Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - CAPITAL SENIOR LIVING CORP | d631387dex991.htm |

| 8-K - 8-K - CAPITAL SENIOR LIVING CORP | d631387d8k.htm |

Capital Senior Living A Leading Pure-Play Senior Housing Owner-Operator Exhibit 99.2

Forward-Looking Statements The forward-looking statements in this presentation are subject to certain risks and uncertainties that could cause results and financial condition to differ materially from those indicated in the forward-looking statements, including, but not limited to, the Company’s ability to generate sufficient cash flow to satisfy its debt and lease obligations and to fund the Company’s capital improvement projects to expand, redevelop, and/or reposition its senior living communities; the Company’s ability to obtain additional capital on terms acceptable to it; the Company’s ability to extend or refinance its existing debt as such debt matures; the Company’s compliance with its debt and lease agreements, including certain financial covenants, and the risk of cross-default in the event such non-compliance occurs; the Company’s ability to complete acquisitions and dispositions upon favorable terms or at all; the risk of oversupply and increased competition in the markets which the Company operates; the risk of increased competition for skilled workers due to wage pressure and changes in regulatory requirements; the departure of the Company’s key officers and personnel; the cost and difficulty of complying with applicable licensure, legislative oversight, or regulatory changes; the risks associated with a decline in economic conditions generally; the adequacy and continued availability of the Company’s insurance policies and the Company’s ability to recover any losses it sustains under such policies; changes in accounting principles and interpretations; and the other risks and factors identified from time to time in the Company’s reports filed with the Securities and Exchange Commission (“SEC”), to differ materially, including, but not without limitation to, the Company’s ability to complete the refinancing of certain of our wholly owned communities, realize the anticipated savings related to such financing, find suitable acquisition properties at favorable terms, financing, licensing, business conditions, risks of downturns in economic conditions generally, satisfaction of closing conditions such as those pertaining to licensures, availability of insurance at commercially reasonable rates and changes in accounting principles and interpretations among others, and other risks and factors identified from time to time in our reports filed with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement forward-looking statements in this presentation that become untrue because of new information, subsequent events or otherwise.

Non-GAAP Financial Measures Adjusted EBITDAR is a financial valuation measure and Adjusted Net Income/(Loss) and Adjusted CFFO are financial performance measures that are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). Non-GAAP financial measures may have material limitations in that they do not reflect all of the costs associated with our results of operations as determined in accordance with GAAP. As a result, these non-GAAP financial measures should not be considered a substitute for, nor superior to, financial results and measures determined or calculated in accordance with GAAP. Adjusted EBITDAR is a valuation measure commonly used by our management, research analysts and investors to value companies in the senior living industry. Because Adjusted EBITDAR excludes interest expense and rent expense, it allows our management, research analysts and investors to compare the enterprise values of different companies without regard to differences in capital structures and leasing arrangements. The Company believes that Adjusted Net Income/(Loss) and Adjusted CFFO are useful as performance measures in identifying trends in day-to-day operations because they exclude the costs associated with acquisitions and conversions and other items that do not ordinarily reflect the ongoing operating results of our primary business. Adjusted Net Income/(Loss) and Adjusted CFFO provide indicators to management of progress in achieving both consolidated and individual business unit operating performance and are used by research analysts and investors to evaluate the performance of companies in the senior living industry. The Company strongly urges you to review the reconciliation of net loss to Adjusted EBITDAR and the reconciliation of net (loss) income to Adjusted Net Income/(Loss) and Adjusted CFFO, on the last page of the Company’s second quarter 2018 earnings release dated July 31, 2018, along with the Company’s consolidated balance sheets, statements of operations, and statements of cash flows, which can be found on the Company’s website at www.capitalsenior.com/investor-relations/press-releases/

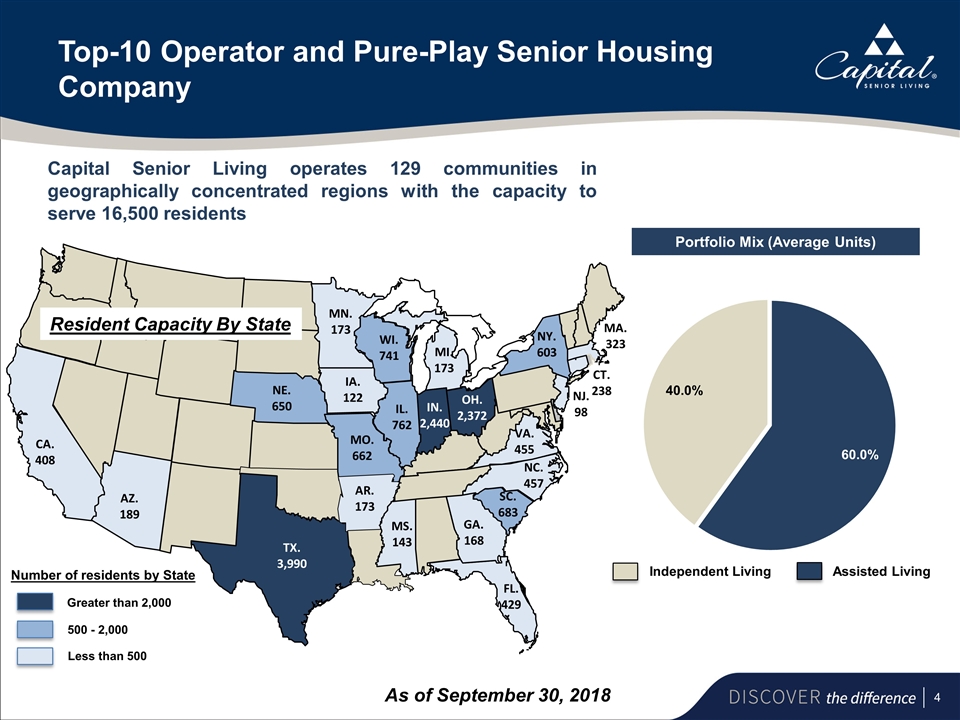

Top-10 Operator and Pure-Play Senior Housing Company Portfolio Mix (Average Units) As of September 30, 2018 AR. 173 AZ. 189 CT. 238 FL. 429 IA. 122 IL. 762 IN. 2,440 MI. 173 MN. 173 MO. 662 MS. 143 NC. 457 SC. 683 NE. 650 NJ. 98 NY. 603 OH. 2,372 TX. 3,990 VA. 455 CA. 408 CA. 408 AZ. 189 Resident Capacity By State Capital Senior Living operates 129 communities in geographically concentrated regions with the capacity to serve 16,500 residents WI. 741 GA. 168 MA. 323 Number of residents by State Greater than 2,000 500 - 2,000 Less than 500 Assisted Living

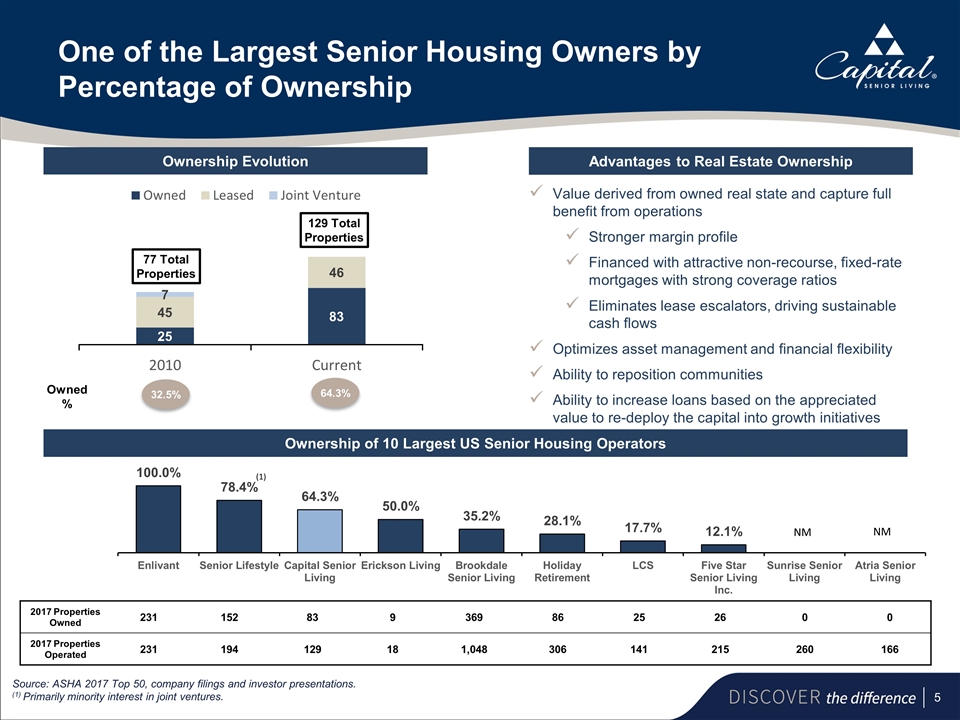

One of the Largest Senior Housing Owners by Percentage of Ownership Ownership Evolution Advantages to Real Estate Ownership Ownership of 10 Largest US Senior Housing Operators Value derived from owned real state and capture full benefit from operations Stronger margin profile Financed with attractive non-recourse, fixed-rate mortgages with strong coverage ratios Eliminates lease escalators, driving sustainable cash flows Optimizes asset management and financial flexibility Ability to reposition communities Ability to increase loans based on the appreciated value to re-deploy the capital into growth initiatives Owned % 129 Total Properties 77 Total Properties 32.5% 64.3% 2017 Properties Owned 231 152 83 9 369 86 25 26 0 0 2017 Properties Operated 231 194 129 18 1,048 306 141 215 260 166 Source: ASHA 2017 Top 50, company filings and investor presentations. (1) Primarily minority interest in joint ventures. (1) NM NM

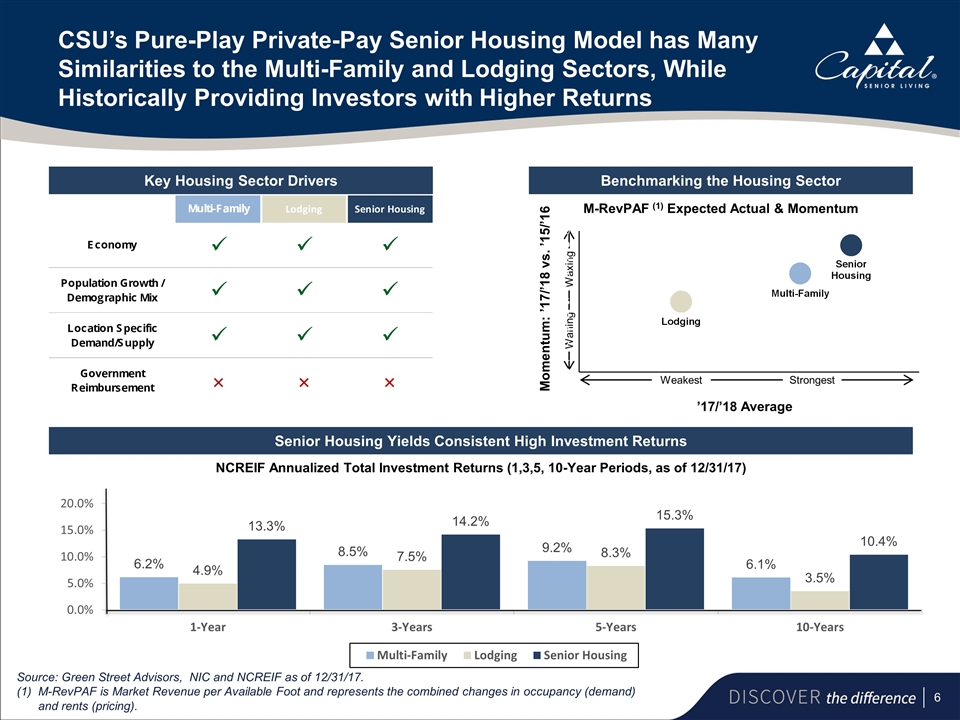

CSU’s Pure-Play Private-Pay Senior Housing Model has Many Similarities to the Multi-Family and Lodging Sectors, While Historically Providing Investors with Higher Returns Key Housing Sector Drivers Benchmarking the Housing Sector Senior Housing Yields Consistent High Investment Returns NCREIF Annualized Total Investment Returns (1,3,5, 10-Year Periods, as of 12/31/17) Momentum: ’17/’18 vs. ’15/’16 ’17/’18 Average M-RevPAF (1) Expected Actual & Momentum Source: Green Street Advisors, NIC and NCREIF as of 12/31/17. (1)M-RevPAF is Market Revenue per Available Foot and represents the combined changes in occupancy (demand) and rents (pricing). Strongest Weakest Waning Waxing

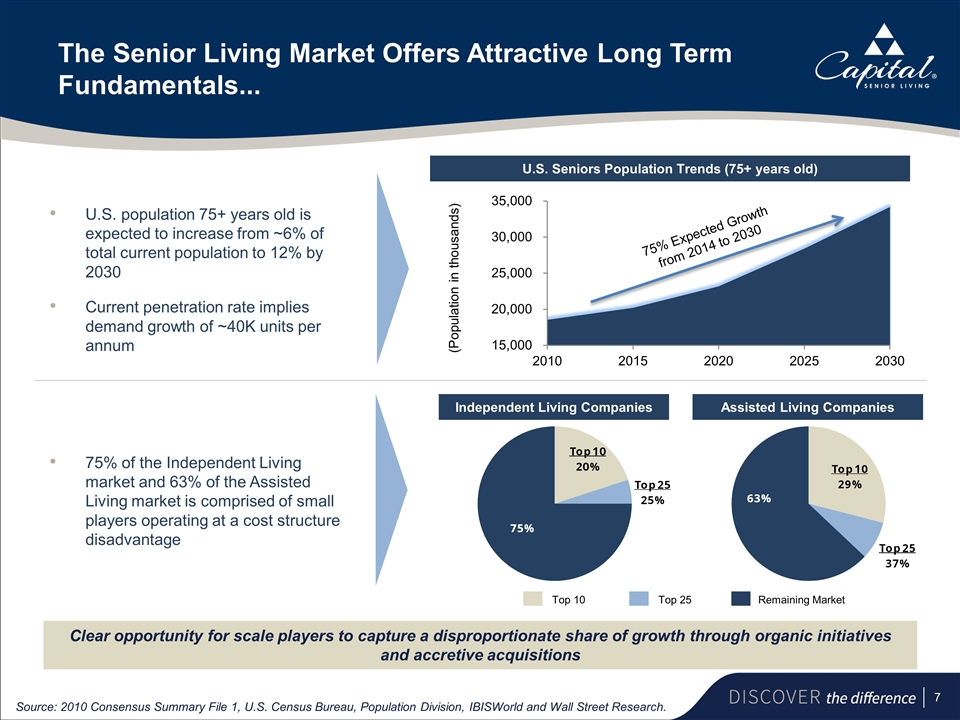

The Senior Living Market Offers Attractive Long Term Fundamentals... U.S. population 75+ years old is expected to increase from ~6% of total current population to 12% by 2030 Current penetration rate implies demand growth of ~40K units per annum 75% of the Independent Living market and 63% of the Assisted Living market is comprised of small players operating at a cost structure disadvantage (Population in thousands) 75% Expected Growth from 2014 to 2030 Top 10 Remaining Market Top 25 Clear opportunity for scale players to capture a disproportionate share of growth through organic initiatives and accretive acquisitions Source: 2010 Consensus Summary File 1, U.S. Census Bureau, Population Division, IBISWorld and Wall Street Research. U.S. Seniors Population Trends (75+ years old) Independent Living Companies Assisted Living Companies

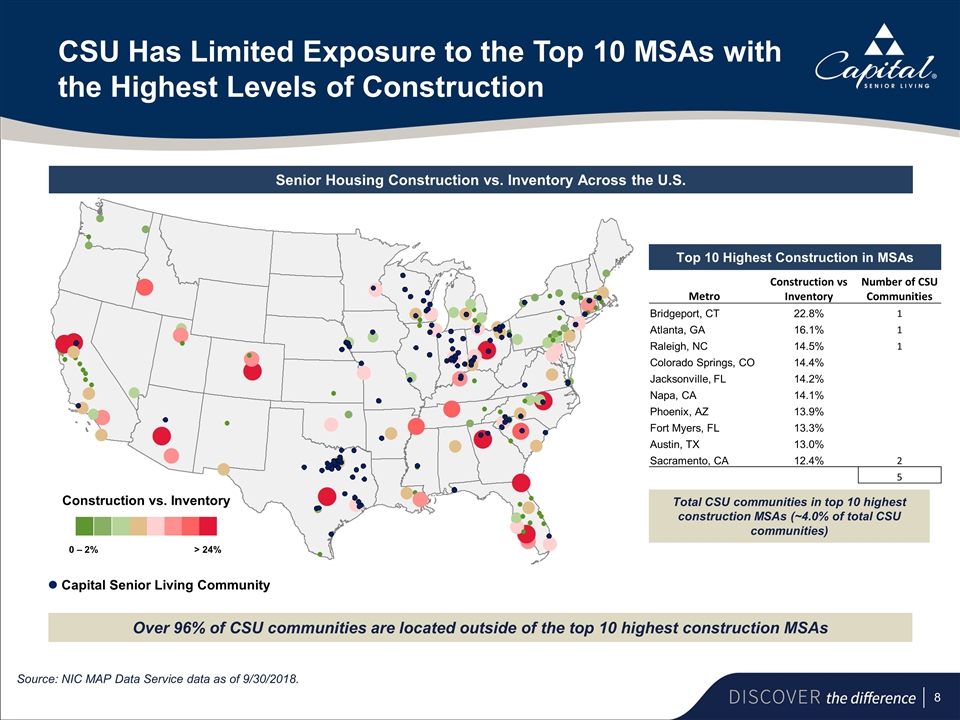

CSU Has Limited Exposure to the Top 10 MSAs with the Highest Levels of Construction Source: NIC MAP Data Service data as of 9/30/2018. Senior Housing Construction vs. Inventory Across the U.S. Top 10 Highest Construction in MSAs Total CSU communities in top 10 highest construction MSAs (~4.0% of total CSU communities) Over 96% of CSU communities are located outside of the top 10 highest construction MSAs Capital Senior Living Community 0 – 2% Construction vs. Inventory > 24% Metro Construction vs Inventory Number of CSU Communities Bridgeport, CT 22.8% 1 Atlanta, GA 16.1% 1 Raleigh, NC 14.5% 1 Colorado Springs, CO 14.4% Jacksonville, FL 14.2% Napa, CA 14.1% Phoenix, AZ 13.9% Fort Myers, FL 13.3% Austin, TX 13.0% Sacramento, CA 12.4% 2 5

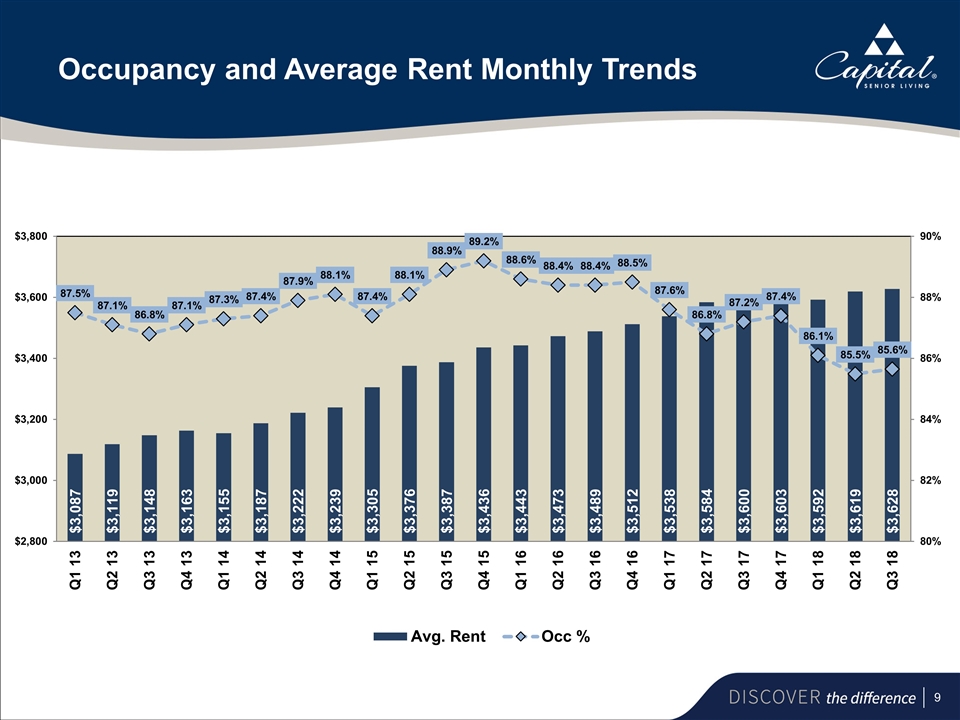

Occupancy and Average Rent Monthly Trends

Operational Initiatives New Leadership in Operations, Human Resources, Sales and Marketing Restructure of our Sales and Marketing Organization Move to a more Centralized Operating Platform Rebasing of Expenses Scale Initiatives Implementing a common electronic information platform Innovative Referral Streams

Strategic Focus Areas Shift to a consistent operating model Centralize functions to create economies of scale Implemented a front-end procurement platform to reduce costs and centralize certain Account Payable functions Negotiating national contracts across several cost categories Implement a common electronic information platform Differentiate through quality and customer service Common customer service platform Short-term expense rebasing Restructure growth engine to rebuild occupancy Focus executive directors on NOI and operations Improving sales fundamentals and innovative business development

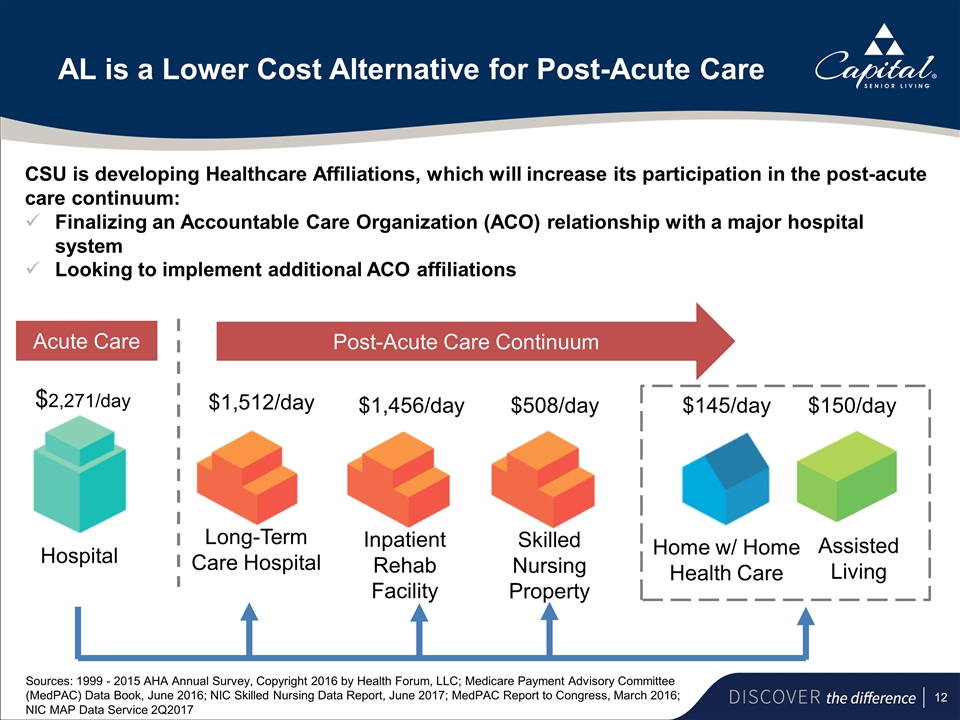

AL is a Lower Cost Alternative for Post-Acute Care Acute Care Post-Acute Care Continuum Hospital $2,271/day Long-Term Care Hospital $1,512/day Inpatient Rehab Facility $1,456/day Skilled Nursing Property $508/day Home w/ Home Health Care $145/day Assisted Living $150/day Sources: 1999 - 2015 AHA Annual Survey, Copyright 2016 by Health Forum, LLC; Medicare Payment Advisory Committee (MedPAC) Data Book, June 2016; NIC Skilled Nursing Data Report, June 2017; MedPAC Report to Congress, March 2016; NIC MAP Data Service 2Q2017 CSU is developing Healthcare Affiliations, which will increase its participation in the post-acute care continuum: Finalizing an Accountable Care Organization (ACO) relationship with a major hospital system Looking to implement additional ACO affiliations

Quality Uphold Highest Quality Standards Reduce Variation/Enhance Safety Service Maintain a Family-Centered Culture Implement Best Practices in Family Experience People Engage Colleagues Cultivate Talent Growth Serve New Residents Cost Move to Centralization/Standardization The Capital Operating System drives all facets of our community operations Upholding Highest Standards of Core Pillars to Improve Resident Experience

J.D. Power, a global marketing information company, recognized Capital Senior Living as one of the top senior living providers in the nation in their 2018 Senior Living Satisfaction Study The most important factors of satisfaction included: Community staff Convenient location Food and beverage Room, building and grounds Senior service Activities Capital Senior Living scored well above the industry average and ranked third overall among senior living operators nationally The Company’s annual resident satisfaction survey, conducted by an independent third party, resulted in 94.6% satisfaction among all residents across its 129 communities CSU Received Top Scores in Resident Satisfaction

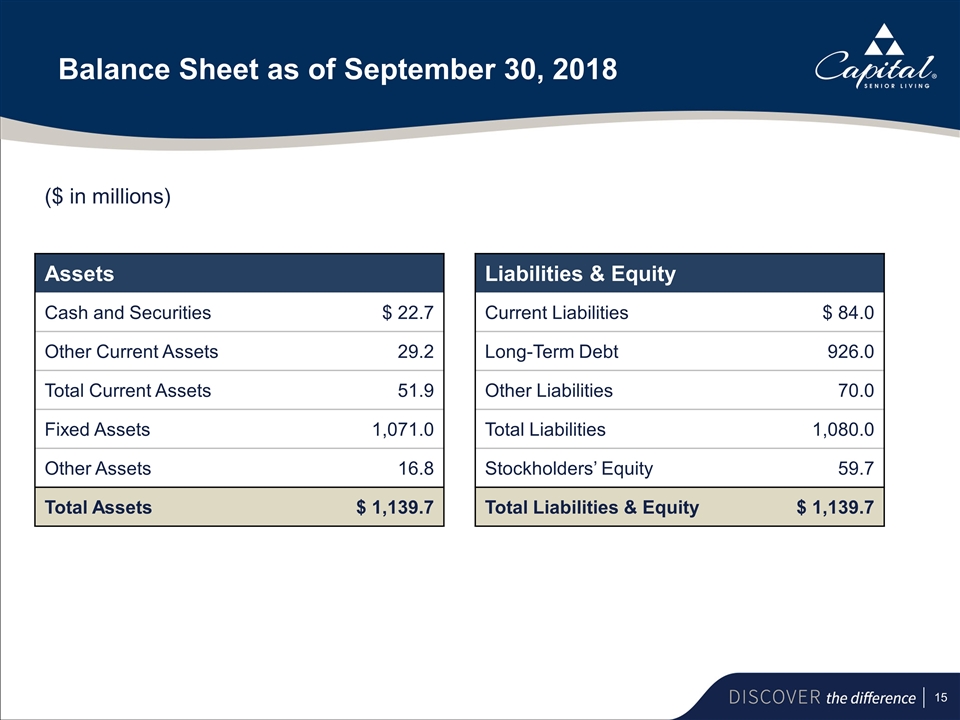

Balance Sheet as of September 30, 2018 Assets Cash and Securities $ 22.7 Other Current Assets 29.2 Total Current Assets 51.9 Fixed Assets 1,071.0 Other Assets 16.8 Total Assets $ 1,139.7 Liabilities & Equity Current Liabilities $ 84.0 Long-Term Debt 926.0 Other Liabilities 70.0 Total Liabilities 1,080.0 Stockholders’ Equity 59.7 Total Liabilities & Equity $ 1,139.7 ($ in millions)

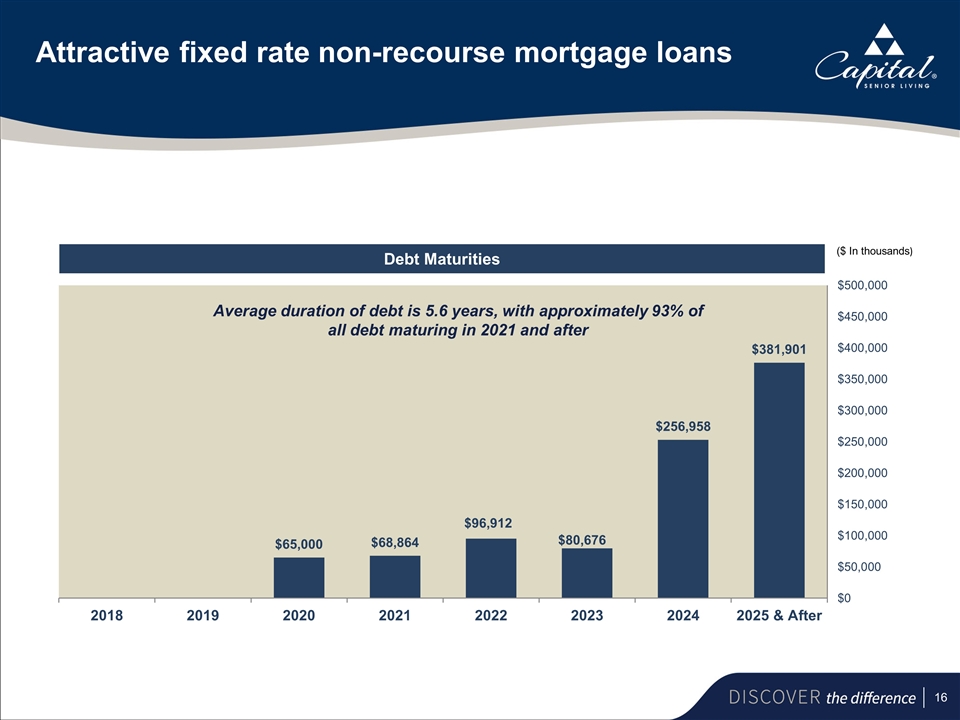

Debt Maturities Average duration of debt is 5.6 years, with approximately 93% of all debt maturing in 2021 and after ($ In thousands) Attractive fixed rate non-recourse mortgage loans