Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - EnerSys | ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - EnerSys | ex2-1.htm |

| 8-K - ENERSYS FORM 8-K - EnerSys | enersys8k.htm |

Exhibit 99.2

we are proud to be EnerSys 29 October 2018 EnerSys to Acquire Alpha Group A Compelling Combination, Providing a Full Suite of Power Solutions

Forward-Looking Information This presentation includes forward-looking statements and/or information, which are based on the Company’s current expectations and assumptions, and are subject to a number of risks and uncertainties that could cause actual results to materially differ from those anticipated. Such risks include, among others, risks associated with competitive actions, technology development and implementation, intellectual property infringement, failure to integrate acquired businesses, penetration of existing markets, expansion into new markets, hiring and retaining high quality management and key employees and general economic conditions including the risks described in the Company’s most recent annual/quarterly report, as applicable, on Form 10-K/10-Q respectively, filed with the SEC, along with other unforeseen risks. Nothing that we say today should be interpreted as an update to the information or guidance that we provided in our most recent investor call, our most recent quarterly/annual report, as applicable, on Form 10-Q/10-K respectively, filed with the SEC, and our current reports filed with the SEC on Form 8-K since such quarterly/annual report.

A Uniquely Compelling Acquisition North American leader in commercial-grade energy solutions for the broadband, telecom, and industrial markets, with strongly recognized brands Provides immediate material market share to attractive secular megatrends AND establishes an additional long-term growth platform Enables EnerSys to become the sole fully-integrated power and energy storage solution provider Complementary financial profile – accretive to near term growth and margins Compelling value creation through more than $25mm of annual run-rate synergies Immediately accretive to earnings; EnerSys retains strong balance sheet

Key Transaction Terms Structure & Consideration EnerSys to acquire Alpha Group (“Alpha”) from its founders in a cash and stock transaction $750mm1 total consideration, or 11x LTM EBITDA pre-synergies (8x including run-rate synergies2)$650mm in cash consideration, funded with existing cash and credit facilities and new debt$100mm in stock consideration, issued to Fred Kaiser, founder of Alpha Management Drew Zogby to lead the division as President, post transactionKey Alpha management to remain with the business on retention plans Expected Transaction Benefits Accelerates revenue growth, and establishes additional platform for long-term growthCombined LTM revenue of over $3.2 billion and adjusted EBITDA of ~$422 mm2, or ~13% marginOver $25mm of identified run-rate cost and revenue synergiesTransaction immediately accretive to earnings in FY 2019 (before one-time acquisition costs) Timing and Closing Conditions Completion subject to antitrust clearances and other customary conditionsClosing expected by year end Total consideration subject to regular working capital adjustmentsIncludes full run-rate synergies of over $25mm

Alpha at a Glance Provider of highly integrated power solutions and services to Broadband, Telecom, Renewable and Industrial customers Industry leading reputation and brand with end-to-end power solutionsU.S. market leader with global blue-chip customer base across diverse, global and growing end marketsConsistent growth, profitability and cash flow generation Alpha's Value Proposition ¹ Displays breakdown for FY2017. Revenue by Segment¹ Revenue by Solution¹ Blue Chip Customers Key Financial Highlights $591mmLTM Jun-2018 Revenue 11%LTM Jun-2018 Adj. EBITDA Margin 1,000+Customers >100CountriesSold Into 20%Jun-17 to Jun-18LTM Revenue Growth Revenue by Geography¹ Renewable Industrial Telecom Broadband Product Services U.S. Canada RoW Largest Broadband Operators Multi National Industrial OEM Largest Mobile Network Operators

Strong Position in Broadband and Telecom ¹ As of December 31, 2017, Includes Product and Service Revenue. Broadband(71% of Revenue)1 Telecom(15% of Revenue)1 Renewable(8% of Revenue)1 Industrial(6% of Revenue)1 Serving Broadband and Internet Providers GloballyProviding products and services to support Outside Plant, Facility and Fiber Network Equipment Serving all major Telecommunication providers Nationwide in the U.S.Supporting Line Power, Central Offices, Small Cell and Base Station Power needs Serving residential and non-residential renewable energy providersSupporting energy production, storage, engineered systems and management Serving indoor and outdoor private and public industrial customersProviding key backup solutions for Smart City and Internet-of-Things enabled infrastructure

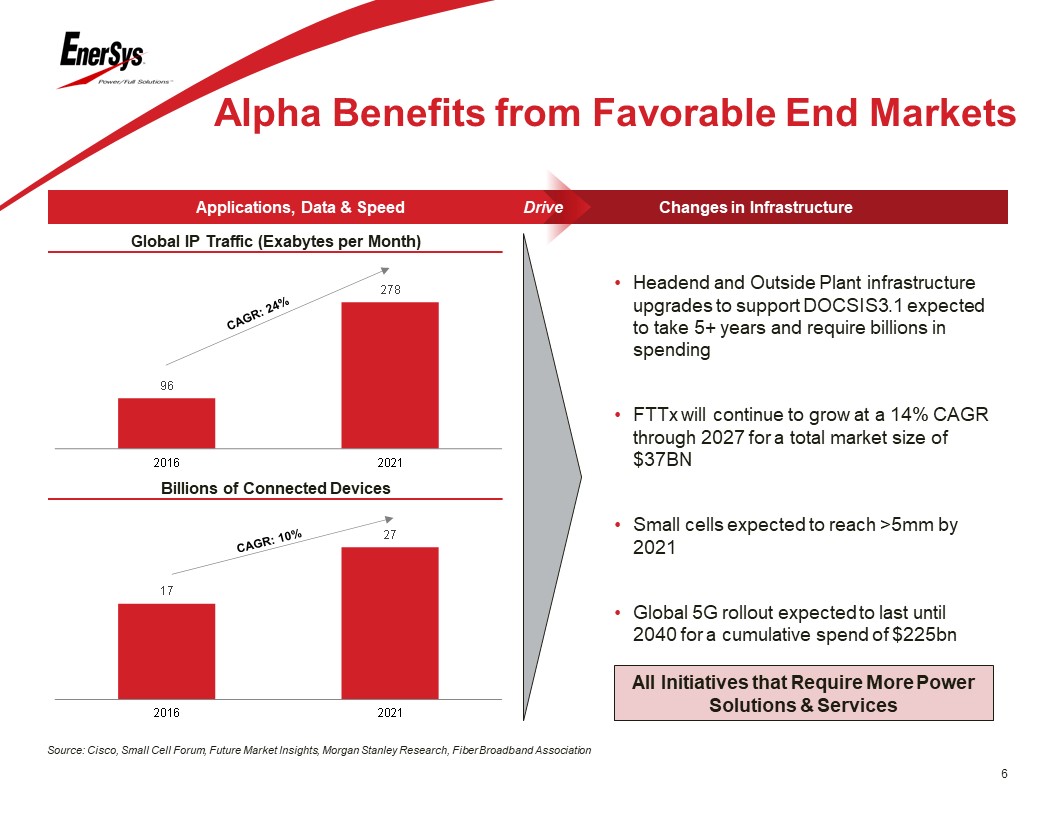

Alpha Benefits from Favorable End Markets Source: Cisco, Small Cell Forum, Future Market Insights, Morgan Stanley Research, Fiber Broadband Association Changes in Infrastructure Applications, Data & Speed Drive Headend and Outside Plant infrastructure upgrades to support DOCSIS3.1 expected to take 5+ years and require billions in spending FTTx will continue to grow at a 14% CAGR through 2027 for a total market size of $37BNSmall cells expected to reach >5mm by 2021Global 5G rollout expected to last until 2040 for a cumulative spend of $225bn All Initiatives that Require More Power Solutions & Services Global IP Traffic (Exabytes per Month) Billions of Connected Devices

Two Highly Complementary Businesses Mission Powering the Future – Everywhere for EveryoneThe global leader in stored energy solutions for industry Keep the world working by delivering solutions that meet today’s and future power challenges LTM Net Revenues1 $2,630mm $591mm Adjusted LTM EBITDA / Margin1 $330mm / 13% $67mm / 11% ($92mm, 16% incl. synergies2) Distinctive Capabilities Advanced lead-acid battery capabilities, global manufacturing capabilities, global services and support capabilities Platform designs for inverters, rectifiers and gateway devices Key End Markets Industrial Forklifts, Telecom, UPS, Fleet, Medical, Utility, Transportation, Government, Aerospace, Defense and other Broadband, Telecom & Wireless, Renewable Energy, Industrial Customers Diversified dealers / OEMsEnd users Broadband operators and wireless tower and small cell operators Employees ~9,600 ~1,300 1 LTM figures are as of 30-Jun-20182 Includes full run-rate synergies of over $25mm Two highly complementary platforms poised for synergy and growth acceleration

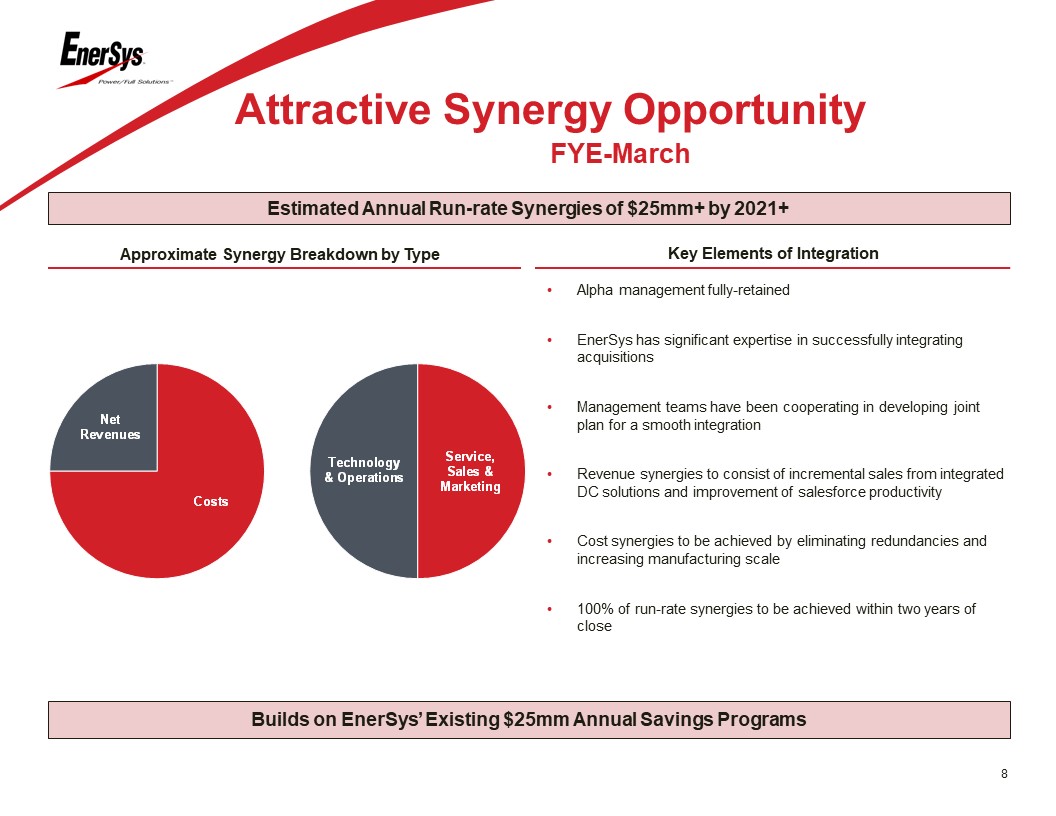

Attractive Synergy Opportunity Estimated Annual Run-rate Synergies of $25mm+ by 2021+ FYE-March Approximate Synergy Breakdown by Type Builds on EnerSys’ Existing $25mm Annual Savings Programs Alpha management fully-retainedEnerSys has significant expertise in successfully integrating acquisitionsManagement teams have been cooperating in developing joint plan for a smooth integrationRevenue synergies to consist of incremental sales from integrated DC solutions and improvement of salesforce productivityCost synergies to be achieved by eliminating redundancies and increasing manufacturing scale100% of run-rate synergies to be achieved within two years of close Key Elements of Integration

Pro Forma Financial Impact FY 2016-18A Revenue CAGR LTM EBITDA Margin 2019E Earnings Per Share1 Net Debt / LTM EBITDA + + + + 1 Per IBES median estimates2 Includes full run-rate synergies3 Includes 50% run-rate synergies ~70 bps CAGR increase ~50 bps margin expansion 2

Summary of Transaction Benefits North American leader in commercial-grade energy solutions for the broadband, telecom, and industrial markets, with strongly recognized brands A uniquely attractive platform for growth for ENS Provides immediate material market share to attractive secular megatrends AND establishes an additional long-term growth platform Enables EnerSys to become the sole fully-integrated power and energy storage solution provider Complementary financial profile – accretive to near term growth and margins Compelling value creation through more than $25mm of annual run-rate synergies Immediately accretive to earnings; EnerSys retains strong balance sheet