Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - LILIS ENERGY, INC. | a2018q3exhibit991.htm |

| 8-K - 8-K - LILIS ENERGY, INC. | a2018q3form8-kearningsrele.htm |

Third Quarter 2018 Earnings Presentation NYSE American | LLEX

Disclaimer This presentation contains forward-looking statements. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a forward-looking statement. These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward-looking information. The identification in this presentation of factors that may affect Lilis’ future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. These forward-looking statements are given only as of the date of this presentation. Except as required by law, we do not intend, and undertake no obligations, to update any forward-looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. These forward-looking statements include, among other things, statements about Lilis’ expectations, beliefs, intentions or business strategies for the future, statements concerning Lilis’ outlook with regard to the timing and amount of future production of oil, natural gas liquids and natural gas, price realizations, the nature and timing of capital expenditures for exploration and development, plans for funding operations and drilling program capital expenditures, the timing and success of specific projects, operating costs and other expenses, proved oil and natural gas reserves, liquidity and capital resources, outcomes and effects of litigation, claims and disputes and derivative activities. Factors that could cause Lilis’ actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: the success of Lilis’ exploration and development efforts; the price of oil, gas and other produced gases and liquids; the worldwide economic situation; changes in interest rates or inflation; the ability of Lilis to transport gas, oil and other products; the ability of Lilis to raise additional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; Lilis’ capital costs, which may be affected by delays or cost overruns; cost of production; environmental and other regulations, as the same presently exist or may later be amended; Lilis’ ability to identify, finance and integrate any future acquisitions; and the volatility of Lilis’ stock price. See the risks discussed in Lilis’ Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. RECONCILIATION OF NET INCOME TO ADJUSTED EBITDAX (UNAUDITED) Adjusted EBITDAX (as defined below) is presented herein and reconciled from the GAAP measure of net income because of its wide acceptance by the investment community as a financial indicator. The Company defines Adjusted EBITDAX as net income, plus (1) exploration and abandonments expense, (2) depreciation, depletion and amortization expense, (3) accretion of discount on asset retirement obligations expense, (4) non-cash stock-based compensation expense, (5) (gain) loss on derivatives, (6) net cash receipts from (payments on) derivatives, (7) gain on disposition of assets, net, (8) interest expense, (9) loss on extinguishment of debt, (10) gain on equity method investment distribution and (11) federal and state income tax expense. Adjusted EBITDAX is not a measure of net income or cash flows as determined by GAAP. The Company’s Adjusted EBITDAX measure provides additional information which may be used to better understand the Company’s operations. Adjusted EBITDAX is one of several metrics that the Company uses as a supplemental financial measurement in the evaluation of its business and should not be considered as an alternative to, or more meaningful than, net income as an indicator of operating performance. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic cost of depreciable and depletable assets. Adjusted EBITDAX, as used by the Company, may not be comparable to similarly titled measures reported by other companies. The Company believes that Adjusted EBITDAX is a widely followed measure of operating performance and is one of many metrics used by the Company’s management team and by other users of the Company’s consolidated financial statements. For example, Adjusted EBITDAX can be used to assess the Company’s operating performance and return on capital in comparison to other independent exploration and production companies without regard to financial or capital structure, and to assess the financial performance of the Company’s assets and the Company without regard to capital structure or historical cost basis. 2

Third Quarter 2018 Highlights Continued Strong Performance and Growth — Net production during 3Q18 was a record-high 514 MBOE, or ~5.6 MBOE/d, up 234% year-over-year and up 16% compared to 2Q18 — Current production of approximately 7,000 Boepd with an excess of 8,000 Boepd of productive capacity (1) — Company expects to exceed year-end production exit rate guidance of 8,000 Boepd in the near future as wells become fully operational and production from wells on flowback increases — Achieved record-high quarterly Adjusted EBITDAX of $12.4 million for 3Q18 ($49.7 million annualized), which represents 177% growth year to date and 51% growth compared to 2Q18 — Continued EBITDAX growth and improved pricing positions the Company for free cash flow neutrality (D&C basis) during the second half of 2019 Successful Execution of Operational Goals — Continue to delineate our position in the Delaware Basin leveraging strong results from Wolfcamp A and B and Bone Spring wells, with additional wells in process in the Wolfcamp A and B and Bone Spring. We are pleased with initial positive results from eastern wells and plan additional activity there in the fourth quarter and 2019 — Actual production results through type curve comparison continue to perform well and demonstrate some of the best wells in the Delaware Basin — Executed multiple acreage swaps and acquisitions in the third quarter increasing the Company’s net acreage, working interest, and net revenue interest in core areas. We increased net acreage to over 20,000, operatorship to 99%, and working interest to 76% — Completed infrastructure agreements for crude oil, gas, and produced water now fully in place with firm transportation for crude and Gulf Coast pricing — D&C capital expenditures remaining on track with our $100 million overall budget for full-year 2018 Consistent Growth of Proved Reserves — Total proved reserves have increased 308% from 11.5 MMBOE, at year-end 2017, to 46.7 MMBOE, as of September 30, 2018; up 24% from 37.6 MMBOE, as of June 30, 2018 — Total proved PV-10 growth of 467% from $69 million, at year-end 2017, to $391 million, as of September 30, 2018 (on an SEC basis) Improved Liquidity and Access to Capital — On October 10, 2018, entered into a credit facility and established a first lien revolving credit facility with an initial borrowing base of $95 million and reduced leverage through a partial second lien conversion of $68 million into common and preferred equity • Increased liquidity to $68 million • Our new credit facility offers a lower cost of capital and the ability to grow with our reserve base, providing sufficient liquidity to fund our 2018 and 2019 drilling program — Liquidity also increased without dilution through execution of crude gathering, water gathering, and disposal contracts; received $15 million of non- dilutive capital during 3Q18 and expect to achieve additional cost savings in 2019 ($55 million received year-to-date) (1) Amount of production represents actual amount produced to sales; however, daily actual sales varies due to timing of vendor payments 3

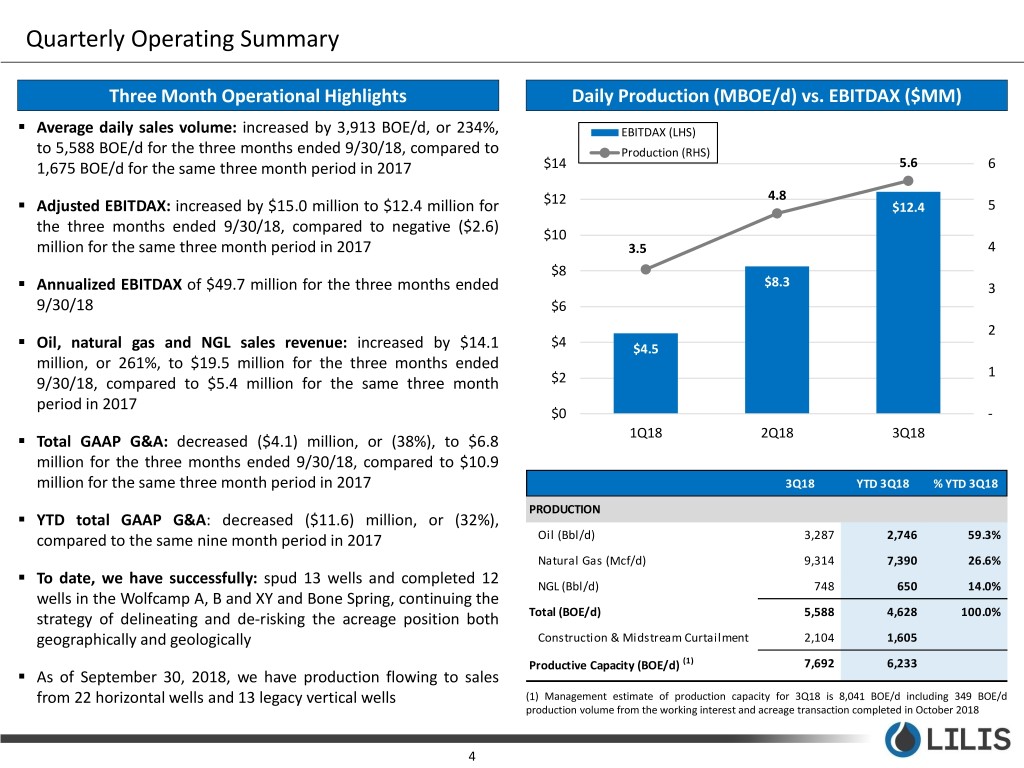

Quarterly Operating Summary Three Month Operational Highlights Daily Production (MBOE/d) vs. EBITDAX ($MM) ▪ Average daily sales volume: increased by 3,913 BOE/d, or 234%, EBITDAX (LHS) to 5,588 BOE/d for the three months ended 9/30/18, compared to Production (RHS) 1,675 BOE/d for the same three month period in 2017 $14 5.6 6 ▪ $12 4.8 Adjusted EBITDAX: increased by $15.0 million to $12.4 million for $12.4 5 the three months ended 9/30/18, compared to negative ($2.6) $10 million for the same three month period in 2017 3.5 4 ▪ $8 Annualized EBITDAX of $49.7 million for the three months ended $8.3 3 9/30/18 $6 ▪ 2 Oil, natural gas and NGL sales revenue: increased by $14.1 $4 $4.5 million, or 261%, to $19.5 million for the three months ended 1 9/30/18, compared to $5.4 million for the same three month $2 period in 2017 $0 - 1Q18 2Q18 3Q18 ▪ Total GAAP G&A: decreased ($4.1) million, or (38%), to $6.8 million for the three months ended 9/30/18, compared to $10.9 million for the same three month period in 2017 3Q18 YTD 3Q18 % YTD 3Q18 PRODUCTION ▪ YTD total GAAP G&A: decreased ($11.6) million, or (32%), compared to the same nine month period in 2017 Oil (Bbl/d) 3,287 2,746 59.3% Natural Gas (Mcf/d) 9,314 7,390 26.6% ▪ To date, we have successfully: spud 13 wells and completed 12 NGL (Bbl/d) 748 650 14.0% wells in the Wolfcamp A, B and XY and Bone Spring, continuing the strategy of delineating and de-risking the acreage position both Total (BOE/d) 5,588 4,628 100.0% geographically and geologically Construction & Midstream Curtailment 2,104 1,605 Productive Capacity (BOE/d) (1) 7,692 6,233 ▪ As of September 30, 2018, we have production flowing to sales from 22 horizontal wells and 13 legacy vertical wells (1) Management estimate of production capacity for 3Q18 is 8,041 BOE/d including 349 BOE/d production volume from the working interest and acreage transaction completed in October 2018 4

Operations – Upcoming Well Status and Recent Well Results Upcoming Well Status Well Status Target Count Well Name Lateral Length Flowback Bone Spring 1 Tiger #3H – 3rd Bone Spring 1 ½ mile lateral Operations WCA 2 East Axis #2H – Wolfcamp A 1 ½ mile lateral 3 North West Axis #1H – Wolfcamp A 1 ½ mile lateral Completion WCA 4 Oso #1H – Wolfcamp A 1 ½ mile lateral Operations 5 Haley #1H – Wolfcamp A 1 mile lateral 6 Haley #2H – Wolfcamp A 1 mile lateral Drilling WCA 7 North East Axis #2H – Wolfcamp A 1 ½ mile lateral Operations WCB 8 Ox #1H – Wolfcamp B 1 ½ mile lateral 3Q18 Well Results Location Map Well Name Target Commentary Newly Announced Well Results 4 Lilis’ first 1.5-mile Wolfcamp A well drilled, strong initial performance prior to Moose being choked due to facility constraints 1 WCA Lea #1H • 24-hr rate: 1,691 BOE/d or 232 BOE/d per 1,000 lateral ft. – (72% Liquids) • IP 30 rate 1,035 BOE/d – (72% Liquids) AG Hill Bone Lilis’ first 2nd Bone Spring well drilled, continuing the 2018 delineation program 5 2 #2H Spring • 24-hr rate: 845 BOE/d or 186 BOE/d per 1,000 lateral ft. – (77% Liquids) Axis Lilis’ second 1.5-mile Wolfcamp B well drilled, with strong initial performance 3 WCB 3 2 #1H • 24-hr rate: 1,571 BOE/d or 202 BOE/d per 1,000 lateral ft. – (82% Liquids) 1 Previously Announced Well Results Lilis’ first Wolfcamp A well drilled in New Mexico, registering the highest IP 24 the Prize Hog Company has completed in New Mexico Loving Winkler 4 WCA #2H • 24-hr rate of 1,825 BOE/d or 411 BOE/d per 1,000 lateral ft. – (77% liquids) • IP 30 rate 1,436 BOE/d – (77% Liquids) rd Antelope Bone Lilis’ first Bone Spring well drilled in Texas, completed in the 3 Bone Spring, 5 confirming another viable bench #1H Spring • 24-hr rate: 1,309 BOE/d or 235 BOE/d per 1,000 lateral ft. – (53% liquids) 5

Recent Acreage Transactions Acreage Activity Highlights Acreage Map As a result of the recent transactions completed in the second half International of 2018: Cities ▪ Net Acres: increased to 20,562 on 9/30/18 ▪ Net Working Interest (“NWI”): increased to 76% on 9/30/18 ▪ All acreage traded away was non-operated Acreage Transactions Hog Prospect August 2018 ▪ Lilis closed an acre-for-acre trade of approximately 1,500 net acres in the Delaware Basin, primarily Winkler County, Texas C-23 C-24 September 2018 ▪ Lilis closed an acre-for-acre trade of approximately 750 net acres C-74 C-75 in the Delaware Basin in Lea County, New Mexico October 2018 ▪ Acquired position was of the largest outstanding non-op WI partner within Lilis’ Texas core AOI ▪ Attractive purchase price of $11,400 per acre purchase price (1) for approximately 570 net acres and 349 BOE/d ▪ Purchase significantly increases existing and future well WI — Bison 1H: 13.5% — Moose 1H: 18.2% — Oso 1H: 20.5% — Tiger 3H: 20.5% ▪ January 1, 2018 effective date (1) Assume 349 Boepd of production and 570 acres acquired, at $30,000 per flowing barrel. 6

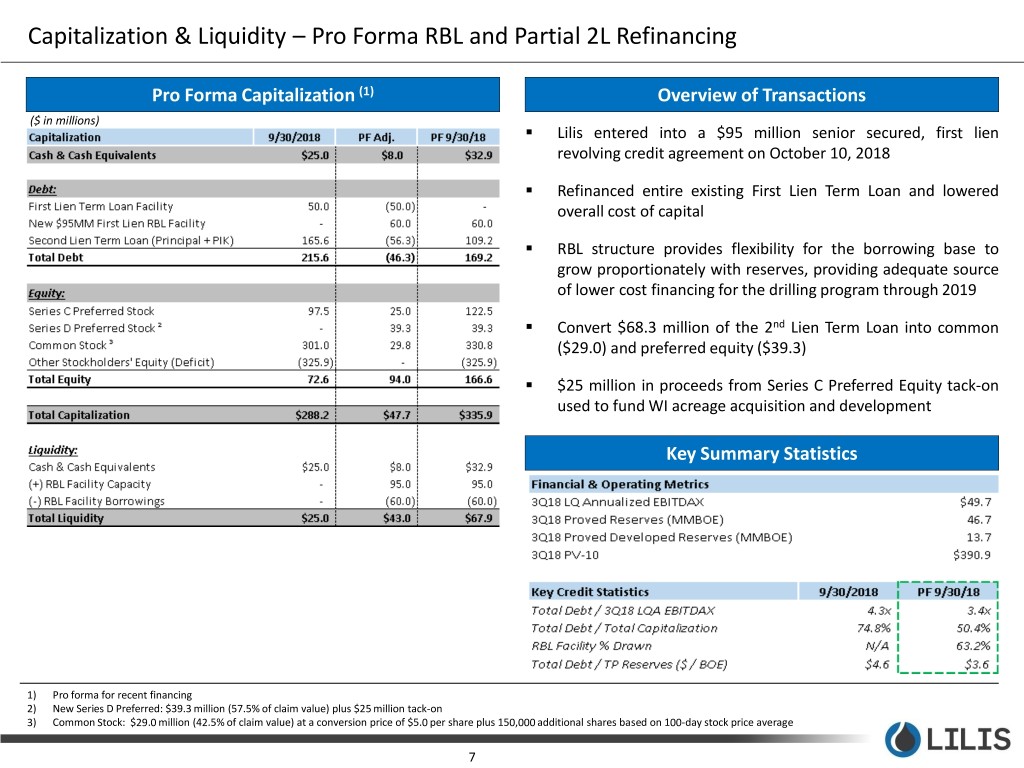

Capitalization & Liquidity – Pro Forma RBL and Partial 2L Refinancing Pro Forma Capitalization (1) Overview of Transactions ($ in millions) ▪ Lilis entered into a $95 million senior secured, first lien revolving credit agreement on October 10, 2018 ▪ Refinanced entire existing First Lien Term Loan and lowered overall cost of capital ▪ RBL structure provides flexibility for the borrowing base to grow proportionately with reserves, providing adequate source of lower cost financing for the drilling program through 2019 ▪ Convert $68.3 million of the 2nd Lien Term Loan into common ($29.0) and preferred equity ($39.3) ▪ $25 million in proceeds from Series C Preferred Equity tack-on used to fund WI acreage acquisition and development Key Summary Statistics 1) Pro forma for recent financing 2) New Series D Preferred: $39.3 million (57.5% of claim value) plus $25 million tack-on 3) Common Stock: $29.0 million (42.5% of claim value) at a conversion price of $5.0 per share plus 150,000 additional shares based on 100-day stock price average 7

Consistent Reserve Growth throughout 2018 3Q18 Reserve Report Summary (SEC Pricing) Total Proved Reserves Net Reserves (PV-10, in thousands) Oil Gas NGL Total % of $186,949 $183,567 Category PV10 (Mbbl) (MMcf) (Mbbl) Mboe Total PDP: 5,354 24,737 2,376 11,853 25% $183,567 $390,859 PNP: 1,129 2,565 272 1,828 4% $20,342 PUD: 20,029 47,326 5,080 32,997 71% $186,949 Total Proved 26,512 74,628 7,728 46,678 100% $390,859 $20,342 PDP PDNP PUD Oil Growth Gas Growth NGL Growth Total Proved Growth 50,000 46,678 40,000 37,579 30,000 26,512 18,626 20,000 11,921 12,438 11,453 11,055 10,000 7,171 6,309 7,031 7,728 2,677 3,097 1,604 1,649 0 YE 2017 1Q'18 2Q'18 3Q'18 YE 2017 1Q'18 2Q'18 3Q'18 YE 2017 1Q'18 2Q'18 3Q'18 YE 2017 1Q'18 2Q'18 3Q'18 8

Appendix 9

Condensed Consolidated Statements of Operations (Unaudited) For the Three Months Ended For the Nine Months Ended September 30, September 30, 2018 2017 2018 2017 ($ in thousands except per share data) Oil and gas revenue $ 19,482 $ 5,390 $ 51,360 $ 13,779 Operating expenses: Production costs 2,772 1,409 8,532 3,336 Gathering, processing and transportation 963 405 2,297 842 Production taxes 1,446 290 3,604 710 General and administrative 6,838 10,943 24,682 36,273 Depreciation, depletion, amortization and accretion 7,172 1,443 17,572 3,946 Total operating expenses 19,191 14,490 56,687 45,107 Operating income (loss) 291 (9,100) (5,327) (31,328) Other income (expense): Gain (loss) from commodity derivatives, net (4,811) - (9,383) - Fair value change in derivative instruments 10,612 6,368 19,499 4,254 Interest expense, net (8,949) (3,656) (26,609) (11,084) Other, net 1 151 2 19 Total other income (expense) (3,147) 2,863 (16,491) (6,811) Net loss before income tax (2,856) (6,237) (21,818) (38,139) Dividends on redeemable 6% preferred stock - - (6,527) - Dividends and deemed dividends on Series B convertible preferred stock - - - (4,635) Dividends on Series C convertible preferred stock (2,410) - - (122) Net loss attributable to common stockholders $ (5,266) $ (6,237) $ (28,345) $ (42,896) Basic net loss per common share $ (0.08) $ (0.12) $ (0.47) $ (1.06) Diluted net loss per common share $ (0.09) $ (0.12) $ (0.47) $ (1.06) Weighted average common shares outstanding (basic) 64,572,104 50,785,588 60,082,902 40,596,281 Weighted average common shares outstanding (diluted) 88,710,081 50,785,588 60,082,902 40,596,281 10

Adjusted EBITDAX (Unaudited) The following table provides a reconciliation of the GAAP measure of net income (loss) to Adjusted EBITDAX (please see the Disclaimer on slide 2): For the Three Months Ended For the Nine Months Ended September 30, September 30, 2018 2017 2018 2017 Reconciliation of Adjusted EBITDAX: ($ in thousands except per share data) Net loss $ (2,856) $ (6,237) $ (21,818) $ (38,139) Non-cash equity-based compensation 2,100 5,091 7,654 14,477 Interest expense, net 8,949 3,656 26,609 11,084 Depreciation, depletion, amortization and accretion 7,172 1,443 17,572 3,946 Loss (gain) from fair value changes of debt conversion and warrant derivatives (10,612) (6,368) (19,499) (4,254) Loss from commodity derivatives, net 6,521 - 9,383 - Other expense (income), net (1) (151) (2) (19) Non-recurring cash G&A expenses 1,148 - 5,598 8,783 Adjusted EBITDAX $ 12,421 $ (2,566) $ 25,497 $ (4,122) 11

Current Fully Diluted Share Count – Unaudited 9/30/18 PF Exchange LLEX Diluted Share Count Actual Exercised 10/10/18 Pro Forma As % of Fully 9/30/18 under TSM 2L Exchange (1) 9/30/18 Diluted Shares Common Shares Outstanding Shares Outstanding (9/30/18) 65,768,908 5,952,763 71,721,671 59.5% Dilutives (2) Warrants ($2.50) - expire 12.31.18 120,000 (54,545) 65,455 0.1% Warrants ($2.50) - expire throughout 2019 2,228,267 (1,012,849) 1,215,418 1.0% Warrants ($3.50) - expire 1.8.20 144,642 (92,045) 52,597 0.0% Warrants ($4.50) - Pipe Offering - expire 3.6.22 2,579,420 (2,110,435) 468,985 0.4% Total Warrants 5,072,329 (3,269,874) 1,802,455 1.5% Options (avg. $3.68) 4,874,450 (3,261,450) 1,613,000 1.3% Total In-the-Money (3) 4,874,450 (3,261,450) 1,613,000 1.3% Current Net In-the Money Shares 75,715,687 (6,531,324) 5,952,763 75,137,126 62.3% Dilutives 2L Conv. Note - Värde Partners 25,588,997 (8,685,885) 16,903,112 14.0% Series C Preferred Equity - Värde Partners(4) 17,335,151 4,065,041 21,400,192 17.7% Series D Preferred Equity - Värde Partners(4) - 7,137,091 7,137,091 5.9% Current Fully Diluted Shares 118,639,835 (6,531,324) 8,469,009 120,577,520 100.0% Notes: 1) 2L exchange numbers are subject to further review. Final numbers to be determined prior to the filing of 4Q'18 financials 2) Assumes $5.50 share price for treasury stock method 3) Dilutives exclude 65,000 out of the money warrants and 225,000 out of the money options 4) Assumes cash consideration is paid for the Series C and D Preferred redemption features 12

Wobbe Ploegsma VP of Finance & Capital Markets ir@lilisenergy.com 210.999.5400 NYSE American | LLEX