Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MEDLEY MANAGEMENT INC. | a8k-retrospectiveadjustmen.htm |

Exhibit 99.1

The Company's 2017 Annual Report is being revised to reflect the implementation of certain reporting changes related to new accounting policies as described in Item 8.01 of the accompanying Current Report on Form 8-K. The 2017 Annual Report is revised as follows:

• | The information previously set forth under the heading “Item 6. Selected Financial Data” in the 2017 Annual Report is replaced in its entirety by the information set forth below in this Exhibit 99.1 under the heading “Item 6. Selected Financial Data.” |

• | The information previously set forth in each of the sections identified and described below under the heading “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the 2017 Annual Report is replaced in its entirety by the information set forth below in this Exhibit 99.1 in the corresponding sections under the heading of “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations”: |

- Overview

- Results of Operations

- Liquidity and Capital Resources

• | The information previously set forth under the heading “Item 8. Financial Statements and Supplementary Data” in the 2017 Annual Report is replaced in its entirety by the information set forth below in this Exhibit 99.1 under the heading “Item 8. Financial Statements and Supplementary Data.” |

Other than as set forth herein, the 2017 Annual Report remains materially consistent with the Company's previously issued 2017 Annual Report. Those sections of the 2017 Annual Report which have not been revised as set forth herein are not materially impacted by the actions taken described in this Exhibit 99.1 and the accompanying Current Report on Form 8-K and/or have already been updated through the Quarterly Reports on Form 10-Q for the quarters ended March 31 and June 30, 2018 (the “Quarterly Reports on Form 10-Q”), including Risk Factors and the Note Regarding Forward Looking Statements contained in the Quarterly Reports on Form 10-Q, and are not included in this Exhibit 99.1. Accordingly, the revised information set forth in this Exhibit 99.1 should be read in conjunction with the 2017 Annual Report and the Quarterly Reports on Form 10-Q.

1

Item 6. Selected Financial Data

The following selected consolidated financial data presents selected data on the financial condition and results of operations of Medley Management Inc., and for periods prior to September 29, 2014, the financial condition and results of operations of Medley LLC, the predecessor of Medley Management Inc. Medley LLC is considered the predecessor of Medley Management Inc. for accounting purposes, and its consolidated financial statements are the historical financial statements of Medley Management Inc. During fiscal year 2015, we adopted new consolidation guidance which resulted in the deconsolidation of our Consolidated Funds, effective January 1, 2015. Prior to January 1, 2015, we consolidated certain funds in our consolidated financial statements which had a significant gross-up effect on our assets, liabilities and cash flows but no effect on the net income attributable to Medley Management Inc. and non-controlling interests in Medley LLC. This financial data should be read together with “Management's Discussion and Analysis of Financial Condition and Results of Operations” and the historical financial statements and related notes thereto included in this Form 10-K.

We derived the following selected consolidated financial data of Medley Management Inc. as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015 from the audited consolidated financial statements included in this Form 10-K. The following selected consolidated statement of operations data for the years ended December 31, 2014 and 2013 and the selected financial condition data as of December 31, 2015 were derived from our audited consolidated financial statements not included in this Form 10-K. The following selected financial condition data as of December 31, 2014 and 2013 were derived from our audited consolidated financial statements not included in this Form 10-K, which were adjusted for the adoption of ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs. Effective January 1, 2016, we adopted this new guidance and retrospectively presented debt issuance costs related to our long-term debt as a deduction from the carrying amount of the associated debt on our consolidated balance sheets. As a result of this adoption, we reclassified $2.2 million and $0.3 million as of December 31, 2014 and 2013, respectively, of debt issuance costs from other assets to debt obligations. See Note 2, “Summary of Significant Accounting Policies” to our audited consolidated financial statements included in this Form 10-K for a description of the new guidance.

In connection with the adoption of the new revenue recognition guidance, ASC 606, Revenue from Contracts with Customers, on January 1, 2018, the Company reassessed its accounting policy for performance fees earned during the period which represent a capital allocation to the general partner or investment manager. As a result of this reassessment the Company has determined that it should account for such performance fees within the scope of ASC 323, Investments - Equity Method and Joint Ventures. Accordingly, these performance fees are now classified as carried interest within investment income on the Company's consolidated statements of operations and balances due for such fees are included as a part of equity method investments within Investments, at fair value on the Company's consolidated balance sheets.

For periods prior to the reorganization and IPO on September 29, 2014, all payments made to our senior professionals who are members of Medley LLC, including guaranteed payments, were reflected as distributions from members' capital. Subsequent to the reorganization and IPO, all guaranteed payments made to our senior professionals who are members of Medley LLC are recognized as compensation expense. Prior to our reorganization and IPO, our business was organized as a partnership for tax purposes and was not subject to U.S. federal, state and local corporate income taxes. A provision for income taxes was made for certain entities that were subject to New York City's unincorporated business tax related to taxable income allocated to New York city. As a result of the corporate reorganization and IPO, Medley Management Inc. is subject to U.S. federal, state and local corporate income taxes on its allocable portion of income from Medley LLC at prevailing corporate tax rates.

Our historical results are not necessarily indicative of the results expected for any future period.

For the Years Ended December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

(Amounts in thousands except share and per share amounts) | |||||||||||||||||||

Statement of Operations Data: | |||||||||||||||||||

Revenues | |||||||||||||||||||

Management fees | $ | 58,104 | $ | 65,496 | $ | 75,675 | $ | 61,252 | $ | 36,446 | |||||||||

Performance fees | (1,974 | ) | 2,443 | (3,055 | ) | 2,050 | 2,412 | ||||||||||||

Other revenues and fees | 9,201 | 8,111 | 7,436 | 8,871 | 5,011 | ||||||||||||||

Investment income (loss): | |||||||||||||||||||

2

Carried interest | 230 | (22 | ) | (12,630 | ) | — | — | ||||||||||||

Other investment loss | (528 | ) | (87 | ) | (833 | ) | (271 | ) | 244 | ||||||||||

Total revenues | 65,033 | 75,941 | 66,593 | 71,902 | 44,113 | ||||||||||||||

Expenses | |||||||||||||||||||

Compensation and benefits | 27,432 | 27,800 | 26,768 | 20,322 | 13,712 | ||||||||||||||

Performance fee compensation | (874 | ) | (319 | ) | (8,049 | ) | (1,543 | ) | 7,192 | ||||||||||

Consolidated Funds expenses | — | — | — | 1,670 | 1,225 | ||||||||||||||

General, administrative and other expenses | 13,045 | 28,540 | 16,836 | 16,312 | 12,655 | ||||||||||||||

Total expenses | 39,603 | 56,021 | 35,555 | 36,761 | 34,784 | ||||||||||||||

Other income (expense) | |||||||||||||||||||

Dividend income | 4,327 | 1,304 | 886 | 886 | 886 | ||||||||||||||

Interest expense | (11,855 | ) | (9,226 | ) | (8,469 | ) | (5,520 | ) | (1,479 | ) | |||||||||

Other income (expenses), net | 1,363 | (983 | ) | (808 | ) | (1,502 | ) | (727 | ) | ||||||||||

Interest and other income of Consolidated Funds | — | — | — | 71,468 | 52,550 | ||||||||||||||

Interest expense of Consolidated Funds | — | — | — | (9,951 | ) | (2,638 | ) | ||||||||||||

Net realized gain (loss) on investments of Consolidated Funds | — | — | — | 789 | (16,080 | ) | |||||||||||||

Net change in unrealized depreciation on investments of Consolidated Funds | — | — | — | (20,557 | ) | (3,361 | ) | ||||||||||||

Net change in unrealized depreciation (appreciation) on secured borrowings of Consolidated Funds | — | — | — | 1,174 | (306 | ) | |||||||||||||

Total other income (expense), net | (6,165 | ) | (8,905 | ) | (8,391 | ) | 36,787 | 28,845 | |||||||||||

Income before income taxes | 19,265 | 11,015 | 22,647 | 71,928 | 38,174 | ||||||||||||||

Provision for income taxes | 1,956 | 1,063 | 2,015 | 2,528 | 1,639 | ||||||||||||||

Net income | 17,309 | 9,952 | 20,632 | 69,400 | 36,535 | ||||||||||||||

Net income attributable to non-controlling interests in Consolidated Funds | — | — | — | 29,717 | 12,898 | ||||||||||||||

Net income (loss) attributable to redeemable non-controlling interests and non-controlling interests in consolidated subsidiaries | 6,718 | 2,549 | (885 | ) | 1,933 | — | |||||||||||||

Net income attributable to non-controlling interests in Medley LLC | 9,664 | 6,406 | 18,406 | 36,055 | $ | 23,637 | |||||||||||||

Net income attributable to Medley Management Inc. | $ | 927 | $ | 997 | $ | 3,111 | $ | 1,695 | |||||||||||

Per share data: | |||||||||||||||||||

Dividends declared per Class A common stock | $ | 0.80 | $ | 0.80 | $ | 0.60 | $ | 0.20 | |||||||||||

Net income per Class A common stock - Basic and Diluted | $ | 0.07 | $ | 0.02 | $ | 0.46 | $ | 0.24 | (1) | ||||||||||

Weighted average shares outstanding - Basic and Diluted | 5,553,026 | 5,804,042 | 6,002,422 | 6,000,000 | |||||||||||||||

(1) | Based on net income attributable to Medley Management Inc. for the period September 29, 2014 through December 31, 2014. |

3

As of December 31, | |||||||||||||||||||

2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

(Amounts in thousands) | |||||||||||||||||||

Balance Sheet Data: | |||||||||||||||||||

Assets | |||||||||||||||||||

Cash and cash equivalents | $ | 36,327 | $ | 49,666 | $ | 71,688 | $ | 87,206 | $ | 5,395 | |||||||||

Restricted cash equivalents | — | 4,897 | — | — | — | ||||||||||||||

Investments, at fair value | 56,632 | 31,904 | 16,360 | 9,901 | 10,173 | ||||||||||||||

Management fees receivable | 14,714 | 12,630 | 16,172 | 15,173 | 8,921 | ||||||||||||||

Performance fees receivable | 2,987 | 4,961 | 2,518 | 5,573 | 3,339 | ||||||||||||||

Other assets | 17,262 | 18,311 | 13,015 | 7,058 | 4,971 | ||||||||||||||

Assets of Consolidated Funds: | |||||||||||||||||||

Cash and cash equivalents | — | — | — | 38,111 | 60,355 | ||||||||||||||

Investments, at fair value | — | — | — | 734,870 | 453,396 | ||||||||||||||

Interest and dividends receivable | — | — | — | 6,654 | 2,969 | ||||||||||||||

Other assets | — | — | — | 3,681 | 436 | ||||||||||||||

Total assets | $ | 127,922 | $ | 122,369 | $ | 119,753 | $ | 908,227 | $ | 549,955 | |||||||||

Liabilities and Equity | |||||||||||||||||||

Loans payable | $ | 9,233 | $ | 52,178 | $ | 100,871 | $ | 100,885 | $ | 27,653 | |||||||||

Senior unsecured debt | 116,892 | 49,793 | — | — | — | ||||||||||||||

Accounts payable, accrued expenses and other liabilities | 25,130 | 37,255 | 36,569 | 39,390 | 33,838 | ||||||||||||||

Liabilities of Consolidated Funds: | |||||||||||||||||||

Accounts payable, accrued expenses and other liabilities | — | — | — | 5,767 | 1,325 | ||||||||||||||

Secured borrowings | — | — | — | 141,135 | 41,178 | ||||||||||||||

Total liabilities | 151,255 | 139,226 | 137,440 | 287,177 | 103,994 | ||||||||||||||

Redeemable Non-controlling Interests | 53,741 | 30,805 | — | — | — | ||||||||||||||

Equity | |||||||||||||||||||

Total stockholders' equity (deficit), Medley Management Inc. | (7,971 | ) | (1,853 | ) | (39 | ) | (2,052 | ) | — | ||||||||||

Non-controlling interests in Consolidated Funds | — | — | — | 625,548 | 464,475 | ||||||||||||||

Non-controlling interests in consolidated subsidiaries | (1,702 | ) | (1,717 | ) | (459 | ) | 1,526 | 40 | |||||||||||

Non-controlling interests in Medley LLC | (67,401 | ) | (44,092 | ) | (17,189 | ) | (3,972 | ) | — | ||||||||||

Medley LLC members' deficit prior to reorganization | — | — | — | — | (18,554 | ) | |||||||||||||

Total (deficit) equity | (77,074 | ) | (47,662 | ) | (17,687 | ) | 621,050 | 445,961 | |||||||||||

Total liabilities, redeemable non-controlling interests and equity | $ | 127,922 | $ | 122,369 | $ | 119,753 | $ | 908,227 | $ | 549,955 | |||||||||

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our audited consolidated financial statements and related notes as of December 31, 2017 and 2016 and for the years ended December 31, 2017, 2016 and 2015 included in this Form 10-K.

4

Overview

We are an alternative asset management firm offering yield solutions to retail and institutional investors. We focus on credit-related investment strategies, primarily originating senior secured loans to private middle market companies in the U.S. that have revenues between $50 million and $1 billion. We generally hold these loans to maturity. Our national direct origination franchise provides capital to the middle market in the U.S. Over the past 16 years, we have provided capital to over 400 companies across 35 industries in North America.

We manage three permanent capital vehicles, two of which are BDCs and one interval fund, as well as long-dated private funds and SMAs, focusing on senior secured credit.

• | Permanent capital vehicles: MCC, SIC and STRF, have a total AUM of $2.3 billion as of December 31, 2017. |

• | Long-dated private funds and SMAs: MOF II, MOF III, MOF III Offshore, Tac Ops, MCOF, Aspect and SMAs, have a total AUM of $2.9 billion as of December 31, 2017. |

As of December 31, 2017, we had $5.2 billion of AUM, $2.3 billion in permanent capital vehicles and $2.9 billion in long-dated private funds and SMAs. Our year over year AUM decline as of December 31, 2017 was 3% and was driven in large part by income and return of capital distributions, offset in part by the growth of our long-dated private funds and SMAs. Our compounded annual AUM growth rate from December 31, 2010 through December 31, 2017 was 26% and our compounded annual Fee Earning AUM growth rate was 19%, both of which have been driven in large part by the growth in our permanent capital vehicles. As of December 31, 2017, we had $3.2 billion of Fee Earning AUM, $2.1 billion in permanent capital vehicles and $1.1 billion in long-dated private funds and SMAs. Typically the investment periods of our institutional commitments range from 18 to 24 months and we expect our Fee Earning AUM to increase as capital commitments included in AUM are invested.

In general, our institutional investors do not have the right to withdraw capital commitments and, to date, we have not experienced any withdrawals of capital commitments. For a description of the risk factor associated with capital commitments, see “Risk Factors – Third-party investors in our private funds may not satisfy their contractual obligation to fund capital calls when requested, which could adversely affect a fund’s operations and performance” included in this Annual Report on Form 10-K.

Direct origination, careful structuring and active monitoring of the loan portfolios we manage are important success factors in our business, which can be adversely affected by difficult market and political conditions, such as the turmoil in the global capital markets from 2007 to 2009. Since our inception in 2006, we have adhered to a disciplined investment process that employs these principles with the goal of delivering strong risk-adjusted investment returns while protecting investor capital. We believe that our ability to directly originate, structure and lead deals enables us to achieve these goals. In addition, the loans we manage generally have a contractual maturity of between three and seven years and are typically floating rate, which we believe positions our business well for rising interest rates.

The significant majority of our revenue is derived from management fees, which include base management fees earned on all of our investment products as well as Part I incentive fees earned from our permanent capital vehicles and certain of our long-dated private funds. Our base management fees are generally calculated based upon fee earning assets and paid quarterly in cash. Our Part I incentive fees are typically calculated based upon net investment income, subject to a hurdle rate, and are also paid quarterly in cash.

We also may earn performance fees from our long-dated private funds and SMAs. Typically, these performance fees are 15.0% to 20.0% of the total return above a hurdle rate. These performance fees are accrued quarterly and paid after the return of all invested capital and an amount sufficient to achieve the hurdle rate of return.

We also may receive incentive fees related to realized capital gains in our permanent capital vehicles and certain of our long-dated private funds that we refer to as Part II incentive fees. Part II incentive fees are payable annually and are calculated at the end of each applicable year by subtracting (i) the sum of cumulative realized capital losses and unrealized capital depreciation from (ii) cumulative aggregate realized capital gains. If the amount calculated is positive, then the Part II incentive fee for such year is equal to 20% of such amount, less the aggregate amount of Part II incentive fees paid in all prior years. If such amount is negative, then no Part II incentive fee will be payable for such year. As our investment strategy is focused on generating yield from senior secured credit, historically we have not generated Part II incentive fees.

For the years ended December 31, 2017, 2016 and 2015, 87%, 89% and 90%, respectively, of our revenues were generated from management fees and performance fees derived primarily from net interest income on senior secured loans.

Our primary expenses are compensation to our employees and general, administrative and other expenses. Compensation includes salaries, discretionary bonuses, stock-based compensation and benefits paid and payable to our employees. Performance fee compensation is related to performance fees, generally consisting of incentive allocations in our long-dated private funds that we grant to certain of our professionals. General and administrative expenses include costs primarily related to professional services, office rent and related expenses, depreciation and amortization, travel and related expenses, information technology, communication

5

and information services, placement fees and third-party marketing expenses, other general operating items, and, in 2016, expense support agreement expenses related to SIC.

Reorganization and Initial Public Offering

Medley Management Inc. was incorporated on June 13, 2014 and commenced operations on September 29, 2014 upon the completion of its IPO of its Class A common stock. We raised $100.4 million, net of underwriting discounts, through the issuance of 6,000,000 shares of Class A common stock at a public offering price of $18.00 per share. The offering proceeds were used to purchase 6,000,000 newly issued LLC Units from Medley LLC. Prior to the IPO, Medley Management Inc. had not engaged in any business or other activities except in connection with its formation and IPO.

In connection with the IPO, Medley Management Inc. issued 100 shares of Class B common stock to Medley Group LLC (“Medley Group”), an entity wholly owned by the pre-IPO members of Medley LLC. For so long as the pre-IPO members and then-current Medley personnel hold at least 10% of the aggregate number of shares of Class A common stock and LLC Units (excluding those LLC Units held by Medley Management Inc.) then outstanding, the Class B common stock entitles Medley Group to a number of votes that is equal to 10 times the aggregate number of LLC Units held by all non-managing members of Medley LLC that do not themselves hold shares of Class B common stock and entitle each other holder of Class B common stock, without regard to the number of shares of Class B common stock held by such other holder, to a number of votes that is equal to 10 times the number of membership units held by such holder.

In connection with the IPO, Medley LLC amended and restated its limited liability agreement to modify its capital structure by reclassifying the 23,333,333 interests held by the pre-IPO members into a single new class of units. The pre-IPO members also entered into an exchange agreement under which they (or certain permitted transferees thereof) have the right, subject to the terms of the exchange agreement, to exchange their LLC Units for shares of Medley Management Inc.’s Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. In addition, pursuant to the amended and restated limited liability agreement, Medley Management Inc. became the sole managing member of Medley LLC.

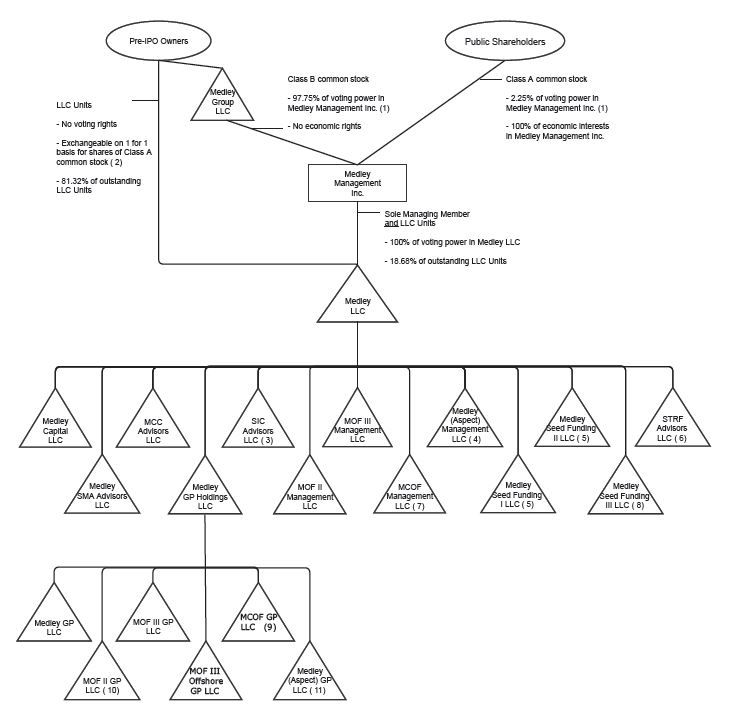

Our Structure

Medley Management Inc. is a holding company and its sole material asset is a controlling equity interest in Medley LLC. Medley Management Inc. operates and controls all of the business and affairs and consolidates the financial results of Medley LLC and its subsidiaries. We and our pre-IPO owners have also entered into an exchange agreement under which they (or certain permitted transferees) have the right (subject to the terms of the exchange agreement), to exchange their LLC Units for shares of our Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications.

Medley Group LLC, an entity wholly-owned by our pre-IPO owners, holds all 100 issued and outstanding shares of our Class B common stock. For so long as our pre-IPO owners and then-current Medley personnel hold at least 10% of the aggregate number of shares of Class A common stock and LLC Units (excluding those LLC Units held by Medley Management Inc.), which we refer to as the “Substantial Ownership Requirement,” the Class B common stock entitles Medley Group LLC, without regard to the number of shares of Class B common stock held by it, to a number of votes that is equal to 10 times the aggregate number of LLC Units held by all non-managing members of Medley LLC that do not themselves hold shares of Class B common stock and entitle each other holder of Class B common stock, without regard to the number of shares of Class B common stock held by such other holder, to a number of votes that is equal to 10 times the number of LLC Units held by such holder. For purposes of calculating the Substantial Ownership Requirement, (1) shares of Class A common stock deliverable to our pre-IPO owners and then-current Medley personnel pursuant to outstanding equity awards will be deemed then outstanding and (2) shares of Class A common stock and LLC Units held by any estate, trust, partnership or limited liability company or other similar entity of which any pre-IPO owner or then-current Medley personnel, or any immediate family member thereof, is a trustee, partner, member or similar party will be considered held by such pre-IPO owner or other then-current Medley personnel. From and after the time that the Substantial Ownership Requirement is no longer satisfied, the Class B common stock will entitle Medley Group LLC, without regard to the number of shares of Class B common stock held by it, to a number of votes that is equal to the aggregate number of LLC Units held by all non-managing members of Medley LLC that do not themselves hold shares of Class B common stock and entitle each other holder of Class B common stock, without regard to the number of shares of Class B common stock held by such other holder, to a number of votes that is equal to the number of LLC Units held by such holder. At the completion of our IPO, our pre-IPO owners were comprised of all of the non-managing members of Medley LLC. However, Medley LLC may in the future admit additional non-managing members that would not constitute pre-IPO owners. If at any time the ratio at which LLC Units are exchangeable for shares of our Class A common stock changes from one-for-one as set forth in the Exchange Agreement, the number of votes to which Class B common stockholders are entitled will be adjusted accordingly. Holders of shares of our Class B common stock will vote together with holders of our Class A common stock as a single class on all matters on which stockholders are entitled to vote generally, except as otherwise required by law.

6

Other than Medley Management Inc., holders of LLC Units, including our pre-IPO owners, are, subject to limited exceptions, prohibited from transferring any LLC Units held by them upon consummation of our IPO, or any shares of Class A common stock received upon exchange of such LLC Units, until the third anniversary of our IPO without our consent. Thereafter and prior to the fourth and fifth anniversaries of our IPO, such holders may not transfer more than 33 1/3% and 66 2/3%, respectively, of the number of LLC Units held by them upon consummation of our IPO, together with the number of any shares of Class A common stock received by them upon exchange therefor, without our consent. While this agreement could be amended or waived by us, our pre-IPO owners have advised us that they do not intend to seek any waivers of these restrictions.

The diagram below depicts our organizational structure (excluding those operating subsidiaries with no material operations or assets) as of March 7, 2018:

(1) | The Class B common stock provides Medley Group LLC with a number of votes that is equal to 10 times the aggregate number of LLC Units held by all non-managing members of Medley LLC. From and after the time that the Substantial Ownership Requirement is no longer satisfied, the Class B common stock will provide Medley Group LLC with a number of votes that is equal to the aggregate number of LLC Units held by all non-managing members of Medley LLC that do not themselves hold shares of Class B common stock. |

(2) | If our pre-IPO owners exchanged all of their vested LLC Units for shares of Class A common stock, they would hold 81.32% of the outstanding shares of Class A common stock, entitling them to an equivalent percentage of economic interests and voting power in Medley Management Inc., Medley Group LLC would hold no voting power or economic interests in Medley Management Inc. and Medley Management Inc. would hold 100% of outstanding LLC Units and 100% of the voting power in Medley LLC. |

7

(3) | Strategic Capital Advisory Services, LLC owns 20% of SIC Advisors LLC and is entitled to receive distributions of up to 20% of the gross cash proceeds received by SIC Advisors LLC from the management and incentive fees payable by Sierra Income Corporation to SIC Advisors LLC, net of certain expenses, as well as 20% of the returns of the investments held at SIC Advisors LLC. |

(4) | Medley LLC holds 96.5% of the Class B economic interests in Medley (Aspect) Management LLC. |

(5) | Medley LLC holds 100% of the outstanding Common Interest, and DB Med Investor I LLC holds 100% of the outstanding Preferred Interest in each of Medley Seed Funding I LLC and Medley Seed Funding II LLC. |

(6) | Medley Seed Funding III LLC holds 100% of the Senior Preferred Interest, Strategic Capital Advisory Services, LLC holds 100% of the Junior Preferred Interest and Medley LLC holds 100% of the Common Interest in STRF Advisors LLC. |

(7) | Medley LLC holds 95.5% of the Class B economic interests in MCOF Management LLC. |

(8) | Medley LLC holds 100% of the outstanding Common Interest, and DB MED Investor II LLC holds 100% of the outstanding Preferred Interest in Medley Seed Funding III LLC. |

(9) | Medley GP Holdings LLC holds 95.5% of the Class B economic interests in each of MCOF GP LLC. |

(10) | Certain employees, former employees and former members of Medley LLC hold approximately 40% of the limited liability company interests in MOF II GP LLC, the entity that serves as general partner of MOF II, entitling the holders to share the performance fees earned from MOF II. |

(11) | Medley LLC holds 96.5% of the Class B economic interests in Medley (Aspect) GP LLC. |

Trends Affecting Our Business

Our results of operations, including the fair value of our AUM, are affected by a variety of factors, including conditions in the global financial markets as well as economic and political environments, particularly in the U.S.

During 2017, the domestic economy exhibited continued growth, and key financial market indicators generated positive readings. Coincident with improving economic growth, LIBOR rates have increased, while credit spreads have tightened. Across the lending spectrum, year over year loan issuance has increased, driven by several factors, including robust merger and acquisition activity, as well as significant refinance activity. Our platform provides us the ability to lend across the capital structure and at varying interest rates providing our firm access to a larger borrower subset over time.

In addition to these macroeconomic trends and market factors, our future performance is dependent on our ability to attract new capital. We believe the following factors will influence our future performance:

• | The extent to which investors favor directly originated private credit investments. Our ability to attract additional capital is dependent on investors’ views of directly originated private credit investments relative to traditional assets. We believe fundraising efforts will continue to be impacted by certain fundamental asset management trends that include: (i) the increasing importance of directly originated private credit investment strategies for institutional investors; (ii) increasing demand for directly originated private credit investments from retail investors; (iii) recognition by the consultant channel, which serves endowment and pension fund investors, that directly originated private credit is an important component of asset allocation; (iv) increasing demand from insurance companies seeking alternatives to investing in the liquid credit markets; and (v) de-leveraging of the global banking system, bank consolidation and increased bank regulatory requirements. |

• | Our ability to generate strong, stable returns and retain investor capital throughout market cycles. The capital we are able to attract and retain drives the growth of our AUM, fee earning AUM and management fees. We believe we are well positioned to invest through market cycles given our AUM is in either permanent capital vehicles or long-dated private funds and SMAs. |

• | Our ability to source investments with attractive risk-adjusted returns. Our ability to grow our revenue is dependent on our continued ability to source attractive investments and deploy the capital that we have raised. We believe that the current economic environment provides attractive investment opportunities. Our ability to identify attractive investments and execute on those investments is dependent on a number of factors, including the general macroeconomic environment, valuation, size and the liquidity of these investment opportunities. A significant decrease in the quality or quantity of investment opportunities in the directly originated private credit market, a substantial increase in corporate default rates, an increase in competition from new entrants providing capital to the private debt market and a decrease in recovery rates of directly originated private credit could adversely affect our ability to source investments with attractive risk-adjusted returns. |

• | The attractiveness of our product offering to investors. We believe defined contribution plans, retail investors, public institutional investors, pension funds, endowments, sovereign wealth funds and insurance companies are increasing exposure to directly originated private credit investment products to seek differentiated returns and current yield. Our permanent capital vehicles and long-dated private funds and SMAs benefit from this demand by offering institutional and retail investors the ability to invest in our private credit investment strategy. We believe that the breadth, diversity and number of investment vehicles we offer allow us to maximize our reach with investors. |

• | The strength of our investment process, operating platform and client servicing capabilities. Following the most recent financial crisis, investors in alternative investments, including those managed by us, have heightened their focus on matters such as manager due diligence, reporting transparency and compliance infrastructure. Since inception, we have invested heavily in our investment monitoring systems, compliance and enterprise risk |

8

management systems to proactively address investor expectations and the evolving regulatory landscape. We believe these investments in operating infrastructure will continue to support our growth in AUM.

Components of Our Results of Operations

Management Fees. Management fees include both base management fees as well as Part I incentive fees.

• | Base Management Fees. Base management fees are generally based on a defined percentage of (i) average or total gross assets, including assets acquired with leverage, (ii) total commitments, (iii) net invested capital, (iv) NAV or (v) lower of cost or market value of a fund’s portfolio investments. These fees are calculated quarterly and are paid in cash in advance or in arrears. Base management fees are recognized as revenue in the period advisory services are rendered, subject to our assessment of collectability. |

In addition, we also receive non asset-based management fees that may include special fees such as origination fees, transaction fees and similar fees paid to us in connection with portfolio investments of our funds. These fees are specific to particular transactions and the contractual terms of the portfolio investments, and are recognized when earned.

• | Part I Incentive Fees. We also include Part I incentive fees that we receive from our permanent capital vehicles and certain of our long-dated private funds in management fees. Part I incentive fees are paid quarterly, in cash, and are driven primarily by net interest income on senior secured loans. As it relates to MCC, these fees are subject to netting against realized and unrealized losses. We are primarily an asset manager of yield-oriented products and our incentive fees are primarily derived from spread income rather than trading or capital gains. In addition, we also carefully manage interest rate risk. We are generally positioned to benefit from a raising rate environment, which should benefit fees paid to us from our vehicles and funds. |

Performance Fees. Performance fees are contractual fees which do not represent a capital allocation to the general partner or investment manager that are earned based on the performance of certain funds, typically our separately managed accounts. Performance fees are earned based on the fund performance during the period, subject to the achievement of minimum return levels in accordance with the respective terms set out in each fund’s investment management agreement.

Prior to the adoption of the new revenue recognition standard on January 1, 2018, we accounted for contractual based performance fees under Method 2 of ASC 605, Revenue Recognition, for revenue based on a formula. Under this method, performance fees for any period were based upon an assumed liquidation of the underlying fund's net assets on the reporting date and were subject to reversal to the extent that cumulative previously recognized performance fees exceeded the amount due to the general partner or investment manager based on a fund's cumulative investment returns. Effective January 1, 2018, we account for such performance fees in accordance with ASC 606, Revenue from Contracts with Customers, and will only recognize contractual based performance fees when it is probable that a significant reversal of such fees will not occur in the future.

The timing and amount of performance fees generated by our funds is uncertain. If we were to have a realization event in a particular quarter or year, it may have a significant impact on our results for that particular quarter or year that may not be replicated in subsequent periods. Refer to “Risk Factors — Risks Related to Our Business and Industry” included in this Annual Report on Form 10-K.

• | Part II Incentive Fees. For our permanent capital vehicles and certain of our long-dated private funds, Part II incentive fees generally represent 20.0% of each fund’s cumulative realized capital gains (net of realized capital losses and unrealized capital depreciation). We have not received these fees historically, and do not expect such fees to be material in the future given our focus on senior secured lending. |

Other Revenues and Fees. We provide administrative services to certain of our vehicles that are reported as other revenues and fees. Such fees are recognized as revenue in the period that administrative services are rendered. These fees are generally based on expense reimbursements for the portion of overhead and other expenses incurred by certain professionals directly attributable to each respective fund. These fees are reported within total revenues in our consolidated financial statements included in this Form 10-K.

Carried Interest. Carried interest are performance based fees that represent a capital allocation of income to the general partner or investment manager. Carried interest is allocated to us based on cumulative fund performance to date, subject to the achievement of minimum return levels in accordance with the respective terms set out in each fund’s governing documents.

Prior to January 1, 2018, we accounted for carried interest under Method 2 of ASC 605, as previously described above. Upon adoption of the new revenue recognition standard, we reassessed our accounting policy for carried interest, and determined that carried interest is within the scope of the accounting for equity method investments, and, as such, is not within the scope of the new revenue recognition guidance. Under the equity method of accounting, we will record carried interest in a consistent manner as we historically had which is based upon an assumed liquidation of that fund's net assets as of the reporting date, regardless of whether such amounts have been realized. For any given period, carried interest on our condensed consolidated statements of

9

operations may include reversals of previously recognized carried interest due to a decrease in the value of a particular fund that results in a decrease of cumulative carried interest earned to date. Since fund return hurdles are cumulative, previously recognized fees also may be reversed in a period of appreciation that is lower than the particular fund's hurdle rate.

Carried interest received in prior periods may be required to be returned by us in future periods if the funds’ investment performance declines below certain levels. Each fund is considered separately in this regard and, for a given fund, carried interest can never be negative over the life of a fund. If upon a hypothetical liquidation of a fund’s investments, at their then current fair values, previously recognized and distributed carried interest would be required to be returned, a liability is established for the potential clawback obligation. As of December 31, 2018, we have not received any carried interest distributions, except for tax distributions related to our allocation of net income, which included an allocation of carried interest. Pursuant to the organizational documents of each respective fund, a portion of these tax distributions may be subject to clawback. As of December 31, 2018, we have accrued $7.2 million for clawback obligations that would need to be paid if the funds were liquidated at fair value as of the end of the reporting period. Our actual obligation, however, would not become payable or realized until the end of a fund’s life.

Other Investment Income. Other investment income is comprised of unrealized appreciation (depreciation) resulting from changes in fair value of our equity method investments in addition to the income and expense allocations from such investments.

In certain cases, the entities that receive management and incentive fees from our funds are owned by Medley LLC together with other persons. See “Critical Accounting Policies” and Note 2, “Summary of Significant Accounting Policies,” to our consolidated financial statements included in this Form 10-K for additional information regarding the manner in which management fees, performance fees and other fees are generated.

Expenses

Compensation and Benefits. Compensation and benefits consists primarily of salaries, discretionary bonuses and benefits paid and payable to our employees. Compensation also includes stock-based compensation associated with the grants of equity-based awards to our employees. Compensation expense relating to equity based awards are measured at fair value as of the grant date, reduced for actual forfeitures when they occur, and expensed over the vesting period on a straight-line basis. Bonuses are accrued over the service period to which they relate.

Guaranteed payments made to our senior professionals who are members of Medley LLC are recognized as compensation expense. The guaranteed payments to our Co-Chief Executive Officers are performance based and periodically set subject to maximums based on our total assets under management. Such maximums aggregated to $2.5 million for each of the Co-Chief Executive Officers for the years ended December 31, 2017, 2016 and 2015. During the years ended December 31, 2017, 2016 and 2015, neither of our Co-Chief Executive Officers received any guaranteed payments.

Performance Fee Compensation. Performance fee compensation includes compensation related to performance fees, which generally consists of profit interests that we grant to our employees. Depending on the nature of each fund, the performance fee participation is generally structured as a fixed percentage or as an annual award. The liability is recorded subject to the vesting of the profit interests granted and is calculated based upon the net present value of the projected performance fees to be received. Payments to profit interest holders are payable when the performance fees are paid to Medley LLC by the respective fund. It is possible that we may record performance fee compensation during a period in which we do not record any performance fee revenue or we have a reversal of previously recognized performance fee revenue.

General, Administrative and Other Expenses. General and administrative expenses include costs primarily related to professional services, office rent, depreciation and amortization, general insurance, recruiting, travel and related expenses, information technology, communication and information services, other general operating items and, in 2016 and 2015, SIC expenses under an expense support and reimbursement agreement.

Other Income (Expense)

Dividend Income. Dividend income consists of dividends associated with our investments in SIC and MCC. Dividends are recognized on an accrual basis to the extent that such amounts are declared and expected to be collected.

Interest Expense. Interest expense consists primarily of interest expense relating to debt incurred by us.

Other Income (Expenses), Net. Other income (expenses), net consists primarily of expenses associated with our revenue share payable.

Provision for Income Taxes. Medley Management Inc. is subject to U.S. federal, state and local corporate income taxes on its allocable portion of taxable income from Medley LLC at prevailing corporate tax rates. Medley LLC and its subsidiaries are not subject to U.S. federal, state and local corporate income taxes since all of its income or losses are passed through to its members. However, Medley LLC and its subsidiaries are subject to New York City’s unincorporated business tax on its taxable income allocated to New York City. Our effective income tax rate is dependent on many factors, including the impact of nondeductible items and a rate benefit attributable to the fact that a portion of our earnings are not subject to corporate level taxes.

10

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. To the extent it is more likely than not that the deferred tax assets will not be recognized, a valuation allowance is provided to offset their benefit.

We recognize the benefit of an income tax position only if it is more likely than not that the tax position will be sustained upon tax examination, based solely on the technical merits of the tax position. Otherwise, no benefit is recognized. The tax benefits recognized are measured based on the largest benefit that has a greater than 50% percent likelihood of being realized upon ultimate settlement. Interest expense and penalties related to income tax matters are recognized as a component of the provision for income taxes.

On December 22, 2017, the U.S. government enacted the Tax Cuts and Jobs Act (the “Tax Act”). The Tax Act includes significant changes to the U.S. corporate income tax system including: a federal corporate rate reduction from 34% to 21%; limitations on the deductibility of interest expense and executive compensation; and the transition of U.S. international taxation from a worldwide tax system to a modified territorial tax system. Changes under the Tax Act are effective for us as of January 1, 2018.

ASC 740, Income Taxes, requires us to remeasure our deferred tax assets and liabilities as of the date of enactment, with the resulting tax effects accounted for in the reporting period of enactment. Based on the reduction of the corporate income tax rate, we re-measured our deferred tax assets and liabilities based on the rates at which they are expected to to be utilized in the future. The impact of this change resulted in a $0.3 million decrease in our deferred tax asset balance and corresponding increase in the provision for income taxes for the year ended December 31, 2017.

Net Income Attributable to Redeemable Non-Controlling Interests and Non-Controlling Interests in Consolidated Subsidiaries. Net income attributable to redeemable non-controlling interests and non-controlling interests in consolidated subsidiaries represents the ownership interests that third parties hold in certain consolidated subsidiaries.

Net Income Attributable to Non-Controlling Interests in Medley LLC. Net income attributable to non-controlling interests in Medley LLC represents the ownership interests that non-managing members’ hold in Medley LLC.

Our private funds are closed-end funds, and accordingly do not permit investors to redeem their interests other than in limited circumstances that are beyond our control, such as instances in which retaining the limited partnership interest could cause the limited partner to violate a law, regulation or rule. In addition, SMAs for a single investor may allow such investor to terminate the investment management agreement at the discretion of the investor pursuant to the terms of the applicable documents. We manage assets for MCC and SIC, both of which are BDCs. The capital managed by MCC and SIC is permanently committed to these funds and cannot be redeemed by investors.

Managing Business Performance

Non-GAAP Financial Information

In addition to analyzing our results on a GAAP basis, management also makes operating decisions and assesses business performance based on the financial and operating metrics and data that are presented without the consolidation of any fund(s). Core Net Income, Core EBITDA, Core Net Income Per Share and Core Net Income Margin are non-GAAP financial measures that are used by management to assess the performance of our business. There are limitations associated with the use of non-GAAP financial measures as compared to the use of the most directly comparable U.S. GAAP financial measure and these measures supplement and should be considered in addition to and not in lieu of the results of operations discussed further under "Results of Operations,’’ which are prepared in accordance with U.S. GAAP. Furthermore, such measures may be inconsistent with measures presented by other companies. For a reconciliation of these measures to the most comparable measure in accordance with U.S. GAAP, see "Reconciliation of Certain Non-GAAP Performance Measures to Consolidated U.S. GAAP Financial Measures.’’

Core Net Income. Core Net Income is an income measure that is used by management to assess the performance of our business through the removal of non-core items, as well as non-recurring expenses associated with our IPO. It is calculated by adjusting net income attributable to Medley Management Inc. and net income attributable to non-controlling interests in Medley LLC to exclude reimbursable expenses associated with the launch of funds, amortization of stock-based compensation expense associated with grants of restricted stock units at the time of our IPO, other non-core items and the income tax impact of these adjustments.

Core Earnings Before Interest, Income Taxes, Depreciation and Amortization (Core EBITDA). Core EBITDA is an income measure also used by management to assess the performance of our business. Core EBITDA is calculated as Core Net Income before interest expense, income taxes, depreciation and amortization.

Pro-Forma Weighted Average Shares Outstanding. The calculation of Pro-Forma Weighted Average Shares Outstanding assumes the conversion by the pre-IPO holders of 23,333,333 Medley LLC units for 23,333,333 shares of Class A common stock

11

at the beginning of each period presented, as well as the vesting of the weighted average number of restricted stock units and, in 2017, the conversion of 320,000 restricted LLC units for an equal number of shares of Class A common stock.

Core Net Income Per Share. Core Net Income Per Share is Core Net Income adjusted for corporate income taxes assuming that all of our pre-tax earnings are subject to federal, state and local corporate income taxes, divided by Pro-Forma Weighted Average Shares Outstanding (as defined above). In determining corporate income taxes we used an annual effective corporate tax rate of 43.0%. Please refer to the calculation of Core Net Income Per Share in “ Reconciliation of Certain Non-GAAP Performance Measures to Consolidated U.S. GAAP Financial Measures.”

Core Net Income Margin. Core Net Income Margin equals Core Net Income Per Share divided by total revenue per share.

Key Performance Indicators

When we review our performance we focus on the indicators described below:

For the Years Ended December 31, | |||||||||||

2017 | 2016 | 2015 | |||||||||

(Amounts in thousands, except AUM, share and per share amounts) | |||||||||||

Consolidated Financial Data: | |||||||||||

Net income attributable to Medley Management Inc. and non-controlling interests in Medley LLC | $ | 10,591 | $ | 7,403 | $ | 21,517 | |||||

Net income per Class A common stock | $ | 0.07 | $ | 0.02 | $ | 0.46 | |||||

Net Income Margin (1) | 16.3 | % | 9.7 | % | 32.3 | % | |||||

Weighted average shares - Basic and Diluted | 5,553,026 | 5,804,042 | 6,002,422 | ||||||||

Non-GAAP Data: | |||||||||||

Core Net Income | $ | 15,090 | $ | 25,531 | $ | 29,747 | |||||

Core EBITDA | $ | 29,226 | $ | 38,481 | $ | 41,721 | |||||

Core Net Income Per Share | $ | 0.33 | $ | 0.54 | $ | 0.61 | |||||

Core Net Income Margin | 15.5 | % | 21.7 | % | 28.1 | % | |||||

Pro-Forma Weighted Average Shares Outstanding | 30,851,882 | 30,689,412 | 30,459,958 | ||||||||

Other Data (at period end, in millions): | |||||||||||

AUM | $ | 5,198 | $ | 5,335 | $ | 4,779 | |||||

Fee Earning AUM | $ | 3,158 | $ | 3,190 | $ | 3,302 | |||||

(1) | Net Income Margin equals Net income attributable to Medley Management Inc. and non-controlling interests in Medley LLC divided by total revenue. |

12

Results of Operations

The following table and discussion sets forth information regarding our consolidated results of operations for the years ended December 31, 2017, 2016 and 2015. The audited consolidated financial statements of Medley have been prepared on substantially the same basis for all historical periods presented.

For the Years Ended December 31, | |||||||||||

2017 | 2016 | 2015 | |||||||||

(Amounts in thousands, except AUM data) | |||||||||||

Revenues | |||||||||||

Management fees | $ | 58,104 | $ | 65,496 | $ | 75,675 | |||||

Performance fees | (1,974 | ) | 2,443 | (3,055 | ) | ||||||

Other revenues and fees | 9,201 | 8,111 | 7,436 | ||||||||

Investment income: | |||||||||||

Carried interest | 230 | (22 | ) | (12,630 | ) | ||||||

Other investment loss | (528 | ) | (87 | ) | (833 | ) | |||||

Total Revenues | 65,033 | 75,941 | 66,593 | ||||||||

Expenses | |||||||||||

Compensation and benefits | 27,432 | 27,800 | 26,768 | ||||||||

Performance fee compensation | (874 | ) | (319 | ) | (8,049 | ) | |||||

General, administrative and other expenses | 13,045 | 28,540 | 16,836 | ||||||||

Total Expenses | 39,603 | 56,021 | 35,555 | ||||||||

Other Income (Expense) | |||||||||||

Dividend income | 4,327 | 1,304 | 886 | ||||||||

Interest expense | (11,855 | ) | (9,226 | ) | (8,469 | ) | |||||

Other income (expense), net | 1,363 | (983 | ) | (808 | ) | ||||||

Total Other Expense, Net | (6,165 | ) | (8,905 | ) | (8,391 | ) | |||||

Income before income taxes | 19,265 | 11,015 | 22,647 | ||||||||

Provision for income taxes | 1,956 | 1,063 | 2,015 | ||||||||

Net Income | 17,309 | 9,952 | 20,632 | ||||||||

Net income attributable to redeemable non-controlling interests and non-controlling interests in consolidated subsidiaries | 6,718 | 2,549 | (885 | ) | |||||||

Net income attributable to non-controlling interests in Medley LLC | 9,664 | 6,406 | 18,406 | ||||||||

Net Income Attributable to Medley Management Inc. | $ | 927 | $ | 997 | $ | 3,111 | |||||

Other data (at period end, in millions): | |||||||||||

AUM | $ | 5,198 | $ | 5,335 | $ | 4,779 | |||||

Fee earning AUM | $ | 3,158 | $ | 3,190 | $ | 3,302 | |||||

13

Year Ended December 31, 2017 Compared to Year Ended December 31, 2016

Revenues

Management Fees. Total management fees decreased by $7.4 million, or 11%, to $58.1 million for the year ended December 31, 2017 compared to the year ended December 31, 2016.

• | Our management fees from permanent capital vehicles decreased by $9.4 million during the year ended December 31, 2017 compared to 2016. The decrease was due primarily to a decline in Part I incentive fees of $4.6 million from SIC and $4.9 million from MCC, offset in part, by an increase in base management fees from SIC. |

• | Our management fees from long-dated private funds and SMAs increased by $2.0 million for the year ended December 31, 2017, compared to 2016. The increase was due primarily to an increase in base management fees from our SMAs. |

Performance Fees. There was a reversal of performance fees of $2.0 million during the year ended December 31, 2017 compared to an accrual of performance fees revenue of $2.4 million in 2016. The variance was attributed primarily to reversals of previously recognized performance fees as a result of declines in the underlying fund values of our SMAs.

Other Revenues and Fees. Other revenues and fees increased by $1.1 million, or 13%, to $9.2 million for the year ended December 31, 2017 compared to 2016. The increase was due primarily to an increase in loan administrative and transaction fees as well as administrative fees from our permanent capital vehicles and other private funds.

Investment Income. Investment income decreased by approximately $0.2 million to a loss of $0.3 million for the year ended December 31, 2017 compared to the same period in 2016. The decrease was due primarily to losses from our equity method investments, partially offset with higher carried interest from our private long dated funds.

Expenses

Compensation and Benefits. Compensation and benefits decreased by $0.4 million, or 1% to $27.4 million for the year ended December 31, 2017 compared to 2016. The variance was due primarily to a decrease in stock compensation expense of $1.1 million as a result of forfeited RSUs as well as lower discretionary compensation accruals of $0.3 million, partly offset by an increase in severance charges of $1.0 million.

Performance Fee Compensation. There was a reversal in performance fee compensation of $0.9 million during the year ended December 31, 2017 as compared to a reversal of performance fee compensation of $0.3 million during 2016. The variance in performance fee compensation was due primarily to changes in projected future payments of $0.9 million.

General, Administrative and Other Expenses. General, administrative and other expenses decreased by $15.5 million to $13.0 million for the year ended December 31, 2017 compared to 2016. The decrease was due primarily to a $16.1 million decrease in expense support agreement expenses related to SIC and $0.5 million decrease in professional fees. The expense support agreement with SIC expired on December 31, 2016, as such, we are no longer responsible for expenses under the expense support agreement relating to SIC. The decreases in these expenses were offset, in part, by expenses related to our consolidated fund, STRF.

Other Income (Expense)

Dividend Income. Dividend income increased by $3.0 million to $4.3 million for the year ended December 31, 2017 compared to 2016. The increase was due primarily to dividend income from our investment in available for sale securities attributed to additional purchases made during 2017.

Interest Expense. Interest expense increased by $2.6 million, or 28%, to $11.9 million for the year ended December 31, 2017 compared to the same period in 2016. The increase was primarily due to an acceleration of amortization of debt issuance costs and discount relating to prepayments made on our Term Loan Facility as a result of the refinancing of our indebtedness from the issuance of senior unsecured debt. In addition, our average debt outstanding during the year ended December 31, 2017 and 2016 was $127.8 million and $106.0 million, respectively.

Other Income (Expenses), net. Other income (expenses), net increased by $2.3 million to $1.4 million for the year ended December 31, 2017 compared to 2016. The increase was due primarily to the impact of revaluation of our revenue share payable.

14

Provision for Income Taxes

Our effective income tax rate was 10.2% and 9.7% for the years ended December 31, 2017 and 2016, respectively. Our tax rate is affected by recurring items, such as permanent differences and income allocated to certain redeemable non-controlling interests which is not subject to U.S. federal, state and local corporate income taxes. The increase in the effective tax rate during the year ended December 31, 2017 as compared to 2016 was due primarily to the impact of discrete items associated with the vesting and forfeiture of RSUs as well as the re-measurement our deferred tax asset balance as a result the enactment of the Tax Act offset, in part, by an increase in taxable income allocable to certain redeemable non-controlling interests which is not subject to corporate level income taxes.

Redeemable Non-Controlling Interests and Non-Controlling Interests in Consolidated Subsidiaries

Net income attributable to redeemable non-controlling interests and non-controlling interests in consolidated subsidiaries increased by $4.2 million to $6.7 million for the year ended December 31, 2017 compared to 2016. The increase was due primarily to an increase in dividend income earned and allocated to DB MED Investor I LLC, a third party, based on its preferred ownership interests held in one of our consolidated subsidiaries as well as income allocated to SC Distributors LLC for its interests in SIC Advisors.

Year Ended December 31, 2016 Compared to Year Ended December 31, 2015

Revenues

Management Fees. Total management fees decreased by $10.2 million, or 13%, to $65.5 million for the year ended December 31, 2016 compared to the year ended December 31, 2015.

• | Our management fees from permanent capital vehicles decreased by $8.1 million for the year ended December 31, 2016 compared to 2015. Management fees from SIC increased by $7.6 million due to an increase in Part I incentive fees and an 16% increase in average fee earning AUM for the year ended December 31, 2016 compared to2015. Management fees from MCC decreased by $15.7 million due to a decrease in Part I incentive fees and a 14% decrease in average fee earning AUM for the year ended December 31, 2016 compared to 2015. |

• | Our management fees from long-dated private funds and SMAs decreased by $2.1 million for the year ended December 31, 2016, compared to 2015. The decrease was primarily due to a decrease in origination fees, partly offset by an increase in base management fees. |

Performance Fees. Performance fees increased to $2.4 million for the year ended December 31, 2016 compared to a reversal of performance fees of $3.1 million during 2015. The increase was due to an increase in SMA performance fees accrual for the year ended December 31, 2016 compared to a reversal of performance fees of MOF II and SMAs for the year ended December 31, 2015, which was the result of a decline in the underlying fund values.

Other Revenues and Fees. Other revenues and fees increased by $0.7 million, or 9%, to $8.1 million for the year ended December 31, 2016 compared to 2015. The increase was due primarily to an increase in administrative fees from our permanent capital vehicles.

Investment Income. Investment income increased by approximately $13.4 million to a loss of $0.1 million for the year ended December 31, 2016 compared to the same period in 2015. The increase was due to no carried interest from our long dated private funds in 2016 versus a reversal of $12.6 million in 2015.

Expenses

Compensation and Benefits. Compensation and benefits increased by $1.0 million, or 4% to $27.8 million for the year ended December 31, 2016 compared to 2015. The increase was due primarily to an increase in salaries, that resulted from an increase in headcount, and an increase in stock-based compensation expense, partly offset by a decrease in discretionary compensation during the year ended December 31, 2016

Performance Fee Compensation. There was a reversal in performance fee compensation of $0.3 million during the year ended December 31, 2016 as compared to a reversal of performance fee compensation of $8.0 million during 2015. The variance in performance fee compensation was due primarily to changes in projected future payments.

General, Administrative and Other Expenses. General, administrative and other expenses increased by $11.7 million to $28.5 million for the year ended December 31, 2016 compared to 2015. The increase was due primarily to an increase in expense support agreement expenses related to SIC. The expense support agreement with SIC expired on December 31, 2016, as such, we are no longer be responsible for expenses under the expense support agreement relating to SIC.

15

Other Income (Expense)

Dividend Income. Dividend income increased by $0.4 million to $1.3 million for the year ended December 31, 2016 compared to 2015. The increase was due to dividend income from our investment in available-for-sale securities which were acquired during the year ended December 31, 2016.

Interest Expense. Interest expense increased by $0.8 million, or 9%, to $9.2 million for the year ended December 31, 2016 compared to 2015. The increase was primarily due to an acceleration of amortization of debt issuance costs and discount relating to prepayments made on our Term Loan Facility as a result of the refinancing of our indebtedness from the issuance of senior unsecured debt. Average debt outstanding during the years ended December 31, 2016 and 2015 was $106.0 million and $105.9 million, respectively.

Other Income (Expenses), net. Other expenses, net increased by $0.2 million to $1.0 million for the year ended December 31, 2016 compared to 2015. The increase was due primarily to the impact of revaluation of our revenue share payable.

Provision for Income Taxes

Our effective income tax rate was 9.7% and 8.9% for the years ended December 31, 2016 and 2015, respectively. Our tax rate is affected by recurring items, such as permanent differences and income allocated to certain redeemable non-controlling interests which is not subject to U.S. federal, state and local corporate income taxes. It is also affected by discrete items that may occur in any given year, but are not consistent from year to year. The increase in the effective tax rate during the year ended December 31, 2016 as compared to 2015 was primarily attributed to the variance in the reversal of performance compensation which is not included in taxable income.

Redeemable Non-Controlling Interests and Non-Controlling Interests in Consolidated Subsidiaries

Net income attributable to redeemable non-controlling interests and non-controlling interests in consolidated subsidiaries increased by $3.4 million to $2.5 million for the year ended December 31, 2016 compared to 2015. The increase was due primarily to a reversal of MOF II performance fees for the year ended December 31, 2015, a portion of which was allocated to non-controlling interests in consolidated subsidiaries.

Liquidity and Capital Resources

Our primary cash flow activities involve: (i) generating cash flow from operations, which largely includes management fees; (ii) making distributions to our members and redeemable non-controlling interests; (iii) paying dividends and (iv) borrowings, interest payments and repayments under our debt facilities. As of December 31, 2017, we had $36.3 million in cash and cash equivalents.

Our material source of cash from our operations is management fees, which are collected quarterly. We primarily use cash flows from operations to pay compensation and benefits, general, administrative and other expenses, federal, state and local corporate income taxes, debt service costs and distributions to our owners. Our cash flows, together with the proceeds from equity and debt issuances, are also used to fund investments in limited partnerships, purchase available for sale securities, purchase fixed assets and other capital items. If cash flows from operations were insufficient to fund distributions, we expect that we would suspend paying such distributions.

Debt Instruments

Senior Unsecured Debt

On August 9, 2016, Medley LLC completed a registered public offering of $25.0 million of an aggregate principal amount of 6.875% senior notes due 2026 (the “2026 Notes”). On October 18, 2016, Medley LLC completed a registered public offering of an additional $28.6 million in aggregate principal amount of the 2026 Notes. The 2026 Notes mature on August 15, 2026.

On January 18, 2017, Medley LLC completed a registered public offering of $34.5 million in aggregate principal amount of 7.25% senior notes due 2024 (the “2024 Notes”). On February 22, 2017, Medley LLC completed a registered public offering of an additional $34.5 million in aggregate principal amount of 2024 Notes. The 2024 Notes mature on January 30, 2024.

As of December 31, 2017, the outstanding senior unsecured debt balance was $116.9 million, and is reflected net of unamortized discount, premium and debt issuance costs of $5.7 million.

16

See Note 7 "Senior Unsecured Debt" to our consolidated financial statements included in this Form 10-K for additional information on the 2026 Notes and the 2024 Notes.

Revolving Credit Facility

On August 19, 2014, we entered into a $15.0 million senior secured revolving credit facility with City National Bank (as amended, the “Revolving Credit Facility”), as administrative agent and collateral agent thereunder, and the lenders from time to time party thereto. On September 22, 2017 we amended the Revolving Credit Facility to, among other things, extend the maturity date until March 31, 2020 and provide for an incremental facility in an amount up to $10.0 million upon the satisfaction of certain customary conditions. We intend to use any proceeds of borrowings under the Revolving Credit Facility for general corporate purposes, including funding our working capital needs. We have not incurred any borrowings under the Revolving Credit Facility through December 31, 2017. As of December 31, 2017, we were in compliance with the financial covenants under our Revolving Credit Facility.

Interest Rate and Fees

Borrowings under the Revolving Credit Facility bear interest, at our option, either (i) at ABR, plus an applicable margin not to exceed 0.25 percentage points, or (ii) at an adjusted LIBOR plus an applicable margin not to exceed 2.50 percentage points. In addition to paying interest on any outstanding principal under the Revolving Credit Facility, we are required to pay an unused line fee on the first day of the second month following each fiscal quarter in an amount equal to (i) if the average daily balance for the applicable fiscal quarter was less than $9.0 million, 0.50% per annum, or (ii) if the average daily balance for the applicable fiscal quarter was equal to or greater than $9.0 million, 0.25% per annum.

Guarantees and Collateral

Any obligations under the Revolving Credit Facility are unconditionally and irrevocably guaranteed by certain of Medley LLC’s subsidiaries. In addition, any outstanding borrowings are collateralized by first priority or equivalent security interests in (i) all the capital stock of, or other equity interests in, the borrower and each of the borrower’s and credit agreement guarantors’ direct or indirect domestic subsidiaries and 65% of the capital stock of, or other equity interests in, each of the borrower’s or any subsidiary guarantors’ direct wholly owned first-tier restricted foreign subsidiaries, and (ii) certain tangible and intangible assets of the borrower and the credit agreement guarantors (subject to certain exceptions and qualifications).

None of our non-wholly owned domestic subsidiaries are obligated to guarantee the Revolving Credit Facility.

Certain Covenants and Events of Default

The Revolving Credit Facility contains a number of significant affirmative and negative covenants and customary events of default. Such covenants, among other things, will limit or restrict, subject to certain exceptions, the ability of the borrower and its restricted subsidiaries to:

• | incur additional indebtedness, make guarantees and enter into hedging arrangements; |

• | create liens on assets; |

• | enter into sale and leaseback transactions; |

• | engage in mergers or consolidations; |

• | make fundamental changes; |

• | pay dividends and distributions or repurchase our capital stock; |

• | make investments, loans and advances, including acquisitions; |

• | engage in certain transactions with affiliates; |

• | make changes in the nature of their business; and |

• | make prepayments of junior debt. |

In addition, the credit agreement governing our Revolving Credit Facility contains financial covenants that requires us to maintain a Maximum Net Leverage Ratio of not greater than 5.0 to 1.0, a Total Leverage Ratio of not greater than 7.0 to 1.0, and Core EBITDA of not less than $15.0 million. These ratios are calculated on a trailing twelve months basis and are calculated using our standalone financial results and include adjustments to calculate Core EBITDA.

Our Revolving Credit Facility contains certain customary representations and warranties, affirmative covenants and events of default. If an event of default occurs, the lender under the Revolving Credit Facility will be entitled to take various actions, including the acceleration of any amounts due under the Revolving Credit Facility and all actions permitted to be taken by a secured creditor.

17

Non-Recourse Promissory Notes

In April 2012, we borrowed $5.0 million under a non-recourse promissory note with a foundation, and $5.0 million under a non-recourse promissory note with a trust. These notes are scheduled to mature in March 2019.

See Note 6 "Loans Payable" to our consolidated financial statements included in this Form 10-K for additional information regarding the promissory notes.

Cash Flows

The significant captions and amounts from our consolidated statements of cash flows are summarized below. Negative amounts represent a net outflow, or use of cash.

For the Years Ended December 31, | |||||||||||

2017 | 2016 | 2015 | |||||||||

(Amounts in thousands) | |||||||||||

Statements of cash flows data | |||||||||||

Net cash provided by operating activities | $ | 12,563 | $ | 15,895 | $ | 24,063 | |||||

Net cash used in investing activities | (35,203 | ) | (18,826 | ) | (1,373 | ) | |||||

Net cash provided by (used in) financing activities | 4,404 | (14,194 | ) | (38,208 | ) | ||||||

Net decrease in cash and cash equivalents | $ | (18,236 | ) | $ | (17,125 | ) | $ | (15,518 | ) | ||

Operating Activities

Our net cash flow provided by operating activities was $12.6 million, $15.9 million and $24.1 million during the years ended December 31, 2017, 2016 and 2015, respectively. During the years ended December 31, 2017, 2016 and 2015, net cash flow provided by operating activities was attributed to net income of $17.3 million, $10.0 million and $20.6 million, respectively, non-cash adjustments of $7.6 million, $6.7 million and $17.4 million, respectively, and changes in operating assets and liabilities of $(12.5) million, $(0.7) million and $(14.0) million, respectively.

Investing Activities

Our investing activities generally reflect cash used for acquisitions of fixed assets, distributions received from our equity method investments and purchases of available for sale securities. Purchases of fixed assets were $0.1 million, $1.9 million and $0.8 million for the years ended December 31, 2017, 2016 and 2015, respectively. Capital contributions to equity method investments represented a use of cash from financing activities of $0.3 million for each of the years ended December 31, 2017 and 2016 and $1.1 million for the year ended December 31, 2015. Distributions received from equity method investments during each of the years ended December 31, 2017 and 2016 were $0.2 million and were $0.5 million for the year ended December 31, 2015. Excluding the investments held by our consolidated fund, purchases of available for sale securities were $35.0 million during the year ended December 31, 2017 and $16.8 million during the year ended December 31, 2016.

Financing Activities

Dividends paid were $5.8 million, $5.5 million and $4.1 million during the years ended December 31, 2017, 2016 and 2015, respectively. Distributions to members and non-controlling interests were $30.0 million, $23.7 million and $32.7 million for the years ended December 31, 2017, 2016 and 2015, respectively. Capital contributions from non-controlling interests and redeemable non-controlling interests resulted in an inflow of cash of $23.0 million for the year ended December 31, 2017 and $17.0 million during the year ended December 31, 2016. Repurchases of Class A common stock represented a use of cash from financing activities of $3.6 million, $1.2 million and $0.1 million for the years ended December 31, 2017, 2016 and 2015, respectively.

On August 9, 2016, Medley LLC completed its first registered public offering of senior unsecured debt and on October 18, 2016, January 18, 2017, and February 22, 2017 Medley LLC completed additional registered public offerings of senior unsecured debt. The proceeds from these offerings, net of offering expenses payable by us, amounted to $116.2 million. The net proceeds from the offerings were used to pay-down the outstanding indebtedness under the Term Loan Facility with the remaining amount to be used for working capital purposes. Repayments of loans payable resulted in an outflow of cash of $44.8 million and $50.5 million for the years ended December 31, 2017 and 2016, respectively. Proceeds from the issuance of debt obligations provided an inflow of cash of $69.1 million for the year ended December 31, 2017 and $52.6 million for the year ended December 31, 2016.

Sources and Uses of Liquidity