Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - EnerSys | exhibit321_4qxfy16.htm |

| EX-31.2 - EXHIBIT 31.2 - EnerSys | exhibit312_4qxfy16.htm |

| EX-31.1 - EXHIBIT 31.1 - EnerSys | exhibit311_4qxfy16.htm |

| EX-23.1 - EXHIBIT 23.1 - EnerSys | exhibit231_4qxfy16.htm |

| EX-21.1 - EXHIBIT 21.1 - EnerSys | exhibit211_4qxfy16.htm |

| EX-12.1 - EXHIBIT 12.1 - EnerSys | exhibit121_4qxfy16.htm |

| EX-10.49 - EXHIBIT 10.49 - EnerSys | exhibit1049_4qxfy16.htm |

| EX-10.48 - EXHIBIT 10.48 - EnerSys | exhibit1048_4qxfy16.htm |

| EX-10.47 - EXHIBIT 10.47 - EnerSys | exhibit1047_4qxfy16.htm |

| EX-10.46 - EXHIBIT 10.46 - EnerSys | exhibit1046_4qxfy16.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ý | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended March 31, 2016 or |

¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number: 001-32253

ENERSYS

(Exact name of registrant as specified in its charter)

Delaware | 23-3058564 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2366 Bernville Road

Reading, Pennsylvania 19605

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: 610-208-1991

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.01 par value per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ý YES ¨ NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ YES ý NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý YES ¨ NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

1

Large accelerated filer x | Accelerated filer ¨ | |

Non-accelerated filer ¨ | Smaller reporting company ¨ | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ YES ý NO

State the aggregate market value of the voting and non-voting common equity held by non-affiliates at September 27, 2015: $2,273,628,924 (1) (based upon its closing transaction price on the New York Stock Exchange on September 25, 2015).

(1) | For this purpose only, “non-affiliates” excludes directors and executive officers. |

Common stock outstanding at May 27, 2016: 43,260,603 Shares of Common Stock

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on July 28, 2016 are incorporated by reference in Part III of this Annual Report.

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Private Securities Litigation Reform Act of 1995 (the “Reform Act”) provides a safe harbor for forward-looking statements made by or on behalf of EnerSys. EnerSys and its representatives may, from time to time, make written or verbal forward-looking statements, including statements contained in EnerSys' filings with the Securities and Exchange Commission ("SEC") and its reports to stockholders. Generally, the inclusion of the words “anticipates,” “believe,” “expect,” “future,” “intend,” “estimate,” “anticipate,” “will,” “plans,” or the negative of such terms and similar expressions identify statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and that are intended to come within the safe harbor protection provided by those sections. All statements addressing operating performance, events, or developments that EnerSys expects or anticipates will occur in the future, including statements relating to sales growth, earnings or earnings per share growth, and market share, as well as statements expressing optimism or pessimism about future operating results, are forward-looking statements within the meaning of the Reform Act. The forward-looking statements are and will be based on management’s then-current beliefs and assumptions regarding future events and operating performance and on information currently available to management, and are applicable only as of the dates of such statements.

Forward-looking statements involve risks, uncertainties and assumptions. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy. Actual results may differ materially from those expressed in these forward-looking statements due to a number of uncertainties and risks, including the risks described in this Annual Report on Form 10-K and other unforeseen risks. You should not put undue reliance on any forward-looking statements. These statements speak only as of the date of this Annual Report on Form 10-K, even if subsequently made available by us on our website or otherwise, and we undertake no obligation to update or revise these statements to reflect events or circumstances occurring after the date of this Annual Report on Form 10-K.

Our actual results may differ materially from those contemplated by the forward-looking statements for a number of reasons, including the following factors:

• | general cyclical patterns of the industries in which our customers operate; |

• | the extent to which we cannot control our fixed and variable costs; |

• | the raw materials in our products may experience significant fluctuations in market price and availability; |

• | certain raw materials constitute hazardous materials that may give rise to costly environmental and safety claims; |

• | legislation regarding the restriction of the use of certain hazardous substances in our products; |

• | risks involved in our operations such as disruption of markets, changes in import and export laws, environmental regulations, currency restrictions and local currency exchange rate fluctuations; |

• | our ability to raise our selling prices to our customers when our product costs increase; |

• | the extent to which we are able to efficiently utilize our global manufacturing facilities and optimize our capacity; |

• | general economic conditions in the markets in which we operate; |

• | competitiveness of the battery markets and other energy solutions for industrial applications throughout the world; |

• | our timely development of competitive new products and product enhancements in a changing environment and the acceptance of such products and product enhancements by customers; |

• | our ability to adequately protect our proprietary intellectual property, technology and brand names; |

• | litigation and regulatory proceedings to which we might be subject; |

• | our expectations concerning indemnification obligations; |

• | changes in our market share in the geographic business segments where we operate; |

• | our ability to implement our cost reduction initiatives successfully and improve our profitability; |

• | quality problems associated with our products; |

• | our ability to implement business strategies, including our acquisition strategy, manufacturing expansion and restructuring plans; |

• | our acquisition strategy may not be successful in locating advantageous targets; |

• | our ability to successfully integrate any assets, liabilities, customers, systems and management personnel we acquire into our operations and our ability to realize related revenue synergies and cost savings within expected time frames; |

• | potential goodwill impairment charges, future impairment charges and fluctuations in the fair values of reporting units or of assets in the event projected financial results are not achieved within expected time frames; |

• | our debt and debt service requirements which may restrict our operational and financial flexibility, as well as imposing unfavorable interest and financing costs; |

• | our ability to maintain our existing credit facilities or obtain satisfactory new credit facilities; |

• | adverse changes in our short- and long-term debt levels under our credit facilities; |

• | our exposure to fluctuations in interest rates on our variable-rate debt; |

• | our ability to attract and retain qualified management and personnel; |

3

• | our ability to maintain good relations with labor unions; |

• | credit risk associated with our customers, including risk of insolvency and bankruptcy; |

• | our ability to successfully recover in the event of a disaster affecting our infrastructure; |

• | terrorist acts or acts of war, could cause damage or disruption to our operations, our suppliers, channels to market or customers, or could cause costs to increase, or create political or economic instability; and |

• | the operation, capacity and security of our information systems and infrastructure. |

This list of factors that may affect future performance is illustrative, but by no means exhaustive. Accordingly, all forward-looking statements should be evaluated with the understanding of their inherent uncertainty.

4

EnerSys

Annual Report on Form 10-K

For the Fiscal Year Ended March 31, 2016

Index

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

5

PART I

ITEM 1. | BUSINESS |

Overview

EnerSys (the “Company,” “we,” or “us”) is the world’s largest manufacturer, marketer and distributor of industrial batteries. We also manufacture, market and distribute related products such as chargers, power equipment, outdoor cabinet enclosures and battery accessories, and we provide related after-market and customer-support services for industrial batteries. We market and sell our products globally to over 10,000 customers in more than 100 countries through a network of distributors, independent representatives and our internal sales force.

We operate and manage our business in three geographic regions of the world—Americas, EMEA and Asia, as described below. Our business is highly decentralized with manufacturing locations throughout the world. More than half of our manufacturing capacity is located outside of the United States, and approximately 50% of our net sales were generated outside of the United States. The Company has three reportable segments based on geographic regions, defined as follows:

• | Americas, which includes North and South America, with our segment headquarters in Reading, Pennsylvania, USA; |

• | EMEA, which includes Europe, the Middle East and Africa, with our segment headquarters in Zug, Switzerland; and |

• | Asia, which includes Asia, Australia and Oceania, with our segment headquarters in Singapore. |

We have two primary product lines: reserve power and motive power products. Net sales classifications by product line are as follows:

• | Reserve power products are used for backup power for the continuous operation of critical applications in telecommunications systems, uninterruptible power systems, or “UPS” applications for computer and computer-controlled systems, and other specialty power applications, including security systems, premium starting, lighting and ignition applications, in switchgear, electrical control systems used in electric utilities, large-scale energy storage, energy pipelines, in commercial aircraft, satellites, military aircraft, submarines, ships and tactical vehicles. Reserve power products also include thermally managed cabinets and enclosures for electronic equipment and batteries. |

• | Motive power products are used to provide power for electric industrial forklifts used in manufacturing, warehousing and other material handling applications as well as mining equipment, diesel locomotive starting and other rail equipment. |

Additionally, see Note 22 to the Consolidated Financial Statements for information on segment reporting.

Fiscal Year Reporting

In this Annual Report on Form 10-K, when we refer to our fiscal years, we state “fiscal” and the year, as in “fiscal 2016”, which refers to our fiscal year ended March 31, 2016. The Company reports interim financial information for 13-week periods, except for the first quarter, which always begins on April 1, and the fourth quarter, which always ends on March 31. The four quarters in fiscal 2016 ended on June 28, 2015, September 27, 2015, December 27, 2015, and March 31, 2016, respectively. The four quarters in fiscal 2015 ended on June 29, 2014, September 28, 2014, December 28, 2014, and March 31, 2015, respectively.

History

EnerSys and its predecessor companies have been manufacturers of industrial batteries for over 125 years. Morgan Stanley Capital Partners teamed with the management of Yuasa, Inc. in late 2000 to acquire from Yuasa Corporation (Japan) its reserve power and motive power battery businesses in North and South America. We were incorporated in October 2000 for the purpose of completing the Yuasa, Inc. acquisition. On January 1, 2001, we changed our name from Yuasa, Inc. to EnerSys to reflect our focus on the energy systems nature of our businesses.

In 2004, EnerSys completed its initial public offering (the “IPO”) and the Company’s common stock commenced trading on the New York Stock Exchange, under the trading symbol “ENS”.

6

Key Developments

There have been several key stages in the development of our business, which explain to a significant degree our results of operations over the past several years.

In March 2002, we acquired the reserve power and motive power business of the Energy Storage Group of Invensys plc. (“ESG”). Our successful integration of ESG provided global scale in both the reserve and motive power markets. The ESG acquisition also provided us with a further opportunity to reduce costs and improve operating efficiency that, among other initiatives, led to closing underutilized manufacturing plants, distribution facilities, sales offices and eliminating other redundant costs, including staff.

During fiscal years 2003 through 2015, we made twenty-five acquisitions around the globe. In fiscal 2016, we completed the acquisition of ICS Industries Pty. Ltd. (ICS), headquartered in Melbourne, Australia. ICS is a leading full line shelter designer and manufacturer with installation and maintenance services serving the telecommunications, utilities, datacenter, natural resources and transport industries operating in Australia and serving customers in the Asia Pacific region.

Our Customers

We serve over 10,000 customers in over 100 countries, on a direct basis or through our distributors. We are not overly dependent on any particular end market. Our customer base is highly diverse and no single customer accounts for more than 5% of our revenues.

Our reserve power customers consist of both global and regional customers. These customers are in diverse markets including telecom, UPS, electric utilities, security systems, emergency lighting, premium starting, lighting and ignition applications and space satellites. In addition, we sell our aerospace and defense products in numerous countries, including the governments of the U.S., Germany and the U.K. and to major defense and aviation original equipment manufacturers (“OEMs”).

Our motive power products are sold to a large, diversified customer base. These customers include material handling equipment dealers, OEMs and end users of such equipment. End users include manufacturers, distributors, warehouse operators, retailers, airports, mine operators and railroads.

Distribution and Services

We distribute, sell and service reserve and motive power products throughout the world, principally through company-owned sales and service facilities, as well as through independent manufacturers’ representatives. Our company-owned network allows us to offer high-quality service, including preventative maintenance programs and customer support. Our warehouses and service locations enable us to respond quickly to customers in the markets we serve. We believe that the extensive industry experience of our sales organization results in strong long-term customer relationships.

Manufacturing and Raw Materials

We manufacture and assemble our products at manufacturing facilities located in the Americas, EMEA and Asia. With a view toward projected demand, we strive to optimize and balance capacity at our battery manufacturing facilities globally, while simultaneously minimizing our product cost. By taking a global view of our manufacturing requirements and capacity, we believe we are better able to anticipate potential capacity bottlenecks and equipment and capital funding needs.

The primary raw materials used to manufacture our products include lead, plastics, steel and copper. We purchase lead from a number of leading suppliers throughout the world. Because lead is traded on the world’s commodity markets and its price fluctuates daily, we periodically enter into hedging arrangements for a portion of our projected requirements to reduce the volatility of our costs.

Competition

The industrial battery market is highly competitive both among competitors who manufacture and sell industrial batteries and among customers who purchase industrial batteries. Our competitors range from development stage companies to large domestic and international corporations. Certain of our competitors produce energy storage products utilizing technologies that we do not possess at this time. We compete primarily on the basis of reputation, product quality, reliability of service, delivery and price. We believe that our products and services are competitively priced.

7

Americas

We believe that we have the largest market share in the Americas industrial battery market. We compete principally with East Penn Manufacturing, Exide Technologies and New Power in both the reserve and motive products markets; and also C&D Technologies Inc., EaglePicher (OM Group), NorthStar Battery, SAFT as well as Chinese producers in the reserve products market.

EMEA

We believe that we have the largest market share in the European industrial battery market. Our primary competitors are Exide Technologies, FIAMM, Hoppecke, SAFT as well as Chinese producers in the reserve products market; and Eternity, Exide Technologies, Hoppecke, Midac and TAB in the motive products market.

Asia

We have a small share of the fragmented Asian industrial battery market. We compete principally with GS-Yuasa, Shin-Kobe and Zibo Torch in the motive products market; and Amara Raja, China Shoto, Coslight, Exide Industries, Leoch and Narada, in the reserve products market.

Warranties

Warranties for our products vary geographically and by product type and are competitive with other suppliers of these types of products. Generally, our reserve power product warranties range from one to twenty years and our motive power product warranties range from one to seven years. The length of our warranties is varied to reflect regional characteristics and competitive influences. In some cases, our warranty period may include a pro rata period, which is typically based around the design life of the product and the application served. Our warranties generally cover defects in workmanship and materials and are limited to specific usage parameters.

Intellectual Property

We have numerous patents and patent licenses in the United States and other jurisdictions but do not consider any one patent to be material to our business. From time to time, we apply for patents on new inventions and designs, but we believe that the growth of our business will depend primarily upon the quality of our products and our relationships with our customers, rather than the extent of our patent protection.

We believe we are leaders in thin plate pure lead technology ("TPPL"). Some aspects of this technology may be patented in the future. We believe that a significant capital investment would be required by any party desiring to produce products using TPPL technology for our markets.

We own or possess exclusive and non-exclusive licenses and other rights to use a number of trademarks in various jurisdictions. We have obtained registrations for many of these trademarks in the United States and other jurisdictions. Our various trademark registrations currently have durations of approximately 10 to 20 years, varying by mark and jurisdiction of registration and may be renewable. We endeavor to keep all of our material registrations current. We believe that many such rights and licenses are important to our business by helping to develop strong brand-name recognition in the marketplace.

Seasonality

Our business generally does not experience significant quarterly fluctuations in net sales as a result of weather or other trends that can be directly linked to seasonality patterns, but historically our fourth quarter is our best quarter with higher revenues and generally more working days and our second quarter is the weakest due to the summer holiday season in Western Europe and Americas.

Product and Process Development

Our product and process development efforts are focused on the creation and optimization of new battery products using existing technologies, which, in certain cases, differentiate our stored energy solutions from that of our competition. We allocate our resources to the following key areas:

• | the design and development of new products; |

8

• | optimizing and expanding our existing product offering; |

• | waste and scrap reduction; |

• | production efficiency and utilization; |

• | capacity expansion without additional facilities; and |

• | quality attribute maximization. |

Employees

At March 31, 2016, we had approximately 9,400 employees. Of these employees, approximately 29% were covered by collective bargaining agreements. Employees covered by collective bargaining agreements that did not exceed twelve months were approximately 7% of the total workforce. The average term of these agreements is two years, with the longest term being three years. We consider our employee relations to be good. We did not experience any significant labor unrest or disruption of production during fiscal 2016.

Environmental Matters

In the manufacture of our products throughout the world, we process, store, dispose of and otherwise use large amounts of hazardous materials, especially lead and acid. As a result, we are subject to extensive and evolving environmental, health and safety laws and regulations governing, among other things: the generation, handling, storage, use, transportation and disposal of hazardous materials; emissions or discharges of hazardous materials into the ground, air or water; and the health and safety of our employees. In addition, we are required to comply with the regulation issued from the European Union called Registration, Evaluation, Authorization and Restriction of Chemicals or “REACH,” that came into force on June 1, 2007. Under the regulation, companies which manufacture or import more than one ton of a covered chemical substance per year are required to register it in a central database administered by the European Chemicals Agency. REACH requires a registration over a period of 11 years. Compliance with these laws and regulations results in ongoing costs. Failure to comply with these laws and regulations, or to obtain or comply with required environmental permits, could result in fines, criminal charges or other sanctions by regulators. From time to time, we have had instances of alleged or actual noncompliance that have resulted in the imposition of fines, penalties and required corrective actions. Our ongoing compliance with environmental, health and safety laws, regulations and permits could require us to incur significant expenses, limit our ability to modify or expand our facilities or continue production and require us to install additional pollution control equipment and make other capital improvements. In addition, private parties, including current or former employees, can bring personal injury or other claims against us due to the presence of, or their exposure to, hazardous substances used, stored, transported or disposed of by us or contained in our products.

Sumter, South Carolina

We currently are responsible for certain environmental obligations at our former battery facility in Sumter, South Carolina, that predate our ownership of this facility. This battery facility was closed in 2001 and is separate from our current metal fabrication facility in Sumter. We have a reserve for this facility that totaled $1.1 million as of March 31, 2016. Based on current information, we believe this reserve is adequate to satisfy our environmental liabilities at this facility.

Environmental and safety certifications

Sixteen of our facilities in the Americas, EMEA and Asia are certified to ISO 14001 standards. ISO 14001 is a globally recognized, voluntary program that focuses on the implementation, maintenance and continual improvement of an environmental management system and the improvement of environmental performance. Seven facilities in Europe and one in Africa are certified to OHSAS 18001 standards. OHSAS 18001 is a globally recognized occupational health and safety management systems standard.

Quality Systems

We utilize a global strategy for quality management systems, policies and procedures, the basis of which is the ISO 9001:2008 standard, which is a worldwide recognized quality standard. We believe in the principles of this standard and reinforce this by requiring mandatory compliance for all manufacturing, sales and service locations globally that are registered to the ISO 9001 standard. This strategy enables us to provide consistent quality products and services to meet our customers’ needs.

9

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. These filings are available to the public on the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file with the SEC at the SEC’s public reference room, located at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room.

Our Internet address is http://www.enersys.com. We make available free of charge on http://www.enersys.com our annual, quarterly and current reports, and amendments to those reports, as soon as reasonably practical after we electronically file such material with, or furnish it to, the SEC.

ITEM 1A. | RISK FACTORS |

The following risks and uncertainties, as well as others described in this Annual Report on Form 10-K, could materially and adversely affect our business, our results of operations and financial conditions and could cause actual results to differ materially from our expectations and projections. Stockholders are cautioned that these and other factors, including those beyond our control, may affect future performance and cause actual results to differ from those which may, from time to time, be anticipated. There may be additional risks that are not presently material or known. See “Cautionary Note Regarding Forward-Looking Statements.” All forward-looking statements made by us or on our behalf are qualified by the risks described below.

We operate in an extremely competitive industry and are subject to pricing pressures.

We compete with a number of major international manufacturers and distributors, as well as a large number of smaller, regional competitors. Due to excess capacity in some sectors of our industry and consolidation among industrial battery purchasers, we have been subjected to significant pricing pressures. We anticipate continued competitive pricing pressure as foreign producers are able to employ labor at significantly lower costs than producers in the U.S. and Western Europe, expand their export capacity and increase their marketing presence in our major Americas and European markets. Several of our competitors have strong technical, marketing, sales, manufacturing, distribution and other resources, as well as significant name recognition, established positions in the market and long-standing relationships with OEMs and other customers. In addition, certain of our competitors own lead smelting facilities which, during periods of lead cost increases or price volatility, may provide a competitive pricing advantage and reduce their exposure to volatile raw material costs. Our ability to maintain and improve our operating margins has depended, and continues to depend, on our ability to control and reduce our costs. We cannot assure you that we will be able to continue to control our operating expenses, to raise or maintain our prices or increase our unit volume, in order to maintain or improve our operating results.

The uncertainty in global economic conditions could negatively affect the Company’s operating results.

Our operating results are directly affected by the general global economic conditions of the industries in which our major customer groups operate. Our business segments are highly dependent on the economic and market conditions in each of the geographic areas in which we operate. Our products are heavily dependent on the end markets that we serve and our operating results will vary by geographic segment, depending on the economic environment in these markets. Sales of our motive power products, for example, depend significantly on demand for new electric industrial forklift trucks, which in turn depends on end-user demand for additional motive capacity in their distribution and manufacturing facilities. The uncertainty in global economic conditions varies by geographic segment, and can result in substantial volatility in global credit markets, particularly in the United States, where we service the vast majority of our debt. These conditions affect our business by reducing prices that our customers may be able or willing to pay for our products or by reducing the demand for our products, which could in turn negatively impact our sales and earnings generation and result in a material adverse effect on our business, cash flow, results of operations and financial position.

10

Government reviews, inquiries, investigations, and actions could harm our business or reputation.

As we operate in various locations around the world, our operations in certain countries are subject to significant governmental scrutiny and may be adversely impacted by the results of such scrutiny. The regulatory environment with regard to our business is evolving, and officials often exercise broad discretion in deciding how to interpret and apply applicable regulations. From time to time, we receive formal and informal inquiries from various government regulatory authorities, as well as self-regulatory organizations, about our business and compliance with local laws, regulations or standards. For example, certain of the Company’s European subsidiaries have received subpoenas and requests for documents and, in some cases, interviews from, and have had on-site inspections conducted by the competition authorities of Belgium, Germany and the Netherlands relating to conduct and anticompetitive practices of certain industrial battery participants. The Company is responding to inquiries related to these matters. The Company settled the Belgian regulatory proceeding in February 2016 by acknowledging certain anticompetitive practices and conduct and agreeing to pay a fine of $2.0 million. (See Note 18 to the Consolidated Financial Statements for additional details.) Any determination that our operations or activities, or the activities of our employees, are not in compliance with existing laws, regulations or standards could result in the imposition of substantial fines, interruptions of business, loss of supplier, vendor or other third-party relationships, termination of necessary licenses and permits, or similar results, all of which could potentially harm our business and/or reputation. Even if an inquiry does not result in these types of determinations, regulatory authorities could cause us to incur substantial costs or require us to change our business practices in a manner materially adverse to our business, and it potentially could create negative publicity which could harm our business and/or reputation.

Reliance on third party relationships and derivative agreements could adversely affect the Company’s business.

We depend on third parties, including suppliers, distributors, lead toll operators, freight forwarders, insurance brokers, commodity brokers, major financial institutions and other third party service providers, for key aspects of our business, including the provision of derivative contracts to manage risks of (a) lead cost volatility, (b) foreign currency exposures and (c) interest rate volatility. Failure of these third parties to meet their contractual, regulatory and other obligations to the Company, or the development of factors that materially disrupt our relationships with these third parties, could expose us to the risks of business disruption, higher lead costs, unfavorable foreign currency rates and higher expenses, which could have a material adverse effect on our business.

Our operating results could be adversely affected by changes in the cost and availability of raw materials.

Lead is our most significant raw material and is used along with significant amounts of plastics, steel, copper and other materials in our manufacturing processes. We estimate that raw material costs account for over half of our cost of goods sold. The costs of these raw materials, particularly lead, are volatile and beyond our control. Additionally, availability of the raw materials used to manufacture our products may be limited at times resulting in higher prices and/or the need to find alternative suppliers. Furthermore, the cost of raw materials may also be influenced by transportation costs. Volatile raw material costs can significantly affect our operating results and make period-to-period comparisons extremely difficult. We cannot assure you that we will be able to either hedge the costs or secure the availability of our raw material requirements at a reasonable level or, even with respect to our agreements that adjust pricing to a market-based index for lead, pass on to our customers the increased costs of our raw materials without affecting demand or that limited availability of materials will not impact our production capabilities. Our inability to raise the price of our products in response to increases in prices of raw materials or to maintain a proper supply of raw materials could have an adverse effect on our revenue, operating profit and net income.

Our operations expose us to litigation, tax, environmental and other legal compliance risks.

We are subject to a variety of litigation, tax, environmental, health and safety and other legal compliance risks. These risks include, among other things, possible liability relating to product liability matters, personal injuries, intellectual property rights, contract-related claims, government contracts, taxes, health and safety liabilities, environmental matters and compliance with U.S. and foreign laws, competition laws and laws governing improper business practices. We or one of our business units could be charged with wrongdoing as a result of such matters. If convicted or found liable, we could be subject to significant fines, penalties, repayments or other damages (in certain cases, treble damages). As a global business, we are subject to complex laws and regulations in the U.S. and other countries in which we operate. Those laws and regulations may be interpreted in different ways. They may also change from time to time, as may related interpretations and other guidance. Changes in laws or regulations could result in higher expenses and payments, and uncertainty relating to laws or regulations may also affect how we conduct our operations and structure our investments and could limit our ability to enforce our rights.

In the area of taxes, changes in tax laws and regulations, as well as changes in related interpretations and other tax guidance could materially impact our tax receivables and liabilities and our deferred tax assets and tax liabilities. Additionally, in the

11

ordinary course of business, we are subject to examinations by various authorities, including tax authorities. In addition to ongoing investigations, there could be additional investigations launched in the future by governmental authorities in various jurisdictions and existing investigations could be expanded. The global and diverse nature of our operations means that these risks will continue to exist and additional legal proceedings and contingencies will arise from time to time. Our results may be affected by the outcome of legal proceedings and other contingencies that cannot be predicted with certainty.

In the manufacture of our products throughout the world, we process, store, dispose of and otherwise use large amounts of hazardous materials, especially lead and acid. As a result, we are subject to extensive and changing environmental, health and safety laws and regulations governing, among other things: the generation, handling, storage, use, transportation and disposal of hazardous materials; remediation of polluted ground or water; emissions or discharges of hazardous materials into the ground, air or water; and the health and safety of our employees. Compliance with these laws and regulations results in ongoing costs. Failure to comply with these laws or regulations, or to obtain or comply with required environmental permits, could result in fines, criminal charges or other sanctions by regulators. From time to time we have had instances of alleged or actual noncompliance that have resulted in the imposition of fines, penalties and required corrective actions. Our ongoing compliance with environmental, health and safety laws, regulations and permits could require us to incur significant expenses, limit our ability to modify or expand our facilities or continue production and require us to install additional pollution control equipment and make other capital improvements. In addition, private parties, including current or former employees, could bring personal injury or other claims against us due to the presence of, or exposure to, hazardous substances used, stored or disposed of by us or contained in our products.

Certain environmental laws assess liability on owners or operators of real property for the cost of investigation, removal or remediation of hazardous substances at their current or former properties or at properties at which they have disposed of hazardous substances. These laws may also assess costs to repair damage to natural resources. We may be responsible for remediating damage to our properties that was caused by former owners. Soil and groundwater contamination has occurred at some of our current and former properties and may occur or be discovered at other properties in the future. We are currently investigating and monitoring soil and groundwater contamination at several of our properties, in most cases as required by regulatory permitting processes. We may be required to conduct these operations at other properties in the future. In addition, we have been and in the future may be liable to contribute to the cleanup of locations owned or operated by other persons to which we or our predecessor companies have sent wastes for disposal, pursuant to federal and other environmental laws. Under these laws, the owner or operator of contaminated properties and companies that generated, disposed of or arranged for the disposal of wastes sent to a contaminated disposal facility can be held jointly and severally liable for the investigation and cleanup of such properties, regardless of fault. Additionally, our products may become subject to fees and taxes in order to fund cleanup of such properties, including those operated or used by other lead-battery industry participants.

Changes in environmental and climate laws or regulations, could lead to new or additional investment in production designs and could increase environmental compliance expenditures. Changes in climate change concerns, or in the regulation of such concerns, including greenhouse gas emissions, could subject us to additional costs and restrictions, including increased energy and raw materials costs. Additionally, we cannot assure you that we have been or at all times will be in compliance with environmental laws and regulations or that we will not be required to expend significant funds to comply with, or discharge liabilities arising under, environmental laws, regulations and permits, or that we will not be exposed to material environmental, health or safety litigation.

Also, the U.S. Foreign Corrupt Practices Act (“FCPA”) and similar worldwide anti-bribery laws in non-U.S. jurisdictions generally prohibit companies and their intermediaries from making improper payments to non-U.S. officials for the purpose of obtaining or retaining business. The FCPA applies to companies, individual directors, officers, employees and agents. Under the FCPA, U.S. companies may be held liable for actions taken by strategic or local partners or representatives. The FCPA also imposes accounting standards and requirements on publicly traded U.S. corporations and their foreign affiliates, which are intended to prevent the diversion of corporate funds to the payment of bribes and other improper payments. Certain of our customer relationships outside of the U.S. are with governmental entities and are therefore subject to such anti-bribery laws. Our policies mandate compliance with these anti-bribery laws. Despite meaningful measures that we undertake to facilitate lawful conduct, which include training and internal control policies, these measures may not always prevent reckless or criminal acts by our employees or agents. As a result, we could be subject to criminal and civil penalties, disgorgement, further changes or enhancements to our procedures, policies and controls, personnel changes or other remedial actions. Violations of these laws, or allegations of such violations, could disrupt our operations, involve significant management distraction and result in a material adverse effect on our competitive position, results of operations, cash flows or financial condition.

There is also a regulation to improve the transparency and accountability concerning the supply of minerals coming from the conflict zones in and around the Democratic Republic of Congo. New U.S. legislation includes disclosure requirements regarding the use of conflict minerals mined from the Democratic Republic of Congo and adjoining countries and procedures

12

regarding a manufacturer’s efforts to prevent the sourcing of such conflict minerals. The implementation of these requirements could affect the sourcing and availability of minerals used in the manufacture of our products. As a result, there may only be a limited pool of suppliers who provide conflict-free metals, and we cannot assure you that we will be able to obtain products in sufficient quantities or at competitive prices. Future regulations may become more stringent or costly and our compliance costs and potential liabilities could increase, which may harm our business.

We are exposed to exchange rate risks, and our net earnings and financial condition may suffer due to currency translations.

We invoice our foreign sales and service transactions in local and foreign currencies and translate net sales using actual exchange rates during the period. We translate our non-U.S. assets and liabilities into U.S. dollars using current exchange rates as of the balance sheet dates. Because a significant portion of our revenues and expenses are denominated in foreign currencies, changes in exchange rates between the U.S. dollar and foreign currencies, primarily the euro, British pound, Polish zloty, Chinese renminbi, Mexican peso and Swiss franc may adversely affect our revenue, cost of goods sold and operating margins. For example, foreign currency depreciation against the U.S. dollar will reduce the value of our foreign revenues and operating earnings as well as reduce our net investment in foreign subsidiaries. Approximately 50% of net sales were generated outside of the United States for the last three fiscal years.

Most of the risk of fluctuating foreign currencies is in our EMEA segment, which comprised approximately 40% of our net sales during the last three fiscal years. The euro is the dominant currency in our EMEA operations. In the event that one or more European countries were to replace the euro with another currency, our sales into such countries, or into Europe generally, would likely be adversely affected until stable exchange rates are established.

The translation impact from currency fluctuations on net sales and operating earnings in our Americas and Asia segments are not as significant as our EMEA segment, as a substantial majority of these net sales and operating earnings are in U.S. dollars or foreign currencies that have been closely correlated to the U.S. dollar.

If foreign currencies depreciate against the U.S. dollar, it would make it more expensive for our non-U.S. subsidiaries to purchase certain of our raw material commodities that are priced globally in U.S. dollars, while the related revenue will decrease when translated to U.S. dollars. Significant movements in foreign exchange rates can have a material impact on our results of operations and financial condition. We periodically engage in hedging of our foreign currency exposures, but cannot assure you that we can successfully hedge all of our foreign currency exposures or do so at a reasonable cost.

We quantify and monitor our global foreign currency exposures. Our largest foreign currency exposure is from the purchase and conversion of U.S. dollar based lead costs into local currencies in Europe. Additionally, we have currency exposures from intercompany financing and intercompany and third party trade transactions. On a selective basis, we enter into foreign currency forward contracts and purchase option contracts to reduce the impact from the volatility of currency movements; however, we cannot be certain that foreign currency fluctuations will not impact our operations in the future.

If we are unable to effectively hedge against currency fluctuations, our operating costs and revenues in our non-U.S. operations may be adversely affected, which would have an adverse effect on our operating profit and net income.

We may experience difficulties implementing our new global enterprise resource planning system.

We are engaged in a multi-year implementation of a new global enterprise resource planning system (“ERP”). The ERP is designed to efficiently maintain our books and records and provide information important to the operation of our business to our management team. The ERP will continue to require significant investment of human and financial resources. In implementing the ERP, we may experience significant delays, increased costs and other difficulties. Any significant disruption or deficiency in the design and implementation of the ERP could adversely affect our ability to process orders, ship product, send invoices and track payments, fulfill contractual obligations or otherwise operate our business. While we have invested significant resources in planning, project management and training, additional and significant implementation issues may arise. In addition, our efforts to centralize various business processes and functions within our organization in connection with our ERP implementation may disrupt our operations and negatively impact our business, results of operations and financial condition.

13

Our international operations may be adversely affected by actions taken by foreign governments or other forces or events over which we may have no control.

We currently have significant manufacturing and/or distribution facilities outside of the United States, in Argentina, Australia, Belgium, Brazil, Bulgaria, Canada, the Czech Republic, France, Germany, India, Italy, Malaysia, Mexico, PRC, Poland, South Africa, Spain, Switzerland, Tunisia and the United Kingdom. We may face political instability, economic uncertainty, and/or difficult labor relations in our foreign operations. We also may face barriers in the form of long-standing relationships between potential customers and their existing suppliers, national policies favoring domestic manufacturers and protective regulations including exchange controls, restrictions on foreign investment or the repatriation of profits or invested capital, changes in export or import restrictions and changes in the tax system or rate of taxation in countries where we do business. We cannot assure you that we will be able to successfully develop and expand our international operations and sales or that we will be able to overcome the significant obstacles and risks of our international operations. This may impair our ability to compete with battery manufacturers who are based in such foreign countries or who have long established manufacturing or distribution facilities or networks in such countries.

Our failure to introduce new products and product enhancements and broad market acceptance of new technologies introduced by our competitors could adversely affect our business.

Many new energy storage technologies have been introduced over the past several years. For certain important and growing markets, such as aerospace and defense, lithium-based battery technologies have a large and growing market share. Our ability to achieve significant and sustained penetration of key developing markets, including aerospace and defense, will depend upon our success in developing or acquiring these and other technologies, either independently, through joint ventures or through acquisitions. If we fail to develop or acquire, and manufacture and sell, products that satisfy our customers’ demands, or we fail to respond effectively to new product announcements by our competitors by quickly introducing competitive products, then market acceptance of our products could be reduced and our business could be adversely affected. We cannot assure you that our lead-acid products will remain competitive with products based on new technologies.

We may not be able to adequately protect our proprietary intellectual property and technology.

We rely on a combination of copyright, trademark, patent and trade secret laws, non-disclosure agreements and other confidentiality procedures and contractual provisions to establish, protect and maintain our proprietary intellectual property and technology and other confidential information. Certain of these technologies, especially TPPL technology, are important to our business and are not protected by patents. Despite our efforts to protect our proprietary intellectual property and technology and other confidential information, unauthorized parties may attempt to copy or otherwise obtain and use our intellectual property and proprietary technologies. If we are unable to protect our intellectual property and technology, we may lose any technological advantage we currently enjoy and may be required to take an impairment charge with respect to the carrying value of such intellectual property or goodwill established in connection with the acquisition thereof. In either case, our operating results and net income may be adversely affected.

Relocation of our customers’ operations could adversely affect our business.

The trend by a number of our North American and Western European customers to move manufacturing operations and expand their businesses in faster growing and low labor-cost markets may have an adverse impact on our business. As our customers in traditional manufacturing-based industries seek to move their manufacturing operations to these locations, there is a risk that these customers will source their energy storage products from competitors located in those territories and will cease or reduce the purchase of products from our manufacturing plants. We cannot assure you that we will be able to compete effectively with manufacturing operations of energy storage products in those territories, whether by establishing or expanding our manufacturing operations in those lower-cost territories or acquiring existing manufacturers.

We may fail to implement our cost reduction initiatives successfully and improve our profitability.

We must continue to implement cost reduction initiatives to achieve additional cost savings in future periods. We cannot assure you that we will be able to achieve all of the cost savings that we expect to realize from current or future initiatives. In particular, we may be unable to implement one or more of our initiatives successfully or we may experience unexpected cost increases that offset the savings that we achieve. Given the continued competitive pricing pressures experienced in our industry, our failure to realize cost savings would adversely affect our results of operations.

14

Quality problems with our products could harm our reputation and erode our competitive position.

The success of our business will depend upon the quality of our products and our relationships with customers. In the event that our products fail to meet our customers’ standards, our reputation could be harmed, which would adversely affect our marketing and sales efforts. We cannot assure you that our customers will not experience quality problems with our products.

We offer our products under a variety of brand names, the protection of which is important to our reputation for quality in the consumer marketplace.

We rely upon a combination of trademark, licensing and contractual covenants to establish and protect the brand names of our products. We have registered many of our trademarks in the U.S. Patent and Trademark Office and in other countries. In many market segments, our reputation is closely related to our brand names. Monitoring unauthorized use of our brand names is difficult, and we cannot be certain that the steps we have taken will prevent their unauthorized use, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the U.S. We cannot assure you that our brand names will not be misappropriated or utilized without our consent or that such actions will not have a material adverse effect on our reputation and on our results of operations.

We may fail to implement our plans to make acquisitions or successfully integrate them into our operations.

As part of our business strategy, we have grown, and plan to continue growing, by acquiring other product lines, technologies or facilities that complement or expand our existing business. There is significant competition for acquisition targets in the industrial battery industry. We may not be able to identify suitable acquisition candidates or negotiate attractive terms. In addition, we may have difficulty obtaining the financing necessary to complete transactions we pursue. In that regard, our credit facilities restrict the amount of additional indebtedness that we may incur to finance acquisitions and place other restrictions on our ability to make acquisitions. Exceeding any of these restrictions would require the consent of our lenders. We may be unable to successfully integrate any assets, liabilities, customers, systems and management personnel we acquire into our operations and we may not be able to realize related revenue synergies and cost savings within expected time frames. Our failure to execute our acquisition strategy could have a material adverse effect on our business. We cannot assure you that our acquisition strategy will be successful or that we will be able to successfully integrate acquisitions we do make.

Any acquisitions that we complete may dilute stockholder ownership interests in EnerSys, may have adverse effects on our financial condition and results of operations and may cause unanticipated liabilities.

Future acquisitions may involve the issuance of our equity securities as payment, in part or in full, for the businesses or assets acquired. Any future issuances of equity securities would dilute stockholder ownership interests. In addition, future acquisitions might not increase, and may even decrease our earnings or earnings per share and the benefits derived by us from an acquisition might not outweigh or might not exceed the dilutive effect of the acquisition. We also may incur additional debt or suffer adverse tax and accounting consequences in connection with any future acquisitions.

The failure or security breach of critical computer systems could seriously affect our sales and operations.

We operate a number of critical computer systems throughout our business that can fail for a variety of reasons. If such a failure were to occur, we may not be able to sufficiently recover from the failure in time to avoid the loss of data or any adverse impact on certain of our operations that are dependent on such systems. This could result in lost sales and the inefficient operation of our facilities for the duration of such a failure.

In addition, our computer systems are essential for the exchange of information both within the company and in communicating with third parties. Despite our efforts to protect the integrity of our systems and network as well as sensitive, confidential or personal data or information, our facilities and systems and those of our third-party service providers may be vulnerable to security breaches, theft, misplaced or lost data, programming and/or human errors that could potentially lead to the compromising of sensitive, confidential or personal data or information, improper use of our systems, software solutions or networks, unauthorized access, use, disclosure, modification or destruction of information, defective products, production downtimes and operational disruptions, which in turn could adversely affect our reputation, competitiveness, and results of operations.

Our ability to maintain adequate credit facilities.

Our ability to continue our ongoing business operations and fund future growth depends on our ability to maintain adequate credit facilities and to comply with the financial and other covenants in such credit facilities or to secure alternative sources of

15

financing. However, such credit facilities or alternate financing may not be available or, if available, may not be on terms favorable to us. If we do not have adequate access to credit, we may be unable to refinance our existing borrowings and credit facilities when they mature and to fund future acquisitions, and this may reduce our flexibility in responding to changing industry conditions.

Our indebtedness could adversely affect our financial condition and results of operations.

As of March 31, 2016, we had $628.6 million of total consolidated debt (including capital lease obligations). This level of debt could:

• | increase our vulnerability to adverse general economic and industry conditions, including interest rate fluctuations, because a portion of our borrowings bear, and will continue to bear, interest at floating rates; |

• | require us to dedicate a substantial portion of our cash flow from operations to debt service payments, which would reduce the availability of our cash to fund working capital, capital expenditures or other general corporate purposes, including acquisitions; |

• | limit our flexibility in planning for, or reacting to, changes in our business and industry; |

• | restrict our ability to introduce new products or new technologies or exploit business opportunities; |

• | place us at a disadvantage compared with competitors that have proportionately less debt; |

• | limit our ability to borrow additional funds in the future, if we need them, due to financial and restrictive covenants in our debt agreements; and |

• | have a material adverse effect on us if we fail to comply with the financial and restrictive covenants in our debt agreements. |

There can be no assurance that we will continue to declare cash dividends at all or in any particular amounts.

During fiscal 2016, we announced the declaration of a quarterly cash dividend of $0.175 per share of common stock for quarters ended June 28, 2015, September 27, 2015, December 27, 2015 and March 31, 2016. On May 5, 2016, we announced a fiscal 2017 first quarter cash dividend of $0.175 per share of common stock. Future payment of a regular quarterly cash dividend on our common shares will be subject to, among other things, our results of operations, cash balances and future cash requirements, financial condition, statutory requirements of Delaware law, compliance with the terms of existing and future indebtedness and credit facilities, and other factors that the Board of Directors may deem relevant. Our dividend payments may change from time to time, and we cannot provide assurance that we will continue to declare dividends at all or in any particular amounts. A reduction in or elimination of our dividend payments could have a negative effect on our share price.

We depend on our senior management team and other key employees, and significant attrition within our management team or unsuccessful succession planning could adversely affect our business.

Our success depends in part on our ability to attract, retain and motivate senior management and other key employees. Achieving this objective may be difficult due to many factors, including fluctuations in global economic and industry conditions, competitors’ hiring practices, cost reduction activities, and the effectiveness of our compensation programs. Competition for qualified personnel can be very intense. We must continue to recruit, retain and motivate senior management and other key employees sufficient to maintain our current business and support our future projects. We are vulnerable to attrition among our current senior management team and other key employees. A loss of any such personnel, or the inability to recruit and retain qualified personnel in the future, could have an adverse effect on our business, financial condition and results of operations. In addition, if we are unsuccessful in our succession planning efforts, the continuity of our business and results of operations could be adversely affected.

ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

16

ITEM 2. | PROPERTIES |

The Company’s worldwide headquarters is located in Reading, Pennsylvania. Geographic headquarters for our Americas, EMEA and Asia segments are located in Reading, Pennsylvania, Zug, Switzerland and Singapore, respectively. The Company owns approximately 80% of its manufacturing facilities and distribution centers worldwide. The following sets forth the Company’s principal owned or leased facilities by business segment:

Americas: Sylmar, California; Longmont, Colorado; Hays, Kansas; Richmond, Kentucky; Warrensburg, Missouri; Cleveland, Ohio; Horsham, Pennsylvania; Sumter, South Carolina; Ooltewah, Tennessee and Spokane, Washington in the United States; Monterrey and Tijuana in Mexico; Buenos Aires, Argentina and Sao Paulo, in Brazil.

EMEA: Targovishte, Bulgaria; Hostomice, Czech Republic; Arras, France; Hagen and Zwickau in Germany; Bielsko-Biala, Poland; Newport and Culham in the United Kingdom; Port Elizabeth, South Africa; and Tunis, Tunisia.

Asia: Jiangsu, Chongqing and Yangzhou in the PRC and Andhra Pradesh in India.

We consider our plants and facilities, whether owned or leased, to be in satisfactory condition and adequate to meet the needs of our current businesses and projected growth. Information as to material lease commitments is included in Note 9 - Leases to the Consolidated Financial Statements.

ITEM 3. | LEGAL PROCEEDINGS |

From time to time, we are involved in litigation incidental to the conduct of our business. See Litigation and Other Legal Matters in Note 18 - Commitments, Contingencies and Litigation to the Consolidated Financial Statements, which is incorporated herein by reference.

ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

17

PART II

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

The Company’s common stock has been listed on the New York Stock Exchange under the symbol “ENS” since it began trading on July 30, 2004. Prior to that time, there had been no public market for our common stock. The following table sets forth, on a per share basis for the periods presented, the range of high, low and closing prices of the Company’s common stock.

Quarter Ended | High Price | Low Price | Closing Price | Dividends Declared | ||||||||||||

March 31, 2016 | $ | 58.89 | $ | 42.60 | $ | 55.72 | $ | 0.175 | ||||||||

December 27, 2015 | 66.95 | 51.02 | 57.18 | 0.175 | ||||||||||||

September 27, 2015 | 71.85 | 49.21 | 51.66 | 0.175 | ||||||||||||

June 28, 2015 | 73.27 | 63.63 | 71.58 | 0.175 | ||||||||||||

March 31, 2015 | $ | 66.89 | $ | 57.47 | $ | 64.24 | $ | 0.175 | ||||||||

December 28, 2014 | 63.39 | 50.63 | 61.78 | 0.175 | ||||||||||||

September 28, 2014 | 70.00 | 57.88 | 60.07 | 0.175 | ||||||||||||

June 29, 2014 | 71.94 | 62.72 | 68.91 | 0.175 | ||||||||||||

Holders of Record

As of May 27, 2016, there were approximately 370 record holders of common stock of the Company. Because many of these shares are held by brokers and other institutions on behalf of stockholders, the Company is unable to estimate the total number of stockholders represented by these record holders.

Recent Sales of Unregistered Securities

During the fourth quarter of fiscal 2016, we did not issue any unregistered securities.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table summarizes the number of shares of common stock we purchased from participants in our equity incentive plans as well as repurchases of common stock authorized by the Board of Directors. As provided by the Company’s equity incentive plans, (a) vested options outstanding may be exercised through surrender to the Company of option shares or vested options outstanding under the Company’s equity incentive plans to satisfy the applicable aggregate exercise price (and any withholding tax) required to be paid upon such exercise and (b) the withholding tax requirements related to the vesting and settlement of restricted stock units and market share units may be satisfied by the surrender of shares of the Company’s common stock.

18

Purchases of Equity Securities

Period | (a) Total number of shares (or units) purchased | (b) Average price paid per share (or unit) | (c) Total number of shares (or units) purchased as part of publicly announced plans or programs | (d) Maximum number (or approximate dollar value) of shares (or units) that may be purchased under the plans or programs(1)(2) | ||||||||||

December 28, 2015 - January 24, 2016 | 961,444 | $ | 60.63 | 961,444 | $ | 38,600,000 | ||||||||

January 25, 2016 - February 21, 2016 | 131,962 | 44.38 | 131,962 | 32,743,463 | ||||||||||

February 22, 2016 - March 31, 2016 | 113,352 | 47.27 | 113,352 | 27,385,432 | ||||||||||

Total | 1,206,758 | $ | 57.60 | 1,206,758 | ||||||||||

(1) | The Company's Board of Directors has authorized the Company to repurchase up to such number of shares as shall equal the dilutive effects of any equity-based award granted during such fiscal year under the Second Amended and Restated 2010 Equity Incentive Plan and the number of shares exercised through stock option awards during such fiscal year. This repurchase program was exhausted for fiscal 2016. |

(2) | The Company's Board of Directors has authorized the Company to repurchase up to a $180 million of its common stock. On August 13, 2015, the Company prepaid $180 million, pursuant to an accelerated share repurchase (“ASR”) with a major financial institution, and received an initial delivery of 2,000,000 shares. On January 13, 2016, the ASR was settled and the Company received an additional 961,444 shares and $13.6 million in cash for the remaining amount not settled in shares. The Company repurchased a total of 2,961,444 shares under the ASR for a total cash investment of $166.4 million at an average price of $56.19. The Company also purchased an additional 245,314 shares during the fourth quarter through open market transactions for a total cash investment of $11.2 million at an average price of $45.72. |

19

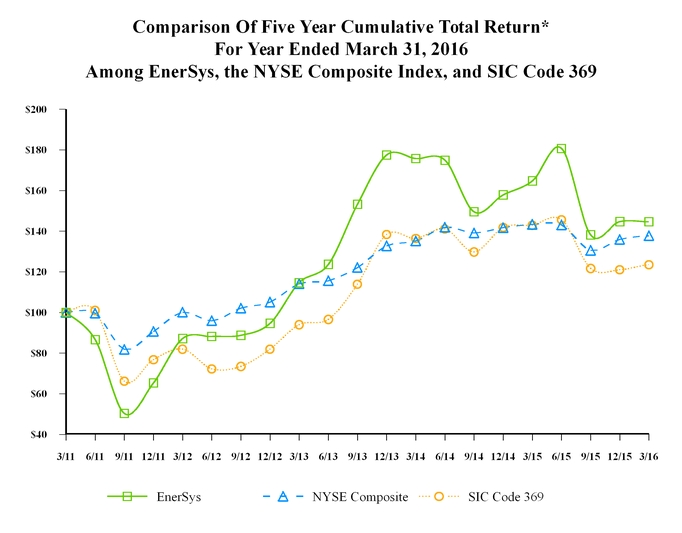

STOCK PERFORMANCE GRAPH

The following graph compares the changes in cumulative total returns on EnerSys’ common stock with the changes in cumulative total returns of the New York Stock Exchange Composite Index, a broad equity market index, and the total return on a selected peer group index. The peer group selected is based on the standard industrial classification codes (“SIC Codes”) established by the U.S. government. The index chosen was “Miscellaneous Electrical Equipment and Suppliers” and comprises all publicly traded companies having the same three-digit SIC Code (369) as EnerSys.

The graph was prepared assuming that $100 was invested in EnerSys’ common stock, the New York Stock Exchange Composite Index and the peer group (duly updated for changes) on March 31, 2011.

*$100 invested on March 31, 2011 in stock or index, including reinvestment of dividends.

20

ITEM 6. | SELECTED FINANCIAL DATA |

Fiscal Year Ended March 31, | ||||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

(In thousands, except share and per share data) | ||||||||||||||||||||

Consolidated Statements of Income: | ||||||||||||||||||||

Net sales | $ | 2,316,249 | $ | 2,505,512 | $ | 2,474,433 | $ | 2,277,559 | $ | 2,283,369 | ||||||||||

Cost of goods sold | 1,704,472 | 1,864,601 | 1,844,813 | 1,708,203 | 1,770,664 | |||||||||||||||

Gross profit | 611,777 | 640,911 | 629,620 | 569,356 | 512,705 | |||||||||||||||

Operating expenses | 352,767 | 358,381 | 344,421 | 312,324 | 297,806 | |||||||||||||||

Restructuring and other exit charges | 12,978 | 11,436 | 27,326 | 7,164 | 4,988 | |||||||||||||||

Impairment of goodwill, indefinite-lived intangibles and fixed assets | 36,252 | 23,946 | 5,179 | — | — | |||||||||||||||

Legal proceedings charge / (reversal of legal accrual, net of fees) | 3,201 | (16,233 | ) | 58,184 | — | (900 | ) | |||||||||||||

Gain on sale of facility | (3,420 | ) | — | — | — | — | ||||||||||||||

Operating earnings | 209,999 | 263,381 | 194,510 | 249,868 | 210,811 | |||||||||||||||

Interest expense | 22,343 | 19,644 | 17,105 | 18,719 | 16,484 | |||||||||||||||

Other (income) expense, net | 5,719 | (5,602 | ) | 13,658 | 916 | 3,068 | ||||||||||||||

Earnings before income taxes | 181,937 | 249,339 | 163,747 | 230,233 | 191,259 | |||||||||||||||

Income tax expense | 50,113 | 67,814 | 16,980 | 65,275 | 47,292 | |||||||||||||||

Net earnings | 131,824 | 181,525 | 146,767 | 164,958 | 143,967 | |||||||||||||||

Net (losses) earnings attributable to noncontrolling interests | (4,326 | ) | 337 | (3,561 | ) | (1,550 | ) | (36 | ) | |||||||||||

Net earnings attributable to EnerSys stockholders | $ | 136,150 | $ | 181,188 | $ | 150,328 | $ | 166,508 | $ | 144,003 | ||||||||||

Net earnings per common share attributable to EnerSys stockholders: | ||||||||||||||||||||

Basic | $ | 3.08 | $ | 3.97 | $ | 3.17 | $ | 3.47 | $ | 2.95 | ||||||||||

Diluted | $ | 2.99 | $ | 3.77 | $ | 3.02 | $ | 3.42 | $ | 2.93 | ||||||||||

Weighted-average number of common shares outstanding: | ||||||||||||||||||||

Basic | 44,276,713 | 45,606,317 | 47,473,690 | 48,022,005 | 48,748,205 | |||||||||||||||

Diluted | 45,474,130 | 48,052,729 | 49,788,155 | 48,635,449 | 49,216,035 | |||||||||||||||

Fiscal Year Ended March 31, | ||||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Consolidated cash flow data: | ||||||||||||||||||||

Net cash provided by operating activities | $ | 307,571 | $ | 194,471 | $ | 193,621 | $ | 244,400 | $ | 204,196 | ||||||||||

Net cash used in investing activities | (80,923 | ) | (59,616 | ) | (232,005 | ) | (55,092 | ) | (72,420 | ) | ||||||||||

Net cash (used in) provided by financing activities | (105,729 | ) | (59,313 | ) | 21,562 | (95,962 | ) | (79,382 | ) | |||||||||||

Other operating data: | ||||||||||||||||||||

Capital expenditures | 55,880 | 63,625 | 61,995 | 55,286 | 48,943 | |||||||||||||||

As of March 31, | ||||||||||||||||||||

2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||

(In thousands) | ||||||||||||||||||||

Consolidated balance sheet data: | ||||||||||||||||||||

Cash and cash equivalents | $ | 397,307 | $ | 268,921 | $ | 240,103 | $ | 249,348 | $ | 160,490 | ||||||||||

Working capital | 845,068 | 769,881 | 719,297 | 685,403 | 611,372 | |||||||||||||||

Total assets (1) | 2,214,488 | 2,136,555 | 2,318,959 | 1,984,512 | 1,920,321 | |||||||||||||||

Total debt, including capital leases, excluding discount on the Convertible Notes (1)(2) | 628,631 | 513,213 | 319,401 | 175,134 | 251,467 | |||||||||||||||

Total EnerSys stockholders’ equity | 1,013,131 | 1,038,900 | 1,246,402 | 1,169,401 | 1,032,195 | |||||||||||||||

(1) Net of debt issuance costs

(2) Convertible Notes as defined under Liquidity and Capital Resources in Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

21

ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our results of operations and financial condition for the fiscal years ended March 31, 2016, 2015 and 2014, should be read in conjunction with our audited consolidated financial statements and the notes to those statements included in Item 8. Financial Statements and Supplementary Data, of this Annual Report on Form 10-K. Our discussion contains forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, opinions, expectations, anticipations and intentions and beliefs. Actual results and the timing of events could differ materially from those anticipated in those forward-looking statements as a result of a number of factors. See “Cautionary Note Regarding Forward-Looking Statements,” “Business” and “Risk Factors,” sections elsewhere in this Annual Report on Form 10-K. In the following discussion and analysis of results of operations and financial condition, certain financial measures may be considered “non-GAAP financial measures” under the SEC rules. These rules require supplemental explanation and reconciliation, which is provided in this Annual Report on Form 10-K.

EnerSys’ management uses the non-GAAP measures, EBITDA and Adjusted EBITDA, in its computation of compliance with loan covenants. These measures, as used by EnerSys, adjust net earnings determined in accordance with GAAP for interest, taxes, depreciation and amortization, and certain charges or credits as permitted by our credit agreements, that were recorded during the periods presented.

EnerSys’ management uses the non-GAAP measures,"primary working capital" and "primary working capital percentage" (see definition in “Overview” below) along with capital expenditures, in its evaluation of business segment cash flow and financial position performance.

These non-GAAP disclosures have limitations as analytical tools, should not be viewed as a substitute for cash flow or operating earnings determined in accordance with GAAP, and should not be considered in isolation or as a substitute for analysis of the Company’s results as reported under GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. This supplemental presentation should not be construed as an inference that the Company’s future results will be unaffected by similar adjustments to operating earnings determined in accordance with GAAP.

Overview