Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MIDSOUTH BANCORP INC | midsouth-form8xkxconsentor.htm |

| EX-99.1 - EXHIBIT 99.1 - MIDSOUTH BANCORP INC | ex991consentorder.htm |

UNITED STATES OF AMERICA

DEPARTMENT OF THE TREASURY

COMPTROLLER OF THE CURRENCY

AA-SO-2018-62

AA-SO-2018-62STIPULATION AND CONSENT ero THE ISSUANCE

OF A CONSENT ORDER

WHEREAS, the Comptroller of the Currency of the United States of America

("Comptroller"), based on information derived from the exercise of his regulatory and supervisory responsibilities, intends to issue a cease and desist order to MidSouth Bank, National Association, Lafayette, Louisiana ("Bank"), pursuant to 12 U.S.C. 181 8(b), for violations of 12 C.F.R. { 21.21.

WHEREAS, in the interest of cooperation and to avoid additional costs associated with administrative and judicial proceedings with respect to the above matter, the Bank, through its duly elected and acting Board of Directors (the "Board"), has agreed to execute this Stipulation and Consent to the Issuance of a Consent Order ("Stipulation"), that is accepted by the

Comptroller, through his duly authorized representative;

NOW THEREFORE, in consideration of the above premises, it is stipulated by the

Bank that:

ARTICLE I

JURISDICTION

( l ) The Bank is a national banking association chartered and examined by the

15

Comptroller pursuant to the National Bank Act of 1 864, as amended, 12 U.S.C. l , et seq.

(2)The Comptroller is "the appropriate Federal banking agency" regarding the Bank pursuant to 12 U.S.C. 1 813(q) and 181 8(b).

(3)The Bank is an "insured depository institution" within the meaning of

12 U.S.C.  and 1813(c).

and 1813(c).

and 1813(c).

and 1813(c).ARTICLE Il

AGREEMENT

(l ) The Bank, without admitting or denying any wrongdoing, hereby consents and agrees to the issuance of the accompanying Consent Order ("Order") by the Comptroller.

(2)The Bank consents and agrees that said Order shall be deemed an "order issued with the consent of the depository institution" as defined in 12 U.S.C. SS 181 8(h)(2), and consents and agrees that said Order shall become effective upon its execution by the OCC through the Comptroller's duly authorized representative, and shall be fully enforceable by the Comptroller under the provisions of 12 U.S.C. 181 8.

(3)Notwithstanding the absence of mutuality of obligation, or of consideration, or of a contract, the Comptroller may enforce any of the commitments or obligations herein undertaken by the Bank under his supervisory powers, including 12 U.S.C. 181 8(i), and not as a matter of contract law. The Bank expressly acknowledges that neither the Bank nor the

Comptroller has any intention to enter into a contract.

16

(4)The Bank declares that no separate promise or inducement of any kind has been made by the OCC, or by its officers, employees, or agents, to cause or induce the Bank to consent to the issuance of the Order and/or execute this Stipulation.

(5)The Bank expressly acknowledges that no officer or employee of the Comptroller has statutory or other authority to bind the United States, the United States Treasury Department, the Comptroller, or any other federal bank regulatory agency or entity, or any officer or employee of any of those entities to a contract affecting the Comptroller's exercise of his supervisory responsibilities.

(6)The terms and provisions of the Stipulation and the Order shall be binding upon, and inure to the benefit of, the parties hereto and their successors in interest. Nothing in this Stipulation or the Order, express or implied, shall give to any person or entity, other than the parties hereto, and their successors hereunder, any benefit or any legal or equitable right, remedy or claim under this Stipulation or the Order.

ARTICLE Ill

WAIVERS

(l ) The Bank, by signing this Stipulation and consenting to the Order, hereby waives:

(a) | any and all rights to the issuance of a Notice of Charges pursuant to |

12 | U.S.C. 1818(b); |

(b) | any and all procedural rights available in connection with the issuance of the Order; |

(c) | any and all rights to a hearing and a final agency decision pursuant to |

12 | U.S.C. 1 818(b) and (h), 12 C.F.R. Pan 19; |

(d) | all rights to seek any type of administrative or judicial review of the |

17

Order;

(e) | any and all claims for fees, costs, or expenses against the Comptroller, or any of his agents, officers or employees, related in any way to this enforcement matter or the Order, whether arising under common law or under the terms of any statute, including, but not limited to, the Equal |

Access to Justice Act, 5 U.S.C. 504 and 28 U.S.C. 2412;

(f) | any and all rights to assert this proceeding, this Stipulation, consent to the issuance of the Order, and/or the issuance of the Order, as the basis for a claim of double jeopardy in any pending or future proceeding brought by the United States Department of Justice, or any other governmental entity; and |

(g) | any and all rights to challenge or contest the validity of the Order. |

ARTICLE IV

CLOSING

(l ) The provisions of this Stipulation and the Order shall not inhibit, estop, bar, or otherwise prevent the Comptroller from taking any other action affecting the Bank if, at any time, it deems it appropriate to do so to fulfill the responsibilities placed upon it by the several laws of the United States of America.

(2)Nothing in this Stipulation or the Order shall preclude any proceedings brought by the Comptroller to enforce the terms of the Order, and nothing in this Stipulation or the Order constitutes, nor shall the Bank contend that it constitutes, a release, discharge, compromise, settlement, dismissal, or resolution of any actions, or in any way affects any actions

18

that may be or have been brought by any other representative of the United States or an agency

thereof, including, without limitation, the United States Department of Justice.

(1)The terms of this Stipulation, including this paragraph, and of the Order are not subject to amendment or modification by any extraneous expression, prior agreements orprior arrangements between the parties, whether oral or written.

IN TESTIMONY WHEREOF, the undersigned, authorized by the Comptroller as his

representative, has hereunto set his hand on behalf of the Comptroller.

IN TESTIMONY WHEREOF, the undersigned, as the duly elected and acting Board of Directors of the Bank, have hereunto set their hands on behalf of the Bank.

19

that may be or have been brought by any other representative of the United States or an agency

thereof, including, without limitation, the United States Department of Justice.

(3)The terms of this Stipulation, including this paragraph, and of the Order are not subject to amendment or modification by any extraneous expression, prior agreements or

prior arrangements between the parties, whether oral or written.

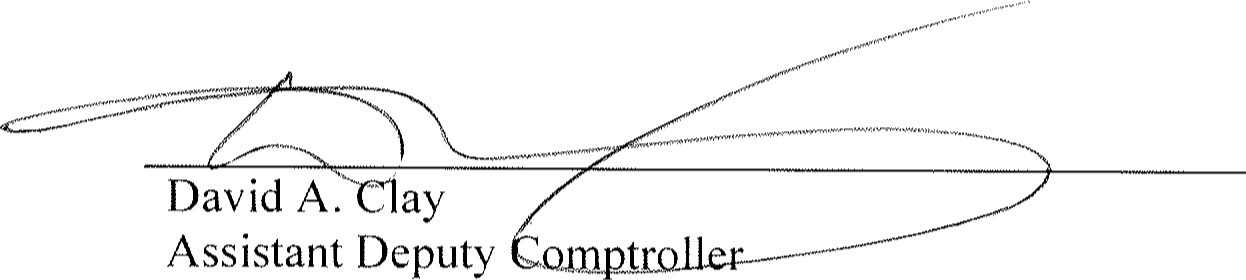

IN TESTIMONY WHEREOF, the undersigned, authorized by the Comptroller as his

representative, has hereunto set his hand on behalf of the Comptroller.

10/25/18

10/25/18Date

New Orleans Field Office

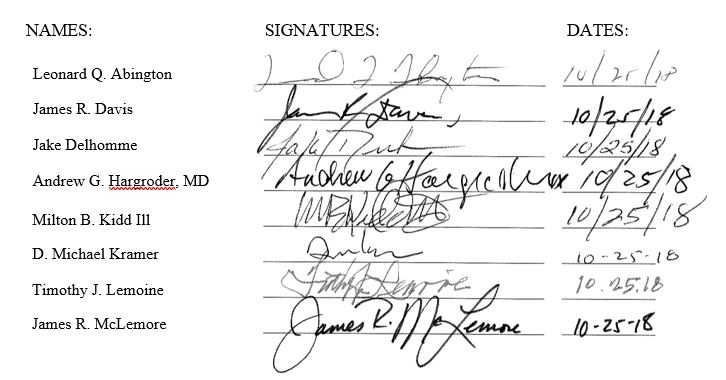

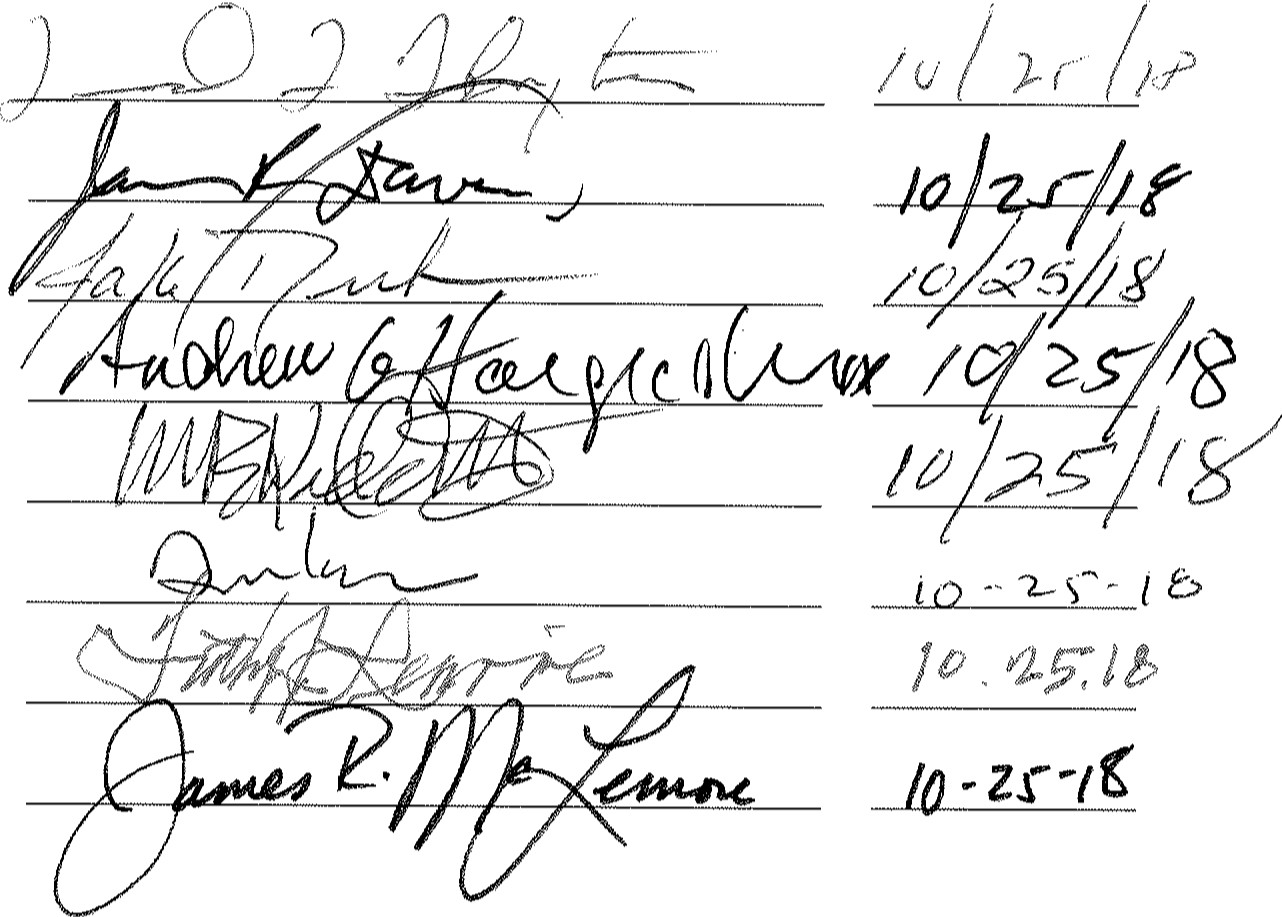

IN TESTIMONY WHEREOF, the undersigned, as the duly elected and acting Board of Directors of the Bank, have hereunto set their hands on behalf of the Bank.

NAMES: SIGNATURES: DATES:

Leonard Q. Abington

Leonard Q. AbingtonJames R. Davis

Jake Delhomme

Andrew G. Hargroder, MD

Milton B. Kidd Ill

D. Michael Kramer

Timothy J. Lemoine

James R. McLemore

20

20