Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BRINKS CO | ex991q32018.htm |

| 8-K - 8-K - BRINKS CO | a2018108k3qearnings.htm |

EXHIBIT 99.2 Third Quarter 2018 October 24, 2018

Safe Harbor Statements and Non-GAAP Results These materials contain forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," "predict," "intend," "plan," "believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in these materials includes, but is not limited to information regarding: 2018 and 2019 non-GAAP outlook, including revenue, operating profit, margin rate, earnings per share and adjusted EBITDA; future tax rates and payments; 2018 and 2019 outlook for specific businesses; closing of the Rodoban acquisition; expected impact of currency translation; 2018 and 2019 cash flow, net debt and leverage outlook; capex outlook for 2018 - 2010; and future investment in and results of acquisitions. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated. These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to: our ability to improve profitability and execute further cost and operational improvement and efficiencies in our core businesses; our ability to improve service levels and quality in our core businesses; market volatility and commodity price fluctuations; seasonality, pricing and other competitive industry factors; investment in information technology (“IT”) and its impact on revenue and profit growth; our ability to maintain an effective IT infrastructure and safeguard confidential information; our ability to effectively develop and implement solutions for our customers; risks associated with operating in foreign countries, including changing political, labor and economic conditions, regulatory issues, currency restrictions and devaluations, restrictions on and cost of repatriating earnings and capital, impact on the Company’s financial results as a result of jurisdictions determined to be highly inflationary, and restrictive government actions, including nationalization; labor issues, including negotiations with organized labor and work stoppages; the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates; our ability to identify, evaluate and complete acquisitions and other strategic transactions and to successfully integrate acquired companies; costs related to dispositions and market exits; our ability to obtain appropriate insurance coverage, positions taken by insurers relative to claims and the financial condition of insurers; safety and security performance and loss experience; employee, environmental and other liabilities in connection with former coal operations, including black lung claims; the impact of the Patient Protection and Affordable Care Act on legacy liabilities and ongoing operations; funding requirements, accounting treatment, and investment performance of our pension plans, the VEBA and other employee benefits; changes to estimated liabilities and assets in actuarial assumptions; the nature of hedging relationships and counterparty risk; access to the capital and credit markets; our ability to realize deferred tax assets; the outcome of pending and future claims, litigation, and administrative proceedings; public perception of our business, reputation and brand; changes in estimates and assumptions underlying critical accounting policies; the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations. This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2017, and in our other public filings with the Securities and Exchange Commission. Unless otherwise noted, the forward-looking information discussed today and included in these materials is representative as of today only and The Brink's Company undertakes no obligation to update any information contained in this document. These materials are copyrighted and may not be used without written permission from Brink's. Today’s presentation is focused primarily on non-GAAP results. Detailed reconciliations of non-GAAP to GAAP results are included in the appendix and in the Third Quarter 2018 Earnings Release available in the Quarterly Results section of the Brink’s website: www.brinks.com. 2

Third-Quarter 2018 Non-GAAP Results Strong Organic Growth More Than Offsets Currency Headwinds (Non-GAAP, $ Millions, except EPS) Revenue +3% Op Profit +25% Adj. EBITDA +21% EPS +8% Constant currency +13% Constant currency +55% Constant currency +44% Constant currency +42% Organic +7% Organic +50% Acq +6% Acq +6% FX (10%) FX (31%) $162 $119 $935 $1.19 $136 $852 $829 $95 $112 $0.91 16% $735 $76 Margin $0.84 $94 $63 $0.68 13.5% 11.2% Margin Margin 9.2% Margin 12.7% Margin 8.6% Margin 2016 2017 2018 Const. 2016 2017 2018 Const. 2016 2017 2018 Const. 2016 2017 2018 Const. Curr. Curr. Curr. Curr. Notes: See detailed reconciliations of non-GAAP to GAAP results included in the third quarter Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2016 results in the Appendix. 3 Constant currency represents 2018 results at 2017 exchange rates.

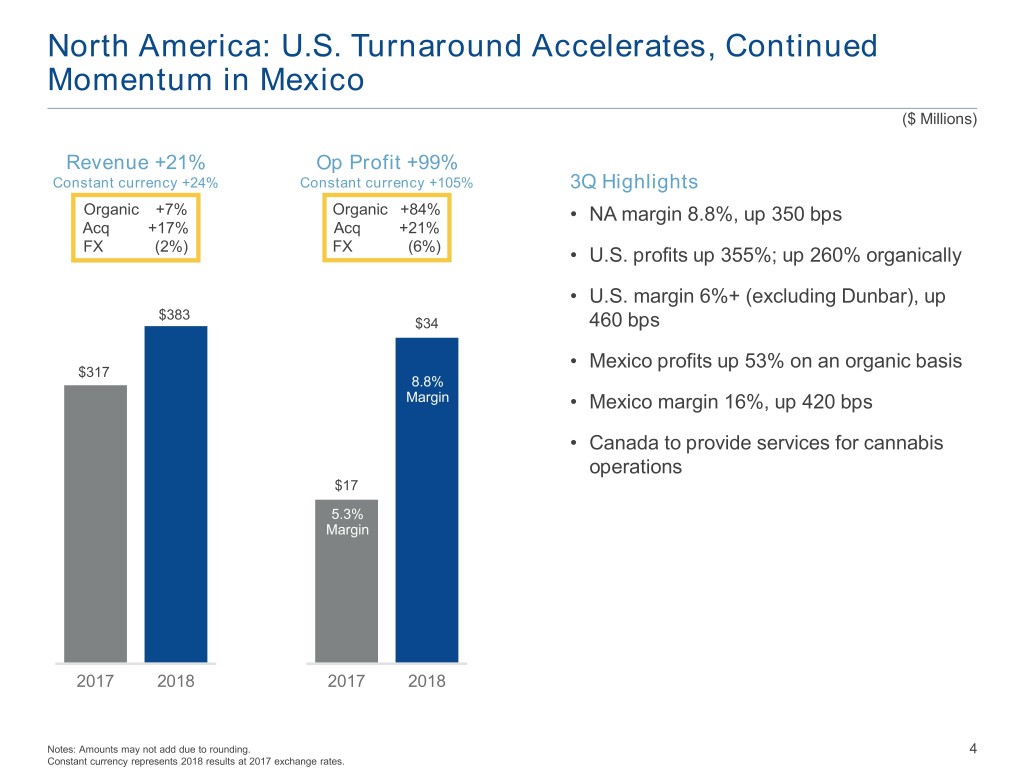

North America: U.S. Turnaround Accelerates, Continued Momentum in Mexico ($ Millions) Revenue +21% Op Profit +99% Constant currency +24% Constant currency +105% 3Q Highlights Organic +7% Organic +84% • NA margin 8.8%, up 350 bps Acq +17% Acq +21% FX (2%) FX (6%) • U.S. profits up 355%; up 260% organically • U.S. margin 6%+ (excluding Dunbar), up $383 $34 460 bps • Mexico profits up 53% on an organic basis $317 8.8% Margin8.1% Margin • Mexico margin 16%, up 420 bps • Canada to provide services for cannabis operations 5.4$17% Margin 5.3% Margin 2017 2018 2017 2018 Notes: Amounts may not add due to rounding. 4 Constant currency represents 2018 results at 2017 exchange rates.

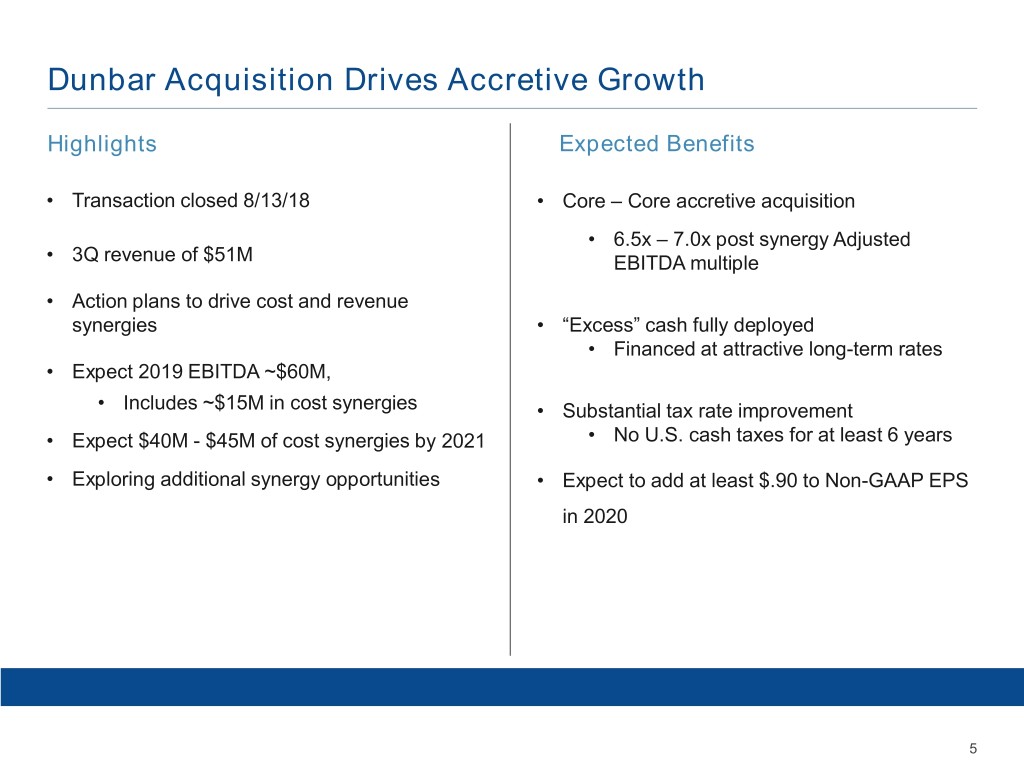

Dunbar Acquisition Drives Accretive Growth Highlights Expected Benefits • Transaction closed 8/13/18 • Core – Core accretive acquisition • 6.5x – 7.0x post synergy Adjusted • 3Q revenue of $51M EBITDA multiple • Action plans to drive cost and revenue synergies • “Excess” cash fully deployed • Financed at attractive long-term rates • Expect 2019 EBITDA ~$60M, • Includes ~$15M in cost synergies • Substantial tax rate improvement • Expect $40M - $45M of cost synergies by 2021 • No U.S. cash taxes for at least 6 years • Exploring additional synergy opportunities • Expect to add at least $.90 to Non-GAAP EPS in 2020 5

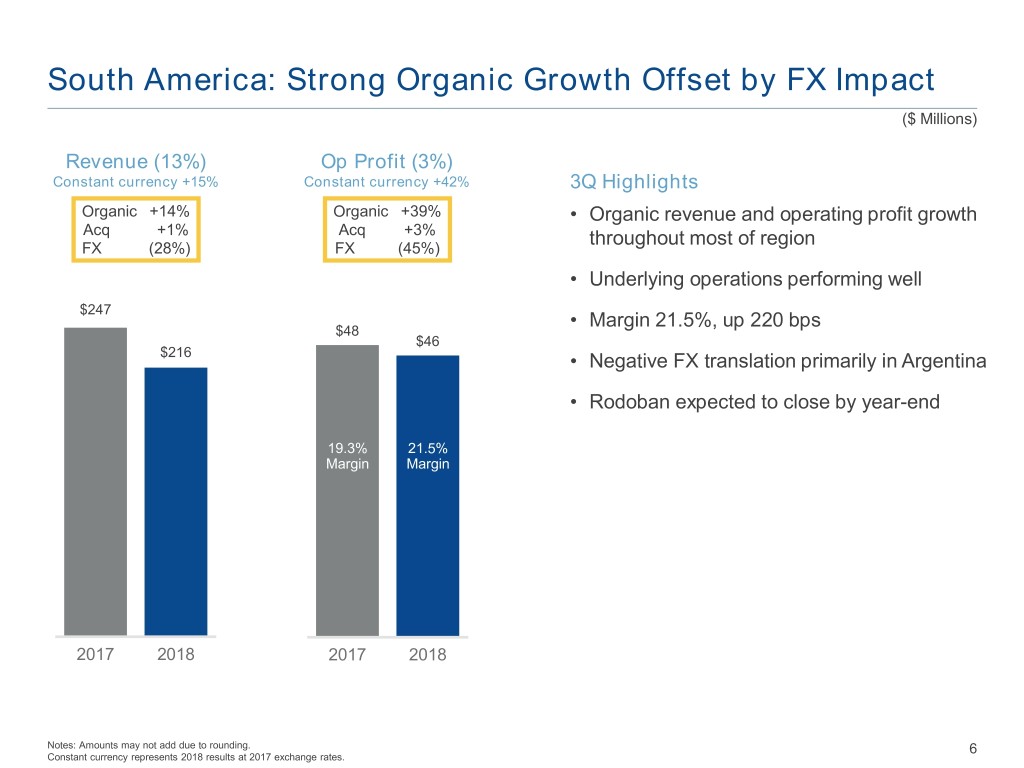

South America: Strong Organic Growth Offset by FX Impact ($ Millions) Revenue (13%) Op Profit (3%) Constant currency +15% Constant currency +42% 3Q Highlights Organic +14% Organic +39% • Organic revenue and operating profit growth Acq +1% Acq +3% FX (28%) FX (45%) throughout most of region • Underlying operations performing well $247 • Margin 21.5%, up 220 bps $48 $46 $216 • Negative FX translation primarily in Argentina • Rodoban expected to close by year-end 19.3% 21.5% Margin Margin 2017 2018 2017 2018 Notes: Amounts may not add due to rounding. 6 Constant currency represents 2018 results at 2017 exchange rates.

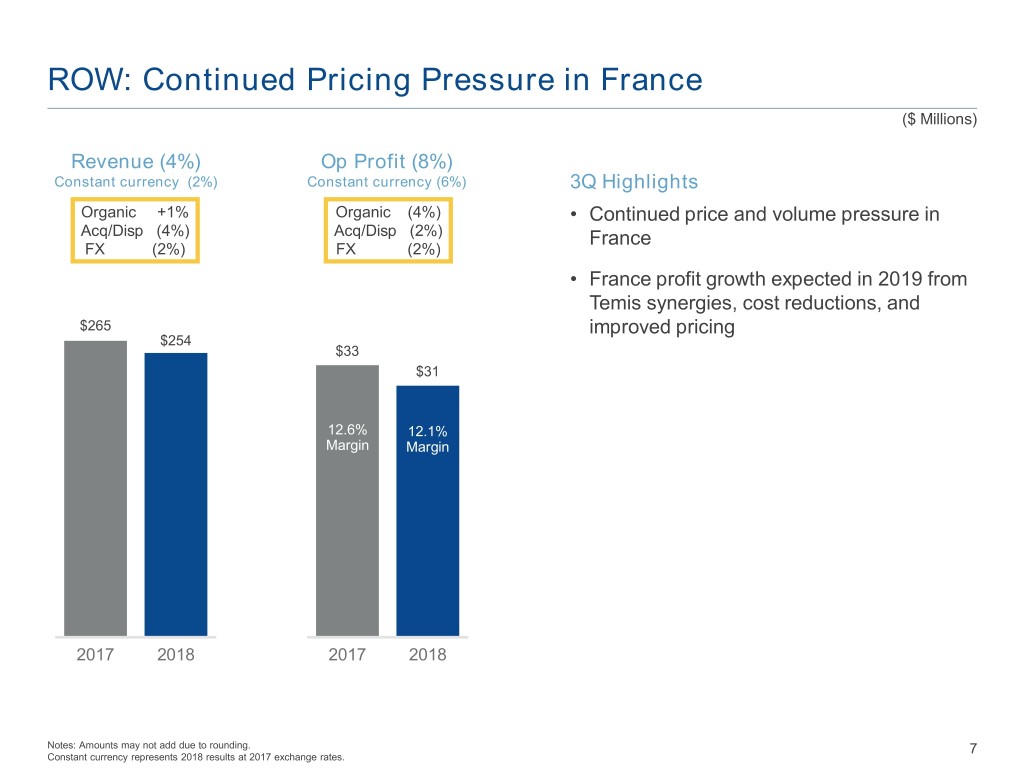

ROW: Continued Pricing Pressure in France ($ Millions) Revenue (4%) Op Profit (8%) Constant currency (2%) Constant currency (6%) 3Q Highlights Organic +1% Organic (4%) • Continued price and volume pressure in Acq/Disp (4%) Acq/Disp (2%) France FX (2%) FX (2%) • France profit growth expected in 2019 from Temis synergies, cost reductions, and $265 improved pricing $254 $33 $31 12.6% 12.1% Margin Margin 2017 2018 2017 2018 Notes: Amounts may not add due to rounding. 7 Constant currency represents 2018 results at 2017 exchange rates.

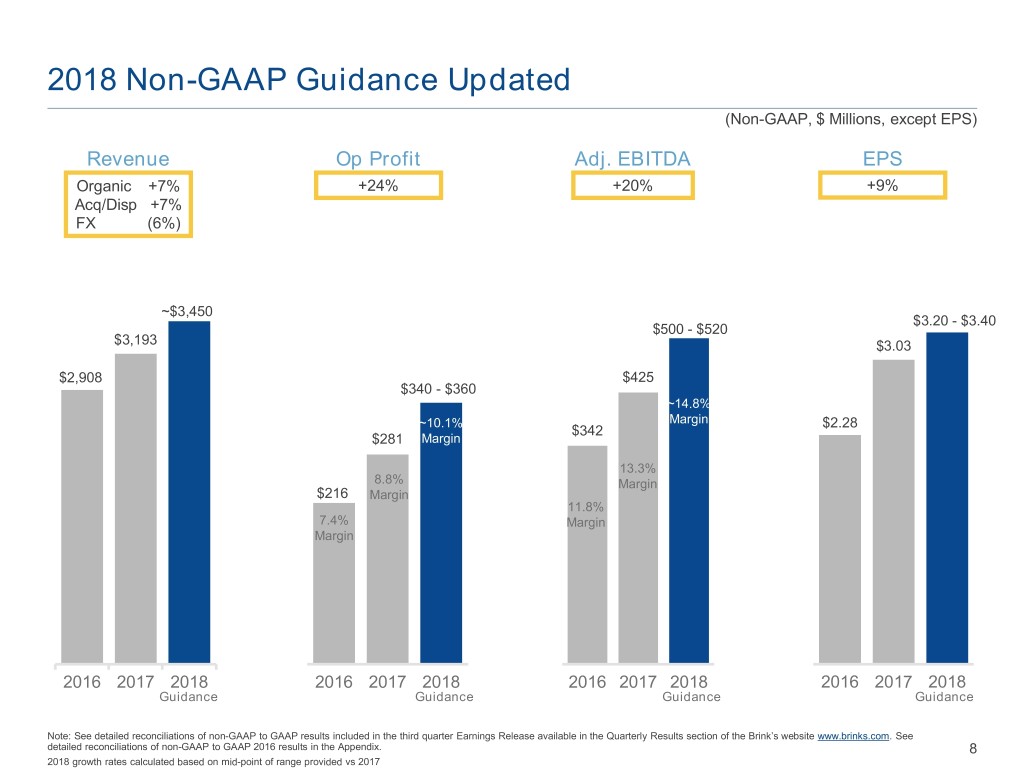

2018 Non-GAAP Guidance Updated (Non-GAAP, $ Millions, except EPS) Revenue Op Profit Adj. EBITDA EPS Organic +7% +24% +20% +9% Acq/Disp +7% FX (6%) ~$3,450 $3.20 - $3.40 $500 - $520 $3,193 $3.03 $2,908 $425 $340 - $360 ~14.8% ~10.1% Margin $2.28 $342 $281 Margin 13.3% 8.8% Margin $216 Margin 11.8% 7.4% Margin Margin 2016 2017 2018 2016 2017 2018 2016 2017 2018 2016 2017 2018 Guidance Guidance Guidance Guidance Note: See detailed reconciliations of non-GAAP to GAAP results included in the third quarter Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2016 results in the Appendix. 8 2018 growth rates calculated based on mid-point of range provided vs 2017

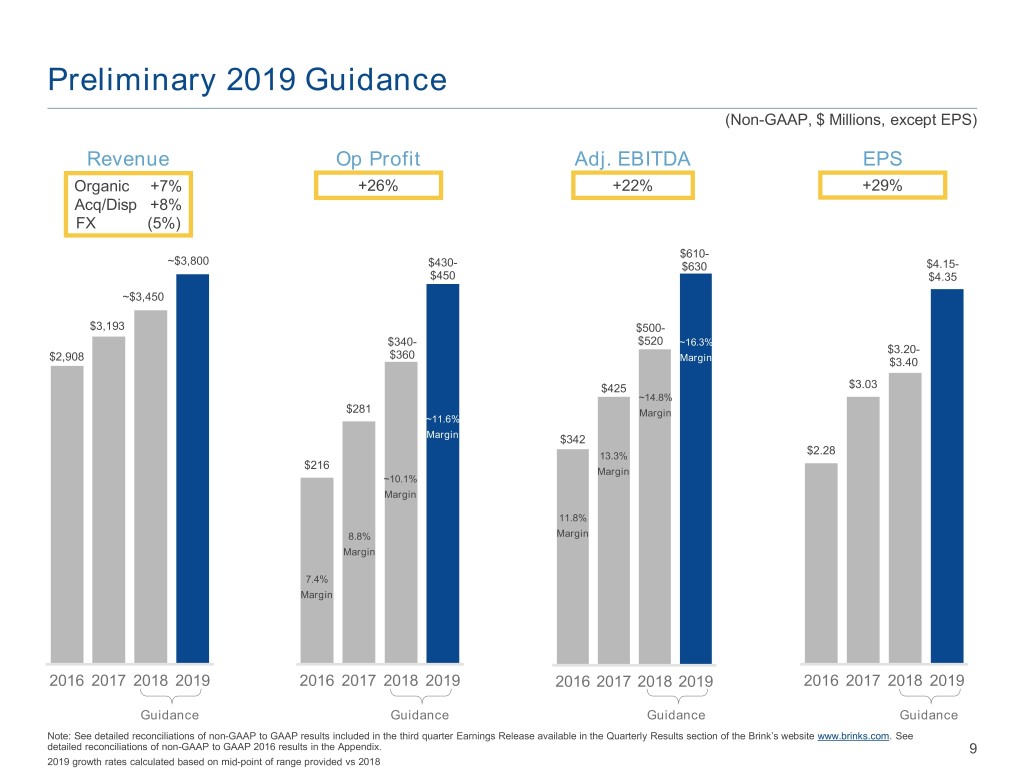

Preliminary 2019 Guidance (Non-GAAP, $ Millions, except EPS) Revenue Op Profit Adj. EBITDA EPS Organic +7% +26% +22% +29% Acq/Disp +8% FX (5%) $610- ~$3,800 $430- $630 $4.15- $450 $4.35 ~$3,450 $3,193 $500- $340- $520 ~16.3%15.8% - $360 $3.20- $2,908 Margin16.3% $3.40 Margin 11.2%xx%- $425 $3.03 ~14.8%15.9% 11.7%Margin $281 MarginMargin ~11.6%Margin Margin $342 ~14.5% $2.28 13.3%13.5% Margin $216 MarginMargin ~10.1% 9.9%- Margin 10.4% 13.3% Margin 11.8%12.7% Margin 8.8% MarginMargin Margin8.8% 11.8% Margin Margin 7.4% Margin7.4% Margin 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 2016 2017 2018 2019 Guidance Guidance Guidance Guidance Note: See detailed reconciliations of non-GAAP to GAAP results included in the third quarter Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2016 results in the Appendix. 9 2019 growth rates calculated based on mid-point of range provided vs 2018

Financial Update

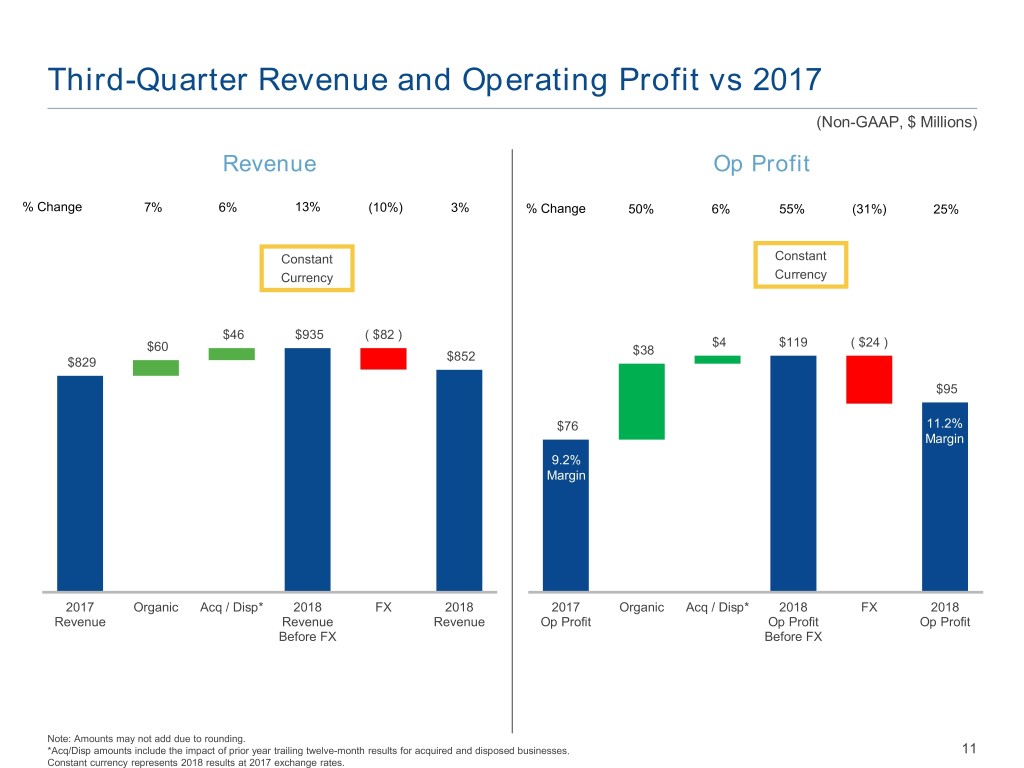

Third-Quarter Revenue and Operating Profit vs 2017 (Non-GAAP, $ Millions) Revenue Op Profit % Change 7% 6% 13% (10%) 3% % Change 50% 6% 55% (31%) 25% Constant Constant Currency Currency $46 $935 ( $82 ) $4 $119 ( $24 ) $60 $38 $829 $852 $95 $76 11.2% Margin 9.2% Margin 2017 Organic Acq / Disp* 2018 FX 2018 2017 Organic Acq / Disp* 2018 FX 2018 Revenue Revenue Revenue Op Profit Op Profit Op Profit Before FX Before FX Note: Amounts may not add due to rounding. *Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses. 11 Constant currency represents 2018 results at 2017 exchange rates.

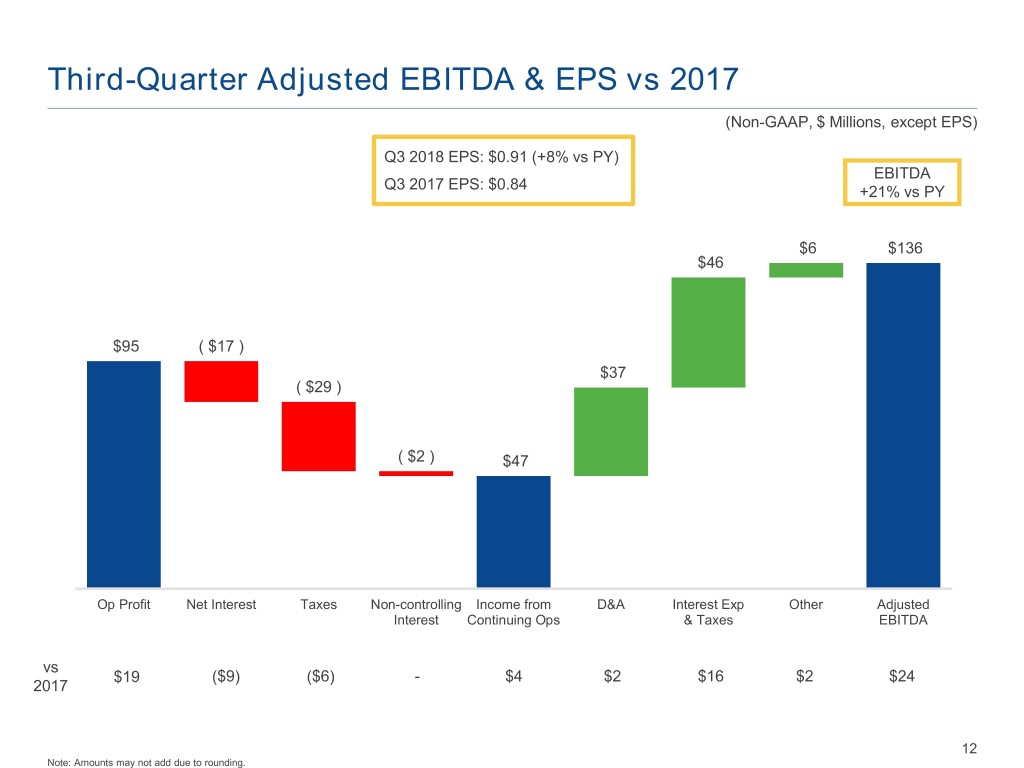

Third-Quarter Adjusted EBITDA & EPS vs 2017 (Non-GAAP, $ Millions, except EPS) Q3 2018 EPS: $0.91 (+8% vs PY) EBITDA Q3 2017 EPS: $0.84 +21% vs PY $6 $136 $46 $95 ( $17 ) $37 ( $29 ) ( $2 ) $47 Op Profit Net Interest Taxes Non-controlling Income from D&A Interest Exp Other Adjusted Interest Continuing Ops & Taxes EBITDA vs $19 ($9) ($6) - $4 $2 $16 $2 $24 2017 12 Note: Amounts may not add due to rounding.

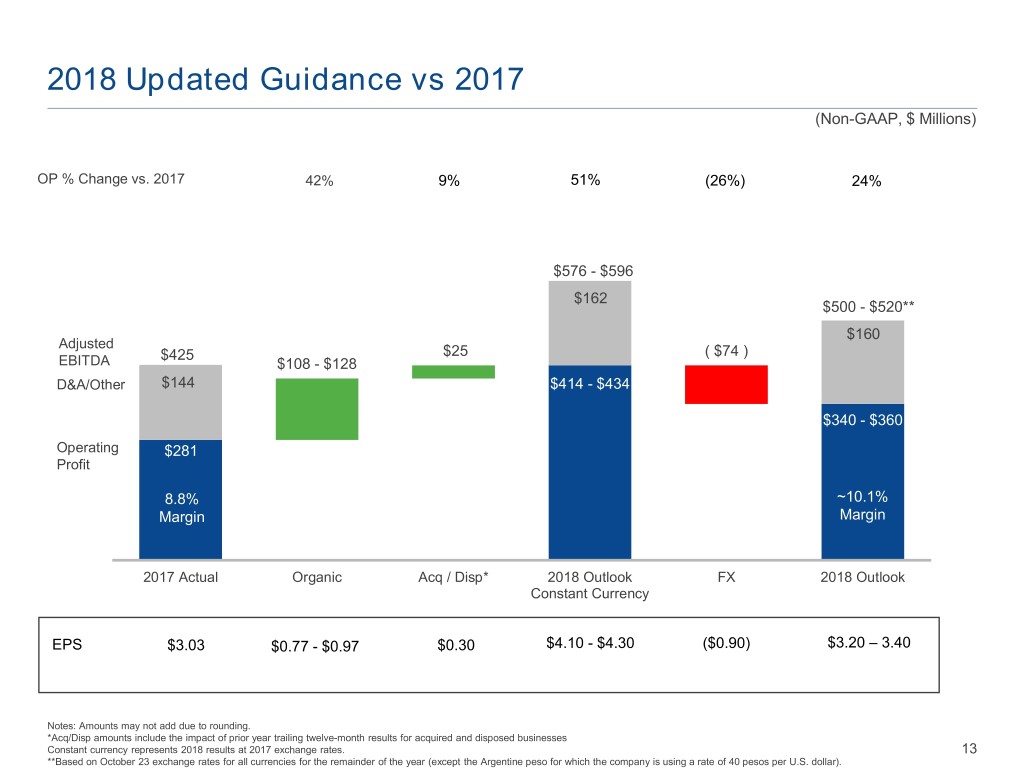

2018 Updated Guidance vs 2017 (Non-GAAP, $ Millions) OP % Change vs. 2017 42% 9% 51% (26%) 24% $576 - $596 $162 $500 - $520** $160 Adjusted $425 $25 ( $74 ) EBITDA $108 - $128 D&A/Other $144 $414 - $434 $340 - $360 Operating $281 Profit 8.8% ~10.1% Margin Margin 2017 Actual Organic Acq / Disp* 2018 Outlook FX 2018 Outlook Constant Currency EPS $3.03 $0.77 - $0.97 $0.30 $4.10 - $4.30 ($0.90) $3.20 – 3.40 Notes: Amounts may not add due to rounding. *Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses Constant currency represents 2018 results at 2017 exchange rates. 13 **Based on October 23 exchange rates for all currencies for the remainder of the year (except the Argentine peso for which the company is using a rate of 40 pesos per U.S. dollar).

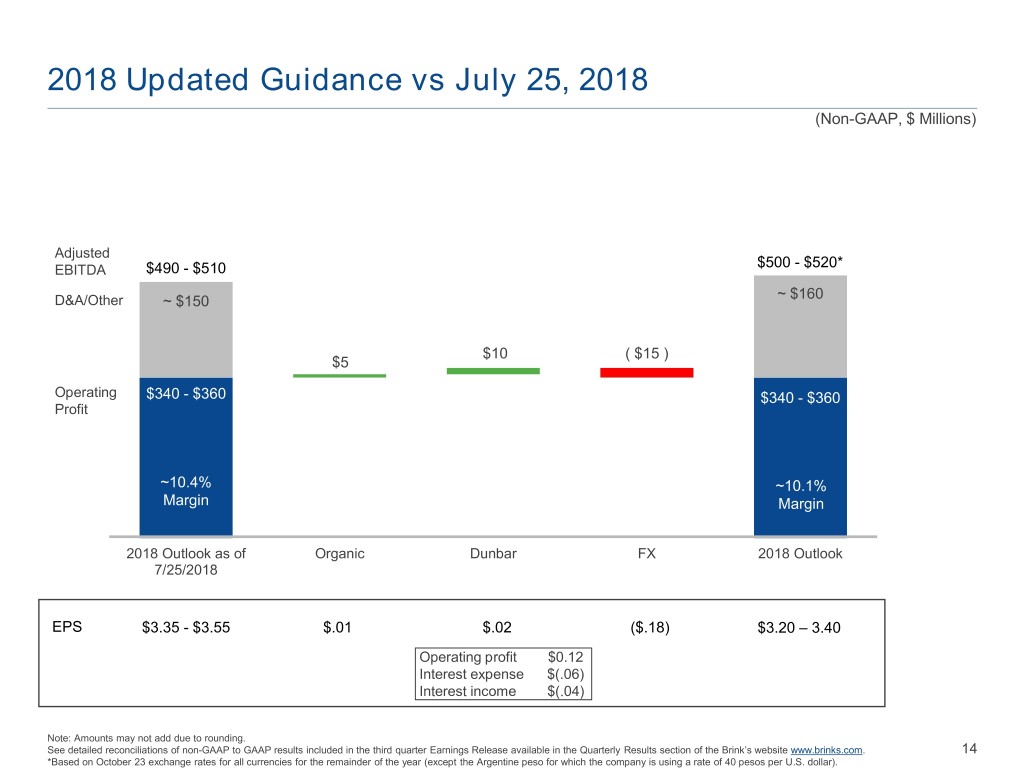

2018 Updated Guidance vs July 25, 2018 (Non-GAAP, $ Millions) Adjusted $500 - $520* EBITDA $490 - $510 ~ $160 D&A/Other ~ $150 $10 ( $15 ) $5 Operating $340 - $360 $340 - $360 Profit ~10.4% ~10.1% Margin Margin 2018 Outlook as of Organic Dunbar FX 2018 Outlook 7/25/2018 EPS $3.35 - $3.55 $.01 $.02 ($.18) $3.20 – 3.40 Operating profit $0.12 Interest expense $(.06) Interest income $(.04) Note: Amounts may not add due to rounding. See detailed reconciliations of non-GAAP to GAAP results included in the third quarter Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. 14 *Based on October 23 exchange rates for all currencies for the remainder of the year (except the Argentine peso for which the company is using a rate of 40 pesos per U.S. dollar).

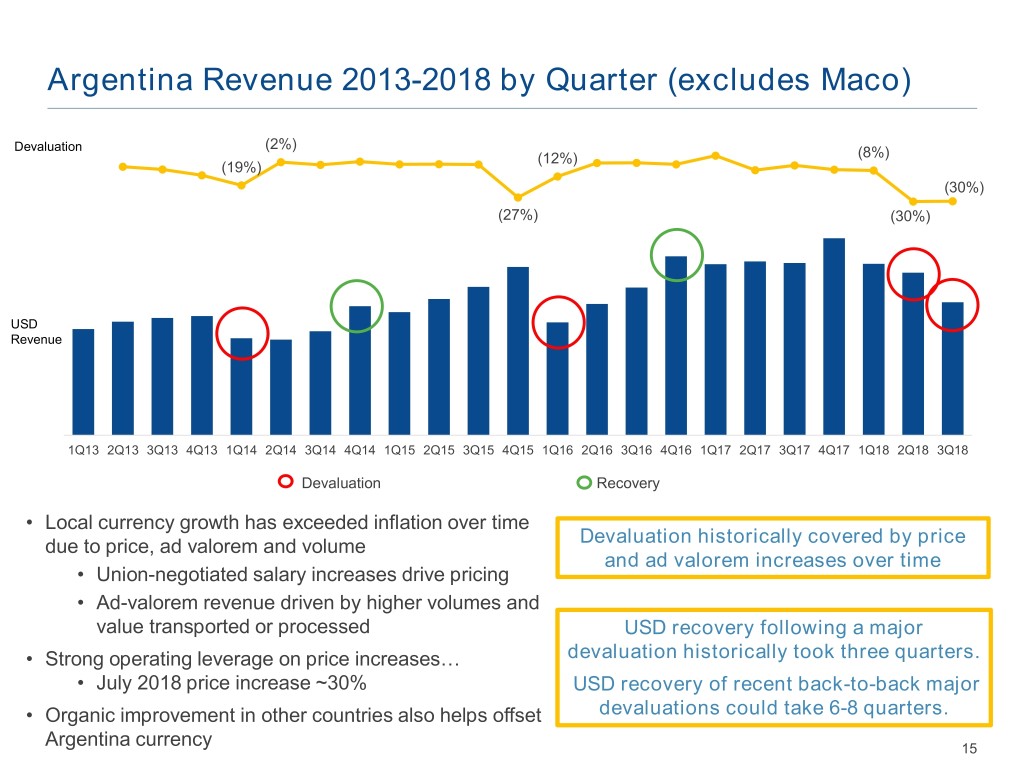

Argentina Revenue 2013-2018 by Quarter (excludes Maco) Devaluation (2%) (12%) (8%) (19%) (30%) (27%) (30%) USD Revenue 1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 Devaluation Recovery • Local currency growth has exceeded inflation over time due to price, ad valorem and volume Devaluation historically covered by price and ad valorem increases over time • Union-negotiated salary increases drive pricing • Ad-valorem revenue driven by higher volumes and value transported or processed USD recovery following a major • Strong operating leverage on price increases… devaluation historically took three quarters. • July 2018 price increase ~30% USD recovery of recent back-to-back major • Organic improvement in other countries also helps offset devaluations could take 6-8 quarters. Argentina currency 15

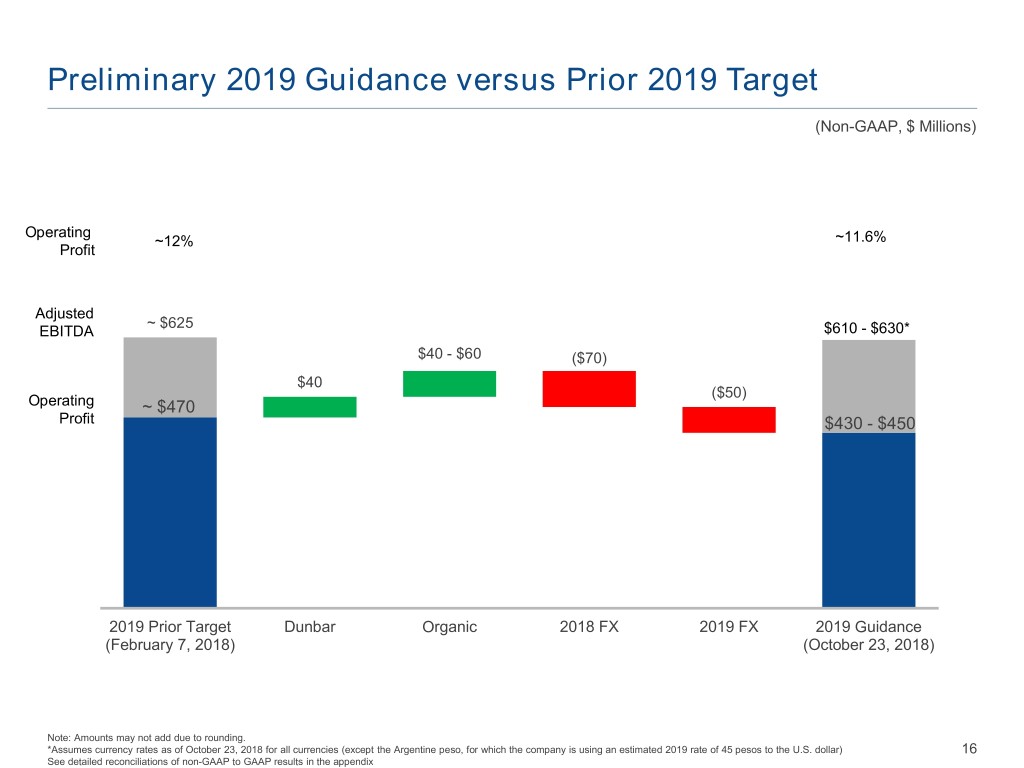

Preliminary 2019 Guidance versus Prior 2019 Target (Non-GAAP, $ Millions) Operating ~12% ~11.6% Profit Adjusted ~ $625 EBITDA $610 - $630* $40 - $60 ($70) $40 ($50) Operating ~ $470 Profit $430 - $450 2019 Prior Target Dunbar Organic 2018 FX 2019 FX 2019 Guidance (February 7, 2018) (October 23, 2018) Note: Amounts may not add due to rounding. *Assumes currency rates as of October 23, 2018 for all currencies (except the Argentine peso, for which the company is using an estimated 2019 rate of 45 pesos to the U.S. dollar) 16 See detailed reconciliations of non-GAAP to GAAP results in the appendix

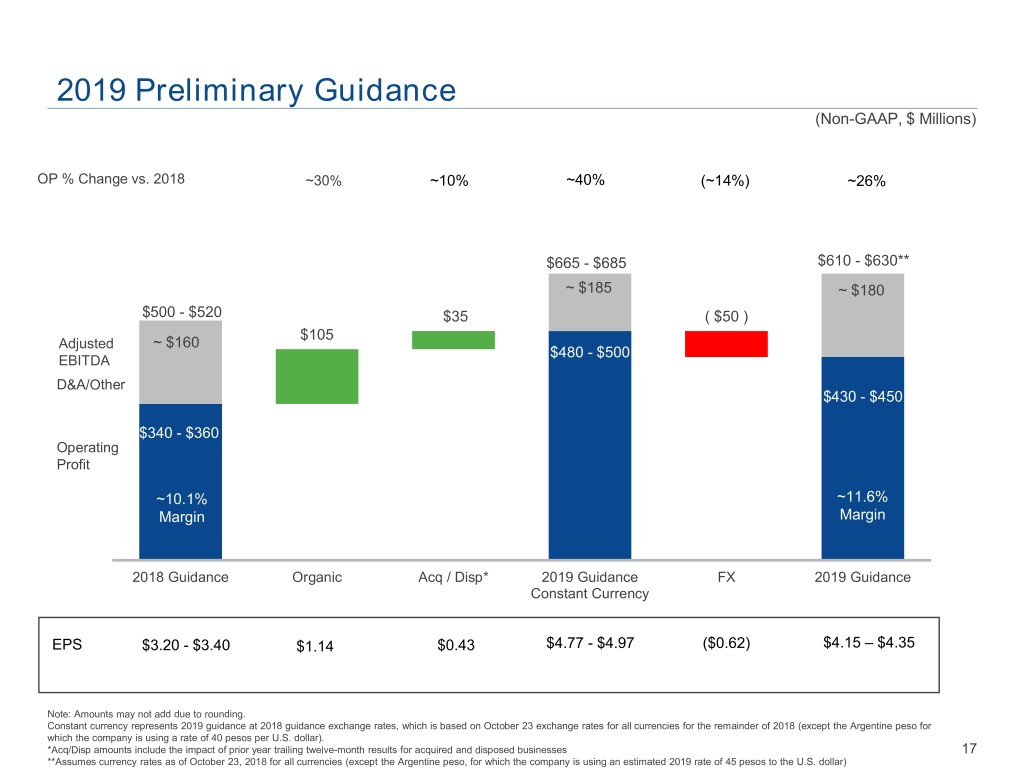

2019 Preliminary Guidance (Non-GAAP, $ Millions) OP % Change vs. 2018 ~30% ~10% ~40% (~14%) ~26% $665 - $685 $610 - $630** ~ $185 ~ $180 $500 - $520 $35 ( $50 ) $105 Adjusted ~ $160 $480 - $500 EBITDA D&A/Other $430 - $450 $340 - $360 Operating Profit ~10.1% ~11.6% Margin Margin 2018 Guidance Organic Acq / Disp* 2019 Guidance FX 2019 Guidance Constant Currency EPS $3.20 - $3.40 $1.14 $0.43 $4.77 - $4.97 ($0.62) $4.15 – $4.35 Note: Amounts may not add due to rounding. Constant currency represents 2019 guidance at 2018 guidance exchange rates, which is based on October 23 exchange rates for all currencies for the remainder of 2018 (except the Argentine peso for which the company is using a rate of 40 pesos per U.S. dollar). *Acq/Disp amounts include the impact of prior year trailing twelve-month results for acquired and disposed businesses 17 **Assumes currency rates as of October 23, 2018 for all currencies (except the Argentine peso, for which the company is using an estimated 2019 rate of 45 pesos to the U.S. dollar)

Free Cash Flow (Non-GAAP, $ Millions) Free cash flow includes completed & announced acquisitions Actual Target Target 2017 2018 2019 Adjusted EBITDA $425 ~$510 ~$620 Guidance Working Capital & Other (86) ~(15) ~(45) DSO and DPO improvement, restructuring Cash Taxes (84) ~(75) ~(75) No cash taxes projected in U.S. for at least six years Cash Interest (27) ~(65) ~(85) Impact of acquisitions Non-GAAP Cash from Operating Activities 229 ~355 ~415 Capital Expenditures excl. CompuSafes (185) ~(200) ~(230) Investment above historic levels to support strategic initiatives and Dunbar acquisition CompuSafes (38) (25) (25) Exclude Capital Leases 52 55 55 Fleet investment under capital leases Non-GAAP Cash Capital Expenditures ~(170) ~(170) ~(200) Non-GAAP Free Cash Flow before dividends 58 ~185 ~215 EBITDA – Non-GAAP Cash CapEx 255 ~340 ~420 Notes: Amounts may not add due to rounding. 18 Non-GAAP Free Cash Flow excludes the impact of Venezuela operations. See detailed reconciliations of cash flows in the appendix.

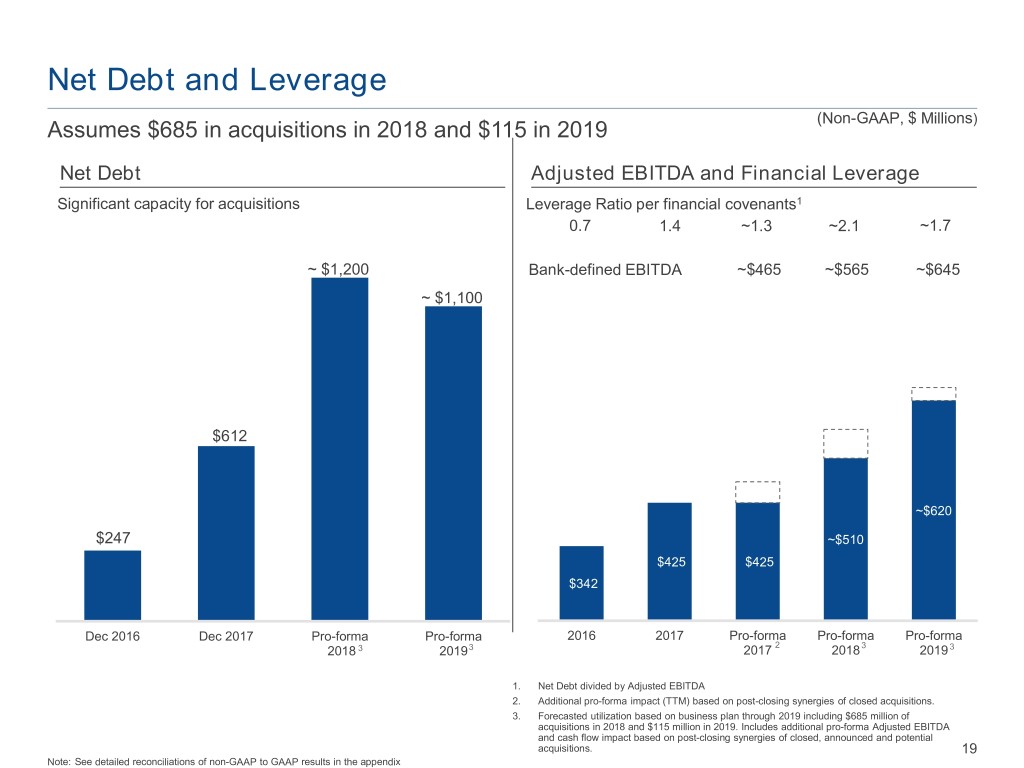

Net Debt and Leverage (Non-GAAP, $ Millions) Assumes $685 in acquisitions in 2018 and $115 in 2019 Net Debt Adjusted EBITDA and Financial Leverage Significant capacity for acquisitions Leverage Ratio per financial covenants1 0.7 1.4 ~1.3 ~2.1 ~1.7 ~ $1,200 Bank-defined EBITDA ~$465 ~$565 ~$645 ~ $1,100 $612 ~$620 $247 ~$510 $425 $425 $342 Dec 2016 Dec 2017 Pro-forma Pro-forma 2016 2017 Pro-forma Pro-forma Pro-forma 2 2018 3 20193 2017 2018 3 2019 3 1. Net Debt divided by Adjusted EBITDA 2. Additional pro-forma impact (TTM) based on post-closing synergies of closed acquisitions. 3. Forecasted utilization based on business plan through 2019 including $685 million of acquisitions in 2018 and $115 million in 2019. Includes additional pro-forma Adjusted EBITDA and cash flow impact based on post-closing synergies of closed, announced and potential acquisitions. 19 Note: See detailed reconciliations of non-GAAP to GAAP results in the appendix

Three-Year Strategic Plan - Strategy 1.0 + 1.5 Organic Growth + Acquisitions 2019 Adjusted EBITDA Target $620 Million – 3-yr CAGR ~22%* Strategy 1.5 • Focus on “core-core” & “core-adjacent” Acquisitions 13.3% • Capture synergies & improveMargin density 2019 EBITDA Target: $130* • ~$1.05B 2017-2018 investment…$115M in 2019 (Acquisitions announced/closed to date) Strategy 1.0 • Close the Gap Core Organic Growth • Accelerate Profitable Growth 2019 EBITDA Target: $490* • Introduce Differentiated Services – technology-driven 2017 2018 2019 Organic Growth + Acquisitions = Increased Value for Shareholders Note: See detailed reconciliations of non-GAAP to GAAP results included in the appendix. 20 * Growth rates calculated based on the mid-point of the range

Similarities with Route-Based Business Services Companies Route-based Brink’s Service Providers Specialized fleet Focus on route density and optimization Strong recurring revenue Ability to leverage physical infrastructure Accretive/high-synergy M&A Organic growth: ~4-6% EBITDA margin ~22%* ~16% (FY19E) EBITDA CAGR ~9%* ~18%* Source: Publically available information, analyst reports and internal estimates; organic growth components may differ between companies. Route-based service providers include Cintas (CTAS), Iron Mountain (IRM), Rollins, Inc. (ROL), ServiceMaster (SERV), Stericycle (SRCL), UniFirst (UNF) and Waste Management (WM). *Based on 2015-2017 data 21

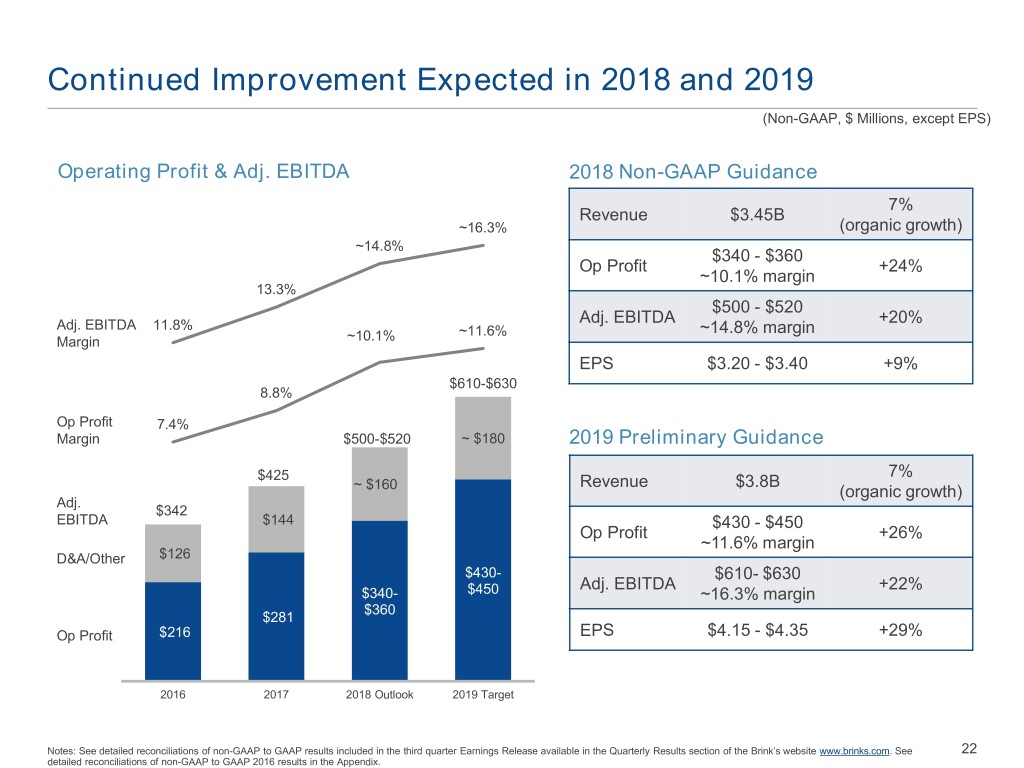

Continued Improvement Expected in 2018 and 2019 (Non-GAAP, $ Millions, except EPS) Operating Profit & Adj. EBITDA 2018 Non-GAAP Guidance 7% Revenue $3.45B ~16.3% (organic growth) ~14.8% $340 - $360 Op Profit +24% ~10.1% margin 13.3% $500 - $520 Adj. EBITDA +20% Adj. EBITDA 11.8% ~11.6% ~14.8% margin Margin ~10.1% EPS $3.20 - $3.40 +9% $610-$630 8.8% Op Profit 7.4% Margin $500-$520 ~ $180 2019 Preliminary Guidance 7% $425 Revenue $3.8B ~ $160 (organic growth) Adj. $342 EBITDA $144 $430 - $450 Op Profit +26% ~11.6% margin D&A/Other $126 $430- $610- $630 Adj. EBITDA +22% $340- $450 ~16.3% margin $360 $281 Op Profit $216 EPS $4.15 - $4.35 +29% 2016 2017 2018 Outlook 2019 Target Notes: See detailed reconciliations of non-GAAP to GAAP results included in the third quarter Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See 22 detailed reconciliations of non-GAAP to GAAP 2016 results in the Appendix.

Appendix

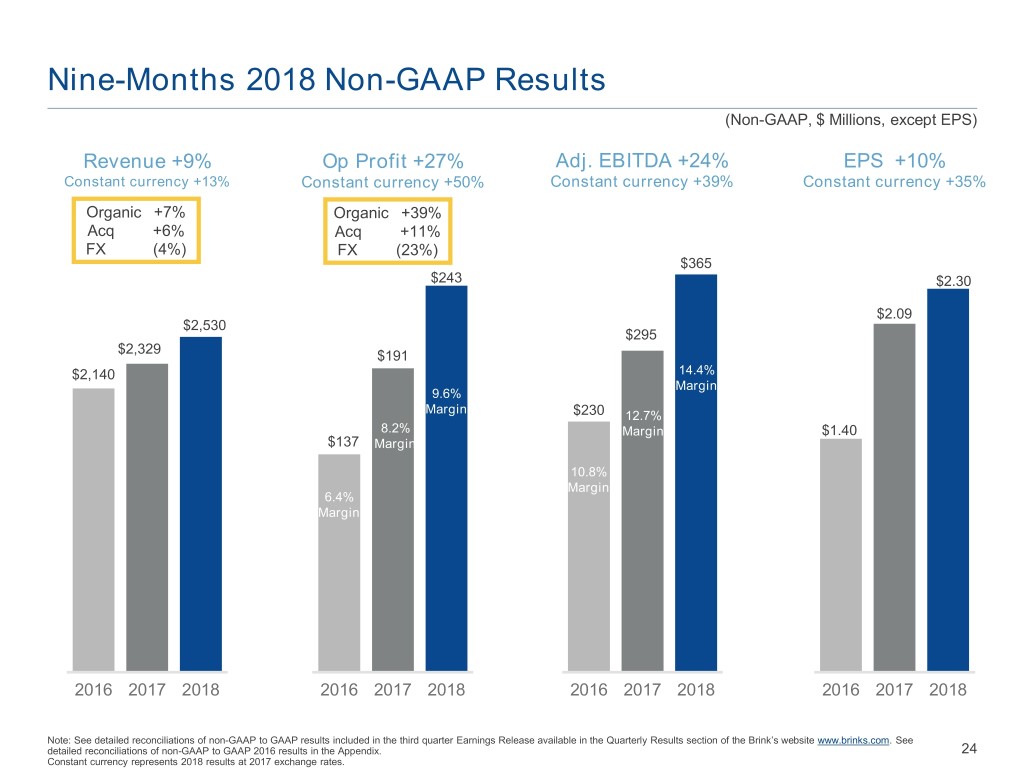

Nine-Months 2018 Non-GAAP Results (Non-GAAP, $ Millions, except EPS) Revenue +9% Op Profit +27% Adj. EBITDA +24% EPS +10% Constant currency +13% Constant currency +50% Constant currency +39% Constant currency +35% Organic +7% Organic +39% Acq +6% Acq +11% FX (4%) FX (23%) $365 $243 $2.30 $2.09 $2,530 $295 $2,329 $191 $2,140 14.4% Margin 9.6% Margin $230 12.7% 8.2% Margin $1.40 $137 Margin 10.8% Margin 6.4% Margin 2016 2017 2018 2016 2017 2018 2016 2017 2018 2016 2017 2018 Note: See detailed reconciliations of non-GAAP to GAAP results included in the third quarter Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2016 results in the Appendix. 24 Constant currency represents 2018 results at 2017 exchange rates.

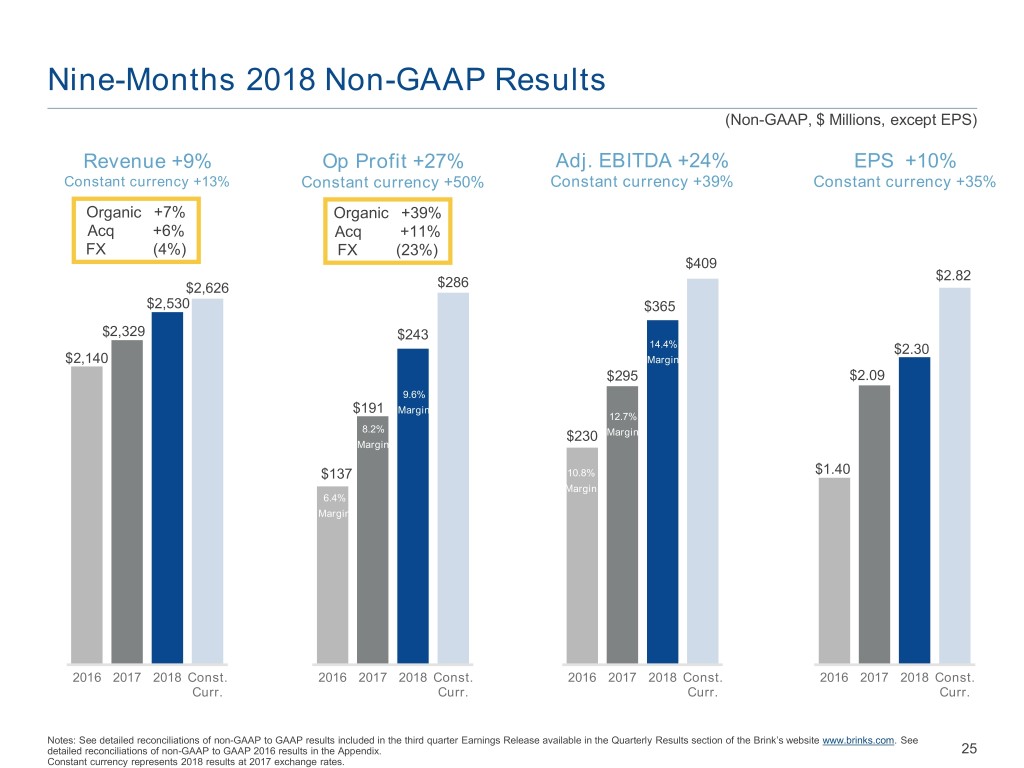

Nine-Months 2018 Non-GAAP Results (Non-GAAP, $ Millions, except EPS) Revenue +9% Op Profit +27% Adj. EBITDA +24% EPS +10% Constant currency +13% Constant currency +50% Constant currency +39% Constant currency +35% Organic +7% Organic +39% Acq +6% Acq +11% FX (4%) FX (23%) $409 $2.82 $2,626 $286 $2,530 $365 $2,329 $243 14.4% $2.30 $2,140 Margin $295 $2.09 9.6% $191 Margin 12.7% 8.2% $230 Margin Margin $137 10.8% $1.40 Margin 6.4% Margin 2016 2017 2018 Const. 2016 2017 2018 Const. 2016 2017 2018 Const. 2016 2017 2018 Const. Curr. Curr. Curr. Curr. Notes: See detailed reconciliations of non-GAAP to GAAP results included in the third quarter Earnings Release available in the Quarterly Results section of the Brink’s website www.brinks.com. See detailed reconciliations of non-GAAP to GAAP 2016 results in the Appendix. 25 Constant currency represents 2018 results at 2017 exchange rates.

CapEx Expected to Return to ~4% of Revenue in 2020 (Non-GAAP, $ Millions) Capital expenditures 2015-20201 Higher 2017-19 CapEx reflects investment in strategic initiatives ~$230 ~$200 High Return $185 $185 High Growth Return CapEx High Growth Return CapEx Growth CapEx $124 ~4% of Revenue $106 Facility Equipment / Other IT Armored Vehicles 2015 Actual 2016 Actual 2017 Actual 2017 Actual 2018 Target 2019 Target 2020 Target % Revenue 3.5% 4.2% 5.8% 5.8% ~6% 2 ~6%2 ~4% 2 D&A1 $118 $112 $119 $119 Reinvestment Ratio 0.9 1.1 1.6 1.6 1. Excludes CompuSafe® 26 2. Excludes potential acquisitions (through year-end 2019).

Non-GAAP Income Tax Evolution 2018 Outlook Dunbar Acquisition Statutory Tax Rate1 • U.S. had no statutory • Increases U.S. statutory Argentina2 35% income for years income Brazil 34% - Paid no U.S. Federal tax • Utilizes FTCs Chile 27% - No Foreign Tax Credit (FTC) utilization Colombia 37% • Utilizes components of France 34% $173M U.S. DTA Israel2 36% • U.S. Tax Reform Mexico 30% - Rate 35% to 21% no help • IRC 338(h)(10) election U.S. N/A - Other provisions hurt • Incorporates U.S. 21% rate Weighted average 32% • Initiatives in ETR - M&A impact Tax Law and Related - FTC & withholding taxes Future ETR Target 31%-33% Acquisition Changes 2% - Global capital structure Near-Term Cash Rate Target <25% - Mexico expense deduct Withholding taxes, etc. 3% - Pending tax laws 2018 ETR 37% 2018 Cash Tax Rate 27% No U.S. Federal cash tax payments expected for at least 6 years 1. Top 7 in alphabetical order; U.S. has no statutory earnings 27 2. Including dividend withholding taxes

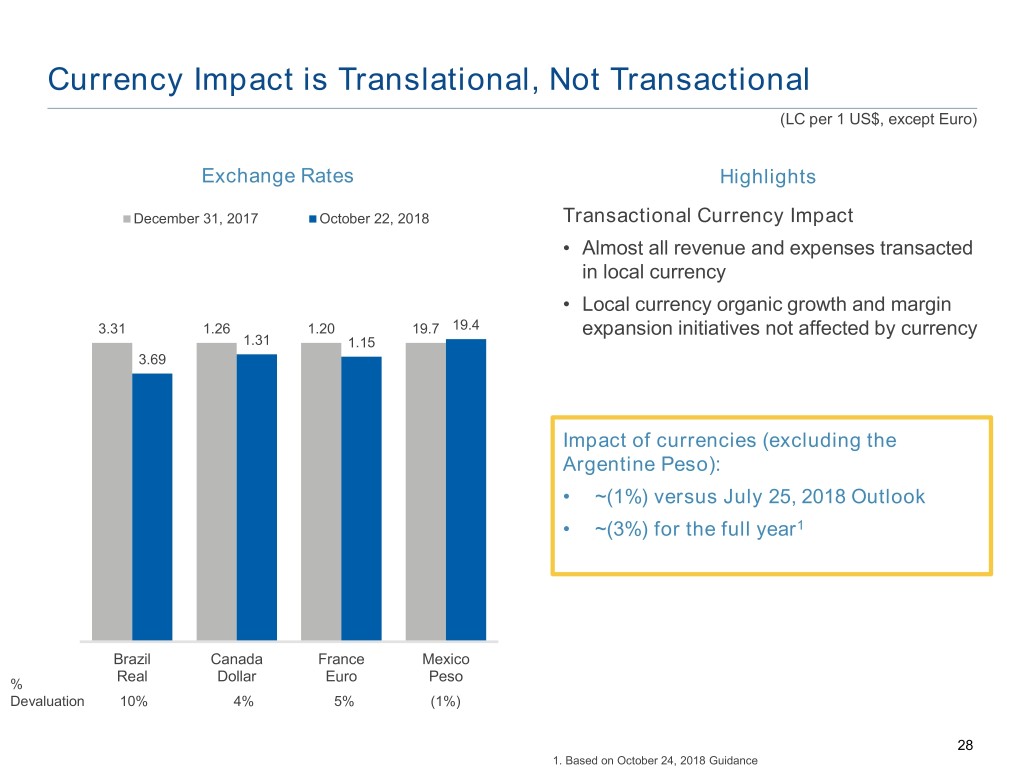

Currency Impact is Translational, Not Transactional (LC per 1 US$, except Euro) Exchange Rates Highlights December 31, 2017 October 22, 2018 Transactional Currency Impact • Almost all revenue and expenses transacted in local currency • Local currency organic growth and margin 3.31 1.26 1.20 19.7 19.4 expansion initiatives not affected by currency 1.31 1.15 3.69 Impact of currencies (excluding the Argentine Peso): • ~(1%) versus July 25, 2018 Outlook • ~(3%) for the full year1 Brazil Canada France Mexico Real Dollar Euro Peso % Devaluation 10% 4% 5% (1%) 28 1. Based on October 24, 2018 Guidance

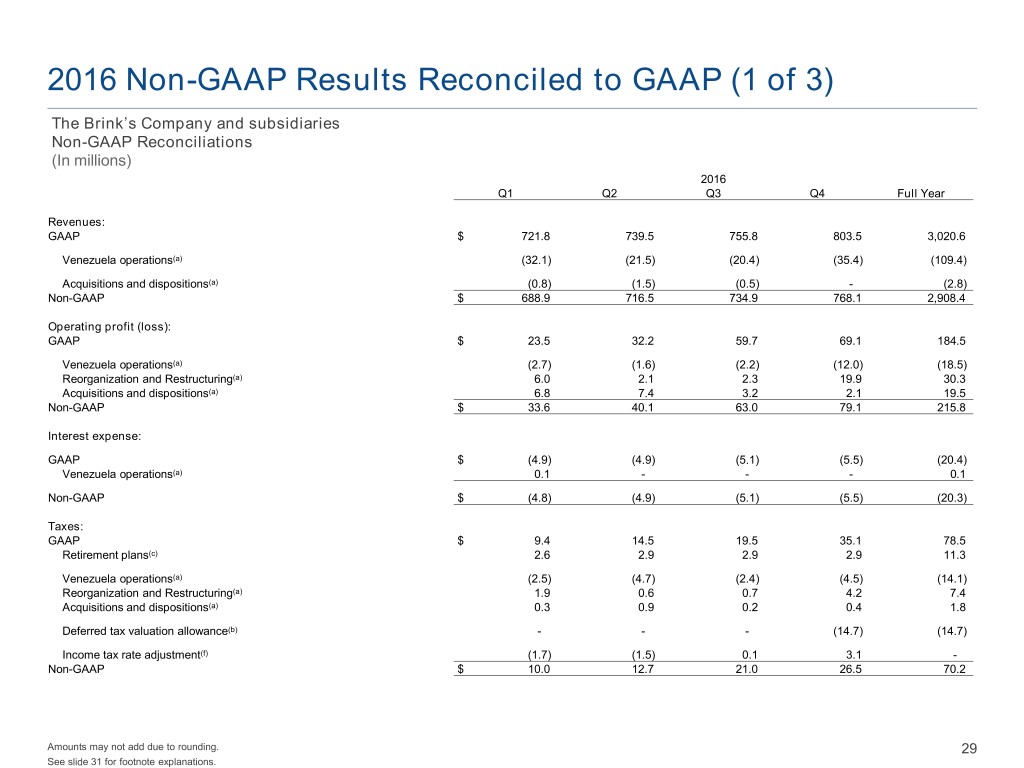

2016 Non-GAAP Results Reconciled to GAAP (1 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2016 Q1 Q2 Q3 Q4 Full Year Revenues: GAAP $ 721.8 739.5 755.8 803.5 3,020.6 Venezuela operations(a) (32.1) (21.5) (20.4) (35.4) (109.4) Acquisitions and dispositions(a) (0.8) (1.5) (0.5) - (2.8) Non-GAAP $ 688.9 716.5 734.9 768.1 2,908.4 Operating profit (loss): GAAP $ 23.5 32.2 59.7 69.1 184.5 Venezuela operations(a) (2.7) (1.6) (2.2) (12.0) (18.5) Reorganization and Restructuring(a) 6.0 2.1 2.3 19.9 30.3 Acquisitions and dispositions(a) 6.8 7.4 3.2 2.1 19.5 Non-GAAP $ 33.6 40.1 63.0 79.1 215.8 Interest expense: GAAP $ (4.9) (4.9) (5.1) (5.5) (20.4) Venezuela operations(a) 0.1 - - - 0.1 Non-GAAP $ (4.8) (4.9) (5.1) (5.5) (20.3) Taxes: GAAP $ 9.4 14.5 19.5 35.1 78.5 Retirement plans(c) 2.6 2.9 2.9 2.9 11.3 Venezuela operations(a) (2.5) (4.7) (2.4) (4.5) (14.1) Reorganization and Restructuring(a) 1.9 0.6 0.7 4.2 7.4 Acquisitions and dispositions(a) 0.3 0.9 0.2 0.4 1.8 Deferred tax valuation allowance(b) - - - (14.7) (14.7) Income tax rate adjustment(f) (1.7) (1.5) 0.1 3.1 - Non-GAAP $ 10.0 12.7 21.0 26.5 70.2 Amounts may not add due to rounding. 29 See slide 31 for footnote explanations.

2016 Non-GAAP Results Reconciled to GAAP (2 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2016 Q1 Q2 Q3 Q4 Full Year Income (loss) from continuing operations attributable to Brink's: GAAP $ (3.1) 0.3 24.5 14.5 36.2 Retirement plans(c) 4.7 5.2 5.0 5.3 20.2 Venezuela operations(a) 1.7 5.0 0.4 (4.5) 2.6 Reorganization and Restructuring(a) 4.1 1.5 1.7 16.4 23.7 Acquisitions and dispositions(a) 6.5 6.5 2.9 2.3 18.2 Deferred tax valuation allowance(b) - - - 14.7 14.7 Income tax rate adjustment(f) 2.1 1.8 (0.2) (3.7) - Non-GAAP $ 16.0 20.3 34.3 45.0 115.6 EPS: GAAP $ (0.06) 0.01 0.48 0.28 0.72 Retirement plans(c) 0.09 0.10 0.10 0.10 0.39 Venezuela operations(a) 0.04 0.09 0.01 (0.09) 0.05 Reorganization and Restructuring(a) 0.08 0.03 0.04 0.33 0.47 Acquisitions and dispositions(a) 0.13 0.13 0.06 0.04 0.37 Deferred tax valuation allowance(b) - - - 0.29 0.29 Income tax rate adjustment(f) 0.04 0.04 (0.01) (0.07) - Non-GAAP $ 0.32 0.40 0.68 0.88 2.28 Depreciation and Amortization: GAAP $ 32.2 32.9 32.4 34.1 131.6 Venezuela operations(a) (0.1) (0.2) (0.1) (0.3) (0.7) Reorganization and Restructuring(a) - - - (0.8) (0.8) Acquisitions and dispositions(a) (0.9) (0.9) (0.9) (0.9) (3.6) Non-GAAP $ 31.2 31.8 31.4 32.1 126.5 Amounts may not add due to rounding. 30 See slide 31 for footnote explanations.

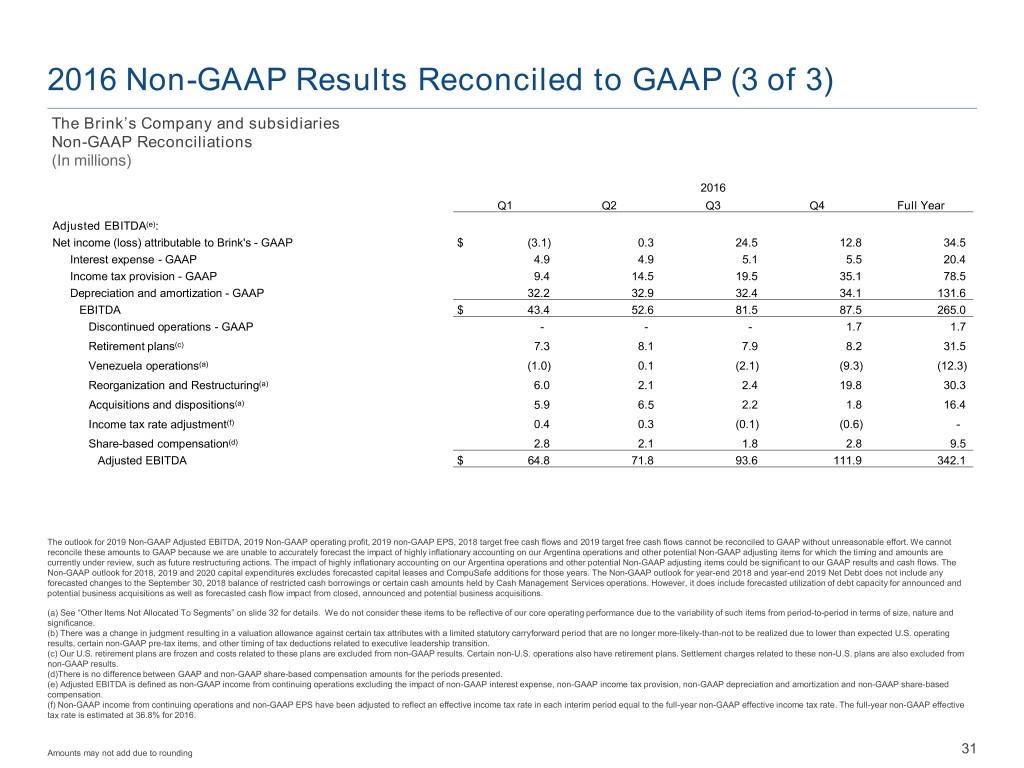

2016 Non-GAAP Results Reconciled to GAAP (3 of 3) The Brink’s Company and subsidiaries Non-GAAP Reconciliations (In millions) 2016 Q1 Q2 Q3 Q4 Full Year Adjusted EBITDA(e): Net income (loss) attributable to Brink's - GAAP $ (3.1) 0.3 24.5 12.8 34.5 Interest expense - GAAP 4.9 4.9 5.1 5.5 20.4 Income tax provision - GAAP 9.4 14.5 19.5 35.1 78.5 Depreciation and amortization - GAAP 32.2 32.9 32.4 34.1 131.6 EBITDA $ 43.4 52.6 81.5 87.5 265.0 Discontinued operations - GAAP - - - 1.7 1.7 Retirement plans(c) 7.3 8.1 7.9 8.2 31.5 Venezuela operations(a) (1.0) 0.1 (2.1) (9.3) (12.3) Reorganization and Restructuring(a) 6.0 2.1 2.4 19.8 30.3 Acquisitions and dispositions(a) 5.9 6.5 2.2 1.8 16.4 Income tax rate adjustment(f) 0.4 0.3 (0.1) (0.6) - Share-based compensation(d) 2.8 2.1 1.8 2.8 9.5 Adjusted EBITDA $ 64.8 71.8 93.6 111.9 342.1 The outlook for 2019 Non-GAAP Adjusted EBITDA, 2019 Non-GAAP operating profit, 2019 non-GAAP EPS, 2018 target free cash flows and 2019 target free cash flows cannot be reconciled to GAAP without unreasonable effort. We cannot reconcile these amounts to GAAP because we are unable to accurately forecast the impact of highly inflationary accounting on our Argentina operations and other potential Non-GAAP adjusting items for which the timing and amounts are currently under review, such as future restructuring actions. The impact of highly inflationary accounting on our Argentina operations and other potential Non-GAAP adjusting items could be significant to our GAAP results and cash flows. The Non-GAAP outlook for 2018, 2019 and 2020 capital expenditures excludes forecasted capital leases and CompuSafe additions for those years. The Non-GAAP outlook for year-end 2018 and year-end 2019 Net Debt does not include any forecasted changes to the September 30, 2018 balance of restricted cash borrowings or certain cash amounts held by Cash Management Services operations. However, it does include forecasted utilization of debt capacity for announced and potential business acquisitions as well as forecasted cash flow impact from closed, announced and potential business acquisitions. (a) See “Other Items Not Allocated To Segments” on slide 32 for details. We do not consider these items to be reflective of our core operating performance due to the variability of such items from period-to-period in terms of size, nature and significance. (b) There was a change in judgment resulting in a valuation allowance against certain tax attributes with a limited statutory carryforward period that are no longer more-likely-than-not to be realized due to lower than expected U.S. operating results, certain non-GAAP pre-tax items, and other timing of tax deductions related to executive leadership transition. (c) Our U.S. retirement plans are frozen and costs related to these plans are excluded from non-GAAP results. Certain non-U.S. operations also have retirement plans. Settlement charges related to these non-U.S. plans are also excluded from non-GAAP results. (d)There is no difference between GAAP and non-GAAP share-based compensation amounts for the periods presented. (e) Adjusted EBITDA is defined as non-GAAP income from continuing operations excluding the impact of non-GAAP interest expense, non-GAAP income tax provision, non-GAAP depreciation and amortization and non-GAAP share-based compensation. (f) Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate is estimated at 36.8% for 2016. Amounts may not add due to rounding 31

Non-GAAP Reconciliation - Other The Brink’s Company and subsidiaries Other Items Not Allocated to Segments (Unaudited) (In millions) Brink’s measures its segment results before income and expenses for corporate activities and for certain other items. A summary of the other items not allocated to segment results is below. Venezuela operations We have excluded from our segment results all of our Venezuela operating results, due to the Venezuelan government's restrictions that have prevented us from repatriating funds. As a result, the Chief Executive Officer, the Company's Chief Operating Decision maker ("CODM"), assesses segment performance and makes resource decisions by segment excluding Venezuela operating results. Reorganization and Restructuring 2016 Restructuring In the fourth quarter of 2016, management implemented restructuring actions across our global business operations and our corporate functions. As a result of these actions, we recognized $18.1 million in related 2016 costs. Executive Leadership and Board of Directors In 2015, we recognized $1.8 million in charges related to Executive Leadership and Board of Directors restructuring actions, which were announced in January 2016. We recognized $4.3 million in charges in 2016 related to the Executive Leadership and Board of Directors restructuring actions. 2015 Restructuring Brink's initiated a restructuring of its business in the third quarter of 2015. We recognized $11.6 million in related 2015 costs and an additional $6.5 million in 2016 related to this restructuring. The actions under this program were substantially completed by the end of 2016, with cumulative pretax charges of approximately $18 million. Due to the unique circumstances around these charges, they have not been allocated to segment results and are excluded from non-GAAP results. Acquisitions and dispositions Certain acquisition and disposition items that are not considered part of the ongoing activities of the business and are special in nature are consistently excluded from non-GAAP results. These items are described below: 2016 Acquisitions and Dispositions - Due to management's decision in the first quarter of 2016 to exit the Republic of Ireland, the prospective impacts of shutting down this operation were included in items not allocated to segments and were excluded from the operating segments effective March 1, 2016. This activity is also excluded from the consolidated non-GAAP results. Beginning May 1, 2016, due to management's decision to also exit Northern Ireland, the results of shutting down these operations were treated similarly to the Republic of Ireland. - Amortization expense for acquisition-related intangible assets was $3.6 million in 2016. - Brink's recognized a $2.0 million loss related to the sale of corporate assets in the second quarter of 2016. 32

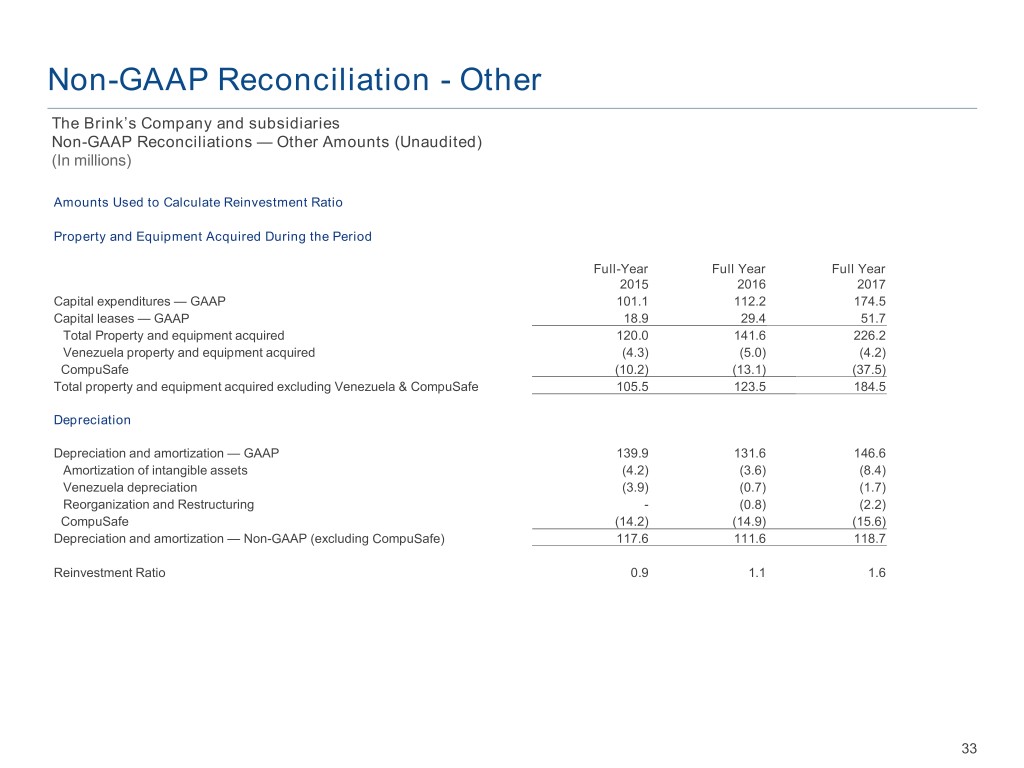

Non-GAAP Reconciliation - Other The Brink’s Company and subsidiaries Non-GAAP Reconciliations — Other Amounts (Unaudited) (In millions) Amounts Used to Calculate Reinvestment Ratio Property and Equipment Acquired During the Period Full-Year Full Year Full Year 2015 2016 2017 Capital expenditures — GAAP 101.1 112.2 174.5 Capital leases — GAAP 18.9 29.4 51.7 Total Property and equipment acquired 120.0 141.6 226.2 Venezuela property and equipment acquired (4.3) (5.0) (4.2) CompuSafe (10.2) (13.1) (37.5) Total property and equipment acquired excluding Venezuela & CompuSafe 105.5 123.5 184.5 Depreciation Depreciation and amortization — GAAP 139.9 131.6 146.6 Amortization of intangible assets (4.2) (3.6) (8.4) Venezuela depreciation (3.9) (0.7) (1.7) Reorganization and Restructuring - (0.8) (2.2) CompuSafe (14.2) (14.9) (15.6) Depreciation and amortization — Non-GAAP (excluding CompuSafe) 117.6 111.6 118.7 Reinvestment Ratio 0.9 1.1 1.6 33

Non-GAAP Reconciliation – Cash Flows The Brink’s Company and subsidiaries (In millions) Full Year 2017 Cash flows from operating activities Operating activities - GAAP $ 252.1 Venezuela operations (17.3) (Increase) decrease in certain customer obligations(a) (6.1) Operating activities - non-GAAP $ 228.7 (a) To adjust for the change in the balance of customer obligations related to cash received and processed in certain of our secure Cash Management Services operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources. Non-GAAP cash flows from operating activities is a supplemental financial measure that is not required by, or presented in accordance with GAAP. The purpose of this non-GAAP measure is to report financial information excluding cash flows from Venezuela operations and the impact of cash received and processed in certain of our Cash Management Services operations. We believe this measure is helpful in assessing cash flows from operations, enables period-to-period comparability and is useful in predicting future operating cash flows. This non-GAAP measure should not be considered as an alternative to cash flows from operating activities determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows. 34

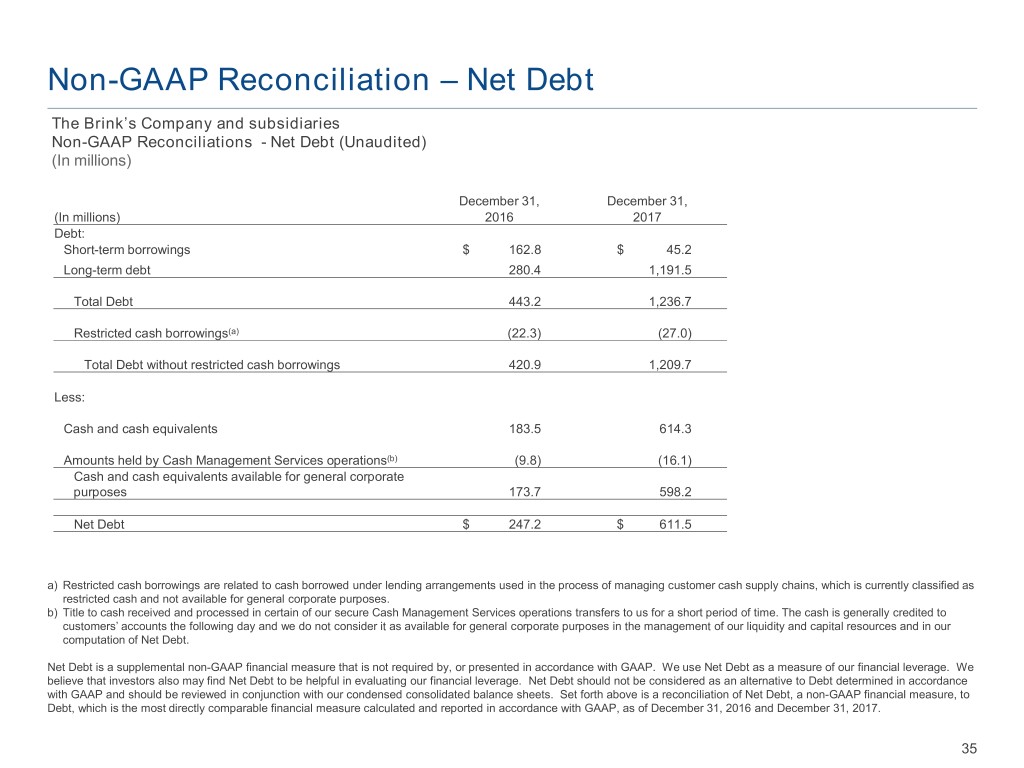

Non-GAAP Reconciliation – Net Debt The Brink’s Company and subsidiaries Non-GAAP Reconciliations - Net Debt (Unaudited) (In millions) December 31, December 31, (In millions) 2016 2017 Debt: Short-term borrowings $ 162.8 $ 45.2 Long-term debt 280.4 1,191.5 Total Debt 443.2 1,236.7 Restricted cash borrowings(a) (22.3) (27.0) Total Debt without restricted cash borrowings 420.9 1,209.7 Less: Cash and cash equivalents 183.5 614.3 Amounts held by Cash Management Services operations(b) (9.8) (16.1) Cash and cash equivalents available for general corporate purposes 173.7 598.2 Net Debt $ 247.2 $ 611.5 a) Restricted cash borrowings are related to cash borrowed under lending arrangements used in the process of managing customer cash supply chains, which is currently classified as restricted cash and not available for general corporate purposes. b) Title to cash received and processed in certain of our secure Cash Management Services operations transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources and in our computation of Net Debt. Net Debt is a supplemental non-GAAP financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our condensed consolidated balance sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most directly comparable financial measure calculated and reported in accordance with GAAP, as of December 31, 2016 and December 31, 2017. 35