Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Customers Bancorp, Inc. | a3q18pressrelease.htm |

| 8-K - 8-K - Customers Bancorp, Inc. | a8k93018.htm |

Executing On Our Unique Higher Performing Banking Model Q3 Earnings Call Investor Presentation October, 2018 Member FDIC NYSE: CUBI

Strategic Priorities 1) Create shareholder value through improved profitability • We target an ROAA of 1.25% in the next 3-5 years • We target a double digit ROTCE in the next 3 years • We target a NIM of 2.75%+ in the next 12-18 months 2) Focus and grow core banking operations • We expect to grow our core banking franchise (low cost deposits, C&I lending) through reductions in non-core areas (multi-family loans and high cost wholesale funding) • We expect to manage the consolidated balance sheet under $10 billion at December 31st significantly improving capital and profitability while preserving full interchange income from debit cards (1) 3) Grow BankMobile for 2-3 years before monetizing the investment • BankMobile’s merger with Flagship Community Bank was terminated on October 18, 2018 given regulatory complications, notably concerns that Customers and Flagship would be considered affiliates by the Federal Reserve and interchange income would be significantly reduced under the Durbin Amendment. The termination triggered $2.0 million of after-tax merger and acquisition termination costs • We now expect to retain BankMobile for 2-3 years, but will regularly assess the situation • We expect BankMobile to generate a positive contribution to Customers’ earnings by the end of 2019 • We are excited about BankMobile’s new White Label partner, which we expect to generate significant low cost deposit growth 4) Strengthen our mix • In September, we sold $495 million of low yielding securities which were funded with high cost borrowings • We expect to grow C&I lending and consumer lending and create space on the balance sheet with multi-family reductions • We expect to grow low cost deposits and run-off high cost funding; we currently have over $700 million of deposits with a cost of 2.5%+ 5) Deploy excess capital to benefit shareholders • We expect our year-end TCE ratio will be approximately 7.5%, above our 7.0% target • As we retain earnings and maintain a flat balance sheet, capital ratios will build • Our board will evaluate the options for excess capital, including share repurchases or calling preferred shares when they become callable (1) Given the shift in strategy, Customers is withdrawing all prior 2018 guidance 2

Strategic Priorities: Improving Profitability NIM Trajectory Profitability 2.75%+ • We expect to reach our NIM target of 2.75%+ by the end of 2019 2.47% • We target an ROA of 1.25% in 3-5 years, double digit ROTCE. We can get there with a: • 2.75% NIM • 52% efficiency • growth in fee income. Q3 '18 August Sale of Reduced $300M Grow $500M Shift $500M Possible 12-18 Actual NIM $495M PPMT Inc Warehouse of from MF to Funding Month Securities Contraction BankMobile Consumer Pressures Target Funded with DDA Borrowings 3

Investment Proposition Highly Focused, Innovative, Relationship Banking Based Commercial Bank Business bank with a unique private banking service model; approximately $10 billion in assets Highly skilled teams targeting privately held businesses and high net worth families Strong Organic Growth, Well Capitalized, Branch Lite Bank in Attractive Markets Target market from Boston to Washington DC along Interstate 95, and Chicago Robust risk management driven business strategy Significantly Improving Profitability & Efficient Operations Operating efficiencies offset tighter margins and generate sustainable profitability Target above average ROAA (1.25% in 3-5 years and double digit ROTCE) Strong Credit Quality & Expanding Margin Unwavering underwriting standards Loan portfolio performance consistently better than industry and peers Attractive Valuation October 24, 2018 share price of $18.60, 8.2x street estimated 2019 EPS of $2.27 and 0.82x tangible book value(1) September 30, 2018 tangible book value(1) of $22.74, which has grown at a CAGR of 8% over the last 5 years BankMobile We expect to retain BankMobile, our disruptive digital banking strategy, for the next 2-3 years and are excited about our recently announced first White Label partnership (1) Tangible book value is a non-GAAP measure. Refer to the reconciliation schedules at the end of this document. 4

Customers Bancorp, Inc. Q3’18 Financial Results 5

Q3 2018 Key Financial Results Community Business Banking Consolidated Segment Valuation (3) GAAP Diluted Earnings Per Share (EPS) $0.07 $0.26 Oct 24 Price $18.60 "Adjusted" Diluted Earnings Per Share (EPS) (1) $0.62 $0.73 P/E 2018 8.2x YOY Change 29% 15% P/E 2019 8.2x (2) GAAP Net Income Available to Common ($ millions) $2.4 $8.3 P/TBV 0.82x "Adjusted" Net Income Available to Common ($ millions) (1) $20.1 $23.7 Tangible Book Value (TBV)(2) $22.74 Return on Average Assets (ROAA) 0.22% 0.44% "Adjusted" ROAA (1) 0.88% 1.02% Return on Average Common Equity (ROACE) 1.31% 4.67% "Adjusted" ROACE (1) 10.9% 13.4% Efficiency 66% 50% Q3 2018 Highlights • 29% YOY growth in adjusted EPS • 15% YOY growth in C&I lending (excluding loans to mortgage companies) • 7% YOY decline in Multi-family loans • $1.2 billion growth (17% QOQ) in Q3 total deposits • Sold $495M of lower yielding securities; repaid similar amount of borrowings in October • Pristine credit quality (1) A non-GAAP measure. Refer to the reconciliation schedules at the end of this document (2) Tangible book value is a non-GAAP measure; refer to reconciliation at the end of this document (3) 2018 and 2019 consensus EPS estimates of $2.28 and $2.27, respectively, were sourced from S&P Global 6

Q3 2018 Consolidated Results GAAP vs. Adjusted EPS(1) $0.70 Q3 2018 Net Income to Common Shareholders of $0.64 $0.64 $0.64 $2.4 million, and Diluted Earnings Per Common $0.60 $0.62 $0.62 Share of $0.07. $0.55 $0.56 $0.50 • 29% year-over-year growth in adjusted earnings $0.48 per share(1) $0.40 • $0.26 of diluted EPS from the Community Business Banking segment; $0.73 adjusted EPS $0.30 EPS(1) from the Community Business Banking segment $0.20 • $0.18 of diluted loss from the BankMobile $0.10 $0.13 segment, which assumes a 3.10% earnings rate on BankMobile’s low cost deposits. $0.11 $0.07 adjusted diluted loss(1) per share from the $0.00 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 BankMobile segment GAAP EPS Adjusted EPS(1) Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 GAAP EPS $0.13 $0.55 $0.64 $0.62 $0.07 Adjustments: Impairment Loss on Equity Security $0.40 $0.00 $0.00 $0.00 $0.00 Merger and Acquisition Related Expenses $0.00 $0.01 $0.00 $0.02 $0.07 D&A Catchup (2) $0.05 $0.00 $0.00 $0.00 $0.00 Securities (Gains) losses ($0.10) ($0.00) $0.00 $0.00 $0.48 Adjusted EPS(1) $0.48 $0.56 $0.64 $0.64 $0.62 (1) Adjusted EPS is a non-GAAP measure; refer to the reconciliation schedules at the end of this document (2) D&A Catchup refers to the reallocation of depreciation and amortization expense after the Q3 2017 decision to classify BankMobile as held and used instead of held for sale 7 Source: Company data. Total may not equal sum of parts due to rounding

Q3 2018 Highlights: Community Business Banking Segment Community Business Banking Segment GAAP vs. Adjusted EPS(1) $0.80 $0.70 $0.72$0.73 $0.73 Community Business Banking segment Q3 2018 profits of $8.3 $0.68$0.68 $0.67$0.67 $0.60 $0.64 million (or $0.26 per diluted share); adjusted segment profits of $0.50 $23.7 million (or $0.73 per diluted share)(1) $0.40 EPS $0.30 $0.34 $0.20 $0.26 $0.10 $0.00 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Bank Segment Reported Bank Segment Adj(1) Community Business Banking Segment Income Statement ($ in 000s, Except Per Share Data) Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Net interest income $65,335 $65,103 $60,637 $63,928 $60,174 Provision for loan losses $1,874 $179 $1,874 ($1,247) $2,502 Securities Gains / (Losses) / (Impairment) ($3,000) $268 $10 ($84) ($19,895) Other Non-interest income $7,190 $7,932 $8,429 $7,549 $12,139 Non-interest expense $33,990 $33,900 $34,331 $37,721 $36,115 Income before income tax expense $33,661 $39,224 $32,871 $34,919 $13,801 Income tax expense $18,999 $13,369 $7,728 $7,910 $1,930 Net income $14,662 $25,855 $25,143 $27,009 $11,871 Preferred stock dividends $3,615 $3,615 $3,615 $3,615 $3,615 Net income available to common $11,047 $22,240 $21,528 $23,394 $8,256 Community Business Banking Segment EPS $0.34 $0.68 $0.67 $0.72 $0.26 Adjustments: Securities (Gains) / Losses / Impairment $0.30 $0.00 $0.00 $0.00 $0.48 Segment Adjusted EPS(1) $0.64 $0.68 $0.67 $0.73 $0.73 8 (1) A Non-GAAP measure; refer to the reconciliation schedules at the end of this document

Q3 2018 Deposits: Growth Accelerated in Q3’18 YTD Deposit Growth $9.0 $8.5 Billions $8.0 $7.3 $7.0 YTD Growth: $6.8 $2.4 $7.0 Time: +26% We are improving our funding mix as we $2.1 replace higher cost funding with lower cost $6.0 $1.9 $1.9 core deposits from BankMobile, our Digital Direct Bank, and core business units $5.0 MMKT / Savings: $4.0 $3.9 +19% $3.4 $3.5 $3.3 $3.0 $2.0 Demand: +38% $1.0 $2.2 $1.6 $1.8 $1.7 $- Q4 2017 Q1 2018 Q2 2018 Q3 2018 Demand MMKT / Savings CDs 9 Source: Company Data 9

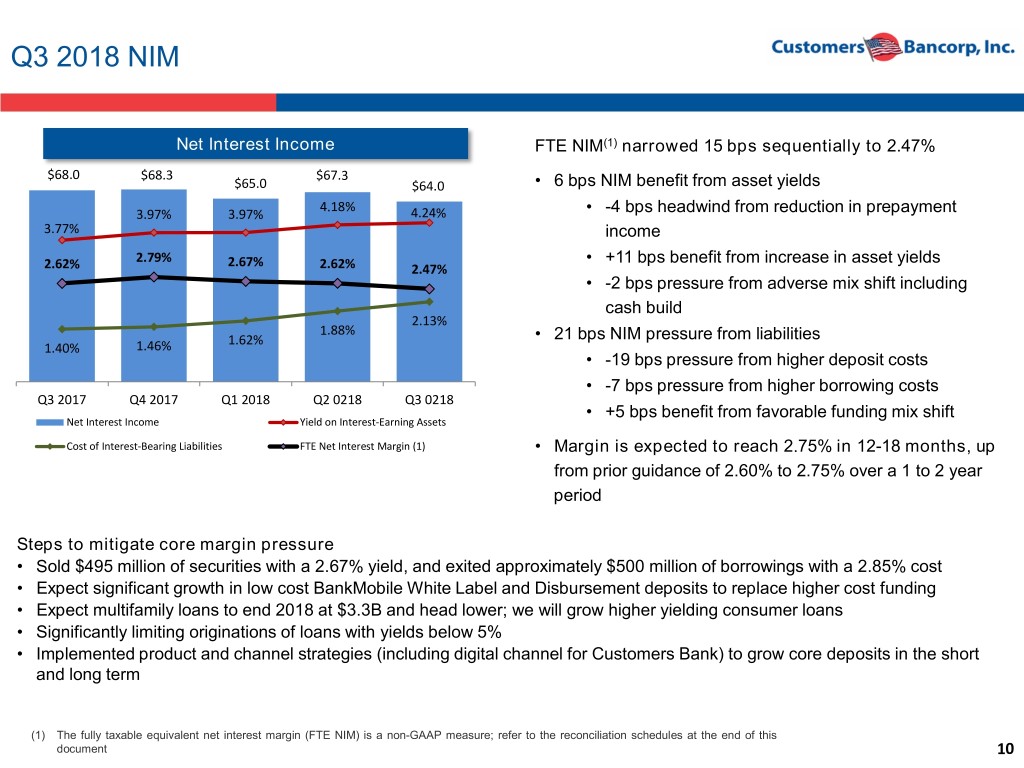

Q3 2018 NIM Net Interest Income FTE NIM(1) narrowed 15 bps sequentially to 2.47% $68.0 $68.3 $67.3 $65.0 $64.0 • 6 bps NIM benefit from asset yields 4.18% 3.97% 3.97% 4.24% • -4 bps headwind from reduction in prepayment 3.77% income 2.79% 2.67% • +11 bps benefit from increase in asset yields 2.62% 2.62% 2.47% • -2 bps pressure from adverse mix shift including cash build 2.13% 1.88% 1.62% • 21 bps NIM pressure from liabilities 1.40% 1.46% • -19 bps pressure from higher deposit costs • -7 bps pressure from higher borrowing costs Q3 2017 Q4 2017 Q1 2018 Q2 0218 Q3 0218 • +5 bps benefit from favorable funding mix shift Net Interest Income Yield on Interest-Earning Assets Cost of Interest-Bearing Liabilities FTE Net Interest Margin (1) • Margin is expected to reach 2.75% in 12-18 months, up from prior guidance of 2.60% to 2.75% over a 1 to 2 year period Steps to mitigate core margin pressure • Sold $495 million of securities with a 2.67% yield, and exited approximately $500 million of borrowings with a 2.85% cost • Expect significant growth in low cost BankMobile White Label and Disbursement deposits to replace higher cost funding • Expect multifamily loans to end 2018 at $3.3B and head lower; we will grow higher yielding consumer loans • Significantly limiting originations of loans with yields below 5% • Implemented product and channel strategies (including digital channel for Customers Bank) to grow core deposits in the short and long term (1) The fully taxable equivalent net interest margin (FTE NIM) is a non-GAAP measure; refer to the reconciliation schedules at the end of this document 10

Loan Repricing Characteristics Loan Repricing by Segment, at September 30, 2018 • 84% of our C&I loans, including loans to mortgage companies, 40% of our CRE loans, and 13% of our Multifamily loans reprice within 1 year • C&I loans (including those to mortgage companies) make up 38% of our total loans *Repricing includes the following: contractual loan repricing and maturities, contractual principal payments, and assumed loan prepayments 11

Q3 2018 Loans Loan Growth $12 5.0% 4.38% 4.26% 4.5% 3.98% $10 3.88% 3.81% 3.76% 4.0% $0.3 $0.6 $0.3 3.5% $8 $0.4 3.0% $3.4 $0.4 $3.5 $6 $3.4 2.5% $2.9 2.0% $4 $2.1 Loans on Yield Loans ($ in Billions) $0.3 1.5% $3.6 $3.5 $2.9 $3.2 $1.3 1.0% $2 $2.3 $1.1 0.5% $0.9 $1.0 $1.3 $1.3 $1.3 $0 $0.6 0.0% 2013 2014 2015 2016 2017 Q3 2018 Non-Owner Occupied CRE Multi Family loans Commercial Consumer & Residential Yield on Loans Q3 2018 loans totaled $8.8 Billion • The yield on loans increased 3 bps sequentially and 44 bps from Q3 2017 • 15% YOY growth in C&I (excluding commercial loans to mortgage companies) • 7% YOY decline in Multi-family loans 12 Source: Company data

Outstanding Credit Quality Credit metrics remain better than peers NPL Net Charge Offs 3.00% 0.80% 2.64% 0.68% 0.70% 2.50% 2.06% 0.60% 2.00% 0.48% 1.70% 1.70% 0.50% 0.45% 0.47% 0.45% 1.48% 0.42% 1.50% 1.30% 0.40% 1.18% 1.21% 0.30% 0.92% 0.30% 1.00% 0.85% 0.80% 0.78% 0.21% 0.60% 0.19% 0.20% 0.16% 0.50% 0.30% 0.15% 0.15% 0.20% 0.15% 0.22% 0.27% 0.10% 0.07% 0.02% 0.00% 0.22% 0.07% 0.19% 0.02% 0.00% 2013 2014 2015 2016 2017 YTD 2013 2014 2015 2016 2017 YTD Industry Peer Customers Bancorp, Inc. Industry Peer Customers Bancorp, Inc. Note: Customers 2015 charge-offs includes 12 bps for a $9 million fraudulent loan Source: S&P Global, Company data. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable asset size and predominantly commercial business focused loan portfolios as further described in our 2018 proxy. Industry data includes all commercial and savings banks. Peer and industry data as of June 30, 2018. Industry and peer data in the current YTD period is not yet available for all companies. 13

Superior Operating Efficiency and Costs Our Community Banking Segment operating costs, as a percentage of assets, are at least 100 bps lower than peers and at least 175 bps lower than the industry Total Operating Costs as a % of Average Assets (1) 3.50% 3.26% 3.17% 3.13% 3.18% 3.03% 3.00% 3.08% 2.87% 2.50% 2.69% 2.63% 2.60% 2.52% 2.45% 2.00% 1.50% 1.00% 0.50% 2.13% 1.75% 1.48% 1.44% 1.27% 1.37% 0.00% 2013 2014 2015 2016 2017 YTD Industry Peer CUBI Community Banking Segment (1) Source: S&P Global and Company data. Data based on Community Banking Segment unless labeled Consolidated. Peer data consists of Northeast and Mid-Atlantic banks and thrifts with comparable asset size and predominantly commercial business focused loan portfolios as further described in our 2018 proxy. Industry data includes all commercial and savings banks. Peer and industry data as of June 30, 2018. Industry and peer data in the current YTD period is not yet available for all companies. 14

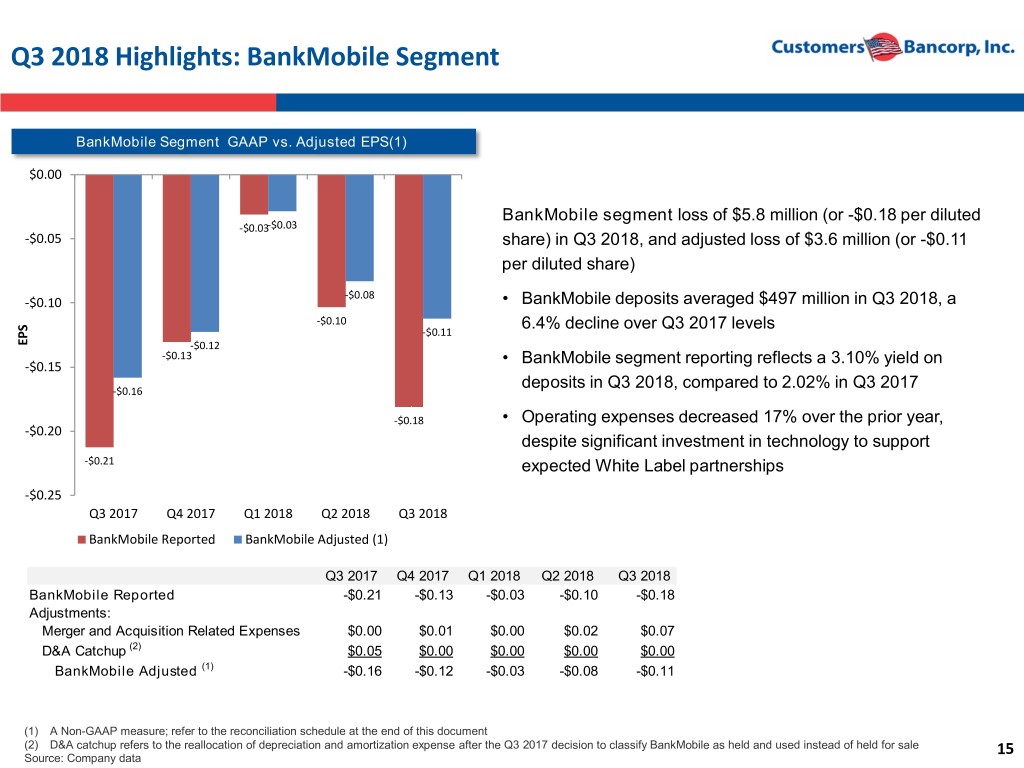

Q3 2018 Highlights: BankMobile Segment BankMobile Segment GAAP vs. Adjusted EPS(1) $0.00 BankMobile segment loss of $5.8 million (or -$0.18 per diluted -$0.03-$0.03 -$0.05 share) in Q3 2018, and adjusted loss of $3.6 million (or -$0.11 per diluted share) -$0.08 -$0.10 • BankMobile deposits averaged $497 million in Q3 2018, a -$0.10 -$0.11 6.4% decline over Q3 2017 levels EPS -$0.12 -$0.13 -$0.15 • BankMobile segment reporting reflects a 3.10% yield on -$0.16 deposits in Q3 2018, compared to 2.02% in Q3 2017 $(0.0 -$0.18 • Operating expenses decreased 17% over the prior year, -$0.20 despite significant investment in technology to support -$0.21 expected White Label partnerships -$0.25 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 BankMobile Reported BankMobile Adjusted (1) Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 BankMobile Reported -$0.21 -$0.13 -$0.03 -$0.10 -$0.18 Adjustments: Merger and Acquisition Related Expenses $0.00 $0.01 $0.00 $0.02 $0.07 D&A Catchup (2) $0.05 $0.00 $0.00 $0.00 $0.00 BankMobile Adjusted (1) -$0.16 -$0.12 -$0.03 -$0.08 -$0.11 (1) A Non-GAAP measure; refer to the reconciliation schedule at the end of this document (2) D&A catchup refers to the reallocation of depreciation and amortization expense after the Q3 2017 decision to classify BankMobile as held and used instead of held for sale 15 Source: Company data

BankMobile Segment Expanded Financials BankMobile Segment Income Statement ($ in 000s), Except Per Share Data Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Interest income $3 $3 $4 $11 $15 $7 $7 $10 $9 $9 $14 Interest expense $7 $7 $7 $17 $20 $18 $16 $15 $16 $135 $62 Fund Transfer Pricing $1,723 $1,306 $1,381 $2,466 $4,247 $2,738 $2,693 $3,202 $4,401 $3,520 $3,875 Net interest income $1,718 $1,301 $1,377 $2,460 $4,242 $2,727 $2,684 $3,197 $4,394 $3,394 $3,827 Provision for loan losses -$1 $0 $250 $546 $0 $0 $478 $652 $243 $463 $422 Deposit Fees $1 $509 $3,916 $2,500 $2,803 $1,875 $2,338 $1,833 $1,805 $1,338 $1,691 Card Revenue $226 $1,730 $11,387 $10,719 $13,308 $8,521 $9,355 $9,542 $9,438 $6,199 $6,903 Other Fees $0 $164 $1,062 $991 $1,216 $1,024 $2,143 $165 $1,228 $1,125 $1,246 Total non-interest income $227 $2,403 $16,365 $14,210 $17,327 $11,420 $13,836 $11,540 $12,471 $8,662 $9,840 Compensation & Benefits $866 $1,708 $5,419 $5,595 $4,949 $6,965 $6,154 $5,909 $5,671 $5,918 $5,695 Occupancy $59 $67 $71 $70 $109 $104 $297 $321 $309 $321 $328 Technology $286 $1,448 $5,847 $6,585 $6,617 $6,386 $11,740 $9,796 $7,129 $7,172 $8,171 Outside services $251 $886 $4,264 $4,267 $4,519 $3,310 $3,871 $3,366 $2,899 $1,665 $2,205 Merger related expenses $176 $874 $144 $0 $0 $0 $0 $410 $106 $869 $2,945 Other non-interest expenses $397 $1,115 $4,178 $3,266 $3,025 $3,081 $4,988 $1,085 $1,835 $85 $1,645 Total Non-interest expense $2,034 $6,099 $19,922 $19,783 $19,219 $19,846 $27,050 $20,888 $17,949 $16,029 $20,989 Income (loss) before income tax expense -$88 -$2,394 -$2,431 -$3,659 $2,350 -$5,699 -$11,008 -$6,803 -$1,327 -$4,436 -$7,744 Income tax expense (benefit) -$33 -$910 -$924 -$1,390 $893 -$2,166 -$4,100 -$2,563 -$326 -$1,090 -$1,902 Net income (loss) available to common -$54 -$1,484 -$1,507 -$2,269 $1,457 -$3,533 -$6,908 -$4,240 -$1,001 -$3,346 -$5,842 EPS $0.00 -$0.05 -$0.05 -$0.07 $0.04 -$0.11 -$0.21 -$0.13 -$0.03 -$0.10 -$0.18 Adjusted EPS for D&A catchup (2) and merger and acquisition charges (1) $0.00 -$0.03 -$0.05 -$0.07 $0.02 -$0.14 -$0.16 -$0.12 -$0.03 -$0.08 -$0.11 End of Period Deposits ($ in Millions) $337 $240 $533 $457 $708 $453 $781 $400 $624 $419 $732 Average Deposits ($ in Millions) $351 $286 $332 $548 $794 $532 $531 $558 $644 $468 $497 Yield Earned on Avg. Deposits 1.99% 1.84% 1.65% 1.79% 2.18% 2.07% 2.02% 2.28% 2.78% 3.03% 3.10% (1) A Non-GAAP measure; refer to the reconciliation schedule at the end of this document (2) D&A catchup refers to the reallocation of depreciation and amortization expense after the Q3 2017 decision to classify BankMobile as held and used instead of held for sale 16

Customers Bank Single Point of Contact Model 17

Customers’ Single Point of Contact Model Private Banking High Tech / Service High Touch Model Excellence in Branch Lite Service Experienced Strong Asset Leadership Quality Unique Private Customer Banking Model Superior Risk Centric Management Approach to Winning Model Relationship driven but never deviate from following critical success factors • Only focus on very strong credit quality niches • Very strong risk management culture • Operate at lower efficiency ratio than peers to deliver sustainable strong profitability and growth • Always attract and retain top quality talent • Culture of innovation and continuous improvement 18

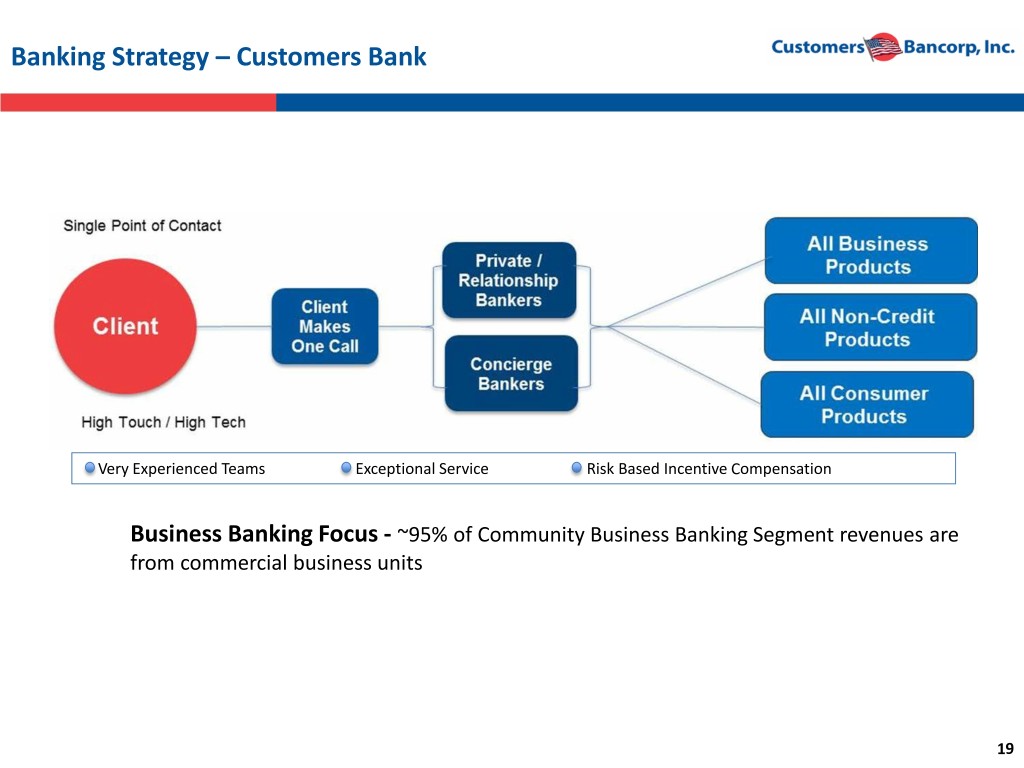

Banking Strategy – Customers Bank Very Experienced Teams Exceptional Service Risk Based Incentive Compensation Business Banking Focus - ~95% of Community Business Banking Segment revenues are from commercial business units 19

Contacts Company: Robert Wahlman, CFO Tel: 610-743-8074 rwahlman@customersbank.com Jay Sidhu Chairman & CEO Tel: 610-935-8693 jsidhu@customersbank.com Bob Ramsey Director of IR and Strategic Planning Tel: 484-926-7118 rramsey@customersbank.com 20

Forward-Looking Statements This presentation, as well as other written or oral communications made from time to time by us, contains forward-looking information within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to future events or future predictions, including events or predictions relating to future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,” “plan,” “intend,” or “anticipate” or the negative thereof or comparable terminology. Forward- looking statements in this presentation include, among other matters, guidance for our financial performance, and our financial performance targets. Forward-looking statements reflect numerous assumptions, estimates and forecasts as to future events. No assurance can be given that the assumptions, estimates and forecasts underlying such forward-looking statements will accurately reflect future conditions, or that any guidance, goals, targets or projected results will be realized. The assumptions, estimates and forecasts underlying such forward-looking statements involve judgments with respect to, among other things, future economic, competitive, regulatory and financial market conditions and future business decisions, which may not be realized and which are inherently subject to significant business, economic, competitive and regulatory uncertainties and known and unknown risks, including the risks described under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2017 and subsequent Quarterly Reports on Form 10-Q, as such factors may be updated from time to time in our filings with the SEC. Our actual results may differ materially from those reflected in the forward-looking statements. In addition to the risks described under “Risk Factors” in our filings with the SEC, important factors to consider and evaluate with respect to our forward-looking statements include: • changes in external competitive market factors that might impact our results of operations; • changes in laws and regulations, including without limitation changes in capital requirements under Basel III; • changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events; • our ability to identify potential candidates for, and consummate, acquisition or investment transactions; • the timing of acquisition, investment or disposition transactions; • constraints on our ability to consummate an attractive acquisition or investment transaction because of significant competition for these opportunities; • local, regional and national economic conditions and events and the impact they may have on us and our customers; • costs and effects of regulatory and legal developments, including the results of regulatory examinations and the outcome of regulatory or other governmental inquiries and proceedings, such as fines or restrictions on our business activities; • our ability to attract deposits and other sources of liquidity; • changes in the financial performance and/or condition of our borrowers; • changes in the level of non-performing and classified assets and charge-offs; • changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; • inflation, interest rate, securities market and monetary fluctuations; 121 21

Forward-Looking Statements (Cont.) • timely development and acceptance of new banking products and services and perceived overall value of these products and services by users, including the products and services being developed and introduced to the market by the BankMobile division of Customers Bank; • changes in consumer spending, borrowing and saving habits; • technological changes; • our ability to increase market share and control expenses; • continued volatility in the credit and equity markets and its effect on the general economy; • effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters; • the businesses of Customers Bank and any acquisition targets or merger partners and subsidiaries not integrating successfully or such integration being more difficult, time-consuming or costly than expected; • material differences in the actual financial results of merger and acquisition activities compared with our expectations, such as with respect to the full realization of anticipated cost savings and revenue enhancements within the expected time frame; • our ability to successfully implement our growth strategy, control expenses and maintain liquidity; • Customers Bank's ability to pay dividends to Customers Bancorp; • risks relating to BankMobile, including: • our ability to maintain interchange income with the small issuer exemption to the Durbin amendment; • our ability to manage our balance sheet under $10 billion by December 31, 2018 and thereafter; • our ability to execute on our White Label strategy to grow demand deposits through strategic partnerships; • material variances in the adoption rate of BankMobile's services by new students • the usage rate of BankMobile's services by current student customers compared to our expectations; 22 22

Forward-Looking Statements (Cont.) • the levels of usage of other BankMobile student customers following graduation of additional product and service offerings of BankMobile or Customers Bank, including mortgages and consumer loans, and the mix of products and services used; • our ability to implement changes to BankMobile's product and service offerings under current and future regulations and governmental policies; • our ability to effectively manage revenue and expense fluctuations that may occur with respect to BankMobile's student-oriented business activities, which result from seasonal factors related to the higher-education academic year; • our ability to implement our strategy regarding BankMobile, including with respect to our intent to spin-off and merge or otherwise dispose of the BankMobile business in the future, depending upon market conditions and opportunities; and • BankMobile's ability to successfully implement its growth strategy and control expenses. • risks related to planned changes in our balance sheet, including: • our ability to reduce the size of our Multifamily loan portfolio; • our ability to execute our digital distribution strategy; and • our ability to manage the risk of change in our loan mix to include a greater proportion of consumer loans. You are cautioned not to place undue reliance on any forward-looking statements we make, which speak only as of the date they are made. We do not undertake any obligation to release publicly or otherwise provide any revisions to any forward-looking statements we may make, including any forward- looking financial information, to reflect events or circumstances occurring after the date hereof or to reflect the occurrence of unanticipated events, except as may be required under applicable law. This presentation shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. 23 23

Reconciliation of Non-GAAP Measures - Unaudited Customers believes that the non-GAAP measurements disclosed within this document are useful for investors, regulators, management and others to evaluate our results of operations and financial condition relative to other financial institutions. These non-GAAP financial measures exclude from corresponding GAAP measures the impact of certain elements that we do not believe are representative of our financial results, which we believe enhance an overall understanding of our performance. Investors should consider our performance and financial condition as reported under GAAP and all other relevant information when assessing our performance or financial condition. Although non-GAAP financial measures are frequently used in the evaluation of a company, they have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our results of operations or financial condition as reported under GAAP. The following tables present reconciliations of GAAP to Non-GAAP measures disclosed within this document. 24

Reconciliation of Non-GAAP Measures - Unaudited Adjusted Net Income to Common Shareholders - Customers Bancorp, Inc. Consolidated ($ in thousands, not including per share amounts) Q3 2018 Q2 2018 Q1 2018 Q4 2017 Q3 2017 US D Per Share US D Per Share US D Per Share US D Per Share US D Per Share GAAP net income to common shareholders $ 2,414 $ 0.07 $ 20,048 $ 0.62 $ 20,527 $ 0.64 $ 18,000 $ 0.55 $ 4,139 $ 0.13 Reconciling items (after tax): Impairment loss on equity securties - - - - - - - - 12,934 0.40 Merger and acquisition related expenses 2,222 0.07 655 0.02 80 - 256 0.01 - - Losses/(gains) on investment securities 15,417 0.48 138 - (10) - (170) - (3,356) (0.10) Catch-up depreciation/amortization on BankMobile assets - - - - - - - - 1,765 0.05 Adjusted net income to common shareholders $ 20,053 $ 0.62 $ 20,841 $ 0.64 $ 20,597 $ 0.64 $ 18,086 $ 0.56 $ 15,482 $ 0.48 Adjusted Net Income to Common Shareholders - Community Banking Business Segment ($ in thousands, not including per share amounts) Q3 2018 Q2 2018 Q1 2018 Q4 2017 Q3 2017 US D Per Share US D Per Share US D Per Share US D Per Share US D Per Share GAAP net income to common shareholders $ 8,256 $ 0.26 $ 23,394 $ 0.72 $ 21,528 $ 0.67 $ 22,240 $ 0.68 $ 11,047 $ 0.34 Reconciling items (after tax): Impairment loss on equity securties - - - - - - - - 12,934 0.40 Losses/(gains) on investment securities 15,417 0.48 138 - (10) - (170) - (3,356) (0.10) Adjusted net income to common shareholders $ 23,673 $ 0.73 $ 23,532 $ 0.73 $ 21,518 $ 0.67 $ 22,070 $ 0.68 $ 20,625 $ 0.64 25

Reconciliation of Non-GAAP Measures - Unaudited Adjusted Net Loss to Common Shareholders - BankMobile Segment ($ in thousands, not including per share amounts) Q3 2018 Q2 2018 Q1 2018 US D Per Share US D Per Share US D Per Share GAAP net loss to common shareholders $ (5,842) $ (0.18) $ (3,346) $ (0.10) $ (1,001) $ (0.03) Reconciling items (after tax): Merger and acquisition related expenses 2,222 0.07 655 0.02 80 - Catch-up depreciation/amortization on BankMobile assets - - - - - - Adjusted net loss to common shareholders $ (3,620) $ (0.11) $ (2,691) $ (0.08) $ (921) $ (0.03) Adjusted Net (Income) Loss to Common Shareholders - BankMobile Segment ($ in thousands, not including per share amounts) - continued Q4 2017 Q3 2017 Q2 2017 Q1 2017 US D Per Share US D Per Share US D Per Share US D Per Share GAAP net income (loss) to common shareholders $ (4,240) $ (0.13) $ (6,908) $ (0.21) $ (3,533) $ (0.11) $ 1,457 $ 0.04 Reconciling items (after tax): Merger and acquisition related expenses 256 0.01 - - - - - - Catch-up depreciation/amortization on BankMobile assets - - 1,765 0.05 (883) (0.03) (882) (0.03) Adjusted net income (loss) to common shareholders $ (3,984) $ (0.12) $ (5,143) $ (0.16) $ (4,416) $ (0.14) $ 575 $ 0.02 Adjusted Net (Income) Loss to Common Shareholders - BankMobile Segment ($ in thousands, not including per share amounts) - continued Q4 2016 Q3 2016 Q2 2016 Q1 2016 US D Per Share US D Per Share US D Per Share US D Per Share GAAP net loss to common shareholders $ (2,269) $ (0.07) $ (1,507) $ (0.05) $ (1,484) $ (0.05) $ (54) $ - Reconciling items (after tax): Merger and acquisition related expenses - - 89 - 542 0.02 109 - Catch-up depreciation/amortization on BankMobile assets - - - - - - - - Adjusted net income (loss) to common shareholders $ (2,269) $ (0.07) $ (1,418) $ (0.05) $ (942) $ (0.03) $ 55 $ - 26

Reconciliation of Non-GAAP Measures - Unaudited Tangible Book Value per Common Share - Customers Bancorp, Inc. Consolidated ($ in thousands, except per share data) Q3 2018 2017 2016 2015 2014 2013 GAAP -Total Shareholders' Equity $ 954,812 $ 920,964 $ 855,872 $ 553,902 $ 443,145 $ 386,623 Reconciling Items: Preferred Stock (217,471) (217,471) (217,471) (55,569) - - Goodwill and Other Intangibles (16,825) (16,295) (17,621) (3,651) (3,664) (3,676) Tangible Common Equity $ 720,516 $ 687,198 $ 620,780 $ 494,682 $ 439,481 $ 382,947 Common shares outstanding 31,687,340 31,382,503 30,289,917 26,901,801 26,745,529 26,646,566 Tangible Book Value per Common Share $ 22.74 $ 21.90 $ 20.49 $ 18.39 $ 16.43 $ 14.37 CA GR 8.31% Customers Bancorp, Inc. Consolidated - Net Interest Margin, tax equivalent ($ in thousands) Q3 2018 Q2 2018 Q1 2018 Q4 2017 Q3 2017 GAAP Net interest income $ 64,001 $ 67,322 $ 65,031 $ 68,300 $ 68,019 Tax-equivalent adjustment 172 171 171 245 203 Net interest income tax equivalent 64,173 $ 67,493 $ 65,202 $ 68,545 $ 68,222 Average total interest earning assets $ 10,318,943 $ 10,329,530 $ 9,881,220 $ 9,758,987 $ 10,352,394 Net interest margin, tax equivalent 2.47% 2.62% 2.67% 2.79% 2.62% 27

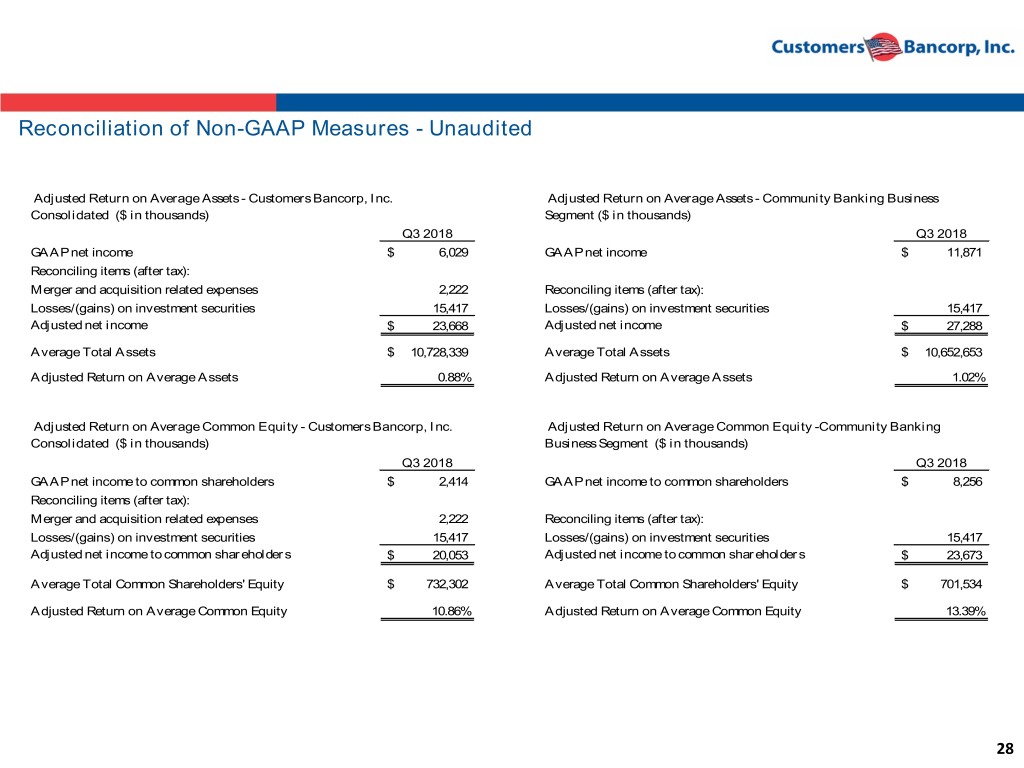

Reconciliation of Non-GAAP Measures - Unaudited Adjusted Return on Average Assets - Customers Bancorp, Inc. Adjusted Return on Average Assets - Community Banking Business Consolidated ($ in thousands) Segment ($ in thousands) Q3 2018 Q3 2018 GAAP net income $ 6,029 GAAP net income $ 11,871 Reconciling items (after tax): Merger and acquisition related expenses 2,222 Reconciling items (after tax): Losses/(gains) on investment securities 15,417 Losses/(gains) on investment securities 15,417 Adjusted net income $ 23,668 Adjusted net income $ 27,288 Average Total Assets $ 10,728,339 Average Total Assets $ 10,652,653 Adjusted Return on Average Assets 0.88% Adjusted Return on Average Assets 1.02% Adjusted Return on Average Common Equity - Customers Bancorp, Inc. Adjusted Return on Average Common Equity -Community Banking Consolidated ($ in thousands) Business Segment ($ in thousands) Q3 2018 Q3 2018 GAAP net income to common shareholders $ 2,414 GAAP net income to common shareholders $ 8,256 Reconciling items (after tax): Merger and acquisition related expenses 2,222 Reconciling items (after tax): Losses/(gains) on investment securities 15,417 Losses/(gains) on investment securities 15,417 Adjusted net income to common shareholders $ 20,053 Adjusted net income to common shareholders $ 23,673 Average Total Common Shareholders' Equity $ 732,302 Average Total Common Shareholders' Equity $ 701,534 Adjusted Return on Average Common Equity 10.86% Adjusted Return on Average Common Equity 13.39% 28