Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | ex991to11-1x20188kreq3earn.htm |

| 8-K - 8-K - TELEFLEX INC | a11-1x20188xkreq32018earni.htm |

Teleflex Incorporated Third Quarter 2018 Earnings Conference Call 1

Conference Call Logistics The release, accompanying slides, and replay webcast are available online at www.teleflex.com (click on “Investors”) Telephone replay available by dialing 855-859-2056 or for international calls, 404-537-3406, pass code number 8158978 2

Today’s Speakers Liam Kelly President and CEO Thomas Powell Executive Vice President and CFO Jake Elguicze Treasurer and Vice President, Investor Relations 3

Note on Forward-Looking Statements This presentation and our discussion contain forward-looking information and statements including, but not limited to, forecasted 2018 GAAP, constant currency and organic constant currency revenue growth, GAAP and adjusted gross and operating margins, GAAP and adjusted earnings per share and the items that are expected to impact each of those forecasted results; our assumptions with respect to the euro to U.S. dollar exchange rate for 2018 and our adjusted weighted average shares for 2018; estimated pre-tax charges we expect to incur in connection with our ongoing restructuring programs; estimated annualized pre-tax savings we expect to realize in connection with our ongoing restructuring programs and a similar initiative within our OEM segment (the “OEM initiative”); our expectations with respect to when we will begin to realize savings from our ongoing restructuring programs and the OEM initiative and when those programs will be substantially completed; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward–looking statements. These risks and uncertainties are addressed in our SEC filings, including our most recent Form 10-K. Note on Non-GAAP Financial Measures This presentation refers to certain non-GAAP financial measures, including, but not limited to, constant currency revenue growth, organic constant currency revenue growth, adjusted diluted earnings per share, adjusted gross and operating margins and adjusted tax rate. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Tables reconciling these non-GAAP financial measures to the most comparable GAAP financial measures are contained within this presentation and the appendices to this presentation. Additional Notes Unless otherwise noted, the following slides reflect continuing operations. 4

3Q18 Highlights Revenue Highlights • As-reported revenue increased 14.0% versus 3Q17 • Constant currency revenue increased 15.0% versus 3Q17 • 3Q18 organic constant currency revenue growth better than expected due to strong business unit execution and return of distributor orders in North America • Reaffirming previously provided full year 2018 constant currency revenue growth guidance Two Scale Acquisitions Continue to Transform Our Portfolio • UroLift continues strong momentum, delivering $49.0 million in 3Q18 revenue, up ~45% versus 3Q17 • Following temporary supply disruption announced 2Q18, UroLift product supply now at ~100% • Five real world UroLift studies presented at 2018 World Congress of Endourology demonstrating significant relief and improved quality of life, consistent with LIFT study • Vascular Solutions 3Q18 global revenue reaches $53.2 million, up ~21% versus 3Q17 Continued Adjusted Gross Margin Expansion and Adjusted EPS Growth • Delivered 130 bps of adjusted gross margin expansion versus 3Q17 • Adjusted operating margin down 30 bps versus 3Q17 • Adjusted EPS of $2.52, up 18.9% versus 3Q17 • Raising previously provided full year 2018 adjusted EPS guidance 5 Note: See appendices for reconciliations of non-GAAP information

3Q18 Constant Currency Revenue Growth Q3 2018 Constant Currency Revenue Growth Volume (excluding surgical product line exit) 3.5% New Product Introductions 1.6% Price 0.7% Surgical Product Line Exit (0.2%) M&A NeoTract 9.2% Other M&A 0.2% Constant Currency Revenue Growth 15.0% 6 Note: See appendices for reconciliations of non-GAAP information

Segment Revenue Review Total Constant Dollars Q3’18 Q3’17 Currency Sales Currency in Millions Revenue Revenue Impact Growth Growth Vascular NA $80.7 $75.1 7.5% (0.3%) 7.8% Interventional NA $66.7 $60.7 9.9% 0.0% 9.9% Anesthesia NA $53.2 $50.8 4.6% (0.2%) 4.8% Surgical NA $42.5 $40.8 4.3% (0.3%) 4.6% EMEA $139.6 $137.0 1.8% (1.1%) 2.9% Asia $76.5 $74.2 3.2% (3.5%) 6.7% OEM $54.9 $48.6 12.9% (0.2%) 13.1% All Other $95.6 $47.5 101.4% (1.6%) 103.0% 7

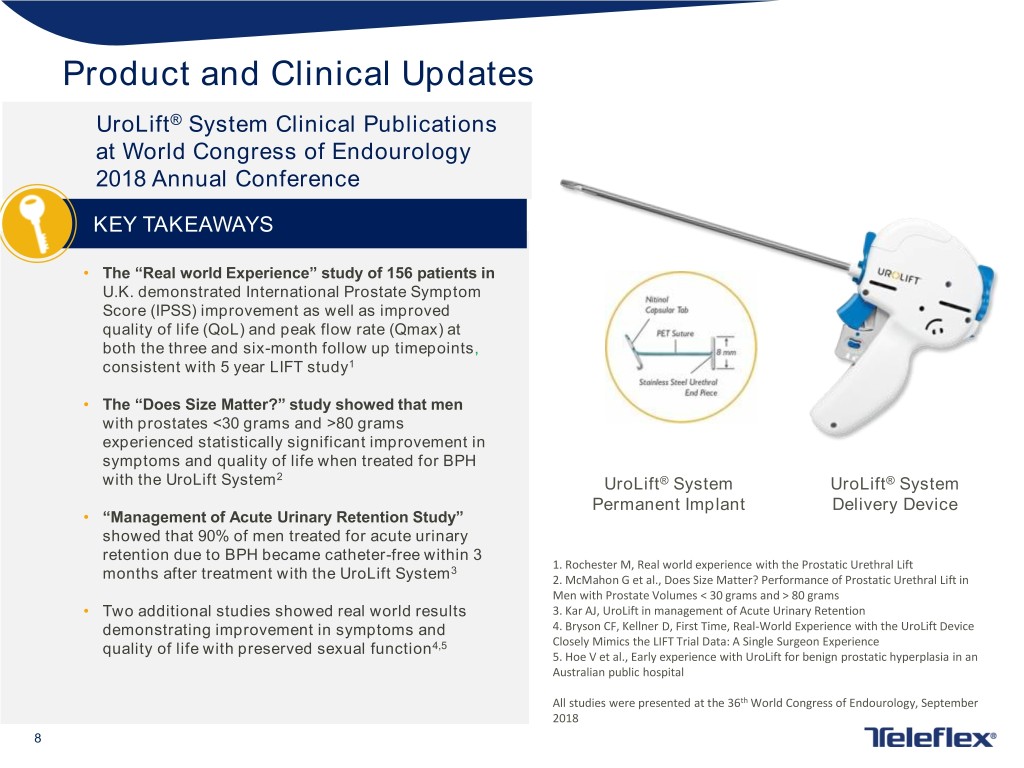

Product and Clinical Updates UroLift® System Clinical Publications at World Congress of Endourology 2018 Annual Conference KEY TAKEAWAYS • The “Real world Experience” study of 156 patients in U.K. demonstrated International Prostate Symptom Score (IPSS) improvement as well as improved quality of life (QoL) and peak flow rate (Qmax) at both the three and six-month follow up timepoints, consistent with 5 year LIFT study1 • The “Does Size Matter?” study showed that men with prostates <30 grams and >80 grams experienced statistically significant improvement in symptoms and quality of life when treated for BPH with the UroLift System2 UroLift® System UroLift® System Permanent Implant Delivery Device • “Management of Acute Urinary Retention Study” showed that 90% of men treated for acute urinary retention due to BPH became catheter-free within 3 3 1. Rochester M, Real world experience with the Prostatic Urethral Lift months after treatment with the UroLift System 2. McMahon G et al., Does Size Matter? Performance of Prostatic Urethral Lift in Men with Prostate Volumes < 30 grams and > 80 grams • Two additional studies showed real world results 3. Kar AJ, UroLift in management of Acute Urinary Retention demonstrating improvement in symptoms and 4. Bryson CF, Kellner D, First Time, Real-World Experience with the UroLift Device quality of life with preserved sexual function4,5 Closely Mimics the LIFT Trial Data: A Single Surgeon Experience 5. Hoe V et al., Early experience with UroLift for benign prostatic hyperplasia in an Australian public hospital All studies were presented at the 36th World Congress of Endourology, September 2018 8

Product and Clinical Updates RePlas® “FDP1” Phase 1 Safety Trial Abstract Presented at AABB 2018 KEY TAKEAWAYS Re-Plas® Freeze-Dried Plasma • Phase 1 study to determine the safety of autologous infusions of whole blood (CPD) derived freeze dried plasma (FDP) or plasmapheresis (ACD) derived FDP into normal healthy subjects. • Three cohorts of 8 subjects per cohort (n=24). Cohort 3 was a randomized, double-blind, crossover study that compared the clinical and laboratory levels of thrombogenesis biomarkers RePlas® Sterile Water Fluid Blood after FDP vs fresh frozen plasma (FFP) FDP unit for Injection transfer set for infusions. (equivalent to (SWFI) 250ml set transfusion one FFP unit) • Preliminary data suggest that RePlas® FDP is well tolerated in normal healthy volunteers. Coagulation parameters remained stable, Positive phase 1 safety data to thrombin activation was not increased, and there were no serious adverse events or safety support early 2019 BLA submission concerns. 9

Acquisition Updates Acquisition of Essential Medical; October 4th, 2018 The MANTA Vascular Closure Device KEY TAKEAWAYS • The MANTA Vascular Closure Device is a unique system specifically designed for closure of large bore arteriotomies utilizing devices or sheaths ranging from 10 French to 18 French. • Approved in the EU; >8,100 procedures completed to date. • In its CE Mark study, the MANTA Device demonstrated rapid and reliable hemostasis with its resorbable collagen-based technology and complication rates that were non-inferior to surgical and suture-based closure methods. 1 Anticipated PMA Approval 2019 1. "Percutaneous Plug-Based Arteriotomy Closure Device for Large-Bore Access" by Nicolas M. Van Mieghem, MD, et al in Journal of the American College of Cardiology: Cardiovascular Interventions, Vol 10, No. 6, 2017. 10

Product Categories Driving Durable Organic Revenue Growth Current Portfolio Interventional Vascular Airway Urology Intraosseous Access Access Management Interventional Cardiology ® ® ® The UroLift® EZ-IO OnControl Rüsch® Polaris™ Fiber Turnpike® TrapLiner® Chocolate Intraosseous Vascular Powered PICCS Optic Single-Use PTCA Balloon Catheters Catheter System Access Device Bone Access System Laryngoscope Blade Catheter Pipeline^ Re-Plas® ® MANTA™ ® The UroLift Freeze-dried Percuvance Vascular Closure Plasma 2 System Device R&D in process R&D in process 11 ^Re-Plas and the UroLift 2 System are not approved for sale or distribution. Percuvance has received 510(k) clearance but has not yet been launched. The Manta is not approved for sale or distribution in the United States.

3Q18 Financial Review Revenue of $609.7 million • Up 14.0% vs. prior year period on an as-reported basis • Up 15.0% vs. prior year period on a constant currency basis Gross Margin • GAAP gross margin of 56.2%, up 100 bps vs. prior year period • Adjusted gross margin of 57.0%, up 130 bps vs. prior year period Operating Margin • GAAP operating margin of 13.5%, down 710 bps vs. prior year period • Adjusted operating margin of 26.0%, down 30 bps vs. prior year period Tax Rate • GAAP tax rate of (2.3%), down 1,350 bps vs. prior year period • Adjusted tax rate of 10.7%, down 740 bps vs. prior year period Earnings per Share • GAAP EPS of $1.21, down 28.8% vs. prior year period • Adjusted EPS of $2.52, up 18.9% vs. prior year period 12 Note: See appendices for reconciliations of non-GAAP information

2018 Financial Outlook 2018 Revenue Guidance • Lowered as-reported revenue growth guidance from a range of between 14% and 15% to a range of between 13.5% and 14.5% • Reaffirmed constant currency revenue growth guidance range of between 12% and 13% • Reaffirmed organic constant currency revenue growth guidance range of between 5% and 5.5% 2018 Gross Margin Guidance • Lowered GAAP gross margin guidance from a range of between 56.85% and 57.5% to a range of between 56.35% and 56.75% • Lowered adjusted gross margin guidance from a range of between 57.5% and 58.0% to a range of between 57.0% and 57.25% 2018 Operating Margin Guidance • Lowered GAAP operating margin guidance from a range of between 14.85% and 15.45% to a range of between 12.95% and 13.45% • Lowered adjusted operating margin guidance from a range of between 26.1% and 26.5% to a range of between 25.8% and 26.1% 2018 Earnings per Share Guidance • Lowered GAAP earnings per share guidance from a range of between $4.60 and $4.70 to a range of between $4.00 and $4.10 • Raised adjusted earnings per share guidance from a range of between $9.70 and $9.90 to a range of between $9.80 and $9.95 13 Note: See appendices for reconciliations of non-GAAP information

Question and Answer Section 14

THANK YOU 15

Appendices 16

Non-GAAP Financial Measures The presentation to which these appendices are attached and the following appendices include, among other things, tables reconciling the following non-GAAP financial measures to the most comparable GAAP financial measure: • Constant currency revenue growth. This measure excludes the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. • Organic constant currency revenue growth. This measure excludes (i) the impact of translating the results of international subsidiaries at different currency exchange rates from period to period; and (ii) the results of acquired businesses (other than acquired distributors) for the first 12 months following the acquisition date. • Adjusted diluted earnings per share. This measure excludes, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) other items identified in note (C) to each of the reconciliation tables appearing in Appendices I, J, K and L; (iv) amortization of the debt discount on the Company’s previously outstanding convertible notes; (v) intangible amortization expense; (vi) loss on extinguishment of debt; and (vii) tax adjustments identified in note (F) to the reconciliation tables appearing in Appendices I and J, and note (G) in the reconciliation tables K and L. In addition, the calculation of diluted shares within adjusted earnings per share for the 2017 periods gives effect to the anti-dilutive impact of the Company’s previously outstanding convertible note hedge agreements, which reduced the potential economic dilution that otherwise would have occurred upon conversion of the Company’s senior subordinated convertible notes (under GAAP, the anti- dilutive impact of the convertible note hedge agreements is not reflected in diluted shares). • Adjusted gross profit and margin. These measures exclude, depending on the period presented, the impact of (i) restructuring, restructuring related and impairment items, (ii) acquisition, integration and divestiture related items and (iii) other items identified in note (C) to the reconciliation tables appearing in Appendices E and F. • Adjusted operating profit and margin. These measures exclude, depending on the period presented, (i) the impact of restructuring, restructuring related and impairment items; (ii) acquisitions, integration and divestiture related items; (iii) other items identified in note (C) to the reconciliation tables appearing in Appendices G and H; and (iv) intangible amortization expense. • Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated with (i) restructuring, restructuring related and impairment items; (ii) acquisition, integration and divestiture related items; (iii) other items identified in note (A) to the reconciliation tables appearing in Appendices M and N; (iv) amortization of the debt discount on the Company’s previously outstanding convertible notes; (v) intangible amortization expense; and (v) tax adjustments identified in note (B) to the reconciliation tables appearing in Appendices M and N. 17

Appendix A – Reconciliation of Constant Currency Revenue Growth Dollars in Millions Three Months Ended % Increase / (Decrease) Total Currency Constant Currency September 30, 2018 October 1, 2017 Revenue Growth Impact Revenue Growth Vascular North America $ 80.7 $ 75.1 7.5% (0.3%) 7.8% Interventional North America 66.7 60.7 9.9% 0.0% 9.9% Anesthesia North America 53.2 50.8 4.6% (0.2%) 4.8% Surgical North America 42.5 40.8 4.3% (0.3%) 4.6% EMEA 139.6 137.0 1.8% (1.1%) 2.9% Asia 76.5 74.2 3.2% (3.5%) 6.7% OEM 54.9 48.6 12.9% (0.2%) 13.1% All Other 95.6 47.5 101.4% (1.6%) 103.0% Net Revenues $ 609.7 $ 534.7 14.0% (1.0%) 15.0% 18

Appendix B – Reconciliation of Constant Currency Revenue Growth Dollars in Millions Nine Months Ended % Increase / (Decrease) Total Currency Constant Currency September 30, 2018 October 1, 2017 Revenue Growth Impact Revenue Growth Vascular North America $ 243.8 $ 232.9 4.7% 0.1% 4.6% Interventional North America 191.9 158.9 20.7% 0.1% 20.6% Anesthesia North America 154.3 148.1 4.1% 0.0% 4.1% Surgical North America 123.9 131.5 (5.7%) 0.1% (5.8%) EMEA 452.9 409.1 10.7% 7.2% 3.5% Asia 207.1 190.4 8.8% 1.7% 7.1% OEM 153.3 137.1 11.8% 1.4% 10.4% All Other 279.6 143.2 95.2% (0.3%) 95.5% Net Revenues $ 1,806.8 $ 1,551.2 16.5% 2.5% 14.0% 19

Appendix C – Revenue Growth Dollars in Millions Year-Over-Year Growth % Basis Points Three Months Ended October 1, 2017 Revenue As-Reported $ 534.7 Foreign currency $ (4.7) -1.0% -100 Volume (excluding Surgical product line exit) $ 18.7 3.5% 350 Surgical product line exit $ (1.2) -0.2% -20 New product sales $ 8.6 1.6% 160 Pricing $ 3.7 0.7% 70 Acquisitions1 $ 49.9 9.4% 940 Three Months Ended September 30, 2018 Revenue As-Reported $ 609.7 14.0% 1 = Includes: NeoTract $ 49.0 9.2% Other Acquisitions $ 0.9 0.2% 20

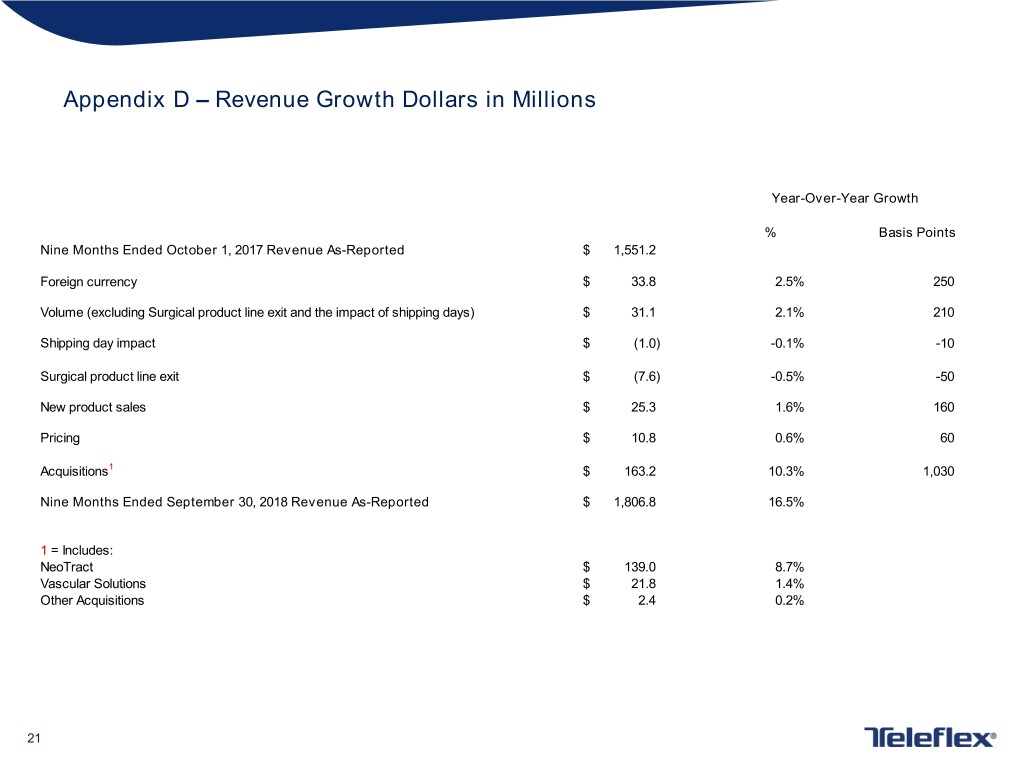

Appendix D – Revenue Growth Dollars in Millions Year-Over-Year Growth % Basis Points Nine Months Ended October 1, 2017 Revenue As-Reported $ 1,551.2 Foreign currency $ 33.8 2.5% 250 Volume (excluding Surgical product line exit and the impact of shipping days) $ 31.1 2.1% 210 Shipping day impact $ (1.0) -0.1% -10 Surgical product line exit $ (7.6) -0.5% -50 New product sales $ 25.3 1.6% 160 Pricing $ 10.8 0.6% 60 Acquisitions1 $ 163.2 10.3% 1,030 Nine Months Ended September 30, 2018 Revenue As-Reported $ 1,806.8 16.5% 1 = Includes: NeoTract $ 139.0 8.7% Vascular Solutions $ 21.8 1.4% Other Acquisitions $ 2.4 0.2% 21

Appendix E – Reconciliation of Adjusted Gross Profit and Margin Dollars in Thousands Three Months Ended September 30, 2018 October 1, 2017 Teleflex gross profit as-reported $ 342,573 $ 295,227 Teleflex gross margin as-reported 56.2% 55.2% Restructuring, restructuring related and impairment items (A) 4,401 2,768 Acquisition, integration and divestiture related items (B) 352 - Other items (C) - - Adjusted Teleflex gross profit $ 347,326 $ 297,995 Adjusted Teleflex gross margin 57.0% 55.7% Teleflex revenue as-reported $ 609,672 $ 534,703 (A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. (B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; and inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date). For the three months ended September 30, 2018, the majority of these charges were related to our acquisition of NeoTract. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other Items are discrete items that occur sporadically and can affect period-to-period comparisons. 22

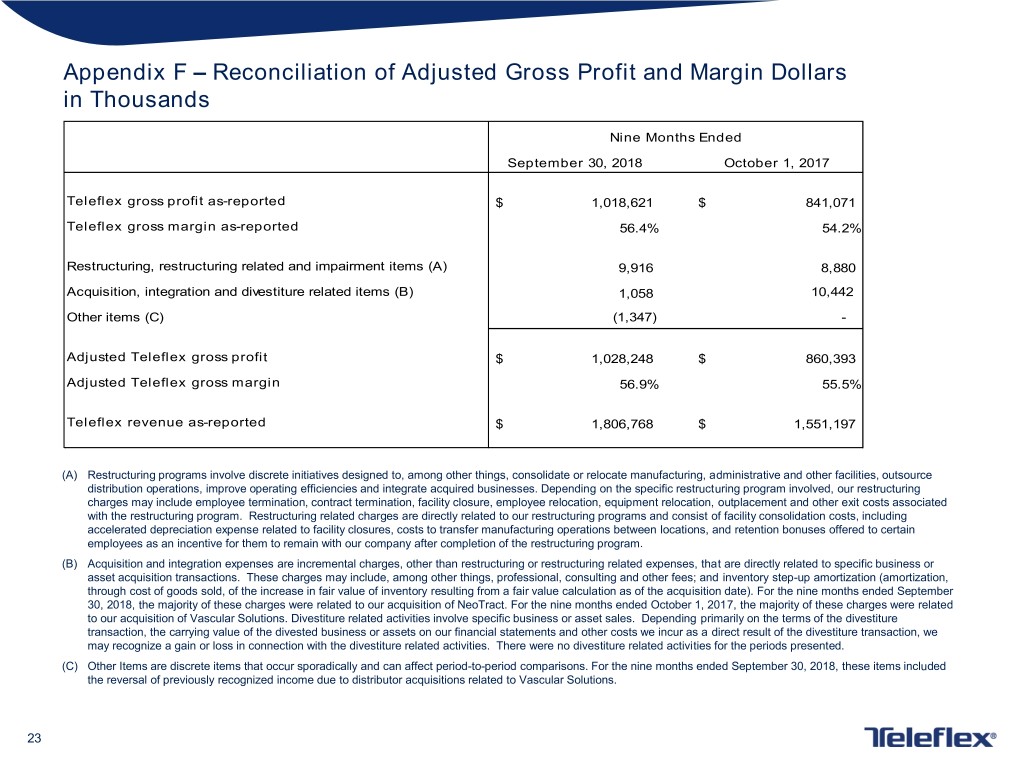

Appendix F – Reconciliation of Adjusted Gross Profit and Margin Dollars in Thousands Nine Months Ended September 30, 2018 October 1, 2017 Teleflex gross profit as-reported $ 1,018,621 $ 841,071 Teleflex gross margin as-reported 56.4% 54.2% Restructuring, restructuring related and impairment items (A) 9,916 8,880 Acquisition, integration and divestiture related items (B) 1,058 10,442 Other items (C) (1,347) - Adjusted Teleflex gross profit $ 1,028,248 $ 860,393 Adjusted Teleflex gross margin 56.9% 55.5% Teleflex revenue as-reported $ 1,806,768 $ 1,551,197 (A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. (B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; and inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date). For the nine months ended September 30, 2018, the majority of these charges were related to our acquisition of NeoTract. For the nine months ended October 1, 2017, the majority of these charges were related to our acquisition of Vascular Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other Items are discrete items that occur sporadically and can affect period-to-period comparisons. For the nine months ended September 30, 2018, these items included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions. 23

Appendix G – Reconciliation of Adjusted Operating Profit and Margin Dollars in Thousands Three Months Ended September 30, 2018 October 1, 2017 Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes $ 82,105 $ 110,354 Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes margin 13.5% 20.6% Restructuring, restructuring related and impairment items (A) 23,823 2,997 Acquisition, integration and divestiture related items (B) 15,508 2,561 Other items (C) 266 2,314 Intangible amortization expense (D) 36,966 22,601 Adjusted Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes $ 158,668 $ 140,827 Adjusted Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes margin 26.0% 26.3% Teleflex revenue as-reported $ 609,672 $ 534,703 (A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with a the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. For the three months ended September 30, 2018 and October 1, 2017, pre-tax impairment charges were $17.2 million and $0 million, respectively. (B) Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); and fair value adjustments to contingent consideration liabilities. For the three months ended September 30, 2018, the majority of these charges were related to contingent consideration liabilities and our acquisition of NeoTract. For the three months ended October 1, 2017, the majority of these charges were related to our acquisition of Vascular Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other items are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended September 30, 2018, the majority of these items included relabeling costs. For the three months ended October 1, 2017, other items included losses associated with a litigation settlement and relabeling costs. (D) Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. 24

Appendix H – Reconciliation of Adjusted Operating Profit and Margin Dollars in Thousands Nine Months Ended September 30, 2018 October 1, 2017 Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes $ 202,438 $ 281,375 Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes margin 11.2% 18.1% Restructuring, restructuring related and impairment items (A) 87,953 23,870 Acquisition, integration and divestiture related items (B) 54,939 22,056 Other items (C) 1,145 (3,786) Intangible amortization expense (D) 111,974 63,976 Adjusted Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes $ 458,449 $ 387,491 Adjusted Teleflex income from continuing operations before interest, loss on extinguishment of debt and taxes margin 25.4% 25.0% Teleflex revenue as-reported $ 1,806,768 $ 1,551,197 (A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. For the nine months ended September 30, 2018 and October 1, 2017, pre-tax impairment charges were $19.1 million and $0 million, respectively. (B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); and fair value adjustments to contingent consideration liabilities. For the nine months ended September 30, 2018, the majority of these charges were related to contingent consideration liabilities and our acquisition of NeoTract. For the nine months ended October 1, 2017, the majority of these charges were related to our acquisition of Vascular Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other items are discrete items that occur sporadically and can affect period-to-period comparisons. For the nine months ended September 30, 2018, these items included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions and relabeling costs. In addition, these items included a charge we incurred as a result of our continuing evaluation of the impact of the Tax Cuts and Jobs Act ("TCJA") on our consolidated operations. During the second quarter of 2018, we identified provisions of the TCJA that could have adverse consequences due to our organizational structure. We implemented certain changes in the organizational structure (which, pursuant to tax law, had an impact to 2017), as a result of which we incurred a $1.9 million net worth tax in a foreign jurisdiction with respect to the 2017 tax year. Because the decision to make the change resulting in the net worth tax occurred in the second quarter of 2018, and as permitted under GAAP, we recorded the net worth tax charge in 2018, and the adjustment eliminating the charge is included in the table above among "Other Items" for the 2018 period. We will continue to evaluate the TCJA over the next several months, which may result in further adjustments. For the nine months ended October 1, 2017, other items included both gains and losses associated with litigation settlements and relabeling costs. (D) Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. 25

Appendix I – Reconciliation of Adjusted EPS from Continuing Operations Three Months Ended– September 30, 2018 Dollars in Millions, except per share data Selling, general Restructuring Net income (loss) Diluted earnings Shares used in Cost of Research and and and Interest Income attributable to common per share available calculation of GAAP goods development administrative impairment expense, net taxes shareholders from to common and adjusted sold expenses expenses charges continuing operations shareholders earnings per share GAAP Basis $267.1 $214.9 $26.4 $19.2 $26.9 ($1.3) $56.5 $1.21 46,815 Adjustments Restructuring, restructuring related and 4.4 0.2 0.1 19.2 — 8.7 15.1 $0.32 — impairment items (A) Acquisition, integration and divestiture related 0.4 15.0 0.2 — — 0.7 14.9 $0.32 — items (B) Other items (C) — 0.3 — — — 0.1 0.2 $0.00 — Amortization of debt discount on convertible — — — — — — — — — notes (D) Intangible amortization — 36.9 0.1 — — 5.8 31.1 $0.66 — expense (E) Tax adjustments (F) — — — — — 0.0 (0.0) ($0.00) — Shares due to Teleflex — — — — — — — — — under note hedge (G) Adjusted basis $262.3 $162.6 $26.0 — $26.9 $14.1 $117.8 $2.52 46,815 26

Appendix J – Reconciliation of Adjusted EPS from Continuing Operations Three Months Ended – October 1, 2017 Dollars in Millions, except per share data Selling, general Restructuring Net income (loss) Diluted earnings Shares used in Cost of Research and and and Interest Income attributable to common per share available calculation of GAAP goods development administrative impairment expense, net taxes shareholders from to common and adjusted sold expenses expenses charges continuing operations shareholders earnings per share GAAP Basis $239.5 $163.8 $21.2 ($0.1) $21.0 $10.0 $79.4 $1.70 46,587 Adjustments Restructuring, restructuring related and 2.8 0.1 0.2 (0.1) — 1.1 1.9 $0.04 — impairment items (A) Acquisition, integration and divestiture related — 2.6 — — — (0.3) 2.8 $0.06 — items (B) Other items (C) — 2.3 — — — 0.6 1.7 $0.04 — Amortization of debt discount on convertible — — — — 0.1 0.0 0.1 $0.00 — notes (D) Intangible amortization — 22.5 0.1 — — 6.0 16.6 $0.36 — expense (E) Tax adjustments (F) — — — — — 4.1 (4.1) ($0.09) — Shares due to Teleflex — — — — — — — $0.01 (141) under note hedge (G) Adjusted basis $236.7 $136.3 $20.9 — $20.9 $21.7 $98.3 $2.12 46,446 27

Appendices I and J – tickmarks (A) Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. For the three months ended September 30, 2018 and October 1, 2017, after-tax restructuring related charges were $4.0 million and $1.9 million, respectively. For the three months ended September 30, 2018 and October 1, 2017, after-tax impairment charges were $9.2 million and $0 million, respectively (B) Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); and fair value adjustments to contingent consideration liabilities. For the three months ended September 30, 2018, the majority of these charges were related to contingent consideration liabilities and our acquisition of NeoTract. For the three months ended October 1, 2017, the majority of these charges were related to our acquisition of Vascular Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended September 30, 2018, these items included relabeling costs. For the three months ended October 1, 2017, other items included losses associated with a litigation settlement and relabeling costs. (D) Amortization of debt discount on convertible notes - When we sold $400 million principal amount of our 3.875% convertible notes (the “convertible notes”) in 2010, we allocated the proceeds between the liability and equity components of the debt, in accordance with GAAP. As a result, the $83.7 million difference between the proceeds of the sale of the convertible notes and the liability component of the debt constituted a debt discount that was to be amortized to interest expense over the approximately seven-year term of the convertible notes, which significantly increased the amount we recorded as interest expense attributable to the convertible notes. The amount of the amortization of the debt discount was reduced as a result of our repurchases of convertible notes in 2016 and 2017 and redemptions of the convertible notes by holders of the notes, although we continued to amortize the remaining portion of the debt discount to interest expense until August 2017, when all remaining convertible notes were either converted or matured. (E) Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. (F) Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law changes affecting our deferred tax liability. (G) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduced the potential economic dilution that otherwise would have occurred upon conversion of the Company's convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in the weighted average number of diluted shares. 28

Appendix K – Reconciliation of Adjusted EPS from Continuing Operations Nine Months Ended – September 30, 2018 Dollars in Millions, except per share data Selling, general Restructuring Net income (loss) Diluted earnings Shares used in Cost of Research and Loss on and and Interest Income attributable to common per share available calculation of GAAP goods development extinguishment administrative impairment expense, net taxes shareholders from to common and adjusted sold expenses of debt, net expenses charges continuing operations shareholders earnings per share GAAP Basis $788.1 $660.1 $78.4 $77.6 $79.0 — $14.5 $108.9 $2.33 46,785 Adjustments Restructuring, restructuring related and 9.9 0.2 0.2 77.6 — — 10.6 77.4 $1.65 — impairment items (A) Acquisition, integration and divestiture related 1.1 53.4 0.5 — — — 1.0 53.9 $1.15 — items (B) Other items (C) (1.3) 2.5 — — — — (0.1) 1.2 $0.03 — Amortization of debt discount on convertible — — — — — — — — — — notes (D) Intangible amortization — 111.6 0.3 — — — 20.0 91.9 $1.96 — expense (E) Loss on extinguishment — — — — — — — — — — of debt (F) Tax adjustments (G) — — — — — — (0.5) 0.5 $0.01 — Shares due to Teleflex — — — — — — — — — — under note hedge (H) Adjusted basis $778.5 $492.4 $77.4 — $79.0 — $45.6 $333.9 $7.14 46,785 29

Appendix L – Reconciliation of Adjusted EPS from Continuing Operations Nine Months Ended – October 1, 2017 Dollars in Millions, except per share data Selling, general Restructuring Net income (loss) Diluted earnings Shares used in Cost of Research and Loss on and and Interest Income attributable to common per share available calculation of GAAP goods development extinguishment administrative impairment expense, net taxes shareholders from to common and adjusted sold expenses of debt, net expenses charges continuing operations shareholders earnings per share GAAP Basis $710.1 $486.7 $59.3 $13.7 $58.3 $5.6 $19.4 $198.1 $4.24 46,673 Adjustments Restructuring, restructuring related and 8.9 0.5 0.8 13.7 — — 7.2 16.7 $0.36 — impairment items (A) Acquisition, integration and divestiture related 10.4 11.6 — — 2.1 — 6.8 17.3 $0.37 — items (B) Other items (C) — (3.8) — — — — (1.7) (2.1) ($0.04) — Amortization of debt discount on convertible — — — — 0.9 — 0.3 0.6 $0.01 — notes (D) Intangible amortization — 63.7 0.3 — — — 17.7 46.3 $0.99 — expense (E) Loss on extinguishment — — — — — 5.6 2.0 3.5 $0.08 — of debt (F) Tax adjustments (G) — — — — — — 4.6 (4.6) ($0.10) — Shares due to Teleflex — — — — — — — — $0.05 (373) under note hedge (H) Adjusted basis $690.8 $414.7 $58.2 — $55.3 — $56.4 $275.8 $5.96 46,300 30

Appendices K and L – tickmarks (A) Restructuring, restructuring related and impairment items - Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. For the nine months ended September 30, 2018 and October 1, 2017, after-tax restructuring related charges were $8.7 million and $6.4 million, respectively. For the nine months ended September 30, 2018 and October 1, 2017, after-tax impairment charges were $10.7 million and $0 million, respectively. (B) Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration liabilities; and bridge loan facility and backstop financing fees in connection with facilities that ultimately were not utilized. For the nine months ended September 30, 2018, the majority of these charges were related to contingent consideration liabilities and our acquisition of NeoTract. For the nine months ended October 1, 2017, the majority of these charges were related to our acquisition of Vascular Solutions. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. For the nine months ended September 30, 2018, these items included the reversal of previously recognized income due to distributor acquisitions related to Vascular Solutions and relabeling costs. In addition, these items included a charge we incurred as a result of our continuing evaluation of the impact of the Tax Cuts and Jobs Act ("TCJA") on our consolidated operations. During the second quarter of 2018, we identified provisions of the TCJA that could have adverse consequences due to our organizational structure. We implemented certain changes in the organizational structure (which, pursuant to tax law, had an impact to 2017), as a result of which we incurred a $1.9 million net worth tax in a foreign jurisdiction with respect to the 2017 tax year. Because the decision to make the change resulting in the net worth tax occurred in the second quarter of 2018, and as permitted under GAAP, we recorded the net worth tax charge in 2018, and the adjustment eliminating the charge is included in the table above among "Other Items" for the 2018 period. We will continue to evaluate the TCJA over the next several months, which may result in further adjustments. For the nine months ended October 1, 2017, other items included both gains and losses associated with litigation settlements and relabeling costs. (D) Amortization of debt discount on convertible notes - When we sold $400 million principal amount of our 3.875% convertible notes (the “convertible notes”) in 2010, we allocated the proceeds between the liability and equity components of the debt, in accordance with GAAP. As a result, the $83.7 million difference between the proceeds of the sale of the convertible notes and the liability component of the debt constituted a debt discount that was to be amortized to interest expense over the approximately seven-year term of the convertible notes, which significantly increased the amount we recorded as interest expense attributable to the convertible notes. The amount of the amortization of the debt discount was reduced as a result of our repurchases of convertible notes in 2016 and 2017 and redemptions of the convertible notes by holders of the notes, although we continued to amortize the remaining portion of the debt discount to interest expense until August 2017, when all remaining convertible notes were either converted or matured. (E) Intangible amortization expense - Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. (F) Loss on extinguishment of debt - In connection with debt refinancings, debt repayments, repurchases of convertible notes and redemptions of convertible notes, outstanding indebtedness is extinguished. These events, which have occurred from time to time on an irregular basis, have resulted in losses reflecting, among other things, unamortized debt issuance costs, as well as debt prepayment fees and premiums (including conversion premiums resulting from conversion of convertible securities). (G) Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law changes affecting our deferred tax liability. (H) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduced the potential economic dilution that otherwise would have occurred upon conversion of the Company's convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in the weighted average number of diluted shares. 31

Appendix M – Reconciliation of Adjusted Tax Rate Dollars in Thousands Three Months Ended September 30, 2018 Income from Taxes on continuing income from operations continuing before taxes operations Tax rate (A) Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. For the three months ended September 30, 2018, these items included relabeling costs. GAAP basis $55,254 ($1,286) -2.3% For the three months ended October 1, 2017, other items included losses associated with a litigation settlement and Restructuring, restructuring related and impairment charges 23,823 8,748 relabeling costs. (B) Tax adjustments - These adjustments represent the impact of the Acquisition, integration and divestiture related items 15,508 652 expiration of applicable statutes of limitations for prior year returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law changes affecting our Other items (A) 266 66 deferred tax liability. Amortization of debt discount on convertible notes 0 0 Intangible amortization expense 36,966 5,835 Tax adjustment (B) 0 42 Adjusted basis $131,817 $14,057 10.7% Three Months Ended October 1, 2017 GAAP basis $89,376 $9,978 11.2% Restructuring, restructuring related and impairment charges 2,997 1,146 Acquisition, integration and divestiture related items 2,561 (269) Other items (A) 2,314 613 Amortization of debt discount on convertible notes 125 46 Intangible amortization expense 22,601 6,049 Tax adjustment (B) 0 4,127 Adjusted basis $119,974 $21,690 18.1% 32

Appendix N – Reconciliation of Adjusted Tax Rate Dollars in Thousands Nine Months Ended September 30, 2018 Income from Taxes on continuing income from operations continuing before taxes operations Tax rate (A) Other items - These are discrete items that occur sporadically and can affect period-to-period comparisons. For the nine months ended September 30, 2018, these items included the reversal of GAAP basis $123,451 $14,532 11.8% previously recognized income due to distributor acquisitions related to Vascular Solutions and relabeling costs. In addition, Restructuring, restructuring related and impairment charges 87,953 10,587 these items included a charge we incurred as a result of our continuing evaluation of the impact of the Tax Cuts and Jobs Act Acquisition, integration and divestiture related items 54,939 1,013 ("TCJA") on our consolidated operations. During the second quarter of 2018, we identified provisions of the TCJA that could Other items (A) 1,145 (50) have adverse consequences due to our organizational structure. We implemented certain changes in the organizational structure Amortization of debt discount on convertible notes 0 0 (which, pursuant to tax law, had an impact to 2017), as a result of which we incurred a $1.9 million net worth tax in a foreign Intangible amortization expense 111,974 20,045 jurisdiction with respect to the 2017 tax year. Because the decision to make the change resulting in the net worth tax Loss on extinguishment of debt 0 0 occurred in the second quarter of 2018, and as permitted under GAAP, we recorded the net worth tax charge in 2018, and the Tax adjustment (B) 0 (524) adjustment eliminating the charge is included in the table above among "Other Items" for the 2018 period. We will continue to Adjusted basis $379,462 $45,603 12.0% evaluate the TCJA over the next several months, which may result in further adjustments. For the nine months ended October 1, 2017, other items included both gains and losses associated with litigation settlements and relabeling costs. Nine Months Ended October 1, 2017 (B) Tax adjustments - These adjustments represent the impact of the expiration of applicable statutes of limitations for prior year GAAP basis $217,514 $19,404 8.9% returns, the resolution of audits, the filing of amended returns with respect to prior tax years and/or tax law changes affecting our Restructuring, restructuring related and impairment charges 23,870 7,217 deferred tax liability. Acquisition, integration and divestiture related items 24,127 6,826 Other items (A) (3,786) (1,718) Amortization of debt discount on convertible notes 881 322 Intangible amortization expense 63,976 17,668 Loss on extinguishment of debt 5,593 2,046 Tax adjustment (B) 0 4,621 Adjusted basis $332,175 $56,386 17.0% 33

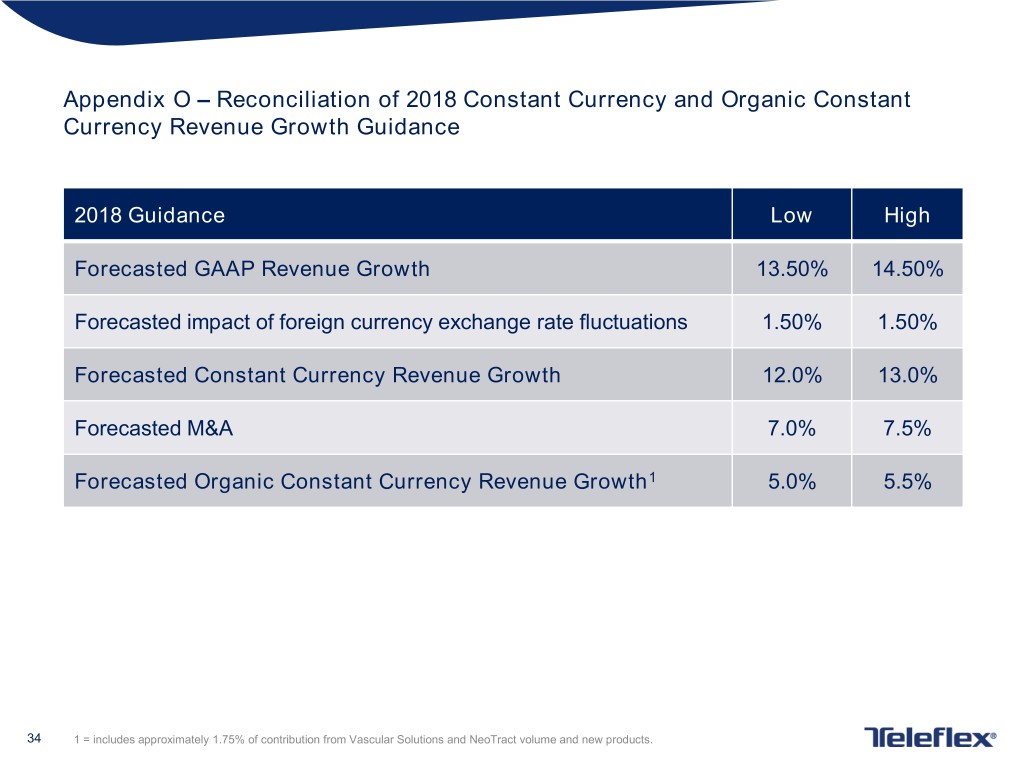

Appendix O – Reconciliation of 2018 Constant Currency and Organic Constant Currency Revenue Growth Guidance 2018 Guidance Low High Forecasted GAAP Revenue Growth 13.50% 14.50% Forecasted impact of foreign currency exchange rate fluctuations 1.50% 1.50% Forecasted Constant Currency Revenue Growth 12.0% 13.0% Forecasted M&A 7.0% 7.5% Forecasted Organic Constant Currency Revenue Growth1 5.0% 5.5% 34 1 = includes approximately 1.75% of contribution from Vascular Solutions and NeoTract volume and new products.

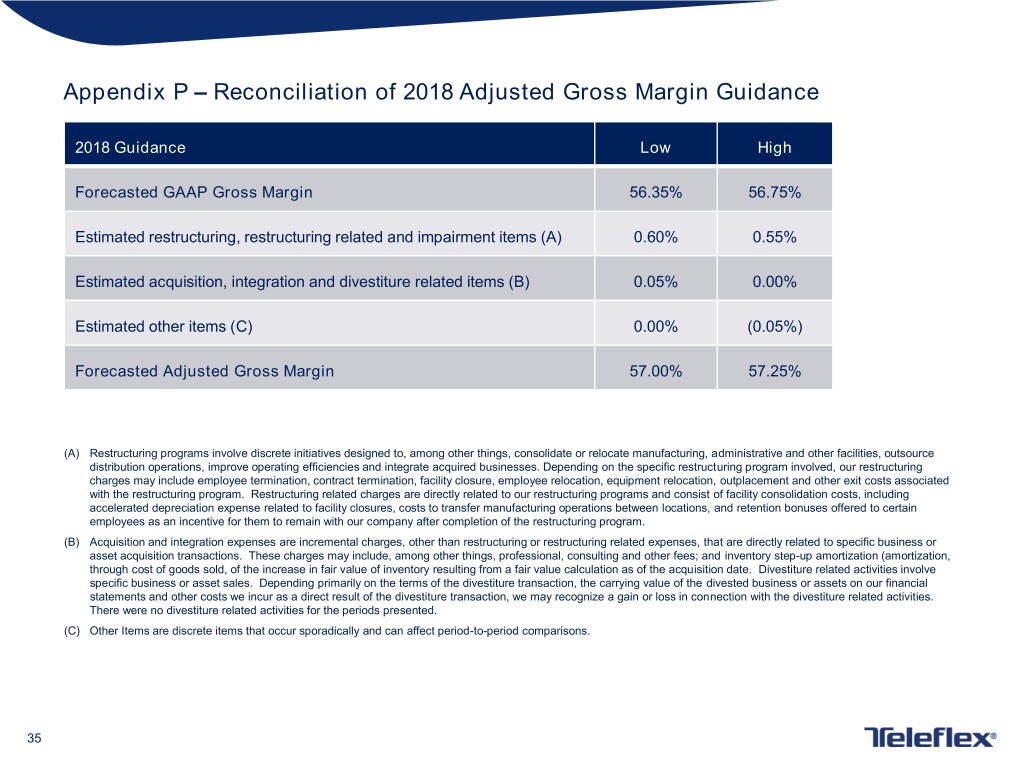

Appendix P – Reconciliation of 2018 Adjusted Gross Margin Guidance 2018 Guidance Low High Forecasted GAAP Gross Margin 56.35% 56.75% Estimated restructuring, restructuring related and impairment items (A) 0.60% 0.55% Estimated acquisition, integration and divestiture related items (B) 0.05% 0.00% Estimated other items (C) 0.00% (0.05%) Forecasted Adjusted Gross Margin 57.00% 57.25% (A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. (B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; and inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other Items are discrete items that occur sporadically and can affect period-to-period comparisons. 35

Appendix Q – Reconciliation of 2018 Adjusted Operating Margin Guidance 2018 Guidance Low High Forecasted GAAP Operating Margin 12.95% 13.45% Estimated restructuring, restructuring related and impairment items (A) 3.85% 3.80% Estimated acquisition, integration and divestiture related items (B) 2.75% 2.70% Estimated other items (C) 0.10% 0.05% Estimated intangible amortization expense (D) 6.15% 6.10% Forecasted Adjusted Operating Margin 25.80% 26.10% (A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. (B) Acquisition, integration and divestiture related items - Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); and fair value adjustments to contingent consideration liabilities. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) Other items are discrete items that occur sporadically and can affect period-to-period comparisons. (D) Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. 36

Appendix R – Reconciliation of 2018 Adjusted Earnings Per Share Guidance 2018 Guidance Low High Forecasted GAAP Diluted Earnings Per Share $4.00 $4.10 Estimated Restructuring, restructuring related and impairment items (A) $1.75 $1.76 Estimated Acquisition, integration and divestiture related items (B) $1.38 $1.40 Estimated Other items (C) $0.04 $0.05 Estimated intangible amortization expense (D) $2.63 $2.64 Forecasted Adjusted Diluted Earnings Per Share $9.80 $9.95 (A) Restructuring programs involve discrete initiatives designed to, among other things, consolidate or relocate manufacturing, administrative and other facilities, outsource distribution operations, improve operating efficiencies and integrate acquired businesses. Depending on the specific restructuring program involved, our restructuring charges may include employee termination, contract termination, facility closure, employee relocation, equipment relocation, outplacement and other exit costs associated with the restructuring program. Restructuring related charges are directly related to our restructuring programs and consist of facility consolidation costs, including accelerated depreciation expense related to facility closures, costs to transfer manufacturing operations between locations, and retention bonuses offered to certain employees as an incentive for them to remain with our company after completion of the restructuring program. (B) Acquisition and integration expenses are incremental charges, other than restructuring or restructuring related expenses, that are directly related to specific business or asset acquisition transactions. These charges may include, among other things, professional, consulting and other fees; systems integration costs; legal entity restructuring expense; inventory step-up amortization (amortization, through cost of goods sold, of the increase in fair value of inventory resulting from a fair value calculation as of the acquisition date); fair value adjustments to contingent consideration liabilities; and bridge loan facility and backstop financing fees in connection with facilities that ultimately were not utilized. Divestiture related activities involve specific business or asset sales. Depending primarily on the terms of the divestiture transaction, the carrying value of the divested business or assets on our financial statements and other costs we incur as a direct result of the divestiture transaction, we may recognize a gain or loss in connection with the divestiture related activities. There were no divestiture related activities for the periods presented. (C) These are discrete items that occur sporadically and can affect period-to-period comparisons. (D) Certain intangible assets, including customer relationships, intellectual property, distribution rights, trade names and non-competition agreements, initially are recorded at historical cost and then amortized over their respective estimated useful lives. The amount of such amortization can vary from period to period as a result of, among other things, business or asset acquisitions or dispositions. 37

Appendix S – 2018 Financial Outlook Assumptions Euro to U.S. Dollar exchange rate assumed to be approximately 1.18 for full year 2018 Adjusted weighted average shares expected to be approximately 46.9 million for full year 2018 2018 Calendar of shipping days: Q1’18 vs. Q1’17: 1 less day Q2’18 vs. Q2’17: 1 additional day Q3’18 vs. Q3’17: no difference Q4’18 vs. Q4’17: 1 additional day FY’18 vs. FY’17: 1 additional day 38

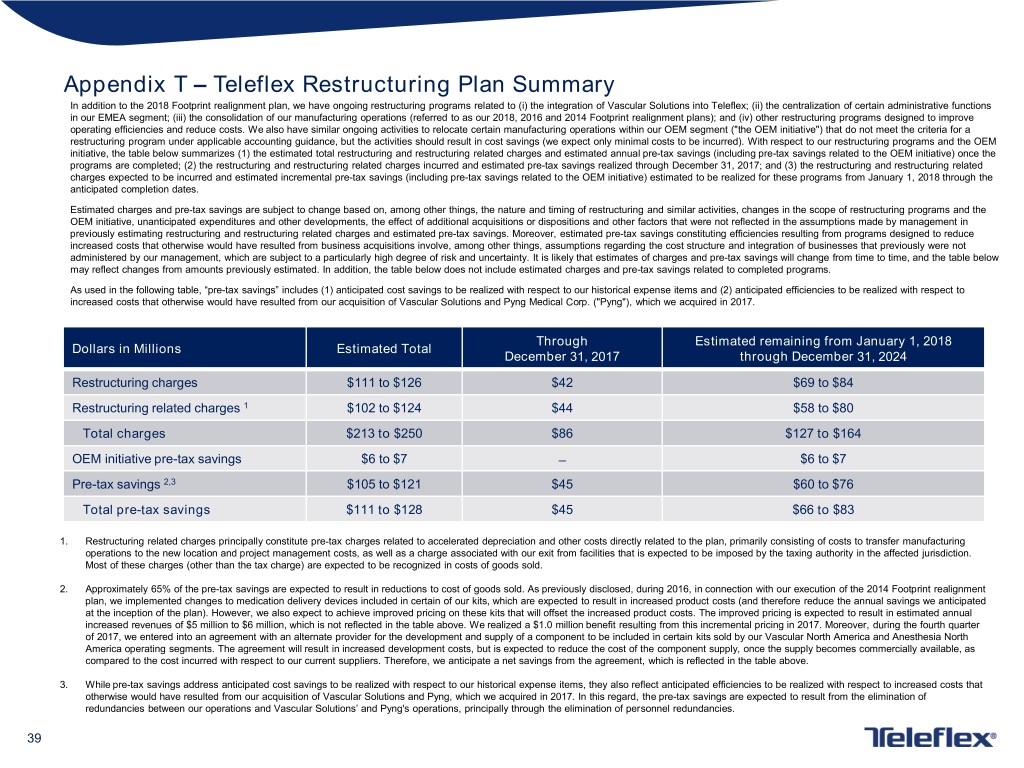

Appendix T – Teleflex Restructuring Plan Summary In addition to the 2018 Footprint realignment plan, we have ongoing restructuring programs related to (i) the integration of Vascular Solutions into Teleflex; (ii) the centralization of certain administrative functions in our EMEA segment; (iii) the consolidation of our manufacturing operations (referred to as our 2018, 2016 and 2014 Footprint realignment plans); and (iv) other restructuring programs designed to improve operating efficiencies and reduce costs. We also have similar ongoing activities to relocate certain manufacturing operations within our OEM segment ("the OEM initiative") that do not meet the criteria for a restructuring program under applicable accounting guidance, but the activities should result in cost savings (we expect only minimal costs to be incurred). With respect to our restructuring programs and the OEM initiative, the table below summarizes (1) the estimated total restructuring and restructuring related charges and estimated annual pre-tax savings (including pre-tax savings related to the OEM initiative) once the programs are completed; (2) the restructuring and restructuring related charges incurred and estimated pre-tax savings realized through December 31, 2017; and (3) the restructuring and restructuring related charges expected to be incurred and estimated incremental pre-tax savings (including pre-tax savings related to the OEM initiative) estimated to be realized for these programs from January 1, 2018 through the anticipated completion dates. Estimated charges and pre-tax savings are subject to change based on, among other things, the nature and timing of restructuring and similar activities, changes in the scope of restructuring programs and the OEM initiative, unanticipated expenditures and other developments, the effect of additional acquisitions or dispositions and other factors that were not reflected in the assumptions made by management in previously estimating restructuring and restructuring related charges and estimated pre-tax savings. Moreover, estimated pre-tax savings constituting efficiencies resulting from programs designed to reduce increased costs that otherwise would have resulted from business acquisitions involve, among other things, assumptions regarding the cost structure and integration of businesses that previously were not administered by our management, which are subject to a particularly high degree of risk and uncertainty. It is likely that estimates of charges and pre-tax savings will change from time to time, and the table below may reflect changes from amounts previously estimated. In addition, the table below does not include estimated charges and pre-tax savings related to completed programs. As used in the following table, “pre-tax savings” includes (1) anticipated cost savings to be realized with respect to our historical expense items and (2) anticipated efficiencies to be realized with respect to increased costs that otherwise would have resulted from our acquisition of Vascular Solutions and Pyng Medical Corp. ("Pyng"), which we acquired in 2017. Through Estimated remaining from January 1, 2018 Dollars in Millions Estimated Total December 31, 2017 through December 31, 2024 Restructuring charges $111 to $126 $42 $69 to $84 Restructuring related charges 1 $102 to $124 $44 $58 to $80 Total charges $213 to $250 $86 $127 to $164 OEM initiative pre-tax savings $6 to $7 ̶ $6 to $7 Pre-tax savings 2,3 $105 to $121 $45 $60 to $76 Total pre-tax savings $111 to $128 $45 $66 to $83 1. Restructuring related charges principally constitute pre-tax charges related to accelerated depreciation and other costs directly related to the plan, primarily consisting of costs to transfer manufacturing operations to the new location and project management costs, as well as a charge associated with our exit from facilities that is expected to be imposed by the taxing authority in the affected jurisdiction. Most of these charges (other than the tax charge) are expected to be recognized in costs of goods sold. 2. Approximately 65% of the pre-tax savings are expected to result in reductions to cost of goods sold. As previously disclosed, during 2016, in connection with our execution of the 2014 Footprint realignment plan, we implemented changes to medication delivery devices included in certain of our kits, which are expected to result in increased product costs (and therefore reduce the annual savings we anticipated at the inception of the plan). However, we also expect to achieve improved pricing on these kits that will offset the increased product costs. The improved pricing is expected to result in estimated annual increased revenues of $5 million to $6 million, which is not reflected in the table above. We realized a $1.0 million benefit resulting from this incremental pricing in 2017. Moreover, during the fourth quarter of 2017, we entered into an agreement with an alternate provider for the development and supply of a component to be included in certain kits sold by our Vascular North America and Anesthesia North America operating segments. The agreement will result in increased development costs, but is expected to reduce the cost of the component supply, once the supply becomes commercially available, as compared to the cost incurred with respect to our current suppliers. Therefore, we anticipate a net savings from the agreement, which is reflected in the table above. 3. While pre-tax savings address anticipated cost savings to be realized with respect to our historical expense items, they also reflect anticipated efficiencies to be realized with respect to increased costs that otherwise would have resulted from our acquisition of Vascular Solutions and Pyng, which we acquired in 2017. In this regard, the pre-tax savings are expected to result from the elimination of redundancies between our operations and Vascular Solutions’ and Pyng's operations, principally through the elimination of personnel redundancies. 39

Appendix U – GPO and IDN Review Group Purchasing Organization Update • 11 renewed agreements • 0 new agreements • 0 existing agreements lost IDN Update • 8 renewed agreements • 2 new agreements • 0 existing agreements lost 40