Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - DENBURY INC | dnr-20181028x8kex991.htm |

| EX-10.3 - VOTING AND SUPPORT AGREEMENT (PVAC) - DENBURY INC | dnr-20181028x8kex103.htm |

| EX-10.2 - VOTING AND SUPPORT AGREEMENT (KLS) - DENBURY INC | dnr-20181028x8kex102.htm |

| EX-10.1 - VOTING AND SUPPORT AGREEMENT (SVP) - DENBURY INC | dnr-20181028x8kex101.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - DENBURY INC | dnr-20181028x8kex21.htm |

| 8-K - 8-K - DENBURY INC | dnr-20181029x8kmerger.htm |

Transformational Combination of & October 29, 2018 Creates a Leading, Diversified Mid-Cap Oil Producer with Top-Tier Industry Margins and Strong Production Growth Trajectory NYSE:DNR www.denbury.com

Cautionary Statements Forward-Looking Statements and Cautionary Statements The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that Denbury or Penn Virginia expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward- looking statements include, but are not limited to, statements regarding the Transaction, pro forma descriptions of the combined company and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the businesses, the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement, the possibility that stockholders of Denbury may not approve the issuance of new shares of common stock in the Transaction or the amendment of Denbury’s charter or that shareholders of Penn Virginia may not approve the merger agreement, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, the risk that any announcements relating to the Transaction could have adverse effects on the market price of Denbury’s common stock or Penn Virginia’s common stock, the risk that the Transaction and its announcement could have an adverse effect on the ability of Denbury and Penn Virginia to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending Transaction could distract management of both entities from ongoing business operations or cause them to incur substantial costs, the risk that problems may arise in successfully integrating the businesses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than expected to achieve those synergies and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond Denbury’s or Penn Virginia’s control, including those detailed in Denbury’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at www.denbury.com and on the SEC’s website at http://www.sec.gov, and those detailed in Penn Virginia’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on Penn Virginia’s website at www.pennvirginia.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on assumptions that Denbury or Penn Virginia believe to be reasonable but that may not prove to be accurate. Any forward- looking statement speaks only as of the date on which such statement is made, and Denbury and Penn Virginia undertake no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof. NYSE:DNR 2 www.denbury.com

Additional Information No Offer or Solicitation This presentation relates to a proposed business combination transaction (the “Transaction”) between Denbury Resources Inc. (“Denbury”) and Penn Virginia Corporation (“Penn Virginia”). This communication is for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, in any jurisdiction, pursuant to the Transaction or otherwise, nor shall there be any sale, issuance, exchange or transfer of the securities referred to in this document in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Important Additional Information In connection with the Transaction, Denbury will file with the U.S. Securities and Exchange Commission (“SEC”) a registration statement on Form S-4, that will include a joint proxy statement of Denbury and Penn Virginia and a prospectus of Denbury. The Transaction will be submitted to Denbury’s stockholders and Penn Virginia’s stockholders for their consideration. Denbury and Penn Virginia may also file other documents with the SEC regarding the Transaction. The definitive joint proxy statement/prospectus will be sent to the stockholders of Denbury and Penn Virginia. This document is not a substitute for the registration statement and joint proxy statement/prospectus that will be filed with the SEC or any other documents that Denbury or Penn Virginia may file with the SEC or send to stockholders of Denbury or Penn Virginia in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF DENBURY AND PENN VIRGINIA ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE TRANSACTION WHEN IT BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and all other documents filed or that will be filed with the SEC by Denbury or Penn Virginia through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by Denbury will be made available free of charge on Denbury’s website at www.denbury.com or by directing a request to John Mayer, Director of Investor Relations, Denbury Resources Corporation, 5320 Legacy Drive, Plano, TX 75024, Tel. No. (972) 673-2383. Copies of documents filed with the SEC by Penn Virginia will be made available free of charge on Penn Virginia’s website at www.pennvirginia.com, under the heading “SEC Filings,” or by directing a request to Investor Relations, Penn Virginia Corporation, 16285 Park Ten Place, Suite 500, Houston, TX 77084, Tel. No. (713) 722-6540. Participants in the Solicitation Denbury, Penn Virginia and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect to the Transaction. Information regarding Denbury’s directors and executive officers is contained in the proxy statement for Denbury’s 2018 Annual Meeting of Stockholders filed with the SEC on April 12, 2018, and certain of its Current Reports on Form 8-K. You can obtain a free copy of this document at the SEC’s website at http://www.sec.gov or by accessing Denbury’s website at www.denbury.com. Information regarding Penn Virginia’s executive officers and directors is contained in the proxy statement for Penn Virginia’s 2018 Annual Meeting of Stockholders filed with the SEC on March 28, 2018, and its Current Report on Form 8-K filed on September 12, 2018. You can obtain a free copy of this document at the SEC’s website at www.sec.gov or by accessing Penn Virginia’s website at www.pennvirginia.com. Investors may obtain additional information regarding the interests of those persons and other persons who may be deemed participants in the Transaction by reading the joint proxy statement/prospectus regarding the Transaction when it becomes available. You may obtain free copies of this document as described above. NYSE:DNR 3 www.denbury.com

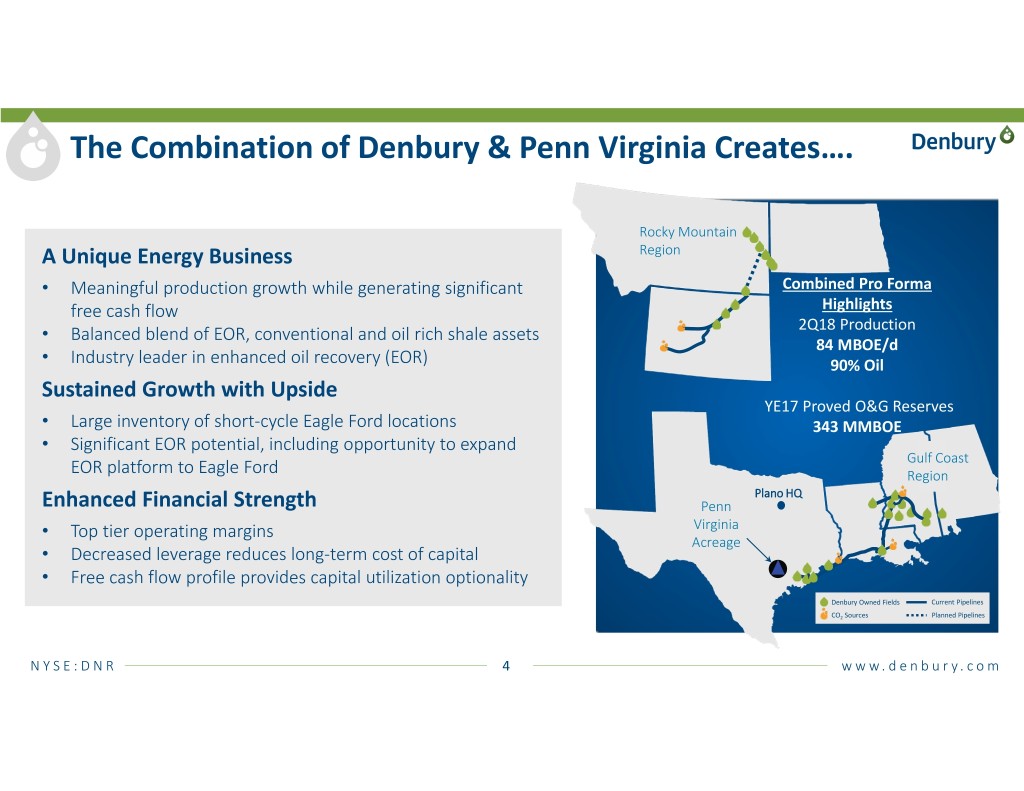

The Combination of Denbury & Penn Virginia Creates…. Rocky Mountain A Unique Energy Business Region • Meaningful production growth while generating significant Combined Pro Forma free cash flow Highlights 2Q18 Production • Balanced blend of EOR, conventional and oil rich shale assets 84 MBOE/d • Industry leader in enhanced oil recovery (EOR) 90% Oil Sustained Growth with Upside YE17 Proved O&G Reserves • Large inventory of short-cycle Eagle Ford locations 343 MMBOE • Significant EOR potential, including opportunity to expand Gulf Coast EOR platform to Eagle Ford Region Plano HQ Enhanced Financial Strength Penn • Top tier operating margins Virginia Acreage • Decreased leverage reduces long-term cost of capital • Free cash flow profile provides capital utilization optionality Denbury Owned Fields Current Pipelines CO2 Sources Planned Pipelines NYSE:DNR 4 www.denbury.com

Combination Aligns with Denbury’s Strategic Objectives Objective Penn Virginia Impact � Adds new core area in the oil window of the prolific Eagle Ford Shale play Add High Value � Large development inventory – ~560 Gross Lower Eagle Ford locations Investment Diversity � Expands high-return, short-cycle investment opportunity set Enhance Growth While � Rapidly growing Eagle Ford production enhances Denbury’s growth profile Delivering Free Cash � Eagle Ford asset base expected to generate free cash flow in 2019 Flow � Increases Denbury’s already top-tier operating margin Leverage and Expand � Multiple ongoing nearby rich hydrocarbon gas EOR pilots and projects EOR Platform � Opportunity to apply Denbury’s leading EOR expertise to the Eagle Ford Shale � Immediately accretive to cash flow and key per-share metrics Increase Financial � Path to < 2.5X debt / EBITDAX by year-end 2019 at current strip prices Strength � Free cash flow profile provides optionality for the utilization of capital � Increased size and scale and enhanced credit metrics should reduce long-term cost of capital NYSE:DNR 5 www.denbury.com

Transaction Overview Transaction Value: $1.7 Billion; 68% Stock and 32% Cash • $833 million equity; 12.4 shares of Denbury for each share of Penn Virginia (est. 191.6 million shares) • $400 million cash; $25.86 for each share of Penn Virginia • $483 million net debt assumed by Denbury • Denbury shareholders will own 71% of combined company Approvals and Timing • Subject to Denbury and Penn Virginia shareholder approvals as well as HSR approval • Closing expected in Q1 2019 Pro + = Forma Enterprise Value (Billions)(1) $4.5 $1.5 $6.0 YE17 Proved Reserves (MMBOE) 260 83(2) 343 2Q18 Production (MBOE/d) 62 22 84 2Q18 Liquids Production % 97% 88% 94% 2Q18 Annualized EBITDAX (Millions) $612 $303 $915 (1) FactSet data as of 10/26/18. (2) Pro forma for the acquisition of Eagle Ford assets located primarily in Gonzales and Lavaca Counties, Texas, from Hunt Oil Company on March 1, 2018 NYSE:DNR 6 www.denbury.com

Why We Like the Eagle Ford � Expansive play with large oil window � Light Louisiana Sweet (LLS) premium oil pricing Oil Condensate � Well developed midstream infrastructure Denbury’s Gulf Dry Gas Coast Assets � Significant upside potential through: Penn Virginia Assets � Enhanced oil recovery � Upper Eagle Ford � Austin Chalk � Close proximity to Denbury’s Gulf Coast operations � Follow-on consolidation potential NYSE:DNR 7 www.denbury.com

Why We like Penn Virginia � Large and contiguous acreage position in Eagle Ford oil window – 97,900 gross (84,060 net) acres Penn Virginia Fayette County Other Operator EOR Pilots � 87% Liquids / 74% oil production Gonzales County � Receives LLS premium pricing � Strong growth trajectory Lavaca County � Substantial lower Eagle Ford inventory estimated at 560 gross (461 net) locations � Top tier operating margin � Ongoing nearby EOR pilots Dewitt County � Knowledgeable and experienced operating team NYSE:DNR 8 www.denbury.com

Potential Opportunity for EOR in the Eagle Ford Large EOR Target • ~90% of original oil in place left after primary production • High hydrocarbon resource density Significantly Derisked by Multiple Lower Eagle Ford EOR Projects • Several immediately offsetting PVA acreage; all using rich hydrocarbon gas injection • Significant regional supply of rich hydrocarbon gas available for EOR • Demonstrated containment of injected gas Possible Application for CO2 in EOR • Potential for improved recovery over rich hydrocarbon gas • Ability to leverage Denbury’s Gulf Coast CO2 supply and infrastructure NYSE:DNR 9 www.denbury.com

Combination Maintains Industry-Leading Oil Weighting…. 100% 97% 2Q18 % Liquids Production Oil Production 94% NGL Production 90% 90% 87% 80% 70% 74% 60% 50% 40% 30% 20% 10% 0% DNR(1) Pro CPG JAG PVAC WLL CRZO WPX HPR OXY OAS(1) CDEV CPE(1) EPE CRC AMR XOG LPI SN SRCI NFX PDCE SM MUR CLR(1) Forma Source: Bloomberg and Company filings for period ended 6/30/2018. 1) NGL production is not reported separately for this entity. NYSE:DNR 10 www.denbury.com

….While Delivering Top Tier Operating Margins…. 2Q18 Peer Operating Margins ($/BOE) $50 $45 $40 $35 $30 $25 $20 $15 $10 $5 $- Pro PVAC CPE JAG CRZO OAS DNR HPR WPX WLL CLR EPE MUR CDEV CRC AMR XOG OXY LPI PDCE NFX SM SRCI SN Forma Operating Margin per BOE (1) 45.57 44.18 44.14 40.95 40.79 40.76 39.04 38.12 35.05 34.26 32.60 32.56 32.56 32.30 31.90 31.26 30.63 29.41 28.47 27.94 27.88 27.20 26.92 22.44 Lifting Cost per BOE (2) 9.45 7.84 6.27 9.87 13.98 22.77 27.53 7.59 10.66 11.58 8.66 11.26 9.62 9.30 21.98 8.88 8.24 14.12 5.98 6.80 10.27 11.20 6.58 12.69 Revenue per BOE (3) 55.02 52.02 50.41 50.82 54.77 63.53 66.57 45.71 45.71 45.84 41.26 43.82 42.18 41.60 53.88 40.14 38.87 43.53 34.45 34.74 38.15 38.40 33.50 35.13 Highest revenue per BOE in the peer group Source: Company filings for the period ended 6/30/2018. 1) Operating margin calculated as revenues less lifting costs. 2) Lifting cost calculated as lease operating expenses, marketing/transportation expenses and production and ad valorem taxes. 3) Revenues exclude gain/loss on derivative settlements. NYSE:DNR 11 www.denbury.com

….and Creating a Leading Mid-Cap Oil Producer 10 Enterprise Value ($ Billion) 8 9.1 7.4 6 6.1 6.0 6.0 6.0 5.4 4 4.5 4.0 3.7 3.3 2 2.9 2.8 2.8 2.3 2.1 1.5 1.3 0 WPX CRC NFX OAS WLL Pro CDEV DNR PDCE AMR CRZO JAG CPE XOG SRCI LPI PVAC HPR Forma 200 187 2Q18 Production (MBOE/d) 150 134 126 125 100 103 84 79 50 74 67 62 58 57 48 35 29 26 26 0 22 NFX CRC WLL WPX PDCE Pro OAS XOG LPI DNR CDEV CRZO SRCI JAG CPE AMR HPR PVAC Forma Source: FactSet as of 10/26/18 for enterprise values; Company filings for 2Q18 production. NYSE:DNR 12 www.denbury.com

Capital Structure Financing Commitment Letter from J.P. Morgan Chase • $1.2 billion new senior secured bank credit facility • $0.4 billion senior secured 2nd lien bridge loan Est. Pro Forma for (1) In millions, as of 9/30/18, unless otherwise noted Transaction Bank Credit Facility $─ $283 $483 Second Lien Notes / Term Loan 1,521 200 1,921 Pipeline Financings / Capital Lease Obligations 194 ─ 194 Senior Subordinated Notes 826 ─ 826 Total Debt $2,541 $483 $3,424 Liquidity and Credit Statistics Availability under credit facility $553 $654 2Q18 Annualized EBITDAX 612 $303 915 2Q18 Annualized EBITDAX (excluding hedge 831 352 1,183 settlements) (2) Net Debt /EBITDAX 4.0x 1.4x 3.7x (2) Net Debt /EBITDAX (excluding hedge settlements) 3.0x 1.2x 2.8x 1) Pro forma adjustments reflect $400 million cash outlay for the transaction, excluding fees and expenses. 2) Net debt balances are net of cash and cash equivalents of $62 million and $8 million for DNR and PVAC, respectively. NYSE:DNR 13 www.denbury.com

Uncommon Company, Extraordinary Potential � – Enhanced with Penn Virginia Combination » Industry Leading Oil Weighting Extreme Oil Gearing » Favorable Crude Quality & High Exposure to LLS Pricing � » Top Tier Operating Margin & Significant Free Cash Flow » Blend of EOR, Conventional and Oil-rich Shale Assets Operating Advantages » Broad EOR experience base and technical strength » Vertically Integrated CO2 Supply and Infrastructure � » Operating Outside Constrained Basins Significant Organic » Meaningful Production Growth » Large Inventory of Short-Cycle Eagle Ford Locations � Growth Potential » Significant EOR Development Potential » Strong Liquidity Rapidly De-Levering » Enhanced Credit Profile � » No Near-Term Debt Maturities NYSE:DNR 14 www.denbury.com