Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - COVANTA HOLDING CORP | exhibit991q318.htm |

| 8-K - 8-K - COVANTA HOLDING CORP | form8-kq318earnings.htm |

Exhibit 99.2 Third Quarter 2018 Earnings Conference Call NYSE: CVA October 25, 2018

Cautionary Statements All information included in this earnings presentation is based on continuing operations, unless otherwise noted. Forward-Looking Statements Certain statements in this press release may constitute “forward-looking” statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”) or in releases made by the Securities and Exchange Commission (“SEC”), all as may be amended from time to time. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results, performance or achievements of Covanta Holding Corporation and its subsidiaries (“Covanta”) or industry results, to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “may,” “will,” “would,” “could,” “should,” “seeks,” or “scheduled to,” or other similar words, or the negative of these terms or other variations of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws. Covanta cautions investors that any forward-looking statements made by Covanta are not guarantees or indicative of future performance. Important assumptions and other important factors, risks and uncertainties that could cause actual results to differ materially from those forward-looking statements with respect to Covanta include, but are not limited to: the risks and uncertainties affecting Covanta's business described in periodic securities filings by Covanta with the SEC. Important factors, risks, and uncertainties that could cause actual results of Covanta and the JV to differ materially from those forward-looking statements include, but are not limited to: seasonal or long-term fluctuations in the prices of energy, waste disposal, scrap metal and commodities, and Covanta's ability to renew or replace expiring contracts at comparable prices and with other acceptable terms; adoption of new laws and regulations in the United States and abroad, including energy laws, tax laws, environmental laws, labor laws and healthcare laws; advances in technology; difficulties in the operation of our facilities, including fuel supply and energy delivery interruptions, failure to obtain regulatory approvals, equipment failures, labor disputes and work stoppages, and weather interference and catastrophic events; failure to maintain historical performance levels at Covanta's facilities and Covanta's ability to retain the rights to operate facilities Covanta does not own; Covanta's and the joint ventures ability to avoid adverse publicity or reputational damage relating to its business; difficulties in the financing, development and construction of new projects and expansions, including increased construction costs and delays; Covanta's ability to realize the benefits of long-term business development and bear the costs of business development over time; Covanta's ability to utilize net operating loss carryforwards; limits of insurance coverage; Covanta's ability to avoid defaults under its long-term contracts; performance of third parties under its contracts and such third parties' observance of laws and regulations; concentration of suppliers and customers; geographic concentration of facilities; increased competitiveness in the energy and waste industries; changes in foreign currency exchange rates; limitations imposed by Covanta's existing indebtedness and its ability to perform its financial obligations and guarantees and to refinance its existing indebtedness; exposure to counterparty credit risk and instability of financial institutions in connection with financing transactions; the scalability of its business; restrictions in its certificate of incorporation and debt documents regarding strategic alternatives; failures of disclosure controls and procedures and internal controls over financial reporting; Covanta's and the joint ventures ability to attract and retain talented people; general economic conditions in the United States and abroad, including the availability of credit and debt financing; and other risks and uncertainties affecting Covanta's businesses described periodic securities filings by Covanta with the SEC. Although Covanta believes that its plans, cost estimates, returns on investments, intentions and expectations reflected in or suggested by such forward-looking statements are reasonable, actual results could differ materially from a projection or assumption in any forward-looking statements. Covanta's and the joint ventures future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties. The forward-looking statements contained in this press release are made only as of the date hereof and Covanta does not have, or undertake, any obligation to update or revise any forward-looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law. Note: All estimates with respect to 2018 and future periods are as of October 25, 2018. Covanta does not have or undertake any obligation to update or revise any forward-looking statements whether as a result of new information, subsequent events or otherwise, unless otherwise required by law. Discussion of Non-GAAP Financial Measures We use a number of different financial measures, both United States generally accepted accounting principles (“GAAP”) and non-GAAP, in assessing the overall performance of our business. To supplement our assessment of results prepared in accordance with GAAP, we use the measures of Adjusted EBITDA, Free Cash Flow, Free Cash Flow Before Working Capital, and Adjusted EPS which are non-GAAP measures as defined by the Securities and Exchange Commission. The non-GAAP financial measures of Adjusted EBITDA, Free Cash Flow, Free Cash Flow Before Working Capital, and Adjusted EPS as described below, and used in this release, are not intended as a substitute or as an alternative to net income, cash flow provided by operating activities or diluted earnings per share as indicators of our performance or liquidity or any other measures of performance or liquidity derived in accordance with GAAP. In addition, our non-GAAP financial measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The presentations of Adjusted EBITDA, Free Cash Flow, Free Cash Flow Before Working Capital, and Adjusted EPS are intended to enhance the usefulness of our financial information by providing measures which management internally use to assess and evaluate the overall performance of its business and those of possible acquisition or divestiture candidates, and highlight trends in the overall business. Note: Throughout this presentation, certain amounts may not total due to rounding. 2 October 25, 2018

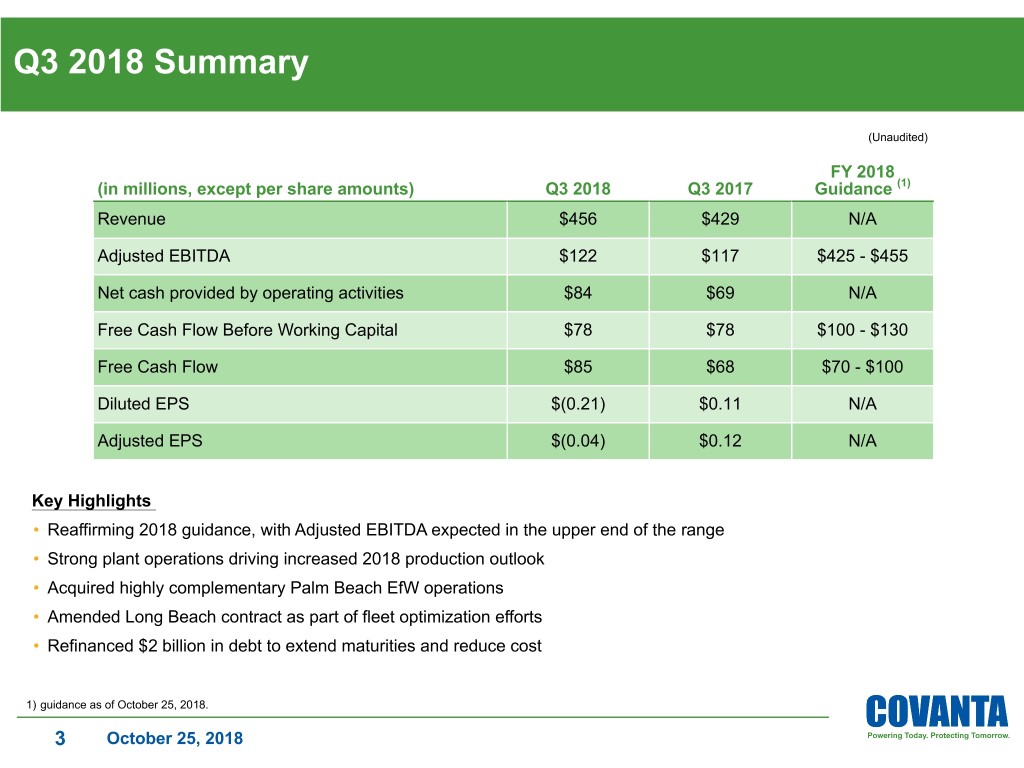

Q3 2018 Summary (Unaudited) FY 2018 (in millions, except per share amounts) Q3 2018 Q3 2017 Guidance (1) Revenue $456 $429 N/A Adjusted EBITDA $122 $117 $425 - $455 Net cash provided by operating activities $84 $69 N/A Free Cash Flow Before Working Capital $78 $78 $100 - $130 Free Cash Flow $85 $68 $70 - $100 Diluted EPS $(0.21) $0.11 N/A Adjusted EPS $(0.04) $0.12 N/A Key Highlights • Reaffirming 2018 guidance, with Adjusted EBITDA expected in the upper end of the range • Strong plant operations driving increased 2018 production outlook • Acquired highly complementary Palm Beach EfW operations • Amended Long Beach contract as part of fleet optimization efforts • Refinanced $2 billion in debt to extend maturities and reduce cost 1) guidance as of October 25, 2018. 3 October 25, 2018

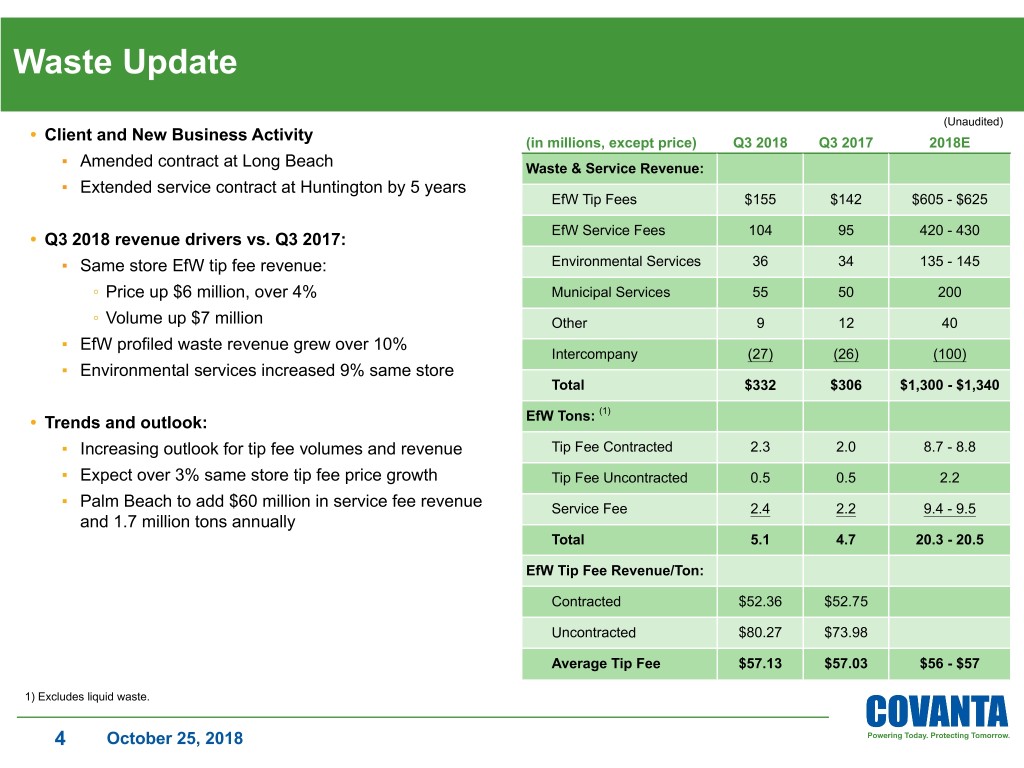

Waste Update (Unaudited) • Client and New Business Activity (in millions, except price) Q3 2018 Q3 2017 2018E ▪ Amended contract at Long Beach Waste & Service Revenue: ▪ Extended service contract at Huntington by 5 years EfW Tip Fees $155 $142 $605 - $625 EfW Service Fees 104 95 420 - 430 • Q3 2018 revenue drivers vs. Q3 2017: ▪ Same store EfW tip fee revenue: Environmental Services 36 34 135 - 145 ◦ Price up $6 million, over 4% Municipal Services 55 50 200 ◦ Volume up $7 million Other 9 12 40 ▪ EfW profiled waste revenue grew over 10% Intercompany (27) (26) (100) ▪ Environmental services increased 9% same store Total $332 $306 $1,300 - $1,340 (1) • Trends and outlook: EfW Tons: ▪ Increasing outlook for tip fee volumes and revenue Tip Fee Contracted 2.3 2.0 8.7 - 8.8 ▪ Expect over 3% same store tip fee price growth Tip Fee Uncontracted 0.5 0.5 2.2 ▪ Palm Beach to add $60 million in service fee revenue Service Fee 2.4 2.2 9.4 - 9.5 and 1.7 million tons annually Total 5.1 4.7 20.3 - 20.5 EfW Tip Fee Revenue/Ton: Contracted $52.36 $52.75 Uncontracted $80.27 $73.98 Average Tip Fee $57.13 $57.03 $56 - $57 1) Excludes liquid waste. 4 October 25, 2018

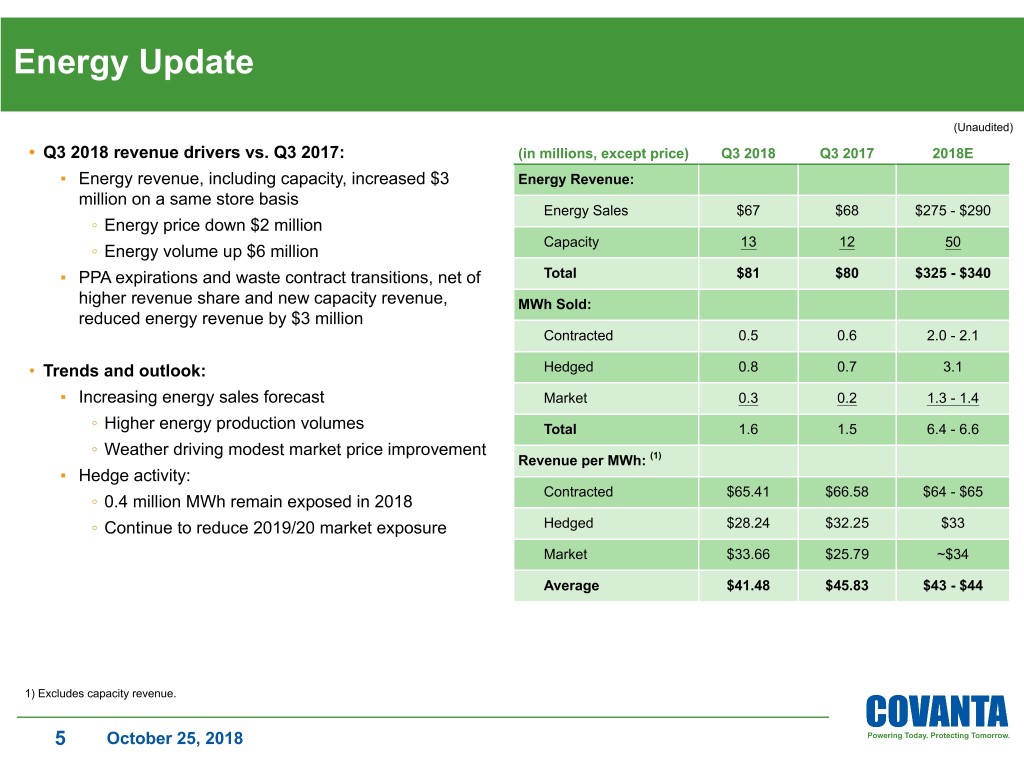

Energy Update (Unaudited) • Q3 2018 revenue drivers vs. Q3 2017: (in millions, except price) Q3 2018 Q3 2017 2018E ▪ Energy revenue, including capacity, increased $3 Energy Revenue: million on a same store basis Energy Sales $67 $68 $275 - $290 ◦ Energy price down $2 million Capacity 13 12 50 ◦ Energy volume up $6 million ▪ PPA expirations and waste contract transitions, net of Total $81 $80 $325 - $340 higher revenue share and new capacity revenue, MWh Sold: reduced energy revenue by $3 million Contracted 0.5 0.6 2.0 - 2.1 • Trends and outlook: Hedged 0.8 0.7 3.1 ▪ Increasing energy sales forecast Market 0.3 0.2 1.3 - 1.4 ◦ Higher energy production volumes Total 1.6 1.5 6.4 - 6.6 ◦ Weather driving modest market price improvement Revenue per MWh: (1) ▪ Hedge activity: Contracted $65.41 $66.58 $64 - $65 ◦ 0.4 million MWh remain exposed in 2018 ◦ Continue to reduce 2019/20 market exposure Hedged $28.24 $32.25 $33 Market $33.66 $25.79 ~$34 Average $41.48 $45.83 $43 - $44 1) Excludes capacity revenue. 5 October 25, 2018

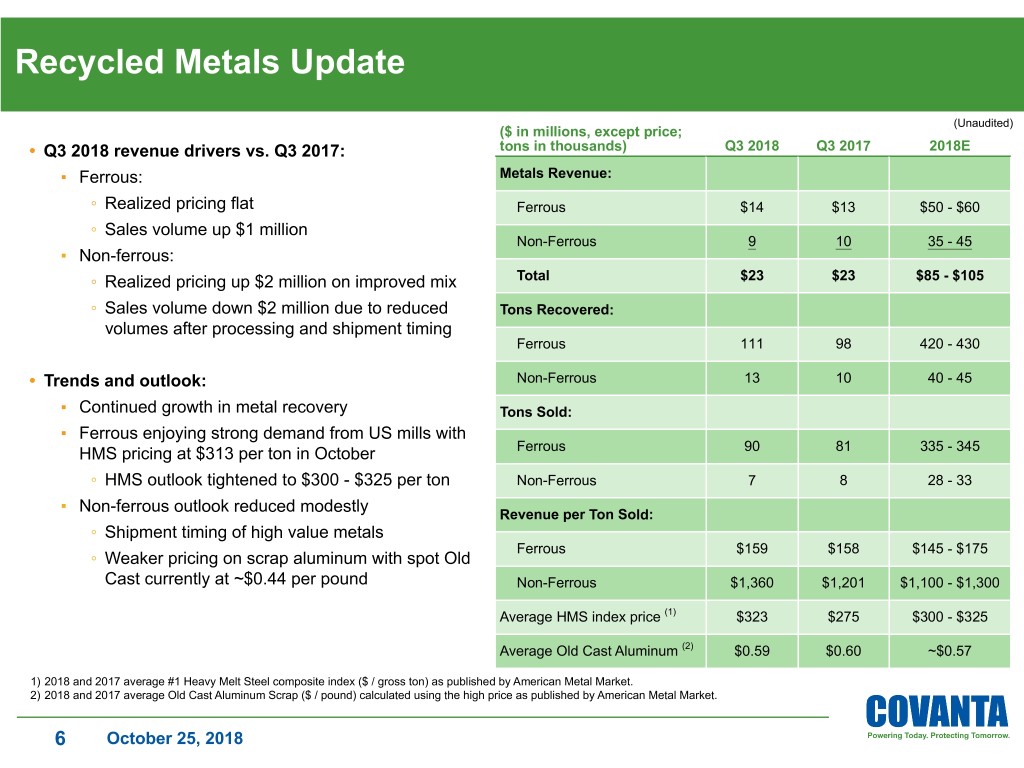

Recycled Metals Update (Unaudited) ($ in millions, except price; • Q3 2018 revenue drivers vs. Q3 2017: tons in thousands) Q3 2018 Q3 2017 2018E ▪ Ferrous: Metals Revenue: ◦ Realized pricing flat Ferrous $14 $13 $50 - $60 ◦ Sales volume up $1 million Non-Ferrous 9 10 35 - 45 ▪ Non-ferrous: ◦ Realized pricing up $2 million on improved mix Total $23 $23 $85 - $105 ◦ Sales volume down $2 million due to reduced Tons Recovered: volumes after processing and shipment timing Ferrous 111 98 420 - 430 • Trends and outlook: Non-Ferrous 13 10 40 - 45 ▪ Continued growth in metal recovery Tons Sold: ▪ Ferrous enjoying strong demand from US mills with HMS pricing at $313 per ton in October Ferrous 90 81 335 - 345 ◦ HMS outlook tightened to $300 - $325 per ton Non-Ferrous 7 8 28 - 33 ▪ Non-ferrous outlook reduced modestly Revenue per Ton Sold: ◦ Shipment timing of high value metals Ferrous $159 $158 $145 - $175 ◦ Weaker pricing on scrap aluminum with spot Old Cast currently at ~$0.44 per pound Non-Ferrous $1,360 $1,201 $1,100 - $1,300 Average HMS index price (1) $323 $275 $300 - $325 Average Old Cast Aluminum (2) $0.59 $0.60 ~$0.57 1) 2018 and 2017 average #1 Heavy Melt Steel composite index ($ / gross ton) as published by American Metal Market. 2) 2018 and 2017 average Old Cast Aluminum Scrap ($ / pound) calculated using the high price as published by American Metal Market. 6 October 25, 2018

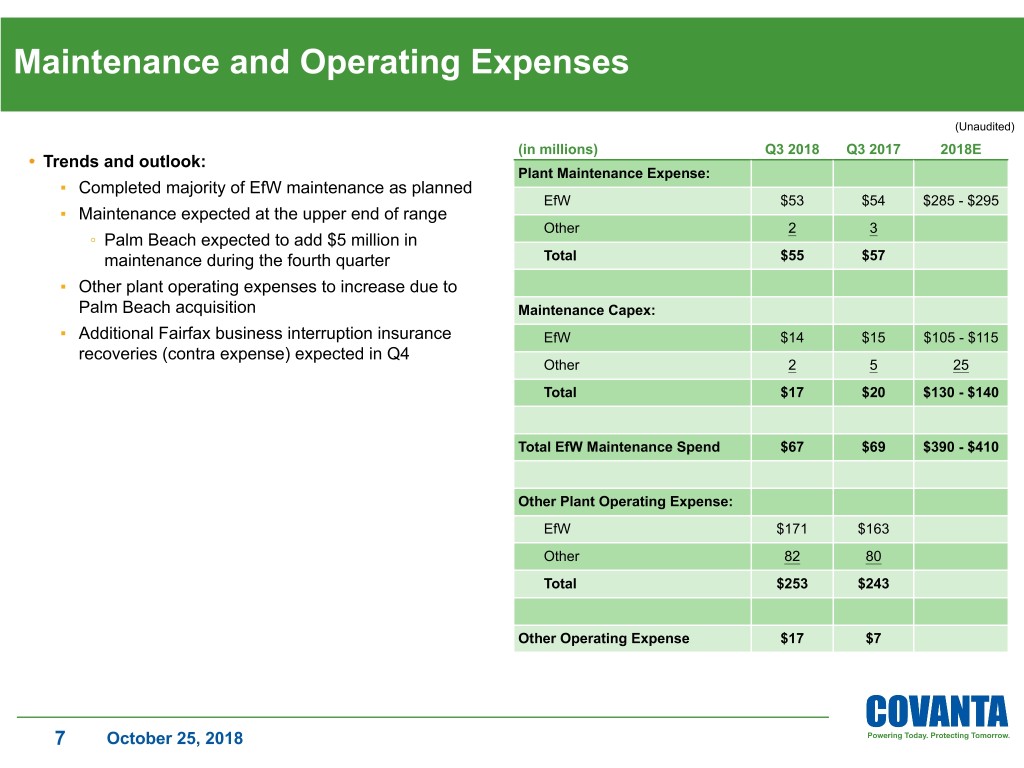

Maintenance and Operating Expenses (Unaudited) (in millions) Q3 2018 Q3 2017 2018E • Trends and outlook: Plant Maintenance Expense: ▪ Completed majority of EfW maintenance as planned EfW $53 $54 $285 - $295 ▪ Maintenance expected at the upper end of range Other 2 3 ◦ Palm Beach expected to add $5 million in maintenance during the fourth quarter Total $55 $57 ▪ Other plant operating expenses to increase due to Palm Beach acquisition Maintenance Capex: ▪ Additional Fairfax business interruption insurance EfW $14 $15 $105 - $115 recoveries (contra expense) expected in Q4 Other 2 5 25 Total $17 $20 $130 - $140 Total EfW Maintenance Spend $67 $69 $390 - $410 Other Plant Operating Expense: EfW $171 $163 Other 82 80 Total $253 $243 Other Operating Expense $17 $7 7 October 25, 2018

Financial Overview 8 October 25, 2018

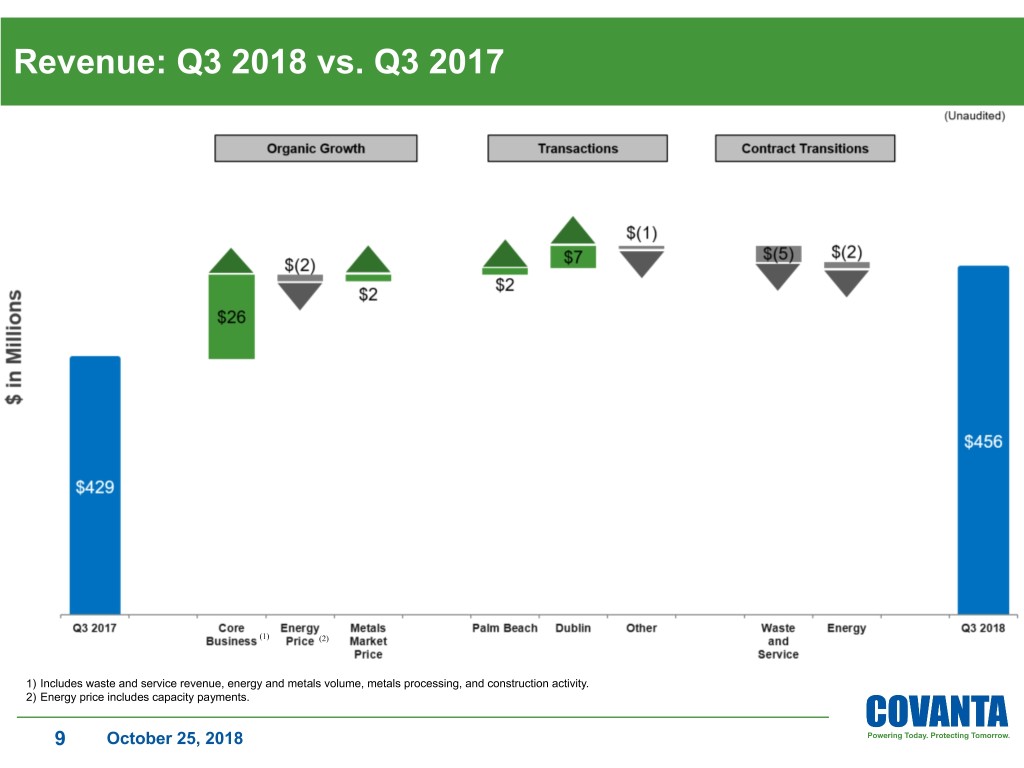

Revenue: Q3 2018 vs. Q3 2017 (1) (2) 1) Includes waste and service revenue, energy and metals volume, metals processing, and construction activity. 2) Energy price includes capacity payments. 9 October 25, 2018

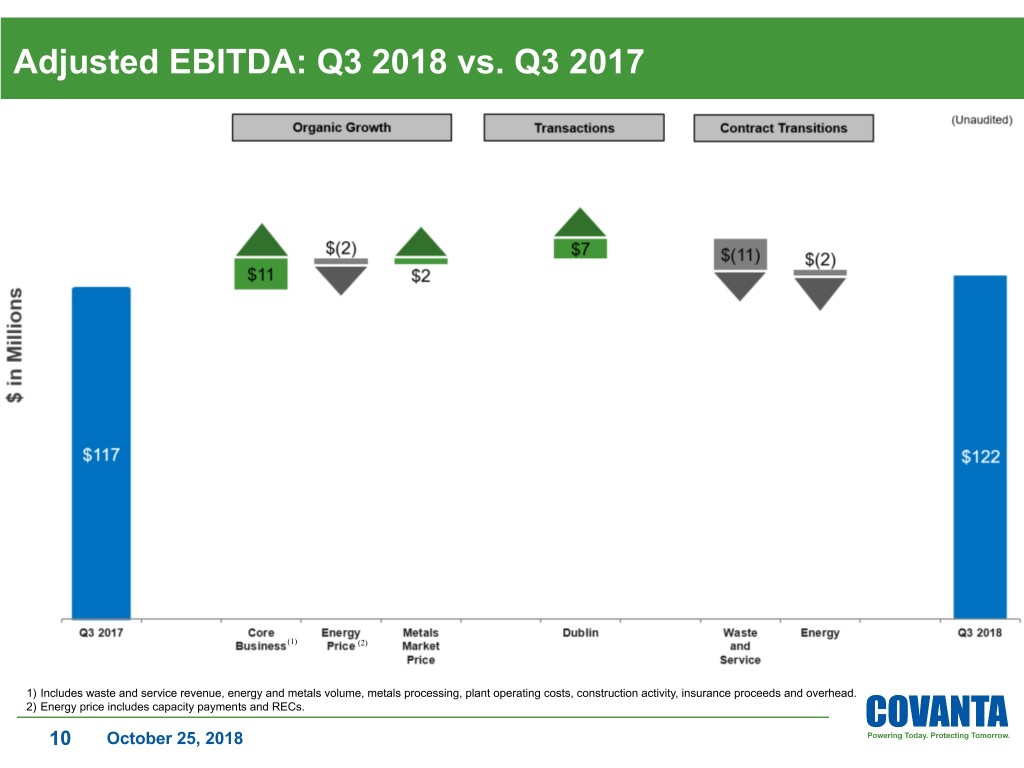

Adjusted EBITDA: Q3 2018 vs. Q3 2017 (1) (2) 1) Includes waste and service revenue, energy and metals volume, metals processing, plant operating costs, construction activity, insurance proceeds and overhead. 2) Energy price includes capacity payments and RECs. 10 October 25, 2018

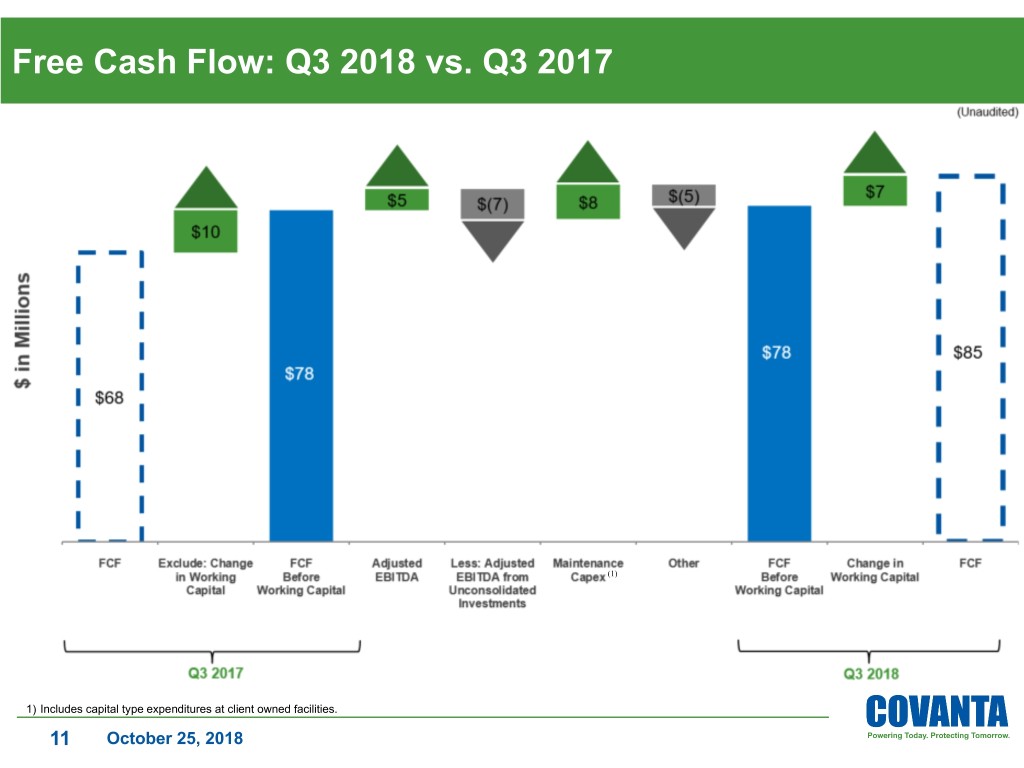

Free Cash Flow: Q3 2018 vs. Q3 2017 (1) 1) Includes capital type expenditures at client owned facilities. 11 October 25, 2018

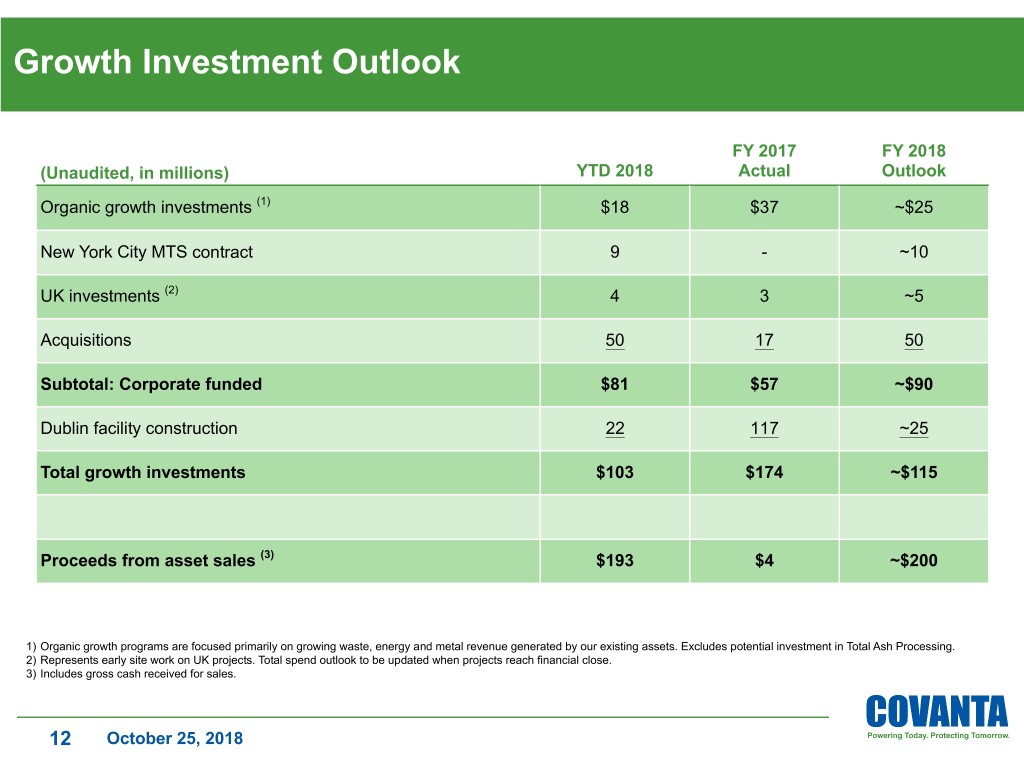

Growth Investment Outlook FY 2017 FY 2018 (Unaudited, in millions) YTD 2018 Actual Outlook Organic growth investments (1) $18 $37 ~$25 New York City MTS contract 9 - ~10 UK investments (2) 4 3 ~5 Acquisitions 50 17 50 Subtotal: Corporate funded $81 $57 ~$90 Dublin facility construction 22 117 ~25 Total growth investments $103 $174 ~$115 Proceeds from asset sales (3) $193 $4 ~$200 1) Organic growth programs are focused primarily on growing waste, energy and metal revenue generated by our existing assets. Excludes potential investment in Total Ash Processing. 2) Represents early site work on UK projects. Total spend outlook to be updated when projects reach financial close. 3) Includes gross cash received for sales. 12 October 25, 2018

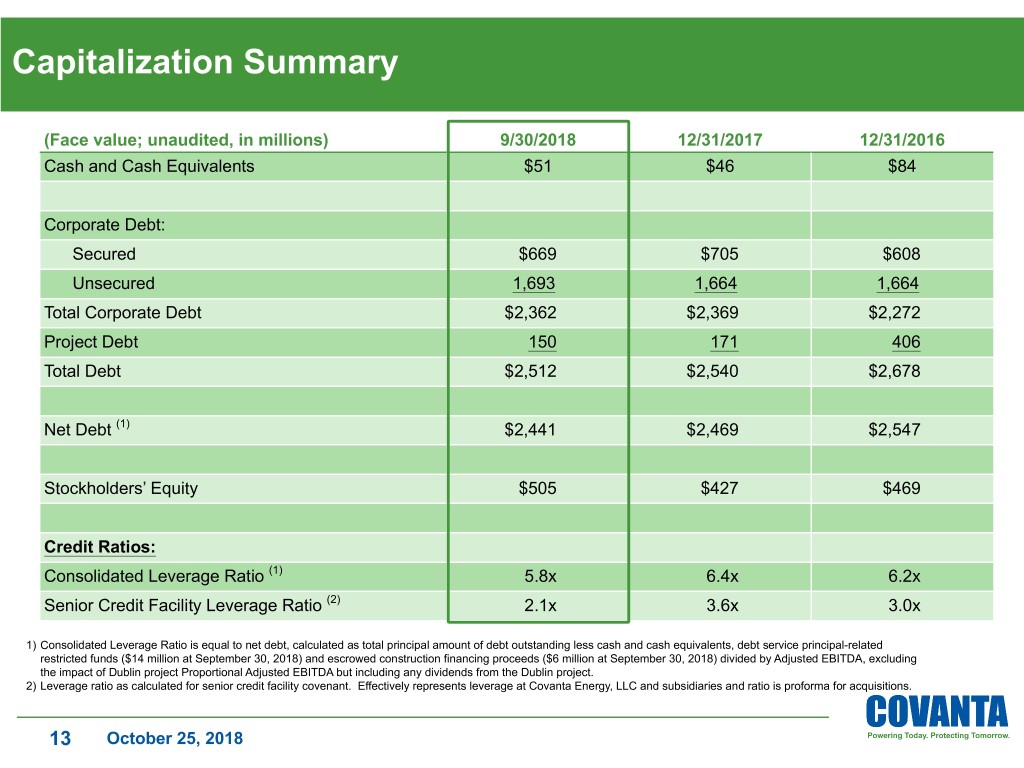

Capitalization Summary (Face value; unaudited, in millions) 9/30/2018 12/31/2017 12/31/2016 Cash and Cash Equivalents $51 $46 $84 Corporate Debt: Secured $669 $705 $608 Unsecured 1,693 1,664 1,664 Total Corporate Debt $2,362 $2,369 $2,272 Project Debt 150 171 406 Total Debt $2,512 $2,540 $2,678 Net Debt (1) $2,441 $2,469 $2,547 Stockholders’ Equity $505 $427 $469 Credit Ratios: Consolidated Leverage Ratio (1) 5.8x 6.4x 6.2x Senior Credit Facility Leverage Ratio (2) 2.1x 3.6x 3.0x 1) Consolidated Leverage Ratio is equal to net debt, calculated as total principal amount of debt outstanding less cash and cash equivalents, debt service principal-related restricted funds ($14 million at September 30, 2018) and escrowed construction financing proceeds ($6 million at September 30, 2018) divided by Adjusted EBITDA, excluding the impact of Dublin project Proportional Adjusted EBITDA but including any dividends from the Dublin project. 2) Leverage ratio as calculated for senior credit facility covenant. Effectively represents leverage at Covanta Energy, LLC and subsidiaries and ratio is proforma for acquisitions. 13 October 25, 2018

Appendix 14 October 25, 2018

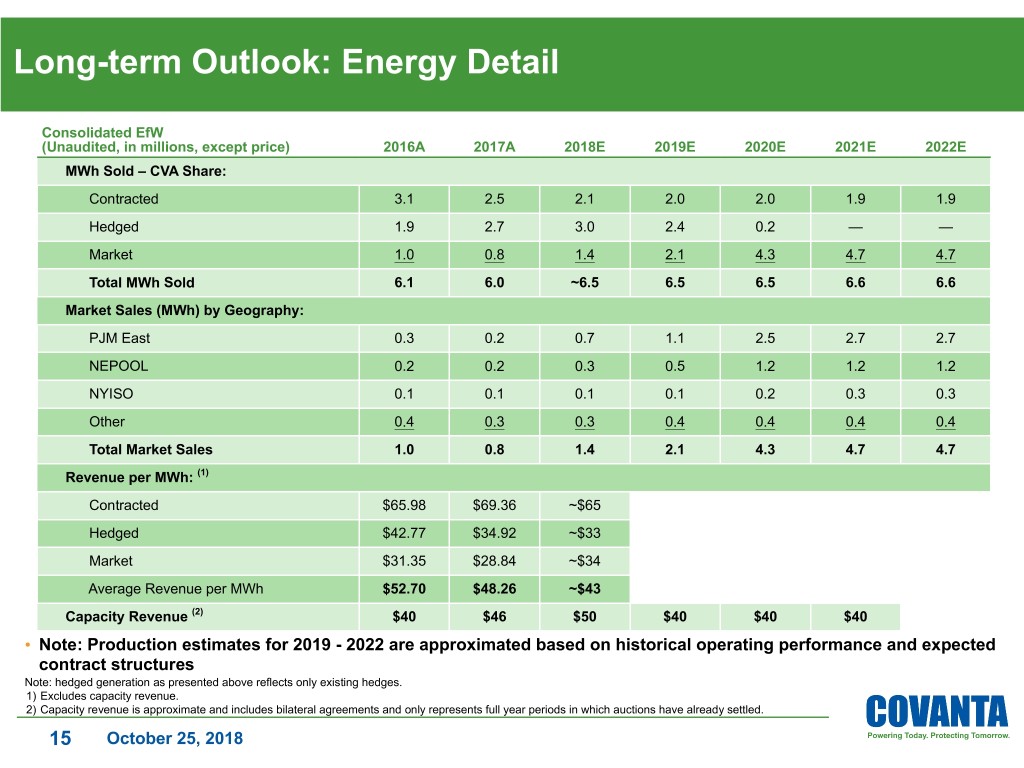

Long-term Outlook: Energy Detail Consolidated EfW (Unaudited, in millions, except price) 2016A 2017A 2018E 2019E 2020E 2021E 2022E MWh Sold – CVA Share: Contracted 3.1 2.5 2.1 2.0 2.0 1.9 1.9 Hedged 1.9 2.7 3.0 2.4 0.2 — — Market 1.0 0.8 1.4 2.1 4.3 4.7 4.7 Total MWh Sold 6.1 6.0 ~6.5 6.5 6.5 6.6 6.6 Market Sales (MWh) by Geography: PJM East 0.3 0.2 0.7 1.1 2.5 2.7 2.7 NEPOOL 0.2 0.2 0.3 0.5 1.2 1.2 1.2 NYISO 0.1 0.1 0.1 0.1 0.2 0.3 0.3 Other 0.4 0.3 0.3 0.4 0.4 0.4 0.4 Total Market Sales 1.0 0.8 1.4 2.1 4.3 4.7 4.7 Revenue per MWh: (1) Contracted $65.98 $69.36 ~$65 Hedged $42.77 $34.92 ~$33 Market $31.35 $28.84 ~$34 Average Revenue per MWh $52.70 $48.26 ~$43 Capacity Revenue (2) $40 $46 $50 $40 $40 $40 • Note: Production estimates for 2019 - 2022 are approximated based on historical operating performance and expected contract structures Note: hedged generation as presented above reflects only existing hedges. 1) Excludes capacity revenue. 2) Capacity revenue is approximate and includes bilateral agreements and only represents full year periods in which auctions have already settled. 15 October 25, 2018

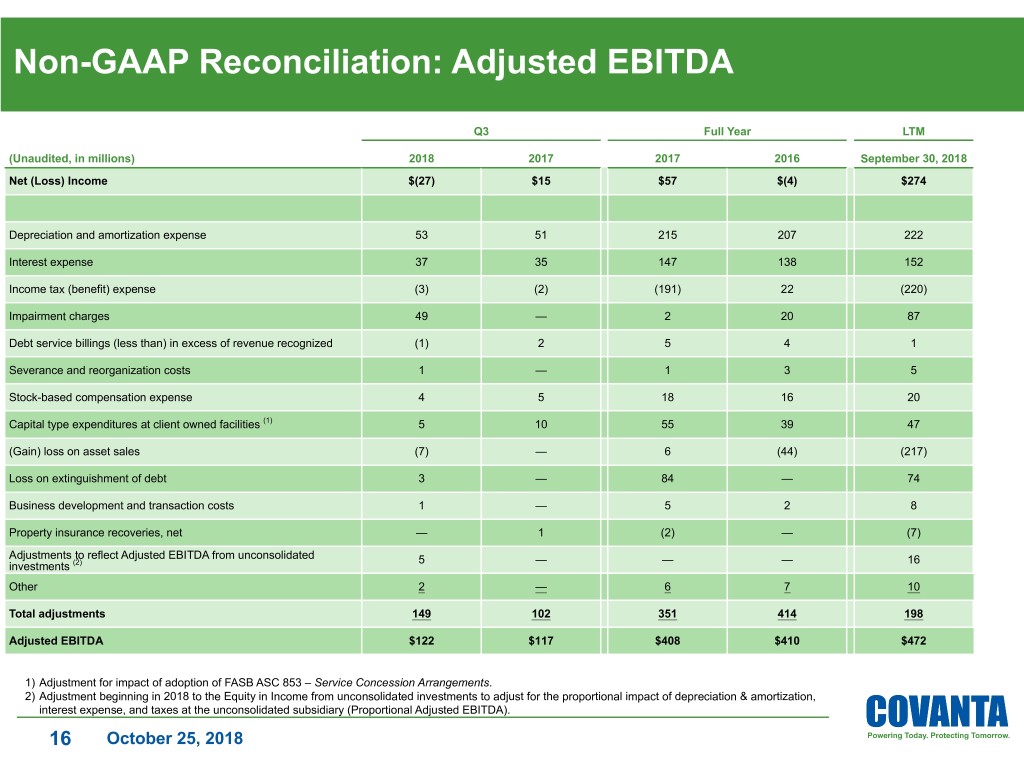

Non-GAAP Reconciliation: Adjusted EBITDA Q3 Full Year LTM (Unaudited, in millions) 2018 2017 2017 2016 September 30, 2018 Net (Loss) Income $(27) $15 $57 $(4) $274 Depreciation and amortization expense 53 51 215 207 222 Interest expense 37 35 147 138 152 Income tax (benefit) expense (3) (2) (191) 22 (220) Impairment charges 49 — 2 20 87 Debt service billings (less than) in excess of revenue recognized (1) 2 5 4 1 Severance and reorganization costs 1 — 1 3 5 Stock-based compensation expense 4 5 18 16 20 Capital type expenditures at client owned facilities (1) 5 10 55 39 47 (Gain) loss on asset sales (7) — 6 (44) (217) Loss on extinguishment of debt 3 — 84 — 74 Business development and transaction costs 1 — 5 2 8 Property insurance recoveries, net — 1 (2) — (7) Adjustments to reflect Adjusted EBITDA from unconsolidated 5 — — — 16 investments (2) Other 2 — 6 7 10 Total adjustments 149 102 351 414 198 Adjusted EBITDA $122 $117 $408 $410 $472 1) Adjustment for impact of adoption of FASB ASC 853 – Service Concession Arrangements. 2) Adjustment beginning in 2018 to the Equity in Income from unconsolidated investments to adjust for the proportional impact of depreciation & amortization, interest expense, and taxes at the unconsolidated subsidiary (Proportional Adjusted EBITDA). 16 October 25, 2018

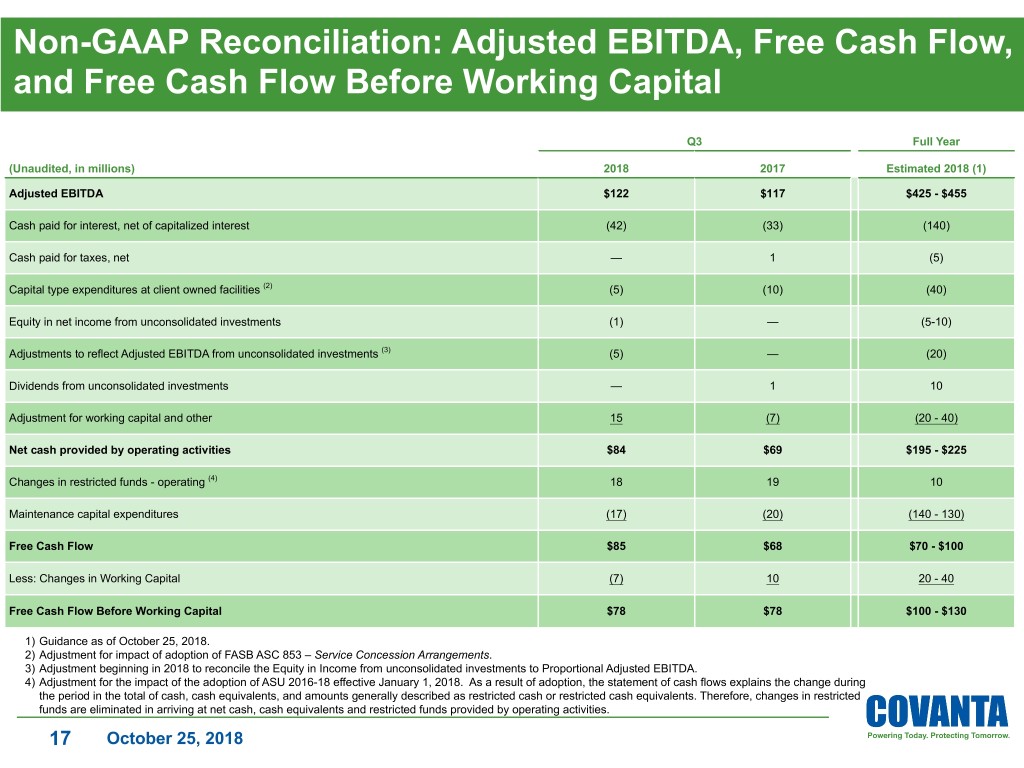

Non-GAAP Reconciliation: Adjusted EBITDA, Free Cash Flow, and Free Cash Flow Before Working Capital Q3 Full Year (Unaudited, in millions) 2018 2017 Estimated 2018 (1) Adjusted EBITDA $122 $117 $425 - $455 Cash paid for interest, net of capitalized interest (42) (33) (140) Cash paid for taxes, net — 1 (5) Capital type expenditures at client owned facilities (2) (5) (10) (40) Equity in net income from unconsolidated investments (1) — (5-10) Adjustments to reflect Adjusted EBITDA from unconsolidated investments (3) (5) — (20) Dividends from unconsolidated investments — 1 10 Adjustment for working capital and other 15 (7) (20 - 40) Net cash provided by operating activities $84 $69 $195 - $225 Changes in restricted funds - operating (4) 18 19 10 Maintenance capital expenditures (17) (20) (140 - 130) Free Cash Flow $85 $68 $70 - $100 Less: Changes in Working Capital (7) 10 20 - 40 Free Cash Flow Before Working Capital $78 $78 $100 - $130 1) Guidance as of October 25, 2018. 2) Adjustment for impact of adoption of FASB ASC 853 – Service Concession Arrangements. 3) Adjustment beginning in 2018 to reconcile the Equity in Income from unconsolidated investments to Proportional Adjusted EBITDA. 4) Adjustment for the impact of the adoption of ASU 2016-18 effective January 1, 2018. As a result of adoption, the statement of cash flows explains the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. Therefore, changes in restricted funds are eliminated in arriving at net cash, cash equivalents and restricted funds provided by operating activities. 17 October 25, 2018

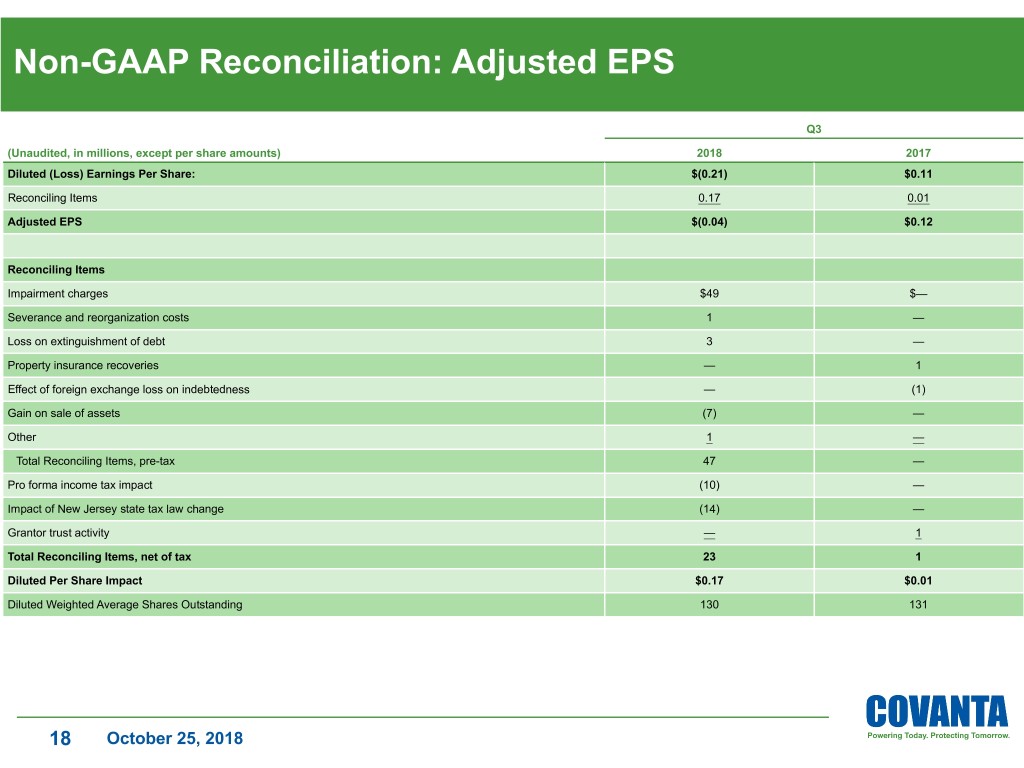

Non-GAAP Reconciliation: Adjusted EPS Q3 (Unaudited, in millions, except per share amounts) 2018 2017 Diluted (Loss) Earnings Per Share: $(0.21) $0.11 Reconciling Items 0.17 0.01 Adjusted EPS $(0.04) $0.12 Reconciling Items Impairment charges $49 $— Severance and reorganization costs 1 — Loss on extinguishment of debt 3 — Property insurance recoveries — 1 Effect of foreign exchange loss on indebtedness — (1) Gain on sale of assets (7) — Other 1 — Total Reconciling Items, pre-tax 47 — Pro forma income tax impact (10) — Impact of New Jersey state tax law change (14) — Grantor trust activity — 1 Total Reconciling Items, net of tax 23 1 Diluted Per Share Impact $0.17 $0.01 Diluted Weighted Average Shares Outstanding 130 131 18 October 25, 2018

Non-GAAP Financial Measures Free Cash Flow and Free Cash Flow Before Working Capital Free Cash Flow is defined as cash flow provided by operating activities, plus changes in restricted funds - operating, less maintenance capital expenditures, which are capital expenditures primarily to maintain our existing facilities. Free Cash Flow Before Working Capital is defined as Free Cash Flow excluding changes in working capital. We use the non-GAAP measures of Free Cash Flow and Free Cash Flow Before Working Capital as a criteria of liquidity and for performance-based components of employee compensation. We use Free Cash Flow and Free Cash Flow Before Working Capital as measures of liquidity to determine amounts we can reinvest in our core businesses, such as amounts available to make acquisitions, invest in construction of new projects, make principal payments on debt, or amounts we can return to our stockholders through dividends and/or stock repurchases. In order to provide a meaningful basis for comparison, we are providing information with respect to our Free Cash Flow for the three and nine months ended September 30, 2018 and 2017 reconciled for each such period to cash flow provided by operating activities, which we believe to be the most directly comparable measure under GAAP. Adjusted EBITDA We use Adjusted EBITDA to provide additional ways of viewing aspects of operations that, when viewed with the GAAP results provide a more complete understanding of our core business. As we define it, Adjusted EBITDA represents earnings before interest, taxes, depreciation and amortization, as adjusted for additional items subtracted from or added to net income including the effects of impairment losses, gains or losses on sales, dispositions or retirements of assets, adjustments to reflect the Adjusted EBITDA from our unconsolidated investments, adjustments to exclude significant unusual or non-recurring items that are not directly related to our operating performance plus adjustments to capital type expenses for our service fee facilities in line with our credit agreements. We adjust for these items in our Adjusted EBITDA as our management believes that these items would distort their ability to efficiently view and assess our core operating trends. As larger parts of our business are being conducted through unconsolidated entities that we do not control, we are adjusting for our proportionate share of the entities depreciation and amortization, interest expense and taxes in order to improve comparability to the Adjusted EBITDA of our wholly owned entities. In order to provide a meaningful basis for comparison, we are providing information with respect to our Adjusted EBITDA for the three and nine months ended September 30, 2018 and 2017, reconciled for each such period to net income and cash flow provided by operating activities, which are believed to be the most directly comparable measures under GAAP. Our projections of the proportional contribution of our interests in the JV to our Adjusted EBITDA and Free Cash Flow are not based on GAAP net income/loss or cash flow provided by operating activities, respectively, and are anticipated to be adjusted to exclude the effects of events or circumstances in 2018 that are not representative or indicative of our results of operations and that are not currently determinable. Due to the uncertainty of the likelihood, amount and timing of any such adjusting items, we do not have information available to provide a quantitative reconciliation of projected net income/loss to an Adjusted EBITDA projection. Adjusted EPS Adjusted EPS excludes certain income and expense items that are not representative of our ongoing business and operations, which are included in the calculation of Diluted Earnings Per Share in accordance with GAAP. The following items are not all-inclusive, but are examples of reconciling items in prior comparative and future periods. They would include impairment charges, the effect of derivative instruments not designated as hedging instruments, significant gains or losses from the disposition or restructuring of businesses, gains and losses on assets held for sale, transaction-related costs, income and loss on the extinguishment of debt and other significant items that would not be representative of our ongoing business. We will use the non-GAAP measure of Adjusted EPS to enhance the usefulness of our financial information by providing a measure which management internally uses to assess and evaluate the overall performance and highlight trends in the ongoing business. In order to provide a meaningful basis for comparison, we are providing information with respect to our Adjusted EPS for the three and nine months ended September 30, 2018 and 2017, reconciled for each such period to diluted income per share, which is believed to be the most directly comparable measure under GAAP. 19 October 25, 2018