Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended July 31, 2018

Commission File Number: 000-53848

RISE GOLD CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 30-0692325 |

| (State or other jurisdiction of incorporation) | (IRS Employer Identification Number) |

650 – 669 Howe Street

Vancouver, British Columbia, Canada V6C 0B4

(Address of principal executive offices)

(604) 260-4577

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, Par Value $0.001 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934: ☐ Yes ☒ No

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

- 1 -

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Smaller reporting company ☒ |

| Non-accelerated filer ☐ | Emerging growth company ☒ |

| Accelerated filer ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

☐ Yes ☒ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: US$9,029,303

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of October 25, 2018, the registrant had 138,490,357 shares of common stock issued and outstanding.

- 2 -

| Table of Contents | ||

| Item | Page | |

| PART I | ||

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 9 |

| Item 1B. | Unresolved Staff Comments | 9 |

| Item 2. | Properties | 9 |

| Item 3. | Legal Proceedings | 35 |

| Item 4. | Mine Safety Disclosures | 35 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 35 |

| Item 6. | Selected Financial Data | 37 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 38 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 39 |

| Item 8. | Financial Statements and Supplementary Data | 39 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 63 |

| Item 9A. | Controls and Procedures | 63 |

| Item 9B. | Other Information | 64 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 64 |

| Item 11. | Executive Compensation | 67 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 70 |

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 72 |

| Item 14. | Principal Accounting Fees and Services | 73 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 74 |

| SIGNATURES | 76 | |

- 3 -

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (this “Report”) contains “forward-looking statements” relating to Rise Gold Corp. (the “Company”) which represent our current expectations or beliefs, including statements concerning its operations, performance, financial condition and growth. For this purpose, any statements contained in this Report that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, such as credit losses, dependence on management and key personnel, our ability to continue our growth strategy and competition, certain of which are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements.

CURRENCY

In this Report, unless otherwise indicated, all dollar amounts are expressed in Canadian dollars and references to $ are to Canadian dollars.

PART I

| Item 1. | Business |

DESCRIPTION OF BUSINESS

General Corporate Information

Our company was incorporated on February 9, 2007 as Atlantic Resources Inc. in the state of Nevada pursuant to the Nevada Revised Statutes. On April 11, 2012, we changed our name to Patriot Minefinders Inc. On January 14, 2015, we changed our name to Rise Resources Inc. On March 29, 2017, we changed our name to Rise Gold Corp.

On January 14, 2015, we completed a merger with our wholly owned subsidiary, Rise Resources Inc., and formally assumed the subsidiary’s name by filing Articles of Merger with the Nevada Secretary of State. The subsidiary was incorporated entirely for the purpose of effecting the name change and the merger did not affect our Articles of Incorporation or corporate structure in any other way.

On January 22, 2015, we completed a 1 for 80 reverse split of our common stock and effected a corresponding decrease in our authorized capital by filing a Certificate of Change with the Nevada Secretary of State (the “Reverse Split”). As a result of the Reverse Split, our authorized capital decreased from 1,680,000,000 shares to 21,000,000 and our issued and outstanding common stock decreased from 63,400,000 shares to 792,518, with each fractional share being rounded up to the nearest whole share.

Both the name change and Reverse Split became effective in the market at the open of business on February 9, 2015.

On April 9, 2015, we increased our authorized capital from 21,000,000 to 400,000,000 shares of common stock.

- 4 -

On March 29, 2017, we completed another merger with our wholly owned subsidiary, Rise Gold Corp., and formally assumed the subsidiary’s name by filing Articles of Merger with the Nevada Secretary of State. The subsidiary was incorporated entirely for the purpose of effecting the name change and the merger did not affect our Articles of Incorporation or corporate structure in any other way.

We currently have one wholly owned subsidiary, Rise Grass Valley, Inc., which holds certain of our interests and assets located in the United States, and in particular, our interest in the I-M Mine Property. Rise Grass Valley, Inc. was incorporated in the state of Nevada pursuant to the Nevada Revised Statutes.

Our common stock is currently listed in Canada on the CSE under the symbol “RISE”. We are a reporting issuer in British Columbia, Alberta, and Ontario in Canada. Our common stock is also currently traded in the United States on the OTCQB Market under the symbol “RYES”. We are an SEC reporting company by virtue of our class of common stock being registered under Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Description of Business

We are a mineral exploration company and our primary asset is a major past producing high grade property near Grass Valley, California, United States, which we own outright. In the past, we have held several other potential mineral properties in British Columbia, Canada, which have been written off based on the strength of the I-M Mine Project.

Business Development

Developments in our Company’s business during the July 31, 2018 fiscal year covered by this report include the following:

On August 8, 2017, we entered into a shares for debt settlement transaction with one of our creditors, providing for the settlement of approximately of approximately $95,952 of indebtedness through the issuance of 417,184 units of our securities at a deemed issue price of $0.23 per unit. Each unit was comprised of one share of common stock and one common stock purchase warrant. Each warrant entitles the holder to acquire one additional share of common stock at a price of $0.40 until May 5, 2019.

On September 25, 2017, we completed the first tranche of a non-brokered private placement, issuing an aggregate of 7,077,140 units at a price of $0.15 per unit for gross proceeds of $1,061,571. Each unit consists of one share of common stock and one transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance. In connection with the private placement, we paid or accrued finder’s fees of $540 and issued a total of 3,600 finder warrants exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On November 28, 2017, our common stock began trading on the OTCQB Market.

On December 11, 2017 the U.S. Securities and Exchange Commission declared effective our registration statement on Form S-1 relating to the resale of up to 52,560,780 shares of our common stock held by certain stockholders named in the registration statement.

On December 27, 2017, we completed the second tranche of a non-brokered private placement, issuing an aggregate of 6,417,000 units at a price of $0.15 per unit for gross proceeds of $962,550. Each unit

- 5 -

consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance. In connection with the private placement, we paid finders fees of $55,779 and issued a total of 371,860 finders’ warrants exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On January 3, 2018, we completed the third and final tranche of a non-brokered private placement, issuing an aggregate of 133,333 units at a price of $0.15 per unit for gross proceeds of $20,000. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.25 for a period of two years from the date of issuance.

On April 18, 2018, we completed a non-brokered private placement, issuing an aggregate of 35,161,000 units at a price of $0.10 per unit for gross proceeds of $3,516,100. Each unit consisted of one share of common stock and one non-transferable share purchase warrant exercisable into one share of common stock at a price of $0.15 for a period of three years from the date of issuance. In connection with the private placement, we paid finders fees of $2,100 and issued a total of 21,000 finders’ warrants exercisable into one share of common stock at a price of $0.15 for a period of two years from the date of issuance.

On April 18, 2018, Cale Thomas resigned from our Board of Directors and was replaced by John G. Proust. Our Board of Directors also granted a total of 6,381,000 stock options to certain of our employees, consultants and directors pursuant to the terms of our stock option plan. These options are exercisable at $0.12 per share until April 19, 2023.

On April 18, 2018, we entered into a consulting services agreement (the “JPA Agreement”) with J. Proust & Associates (the “Consultant”) pursuant to which the Consultant agreed to provide business advisory, finance, accounting, corporate administrative services and an office to our company to maintain continuous disclosure obligations and comply with public listing requirements on the Canadian Securities Exchange (the “CSE”) in Canada. Pursuant to the terms of the JPA Agreement, the Consultant provides such business advisory, finance, accounting and corporate administrative services as we may request from time to time. The Consultant has provided us with personnel for the positions of Chief Financial Officer, treasurer, controller and corporate secretary.

On May 1, 2018, Cale Thomas resigned as our Chief Financial Officer, Treasurer and Secretary. He was replaced on the same date by the appointment of Vince Boon as Chief Financial Officer and Eileen Au as Corporate Secretary and Treasurer. On May 16, 2018, Ms. Au resigned as Treasurer and Mr. Boon was appointed Treasurer in her stead. We also engaged certain technical advisers to assist with the advancement of our I-M Mine Project.

Plan of Operations

As at July 31, 2018, we had a cash balance of $69,616, compared to a cash balance of $337,099 as of July 31, 2017.

Our plan of operations for the next 12 months is to continue our current diamond drilling exploration activities at the I-M Mine Property. We plan to continue the recommended work program as outlined in the Report on the I-M Mine Property, which was issued on June 1, 2017.

The I-M Mine Property hosts numerous exploration targets that warrant drilling. While a significant drill program is required to test these targets, our initial plans are to complete the limited exploratory work program described in the Report. Contingent upon available financing, we plan to drill additional targets.

- 6 -

The Report recommended a single 6,000 ft (1,830 m) surface diamond drill hole to provide geological samples from most of the major lithological units on the I-M Mine Property geology. The single hole has been designed to pierce the #1 Vein projection approximately 400 ft (122 m) below the elevation of the I2400 Level and then carry on through the potential western extensions of the Idaho 3 Vein System. The objectives of this drill hole were as follows:

| 1) | Provide a long drill intercept of the Brunswick Block from surface to the Serpentinite contact |

| 2) | Test the up-dip area and below the 52 Vein (60 Winze) mineralized area in the Brunswick Block |

| 3) | Test the #1 Vein below the I2400 Level |

| 4) | Test the serpentinite footwall for potential 3 Vein/Rose Garden analogies |

| 5) | Test and obtain samples of ankerite alteration in the serpentinite unit |

| 6) | Test for the location of the major Idaho faults |

| 7) | Drill through the serpentinite unit to provide further insight on the thickness and geometry of this unit at depth |

| 8) | Determine drill hole deviation, drilling productivity, and drilling costs to allow refinement of the design of a major drill program at the I-M Mine Property |

In addition, Amec Foster Wheeler has recommended that the digital geological model created by the Rise management team be expanded to include model channel samples, the lithological contacts and structures such as the diabase dikes, ankerite alteration envelopes, minor quartz veins, and all faults mapped by the historic mine operators. This work may provide additional insight into the mineralization controls at the I-M Mine Property.

The cost of the work program was estimated in the Report to be approximately $595,000 as shown in the following table:

| Estimated Cost of Recommended Work Program | ||||||

| Hole Length (m) | 1829 | m | ||||

| Duration | 38 | days | ||||

| Drilling Cost | $ | 390,000 | ||||

| Mobilization | $ | 7,000 | ||||

| Standby charges | $ | 40,000 | ||||

| Centrifuge System | $ | 36,000 | ||||

| Living Allowance | $ | 29,000 | ||||

| Geology & Assaying | $ | 38,000 | ||||

| Supplies | $ | 15,000 | ||||

| Total Drilling Cost | $ | 555,000 | =$303/m | |||

| Geological Modelling | $ | 40,000 | ||||

| Total Work Program | $ | 595,000 | ||||

- 7 -

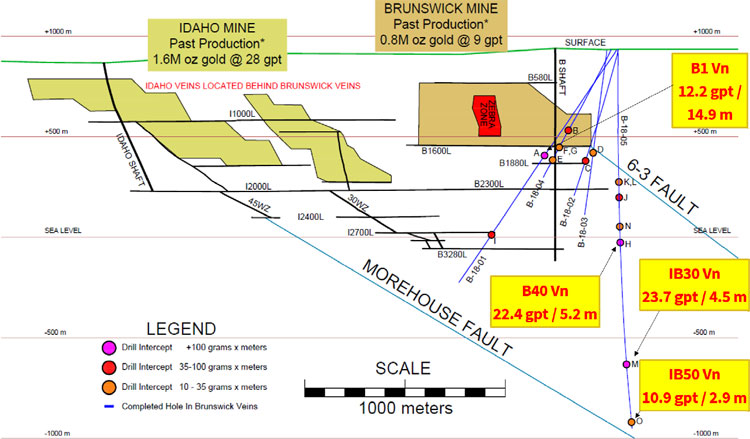

On January 3, 2018, we announced the assay results from drill hole B-17-01, the first drill hole of the exploration drilling program at the I-M Gold Project. Diamond drill hole B-17-01 (the “Drillhole”) was completed in November 2017. The Drillhole had a total length of 1419 m (4654 ft) and reached a depth of ~1157 m (3794 ft) below surface. The starting azimuth of the Drillhole was 310 degrees and the ending azimuth was 278 degrees with an average inclination of ~55 degrees. An intercept of 62.7 gpt gold over 2.7 m was intersected in the center vein of the Brunswick #1 Vein Set, approximately 50 m below the B1600 level at a depth of ~540 m below surface. The true width of the intercept is estimated at 1.4 m. The Drillhole intersected three sub-parallel veins at the Brunswick #1 Vein. The B1 Vein Set, including the Center Vein and two sections of internal waste, averaged 12.2 gpt gold over 14.9 m with an estimated true width of 7.8 m.

The Drillhole azimuth deviated significantly from the planned azimuth and, therefore, did not intersect the Idaho #1 Vein at depth as contemplated in the recommended Work Program. The target described in the Report remains untested and will be tested with future drilling.

On April 25. 2018, we announced the recommencement of exploration core drilling at the I-M Gold Project. We plan to drill additional holes in the B1 Vein to follow-up on Drillhole B-17-01. These holes will target an area between the B1600 level and the B2300 level. Historical records report both levels on the B1 Vein to be mineralized. We will also test several other Brunswick veins which are parallel to the B1 Vein. We expect to be drilling the Brunswick targets until approximately mid-June and then we will move the drill to test the Idaho #1 Vein target as recommended in the Technical Report.

We have implemented a quality control program for our drill program to ensure best practices in the sampling and analysis of the drill core. This includes the insertion of blind blanks, duplicates and certified standards. HQ and NQ sized drill core is saw cut with half of the drill core sampled at intervals based on geological criteria including lithology, visual mineralization, and alteration. The remaining half of the core is stored on-site at our warehouse in Grass Valley, California. Drill core samples are transported in sealed bags to ALS Minerals analytical assay lab in Reno, Nevada.

All gold assays were obtained using a method of screen fire assaying. The Historic I-M Mine Project is known to contain ‘coarse’ gold, for which a screen fire assay is the best way to obtain a definitive result. This procedure involves screening a large pulverized sample of up to 1 kg at 100 microns. The entire oversize (including the disposable screen) is fire assayed as this contains the ‘coarse’ gold and a duplicate determination is made on the ‘minus’ 100 micron fraction. A calculation can then be made to determine the total weight of gold in the sample. Any +100 micron material remaining on the screen is retained and analyzed in its entirety by fire assay with gravimetric finish and reported as the Au (+) fraction result. The –100 micron fraction is homogenized and two sub-samples of 50 grams are analyzed by fire assay with

- 8 -

AAS finish. If the grade of the material exceeds 10 gpt the sample is re-assayed using a gravimetric finish. The average of the two results is taken and reported as the Au (-) fraction result. All three values are used in calculating the combined gold content of the plus and minus fractions.

We have not attained profitable operations and are dependent upon obtaining financing to pursue our proposed exploration activities. For these reasons, our auditors believe that there is substantial doubt that we will be able to continue as a going concern.

Employees

We currently have eight full-time employees, which include our Chief Executive Officer. Our other officers and directors provide services to us on an as-needed basis, and we plan to rely on their efforts, as well as those of a number of independent consultants, to manage our operations for the foreseeable future.

Government Regulations

We plan to engage in mineral exploration and development activities and will accordingly be exposed to environmental risks associated with mineral exploration activity. We are the operator of the I-M Mine Property.

Our exploration and development activities will be subject to extensive federal, state and local laws, regulations and permits governing protection of the environment. Among other things, its operations must comply with the provisions of the Federal Mine Safety and Health Act of 1977 as administered by the United States Department of Labor.

Our plan is to conduct our operations in a way that safeguards public health and the environment. It believes that its operations comply with applicable environmental laws and regulations in all material respects.

The costs associated with implementing and complying with environmental requirements can be substantial and possible future legislation and regulations could cause us to incur additional operating expenses, capital expenditures, restrictions and delays in developing or conducting operations on its properties, including the I-M Mine Property, the extent of which cannot be predicted with any certainty.

To the best of our knowledge, there are no existing environmental liabilities on the I-M Mine Property.

| Item 1A. | Risk Factors |

Not required.

| Item 1B. | Unresolved Staff Comments |

None.

| Item 2. | Properties |

Selective Glossary of Technical Terms

accretion – Process by which material is added to a tectonic plate or landmass. This material may be sediment, volcanic arcs, seamounts or other igneous features.

- 9 -

albite – A kind of plagioclase mineral within the feldspar group with formula NaAlSi3O8. Its colour is white to grey.

amphibolite – A gneiss or schist largely made up of amphibole and plagioclase minerals.

ankerite – A calcium, iron, magnesium, manganese carbonate mineral of the group of rhombohedral carbonates.

arsenic – Chemical element with the symbol As and occurs in many minerals, usually in combination with sulfur and metals, but also as a pure elemental crystal.

carbonate – Class of sedimentary rocks composed primarily of carbonate minerals; the two major types are limestone and dolomite.

chalcopyrite – A sulphide mineral of copper common in the zone of secondary enrichment.

chlorite – Group name for about 10 related minerals and a member of the mica group of minerals. Chlorite is very common, and is often an uninteresting green mineral coating the surface of more important minerals.

en-echelon – Roughly parallel but staggered structures.

epizonal – Depth of formation of an orogenic deposit (<6 km / <3.7 mi).

facies – The characteristics of a rock unit that reflect its environment of deposition and allow it to be distinguished from rock deposited in an adjacent environment.

foliation – Repetitive layering in metamorphic rocks; the thickness of the layers can vary.

footwall – The rock on the underside of a vein or mineralized structure.

free gold – Gold, uncombined with other minerals, found in a pure state.

free milling – Mineralized material of gold from which the precious metals can be recovered by concentrating methods without resorting to pressure leaching or other chemical treatment.

gabbro – A dark, coarse-grained igneous rock.

galena – Lead sulphide, the most common form of lead.

gangue – The worthless minerals in an mineralized deposit.

greenschist – Metamorphic rocks that formed under the lowest temperatures and pressures usually produced by regional metamorphism, typically 300–450 °C (570–840 °F) and 2–10 kilobars (14,500–58,000 psi).

hangingwall – The rock on the upper side of a vein or mineralized deposit.

hydrothermal – Relating to hot fluids circulating in the earth’s crust.

hydrothermal gold deposit – During the reaction between mineral-bearing hydrothermal fluids and wall-rocks, some elements are concentrated in specific locations to form hydrothermal gold deposits. They are usually controlled by faults or shear structures, occurring as veins and stockworks, or by strata.

hypozonal – Depth of Formation of an orogenic deposit (>12 km / >7.5 mi).

intrusive – A body of igneous rock formed by the consolidation of magma intruded into other rocks, in contrast to lavas, which are extruded upon the surface.

- 10 -

jura-triassic arc belt – One of the geologic packages of the Sierra Nevada Foothills belt which consists of a Paleozoic basement of disrupted ophiolite, serpentinite mélange, and ultra-mafic rocks overlain by uppermost Triassic-Early Jurassic arc volcanics and coeval 200 Ma intrusive rocks.

lithology – Description of its physical characteristics of a rock unit at outcrop, in hard or core samples or with microscopy, such as colour, texture, grain size, or composition.

low-sulphide au-quartz vein – Gold-bearing quartz veins and veinlets with minor sulphides crosscutting a wide variety of host rocks and are localized along major regional faults and related splays. The wallrock is typically altered to silica, pyrite and muscovite within a broader carbonate alteration halo.

mafic – Igneous rocks composed mostly of dark, iron- and magnesium-rich minerals.

mariposite – A mineral which is a chromium-rich variety of mica, which imparts an attractive green colour to the generally white dolomitic marble in which it is commonly found.

mélange – A large-scale breccia, a mappable body of rock characterized by a lack of continuous bedding and the inclusion of fragments of rock of all sizes, contained in a fine-grained deformed matrix.

matrix – Finer-grained mass of material wherein larger grains, crystals or clasts are embedded.

meta-volcanic rocks – A type of metamorphic rock that was first produced by a volcano, either as lava or tephra and then buried underneath subsequent rock and subjected to high pressure and temperatures, causing the rock to recrystallize.

mesothermal quartz vein – Also known as and are type-examples of low-sulfide Au-quartz vein deposits.

mesozonal – Depth of formation of an orogenic deposit (6–12 km / 3.7-7.5 mi).

metamorphosed – Rocks which have undergone a change in texture or composition as the result of heat and/or pressure.

mill head grade – The grade of the mineralized material which is fed into the processing plant to be concentrated into gold bullion. The mill head grade includes mining dilution from un-mineralized rock adjacent to the veins. The mill head grade does not account for metallurgical recovery of gold during the processing of the mineralized material.

ophiolitic rock – An assemblage of the Earth’s oceanic crust and the underlying upper mantle that has been uplifted and exposed above sea level and often emplaced onto continental crustal rocks.

orogeny – An episode of intense deformation of the rocks in a region, generally accompanied by metamorphism and plutonic activity.

orogenic gold deposit – Dominantly form in metamorphic rocks in the mid- to shallow crust (5-15 km depth), at or above the brittle-ductile transition, in compressional settings that facilitate transfer of hot gold bearing fluids from deeper levels. The term “orogenic” is used because these deposits likely form in accretionary and collisional orogens.

paleozoic – Geological era that followed the Precambrian and during which began with the appearance of complex life, as indicated by fossils (from 245 to 570 mil. of years ago).

pyrite – A yellow iron sulphide mineral, normally of little value. It is sometimes referred to as “fool’s gold”.

quartz – Common rock-forming mineral consisting of silicon and oxygen.

sedimentary rock – Secondary rocks formed from material derived from other rocks and laid down under water. Examples are limestone, shale, and sandstone.

- 11 -

serpentinite – Type of metamorphic rock composed mostly of mineral serpentine. It is usually dark green to green-black in colour, massive and macroscopically dense.

schistosity – Geological foliation (metamorphic arrangement in layers) with medium to large grained flakes in a preferred sheetlike orientation.

scheelite – A variously colored mineral, CaWO4, found in igneous rocks and a common form of tungsten.

sericite – A fine grained mica and a common alteration mineral of orthoclase or plagioclase feldspars in areas that have been subjected to hydrothermal alteration typically associated with hydrothermal deposits.

splay – A series of branching faults near the termination of a major fault which spread the displacement over a large area.

stope – An excavation in a mine from which mineralized material is, or has been extracted.

tectonism – Geological term used to describe major structural features and the processes that create them, including compressional or tensional movements on a planetary surface that produce faults, mountains, ridges, or scarps.

terrane – A crustal block or fragment that is typically bounded by faults and that has a geologic genesis distinct from those of surrounding areas.

tertiary – Former term for the geologic period from 65 million to 2.6 million years ago, a timespan that occurs between the superseded Secondary period and the Quaternary.

thermal gradient – Rate of increasing temperature with respect to increasing depth in the Earth’s interior.

ultra-mafic – Igneous and meta-igneous rocks with a very low silica content, composed entirely or almost entirely of ferromagnesian minerals, and are composed of usually greater than 90% mafic minerals.

Abbreviations

| Imperial | Metric | ||

| AC | acres | m | meter |

| SF | square foot | km | kilometer |

| lb | pound | ha | hectare |

| oz | ounce | g | grams |

| mi | mile | kg | kilogram |

| ft | foot | gpt | grams per tonne |

Conversions

| Imperial to Metric | Metric to Imperial | |||

| Imperial Measure | Metric Unit | Metric Measure | Imperial Unit | |

| 2.47 acres | 1 hectare | 0.4047 hectare | 1 acre | |

| 3.28 feet | 1 metre | 0.3048 metre | 1 foot | |

| 0.62 mile | 1 kilometre | 1.609 kilometres | 1 mile | |

| 0.03215 troy ounce | 1 gram | 31.1035 grams | 1 troy ounce | |

| 0.02917 troy ounce per ton | 1 gpt | 34.2857 gpt | 1 troy ounce per ton | |

| 1.102 short ton | 1 tonne | 0.907 tonne | 1 short ton | |

| 2.2046 pounds | 1 kilogram | 0.4536 kilogram | 1 pound | |

- 12 -

I-M Mine Property, California

Our principal mineral property is the I-M Mine Property.

I-M Mine Project

The information in this Report with respect to the I-M Mine Property is derived from a technical report prepared in compliance with National Instrument 43-101 (Standards of Disclosure for Mineral Projects) (“NI 43-101”) mandated by Canadian Securities Regulatory authorities. Entitled “Technical Report on the Idaho-Maryland Project, Grass Valley, California, USA” (the “Technical Report”) and dated June 1, 2017, the Technical Report was prepared by Greg Kulla, P.Geo. (the “Author”) of Amec Foster Wheeler Americas Limited. The Author is an independent Qualified Person for purposes of NI 43-101. The full text of the Technical Report is available for review at our corporate offices located at Suite 650 – 669 Howe Street, Vancouver, BC V6C 0B4, and may also be accessed online, under our company’s profile, on the SEDAR website: www.sedar.com. Readers are encouraged to review the Technical Report in its entirety.

Project Location, Description and Access

Property Location

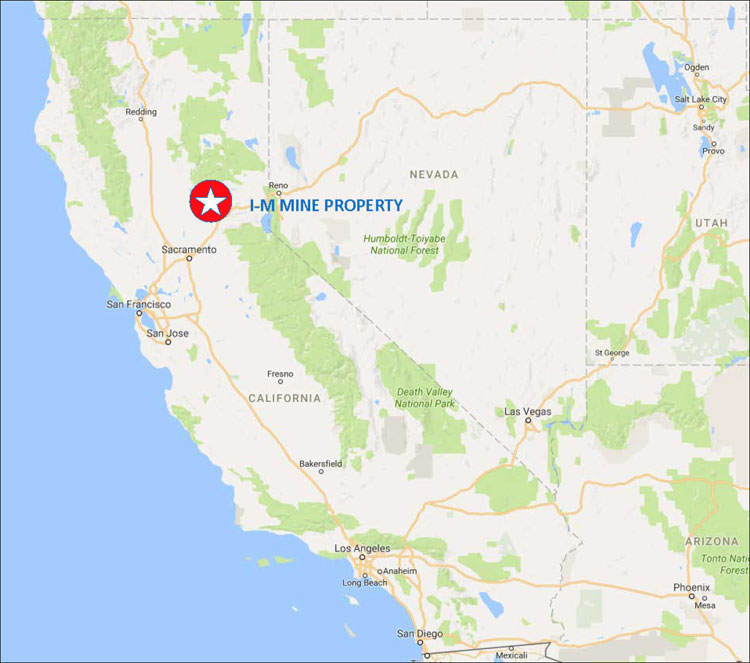

The I-M Mine Property comprises approximately 93 acres (38 hectares) surface land and approximately 2,800 acres (1,133 hectares) of mineral rights located near Grass Valley of Nevada County in northern California, USA. The I-M Mine Property is situated in the Grass Valley-Nevada City District along the western slope of the Sierra Nevada, as shown on the overview map and regional map in Figure 1 and Figure 2, respectively and is located approximately 60 miles northeast of Sacramento, CA and 90 miles west of Reno, NV.

- 13 -

Figure 1: Idaho-Maryland Mine Property Location Overview

- 14 -

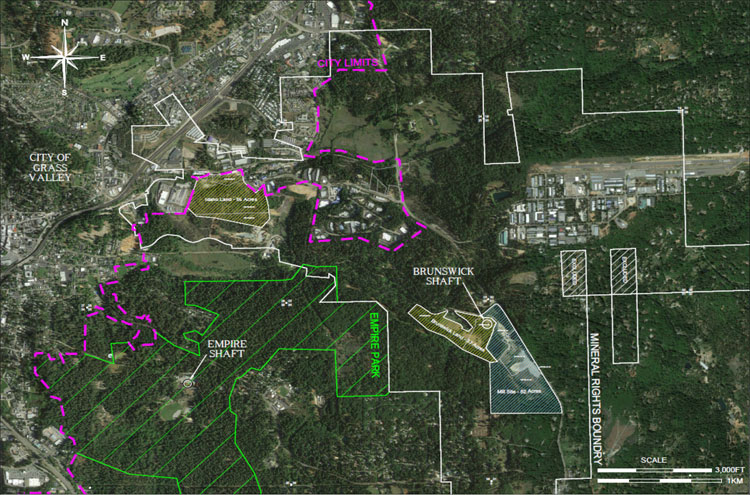

Figure 2: Idaho-Maryland Mine Property, Regional Map

- 15 -

Property Description

The recorded owner of the surface land and mineral rights associated with the I-M Mine Property, as documented by a Quitclaim Deed recorded by the Nevada County Recorder on the 26th of January 2017 (Document #: 20170001985), is Rise Grass Valley Inc., a Nevada Corporation and subsidiary of Rise Gold Corp. Rise Grass Valley Inc. purchased the I-M Mine Property, inclusive of its mineral rights from the Grantors of the BET Group Estate, as described in the Quitclaim Deed (Document #: 20170001985), on the 25th of January 2017.

Surface Rights

The I–M Mine Property surface rights include two parts of fee simple land, (1) Idaho land representing 56 acres (23 hectares) and (2) Brunswick land representing 37 acres (15 hectares) as displayed in Figure 3.

The I-M Mine Property consists of parcels of surface land located in portions of Section 26 and 36, Township 16 North – Range 8 East Mount Diablo Base and Meridian (MDM) and Section 31, Township 16 North – Range 9 East MDM as detailed in Table 1 and displayed in Figure 3.

| Table 1: | Idaho-Maryland Mine Property – Surface Land Legal Description |

| Parcel Number |

Description | Lot Size |

| 09-550-32 | SEC 26, TWN 16N, RNG 8E, MDM, PTN N 1/2 26-16-8 | 20,908

SF (0.48 AC) |

| 09-550-37 | SEC 26, TWN 16N, RNG 8E, MDM, PTN NE 1/4 26-16-8 | 4.47 AC |

| 09-550-38 | SEC 26, TWN 16N, RNG 8E, MDM, PTN NE 1/4 26-16-8 | 40.1 AC |

| 09-550-39 | SEC 26, TWN 16N, RNG 8E, MDM, PTN NE 1/4 26-16-8 | 42,668 SF |

| 344 CENTENNIAL DRIVE GRASS VALLEY, CA 95945 | (0.98 AC) | |

| 09-550-40 | SEC 26, TWN 16N, RNG 8E, MDM, PTN NE 1/4 26-16-8 | 5,662

SF (0.13 AC) |

| 09-560-36 | SEC 26, TWN 16N, RNG 8E, MDM, PTN N 1/2 SE 1/4 26-16-8 | 10.25 AC |

| 09-630-37 | SEC 36, TWN 16N, RNG 8E, MDM, LOT 6 BET ACRES | 21.8 AC |

| 09-630-39 | SEC

36, TWN 16N, RNG 8E, MDM & SEC 31, TWN 16N, RNG 9E, MDM, LOT 7 BET ACRES |

15.07 AC |

- 16 -

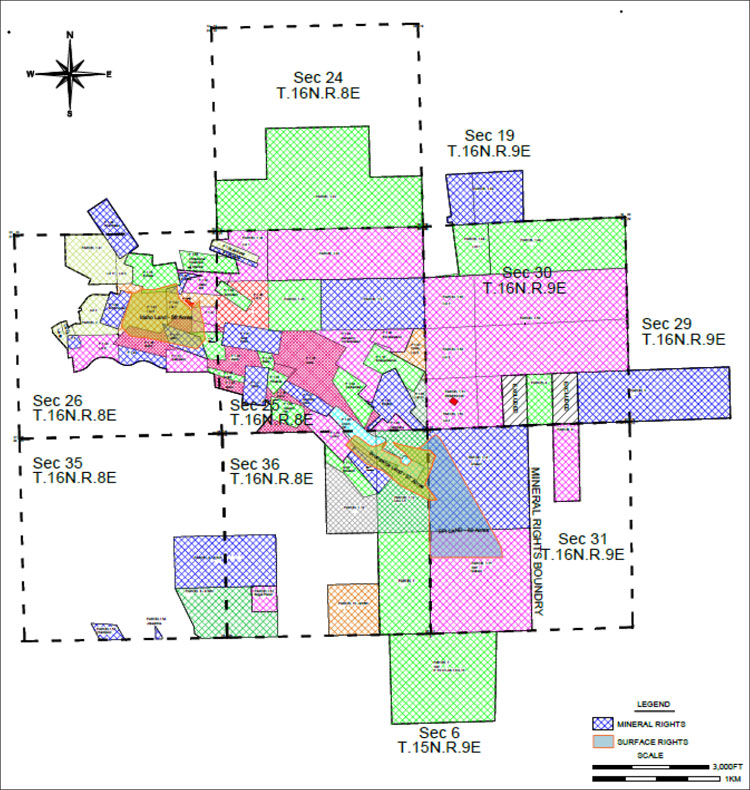

| Figure 3: | Idaho-Maryland Mine Property, Surface and Mineral Land Holdings |

- 17 -

Surface Land Obligations

Fee simple ownership entitles the owner to all rights of a property, which are only restricted by law or private restrictions, such as zone ordinances or covenants. Fee simple owners retain possession of their property permanently, assuming all obligations to the land are met.

The surface land is subject to a tax lien imposed by and payable to Nevada County. The parcels comprising the Idaho land and Brunswick land have a combined annual property tax of $16,126.78 for the fiscal year ending June 30th, 2018. The total amount includes County taxes and Agency taxes. The I-M Mine Property remains in good standing with property taxes paid in full through January 31th, 2019.

The Nevada Irrigation District supplies treated water to the I-M Mine Property. Water to the Brunswick land is delivered from the Loma Rica System, while water to the Idaho land is delivered from the E. George System. A nominal service fee is charged.

There are no further interests registered against the title of the surface rights.

Land Designation

The Brunswick land is located approximately 1 to 2 miles southeast of the city limits of the City of Grass Valley in Nevada County. The Idaho land is located on Idaho-Maryland Rd adjacent to the city limits of the City of Grass Valley in Nevada County. The I-M Mine Property in relation to city limits is shown on Figure 3. Due to its proximity, the I-M Mine Property is located within the City of Grass Valley’s planning area boundary, with Brunswick land located in the “Long-term Annexation” and Idaho land located in the “Near-term Annexation” Sphere of Influence. Based on the City of Grass Valley 2020 General Plan, the planned land use designation for the Brunswick land remains “M-1” Manufacturing/Industrial, while the planned land use designation for the Idaho land is “BP” Business Park (CoGV-CDD, 2009).

Each of the parcels of Brunswick land and Idaho land are positioned within the County’s “M1” Light Industrial Zone. Within the “M1” District, surface access to subsurface mining (e.g., vent and escape shafts) is allowed with a Use Permit (Nevada County Code § L-II 3.21.). Mineral exploration, however, is distinct from the definitions of “subsurface mining” and “surface mining.” Exploration involves the search for economic minerals through the use of geological surveys, geophysical or geochemical prospecting, bore holes and trial pits, and surface or underground headings, drifts, or tunnels (NCC § L-II 3.22(B)(5).). Exploration diamond drilling on M1-Industrial Land is an allowed use and does not require a discretionary permit provided that no water is discharged offsite and disturbance per site is less than 1 acre and 1,000 yd3 material (NCC, 2017).

The Project area is private land and no permits or consultations with the US Bureau of Land Management (BLM) or the US Forest Service (USFS) are required.

Mineral Rights

The I-M Mine Property consists of mineral rights on 10 parcels, including 55 subparcels, totaling 2,800 acres (1,133 hectares), of full or partial interest, as detailed in Table 2 and displayed in Figure 4. The mineral rights encompass the past producing I-M Mine Property which includes the Idaho and Brunswick underground gold mines.

- 18 -

The original mineral rights were granted at various times since 1851. Through various patents and agreements since the original grants, there has been a succession of ownership of the mineral rights.

The Quitclaim Deed describes the mineral rights as follows:

The I-M Mine Property consists of all rights to minerals within, on, and under the land shown upon the Subdivision Map of BET ACRES, No. 85-7, filed in the Office of the County Records, Nevada County, California, on February 24, 1987, in Book 7 of Subdivisions, at Page 75 et seq.

The I-M Mine Property consists of all rights to minerals within, on, and under the land located in portions of Sections 23, 24, 25, 26, 35, and 36 in Township 16 North – Range 8 East MDM, Sections 19, 29, 30, and 31 in Township 16 North – Range 9 East MDM, and Section 6 in Township 15 North – Range 9 East MDM and all other mineral rights associated with the Idaho-Maryland Mine.

The mineral rights are defined as parcels and subparcels in a Quitclaim Deed (Document #: 20170001985). All property is described in that Quitclaim Deed by Idaho Maryland Industries Inc. in favor of William Ghidotti and Marian Ghidotti, his wife as tenants in common, dated June 10, 1963. The Quitclaim deed is located at vol. 337, pp. 175-196 in the official records of Nevada County, as recorded on June 12, 1963.

Mineral rights pertain to all minerals, gas, oil and mineral deposits of every kind and nature beneath the surface of all such real property, together with all necessary and convenient rights to explore for, develop, produce, extract and take the same, subject to the express limitation that the fore-going exception and reservation shall not include any right of entry upon the surface of said land without the consent of the owner of such surface of said land, as excepted in the Quitclaim Deed recorded the 26th of January 2017 (Document #: 20170001985). Mineral rights are severed from surface rights at a depth of 200 ft (61 m) below surface, with all mineral rights being contiguous below 200 ft (61 m) of surface.

There are no interests registered against or obligations required of the mineral rights of the I-M Mine Property.

- 19 -

| Figure 4: | Idaho-Maryland Mine Property, Surface and Mineral Rights |

Property Access

The I-M Mine Property is situated east of the City of Grass Valley and south of Nevada City, in western Nevada County. State Route 49, State Route 20, and State Route 174 (state highways) connect the Grass Valley area regionally. The Brunswick land and the adjacent Mill Site are situated on the south western quadrant of the intersection of the East Bennett Road, a two-lane artery, and Brunswick Road, a major two-lane artery connecting Grass Valley with State Highway 174. Access to the Brunswick land is on Millsite Road via the East Bennet Road, approximately 2.8 miles east of Grass Valley Center. The Idaho land is situated along the Idaho Maryland

- 20 -

Road to the south, centered between Railroad Avenue and Brunswick Road. The Idaho land can be accessed by Idaho Maryland Road or Centennial Drive and multiple trails are present across the property.

Agreements

Rise owns a 100% interest in the I-M Mine Property and there are no known royalties on future gold production. There are no other known agreements or encumbrances to which the I-M Mine Property is subject.

Environmental Liabilities

Environmental studies have been completed on all the surface holdings owned by Rise. The environmental studies were completed prior to Rise purchasing the Idaho land and Brunswick land.

Idaho Land

In 2016, a Draft Preliminary Endangerment Report on the Idaho Land was prepared for the City of Grass Valley by Geocon Consultants Inc. This report provided conclusions and recommendations to support redevelopment of this site for commercial and industrial use. Geocon noted the metal of greatest concern with respect to potential health risks for future site occupants is arsenic which is present in mine tailings and waste berms located on the site. Geocon noted that the presence of arsenic in mine waste on the site does not currently appear to pose a significant risk to public health or the environment in its current state and that an expedited response action does not appear warranted at this time (Geocon, 2016).

Brunswick Land

In 2007, a Phase I Environmental Site Assessment for the Round-Hole and New Brunswick Mine Sites was prepared by Engineering/Remediation Resources Group, Inc. (“ERRG”) for Idaho-Maryland Mining Corporation. The report concluded that there were no current recognized environmental conditions on the I-M Mine Property at the time, although there are suspect environmental concerns regarding spills of hydrocarbons from vandalism at the New Brunswick Shaft, roofing asphalt on the property, debris from illegal dumping on the property boundaries, and the potential for naturally occurring asbestos in serpentinite rocks on the property. ERRG did not complete an analysis to determine if contamination from historic mining and mineral processing was present, although ERRG has recommended further sampling and studies to determine this (ERRG, 2007).

Permits

All parcels included in the I-M Mine Property are within the “M1” Light Industrial Zoning District of Nevada County. Mineral exploration is allowed in M1 Districts subject to zoning compliance and building permit issuance, if required. A Use Permit is only required for mineral exploration if one of the following conditions are triggered, as per NCC § L-II 3.22(D)(2):

| (a) | Overburden or mineral deposits in excess of 1,000 cubic yards are disturbed, or |

| (b) | The operation in any one location exceeds one acre in size, or |

| (c) | Dewatering will occur or water will be discharged from the site as a result of the operation. |

Additionally, all exploratory operations shall require a reclamation plan and secure adequate financial assurances to ensure site reclamation unless:

| (a) | Less than 1,000 cubic yards of overburden are disturbed, and |

| (b) | The size of the operation in any one location is one acre or less. |

- 21 -

In those instances where a reclamation plan is not required, an erosion control plan as per NCC § L-V 13.14., approved by the Nevada County Planning Department, and a grading permit shall be required for those operations in which 50 cubic yards or more of overburden are disturbed as per NCC § L-II 3.22(D)(2) (NCC, 2017).

A building permit, issued by the County, may be required for construction or installation of drilling facilities. A building permit is a ministerial approval. Ministerial approval is a non-discretionary approval.

Surface exploration drilling will be subject to Nevada County Noise Regulations. The Noise Element of the Nevada County General Plan (2014) establishes maximum allowable exterior noise levels for various land use categories (NC-BOS, 2014).

Other significant risks

No significant factors or risks are currently known to exist which would affect access, title, or the right or ability to perform exploration work on the I-M Mine Property.

History

The Idaho-Maryland Mine (the “I-M Mine”), located in the Grass Valley mining district of northern California was one of the most productive and best known gold mines in the Unites States, with gold production from the I-M Mine Property dating back to 1863.

The I-M Mine, as it now exists, represents a consolidation of a number of important early day producing mines including Eureka, Idaho, Maryland, Brunswick, and Union Hill Mines. Based on historic production records, the I-M Mine produced a total of 2.4 Moz gold at an average mill head grade of approximately 0.5 oz/ton (17.1 gpt). The I-M Mine was reportedly the second largest gold mine in the United States in 1941 (Clark, 2005), producing up to 129,000 oz gold per year before being forced to shut down by the US government in 1942 (Shore, 1943). Due to lack of development, a decline in gold production was experienced and recovery from war-time shutdown never occurred.

Historic Exploration & Mine Development

The I-M Mine has a rich history of mining work completed between 1863 and 1956 by various operators. Extensive exploration and underground mine development was completed during that time on the I-M Mine Property. The I-M Mine Property and its comprehensive collection of original documents was rediscovered in 1990 by Consolidated Del Norte Ventures Inc., the predecessor company of Emgold Mining Corporation (“Emgold”), and efforts were made to reopen the historic mine.

Exploration & Mine Development 1851-1956

Exploration by historic operators from 1851 through to 1956 was mainly completed by lateral exploration (drift development) and raise or winze development. Levels were driven along the strike of the veins to determine their extent. Raises were developed upwards following the dip of the vein and winzes were sunk down along the dip of the vein. Chip samples were assayed for mineralization of the quartz vein. In 1923, the first prospect drill was purchased. Following that, exploration holes were completed ahead of mine development to confirm vein locations and to locate vein extensions.

The I-M Mine encompasses a system of underground tunnels, many raises, numerous winzes, four inclined shafts, and two vertical shafts. An estimated equivalent of 72.8 miles (117 km) of underground tunnel occur at the I-M Mine, assuming typical drift dimensions of 7.5 ft x 8.5 ft (W x H).

- 22 -

Based on available historic records, 883 exploratory holes totalling approximately 234,100 ft (71,354 m) were diamond drilled at a diameter of 7/8” (EX-size). Historic drill logs were not available for review and no historic drill core was preserved from past mining operations at the I-M Mine.

Exploration & Mine Development 2003-2004

Emgold and its former entities leased the I-M Mine Property from 1990 to 2013. Development work during this period included completion of a preliminary investigation of the mine records, publishing various technical reports on the I-M Mine Property, leasing or purchasing adjacent properties, various permit applications and associated environmental studies, development of a ceramics technology process, and completion of an exploration program. Emgold was unsuccessful in reopening the historic mine due to inability to raise necessary funding in the midst of unfavourable market conditions.

Emgold completed an exploration program on the I-M Mine Property in 2003 and 2004. Gold exploration consisted of 31 diamond drill holes totalling 21,335 ft (6,502 m) and 7 drill holes totalling 3,537 ft (1,078 m) were completed for geotechnical and ceramics feedstock work.

The surface exploration drill program focused on the westernmost portion of what Emgold termed the Idaho Deformation Corridor, along the Idaho Fault Zone. Exploration drilling was mainly conducted from two sites; 1) west of the Eureka shaft and 2) west of the Idaho shaft, both targeting near surface mineralization around historic workings.

The Emgold diamond drill hole database was acquired by Rise in the purchase of the I-M Mine Property. As per the purchase agreement with the BET Group, ownership transfer of the I-M Mine Property included all historical documents to which the BET Group held rights, inclusive of Emgold data.

Production History

Rise has completed a compilation of the mine production data of the I-M Mine during historic operation from 1866 through 1955, the final year of production from the mine. Rise estimates that the I-M Mine produced a total of 2,414,000 oz of gold from 5,298,000 tons of mill feed and that the life of mine average mill head-grade averaged approximately 0.50 oz/ton (17.1 gpt). Total production for the I-M Mine is detailed in Table 3.

| Table 3: | Total Idaho-Maryland Mine Production from 1866-1955* |

| Mined & Milled | Mill Head Grade | Metallurgical Recovery |

Yield | Gold Produced | |||

| tons | tonnes | oz/ton | gpt | % | oz/ton | oz | |

| Idaho Mine | |||||||

| #1 Vein | 978,000 | 887,000 | 1.12 | 38.6 | 85% | 0.96 | 935,000 |

| 3 Vein system | 1,215,000 | 1,102,000 | 0.60 | 20.4 | 95% | 0.56 | 686,000 |

| Total | 2,193,000 | 1,989,000 | 0.83 | 28.4 | 89% | 0.74 | 1,621,000 |

| Brunswick Mine | |||||||

| Old Brunswick | 41,000 | 37,000 | 0.56 | 19.3 | 85% | 0.49 | 20,000 |

| Union Hill | 35,000 | 32,000 | 1.21 | 41.5 | 85% | 1.03 | 36,000 |

| New Brunswick | 3,029,000 | 2,748,000 | 0.26 | 8.8 | 95% | 0.24 | 737,000 |

| Total | 3,105,000 | 2,817,000 | 0.27 | 9.3 | 94% | 0.26 | 793,000 |

| Total I-M Mine | 5,298,000 | 4,806,000 | 0.50 | 17.1 | 91% | 0.46 | 2,414,000 |

| * | Details regarding data verification are presented under the heading “Data Verification” below. |

- 23 -

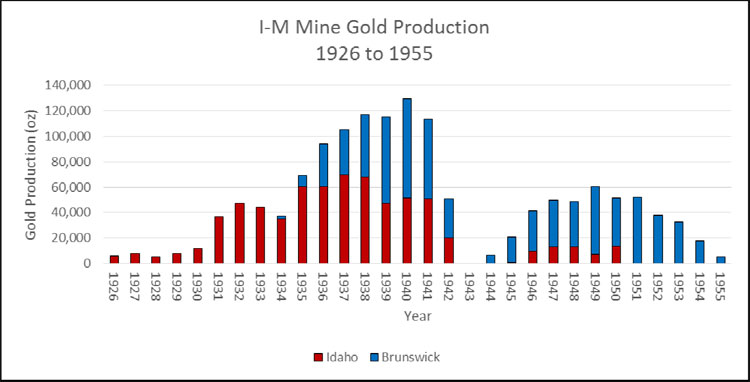

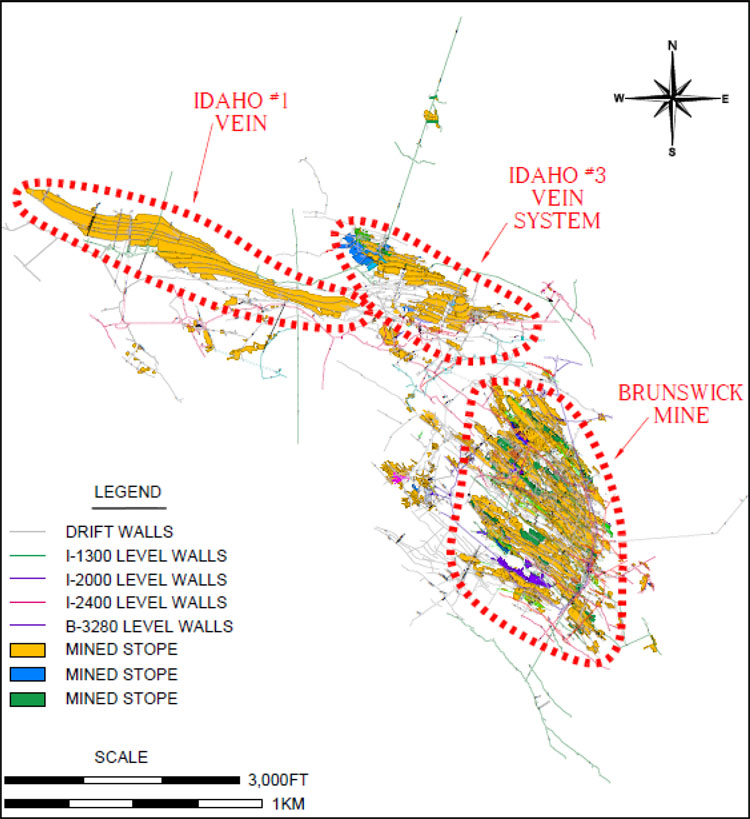

In 1926, Errol MacBoyle took over management of the I-M Mine and, as President and General Manager, led the mine into its most successful period of production. A graph of production from the Idaho and Brunswick Mines from 1926 to 1955 is displayed in Figure 5. The historic mine workings of the I-M Mine are displayed in Figure 6.

| Figure 5: | I-M Mine Gold Production from 1926-1955* |

| * | Details regarding data verification are presented on page 31 of the Application. |

- 24 -

| Figure 6: | Idaho-Maryland Mine Workings, Plan View |

- 25 -

Mill Head Grade

The mill head grade is the grade of the mineralized material which is fed into the processing plant to be concentrated into gold bullion. The mill head grade includes mining dilution from un-mineralized rock adjacent to the veins. The mill head grade does not account for metallurgical recovery of gold during the processing of the mineralized material.

Data Verification

Detailed production information from the internal records of the I-M Mine is available for the period from 1926 through 1955. Whenever possible, mill reports were reconciled against financial statements and submissions by Rise to the US Bureau of Mines. Where reconciliation between documents was possible, only minor variations in production reporting were noted. The entire library of documents is no longer fully complete but there is sufficient material to make an accurate estimate of historic production during this period. The following materials were used to prepare an estimate during the period from 1926-1955:

| ● | Idaho Maryland Mines Co. Financial Statements (1926-1932, 1934-1942) |

| ● | Idaho Maryland Mines Co. Mill Reports (1933-1942, 1946-1950) |

| ● | Idaho Maryland Mines Co. Final Distributions Sheets (1944, 1945) |

| ● | Idaho Maryland Mines Co. Breakdown of Income and Expenses (1946-1949) |

| ● | Idaho Maryland Mines Co. Cost Data & Cost Sheets from (1946-1949) |

| ● | Idaho Maryland Mines Corp. Lode Mine Production Report to US Bureau of Mines (1944-1945, 1947-1948, 1950, 1952, 1953, 1955) |

For the period prior to 1926 there are no internal corporate records regarding historic production. The Author believes this information is reliable but the source documents used by the authors of these documents are not available for reconciliation. The following documents were used to prepare an estimate during the period from 1866-1925:

| ● | Lindgren, Waldemar. The Gold Quartz Veins of Nevada City and Grass Valley Districts, California (1896) |

| ● | Hamilton, Fletcher. Mines and Mineral Resources of Nevada County (1918) |

| ● | Clark, Jack. Gold in Quartz: The Legendary Idaho Maryland Mine (2005) |

Detailed records of metallurgical recoveries from the I-M Mine prior to 1924 are also not available. From 1924-1930 gold recoveries ranged from 72% to 89% using a similar process to that used in the years prior to 1924. Lindgren (1896) estimated that gold mills in the Grass Valley mines averaged 75% metallurgical gold recovery but noted that the I-M Mine was unique in that it treated the tailings from its concentrates by secondary processes. Rise has assumed a metallurgical recovery of 85% for the pre-1924 processing at the I-M Mine which it believes is the best estimate possible given the information available.

- 26 -

Geological Setting, Mineralization and Deposit Types

Geology

The I-M Mine Property is located in the Grass Valley area of the Western Sierra Nevada Foothills of Northern California. This belt of rocks consists of late Paleozoic marine sedimentary and ophiolitic rocks, and early and late Mesozoic submarine volcanic-arc and basinal terranes.

The Jura-Triassic arc belt has yielded the majority of gold production in the Western Sierra Nevada Foothills. Gold deposits in Jura-Triassic arc belt are associated with second, third, and fourth–order faults related to the regionally significant Wolf Creek/Bear Mountain and Melones faults.

The Grass Valley area is dominated by blocks of variably metamorphosed volcanic, mafic plutonic, and minor sedimentary rocks hosted in a serpentinite matrix. The whole package of rocks exhibits a region foliation and is interpreted as a serpentinite-matrix tectonic mélange. These rocks were variably metamorphosed from lower greenschist to amphibolite facies during and after accretion to the continental margin. Two distinct gold vein groups exist within the Grass Valley district: steeply dipping E-W-trending veins in the northern and generally N-S trending veins with gentler dips averaging 35° in the southern part of the district. The most important E-W veins are associated with the I-M Mine Property. Both vein sets have extraordinary vertical and lateral persistence; individual veins extend for kilometers.

Mineralization

All of the significant gold production from the I-M Mine was localized within and around the Brunswick Block, which consists of variably metamorphosed volcanic and intrusive, and minor sedimentary rocks. The Brunswick Block is surrounded to the west, north, and east by gabbro and serpentinite rocks. Overlying Tertiary volcanic rocks mask rock units along the southern boundary of the Brunswick Block. The contacts between the Brunswick Block and surrounding gabbro and serpentinite are dominated by the 6-3, the Idaho, and the Morehouse Fault domains. Mineralization is closely associated with these significant second or third order structures close to the contact between the Brunswick block and serpentinite contact. Gold in the quartz veins occurs as native gold, ranging from very fine grains to large nuggets within the quartz. Sulfide minerals, primarily pyrite with lesser galena, chalcopyrite, from 1% to 4% are commonly associated with gold mineralization. Scheelite is common in the Union Hill area near the Brunswick mine. Gangue minerals include quartz, carbonate, sericite, chlorite, mariposite, and albite. Ankerite is a common alteration mineral and may occur in the mafic and ultra-mafic rocks and the meta-volcanic rocks. The mineralized wallrock is strongly carbonate altered.

Gold mineralization on the I-M Mine Property can be divided into three significant vein systems: the Idaho, the Brunswick, and the Morehouse systems.

Idaho System

The #1 Vein, #2 Vein, and 3 Vein System comprise the Idaho Vein System.

The Eureka discovery showing outcropped at the western end of the #1 Vein system but had only minor gold concentration and could not be traced on surface east or west. High grade mineralization plunging to the south east was intersected starting at approximately 100 ft (30 m) below surface at this showing. Follow-up exploration and mining led to the development of the prolific Eureka-Idaho ore shoot which plunges at approximately 30° to the south east and has a pitch length of almost 1 mile (1.6 km) and a breadth of 500 ft to 1,000 ft (152 m to 305 m). The width of the vein within the ore shoot averaged approximately 3 ft (~1 m) and in places ranged up to 8 ft (~2.4 m). The average insitu grade of the #1 Vein would likely have been slightly higher than the estimated mill head grade of 1.12 oz/ton (39 gpt). The trend of the shoot is approximately parallel to an expected trend of the intersection of the Idaho and Morehouse faults suggesting the interaction of

- 27 -

the Idaho and Morehouse faults may have played a role on the formation of the rich mineralization encountered in the Eureka-Idaho stope. Alternatively, the shape of the Brunswick Block may have influenced this trend.

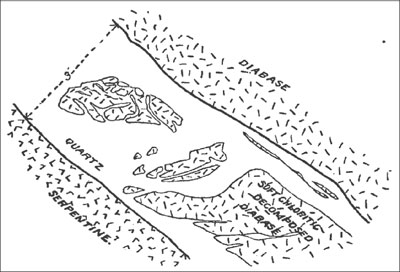

The Idaho #1 Vein occurs coincident with a diabase dike hosted in serpentinite, in close proximity to the serpentinite-Brunswick Block contact. Just west of the Idaho shaft, at the western end of the Idaho #1 Vein, the diabase dike bends in an arc to the south mimicking a fold around the nose of the Brunswick Block. The Eureka-Idaho ore shoot pinches out at the I1500 Level but significant gold grades coincident with a diabase dike hosted in serpentinite in close proximity to the serpentinite-Brunswick contact were exposed in workings on the I2400 Level suggesting the vein may open up again or a second vein is present. To the east, the Eureka-Idaho ore shoot pinches out near the #2 Vein. All rocks are highly altered and contain much ankerite. The cross section in Figure 7 shows the general form and relationship of the #1 Vein with the serpentinite and diabase dike.

| Figure 7: | #1 Vein Cross Section, Section looking East (Lindgren, 1896) |

The #2 Vein is a disrupted zone of quartz veins trending northeast and dipping steeply to the south east. This vein system is hosted in the serpentinite approximately coincident with where the serpentinite-Brunswick Block contact bends abruptly to the north before turning east again. #2 Vein trends northeast into the 3 Vein System.

The 3 Vein System, like the #1 Vein system, hosts a prolific ore shoot. The 3 Vein System comprises an Idaho fault split into four main branches. Connecting diagonal structures between the four fault branches were also mineralized. As with the #1 Vein, gold mineralization is associated with a diabase dike sub parallel to the serpentine-Brunswick Block contact. The main 3 Vein was mined continuously over a vertical distance of approximately 1,500 ft (457 m) and an average horizontal strike length of approximately 700 ft (213 m). There were several important veins which splayed from the main 3 Vein, forming the larger 3 Vein System. The most important of which were named the 5 Vein, 13 Vein, and 22 Vein. Minor splays from the main 3 Vein included 19 Vein, 4 Vein, and 6 Vein. The 3 Vein ranged in dip from 45° to 70°, with an average dip of approximately 55°. An average vein width of approximately 5 ft (1.5 m) was typical but in places reached widths of over 20 ft (6 m).

In the 3 Vein System, the best mineralization was typically found in quartz veins where the Idaho structures intersected areas where diabase dikes or Brunswick Block rocks are in contact with the serpentinite unit. Veins hosted solely in serpentinite were rarely of economic importance due to the yielding nature of the serpentinite which typically does not allow wide or continuous open structures to form from faulting. The 23 Vein is an exception. Also known as the Rose Garden, it was intersected by exploration drifting 2,000 ft (610 m) east of the main 3 Vein System on I2000 Level. The mine operator was following the Idaho #5 Vein towards the 6-3 Fault and located the 23 Vein by diamond drilling. The 23 Vein dips to the northwest as opposed to the

- 28 -

southwest and is hosted entirely in serpentinite. It is quite narrow but was noted to contain abundant visible gold. The 23 Vein was followed along strike to the south east directly to its intersection with the 6-3 Fault.

Brunswick System

The Brunswick vein system constitutes a distinct vein system within meta-volcanic rocks of the Brunswick Block. The veins strike northwesterly and have a southwesterly dip. These parallel, vertically dipping mineralized veins were mined above 1600L along continuous strike lengths ranging from 430 ft (131 m) to 1,000 ft (305 m) with continuous vertical heights reaching up to 1,000 ft (305 m). These veins generally range from several inches up to 8 ft (2.4 m) in width. A few veins with opposite strike and dip occur. The veins are most numerous and have the highest grades near the 6-3 Fault. The veins nearest to the fault turn to the north on the footwall side, suggesting a northward component of movement of the hanging wall. A quartz-carbonate stockwork develops near the fault. The quartz stringers dip from the veins toward the fault and many have connecting diagonals extending from an upper to a lower stringer toward the fault. The Brunswick veins generally pinch out before rarely coming in contact with the fault footwall. No significant mineralization is present in the fault. Only a few unimportant veins are known beyond its hanging wall.

In the area of the Brunswick veins there are layers of meta-sedimentary rocks within the meta-volcanic rocks that exhibit the regional N-W schistosity dipping very steeply to the north. Where the Brunswick veins cross these meta-sedimentary rocks vein splitting and en-echelon crossings occur forming what is known in the historical records as “Zebra Rock.” The “Zebra Rock” produced “fair” to “good” grades of large tonnage and the presence of free gold was reported. A large “Zebra Rock” zone was intersected and mined along the western extents of 16 Vein from levels 1300L to 1000L. Mining in this zone occurred over strike lengths from 360 ft to 525 ft (110 m to 160 m) and reached widths of up to 110 ft (34 m) on 1100 level.

Morehouse System

The Morehouse vein system is not as well understood as the Idaho #1, #2, 3 Vein System, and Brunswick vein systems. It is defined by fault and quartz-vein and quartz stockwork intersections in workings and drill holes in only a few areas such as the Morehouse, 16 Vein, 52 Vein, and 60 Winze. There is little historic production from the Morehouse Vein system.

The Morehouse vein is associated with the serpentinite-hosted diabase dike wrapping around the western end of the Brunswick Block. Underground working show the Morehouse connects directly to the Idaho #1 Vein. The extension of the Idaho shaft in 1923 to I1500 Level intersected the Morehouse splay and the shaft station on I1500 Level is right above the #1 Vein.

The best Morehouse mineralization intersected to date, and the only significant production, occurs within the Brunswick Block at the 52 Vein and 60 Winze areas. There is very little other exploration of this vein in the Brunswick Block.

Mineral Deposit Type

The Author describes the Idaho System deposits on the I-M Mine Property as an orogenic gold deposit. Orogenic gold deposits encompass a broad range of depth of formation and different host lithologies; however, common to orogenic gold deposits is a spatial association with compressional to transpressional deformation processes at convergent plate margins in accretionary and collisional orogens. Most ores are post-orogenic with respect to tectonism of their immediate host rocks but are simultaneously syn-orogenic with respect to ongoing deep-crustal, subduction-related thermal gradient. Depth of formation of orogenic deposits are best subdivided into epizonal (<6 km / <3.7 mi), mesozonal (6–12 km / 3.7-7.5 mi), and hypozonal (>12 km / >7.5 mi).

The gold deposits on the I-M Mine Property have been classified as Mesothermal Quartz Veins (Lindgren, 1894), are also known as and are type-examples of low-sulfide Au-quartz vein deposits (Berger, 1986), and gold quartz vein deposits (Ash, 2001). These classifications are sub-groups of orogenic gold deposit type.

- 29 -

Exploration

Rise has initiated but not yet completed the recommended exploration work program on the I-M Mine Property. Prior to initiating this work, it had completed a comprehensive exploration desktop study which involved the compilation of the extensive historical dataset into digital format and used this data to identify several promising exploration targets. Data compilation and processing completed by Rise is summarized as follows:

| ● | Scanned historical documents into a digital library |

| ● | Reviewed available historical exploration and development data of the I-M Mine |

| ● | Reviewed reports on the I-M Property and local geology, written by geologists and engineers employed at the Mine, hired as Consultants, or external professionals |

| ● | Prepared a detailed 3D mine model of the mine workings (drifts, raises, and winzes) and stopes |

| ● | Prepared a 3D geological model of vein locations, faults, rock types, and contact locations |

| ● | Developed a historical diamond drill hole database |

| ● | Tabulated historical production at the I-M Mine |

Compilation of the historic data led to the identification of several significant unexplored exploration targets below the current workings within the I-M Mine Property which include:

#1 Vein Target

| ● | This is a possible down-plunge extension of the prolific Eureka-Idaho stope. The #1 Vein target covers an area 2,150 ft (655 m) between the I2400 Level west and east drifts and 500 ft to 1,000 ft (152 m to 305 m) down-dip from the I2400 level. Within this area gold mineralization may occur within a quartz vein adjacent to the diabase dike similar to that encountered in the prolific Eureka-Idaho stope above or may be hosted within the adjacent diabase dike. The projected down-dip extension of the #1 Vein target is defined in relation to the deepest mineralization encountered at the nearby Empire Mine. This does not preclude deeper mineralization. |

Crackle Zone Target

| ● | This is a wedge-shaped area 2,000 ft (610 m) wide and 500 ft to 1,000 ft (152 m to 305 m) thick at the I2700 Level, plunging as much as 5,000 ft (1,524 m) to the south east where it pinches out against the intersection of the Idaho, Morehouse, and 6-3 Faults. Within this zone, gold mineralization may occur in shallow dipping quartz veins and irregular quartz stockworks in metavolcanic rocks that may be highly fractured due to the interaction of the Idaho, Morehouse, and 6-3 Faults. |

Brunswick Target

| ● | The Brunswick area offers many areas with potential for discovery of mineralization, particularly the area below the existing stoping and in the untested area in the immediate footwall of the 6-3 Fault south east of the Brunswick shaft. In Brunswick Mine, the richest mineralization was typically found near the 6-3 Fault. Below 1600 Level, development in the southern region of the Brunswick Mine deviated to the west, away from the 6-3 Fault leaving a region of unexplored ground in the footwall adjacent to the fault approximately 500 ft to 1,000 ft (152 m to 305 m) thick, 1,000 ft to 2,000 ft (305 m to 610 m) wide, and 1,000 ft to 3,000 ft (305 m to 914 m) deep. |

- 30 -

3 Vein – Rose Garden Target

| ● | Rose Garden-style mineralization is hosted solely in serpentinite with no apparent association with the brittle rocks common in all other mine and target areas of the Idaho-Maryland Project. Serpentinite within the Idaho fault zone, east towards the 6-3 Fault and west of the 3 Vein area may host mineralization similar to the Rose Garden. |

All exploration targets are below current extents of drilling and development and warrant exploration through drilling. Through its life, the I-M Mine faced several shut downs related to fires and war measures that resulted in loss of access to some promising areas due to collapsed workings or early termination of planned developments. Exploration potential may remain in some of these areas.

Drilling

Rise has initiated but not yet completed an exploration drilling program on the I-M Mine Property to date.

Up to July 31th 2018, Rise has completed five drillholes, B-17-01, B-18-02 - B18-05, for total drilling of ~5,760 meters.

Exploration drilling at the Brunswick portion of the Idaho-Maryland Gold project has been successful with numerous gold bearing veins intersected and previously released in 2018 on January 3rd, June 28th, July 23rd, and August 7th. A summary of drill highlights for the program released to date is displayed in Table 1 and Figure 1 below.

TABLE 1 – Previously Released Drill Intercept Highlights from B-17-02 to B-18-05*

| BRUNSWICK CONFIRMATION HOLES (B1600L-B2300L) | ||||||||||||||

| Hole | From (m) | To (m) | Gold (gpt) | Intercept Length (m) | Estimated True Width (m) | Vein | Map Ref | |||||||

| B-18-01 | 638.9 | 653.8 | 12.2 | 14.9 | 7.8 | B1 | A | |||||||

| Including | 643.7 | 646.5 | 62.7 | 2.7 | B1 Center | |||||||||

| Including | 645.0 | 645.6 | 266.0 | 1.6 | ||||||||||

| B-18-04 | 516.9 | 521.0 | 8.0 | 4.1 | 3.0 | B32 | C | |||||||

| Including | 516.9 | 518.0 | 23.0 | 1.1 | ||||||||||

| B-18-02 | 578.4 | 582.8 | 7.9 | 4.4 | 1.0 - 3.4 | B116 or B1 | C | |||||||

| B-18-03 | 516.6 | 518.6 | 6.0 | 2 | 1.7 | B1 East | D | |||||||

| B-18-04 | 711.9 | 715.2 | 5.1 | 2.3 | 1.8 | B18 | E | |||||||

| B-18-04 | 625.2 | 628.0 | 4.0 | 2.8 | 2.1 | B10 | F | |||||||

| B-18-04 | 637.0 | 640.0 | 4.4 | 3 | 2.3 | B10 | G | |||||||

| BRUNSWICK EXTENSION HOLES (B2300L-B3280L) | ||||||||||||||

| Hole | From (m) | To (m) | Gold (gpt) | Intercept Length (m) | Estimated True Width (m) | Vein | Map Ref | |||||||

| B-18-05 | 978.1 | 983.3 | 22.4 | 5.2 | 2.6 | B40 | H | |||||||

| Including | 978.1 | 979.3 | 93.2 | 1.2 | ||||||||||

| B-18-01 | 1111.6 | 1126.8 | 4.5 | 15.2 | ? | ? | I | |||||||

| Including | 1112.1 | 1113.6 | 40.6 | 1.5 | ||||||||||

| B-18-05 | 748.3 | 763.6 | 2.6 | 15.3 | 11.0 | B41 | J | |||||||

| B-18-05 | 667.9 | 671.4 | 5.9 | 3.5 | 2.0 | B6 | K | |||||||

| Including | 670.3 | 671.4 | 13.0 | 1.1 | ||||||||||

| B-18-05 | 682.9 | 690.4 | 2.4 | 7.5 | 4.1 | B6 | L | |||||||

| B-18-05 | 899.6 | 905.5 | 2.5 | 5.9 | 3.4 | B39 | N | |||||||

| IDAHO DEEP DRILLING (~1km BELOW MINE) | ||||||||||||||

| Hole | From (m) | To (m) | Gold (gpt) | Intercept Length (m) | Estimated True Width (m) | Vein | Map Ref | |||||||

| B-18-05 | 1590.1 | 1594.6 | 23.7 | 4.5 | 3.2 | IB30 | M | |||||||

| Including | 1593.6 | 1594.0 | 230.0 | 0.4 | ||||||||||

| B-18-05 | 1887.5 | 1890.4 | 10.9 | 2.9 | 2.0 | IB50 | O | |||||||

| Including | 1889.4 | 1889.9 | 61.0 | 0.5 | ||||||||||

| * | Details of drill intercepts in previous Rise Gold news releases previously released in 2018 on January 3rd, June 28th, July 23rd, and August 7th. |

- 31 -

FIGURE 1 – Longsection Showing Drill Results Previously Released

Rise has prepared a drill hole database derived from information contained in the collection of historic documents and records acquired through the purchase of the I-M Mine Property. The drill hole database is

- 32 -

divided into I-M Mine drilling completed before the mine shut down in 1956 and Emgold drilling completed in 2004.

Sampling, Analysis and Data Verification

Sample Preparation and Analysis

Rise has implemented a quality control program for its drill program to ensure best practice in the sampling and analysis of the drill core. This includes the insertion of blind blanks, duplicates and certified standards. HQ- and NQ-sized drill core is saw cut with half of the drill core sampled at intervals based on geological criteria including lithology, visual mineralization, and alteration. The remaining half of the core is stored on-site at our warehouse in Grass Valley, California. Drill core samples are transported in sealed bags to ALS Minerals analytical assay lab in Reno, Nevada.

All gold assays were obtained using a method of screen fire assaying. This procedure involves screening a large pulverized sample of up to 1 kg at 100 microns. Any +100 micron material remaining on the screen is retained and analyzed in its entirety by fire assay with gravimetric finish and reported as the Au (+) fraction result. The –100 micron fraction is homogenized and two sub-samples of 30-50 grams are analyzed by fire assay with AAS finish. If the grade of the material exceeds 10 gpt the sample is re-assayed using a gravimetric finish. The average of the two results is taken and reported as the Au (-) fraction result. All three values are used in calculating the combined gold content of the plus and minus fractions.

There is no detailed information describing sample preparation, analysis and security procedures applied by mine operators prior to 2002. The historical samples are reportedly fire-assayed at former mine site laboratories. No records exist of any QA/QC program.

Emgold sample preparation, analysis and security procedures for core collected by Emgold are described in a 2009 Technical Report prepared by Robert Pease, P.G., for Emgold titled “Idaho-Maryland Mine Project, Grass Valley CA”. Three-foot core samples were cut in half by a wet saw. The half core samples were put in a sample bag, tagged, and shipped to a laboratory. All samples were crushed to 80% passing -10 mesh, rotary split to a 500 g subsample which was pulverized to 95% passing -150 mesh. All samples were analyzed using screened metallics fire assay methods. The QAQC program used Standard Reference Materials, blank samples, coarse reject and pulp duplicate samples, and third party laboratory check assays. Insertion rate of SRMs and duplicates was approximately 1 in 20 samples. Blanks were only inserted immediately following mineralized intervals. The control samples were reportedly used to successfully control the assay quality process.

Historical Data Verification

The Author inspected Rise’s 3D model on screen, reviewed several historical reports, and reviewed many historical documents including cross sections and level plans used to prepare the model. The drill hole database developed by Rise was not verified; however, drilling is not used extensively to support the reported exploration targets.

The Author did not assess previous I-M Mine operators or Emgold drilling sampling and assay quality. The Emgold drilling focused on shallow mineralization not considered part of the exploration targets described in the Report.

Although Rise has carefully digitized and checked the locations and values of drill hole results from level plans and other documents, the absence of drill hole related documentation, such as drill logs, drill hole deviation, core recovery and density measurements, assay certificates, and possible channel sample grade biases, could materially impact the accuracy and reliability of the reported results. The database that has been created, however, is suitable for exploration targeting.

- 33 -

Mineral Processing and Metallurgical Testing

Rise has conducted no mineral processing or metallurgical testing analyses on the I-M Mine Property.

A significant amount of production has occurred on the I-M Mine Property which confirms that gold can be recovered, mainly by gravity and flotation methods. Nearly all gold at the I-M Mine is free milling, as demonstrated by cyanide leaching of concentrates and tailings by the I-M Mine during past production.

Mineral Resource and Mineral Reserve Estimates