Attached files

| file | filename |

|---|---|

| EX-10.11 - EXHIBIT 10.11 - PLANTRONICS INC /CA/ | ex1011fy17.htm |

| EX-31.2 - EXHIBIT 31.2 - PLANTRONICS INC /CA/ | ex312fy17.htm |

| EX-32.1 - EXHIBIT 32.1 - PLANTRONICS INC /CA/ | ex321fy17.htm |

| EX-31.1 - EXHIBIT 31.1 - PLANTRONICS INC /CA/ | ex311fy17.htm |

| EX-23.1 - EXHIBIT 23.1 - PLANTRONICS INC /CA/ | ex23fy17.htm |

| EX-21.1 - EXHIBIT 21.1 - PLANTRONICS INC /CA/ | ex21fy17.htm |

| EX-10.12 - EXHIBIT 10.12 - PLANTRONICS INC /CA/ | ex1012fy17.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MARK ONE)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended April 1, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to _____________

Commission file number: 1-12696

Plantronics, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 77-0207692 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

345 Encinal Street, Santa Cruz, California | 95060 | |

(Address of principal executive offices) | (Zip Code) | |

(831) 426-5858

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

COMMON STOCK, $0.01 PAR VALUE | NEW YORK STOCK EXCHANGE | |

Securities registered pursuant to Section 12(g) of the Act:

NONE

(Title of Class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one).

Large Accelerated Filer x | Accelerated Filer ¨ |

Non-accelerated Filer ¨ (Do not check if a smaller reporting company) | Smaller Reporting Company ¨ |

Emerging Growth Company ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates of the Registrant, based upon the closing price of $51.96 for shares of the Registrant's common stock on September 30, 2016, the last trading day of the Registrant’s most recently completed second fiscal quarter as reported by the New York Stock Exchange, was approximately $1,708,907,133. In calculating such aggregate market value, shares of common stock owned of record or beneficially by officers, directors, and persons known to the Registrant to own more than five percent of the Registrant's voting securities as of September 30, 2016 (other than such persons of whom the Registrant became aware only through the filing of a Schedule 13G filed with the Securities and Exchange Commission) were excluded because such persons may be deemed to be affiliates. This determination of affiliate status is for purposes of this calculation only and is not conclusive.

As of May 8, 2017, 33,437,423 shares of common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's Proxy Statement for its 2017 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended April 1, 2017.

Plantronics, Inc.

FORM 10-K

For the Year Ended March 31, 2017

TABLE OF CONTENTS

Part I. | Page | ||

Item 1. | |||

Item 1A. | |||

Item 1B. | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Part II. | |||

Item 5. | |||

Item 6. | |||

Item 7. | |||

Item 7A. | |||

Item 8. | |||

Item 9. | |||

Item 9A. | |||

Item 9B. | |||

Part III. | |||

Item 10. | |||

Item 11. | |||

Item 12. | |||

Item 13. | |||

Item 14. | |||

Part IV. | |||

Item 15. | |||

Plantronics®, Clarity®, and Simply Smarter Communications® are trademarks or registered trademarks of Plantronics, Inc.

DECT™ is a trademark of ETSI registered for the benefit of its members in France and other jurisdictions.

The Bluetooth name and the Bluetooth® trademarks are owned by Bluetooth SIG, Inc. and are used by Plantronics, Inc. under license.

All other trademarks are the property of their respective owners.

PART I

This Form 10-K is filed with respect to our Fiscal Year 2017. Each of our fiscal years ends on the Saturday closest to the last day of March. Fiscal years 2017 and 2015 each had 52 weeks and ended on April 1, 2017 and March 28, 2015, respectively. Fiscal Year 2016 had 53 weeks and ended on April 2, 2016. For purposes of consistent presentation, we have indicated in this report that each fiscal year ended "March 31" of the given year, even though the actual fiscal year end was on a different date.

CERTAIN FORWARD-LOOKING INFORMATION

This Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements may generally be identified by the use of such words as "expect," "anticipate," "believe," "estimate," "intend," "predict," "project," or "will," or variations of such words and similar expressions are based on current expectations and entail various risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of a number of factors, including, but not limited to, the factors discussed in the subsection entitled "Risk Factors" in Item 1A of this Form 10-K. This Form 10-K should be read in conjunction with these risk factors. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law.

ITEM 1. BUSINESS

COMPANY BACKGROUND

Plantronics, Inc. (“Plantronics,” “Company,” “we,” “our,” or “us”) is a leading global designer, manufacturer, and marketer of lightweight communications headsets, audio solutions, telephone headset systems, other communication endpoints, and accessories for the business and consumer markets under the Plantronics brand. We operate our business as one segment.

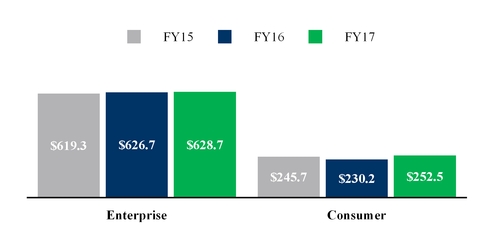

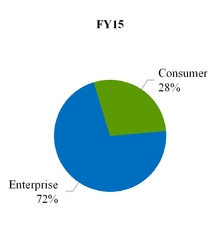

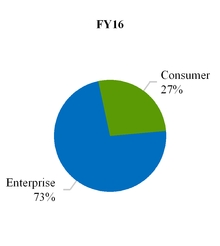

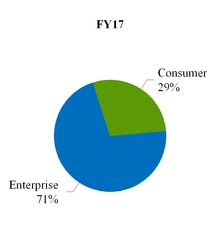

Our headsets are communications tools providing a hands-free connection to communication or entertainment devices, while also allowing freedom of movement for our users. We use a variety of technologies to develop high quality products that meet the needs of our customers, whether for communications or personal entertainment. Our headsets are widely used with applications such as Unified Communications (“UC”), in contact centers, in the office and in the home, with mobile devices and Internet telephony, for gaming, and for other specialty applications. Our major product categories include Enterprise, which includes corded and cordless communication headsets, audio processors, and telephone systems; and Consumer, which includes Bluetooth and corded products for mobile device applications, personal computer ("PC") and gaming headsets, and specialty products marketed for hearing impaired individuals (through our Clarity brand).

We ship our products to approximately 80 countries through a network of distributors, retailers, wireless carriers, original equipment manufacturers (“OEMs”), and telephony and other service providers. We have well-developed distribution channels in North America, Europe, and in some parts of the Asia Pacific region where use of our products is widespread. Our distribution channels in other geographic regions are less mature, and while we primarily serve the Enterprise markets in those regions, we continue to expand into mobile, gaming and computer audio, and specialty telephone categories in those regions and other international locations. While not always the case, revenues from our Consumer category are typically seasonal, with the third fiscal quarter typically being the strongest due to the holiday season.

Plantronics was founded and incorporated in 1961 and most recently became a public company in 1994. Plantronics is incorporated in the State of Delaware and is listed on the New York Stock Exchange ("NYSE") under the ticker symbol "PLT".

Our principal executive offices are located at 345 Encinal Street, Santa Cruz, California, 95060. Our telephone number is (831) 426-5858. Our Company website is www.plantronics.com.

In the Investor Relations section of our website, we provide access free of charge to the following filings: our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. This access is provided directly or through a link on our website, shortly after these documents are electronically filed with, or furnished to, the Securities and Exchange Commission. In addition, documents regarding our corporate governance and the charters of the standing committees of our Board of Directors are also accessible in the Investor Relations section of our website.

1

MARKET INFORMATION

General Industry Background

Plantronics operates predominantly in the electronics industry and focuses on the design, manufacture, and distribution of audio solutions for business and consumer applications, and other specialty products for the hearing impaired. We develop enhanced communication products for offices and contact centers, mobile devices, cordless phones, and computers and gaming consoles. We offer our products under two brands – Plantronics and Clarity.

The proliferation of voice communications applications across much of people's daily lives makes communications headsets a key driver of efficiency, ergonomic comfort, and safety for our users. The increased adoption of new and existing technologies, such as UC, Bluetooth, Voice over Internet Protocol ("VoIP"), Digital Signal Processing ("DSP"), and Digital Enhanced Cordless Telecommunications (“DECT™”), each of which is described below, has contributed to increased demand for our headsets and other audio solutions:

• | UC is the integration of voice, data, and video-based communications systems enhanced with software applications and IP networks. It may include the integration of devices and media associated with a variety of business workflows and applications, including e-mail, instant messaging, presence, audio, video conferencing, and unified messaging. UC seeks to provide seamless connectivity and user experience for enterprise workers regardless of their location and environment, improving overall business efficiency and providing more effective collaboration among an increasingly distributed workforce. |

• | Bluetooth wireless technology is a short-range communications protocol intended to replace the cables connecting portable and/or fixed devices while maintaining high levels of security. The key features of Bluetooth technology are ubiquity, low power, and low cost. The Bluetooth specification defines a uniform structure for a wide range of devices to connect and communicate with each other. Bluetooth standard has achieved global acceptance such that any Bluetooth enabled device, almost anywhere in the world, can connect to other Bluetooth enabled devices in proximity. |

• | VoIP is a technology that allows a person to communicate using a broadband Internet connection instead of a regular (or analog) telephone line. VoIP converts the voice signal into a digital signal that travels over the Internet or other packet-switched networks and then converts it back at the other end so that the caller can speak to anyone with another VoIP connection or a regular (or analog) phone line. |

• | DSP is a technology that delivers acoustic protection and optimal sound quality through noise reduction, echo cancellation, and other algorithms to improve both transmit and receive quality. |

• | DECT is a wireless communications technology that optimizes audio quality, lowers interference with other wireless devices, and is digitally encrypted for heightened call security. |

Solutions

UC solutions continue to represent our primary focus area. Our portfolio of solutions, which combines hardware with highly innovative sensor technology and software functionality, provides the ability to reach people using the mode of communication that is most effective, on the device that is most convenient, and with control over when and how they can be reached. For example, the advanced sensor technology in our UC solutions can detect a user's presence, including proximity to the user's PC and whether the headset is being worn, and can share this information with others to make them aware of the user's presence and availability. Using this same technology, our solutions can automatically pause audio applications during an incoming call, change the default audio selection to the user's headset, and then answer the call; all of this is achieved without manual intervention. Finally, our solutions allow users to transition calls seamlessly between PCs, smartphones, tablets, and desk phones, without interruption in the conversation or loss in audio quality. We believe we are early in the UC solutions market adoption cycle and that UC systems will become more commonly adopted by enterprises to reduce costs and improve collaboration. We believe our solutions will be an important part of the UC environment through the offering of contextual intelligence.

2

Our products enhance communications by providing the following benefits:

• | Sensor technology that allows calls to be answered automatically when the user attaches the headset, switches the audio from the headset to the mobile device when the user removes the headset and, with some softphone applications, updates the user's presence |

• | Smarter Working capability through seamless communications and high quality audio across a mobile device, desk phone, and PC, with a single audio endpoint thereby allowing users to communicate more flexibly from a wide array of physical locations and be more productive when away from a traditional office environment |

• | A convenient means for connecting between various applications and voice networks, whether between land lines and mobile devices, or between PC-based communications and other networks |

• | Better sound quality that provides clearer conversations on both ends of a call through a variety of features and technologies, including noise-canceling microphones, DSP, and more |

• | Wireless freedom, allowing people to take and make calls as they move freely without cords or cables around their office or home, or easily from public to private space when privacy is required |

• | Multi-tasking benefits that allow people to use computers and mobile devices, including smartphones or other devices, while talking hands-free |

• | UC integration of telephony, mobile technologies, cloud-based communications, and PC applications, and by providing greater privacy than traditional speakerphones |

• | Generating analytics related to headset usage, communications quality, conversational dynamics, and other similar data our customers desire |

• | Compliance with hands-free legislation and enhanced roadway safety by allowing users to have both hands free to drive while talking on a mobile phone |

• | Voice command and control that allow people to take advantage of voice dialing and/or other voice-based features to make communications and the human/electronic interface more natural and convenient |

Product Categories

Our audio solutions are designed to meet the needs of offices (ranging from enterprise to remote working), contact centers, mobile devices (such as mobile phones, smartphones, and tablets), computer and gaming, residential, and other specialty applications. These applications are increasingly overlapping as work styles and lifestyles change, and people use devices for multiple functions such as communication, music, and video entertainment. We serve these markets through our product categories listed below.

Enterprise

The Enterprise market comprises our largest revenue stream and we believe it also represents our largest revenue and profit growth opportunity. We offer a broad range of communications audio solutions, including high-end, ergonomically designed headsets, audio processors, and telephone systems. Our end-users comprise enterprise employees and small office, home office, and remote workers. Growth in this category comes from the following three main factors:

• | Increasing deployment of UC solutions |

• | Robust job market |

• | Growing awareness of the benefits of using headsets, including the benefits of wireless solutions |

Contact centers are some of the most mature customers and we expect contract center customer demand to grow slowly over the long-term. Contact centers have begun to adopt UC to help improve productivity and reduce costs. We expect this trend to continue. We develop audio endpoints tailored specifically to UC, and as UC adoption continues to increase, we expect to continue to lead in new product performance by creating solutions that combine hardware and software for an improved customer experience.

3

Consumer

We believe the mobile headset category will continue to grow as individuals use the technology for both communications and entertainment. The use of headsets designed for mobile devices represents a high volume opportunity and is our second largest revenue stream. The use of mono headsets typically used with mobile devices has experienced a sharp decline over the past year, while the use of stereo Bluetooth technology has increased as individuals want to remain wireless without compromising on stereo sound quality. Our mono and stereo Bluetooth mobile headsets merge technological innovations with style, because we believe that style has become as important as functionality in shaping consumers' purchasing decisions in the wearable technology space. While growth in the mono mobile headset market has slowed and continues to mature, we believe future growth in our Consumer category will be driven primarily by demand for stereo Bluetooth technology.

Gaming and computer audio headsets, whether used for interactive on-line or console gaming, or switching between music and phone calls for multi-functional devices, represent an emerging opportunity for us. As devices providing these users' needs converge, our headsets need to be compatible with PCs, mobile phones, tablets, gaming consoles, and various combinations of these. We believe our product development roadmaps address the convergence brought about by these needs and we are currently investing in this area to enable future growth.

FOREIGN OPERATIONS

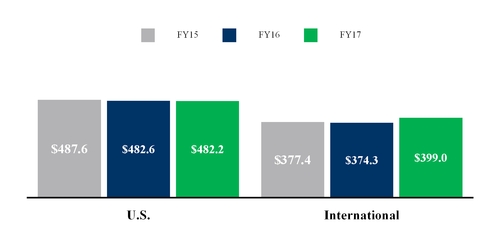

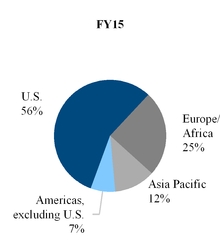

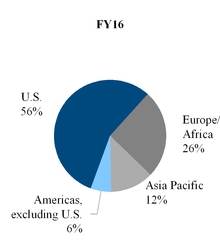

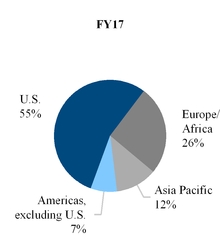

In Fiscal Years 2015, 2016, and 2017, net revenues outside the U.S. accounted for approximately 44%, 44%, and 45%, respectively, of our total net revenues. Revenues derived from foreign sales are generally subject to additional risks, such as fluctuations in exchange rates, increased tariffs, the imposition of other trade restrictions or barriers, the impact of adverse global economic conditions, and potential currency restrictions. In Fiscal Year 2017, the impacts due to unfavorable foreign exchange fluctuations were immaterial to our net revenues.

We continue to engage in hedging activities to limit our transaction and economic exposures, and to mitigate our exchange rate risks. We manage our economic exposure by hedging a portion of our anticipated Euro ("EUR") and British Pound Sterling ("GBP") denominated sales and our Mexican Peso ("MXN") denominated expenditures, which together constitute the most significant portion of our currency exposure. In addition, we manage our balance sheet exposure by hedging EUR, GBP, Australian Dollar ("AUD"), and Canadian Dollar ("CAD") denominated cash, accounts receivable, and accounts payable balances. Excess foreign currencies not required for local operations are converted into U.S. Dollars ("USD"). While our existing hedges cover a certain amount of exposure for Fiscal Year 2018, long-term strengthening of the USD relative to the currencies of other countries in which we sell may have a material adverse impact on our financial results. In addition, our results may be adversely impacted by future changes in foreign currency exchange rates relative to original hedging contracts generally secured 12 to 24 months prior. See further discussion on our business risks associated with foreign operations under the risk titled, "We are exposed to fluctuations in foreign currency exchange rates, which may adversely affect our revenues, gross profit, and profitability" within Item 1A Risk Factors in this Form 10-K.

Further information regarding our foreign operations, as required by Item 101(d) of Regulation S-K, can be found in Note 17, Geographic Information, of our Notes to Consolidated Financial Statements in this Form 10-K.

COMPETITION

The market for our products is very competitive and some of our competitors have greater financial resources than we do, as well as more substantial production, marketing, engineering and other capabilities to develop, manufacture, market, and sell their products.

One of our primary competitors is GN Netcom, a subsidiary of GN Store Nord A/S., a Danish telecommunications conglomerate that competes with us in the Enterprise and Consumer areas and, to a lesser extent, in the gaming and computer audio areas. In addition, Motorola, Samsung, and LG are significant competitors in the consumer mono Bluetooth headset category. Sennheiser Communications, and regional companies are competitors in the computer, office, and contact center categories, while Apple, Skullcandy, Logitech, Bose, and LG are competitors in the stereo Bluetooth headset category. In addition, Turtle Beach, Skullcandy, Logitech, and Razer are competitors in the gaming category.

4

We believe the principal factors to be successful and competitive in each of the markets we serve are as follows:

• | Understanding of emerging trends and new communication technologies, such as UC, and our ability to react quickly to the opportunities they provide |

• | Alliances and integration/compatibility with major UC vendors |

• | Ability to design, manufacture, and sell products that deliver on performance, style, comfort, features, sound quality, simplicity, price, and reliability |

• | Ability to create and monetize software solutions that provide analytics from headsets and allow business to improve IT and employee performance through insights derived from our analytics. |

• | Brand name recognition and reputation |

• | Superior global customer service, support, and warranty terms |

• | Effective and efficient global distribution channels |

• | Global reach |

We believe that our products and strategy enable us to compete based on these factors.

RESEARCH AND DEVELOPMENT

The success of our new product introductions is dependent on a number of factors, including appropriate new product selection, timely completion and introduction, cost-effective manufacturing, quality, acceptance of new technologies, and general market acceptance. See further discussion regarding our business risks associated with our manufacturers under the risk titled, "Our business will be materially adversely affected if we are unable to develop, manufacture, and market new products in response to changing customer requirements and new technologies" within Item 1A Risk Factors in this Form 10-K.

During Fiscal Years 2015, 2016, and 2017, we incurred approximately $91.6 million, $90.4 million, and $88.3 million, respectively, in research, development, and engineering expenses. Historically, we have conducted most of our research, development, and engineering with an in-house staff and the limited use of contractors. Key locations for our research, development, and engineering staff are in the U.S., Mexico, China, and the United Kingdom.

During Fiscal Year 2017, we developed and introduced innovative products that enabled us to better address changing customer demands and emerging trends. Our goal is to bring the right products to customers at the right time and have best-in-class development processes.

In Fiscal Year 2018, we will continue to focus our core research and development efforts on Core Enterprise, UC, and peripheral "as-a-service" offerings, which will require incremental investments in firmware and software engineering to enhance the broad compatibility of our products with the enterprise systems into which they will be deployed and to develop value-added software applications for business users.

The products we are developing require significant technological knowledge and speed to market. Separately or together, this technological knowledge and our intellectual property gives us a competitive advantage. We continually strive to improve the efficiency of our development processes through, among other things, strategic architecting, common platforms, and increased use of software and test tools.

SALES AND DISTRIBUTION

We maintain a worldwide sales force to provide ongoing customer support and service globally. To support our customers' needs, we have a well-established, multi-level distribution network in North America, Europe, and in some parts of the Asia Pacific region where use of our products is widespread. Our distribution channels in other regions are less mature, and while we primarily serve the Enterprise market in those regions, we are expanding into the Consumer market in those locations.

Our global commercial sales channel includes technology and electronics distributors, and national and regional resellers. The resellers typically offer a wide variety of products from multiple vendors to both other resellers and end users. Our commercial distribution channel generally maintains an inventory of our products. Our distribution of specialty products includes distributors, retail, government programs, and health care professionals.

5

Our retail channel consists of both traditional and online consumer electronics retailers, consumer product retailers, office supply distributors, wireless carriers, catalog and mail order companies, and mass merchants. Our headsets are sold through retailers to corporate customers, small businesses, and to individuals who use them for a variety of personal and professional purposes. Revenues from this channel are seasonal, with our third fiscal quarter typically being the strongest quarter due to holiday seasonality.

We have a diverse group of customers located throughout the world. Our principal channel partners are distributors, retailers, and carriers. Our commercial distributors and retailers represent our first and second largest sales channels in terms of net revenues, respectively. No customer accounted for more than 10% of our consolidated net revenues in Fiscal Years 2015 and 2016. One customer, Ingram Micro Group, accounted for 10.9% of consolidated net revenues in Fiscal Year 2017.

Our distributors, resellers, system integrators, e-commerce partners, telephony and computer equipment providers resell our commercial headsets and end point products. Wireless carriers, retailers, and e-commerce partners also sell our consumer headsets as Plantronics-branded products. Carriers purchase headset products from us for use by their own agents and in some cases, also offer headsets to their customers.

We have also established strong UC alliances with leading providers of UC software solutions, and these alliances enhance the sales and distribution of our products to large enterprises deploying UC solutions. In some cases, these partners also resell our solutions to customers as part of a broader communications solution.

Our products may also be purchased directly from our website at www.plantronics.com.

We continue to evaluate our logistics processes and implement new strategies to further reduce our transportation costs and improve lead-times to customers. Currently, we have distribution centers in the following locations:

• | Tijuana, Mexico, which provides logistics services for products destined for customers in the U.S., Canada, Asia Pacific, Middle East, and Latin America regions |

• | Prague, Czech Republic, which provides logistics services for products shipped to customers in our Europe and Africa regions |

• | Suzhou, China, which provides logistics services for products shipped to customers in Mainland China |

• | Melbourne, Australia, which provides logistics services for products shipped to the retail channel in Australia and New Zealand |

• | Sao Paulo, Brazil, which provides logistics services for products shipped to customers in Brazil |

• | Tokyo, Japan, which provides logistics services for products shipped to customers in Japan |

With respect to the above locations, we use third party warehouses in the Czech Republic, Australia, Brazil, and Japan. We operate warehouse facilities in Mexico and China.

BACKLOG

Our backlog of unfilled orders was $23.4 million and $18.6 million at March 31, 2016 and 2017, respectively. We include all purchase orders scheduled for future delivery in backlog. We have a “book and ship” business model whereby we fulfill most orders within 48 hours of receipt of the order. As a result, our net revenues in any fiscal year depend primarily on orders booked and shipped in that year. In addition, our backlog is occasionally subject to cancellation or rescheduling by the customer on short notice with little or no penalty. Therefore, there is a lack of meaningful correlation between backlog at the end of a fiscal year and the following fiscal year's net revenues. Similarly, there is a lack of meaningful correlation between year-over-year changes in backlog as compared with year-over-year changes in net revenues. As a result, we do not believe that backlog information is material to an understanding of our overall business.

MANUFACTURING AND SOURCES OF MATERIALS

Our manufacturing operations consist primarily of assembly and testing, both of which are performed in our manufacturing facility in Tijuana, Mexico. We outsource the manufacturing of our Bluetooth products to third party manufacturers in China. We also outsource the manufacturing of a limited number of our other products to third parties, typically in China and other countries in Asia. For a further discussion of the business risks associated with our manufacturers see the risk titled, “We have significant foreign manufacturing operations and rely on third party manufacturers located outside the U.S., and a significant amount of our revenues are generated internationally, which subjects our business to risks of international operations” within Item 1A Risk Factors in this Annual Report on Form 10-K.

6

We purchase the components for our products primarily from suppliers in Asia, Mexico, the U.S., and Europe, including proprietary semi-custom integrated circuits, amplifier boards, and other electrical components. The majority of the components and sub-assemblies used in our manufacturing operations are obtained, or are reasonably available, from dual-source suppliers, although we do have a number of sole-source suppliers.

We procure materials to meet forecasted customer requirements. Special products and certain large orders are quoted for delivery after receipt of orders at specific lead times. We maintain minimum levels of finished goods based on estimated market demand, in addition to inventories of raw materials, work in process, sub-assemblies, and components. In addition, a substantial portion of the raw materials, components, and sub-assemblies used in our products are provided by our suppliers on a consignment basis. Refer to “Off Balance Sheet Arrangements”, within Item 7, Management's Discussion and Analysis, in this Annual Report on Form 10-K for additional details regarding consigned inventories. We write-down inventory items determined to be either excess or obsolete to their net realizable value.

ENVIRONMENTAL MATTERS

We are subject to various federal, state, local, and foreign environmental laws and regulations, including those governing the use, discharge, and disposal of hazardous substances in the ordinary course of our manufacturing process. We believe that our current manufacturing and other operations comply in all material respects with applicable environmental laws and regulations. We are required to comply and we believe are currently in compliance with the European Union (“EU”) and other Directives on the Restrictions of the use of Certain Hazardous Substances in Electrical and Electronic Equipment (“RoHS”) and on Waste Electrical and Electronic Equipment (“WEEE”) requirements. Additionally, we believe we are compliant with the RoHS initiatives in China and Korea; however, it is possible that future environmental legislation may be enacted or current environmental legislation may be interpreted to create an environmental liability with respect to our facilities, operations, or products. See further discussion of our business risks associated with environmental legislation under the risk titled, "We are subject to environmental laws and regulations that expose us to a number of risks and could result in significant liabilities and costs" within Item 1A Risk Factors of this Form 10-K.

INTELLECTUAL PROPERTY

We maintain a program of seeking patent protection for our technologies when we believe it is commercially appropriate. As of March 31, 2017, we had approximately 780 worldwide patents in force, expiring between calendar years 2017 and 2041.

We intend to continue seeking patents on our inventions when commercially appropriate. Our success will depend in part on our ability to obtain patents and preserve other intellectual property rights covering the design and operation of our products. See further discussion of our business risks associated with our intellectual property under the risk titled, "Our intellectual property rights could be infringed on by others, and we may infringe on the intellectual property rights of others resulting in claims or lawsuits. Even if we prevail, claims and lawsuits are costly and time consuming to pursue or defend and may divert management's time from our business" within Item 1A Risk Factors of this Form 10-K.

We own trademark registrations in the U.S. and a number of other countries with respect to the Plantronics and Clarity trademarks, as well as the names of many of our products and product features. We currently have pending U.S. and foreign trademark applications in connection with certain new products and product features and may seek copyright protection where we believe it is applicable. We own a number of domain name registrations and intend to seek more as appropriate. We also attempt to protect our trade secrets and other proprietary information through comprehensive security measures, including agreements with customers and suppliers, and proprietary information agreements with employees and consultants. See further discussion of our business risks associated with intellectual property under the risk titled "Our intellectual property rights could be infringed on by others, and we may infringe on the intellectual property rights of others resulting in claims or lawsuits. Even if we prevail, claims and lawsuits are costly and time consuming to pursue or defend and may divert management’s time from our business."

EMPLOYEES

On March 31, 2017, we employed approximately 3,852 people worldwide, including approximately 2,729 employees at our manufacturing facility in Tijuana, Mexico. To our knowledge, no employees are currently covered by collective bargaining agreements.

7

EXECUTIVE OFFICERS OF THE REGISTRANT

Set forth in the table below is certain information regarding the executive team of Plantronics:

NAME | AGE | POSITION | ||

Joe Burton | 52 | President and Chief Executive Officer | ||

Pamela Strayer | 48 | Senior Vice President and Chief Financial Officer | ||

Mary Huser | 53 | Senior Vice President, General Counsel and Corporate Secretary | ||

Shantanu Sarkar | 48 | Senior Vice President of Product Development | ||

Mr. Burton joined Plantronics in 2011 as Senior Vice President of Engineering and Development and Chief Technology Officer and was promoted to various positions including Executive Vice President and Chief Commercial Officer before being named President and Chief Executive Officer and appointed to our Board of Directors in 2016. Prior to joining Plantronics, Mr. Burton held various executive management, engineering leadership, strategy, and architecture-level positions. From 2010 to 2011, Mr. Burton was employed by Polycom, Inc., a global provider of unified communications solutions for telepresence, video, and voice, most recently as Executive Vice President, Chief Strategy and Technology Officer and, for a period of time, as General Manager, Service Provider concurrently with his technology leadership role. From 2001 to 2010, Mr. Burton was employed by Cisco Systems, Inc., a global provider of networking equipment, and served in various roles with increasing responsibility including Vice President and Chief Technology Officer for Unified Communications and Vice President, SaaS Platform Engineering, Collaboration Software Group. He holds a Bachelor of Science degree in Computer Information Systems from Excelsior College (formerly Regents College) and attended the Stanford Executive Program.

Ms. Strayer joined Plantronics in 2012 as Senior Vice President and Chief Financial Officer. She is responsible for all aspects of the Company's financial management, in addition to managing the information technology and investor relations organizations. Prior to joining Plantronics, from 2005 to 2012, Ms. Strayer held senior financial management roles at Autodesk, Inc., a world leading software design and services company. Most recently, Ms. Strayer served as Autodesk's Vice President of Finance, Corporate Controller, and Principal Accounting Officer. Prior to Autodesk, Ms. Strayer held senior finance positions at Epiphany, Inc., a developer of customer relationship management software and Informix Software, Inc., a developer of database software for computers. She also worked in audit services at KPMG, LLP. Ms. Strayer holds a bachelor's degree in Business Administration from The Ohio State University and is a California licensed Certified Public Accountant.

Ms. Huser joined Plantronics in March 2017 as Senior Vice President, General Counsel and Corporate Secretary. Prior to joining Plantronics, Ms. Huser served as Vice President, Deputy General Counsel at BlackBerry, a mobile-native security software and services company, and General Counsel of its Technology Solutions division from 2013 to 2014 and again during 2016 until she joined Plantronics. Before BlackBerry, during 2015, Ms. Huser was Senior Vice President, Legal for McKesson Corporation, a global healthcare supply chain, retail pharmacy, specialty care and information technology company. Prior to that time, she was a partner, office managing partner and practice group leader at Bingham McCutchen LLP, an international law firm, from 1988 to 2007 and again from 2010 to 2013. Ms. Huser also served as Vice President, Deputy General Counsel of eBay, Inc., an online global commerce leader, from 2008 to 2010. Ms. Huser graduated from the University of Wisconsin - Madison, with a Bachelor of Business Administration, Accounting and Marketing and holds a Juris Doctorate from Stanford Law School.

Mr. Sarkar joined Plantronics in 2011 as Plantronics Vice President, Software and Firmware and was promoted through ever increasing roles and responsibilities to his current role as Senior Vice President of Product Development in 2016. Before joining Plantronics, Mr. Sarkar led the Advanced Technology, Strategy and Corporate Development Team at Polycom in 2011 and worked at Cisco for 14 years leading engineering teams, strategy, worldwide UC standards engagement, mergers and acquisitions, advanced technology for collaboration, and product development in the Cisco Voice Technology Group. Mr. Sarkar holds a M.S. in Computer Science from The Ohio State University and a Bachelor of Science degree in Computer Science from the Indian Institute of Technology, Kharagpur, India.

Executive officers serve at the discretion of the Board of Directors. There are no family relationships between any of the directors and executive officers of Plantronics.

8

ITEM 1A. RISK FACTORS

You should carefully consider the following risk factors in connection with any investment in our stock. Our stock price will reflect the performance of our business relative to, among other things, our competition, expectations of securities analysts or investors, and general economic, market and industry conditions. Our business, financial condition, and results of operations could be materially adversely affected if any of the following risks occur. Accordingly, the trading price of our stock could decline, and investors could lose all or part of their investment.

Adverse or uncertain economic conditions may materially adversely affect us.

Our operations and financial performance are dependent on the global economy. Uncertainty regarding future economic conditions makes it challenging both in the near and long-term to forecast operating results, make business decisions, and identify risks that may affect our business, sources and uses of cash, financial condition, and results of operations. Economic concerns, such as uncertain or inconsistent global or regional economic growth, stagnation or contraction, including the pace of economic growth in the United States in comparison to other geographic and economic regions, pressure on economic growth in Europe, uncertain growth prospects in the Asia Pacific region, as well as anxiety regarding geopolitical conflicts and their short and long-term economic impact, increase the uncertainty and unpredictability for our business as consumers, businesses and governmental agencies periodically and often unpredictably postpone or forego spending. A global economic downturn or erratic or declining business or governmental spending or hiring may reduce sales of our products, increase sales cycles, slow adoption of new technologies, increase price competition, and cause customers and suppliers to default on their financial obligations.

Additionally, to the extent governments implement austerity measures in response to economic conditions, demand for our products by governmental agencies subject to the measures and by customers who derive all or a portion of their revenues from these agencies may decline. Similarly, to the extent uncertainty regarding public debt limits or governmental budgets, particularly in the U.S and Europe, hinder spending by retail consumers, businesses or governmental agencies, sales of our products may be materially harmed or delayed.

Additionally, our customers suffer from their own financial and economic challenges. If global or regional economic conditions deteriorate, whether in general or in specific market segments, one or more customers may demand pricing accommodations, delay payments or become insolvent. It is impossible to reliably determine if and to what extent customers may suffer, whether we will be required to adjust our prices or face collection issues with customers or if customer bankruptcies will occur.

Our operating results are difficult to predict, and fluctuations may cause volatility in the trading price of our common stock.

Given the nature of the markets in which we compete, our revenues and profitability vary from quarter to quarter and are difficult to predict for many reasons, including the following:

•variations in the volume and timing of orders received during each quarter;

• | shifts in product, geographic or channel mix; |

• | the timing of customers' sales promotions and campaigns; |

• | the timing of large customer deployments, including UC infrastructure; |

• | the timing of new product introductions by us and our competitors and obsolescence or discontinuance of existing products; |

• | competition, including pricing pressure, promotions and campaigns by us, our competitors or our customers; |

• | failure to timely introduce new products within projected costs; |

• | changes in technology and desired product features, including whether those changes occur in anticipated manners and timeframes; |

• | general economic conditions in the U.S. and our international markets, including foreign currency fluctuations; |

• | seasonality, including related to our retail channels during the holiday season; |

• | customer cancellations and rescheduling; |

• | fluctuations in raw materials and components costs; and |

• | investments in and the costs associated with new product development and strategic initiatives. |

Fluctuations in our operating results, including the failure to meet our expectations or the expectations of financial analysts, may cause volatility, including material decreases, in the trading price of our common stock.

9

The success of our business depends heavily on our ability to effectively market our Enterprise products, and our business could be materially adversely affected if markets do not develop as expected or we are unable to compete successfully.

Our Enterprise products represent our largest source of revenue, and we regard the market for headsets designed for UC as our greatest long-term opportunity in the Enterprise market. We believe the implementation of UC technologies by large enterprises will be a significant long-term driver of UC headset adoption, and, as a result, a key long-term driver of our revenue and profit growth. Accordingly, we continue to invest in the development of new products and enhance existing products to be more appealing in functionality and design for the UC office market; however, there is no guarantee significant UC growth will occur, when it might occur, or that we will successfully take advantage of it if it does occur.

Our ability to realize and achieve positive financial results from Enterprise product sales, and UC sales in particular, could be adversely affected by a number of factors, including the following:

• | As UC becomes more widely adopted, competitors may offer solutions that effectively commoditize our headsets, which, in turn, may pressure us to reduce the prices of one or more of our products. |

• | The market success of major platform providers and strategic partners such as Microsoft Corporation, Cisco Systems, Inc., Avaya, Inc., Alcatel-Lucent, and Huawei, and our influence over such providers with respect to the functionality of their platforms and product offerings, their rate of deployment, and their willingness to integrate their platforms and product offerings with our solutions, is limited. For example, Microsoft’s decision to transition from Lync to Skype for Business in early Fiscal Year 2016 proved to be a more significant market transition than anticipated and caused end customers to pause their deployment schemes or schedules while they assessed the implications of Microsoft’s decision. |

• | Failure to timely introduce solutions that are cost effective, feature-rich, stable, and attractive to customers within forecasted development budgets. |

• | Failure to successfully implement and execute new and different processes involving the design, development, and manufacturing of complex electronic systems composed of hardware, firmware, and software that works seamlessly and continuously in a wide variety of environments and with multiple devices. |

• | Failure of UC solutions generally, or our solutions in particular, to be adopted with the breadth and speed we anticipate. For example, concerns about data privacy and the security of information and data stored over the Internet and wireless security in general, each of which is further enabled by UC solutions, including our products, have caused entities in various markets to reassess data protection compliance and security safeguards of our devices. |

• | Failure of our sales model and expertise to support complex integration of hardware and software with UC infrastructure consistent with changing customer expectations. |

• | Increased competition for market share, particularly given that some competitors have superior technical and economic resources enabling them to take greater advantage of market opportunities. |

• | Sales cycles for more complex UC deployments are longer as compared to our traditional Enterprise products. |

• | Our inability to timely and cost-effectively adapt to changes and future business requirements may impact our profitability in this market and our overall margins. |

• | Failure to expand our technical support capabilities to support the complex and proprietary platforms in which our products are and will be integrated as well as increases in our support expenditures over time. |

If our investments in, and strategic focus on, Enterprise products and UC products, in particular, do not generate incremental revenue, our business, financial condition, and results of operations could be materially adversely affected.

If we fail to accurately forecast demand we may under or overestimate production requirements resulting in lost business or write offs of excess inventory which may materially harm our business, reputation and results of operations.

Our industry is characterized by rapid technological changes, evolving industry standards, frequent new product introductions, short-term customer commitments, and changes in demand. Production levels are forecasted based on anticipated and historic product demand and we often place orders with suppliers for materials, components and sub-assemblies (“materials and components”) as well as finished products 13 weeks or more in advance of projected customer orders. Actual customer demand depends on many factors and may vary significantly from forecasts. We will lose opportunities to increase revenues and profits and may incur increased costs and penalties including expedited shipping fees and late delivery penalties if we underestimate customer demand.

Conversely, overestimating demand could result in higher inventories of materials and components and finished products, which may later require us to write off all or a material portion of our inventories. We routinely review inventory for usage potential, including fulfillment of customer warranty obligations and spare part requirements, and we write down to the lower of cost or market value the excess and obsolete inventory, which may materially adversely affect our results of operations.

10

For instance, periodically, we or our competitors announce new products, capabilities, or technologies that replace or shorten the life cycles of legacy products or cause customers to defer or stop purchasing legacy products until new products become available. Additionally, new product announcements may incite customers to increase purchases of successful legacy products as part of a last-time buy strategy, thereby increasing sales in the short-term while decreasing future sales and delaying new product adoption. These risks increase the difficulty of accurately forecasting demand for discontinued and new products as well as the likelihood of inventory obsolescence, loss of revenue and associated gross profit.

If any of the above occur, our business, financial condition and results of operations could be materially harmed.

If our suppliers and sub-suppliers cannot timely deliver sufficient quantities of quality materials and components and finished products, our ability to fulfill customer demand may be adversely impacted and our growth, business, reputation and financial condition may be materially adversely effected.

Our growth and ability to meet customer demand depends in part on our ability to timely obtain sufficient quantities of materials and components as well as finished products of acceptable quality at acceptable prices. We buy materials and components from a variety of suppliers and assemble them into finished products. In addition, certain of our products and key portions of our products lines are manufactured for us by third party original design and contract manufacturers ("ODMs") who obtain materials and sub-components from long and often complex chains of sub-suppliers. The cost, quality, and availability of the services, materials and components and finished products these ODMs and third parties supply are essential to our success.

Our reliance on these ODMs and third parties therefore involves significant risks, including the following:

• | We rely on suppliers for critical aspects of our business. For instance, we obtain a majority of our Bluetooth products from GoerTek, Inc. Suppliers such as GoerTek may choose to discontinue supplying materials and components or finished products to us for a variety of reasons, including availability and price. Although we design products for durability and long life cycles with an emphasis on common components across multiple product lines, the accelerating pace of technological advancement by our suppliers frequently makes it more difficult to continue to procure essential components like integrated circuits for those of our products already in the market. Consequently, the failure to obtain key components to meet customer demand may (i) require us to obtain a replacement supply of satisfactory quality which may be difficult, time-consuming, or costly, (ii) force us to redesign or end-of-life certain products, (iii) delay manufacturing or render us unable to meet customer demand, or (iv) require us to make large last-time buys based on speculative long-term forecasts in excess of our short-term needs, holding materials and components or finished products in inventory for extended periods of time or underestimating our needs and being unable to meet customer demand. Consequently, if one or more suppliers is unable or unwilling to meet our demand, delivery, or price requirements, our business and operating results could be materially adversely affected. |

• | Although we endeavor to use standard materials and components in our products whenever feasible, the lack of viable alternative sources or the high development costs associated with existing and emerging wireless and other technologies may require us to work with a single source for silicon chips, chip-sets, or other materials and components in one or more products. Moreover, lead times are particularly long for silicon-based components incorporating radio frequency and digital signal processing technologies and such materials and components make up an increasingly larger portion of our product costs. Additionally, many orders for consumer products have shorter lead times than component lead times, making it necessary for us or our suppliers to carry more inventory in anticipation of orders, which may not materialize. |

• | A substantial portion of the materials and components used in our products are provided by our suppliers on consignment. As such, we do not take title to the materials and components until they are consumed in the production process. Prior to consumption, title and risk of loss remains with the suppliers. Our supply agreements generally allow us to return parts in excess of maximum order quantities at the suppliers’ expense. Returns for other reasons are negotiated with suppliers on a case-by-case basis and are generally immaterial. If we are required or choose to purchase all or a material portion of the consigned materials and components or if a material number of our suppliers refuse to accept orders on consignment, our inventory turn rate may decline or we could incur material unanticipated expenses, including write-downs for excess and obsolete inventory. |

• | Rapid increases in production levels to meet product demand, whether or not forecasted, could result in shipment delays, higher costs for materials and components, increased expenditures for freight to expedite delivery of required materials, late delivery penalties, and higher overtime costs and other expenses, any of which could materially negatively impact our revenues, reduce profit margins, and harm relationships with affected customers. For instance, in Fiscal Year 2015, sales of our BackBeat Fit were constrained by limited sub-component supply availability. If similar constraints were to occur in existing or future product lines our ability to meet demand and our corresponding ability to sell affected products may be materially reduced. Moreover, our failure to timely deliver desirable products to meet demand may harm relationships with our customers. Further, if production is increased rapidly, manufacturing yields may decrease, which may also reduce our revenues or margins. |

Any of the foregoing could materially and adversely affect our business, financial condition, and results of operations.

11

Prices of certain raw materials and components may rise depending upon global market conditions which may adversely affect our margins.

We have experienced and expect to continue to experience volatility in prices from our suppliers, particularly in light of price fluctuations for oil, gold, copper, and other materials and components in the U.S. and around the world, which could negatively affect our profitability or market share. If we are unable to pass cost increases on to our customers or achieve operating efficiencies that offset any increases, our business, financial condition, and results of operations may be materially and adversely affected.

We have strong competitors and expect to face additional competition from existing and new market participants in the future. If we are unable to compete effectively, our results of operations may be adversely affected.

All of the markets in which we sell our products are intensely competitive and market leadership may change as a result of new product introductions, new market participants and pricing. We face pressure on our selling prices, sales terms and conditions, and in connection with product performance and functionality. Also, aggressive industry pricing practices may result in decreasing margins.

One of our primary competitors is GN Netcom, a subsidiary of GN Store Nord A/S (“GN”), a Danish telecommunications conglomerate with whom we compete in the Enterprise and mobile categories. We also compete with consumer electronics companies that manufacture and sell mobile phones or computer peripheral equipment. Many of our competitors are larger, offer broader product lines, may integrate their products with communications headset devices and adapters manufactured by them or others, offer products incompatible with our headsets, and have substantially greater financial, marketing, and other resources.

Competitors in audio devices vary by product line. For sales of our Enterprise products, including UC, our largest competitors include GN and Sennheiser Communications. In our Consumer market, our mono Bluetooth communication headsets for cell phones compete with GN's Jabra brand, Motorola, Samsung, and LG, among many others. Many of these competitors have substantially greater resources than us, and each has an established market position. For our Stereo Consumer products, our primary competitors include Apple, Sennheiser, Beats, LG, Logitech, Samsung and Bose. In the gaming category of our Consumer products market, our primary competitors are Turtle Beach, Skullcandy, Logitech and Razer.

We face additional competition from companies, principally located in or originating from the Asia Pacific region, which offer very low cost products, including headsets modeled on, direct copies of, or counterfeits of our products. Furthermore, online marketplaces make it easier for disreputable and fraudulent sellers to introduce their copies or counterfeit products into the stream of commerce by commingling legitimate products with copies and counterfeits; thereby making it extremely difficult to track and remove copies and counterfeits. The introduction of low cost alternatives, copies and counterfeits has resulted in and will continue to cause market pricing pressure, customer dissatisfaction and harm to our reputation and brand name. If headset prices are substantially reduced by new or existing market participants, our business, financial condition, or results of operations could be materially and adversely affected.

Likewise, if we do not distinguish our products, through distinctive, technologically advanced features and design, as well as continue to build and strengthen our brand recognition, our products may become commoditized and our business could be harmed. In addition, failure to effectively market our products to customers could lead to lower and more volatile revenue and earnings, excess inventory, and the inability to recover associated development costs, any of which could also have a material adverse effect on our business, financial condition, results of operations, and cash flows.

The markets for our Consumer products are volatile and our ability to compete successfully in one or more of these categories is subject to many risks.

Competition in the markets for our Consumer products, which consist primarily of Bluetooth headsets, gaming, entertainment and computer audio headsets, is intense and presents many significant manufacturing, marketing and operational risks and uncertainties. The risks include the following:

• | The global market for mono Bluetooth continues to decrease, which is at least partially attributable to the integration of Bluetooth systems into automobiles. The market for stereo Bluetooth headsets continues to grow rapidly, although it remains dominated by lifestyle brands. Our market share has been and is significantly larger in the mono Bluetooth than stereo Bluetooth market and thus far we have been unable to sufficiently increase share in the stereo Bluetooth market to offset decreases in the mono Bluetooth market. |

• | Reductions in the number of suppliers participating in the Bluetooth market has reduced our sourcing options and may in the future increase our costs at a time when our ability to offset higher costs with product price increases is limited. |

• | Difficulties retaining or obtaining shelf space and maintaining a robust and compelling eCommerce presence for our Consumer products in our sales channel, particularly with large "brick and mortar" retailers and Internet "etailers" as the market for mono Bluetooth headsets contracts. |

• | Relying on a dwindling number of retail customers that have significant market share in the shrinking mono Bluetooth category increases our exposure to pricing pressure, unexpected changes in demand and may result in unanticipated fluctuations in our revenues and margins. |

12

• | The varying pace and scale of economic activity in many regions of the world creates demand uncertainty and unpredictability for our Consumer products. |

• | The need to rapidly and frequently adopt new technology to keep pace with changing market trends. In particular, we anticipate a trend towards more integrated solutions that combine audio, video, and software functionality that we expect will shorten product lifecycles. |

• | Our ability to maintain insight into, and quickly respond to, sudden changes in laws or regulations. |

Failure to compete successfully in the consumer business markets may have an adverse effect on our business, results of operations, and financial condition.

We are exposed to differences and frequent fluctuations in foreign currency exchange rates, which may adversely affect our revenues, gross profit, and profitability.

Fluctuations in foreign currency exchange rates impact our revenues and profitability because we report our financial statements in USD and purchase a majority of our component parts from our supply chain in USD, whereas a significant portion of our sales are transacted in other currencies, particularly the Euro and the British Pound Sterling ("GBP"). If the USD strengthens further, it could further harm our financial condition and and operating results in the future. Furthermore, fluctuations in foreign currency rates impact our global pricing strategy, which may result in our lowering or raising selling prices in one or more currencies to minimize disparities with USD prices and to respond to currency-driven competitive pricing actions. Should the dollar remain strong or strengthen further against foreign currencies, principally the Euro and the GBP, we may be compelled to raise prices for customers in the affected regions. Price increases may be unacceptable to our customers who could choose to replace our products with less costly alternatives in which case our sales and market share will be adversely impacted. If we reduce prices to stay competitive in the affected regions, our profitability may be harmed.

Large or frequent fluctuations in foreign currency rates, coupled with the ease of identifying global price differences for our products via the Internet, increases pricing pressure and allows unauthorized third party “grey market” resellers to take advantage of price disparities, thereby undermining our premium brand image, established sales channels, and support and operations infrastructure. We also have significant manufacturing operations in Mexico and fluctuations in the Mexican Peso exchange rate can impact our gross profit and profitability. Additionally, the majority of our suppliers are located internationally, principally in Asia, and volatile or sustained increases or decreases in exchange rates between the U.S. Dollar and Asian currencies may result in increased costs or reductions in the number of suppliers qualified to meet our standards.

Although we hedge currency exchange rates exposures we deem material, changes in exchange rates may nonetheless still have a negative impact on our financial results. Among the factors that may affect currency values are trade balances, the level of short-term interest rates, differences in relative values of similar assets in different currencies, long-term opportunities for investment and capital appreciation, decisions and actions of central banks and political developments.

We hedge a portion of our Euro and GBP forecasted revenue exposures for the future, typically over 12-month periods. In addition, we hedge a portion of our Mexican Peso forecasted cost of revenues and maintain foreign currency forward contracts denominated in Euros, GBP, Australian and Canadian Dollars that hedge against a portion of our foreign-currency denominated assets and liabilities. Our foreign currency hedging contracts reduce, but do not eliminate, the impact of currency exchange rate movements, particularly if the fluctuations are significant or sustained, and we do not execute hedging contracts in all currencies in which we conduct business. There is no assurance that our hedging strategies will be effective. Additionally, even if our hedging techniques are successful in the periods during which the rates are hedged, our future revenues, gross profit, and profitability may be negatively affected both at current rates and by adverse fluctuations in currencies against the USD. See Item 7A for further quantitative information regarding potential foreign currency fluctuations.

In May 2015 we issued $500.0 million of 5.50% senior unsecured notes and entered into an Amended and Restated $100.0 million revolving line of credit facility. Issuance of the notes and any draws against the credit facility may adversely affect our future financial condition and financial results.

As of April 1, 2017, we had $500 million in 5.50% senior unsecured notes outstanding and the ability to draw up to $100.0 million against a revolving line of credit agreement with Wells Fargo Bank, National Association. Risks relating to our long-term indebtedness include:

• | Requiring us to dedicate a portion of our cash flow from operations to payments on our currently existing or future indebtedness, thereby reducing the availability of cash flow to fund working capital, capital expenditures, acquisitions, investments and other general corporate purposes; |

• | Limiting our flexibility in planning for, or reacting to, changes in our business and the markets in which we operate including, without limitation, restricting our ability and the ability of our subsidiaries to incur liens or enter into certain types of transactions such as sale and lease-back transactions; |

• | Limiting our ability to borrow additional funds or to borrow funds at rates or on other terms we find acceptable; and |

• | Our inability to repay or refinance the then-outstanding principal balance of the Notes on maturity. |

13

Periodically, we have drawn funds under our existing credit facilities in connection with our corporate return of capital policy and for other purposes. Amounts drawn under our outstanding credit agreement are subject to interest charges. Moreover, the credit agreement contains affirmative and negative covenants with which we must comply in addition to those covenants in our senior unsecured notes. These restrictions apply regardless of whether any loans under the credit agreement are outstanding and could adversely impact how we operate our business, our operating results, and dividend declarations, which, in turn, may negatively impact our stock price. During the fourth quarter of Fiscal Year 2016, we breached the funded debt to EBITDA ratio covenant of our credit agreement for which we subsequently obtained a waiver from Wells Fargo in the first quarter of Fiscal Year 2017. Although we have amended the credit agreement to reduce the risk of future violations of the covenant, we cannot be sure we will not breach this or any other covenant in the future or that Wells Fargo will not seek to enforce any or all remedies against us for any same or similar breach.

In addition, if we borrow additional funds under the credit agreement, we may be required to increase the borrowing limit under the credit agreement or seek additional sources of borrowing. Given current credit and debt markets, there is no assurance that if we were to seek additional credit or debt, it would be available when needed or if it is available, the cost or terms and conditions would be acceptable.

If any of the foregoing risks occur, we may be unable to pay any indebtedness, including interest, when due, and may be required to curtail activities to comply with our obligations under the senior unsecured notes. Additionally, changes by any rating agency to our credit rating may negatively impact the value and liquidity of both our debt and equity securities, as well as the potential costs associated with a refinancing of our debt. The rating agencies measure us by our performance against certain financial metrics. If we do not meet these metrics there is a risk the rating agencies may downgrade our rating. Under certain circumstances, if our credit ratings are downgraded or other negative action is taken, our ability to obtain additional financing in the future could be diminished and could affect the terms of any such financing. If any of those things occur, our financial condition and results of operations may be adversely affected.

We cannot guarantee we will continue to repurchase our common stock pursuant to stock repurchase programs or that we will declare future dividend payments at historic rates or at all. The repurchase of our common stock and the payment of dividends may require us to borrow against our credit agreement or incur indebtedness and may not achieve our objectives.

In March 2015, we announced a new corporate return of capital policy with the long-term goal of increasing the return of cash to stockholders to approximately 60% of free cash flow, defined as total operating cash flow less capital expenditures. We intend to achieve this goal primarily through stock repurchases and quarterly dividends. Over the last two fiscal years we have repurchased 9.8 million shares and consistently declared quarterly dividends of $0.15 per share. To finance a material portion of our stock repurchases in Fiscal Year 2016, we used our revolving line of credit agreement with Wells Fargo Bank as well as the issuance of the senior unsecured notes.

Any determination to pay cash dividends at recent rates or at all, or authorization or continuance of any share repurchase programs is contingent on a variety of factors, including our financial condition, results of operations, business requirements, and our Board of Directors' continuing determination that such dividends or share repurchases are in the best interests of our stockholders and in compliance with all applicable laws and agreements.

Additionally, in order to continue our stock repurchases and dividend declarations, we may need to draw against available funds under our credit agreement or incur additional indebtedness, any of which may obligate us to pay interest, require payment of other expenses, and may not be available to us or available on terms we deem acceptable. Accordingly, there is no assurance that we will continue to repurchase stock at recent historical levels or at all, or that our stock repurchase programs or dividend declarations will have a beneficial impact on our stock price.

Our corporate tax rate may increase or we may incur additional income tax liabilities, which could adversely impact our cash flow, financial condition and results of operations.

We have significant operations in various tax jurisdictions throughout the world, and a substantial portion of our taxable income has historically been generated in jurisdictions outside of the U.S. Currently, some of our operations are taxed at rates substantially lower than U.S. tax rates. If our income in these lower tax jurisdictions were no longer to qualify for these lower tax rates, the applicable tax laws were rescinded or changed, or the mix of our earnings shifts from lower rate jurisdictions to higher rate jurisdictions, our operating results could be materially adversely affected.

Various governmental tax authorities have recently increased their scrutiny of tax strategies employed by corporations and individuals. In addition, the Organization for Economic Cooperation and Development issued guidelines and proposals during Fiscal Year 2016 that may change how our tax obligations are determined in many of the countries in which we do business. If U.S. or other foreign tax authorities change applicable tax laws or successfully challenge the manner in which our profits are currently recognized, our overall taxes could increase, and our business, cash flow, financial condition, and results of operations could be materially adversely affected.

14

We are also subject to examination by the Internal Revenue Service ("IRS") and other tax authorities, including state revenue agencies and foreign governments. While we regularly assess the likelihood of favorable or unfavorable outcomes resulting from examinations by the IRS and other tax authorities to determine the adequacy of our provision for income taxes, there can be no assurance that the actual outcome resulting from these examinations will not materially adversely affect our financial condition and results of operations.

Our business will be materially adversely affected if we are unable to develop, manufacture, and market new products in response to changing customer requirements and new technologies.

The technology used in our products is evolving more rapidly now than in the past and we anticipate this trend will continue. Historically, new products primarily offered stylistic changes and quality improvements rather than significant new technologies. Our increasing reliance and focus on the UC market has resulted in a growing number of our products that integrate complex, state-of-the-art technology, increasing the risks associated with new product ramp-up, including product performance and defects in the early stages of production.