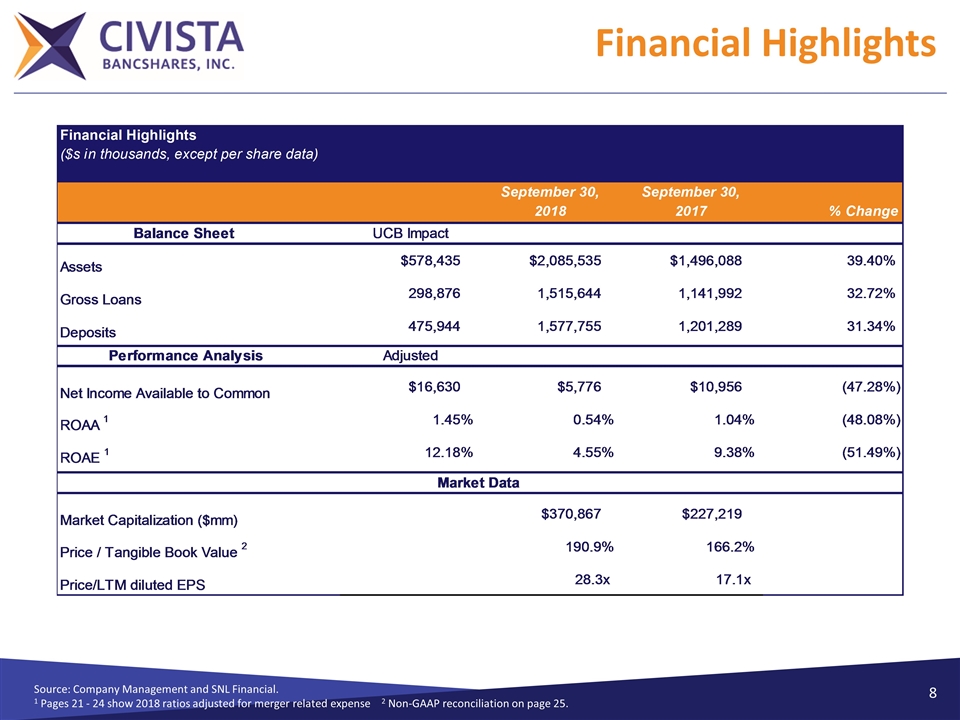

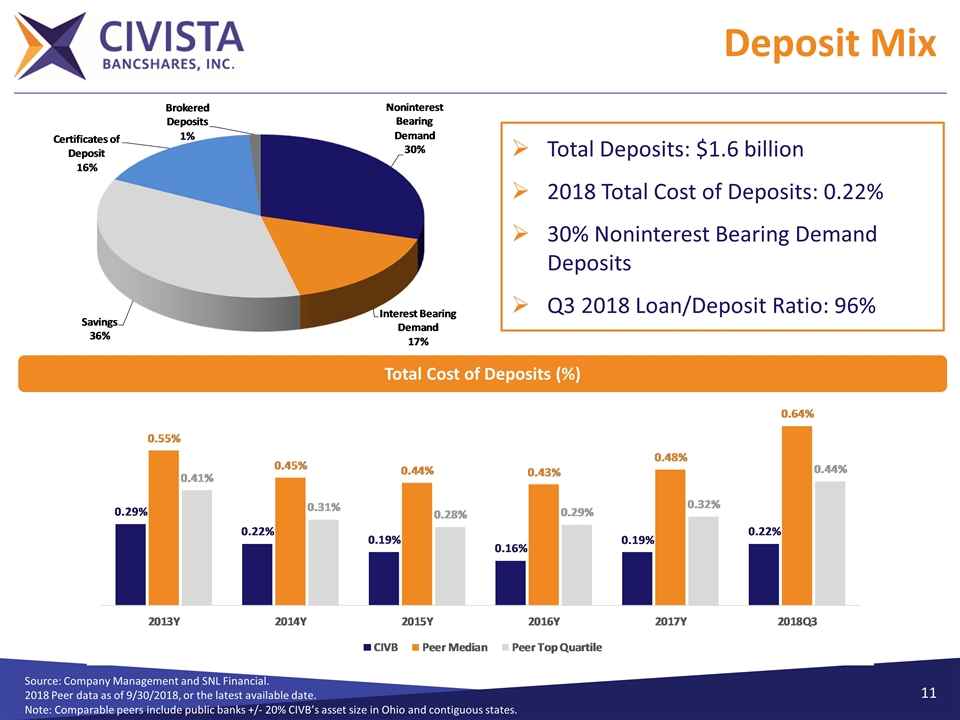

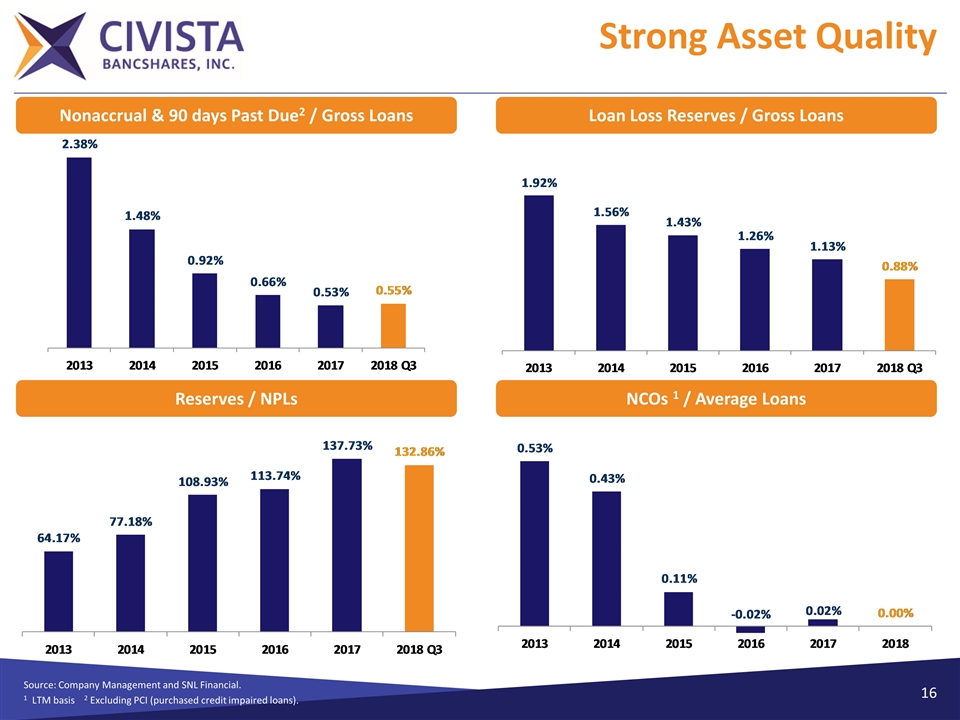

Investment Highlights Experienced management team with a deep bench Community bank franchise in growth markets with an established operating model Gather attractive low-cost rural deposits (22 bps total cost of deposits) Generate loans in select growing urban markets (operations in the 5 largest MSAs in Ohio) Use of LPOs to extend our reach Two Loan Production Offices in Cleveland MSA (Westlake and Mayfield Heights) One Loan Production Office in Cincinnati MSA (Fort Mitchell, KY) Disciplined underwriting verified with strong credit quality metrics Nonaccrual and 90 days Past Due (excluding PCI1) to Gross Loans of 0.55% as of 09/30/2018 Noninterest income enhanced by unique tax refund processing platform Continued strong year-to-date returns in 2018 ROAA: 0.54% - actual 1.45% - adjusted 2 ROAE: 4.55% -actual12.18% - adjusted 2 FTE NIM 4.14% Added to Russell 2000 index in June 2017 Source: Company Management and SNL Financial. 1PCI – purchased credit impaired loans. 2 Pages 21 -24 show 2018 ratios adjusted for merger related expense

Financial Highlights Source: Company Management and SNL Financial. 1 Pages 21 - 24 show 2018 ratios adjusted for merger related expense 2 Non-GAAP reconciliation on page 25.

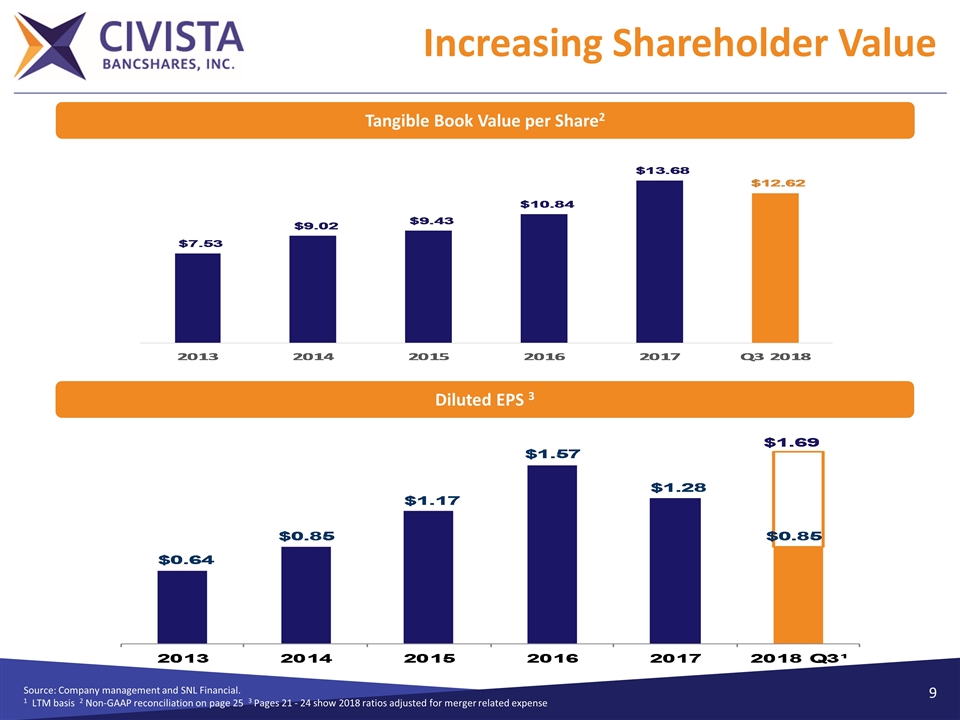

Increasing Shareholder Value Source: Company management and SNL Financial. 1 LTM basis 2 Non-GAAP reconciliation on page 25 3 Pages 21 - 24 show 2018 ratios adjusted for merger related expense Tangible Book Value per Share2 Diluted EPS 3

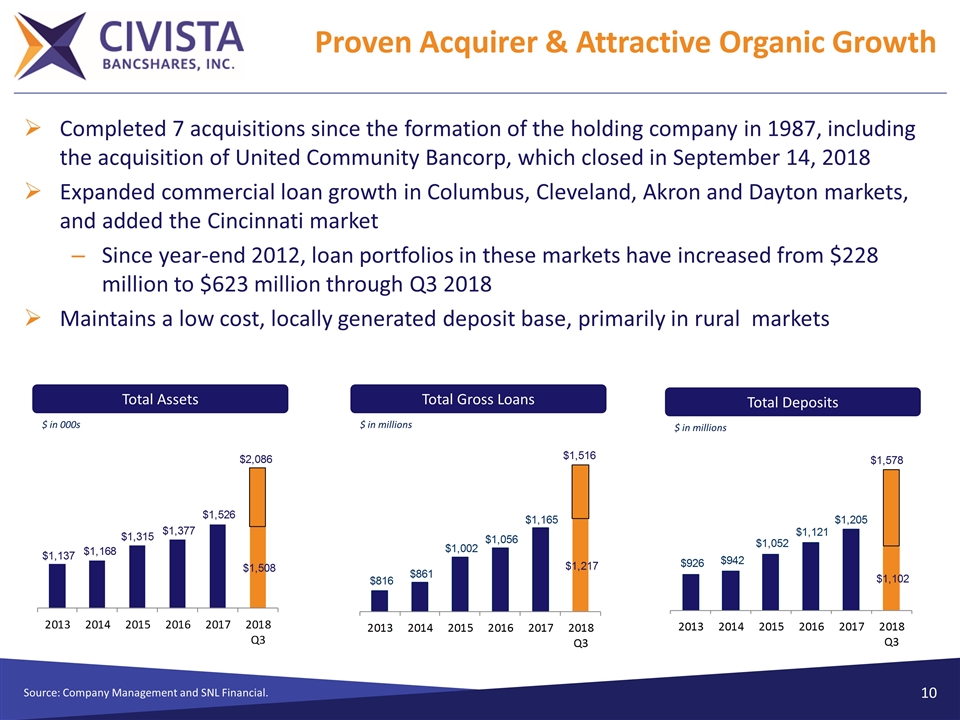

Proven Acquirer & Attractive Organic Growth Source: Company Management and SNL Financial. Completed 7 acquisitions since the formation of the holding company in 1987, including the acquisition of United Community Bancorp, which closed in September 14, 2018 Expanded commercial loan growth in Columbus, Cleveland, Akron and Dayton markets, and added the Cincinnati market Since year-end 2012, loan portfolios in these markets have increased from $228 million to $623 million through Q3 2018 Maintains a low cost, locally generated deposit base, primarily in rural markets Total Assets $ in 000s Total Gross Loans $ in millions Total Deposits $ in millions

Source: Company Management and SNL Financial. 2018 Peer data as of 9/30/2018, or the latest available date. Note: Comparable peers include public banks +/- 20% CIVB’s asset size in Ohio and contiguous states. Deposit Mix Total Deposits: $1.6 billion 2018 Total Cost of Deposits: 0.22% 30% Noninterest Bearing Demand Deposits Q3 2018 Loan/Deposit Ratio: 96% Total Cost of Deposits (%)

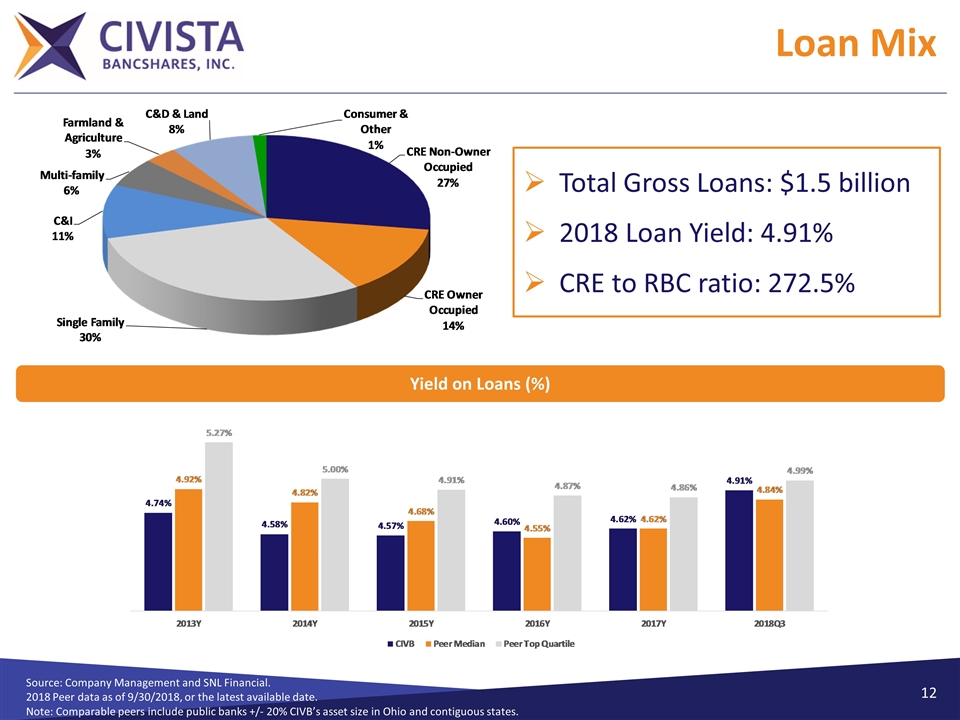

Source: Company Management and SNL Financial. 2018 Peer data as of 9/30/2018, or the latest available date. Note: Comparable peers include public banks +/- 20% CIVB’s asset size in Ohio and contiguous states. Loan Mix Total Gross Loans: $1.5 billion 2018 Loan Yield: 4.91% CRE to RBC ratio: 272.5% Yield on Loans (%)

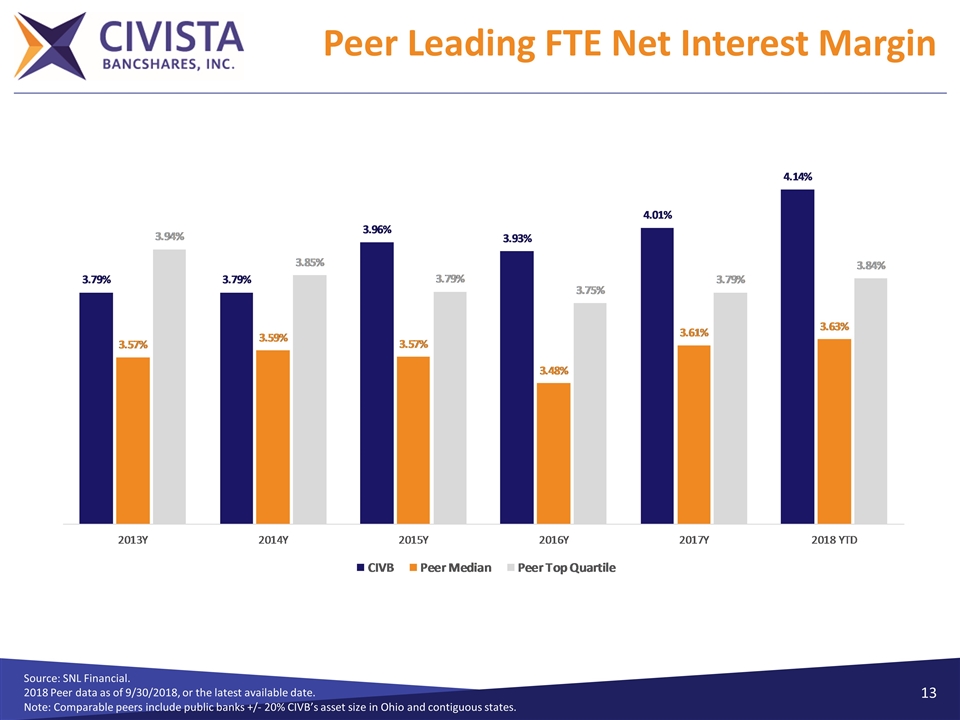

Peer Leading FTE Net Interest Margin Source: SNL Financial. 2018 Peer data as of 9/30/2018, or the latest available date. Note: Comparable peers include public banks +/- 20% CIVB’s asset size in Ohio and contiguous states.

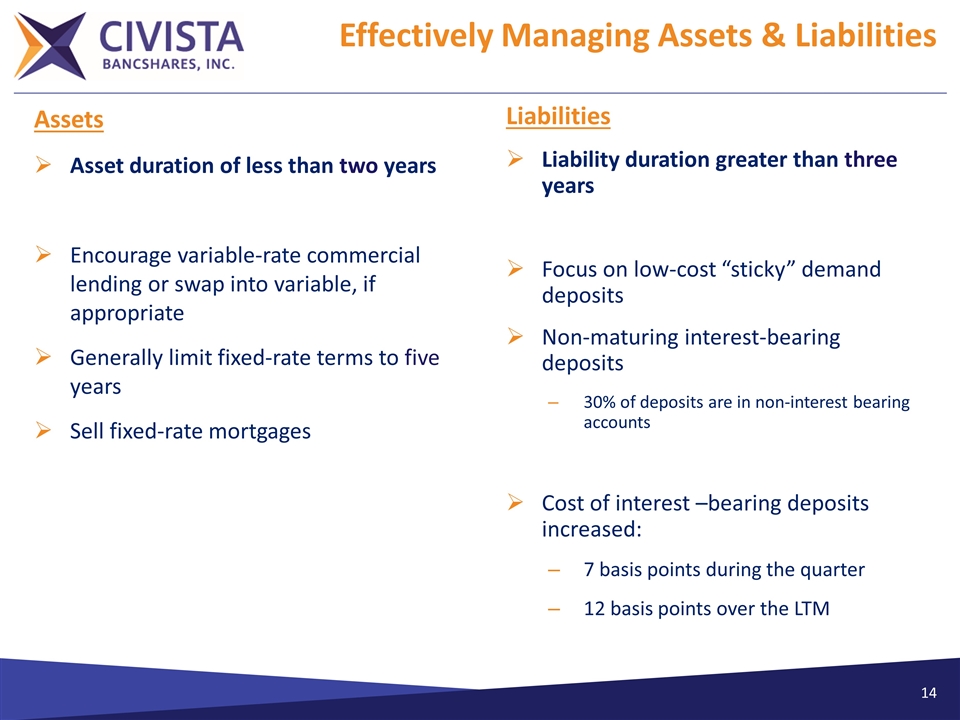

Effectively Managing Assets & Liabilities Assets Asset duration of less than two years Encourage variable-rate commercial lending or swap into variable, if appropriate Generally limit fixed-rate terms to five years Sell fixed-rate mortgages Liabilities Liability duration greater than three years Focus on low-cost “sticky” demand deposits Non-maturing interest-bearing deposits 30% of deposits are in non-interest bearing accounts Cost of interest –bearing deposits increased: 7 basis points during the quarter 12 basis points over the LTM

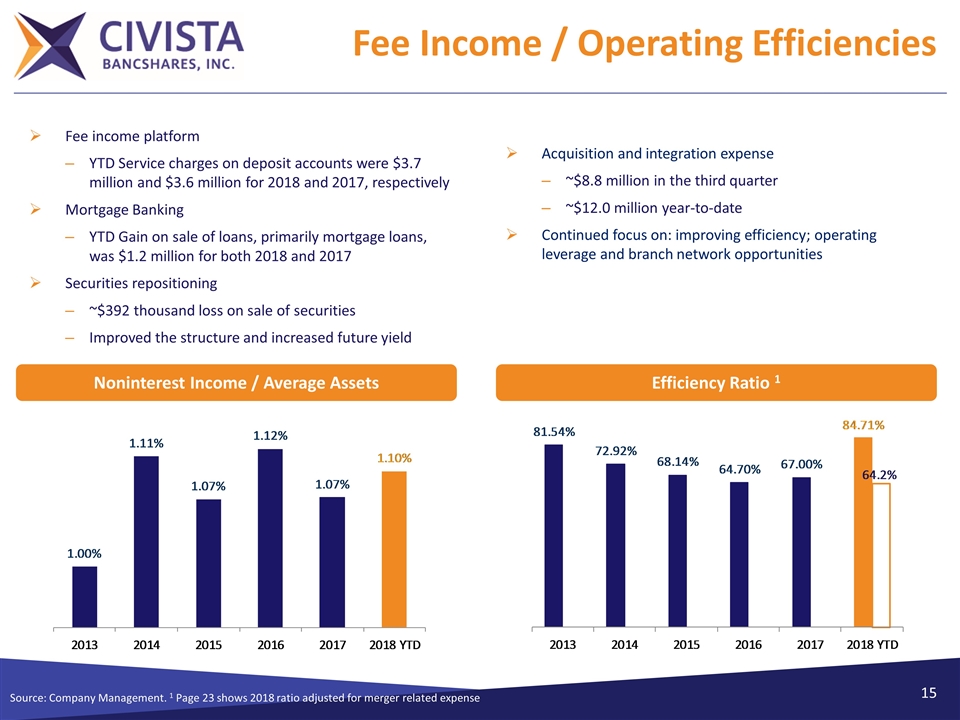

Fee Income / Operating Efficiencies Source: Company Management. 1 Page 23 shows 2018 ratio adjusted for merger related expense Efficiency Ratio 1 Noninterest Income / Average Assets Fee income platform YTD Service charges on deposit accounts were $3.7 million and $3.6 million for 2018 and 2017, respectively Mortgage Banking YTD Gain on sale of loans, primarily mortgage loans, was $1.2 million for both 2018 and 2017 Securities repositioning ~$392 thousand loss on sale of securities Improved the structure and increased future yield Acquisition and integration expense ~$8.8 million in the third quarter ~$12.0 million year-to-date Continued focus on: improving efficiency; operating leverage and branch network opportunities

Source: Company Management and SNL Financial. 1 LTM basis 2 Excluding PCI (purchased credit impaired loans). Strong Asset Quality Reserves / NPLs NCOs 1 / Average Loans Loan Loss Reserves / Gross Loans NPAs & 90+PD / Assets Loan Loss Reserves / Gross Loans Nonaccrual & 90 days Past Due2 / Gross Loans

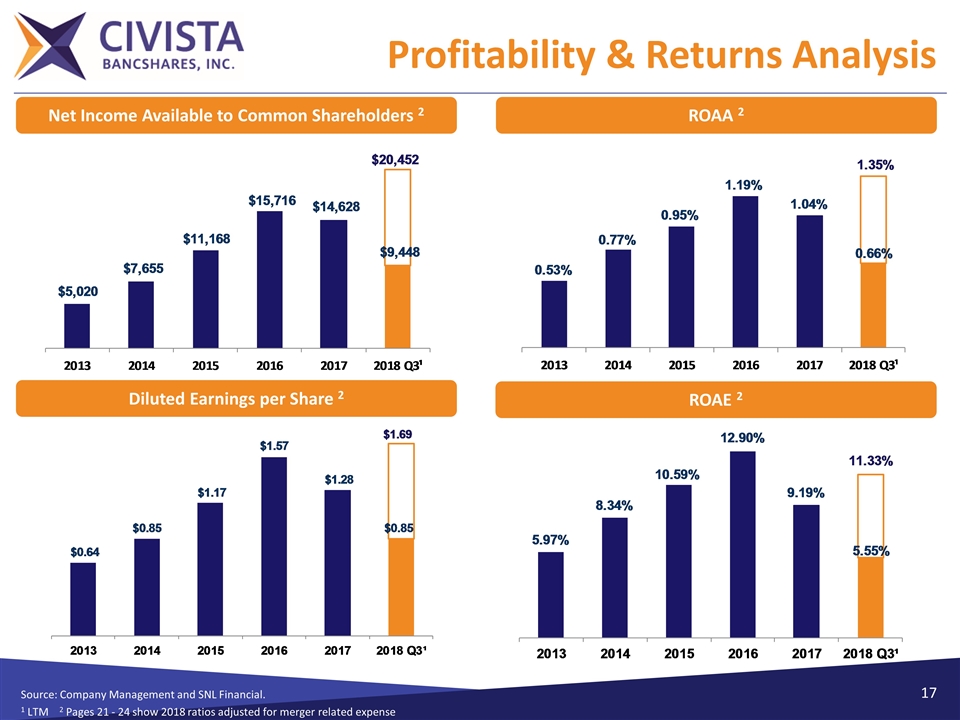

Profitability & Returns Analysis Source: Company Management and SNL Financial. 1 LTM 2 Pages 21 - 24 show 2018 ratios adjusted for merger related expense Diluted Earnings per Share 2 ROAE 2 ROAA 2 Net Income Available to Common Shareholders 2

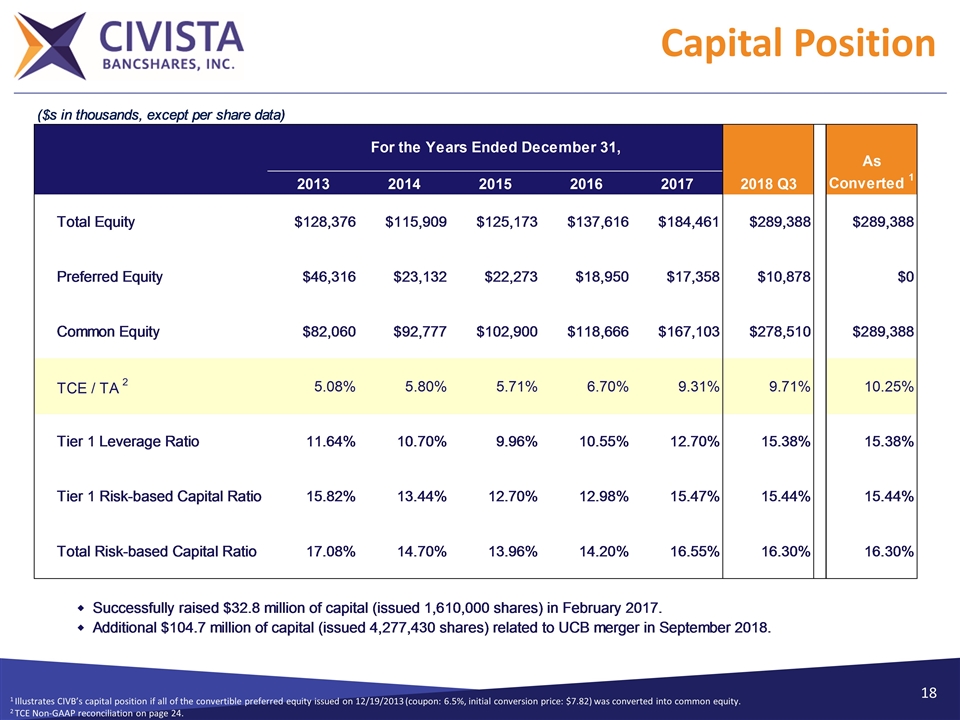

1 Illustrates CIVB’s capital position if all of the convertible preferred equity issued on 12/19/2013 (coupon: 6.5%, initial conversion price: $7.82) was converted into common equity. 2 TCE Non-GAAP reconciliation on page 24. Capital Position

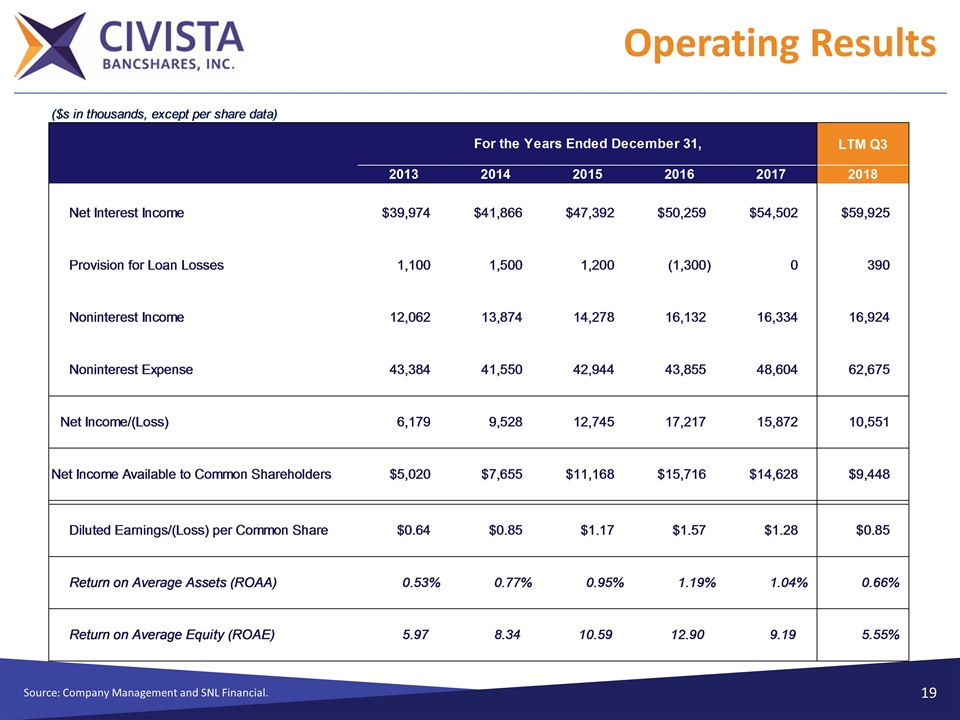

Source: Company Management and SNL Financial. Operating Results

Compelling Investment Opportunity Strong asset quality Proven acquirer Completed 7 acquisitions since the formation of the holding company in 1987, including the acquisition of United Community Bancorp, which closed on September 14, 2018 Peer leading NIM Low cost deposits – 42 bps lower than peers High yield loan portfolio – 7 bps higher than peers Experienced management team with an average of 26 years in banking Strategically positioned in attractive Ohio lending markets funded by low cost deposits Two Loan Production Offices in Cleveland MSA (Westlake and Mayfield Heights) One Loan Production Office in Cincinnati MSA (Fort Mitchell, KY) Continued profitability improvement from 2013 to Q3 2018 Net Income CAGR: 15.1% TBV / Share CAGR: 11.5% EPS CAGR: 5.9% Peer data as of 9/30/2018, or the latest available date.

Non-GAAP Information 21

Non-GAAP Information 22

Non-GAAP Information 23

Non-GAAP Information 24

Non-GAAP Reconciliation

Thank You