Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - MASIMO CORP | investorrelationsnongaap.htm |

| EX-99.1 - EXHIBIT 99.1 - MASIMO CORP | masi-20181031xex991.htm |

| 8-K - 8-K - MASIMO CORP | masi-20181031x8k.htm |

Q3 2018 Results Supplemental Presentation to Earnings Press Release October 31, 2018 © 2018 Masimo. All Rights Reserved.

Forward-Looking Statements All statements other than statements of historical facts contained herein that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, the statements about our expectations for full fiscal year 2018 total, product, royalty revenues and other, GAAP earnings per diluted share and our long-term outlook; demand for our products; anticipated revenue and earnings growth; our financial condition, results of operations and business generally; expectations regarding our ability to design and deliver innovative new noninvasive technologies and reduce the cost of care; and demand for our technologies. These forward-looking statements are based on management’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks include, but are not limited to, those related to: our dependence on Masimo SET® and Masimo rainbow SET™ products and technologies for substantially all of our revenue; any failure in protecting our intellectual property; exposure to competitors’ assertions of intellectual property claims; the highly competitive nature of the markets in which we sell our products and technologies; any failure to continue developing innovative products and technologies; the lack of acceptance of any of our current or future products and technologies; obtaining regulatory approval of our current and future products and technologies; the risk that the implementation of our international realignment will not continue to produce anticipated operational and financial benefits, including a continued lower effective tax rate; the loss of our customers; the failure to retain and recruit senior management; product liability claims exposure; a failure to obtain expected returns from the amount of intangible assets we have recorded; the maintenance of our brand; the amount and type of equity awards that we may grant to employees and service providers in the future; our ongoing litigation and related matters; and other factors discussed in the “Risk Factors” section of our most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including our most recent Form 10-K and Form 10-Q, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. © 2018 Masimo. All Rights Reserved.

Non-GAAP Financial Measures The non-GAAP financial measures contained herein are a supplement to the corresponding financial measures prepared in accordance with U.S. generally accepted accounting principles (GAAP). The non-GAAP financial measures presented exclude the items that are more fully described below. Management believes that adjustments for these items assist investors in making comparisons of period-to- period operating results and that these items are not indicative of the company’s on-going core operating performance. These non- GAAP financial measures have certain limitations in that they do not reflect all of the costs associated with the operations of the company’s business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to, and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. The non-GAAP financial measures presented by the company may be different from the non-GAAP financial measures used by other companies. The company has presented the following non-GAAP measures to assist investors in understanding the company’s core net operating results on an on-going basis: (i) non-GAAP net income, (ii) non-GAAP product revenue, (iii) non-GAAP gross profit, (iv) non-GAAP operating expenses, (v) non-GAAP non-operating income (expense), and (vi) non-GAAP net income per diluted share. These non- GAAP financial measures may also assist investors in making comparisons of the company’s core operating results with those of other companies. Management believes non-GAAP product revenue, non-GAAP gross profit, non-GAAP net income and non-GAAP net income per diluted share are important measures in the evaluation of the company’s performance and uses these measures to better understand and evaluate our business. The non-GAAP financial measures reflect adjustments for the following items, as well as the related income tax effects thereof: acquisition-related depreciation and amortization, realized and unrealized gains or losses from foreign currency transactions, excess tax benefits from stock-based compensation and tax impacts that may not be representative of the ongoing results of our core operations. For additional financial details, please visit the Investor Relations section of the Company’s website at www.masimo.com to access Supplementary Financial Information. © 2018 Masimo. All Rights Reserved.

Impact of Adoption of New Accounting Standard (ASC 606) During the first quarter of 2018, the Company adopted Financial Accounting Standards Board (FASB) Accounting Standards Update No. 2014-09, Revenue (Topic 606): Revenue from Contracts with Customers (ASU 2014-09). The new revenue recognition standard requires the Company to make numerous assumptions that are based upon historical trends and management judgment. These assumptions may change over time and may have a material impact on our revenue recognition, guidance and results of operations. In accordance with the full retrospective method of adoption, the Company has adjusted certain amounts previously reported in its unaudited condensed consolidated financial statements to comply with the new standard, as indicated by the notation, “As Adjusted”. For additional information with respect to the impact of the adoption of this new accounting standard and reconciliations to the prior reported amounts, please reference Note 2 to our condensed consolidated financial statements that will be included in Part I, Item 1 of our Quarterly Report on Form 10-Q (Form 10-Q) for the quarter ended September 30, 2018 once filed with the Securities and Exchange Commission (SEC) and Exhibit 99.3 that was included in our Current Report on Form 8-K that was filed with the SEC today. © 2018 Masimo. All Rights Reserved.

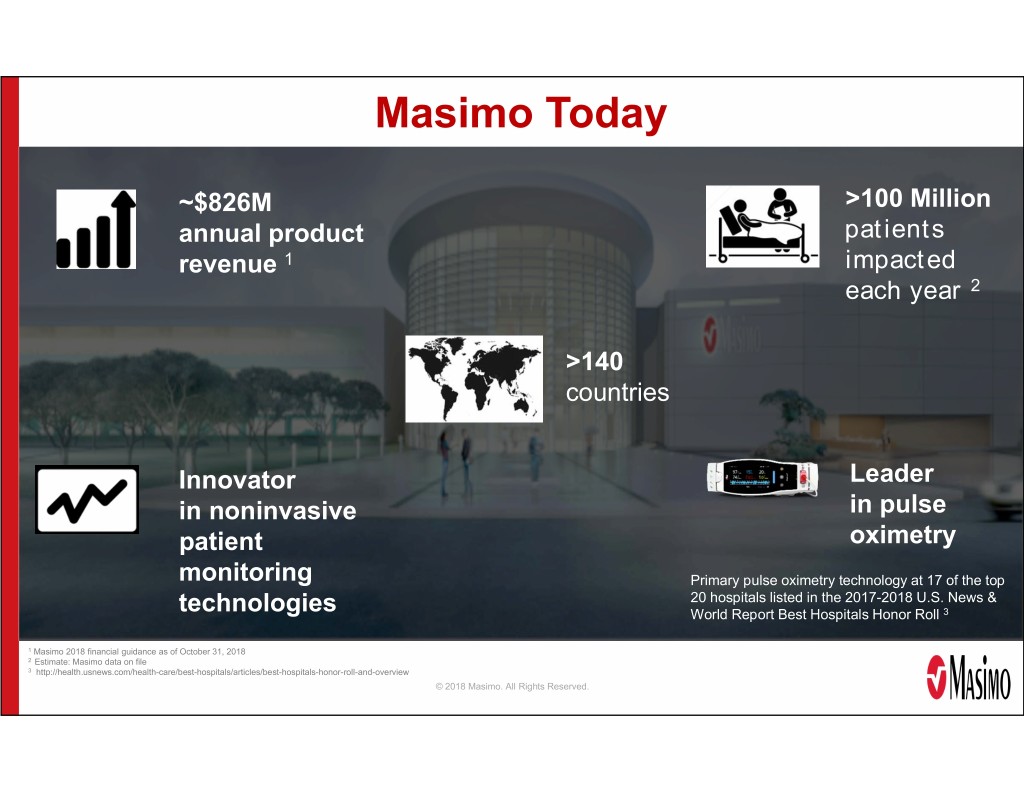

Masimo Today ~$826M >100 Million annual product patients revenue 1 impacted each year 2 >140 countries Innovator Leader in noninvasive in pulse patient oximetry monitoring Primary pulse oximetry technology at 17 of the top 20 hospitals listed in the 2017-2018 U.S. News & technologies World Report Best Hospitals Honor Roll 3 1 Masimo 2018 financial guidance as of October 31, 2018 2 Estimate: Masimo data on file 3 http://health.usnews.com/health-care/best-hospitals/articles/best-hospitals-honor-roll-and-overview © 2018 Masimo. All Rights Reserved.

Seven Year Plan ► Our customers and partners are embracing us ► Targeting long-term revenue growth of 8%-10% ► Targeting long-term operating profit margin of 30% ► Targets do not include contributions from products in pipeline or M&A ► We are a 29 year-old company that has the passion of a start-up ► Our technologies provide meaningful clinical benefits and reduce costs of care © 2018 Masimo. All Rights Reserved.

Q3 2018 Highlights ► Total revenue, including royalty and other revenue, of $210.6 million ► Product revenue increased 12.4% to $202.1 million, up 12.8% on a constant currency basis ► Shipped 59,100 noninvasive technology boards and monitors ► GAAP operating profit margin of 23.1%; Non-GAAP operating profit margin increased 100 basis points to 23.5% ► GAAP diluted earnings per share of $1.02; Non-GAAP diluted earnings per share increased 26.8% to $0.71 © 2018 Masimo. All Rights Reserved.

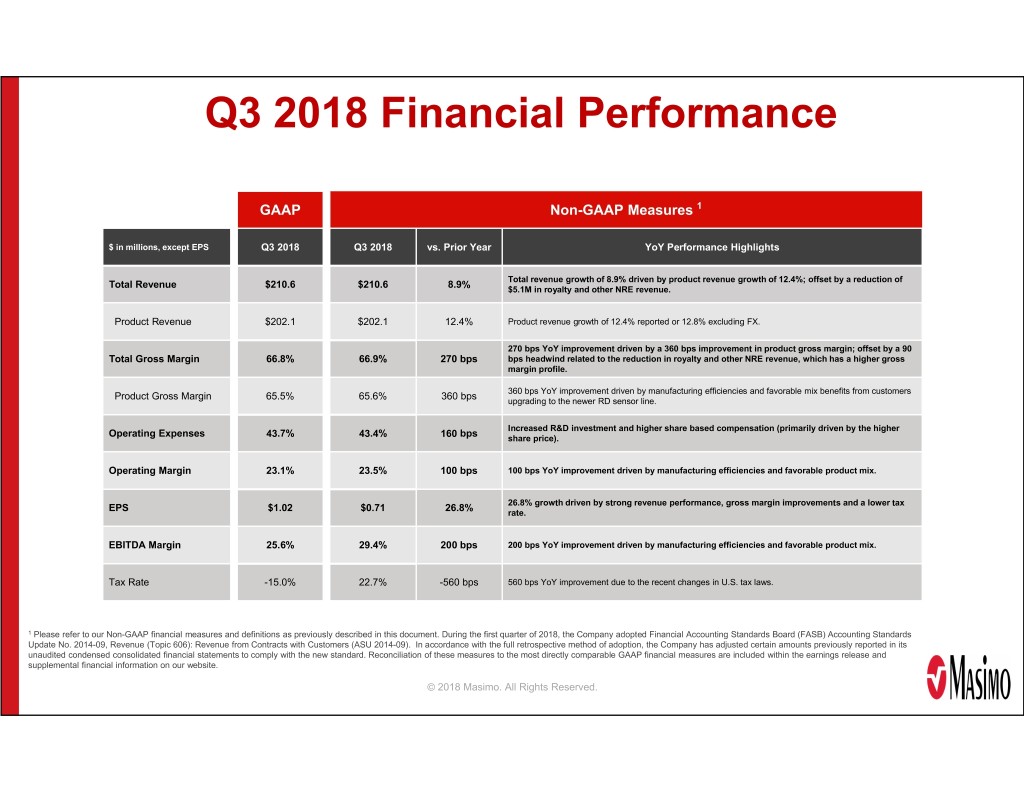

Q3 2018 Financial Performance GAAP Non-GAAP Measures 1 $ in millions, except EPS Q3 2018 Q3 2018 vs. Prior Year YoY Performance Highlights Total revenue growth of 8.9% driven by product revenue growth of 12.4%; offset by a reduction of Total Revenue $210.6 $210.6 8.9% $5.1M in royalty and other NRE revenue. Product Revenue $202.1 $202.1 12.4% Product revenue growth of 12.4% reported or 12.8% excluding FX. 270 bps YoY improvement driven by a 360 bps improvement in product gross margin; offset by a 90 Total Gross Margin 66.8% 66.9% 270 bps bps headwind related to the reduction in royalty and other NRE revenue, which has a higher gross margin profile. 360 bps YoY improvement driven by manufacturing efficiencies and favorable mix benefits from customers Product Gross Margin 65.5% 65.6% 360 bps upgrading to the newer RD sensor line. Increased R&D investment and higher share based compensation (primarily driven by the higher Operating Expenses 43.7% 43.4% 160 bps share price). Operating Margin 23.1% 23.5% 100 bps 100 bps YoY improvement driven by manufacturing efficiencies and favorable product mix. 26.8% growth driven by strong revenue performance, gross margin improvements and a lower tax EPS $1.02 $0.71 26.8% rate. EBITDA Margin 25.6% 29.4% 200 bps 200 bps YoY improvement driven by manufacturing efficiencies and favorable product mix. Tax Rate -15.0% 22.7% -560 bps 560 bps YoY improvement due to the recent changes in U.S. tax laws. 1 Please refer to our Non-GAAP financial measures and definitions as previously described in this document. During the first quarter of 2018, the Company adopted Financial Accounting Standards Board (FASB) Accounting Standards Update No. 2014-09, Revenue (Topic 606): Revenue from Contracts with Customers (ASU 2014-09). In accordance with the full retrospective method of adoption, the Company has adjusted certain amounts previously reported in its unaudited condensed consolidated financial statements to comply with the new standard. Reconciliation of these measures to the most directly comparable GAAP financial measures are included within the earnings release and supplemental financial information on our website. © 2018 Masimo. All Rights Reserved.

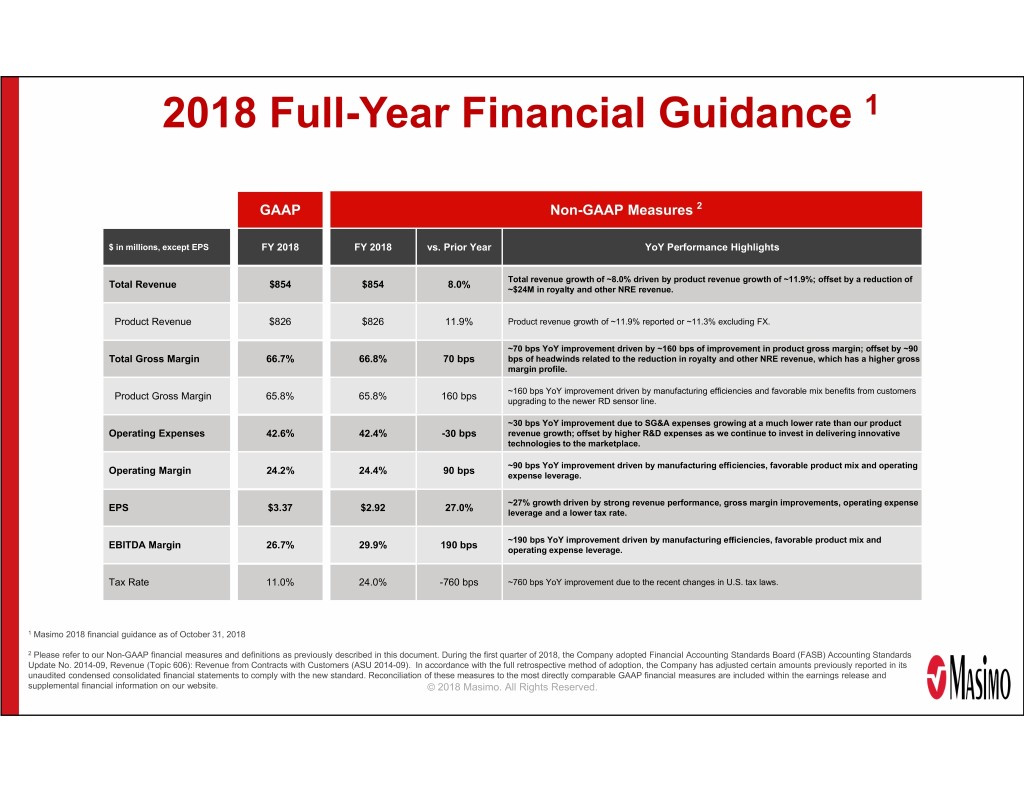

2018 Full-Year Financial Guidance 1 GAAP Non-GAAP Measures 2 $ in millions, except EPS FY 2018 FY 2018 vs. Prior Year YoY Performance Highlights Total revenue growth of ~8.0% driven by product revenue growth of ~11.9%; offset by a reduction of Total Revenue $854 $854 8.0% ~$24M in royalty and other NRE revenue. Product Revenue $826 $826 11.9% Product revenue growth of ~11.9% reported or ~11.3% excluding FX. ~70 bps YoY improvement driven by ~160 bps of improvement in product gross margin; offset by ~90 Total Gross Margin 66.7% 66.8% 70 bps bps of headwinds related to the reduction in royalty and other NRE revenue, which has a higher gross margin profile. ~160 bps YoY improvement driven by manufacturing efficiencies and favorable mix benefits from customers Product Gross Margin 65.8% 65.8% 160 bps upgrading to the newer RD sensor line. ~30 bps YoY improvement due to SG&A expenses growing at a much lower rate than our product Operating Expenses 42.6% 42.4% -30 bps revenue growth; offset by higher R&D expenses as we continue to invest in delivering innovative technologies to the marketplace. ~90 bps YoY improvement driven by manufacturing efficiencies, favorable product mix and operating Operating Margin 24.2% 24.4% 90 bps expense leverage. ~27% growth driven by strong revenue performance, gross margin improvements, operating expense EPS $3.37 $2.92 27.0% leverage and a lower tax rate. ~190 bps YoY improvement driven by manufacturing efficiencies, favorable product mix and EBITDA Margin 26.7% 29.9% 190 bps operating expense leverage. Tax Rate 11.0% 24.0% -760 bps ~760 bps YoY improvement due to the recent changes in U.S. tax laws. 1 Masimo 2018 financial guidance as of October 31, 2018 2 Please refer to our Non-GAAP financial measures and definitions as previously described in this document. During the first quarter of 2018, the Company adopted Financial Accounting Standards Board (FASB) Accounting Standards Update No. 2014-09, Revenue (Topic 606): Revenue from Contracts with Customers (ASU 2014-09). In accordance with the full retrospective method of adoption, the Company has adjusted certain amounts previously reported in its unaudited condensed consolidated financial statements to comply with the new standard. Reconciliation of these measures to the most directly comparable GAAP financial measures are included within the earnings release and supplemental financial information on our website. © 2018 Masimo. All Rights Reserved.

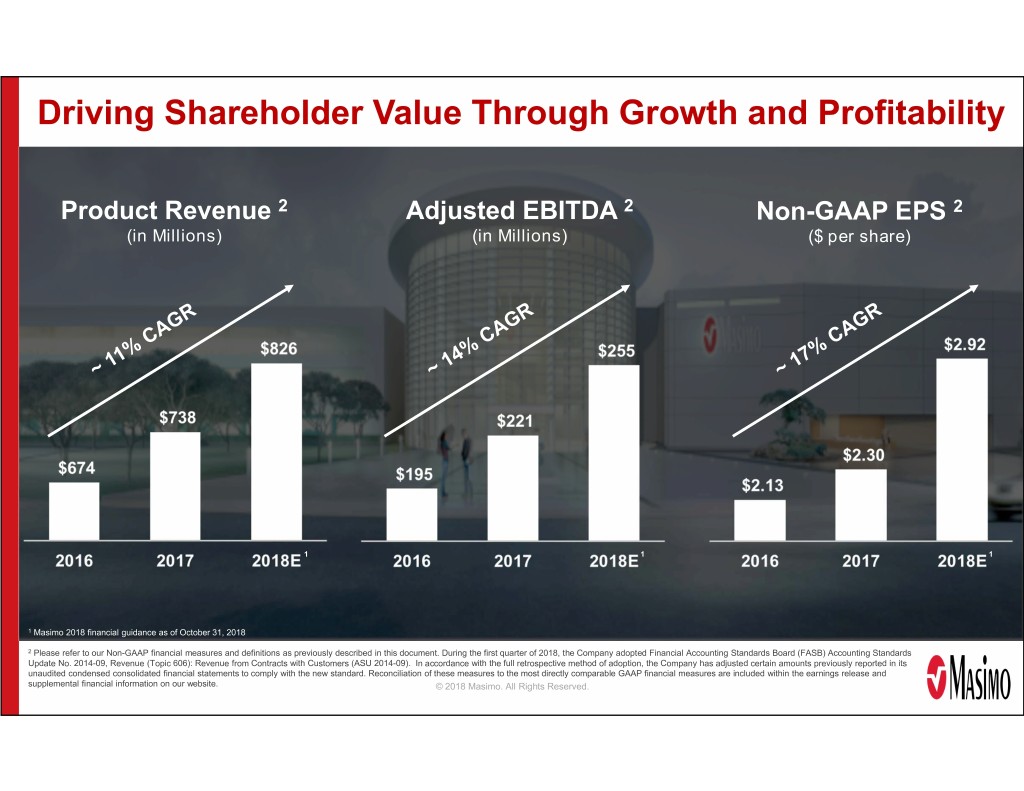

Driving Shareholder Value Through Growth and Profitability Product Revenue 2 Adjusted EBITDA 2 Non-GAAP EPS 2 (in Millions) (in Millions) ($ per share) 1 1 1 1 Masimo 2018 financial guidance as of October 31, 2018 2 Please refer to our Non-GAAP financial measures and definitions as previously described in this document. During the first quarter of 2018, the Company adopted Financial Accounting Standards Board (FASB) Accounting Standards Update No. 2014-09, Revenue (Topic 606): Revenue from Contracts with Customers (ASU 2014-09). In accordance with the full retrospective method of adoption, the Company has adjusted certain amounts previously reported in its unaudited condensed consolidated financial statements to comply with the new standard. Reconciliation of these measures to the most directly comparable GAAP financial measures are included within the earnings release and supplemental financial information on our website. © 2018 Masimo. All Rights Reserved.

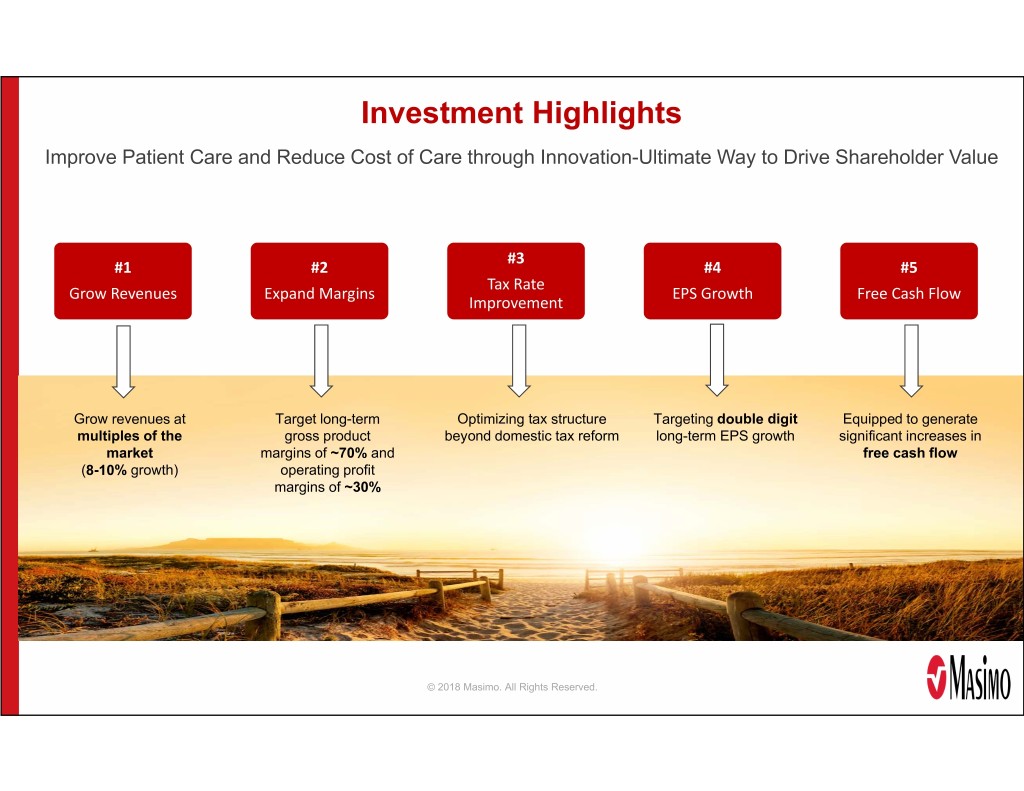

Investment Highlights Improve Patient Care and Reduce Cost of Care through Innovation-Ultimate Way to Drive Shareholder Value #3 #1 #2 #4 #5 Tax Rate Grow Revenues Expand Margins EPS Growth Free Cash Flow Improvement Grow revenues at Target long-term Optimizing tax structure Targeting double digit Equipped to generate multiples of the gross product beyond domestic tax reform long-term EPS growth significant increases in market margins of ~70% and free cash flow (8-10% growth) operating profit margins of ~30% © 2018 Masimo. All Rights Reserved.

© 2018 Masimo. All Rights Reserved.