Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - C. H. ROBINSON WORLDWIDE, INC. | ex991earningsreleaseq32018.htm |

| 8-K - 8-K - C. H. ROBINSON WORLDWIDE, INC. | chrw93018earnings8-k.htm |

Earnings Conference Call – Third Quarter 2018 October 31, 2018 John Wiehoff, Chairman & CEO Andrew Clarke, CFO Robert Biesterfeld, COO & President of NAST Robert Houghton, VP of Investor Relations 1

Safe Harbor Statement Except for the historical information contained herein, the matters set forth in this presentation and the accompanying earnings release are forward-looking statements that represent our expectations, beliefs, intentions or strategies concerning future events. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our historical experience or our present expectations, including, but not limited to such factors as changes in economic conditions, including uncertain consumer demand; economic recessions; changes in market demand and pressures on the pricing for our services; fuel prices and availability; changes in the availability of equipment and services from third party providers, including the availability of contracted truckload carriers and changes in prices; changes in political and governmental conditions domestically and internationally; catastrophic events such as environmental events or terrorist attacks; failure to retain employees; failure of any of our technology or operating systems, including due to data security breaches or hacking; competition and growth rates within the third party logistics industry; risks associated with our decentralized operations; seasonality in the transportation industry; risks associated with litigation and insurance coverage; risks associated with operations outside of the U.S.; risks associated with the produce industry, including food safety and contamination issues; risk of unexpected or unanticipated events or opportunities that might require additional capital expenditures; our dependence on our largest customers; risks associated with identifying suitable acquisitions and investments and with integrating acquired companies; risks associated with our long-term growth and profitability; and other risks and uncertainties detailed in our Annual and Quarterly Reports. 2 2

Q3 2018 – Key Themes ▪ Strong financial performance including net revenue and operating margin expansion ▪ Double-digit increase in truckload cost and price ▪ Third quarter financial performance demonstrates the strength of our business model 3 3

Results Q3 2018 in thousands, except per share amounts and headcount Three Months Ended September 30 Nine Months Ended September 30 2018 2017 % Change 2018 2017 % Change Total Revenues $4,291,900 $3,784,451 13.4% $12,493,264 $10,909,594 14.5% Total Net Revenues $694,044 $593,846 16.9% $1,991,452 $1,736,201 14.7% Net Revenue Margin % 16.2% 15.7% 50 bps 15.9% 15.9% 0 bps Personnel Expenses $335,299 $293,204 14.4% $1,004,226 $867,928 15.7% Selling, General, and Admin $112,772 $106,177 6.2% $330,660 $304,030 8.8% Income from Operations $245,973 $194,465 26.5% $656,566 $564,243 16.4% Operating Margin % 35.4% 32.7% 270 bps 33.0% 32.5% 50 bps Depreciation and Amortization $23,923 $23,963 (0.2%) $72,402 $69,340 4.4% Net Income $175,895 $119,186 47.6% $477,355 $352,337 35.5% Earnings Per Share (Diluted) $1.25 $0.85 47.1% $3.39 $2.49 36.1% Average Headcount 15,291 14,903 2.6% 15,189 14,590 4.1% ▪ Total revenues increase driven by higher pricing, volume and fuel costs ▪ Operating expenses growth driven by increases in variable compensation and average headcount ▪ Net income and earnings per share increases include favorable impact of U.S. corporate tax reform 4 4

Q3 2018 Other Income Statement Items ▪ Q3 effective tax rate of 26.5% vs. 35.2% last year ▪ Interest expense increase due to higher debt levels and an increase in variable interest rates ▪ $7 million favorable impact from currency revaluation ▪ Weighted average diluted shares outstanding down 0.6 percent ‹#› 5

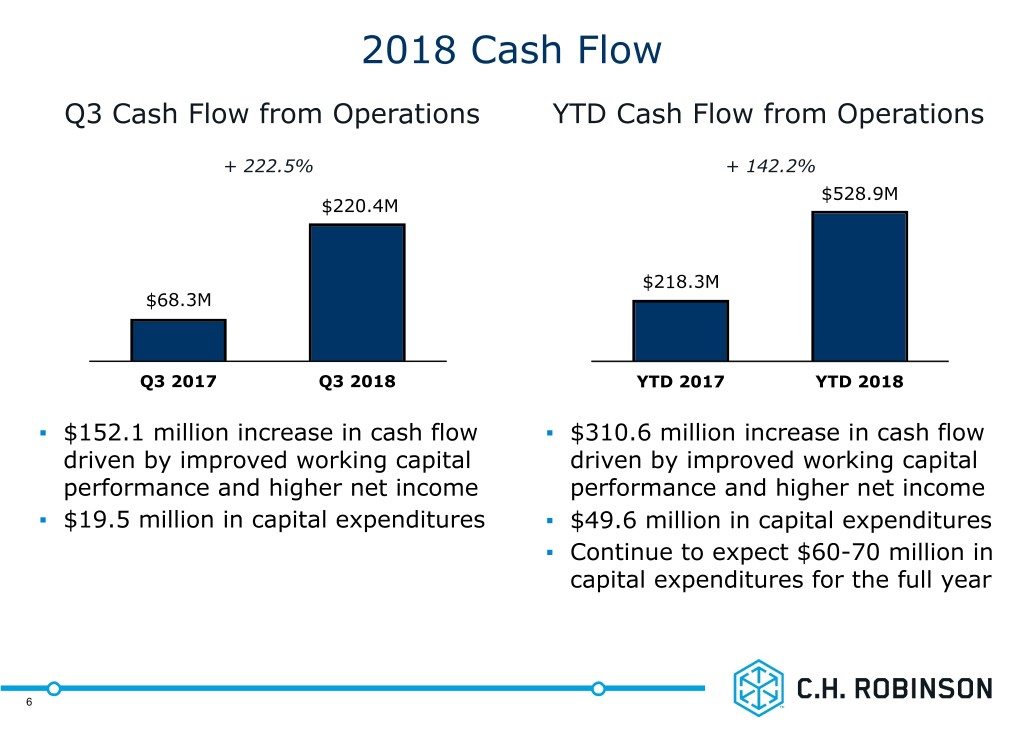

2018 Cash Flow Q3 Cash Flow from Operations YTD Cash Flow from Operations + 222.5% + 142.2% $528.9M $220.4M $218.3M $68.3M Q3 2017 Q3 2018 YTD 2017 YTD 2018 ▪ $152.1 million increase in cash flow ▪ $310.6 million increase in cash flow driven by improved working capital driven by improved working capital performance and higher net income performance and higher net income ▪ $19.5 million in capital expenditures ▪ $49.6 million in capital expenditures ▪ Continue to expect $60-70 million in capital expenditures for the full year ‹#› 6 ▪ Dividend payout ratio of 40.9%

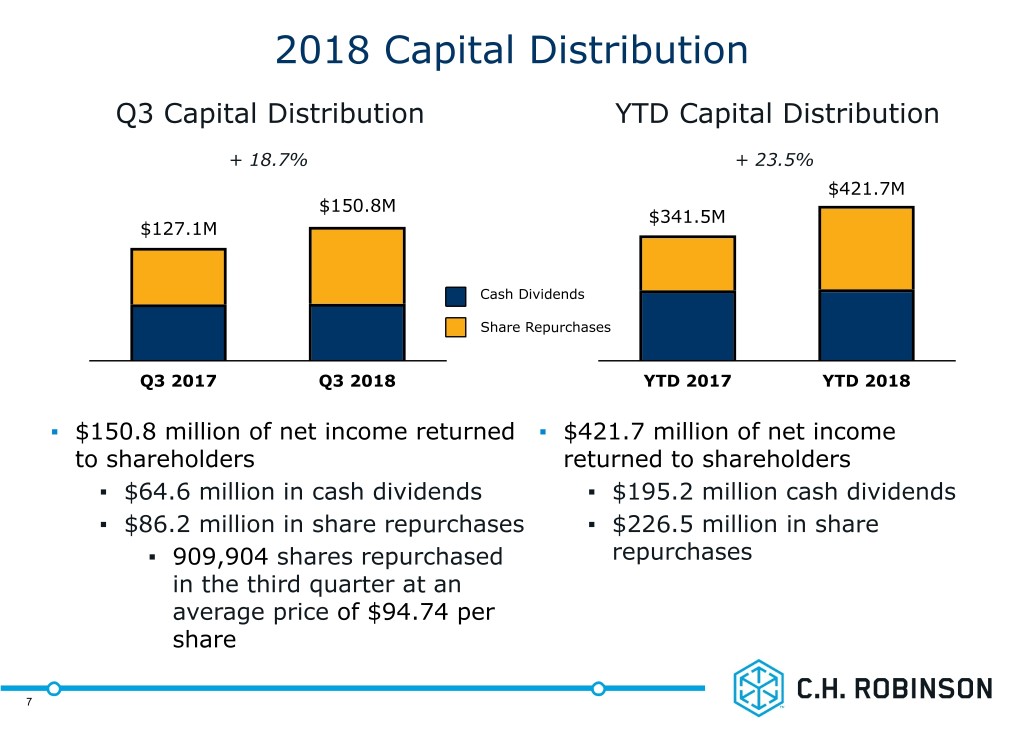

2018 Capital Distribution Q3 Capital Distribution YTD Capital Distribution + 18.7% + 23.5% $421.7M $150.8M $341.5M $127.1M Cash Dividends Share Repurchases Q3 2017 Q3 2018 YTD 2017 YTD 2018 ▪ $150.8 million of net income returned ▪ $421.7 million of net income to shareholders returned to shareholders ▪ $64.6 million in cash dividends ▪ $195.2 million cash dividends ▪ $86.2 million in share repurchases ▪ $226.5 million in share ▪ 909,904 shares repurchased repurchases in the third quarter at an average price of $94.74 per share ‹#› 7 ▪ Dividend payout ratio of 40.9%

Q3 2018 Balance Sheet in thousands September 30, December 31, 2018 2017 % Change Accounts Receivable, Net $2,251,944 $2,113,930 Contract Assets(1) $201,411 — Accounts Payable and O/S Checks $1,152,633 $1,096,664 Accrued Transportation Expense(1) $156,810 — Net Operating Working Capital(2) $1,143,912 $1,017,266 12.4% ▪ Total debt balance $1.34 billion(3) ▪ $600 million senior unsecured notes, 4.20% coupon ▪ $500 million private placement debt, 4.28% average coupon ▪ $250 million accounts receivable securitization debt facility, 2.98% average rate ▪ Increased size of revolving credit facility to $1 billion on October 25 (1) Balance sheet as of September 30, 2018, includes contract assets and accrued transportation expense as the result of an accounting policy change that recognizes revenues for in-transit shipments. (2) Net operating working capital is defined as net accounts receivable and contract assets less accounts payable, outstanding checks and accrued transportation expense. (3) There was no outstanding balance on the credit facility as of September 30, 2018. The average borrowing rate on the credit facility during the third quarter was 3.58%. ‹#› 8

Fourth Quarter 2018 Trends – October ▪ October to date total company net revenue per day has increased approximately 9 percent when compared to October 2017 ▪ Truckload volume per day has declined approximately 2 percent on a year-over-year basis in October ▪ Fourth quarter 2017 items of note ▪ 12.5 percent net revenue growth ▪ $31.8 million non-recurring tax benefit 9 9

North America Truckload Cost and Price Change(1) TRANSPORTATION NET REVENUE MARGIN 23% 20% E C I R 21% P 15% D N A 10% 19% T S O C 5% N 17% I E 0% G N 15% A H -5% C YoY Price Change % 13% Y -10% YoY Cost Change O Y Transportation Net Revenue Margin -15% 11% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 North America Q3 ▪ North America Truckload cost and price change chart Truckload represents truckload shipments from all North America Volume (1.5%) segments. Transportation net revenue margin represents total Transportation results from all segments. Price 14.0% Cost 12.0% Net Revenue Margin (1) Cost and price change exclude the estimated impact of fuel. ‹#› 10

North America Truckload Cost and Price Per Mile(1) Price per Mile Cost per Mile ▪ North America Truckload cost and price per mile chart represents truckload shipments from all North America segments ▪ 2018 third quarter cost and price per mile remain above year-ago levels ▪ Continued price movements in response to changes in marketplace conditions (1) Cost and price per mile exclude the estimated impact of fuel. ‹#› 11

Q3 2018 NAST Results by Service Line Truckload, Less Than Truckload and Intermodal in thousands Three Months Ended September 30 Net Revenues 2018 2017 % Change ▪ Double-digit price Truckload $334,665 $266,632 25.5% increases in truckload, LTL LTL $116,789 $97,634 19.6% and intermodal Intermodal $7,877 $7,109 10.8% Other $6,191 $6,028 2.7% ▪ Volume increase in LTL Total $465,522 $377,403 23.3% ▪ Sequential improvement in truckload volume trends Truckload LTL Intermodal ▪ Added 5,000 new carriers Pricing(1)(2) 14.0% in the quarter Cost(1)(2) 12.0% Volume (0.5%) 4.5% (6.0%) Net Revenue Margin (1) Represents price and cost YoY change for North America shipments across all segments. (2) Pricing and cost measures exclude the estimated impact of the change in fuel prices. ‹#› 12

Q3 2018 NAST Operating Income Q3 Operating Income Q3 Operating Margin % + 34.9% + 380 bps $204.2M 43.9% $151.4M 40.1% Q3 2017 Q3 2018 Q3 2017 Q3 2018 ▪ Increased net revenues ▪ Progress against productivity initiatives ▪ Headcount approximately flat ‹#› 13

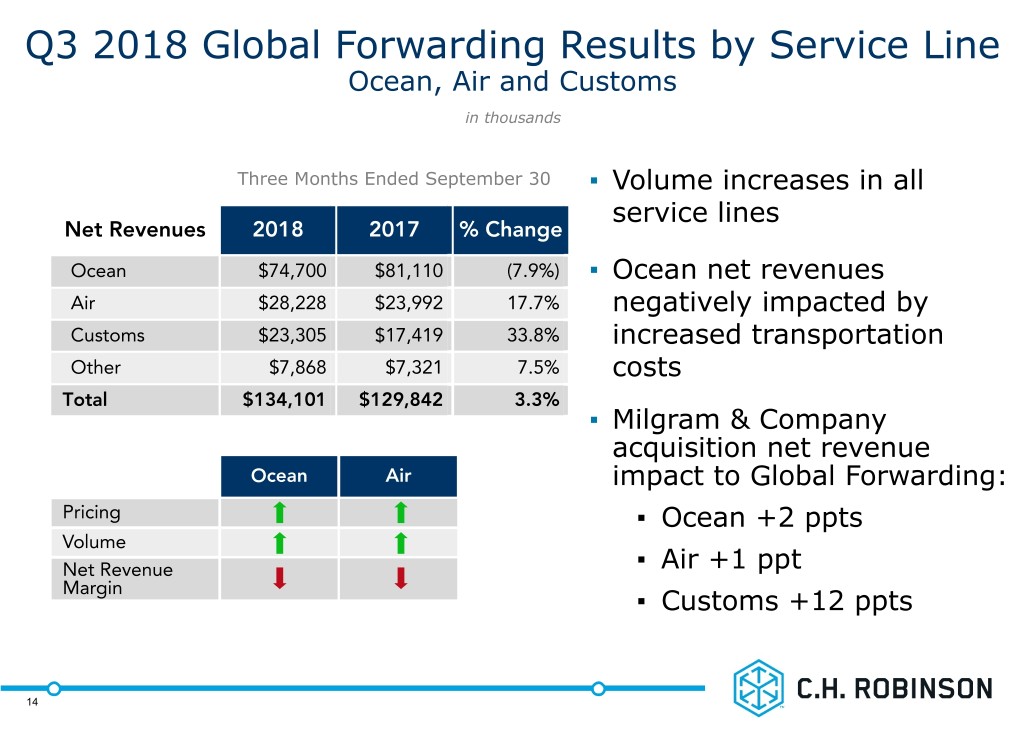

Q3 2018 Global Forwarding Results by Service Line Ocean, Air and Customs in thousands Three Months Ended September 30 ▪ Volume increases in all service lines Net Revenues 2018 2017 % Change Ocean $74,700 $81,110 (7.9%) ▪ Ocean net revenues Air $28,228 $23,992 17.7% negatively impacted by Customs $23,305 $17,419 33.8% increased transportation Other $7,868 $7,321 7.5% costs Total $134,101 $129,842 3.3% ▪ Milgram & Company acquisition net revenue Ocean Air impact to Global Forwarding: Pricing ▪ Ocean +2 ppts Volume Net Revenue ▪ Air +1 ppt Margin ▪ Customs +12 ppts ‹#› 14

Q3 2018 Global Forwarding Operating Income Q3 Operating Income Q3 Operating Margin % (23.4%) (620 bps) $31.1M 24.0% $23.8M 17.8% Q3 2017 Q3 2018 Q3 2017 Q3 2018 ▪ Investments in headcount and increased variable compensation ▪ 8.9 percent increase in average headcount ▪ Milgram headcount added 5 percentage points ‹#› 15

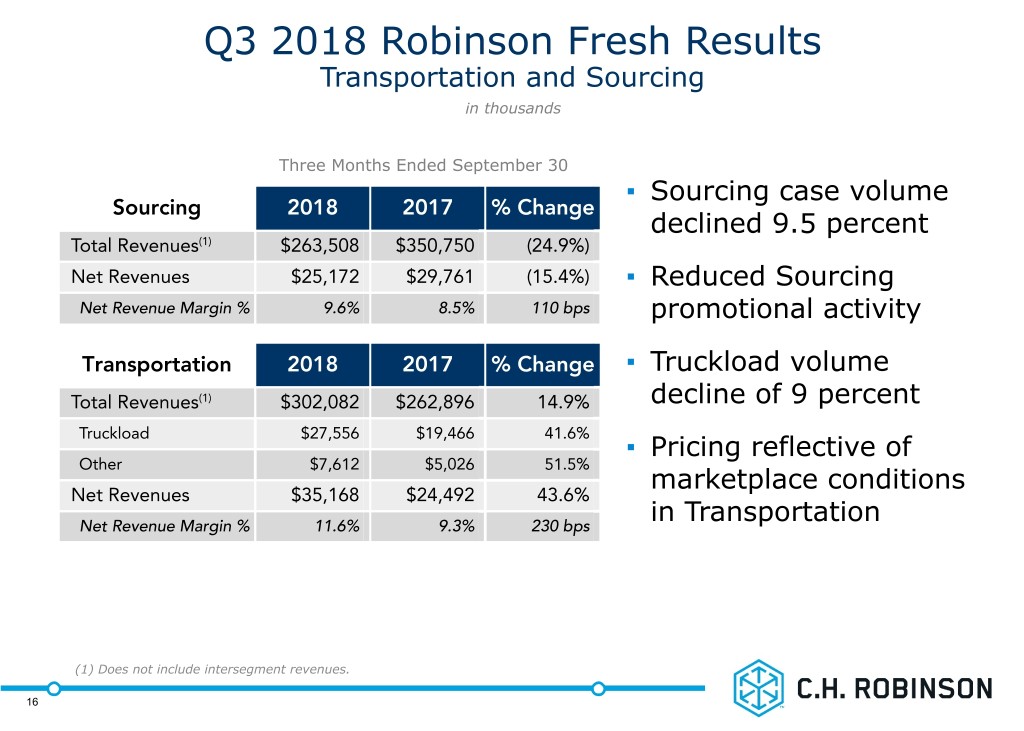

Q3 2018 Robinson Fresh Results Transportation and Sourcing in thousands Three Months Ended September 30 ▪ Sourcing case volume Sourcing 2018 2017 % Change declined 9.5 percent Total Revenues(1) $263,508 $350,750 (24.9%) Net Revenues $25,172 $29,761 (15.4%) ▪ Reduced Sourcing Net Revenue Margin % 9.6% 8.5% 110 bps promotional activity Transportation 2018 2017 % Change ▪ Truckload volume Total Revenues(1) $302,082 $262,896 14.9% decline of 9 percent Truckload $27,556 $19,466 41.6% ▪ Pricing reflective of Other $7,612 $5,026 51.5% marketplace conditions Net Revenues $35,168 $24,492 43.6% in Transportation Net Revenue Margin % 11.6% 9.3% 230 bps (1) Does not include intersegment revenues. ‹#› 16

Q3 2018 Robinson Fresh Operating Income Q3 Operating Income Q3 Operating Margin % + 84.8% + 1,410 bps $21.4M 35.5% $11.6M 21.4% Q3 2017 Q3 2018 Q3 2017 Q3 2018 ▪ Increased transportation net revenues ▪ Operating expense reduction initiatives continue ▪ 8.8 percent reduction in operating expenses ▪ 5.8 percent reduction in average headcount ‹#› 17

Q3 2018 All Other and Corporate Results Managed Services and Other Surface Transportation in thousands Three Months Ended September 30 Net Revenues 2018 2017 % Change Managed Services $20,080 $18,487 8.6% Other Surface Transportation $14,001 $13,861 1.0% Total $34,081 $32,348 5.4% Managed Services ▪ On track for $4 billion in freight under management in 2018 Europe Surface Transportation ▪ Volume growth ‹#› 18

Final Comments ▪ Cost and price remain above year-ago levels ▪ Continued business model strength ▪ Escalating tariff activity ▪ Investing to deliver increased value to customers, carriers, employees and shareholders ‹#› 19

Appendix 20

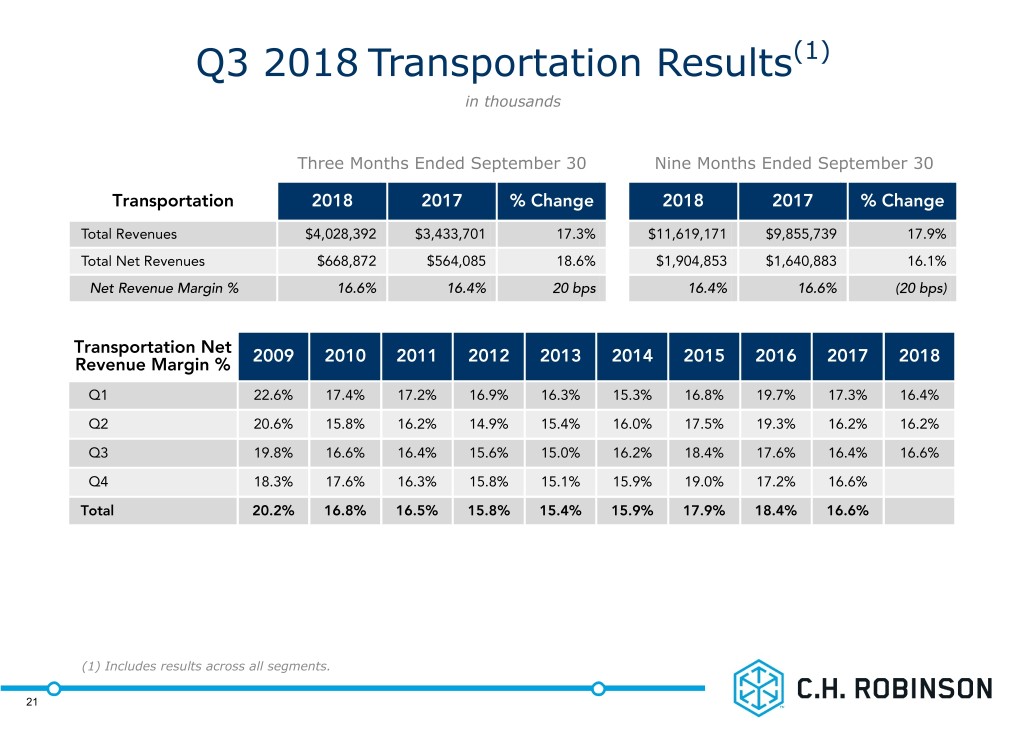

Q3 2018 Transportation Results(1) in thousands Three Months Ended September 30 Nine Months Ended September 30 Transportation 2018 2017 % Change 2018 2017 % Change Total Revenues $4,028,392 $3,433,701 17.3% $11,619,171 $9,855,739 17.9% Total Net Revenues $668,872 $564,085 18.6% $1,904,853 $1,640,883 16.1% Net Revenue Margin % 16.6% 16.4% 20 bps 16.4% 16.6% (20 bps) Transportation Net Revenue Margin % 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Q1 22.6% 17.4% 17.2% 16.9% 16.3% 15.3% 16.8% 19.7% 17.3% 16.4% Q2 20.6% 15.8% 16.2% 14.9% 15.4% 16.0% 17.5% 19.3% 16.2% 16.2% Q3 19.8% 16.6% 16.4% 15.6% 15.0% 16.2% 18.4% 17.6% 16.4% 16.6% Q4 18.3% 17.6% 16.3% 15.8% 15.1% 15.9% 19.0% 17.2% 16.6% Total 20.2% 16.8% 16.5% 15.8% 15.4% 15.9% 17.9% 18.4% 16.6% (1) Includes results across all segments. ‹#› 21

Q3 2018 NAST Results in thousands, except headcount Three Months Ended September 30 Nine Months Ended September 30 2018 2017 % Change 2018 2017 % Change Total Revenues(1) $2,931,461 $2,469,420 18.7% $8,473,376 $7,110,223 19.2% Total Net Revenues $465,522 $377,403 23.3% $1,317,104 $1,109,749 18.7% Net Revenue Margin % 15.9% 15.3% 60 bps 15.5% 15.6% (10 bps) Income from Operations $204,158 $151,392 34.9% $562,802 $447,553 25.8% Operating Margin % 43.9% 40.1% 380 bps 42.7% 40.3% 240 bps Depreciation and Amortization $6,096 $5,808 5.0% $18,314 $17,104 7.1% Total Assets $2,515,823 $2,297,980 9.5% $2,515,823 $2,297,980 9.5% Average Headcount 7,007 6,998 0.1% 6,931 6,921 0.1% (1) Does not include intersegment revenues. ‹#› 22

Q3 2018 Global Forwarding Results in thousands, except headcount Three Months Ended September 30 Nine Months Ended September 30 2018 2017 % Change 2018 2017 % Change Total Revenues(1) $639,268 $552,134 15.8% $1,810,619 $1,549,742 16.8% Total Net Revenues $134,101 $129,842 3.3% $401,169 $357,411 12.2% Net Revenue Margin % 21.0% 23.5% (250 bps) 22.2% 23.1% (90 bps) Income from Operations $23,835 $31,125 (23.4%) $61,844 $75,006 (17.5%) Operating Margin % 17.8% 24.0% (620 bps) 15.4% 21.0% (560 bps) Depreciation and Amortization $8,735 $8,455 3.3% $26,397 $24,574 7.4% Total Assets $944,928 $840,762 12.4% $944,928 $840,762 12.4% Average Headcount 4,684 4,301 8.9% 4,725 4,113 14.9% (1) Does not include intersegment revenues. ‹#› 23

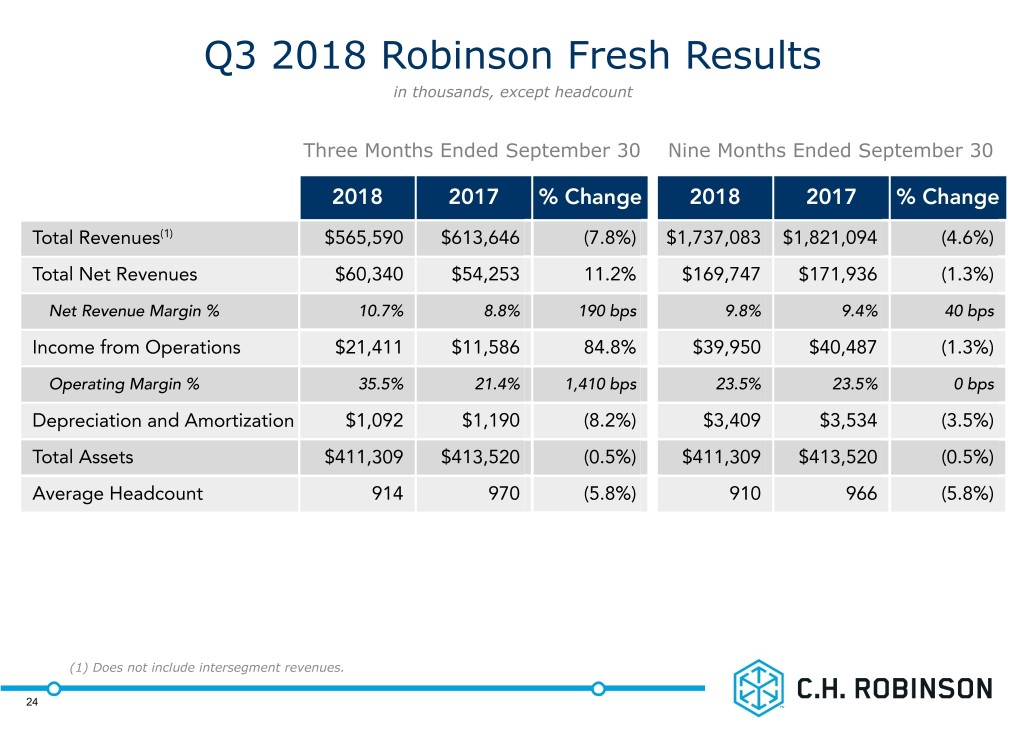

Q3 2018 Robinson Fresh Results in thousands, except headcount Three Months Ended September 30 Nine Months Ended September 30 2018 2017 % Change 2018 2017 % Change Total Revenues(1) $565,590 $613,646 (7.8%) $1,737,083 $1,821,094 (4.6%) Total Net Revenues $60,340 $54,253 11.2% $169,747 $171,936 (1.3%) Net Revenue Margin % 10.7% 8.8% 190 bps 9.8% 9.4% 40 bps Income from Operations $21,411 $11,586 84.8% $39,950 $40,487 (1.3%) Operating Margin % 35.5% 21.4% 1,410 bps 23.5% 23.5% 0 bps Depreciation and Amortization $1,092 $1,190 (8.2%) $3,409 $3,534 (3.5%) Total Assets $411,309 $413,520 (0.5%) $411,309 $413,520 (0.5%) Average Headcount 914 970 (5.8%) 910 966 (5.8%) (1) Does not include intersegment revenues. ‹#› 24

Q3 2018 All Other and Corporate Results in thousands, except headcount Three Months Ended September 30 Nine Months Ended September 30 2018 2017 % Change 2018 2017 % Change Total Revenues(1) $155,581 $149,251 4.2% $472,186 $428,535 10.2% Total Net Revenues $34,081 $32,348 5.4% $103,432 $97,105 6.5% Income from Operations ($3,431) $362 NM ($8,030) $1,197 NM Depreciation and Amortization $8,000 $8,510 (6.0%) $24,282 $24,128 0.6% Total Assets $620,662 $623,326 (0.4%) $620,662 $623,326 (0.4%) Average Headcount 2,686 2,634 2.0% 2,623 2,590 1.3% (1) Does not include intersegment revenues. ‹#› 25

26