Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MATERION Corp | mtrn_2018novemberx8kinvest.htm |

INVESTOR PRESENTATION November 2018

Forward-looking Statements These slides contain (and the accompanying oral discussion will contain, where applicable) “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to differ materially from the results expressed or implied by these statements, including health issues, litigation and regulation relating to our business, our ability to achieve and/or maintain profitability, significant cyclical fluctuations in our customers’ businesses, competitive substitutes for our products, risks associated with our international operations, including foreign currency rate fluctuations, energy costs and the availability and prices of raw materials, and other factors disclosed in periodic reports filed with the Securities and Exchange Commission. Consequently, these forward-looking statements should be regarded as the Company’s current plans, estimates, and beliefs. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions to these forward-looking statements that may be made to reflect any future events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events. These slides include certain non-GAAP financial measures as defined by the rules and regulations of the Securities and Exchange Commission. A reconciliation of those measures to the most directly comparable GAAP equivalent is provided in the Appendix to this presentation. 2

Q3 2018 Highlights ► Seven consecutive quarters of sales and profit growth ► Record adjusted operating profit ► All three businesses reported double-digit operating profit margins for the first time ► PAC generated a record operating profit of $16.7 million ► Working capital as a % of net sales < 25% ► Ended Q3 2018 in a net cash position of ~ $50M, even with incremental $21M pension contribution ► Raised full-year earnings guidance for second time this year 3

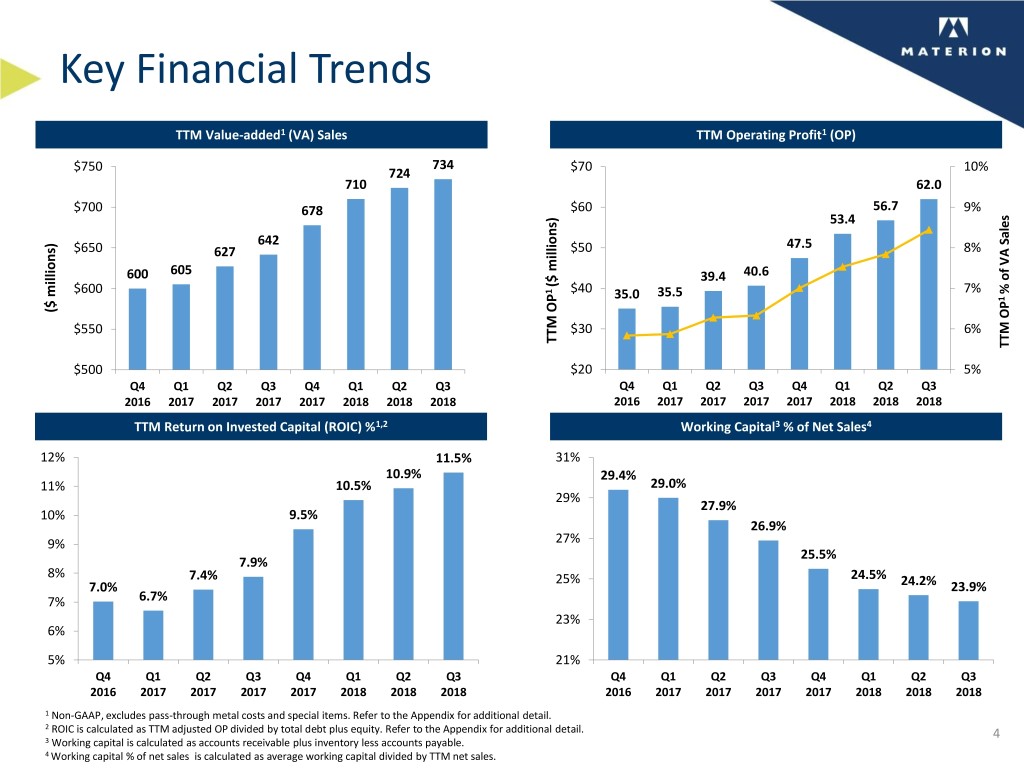

Key Financial Trends TTM Value-added1 (VA) Sales TTM Operating Profit1 (OP) 734 $750 724 $70 10% 710 62.0 $700 678 $60 56.7 9% 53.4 642 47.5 $650 627 $50 8% 600 605 39.4 40.6 ($ millions) ($ 1 1 $600 $40 35.5 7% ofVA % Sales 35.0 1 ($ millions) ($ $550 $30 6% TTM OP TTM TTMOP $500 $20 5% Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2016 2017 2017 2017 2017 2018 2018 2018 2016 2017 2017 2017 2017 2018 2018 2018 TTM Return on Invested Capital (ROIC) %1,2 Working Capital3 % of Net Sales4 12% 11.5% 31% 10.9% 29.4% 11% 10.5% 29.0% 29% 27.9% 10% 9.5% 26.9% 9% 27% 25.5% 7.9% 8% 7.4% 25% 24.5% 7.0% 24.2% 23.9% 7% 6.7% 23% 6% 5% 21% Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2016 2017 2017 2017 2017 2018 2018 2018 2016 2017 2017 2017 2017 2018 2018 2018 1 Non-GAAP, excludes pass-through metal costs and special items. Refer to the Appendix for additional detail. 2 ROIC is calculated as TTM adjusted OP divided by total debt plus equity. Refer to the Appendix for additional detail. 4 3 Working capital is calculated as accounts receivable plus inventory less accounts payable. 4 Working capital % of net sales is calculated as average working capital divided by TTM net sales.

Materion Company Profile Company Overview Value-added Sales 1 1 • Materion is an integrated producer of high- 2017 VA Sales by Segment 2017 VA Sales by End Market performance advanced engineered materials Precision Performance Alloys Medical Coatings & Composites Energy - Leading market position for specialty 13% 9% Telecom 7% Consumer Infrastructure 30% Electronics products across multiple end markets 5% 54% Defense 9% - Strong positions in growing markets with 33% high barriers to entry Automotive 8% Advanced Electronics 15% Materials 17% Industrial - Only global vertically integrated producer Components Other of beryllium (Be) and Be alloys $800 12% • New CEO hired in March 2017 with One 734.4 Materion focus on building performance $700 677.7 10% excellence in five main areas: 599.9 $600 8% - Operational $500 6% - Commercial $400 4% - Innovation $300 2% - Digital $200 0% 2016 2017 Q3 2018 TTM - Inorganic growth Value-added Sales1 (millions) Adjusted Operating Profit (OP) Margin1 5 1 Non-GAAP, excludes pass-through metal costs and special items. Refer to the Appendix for additional detail.

Key Facts Share Statistics as of 09/28/2018 Q3 2018 TTM Financial Information Trading Symbol MTRN Revenues Stock Price $60.50 $1,218M Shares O/S, Diluted 20.6M 52 wk Range $42.33 - $64.34 Value-added sales1 $734M 3 Mo Avg Vol 102,416 Market Cap $1,246M Adjusted EPS1 $2.24 Enterprise Value $1,196M $70 Materion Share Performance TTM 9.28.18 Adjusted EBITDA1 $107M $65 $60 Debt-to-capitalization1 <1% $55 $50 Operating cash flow $81M $45 $40 Dividend yield ~1% 6 Research coverage: KeyBanc, Jefferies, Sidoti, and Stonegate 1 Non-GAAP, excludes pass-through metal costs and special items. Refer to the Appendix for additional detail.

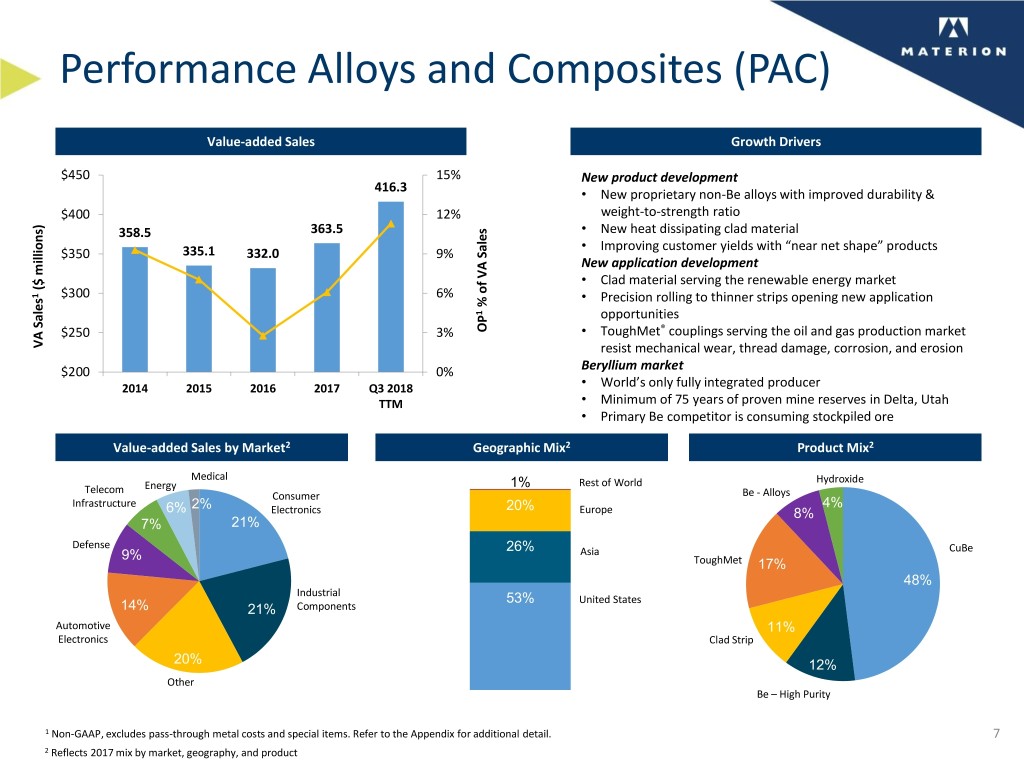

Performance Alloys and Composites (PAC) Value-added Sales Growth Drivers $450 15% New product development 416.3 • New proprietary non-Be alloys with improved durability & $400 12% weight-to-strength ratio 358.5 363.5 • New heat dissipating clad material • Improving customer yields with “near net shape” products $350 335.1 332.0 9% New application development • Clad material serving the renewable energy market ($ ($ millions) 1 $300 6% • Precision rolling to thinner strips opening new application % of VA Sales VA of % 1 opportunities $250 3% OP • ToughMet® couplings serving the oil and gas production market VA Sales VA resist mechanical wear, thread damage, corrosion, and erosion $200 0% Beryllium market 2014 2015 2016 2017 Q3 2018 • World’s only fully integrated producer TTM • Minimum of 75 years of proven mine reserves in Delta, Utah • Primary Be competitor is consuming stockpiled ore Value-added Sales by Market2 Geographic Mix2 Product Mix2 Medical 1% Rest of World Hydroxide Telecom Energy Consumer Be - Alloys Infrastructure 2% 20% 4% 6% Electronics Europe 8% 7% 21% Defense 26% 9% Asia CuBe ToughMet 17% 48% Industrial 53% United States 14% 21% Components Automotive 11% Electronics Clad Strip 20% 12% Other Be – High Purity 1 Non-GAAP, excludes pass-through metal costs and special items. Refer to the Appendix for additional detail. 7 2 Reflects 2017 mix by market, geography, and product

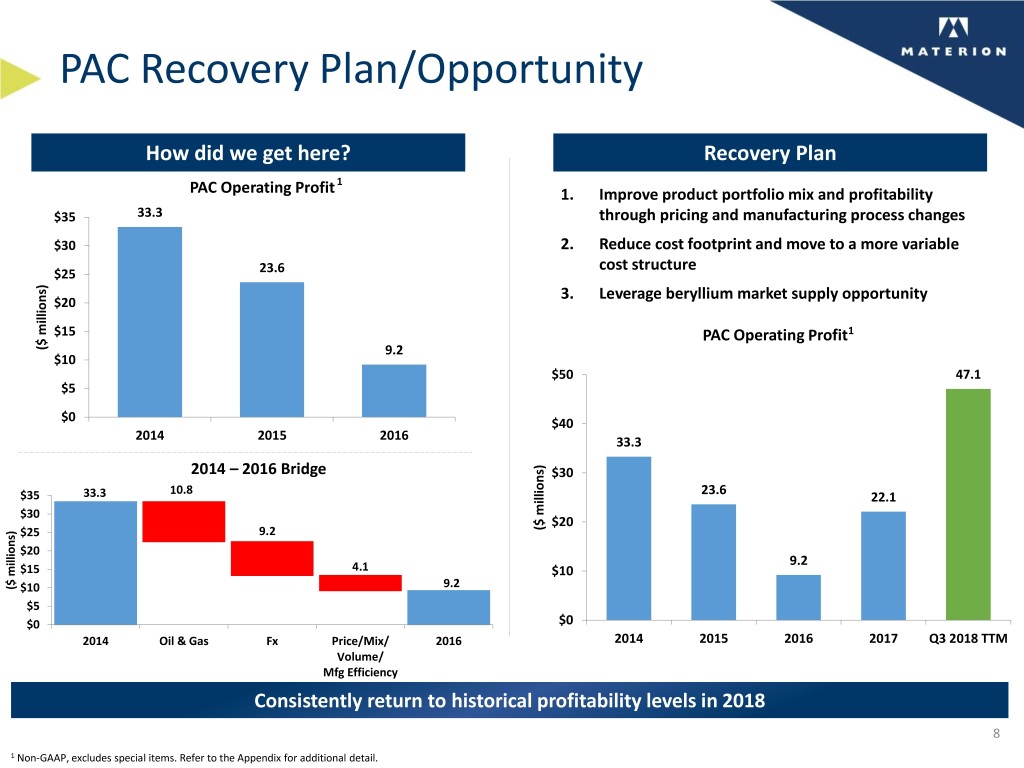

PAC Recovery Plan/Opportunity How did we get here? Recovery Plan 1 PAC Operating Profit 1. Improve product portfolio mix and profitability $35 33.3 through pricing and manufacturing process changes $30 2. Reduce cost footprint and move to a more variable cost structure $25 23.6 3. Leverage beryllium market supply opportunity $20 $15 PAC Operating Profit1 ($ ($ millions) 9.2 $10 $50 47.1 $5 $0 $40 2014 2015 2016 33.3 2014 – 2016 Bridge $30 10.8 23.6 $35 33.3 22.1 $30 $20 $25 9.2 millions) ($ $20 9.2 $15 4.1 $10 ($ millions) ($ $10 9.2 $5 $0 $0 2014 Oil & Gas Fx Price/Mix/ 2016 2014 2015 2016 2017 Q3 2018 TTM Volume/ Mfg Efficiency Consistently return to historical profitability levels in 2018 8 1 Non-GAAP, excludes special items. Refer to the Appendix for additional detail.

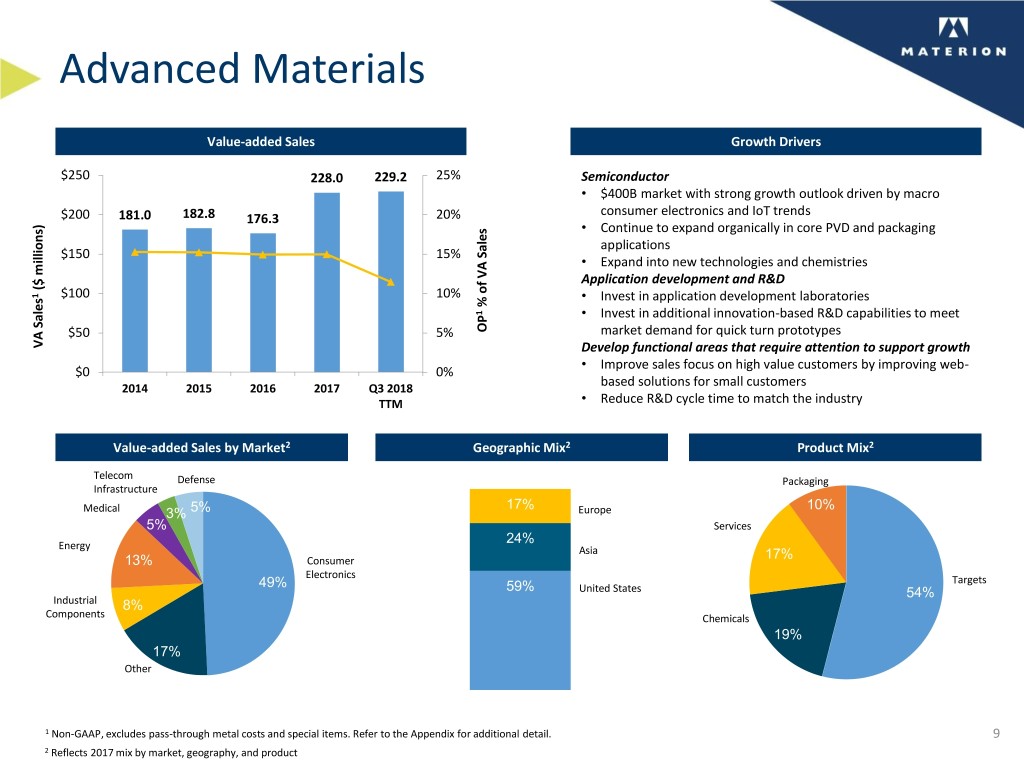

Advanced Materials Value-added Sales Growth Drivers $250 228.0 229.2 25% Semiconductor • $400B market with strong growth outlook driven by macro consumer electronics and IoT trends $200 181.0 182.8 176.3 20% • Continue to expand organically in core PVD and packaging applications $150 15% • Expand into new technologies and chemistries Application development and R&D ($ ($ millions) 1 $100 10% • Invest in application development laboratories % of VA Sales VA of % 1 • Invest in additional innovation-based R&D capabilities to meet $50 5% OP market demand for quick turn prototypes VA Sales VA Develop functional areas that require attention to support growth • Improve sales focus on high value customers by improving web- $0 0% based solutions for small customers 2014 2015 2016 2017 Q3 2018 TTM • Reduce R&D cycle time to match the industry Value-added Sales by Market2 Geographic Mix2 Product Mix2 Telecom Defense Packaging Infrastructure 17% 10% Medical 3% 5% Europe 5% Services 24% Energy Asia 17% 13% Consumer Electronics 49% Targets 59% United States 54% Industrial 8% Components Chemicals 19% 17% Other 1 Non-GAAP, excludes pass-through metal costs and special items. Refer to the Appendix for additional detail. 9 2 Reflects 2017 mix by market, geography, and product

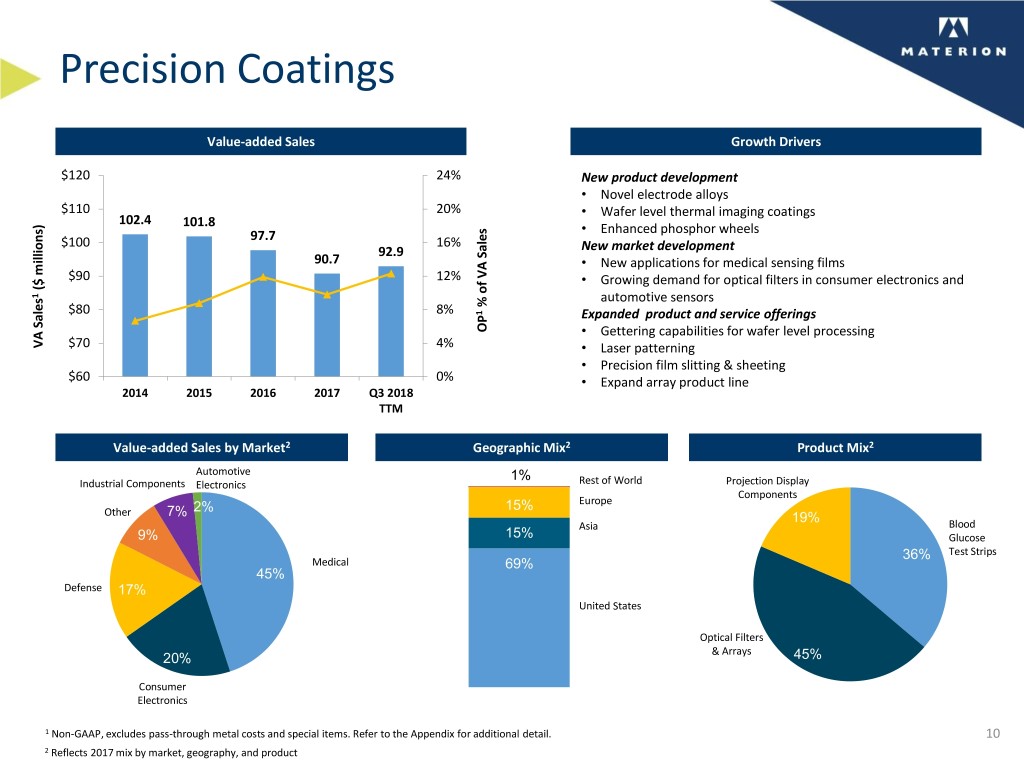

Precision Coatings Value-added Sales Growth Drivers $120 24% New product development • Novel electrode alloys $110 20% • Wafer level thermal imaging coatings 102.4 101.8 • Enhanced phosphor wheels $100 97.7 16% 92.9 New market development 90.7 • New applications for medical sensing films $90 12% • Growing demand for optical filters in consumer electronics and ($ ($ millions) 1 automotive sensors % of VA Sales VA of % $80 8% 1 Expanded product and service offerings OP • Gettering capabilities for wafer level processing VA Sales VA $70 4% • Laser patterning • Precision film slitting & sheeting $60 0% • Expand array product line 2014 2015 2016 2017 Q3 2018 TTM Value-added Sales by Market2 Geographic Mix2 Product Mix2 Automotive 1% Industrial Components Electronics Rest of World Projection Display Components 2% 15% Europe Other 7% 19% Asia Blood 9% 15% Glucose 36% Test Strips Medical 69% 45% Defense 17% United States Optical Filters & Arrays 20% 45% Consumer Electronics 1 Non-GAAP, excludes pass-through metal costs and special items. Refer to the Appendix for additional detail. 10 2 Reflects 2017 mix by market, geography, and product

Consistently Deliver Profitable Growth PROFITABLE GLOBAL GROWTH COMMERCIAL OPERATIONAL INNOVATION ACQUISITIONS DIGITAL EXCELLENCE EXCELLENCE PERFORMANCE-BASED CULTURE AND RESULTS Deliver sustained double-digit EPS growth 11

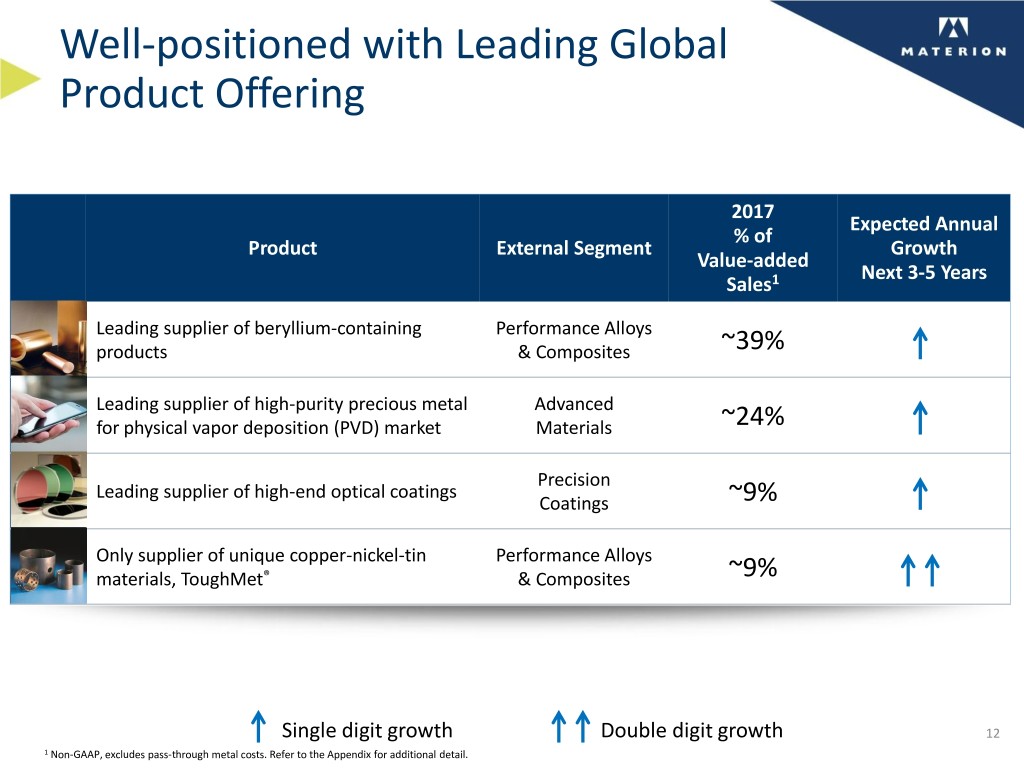

Well-positioned with Leading Global Product Offering 2017 Expected Annual % of Product External Segment Growth Value-added Next 3-5 Years Sales1 Leading supplier of beryllium-containing Performance Alloys products & Composites ~39% Leading supplier of high-purity precious metal Advanced for physical vapor deposition (PVD) market Materials ~24% Precision Leading supplier of high-end optical coatings Coatings ~9% Only supplier of unique copper-nickel-tin Performance Alloys materials, ToughMet® & Composites ~9% Single digit growth Double digit growth 12 1 Non-GAAP, excludes pass-through metal costs. Refer to the Appendix for additional detail.

Global Megatrends Play to Our Strengths Key Trends Characteristics of our Materials • Miniaturization of electronics/IoT Conductivity • Additional electronic instruments for Corrosion resistance autos, aircraft Weight savings (lighter) • Expanding high performance optical device opportunities Purity Wavelength management • Innovation in medical diagnostics and sensors Thermal management • Extraction of oil and gas from Lubricity previously inaccessible locations Reliability • Alternative energy Durability • New aircraft builds and retrofits Miniaturization • Advancements in lighting (LED) Strength 13

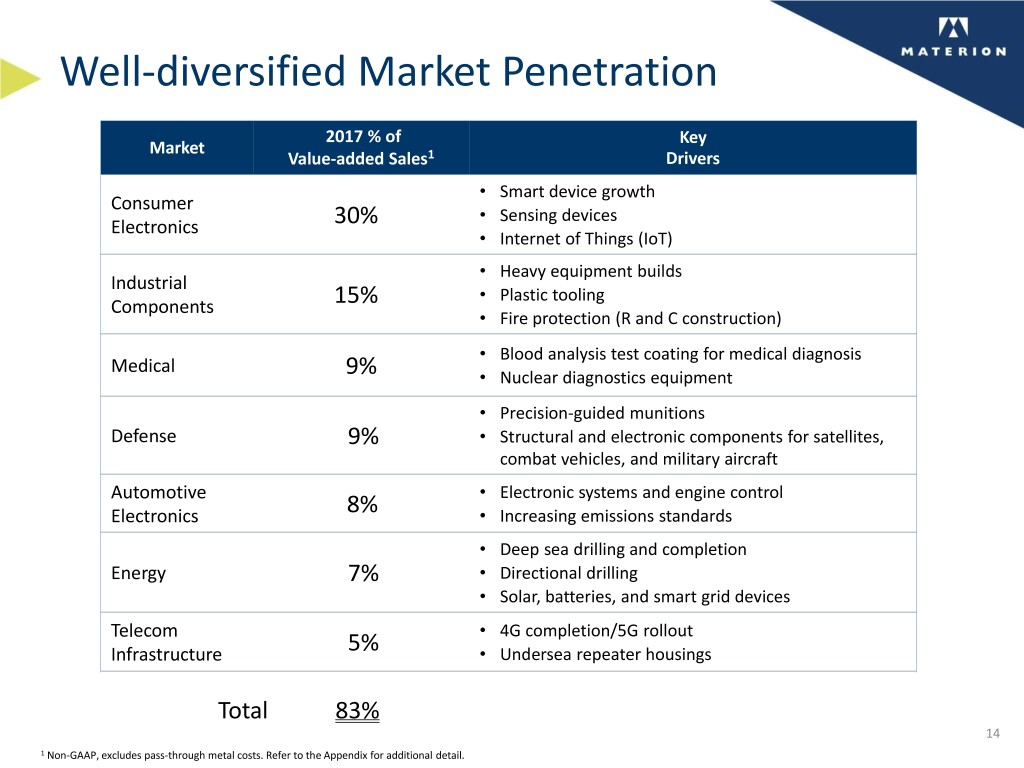

Well-diversified Market Penetration 2017 % of Key Market Value-added Sales1 Drivers • Smart device growth Consumer • Sensing devices Electronics 30% • Internet of Things (IoT) • Heavy equipment builds Industrial • Plastic tooling Components 15% • Fire protection (R and C construction) • Blood analysis test coating for medical diagnosis Medical 9% • Nuclear diagnostics equipment • Precision-guided munitions Defense 9% • Structural and electronic components for satellites, combat vehicles, and military aircraft Automotive • Electronic systems and engine control Electronics 8% • Increasing emissions standards • Deep sea drilling and completion Energy 7% • Directional drilling • Solar, batteries, and smart grid devices Telecom • 4G completion/5G rollout Infrastructure 5% • Undersea repeater housings Total 83% 14 1 Non-GAAP, excludes pass-through metal costs. Refer to the Appendix for additional detail.

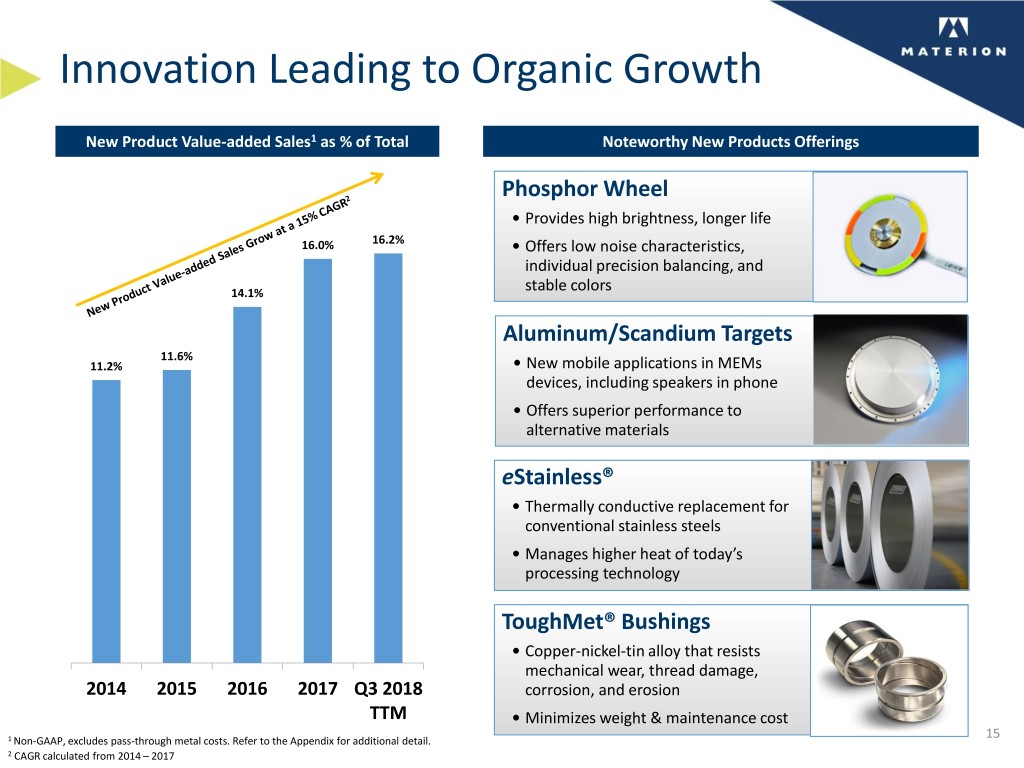

Innovation Leading to Organic Growth New Product Value-added Sales1 as % of Total Noteworthy New Products Offerings Phosphor Wheel • Provides high brightness, longer life 16.0% 16.2% • Offers low noise characteristics, individual precision balancing, and 14.1% stable colors Aluminum/Scandium Targets 11.6% 11.2% • New mobile applications in MEMs devices, including speakers in phone • Offers superior performance to alternative materials eStainless® • Thermally conductive replacement for conventional stainless steels • Manages higher heat of today’s processing technology ToughMet® Bushings • Copper-nickel-tin alloy that resists mechanical wear, thread damage, 2014 2015 2016 2017 Q3 2018 corrosion, and erosion TTM • Minimizes weight & maintenance cost 15 1 Non-GAAP, excludes pass-through metal costs. Refer to the Appendix for additional detail. 2 CAGR calculated from 2014 – 2017

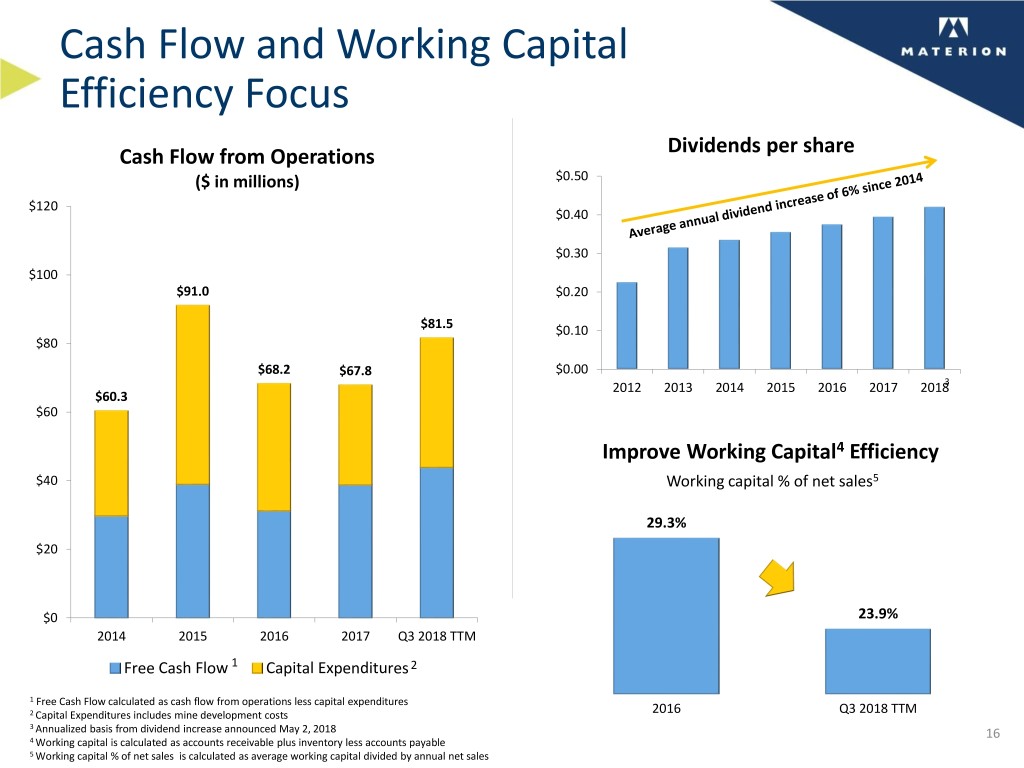

Cash Flow and Working Capital Efficiency Focus Dividends per share Cash Flow from Operations ($ in millions) $0.50 $120 $0.40 $0.30 $100 $91.0 $0.20 $81.5 $0.10 $80 $68.2 $67.8 $0.00 2012 2013 2014 2015 2016 2017 20183 $60.3 $60 Improve Working Capital4 Efficiency $40 Working capital % of net sales5 29.3% $20 $0 23.9% 2014 2015 2016 2017 Q3 2018 TTM Free Cash Flow 1 Capital Expenditures 2 1 Free Cash Flow calculated as cash flow from operations less capital expenditures 2 Capital Expenditures includes mine development costs 2016 Q3 2018 TTM 3 Annualized basis from dividend increase announced May 2, 2018 16 4 Working capital is calculated as accounts receivable plus inventory less accounts payable 5 Working capital % of net sales is calculated as average working capital divided by annual net sales

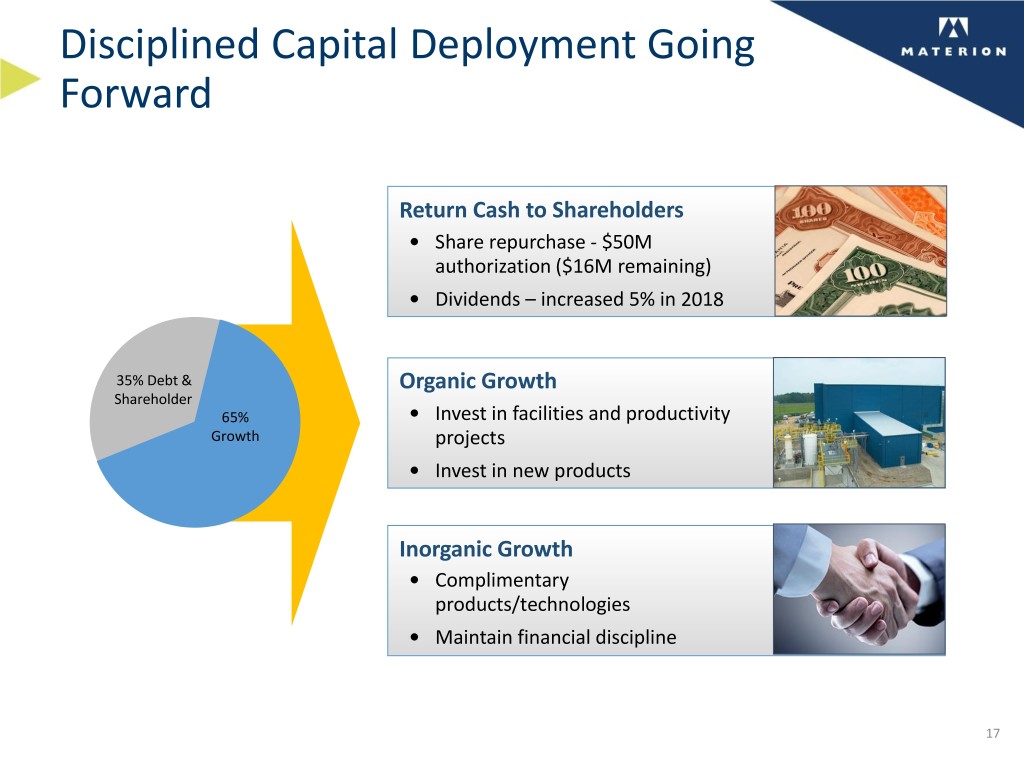

Disciplined Capital Deployment Going Forward Return Cash to Shareholders • Share repurchase - $50M authorization ($16M remaining) • Dividends – increased 5% in 2018 35% Debt & Organic Growth Shareholder 65% • Invest in facilities and productivity Growth projects • Invest in new products Inorganic Growth • Complimentary products/technologies • Maintain financial discipline 17

Materion Investment Thesis ► Clearly defined strategy and execution led by new management team ► Differentiated product portfolio aligned with global megatrends to accelerate future growth ► Driving significant improvement in profitability and cash flow growth ► Consistently delivering profitable growth ► Seven consecutive quarters of year-over-year VA sales and OP growth 18

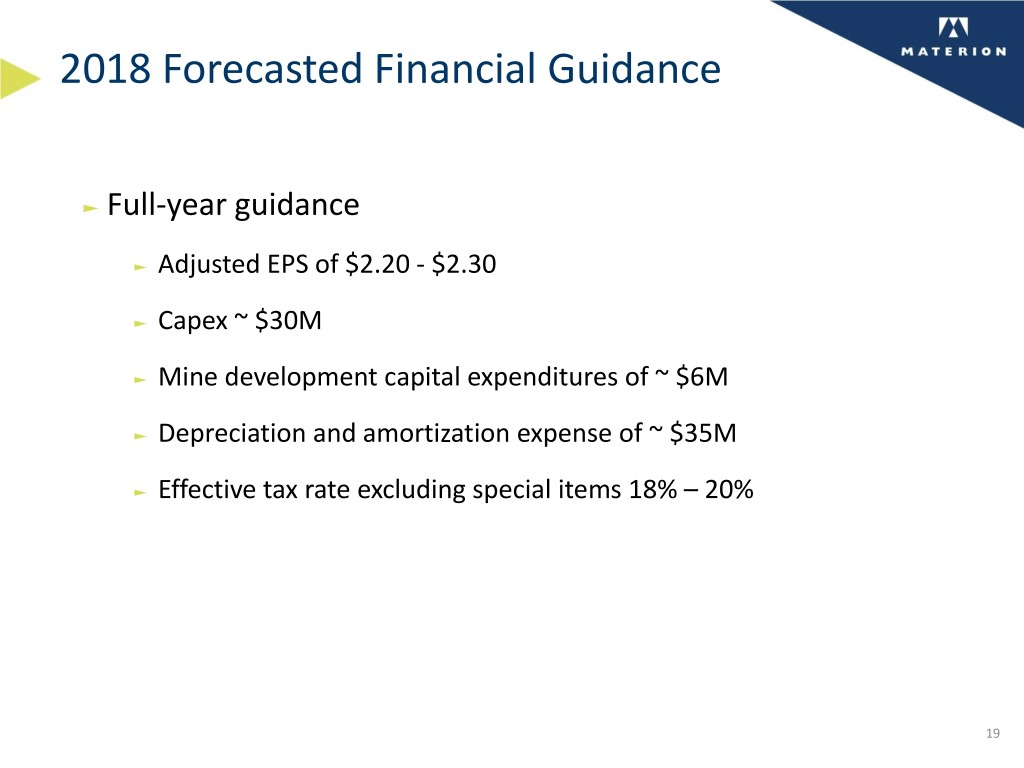

2018 Forecasted Financial Guidance ► Full-year guidance ► Adjusted EPS of $2.20 - $2.30 ► Capex ~ $30M ► Mine development capital expenditures of ~ $6M ► Depreciation and amortization expense of ~ $35M ► Effective tax rate excluding special items 18% – 20% 19

Appendix

Materion: Making Advanced Materials That Improve the World Industrial Components Medical 15% 9% Defense 9% Automotive Electronics Consumer Electronics 8% 30% Performance Alloys and Composites Advanced Materials 54% 33% Energy 7% Precision Coatings 13% Telecom Infrastructure 5% 0 1 % of Value-added Sales 2017 A-2 1 Non-GAAP, excludes pass-through metal costs. Refer to the Appendix for additional detail.

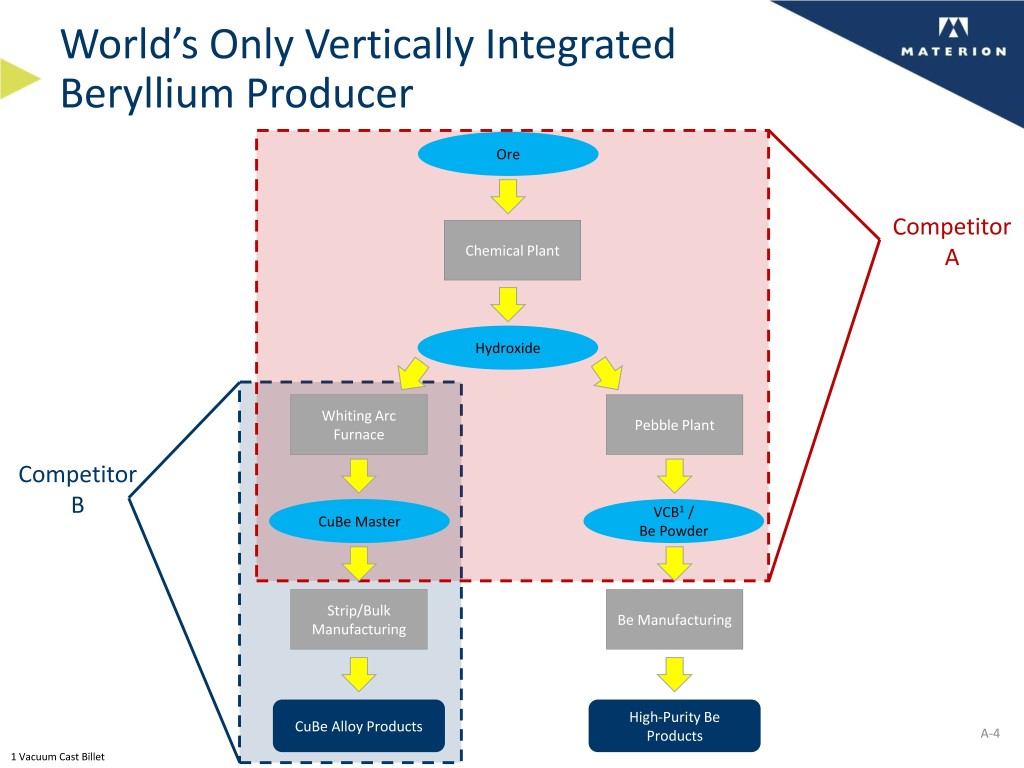

Beryllium Market Supply Opportunity Materion – leading position in beryllium market • Only global integrated producer – Minimum of 75 years of proven reserves in Utah mine – Supplies over 70% of world’s mined beryllium • ~40% of company sales include beryllium in some form • Global stockpiled sources depleting • Only significant commercially active bertrandite ore mine • Materion positioned to support world demand • Significant incremental profit potential A-3

World’s Only Vertically Integrated Beryllium Producer Ore Competitor Chemical Plant A Hydroxide Whiting Arc Pebble Plant Furnace Competitor B VCB1 / CuBe Master Be Powder Strip/Bulk Be Manufacturing Manufacturing High-Purity Be CuBe Alloy Products Products A-4 1 Vacuum Cast Billet

Financial Information

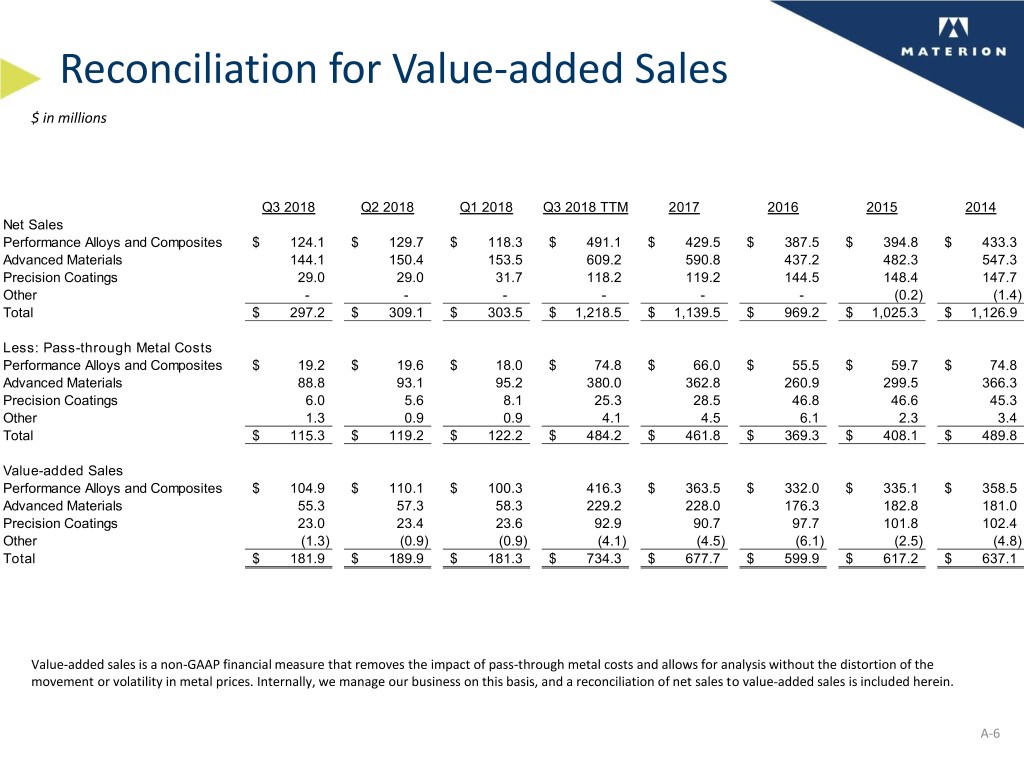

Reconciliation for Value-added Sales $ in millions Q3 2018 Q2 2018 Q1 2018 Q3 2018 TTM 2017 2016 2015 2014 Net Sales Performance Alloys and Composites $ 124.1 $ 129.7 $ 118.3 $ 491.1 $ 429.5 $ 387.5 $ 394.8 $ 433.3 Advanced Materials 144.1 150.4 153.5 609.2 590.8 437.2 482.3 547.3 Precision Coatings 29.0 29.0 31.7 118.2 119.2 144.5 148.4 147.7 Other - - - - - - (0.2) (1.4) Total $ 297.2 $ 309.1 $ 303.5 $ 1,218.5 $ 1,139.5 $ 969.2 $ 1,025.3 $ 1,126.9 Less: Pass-through Metal Costs Performance Alloys and Composites $ 19.2 $ 19.6 $ 18.0 $ 74.8 $ 66.0 $ 55.5 $ 59.7 $ 74.8 Advanced Materials 88.8 93.1 95.2 380.0 362.8 260.9 299.5 366.3 Precision Coatings 6.0 5.6 8.1 25.3 28.5 46.8 46.6 45.3 Other 1.3 0.9 0.9 4.1 4.5 6.1 2.3 3.4 Total $ 115.3 $ 119.2 $ 122.2 $ 484.2 $ 461.8 $ 369.3 $ 408.1 $ 489.8 Value-added Sales Performance Alloys and Composites $ 104.9 $ 110.1 $ 100.3 416.3 $ 363.5 $ 332.0 $ 335.1 $ 358.5 Advanced Materials 55.3 57.3 58.3 229.2 228.0 176.3 182.8 181.0 Precision Coatings 23.0 23.4 23.6 92.9 90.7 97.7 101.8 102.4 Other (1.3) (0.9) (0.9) (4.1) (4.5) (6.1) (2.5) (4.8) Total $ 181.9 $ 189.9 $ 181.3 $ 734.3 $ 677.7 $ 599.9 $ 617.2 $ 637.1 Value-added sales is a non-GAAP financial measure that removes the impact of pass-through metal costs and allows for analysis without the distortion of the movement or volatility in metal prices. Internally, we manage our business on this basis, and a reconciliation of net sales to value-added sales is included herein. A-6

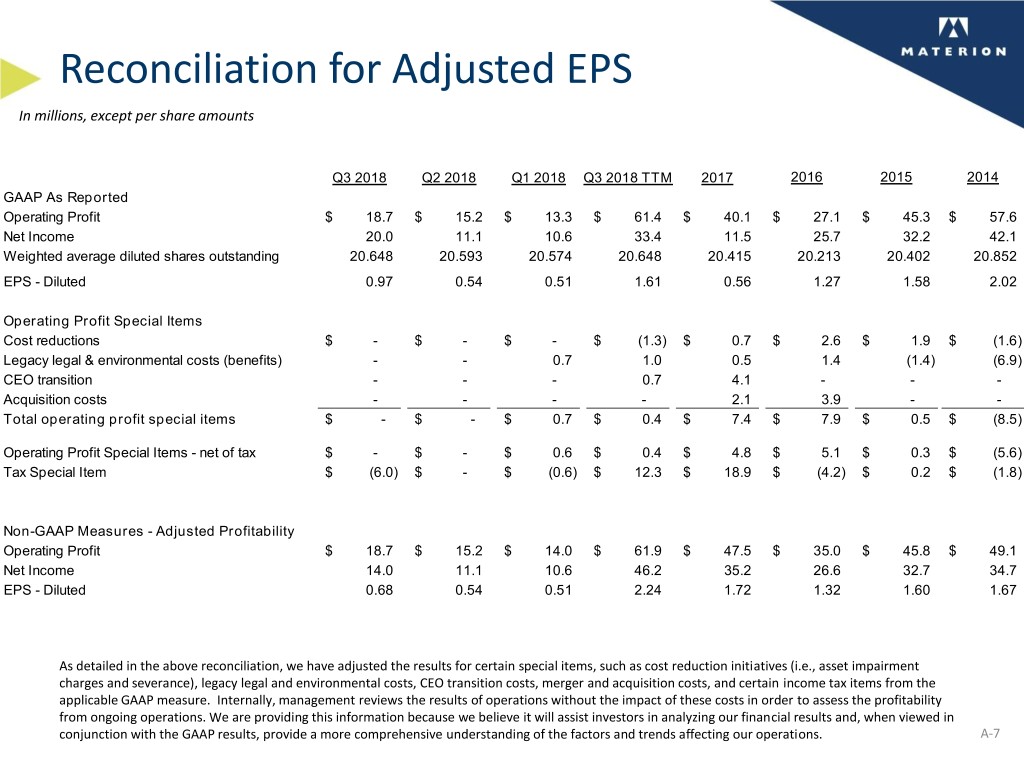

Reconciliation for Adjusted EPS In millions, except per share amounts Q3 2018 Q2 2018 Q1 2018 Q3 2018 TTM 2017 2016 2015 2014 GAAP As Reported Operating Profit $ 18.7 $ 15.2 $ 13.3 $ 61.4 $ 40.1 $ 27.1 $ 45.3 $ 57.6 Net Income 20.0 11.1 10.6 33.4 11.5 25.7 32.2 42.1 Weighted average diluted shares outstanding 20.648 20.593 20.574 20.648 20.415 20.213 20.402 20.852 EPS - Diluted 0.97 0.54 0.51 1.61 0.56 1.27 1.58 2.02 Operating Profit Special Items Cost reductions $ - $ - $ - $ (1.3) $ 0.7 $ 2.6 $ 1.9 $ (1.6) Legacy legal & environmental costs (benefits) - - 0.7 1.0 0.5 1.4 (1.4) (6.9) CEO transition - - - 0.7 4.1 - - - Acquisition costs - - - - 2.1 3.9 - - Total operating profit special items $ - $ - $ 0.7 $ 0.4 $ 7.4 $ 7.9 $ 0.5 $ (8.5) Operating Profit Special Items - net of tax $ - $ - $ 0.6 $ 0.4 $ 4.8 $ 5.1 $ 0.3 $ (5.6) Tax Special Item $ (6.0) $ - $ (0.6) $ 12.3 $ 18.9 $ (4.2) $ 0.2 $ (1.8) Non-GAAP Measures - Adjusted Profitability Operating Profit $ 18.7 $ 15.2 $ 14.0 $ 61.9 $ 47.5 $ 35.0 $ 45.8 $ 49.1 Net Income 14.0 11.1 10.6 46.2 35.2 26.6 32.7 34.7 EPS - Diluted 0.68 0.54 0.51 2.24 1.72 1.32 1.60 1.67 As detailed in the above reconciliation, we have adjusted the results for certain special items, such as cost reduction initiatives (i.e., asset impairment charges and severance), legacy legal and environmental costs, CEO transition costs, merger and acquisition costs, and certain income tax items from the applicable GAAP measure. Internally, management reviews the results of operations without the impact of these costs in order to assess the profitability from ongoing operations. We are providing this information because we believe it will assist investors in analyzing our financial results and, when viewed in conjunction with the GAAP results, provide a more comprehensive understanding of the factors and trends affecting our operations. A-7

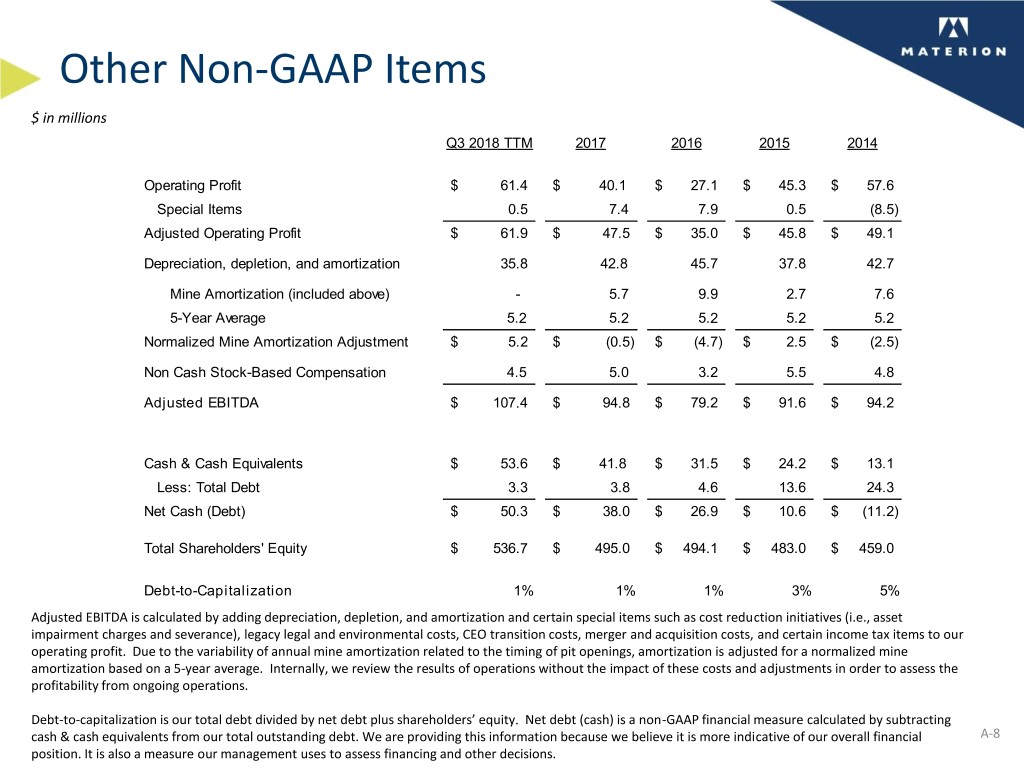

Other Non-GAAP Items $ in millions Q3 2018 TTM 2017 2016 2015 2014 Operating Profit $ 61.4 $ 40.1 $ 27.1 $ 45.3 $ 57.6 Special Items 0.5 7.4 7.9 0.5 (8.5) Adjusted Operating Profit $ 61.9 $ 47.5 $ 35.0 $ 45.8 $ 49.1 Depreciation, depletion, and amortization 35.8 42.8 45.7 37.8 42.7 Mine Amortization (included above) - 5.7 9.9 2.7 7.6 5-Year Average 5.2 5.2 5.2 5.2 5.2 Normalized Mine Amortization Adjustment $ 5.2 $ (0.5) $ (4.7) $ 2.5 $ (2.5) Non Cash Stock-Based Compensation 4.5 5.0 3.2 5.5 4.8 Adjusted EBITDA $ 107.4 $ 94.8 $ 79.2 $ 91.6 $ 94.2 Cash & Cash Equivalents $ 53.6 $ 41.8 $ 31.5 $ 24.2 $ 13.1 Less: Total Debt 3.3 3.8 4.6 13.6 24.3 Net Cash (Debt) $ 50.3 $ 38.0 $ 26.9 $ 10.6 $ (11.2) Total Shareholders' Equity $ 536.7 $ 495.0 $ 494.1 $ 483.0 $ 459.0 Debt-to-Capitalization 1% 1% 1% 3% 5% Adjusted EBITDA is calculated by adding depreciation, depletion, and amortization and certain special items such as cost reduction initiatives (i.e., asset impairment charges and severance), legacy legal and environmental costs, CEO transition costs, merger and acquisition costs, and certain income tax items to our operating profit. Due to the variability of annual mine amortization related to the timing of pit openings, amortization is adjusted for a normalized mine amortization based on a 5-year average. Internally, we review the results of operations without the impact of these costs and adjustments in order to assess the profitability from ongoing operations. Debt-to-capitalization is our total debt divided by net debt plus shareholders’ equity. Net debt (cash) is a non-GAAP financial measure calculated by subtracting cash & cash equivalents from our total outstanding debt. We are providing this information because we believe it is more indicative of our overall financial A-8 position. It is also a measure our management uses to assess financing and other decisions.

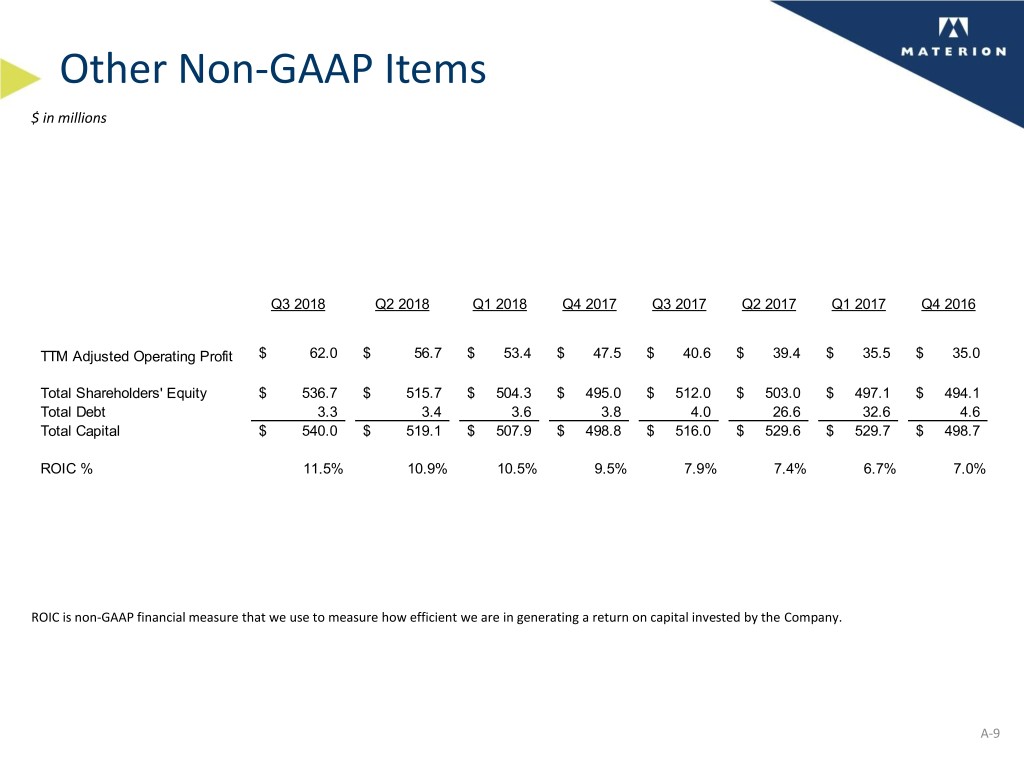

Other Non-GAAP Items $ in millions Q3 2018 Q2 2018 Q1 2018 Q4 2017 Q3 2017 Q2 2017 Q1 2017 Q4 2016 TTM Adjusted Operating Profit $ 62.0 $ 56.7 $ 53.4 $ 47.5 $ 40.6 $ 39.4 $ 35.5 $ 35.0 Total Shareholders' Equity $ 536.7 $ 515.7 $ 504.3 $ 495.0 $ 512.0 $ 503.0 $ 497.1 $ 494.1 Total Debt 3.3 3.4 3.6 3.8 4.0 26.6 32.6 4.6 Total Capital $ 540.0 $ 519.1 $ 507.9 $ 498.8 $ 516.0 $ 529.6 $ 529.7 $ 498.7 ROIC % 11.5% 10.9% 10.5% 9.5% 7.9% 7.4% 6.7% 7.0% ROIC is non-GAAP financial measure that we use to measure how efficient we are in generating a return on capital invested by the Company. A-9

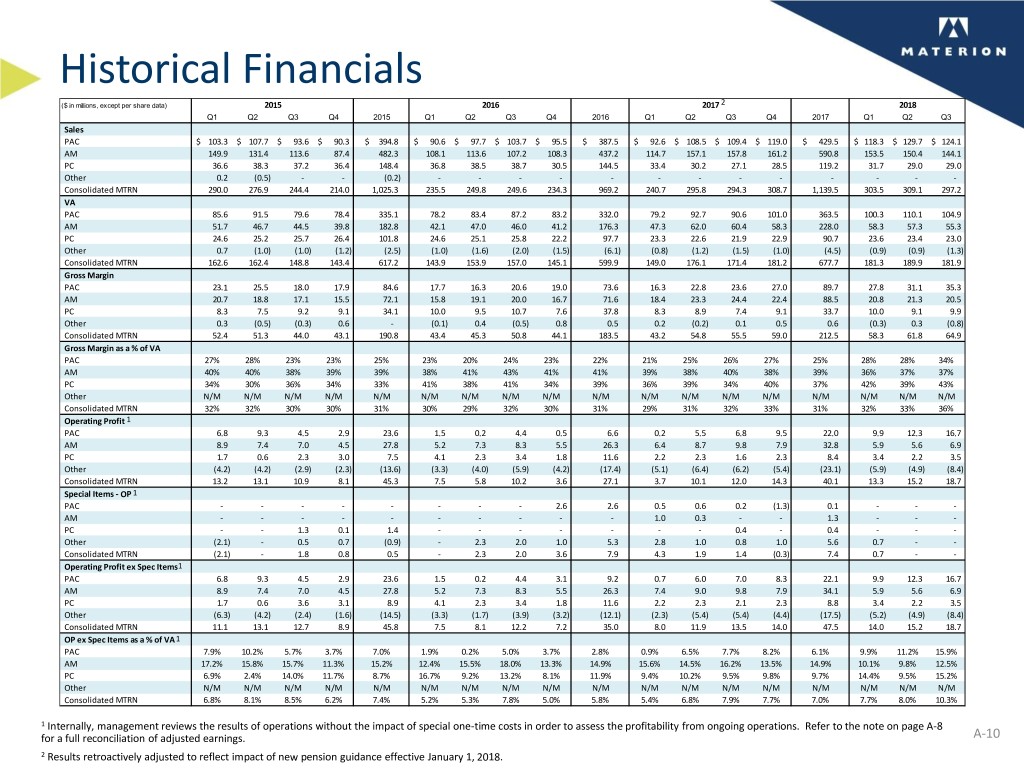

Historical Financials ($ in millions, except per share data) 2015 2016 2017 2 2018 Q1 Q2 Q3 Q4 2015 Q1 Q2 Q3 Q4 2016 Q1 Q2 Q3 Q4 2017 Q1 Q2 Q3 Sales PAC $ 103.3 $ 107.7 $ 93.6 $ 90.3 $ 394.8 $ 90.6 $ 97.7 $ 103.7 $ 95.5 $ 387.5 $ 92.6 $ 108.5 $ 109.4 $ 119.0 $ 429.5 $ 118.3 $ 129.7 $ 124.1 AM 149.9 131.4 113.6 87.4 482.3 108.1 113.6 107.2 108.3 437.2 114.7 157.1 157.8 161.2 590.8 153.5 150.4 144.1 PC 36.6 38.3 37.2 36.4 148.4 36.8 38.5 38.7 30.5 144.5 33.4 30.2 27.1 28.5 119.2 31.7 29.0 29.0 Other 0.2 (0.5) - - (0.2) - - - - - - - - - - - - - Consolidated MTRN 290.0 276.9 244.4 214.0 1,025.3 235.5 249.8 249.6 234.3 969.2 240.7 295.8 294.3 308.7 1,139.5 303.5 309.1 297.2 VA PAC 85.6 91.5 79.6 78.4 335.1 78.2 83.4 87.2 83.2 332.0 79.2 92.7 90.6 101.0 363.5 100.3 110.1 104.9 AM 51.7 46.7 44.5 39.8 182.8 42.1 47.0 46.0 41.2 176.3 47.3 62.0 60.4 58.3 228.0 58.3 57.3 55.3 PC 24.6 25.2 25.7 26.4 101.8 24.6 25.1 25.8 22.2 97.7 23.3 22.6 21.9 22.9 90.7 23.6 23.4 23.0 Other 0.7 (1.0) (1.0) (1.2) (2.5) (1.0) (1.6) (2.0) (1.5) (6.1) (0.8) (1.2) (1.5) (1.0) (4.5) (0.9) (0.9) (1.3) Consolidated MTRN 162.6 162.4 148.8 143.4 617.2 143.9 153.9 157.0 145.1 599.9 149.0 176.1 171.4 181.2 677.7 181.3 189.9 181.9 Gross Margin PAC 23.1 25.5 18.0 17.9 84.6 17.7 16.3 20.6 19.0 73.6 16.3 22.8 23.6 27.0 89.7 27.8 31.1 35.3 AM 20.7 18.8 17.1 15.5 72.1 15.8 19.1 20.0 16.7 71.6 18.4 23.3 24.4 22.4 88.5 20.8 21.3 20.5 PC 8.3 7.5 9.2 9.1 34.1 10.0 9.5 10.7 7.6 37.8 8.3 8.9 7.4 9.1 33.7 10.0 9.1 9.9 Other 0.3 (0.5) (0.3) 0.6 - (0.1) 0.4 (0.5) 0.8 0.5 0.2 (0.2) 0.1 0.5 0.6 (0.3) 0.3 (0.8) Consolidated MTRN 52.4 51.3 44.0 43.1 190.8 43.4 45.3 50.8 44.1 183.5 43.2 54.8 55.5 59.0 212.5 58.3 61.8 64.9 Gross Margin as a % of VA PAC 27% 28% 23% 23% 25% 23% 20% 24% 23% 22% 21% 25% 26% 27% 25% 28% 28% 34% AM 40% 40% 38% 39% 39% 38% 41% 43% 41% 41% 39% 38% 40% 38% 39% 36% 37% 37% PC 34% 30% 36% 34% 33% 41% 38% 41% 34% 39% 36% 39% 34% 40% 37% 42% 39% 43% Other N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M Consolidated MTRN 32% 32% 30% 30% 31% 30% 29% 32% 30% 31% 29% 31% 32% 33% 31% 32% 33% 36% Operating Profit 1 PAC 6.8 9.3 4.5 2.9 23.6 1.5 0.2 4.4 0.5 6.6 0.2 5.5 6.8 9.5 22.0 9.9 12.3 16.7 AM 8.9 7.4 7.0 4.5 27.8 5.2 7.3 8.3 5.5 26.3 6.4 8.7 9.8 7.9 32.8 5.9 5.6 6.9 PC 1.7 0.6 2.3 3.0 7.5 4.1 2.3 3.4 1.8 11.6 2.2 2.3 1.6 2.3 8.4 3.4 2.2 3.5 Other (4.2) (4.2) (2.9) (2.3) (13.6) (3.3) (4.0) (5.9) (4.2) (17.4) (5.1) (6.4) (6.2) (5.4) (23.1) (5.9) (4.9) (8.4) Consolidated MTRN 13.2 13.1 10.9 8.1 45.3 7.5 5.8 10.2 3.6 27.1 3.7 10.1 12.0 14.3 40.1 13.3 15.2 18.7 Special Items - OP 1 PAC - - - - - - - - 2.6 2.6 0.5 0.6 0.2 (1.3) 0.1 - - - AM - - - - - - - - - - 1.0 0.3 - - 1.3 - - - PC - - 1.3 0.1 1.4 - - - - - - - 0.4 - 0.4 - - - Other (2.1) - 0.5 0.7 (0.9) - 2.3 2.0 1.0 5.3 2.8 1.0 0.8 1.0 5.6 0.7 - - Consolidated MTRN (2.1) - 1.8 0.8 0.5 - 2.3 2.0 3.6 7.9 4.3 1.9 1.4 (0.3) 7.4 0.7 - - Operating Profit ex Spec Items1 PAC 6.8 9.3 4.5 2.9 23.6 1.5 0.2 4.4 3.1 9.2 0.7 6.0 7.0 8.3 22.1 9.9 12.3 16.7 AM 8.9 7.4 7.0 4.5 27.8 5.2 7.3 8.3 5.5 26.3 7.4 9.0 9.8 7.9 34.1 5.9 5.6 6.9 PC 1.7 0.6 3.6 3.1 8.9 4.1 2.3 3.4 1.8 11.6 2.2 2.3 2.1 2.3 8.8 3.4 2.2 3.5 Other (6.3) (4.2) (2.4) (1.6) (14.5) (3.3) (1.7) (3.9) (3.2) (12.1) (2.3) (5.4) (5.4) (4.4) (17.5) (5.2) (4.9) (8.4) Consolidated MTRN 11.1 13.1 12.7 8.9 45.8 7.5 8.1 12.2 7.2 35.0 8.0 11.9 13.5 14.0 47.5 14.0 15.2 18.7 OP ex Spec Items as a % of VA1 PAC 7.9% 10.2% 5.7% 3.7% 7.0% 1.9% 0.2% 5.0% 3.7% 2.8% 0.9% 6.5% 7.7% 8.2% 6.1% 9.9% 11.2% 15.9% AM 17.2% 15.8% 15.7% 11.3% 15.2% 12.4% 15.5% 18.0% 13.3% 14.9% 15.6% 14.5% 16.2% 13.5% 14.9% 10.1% 9.8% 12.5% PC 6.9% 2.4% 14.0% 11.7% 8.7% 16.7% 9.2% 13.2% 8.1% 11.9% 9.4% 10.2% 9.5% 9.8% 9.7% 14.4% 9.5% 15.2% Other N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M N/M Consolidated MTRN 6.8% 8.1% 8.5% 6.2% 7.4% 5.2% 5.3% 7.8% 5.0% 5.8% 5.4% 6.8% 7.9% 7.7% 7.0% 7.7% 8.0% 10.3% 1 Internally, management reviews the results of operations without the impact of special one-time costs in order to assess the profitability from ongoing operations. Refer to the note on page A-8 for a full reconciliation of adjusted earnings. A-10 2 Results retroactively adjusted to reflect impact of new pension guidance effective January 1, 2018.