Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Altra Industrial Motion Corp. | aimc-8k_20181025.htm |

| EX-99.1 - EX-99.1 - Altra Industrial Motion Corp. | aimc-ex991_6.htm |

Third Quarter 2018 Results October 25, 2018 Exhibit 99.2

Q3 2018 Conference Call Details Live Webcast October 25, 2018 10:00 AM ET Dial In Number 877-407-8293 Domestic 201-689-8349 International Webcast at www.altramotion.com Replay Through November 7, 2018 877-660-6853 Domestic 201-612-7415 International Conference ID: # 13683742 Webcast Replay at www.altramotion.com

Safe Harbor Statement Cautionary Statement Regarding Forward Looking Statements: All statements, other than statements of historical fact included in this release are forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. Forward-looking statements can generally be identified by phrases such as “believes,” “expects,” “potential,” “continues,” “may,” “should,” “seeks,” “predicts,” “anticipates,” “intends,” “projects,” “estimates,” “plans,” “could,” “designed”, “should be,” and other similar expressions that denote expectations of future or conditional events rather than statements of fact. Forward-looking statements also may relate to strategies, plans and objectives for, and potential results of, future operations, financial results, financial condition, business prospects, growth strategy and liquidity, and are based upon financial data, market assumptions and management's current business plans and beliefs or current estimates of future results or trends available only as of the time the statements are made, which may become out of date or incomplete. Forward-looking statements are inherently uncertain, and investors must recognize that events could differ significantly from our expectations. These statements include, but may not be limited to, the statements under “Business Outlook,” our expectations regarding our tax rate, our expectations regarding our acquisition of the A&S businesses, including but not limited to our expectations regarding the integration of the A&S businesses and the impact of such acquisition on our business, including expected synergies, our expectations regarding delivering our business and our ability to deliver our business, our expectations regarding growth opportunities and our ability to drive growth, our plans to change how we calculate certain non-GAAP measures, our expectations regarding our ability to serve our customers and deliver value for our shareholders and the Company’s guidance for full year 2018. In addition to the risks and uncertainties noted in this release, there are certain factors that could cause actual results to differ materially from those anticipated by some of the statements made. These include: (1) competitive pressures, (2) changes in economic conditions in the United States and abroad and the cyclical nature of our markets, (3) loss of distributors, (4) the ability to develop new products and respond to customer needs, (5) risks associated with international operations, including currency risks, (6) accuracy of estimated forecasts of OEM customers and the impact of the current global economic environment on our customers, (7) risks associated with a disruption to our supply chain, (8) fluctuations in the costs of raw materials used in our products, (9) product liability claims, (10) work stoppages and other labor issues, (11) changes in employment, environmental, tax and other laws and changes in the enforcement of laws, (12) loss of key management and other personnel, (13) risks associated with compliance with environmental laws, (14) the ability to successfully execute, manage and integrate key acquisitions and mergers, (15) failure to obtain or protect intellectual property rights, (16) risks associated with impairment of goodwill or intangibles assets, (17) failure of operating equipment or information technology infrastructure, (18) risks associated with our debt leverage, (19) risks associated with restrictions contained in the agreements governing the Notes and the Altra Credit Facilities, (20) risks associated with compliance with tax laws, (21) risks associated with the global recession and volatility and disruption in the global financial markets, (22) risks associated with implementation of our ERP system, (23) risks associated with the Svendborg, Stromag, and A&S acquisitions and integration and other acquisitions, (24) risks associated with certain minimum purchase agreements we have with suppliers, (25) risks related to our relationships with strategic partners, (26) our ability to offset increased commodity and labor costs with increased prices, (27) risks associated with our exposure to variable interest rates and foreign currency exchange rates, (28) risks associated with interest rate swap contracts, (29) risks associated with our exposure to renewable energy markets, (30) risks related to regulations regarding conflict minerals, (31) risks related to restructuring and plant consolidations, (32) risks related to our acquisition of A&S, including (a) the possibility that we may be unable to achieve expected synergies and operating efficiencies in connection with the proposed transaction within the expected time-frames or at all and to successfully integrate A&S, (b) expected or targeted future financial and operating performance and results, (c) operating costs, customer loss and business disruption (including, without limitation, difficulties in maintain relationships with employees, customers, clients or suppliers) being greater than expected following the transaction, (d) our ability to retain key executives and employees, (e) slowdowns or downturns in economic conditions generally and in the markets in which the A&S businesses participate specifically, (f) lower than expected investments and capital expenditures in equipment that utilizes components produced by us or A&S, (g) lower than expected demand for our or A&S’s repair and replacement businesses, (h) our ability to successfully integrate the merged assets and the associated technology and achieve operational efficiencies, (i) the integration of A&S being more difficult, time-consuming or costly than expected and (j) the inability to undertake certain corporate actions that otherwise could be advantageous to comply with certain tax covenants and (33) other risks, uncertainties and other factors described in the Company's quarterly reports on Form 10-Q and annual reports on Form 10-K and in the Company's other filings with the U.S. Securities and Exchange Commission (SEC) or in materials incorporated therein by reference. Except as required by applicable law, Altra does not intend to, update or alter its forward looking statements, whether as a result of new information, future events or otherwise.

Agenda and Speakers Executive Overview Market Review A&S Combination Q3 Financial Review & 2018 Guidance Strategic Priorities Q&A Carl Christenson Chairman & Chief Executive Officer Christian Storch Vice President & Chief Financial Officer

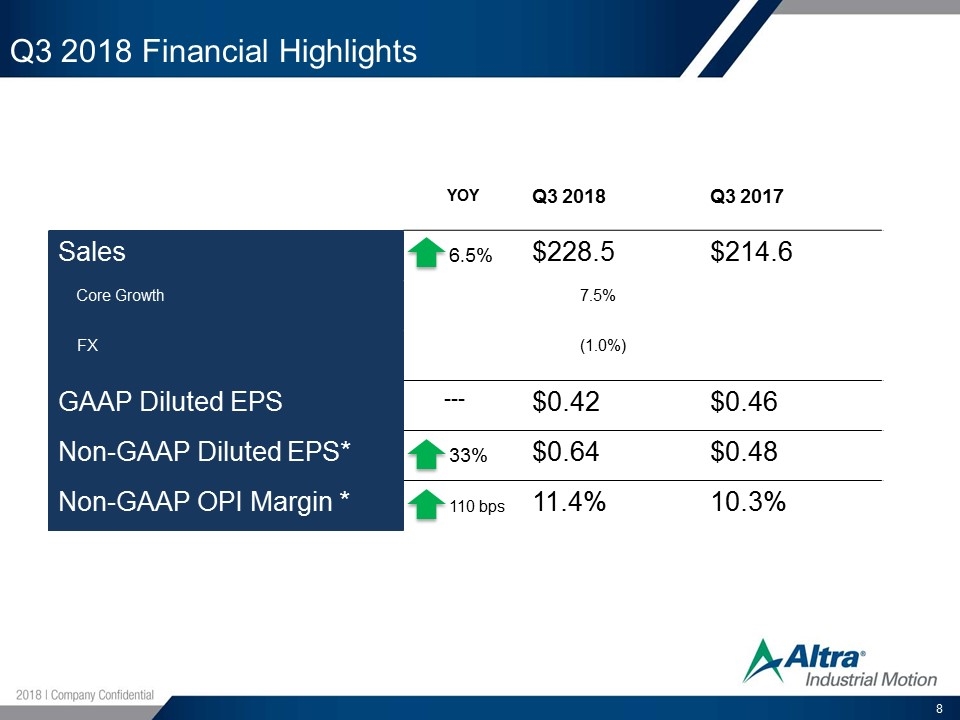

Third-Quarter 2018 Highlights 6.5% increase in net sales to $228.5 million Third-quarter net income was $12.3 million, or $0.42 per diluted share, compared with $13.3 million, or $0.46 per diluted share, in the third quarter of 2017 Non-GAAP adjusted net income in Q3 2018 was $18.7 million, or $0.64 per diluted share, compared with $13.8 million, or $0.48 per diluted share, in the prior-year third quarter * Completed combination with A&S business, integration progressing on schedule YOY organic sales growth; GAAP EPS of $0.42; Non-GAAP EPS was a Record Third Quarter of $0.64, up 33% YOY; Updating FY2018 guidance

Third-Quarter Key End-Market Drivers Oil & Gas delivered strong double-digit sales growth Metals grew double digits as higher steel prices from tariffs continued to support robust spending environment Mining sales are strong year-to-date; tariffs could impact commodity prices and demand Material Handling sales grew double digits supported by strength in forklifts, cranes and hoists, which more than offset soft elevator sales Turf & Garden high single-digit sales growth reflects better-than-expected market strength Wind sales were softer than expected due to supply chain issues and customer shipment delay Conventional Power Gen improved sequentially, down year over year

Combination with A&S Completed Ahead of Schedule $1.9bn Enhanced financial profile Global Leader in Precision Motion Control and Power Transmission Expanded suite of technology & solutions Positioned to accelerate innovation Increased exposure to attractive secular trends Excellent Progress with the Integration Expect weighted average interest expense to be approximately 4.5%-5.0% based on current debt balance and market conditions Completed payroll and IT integration activities. Great progress on supply chain Validated cultural fit; established core vales and core value drivers for the combined organization Combining Fortive Business System and Altra Business system underway Beginning to develop joint sales opportunities Reaffirmed confidence in delivering $50 million of synergies by year four Note: Combined company revenues expected to be approximately $1.9 billion for the twelve months ending June 30, 2018.

Q3 2018 Financial Highlights YOY Q3 2018 Q3 2017 Sales 6.5% $228.5 $214.6 Core Growth 7.5% FX (1.0%) GAAP Diluted EPS --- $0.42 $0.46 Non-GAAP Diluted EPS* 33% $0.64 $0.48 Non-GAAP OPI Margin * 110 bps 11.4% 10.3%

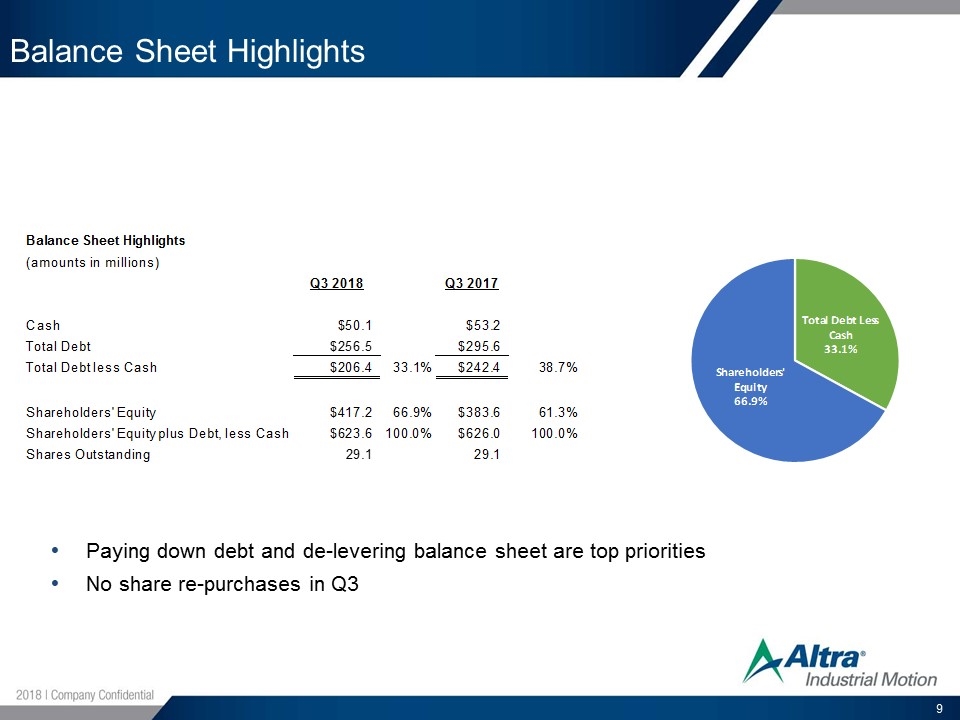

Balance Sheet Highlights Paying down debt and de-levering balance sheet are top priorities No share re-purchases in Q3 Balance Sheet Highlights(amounts in millions)Q3 2018Q3 2017Cash$50.1 $53.2 Total Debt$256.5 $295.6 Total Debt less Cash$206.4 33.1%$242.4 38.7%Shareholders' Equity$417.2 66.9%$383.6 61.3%Shareholders' Equity plus Debt, less Cash$623.6 100.0%$626.0 100.0%Shares Outstanding 29.1 29.1 Total Debt Less Cash33.1%Shareholders' Equity66.9%

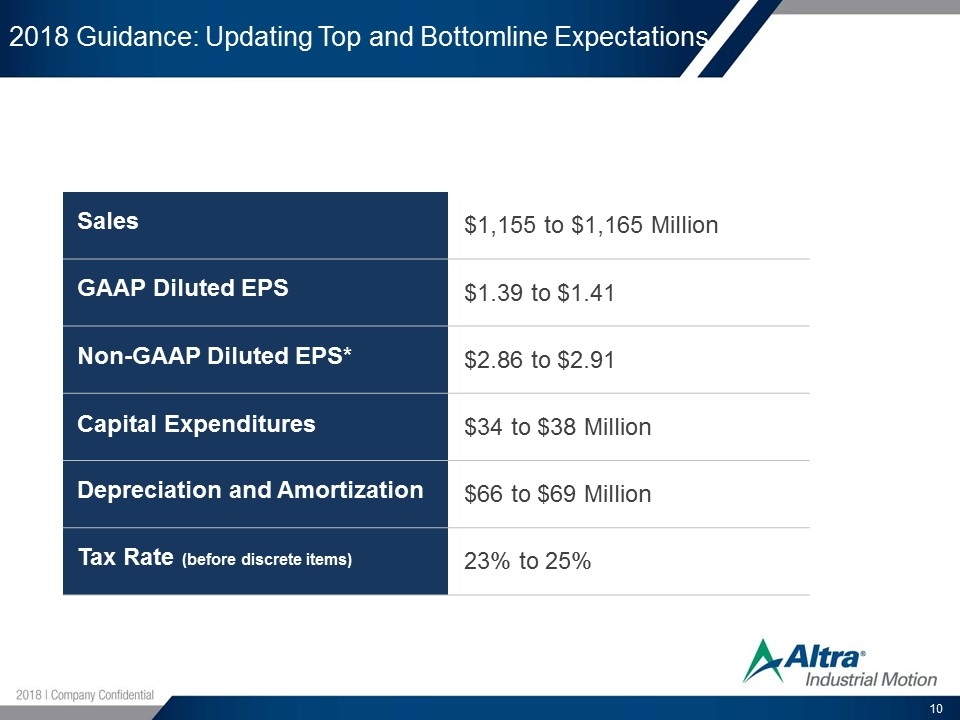

2018 Guidance: Updating Top and Bottomline Expectations Sales $1,155 to $1,165 Million GAAP Diluted EPS $1.39 to $1.41 Non-GAAP Diluted EPS* $2.86 to $2.91 Capital Expenditures $34 to $38 Million Depreciation and Amortization $66 to $69 Million Tax Rate (before discrete items) 23% to 25%

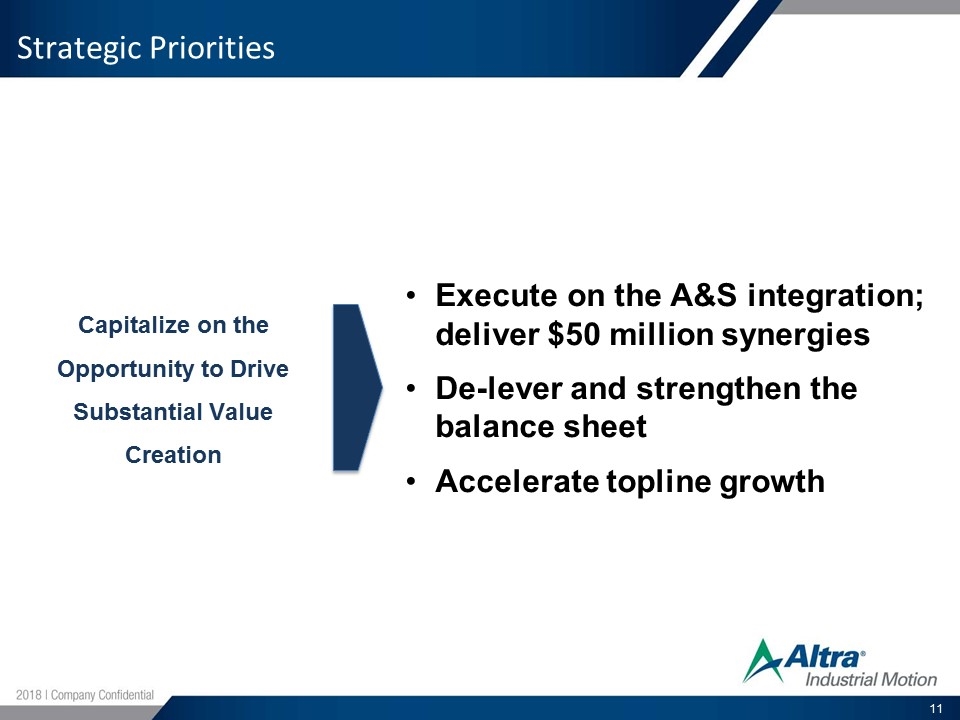

Strategic Priorities Capitalize on the Opportunity to Drive Substantial Value Creation Execute on the A&S integration; deliver $50 million synergies De-lever and strengthen the balance sheet Accelerate topline growth

Discussion of Non-GAAP Measures *As used in this release and the accompanying slides posted on the Company's website, non-GAAP diluted EPS, non-GAAP income from operations and non-GAAP net income are each calculated using either net income or income from operations that excludes acquisition related costs, restructuring costs, and other income or charges that management does not consider to be directly related to the Company's core operating performance. Beginning in the fourth quarter, the Company intends to exclude acquisition related amortization and depreciation from its calculation of non-GAAP net income and non-GAAP income from operations. Non-GAAP diluted EPS is calculated by dividing non-GAAP net income by GAAP weighted average shares outstanding (diluted). Non-GAAP free cash flow is calculated by deducting purchases of property, plant and equipment from net cash flows from operating activities. Non-GAAP operating working capital is calculated by deducting accounts payable from net trade receivables plus inventories. Altra believes that the presentation of non-GAAP net income, non-GAAP income from operations, non-GAAP diluted EPS, non-GAAP free cash flow and non-GAAP operating working capital provides important supplemental information to management and investors regarding financial and business trends relating to the Company's financial condition and results of operations.

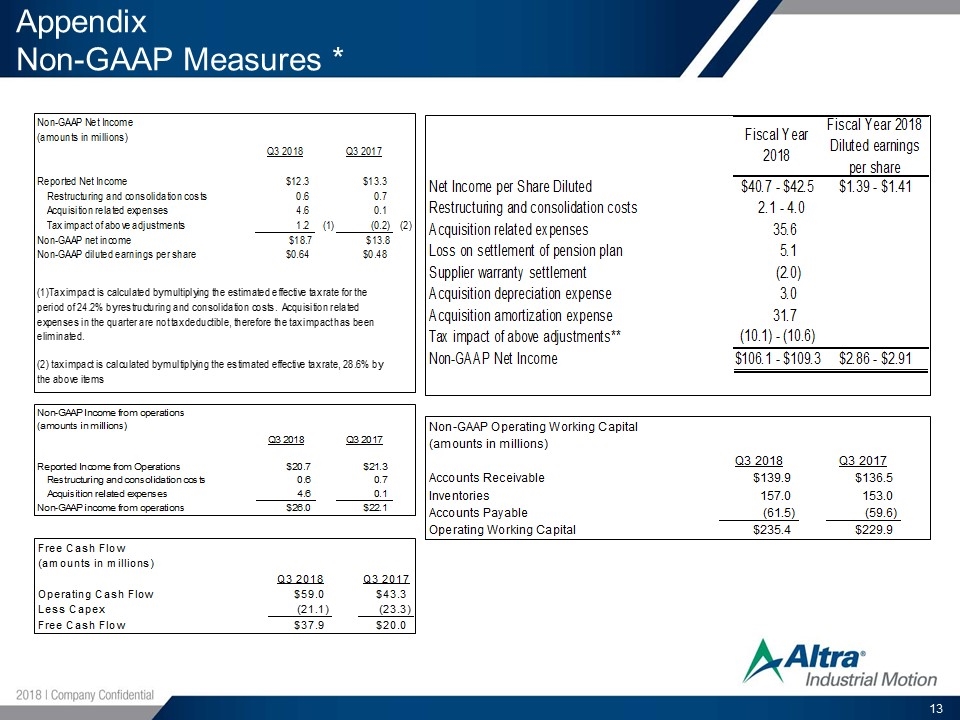

Appendix Non-GAAP Measures * Non-GAAP Net Income(amounts in millions)Q3 2018Q3 2017Reported Net Income$12.3 $13.3 Restructuring and consolidation costs 0.6 0.7 Acquisition related expenses 4.6 0.1 Tax impact of above adjustments 1.2 (1) (0.2) (2)Non-GAAP net income$18.7$13.8Non-GAAP diluted earnings per share$0.64 $0.48 (1)Tax impact is calculated by multiplying the estimated effective tax rate for the period of 24.2% by restructuring and consolidation costs. Acquisition related expenses in the quarter are not tax deductible, therefore the tax impact has been eliminated.(2) tax impact is calculated by multiplying the estimated effective tax rate, 28.6% by the above items"*Reconciliation of 2018 Non-GAAP Net Income and Diluted EPS Guidance" (Amounts in millions except per share information)Fiscal Year 2018Fiscal Year 2018 Diluted earnings per shareNet Income per Share Diluted$40.7 - $42.5$1.39 - $1.41Restructuring and consolidation costs 2.1 - 4.0 Acquisition related expenses 35.6 Loss on settlement of pension plan 5.1 Supplier warranty settlement (2.0)Acquisition depreciation expense 3.0 Acquisition amortization expense 31.7 Tax impact of above adjustments**(10.1) - (10.6)Non-GAAP Net Income$106.1 - $109.3$2.86 - $2.91* Adjustments are pre tax, with net tax impact listed separatrely** Tax impact is calculated by multiplying the effective tax rate for the period of 26.0% by the above items.Non-GAAP Income from operations(amounts in millions)Q3 2018Q3 2017Reported Income from Operations$20.7 $21.3 Restructuring and consolidation costs 0.6 0.7 Acquisition related expenses 4.6 0.1 Non-GAAP income from operations$26.0 $22.1 Non-GAAP Operating Working Capital(amounts in millions)Q3 2018Q3 2017Accounts Receivable$139.9 $136.5 Inventories 157.0 153.0 Accounts Payable (61.5) (59.6)Operating Working Capital$235.4 $229.9 Free Cash Flow(amounts in millions)Q3 2018Q3 2017Operating Cash Flow$59.0 $43.3 Less Capex (21.1) (23.3)Free Cash Flow$37.9 $20.0

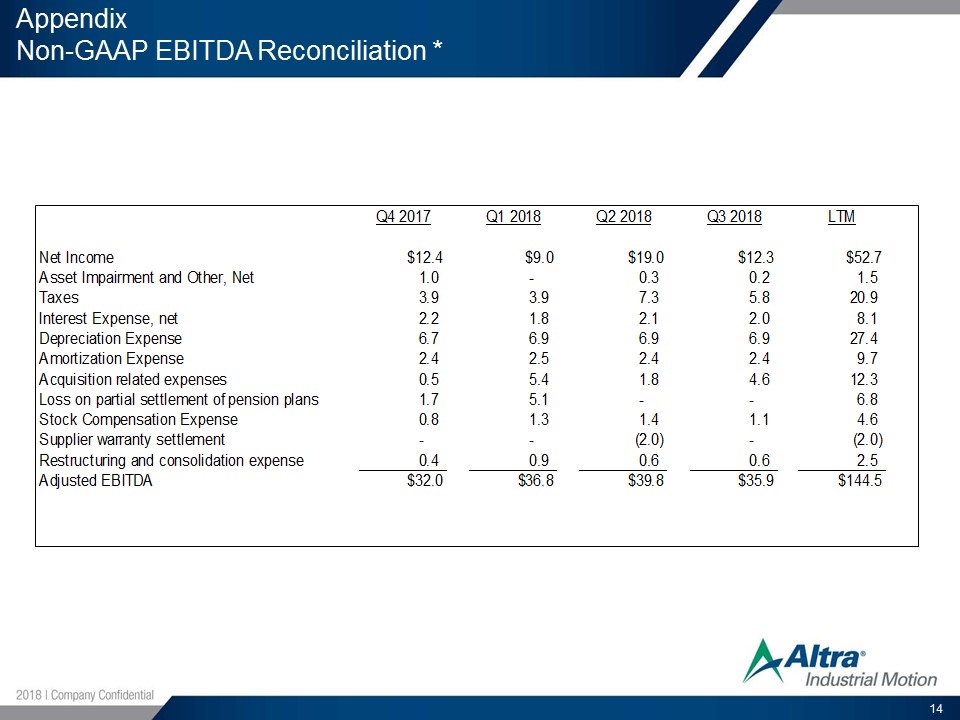

Appendix Non-GAAP EBITDA Reconciliation * EBITDA Reconciliation(amounts in millions)Q4 2017Q1 2018Q2 2018Q3 2018LTMNet Income$12.4$9.0$19.0$12.3$52.7Asset Impairment and Other, Net 1.0 - 0.3 0.2 1.5 Taxes 3.9 3.9 7.3 5.8 20.9 Interest Expense, net 2.2 1.8 2.1 2.0 8.1 Depreciation Expense 6.7 6.9 6.9 6.9 27.4 Amortization Expense 2.4 2.5 2.4 2.4 9.7 Acquisition related expenses 0.5 5.4 1.8 4.6 12.3 Loss on partial settlement of pension plans 1.7 5.1 - - 6.8 Stock Compensation Expense 0.8 1.3 1.4 1.1 4.6 Supplier warranty settlement - - (2.0) - (2.0)Restructuring and consolidation expense 0.4 0.9 0.6 0.6 2.5 Adjusted EBITDA $32.0$36.8$39.8$35.9$144.5

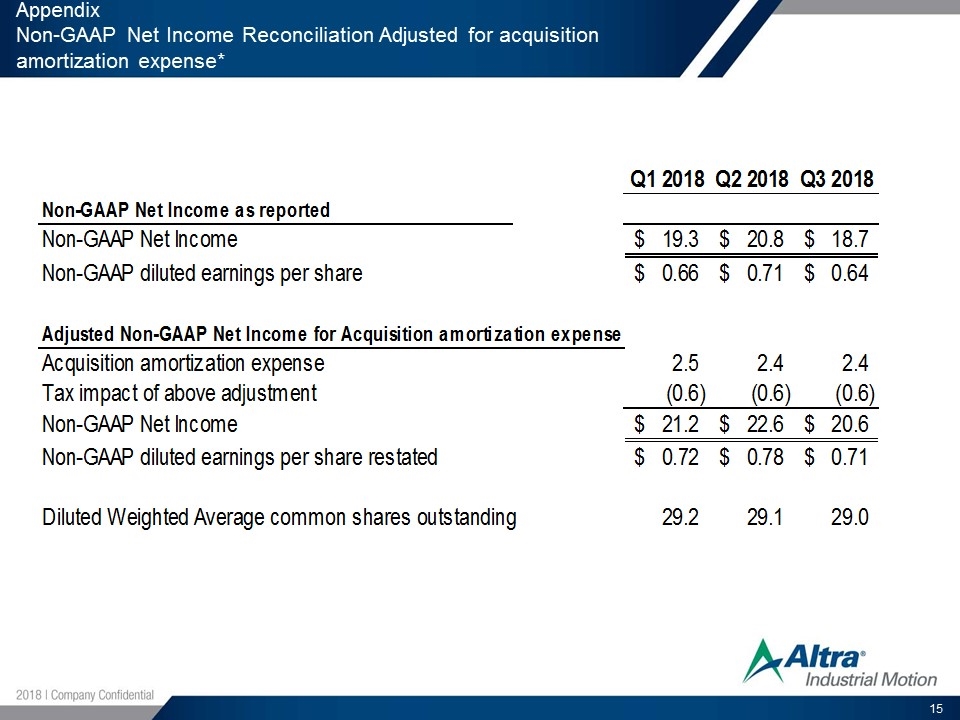

Appendix Non-GAAP Net Income Reconciliation Adjusted for acquisition amortization expense* Restated Non-GAAP Net Income with Acquisition amortization expenseQ3 2018Q1 2018Q2 2018 Q3 2018 Fiscal Year 2018Non-GAAP Net Income as reportedNon-GAAP Net Income $19.3 $20.8 $18.7 $100.5 $103.8 Non-GAAP diluted earnings per share $0.66 $0.71 $0.64 $2.66 $2.71 - Adjusted Non-GAAP Net Income for Acquisition amortization expenseAcquisition amortization expense 2.5 2.4 2.4 7.3 7.3 Tax impact of above adjustment (0.6) (0.6) (0.6) (1.8) (1.8)Non-GAAP Net Income $21.2 $22.6 $20.6 $106.1 $109.3 Non-GAAP diluted earnings per share restated $0.72 $0.78 $0.71 $2.86 $2.91 Diluted Weighted Average common shares outstanding 29.2 29.1 29.0 37.6 37.6