Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PLANTRONICS INC /CA/ | q219earningsrelease8-k.htm |

PRESS RELEASE

INVESTOR CONTACT: Mike Iburg Vice President, Investor Relations (831) 458-7533 | MEDIA CONTACT: Jim Cullinan Vice President, Marketing Buzz and Brand (408) 586-3920 |

Plantronics Announces Second Quarter Fiscal Year 2019 Financial Results

Polycom acquisition doubles net revenues; Voice and Headsets drive comparative y/y growth

SANTA CRUZ, Calif., - November 6, 2018 - Plantronics, Inc. (NYSE: PLT) today announced second quarter results for the period ending September 30, 2018. On July 2, 2018, Plantronics completed the acquisition of Polycom, which is reflected in these results. Highlights of the second quarter include the following (comparisons are against the second quarter Fiscal Year 2018):

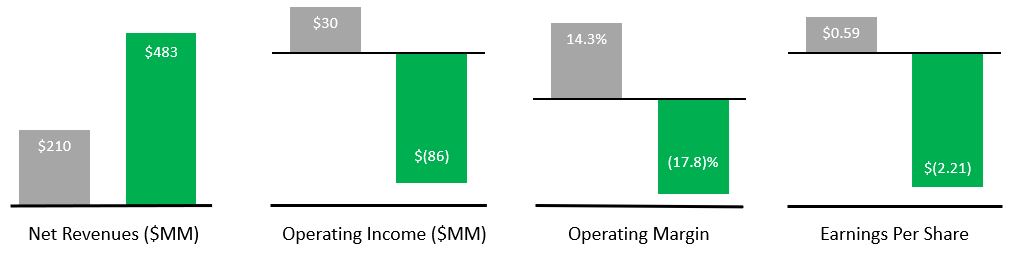

• | GAAP net revenues were $483 million, growing over 100% from the prior year period as a result of the Polycom acquisition. GAAP net revenues were negatively impacted by $37 million of purchase accounting adjustments made at the time of the Polycom acquisition under U.S. GAAP. The revenue guidance range provided to investors on August 7, 2018, excluded the impact of purchase accounting. Adjusting for the purchase accounting impact, net revenues for the second fiscal quarter were within the guidance range of $500 million to $530 million. |

• | GAAP gross margin was 31.6% compared with 51.2%. |

◦ | Non-GAAP gross margin was 49.7% compared with 51.6%. Excluding the revenue impact of purchase accounting adjustments, which reduced gross margins by 3.5%, comparative gross margins were within the long-term target range of 52% - 54%. |

• | GAAP operating income was $(86.0) million compared with $30.2 million. |

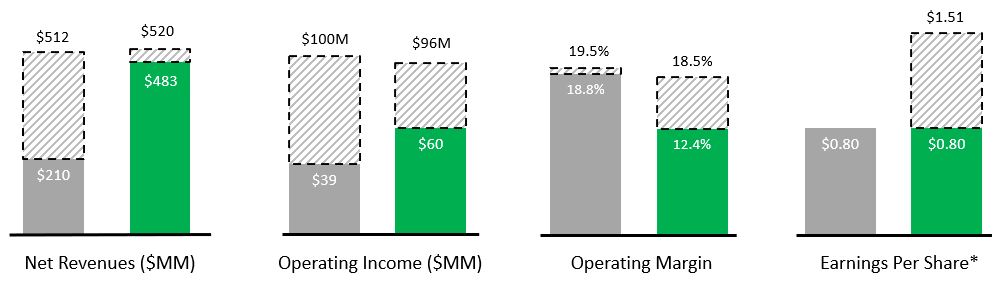

◦ | Non-GAAP operating income was $59.7 million compared with $39.4 million. Excluding the revenue impact of purchase accounting adjustments, operating income was above the guidance range for the quarter of $74 million to $86 million. |

• | GAAP diluted earnings per share ("EPS") were $(2.21) compared with $0.59. |

◦ | Non-GAAP diluted EPS was $0.80, flat to the prior year quarter. Excluding the revenue impact of purchase accounting adjustments, which reduced non-GAAP diluted EPS by $0.71, non-GAAP diluted EPS were above the guidance range for the quarter of $1.00 to $1.25. |

Performance Against August 7, 2018 Guidance

Q2 FY19 Non-GAAP Adjusted for Purchase Accounting | Q2 FY19 Guidance Range | |

Net Revenue | $520M | $500M - $530M |

Operating Income | $96M | $74M - $86M |

Diluted EPS | $1.51 | $1.00 - $1.25 |

Results in the above table are shown on a non-GAAP basis, excluding purchase accounting adjustments, which is consistent with the guidance issued in the Business Outlook section of the August 7, 2018 earnings press release. For further information on reconciling these results to Plantronics GAAP results for the quarter refer to the Revenue Adjustment section below.

Year-over-year GAAP Results

1

Year-over-year Non-GAAP and Combined Comparative Results*

*To provide results on a comparative basis, Plantronics combined comparative results for the current period adjust our non-GAAP results to exclude purchase accounting adjustments made to net revenue at the time of the Polycom acquisition under U.S. GAAP. For the prior period, combined comparative results include both Plantronics and Polycom non-GAAP results reported in the period. Due to lack of comparability in foreign currency derivatives, interest expense, effective tax rate, and diluted weighted average shares, the Company has not provided historical combined comparative diluted earnings per share. See the tables in the Revenue Adjustment section below and at the end of this press release for the reconciliation of GAAP to non-GAAP and combined comparative results.

Revenue Adjustment

As part of the purchase accounting adjustments made at the time of the acquisition of Polycom under U.S. GAAP, net revenues were reduced by $37 million related to fair value adjustments to deferred revenue. The table below illustrates the impact of non-GAAP and combined comparative adjustments to the condensed consolidated statement of operations:

Reconciliation of GAAP to Non-GAAP Further Adjusted for Purchase Accounting

GAAP | Purchase Accounting Amortization | Inventory Valuation Adjustments | Acquisition and Integration Fees | Stock-based Compensation | Restructuring and other related charges | Tax Items and diluted shares | Non-GAAP | Revenue purchase accounting adjustments | Non-GAAP as further adjusted for purchase accounting | ||||||||||||||

Net revenues | $ | 483,069 | — | — | — | — | — | — | $ | 483,069 | 36,585 | $ | 519,654 | ||||||||||

Gross profit | $ | 152,629 | 55,668 | 30,395 | 217 | 1,073 | — | — | $ | 239,982 | 36,585 | $ | 276,567 | ||||||||||

Gross margin | 31.6 | % | 49.7 | % | 53.2 | % | |||||||||||||||||

Operating Profit | $ | (85,976 | ) | 70,947 | 30,395 | 26,253 | 10,840 | 7,261 | — | $ | 59,720 | 36,585 | $ | 96,305 | |||||||||

Operating margin | (17.8 | )% | 12.4 | % | 18.5 | % | |||||||||||||||||

Diluted EPS | $ | (2.21 | ) | 1.78 | 0.76 | 0.66 | 0.27 | 0.18 | (0.64 | ) | $ | 0.80 | 0.71 | $ | 1.51 | ||||||||

When reviewing the financial results presented herein, management believes that investors should consider the above impacts in order to better understand the performance of the business and comparability of results, especially in light of the purchase of Polycom and the related significant impact on the company’s financial statements and results of operations.

2

Highlights for the Second Quarter of Fiscal Year 2019

“The combined company delivered solid results above the midpoint of our guidance in our first consolidated quarter,” stated Joe Burton, President and Chief Executive Officer. "We believe that these results demonstrate the very beginning of our compelling opportunity as a combined company, driven by unified communications. As we integrate and bring new products to market, leveraging our combined strengths, we further believe that we are positioning the company for both near-term and long-term success."

"We are executing well as we bring the two organizations together, capturing synergies by integrating both the systems and

functions while still delivering on our business objectives," stated Pam Strayer, Executive Vice President and Chief Financial Officer. "The integration continues on track and our initial results as a combined company validate the leverage inherent in the model."

• | The company announced the Polycom VVX x50 series of business SIP phones providing significant advancements in price/performance with robust features and great value. These next-generation models, coupled with Polycom Device Management Service for Service Providers (PDMS-SP), our cloud-based device management and analytics platform, provide real opportunities for ITSPs worldwide to offers world-class phones to their end customers with the ability to centrally manage, provision, and troubleshoot. |

• | At Microsoft Ignite, the largest Microsoft user conferences, Plantronics announced Elara, a smart phone workstation for mobile-first worker. Elara creates a new level of productivity for workers and comes with one-touch Microsoft Teams integration, a built-in dial pad, convenient headset integration, and can be configured with a wireless charging pad, speakerphone, and handset. |

• | The company announced the largest consumer headset product launch in our company's history. These eight new headsets, including the Backbeat Fit 3100, Plantronics first truly wireless sport headset, address the needs of runners, travelers, and gamers with the audio quality and durability that they have come to expect from Plantronics. |

Plantronics Announces Quarterly Dividend of $0.15

The Plantronics Board of Directors has declared a quarterly cash dividend of $0.15 per common share, to be paid on December 10, 2018, to all shareholders of record as of the close of market on November 20, 2018.

Business Outlook

The following statements are based on the Company's current expectations, and many of these statements are forward-looking. Actual results are subject to a variety of risks and uncertainties and may differ materially from our expectations.

We currently expect the following range of financial results for the third quarter of Fiscal Year 2019 (all amounts assuming currency rates remain stable):

• | GAAP net revenues of $481 million to $511 million, which are reduced by $29 million due to purchase accounting adjustments; |

◦ | Non-GAAP operating income of $50 million to $65 million, which is reduced by $29 million due to purchase accounting adjustments; |

• | Assuming a non-GAAP tax rate of 19% and approximately 40 million diluted average weighted shares outstanding: |

◦ | Non-GAAP diluted EPS of $0.53 to $0.78, which are reduced by $0.57 due to the after-tax effect of $29 million of purchase accounting adjustments. |

With respect to our operating income and diluted EPS guidance, we have determined that we are unable to provide quantitative reconciliations of these forward-looking non-GAAP measures to the most directly comparable forward-looking GAAP measures with a reasonable degree of confidence in their accuracy without unreasonable effort, as items including stock based compensation, litigation gains and losses, and impacts from discrete tax adjustments and tax laws are inherently uncertain and depend on various factors, many of which are beyond our control.

Our business is inherently difficult to forecast, particularly with continuing uncertainty in regional economic conditions, currency fluctuations, customer cancellations and rescheduling, and there can be no assurance that expectations of incoming orders over the balance of the current quarter will materialize.

3

Conference Call and Prepared Remarks

Plantronics is providing an earnings overview in combination with its press release. The overview is offered to provide shareholders and analysts with additional detail for analyzing results in advance of our quarterly conference call. The overview will be available in the Investor Relations section of our corporate website at investor.plantronics.com along with this press release. A reconciliation of our GAAP to non-GAAP and historical combined comparative results is provided in the tables above and at the end of this press release.

We have scheduled a conference call to discuss second quarter of Fiscal Year 2019 financial results. The conference call will take place today, November 6, 2018, at 2:00 PM (Pacific Time). All interested investors and potential investors in our stock are invited to participate. To listen to the call, please dial in five to ten minutes prior to the scheduled starting time and refer to the “Plantronics Conference Call.” The dial-in from North America is (888) 301-8736 and the international dial-in is (706) 634-7260.

The conference call will also be simultaneously webcast in the Investor Relations section of our website. A replay of the call with the conference ID #55437193 will be available until January 5, 2019 at (855) 859-2056 for callers from North America and at (404) 537-3406 for all other callers.

Use of Non-GAAP and Combined Comparative Financial Information

To supplement our condensed consolidated financial statements presented on a GAAP basis, we use non-GAAP, and where applicable, combined comparative measures of operating results, including non-GAAP gross profit, non-GAAP operating income, non-GAAP net income and non-GAAP diluted EPS, which exclude certain unusual or non-cash expenses and charges that are included in the most directly comparable GAAP measure. These unusual or non-cash expenses and charges include stock-based compensation, acquisition related expenses, purchase accounting amortization and adjustments, restructuring and other related charges and credits, asset impairments, executive transition charges, and the impact of participating securities, all net of any associated tax impact. We also exclude tax benefits from the release of tax reserves, discrete tax adjustments including transfer pricing, tax deduction and tax credit adjustments, and the impact of tax law changes. We exclude these expenses from our non-GAAP and combined comparative measures primarily because management does not believe they are part of our target operating model. We believe that the use of non-GAAP and combined comparative financial measures provides meaningful supplemental information regarding our performance and liquidity and helps investors compare actual results with our long-term target operating model goals. We believe that both management and investors benefit from referring to these non-GAAP and combined comparative financial measures in assessing our performance and when planning, forecasting and analyzing future periods; however, non-GAAP and combined comparative financial measures are not meant to be considered in isolation of, or as a substitute for, or superior to, gross margin, operating income, operating margin, net income or EPS prepared in accordance with GAAP.

Safe Harbor

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements relating to: (i) our expectations regarding near and long-term success based on the integration of Polycom and prospects for the products developed; (ii) estimates of GAAP and non-GAAP financial results for the third quarter of Fiscal Year 2019, including net revenues, purchase accounting adjustments, operating income, tax rates, and diluted weighted average shares outstanding and diluted EPS;, in addition to other matters discussed in this press release that are not purely historical data. We do not assume any obligation to update or revise any such forward-looking statements, whether as the result of new developments or otherwise.

Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those contemplated by such statements. Among the factors that could cause actual results to differ materially from those contemplated are:

• | Micro and macro-economic conditions in our domestic and international markets; |

• | our ability to realize and achieve positive financial results projected to arise in the Enterprise market from UC&C adoption could be adversely affected by a variety of factors including the following: (i) as UC&C becomes more widely adopted, the risk that competitors will offer solutions that will effectively commoditize our products which, in turn, will reduce the sales prices for those products; (ii) our plans are dependent upon adoption of our UC&C solution by major platform providers and strategic partners such as Microsoft Corporation, Cisco Systems, Inc., Avaya, Inc., Alcatel-Lucent, and Huawei, and our influence over such providers with respect to the functionality of their platforms or their product offerings, their rate of deployment, and their willingness to integrate their platforms and product offerings with our solutions is limited; (iii) delays or limitations on our ability to timely introduce solutions that are cost effective, feature-rich, stable, and attractive to our customers within forecasted development budgets; (iv) our successful implementation and execution of new and different processes involving the design, development, and manufacturing of complex |

4

electronic systems composed of hardware, firmware, and software that works seamlessly and continuously in a wide variety of environments and with multiple devices; (v) failure of UC&C solutions generally, or our solutions in particular, to be adopted with the breadth and speed we anticipate; (vi) our sales model and expertise must successfully evolve to support complex integration of hardware, software, and services with UC&C infrastructure consistent with changing customer purchasing expectations; (vii) as UC&C becomes more widely adopted we anticipate that competition for market share will increase, particularly given that some competitors may have superior technical and economic resources; (viii) sales cycles for more complex UC&C deployments are longer as compared to our traditional Enterprise products; (ix) our inability to timely and cost-effectively adapt to changing business requirements may impact our profitability in this market and our overall margins; and (x) our failure to expand our technical support capabilities to support the complex and proprietary platforms in which our UC&C products are and will be integrated;

• | regarding the Polycom acquisition: (i) we may be unable to integrate Polycom's business within our own in a timely and cost-efficient manner or do so without adversely impacting operations, including new product launches; (ii) expected synergies or operating efficiencies may fail to materialize in whole or part or may not occur within expected time-frames; (iii) the acquisition may adversely impact ours or Polycom's relationships with respective customers, suppliers and strategic partners and their operating results and businesses generally (including the diversion of management time on transaction-related issues); (iv) each company may be unable to retain and hire all or a portion of their respective key personnel; (v) legal and regulatory enforcement matters that are pending at Polycom may adversely impact the results of the combined company; (vi) our increased leverage as a result of the transaction will be substantially greater than prior to the acquisition which may pose risks, including reduced flexibility to make changes in our operations in response to business or economic conditions, increased borrowing costs, as well as penalties or costs should we fail to comply with terms of the financial agreements such as debt ratios and financial and operation performance targets; (vii) negative effects on the market price of our common stock as a result of the transaction, particularly in light of the issuance of our stock in the transaction; (viii) our financial reporting including those resulting from the adoption of new accounting pronouncements and associated system implementations in the context of the transaction, our ability to forecast financial results of the combined company and that we may be unable to successfully integrate our reporting system causing an adverse impact to our ability to make timely and accurate filings with the SEC and other domestic and foreign governmental agencies; (ix) the potential impact of the transaction on our future tax rate and payments based on the consolidation global entity and our ability to quickly integrate foreign operations; (x) the challenges of integrating the supply chains of the two companies; and (xi) the potential that our due diligence did not uncover risks and potential liabilities of Polycom; |

• | failure to match production to demand given long lead times and the difficulty of forecasting unit volumes and acquiring the component parts and materials to meet demand without having excess inventory or incurring cancellation charges; |

• | volatility in prices from our suppliers, including our manufacturers located in China, have in the past and could in the future negatively affect our profitability and/or market share; |

• | fluctuations in foreign exchange rates; |

• | new or greater tariffs on our products; |

• | with respect to our stock repurchase program, prevailing stock market conditions generally, and the price of our stock specifically; |

• | the bankruptcy or financial weakness of distributors or key customers, or the bankruptcy of or reduction in capacity of our key suppliers; |

• | additional risk factors including: interruption in the supply of sole-sourced critical components, continuity of component supply at costs consistent with our plans, and the inherent risks of our substantial foreign operations; and |

• | seasonality in one or more of our product categories. |

For more information concerning these and other possible risks, please refer to our Annual Report on Form 10-K filed with the Securities and Exchange Commission on May 9, 2018 and other filings with the Securities and Exchange Commission, as well as recent press releases. The Securities and Exchange Commission filings can be accessed over the Internet at http://www.sec.gov/edgar/searchedgar/companysearch.html.

Financial Summaries

The following related charts are provided:

• |

• |

• |

About Plantronics

Plantronics is an audio pioneer and a leader in the communications industry. Plantronics technology creates rich, natural, people-first audio and collaboration experiences so good ideas can be shared and heard-wherever, whenever and however they happen.

5

The company’s portfolio of integrated communications and collaboration solutions spans headsets, software, desk phones, audio and video conferencing, analytics and services. Our solutions are used worldwide by consumers and businesses alike and are the leading choice for every kind of workspace. For more information visit plantronics.com.

Plantronics and Polycom are registered trademarks of Plantronics, Inc. The Bluetooth name and the Bluetooth trademarks are owned by Bluetooth SIG, Inc. and are used by Plantronics, Inc. under license. All other trademarks are the property of their respective owners.

PLANTRONICS, INC. / 345 Encinal Street / P.O. Box 1802 / Santa Cruz, California 95060

831-426-6060 / Fax 831-426-6098

PLANTRONICS, INC. | |||||||||||||||||

SUMMARY CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | |||||||||||||||||

($ in thousands, except per share data) | |||||||||||||||||

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS | |||||||||||||||||

Three Months Ended | Six Months Ended | ||||||||||||||||

September 30, | September 30, | ||||||||||||||||

2017 | 2018 | 2017 | 2018 | ||||||||||||||

Net Revenues: | |||||||||||||||||

Net product revenues | $ | 210,300 | $ | 435,262 | $ | 414,226 | $ | 656,571 | |||||||||

Net services revenues | — | 47,807 | — | 47,807 | |||||||||||||

Total net revenues | 210,300 | 483,069 | 414,226 | 704,378 | |||||||||||||

Cost of revenues: | |||||||||||||||||

Cost of product revenues | 102,668 | 305,477 | 203,311 | 416,943 | |||||||||||||

Cost of service revenues | — | 24,963 | — | 24,963 | |||||||||||||

Total cost of revenues | 102,668 | 330,440 | 203,311 | 441,906 | |||||||||||||

Gross profit | 107,632 | 152,629 | 210,915 | 262,472 | |||||||||||||

Gross profit % | 51.2 | % | 31.6 | % | 50.9 | % | 37.3 | % | |||||||||

Operating expenses: | |||||||||||||||||

Research, development, and engineering | 19,932 | 57,047 | 41,145 | 80,748 | |||||||||||||

Selling, general, and administrative | 57,696 | 174,297 | 113,929 | 238,500 | |||||||||||||

(Gain) loss, net from litigation settlements | (104 | ) | — | (280 | ) | (30 | ) | ||||||||||

Restructuring and other related charges (credits) | (51 | ) | 7,261 | 2,522 | 8,581 | ||||||||||||

Total operating expenses | 77,473 | 238,605 | 157,316 | 327,799 | |||||||||||||

Operating income | 30,159 | (85,976 | ) | 53,599 | (65,327 | ) | |||||||||||

Operating income % | 14.3 | % | (17.8 | )% | 12.9 | % | (9.3 | )% | |||||||||

Interest expense | (7,260 | ) | (23,893 | ) | (14,563 | ) | (31,220 | ) | |||||||||

Other non-operating income, net | 1,826 | 1,610 | 2,740 | 3,606 | |||||||||||||

Income before income taxes | 24,725 | (108,259 | ) | 41,776 | (92,941 | ) | |||||||||||

Income tax expense (benefit) | 4,772 | (21,550 | ) | 2,995 | (20,703 | ) | |||||||||||

Net income (loss) | $ | 19,953 | $ | (86,709 | ) | $ | 38,781 | $ | (72,238 | ) | |||||||

% of net revenues | 9.5 | % | (17.9 | )% | 9.4 | % | (10.3 | )% | |||||||||

Earnings per common share: | |||||||||||||||||

Basic | $ | 0.59 | $ | (2.21 | ) | $ | 1.16 | $ | (2.01 | ) | |||||||

Diluted | $ | 0.59 | $ | (2.21 | ) | $ | 1.14 | $ | (2.01 | ) | |||||||

Shares used in computing earnings per common share: | |||||||||||||||||

Basic | 32,570 | 39,281 | 32,538 | 35,938 | |||||||||||||

Diluted | 32,809 | 39,281 | 33,111 | 35,938 | |||||||||||||

Effective tax rate | 19.3 | % | (19.9 | )% | 7.2 | % | (22.3 | )% | |||||||||

6

PLANTRONICS, INC. | |||||||||

SUMMARY CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | |||||||||

($ in thousands) | |||||||||

UNAUDITED CONSOLIDATED BALANCE SHEETS | |||||||||

March 31, | September 30, | ||||||||

2018 | 2018 | ||||||||

ASSETS | |||||||||

Cash and cash equivalents | $ | 390,661 | $ | 291,086 | |||||

Short-term investments | 269,313 | 14,705 | |||||||

Total cash, cash equivalents, and short-term investments | 659,974 | 305,791 | |||||||

Accounts receivable, net | 152,888 | 354,066 | |||||||

Inventory, net | 68,276 | 156,908 | |||||||

Other current assets | 18,588 | 57,584 | |||||||

Total current assets | 899,726 | 874,349 | |||||||

Property, plant, and equipment, net | 142,129 | 216,802 | |||||||

Goodwill | 15,498 | 1,334,534 | |||||||

Purchased intangibles, net | — | 914,455 | |||||||

Deferred tax assets | 17,950 | 5,320 | |||||||

Other assets | 1,584 | 24,647 | |||||||

Total assets | $ | 1,076,887 | $ | 3,370,107 | |||||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||||

Accounts payable | $ | 45,417 | $ | 149,917 | |||||

Accrued liabilities | 80,097 | 407,777 | |||||||

Total current liabilities | 125,514 | 557,694 | |||||||

Long-term debt, net of issuance costs | 492,509 | 1,726,241 | |||||||

Deferred tax liability | 1,976 | 115,887 | |||||||

Long-term income taxes payable | 87,328 | 95,228 | |||||||

Other long-term liabilities | 16,590 | 84,997 | |||||||

Total liabilities | 723,917 | 2,580,047 | |||||||

Stockholders' equity | 352,970 | 790,060 | |||||||

Total liabilities and stockholders' equity | $ | 1,076,887 | $ | 3,370,107 | |||||

7

PLANTRONICS, INC. | |||||||||||||||||

SUMMARY CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | |||||||||||||||||

($ in thousands, except per share data) | |||||||||||||||||

UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS | |||||||||||||||||

Three Months Ended | Six Months Ended | ||||||||||||||||

September 30, | September 30, | ||||||||||||||||

2017 | 2018 | 2017 | 2018 | ||||||||||||||

Cash flows from operating activities | |||||||||||||||||

Net Income | $ | 19,953 | $ | (86,709 | ) | $ | 38,781 | $ | (72,238 | ) | |||||||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||||

Depreciation and amortization | 5,361 | 82,398 | 10,743 | 87,646 | |||||||||||||

Amortization of debt issuance cost | 363 | 1,407 | 725 | 1,769 | |||||||||||||

Stock-based compensation | 8,762 | 10,840 | 18,018 | 18,990 | |||||||||||||

Deferred income taxes | (2,222 | ) | (32,322 | ) | 4,384 | (27,690 | ) | ||||||||||

Provision for excess and obsolete inventories | 371 | 2,196 | 900 | 2,808 | |||||||||||||

Restructuring charges (credits) | (51 | ) | 7,261 | 2,522 | 8,581 | ||||||||||||

Cash payments for restructuring charges | (524 | ) | (6,560 | ) | (2,429 | ) | (7,395 | ) | |||||||||

Other operating activities | (1,644 | ) | 9,284 | (1,141 | ) | 9,010 | |||||||||||

Changes in assets and liabilities: | |||||||||||||||||

Accounts receivable, net | (5,219 | ) | (29,165 | ) | 1,246 | (23,863 | ) | ||||||||||

Inventory, net | (3,603 | ) | 16,780 | (5,844 | ) | 16,380 | |||||||||||

Current and other assets | (1,835 | ) | (61,439 | ) | (4,539 | ) | (58,458 | ) | |||||||||

Accounts payable | 2,216 | 14,939 | 3,205 | 20,627 | |||||||||||||

Accrued liabilities | 9,079 | 46,805 | (9,388 | ) | 39,505 | ||||||||||||

Income taxes | 5,401 | 64,753 | (7,890 | ) | 56,878 | ||||||||||||

Cash provided by operating activities | $ | 36,408 | $ | 40,468 | $ | 49,293 | $ | 72,550 | |||||||||

Cash flows from investing activities | |||||||||||||||||

Proceeds from sale of investments | 9,324 | — | 30,895 | 124,640 | |||||||||||||

Proceeds from maturities of investments | 48,363 | — | 106,661 | 131,017 | |||||||||||||

Purchase of investments | (50,670 | ) | (142 | ) | (133,949 | ) | (536 | ) | |||||||||

Acquisitions, net of cash acquired | — | (1,616,692 | ) | — | (1,650,242 | ) | |||||||||||

Capital expenditures | (3,705 | ) | (3,667 | ) | (6,752 | ) | (7,535 | ) | |||||||||

Cash provided by (used for) investing activities | $ | 3,312 | $ | (1,620,501 | ) | $ | (3,145 | ) | $ | (1,402,656 | ) | ||||||

Cash flows from financing activities | |||||||||||||||||

Repurchase of common stock | (25,730 | ) | — | (39,222 | ) | — | |||||||||||

Employees' tax withheld and paid for restricted stock and restricted stock units | (304 | ) | (307 | ) | (10,789 | ) | (13,342 | ) | |||||||||

Proceeds from issuances under stock-based compensation plans | 2,746 | 4,314 | 11,950 | 14,872 | |||||||||||||

Proceeds from debt issuance, net | — | 1,244,713 | — | 1,244,713 | |||||||||||||

Payment of cash dividends | (5,043 | ) | (5,968 | ) | (10,057 | ) | (10,982 | ) | |||||||||

Cash provided by (used for) financing activities | $ | (28,331 | ) | $ | 1,242,752 | $ | (48,118 | ) | $ | 1,235,261 | |||||||

Effect of exchange rate changes on cash and cash equivalents | 1,243 | (2,675 | ) | 3,116 | (4,730 | ) | |||||||||||

Net increase in cash and cash equivalents | 12,632 | (339,956 | ) | 1,146 | (99,575 | ) | |||||||||||

Cash and cash equivalents at beginning of period | 290,484 | 631,042 | 301,970 | 390,661 | |||||||||||||

Cash and cash equivalents at end of period | $ | 303,116 | $ | 291,086 | $ | 303,116 | $ | 291,086 | |||||||||

8

PLANTRONICS, INC. | ||||||||||||||||

UNAUDITED RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES | ||||||||||||||||

($ in thousands, except per share data) | ||||||||||||||||

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA | ||||||||||||||||

Three Months Ended | Six Months Ended | |||||||||||||||

September 30, | September 30, | |||||||||||||||

2017 | 2018 | 2017 | 2018 | |||||||||||||

GAAP Gross profit | $ | 107,632 | $ | 152,629 | $ | 210,915 | $ | 262,472 | ||||||||

Purchase accounting amortization | — | 55,668 | — | 55,668 | ||||||||||||

Inventory valuation adjustment | — | 30,395 | — | 30,395 | ||||||||||||

Acquisition and integration fees | — | 217 | — | 217 | ||||||||||||

Stock-based compensation | 890 | 1,073 | 1,792 | 2,036 | ||||||||||||

Loss on sale of assets | — | — | 899 | — | ||||||||||||

Impairment of indirect tax asset | — | — | 686 | — | ||||||||||||

Non-GAAP Gross profit | $ | 108,522 | $ | 239,982 | $ | 214,292 | $ | 350,788 | ||||||||

Non-GAAP Gross profit % | 51.6 | % | 49.7 | % | 51.7 | % | 49.8 | % | ||||||||

GAAP Research, development, and engineering | $ | 19,932 | $ | 57,047 | $ | 41,145 | $ | 80,748 | ||||||||

Stock-based compensation | (2,008 | ) | (2,768 | ) | (4,109 | ) | (4,990 | ) | ||||||||

Acquisition and integration fees | — | (56 | ) | — | (56 | ) | ||||||||||

Purchase accounting amortization | (17 | ) | — | (80 | ) | — | ||||||||||

Non-GAAP Research, development, and engineering | $ | 17,907 | $ | 54,223 | $ | 36,956 | $ | 75,702 | ||||||||

GAAP Selling, general, and administrative | $ | 57,696 | $ | 174,297 | $ | 113,929 | $ | 238,500 | ||||||||

Acquisition and integration fees | — | (25,980 | ) | — | (31,783 | ) | ||||||||||

Purchase accounting amortization | — | (15,279 | ) | — | (15,279 | ) | ||||||||||

Stock-based compensation | (5,864 | ) | (6,999 | ) | (12,117 | ) | (11,964 | ) | ||||||||

Executive transition costs | (549 | ) | — | (549 | ) | — | ||||||||||

Non-GAAP Selling, general, and administrative | $ | 51,283 | $ | 126,039 | $ | 101,263 | $ | 179,474 | ||||||||

GAAP Operating expenses | $ | 77,473 | $ | 238,605 | $ | 157,316 | $ | 327,799 | ||||||||

Acquisition and integration fees | — | (26,036 | ) | — | (31,839 | ) | ||||||||||

Purchase accounting amortization | (17 | ) | (15,279 | ) | (80 | ) | (15,279 | ) | ||||||||

Stock-based compensation | (7,872 | ) | (9,767 | ) | (16,226 | ) | (16,954 | ) | ||||||||

Executive transition costs | (549 | ) | — | (549 | ) | — | ||||||||||

Restructuring and other related (charges) credits | 51 | (7,261 | ) | (2,522 | ) | (8,581 | ) | |||||||||

Non-GAAP Operating expenses | $ | 69,086 | $ | 180,262 | $ | 137,939 | $ | 255,146 | ||||||||

9

PLANTRONICS, INC. | |||||||||||||||||||

UNAUDITED RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP MEASURES | |||||||||||||||||||

($ in thousands, except per share data) | |||||||||||||||||||

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA (CONTINUED) | |||||||||||||||||||

Three Months Ended | Six Months Ended | ||||||||||||||||||

September 30, | September 30, | ||||||||||||||||||

2017 | 2018 | 2017 | 2018 | ||||||||||||||||

GAAP Operating income | $ | 30,159 | $ | (85,976 | ) | $ | 53,599 | $ | (65,327 | ) | |||||||||

Purchase accounting amortization | 17 | 70,947 | 80 | 70,947 | |||||||||||||||

Inventory valuation adjustment | — | 30,395 | — | 30,395 | |||||||||||||||

Acquisition and integration fees | — | 26,253 | — | 32,056 | |||||||||||||||

Stock-based compensation | 8,762 | 10,840 | 18,018 | 18,990 | |||||||||||||||

Restructuring and other related charges (credits) | (51 | ) | 7,261 | 2,522 | 8,581 | ||||||||||||||

Loss on sale of assets | — | — | 899 | — | |||||||||||||||

Impairment of indirect tax asset | — | — | 686 | — | |||||||||||||||

Executive transition costs | 549 | — | 549 | — | |||||||||||||||

Non-GAAP Operating income | $ | 39,436 | $ | 59,720 | $ | 76,353 | $ | 95,642 | |||||||||||

GAAP Net income | $ | 19,953 | $ | (86,709 | ) | $ | 38,781 | $ | (72,238 | ) | |||||||||

Purchase accounting amortization | 17 | 70,947 | 80 | 70,947 | |||||||||||||||

Inventory valuation adjustment | — | 30,395 | — | 30,395 | |||||||||||||||

Acquisition and integration fees | — | 26,253 | — | 32,056 | |||||||||||||||

Stock-based compensation | 8,762 | 10,840 | 18,018 | 18,990 | |||||||||||||||

Restructuring and other related charges (credits) | (51 | ) | 7,261 | 2,522 | 8,581 | ||||||||||||||

Loss on sale of assets | — | — | 899 | — | |||||||||||||||

Impairment of indirect tax asset | — | — | 686 | — | |||||||||||||||

Executive transition costs | 549 | — | 549 | — | |||||||||||||||

Income tax effect of above items | (3,066 | ) | (25,736 | ) | (8,511 | ) | (30,602 | ) | |||||||||||

Income tax effect of unusual tax items | — | (1,260 | ) | (2 | ) | (3,661 | ) | (1 | ) | (1,359 | ) | 2 | |||||||

Non-GAAP Net income | $ | 26,164 | $ | 31,991 | $ | 49,363 | $ | 56,770 | |||||||||||

GAAP Diluted earnings per common share | $ | 0.59 | $ | (2.21 | ) | $ | 1.14 | $ | (2.01 | ) | |||||||||

Purchase accounting amortization | — | 1.78 | — | 1.93 | |||||||||||||||

Inventory valuation adjustment | — | 0.76 | — | 0.83 | |||||||||||||||

Stock-based compensation | 0.27 | 0.27 | 0.54 | 0.52 | |||||||||||||||

Acquisition related fees | — | 0.66 | — | 0.87 | |||||||||||||||

Restructuring and other related charges (credits) | — | 0.18 | 0.08 | 0.23 | |||||||||||||||

Executive transition costs | 0.02 | — | 0.02 | — | |||||||||||||||

Loss on sale of assets | — | — | 0.03 | — | |||||||||||||||

Impairment of indirect tax asset | — | — | 0.02 | — | |||||||||||||||

Income tax effect | (0.10 | ) | (0.68 | ) | (0.37 | ) | (0.87 | ) | |||||||||||

Effect of participating securities | 0.02 | — | 0.03 | — | |||||||||||||||

Effect of anti-dilutive securities | — | 0.04 | — | 0.04 | |||||||||||||||

Non-GAAP Diluted earnings per common share | $ | 0.80 | $ | 0.80 | $ | 1.49 | $ | 1.54 | |||||||||||

Shares used in diluted earnings per common share calculation: | |||||||||||||||||||

GAAP | 32,809 | 39,281 | 33,111 | 35,938 | |||||||||||||||

non-GAAP | 32,809 | 39,920 | 33,111 | 36,795 | |||||||||||||||

1 | Excluded amounts represent tax benefits resulting from the correction of an immaterial error in the first quarter and the release of tax reserves. |

2 | Excluded amounts represent tax benefits resulting from the release of tax reserves and tax return true-ups |

10

PLANTRONICS, INC. | ||||

UNAUDITED RECONCILIATIONS OF GAAP MEASURES TO NON-GAAP COMBINED MEASURES | ||||

($ in millions) | ||||

UNAUDITED CONSOLIDATED STATEMENTS OF OPERATIONS DATA | ||||

Three Months Ended | ||||

September 30, | ||||

2017 | ||||

Enterprise Headsets | $ | 162.9 | ||

Consumer Headsets | 47.4 | |||

Voice* | 113.6 | |||

Video* | 107.7 | |||

Services* | 80.5 | |||

Combined comparative net revenues | $ | 512.1 | ||

Plantronics GAAP Gross profit | $ | 107.6 | ||

Polycom GAAP gross profit** | 175.5 | |||

Combined comparative gross profit before adjustments | $ | 283.1 | ||

Stock-based compensation | 0.9 | |||

Combined comparative adjusted gross profit | $ | 284.0 | ||

Combined comparative adjusted gross profit % | 55.5 | % | ||

Plantronics GAAP Operating income | $ | 30.2 | ||

Polycom GAAP Operating income** | 57.9 | |||

Combined comparative operating profit before adjustments | $ | 88.1 | ||

Stock-based compensation | 7.9 | |||

Acquisition and integration fees | 0.5 | |||

Purchase accounting amortization | 0.7 | |||

Executive transition costs | 0.5 | |||

Restructuring and other related (charges) credits | 0.7 | |||

Non-recurring legal-related and other matters*** | 1.4 | |||

Combined adjusted operating income | $ | 99.8 | ||

Combined adjusted operating profit % | 19.5 | % | ||

* | Categories were introduced with the acquisition of Polycom on July 2, 2018. Historical Polycom revenues are shown here to arrive at combined comparative historical net revenues. |

** | Prepared in accordance with U.S. GAAP and Polycom's significant accounting policies as noted in Footnote 1. Basis of Presentation and Footnote 2. Summary of Significant Accounting Policies of exhibit 99.2 in form 8-K/A filed by Plantronics on August, 31, 2018. |

*** | Includes immaterial adjustments to conform historical results to Plantronics non-GAAP policy. |

11