Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - MASIMO CORP | q32018supplementalearnin.htm |

| EX-99.1 - EXHIBIT 99.1 - MASIMO CORP | masi-20181031xex991.htm |

| 8-K - 8-K - MASIMO CORP | masi-20181031x8k.htm |

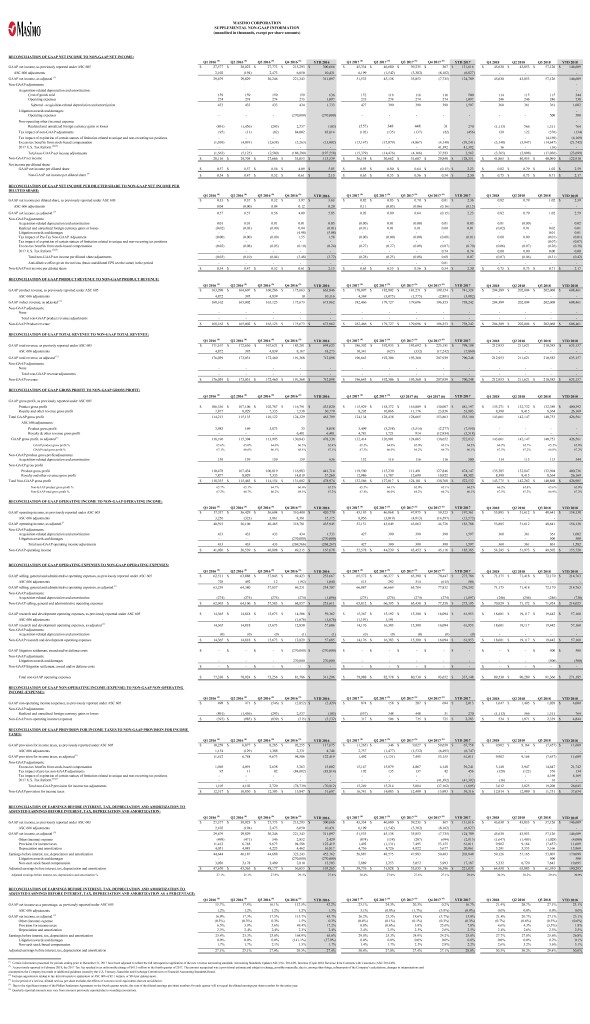

MASIMO CORPORATION SUPPLEMENTAL NON-GAAP INFORMATION (unaudited in thousands, except per share amounts) RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP net income, as previously reported under ASC 605 $ 27,577 $ 30,023 $ 27,773 $ 215,293 $ 300,666 $ 45,334 $ 46,680 $ 39,235 $ 367 $ 131,616 $ 45,630 $ 43,853 $ 57,126 $ 146,609 ASC 606 adjustments 2,102 (194) 2,473 6,050 10,431 6,199 (1,542) (3,382) (8,102) (6,827) - - - - GAAP net income, as adjusted (1) 29,679 29,829 30,246 221,343 311,097 51,533 45,138 35,853 (7,735) 124,789 45,630 43,853 57,126 146,609 Non-GAAP adjustments: - Acquisition-related depreciation and amortization: - Cost of goods sold 159 159 159 159 636 152 116 116 116 500 114 115 115 344 Operating expenses 274 274 274 275 1,097 275 274 274 274 1,097 246 246 246 738 Subtotal - acquisition-related depreciation and amortization 433 433 433 434 1,733 427 390 390 390 1,597 360 361 361 1,082 Litigation awards and damages: - Operating expenses - - - (270,000) (270,000) - - - - - - - 500 500 Non-operating other (income) expense: - Realized and unrealized foreign currency gains or losses (891) (1,456) (293) 2,537 (103) (557) 348 448 31 270 (1,113) 566 1,311 764 9803 Tax impact of non-GAAP adjustments (95) (11) (82) 84,002 83,814 (102) (135) (137) (82) (456) 120 122 (376) ( 134) 0 Tax impact of expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - - - - - (4,169) (4,169) 9800 Excess tax benefits from stock-based compensation (1,010) (4,091) (2,638) (5,263) (13,002) (15,147) (15,079) (4,867) (4,148) (39,241) (3,148) (3,947) (14,647) (21,742) (2)(3) 2017 U.S. Tax Reform - - - - - - - - 41,392 41,392 16 - (16) - Total non-GAAP net income adjustments (1,563) (5,125) (2,580) (188,290) (197,558) (15, 379) 2 (14,476) (4,166) 37,583 3,562 (3,765) (2,898) (17,036) (23, 699) Non-GAAP net income attributable to Masimo Corporation stockholders $ 28,116 $ 24,704 $ 27,666 $ 33,053 $ 113,539 $ 36,154 $ 30,662 $ 31,687 $ 29,848 $ 128,351 $ 41,865 $ 40,955 $ 40,090 $ 122,910 Net income per diluted share: attributable to Masimo Corporation stockholders: GAAP net income per diluted share $ 0.57 $ 0.57 $ 0.56 $ 4.09 $ 5.85 $ 0.93 $ 0.80 $ 0.64 $ (0.15) $ 2.23 $ 0.82 $ 0.79 $ 1.02 $ 2.59 (4) Non-GAAP net income per diluted share $ 0.54 $ 0.47 $ 0.52 $ 0.61 $ 2.13 $ 0.65 $ 0.55 $ 0.56 $ 0.54 $ 2.30 $ 0.75 $ 0.73 $ 0.71 $ 2.17 RECONCILIATION OF GAAP NET INCOME PER DILUTED SHARE TO NON-GAAP NET INCOME PER DILUTED SHARE: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP net income per diluted share, as previously reported under ASC 605tributable to Masimo Corporation stockholders $ 0.53 $ 0.57 $ 0.52 $ 3.97 $ 5.65 $ 0.82 $ 0.83 $ 0.70 $ 0.01 $ 2.36 0.82 0.79 1.02 $ 2.59 ASC 606 adjustments 0.04 (0.00) 0.04 0.12 0.20 0.11 (0.03) (0.06) (0.16) (0.13) - - - - (1) GAAP net income, as adjusted 0.57 0.57 0.56 4.09 5.85 0.93 0.80 0.64 (0.15) 2.23 0.820 0.790 1.020 2.59 Non-GAAP adjustments: Acquisition-related depreciation and amortization 0.01 0.01 0.01 0.01 0.03 (0.00) 0.01 (0.00) 0.01 0.03 0.01 (0.00) - 0.02 Realized and unrealized foreign currency gains or losses (0.02) (0.03) (0.00) 0.04 (0.01) (0.01) 0.01 0.01 0.00 0.01 (0.02) 0.01 0.02 0.01 Litigation awards and damages - - - (4.98) (5.08) - - - - - - - 0.01 0.01 Tax Impact of Pre-Tax Non-GAAP Adjustment (0.00) (0.00) (0.00) 1.55 1.58 (0.00) (0.00) (0.00) (0.00) (0.01) 0.00 0.00 (0.01) (0.01) Tax impact of expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - - - - - (0.07) (0.07) 9800 Excess tax benefits from stock-based compensation (0.02) (0.08) (0.05) (0.10) (0.24) (0.27) (0.27) (0.09) (0.07) (0.70) (0.06) (0.07) (0.26) (0.38) 2017 U.S. Tax Reform (2)(3) - - - - - - - - 0.74 0.74 0.00 0.00 0.00 0.00 Total non-GAAP net income per diluted share adjustments (0.03) (0.10) (0.04) (3.48) (3.72) (0.28) (0.25) (0.08) 0.68 0.07 (0.07) (0.06) (0.31) (0.42) Anti-dilutive effect given the net loss (basic and diluted EPS are the same) in the period - - - - - - - - 0.01 - - - - - Non-GAAP net income per diluted share attributable to Masimo Corporation stockholders (2) $ 0.54 $ 0.47 $ 0.52 $ 0.61 $ 2.13 $ 0.65 $ 0.55 $ 0.56 $ 0.54 $ 2.30 $ 0.75 $ 0.73 $ 0.71 $ 2.17 RECONCILIATION OF GAAP PRODUCT REVENUE TO NON-GAAP PRODUCT REVENUE: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP product revenue, as previously reported under ASC 605$ 163,290 $ 164,607 $ 160,286 $ 175,663 $ 663,846 $ 178,097 $ 182,802 $ 181,271 $ 199,154 $ 741,324 $ 204,389 $ 202,004 $ 202,068 $ 608,461 ASC 606 adjustments 4,872 395 4,839 10 10,116 4,369 (3,075) (1,575) (2,801) (3,082) - - - - GAAP roduct revenue, as adjusted (1) 168,162 165,002 165,125 175,673 673,962 182,466 179,727 179,696 196,353 738,242 204,389 202,004 202,068 608,461 Non-GAAP adjustments: None - - - - - - - - - - - - - - Total non-GAAP product revenue adjustments - - - - - - - - - - - - - - Non-GAAP Product revenue $ 168,162 $ 165,002 $ 165,125 $ 175,673 $ 673,962 $ 182,466 $ 179,727 $ 179,696 $ 196,353 $ 738,242 $ 204,389 $ 202,004 $ 202,068 $ 608,461 RECONCILIATION OF GAAP TOTAL REVENUE TO NON-GAAP TOTAL REVENUE: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP total revenue, as previusly reported under ASC 605 $ 171,167 $ 172,636 $ 167,621 $ 183,201 $ 694,625 $ 186,302 $ 192,933 $ 193,692 $ 225,181 $ 798,108 212,953 211,621 210,583 $ 635,157 ASC 606 adjustments 4,872 395 4,839 8,167 18,273 10,341 (627) (332) (17,242) (7,860) - - - - GAAP total revenue, as adjusted (1) 176,039 173,031 172,460 191,368 712,898 196,643 192,306 193,360 207,939 790,248 212,953 211,621 210,583 635,157 Non-GAAP adjustments: None - - - - - - - - - - - - - - Total non-GAAP revenue adjustments - - - - - - - - - - - - - - Non-GAAP revenue $ 176,039 $ 173,031 $ 172,460 $ 191,368 $ 712,898 $ 196,643 $ 192,306 $ 193,360 $ 207,939 $ 790,248 $ 212,953 $ 211,621 $ 210,583 $ 635,157 RECONCILIATION OF GAAP GROSS PROFIT TO NON-GAAP GROSS PROFIT: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP gross profit, as previously reported under ASC 605 Product gross profit $ 106,336 $ 107,106 $ 102,787 $ 116,791 $ 433,020 $ 115,929 $ 118,372 $ 116,889 $ 130,007 $ 481,197 $ 135,271 $ 132,732 $ 132,389 $ 400,392 Royalty and other revenue gross profit 7,877 8,029 7,335 7,538 30,779 8,205 10,066 11,776 23,856 53,903 8,390 9,415 8,364 26,169 Total GAAP gross profit 114,213 115,135 110,122 124,329 463,799 124,134 128,438 128,665 153,863 535,100 143,661 142,147 140,753 426,561 ASC 606 adjustments: Product gross profit 3,983 169 3,873 33 8,058 3,499 (3,258) (5,514) (2,277) (7,550) - - - - Royalty & other revenue gross profit - - - 6,481 6,481 4,781 1,721 914 (12,934) (5,518) - - - - GAAP gross profit, as adjusted (1) 118,196 115,304 113,995 130,843 478,338 132,414 126,901 124,065 138,652 522,032 143,661 142,147 140,753 426,561 GAAP product gross profit % 65.6% 65.0% 64.6% 66.5% 65.4% 65.5% 64.0% 62.0% 65.1% 64.2% 66.2% 65.7% 65.5% 65.8% GAAP total gross profit % 67.1% 66.6% 66.1% 68.4% 67.1% 67.3% 66.0% 64.2% 66.7% 66.1% 67.5% 67.2% 66.8% 67.2% Non-GAAP product gross profit adjustments: Acquisition-related depreciation and amortization 159 159 159 159 636 152 116 116 116 500 114 115 115 344 Non-GAAP gross profit Product gross profit 110,478 107,434 106,819 116,983 441,714 119,580 115,230 111,491 127,846 474,147 135,385 132,847 132,504 400,736 Royalty and other revenue gross profit 7,877 8,029 7,335 14,019 37,260 12,986 11,787 12,690 10,922 48,385 8,390 9,415 8,364 26,169 Total Non-GAAP gross profit $ 118,355 $ 115,463 $ 114,154 $ 131,002 $ 478,974 $ 132,566 $ 127,017 $ 124,181 $ 138,768 $ 522,532 $ 143,775 $ 142,262 $ 140,868 $ 426,905 Non-GAAP product gross profit % 65.7% 65.1% 64.7% 66.6% 65.5% 65.5% 64.1% 62.0% 65.1% 64.2% 66.2% 65.8% 65.6% 65.9% Non-GAAP total gross profit % 67.2% 66.7% 66.2% 68.5% 67.2% 67.4% 66.0% 64.2% 66.7% 66.1% 67.5% 67.2% 66.9% 67.2% RECONCILIATION OF GAAP OPERATING INCOME TO NON-GAAP OPERATING INCOME: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP operating income, as previously reported under ASC 605$ 37,337 $ 36,429 $ 36,604 $ 310,400 $ 420,770 $ 43,195 $ 46,868 $ 47,975 $ 59,323 $ 197,361 $ 53,885 $ 51,612 $ 48,641 $ 154,138 ASC 606 adjustments 3,256 (323) 3,861 8,381 15,175 8,956 (3,019) (4,913) (14,597) (13,573) - - - - GAAP operating income, as adjusted (1) 40,593 36,106 40,465 318,781 435,945 52,151 43,849 43,062 44,726 183,788 53,885 51,612 48,641 154,138 Non-GAAP adjustments: Acquisition-related depreciation and amortization 433 433 433 434 1,733 427 390 390 390 1,597 360 361 361 1,082 Litigation awards and damages - - - (270,000) (270,000) - - - - - - - 500 500 Total non-GAAP operating income adjustments 433 433 433 (269,566) (268,267) 427 390 390 390 1,597 360 361 861 1,582 Non-GAAP operating income $ 41,026 $ 36,539 $ 40,898 $ 49,215 $ 167,678 $ 52,578 $ 44,239 $ 43,452 $ 45,116 $ 185,385 $ 54,245 $ 51,973 $ 49,502 $ 155,720 RECONCILIATION OF GAAP OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP selling, general and administrative operating expenses, as previously reported under ASC 605$ 62,511 $ 63,888 $ 57,845 $ 69,423 $ 253,667 $ 65,572 $ 66,377 $ 65,390 $ 78,447 $ 275,786 $ 71,175 $ 71,418 $ 72,170 $ 214,763 ASC 606 adjustments 728 492 12 (192) 1,040 515 292 314 (615) 506 - - - - GAAP selling, general and administrative operating expenses, as adjusted (1) 63,239 64,380 57,857 69,231 254,707 66,087 66,669 65,704 77,832 276,292 71,175 71,418 72,170 214,763 Non-GAAP adjustments: Acquisition-related depreciation and amortization (274) (274) (274) (274) (1,096) (275) (274) (274) (274) (1,097) (246) (246) (246) (738) Non-GAAP selling, general and administrative operating expenses $ 62,965 $ 64,106 $ 57,583 $ 68,957 $ 253,611 $ 65,812 $ 66,395 $ 65,430 $ 77,558 $ 275,195 $ 70,929 $ 71,172 $ 71,924 $ 214,025 GAAP research and development operating expenses, as previously reported under ASC 605$ 14,365 $ 14,818 $ 15,673 $ 14,506 $ 59,362 $ 15,367 $ 15,192 $ 15,300 $ 16,094 $ 61,953 $ 18,601 $ 19,117 $ 19,442 $ 57,160 ASC 606 adjustments - - - (1,676) (1,676) (1,191) 1,191 - - - - - - - GAAP research and development operating expenses, as adjusted (1) 14,365 14,818 15,673 12,830 57,686 14,176 16,383 15,300 16,094 61,953 18,601 19,117 19,442 57,160 Non-GAAP adjustments: Acquisition-related depreciation and amortization (0) (0) (0) (1) (1) (0) (0) (0) (0) (0) - - - - Non-GAAP research and development operating expenses $ 14,365 $ 14,818 $ 15,673 $ 12,829 $ 57,685 $ 14,176 $ 16,383 $ 15,300 $ 16,094 $ 61,953 $ 18,601 $ 19,117 $ 19,442 $ 57,160 GAAP litigation settlement, award and/or defense costs $ - $ - $ - $ (270,000) $ (270,000) $ - $ - $ - $ - $ - $ - $ - $ 500 $ 500 Non-GAAP adjustments: Litigation awards and damages - - - 270,000 270,000 - - - - - - - (500) (500) Non-GAAP litigation settlement, award and/or defense costs $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - Total non-GAAP operating expenses $ 77,330 $ 78,924 $ 73,256 $ 81,786 $ 311,296 $ 79,988 $ 82,778 $ 80,730 $ 93,652 $ 337,148 $ 89,530 $ 90,289 $ 91,366 $ 271,185 RECONCILIATION OF GAAP NON-OPERATING INCOME (EXPENSE) TO NON-GAAP NON-OPERATING INCOME (EXPENSE): Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP non-operating income (expense), as previously reported under ASC 605$ 498 $ 471 $ (546) $ (2,852) $ (2,429) $ 874 $ 158 $ 287 $ 694 $ 2,013 $ 1,647 $ 1,405 $ 1,028 $ 4,080 Non-GAAP adjustments: Realized and unrealized foreign currency gains or losses (891) (1,456) (293) 2,537 (103) (557) 348 448 31 270 (1,113) 566 1,311 764 Non-GAAP non-operating income (expense) $ (393) $ (985) $ (839) $ (315) $ (2,532) $ 317 $ 506 $ 735 $ 725 $ 2,283 $ 534 $ 1,971 $ 2,339 $ 4,844 RECONCILIATION OF GAAP PROVISION FOR INCOME TAXES TO NON-GAAP PROVISION FOR INCOME TAXES: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP provision for income taxes, as previously reported under ASC 605$ 10,258 $ 6,877 $ 8,285 $ 92,255 $ 117,675 $ (1,265) $ 346 $ 9,027 $ 59,650 $ 67,758 $ 9,902 $ 9,164 $ (7,457) $ 11,609 ASC 606 adjustments 1,154 (129) 1,388 2,331 4,744 2,757 (1,477) (1,532) (6,495) (6,747) - - - - GAAP provision for income taxes, as adjusted (1) 11,412 6,748 9,673 94,586 122,419 1,492 (1,131) 7,495 53,155 61,011 9,902 9,164 (7,457) 11,609 Non-GAAP adjustments: Excess tax benefits from stock-based compensation 1,010 4,091 2,638 5,263 13,002 15,147 15,079 4,867 4,148 39,241 3,148 3,947 14,647 21,742 Tax impact of pre-tax non-GAAP adjustments 95 11 82 (84,002) (83,814) 102 135 137 82 456 (120) (122) 376 134 Tax impact of expiration of certain statues of limitation related to unique and non-recurring tax positions - - - - - - - - - - - - 4,169 4,169 2017 U.S. Tax Reform (2)(3) - - - - - - - - (41,392) (41,392) (16) - 16 - Total non-GAAP provision for income tax adjustments 1,105 4,102 2,720 (78,739) (70,812) 15,249 15,214 5,004 (37,162) (1,695) 3,012 3,825 19,208 26,045 Non-GAAP provision for income taxes $ 12,517 $ 10,850 $ 12,393 $ 15,847 $ 51,607 $ 16,741 $ 14,083 $ 12,499 $ 15,993 $ 59,316 $ 12,914 $ 12,989 $ 11,751 $ 37,654 RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP net income, as previously reported under ASC 605 $ 27,577 $ 30,023 $ 27,773 $ 215,293 $ 300,666 $ 45,334 $ 46,680 $ 39,235 $ 367 $ 131,616 $ 45,630 $ 43,853 $ 57,126 $ 146,609 ASC 606 adjustments 2,102 (194) 2,473 6,050 10,431 6,199 (1,542) (3,382) (8,102) (6,827) - - - - GAAP net income, as adjusted (1) 29,679 29,829 30,246 221,343 311,097 51,533 45,138 35,853 (7,735) 124,789 45,630 43,853 57,126 146,609 Other (income) expense (498) (471) 546 2,852 2,429 (874) (158) (287) (694) (2,013) (1,647) (1,405) (1,028) (4,080) Provision for income taxes 11,412 6,748 9,673 94,586 122,419 1,492 (1,131) 7,495 53,155 61,011 9,902 9,164 (7,457) 11,609 Depreciation and amortization 4,051 4,081 4,223 4,462 16,817 4,736 4,726 4,922 5,677 20,061 5,241 5,553 5,166 15,960 Earnings before interest, tax, depreciation and amortization 44,644 40,187 44,688 323,243 452,762 56,887 48,575 47,983 50,403 203,848 59,126 57,165 53,807 170,098 Litigation awards and damages - - - (270,000) (270,000) - - - - - - - 500 500 Non-cash stock based compensation 3,026 3,178 3,489 2,810 12,503 2,889 3,253 5,052 5,993 17,187 5,332 6,720 7,643 19,695 Adjusted earnings before interest, tax, depreciation and amortization $ 47,670 $ 43,365 $ 48,177 $ 56,053 $ 195,265 $ 59,776 $ 51,828 $ 53,035 $ 56,396 $ 221,035 $ 64,458 $ 63,885 $ 61,950 $ 190,293 Adjusted earnings before interest, tax, depreciation and amortization % 27.1% 25.1% 27.9% 29.3% 27.4% 30.4% 27.0% 27.4% 27.1% 28.0% 30.3% 30.2% 29.4% 30.0% RECONCILIATION OF EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION TO ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION AS A PERCENTAGE: Q1 2016 (6) Q2 2016 (6) Q3 2016 (6) Q4 2016 (6) YTD 2016 Q1 2017 (6) Q2 2017 (6) Q3 2017 (6) Q4 2017 (6) YTD 2017 Q1 2018 Q2 2018 Q3 2018 YTD 2018 GAAP net income as a percentage, as previously reported under ASC 605 15.7% 17.4% 16.1% 112.5% 42.2% 23.1% 24.3% 20.3% 0.2% 16.7% 21.4% 20.7% 27.1% 23.1% ASC 606 adjustments 1.2% 1.2% 1.2% 1.2% 1.5% 3.1% (0.8%) (1.7%) (3.9%) (0.9%) 0.0% 0.0% 0.0% 0.0% GAAP net income, as adjusted (1) 16.9% 17.3% 17.5% 115.7% 43.7% 26.2% 23.5% 18.6% (3.7%) 15.8% 21.4% 20.7% 27.1% 23.1% Other (income) expense (0.3%) (0.3%) 0.3% 1.5% 0.3% (0.4%) (0.1%) (0.1%) (0.3%) (0.3%) (0.7%) (0.6%) (0.5%) (0.6%) Provision for income taxes 6.5% 3.9% 5.6% 49.4% 17.2% 0.8% (0.6%) 3.9% 25.6% 7.8% 4.6% 4.3% (3.5%) 1.8% Depreciation and amortization 2.3% 2.4% 2.4% 2.3% 2.4% 2.4% 2.5% 2.5% 2.6% 2.5% 2.4% 2.6% 2.5% 2.5% Earnings before interest, tax, depreciation and amortization 25.4% 23.3% 25.8% 168.9% 63.6% 29.0% 25.3% 24.9% 24.2% 25.8% 27.7% 27.0% 25.6% 26.8% Litigation awards and damages 0.0% 0.0% 0.0% (141.1%) (37.9%) 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.2% 0.1% Non-cash stock based compensation 1.7% 1.7% 2.1% 1.5% 1.7% 1.4% 1.7% 2.5% 2.9% 2.2% 2.6% 3.2% 3.6% 3.1% Adjusted earnings before interest, tax, depreciation and amortization 27.1% 25.1% 27.9% 29.3% 27.4% 30.4% 27.0% 27.4% 27.1% 28.0% 30.3% 30.2% 29.4% 30.0% (1) Certain information presented for periods ending prior to December 31, 2017 have been adjusted to reflect the full retrospective application of the new revenue accounting standard, Accounting Standards Update (ASU) No. 2014-09, Revenue (Topic 606): Revenue from Contracts with Customers (ASU 2014-09). (2) As previously reported in February 2018, the 2017 Tax Act resulted in an unfavorable charge of $43.5 million in the fourth quarter of 2017. The amount recognized was a provisional estimate and subject to change, possibly materially, due to, among other things, refinements of the Company’s calculations, changes in interpretations and assumptions the Company has made or additional guidance issued by the U.S. Treasury, Securities and Exchange Commission or Financial Accounting Standards Board. (3) Includes adjustments related to the full retrospective application of ASC 606 of $2.1 million, or $0.4 per diluted share. (4) In the period of a net loss, diluted net loss per share excludes the effects of common stock equivalents that are anti-dilutive. (5) Due to the significant impact of the Philips Settlement Agreement on the fourth quarter results, the sum of the diluted earnings per share numbers for each quarter will not equal the diluted earnings per share number for the entire year. (6) Quarterly reported amounts may vary from amounts previously reported due to rounding conventions.