Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - VISA INC. | earningsdeck4q18pdfw.htm |

| 8-K - 8-K - VISA INC. | form8-kforearningsrelease9.htm |

Q4 and Full-Year 2018 Results (Ending September 30, 2018) Alfred F. Kelly, Jr. , Chief Executive Officer, Visa Inc., commented on the results: “We closed our fiscal year with strong momentum, delivering robust revenue and earnings growth fueled by double-digit increases in payments volume, cross-border volume and processed transactions. The major aspects of the Visa Europe integration concluded successfully with the completion of our platform migration and the shift to commercial client contracts. Aside from the impact of the stronger dollar, positive business trends remain intact as we enter our new fiscal year.” Q4 2018 Full-Year 2018 in billions, except percentages and per share data USD YoY Change USD YoY Change Net Operating Revenues $5.4 12% $20.6 12% GAAP Net Income $2.8 33% $10.3 54% Adjusted Net Income(1) $2.8 31% $10.7 29% GAAP Earnings Per Share $1.23 37% $4.42 58% Adjusted Earnings Per Share(1) $1.21 34% $4.61 32% (1) Adjusted Net Income and Adjusted Earnings Per Share exclude special items in the current and prior fiscal years. Q4 and Full-Year 2018 Key Business Drivers (YoY growth, volume in constant dollars) Payments volume Q4: +11% | Full-Year: +11% Cross-border volume Q4: +10% | Full-Year: +10% Processed transactions Q4: +12% | Full-Year: +12% Visa Inc. Reports Fiscal Fourth Quarter and Full-Year 2018 Results San Francisco, CA, October 24, 2018 – Visa Inc. (NYSE: V) Fiscal Fourth Quarter: GAAP net income of $2.8B or $1.23 per share and adjusted net income of $2.8B or $1.21 per share Net operating revenues of $5.4B, an increase of 12% Fiscal Full-Year: GAAP net income of $10.3B or $4.42 per share and adjusted net income of $10.7B or $4.61 per share Net operating revenues of $20.6B, an increase of 12% Double-digit growth in payments volume, cross-border volume and processed transactions for Q4 and full-year Returned $2.1B and $9.1B of capital to shareholders in the form of share repurchases and dividends for Q4 and full-year, respectively The board of directors increased the Company’s quarterly cash dividend by 19% to $0.25 per share Exhibit 99.1

2 Fiscal Fourth Quarter 2018 — Financial Highlights GAAP net income in the fiscal fourth quarter was $2.8 billion or $1.23 per share, increases of 33% and 37%, respectively, over prior year’s results. On an adjusted basis, the Company’s financial results exclude a $49 million net income benefit from a donation of available-for-sale investment securities to the Visa Foundation. Excluding this special item, adjusted net income for the quarter was $2.8 billion or $1.21 per share, increases of 31% and 34%, respectively, over prior year’s results (refer to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented). Exchange rate shifts versus the prior year negatively impacted earnings per share growth by approximately 1 percentage point. All references to earnings per share assume fully-diluted class A share count. Net operating revenues in the fiscal fourth quarter were $5.4 billion, an increase of 12%, driven by continued growth in payments volume, cross-border volume and processed transactions. Exchange rate shifts versus the prior year negatively impacted reported net operating revenues growth by approximately 0.5 percentage points. Payments volume for the three months ended June 30, 2018, on which fiscal fourth quarter service revenue is recognized, grew 11% over the prior year on a constant-dollar basis. Payments volume for the three months ended September 30, 2018, grew 11% over the prior year on a constant-dollar basis. Cross-border volume growth, on a constant-dollar basis, was 10% for the three months ended September 30, 2018. Total processed transactions, which represent transactions processed by Visa, for the three months ended September 30, 2018, were 32.8 billion, a 12% increase over the prior year. Fiscal fourth quarter service revenues were $2.3 billion, an increase of 10% over the prior year, and are recognized based on payments volume in the prior quarter. All other revenue categories are recognized based on current quarter activity. Data processing revenues rose 16% over the prior year to $2.4 billion. International transaction revenues grew 10% over the prior year to $2.0 billion. Other revenues of $256 million rose 13% over the prior year. Client incentives, a contra revenue item, were $1.5 billion and represent 21.7% of gross revenues. GAAP operating expenses were $2.0 billion for the fiscal fourth quarter, a 23% increase over the prior year's results, including the special item. Excluding the $195 million operating expense impact of the special item, adjusted operating expenses grew 12% over the prior year, primarily driven by personnel expenses. GAAP non-operating income was $132 million for the fiscal fourth quarter. Excluding the realized gain from the special item, the adjusted non-operating expense was $61 million. GAAP effective income tax rate was 19.6% for the quarter ended September 30, 2018, including a one-time $51 million tax benefit related to the special item. Excluding the tax impact from this special item, the adjusted effective income tax rate was 21.0% for the fiscal fourth quarter. Cash, cash equivalents, and available-for-sale investment securities were $15.7 billion at September 30, 2018. The weighted-average number of diluted shares of class A common stock outstanding was 2.31 billion for the quarter ended September 30, 2018.

3 Fiscal Full-Year 2018 — Financial Highlights GAAP net income in the fiscal full-year 2018 was $10.3 billion or $4.42 per share, increases of 54% and 58%, respectively, over prior year’s results. Current year’s results included special items related to the U.S. tax reform, a litigation provision associated with the interchange multi-district litigation case and a donation of available-for-sale investment securities to the Visa Foundation, while prior year’s results included special items related to the legal entity reorganization of Visa Europe and certain other Visa subsidiaries. Excluding these special items, adjusted net income for the full-year was $10.7 billion or $4.61 per share, increases of 29% and 32%, respectively, over prior year’s results (refer to the accompanying financial tables for further details and a reconciliation of the non-GAAP measures presented). Exchange rate shifts versus the prior year positively impacted earnings per share growth by approximately 1.5 percentage points. Net operating revenues in the fiscal full-year 2018 were $20.6 billion, an increase of 12%, driven by continued growth in payments volume, cross-border volume and processed transactions. Exchange rate shifts versus the prior year positively impacted reported net operating revenues growth by approximately 1 percentage point. Payments volume for the twelve months ended September 30, 2018, grew 11% over the prior year on a constant-dollar basis. Cross-border volume growth, on a constant-dollar basis, was 10% for the twelve months ended September 30, 2018. Total processed transactions, which represent transactions processed by Visa, for the twelve months ended September 30, 2018, were 124.3 billion, a 12% increase over the prior year. Fiscal full-year 2018 service revenues were $8.9 billion, an increase of 12% over the prior year. Data processing revenues rose 16% over the prior year to $9.0 billion. International transaction revenues grew 14% over the prior year to $7.2 billion. Other revenues of $944 million rose 12% over the prior year. Client incentives, a contra revenue item, were $5.5 billion and represent 21.0% of gross revenues. GAAP operating expenses were $7.7 billion for the fiscal full-year 2018, a 23% increase over the prior year's results, including the special items. Current year’s results included special items related to a litigation provision associated with the interchange multi- district litigation case and a donation of available-for-sale investment securities to the Visa Foundation, while prior year’s results included special items related to the legal entity reorganization of Visa Europe and certain other Visa subsidiaries. Excluding these special items, adjusted operating expenses grew 14% over the prior year, primarily driven by personnel expenses. GAAP non-operating expense was $148 million for the fiscal full-year 2018. Excluding the realized gain from the donation of available-for-sale investment securities to the Visa Foundation, the adjusted non-operating expense was $341 million. GAAP effective income tax rate was 19.6% for the twelve months ended September 30, 2018. Excluding current year’s special items related to the U.S. tax reform, litigation provision associated with the interchange multi-district litigation case and donation of available-for-sale investment securities to the Visa Foundation, the adjusted effective income tax rate was 20.0% for the fiscal full- year 2018. The weighted-average number of diluted shares of class A common stock outstanding was 2.33 billion for the fiscal full-year ended September 30, 2018.

4 Fiscal Full-Year 2018 — Other Notable Items On September 18, 2018, the Company, Mastercard and U.S. financial institution defendants agreed to settle and resolve class claims in the multi-district interchange litigation. The claims were originally brought by a class of U.S. retailers in 2005. The current agreement addresses monetary claims, and does not resolve class claims seeking modifications to network rules. The proposed settlement amount is approximately $6.2 billion. The Company’s share represents approximately $4.1 billion, which will be satisfied through funds previously deposited with the court plus the $600 million the Company deposited into its litigation escrow on June 28, 2018. No additional funds are required for this class settlement. The Company’s share is covered under its U.S. Retrospective Responsibility Plan, which was created to insulate the Company and class A shareholders from financial liability for certain litigation cases. During the three months ended September 30, 2018, the Company repurchased 11.5 million shares of class A common stock at an average price of $142.84 per share for $1.6 billion. During the twelve months ended September 30, 2018, the Company repurchased a total of 57.5 million shares of class A common stock at an average price of $124.25 per share for $7.2 billion. In addition, the $600 million litigation escrow deposit had the same impact on the Company’s as-converted class A common stock outstanding as a share repurchase as it reduced the conversion rate of class B common stock. The Company has $4.1 billion of remaining authorized funds for share repurchase as of September 30, 2018. On October 16, 2018, the board of directors declared a quarterly cash dividend of $0.25 per share of class A common stock (determined in the case of class B and C common stock and series B and C convertible participating preferred stock on an as- converted basis) payable on December 4, 2018, to all holders of record as of November 16, 2018. Financial Outlook for Fiscal Full-Year 2019 Visa Inc. provides its financial outlook for the following metrics for fiscal full-year 2019: Annual net revenue growth: Low double-digits on a nominal basis, with approximately 1 percentage point of negative foreign currency impact and de minimus impact from the new revenue accounting standard Client incentives as a percentage of gross revenues: 22% to 23% range Annual operating expense growth: Mid-single digit decrease on a GAAP basis and mid-to-high single digit increase adjusted for special items in fiscal 2018 (see note below). GAAP and non-GAAP growth includes an approximately 1.5 to 2 percentage point increase from the new revenue accounting standard Effective tax rate: 20.0% to 20.5% range Annual diluted class A common stock earnings per share growth: High teens on a GAAP nominal dollar basis and mid- teens on an adjusted, non-GAAP nominal dollar basis (see note below). Both include approximately 1 percentage point of negative foreign currency impact Note: Annual adjusted operating expense growth is derived from adjusted full-year 2018 operating expenses of $6.9 billion. Annual adjusted diluted class A common stock earnings per share growth is derived from adjusted full-year 2018 earnings per share results of $4.61. Refer to the accompanying financial tables for details and a reconciliation of the adjusted fiscal full-year 2018 results. Fiscal Fourth Quarter and Full-Year 2018 Earnings Results Conference Call Details Visa’s executive management team will host a live audio webcast beginning at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time) today to discuss the financial results and business highlights. All interested parties are invited to listen to the live webcast at http://investor.visa.com. A replay of the webcast will be available on the Visa Investor Relations website for 30 days. Investor information, including supplemental financial information, is available on Visa Inc.’s Investor Relations website at http://investor.visa.com.

5 Forward-Looking Statements This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to, among other things, our future operations, prospects, developments, strategies, business growth and financial outlook for fiscal full-year 2019. Forward-looking statements generally are identified by words such as “believes,” “estimates,” “expects,” “intends,” “may,” “projects,” “outlook”, “could,” “should,” “will,” “continue” and other similar expressions. All statements other than statements of historical fact could be forward-looking statements, which speak only as of the date they are made, are not guarantees of future performance and are subject to certain risks, uncertainties and other factors, many of which are beyond our control and are difficult to predict. Actual results could differ materially from those expressed in, or implied by, our forward-looking statements due to a variety of factors, including, but not limited to: increased oversight and regulation of the global payments industry and our business; impact of government-imposed restrictions on international payment systems; outcome of tax, litigation and governmental investigation matters; increasingly intense competition in the payments industry, including competition for our clients and merchants; proliferation and continuous evolution of new technologies and business models; our ability to maintain relationships with our clients, merchants and other third parties; brand or reputational damage; management changes; impact of global economic, political, market and social events or conditions; exposure to loss or illiquidity due to settlement guarantees; uncertainty surrounding the impact of the United Kingdom’s withdrawal from the European Union; a disruption, failure, breach or cyber-attack of our networks or systems; our ability to successfully integrate and manage our acquisitions and other strategic investments; and other factors described in our filings with the U.S. Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended September 30, 2017, and our subsequent reports on Forms 10-Q and 8-K. Except as required by law, we do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise. About Visa Inc. Visa Inc. (NYSE: V) is the world’s leader in digital payments. Our mission is to connect the world through the most innovative, reliable and secure payment network - enabling individuals, businesses and economies to thrive. Our advanced global processing network, VisaNet, provides secure and reliable payments around the world, and is capable of handling more than 65,000 transaction messages a second. Our relentless focus on innovation is a catalyst for the rapid growth of connected commerce on any device, and a driving force behind the dream of a cashless future for everyone, everywhere. As the world moves from analog to digital, Visa is applying our brand, products, people, network and scale to reshape the future of commerce. For more information, visit usa.visa.com/about-visa.html, usa.visa.com/visa-everywhere/blog.html and @VisaNews. Contacts Investor Relations Mike Milotich, 650-432-7644, InvestorRelations@visa.com Media Relations Will Stickney, 650-432-2990, GlobalMedia@visa.com

6 Fiscal Fourth Quarter 2018 — Financial Summary YoY Change GAAP Adjusted GAAP Adjusted Operating Revenues Service revenues 2,323$ 2,323$ 10% 10% Data processing revenues 2,394 2,394 16% 16% International transaction revenues 1,963 1,963 10% 10% Other revenues 256 256 13% 13% Client incentives (1,502) (1,502) 12% 12% Net operat ing revenues 5,434 5,434 12% 12% Operating Expenses Personnel 815 815 24% 24% Marketing 264 264 (9)% (9)% Network and processing 188 188 12% 12% Professional fees 134 134 (6)% (6)% Depreciation and amortization 163 163 11% 11% General and administrative 457 262 91% 9% Litigation provision 7 7 414% 414% Total operat ing expenses 2,028 1 ,833 23% 12% Operating income 3,406 3,601 6% 12% Non-operating income (expense) 132 (61) (218)% (46)% Effective tax rate 19.6% 21.0% (11 ppts) (10 ppts) Net income 2,845$ 2 ,796$ 33% 31% Earnings per share 1 .23$ 1 .21$ 37% 34% YoY Change Constant Nominal Payments volume 11% 8% Cross-border volume 10% 8% Processed transactions 12% 12% Q4 FISCAL 2018 KEY BUSINESS DRIVERS (in millions, except percentages and per share data) Q4 FISCAL 2018 INCOME STATEMENT SUMMARY Three Months Ended September 30, 2018

7 Fiscal Full-Year 2018 — Financial Summary YoY Change GAAP Adjusted GAAP Adjusted Operat ing Revenues Service revenues 8,918$ 8,918$ 12% 12% Data processing revenues 9,027 9,027 16% 16% International transaction revenues 7,211 7,211 14% 14% Other revenues 944 944 12% 12% Client incentives (5,491) (5,491) 20% 20% Net operating revenues 20,609 20,609 12% 12% Operat ing Expenses Personnel 3,170 3,170 21% 21% Marketing 988 988 7% 7% Network and processing 686 686 11% 11% Professional fees 446 446 9% 9% Depreciation and amortization 613 613 10% 10% General and administrative 1,145 950 8% 10% Litigation provision 607 7 NM (65)% Total operat ing expenses 7,655 6,860 23% 14% Operat ing income 12,954 13,749 7% 11% Non-operating expense (148) (341) (67)% (24)% Effective tax rate 19.6% 20.0% (23 ppts) (10 ppts) Net income 10,301$ 10 ,729$ 54% 29% Earnings per share 4.42$ 4.61$ 58% 32% NM - Not Meaningful YoY Change Constant Nominal Payments volume 11% 12% Cross-border volume 10% 14% Processed transactions 12% 12% FULL-YEAR FISCAL 2018 INCOME STATEMENT SUMMARY (in millions, except percentages and per share data) Twelve Months Ended September 30, 2018 FULL-YEAR FISCAL 2018 KEY BUSINESS DRIVERS

8 Visa Inc. Consolidated Balance Sheets (unaudited) September 30, 2018 September 30, 2017 (in millions, except par value data) Assets Cash and cash equivalents $ 8,162 $ 9,874 Restricted cash—U.S. litigation escrow 1,491 1,031 Investment securities: Trading 98 82 Available-for-sale 3,449 3,482 Settlement receivable 1,582 1,422 Accounts receivable 1,208 1,132 Customer collateral 1,324 1,106 Current portion of client incentives 340 344 Prepaid expenses and other current assets 562 550 Total current assets 18,216 19,023 Investment securities, available-for-sale 4,082 1,926 Client incentives 538 591 Property, equipment and technology, net 2,472 2,253 Goodwill 15,194 15,110 Intangible assets, net 27,558 27,848 Other assets 1,165 1,226 Total assets $ 69,225 $ 67,977 Liabilities Accounts payable $ 183 $ 179 Settlement payable 2,168 2,003 Customer collateral 1,325 1,106 Accrued compensation and benefits 901 757 Client incentives 2,834 2,089 Accrued liabilities 1,160 1,129 Deferred purchase consideration 1,300 — Current maturities of long-term debt — 1,749 Accrued litigation 1,434 982 Total current liabilities 11,305 9,994 Long-term debt 16,630 16,618 Deferred tax liabilities 4,618 5,980 Deferred purchase consideration — 1,304 Other liabilities 2,666 1,321 Total liabilities 35,219 35,217 Equity Preferred stock, $0.0001 par value, 25 shares authorized and 5 shares issued and outstanding as follows: Series A convertible participating preferred stock, none issued (the "class A equivalent preferred stock") — — Series B convertible participating preferred stock, 2 shares issued and outstanding at September 30, 2018 and 2017 (the "UK&I preferred stock") 2,291 2,326 Series C convertible participating preferred stock, 3 shares issued and outstanding at September 30, 2018 and 2017 (the "Europe preferred stock") 3,179 3,200 Class A common stock, $0.0001 par value, 2,001,622 shares authorized, 1,768 and 1,818 shares issued and outstanding at September 30, 2018 and 2017, respectively — — Class B common stock, $0.0001 par value, 622 shares authorized, 245 shares issued and outstanding at September 30, 2018 and 2017, respectively — — Class C common stock, $0.0001 par value, 1,097 shares authorized, 12 and 13 shares issued and outstanding at September 30, 2018 and 2017, respectively — — Right to recover for covered losses (7) (52) Additional paid-in capital 16,678 16,900 Accumulated income 11,318 9,508 Accumulated other comprehensive income (loss), net: Investment securities, available-for-sale (17) 73 Defined benefit pension and other postretirement plans (61) (76) Derivative instruments classified as cash flow hedges 60 (36) Foreign currency translation adjustments 565 917 Total accumulated other comprehensive income (loss), net 547 878 Total equity 34,006 32,760 Total liabilities and equity $ 69,225 $ 67,977

9 Visa Inc. Consolidated Statements of Operations (unaudited) Three Months Ended September 30, Twelve Months Ended September 30, 2018 2017 2018 2017 (in millions, except per share data) Operating Revenues Service revenues $ 2,323 $ 2,116 $ 8,918 $ 7,975 Data processing revenues 2,394 2,067 9,027 7,786 International transaction revenues 1,963 1,792 7,211 6,321 Other revenues 256 226 944 841 Client incentives (1,502) (1,346) (5,491) (4,565) Net operating revenues 5,434 4,855 20,609 18,358 Operating Expenses Personnel 815 655 3,170 2,628 Marketing 264 290 988 922 Network and processing 188 167 686 620 Professional fees 134 144 446 409 Depreciation and amortization 163 147 613 556 General and administrative 457 238 1,145 1,060 Litigation provision 7 2 607 19 Total operating expenses 2,028 1,643 7,655 6,214 Operating income 3,406 3,212 12,954 12,144 Non-operating Income (Expense) Interest expense (150) (148) (612) (563) Other 282 35 464 113 Total non-operating income (expense) 132 (113) (148) (450) Income before income taxes 3,538 3,099 12,806 11,694 Income tax provision 693 959 2,505 4,995 Net income $ 2,845 $ 2,140 $ 10,301 $ 6,699 Basic earnings per share Class A common stock $ 1.24 $ 0.91 $ 4.43 $ 2.80 Class B common stock $ 2.01 $ 1.49 $ 7.28 $ 4.62 Class C common stock $ 4.94 $ 3.62 $ 17.72 $ 11.21 Basic weighted-average shares outstanding Class A common stock 1,774 1,825 1,792 1,845 Class B common stock 245 245 245 245 Class C common stock 12 13 12 14 Diluted earnings per share Class A common stock $ 1.23 $ 0.90 $ 4.42 $ 2.80 Class B common stock $ 2.01 $ 1.49 $ 7.27 $ 4.61 Class C common stock $ 4.93 $ 3.61 $ 17.69 $ 11.19 Diluted weighted-average shares outstanding Class A common stock 2,306 2,368 2,329 2,395 Class B common stock 245 245 245 245 Class C common stock 12 13 12 14

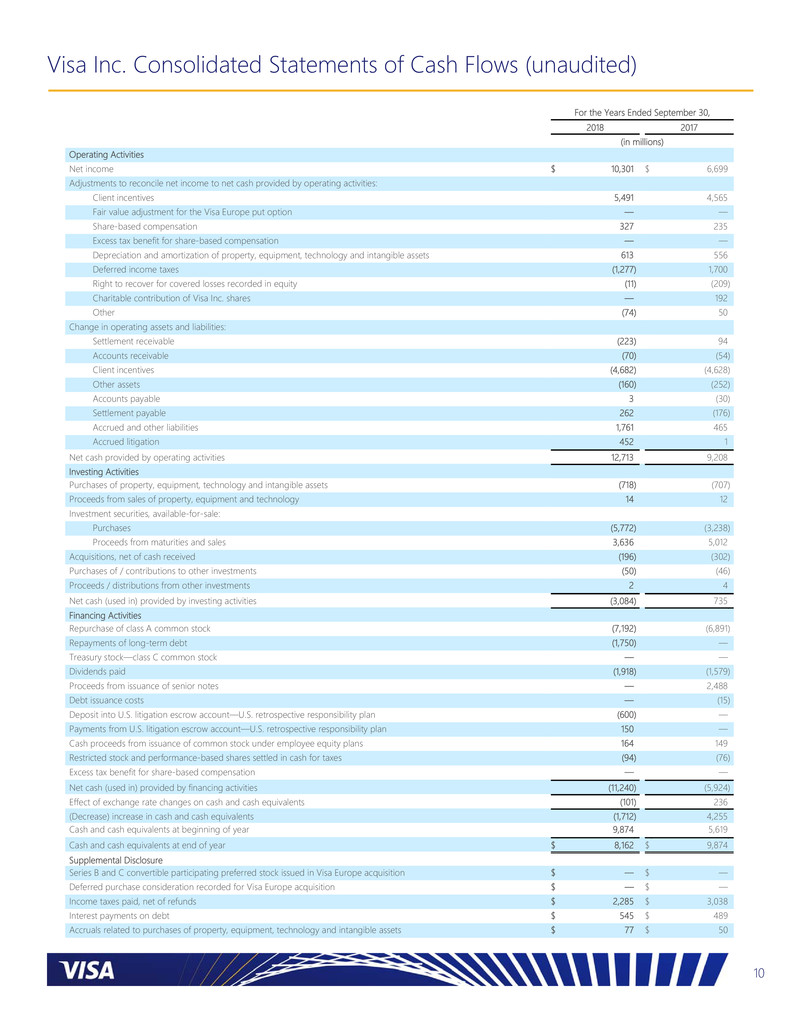

10 Visa Inc. Consolidated Statements of Cash Flows (unaudited) For the Years Ended September 30, 2018 2017 (in millions) Operating Activities Net income $ 10,301 $ 6,699 Adjustments to reconcile net income to net cash provided by operating activities: Client incentives 5,491 4,565 Fair value adjustment for the Visa Europe put option — — Share-based compensation 327 235 Excess tax benefit for share-based compensation — — Depreciation and amortization of property, equipment, technology and intangible assets 613 556 Deferred income taxes (1,277 ) 1,700 Right to recover for covered losses recorded in equity (11 ) (209 ) Charitable contribution of Visa Inc. shares — 192 Other (74 ) 50 Change in operating assets and liabilities: Settlement receivable (223 ) 94 Accounts receivable (70 ) (54 ) Client incentives (4,682 ) (4,628 ) Other assets (160 ) (252 ) Accounts payable 3 (30 ) Settlement payable 262 (176 ) Accrued and other liabilities 1,761 465 Accrued litigation 452 1 Net cash provided by operating activities 12,713 9,208 Investing Activities Purchases of property, equipment, technology and intangible assets (718 ) (707 ) Proceeds from sales of property, equipment and technology 14 12 Investment securities, available-for-sale: Purchases (5,772 ) (3,238 ) Proceeds from maturities and sales 3,636 5,012 Acquisitions, net of cash received (196 ) (302 ) Purchases of / contributions to other investments (50 ) (46 ) Proceeds / distributions from other investments 2 4 Net cash (used in) provided by investing activities (3,084 ) 735 Financing Activities Repurchase of class A common stock (7,192 ) (6,891 ) Repayments of long-term debt (1,750 ) — Treasury stock—class C common stock — — Dividends paid (1,918 ) (1,579 ) Proceeds from issuance of senior notes — 2,488 Debt issuance costs — (15 ) Deposit into U.S. litigation escrow account—U.S. retrospective responsibility plan (600 ) — Payments from U.S. litigation escrow account—U.S. retrospective responsibility plan 150 — Cash proceeds from issuance of common stock under employee equity plans 164 149 Restricted stock and performance-based shares settled in cash for taxes (94 ) (76 ) Excess tax benefit for share-based compensation — — Net cash (used in) provided by financing activities (11,240 ) (5,924 ) Effect of exchange rate changes on cash and cash equivalents (101 ) 236 (Decrease) increase in cash and cash equivalents (1,712 ) 4,255 Cash and cash equivalents at beginning of year 9,874 5,619 Cash and cash equivalents at end of year $ 8,162 $ 9,874 Supplemental Disclosure Series B and C convertible participating preferred stock issued in Visa Europe acquisition $ — $ — Deferred purchase consideration recorded for Visa Europe acquisition $ — $ — Income taxes paid, net of refunds $ 2,285 $ 3,038 Interest payments on debt $ 545 $ 489 Accruals related to purchases of property, equipment, technology and intangible assets $ 77 $ 50

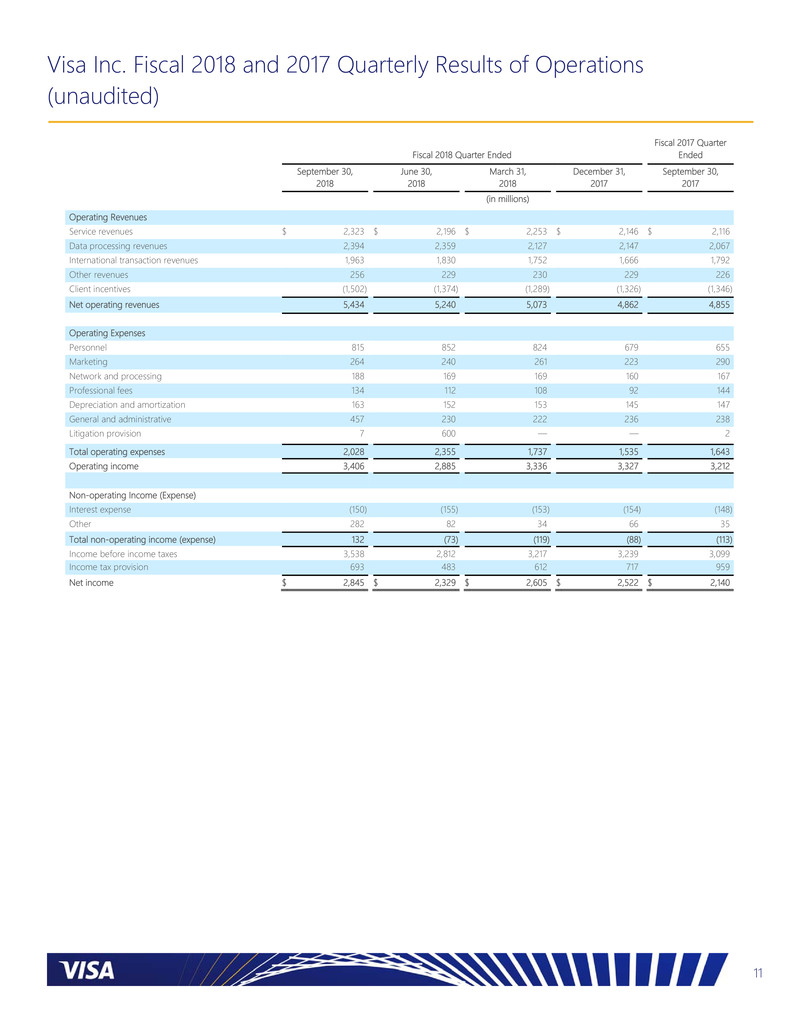

11 Visa Inc. Fiscal 2018 and 2017 Quarterly Results of Operations (unaudited) Fiscal 2018 Quarter Ended Fiscal 2017 Quarter Ended September 30, 2018 June 30, 2018 March 31, 2018 December 31, 2017 September 30, 2017 (in millions) Operating Revenues Service revenues $ 2,323 $ 2,196 $ 2,253 $ 2,146 $ 2,116 Data processing revenues 2,394 2,359 2,127 2,147 2,067 International transaction revenues 1,963 1,830 1,752 1,666 1,792 Other revenues 256 229 230 229 226 Client incentives (1,502) (1,374) (1,289 ) (1,326) (1,346) Net operating revenues 5,434 5,240 5,073 4,862 4,855 Operating Expenses Personnel 815 852 824 679 655 Marketing 264 240 261 223 290 Network and processing 188 169 169 160 167 Professional fees 134 112 108 92 144 Depreciation and amortization 163 152 153 145 147 General and administrative 457 230 222 236 238 Litigation provision 7 600 — — 2 Total operating expenses 2,028 2,355 1,737 1,535 1,643 Operating income 3,406 2,885 3,336 3,327 3,212 Non-operating Income (Expense) Interest expense (150) (155) (153 ) (154) (148) Other 282 82 34 66 35 Total non-operating income (expense) 132 (73) (119 ) (88) (113) Income before income taxes 3,538 2,812 3,217 3,239 3,099 Income tax provision 693 483 612 717 959 Net income $ 2,845 $ 2,329 $ 2,605 $ 2,522 $ 2,140

12 Visa Inc. Reconciliation of Non-GAAP Financial Results (unaudited) Our financial results for the three and twelve months ended September 30, 2018 and the twelve months ended September 30, 2017 reflected the impact of certain significant items that we believe were not indicative of our operating performance in these or future periods, as they were either non-recurring or had no cash impact. As such, we believe the presentation of adjusted financial results excluding the following items provides a clearer understanding of our operating performance for the periods presented. There were no comparable adjustments recorded for the three months ended September 30, 2017. • Charitable contribution. ▪ During the three months ended September 30, 2018, we donated available-for-sale investment securities to the Visa Foundation and recognized a non-cash general and administrative expense of $195 million, before tax, and recorded $193 million of realized gain on the donation of these investments as non-operating income. Net of the related cash tax benefit of $51 million, determined by applying applicable tax rates, adjusted net income decreased by $49 million. ▪ During the twelve months ended September 30, 2017, associated with our legal entity reorganization, we recognized a non-cash general and administrative expense of $192 million, before tax, related to the charitable donation of Visa Inc. shares that were acquired as part of the Visa Europe acquisition and held as treasury stock. Net of the related cash tax benefit of $71 million, determined by applying applicable tax rates, adjusted net income increased by $121 million. • Litigation provision. During the twelve months ended September 30, 2018, we recorded a litigation provision of $600 million and related tax benefits of $137 million associated with the interchange multidistrict litigation. The tax impact is determined by applying applicable federal and state tax rates to the litigation provision. Under the U.S. retrospective responsibility plan, we recover the monetary liabilities related to the U.S. covered litigation through a reduction to the conversion rate of our class B common stock to shares of class A common stock. • Remeasurement of deferred tax balances. During the twelve months ended September 30, 2018, in connection with the Tax Cuts and Jobs Act’s reduction of the corporate income tax rate, we remeasured our net deferred tax liabilities as of the enactment date, resulting in the recognition of a non-recurring, non-cash income tax benefit of $1.1 billion. • Transition tax on foreign earnings. During the twelve months ended September 30, 2018, in connection with the Tax Cuts and Jobs Act’s requirement that we include certain untaxed foreign earnings of non-U.S. subsidiaries in our fiscal 2018 taxable income, we recorded a one-time transition tax estimated to be approximately $1.1 billion. • Elimination of deferred tax balances. During the twelve months ended September 30, 2017, in connection with our legal entity reorganization, we eliminated deferred tax balances originally recognized upon the acquisition of Visa Europe, resulting in the recognition of a non-recurring, non-cash income tax provision of $1.5 billion.

13 Visa Inc. Reconciliation of Non-GAAP Financial Results – continued (unaudited) Adjusted financial results are non-GAAP financial measures and should not be relied upon as substitutes for measures calculated in accordance with U.S. GAAP. The following tables reconcile our as-reported financial measures calculated in accordance with U.S. GAAP, to our respective non-GAAP adjusted financial measures for the three and twelve months ended September 30, 2018 and the twelve months ended September 30, 2017. There were no comparable adjustments recorded during the three months ended September 30, 2017. Three Months Ended September 30, 2018 (in millions, except percentages and per share data) Operating Expenses Operating Margin (1),(2) Non- operating (Expense) Income Income Before Income Taxes Income Tax Provision Effective Income Tax Rate(1) Net Income Diluted Earnings Per Share(1) As reported $ 2,028 63 % $ 132 $ 3,538 $ 693 19.6 % $ 2,845 $ 1.23 Charitable contribution (195) 4 % (193 ) 2 51 (49) (0.02 ) As adjusted $ 1,833 66 % $ (61) $ 3,540 $ 744 21.0 % $ 2,796 $ 1.21 Twelve Months Ended September 30, 2018 (in millions, except percentages and per share data) Operating Expenses Operating Margin (1),(2) Non- operating (Expense) Income Income Before Income Taxes Income Tax Provision Effective Income Tax Rate(1) Net Income Diluted Earnings Per Share(1) As reported $ 7,655 63 % $ (148) $ 12,806 $ 2,505 19.6 % $ 10,301 $ 4.42 Charitable contribution (195) 1 % (193) 2 51 (49) (0.02) Litigation provision (600) 3 % — 600 137 463 0.20 Remeasurement of deferred tax liability — —% — — 1,133 (1,133) (0.49) Transition tax on foreign earnings — —% — — (1,147) 1,147 0.49 As adjusted $ 6,860 67 % $ (341) $ 13,408 $ 2,679 20.0 % $ 10,729 $ 4.61 Twelve Months Ended September 30, 2017 (in millions, except percentages and per share data) Operating Expenses Operating Margin (1),(2) Non- operating (Expense) Income Income Before Income Taxes Income Tax Provision Effective Income Tax Rate(1) Net Income Diluted Earnings Per Share(1) As reported $ 6,214 66 % $ (450) $ 11,694 $ 4,995 42.7 % $ 6,699 $ 2.80 Charitable contribution (192) 1 % — 192 71 121 0.05 Elimination of deferred tax balances — — % — — (1,515) 1,515 0.63 As adjusted $ 6,022 67 % $ (450) $ 11,886 $ 3,551 29.9 % $ 8,335 $ 3.48 (1) Figures in the table may not recalculate exactly due to rounding. Operating margin, effective income tax rate, diluted earnings per share and their respective totals are calculated based on unrounded numbers. (2) Operating margin is calculated as operating income divided by net operating revenues.

14 Operational Performance Data The tables below provide information regarding the available operational results for the 3 months ended September 30, 2018, as well as the prior four quarterly reporting periods and the 12 months ended September 30, 2018 and 2017, for cards carrying the Visa, Visa Electron, V PAY and Interlink brands. Sections 1-3 below reflect the acquisition of Visa Europe, with Europe included in Visa Inc. results effective the 3 months ended September 30, 2016. 1. Branded Volume and Transactions The tables present regional total volume, payments volume, and cash volume, and the number of payments transactions, cash transactions, accounts and cards for cards carrying the Visa, Visa Electron, V PAY and Interlink brands and excludes Europe co- badged volume and transactions for all periods. Card counts include PLUS proprietary cards. Nominal and constant dollar growth rates over prior years are provided for volume-based data. Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $596 4.9% 7.8% $474 7.4% 10.1% 7,030 $122 (3.6%) 0.0% 1,034 3 4 Canada 72 3.9% 9.0% 66 4.1% 9.3% 954 6 1.3% 6.3% 11 - - CEMEA 264 0.4% 6.3% 93 10.2% 17.0% 4,091 171 (4.3%) 1.2% 1,226 3 3 LAC 230 (9.2%) 8.1% 97 (5.4%) 15.9% 3,281 134 (11.8%) 3.1% 1,198 2 2 US 1,078 10.2% 10.2% 934 11.7% 11.7% 17,414 144 1.9% 1.9% 952 5 6 Europe 567 2.2% 7.5% 422 4.8% 9.1% 9,467 145 (4.6%) 3.3% 1,136 18 22 Visa Inc. 2,808 4.5% 8.6% 2,086 8.0% 11.1% 42,236 722 (4.5%) 1.9% 5,558 32 37 Visa Credit Programs US $512 10.7% 10.7% $498 11.0% 11.0% 6,143 $14 0.2% 0.2% 16 - - International 725 3.5% 9.2% 673 4.0% 9.9% 9,958 52 (3.4%) 1.3% 232 969 1,108 Visa Inc. 1,237 6.3% 9.8% 1,171 6.9% 10.3% 16,101 66 (2.6%) 1.1% 247 969 1,108 Visa Debit Programs US $566 9.8% 9.8% $436 12.4% 12.4% 11,271 $130 2.1% 2.1% 936 - - International 1,005 (0.4%) 6.4% 480 7.0% 11.8% 14,864 526 (6.3%) 2.0% 4,375 2,028 2,225 Visa Inc. 1,571 3.1% 7.6% 915 9.5% 12.1% 26,135 656 (4.7%) 2.0% 5,311 2,028 2,225 For the 3 Months Ended September 30, 2018 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $611 13.3% 9.3% $484 17.0% 12.3% 6,696 $128 1.1% (0.7%) 1,006 899 1,004 Canada 73 13.6% 9.2% 67 13.8% 9.4% 921 6 11.2% 6.9% 11 52 58 CEMEA 269 3.0% 6.4% 93 15.0% 18.7% 3,946 176 (2.4%) 0.9% 1,238 351 339 LAC 240 (3.5%) 8.2% 101 1.6% 16.4% 3,199 138 (6.9%) 2.9% 1,183 429 465 US 1,072 9.2% 9.2% 928 10.5% 10.5% 17,191 144 2.0% 2.0% 993 708 855 Europe 578 12.9% 7.3% 428 15.1% 8.8% 9,074 150 7.1% 3.5% 1,096 498 547 Visa Inc. 2,843 9.1% 8.5% 2,101 12.7% 11.1% 41,027 742 0.0% 1.7% 5,527 2,937 3,268 Visa Credit Programs US $506 10.0% 10.0% $493 10.4% 10.4% 5,990 $14 (4.6%) (4.6%) 15 265 335 International 742 12.7% 10.5% 690 13.6% 11.3% 9,687 52 2.3% 0.1% 219 689 764 Visa Inc. 1,248 11.6% 10.3% 1,183 12.2% 11.0% 15,678 66 0.8% (0.9%) 234 954 1,098 Visa Debit Programs US $565 8.6% 8.6% $435 10.5% 10.5% 11,200 $131 2.7% 2.7% 978 443 521 International 1,029 6.4% 6.4% 484 15.8% 12.0% 14,149 546 (0.7%) 1.8% 4,315 1,540 1,649 Visa Inc. 1,595 7.2% 7.1% 919 13.2% 11.3% 25,349 676 0.0% 2.0% 5,293 1,983 2,169 For the 3 Months Ended June 30, 2018

15 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $605 15.7% 8.6% $472 18.1% 10.9% 6,224 $133 8.2% 0.9% 988 886 987 Canada 65 13.3% 9.1% 60 13.0% 8.9% 819 6 16.7% 12.3% 11 51 57 CEMEA 258 9.5% 7.2% 89 21.6% 18.3% 3,586 170 4.1% 2.1% 1,185 346 336 LAC 254 5.8% 8.1% 106 10.6% 15.0% 3,079 148 2.6% 3.7% 1,172 428 461 US 993 9.3% 9.3% 854 10.1% 10.1% 15,881 139 4.6% 4.6% 973 705 872 Europe 558 20.9% 7.9% 416 23.0% 9.6% 8,318 141 15.1% 3.2% 990 495 543 Visa Inc. 2,734 12.6% 8.5% 1,997 15.0% 10.7% 37,907 737 6.6% 2.9% 5,320 2,912 3,257 Visa Credit Programs US $460 10.0% 10.0% $445 10.3% 10.3% 5,420 $15 0.9% 0.9% 15 265 335 International 721 15.9% 9.6% 670 16.6% 10.4% 8,986 51 8.1% 0.8% 206 681 754 Visa Inc. 1,181 13.5% 9.8% 1,115 14.0% 10.3% 14,406 66 6.4% 0.9% 221 946 1,090 Visa Debit Programs US $533 8.7% 8.7% $409 9.9% 9.9% 10,460 $125 5.0% 5.0% 958 440 537 International 1,020 13.8% 7.0% 473 22.7% 12.4% 13,041 546 7.0% 2.7% 4,141 1,526 1,630 Visa Inc. 1,553 12.0% 7.6% 882 16.4% 11.2% 23,501 671 6.7% 3.2% 5,099 1,966 2,167 For the 3 Months Ended March 31, 2018 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $599 9.7% 6.8% $468 11.2% 8.2% 6,357 $131 4.8% 2.1% 1,001 874 971 Canada 72 15.4% 9.8% 67 15.6% 10.1% 884 5 12.5% 7.1% 11 51 57 CEMEA 271 10.3% 6.7% 89 23.8% 19.1% 3,589 182 4.7% 1.6% 1,271 342 332 LAC 270 8.0% 7.0% 112 13.8% 13.7% 3,151 159 4.3% 2.8% 1,202 427 462 US 1,018 8.5% 8.5% 881 9.5% 9.5% 16,471 137 2.7% 2.7% 957 701 882 Europe 565 15.3% 7.7% 416 17.6% 9.4% 8,746 148 9.4% 3.0% 1,058 485 539 Visa Inc. 2,795 10.4% 7.7% 2,033 12.5% 9.8% 39,197 762 5.2% 2.4% 5,500 2,880 3,243 Visa Credit Programs US $492 10.6% 10.6% $478 11.2% 11.2% 5,923 $13 (5.9%) (5.9%) 16 267 340 International 732 12.5% 9.0% 678 12.9% 9.6% 9,332 54 7.3% 1.8% 223 670 744 Visa Inc. 1,223 11.7% 9.6% 1,156 12.2% 10.2% 15,255 67 4.3% 0.1% 239 937 1,084 Visa Debit Programs US $526 6.7% 6.7% $403 7.6% 7.6% 10,548 $124 3.7% 3.7% 941 434 542 International 1,045 10.8% 6.0% 474 17.8% 10.7% 13,394 571 5.6% 2.4% 4,320 1,509 1,617 Visa Inc. 1,572 9.4% 6.2% 877 12.9% 9.3% 23,942 695 5.3% 2.6% 5,261 1,943 2,159 For the 3 Months Ended December 31, 2017 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $568 5.0% 5.0% $441 8.2% 8.8% 6,128 $127 (4.8%) (6.3%) 959 849 952 Canada 69 11.8% 7.0% 64 12.0% 7.2% 843 6 9.4% 4.7% 11 50 56 CEMEA 263 10.8% 7.6% 85 24.4% 19.5% 3,447 178 5.4% 2.7% 1,258 346 334 LAC 254 7.4% 5.8% 102 11.4% 10.3% 2,996 152 4.9% 3.1% 1,146 431 462 US 978 8.2% 8.2% 836 8.9% 8.9% 16,002 142 4.6% 4.6% 1,008 700 863 Europe 555 9.4% 7.9% 403 11.8% 10.1% 8,259 152 3.4% 2.1% 1,090 484 541 Visa Inc. 2,687 8.0% 7.2% 1,931 10.2% 9.5% 37,675 756 2.9% 1.4% 5,471 2,859 3,209 Visa Credit Programs US $463 9.1% 9.1% $449 9.7% 9.7% 5,648 $14 (7.0%) (7.0%) 17 264 336 International 700 6.6% 5.7% 647 7.3% 7.1% 9,080 54 (1.5%) (4.1%) 230 661 734 Visa Inc. 1,163 7.5% 7.0% 1,095 8.2% 8.2% 14,728 68 (2.7%) (4.8%) 247 925 1,070 Visa Debit Programs US $515 7.5% 7.5% $388 8.0% 8.0% 10,353 $127 6.1% 6.1% 991 436 527 International 1,009 8.9% 6.8% 448 17.3% 14.6% 12,594 561 2.9% 1.1% 4,233 1,499 1,611 Visa Inc. 1,524 8.4% 7.1% 836 12.8% 11.4% 22,947 688 3.5% 2.0% 5,224 1,934 2,139 For the 3 Months Ended September 30, 2017

16 (1) Europe payments volume growth, when including Europe in prior periods before the Visa Inc. acquisition, is 10% Constant USD and 2% Nominal USD Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $2,412 10.8% 8.1% $1,898 13.2% 10.4% 26,307 $514 2.6% 0.6% 4,029 3 4 Canada 283 11.3% 9.3% 260 11.4% 9.4% 3,578 22 10.1% 8.1% 45 - - CEMEA 1,062 5.6% 6.6% 364 17.3% 18.3% 15,211 698 0.4% 1.4% 4,921 3 3 LAC 994 0.2% 7.8% 416 5.0% 15.2% 12,709 578 (3.0%) 3.1% 4,755 2 2 US 4,161 9.3% 9.3% 3,596 10.4% 10.4% 66,956 565 2.8% 2.8% 3,875 5 6 Europe 2,268 12.4% 7.6% 1,683 14.7% 9.2% 35,604 585 6.2% 3.2% 4,280 1,496 1,651 Visa Inc. 11,180 9.0% 8.3% 8,218 12.0% 10.7% 160,367 2,963 1.7% 2.3% 21,905 1,509 1,666 Visa Credit Programs US $1,970 10.3% 10.3% $1,914 10.7% 10.7% 23,477 $56 (2.3%) (2.3%) 62 - - International 2,919 10.9% 9.6% 2,711 11.6% 10.3% 37,963 209 3.4% 1.0% 879 969 1,108 Visa Inc. 4,890 10.7% 9.9% 4,625 11.2% 10.5% 61,439 265 2.1% 0.3% 941 969 1,108 Visa Debit Programs US $2,191 8.5% 8.5% $1,682 10.1% 10.1% 43,480 $509 3.3% 3.3% 3,813 - - International 4,100 7.4% 6.5% 1,911 15.5% 11.7% 55,448 2,189 1.3% 2.3% 17,150 2,028 2,225 Visa Inc. 6,291 7.8% 7.1% 3,592 12.9% 11.0% 98,927 2,698 1.7% 2.5% 20,964 2,028 2,225 For the 12 Months Ended September 30, 2018 Total Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Payments Transactions (millions) Cash Volume ($ billions) Growth (Nominal USD) Growth (Constant USD) Cash Transactions (millions) Accounts (millions) Cards (millions) All Visa Credit & Debit Asia Pacific $2,177 3.3% 4.2% $1,676 7.1% 8.4% 23,351 $501 (7.6%) (7.8%) 3,766 849 952 Canada 254 8.4% 7.1% 234 8.6% 7.4% 3,160 20 5.8% 4.5% 43 50 56 CEMEA 1,006 11.4% 7.7% 310 24.8% 18.9% 12,421 696 6.3% 3.3% 5,061 346 334 LAC 992 10.2% 8.0% 396 14.6% 11.5% 12,093 596 7.5% 5.9% 4,664 431 462 US 3,806 10.3% 10.3% 3,256 11.3% 11.3% 61,979 550 4.5% 4.5% 3,878 700 863 Europe (1) 2,018 1,467 31,131 551 4,279 484 541 Visa Inc. 10,253 26.5% 27.4% 7,340 29.7% 31.0% 144,134 2,913 19.2% 19.0% 21,691 2,859 3,209 Visa Credit Programs US $1,786 16.4% 16.4% $1,729 17.1% 17.1% 21,473 $57 (2.7%) (2.7%) 65 264 336 International 2,632 22.4% 23.5% 2,430 21.8% 23.0% 35,017 202 30.5% 30.2% 928 661 734 Visa Inc. 4,417 19.9% 20.6% 4,158 19.8% 20.5% 56,489 259 21.4% 21.3% 993 925 1,070 Visa Debit Programs US $2,020 5.4% 5.4% $1,528 5.5% 5.5% 40,506 $493 5.4% 5.4% 3,813 436 527 International 3,816 52.5% 54.5% 1,654 123.6% 129.8% 47,139 2,162 22.6% 22.4% 16,886 1,499 1,611 Visa Inc. 5,836 32.1% 33.2% 3,182 45.4% 47.7% 87,645 2,654 19.0% 18.8% 20,698 1,934 2,139 For the 12 Months Ended September 30, 2017

17 2. Cross-Border Volume The table below represents cross-border volume growth for cards carrying the Visa, Visa Electron,V PAY, Interlink and PLUS brands. Cross-border volume refers to payments and cash volume where the issuing country is different from the merchant country. 3. Visa Processed Transactions The table below represents transactions involving Visa, Visa Electron, V PAY, Interlink and PLUS cards processed on Visa’s networks. Period Growth (Nominal USD) Growth (Constant USD) 3 Months Ended Sep 30, 2018 8% 10% Jun 30, 2018 15% 10% Mar 31, 2018 21% 11% Dec 31, 2017 14% 9% Sep 30, 2017 12% 10% 12 Months Ended Sep 30, 2018 14% 10% Period Processed Transactions (millions) Growth 3 Months Ended Sep 30, 2018 32,763 12% Jun 30, 2018 31,728 12% Mar 31, 2018 29,321 12% Dec 31, 2017 30,508 12% Sep 30, 2017 29,180 13% 12 Months Ended Sep 30, 2018 124,320 12%

18 Footnote Payments volume represents the aggregate dollar amount of purchases made with cards carrying the Visa, Visa Electron, V PAY and Interlink brands for the relevant period, and cash volume represents the aggregate dollar amount of cash disbursements obtained with these cards for the relevant period and includes the impact of balance transfers and convenience checks, but excludes proprietary PLUS volume. Total volume represents payments and cash volume. Visa payment products are comprised of credit and debit programs, and data relating to each program is included in the tables. Debit programs include Visa’s signature based and Interlink (PIN) debit programs. The data presented is based on results reported quarterly by Visa’s financial institution clients on their operating certificates. Estimates may be utilized if data is unavailable. On occasion, previously presented information may be updated. Prior period updates, if any, are not material. Europe is reported and included in Visa Inc. results effective with the 3 months ended September 2016. Visa’s CEMEA region is comprised of countries in Central Europe, the Middle East and Africa. Several European Union countries in Central Europe, Israel and Turkey are not included in CEMEA. LAC is comprised of countries in Central and South America and the Caribbean. International includes Asia Pacific, Canada, CEMEA, Europe and LAC. Information denominated in U.S. dollars is calculated by applying an established U.S. dollar/local currency exchange rate for each local currency in which Visa Inc. volumes are reported (“Nominal USD”). These exchange rates are calculated on a quarterly basis using the established exchange rate for each quarter. To eliminate the impact of foreign currency fluctuations against the U.S. dollar in measuring performance, Visa Inc. also reports year-over-year growth in total volume, payments volume and cash volume on the basis of local currency information (“Constant USD”). This presentation represents Visa’s historical methodology which may be subject to review and refinement. Effective June 9, 2016, Article 8 of the EU Interchange Fee Regulation states that payment card networks cannot impose reporting requirements or the obligation to pay fees on payment transactions where their payment brand is present but their network is not used. Prior to this regulation, Visa collected a small service fee in a few countries, particularly France, on domestic payment transactions where Visa cards are co-badged with a domestic network. Clients in Europe continued to report co-badged volume through the quarter ended September 2016; however, Europe co-badged volume and transactions have been excluded from all periods.