Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - RTI SURGICAL, INC. | d629971dex991.htm |

| 8-K - 8-K - RTI SURGICAL, INC. | d629971d8k.htm |

RTI Surgical Acquires Paradigm Spine 11/1/2018 Exhibit 99.2

This Investor Presentation is for informational purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of RTI Surgical, Inc. (“RTI” or the “Company”) or any of its affiliates’ securities (as such term is defined under the U.S. Federal Securities Laws). This Investor Presentation has been prepared to assist interested parties in making their own evaluation with respect to RTI’s proposed acquisition of Paradigm Spine, LLC. The information contained in this presentation is derived from various internal and external sources. Please refer to the master transaction agreement for the full terms of the transaction. No representation is made as to the reasonableness of the assumptions made in this presentation or the accuracy or completeness of any projections, modeling, or any other information contained in this presentation. Any data on past performance is no indication as to future performance. RTI assumes no obligation to update the information in this Investor Presentation except as required by law. Forward Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations, estimates and projections about our industry, our management's beliefs and certain assumptions made by our management. Words such as "anticipates," "expects," "intends," "plans," "believes," "seeks," "estimates," variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, except for historical information, any statements made in this communication about anticipated financial results, the impact of the transaction on the complexity of RTI’s operations, any benefits of scaling caused by the transaction, the impact of the transaction on RTI’s growth rates, potential long-term growth for coflex® products, the impact of the transaction on RTI’s market share, and the retention of current customers or the acquisition of additional customers also are forward-looking statements. Many factors could affect our actual financial results and cause them to vary materially from the expectations contained in the forward-looking statements, including those set forth in this document. These statements are not guarantees of future performance and are subject to risks and uncertainties. These risks and uncertainties include, among other things: the failure to obtain RTI shareholder approval of the proposed transaction; the possibility that the closing conditions to the proposed transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval and any conditions imposed in connection with consummation of the proposed transaction; delay in closing the proposed transaction or the possibility of non-consummation of the proposed transaction; the risk that the cost savings and any other synergies from the proposed transaction may not be fully realized or may take longer to realize than expected, including that the proposed transaction may not be accretive within the expected timeframe or to the extent anticipated; the occurrence of any event that could give rise to termination of the definitive agreement; the risk that shareholder litigation in connection with the proposed transaction may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; risks related to the disruption of the proposed transaction to us and our management; the effect of the announcement of the proposed transaction on our ability to retain and hire key personnel and maintain relationships with customers, suppliers and other third parties; the ability and timing to obtain required regulatory approvals and satisfy other closing conditions; and other risks described in public filings with the U.S. Securities and Exchange Commission (SEC). Our actual results may differ materially from the anticipated results reflected in these forward-looking statements. Copies of the company's SEC filings may be obtained by contacting the company or the SEC or by visiting RTI's website at www.rtix.com or the SEC's website at www.sec.gov. Industry and Market Data In this Investor Presentation, RTI relies on and refers to information and statistics regarding industry data. RTI obtained this information and statistics from third-party sources, including reports by market research firms, such as [Note to RTI: Include any market research firms used to provide information on the LSS market.]. RTI has not verified the accuracy of the data obtained from third-party sources, and RTI makes no representations as to the accuracy of such information. Important Additional Information and Where to Find It In connection with the proposed transaction, RTI will file a registration statement on Form S-4 with the SEC. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. INVESTORS AND SECURITY HOLDERS ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, WHEN SUCH DOCUMENTS BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The final proxy statement/prospectus will be mailed to stockholders of RTI. Investors and security holders will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, from RTI at its website, www.rtix.com, or by contacting RTI Investor Relations at (847) 530-0249. Participants in Solicitation The Company and its respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information concerning the Company’s participants is set forth in the proxy statement, filed March 26, 2018, for the Company’s 2018 annual meeting of stockholders as filed with the SEC on Schedule 14A. Additional information regarding the interests of such participants in the solicitation of proxies in respect of the proposed transaction will be included in the registration statement and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Legal Disclosure

Our Path Forward Moderate growth, predictable margin, generates cash High margin, high growth, uses cash DESIRED OUTCOME Build a growing and sustainably profitable business that will treat more patients, create growth opportunities for us and value for investors RTI STRATEGY APPROACH BUSINESS STRATEGY DRIVE OPERATIONAL EXCELLENCE REDUCE COMPLEXITY ACCELERATE GROWTH SPINE OEM Customer intimacy Focused innovation Operational excellence Channel management Disciplined and relevant innovation Patient access

Executing Our Strategic Transformation Enhanced focus on optimizing core competencies Completed portfolio analysis to support divestiture of non-core assets Initiated $25M of cost reduction program in tissue manufacturing Implemented lean manufacturing concepts across global manufacturing Rebuilt product pipeline across all franchises Refocused international on targeted markets with key products Strengthened balance sheet to enable investments in growth Achieved significant progress across the three pillars of our strategic transformation highlighted by our recent strong financial performance Reduce Complexity Drive Operational Excellence Accelerate Growth Returned all franchises to growth

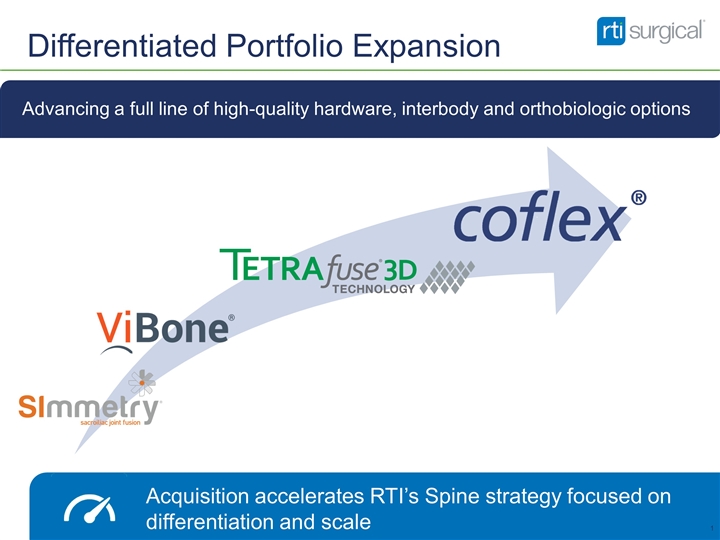

Differentiated Portfolio Expansion Advancing a full line of high-quality hardware, interbody and orthobiologic options Acquisition accelerates RTI’s Spine strategy focused on differentiation and scale

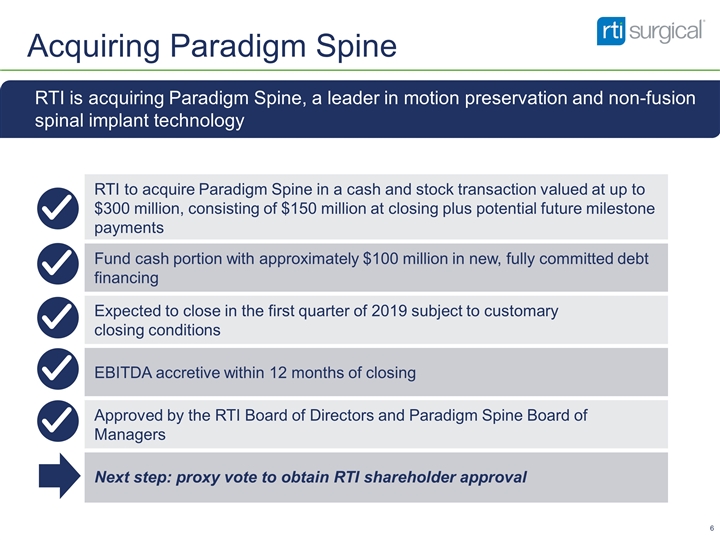

Acquiring Paradigm Spine RTI is acquiring Paradigm Spine, a leader in motion preservation and non-fusion spinal implant technology RTI to acquire Paradigm Spine in a cash and stock transaction valued at up to $300 million, consisting of $150 million at closing plus potential future milestone payments Fund cash portion with approximately $100 million in new, fully committed debt financing Expected to close in the first quarter of 2019 subject to customary closing conditions EBITDA accretive within 12 months of closing Approved by the RTI Board of Directors and Paradigm Spine Board of Managers Next step: proxy vote to obtain RTI shareholder approval

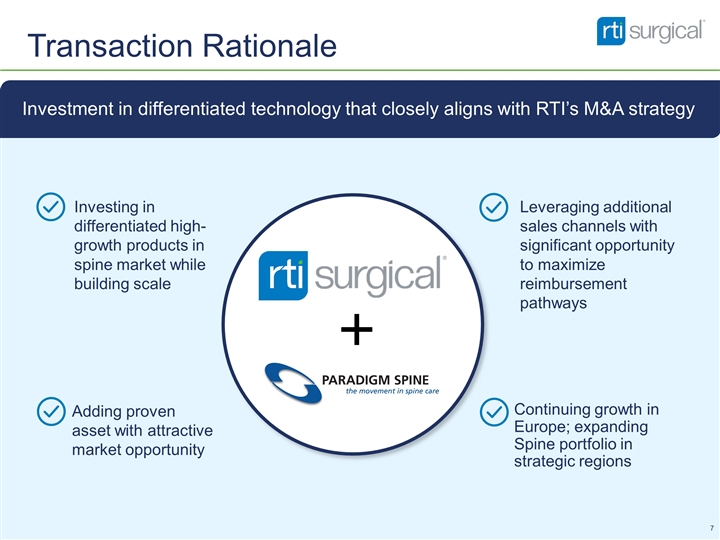

Transaction Rationale Investment in differentiated technology that closely aligns with RTI’s M&A strategy Continuing growth in Europe; expanding Spine portfolio in strategic regions Investing in differentiated high-growth products in spine market while building scale Adding proven asset with attractive market opportunity Leveraging additional sales channels with significant opportunity to maximize reimbursement pathways

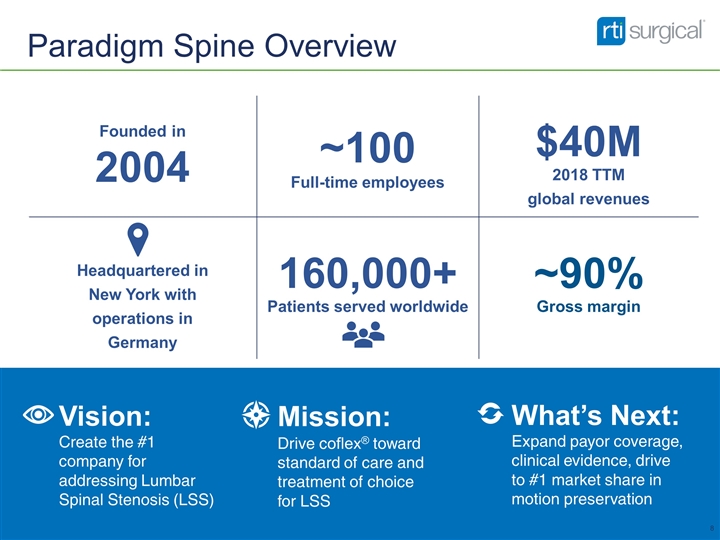

Paradigm Spine Overview Vision: Create the #1 company for addressing Lumbar Spinal Stenosis (LSS) Mission: Drive coflex® toward standard of care and treatment of choice for LSS What’s Next: Expand payor coverage, clinical evidence, drive to #1 market share in motion preservation Founded in 2004 ~100 Full-time employees $40M 2018 TTM global revenues Headquartered in New York with operations in Germany 160,000+ Patients served worldwide ~90% Gross margin

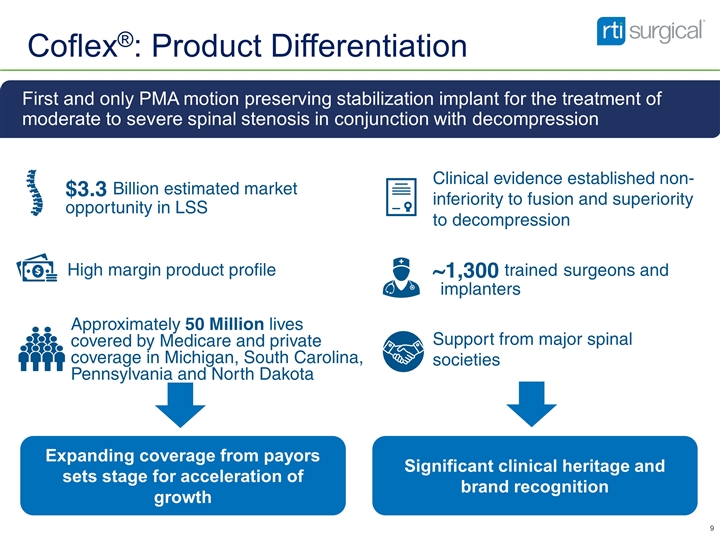

Coflex®: Product Differentiation First and only PMA motion preserving stabilization implant for the treatment of moderate to severe spinal stenosis in conjunction with decompression High margin product profile Clinical evidence established non-inferiority to fusion and superiority to decompression ~1,300 trained surgeons and implanters Support from major spinal societies $3.3 Billion estimated market opportunity in LSS Approximately 50 Million lives covered by Medicare and private coverage in Michigan, South Carolina, Pennsylvania and North Dakota Expanding coverage from payors sets stage for acceleration of growth Significant clinical heritage and brand recognition

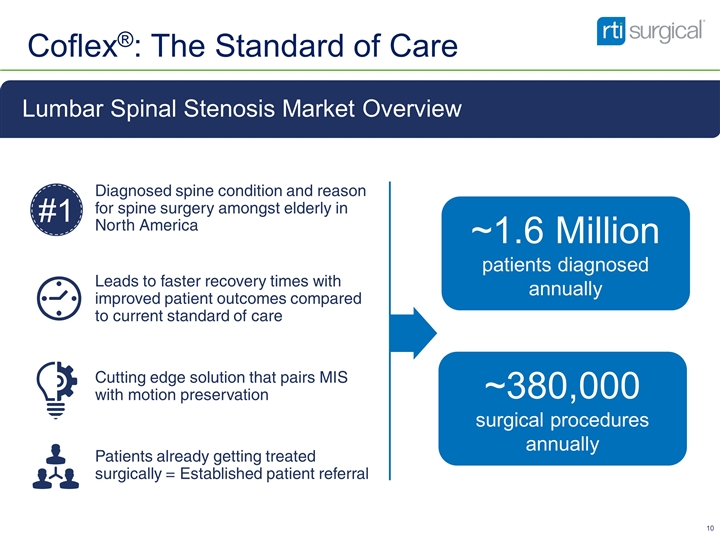

Coflex®: The Standard of Care Lumbar Spinal Stenosis Market Overview ~1.6 Million patients diagnosed annually Estimated Significant $3.3 Billion Market Opportunity Diagnosed spine condition and reason for spine surgery amongst elderly in North America Leads to faster recovery times with improved patient outcomes compared to current standard of care Cutting edge solution that pairs MIS with motion preservation Patients already getting treated surgically = Established patient referral #1 ~380,000 surgical procedures annually

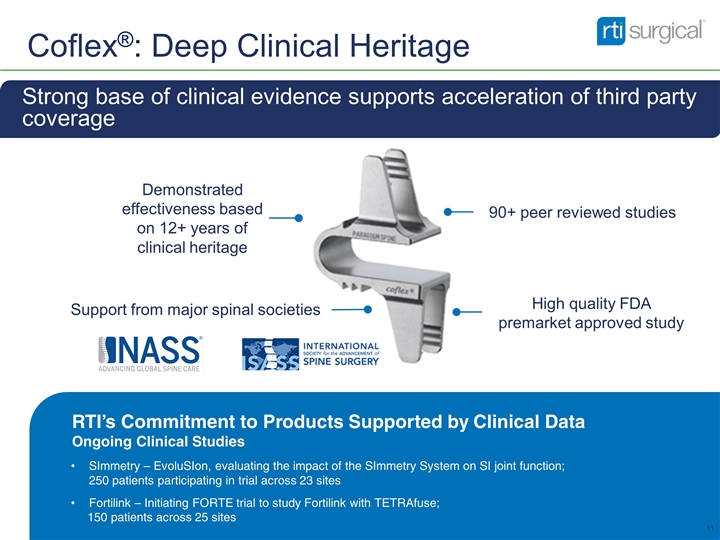

Coflex®: Deep Clinical Heritage Demonstrated effectiveness based on 12+ years of clinical heritage 90+ peer reviewed studies High quality FDA premarket approved study Support from major spinal societies RTI’s Commitment to Products Supported by Clinical Data Ongoing Clinical Studies SImmetry – EvoluSIon, evaluating the impact of the SImmetry System on SI joint function; 250 patients participating in trial across 23 sites Fortilink – Initiating FORTE trial to study Fortilink with TETRAfuse; 150 patients across 25 sites Strong base of clinical evidence supports acceleration of third party coverage

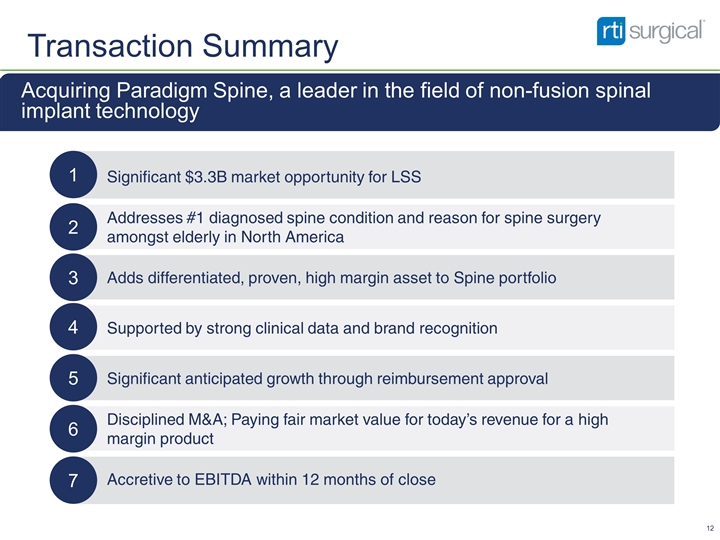

Transaction Summary Acquiring Paradigm Spine, a leader in the field of non-fusion spinal implant technology Significant $3.3B market opportunity for LSS Addresses #1 diagnosed spine condition and reason for spine surgery amongst elderly in North America Adds differentiated, proven, high margin asset to Spine portfolio Supported by strong clinical data and brand recognition Significant anticipated growth through reimbursement approval Disciplined M&A; Paying fair market value for today’s revenue for a high margin product Accretive to EBITDA within 12 months of close 1 2 3 4 5 6 7

Unique Growth Strategy Coming to Life Transaction highlights RTI’s commitment to accelerating growth and driving shareholder value Acquiring Paradigm Spine accelerates RTI’s growth strategy in spine Underscores significant ongoing progress toward completing strategic transformation Focusing on differentiation and scale in Spine supported by OEM cash generation Deal closely aligns with RTI’s M&A strategy