Attached files

| file | filename |

|---|---|

| EX-95 - EXHIBIT 95 - MATERION Corp | mtrn-ex95_20171231.htm |

| EX-32 - EXHIBIT 32 - MATERION Corp | mtrn-ex32_20171231.htm |

| EX-31.2 - EXHIBIT 31.2 - MATERION Corp | mtrn-ex312_20171231.htm |

| EX-31.1 - EXHIBIT 31.1 - MATERION Corp | mtrn-ex311_20171231.htm |

| EX-24 - EXHIBIT 24 - MATERION Corp | mtrn-ex24_20171231.htm |

| EX-23 - EXHIBIT 23 - MATERION Corp | mtrn-ex23_20171231.htm |

| EX-21 - EXHIBIT 21 - MATERION Corp | mtrn-ex21_20171231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

Form 10-K

__________________________________

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 1-15885

__________________________________

MATERION CORPORATION

(Exact name of registrant as specified in its charter)

Ohio | 34-1919973 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

6070 Parkland Blvd., Mayfield Heights, Ohio | 44124 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code

216-486-4200

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, no par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Emerging Growth Company | ¨ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of common shares, no par value, held by non-affiliates of the registrant (based upon the closing sale price on the New York Stock Exchange) on June 30, 2017 was $736,996,309.

As of February 2, 2018, there were 20,116,096 common shares, no par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Shareholders to be held on May 2, 2018 are incorporated by reference into Part III.

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

Forward-looking Statements

Portions of the narrative set forth in this document that are not statements of historical or current facts are forward-looking statements. Our actual future performance may materially differ from that contemplated by the forward-looking statements as a result of a variety of factors. These factors include, in addition to those mentioned elsewhere herein:

▪ | Actual net sales, operating rates, and margins for 2018; |

▪ | The global economy; |

▪ | The impact of any U.S. Federal Government shutdowns and sequestrations; |

▪ | The condition of the markets which we serve, whether defined geographically or by segment, with the major market segments being: consumer electronics, industrial components, medical, automotive electronics, defense, telecommunications infrastructure, energy, commercial aerospace, and science; |

▪ | Changes in product mix and the financial condition of customers; |

▪ | Our success in developing and introducing new products and new product ramp-up rates; |

▪ | Our success in passing through the costs of raw materials to customers or otherwise mitigating fluctuating prices for those materials, including the impact of fluctuating prices on inventory values; |

▪ | Our success in identifying acquisition candidates and in acquiring and integrating such businesses, including our ability to effectively integrate the acquisition of the high-performance target materials business of the Heraeus Group; |

▪ | The impact of the results of acquisitions on our ability to fully achieve the strategic and financial objectives related to these acquisitions; |

▪ | Our success in implementing our strategic plans and the timely and successful completion and start-up of any capital projects; |

▪ | Other financial and economic factors, including the cost and availability of raw materials (both base and precious metals), physical inventory valuations, metal financing fees, tax rates, exchange rates, interest rates, pension costs and required cash contributions and other employee benefit costs, energy costs, regulatory compliance costs, the cost and availability of insurance, credit availability, and the impact of the Company’s stock price on the cost of incentive compensation plans; |

▪ | The uncertainties related to the impact of war, terrorist activities, and acts of God; |

▪ | Changes in government regulatory requirements and the enactment of new legislation that impacts our obligations and operations; |

▪ | The conclusion of pending litigation matters in accordance with our expectation that there will be no material adverse effects; and |

• | The risk factors set forth elsewhere in Item 1A of this Form 10-K. |

1

Item 1. | BUSINESS |

THE COMPANY

Materion Corporation (referred to herein as the Company, our, we, or us), through its wholly owned subsidiaries, is an integrated producer of high-performance advanced engineered materials used in a variety of electrical, electronic, thermal, and structural applications with $1.1 billion in net sales in 2017. The Company was incorporated in Ohio in 1931 and has approximately 2,700 employees. Our products are sold into numerous end markets, including consumer electronics, industrial components, defense, medical, automotive electronics, telecommunications infrastructure, energy, commercial aerospace, science, services, and appliance.

SEGMENT INFORMATION

Our businesses are organized under four reportable segments: Performance Alloys and Composites (PAC), Advanced Materials, Precision Coatings, and Other. Our Other reportable segment includes unallocated corporate costs.

Segment reporting and geographic information relating to net sales, operating profit, and assets is presented in Note C to the Consolidated Financial Statements. Additional information regarding our segments and business is presented below.

Performance Alloys and Composites

The Performance Alloys and Composites segment is comprised of the following three reporting units: Performance Alloys, Beryllium & Composites, and Technical Materials.

Performance Alloys is the largest PAC business and produces beryllium and non-beryllium containing alloy products in strip, bulk, and other custom shapes at manufacturing facilities in the United States, Europe, and Asia. This business also operates the world's largest bertrandite ore mine and refinery, which is located in Utah, providing feedstock hydroxide for its beryllium and beryllium alloy businesses and external sales.

• | Bulk products are the largest of the product families and are made with copper and nickel (with or without beryllium) in plate, rod, bar, tube, and wire product forms and other customized shapes. Depending upon the application, they may provide superior strength, corrosion/wear resistance, thermal conductivity, or lubricity. While the majority of bulk products contain beryllium, a growing portion of net sales is from non-beryllium-containing alloys as a result of product diversification efforts. Applications for bulk products include oil & gas drilling and production components, bearings, bushings, welding rods, plastic mold tooling, and undersea telecommunications housing equipment. Major end markets for bulk products include industrial components, commercial aerospace, energy, and telecommunications infrastructure. Bulk products compete with companies around the world that produce alloys with similar properties. Key competitors include NGK Insulators, IBC Advanced Alloys Corp., Ningxia Orient Tantalum Industry Co., Ltd., Ulba Metallurgical, Le Bronze Industriel, KME AG & Co. KG, Aurubis AG, MKM Mansfelder Kupfer und Messing GmbH, AMPCO Metal, and Chuetsu Metal Works Ltd. |

• | Strip products include various thicknesses of precision strip. These beryllium and non-beryllium containing alloy products are made with copper and nickel to provide unique combinations of high conductivity, high reliability, and formability for use as connectors, contacts, springs, switches, relays, shielding, and bearings. Major end markets for strip products include consumer electronics, telecommunications infrastructure, automotive electronics, aerospace, industrial components, appliance, and medical. Strip products compete with strip from many companies around the world that produce alloys with similar properties as beryllium and non-beryllium containing alloys. Key competitors include NGK Insulators, Global Brass and Copper, Inc., Wieland Electric, Inc., Aurubis Stolberg GmbH, Diehl Metall Stiftung & Co. KG, Nippon Mining, and PMX Industries, Inc. |

Strip and bulk products are manufactured at facilities in Ohio and Pennsylvania and are distributed internationally through a network of company-owned service centers, outside distributors, and agents.

• | Beryllium hydroxide is produced at our milling operations in Utah from our bertrandite ore mine and purchased beryl ore. The hydroxide is used primarily as a raw material input for strip and bulk products and, to a lesser extent, beryllium products. Net sales of beryllium hydroxide to third parties from our Utah operations were less than 5% of Performance Metals’ total net sales in each of the last three years. |

Beryllium & Composites manufactures beryllium, beryllium aluminum, aluminum metal matrix composites (MMCs), beryllia ceramics, and bulk metallic glass materials in rod, plate, bar, strip, and customized shapes. These materials are used in applications th

2

at require high stiffness and/or low density and tend to be premium priced due to their unique combination of properties. Defense and science are the largest end markets for beryllium products, while other end markets served include industrial components, commercial aerospace, medical, energy, and telecommunications infrastructure. Products are also sold for acoustics, optical scanning, and performance automotive applications. While Performance Metals is the only domestic producer of metallic beryllium, it competes primarily with designs utilizing other materials including other lightweight metals, MMCs, and organic composites. Our aluminum powder metal MMCs compete with DWA Aluminum Composites and cast MMCs made by Duralcan USA. Electronic components utilizing beryllia and alumina ceramics are used in the industrial components, medical, defense, telecommunications infrastructure, commercial aerospace, and science end markets. Direct competitors include American Beryllia Inc., CBL Ceramics Limited, and CoorsTek, Inc. Manufacturing facilities for beryllium products are located in Ohio, California, Arizona, and the United Kingdom. The majority of Beryllium product sales are direct but there are also agents and representatives that support worldwide sales.

Technical Materials produces strip metal products with clad inlay and overlay metals, including precious and base metal electroplated systems, electron beam welded systems, contour profiled systems, and solder-coated metal systems. This operating unit is located in Lincoln, Rhode Island. These specialty strip metal products provide a variety of thermal, electrical, or mechanical properties from a surface area or particular section of the material. Our cladding and plating capabilities allow for a precious metal or other base metal to be applied in continuous strip form, only where it is needed, reducing the material cost to the customer as well as providing design flexibility and performance. Major applications for these products include connectors, contacts, power lead frames, and semiconductors, while the largest end markets are automotive electronics and consumer electronics. The energy and medical end markets are smaller but offer further growth opportunities. Technical Materials' products are manufactured at our Lincoln, Rhode Island facility and are sold directly through its sales representatives. Technical Materials' major competitors include Heraeus Inc., AMI Doduco, Inc., and other North American continuous strip and plating companies.

Advanced Materials

Advanced Materials produces advanced chemicals, microelectronics packaging, precious metal, non-precious metal, and specialty metal products, including vapor deposition targets, frame lid assemblies, clad and precious metal pre-forms, high temperature braze materials, and ultra-pure wire. These products are used in semiconductor logic and memory, medical, energy, lighting, defense, optics, and wireless communications applications within the consumer electronics, industrial components, and telecommunications infrastructure end markets. Advanced Materials also has metal recovery operations and in-house refining that allow for the recycling of precious metals.

Advanced Materials products are sold directly from its facilities throughout the United States, Asia, and Europe, as well as through direct sales offices and independent sales representatives throughout the world. Principal competition includes companies such as Eastman Chemical Company, Honeywell International, Inc., Johnson Matthey plc, Praxair, Inc., Solar Applied Materials Technology Corp., Sumitomo Metals Industries, Ltd., and Tanaka Holding Co., Ltd., as well as a number of smaller regional and national suppliers.

The majority of the sales into the consumer electronics end market from this segment are vapor deposition targets, lids, wire, other related precious and non-precious metal products, and advanced chemicals for semiconductors and other microelectronic applications. These materials are used in wireless, light-emitting diode (LED), handheld devices and other applications, as well as in a number of applications within the defense end market. Since we are an up-front material supplier, changes in our consumer electronics sales levels do not necessarily correspond to changes in the end-use consumer demand in the same period due to down-stream inventory positions, the time to develop and deploy new products, and manufacturing lead times and scheduling. While our product and market development efforts allow us to capture new applications, we may lose existing applications and customers from time to time due to the rapid change in technologies and other factors.

Precision Coatings

The Precision Coatings segment includes the following reporting units:

Precision Optics produces sputter-coated precision thin film coatings and optical filter materials. Based in Westford, Massachusetts, the group has manufacturing facilities in the United States and China.

Large Area Coatings produces high-performance sputter-coated precision flexible thin film materials. Based in Windsor, Connecticut, the business manufactures and distributes coated and converted thin film material solutions primarily for medical testing and diagnosis applications.

Precision Coatings products are sold directly from its facilities throughout the United States and Asia, as well as through direct sales offices and independent sales representatives throughout the world. Principal competition includes companies such as Viavi Corporation and Saint-Gobain S.A. and a number of smaller regional and national suppliers.

3

Other

The Other segment is comprised of unallocated corporate costs.

OTHER GENERAL INFORMATION

Products

We are committed to providing high-quality, innovative, and reliable products that will enable our customers’ technologies and fuel their own technological breakthroughs and growth.

Our products include precious and non-precious specialty metals, inorganic chemicals and powders, specialty coatings, specialty engineered beryllium and copper-based alloys, beryllium composites, ceramics and engineered clad, and plated metal systems.

We are constantly looking ahead to realign product and service portfolios toward the latest market and technology trends so that we are able to provide customers with an even broader scope of products, services, and specialized expertise. We believe we are an established leader in our markets, from consumer electronics to medical devices to highly engineered bushings and bearings for heavy industrial equipment.

Approximately 800 customers purchase our products throughout the consumer electronics, industrial components, defense, medical, automotive electronics, telecommunications infrastructure, energy, commercial aerospace, science, services, and appliance end markets. No single customer accounted for more than 10% of our total net sales for 2017.

Availability of Raw Materials

The principal raw materials we use are aluminum, beryllium, cobalt, copper, gold, nickel, palladium, platinum, ruthenium, silver, and tin. Ore reserve data can be found in Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations." The availability of these raw materials, as well as other materials used by us, is adequate and generally not dependent on any one supplier.

Patents and Licenses

We own patents, patent applications, and licenses relating to certain of our products and processes. While our rights under these patents and licenses are of some importance to our operations, our business is not materially dependent on any one patent or license or on all of our patents and licenses as a group.

Research and Development

Active research and development programs seek new product compositions and designs as well as process innovations. Expenditures for research and development amounted to $14.0 million in 2017 and $12.8 million in both 2016 and 2015.

Backlog

The backlog of unshipped orders as of December 31, 2017, 2016, and 2015 was $204.0 million, $175.5 million, and $157.0 million, respectively. Backlog is generally represented by purchase orders that may be terminated under certain conditions. We expect that substantially all of our backlog of orders at December 31, 2017 will be filled over the next 18 months.

Acquisitions

On February 28, 2017, the Company acquired the target materials business of the Heraeus Group (HTB), of Hanau, Germany, for an initial purchase price of $16.5 million. This business operates within the Advanced Materials segment and the results of operations are included as of the date of acquisition. Refer to Note B to the Consolidated Financial Statements for additional detail on the Company's acquisition.

Regulatory Matters

We are subject to a variety of laws that regulate the manufacturing, processing, use, handling, storage, transport, treatment, emission, release, and disposal of substances and wastes used or generated in manufacturing. For decades, we have operated our facilities under applicable standards of inplant and outplant emissions and releases. The inhalation of airborne beryllium particulate may present a health hazard to certain individuals.

On January 9, 2017, the U.S. Occupational Safety and Health Administration (OSHA) published a new standard for workplace exposure to beryllium that, among other things, lowered the permissible exposure by a factor of ten and established new requirements

4

for respiratory protection, personal protective clothing and equipment, medical surveillance, hazard communication, and record keeping. Other government and standard-setting organizations are also reviewing beryllium-related worker safety rules and standards, and will likely make them more stringent. The development, proposal, or adoption of more stringent standards may affect the buying decisions by the users of beryllium-containing products. If the standards are made more stringent and/or our customers or other downstream users decide to reduce their use of beryllium-containing products, our results of operations, liquidity, and financial condition could be materially adversely affected. The impact of this potential adverse effect would depend on the nature and extent of the changes to the standards, the cost and ability to meet the new standards, the extent of any reduction in customer use, and other factors. The magnitude of this potential adverse effect cannot be estimated.

Available Information

We use our Investor Relations website, http://investor.shareholder.com/materion/index.cfm, as a channel for routine distribution of important information, including news releases, analyst presentations, and financial information. As soon as reasonably practicable, we make all documents that we file with, or furnish to, the Securities and Exchange Commission (SEC), including our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to these reports, available free of charge via this website. These reports are also available on the SEC’s website: http://www.sec.gov. The content on any website referred to in this Form 10-K is not incorporated by reference into this Form 10-K unless expressly noted.

Executive Officers of the Registrant

Incorporated by reference from information with respect to executive officers of Materion Corporation set forth in Item 10 in Part III of this Form 10-K.

5

Item 1A. RISK FACTORS

Our business, financial condition, results of operations, and cash flows can be affected by a number of factors, including, but not limited to, those set forth below and elsewhere in this Form 10-K, any one of which could cause our actual results to vary materially from recent results or from our anticipated future results. Therefore, an investment in us involves some risks, including the risks described below. The risks discussed below are not the only risks that we may experience. If any of the following risks occur, our business, results of operations, or financial condition could be negatively impacted.

The businesses of many of our customers are subject to significant fluctuations as a result of the cyclical nature of their industries and their sensitivity to general economic conditions, which could adversely affect their demand for our products and reduce our sales and profitability.

A substantial number of our customers are in the consumer electronics, industrial components, medical, automotive electronics, defense, telecommunications infrastructure, energy, commercial aerospace, and science markets. Each of these markets is cyclical in nature, influenced by a combination of factors which could have a negative impact on our business, including, among other things, periods of economic growth or recession, strength or weakness of the U.S. dollar, the strength of the consumer electronics, automotive electronics, and oil and gas industries, the rate of construction of telecommunications infrastructure equipment, and government spending on defense.

Also, in times when growth rates in our markets are lower, or negative, there may be temporary inventory adjustments by our customers that may negatively affect our business.

Because we experience seasonal fluctuations in our sales, our quarterly results will fluctuate, and our annual performance will be affected by the fluctuations.

We expect seasonal patterns to continue, which may cause our quarterly results to fluctuate. For example, the Christmas season generates increased demand from our customers that manufacture consumer products. If our revenue during any quarter were to fall below the expectations of investors or securities analysts, our share price could decline, perhaps significantly. Unfavorable economic conditions, lower than normal levels of demand, and other occurrences in any quarter could also harm our results of operations. For example, we have experienced customers building inventory in anticipation of increased demand, whereas in other periods, demand decreased because our customers had excess inventory.

A portion of our revenue is derived from the sale of defense-related products through various contracts and subcontracts. These contracts may be suspended, canceled, or delayed, which could have an adverse impact on our revenues.

In 2017, 9% of our value-added sales was derived from sales to customers in the defense end market. A portion of these customers operate under contracts with the U.S. Government, which are vulnerable to termination at any time, for convenience or default. Some of the reasons for cancellation include, but are not limited to, budgetary constraints or re-appropriation of government funds, timing of contract awards, violations of legal or regulatory requirements, and changes in political agenda. If cancellations were to occur, it would result in a reduction in our revenue. Furthermore, significant reductions to defense spending could occur over the next several years due to government spending cuts, which could have a significant adverse impact on us. For example, high-margin defense application delays and/or push-outs may adversely impact our results of operations, including quarterly earnings.

The markets for our products are experiencing rapid changes in technology.

We operate in markets characterized by rapidly changing technology and evolving customer specifications and industry standards. New products may quickly render an existing product obsolete and unmarketable. For example, for many years thermal and mechanical performance have been at the forefront of device packaging for wireless communications infrastructure devices. In recent years, a tremendous effort has been put into developing simpler packaging solutions comprised of copper and other similar components. Our growth and future results of operations depend in part upon our ability to enhance existing products and introduce newly developed products on a timely basis that conform to prevailing and evolving industry standards, meet or exceed technological advances in the marketplace, meet changing customer specifications, achieve market acceptance, and respond to our competitors’ products.

The process of developing new products can be technologically challenging and requires the accurate anticipation of technological and market trends. We may not be able to introduce new products successfully or do so on a timely basis. If we fail to develop new products that are appealing to our customers or fail to develop products on time and within budgeted amounts, we may be unable to recover our research and development costs, which could adversely affect our margins and profitability.

The availability of competitive substitute materials for beryllium-containing products may reduce our customers’ demand for these products and reduce our sales.

6

In certain product applications, we compete with manufacturers of non-beryllium-containing products, including organic composites, metal alloys or composites, titanium, and aluminum. Our customers may choose to use substitutes for beryllium-containing products in their products for a variety of reasons, including, among other things, the lower costs of those substitutes, the health and safety concerns relating to these products, and the risk of litigation relating to beryllium-containing products. If our customers use substitutes for beryllium-containing materials in their products, the demand for beryllium-containing products may decrease, which could reduce our sales.

Our long and variable sales and development cycle makes it difficult for us to predict if and when a new product will be sold to customers.

Our sales and development cycle, which is the period from the generation of a sales lead or new product idea through the development of the product and the recording of sales, may typically take several years, making it very difficult to forecast sales and results of operations. Our inability to accurately predict the timing and magnitude of sales of our products, especially newly introduced products, could affect our ability to meet our customers’ product delivery requirements or cause our results of operations to suffer if we incur expenses in a particular period that do not translate into sales during that period, or at all. In addition, these failures would make it difficult to plan future capital expenditure needs and could cause us to fail to meet our cash flow requirements.

The availability and prices of some raw materials we use in our manufacturing operations fluctuate, and increases in raw material costs can adversely affect our operating results and our financial condition.

We manufacture advanced engineered materials using various precious and non-precious metals, including aluminum, beryllium, cobalt, copper, gold, nickel, palladium, platinum, ruthenium, silver, and tin. The availability of, and prices for, these raw materials are subject to volatility and are influenced by worldwide economic conditions, speculative action, world supply and demand balances, inventory levels, availability of substitute metals, the U.S. dollar exchange rate, production costs of U.S. and foreign competitors, anticipated or perceived shortages, and other factors. Precious metal prices, including prices for gold and silver, have fluctuated significantly in recent years. Higher prices can cause adjustments to our inventory carrying values, whether as a result of quantity discrepancies, normal manufacturing losses, differences in scrap rates, theft or other factors, which could have a negative impact on our profitability and cash flows. Also, the price of our products will generally increase in tandem with rising metal prices, as a result of changes in precious metal prices that are passed through to our customers, which could deter them from purchasing our products and adversely affect our net sales and operating profit.

Further, we maintain some precious metals and copper on a consigned inventory basis. The owners of the precious metals and copper charge a fee that fluctuates based on the market price of those metals and other factors. A significant increase in the market price or the consignment fee of precious metals, and/or copper, could increase our financing costs, which could increase our operating costs.

Utilizing precious metals in the manufacturing process creates challenges in physical inventory valuations that may impact earnings.

We manufacture precious, non-precious, and specialty metal products and also have metal cleaning operations and in-house refineries that allow for the reclaim of precious metals from internally generated or customer scrap. We refine that scrap through our internal operations and externally through outside vendors.

When taking periodic physical inventories in our refinery operations, we reconcile the actual precious metals to what was estimated prior to the physical inventory count. Those estimates are based in part on assays or samples of precious metals taken during the refining process. If those estimates are inaccurate, we may have an inventory long (more physical precious metal than what we had estimated) or short (less physical precious metal than what we had estimated). These fluctuations could have a material impact on our financial statements and may impact earnings. For example, our 2013 gross margin was reduced by a net quarterly physical inventory adjustment totaling $2.2 million at our Albuquerque, New Mexico facility within the Advanced Materials segment. Higher precious metal prices may magnify the value of any potential inventory long or short.

Because we maintain a significant inventory of precious metals, we may experience losses due to employee error and theft.

Because we manufacture products that contain precious metals, we maintain a significant amount of precious metals at certain of our manufacturing facilities. Accordingly, we are subject to the risk of precious metal shortages resulting from employee error and theft. For example, in 2013, the Company filed a claim with its insurance carrier for a theft of approximately $10.0 million of silver at its Albuquerque, New Mexico refinery, which was settled for $6.8 million in the second quarter of 2014.

7

While we maintain controls to prevent theft, including physical security measures, if our controls do not operate effectively or are structured ineffectively, our profitability could be adversely affected, including any charges that we might incur as a result of the shortage of our inventory and by costs associated with increased security, preventative measures, and insurance.

We have a limited number of manufacturing facilities, and damage to those facilities, or to critical pieces of equipment in these facilities, could interrupt our operations, increase our costs of doing business, and impair our ability to deliver our products on a timely basis.

Some of our facilities are interdependent. For instance, our manufacturing facility in Elmore, Ohio relies on our mining operation for its supply of beryllium hydroxide used in production of most of its beryllium-containing materials. Additionally, our Reading, Pennsylvania; Fremont, California; and Tucson, Arizona manufacturing facilities are dependent on materials produced by our Elmore, Ohio manufacturing facility, and our Wheatfield, New York manufacturing facility is dependent on our Buffalo, New York manufacturing facility. The destruction or closure of our mine, any of our manufacturing facilities, or to critical pieces of equipment within these facilities for a significant period of time as a result of harsh weather, fire, explosion, act of war or terrorism, or other natural disaster or unexpected event may interrupt our manufacturing capabilities, increase our capital expenditures and our costs of doing business, and impair our ability to deliver our products on a timely basis. In addition, many of our manufacturing facilities depend on one source for electric power and natural gas, which could be interrupted due to equipment failures, terrorism, or another cause.

If such events occur, we may need to resort to an alternative source of manufacturing or to delay production, which could increase our costs of doing business and/or result in lost sales. Our property damage and business interruption insurance may not cover all of our potential losses and may not continue to be available to us on acceptable terms, if at all.

Disruptions or volatility in global financial markets could adversely impact our financial performance.

Global economic conditions may cause volatility and disruptions in the capital and credit markets. Should global economic conditions deteriorate or access to credit markets be reduced, customers may experience difficulty in obtaining adequate financing, thereby impacting our sales. Our exposure to bad debt losses may also increase if customers are unable to pay for products previously ordered and/or delivered. Negative or uncertain financial and macroeconomic conditions may have a significant adverse impact on our sales, profitability, and results of operations. If current global economic conditions deteriorate, it could trigger an economic downturn of the same or greater severity as the one experienced in 2008 and 2009. This could have a negative impact on our sales and result in potential non-cash goodwill and asset impairment charges.

Our defined benefit pension plans and other post-employment benefit plans are subject to financial market risks that could adversely impact our financial performance.

We provide defined benefit pension plans to eligible employees. Our pension expense and our required contributions to our pension plans are directly affected by the value of plan assets, the projected rate of return on plan assets, the actual rate of return on plan assets, and the actuarial assumptions we use to measure our defined benefit pension plan obligations, including the rate at which future obligations are discounted to a present value, or the discount rate. Significant changes in market interest rates and decreases in the fair value of plan assets and investment losses on plan assets would increase funding requirements and expenses and may adversely impact our results of operations.

We provide post-employment health benefits to eligible employees. Our retiree health expense is directly affected by the assumptions we use to measure our retiree health plan obligations, including the assumed rate at which health care costs will increase and the discount rate used to calculate future obligations. For retiree health accounting purposes, we have used a graded assumption schedule to assume the rate at which health care costs will increase. We cannot predict whether changing market or economic conditions, regulatory changes, or other factors will further increase our retiree health care expenses or obligations, diverting funds we would otherwise apply to other uses.

A major portion of our bank debt consists of variable-rate obligations, which subjects us to interest rate fluctuations.

Our credit facilities are secured by substantially all of our assets (other than non-mining real property and certain other assets). Our working capital line of credit includes variable-rate obligations, which expose us to interest rate risks. If interest rates increase, our debt service obligations on our variable-rate indebtedness would increase even if the amount borrowed remained the same, resulting in a decrease in our net income. We have developed a hedging strategy to manage the risks associated with interest rate fluctuations, but our program may not effectively eliminate all of the financial exposure associated with interest rate fluctuations. Additional information regarding our market risks is contained in Item 7A "Quantitative and Qualitative Disclosures About Market Risk."

8

Our failure to comply with the covenants contained in the terms of our indebtedness could result in an event of default, which could materially and adversely affect our operating results and our financial condition.

The terms of our credit facilities require us to comply with various covenants, including financial covenants. In the event of a global economic downturn, it could have a material adverse impact on our earnings and cash flow, which could adversely affect our ability to comply with our financial covenants and could limit our borrowing capacity. Our ability to comply with these covenants depends, in part, on factors over that we may have no control. A breach of any of these covenants could result in an event of default under one or more of the agreements governing our indebtedness which, if not cured or waived, could give the holders of the defaulted indebtedness the right to terminate commitments to lend and cause all amounts outstanding with respect to the indebtedness to be due and payable immediately. Acceleration of any of our indebtedness could result in cross-defaults under our other debt instruments. Our assets and cash flow may be insufficient to fully repay borrowings under all of our outstanding debt instruments if some or all of these instruments are accelerated upon an event of default, in which case we may be required to seek legal protection from our creditors.

The terms of our indebtedness may restrict our operations, including our ability to pursue our growth and acquisition strategies.

The terms of our credit facilities contain a number of restrictive covenants, including restrictions in our ability to, among other things, borrow and make investments, acquire other businesses, and consign additional precious metals. These covenants could adversely affect our business by limiting our ability to plan for or react to market conditions or to meet our capital needs, as well as adversely affect our ability to pursue our growth, acquisition strategies, and other strategic initiatives.

We may not be able to complete our acquisition strategy or successfully integrate acquired businesses.

We are active in pursuing acquisitions. We intend to continue to consider further growth opportunities through the acquisition of assets or companies and routinely review acquisition opportunities. We cannot predict whether we will be successful in pursuing any acquisition opportunities or what the consequences of any acquisition would be. Future acquisitions may involve the expenditure of significant funds and management time. Depending upon the nature, size, and timing of future acquisitions, we may be required to raise additional financing, which may not be available to us on acceptable terms, or at all. Further, we may not be able to successfully integrate any acquired business with our existing businesses or recognize any expected advantages from any completed acquisition.

In addition, there may be liabilities that we fail, or are unable, to discover in the course of performing due diligence investigations on the assets or companies we have already acquired or may acquire in the future. We cannot assure that rights to indemnification by the sellers of these assets or companies to us, even if obtained, will be enforceable, collectible, or sufficient in amount, scope, or duration to fully offset the possible liabilities associated with the business or property acquired. Any such liabilities, individually or in the aggregate, could have a materially adverse effect on our business, financial condition, and results of operations.

Our products are deployed in complex applications and may have errors or defects that we find only after deployment.

Our products are highly complex, designed to be deployed in complicated applications, and may contain undetected defects, errors, or failures. Although our products are generally tested during manufacturing, prior to deployment, they can only be fully tested when deployed in specific applications. For example, we sell beryllium-copper alloy strip products in a coil form to some customers, who then stamp the alloy for its specific purpose. On occasion, it is not until such customer stamps the alloy that a defect in the alloy is detected. Consequently, our customers may discover errors after the products have been deployed. The occurrence of any defects, errors, or failures could result in installation delays, product returns, termination of contracts with our customers, diversion of our resources, increased service and warranty costs, and other losses to our customers, end users, or to us. Any of these occurrences could also result in the loss of, or delay in, market acceptance of our products, and could damage our reputation, which could reduce our sales.

In addition to the risk of unanticipated warranty or recall expenses, our customer contracts may contain provisions that could cause us to incur penalties, be liable for damages, including liquidated damages, or incur other expenses, if we experience difficulties with respect to the functionality, deployment, operation, and availability of our products and services. In the event of late deliveries, late or improper installations or operations, failure to meet product or performance specifications or other product defects, or interruptions or delays in our managed service offerings, our customer contracts may expose us to penalties, liquidated damages, and other liabilities. In the event we were to incur contractual penalties, such as liquidated damages or other related costs that exceed our expectations, our business, financial condition, and operating results could be materially and adversely affected.

We conduct our sales and distribution operations on a worldwide basis and are subject to the risks associated with doing business outside the United States.

9

We sell to customers outside of the United States from our United States and international operations. We have been and are continuing to expand our geographic reach in Europe and Asia. Revenue from international operations (principally Europe and Asia) accounted for approximately 44% in 2017, 34% in 2016, and 38% in 2015 of Net sales. We anticipate that international shipments will account for a significant portion of our sales for the foreseeable future. There are a number of risks associated with international business activities, including:

• | burdens to comply with multiple and potentially conflicting foreign laws and regulations, including export requirements, tariffs and other barriers, environmental health and safety requirements, and unexpected changes in any of these factors; |

•difficulty in obtaining export licenses from the U.S. Government;

•political and economic instability and disruptions, including terrorist attacks;

• | disadvantages of competing against companies from countries that are not subject to U.S. laws and regulations, including the Foreign Corrupt Practices Act (FCPA); |

•potentially adverse tax consequences due to overlapping or differing tax structures; and

•fluctuations in currency exchange rates.

Any of these risks could have an adverse effect on our international operations by reducing the demand for our products or reducing the prices at which we can sell our products, which could result in an adverse effect on our business, financial position, results of operations, or cash flows. We may hedge our currency transactions to mitigate the impact of currency price volatility on our earnings; however, hedging activities may not be successful. For example, hedging activities may not cover the Company’s net euro and yen exposure, which could have an unfavorable impact on our results of operations.

In addition, we could be adversely affected by violations of the FCPA and similar worldwide anti-bribery laws. The FCPA and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. While policies mandate compliance with these anti-bribery laws, we operate in many parts of the world that have experienced governmental corruption to some degree and, in certain circumstances, strict compliance with anti-bribery laws may conflict with local customs and practices. We cannot assure you that our internal controls and procedures will always protect us from the reckless or criminal acts committed by our employees or agents. If we are found to be liable for FCPA violations or other anti-bribery laws, we could suffer from criminal or civil penalties or other sanctions, which could have a material adverse effect on our business.

Changes in laws or regulations or the manner of their interpretation or enforcement could adversely impact our financial performance and restrict our ability to operate our business or execute our strategies.

New laws or regulations, or changes in existing laws or regulations, or the manner of their interpretation or enforcement, could increase our cost of doing business and restrict our ability to operate our business or execute our strategies. In particular, there may be significant changes in U.S. laws and regulations and existing international trade agreements by the current U.S. presidential administration that could affect a wide variety of industries and businesses, including those businesses we own and operate. If the current U.S. presidential administration materially modifies U.S. laws and regulations and international trade agreements, our business, financial condition, and results of operations could be adversely affected.

We are exposed to lawsuits in the normal course of business, which could harm our business.

During the ordinary conduct of our business, we may become involved in certain legal proceedings, including those involving product liability claims, third-party lawsuits relating to exposure to beryllium, claims against us of infringement of intellectual property rights of third parties, or other litigation matters. Due to the uncertainties of litigation, we can give no assurance that we will prevail at the resolution of future claims. Certain of these matters involve types of claims that, if they result in an adverse ruling to us, could give rise to substantial liability, which could have a material adverse effect on our business, operating results, or financial condition.

Although we have insurance which may be applicable in certain circumstances, some jurisdictions preclude insurance coverage for punitive damage awards. Accordingly, our profitability could be adversely affected if any current or future claimants obtain judgments for any uninsured compensatory or punitive damages. Further, an unfavorable outcome or settlement of a pending beryllium case or adverse media coverage could encourage the commencement of additional similar litigation.

Health issues, litigation, and government regulations relating to our beryllium operations could significantly reduce demand for our products, limit our ability to operate, and adversely affect our profitability.

10

If exposed to respirable beryllium fumes, dusts, or powder, some individuals may demonstrate an allergic reaction to beryllium and may later develop a chronic lung disease known as chronic beryllium disease (CBD). Some people who are diagnosed with CBD do not develop clinical symptoms at all. In others, the disease can lead to scarring and damage of lung tissue, causing clinical symptoms that include shortness of breath, wheezing, and coughing. Severe cases of CBD can cause disability or death.

Further, some scientists claim there is evidence of an association between beryllium exposure and lung cancer, and certain standard-setting organizations have classified beryllium and beryllium compounds as human carcinogens.

The health risks relating to exposure to beryllium have been, and will continue to be, a significant issue confronting the beryllium-containing products industry. The health risks associated with beryllium have resulted in product liability claims, employee, and third-party lawsuits. As of December 31, 2017, we had one CBD case outstanding.

The increased levels of scrutiny by federal, state, foreign, and international regulatory authorities could lead to regulatory decisions relating to the approval or prohibition of the use of beryllium-containing materials for various uses. Concerns over CBD and other potential adverse health effects relating to beryllium, as well as concerns regarding potential liability from the use of beryllium, may discourage our customers’ use of our beryllium-containing products and significantly reduce demand for our products. In addition, adverse media coverage relating to our beryllium-containing products could damage our reputation or cause a decrease in demand for beryllium-containing products, which could adversely affect our profitability.

Our bertrandite ore mining and beryllium-related manufacturing operations and some of our customers’ businesses are subject to extensive health and safety regulations that impose, and will continue to impose, significant costs and liabilities, and future regulation could increase those costs and liabilities, or effectively prohibit production or use of beryllium-containing products.

We, as well as our customers, are subject to laws regulating worker exposure to beryllium. On January 9, 2017, OSHA published a new standard for workplace exposure to beryllium that, among other things, lowered the permissible exposure by a factor of ten and established new requirements for respiratory protection, personal protective clothing and equipment, medical surveillance, hazard communication, and recordkeeping. Materion was a participant in the development of the new standards, which fundamentally represent our current health and safety operating practices. Other government and standard-setting organizations are also reviewing beryllium-related worker safety rules and standards, and will likely make them more stringent. The development, proposal, or adoption of more stringent standards may affect buying decisions by the users of beryllium-containing products. If the standards are made more stringent and/or our customers or other downstream users decide to reduce their use of beryllium-containing products, our results of operations, liquidity, and financial condition could be materially adversely affected. The impact of this potential adverse effect would depend on the nature and extent of the changes to the standards, the cost and ability to meet the new standards, the extent of any reduction in customer use, and other factors. The magnitude of this potential adverse effect cannot be estimated.

Our bertrandite ore mining and manufacturing operations are subject to extensive environmental regulations that impose, and will continue to impose, significant costs and liabilities on us, and future regulation could increase these costs and liabilities or prevent production of beryllium-containing products.

We are subject to a variety of governmental regulations relating to the environment, including those relating to our handling of hazardous materials and air and wastewater emissions. Some environmental laws impose substantial penalties for non-compliance. Others, such as the federal Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA), impose strict, retroactive, and joint and several liability upon entities responsible for releases of hazardous substances. Bertrandite ore mining is also subject to extensive governmental regulation on matters such as permitting and licensing requirements, plant and wildlife protection, reclamation and restoration of mining properties, the discharge of materials into the environment, and the effects that mining has on groundwater quality and availability. Future requirements could impose on us significant additional costs or obligations with respect to our extraction, milling, and processing of ore. If we fail to comply with present and future environmental laws and regulations, we could be subject to liabilities or our operations could be interrupted. In addition, future environmental laws and regulations could restrict our ability to expand our facilities or extract our bertrandite ore deposits. These environmental laws and regulations could also require us to acquire costly equipment, obtain additional financial assurance, or incur other significant expenses in connection with our business, which would increase our costs of production.

Unexpected events and natural disasters at our mine could increase the cost of operating our business.

A portion of our production costs at our mine are fixed regardless of current operating levels. Our operating levels are subject to conditions beyond our control that may increase the cost of mining for varying lengths of time. These conditions include, among other things, weather, fire, natural disasters, pit wall failures, and ore processing changes. Our mining operations also involve the handling and production of potentially explosive materials. It is possible that an explosion could result in death or injuries to

11

employees and others and material property damage to third parties and us. Any explosion could expose us to adverse publicity or liability for damages and materially adversely affect our operations. Any of these events could increase our cost of operations.

A security breach of customer, employee, supplier, or company information may have a material adverse effect on our business, financial condition, and results of operations.

In the conduct of our business, we collect, use, transmit, store, and report data on information systems and interact with customers, vendors, and employees. Increased global information technology (IT) security threats and more sophisticated and targeted computer crime pose a risk to the security of our systems and networks and the confidentiality, availability, and integrity of our data. Despite our security measures, our IT systems and infrastructure may be vulnerable to customer viruses, cyber-attacks, security breaches caused by employee error or malfeasance, or other disruptions. Any such threat could compromise our networks and the information stored there could be accessed, publicly disclosed, lost, or stolen. A security breach of our computer systems could interrupt or damage our operations or harm our reputation, resulting in a loss of sales, operating profits, and assets. In addition, we could be subject to legal claims or proceedings, liability under laws that protect the privacy of personal information and regulatory penalties if confidential information relating to customers, suppliers, employees, or other parties is misappropriated from our computer systems.

Similar security threats exist with respect to the IT systems of our lenders, suppliers, consultants, advisers, and other third parties with whom we conduct business. A security breach of those computer systems could result in the loss, theft, or disclosure of confidential information and could also interrupt or damage our operations, harm our reputation, and subject us to legal claims.

Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

12

Item 2. | PROPERTIES |

We operate manufacturing plants, service and distribution centers, and other facilities throughout the world. During 2017, we made effective use of our productive capacities at our principal facilities. We believe that the quality and production capacity of our facilities is sufficient to maintain our competitive position for the foreseeable future. Information as of December 31, 2017, with respect to our facilities that are owned or leased, and the respective segments in which they are included, is set forth below:

Location | Owned or Leased | Approximate Number of Square Feet | |

Corporate and Administrative Offices | |||

Mayfield Heights, Ohio (1)(2) | Leased | 79,130 | |

Manufacturing Facilities | |||

Albuquerque, New Mexico (2) | Owned/Leased | 13,000/63,223 | |

Alzenau, Germany (2) | Leased | 235,550 | |

Bloomfield, Connecticut (3) | Leased | 44,800 | |

Brewster, New York (2) | Leased | 75,000 | |

Buffalo, New York (2) | Owned | 97,000 | |

Delta, Utah (1) | Owned | 100,836 | |

Elmore, Ohio (1) | Owned/Leased | 681,000/191,000 | |

Farnborough, England (1) | Leased | 10,000 | |

Fremont, California (1) | Leased | 40,000 | |

Hanau, Germany (2) | Leased | 120,000 | |

Limerick, Ireland (2) | Leased | 23,000 | |

Lincoln, Rhode Island (1) | Owned/Leased | 130,000/26,451 | |

Lorain, Ohio (1) | Owned/Leased | 55,000/10,000 | |

Milwaukee, Wisconsin (2) | Owned | 98,750 | |

Reading, Pennsylvania (1) | Owned | 128,863 | |

Santa Clara, California (2) | Leased | 5,800 | |

Shanghai, China (3) | Leased | 101,400 | |

Singapore (2) | Leased | 24,500 | |

Subic Bay, Philippines (2) | Leased | 5,000 | |

Suzhou, China (2) | Leased | 21,743 | |

Taoyuan City, Taiwan (2) | Leased | 32,523 | |

Tucson, Arizona (1) | Owned | 53,000 | |

Tyngsboro, Massachusetts (3) | Leased | 38,000 | |

Westford, Massachusetts (3) | Leased | 53,000 | |

Wheatfield, New York (2) | Owned | 35,000 | |

Windsor, Connecticut (3) | Leased | 34,700 | |

Service, Sales, and Distribution Centers | |||

Elmhurst, Illinois (1) | Leased | 28,500 | |

Maastricht, The Netherlands (2) | Leased | 450 | |

Seoul, Korea (2) | Leased | 13,654 | |

Singapore (1) | Leased | 2,500 | |

Stuttgart, Germany (1) | Leased | 24,800 | |

Tokyo, Japan (1) | Leased | 7,200 | |

Warren, Michigan (1) | Leased | 34,500 | |

(1) | Performance Alloys and Composites |

(2) | Advanced Materials |

(3) | Precision Coatings |

13

In addition to the above, the Company holds certain mineral rights on 7,500 acres in Juab County, Utah, from which the beryllium-bearing ore, bertrandite, is mined by the open pit method. A portion of these mineral rights are held under lease. Ore reserve data can be found in Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Item 3. | LEGAL PROCEEDINGS |

Our subsidiaries and our holding company are subject, from time to time, to a variety of civil and administrative proceedings arising out of our normal operations, including, without limitation, product liability claims, health, safety, and environmental claims, and employment-related actions. Among such proceedings are cases alleging that plaintiffs have contracted, or have been placed at risk of contracting, beryllium sensitization or CBD or other lung conditions as a result of exposure to beryllium (beryllium cases). The plaintiffs in beryllium cases seek recovery under negligence and various other legal theories and demand compensatory and often punitive damages, in many cases of an unspecified sum. Spouses of some plaintiffs claim loss of consortium.

Beryllium Claims

As of December 31, 2017, our subsidiary, Materion Brush Inc., was a defendant in one beryllium case (involving four

plaintiffs). The case was originally filed and dismissed during 2015, but reversed and remanded in 2016 to the trial court. The Company does not expect the resolution of this matter to have a material impact on the consolidated financial statements.

The Company was one of six defendants in a case filed on April 7, 2015 in the Superior Court of the State of California, Los Angeles County, titled Godoy et al. v. The Argen Corporation et al., BC578085. This was a survival and wrongful death complaint. The complaint alleged that the decedent worked at H. Kramer & Co. in California and alleged that he worked as a dental lab technician at various dental labs in California, and that he suffered from CBD and other injuries as a result of grinding, melting and handling beryllium-containing products. The complaint alleged causes of action for negligence, strict liability - failure to warn, strict liability - design defect, fraudulent concealment, and breach of implied warranties. Plaintiffs other than the personal representative of the decedent sought compensatory damages. The survival action brought by the decedent's designated personal representative sought all damages sustained by decedent that he would have been entitled to recover had he lived, including punitive damages. The Company filed a demurrer on May 29, 2015. At a hearing on September 29, 2015, the court granted the demurrer, dismissing all claims against the Company, without leave to amend the complaint. On February 3, 2016, the plaintiffs filed a notice of appeal. On June 23, 2016, the California Supreme Court in a case titled Ramos v. Brenntag Specialties, 2016 WL 3435777, issued a unanimous opinion disapproving the case precedent upon which the Company's successful demurrer had been based. Based on this decision, the parties stipulated that the judgment entered in favor of the defendants be reversed and the matter remanded to the trial court for further proceedings. This case has since been assigned a March 12, 2019 trial date and discovery is ongoing.

The Company has insurance coverage, which may respond, subject to an annual deductible.

Item 4. | MINE SAFETY DISCLOSURES |

Information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and Item 104 of Regulation S-K (17 CFR 229.104) is included in Exhibit 95 to this Form 10-K.

14

PART II

Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information and Dividends

The Company's common shares are listed on the New York Stock Exchange under the symbol “MTRN”. As of February 2, 2018, there were 848 shareholders of record. Refer to Note S of the Consolidated Financial Statements for a summary of dividends declared per common share and market prices with respect to common shares during each quarter of fiscal years 2017 and 2016, which information is incorporated herein by reference. Although the Company’s Board of Directors currently intends to continue the payment of regular quarterly cash dividends on the Company’s common shares, the timing and amount of future dividends will depend on the Board's assessment of our operations, financial condition, projected liabilities, the Company’s compliance with contractual restrictions in its credit agreement or any agreement governing future debt, restrictions imposed by applicable laws, and other factors.

Share Repurchases

The following table presents information with respect to repurchases of common stock made by us during the three months ended December 31, 2017.

Period | Total Number of Shares Purchased (1) | Average Price Paid per Share (1) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (2) | Maximum Dollar Value that May Yet Be Purchased Under the Plans or Programs (2) | ||||||||||

September 30 through November 3, 2017 | 39,767 | $ | 50.52 | — | $ | 15,703,744 | ||||||||

November 4 through December 1, 2017 | 1,936 | 50.37 | — | 15,703,744 | ||||||||||

December 2 through December 31, 2017 | 58 | 47.67 | — | 15,703,744 | ||||||||||

Total | 41,761 | $ | 50.51 | — | $ | 15,703,744 | ||||||||

(1) | Represents shares surrendered to the Company by employees to satisfy tax withholding obligations on stock appreciation rights issued under the Company's stock incentive plan. | |

(2) | On January 14, 2014, we announced that our Board of Directors authorized the repurchase of up to $50.0 million of our common stock; this Board authorization does not have an expiration date. We did not repurchase any shares of the Company's common stock under this authorization during the fourth quarter of 2017. | |

15

Performance Graph

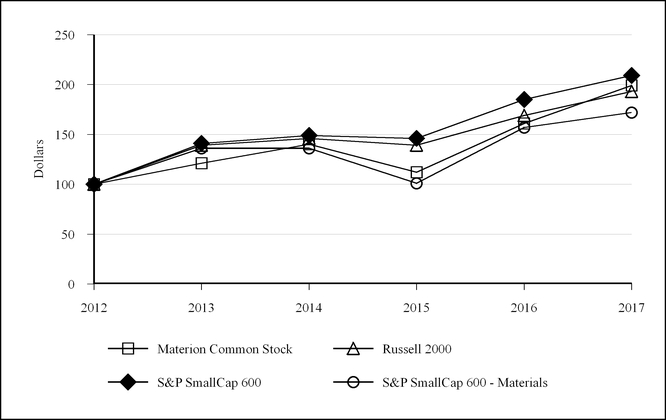

The following graph sets forth the cumulative shareholder return on our common shares as compared to the cumulative total return of the Russell 2000 Index, the S&P SmallCap 600 Index, and the S&P SmallCap 600 Materials Index, as Materion Corporation is a component of these indices.

2013 | 2014 | 2015 | 2016 | 2017 | ||||||||||||||||

Materion Corporation | $ | 121 | $ | 140 | $ | 112 | $ | 161 | $ | 199 | ||||||||||

Russell 2000 | 139 | 146 | 139 | 169 | 193 | |||||||||||||||

S&P SmallCap 600 | 141 | 149 | 146 | 185 | 209 | |||||||||||||||

S&P SmallCap 600 - Materials | 136 | 136 | 101 | 157 | 172 | |||||||||||||||

The above graph assumes that the value of our common shares and each index was $100 on December 31, 2012 and that all applicable dividends were reinvested.

16

Item 6. | SELECTED FINANCIAL DATA |

Materion Corporation and Subsidiaries

(Thousands except per share data) | 2017 | 2016 | 2015 | 2014 | 2013 | |||||||||||||||

For the year | ||||||||||||||||||||

Net sales | $ | 1,139,447 | $ | 969,236 | $ | 1,025,272 | $ | 1,126,890 | $ | 1,166,882 | ||||||||||

Cost of sales | 927,953 | 785,773 | 834,492 | 920,987 | 978,904 | |||||||||||||||

Gross margin | 211,494 | 183,463 | 190,780 | 205,903 | 187,978 | |||||||||||||||

Operating profit | 38,579 | 27,104 | 45,268 | 57,588 | 27,608 | |||||||||||||||

Interest expense - net | 2,183 | 1,789 | 2,450 | 2,787 | 3,036 | |||||||||||||||

Income before income taxes | 36,396 | 25,315 | 42,818 | 54,801 | 24,572 | |||||||||||||||

Income tax expense (benefit) | 24,945 | (425 | ) | 10,660 | 12,670 | 4,360 | ||||||||||||||

Net income | 11,451 | 25,740 | 32,158 | 42,131 | 20,212 | |||||||||||||||

Earnings per share of common stock: | ||||||||||||||||||||

Basic(1) | 0.57 | 1.29 | 1.60 | 2.06 | 0.98 | |||||||||||||||

Diluted(1) | 0.56 | 1.27 | 1.58 | 2.02 | 0.97 | |||||||||||||||

Dividends per share of common stock | 0.395 | 0.375 | 0.355 | 0.335 | 0.315 | |||||||||||||||

Depreciation, depletion, and amortization | 42,751 | 45,651 | 37,817 | 42,721 | 41,649 | |||||||||||||||

Capital expenditures | 27,516 | 27,177 | 29,505 | 29,312 | 27,848 | |||||||||||||||

Mine development expenditures | 1,560 | 9,861 | 22,585 | 1,247 | 4,776 | |||||||||||||||

Year-end position | ||||||||||||||||||||

Net current assets | $ | 283,834 | $ | 254,907 | $ | 249,616 | $ | 282,628 | $ | 266,248 | ||||||||||

Ratio of current assets to current liabilities | 3.2 to 1 | 3.8 to 1 | 3.6 to 1 | 3.7 to 1 | 3.1 to 1 | |||||||||||||||

Property, plant, and equipment: | ||||||||||||||||||||

At cost | 891,789 | 861,267 | 833,834 | 800,671 | 782,879 | |||||||||||||||

Cost less depreciation, depletion, and amortization | 255,578 | 252,631 | 263,629 | 247,588 | 261,893 | |||||||||||||||

Total assets | 791,084 | 741,298 | 742,293 | 761,921 | 777,458 | |||||||||||||||

Long-term liabilities(2) | 161,097 | 150,853 | 157,182 | 173,890 | 153,296 | |||||||||||||||

Long-term debt | 2,827 | 3,605 | 4,276 | 23,196 | 28,780 | |||||||||||||||

Shareholders’ equity | 494,981 | 494,089 | 482,957 | 459,019 | 464,428 | |||||||||||||||

Weighted-average number of shares of common stock outstanding: | ||||||||||||||||||||

Basic | 20,027 | 19,983 | 20,097 | 20,461 | 20,571 | |||||||||||||||

Diluted | 20,415 | 20,213 | 20,402 | 20,852 | 20,943 | |||||||||||||||

(1) Net income per basic and diluted share for 2017 includes the impact of $17.1 million in income tax expense as a result of the Tax Cuts and Jobs Act (TCJA) signed into law on December 22, 2017. For additional information refer to Refer to Note G of the Consolidated Financial Statements.

(2) Long-term liabilities include long-term obligations relating to Retirement and post-employment benefits, Unearned income, and Other long-term liabilities.

17

Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OVERVIEW

We are an integrated producer of high-performance advanced engineered materials used in a variety of electrical, electronic, thermal, and structural applications. Our products are sold into numerous end markets, including consumer electronics, industrial components, defense, medical, automotive electronics, telecommunications infrastructure, energy, commercial aerospace, science, services, and appliance.

RESULTS OF OPERATIONS

(Thousands except per share data) | 2017 | 2016 | 2015 | |||||||||

Net sales | $ | 1,139,447 | $ | 969,236 | $ | 1,025,272 | ||||||

Value-added sales | 677,697 | 599,910 | 617,247 | |||||||||

Gross margin | 211,494 | 183,463 | 190,780 | |||||||||

Gross margin as a % of Value-added sales | 31 | % | 31 | % | 31 | % | ||||||

Selling, general, and administrative (SG&A) expense | 146,170 | 129,683 | 129,941 | |||||||||

SG&A expense as a % of Value-added sales | 22 | % | 22 | % | 21 | % | ||||||

Research and development (R&D) expense | 13,981 | 12,802 | 12,796 | |||||||||

R&D expense as a % of Value-added sales | 2 | % | 2 | % | 2 | % | ||||||

Other — net | 12,764 | 13,874 | 2,775 | |||||||||

Operating profit | 38,579 | 27,104 | 45,268 | |||||||||

Interest expense — net | 2,183 | 1,789 | 2,450 | |||||||||

Effective tax rate | 68.5 | % | (1.7 | )% | 24.9 | % | ||||||

Net income | 11,451 | 25,740 | 32,158 | |||||||||

Diluted earnings per share | 0.56 | 1.27 | 1.58 | |||||||||

2017 Compared to 2016

Net sales were $1,139.4 million in 2017, reflecting an increase of 18% from 2016. Changes in precious metal and copper prices favorably impacted net sales in 2017 by approximately $13.1 million when compared to 2016. Net sales in the Performance Alloys and Composites segment increased $41.9 million due to higher sales volume, including shipments of raw material beryllium hydroxide. Net sales of $119.7 million during 2017 were attributable to the HTB acquisition. Excluding the HTB acquisition, net sales in the Advanced Materials segment increased $33.9 million due to higher sales volume in the consumer electronics and industrial components end markets. These favorable impacts were offset by lower sales volume in the medical end market in the Precision Coatings segment.

Value-added sales were $677.7 million in 2017, an increase of $77.8 million as compared to 2016 value-added sales of $599.9 million. Value-added sales is a non-GAAP financial measure that removes the impact of pass-through metal costs and allows for analysis without the distortion of the movement or volatility in metal prices. Internally, we manage our business on this basis, and a reconciliation of net sales to value-added sales is included herein.

Value-added sales from the HTB acquisition totaled approximately $36.5 million in 2017. Excluding the HTB acquisition, value-added sales to the consumer electronics end market, which accounted for 30% of our total value-added sales during 2017, increased $17.2 million from the prior year. Also, value-added sales in the industrial components end market increased $12.3 million from the prior year.

Gross margin was $211.5 million in 2017, or a 15% increase from the $183.5 million gross margin recorded in 2016. Gross margin expressed as a percentage of value-added sales was 31% in both 2017 and 2016. The increase in gross margin was primarily due to higher sales volume.

SG&A expenses totaled $146.2 million in 2017 as compared to $129.7 million in 2016. Expressed as a percentage of value-added sales, SG&A expenses were 22% in both 2017 and 2016. The increase is attributable to normal course of business expenses from the HTB acquisition of $5.9 million, $4.1 million of CEO transition costs, and higher variable compensation expense related to improved financial performance.

R&D expenses consist primarily of direct personnel costs for pre-production evaluation and testing of new products, prototypes, and applications. R&D expense was flat as a percentage of value-added sales at approximately 2% in both 2017 and 2016.

18

Other-net totaled expense of $12.8 million and $13.9 million in 2017 and 2016, respectively. In 2017, we recorded a $1.4 million gain on the sale of our service center located in Fukaya, Japan compared to an asset impairment charge of $2.6 million in 2016 for land and buildings relating to its closure. Refer to Notes D and E of the Consolidated Financial Statements for the details of the major components of Other-net and Restructuring.

Interest expense - net was $2.2 million in 2017 and $1.8 million in 2016. The lower expense in 2016 resulted from lower average outstanding debt levels.

Income tax expense for 2017 was $24.9 million versus a benefit of $0.4 million in 2016. The effective tax rate for 2017 was 68.5% compared to a negative effective tax rate of 1.7% for 2016.

On December 22, 2017, the TCJA was signed into law. The TCJA includes a number of provisions, including the lowering of the U.S. corporate tax rate from 35 percent to 21 percent, effective January 1, 2018. The TCJA also includes provisions that may partially offset the benefit of such rate reduction, including the repeal of the deduction for domestic production activities. The international provisions of the TCJA establish a territorial-style system for taxing foreign-source income of domestic multinational corporations. As a result of the TCJA, we recorded adjustments for the re-measurement of deferred tax assets (liabilities) and the deemed repatriation tax on unremitted foreign earnings and profits. Refer to Note G of the Consolidated Financial Statements for a discussion of the impact of compliance with the TCJA and a reconciliation of the statutory and effective tax rates.

2016 Compared to 2015