Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PRESS RELEASE - Bankwell Financial Group, Inc. | ex99-1.htm |

| 8-K - BANKWELL FINANCIAL GROUP, INC. 8-K 10 30 18 - Bankwell Financial Group, Inc. | bwfg8k-103018.htm |

Bankwell Financial Group3Q’18 Investor Presentation

Safe Harbor This presentation may contain certain forward-looking statements about the Company. Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged.

Bankwell MILESTONESAssets Bankwell’s Story Bankwell is one of the fastest growing and most profitable community banks in Connecticut. Bankwell was named one of the “Top 100 Best Performing Community Banks of 2016” between $1 billion and $10 billion in assets nationwide based on certain metrics for the year ended December 31, 2016 by S&P Global Market IntelligenceBankwell was named one of 29 banks nationwide to make the Sandler O’Neill + Partners list of “Sm-All Stars”, and the only CT bank to make the list 2002 2007 2008 2010 2013 2014 2017 2016 3Q18 $0 $190,906 $247,041 $395,708 $779,618 $1,099,531 $1,628,919 $1,796,607 $1,885,036 Dollars in thousands Founded The Bank of New Canaan Holding Company formed (BNC Financial Group) Founded second bank, The Bank of Fairfield Founded third bank, Stamford First Bank, a division of The Bank of New Canaan The banks merge into “Bankwell”; Bankwell acquires The Wilton Bank Bankwell acquires Quinnipiac Bank & Trust Company Named one of the “Top 100 Best Performing Community Banks of 2016”1 Named to Sandler O’Neill “Sm-All Stars Class of 2017”2 Building franchise value with continued organic growth

Bankwell Profile $1.89B asset Connecticut-based bank with focus on CRE and C&I lending12 existing branches in Fairfield & New Haven Counties Company Overview NASDAQ: BWFG $162MM deposits per branch, excluding the 3 new branches opened in 2Q; highest in Fairfield & New Haven Counties1Attractive core market of Fairfield County / Bridgeport-Stamford-Norwalk MSAMost affluent MSA in the Nation in per capita personal income (PCPI)2 1 Source: S&P Global Market Intelligence’s Branch Competitors & Pricing Report as of 6/30/18, excluding global money center banks (tickers BAC, WFC, JPM, TD & C)2 Source: Bureau of Economic Analysis’ Metropolitan Area Table, contained within the Local Area Personal Income, 2016 news release on 11/16/17 Existing branches (12) Fairfield County

Why Bankwell? Consistently strong performer in highly attractive markets 1 as of September 28th, 20182 as of September 30th, 2018

Strategic Priorities Balance Sheet Diversification/ Loan Growth Deposit Growth Credit Quality Capital Management Strategic expansion of C&I lendingPrice “smart”, defend NIM through disciplined growth Maintain disciplineExpand portfolio management capabilities Opened three new branchesLaunched online deposit gatheringKey Treasury Management initiatives, targeting Municipalities, Professional Services Maintain strong capital ratiosWell-positioned for opportunistic M&ADividend flexibility

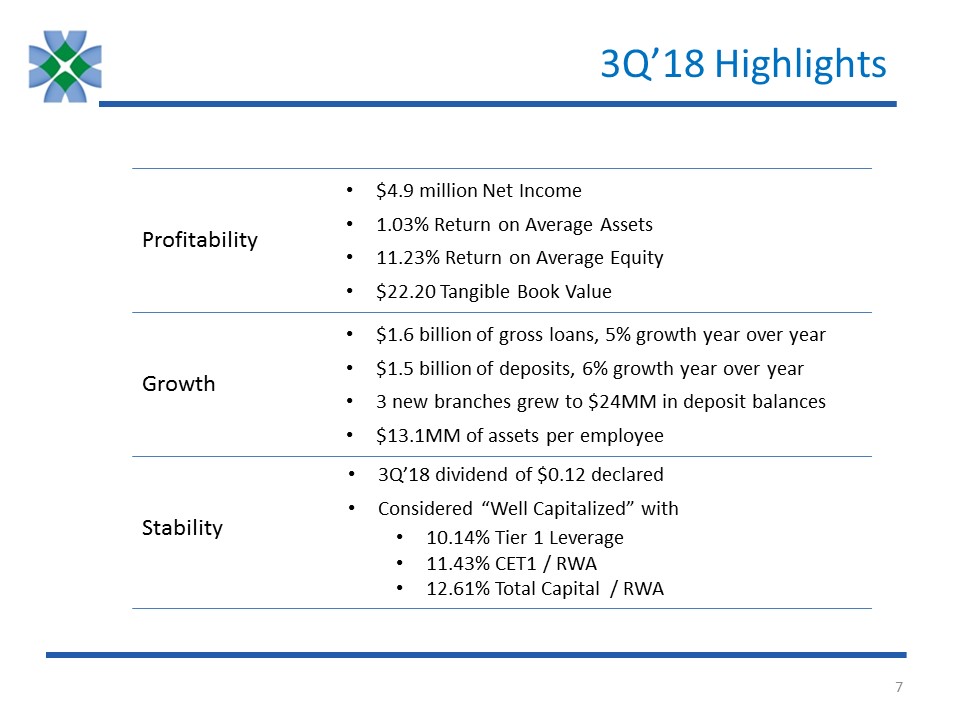

3Q’18 Highlights Profitability Growth Stability $4.9 million Net Income1.03% Return on Average Assets 11.23% Return on Average Equity$22.20 Tangible Book Value $1.6 billion of gross loans, 5% growth year over year$1.5 billion of deposits, 6% growth year over year3 new branches grew to $24MM in deposit balances$13.1MM of assets per employee 3Q’18 dividend of $0.12 declaredConsidered “Well Capitalized” with 10.14% Tier 1 Leverage11.43% CET1 / RWA12.61% Total Capital / RWA

3Q Consolidated Statement of Income 2018 2017 V 1Total Interest Income $20.5 $18.3 $2.2Total Interest Expense $6.3 $4.5 $1.8Net Interest Income $14.2 $13.9 $0.4Provision for Loan Losses $0.3 $0.4 $(0.1)Net Interest Income after Provision $13.9 $13.5 $0.5Non Interest Income $0.9 $0.8 $0.0Non Interest Expense $8.9 $8.1 $0.7Pre-Tax Income $5.9 $6.2 $(0.2)Income Tax Expense $1.1 $1.9 $(0.8)Reported Net Income (Loss) $4.9 $4.3 $0.6EPS $0.62 $0.55 $0.07 Dollars in millions Key driversNet Interest Income growth driven by loan originations, partially offset from rising cost of funds on deposits & increased borrowingsProvision for Loan Losses favorable due to improving historical loss trendsNon Interest Expense increase over prior quarter in support of ongoing business growth, reflected in increased C&B and Occupancy / Equipment expensesTax Expense reflects the impact of the new Corporate Tax Rate of 21%, vs prior rate of 35% 1 Variances are rounded based on actual whole dollar amounts

3Q YTD Consolidated Statement of Income 2018 2017 V 1Total Interest Income $58.5 $52.5 $6.0Total Interest Expense $16.7 $12.0 $4.6Net Interest Income $41.9 $40.5 $1.4Provision for Loan Losses $0.6 $1.8 $(1.2)Net Interest Income after Provision $41.2 $38.6 $2.6Non Interest Income $3.3 $3.1 $0.2Non Interest Expense $26.8 $23.9 $2.9Pre-Tax Income $17.7 $17.8 $(0.1)Income Tax Expense $3.5 $6.0 $2.5Reported Net Income (Loss) $14.2 $11.7 $2.4EPS $1.80 $1.51 $0.29 Dollars in millions Key driversNet Interest Income growth driven by loan originations, partially offset from rising cost of funds on deposits & increased borrowingsProvision for Loan Losses favorable due to improving historical loss trendsNon Interest Expense increase over prior quarter in support of ongoing business growth, including the opening of 3 new branches in ’18,reflected in increased C&B and Occupancy / Equipment expenses; Also impacted by reduced loan origination costs as a result of year-over-year lower loan volumeTax Expense reflects the impact of the new Corporate Tax Rate of 21%, vs prior rate of 35% 1 Variances are rounded based on actual whole dollar amounts

Financial Snapshot Dollars in thousands, except per share data 2014 2015 2016 2017 1Q’18 2Q’18 3Q’18 Total assets $1,099,531 $1,330,372 $1,628,919 $1,796,607 $1,831,243 $1,870,802 $1,885,036 Net loans $915,981 $1,129,748 $1,343,895 $1,520,879 $1,534,565 $1,572,591 $1,585,465 Loans to deposits 110.7% 109.1% 105.6% 110.1% 108.7% 108.4% 107.2% Efficiency ratio 68.7% 62.3% 56.5% 54.9% 62.0% 60.1% 59.6% Net interest margin 3.84% 3.77% 3.54% 3.30% 3.15% 3.15% 3.17% Total capital to risk weighted assets 13.55% 13.39% 12.85% 12.19% 12.35% 12.47% 12.61% Return on average equity 5.13% 6.76% 8.94% 8.93% 11.35% 11.28% 11.23% Tangible book value per share $16.35 $17.43 $18.98 $20.59 $21.12 $21.56 $22.20 Net interest income $31,660 $42,788 $49,092 $54,364 $13,705 $13,908 $14,246 Net income $4,568 $9,030 $12,350 $13,830 $4,600 $4,715 $4,857 EPS (fully diluted) $0.78 $1.21 $1.62 $1.78 $0.59 $0.60 $0.62 1 1 Values are based on reported earnings / performance, which were impacted primarily as a result of the Tax Cut and Jobs Act passed in December 2017 along with several other smaller items. Please refer to BWFG’s 4Q’17 Earnings Release for further detail Quarterly ratios are year-to-date calculations

Financial Performance Trends Net IncomeCAGR 38% RevenueCAGR 15% 1 4Q’17 EPS reduced by $0.26 due to the impact of the Tax Cut and Jobs Act passed in December 2017 along with several other smaller items; on a “core” basis, 2017 EPS is $2.03, please refer to BWFG’s 4Q’17 Earnings Release for further detail The third quarter efficiency ratio was 58.6%, bringing the year to date ratio down to 59.6%NIM has remained stable through 2018, currently at 3.17%, despite rising pressure on deposit costs Dollars in millions EPS $0.78 $1.21 $1.62 $1.78 $1.80Efficiency Ratio 68.7% 62.3% 56.5% 54.9% 59.6%NIM 3.84% 3.77% 3.54% 3.30% 3.17% 1

Loan Portfolio CAGR 16% $1,543 $1,366 $1,148 $930 Dollars in millions $1,608 ‘18 driven by strong originations offset by prepayments

Loan Portfolio Team of skilled credit analysts, most with > 10 years’ experienceStrong risk management practices in placeDeveloped rigorous suite of risk management reports, enabling multi-level portfolio stratificationProven track record as CRE LenderC&I concentration grew from 15.1% in year-end 2015 to 18.0% in 3Q’18, while increasing loan portfolio $460MM over the same time period

CRE Loan Portfolio Retail Composition $ % Retail2 $168 55.30% Grocery $76 25.00% Pharmacy $27 9.03% Restaurant $17 5.50% Gas / Auto Services $16 5.16% Total Retail $303 100.00% Average deal size is $2.1MM Office Composition $ % Office (primarily suburban) $207 71.62% Medical $80 27.67% Condo $2 0.70% Total Office $289 100.00% Average deal size is $2.0MM 1 Includes Owner Occupied CRE2 Comprised primarily of neighborhood and convenience centers, typically characterized by: size up to 125,000 sq. ft.; convenience and service oriented 1 Dollars in millions At year-end 2017, Retail and Office concentrations were 27.21% and 27.90%, respectivelyProperty Type mix has diversified over 2018 while overall portfolio has grown

Geography Distribution Measured approach to expansionFollowing existing customers to new locationsImproved geographic diversification since year-end 2017 CRE to Risk Based Capital Ratio Proven track record as CRE LenderStrong risk management practices in place 1 1 Includes Owner Occupied CRE CRE Loan Portfolio

Asset Quality NPAs $4.31 $5.04 $3.21 $5.48 $20.86 $23.33 $21.96 $MMs NPAs to Total Assets Update on the 2 recent NPAsNPA #1 $4MM loan fully paid off in 3Q’18; BWFG recovered 100% principal plus default interest and expenses.NPA #2 Continuing to work with borrower on multiple pathways to repayment; $3.1MM specific reserve balance as of 3Q. 1Q increase in NPAs driven by two specific relationships (see update box to left)2Q NPAs increase attributable to required repurchase of guaranteed portion of SBA loan deemed an NPA in 1QSubsequent reduction in 3Q NPAs given $4MM payoff (“NPA #1”)The total allowance for loan loss (“ALLL”) reserve is $19.3MM and represents 1.20% of total loansThe general ALLL reserve provides 288% coverage of NPAs that do not carry a specific reserveNet Charge-Offs / Average Loans remains low at 0.02%

Deposits CAGR 17% $835 $1,047 $1,289 $1,398 Dollars in millions $1,493 BWFG increasing deposits in a competitive market

Deposit Market Share Deposit Market Share Location 2013 2014 2015 2016 2017 2018 New Canaan 19.77% 22.71% 24.40% 29.59% 31.10% 32.44% Wilton 6.26% 6.87% 7.76% 9.85% 13.81% 15.18% Fairfield 5.95% 7.65% 6.38% 7.58% 9.18% 9.14% Norwalk not applicable 1.44% 1.97% 2.92% 3.62% Stamford 1.99% 2.84% 2.00% 1.92% 2.28% 2.50% Darien not applicable 0.31% Westport not applicable 0.05% Fairfield County 1.51% 2.00% 1.94% 2.17% 2.54% 2.69% New Haven County 0.40% 0.43% 0.45% 0.55% 0.61% 0.63% From FDIC Market Share Report as of June 30, 2018Darien, Westport and 2nd Stamford locations opened June 9th, 2018 Growing deposit share in very competitive markets

Management Team Name Years Experience Selected Professional Biography Christopher GrusekePresident & CEO(since 2015) 25+ Founding investor of Bankwell’s precursor, Bank of New Canaan, member of BoD and ALCO Committee 2009 to 201220 year Investment Banking career focused on financial institutions, securitizations and interest rate risk managementManagement positions include Chief Operating Officer of Greenwich Capital Markets Penko IvanovEVP & CFO(since 2016) 25+ CFO for Darien Rowayton Bank & Doral Bank’s US OperationsProven track record in building, improving and overseeing all areas of Finance, including Controllership, SOX, Treasury, FP&A, as well as internal and external reporting functionsPrior experience includes 8 years with GE Capital in various finance roles Heidi S. DeWyngaertEVP & Chief Lending Officer(since 2004) 30+ Previously at Webster Bank, managing the Fairfield County Commercial Real Estate group10 years as Vice President for CRE at First Union National Bank David P. DineenEVP & Head of Community Banking(since 2016) 30+ Previously at Capital One Commercial Bank as the National Market Manager for Treasury Management and Deposit Services Managed Retail Branch networks and Treasury Management sales teams at NorthFork Bank and Commerce Bank Christine A. ChivilyEVP & Chief Risk & Credit Officer (since 2013) 30+ Previously a Risk Manager for CRE and C&I at Peoples United BankSVP/Senior Credit Officer at RBS Greenwich Capital Markets (11 years); Director - Northeast Region, Multifamily at Freddie Mac (5 years); Manager, Loan Servicing - Distressed Assets at M&T Bank Laura J. WaitzEVP & Chief of Staff(since 2017) 30+ Previously Senior Managing Director, Global Head of Human Resources at The Blackstone Group (9 years)Also at Citi Alternative Investments as MD & Global Head of Compensation & at Deutsche Bank as Head of Compensation (Americas) & as Global Compensation Mgr. for Private Equity & Investment Bank Experienced management team with a diverse, non-community banking background