Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - BANC OF CALIFORNIA, INC. | d648308dex991.htm |

| 8-K - FORM 8-K - BANC OF CALIFORNIA, INC. | d648308d8k.htm |

November 2018 Investor Presentation Exhibit 99.2

When used in this presentation and in documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to future financial performance, strategic plans or objectives, revenue, expense or earnings projections, or other financial items of Banc of California Inc. and its affiliates (“BANC,” the “Company,” “we,” “us” or “our”). By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (i) a pending investigation by the SEC may result in adverse findings, reputational damage, the imposition of sanctions, increased costs and other negative consequences; (ii) management time and resources may be diverted to address the pending SEC investigation as well as any related litigation, litigation initiated by stockholders and other litigation; (iii) the costs and effects of litigation, including settlements and judgments; (iv) risks that the Company’s merger and acquisition transactions may disrupt current plans and operations and lead to difficulties in customer and employee retention, risks that the costs, fees, expenses and charges related to these transactions could be significantly higher than anticipated and risks that the expected revenues, cost savings, synergies and other benefits of these transactions might not be realized to the extent anticipated, within the anticipated timetables, or at all; (v) risks that funds obtained from capital raising activities will not be utilized efficiently or effectively; (vi) a worsening of current economic conditions, as well as turmoil in the financial markets; (vii) the credit risks of lending activities, which may be affected by deterioration in real estate markets and the financial condition of borrowers, may lead to increased loan and lease delinquencies, losses and nonperforming assets in our loan and lease portfolio, and may result in our allowance for loan and lease losses not being adequate to cover actual losses and require us to materially increase our loan and lease loss reserves; (viii) the quality and composition of our securities portfolio; (ix) changes in general economic conditions, either nationally or in our market areas, or changes in financial markets; (x) continuation of or changes in the historically low short-term interest rate environment, changes in the levels of general interest rates, volatility in the interest rate environment, the relative differences between short- and long-term interest rates, deposit interest rates, our net interest margin and funding sources; (xi) fluctuations in the demand for loans and leases, the number of unsold homes and other properties and fluctuations in commercial and residential real estate values in our market area; (xii) our ability to develop and maintain a strong core deposit base or other low cost funding sources necessary to fund our activities; (xiii) results of examinations of us by regulatory authorities and the possibility that any such regulatory authority may, among other things, limit our business activities, require us to change our business mix, increase our allowance for loan and lease losses, write-down asset values or increase our capital levels, or affect our ability to borrow funds or maintain or increase deposits, any of which could adversely affect our liquidity and earnings; (xiv) legislative or regulatory changes that adversely affect our business, including, without limitation, changes in tax laws and policies and changes in regulatory capital or other rules, as well as additional regulatory burdens that result from our growth to over $10 billion in total assets; (xv) our ability to control operating costs and expenses; (xvi) staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our work force and potential associated charges; (xvii) errors in estimates of the fair values of certain of our assets and liabilities, which may result in significant changes in valuation; (xviii) the network and computer systems on which we depend could fail or experience a security breach; (xix) our ability to attract and retain key members of our senior management team; (xx) increased competitive pressures among financial services companies; (xxi) changes in consumer spending, borrowing and saving habits; (xxii) adverse changes in the securities markets; (xxiii) earthquake, fire or other natural disasters affecting the condition of real estate collateral; (xxiv) the availability of resources to address changes in laws, rules or regulations or to respond to regulatory actions; (xxv) inability of key third-party providers to perform their obligations to us; (xxvi) changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board or their application to our business or final audit adjustments, including additional guidance and interpretation on accounting issues and details of the implementation of new accounting methods; (xxvii) share price volatility and reputational risks, related to, among other things, speculative trading and certain traders shorting our common shares and attempting to generate negative publicity about us; (xxviii) war or terrorist activities; and (xix) other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing, products and services and the other risks described from time to time in other documents that we file with or furnish to the SEC. You should not place undue reliance on forward-looking statements, and we undertake no obligation to update any such statements to reflect circumstances or events that occur after the date on which the forward-looking statement is made. Forward-looking Statements

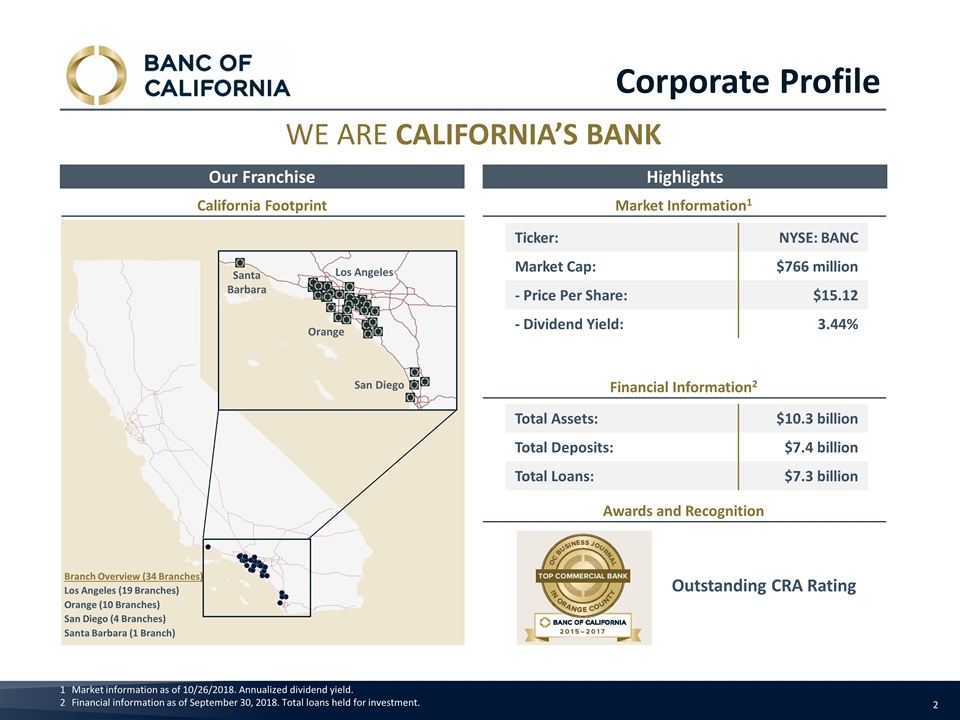

Market information as of 10/26/2018. Annualized dividend yield. Financial information as of September 30, 2018. Total loans held for investment. Ticker: NYSE: BANC Market Cap: $766 million - Price Per Share: $15.12 - Dividend Yield: 3.44% Our Franchise WE ARE CALIFORNIA’S BANK Highlights California Footprint Market Information1 Branch Overview (34 Branches) Los Angeles (19 Branches) Orange (10 Branches) San Diego (4 Branches) Santa Barbara (1 Branch) Los Angeles San Diego Santa Barbara Orange Financial Information2 Total Assets: $10.3 billion Total Deposits: $7.4 billion Total Loans: $7.3 billion Corporate Profile Awards and Recognition Outstanding CRA Rating

The Exact Financing You Need: A Product Set Designed for California PRIVATE BANKING COMMERCIAL & BUSINESS BANKING COMMUNITY BANKING REAL ESTATE BANKING Personal Banking Savings and Investments Credit Cards Small Business Banking Business Banking Middle Market Banking Depository Services Cash Management and Treasury Management Solutions Business Management Banking Sports, Art & Entertainment Banking Real Estate Private Banking Foundations/Non-Profit Banking Private Bank Mortgages Tailored Cash Management and Credit Solutions CRE & Multifamily Lending Mortgage Warehouse Lending Construction Lending Single-Family Residential Mortgages Cash Management and Treasury Management Solutions Escrow Bankruptcy/Fiduciary Services Title/1031/Property Management Government Banking Institutional Deposits SPECIALTY MARKETS

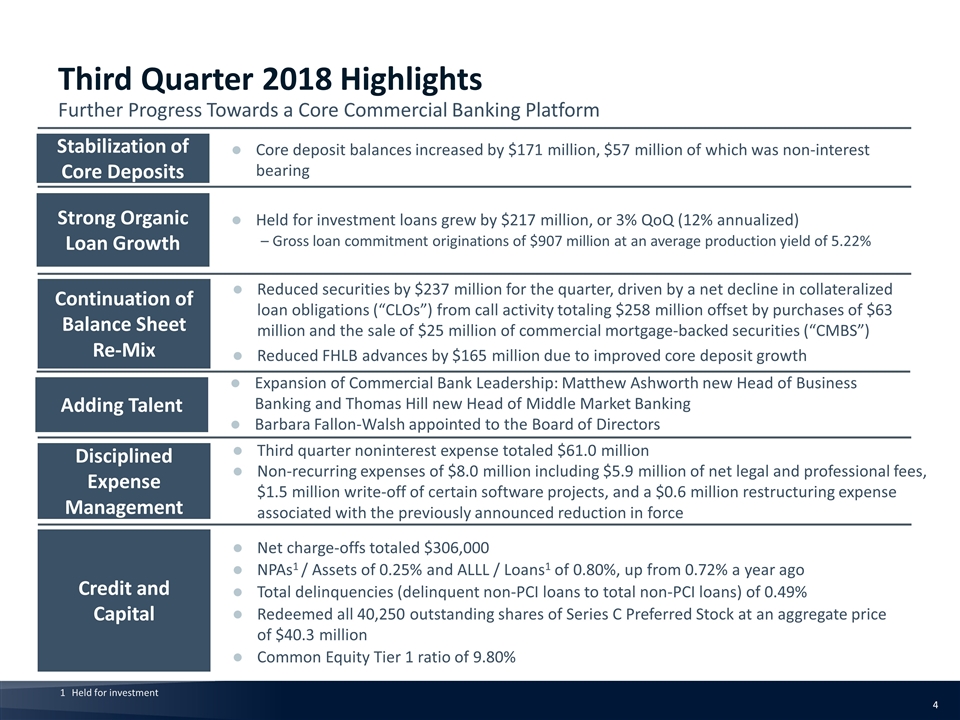

Strong Organic Loan Growth Continuation of Balance Sheet Re-Mix Disciplined Expense Management Held for investment loans grew by $217 million, or 3% QoQ (12% annualized) – Gross loan commitment originations of $907 million at an average production yield of 5.22% Third quarter noninterest expense totaled $61.0 million Non-recurring expenses of $8.0 million including $5.9 million of net legal and professional fees, $1.5 million write-off of certain software projects, and a $0.6 million restructuring expense associated with the previously announced reduction in force Credit and Capital Net charge-offs totaled $306,000 NPAs1 / Assets of 0.25% and ALLL / Loans1 of 0.80%, up from 0.72% a year ago Total delinquencies (delinquent non-PCI loans to total non-PCI loans) of 0.49% Redeemed all 40,250 outstanding shares of Series C Preferred Stock at an aggregate price of $40.3 million Common Equity Tier 1 ratio of 9.80% Third Quarter 2018 Highlights Further Progress Towards a Core Commercial Banking Platform Reduced securities by $237 million for the quarter, driven by a net decline in collateralized loan obligations (“CLOs”) from call activity totaling $258 million offset by purchases of $63 million and the sale of $25 million of commercial mortgage-backed securities (“CMBS”) Reduced FHLB advances by $165 million due to improved core deposit growth Held for investment Core deposit balances increased by $171 million, $57 million of which was non-interest bearing Stabilization of Core Deposits Expansion of Commercial Bank Leadership: Matthew Ashworth new Head of Business Banking and Thomas Hill new Head of Middle Market Banking Barbara Fallon-Walsh appointed to the Board of Directors Adding Talent

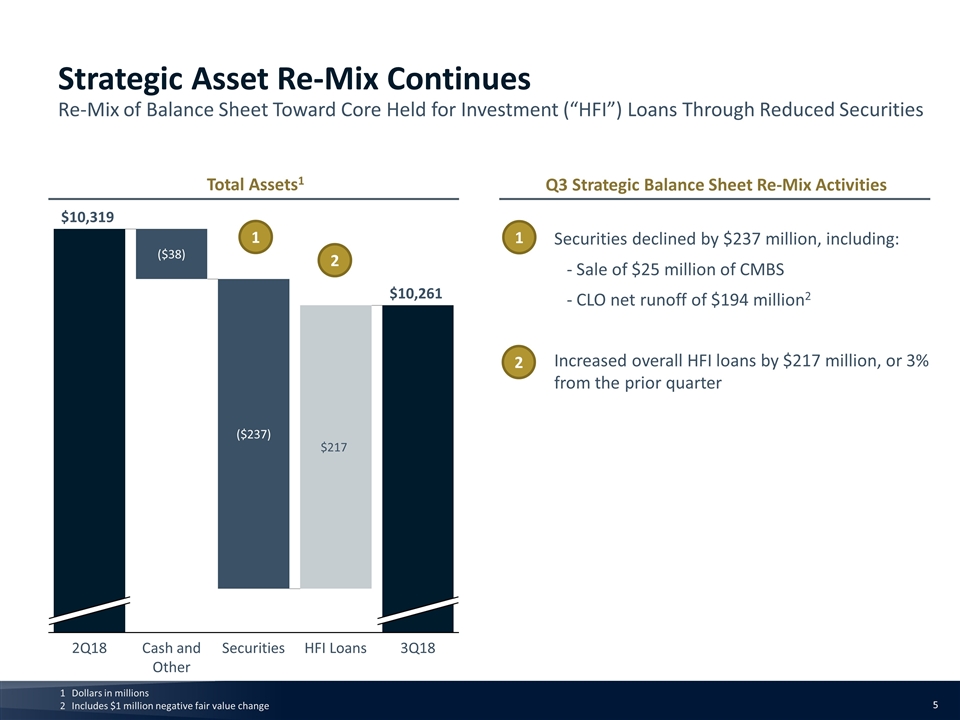

Q3 Strategic Balance Sheet Re-Mix Activities Securities declined by $237 million, including: - Sale of $25 million of CMBS - CLO net runoff of $194 million2 Increased overall HFI loans by $217 million, or 3% from the prior quarter 1 2 Total Assets1 2 1 Strategic Asset Re-Mix Continues Re-Mix of Balance Sheet Toward Core Held for Investment (“HFI”) Loans Through Reduced Securities Dollars in millions Includes $1 million negative fair value change

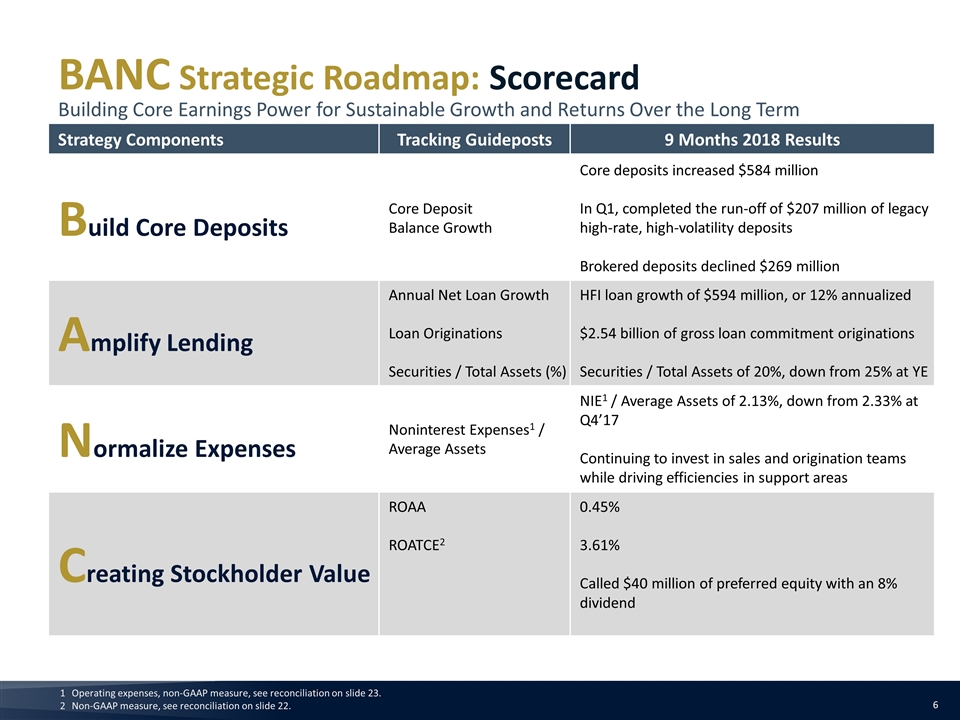

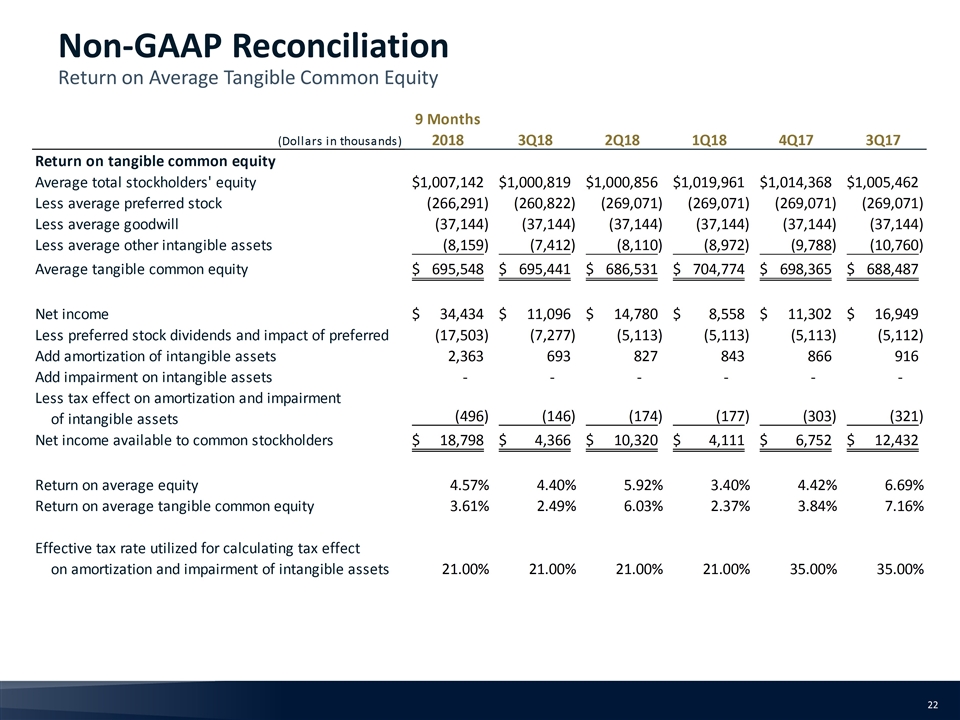

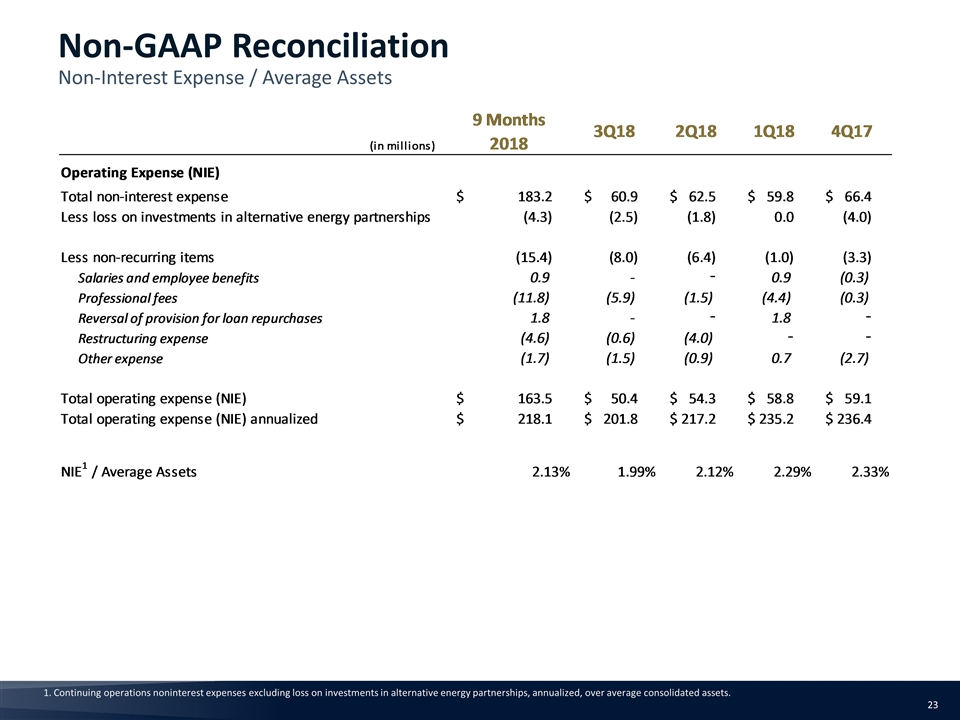

BANC Strategic Roadmap: Scorecard Building Core Earnings Power for Sustainable Growth and Returns Over the Long Term Strategy Components Tracking Guideposts 9 Months 2018 Results Build Core Deposits Core Deposit Balance Growth Core deposits increased $584 million In Q1, completed the run-off of $207 million of legacy high-rate, high-volatility deposits Brokered deposits declined $269 million Amplify Lending Annual Net Loan Growth Loan Originations Securities / Total Assets (%) HFI loan growth of $594 million, or 12% annualized $2.54 billion of gross loan commitment originations Securities / Total Assets of 20%, down from 25% at YE Normalize Expenses Noninterest Expenses1 / Average Assets NIE1 / Average Assets of 2.13%, down from 2.33% at Q4’17 Continuing to invest in sales and origination teams while driving efficiencies in support areas Creating Stockholder Value ROAA ROATCE2 0.45% 3.61% Called $40 million of preferred equity with an 8% dividend Operating expenses, non-GAAP measure, see reconciliation on slide 23. Non-GAAP measure, see reconciliation on slide 22.

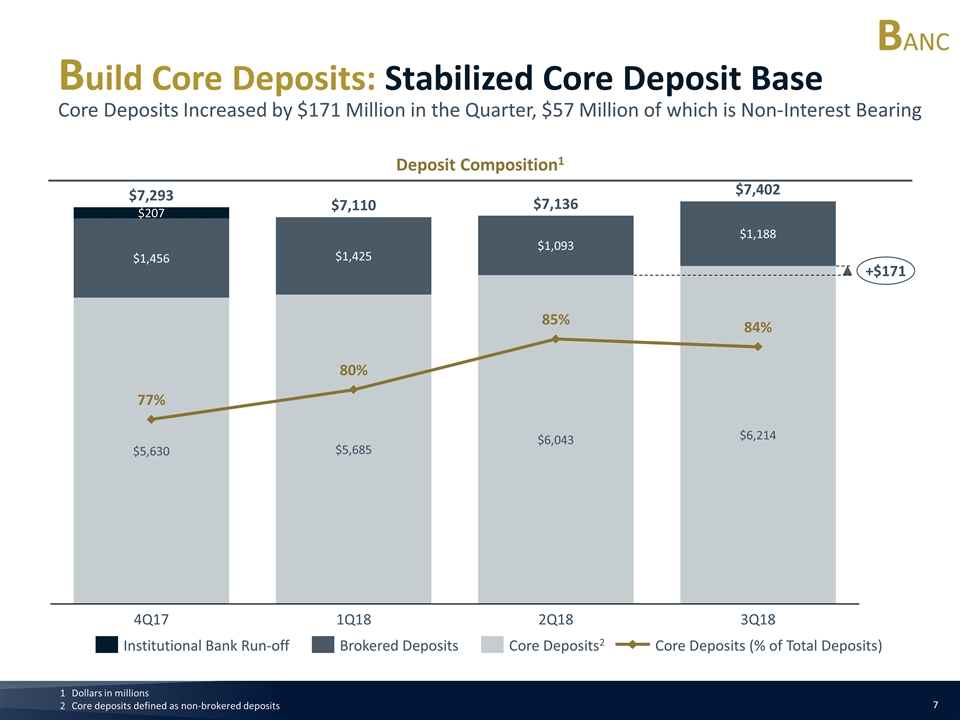

Dollars in millions Core deposits defined as non-brokered deposits Deposit Composition1 $332 $357 Build Core Deposits: Stabilized Core Deposit Base Core Deposits Increased by $171 Million in the Quarter, $57 Million of which is Non-Interest Bearing BANC 2

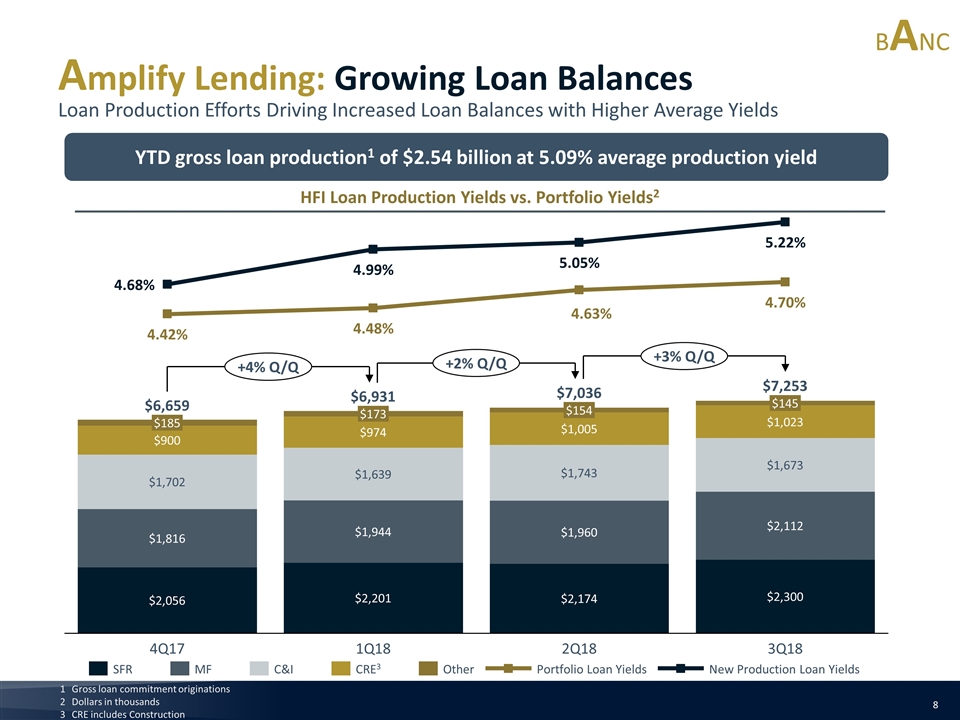

Gross loan commitment originations Dollars in thousands CRE includes Construction Gross loan commitment originations YTD gross loan production1 of $2.54 billion at 5.09% average production yield HFI Loan Production Yields vs. Portfolio Yields2 14% 28% Amplify Lending: Growing Loan Balances Loan Production Efforts Driving Increased Loan Balances with Higher Average Yields BANC 14% 28% 31% Q/Q Q/Q Q/Q 3

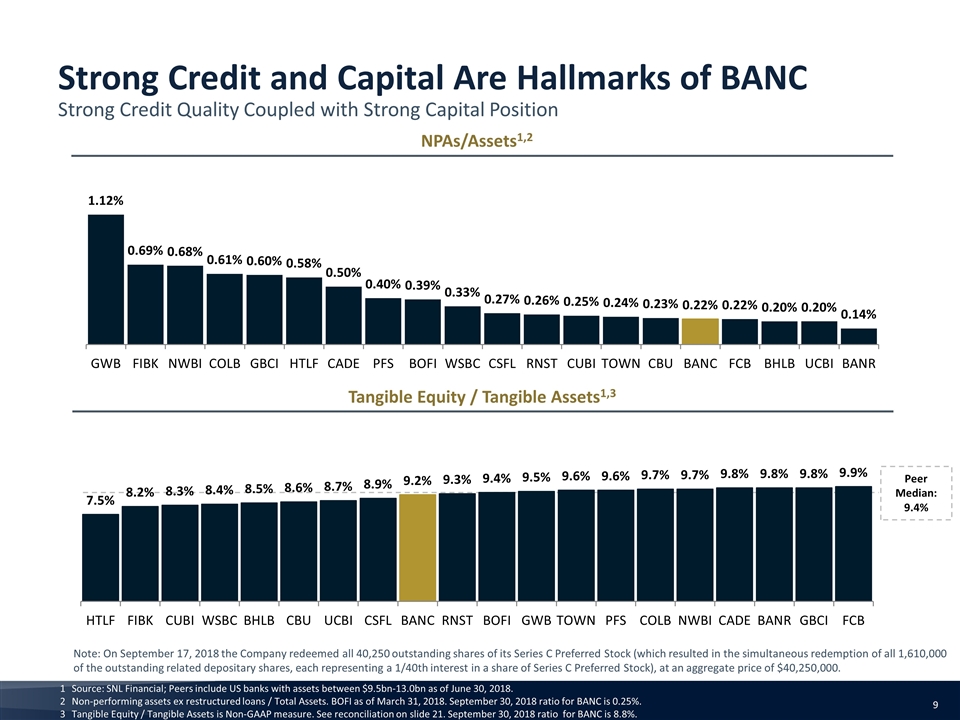

Strong Credit and Capital Are Hallmarks of BANC Strong Credit Quality Coupled with Strong Capital Position NPAs/Assets1,2 Tangible Equity / Tangible Assets1,3 Peer Median: 9.4% Source: SNL Financial; Peers include US banks with assets between $9.5bn-13.0bn as of June 30, 2018. Non-performing assets ex restructured loans / Total Assets. BOFI as of March 31, 2018. September 30, 2018 ratio for BANC is 0.25%. Tangible Equity / Tangible Assets is Non-GAAP measure. See reconciliation on slide 21. September 30, 2018 ratio for BANC is 8.8%. Note: On September 17, 2018 the Company redeemed all 40,250 outstanding shares of its Series C Preferred Stock (which resulted in the simultaneous redemption of all 1,610,000 of the outstanding related depositary shares, each representing a 1/40th interest in a share of Series C Preferred Stock), at an aggregate price of $40,250,000.

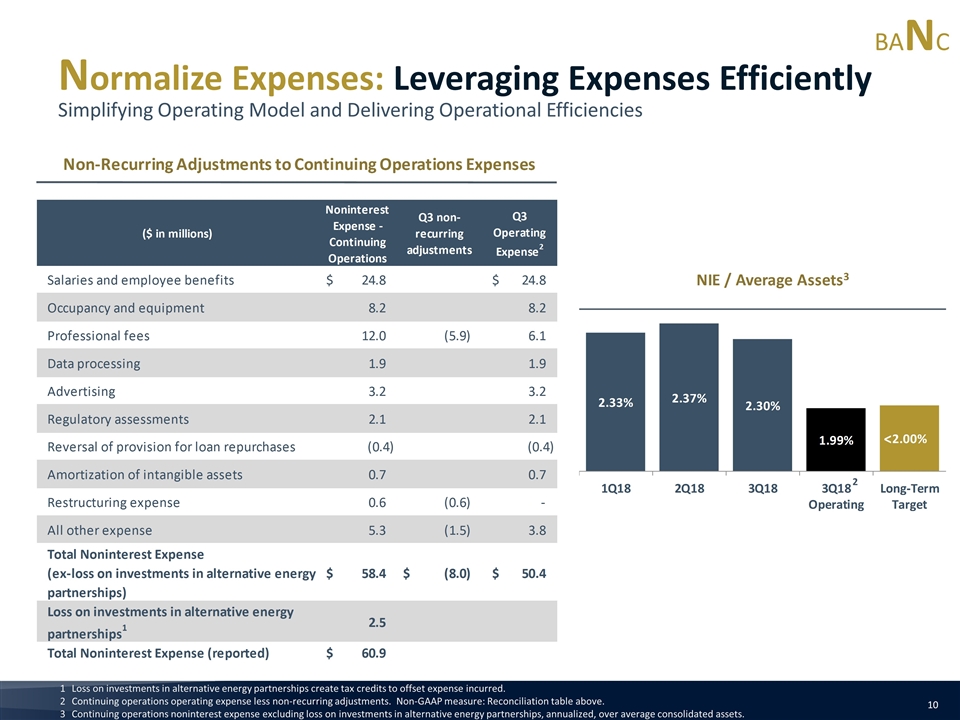

Loss on investments in alternative energy partnerships create tax credits to offset expense incurred. Continuing operations operating expense less non-recurring adjustments. Non-GAAP measure: Reconciliation table above. Continuing operations noninterest expense excluding loss on investments in alternative energy partnerships, annualized, over average consolidated assets. Normalize Expenses: Leveraging Expenses Efficiently Simplifying Operating Model and Delivering Operational Efficiencies BANC < 2

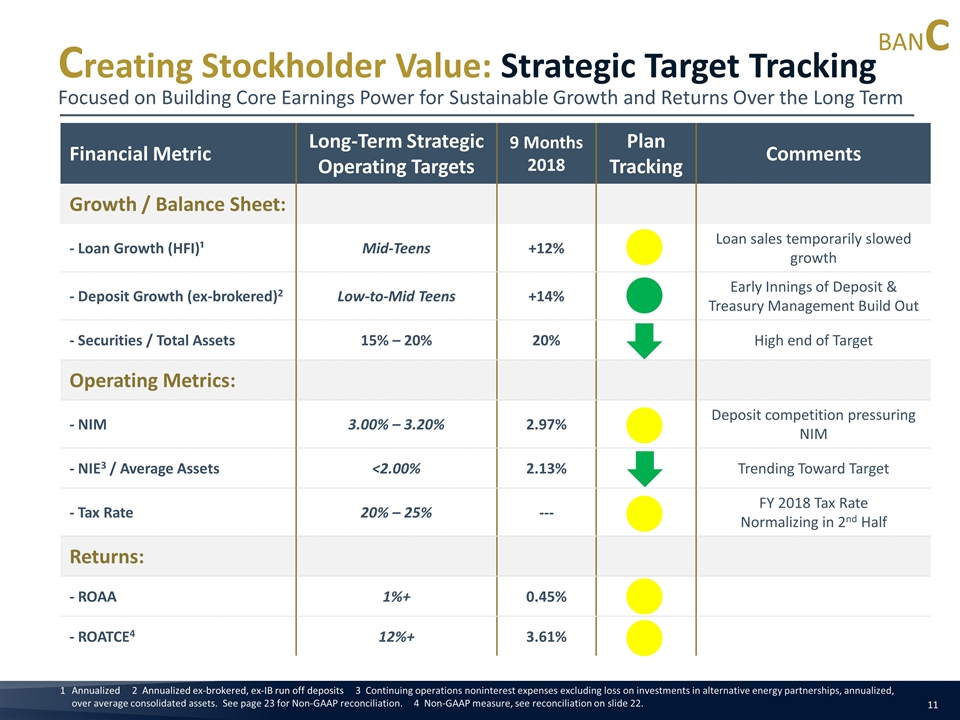

Financial Metric Long-Term Strategic Operating Targets 9 Months 2018 Plan Tracking Comments Growth / Balance Sheet: - Loan Growth (HFI)¹ Mid-Teens +12% Loan sales temporarily slowed growth - Deposit Growth (ex-brokered)2 Low-to-Mid Teens +14% Early Innings of Deposit & Treasury Management Build Out - Securities / Total Assets 15% – 20% 20% High end of Target Operating Metrics: - NIM 3.00% – 3.20% 2.97% Deposit competition pressuring NIM - NIE3 / Average Assets <2.00% 2.13% Trending Toward Target - Tax Rate 20% – 25% --- FY 2018 Tax Rate Normalizing in 2nd Half Returns: - ROAA 1%+ 0.45% - ROATCE4 12%+ 3.61% Annualized 2 Annualized ex-brokered, ex-IB run off deposits 3 Continuing operations noninterest expenses excluding loss on investments in alternative energy partnerships, annualized, over average consolidated assets. See page 23 for Non-GAAP reconciliation. 4 Non-GAAP measure, see reconciliation on slide 22. Creating Stockholder Value: Strategic Target Tracking Focused on Building Core Earnings Power for Sustainable Growth and Returns Over the Long Term BANC

Appendix

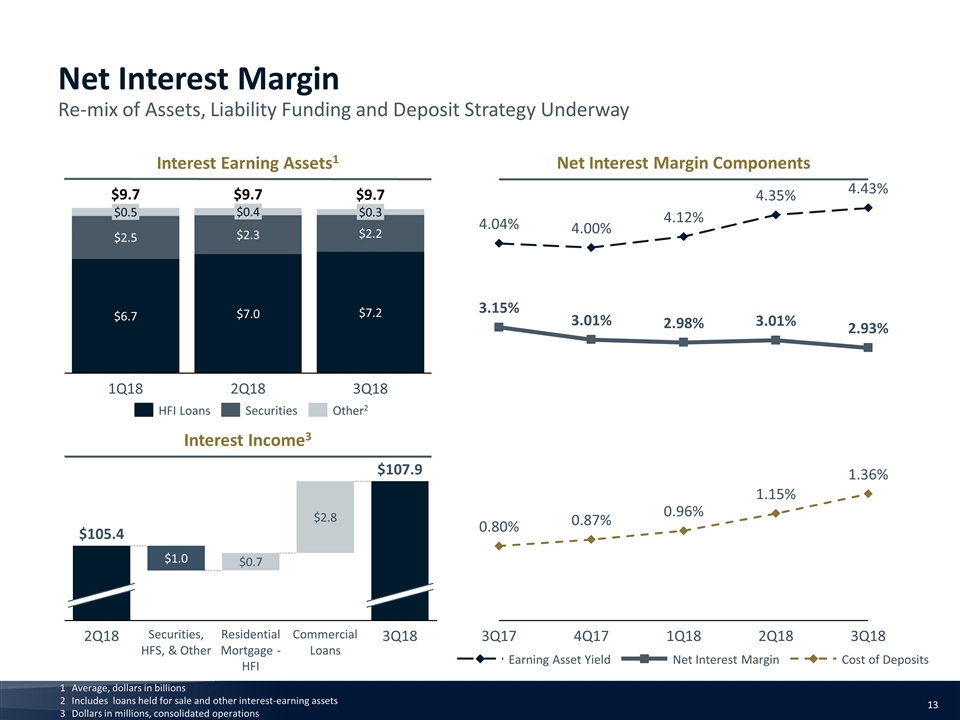

Net Interest Margin Re-mix of Assets, Liability Funding and Deposit Strategy Underway Net Interest Margin Components Interest Earning Assets1 Average, dollars in billions Includes loans held for sale and other interest-earning assets Dollars in millions, consolidated operations Interest Income3 2

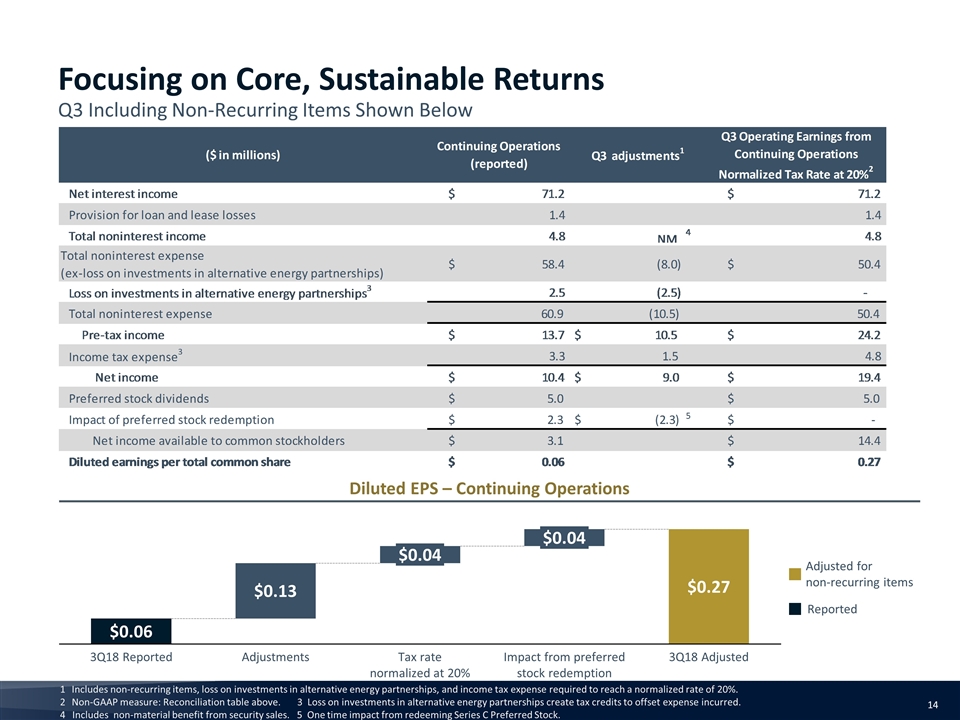

Includes non-recurring items, loss on investments in alternative energy partnerships, and income tax expense required to reach a normalized rate of 20%. Non-GAAP measure: Reconciliation table above. 3 Loss on investments in alternative energy partnerships create tax credits to offset expense incurred. 4 Includes non-material benefit from security sales. 5 One time impact from redeeming Series C Preferred Stock. Focusing on Core, Sustainable Returns Q3 Including Non-Recurring Items Shown Below Diluted EPS – Continuing Operations Reported Adjusted for non-recurring items $ $ $ $ $

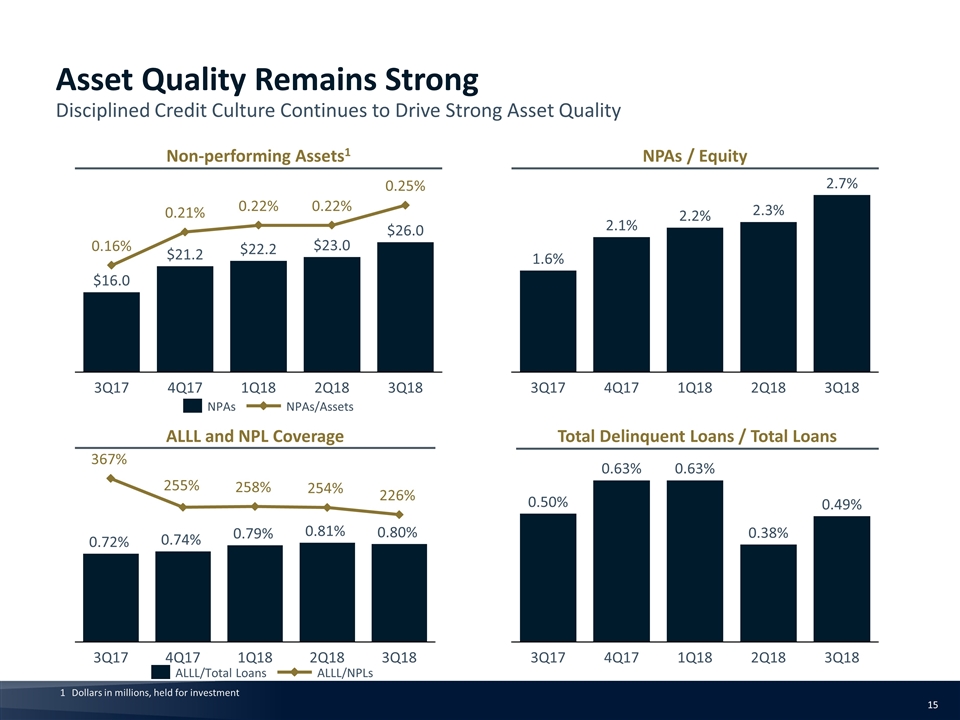

Non-performing Assets1 Asset Quality Remains Strong Disciplined Credit Culture Continues to Drive Strong Asset Quality Dollars in millions, held for investment NPAs / Equity ALLL and NPL Coverage Total Delinquent Loans / Total Loans

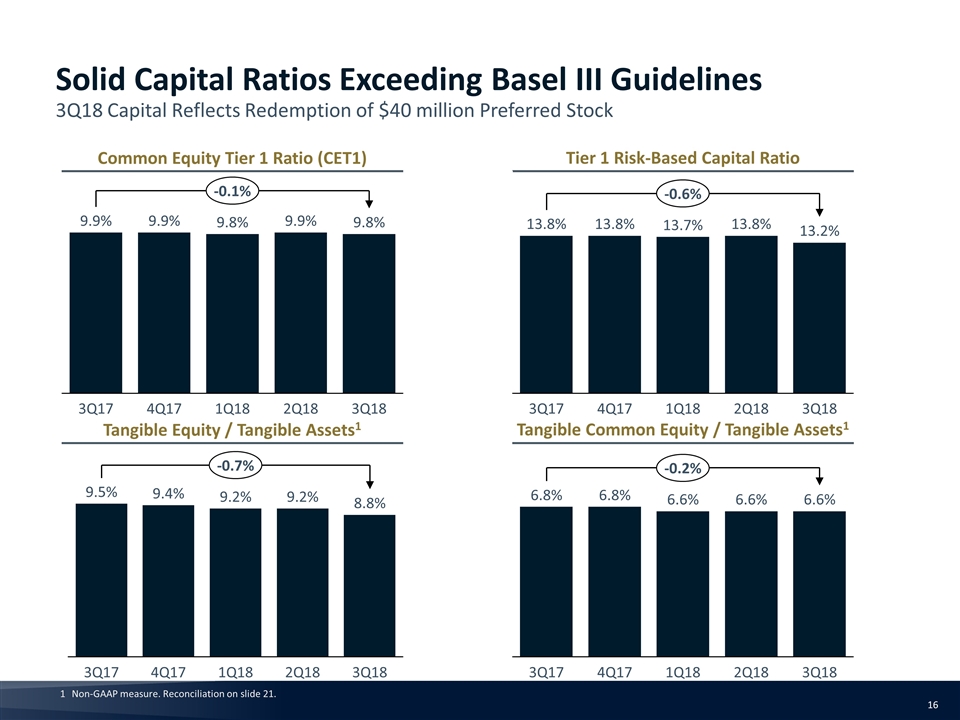

Tangible Equity / Tangible Assets1 Solid Capital Ratios Exceeding Basel III Guidelines 3Q18 Capital Reflects Redemption of $40 million Preferred Stock Common Equity Tier 1 Ratio (CET1) Tangible Common Equity / Tangible Assets1 Tier 1 Risk-Based Capital Ratio Non-GAAP measure. Reconciliation on slide 21. % % % %

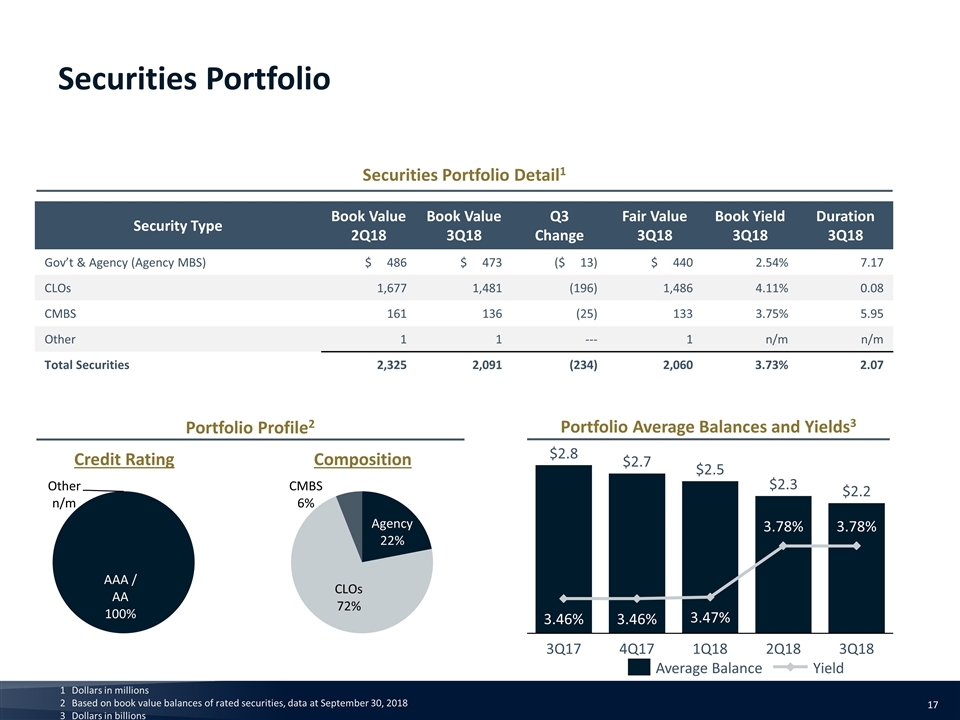

Securities Portfolio Dollars in millions Based on book value balances of rated securities, data at September 30, 2018 Dollars in billions Securities Portfolio Detail1 Security Type Book Value 2Q18 Book Value 3Q18 Q3 Change Fair Value 3Q18 Book Yield 3Q18 Duration 3Q18 Gov’t & Agency (Agency MBS) $ 486 $ 473 ($ 13) $ 440 2.54% 7.17 CLOs 1,677 1,481 (196) 1,486 4.11% 0.08 CMBS 161 136 (25) 133 3.75% 5.95 Other 1 1 --- 1 n/m n/m Total Securities 2,325 2,091 (234) 2,060 3.73% 2.07 Portfolio Profile2 Credit Rating Portfolio Average Balances and Yields3 Composition

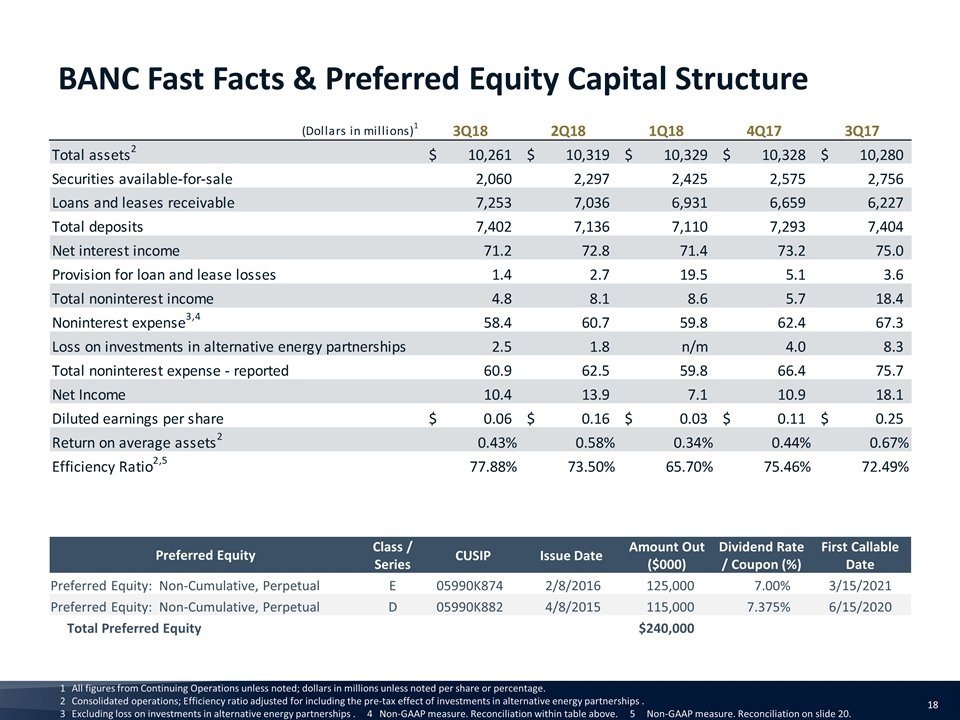

All figures from Continuing Operations unless noted; dollars in millions unless noted per share or percentage. Consolidated operations; Efficiency ratio adjusted for including the pre-tax effect of investments in alternative energy partnerships . Excluding loss on investments in alternative energy partnerships . 4 Non-GAAP measure. Reconciliation within table above. 5 Non-GAAP measure. Reconciliation on slide 20. Preferred Equity Class / Series CUSIP Issue Date Amount Out ($000) Dividend Rate / Coupon (%) First Callable Date Preferred Equity: Non-Cumulative, Perpetual E 05990K874 2/8/2016 125,000 7.00% 3/15/2021 Preferred Equity: Non-Cumulative, Perpetual D 05990K882 4/8/2015 115,000 7.375% 6/15/2020 Total Preferred Equity $240,000 BANC Fast Facts & Preferred Equity Capital Structure

This presentation contains certain financial measures determined by methods other than in accordance with U.S. generally accepted accounting principles (GAAP). These measures include noninterest expense from continuing operations, operating expense from continuing operations, and diluted earnings per share from continuing operations, adjusted for non-recurring items, each excluding loss on investments in alternative energy partnerships and the latter two also reflecting adjustments for non-recurring items. Management believes that these particular measures provide useful supplemental information in understanding our core operating performance. These measures should not be viewed as substitutes for measures determined in accordance with GAAP, nor are they necessarily comparable to non‐GAAP measures that may be presented by other companies. Reconciliations of these measures to measures determined in accordance with GAAP are contained on slides 10, 14, 20, and 23 of this presentation. Non-GAAP measures in this presentation also include tangible equity to tangible assets, tangible common equity to tangible assets, return on average tangible common equity, and adjusted efficiency ratio including the pre-tax effect of investments in alternative energy partnerships. These particular measures are used by management in its analysis of the Company's capital strength and the performance of the Company’s businesses. Banking and financial institution regulators also exclude goodwill and other intangible assets from total stockholders' equity when assessing the capital adequacy of a financial institution. Management believes the presentation of these measures excluding the impact of these items provides useful supplemental information that is essential to a proper understanding of the capital and financial strength of the Company and the performance of its businesses. These measures should not be viewed as substitutes for results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP measures that may be presented by other companies. Reconciliations of these measures to measures determined in accordance with GAAP are contained on slides 20-23 of this presentation. Non-GAAP Financial Information

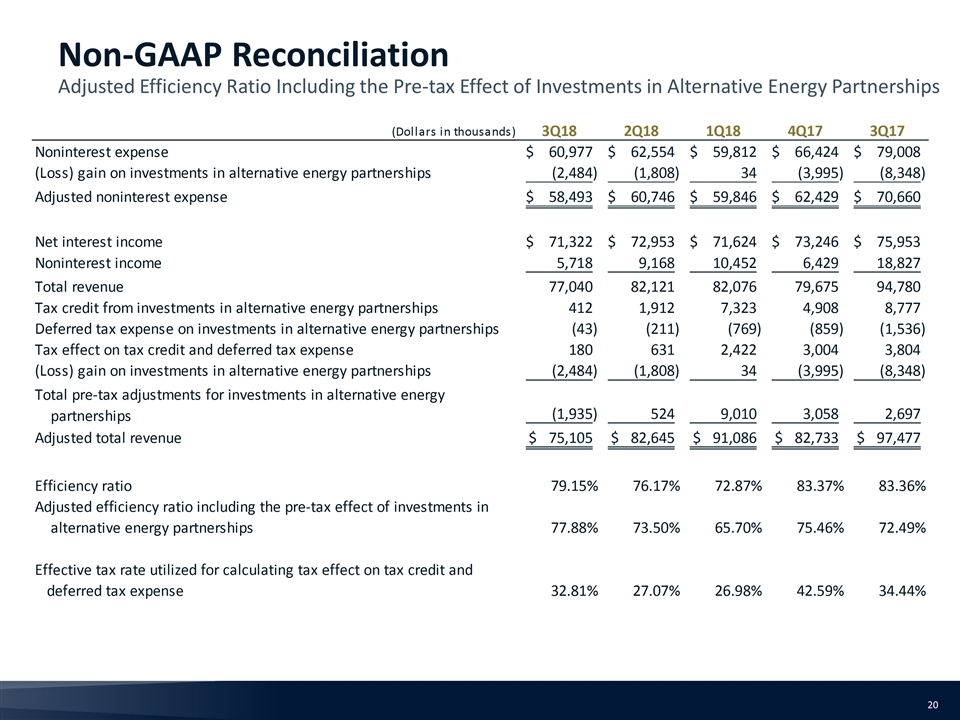

Non-GAAP Reconciliation Adjusted Efficiency Ratio Including the Pre-tax Effect of Investments in Alternative Energy Partnerships

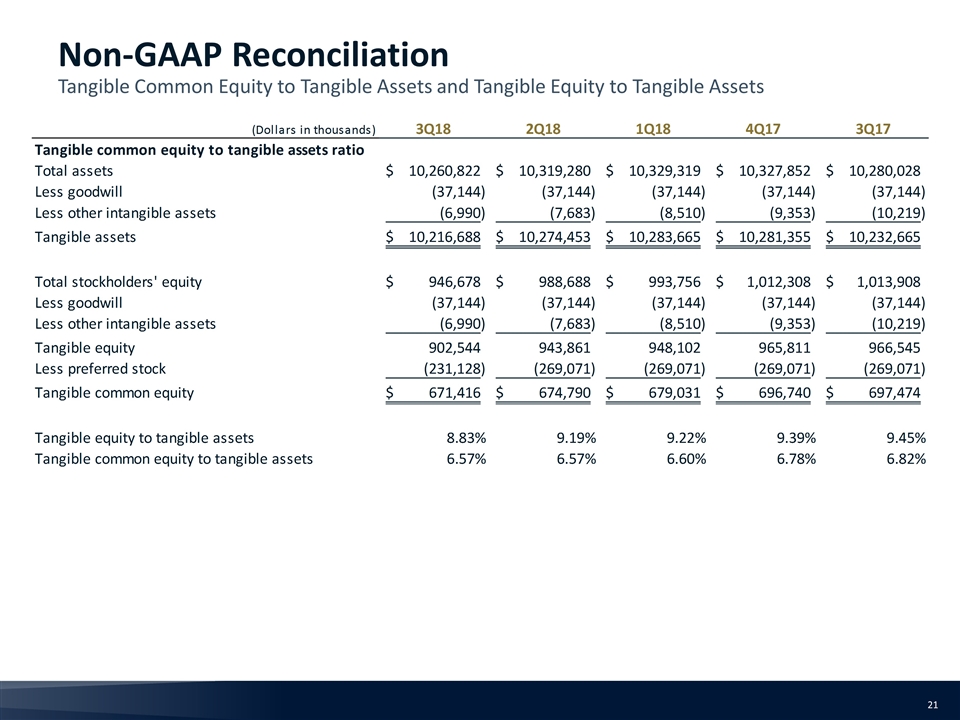

Non-GAAP Reconciliation Tangible Common Equity to Tangible Assets and Tangible Equity to Tangible Assets

Non-GAAP Reconciliation Return on Average Tangible Common Equity

Non-GAAP Reconciliation Non-Interest Expense / Average Assets 1. Continuing operations noninterest expenses excluding loss on investments in alternative energy partnerships, annualized, over average consolidated assets.