Attached files

| file | filename |

|---|---|

| EX-99.4 - EX-99.4 - GRAY TELEVISION INC | d627349dex994.htm |

| EX-99.3 - EX-99.3 - GRAY TELEVISION INC | d627349dex993.htm |

| EX-99.2 - EX-99.2 - GRAY TELEVISION INC | d627349dex992.htm |

| 8-K - FORM 8-K - GRAY TELEVISION INC | d627349d8k.htm |

Exhibit 99.1

Certain Information Excerpted from the Company’s Preliminary Offering Memorandum

and Disclosed Pursuant to Regulation FD

Disclosure Regarding Forward-Looking Statements

In various places herein, we make “forward-looking statements” within the meaning of federal and state securities laws. Forward-looking statements are statements other than those of historical fact. Disclosures that use words such as “believes,” “expects,” “anticipates,” “estimates,” “will,” “may” or “should” and similar words and expressions are generally intended to identify forward-looking statements. These forward-looking statements reflect our then-current expectations and are based upon data available to us at the time the statements are made. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from expectations. The most material, known risks are detailed in the sections entitled “Risks Related to the Raycom Merger” and “Risks Related to Our Business” herein, and the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our quarterly and annual reports filed with the Securities and Exchange Commission. All forward-looking statements herein, or incorporated by reference herein, are qualified by these cautionary statements and are made only as of the date of this Current Report on Form 8-K or the date of the information incorporated by reference herein, as the case may be, and we undertake no obligation to update any information contained herein, or incorporated by reference herein, or to publicly release any revisions to any forward-looking statements to reflect events or circumstances that occur, or that we become aware of, after the date of this Current Report on Form 8-K. Any such forward-looking statements, whether made in or incorporated by reference herein or elsewhere, should be considered in context with the various disclosures made by us about our business. These forward-looking statements fall under the safe harbors of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). The following risks, among others, could cause actual results to differ materially from those described in any forward-looking statements:

| • | we may not be able to complete the Raycom Merger or the KDLT Acquisition (as defined herein), on the terms and within the timeframe currently contemplated or at all, or to satisfy any material regulatory or other unexpected requirements in connection therewith, we may be unable to achieve expected synergies or benefits therefrom on a timely basis or at all, and/or we may encounter other risks or costs associated therewith; |

| • | we have substantial debt and, after issuance of the notes offered hereby and borrowings under the Incremental Term Loans, and the use of proceeds as described herein, we will have the ability to incur significant additional debt, including senior secured debt that would effectively rank senior in priority to the notes, any of which could restrict our future operating and strategic flexibility and expose us to the risks of financial leverage; |

| • | the agreements governing our various debt and other obligations restrict, and are expected to continue to restrict, our business and limit our ability to take certain actions; |

| • | our ability to meet our debt service obligations on the notes offered hereby and our other debt will depend on our future performance, which is, and will be, subject to many factors that are beyond our control; |

| • | we are a holding company with no material independent assets or operations and we depend on our subsidiaries for cash; |

| • | we are dependent on advertising revenues, which are seasonal and cyclical, and may also fluctuate as a result of a number of other factors, including any continuation of uncertain financial and economic conditions; |

| • | we are highly dependent upon a limited number of advertising categories; |

| • | we intend to seek to grow through strategic acquisitions, and acquisitions involve risks and uncertainties; |

| • | we may fail to realize any benefits and incur unanticipated losses related to any acquisition; |

| • | we purchase television programming in advance of earning any related revenue, and may not earn sufficient revenue to offset the costs thereof; |

| • | we are highly dependent on network affiliations and may lose a significant amount of television programming if a network terminates or significantly changes its affiliation with us; |

| • | we are dependent on our retransmission consent agreements with multichannel video programming distributors and any potential changes to the retransmission consent regime could materially adversely affect our business; |

| • | we are subject to risks of competition from local television stations as well as from cable systems, the Internet and other video providers; |

| • | we may incur significant capital and operating costs, including costs related to our obligations under our defined benefit pension plans; |

| • | we may be unable to maintain or increase our internet advertising revenue, which could have a material adverse effect on our business and operating results; |

| • | we may incur impairment charges related to our assets; |

| • | recently enacted changes to the U.S. tax laws may have a material impact on our business or financial condition; |

| • | cybersecurity risks could affect our operating effectiveness; |

| • | certain stockholders or groups of stockholders have the ability to exert significant influence over us; |

| • | we are subject to risks and limitations due to government regulation of the broadcasting industry, including Federal Communications Commission (“FCC” or the “Commission”) control over the renewal and transfer of broadcasting licenses, which could materially adversely affect our operations and growth strategy; and |

| • | the other risks and uncertainties discussed under “Risks Related to the Raycom Merger” and “Risks Related to Our Business” herein. |

Certain Terms Used Herein

When used herein, unless the context requires otherwise, or as specifically described below:

| • | The term “notes” means $500 million aggregate principal amount of senior notes offered in connection with the Raycom Transactions (as defined below); |

| • | The term “Gray”, the “Company” “we”, “us” and “our” means Gray Television, Inc., a Delaware corporation; |

| • | The term “Raycom” means Raycom Media, Inc., a Delaware corporation; |

| • | The term “Merger Agreement” means the Agreement and Plan of Merger by and among the Gray, Raycom, East Future Group, Inc., a wholly owned subsidiary of Gray (“Merger Sub”), and Tara Advisors, LLC, pursuant to which Merger Sub will merge with and into Raycom, with Raycom surviving the Raycom Merger as a direct wholly owned subsidiary of Gray (the “Raycom Merger”); |

| • | The term “Escrow Issuer” means Gray Escrow, Inc., a newly formed, wholly owned subsidiary of Gray; |

| • | The term “Senior Credit Facility” means our existing senior credit facility; |

| • | The term “Incremental Term Loans” means a $1.65 billion incremental term loan under our Senior Credit Facility that we expect to enter into in connection with the Raycom Merger; |

| • | The term “Existing Revolver” means our existing $100 million revolving credit facility; |

| • | The term “2018 Revolver” means the new five year revolving credit facility with borrowings of up to $200 million that we expect to enter into in connection with the Raycom Merger; |

| • | The term “Raycom Transactions” means the offering of notes, the funding of the Incremental Term Loans, the 2018 Revolver and the use of proceeds of each, together with the Raycom Merger, and the payment of fees and expenses in connection with each of the foregoing; |

| • | The term “Escrowed Funds” means the gross proceeds of the notes; |

| • | The term “Escrow Account” the account into which the Escrowed Funds will be deposited; |

| • | The term “Escrow Release Conditions” means the conditions that must be satisfied before the Escrowed Funds will be released from the Escrow Account |

| • | The term “Release Date” the date on which the Escrowed Funds will be released to the Company upon occurrence of the Escrow Release Conditions; |

| • | The term “Assumption” refers to the following events: on the Escrow Release Date, the Escrow Issuer will merge with and into the Company, with the Company as the surviving corporation, and the Company will become the primary obligor under the notes and the indenture and each of the Company’s existing and certain future domestic restricted subsidiaries (other than with respect to Raycom and its subsidiaries which will be required to guarantee the notes when such entities become guarantors under the Senior Credit Facility, which is expected to be on the Release Date or within 5 business days thereafter) will agree to guarantee the notes; |

| • | The term “Escrow End Date” means June 30, 2018 or September 30, 2019, if extended to that date in accordance with the Merger Agreement; |

| • | The term “Escrow Agent” means Wells Fargo Bank, N.A. as escrow agent under the escrow agreement (the “Escrow Agreement”) pursuant to which the Escrow Issuer will deposit into the Escrow Account with the Escrow Agent the Escrowed Funds; |

| • | The term “Trustee” means U.S. Bank National Association, as trustee under the Escrow Agreement; |

| • | The term “Special Mandatory Redemption” means, the Escrow Issuer’s obligation to redeem the notes at 100% of the issue price of the notes, plus accrued and unpaid interest to, but excluding, the redemption date upon occurrence of either (i) the Escrow Release Conditions having not occurred by the Escrow End Date or (ii) prior to the Escrow End Date, the Merger Agreement having bene terminated or the Company notifying the Trustee and the Escrow Agent in writing that it is no longer pursuing the Raycom Merger; |

| • | The term “Special Mandatory Redemption Date” means the third business day following the occurrence of a triggering event for a Special Mandatory Redemption; |

| • | The term “Gray Escrow Guarantee” means the Company’s agreement to pay an amount up to the amount necessary to fund the interest due on the notes from the closing date to, but excluding, the Special Mandatory Redemption Date (the “Shortfall Redemption Amount”) which, when taken together with the Escrowed Funds, will be sufficient to fund the Special Mandatory Redemption of the notes on the third business day following the Escrow End Date, if a Special Mandatory Redemption were to occur on such date; |

| • | The term “MVPDs” means multichannel video programming distributors; |

| • | The term “New Preferred Stock” means shares of a new series of perpetual preferred stock of the Company, with a stated face value of $1,000 per share; |

| • | The term “2024 notes” means our outstanding 5.125% senior notes due 2024; |

| • | The term “2026 notes” means our outstanding 5.875% senior notes due 2026; |

| • | The term “Nielsen” means the Nielsen Company; |

| • | The term “DMA” means designated market area; |

| • | The term “ABC” means the ABC Network; |

| • | The term “NBC” means the NBC Network; |

| • | The term “CBS” means the CBS Network; |

| • | The term “FOX” means the FOX Network; |

| • | The term “CW” means the CW Network or the CW Plus Network, collectively; |

| • | The term “MeTV” means the MeTV Network; |

| • | The term “KDLT Acquisition” means the pending acquisition of KDLT-TV (NBC), a television station serving the Sioux Falls, South Dakota market (DMA 110), which we expect to close in late 2018 or early 2019; |

| • | The term “Prior Acquisitions” means the stations acquired and retained in 2017 as well as those which we began operating under an LMA in 2017, each pursuant to the transactions discussed below: |

| 1. | On January 13, 2017, we acquired the assets of KTVF-TV (NBC), KXDF-TV (CBS), and KFXF-TV (FOX) in the Fairbanks, Alaska television market (DMA 202), from Tanana Valley Television Company and Tanana Valley Holdings, LLC for an adjusted purchase price of $8.0 million. |

| 2. | On January 17, 2017, we acquired the assets of two television stations that were divested by Nexstar Broadcasting, Inc. upon its merger with Media General, Inc.: WBAY-TV (ABC), in the Green Bay, Wisconsin television market (DMA 69), and KWQC-TV (NBC), in the Davenport, Iowa, Rock Island, Illinois, and Moline, Illinois or “Quad Cities” television market (DMA 102), for an adjusted purchase price of $269.9 million. |

| 3. | On May 1, 2017, we acquired the assets of WDTV-TV (CBS) and WVFX-TV (FOX/CW) in the Clarksburg-Weston, West Virginia television market (DMA 169) from Withers Broadcasting Company of West Virginia (the “Clarksburg Acquisition”) for a total purchase price of $26.5 million. On May 13, 2016, we announced that we agreed to enter into the Clarksburg Acquisition. On June 1, 2016, we made a partial payment of $16.5 million and acquired the non-license assets of these stations. Also, on that date we began operating these stations, subject to the control of the seller, under a local marketing agreement (“LMA”) that terminated upon completion of the acquisition. |

| 4. | On May 1, 2017, we acquired the assets of WABI-TV (CBS/CW) in the Bangor, Maine television market (DMA 156) and WCJB-TV (ABC/CW) in the Gainesville, Florida television market (DMA 159) from Community Broadcasting Service and Diversified Broadcasting, Inc. for a total purchase price of $85.0 million. On April 1, 2017, we began operating these stations, subject to the control of the seller, under an LMA that terminated upon completion of the acquisition. |

| 5. | On August 1, 2017, we acquired the assets of WCAX-TV (CBS) in the Burlington, Vermont — Plattsburgh, New York television markets (DMA 97) from Mt. Mansfield Television, Inc., for an adjusted purchase price of $29.0 million. On June 1, 2017, we advanced $23.2 million of the purchase price to the seller and began to operate the station under an LMA, subject to the control of the seller. At closing, we paid the remaining $5.8 million of the purchase price and the LMA was terminated. |

| • | The term “Pending Raycom Acquisitions” means Raycom’s pending acquisitions of WUPV-DT in the Richmond, VA market and KYOU-TV in the Ottumwa, IA market pursuant to purchase agreements previously entered into by Raycom being assumed by Gray; |

| • | The term “Raycom Prior Acquisitions” means the stations and assets acquired by Raycom from June 30, 2016 through June 30, 2018 in the following transactions: |

| 1. | On August 15, 2016, Raycom acquired the real property of KVHP (FOX) in the Lake Charles, Louisiana market (DMA 174) from National Media, Inc. for a cash purchase price of $21.9 million. In conjunction with the purchase, Raycom entered into a shared services arrangement with American Spirit Media, which purchased the FCC license and various other assets of KVHP. |

| 2. | On May 1, 2017, Raycom acquired virtually all of the assets of WWSB (ABC) in the Tampa, Florida market (DMA 13) and WTXL (ABC) in the Tallahassee, Florida market (DMA 108) from Calkins Media, Inc., for a cash purchase price of $67.3 million. |

| 3. | On August 8, 2017, Raycom purchased virtually all of the assets of WVUE (FOX) in the New Orleans, Louisiana market (DMA 51) from Louisiana Media Company, LLC for a cash purchase price of $52.1 million. |

| • | The term “Acquisitions” means the Prior Acquisitions, Raycom Merger, which includes the Pending Raycom Acquisitions, the Raycom Prior Acquisitions and the KDLT Acquisition. |

****

Raycom Merger

On June 23, 2018, we entered into the Merger Agreement to acquire Raycom, a large privately-owned media company. The completion of the Raycom Merger will mark Gray’s transformation from a regional broadcaster into a leading media company with nationwide scale that continues to be based upon high-quality stations in attractive markets. Gray and Raycom have highly complementary portfolios of television stations, as well as highly complementary company cultures, award-winning journalistic commitments, and long histories of community service. Upon the completion of the Raycom Merger, Hilton Howell will continue as Executive Chairman and Chief Executive Officer of Gray, while Raycom President and CEO, Pat LaPlatney, will join Gray as President and Co-Chief Executive Officer. In addition, both Mr. LaPlatney and Raycom’s former President and CEO, Paul McTear, each of whom is currently a member of Raycom’s Board of Directors, will join Gray’s Board of Directors.

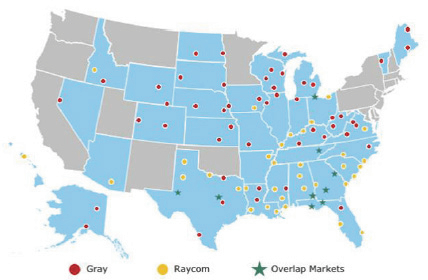

When the Raycom Merger is completed, Raycom will become a direct wholly owned subsidiary of Gray and, giving effect to the divestitures of stations in all overlap markets that Gray has proposed to sell simultaneously with the closing of the Raycom Merger, we will own and/or operate television stations and locally focused digital platforms serving 92 markets. Based on Nielsen’s 2017-2018 television season rankings, Raycom’s market DMAs range from 13 to 200, which are highly complementary to Gray’s existing market DMAs ranging from 61 to 209. Following the Raycom Merger, Gray will be the single largest owner of top-rated local television stations and digital assets in the country. At that time, its station portfolio will reach approximately 24 percent of U.S. television households through approximately 400 separate program streams including over 150 affiliates of the ABC/NBC/CBS/FOX networks, and 100 affiliates of CW, MyNetwork, and MeTV. Gray will own local television stations ranked number-one in all day Nielsen ratings in 62 of the combined 92 markets, and it will own number-one and/or number-two ranked television station in 85 of its 92 markets. In addition to high quality television stations, Gray will acquire additional Raycom businesses that provide (i) sports marketing, production and event management, (ii) sports and entertainment production services and (iii) automotive programming production and marketing solutions, all resulting in Gray becoming a more diversified media company. For the twelve months ended June 30, 2018, these additional Raycom businesses accounted for less than approximately 8% of Raycom’s revenue.

Combined Television Markets

The consummation of the Raycom Merger is subject to the satisfaction or waiver of certain customary closing conditions, including the receipt of approval from the FCC and the expiration or early termination of the waiting period applicable to the Raycom Merger under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. We currently anticipate that the Raycom Merger will be completed during the fourth quarter of 2018. Either party may terminate the Merger Agreement if it is not consummated on or before June 30, 2019, with an automatic extension to September 30, 2019 if necessary to obtain regulatory approval under the circumstances specified in the Merger Agreement.

To attempt to facilitate prompt regulatory approvals and closing of the Raycom Merger, Gray elected to divest certain television stations in each of the nine overlap markets. These divestitures will be completed concurrently with the closing of the Raycom Merger. Specifically, Gray intends to retain and divest stations in the overlap markets as follows:

| Market (DMA Rank |

Retained Full-Power Stations (November 2017 All-Day |

Divested Full-Power Stations (November 2017 All-Day Rank) |

Purchaser of Divested Full-Power | |||

| 61 Knoxville |

Gray WVLT (#2 CBS) | Raycom WTNZ (#5 Fox) | Lockwood Broadcasting, Inc. | |||

| 78 Toledo |

Gray WTVG (#2 ABC) | Raycom WTOL (#1 CBS) | TEGNA Inc. | |||

| 86 Waco |

Gray KWTX (#1 CBS) | Raycom KXXV (#3 ABC) | E.W. Scripps Company | |||

| 108 Tallahassee |

Gray WCTV (#1 CBS) | Raycom WTXL (#2 ABC) | E.W. Scripps Company | |||

| 112 Augusta |

Gray WRDW (#2 CBS) | Raycom WFXG (#3 Fox) | Lockwood Broadcasting, Inc. | |||

| 144 Odessa |

Gray KOSA (#1 CBS) | Raycom KWES (#2 NBC) | TEGNA Inc. | |||

| 151 Panama City |

Gray WJHG (#1 ABC) | Raycom WPGX (#4 Fox) | Lockwood Broadcasting, Inc. | |||

| 154 Albany |

Raycom WALB (#1 ABC) | Gray WSWG (#3 CBS) | Marquee Broadcasting, Inc. | |||

| 173 Dothan |

Gray WTVY (#1 CBS) | Raycom WDFX (#3 Fox) | Lockwood Broadcasting, Inc. |

Upon consummation of the Raycom Merger, all outstanding shares of Raycom capital stock, and options and warrants to purchase Raycom capital stock, will be cancelled, and all indebtedness of Raycom will be repaid, in exchange for aggregate consideration consisting of (i) 11,500,000 shares of the Company’s common stock, no par value per share (the “Common Stock”), (ii) $2.85 billion in cash (subject to certain adjustments as set forth in the Merger Agreement) (the “Cash Merger Consideration”) and (iii) 650,000 shares of a new series of perpetual preferred stock of the Company, with a stated face value of $1,000 per share (the “New Preferred Stock”, and together with the 11,500,000 shares of Common Stock and the Cash Merger Consideration, the “Merger Consideration”). See “Description of New Preferred Stock.”

Financing of the Raycom Merger

In connection with the Raycom Merger, in addition to this offering, we expect to enter into (1) a $1.65 billion incremental term loan (the “Incremental Term Loans”) under our senior credit facility (the “Senior Credit Facility”), subject to market conditions at the time of financing and (2) a replacement of our existing $100 million revolving credit facility (the “Existing Revolver”) with a new five year revolving credit facility with borrowings of up to $200 million (the “2018 Revolver”). We do not intend to draw upon the 2018 Revolver to finance the Raycom Merger. See “Description of Other Indebtedness” for a further description of the Incremental Term Loans and the 2018 Revolver.

Raycom Company Overview

Raycom is headquartered in Montgomery, Alabama. Formed in 1996, Raycom, an employee-owned company, is a large privately-owned local media company and owns and/or provides services for 61 television stations and 2 radio stations in 44 markets located in 20 states. Raycom owns or provides services for stations covering 16% of U.S. television households and employs over 8,300 individuals in full and part-time positions. Raycom’s portfolio includes the number-one and/or number-two ranked television station operations in 75% of its markets.

Raycom primarily operates in mid-sized markets that feature stable economies and strong growth potential. By focusing on mid-sized markets, Raycom faces less competition and is able to achieve lower absolute costs of operations and greater leverage with content providers and other suppliers.

From June 30, 2016 through June 30, 2018, Raycom completed three acquisition transactions.

On August 15, 2016, Raycom acquired the real property of KVHP (FOX) in the Lake Charles, Louisiana market (DMA 174) from National Media, Inc. for a cash purchase price of $21.9 million. In conjunction with the purchase, Raycom entered into a shared services arrangement with American Spirit Media, which purchased the FCC license and various other assets of KVHP.

On May 1, 2017, Raycom acquired virtually all of the assets of WWSB (ABC) in the Tampa, Florida market (DMA 13) and WTXL (ABC) in the Tallahassee, Florida market (DMA 108) from Calkins Media, Inc., for a cash purchase price of $67.3 million.

On August 8, 2017, Raycom purchased virtually all of the assets of WVUE (FOX) in the New Orleans, Louisiana market (DMA 51) from Louisiana Media Company, LLC for a cash purchase price of $52.1 million.

We refer to the stations and assets acquired by Raycom from June 30, 2016 through June 30, 2018 as the “Raycom Prior Acquisitions.”

The following table provides information about the full-power television stations owned by Raycom as of October 23, 2018:

| DMA |

Designated Market |

Station Call |

Primary Channel |

Primary Broadcast | ||||||

| 13 |

Tampa, FL | WWSB | ABC | 2/1/2021 | ||||||

| 19 |

Cleveland, OH | WOIO | CBS | 10/1/2021 | ||||||

| 19 |

Cleveland, OH | WUAB | CW | 10/1/2021 | ||||||

| 23 |

Charlotte, NC | WBTV | CBS | 12/1/2020 | ||||||

| 35 |

Cincinnati, OH | WXIX | FOX | 10/1/2021 | ||||||

| 37 |

West Palm Beach, FL | WFLX | (b) | FOX | 2/1/2021 | |||||

| 44 |

Birmingham, AL | WBRC | FOX | 4/1/2021 | ||||||

| 49 |

Louisville, KY | WAVE | NBC | 8/1/2021 | ||||||

| 50 |

Memphis, TN | WMC | NBC | 8/1/2021 | ||||||

| 51 |

New Orleans, LA | WVUE | FOX | 6/1/2021 | ||||||

| 55 |

Richmond, VA | WWBT | NBC | 10/1/2020 | ||||||

| 61 |

Knoxville, TN | WTNZ | (c) | FOX | 8/1/2021 | |||||

| 65 |

Tucson, AZ | KOLD | CBS | 10/1/2022 | ||||||

| 66 |

Honolulu, HI | KGMB | CBS | 2/1/2023 | ||||||

| 66 |

Honolulu, HI | KHNL | NBC | 2/1/2023 | ||||||

| 66 |

Honolulu, HI | KHBC | (d) | NBC | 2/1/2023 | |||||

| 66 |

Honolulu, HI | KOGG | (d) | NBC | 2/1/2023 | |||||

| 77 |

Columbia, SC | WIS | NBC | 12/1/2020 | ||||||

| 78 |

Toledo, OH | WTOL | (c) | CBS | 10/1/2021 | |||||

| 80 |

Huntsville, AL | WAFF | NBC | 4/1/2021 | ||||||

| 82 |

Paducah, KY | KFVS | CBS | 8/1/2021 | ||||||

| 83 |

Shreveport, LA | KSLA | CBS | 6/1/2021 | ||||||

| 86 |

Waco-Bryan, TX | KXXV | (c) | ABC | 8/1/2022 | |||||

| 90 |

Savannah, GA | WTOC | CBS | 4/1/2021 | ||||||

| 92 |

Charleston, SC | WCSC | CBS | 12/1/2020 | ||||||

| 94 |

Baton Rouge, LA | WAFB | CBS | 6/1/2021 | ||||||

| 95 |

Jackson, MS | WLBT | NBC | 6/1/2021 | ||||||

| 101 |

Myrtle Beach, SC | WMBF | NBC | 12/1/2020 | ||||||

| 103 |

Evansville, IN | WFIE | NBC | 8/1/2021 | ||||||

| 104 |

Boise, ID | KNIN | (b) | FOX | 10/1/2022 | |||||

| 108 |

Tallahassee, FL | WTXL | (c) | ABC | 2/1/2021 | |||||

| 109 |

Tyler-Lufkin, TX | KLTV | (d) | ABC | 8/1/2022 | |||||

| 109 |

Tyler-Lufkin, TX | KTRE | ABC | 8/1/2022 | ||||||

| 112 |

Augusta, GA | WFXG | (c) | FOX | 4/1/2021 | |||||

| 124 |

Montgomery, AL | WSFA | NBC | 4/1/2021 | ||||||

| 127 |

Columbus, GA | WTVM | ABC | 4/1/2021 | ||||||

| 130 |

Wilmington, NC | WECT | NBC | 12/1/2020 | ||||||

| 131 |

Amarillo, TX | KFDA | CBS | 8/1/2022 | ||||||

| 131 |

Amarillo, TX | KEYU | TEL | 8/1/2022 | ||||||

| 144 |

Odessa-Midland, TX | KWES | (c) | NBC | 8/1/2022 | |||||

| 144 |

Odessa-Midland, TX | KWAB | NBC | 8/1/2022 | ||||||

| 145 |

Lubbock, TX | KCBD | NBC | 8/1/2022 | ||||||

| 149 |

Wichita Falls, TX | KSWO | ABC | 8/1/2022 | ||||||

| 151 |

Panama City, FL | WPGX | (c) | FOX | 2/1/2021 | |||||

| 154 |

Albany, GA | WALB | NBC | 4/1/2021 | ||||||

| 157 |

Biloxi-Gulfport, MS | WLOX | ABC | 6/1/2021 | ||||||

| 168 |

Hattiesburg, MS | WDAM | NBC | 6/1/2021 | ||||||

| 173 |

Dothan, AL | WDFX | (c) | FOX | 4/1/2021 | |||||

| 174 |

Lake Charles, LA | KPLC | NBC | 6/1/2021 | ||||||

| 182 |

Jonesboro, AR | KAIT | ABC | 6/1/2021 |

| (a) | DMA rank for the 2017-2018 television season based on information published by Nielsen. |

| (b) | Station operated by a third party pursuant to a shared services agreement. |

| (c) | Station under contract to be divested in connection with the Raycom Merger. |

| (d) | This station is a satellite station under FCC rules and simulcasts the programming of Raycom’s primary channel in its market. This station may offer some locally originated programming, such as local news. |

In addition to television stations, Raycom is the parent company of Community Newspaper Holdings, Inc. (“CNHI”) (community newspapers and information products; over 100 titles located in 23 states), PureCars (digital ad platform for the automotive industry), Raycom Sports Network, LLC (“Raycom Sports”) (a marketing, production, events management and distribution company), Raycom Tupelo-Honey Productions (“RTHP”) (a live event production company) and RTM Studios, Inc. (an automotive programming production and marketing solutions company). Through Raycom Sports, Raycom owns over-the-air syndication, regional cable and digital media rights to Atlantic Coast Conference athletic programming. Raycom has initiated processes to sell or spin off CNHI and PureCars, and consequently Gray will not acquire either CNHI or PureCars in the Raycom Merger. Raycom Sports, RTHP and RTM Studios, Inc. accounted for less than approximately 8% of Raycom’s revenue for the 12 months ended June 30, 2018.

For the twelve months ended June 30, 2018, Raycom generated revenue of $1,107 million, broadcast cash flow of $377 million and operating cash flow of $335 million. For a reconciliation of broadcast cash flow and operating cash flow, see “— Summary Historical Consolidated Financial and Other Data of Raycom.”

Raycom benefits from a large and diverse portfolio of high quality assets. Raycom generated the vast majority of its revenue of $1,107 million in the twelve months ended June 30, 2018 from Big 4 affiliates including 30% from CBS affiliates, 30% from NBC affiliates, 22% from Fox affiliates and 13% from ABC affiliates. Given this makeup, Raycom generated a significant portion of its gross revenue from local advertising. However, no individual market represented more than 6% of Raycom’s total Revenue, with the largest revenue markets being Charlotte, NC and Cleveland, OH.

Estimated Sources and Uses for the Raycom Merger

In connection with the Raycom Merger, in addition to this offering, we expect to enter into the 2018 Revolver and the Incremental Term Loans, subject to market conditions at the time of financing.

We intend to use the net proceeds from this offering, the Incremental Term Loans and cash on hand, to (1) finance the Cash Merger Consideration and (2) pay fees and expenses related to the Raycom Transactions. Pending consummation of the Raycom Merger, the gross proceeds of this offering will be held in the Escrow Account. The release of the Escrowed Funds will be conditioned on, among other things, the contemporaneous consummation of the Raycom Merger. If (1) the Escrow Release Conditions are not satisfied on or prior to the Escrow End Date or (2) prior to the Escrow End Date, the Merger Agreement is terminated or we notify the Trustee and the Escrow Agent in writing that we are no longer pursuing the Raycom Merger, then the Escrow Issuer will be required to redeem the notes at 100% of the issue price of the notes, plus accrued and unpaid interest from the issue date or the most recent date to which interest has been paid or duly provided for on the notes, as the case may be, to, but excluding, the Special Mandatory Redemption Date, with the Escrowed Funds and Gray Escrow Guarantee, as described under “Description of Notes — Escrow of Proceeds; Escrow Conditions.” Pursuant to the Gray Escrow Guarantee, we will agree to pay the Shortfall Redemption Amount which, when taken together with the Escrowed Funds, will be sufficient to fund a Special Mandatory Redemption of the notes on the third business day following the Escrow End Date, if a Special Mandatory Redemption were to occur on such date. See “Description of Notes — Escrow of Proceeds; Escrow Conditions.”

The following table sets forth the estimated sources and uses of funds in connection with the Raycom Merger, the other Raycom Transactions, the KDLT Acquisition and the Pending Raycom Acquisitions. The actual sources and uses of funds may vary from the estimated sources and uses of funds in the table and accompanying footnotes set forth below (in millions).

| (1) | The cash portion of the Merger Consideration is approximately $2.85 billion. |

| (2) | Reflects our estimate of fees and expenses associated with the Raycom Merger and related financing transactions, including underwriting fees, the initial purchasers’ discount, advisory fees and other fees and transaction costs. See “— Summary Unaudited Pro Forma Combined Financial Information.” There can be no assurances that such fees and expenses will not exceed our estimate. |

| (3) | Assumes a share price of $16.58, based upon the closing price of Common Stock on October 26, 2018. |

| (4) | The New Preferred Stock will accrue dividends at 8% per annum payable in cash or 8.5% per annum payable in the form of additional New Preferred Stock, at our election. The holders of the New Preferred Stock will not be entitled to vote on any matter submitted to our stockholders for a vote, except as required by Georgia law. Holders of the New Preferred Stock would be entitled to receive a liquidation preference equal to $1,000 per share plus all accrued and unpaid dividends. See “Description of New Preferred Stock.” |

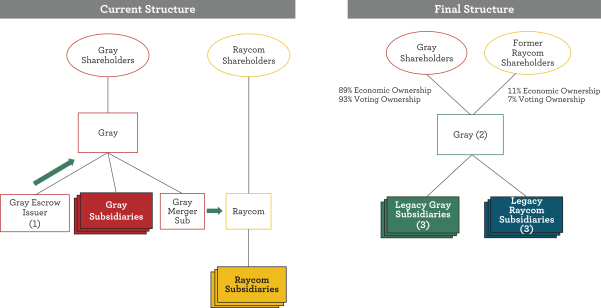

Corporate Structure Chart

| (1) | The Escrow Issuer, a wholly owned subsidiary of Gray, will initially issue the notes. |

| (2) | Assuming satisfaction of the Escrow Release Conditions on or prior to the Escrow End Date, Gray will become the primary obligor of the notes upon the merger of the Escrow Issuer with and into Gray, with Gray as the surviving corporation, and will assume all rights and obligations of the Escrow Issuer under the indenture pursuant to a supplemental indenture. In addition, Gray will continue to be the borrower under the Senior Credit Facility. |

| (3) | Guarantors of the notes following consummation of the Raycom Merger and the Assumption ( Raycom and its subsidiaries will be required to guarantee the notes when such entities become guarantors under the Senior Credit Facility, which is expected to be on the Release Date or within 5 business days thereafter). Prior to the Release Date, Gray will provide the Gray Escrow Guarantee for the Shortfall Redemption Amount which, when taken together with the funds in the Escrow Account, is expected to be sufficient to fund the Special Mandatory Redemption of the notes on the third business day following the Escrow End Date, if a Special Mandatory Redemption were to occur on such date. See “Description of Notes — Escrow of Proceeds; Escrow Conditions.” Following the Release Date, the notes will be fully and unconditionally guaranteed by each of the Company’s existing and future domestic restricted subsidiaries (other than with respect to Raycom and its subsidiaries which will be required to guarantee the notes when such entities become guarantors under the Senior Credit Facility, which is expected to be on the Release Date or within 5 business days thereafter). As of the Release Date, other than as described in the previous sentence with respect Raycom and its subsidiaries, we do not expect to have any non-guarantor subsidiaries (other than Riverwatch Augusta Land, LLC). See “Description of Notes — Subsidiary Guarantees.” |

Certain Preliminary Financial Information for the Quarter Ended September 30, 2018

Gray is in the process of finalizing its financial results for the quarter ended September 30, 2018. We have prepared, and are presenting, the range of estimated financial results set forth below in good faith based upon our internal reporting for the quarter ended September 30, 2018. The estimates represent the most current information available to us. Such estimates have not been subject to our normal financial closing and financial statement preparation processes. As a result, our actual results could be different and those differences could be material. Investors should exercise caution in relying on the information contained herein and should not draw any inferences from this information regarding financial or operating data that is not discussed herein.

| • | We expect our revenue (less agency commissions) to be between $278 million and $280 million for the quarter ended September 30, 2018 compared to $219.0 million for the third quarter ended September 30, 2017; and |

| • | We expect broadcast operating expenses to be between $144 million and $146 million, and corporate and administrative expenses to be between $10.5 million and $11.5 million, for the quarter ended September 30, 2018, compared to $139.5 million and $8.3 million, respectively, for the quarter ended September 30, 2017. |

The estimated results of operations for the quarter ended September 30, 2018 included in this offering memorandum have been prepared by, and are the responsibility of, Gray’s management. RSM US LLP has not audited, reviewed, compiled or performed any procedures with respect to the accompanying preliminary financial information. Accordingly, RSM US LLP does not express an opinion or any other form of assurance with respect thereto.

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL AND OTHER DATA OF RAYCOM

We have derived the following summary historical consolidated financial and other data as of and for each of the years ended December 31, 2017, 2016 and 2015 from the audited consolidated carve-out financial statements, and related notes, of Raycom filed by Gray as Exhibit 99.2 to the Current Report on Form 8-K filed with the SEC on November 1, 2018 (the “Raycom Financial Statement 8-K”) and incorporated herein by reference. We have derived the following summary historical financial and other data of Raycom as of and for the six months ended June 30, 2018 and 2017 from the unaudited interim condensed consolidated carve-out financial statements of Raycom filed as Exhibit 99.3 to the Raycom Financial Statement 8-K and incorporated herein by reference. We have derived the following summary historical consolidated financial and other data as of and for the twelve months ended June 30, 2018 by adding the financial and other data from Raycom’s audited consolidated carve-out financial statements for the year ended December 31, 2017 to the financial and other data from Raycom’s unaudited condensed consolidated carve-out financial statements for the six months ended June 30, 2018 and subtracting the financial and other data from Raycom’s unaudited condensed consolidated carve-out financial statements for the six months ended June 30, 2017. You should not consider Raycom’s results for the six month periods or the twelve month period, or Raycom’s financial condition as of any such dates, to be indicative of Raycom’s results or financial condition to be expected for or as of any other interim period or any full year period. The summary historical consolidated financial and other data presented below does not contain all of the information you should consider before deciding whether or not to invest in the notes, and should be read in conjunction with the risk factors included in this offering memorandum and the historical consolidated financial statements, and notes thereto, of Raycom referred to above and incorporated by reference into this offering memorandum.

| Year Ended December 31, | Six Months Ended June 30, (unaudited) |

Twelve Months Ended |

||||||||||||||||||||||

| 2017 | 2016 | 2015 | 2018 | 2017 | June 30, 2018 (unaudited)(2) |

|||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Statement of Operations Data(1): |

||||||||||||||||||||||||

| Revenues (less agency commissions and rep fees) |

$ | 1,058,851 | $ | 1,038,221 | $ | 917,453 | $ | 558,944 | $ | 510,519 | $ | 1,107,276 | ||||||||||||

| Expenses: |

||||||||||||||||||||||||

| Operating |

482,939 | 414,239 | 375,156 | 261,052 | 236,587 | 507,404 | ||||||||||||||||||

| Selling, general and administrative |

269,212 | 260,418 | 236,969 | 134,443 | 131,967 | 271,688 | ||||||||||||||||||

| Depreciation and amortization |

39,661 | 51,881 | 87,429 | 19,132 | 19,902 | 38,891 | ||||||||||||||||||

| Gain on FCC spectrum Auction |

(32,293 | ) | — | — | — | (32,293 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating expenses |

759,519 | 726,538 | 699,554 | 414,627 | 356,163 | 817,983 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating profit |

299,332 | 311,683 | 217,899 | 144,317 | 154,356 | 289,293 | ||||||||||||||||||

| Other income (expense), net |

23,518 | 5,537 | (10,987 | ) | 665 | 1,552 | 22,631 | |||||||||||||||||

| Interest expense |

(176,811 | ) | (172,746 | ) | (166,235 | ) | (87,617 | ) | (86,952 | ) | (177,476 | ) | ||||||||||||

| Interest income |

1,539 | 1,109 | 244 | 141 | 394 | 1,286 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income before income taxes |

147,578 | 145,583 | 40,921 | 57,506 | 69,350 | 135,734 | ||||||||||||||||||

| Income tax expense |

(97,764 | ) | (50,953 | ) | (11,576 | ) | (14,763 | ) | (25,602 | ) | (86,925 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income |

$ | 49,814 | $ | 94,630 | $ | 29,345 | $ | 42,743 | $ | 43,748 | $ | 48,809 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 82,979 | $ | 82,799 | $ | 71,670 | $ | 120,533 | $ | 56,206 | ||||||||||||||

| Goodwill, net |

999,393 | 992,114 | 983,509 | 999,393 | 997,719 | |||||||||||||||||||

| Total assets |

2,226,788 | 2,191,741 | 2,142,947 | 2,208,912 | 2,216,436 | |||||||||||||||||||

| Total debt |

(2,554,415 | ) | (2,567,010 | ) | (2,587,614 | ) | (2,529,777 | ) | (2,599,959 | ) | ||||||||||||||

| Deficit in net assets |

(512,880 | ) | (537,583 | ) | (605,973 | ) | (494,529 | ) | (521,489 | ) | ||||||||||||||

| Cash Flow Data: |

||||||||||||||||||||||||

| Net cash provided by (used in): |

||||||||||||||||||||||||

| Operating activities |

$ | 82,723 | $ | 121,978 | $ | 136,133 | $ | 95,679 | $ | 46,050 | $ | 132,352 | ||||||||||||

| Investing activities |

(28,943 | ) | (48,075 | ) | (239,385 | ) | (5,377 | ) | (75,081 | ) | 40,761 | |||||||||||||

| Financing activities |

(53,600 | ) | (62,774 | ) | 63,636 | (52,748 | ) | 2,439 | (108,787) | |||||||||||||||

| Other Financial and Operating Data(2): |

||||||||||||||||||||||||

| Broadcast cash flow |

$ | 351,225 | $ | 402,325 | $ | 340,440 | $ | 183,298 | $ | 157,841 | $ | 376,682 | ||||||||||||

| Broadcast cash flow less cash corporate expenses |

312,144 | 365,143 | 306,283 | 165,540 | 143,121 | 334,563 | ||||||||||||||||||

| Operating cash flow |

312,144 | 365,143 | 306,283 | 165,540 | 143,121 | 334,563 | ||||||||||||||||||

| Capital expenditures |

(22,852 | ) | (26,169 | ) | (26,780 | ) | (5,377 | ) | (8,223 | ) | (20,006) | |||||||||||||

| (1) | Our operating results fluctuate significantly between years, in accordance with, among other things, increased political advertising expenditures in even-numbered years. |

| (2) | We define Broadcast Cash Flow as net income plus loss from early extinguishment of debt, corporate and administrative expenses, broadcast non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any gain or loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast obligations and network compensation revenue. |

We define Broadcast Cash Flow Less Cash Corporate Expenses as net income plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any gain or loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, and non-cash 401(k) expense, less any gain on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast obligations and network compensation revenue.

We define Operating Cash Flow as defined in the Senior Credit Facility as Combined Historical Basis net income plus loss from early extinguishment of debt, non-cash stock based compensation, depreciation and amortization (including amortization of intangible assets and program broadcast rights), any loss on disposal of assets, any miscellaneous expense, interest expense, any income tax expense, non-cash 401(k) expense and pension expenses less any gain or loss on disposal of assets, any miscellaneous income, any income tax benefits, payments for program broadcast obligations, network compensation revenue and cash contributions to pension plans.

We use these amounts to approximate amounts used to calculate a key financial performance covenant contained in our debt agreements and believe it is useful to investors to understand this measure and its importance to us.

These non-GAAP terms are not defined in GAAP and our definitions may differ from, and therefore not be comparable to, similarly titled measures used by other companies, thereby limiting their usefulness. Such terms are used by management in addition to and in conjunction with results presented in accordance with GAAP and should be considered as supplements to, and not as substitutes for, net income and cash flows reported in accordance with GAAP.

A reconciliation of each of broadcast cash flow, broadcast cash flow less cash corporate expenses and operating cash flow to net income calculated in accordance with GAAP is as follows:

| Year Ended December 31, | Six Months Ended June 30, (unaudited) |

Twelve Months Ended |

||||||||||||||||||||||

| 2017 | 2016 | 2015 | 2018 | 2017 | June 30, 2018 (unaudited) |

|||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Net income |

$ | 49,814 | $ | 94,630 | $ | 29,345 | $ | 42,743 | $ | 43,748 | $ | 48,809 | ||||||||||||

| Adjustments to reconcile net income to broadcast cash flow, broadcast cash flow less cash corporate expenses and operating cash flow: |

||||||||||||||||||||||||

| Depreciation |

36,434 | 35,100 | 34,500 | 18,157 | 17,884 | 36,707 | ||||||||||||||||||

| Amortization of intangible assets |

3,227 | 16,781 | 52,929 | 975 | 2,018 | 2,184 | ||||||||||||||||||

| Non-cash stock based compensation |

5,416 | 2,239 | 1,544 | 3,472 | 2,087 | 6,801 | ||||||||||||||||||

| (Gain) loss on investments, disposal of assets, and other, net |

(58,363 | ) | (5,537 | ) | 10,987 | (665 | ) | (33,845 | ) | (25,183 | ) | |||||||||||||

| Miscellaneous (income)/expense, net |

1,013 | (1,109 | ) | (244 | ) | (141 | ) | (394 | ) | 1,266 | ||||||||||||||

| Interest expense |

176,811 | 172,746 | 166,235 | 87,617 | 86,952 | 177,476 | ||||||||||||||||||

| Income tax expense |

97,764 | 50,953 | 11,576 | 14,763 | 25,602 | 86,925 | ||||||||||||||||||

| Amortization of program broadcast rights |

20,538 | 21,073 | 22,131 | 9,738 | 9,741 | 20,535 | ||||||||||||||||||

| Payments for program broadcast rights |

(20,510 | ) | (21,733 | ) | (22,720 | ) | (11,119 | ) | (10,672 | ) | (20,957 | ) | ||||||||||||

| Corporate and administrative expenses excluding depreciation, amortization of intangible assets and non-cash stock based compensation |

39,081 | 37,182 | 34,157 | 17,758 | 14,720 | 42,119 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Broadcast cash flow |

351,225 | 402,325 | 340,440 | 183,298 | 157,841 | 376,682 | ||||||||||||||||||

| Corporate and administrative expenses excluding depreciation, amortization of intangible assets and non-cash stock based compensation |

(39,081 | ) | (37,182 | ) | (34,157 | ) | (17,758 | ) | (14,720 | ) | (42,119 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Broadcast cash flow less cash corporate expenses |

312,144 | 365,143 | 306,283 | 165,540 | 143,121 | 334,563 | ||||||||||||||||||

| Contributions to pension plans |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating cash flow |

$ | 312,144 | $ | 365,143 | $ | 306,283 | $ | 165,540 | $ | 143,121 | $ | 334,563 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Risks Related to the Raycom Merger

If the Raycom Merger is consummated but we do not realize the expected benefits, including synergies, therefrom, our business and results of operations or financial condition may be materially adversely impacted.

There is no assurance that Raycom will be successfully or cost effectively integrated into our existing business. After the consummation of the Raycom Merger, we will have significantly more television stations covering additional markets and the third largest portfolio of station and markets in the country. The Raycom Merger will also require us to expand the scope of our operations as we will acquire several additional Raycom businesses that will result in a more diversified media company. Our management will be required to devote significant amount of time and attention to the integration process, including managing a significantly larger and more diversified company than before the consummation of the Raycom Merger and integrating operations of the Raycom business while carrying on the ongoing operations of our business. The process of integrating the business operations may cause an interruption of, or loss of momentum in, the activities of our historical business after consummation of the Raycom Merger. If our management is not able to effectively manage the integration process, or if any significant business activities are interrupted as a result of the integration process, our business could suffer and its liquidity, results of operations and financial condition may be materially adversely impacted. In addition, following the consummation of the Raycom Merger, we may identify additional risks and uncertainties not yet known to us.

Even if we are able to successfully integrate Gray and Raycom, it may not be possible to realize the full benefits, including the expected synergies, that are expected to result from the Raycom Merger, or realize these benefits within the time frame that is expected. Our expected cost savings, as well as any revenue or other synergies, are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, all of which are difficult to predict and many of which are beyond our control. If we fail to realize the benefits we anticipate from the Raycom Merger, our liquidity, results of operations or financial condition may be adversely impacted. The Raycom Merger, if consummated, will create numerous risks and uncertainties relating to the successful combination of the businesses to achieve synergies which could adversely affect our business and results of operations. If the Raycom Merger is consummated, our post-closing recourse is limited.

We may be unable to consummate the Raycom Merger, on the terms and within the timeframe currently contemplated or at all, which may negatively impact our business and results of operations or financial condition.

If the Raycom Merger is not consummated, on the terms and within the timeframe currently contemplated or at all, our ongoing businesses may be materially and adversely affected, we will not have realized any of the potential benefits of having consummated the Raycom Merger, and we will be subject to a number of risks, including the following:

| • | matters relating to the Raycom Merger (including integration planning) may require substantial commitments of time and resources by our management, which could otherwise have been devoted to other opportunities that may have been beneficial to us; and |

| • | we could be subject to litigation related to our failure to consummate the Raycom Merger or to perform our obligations under the Merger Agreement. |

If the Raycom Merger is not consummated on the terms and within the timeframe currently contemplated or at all, any or all of these risks may materially adversely impact our business and results of operations or financial condition.

The Raycom Merger is subject to various closing conditions, including governmental and regulatory approvals as well as other uncertainties, and there can be no assurances as to whether and when it may be completed.

Consummation of the Raycom Merger is subject to customary closing conditions, a number of which are outside our control. It is possible that some of the conditions may prevent, delay or otherwise materially adversely affect the completion of the Raycom Merger. These conditions include, among other things: (i) the expiration or earlier termination of the applicable waiting period under the Hart-Scott-Rodino antitrust act, (ii) approval by the FCC, (iii) the absence of legal restraints preventing consummation of the Raycom Merger, (iv) compliance in all material respects by each party with its respective obligations under the Merger Agreement, and (v) no material adverse effect with respect to Raycom or Gray (as described in the Merger Agreement) since the date of execution of the Merger Agreement. We cannot predict with certainty whether and when any of the required closing conditions will be satisfied.

If the Raycom Merger does not receive, or timely receive, the required regulatory approvals and clearances, or if any event occurs that delays or prevents the Raycom Merger, such failure or delay to complete the Raycom Merger may cause uncertainty or other negative consequences that may materially adversely impact our business and results of operations or financial condition.

We will incur significant transaction and merger-related integration costs in connection with the Raycom Transactions.

We expect to pay significant transaction costs in connection with the Raycom Transactions. These transaction costs include legal, accounting and financial advisory fees and expenses, expenses associated with the new indebtedness that will be incurred in connection with the Raycom Transactions, filing fees, printing expenses, mailing expenses and other related charges. The combined company may also incur costs associated with integrating the operations of the two companies, and these costs may be significant and may have an adverse effect on the combined company’s future operating results if the anticipated cost savings from the Raycom Transactions are not achieved. Although we expect that the elimination of duplicative costs, as well as the realization of other efficiencies related to the integration of the two businesses, should allow the combined company to offset these incremental expenses over time, the net benefit may not be achieved in the near term, or at all.

Uncertainties associated with the Raycom Transactions may cause employees to leave Gray, Raycom or the combined company and may otherwise affect the future business and operations of the combined company.

The combined company’s success after the Raycom Transactions will depend in part upon its ability to retain key employees of Gray and Raycom. Prior to and following the closing of the Raycom Transactions, current and prospective employees of Gray and Raycom may experience uncertainty about their future roles with Gray, Raycom or the combined company and choose to pursue other opportunities, which could have an adverse effect on Gray, Raycom or the combined company. If key employees depart, the integration of the two companies may be more difficult and the combined company’s business following the consummation of the Raycom Transactions may be adversely affected.

Risks Related to Our Business

As used in this section “Risks Related to Our Business,” with regard to risk factors that reference the combined company, or the company following the consummation of the Raycom Merger, the terms “we,” “us,” “our” or similar terms shall be deemed to be a reference in such risk factor to the combined company after the consummation of the Raycom Merger, unless the context otherwise dictates.

The success of our business is, and will be following the consummation of the Raycom Merger, dependent upon advertising revenues, which are seasonal and cyclical, and also fluctuate as a result of a number of factors, some of which are beyond our control.

Our main source of revenue is the sale of advertising time and space. Our ability to sell advertising time and space depends on, among other things:

| • | economic conditions in the areas where our stations are located and in the nation as a whole; |

| • | the popularity of the programming offered by our television stations; |

| • | changes in the population demographics in the areas where our stations are located; |

| • | local and national advertising price fluctuations, which can be affected by the availability of programming, the popularity of programming, and the relative supply of and demand for commercial advertising; |

| • | our competitors’ activities, including increased competition from other advertising-based mediums, particularly cable networks, MVPDs and the internet; |

| • | the duration and extent of any network preemption of regularly scheduled programming for any reason; |

| • | decisions by advertisers to withdraw or delay planned advertising expenditures for any reason; |

| • | labor disputes or other disruptions at major national advertisers, programming providers or networks; and |

| • | other factors beyond our control. |

Our results are also subject to seasonal and cyclical fluctuations. Seasonal fluctuations typically result in higher revenue and broadcast operating income in the second and fourth quarters than in the first and third quarters of each year. This seasonality is primarily attributable to advertisers’ increased expenditures in the spring and in anticipation of holiday season spending in the fourth quarter and an increase in television viewership during this period. In addition, we typically experience fluctuations in our revenue and broadcast operating income between even-numbered and odd-numbered years. In years in which there are impending elections for various state and national offices, which primarily occur in even-numbered years, political advertising revenue tends to increase, often significantly, and particularly during presidential election years. We consider political advertising revenue to be revenue earned from the sale to political candidates, political parties and special interest groups of advertisements broadcast by our stations that contain messages primarily focused on elections and/or public policy issues. In even-numbered years, we typically derive a material portion of our broadcast advertising revenue from political broadcast advertisers. For the years ended December 31, 2017 and 2016, we derived approximately 2% and 11%, respectively, of our total revenue from political advertising revenue and Raycom derived approximately 2% and 8%, respectively, of its total revenue from political advertising revenue. If political advertising revenues declined, especially in an even-numbered year, our results of operations and financial condition could also be materially adversely affected. Also, our stations affiliated with the NBC Network broadcast Olympic Games and typically experience increased viewership and revenue during those broadcasts, which also occur in even-numbered years. As a result of the seasonality and cyclicality of our revenue and broadcast operating income, and the historically significant increase in our revenue and broadcast operating income during even-numbered years, potential investors are cautioned that it has been, and is expected to remain, difficult to engage in period-over-period comparisons of our revenue and results of operations.

Continued uncertain financial and economic conditions may have an adverse impact on our business, results of operations or financial condition including on the combined company after the consummation of the Raycom Merger.

Financial and economic conditions continue to be uncertain over the longer term and the continuation or worsening of such conditions could reduce consumer confidence and have an adverse effect on our business, results of operations and/or financial condition. If consumer confidence were to decline, this decline could negatively affect our advertising customers’ businesses and their advertising budgets. In addition, volatile economic conditions could have a negative impact on our industry or the industries of our customers who advertise on our stations, resulting in reduced advertising sales. Furthermore, it may be possible that actions taken by any governmental or regulatory body for the purpose of stabilizing the economy or financial markets will not achieve their intended effect. In addition to any negative direct consequences to our business or results of operations arising from these financial and economic developments, some of these actions may adversely affect financial institutions, capital providers, advertisers or other consumers on whom we rely, including for access to future capital or financing arrangements necessary to support our business. Our inability to obtain financing in amounts and at times necessary could make it more difficult or impossible to meet our obligations or otherwise take actions in our best interests.

Our dependence upon a limited number of advertising categories could adversely affect our business.

We consider broadcast advertising revenue to be revenue earned primarily from the sale of advertisements broadcast by our stations. Although no single customer represented more than 5% of our broadcast advertising revenue for the year ended December 31, 2017 or the twelve months ended June 30, 2018, we and Raycom derived a material portion of non-political broadcast advertising revenue from advertisers in a limited number of industries, particularly the automotive industry. For the year ended December 31, 2017 and the twelve months ended June 30, 2018, we derived approximately 25% and 24%, respectively, of our total broadcast advertising revenue from our advertisers in the automotive industry and Raycom derived approximately 19% and 17%, respectively, of its total broadcast advertising revenue from its advertisers in the automotive industry. Our results of operations and financial condition could be materially adversely affected, including after the consummation of the Raycom Merger, if broadcast advertising revenue from the automotive, or certain other industries, such as the medical, restaurant, communications, or furniture and appliances, industries, declined.

We intend to continue to evaluate growth opportunities through strategic acquisitions, including after the consummation of the Raycom Merger, and there are significant risks associated with an acquisition strategy.

We intend to continue to evaluate opportunities for growth through selective acquisitions of television stations or station groups. There can be no assurances that we will be able to identify any suitable acquisition candidates, and we cannot predict whether we will be successful in pursuing or completing any acquisitions, or what the consequences of not completing any acquisitions would be. Consummation of any proposed acquisition at any time may also be subject to various conditions such as compliance with FCC rules and policies. Consummation of acquisitions may also be subject to antitrust or other regulatory requirements.

An acquisition strategy involves numerous other risks, including risks associated with:

| • | identifying suitable acquisition candidates and negotiating definitive purchase agreements on satisfactory terms; |

| • | integrating operations and systems and managing a large and geographically diverse group of stations; |

| • | obtaining financing to complete acquisitions, which financing may not be available to us at times, in amounts, or at rates acceptable to us, if at all, and potentially the related risks associated with increased debt; |

| • | diverting our management’s attention from other business concerns; |

| • | potentially losing key employees; and |

| • | potential changes in the regulatory approval process that may make it materially more expensive, or materially delay our ability, to consummate any proposed acquisitions. |

Our failure to identify suitable acquisition candidates, or to complete any acquisitions and integrate any acquired business, or to obtain the expected benefits therefrom, could materially adversely affect our business, financial condition and results of operations.

We may fail to realize any benefits and incur unanticipated losses related to any acquisition.

The success of any strategic acquisition depends, in part, on our ability to successfully combine the acquired business and assets with our business and our ability to successfully manage the assets so acquired. It is possible that the integration process could result in the loss of key employees, the disruption of ongoing business or inconsistencies in standards, controls, procedures and policies that adversely affect our ability to maintain relationships with clients, customers and employees or to achieve the anticipated benefits of the acquisition. Successful integration may also be hampered by any differences between the operations and corporate culture of the two organizations. Additionally, general market and economic conditions may inhibit our successful integration of any business. If we experience difficulties with the integration process, the anticipated benefits of the acquisition may not be realized fully, or at all, or may take longer to realize than expected. Finally, any cost savings that are realized may be offset by losses in revenues from the acquired business, any assets or operations disposed of in connection therewith or otherwise, or charges to earnings in connection with such acquisitions.

We must purchase television programming in advance of knowing whether a particular show will be popular enough for us to recoup our costs.

One of our most significant costs is for the purchase of television programming. If a particular program is not sufficiently popular among audiences in relation to the cost we pay for such program, we may not be able to sell enough related advertising time for us to recover the costs we pay to broadcast the program. We also must usually purchase programming several years in advance, and we may have to commit to purchase more than one year’s worth of programming, resulting in the incurrence of significant costs in advance of our receipt of any related revenue. We may also replace programs that are performing poorly before we have recaptured any significant portion of the costs we incurred in obtaining such programming or fully expensed the costs for financial reporting purposes. Any of these factors could reduce our revenues, result in the incurrence of impairment charges or otherwise cause our costs to escalate relative to revenues.

We are, and will be following the consummation of the Raycom Merger, highly dependent upon our network affiliations, and our business and results of operations may be materially affected if a network (i) terminates its affiliation with us, (ii) significantly changes the economic terms and conditions of any future affiliation agreements with us or (iii) significantly changes the type, quality or quantity of programming provided to us under an affiliation agreement.

Our business depends in large part on the success of our network affiliations. Nearly all of our stations are directly or indirectly affiliated with at least one of the four major broadcast networks pursuant to a separate affiliation agreement. Each affiliation agreement provides the affiliated station with the right to broadcast all programs transmitted by the affiliated network during the term of the related agreement. The combined company’s affiliation agreements generally expire at various dates through December 2023. See “Business — Markets and Stations” incorporated by reference into this offering memorandum for additional information on all of our affiliation agreements and their respective expiration dates.

If we cannot enter into affiliation agreements to replace any agreements in advance of their expiration, we would no longer be able to carry the affiliated network’s programming. This loss of programming would require us to seek to obtain replacement programming. Such replacement programming may involve higher costs and may not be as attractive to our target audiences, thereby reducing our ability to generate advertising revenue. Furthermore, our concentration of CBS and/or NBC affiliates makes us particularly sensitive to adverse changes in our business relationship with, and the general success of, CBS and/or NBC and Raycom’s concentration of NBC and CBS affiliates similarly makes Raycom particularly sensitive to the relationship with and general success of NBC and CBS.

We can give no assurance that any future affiliation agreements will have economic terms or conditions equivalent to or more advantageous to us than our current agreements. If in the future a network or networks impose more adverse economic terms upon us, such event or events could have a material adverse effect on our business and results of operations.

In addition, if we are unable to renew or replace any existing affiliation agreements, we may be unable to satisfy certain obligations under our existing or any future retransmission consent agreements with MVPDs and/or secure payment of retransmission consent fees under such agreements. Furthermore, if in the future a network limited or removed our ability to retransmit network programming to MVPDs, we may be unable to satisfy certain obligations or criteria for fees under any existing or any future retransmission consent agreements. In either case, such an event could have a material adverse effect on our business and results of operations.

We are, and expect to continue to be following the consummation of the Raycom Merger, also dependent upon our retransmission consent agreements with MVPDs, and we cannot predict the outcome of potential regulatory changes to the retransmission consent regime.

We are also dependent, in significant part, on our retransmission consent agreements. Our current retransmission consent agreements expire at various times over the next several years. No assurances can be provided that we will be able to renegotiate all of such agreements on favorable terms, on a timely basis, or at all. The failure to renegotiate such agreements could have a material adverse effect on our business and results of operations.

Our ability to successfully negotiate future retransmission consent agreements may be hindered by potential legislative or regulatory charges to the framework under which these agreements are negotiated.

For example, on March 31, 2014, the FCC amended its rules governing “good faith” retransmission consent negotiations to provide that it is a per se violation of the statutory duty to negotiate in good faith for a television broadcast station that is ranked among the top-four stations in a market (as measured by audience share) to negotiate retransmission consent jointly with another top-four station in the same market if the stations are not commonly owned. As part of the STELA Reauthorization Act of 2014 (“STELAR”), Congress further tightened the restriction to prohibit joint negotiation with any television station in the same market unless the stations are under common de jure control. We currently are not a party to any agreements that delegate our authority to negotiate retransmission consent for any of our television stations or grant us authority to negotiate retransmission consent for any other television station. Nevertheless, we cannot predict how this restriction might impact future opportunities.

The FCC also has sought comment on whether it should modify or eliminate the network non-duplication and syndicated exclusivity rules. We cannot predict the outcome of this proceeding. If, however, the FCC eliminates or relaxes its rules enforcing our program exclusivity rights, it could affect our ability to negotiate future retransmission consent agreements, and it could harm our ratings and advertising revenue if cable and satellite operators import duplicative programming.

In addition, certain online video distributors (“OVDs”) have explored streaming broadcast programming over the internet without approval from or payments to the broadcaster. The majority of federal courts have issued preliminary injunctions enjoining these OVDs from streaming broadcast programming because the courts have generally concluded that OVDs are unlikely to demonstrate that they are eligible for the statutory copyright license that provides cable operators with the requisite copyrights to retransmit broadcast programming, although in July 2015 a district court concluded that OVDs should be eligible for the statutory copyright license. We cannot predict the outcome of that appeal or whether the courts will continue to issue similar injunctions against future OVDs. Separately, on December 19, 2014, the FCC issued an NPRM proposing to classify certain OVDs as MVPDs for purposes of certain FCC carriage rules. If the FCC adopts its proposal, OVDs would need to negotiate for consent from broadcasters before they retransmit broadcast signals. We cannot predict whether the FCC will adopt its proposal or other modified rules that might weaken our rights to negotiate with OVDs.

In September 2015, the FCC, in accordance with STELAR, issued a notice of proposed rulemaking to review the “totality of the circumstances test” used to evaluate whether broadcast stations and MVPDs are negotiating for retransmission consent in good faith. In a July 14, 2016 blog post, the Chairman of the FCC announced that the FCC will not be adopting additional rules governing the retransmission consent process as a part of this proceeding. Instead, the FCC will monitor retransmission consent negotiations and rule on good-faith-negotiation complaints on a case-by-case basis. We cannot predict whether this approach will affect our ability to negotiate retransmission consent agreements, including the rates that we obtain from MVPDs, nor can we predict whether the FCC might reopen this proceeding in the future. The FCC also has taken other actions to implement various provisions of STELAR affecting the carriage of television stations, including (i) adopting rules that allow for the modification of satellite television markets in order to ensure that satellite operators carry the broadcast stations of most interest to their communities, (ii) prohibiting a television station from limiting the ability of an MVPD to carry into its local market television signals that are deemed significantly viewed; and (iii) eliminating the “sweeps prohibition,” which had precluded cable operators from deleting or repositioning local commercial television stations during “sweeps” ratings periods.

Congress also continues to consider various changes to the statutory scheme governing retransmission of broadcast programming. Some of the proposed bills would make it more difficult to negotiate retransmission consent agreements with large MVPDs and would weaken our leverage to seek market-based compensation for our programming. We cannot predict whether any of these proposals will become law, and, if any do, we cannot determine the effect that any statutory changes would have on our business.

We operate in a highly competitive environment. Competition occurs on multiple levels (for audiences, programming and advertisers) and is based on a variety of factors. If we are not able to successfully compete in all relevant aspects, our revenues will be materially adversely affected.

Television stations compete for audiences, certain programming (including news) and advertisers. Signal coverage and carriage on MVPD systems also materially affect a television station’s competitive position. With respect to audiences, stations compete primarily based on broadcast program popularity. We cannot provide any assurances as to the acceptability by audiences of any of the programs we broadcast. Further, because we compete with other broadcast stations for certain programming, we cannot provide any assurances that we will be able to obtain any desired programming at costs that we believe are reasonable. Cable-network programming, combined with increased access to cable and satellite TV, has become a significant competitor for broadcast television programming viewers. Cable networks’ viewership and advertising share have increased due to the growth in MVPD penetration (the percentage of television households that are connected to a MVPD system) and increased investments in programming by cable networks. Further increases in the advertising share of cable networks could materially adversely affect the advertising revenue of our television stations.