Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ManpowerGroup Inc. | ex093018991pressrelease.htm |

| 8-K - 8-K - ManpowerGroup Inc. | man-093018x8k.htm |

ExhibitGlobal Recruiter99.2 Summit Accelerating Performance IN THE HUMAN AGE ManpowerGroup Third Quarter Results October 119, 2018 Corporate Governance Overview

ManpowerGroupFORWARD 2018- LOOKINGSecond Quarter STATEMENT Results Global Recruiter Summit This presentation contains statements, including financial projections, that are forward-looking in nature. These statements are based on managements’ current expectations or beliefs, and are subject to known and unknown risks and uncertainties regarding expected future results. Actual results might differ materially from those projected in the forward-looking statements. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in the ManpowerGroup Inc. Annual Report on Form 10-K dated December 31, 2017, which information is incorporated herein by reference, and such other factors as may be described from time to time in the Company’s SEC filings. Any forward-looking statements in this presentation speak only as of the date hereof. The Company assumes no obligation to update or revise any forward-looking statements. We reference certain non-GAAP financial measures, which we believe provide useful information for investors. We include a reconciliation of these measures, where appropriate, to GAAP on the Investor Relations section of our website at manpowergroup.com. October 2018 2 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Consolidated Financial Highlights As Reported Q3 Financial Highlights 1% Revenue $5.4B 1% CC 10 bps Gross Margin 16.4% 5% Operating Profit $217M 3% CC 20 bps OP Margin 4.0% 19% EPS $2.43 21% CC Throughout this presentation, the difference between reported variances and Constant Currency (CC) variances represents the impact of changes in currency on our financial results. Constant Currency is further explained in the Form 10-K on our Web site. 3 ManpowerGroup October 2018

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit EPS Bridge – Q3 vs. Guidance Midpoint -0.14 +0.13 +0.04 -0.04 +0.02 +0.01 $2.41 $2.39 $2.43 $2.26 Q3 Operational Argentina Other Income Currency Tax Rate WAS Q3 Reported Guidance Performance Translation (23% vs 27%) Midpoint Loss October 2018 4 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Consolidated Gross Margin Change -0.1% +0.1% -0.1% 16.5% 16.4% Q3 2017 Staffing/Interim Permanent MSP Q3 2018 Recruitment October 2018 5 ManpowerGroup

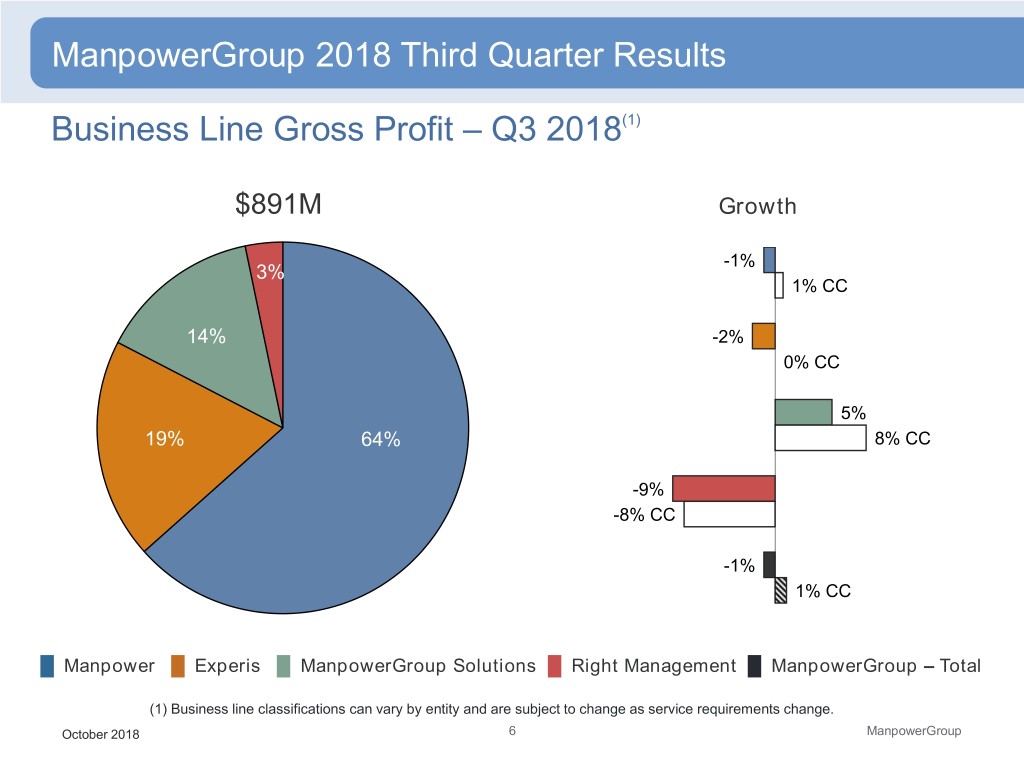

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Business Line Gross Profit – Q3 2018(1) $891M Growth -1% 3% 1% CC 14% -2% 0% CC 5% 19% 64% 8% CC -9% -8% CC -1% 1% CC █ Manpower █ Experis █ ManpowerGroup Solutions █ Right Management █ ManpowerGroup – Total (1) Business line classifications can vary by entity and are subject to change as service requirements change. October 2018 6 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit SG&A Expense Bridge – Q3 YoY (in millions of USD) -11.5 +11.2 +2.3 671.9 673.9 Q3 2017 Currency Acquisitions Operational Impact Q3 2018 12.3% 12.4% % of Revenue % of Revenue October 2018 7 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Americas Segment (19% of Revenue) As Reported Q3 Financial Highlights 2% Revenue $1.0B 2% CC 14% OUP $51M 11% CC 70 bps OUP Margin 4.9% Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs. October 2018 8 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Americas – Q3 Revenue Growth YoY % of Segment Average Daily Revenue Revenue Growth - CC -4% US 61% -4% -4% -1% Mexico 14% 5% 4% -37% Argentina 3% 14% 6% (1) 11% Other 22% 16% Revenue Growth Revenue Growth - CC (1) On an organic basis, revenue for Other increased 6% (11% in constant currency). October 2018 9 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Southern Europe Segment (43% of Revenue) As Reported Q3 Financial Highlights 1% Revenue $2.3B 2% CC 3% OUP $122M 4% CC 10 bps OUP Margin 5.2% October 2018 10 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Southern Europe – Q3 Revenue Growth YoY % of Segment Average Daily Revenue Revenue Growth - CC -1% France -1% 63% -1% 6% 18% Italy 7% 7% -3% 7% Spain 0% -2% 5% 12% Other 8% Revenue Growth Revenue Growth - CC October 2018 11 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Northern Europe Segment (24% of Revenue) As Reported Q3 Financial Highlights 6% Revenue $1.3B 4% CC 19% OUP $40M 17% CC 50 bps OUP Margin 3.1% October 2018 12 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Northern Europe – Q3 Revenue Growth YoY % of Segment Average Daily Revenue Revenue Growth - CC UK -1% 31% 0% 0% -14% Germany 20% -14% -14% -9% Nordics -3% 19% -3% -5% 14% Netherlands -4% -4% 0% 9% Belgium -1% 1% 7% Other 0% 4% Revenue Growth Revenue Growth - CC October 2018 13 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit APME Segment (13% of Revenue) As Reported Q3 Financial Highlights 7% Revenue $713M 10% CC 18% OUP $32M 21% CC 40 bps OUP Margin 4.5% October 2018 14 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit APME – Q3 Revenue Growth YoY Average Daily % of Segment Revenue Growth - CC Revenue 3% 31% Japan 3% 3% -1% 22% Australia/NZ 6% 6% 15% 47% Other 17% Revenue Growth Revenue Growth - CC October 2018 15 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Right Management Segment (1% of Revenue) As Reported Q3 Financial Highlights 9% Revenue $47M 7% CC 19% OUP $7M 18% CC 170 bps OUP Margin 14.0% October 2018 16 ManpowerGroup

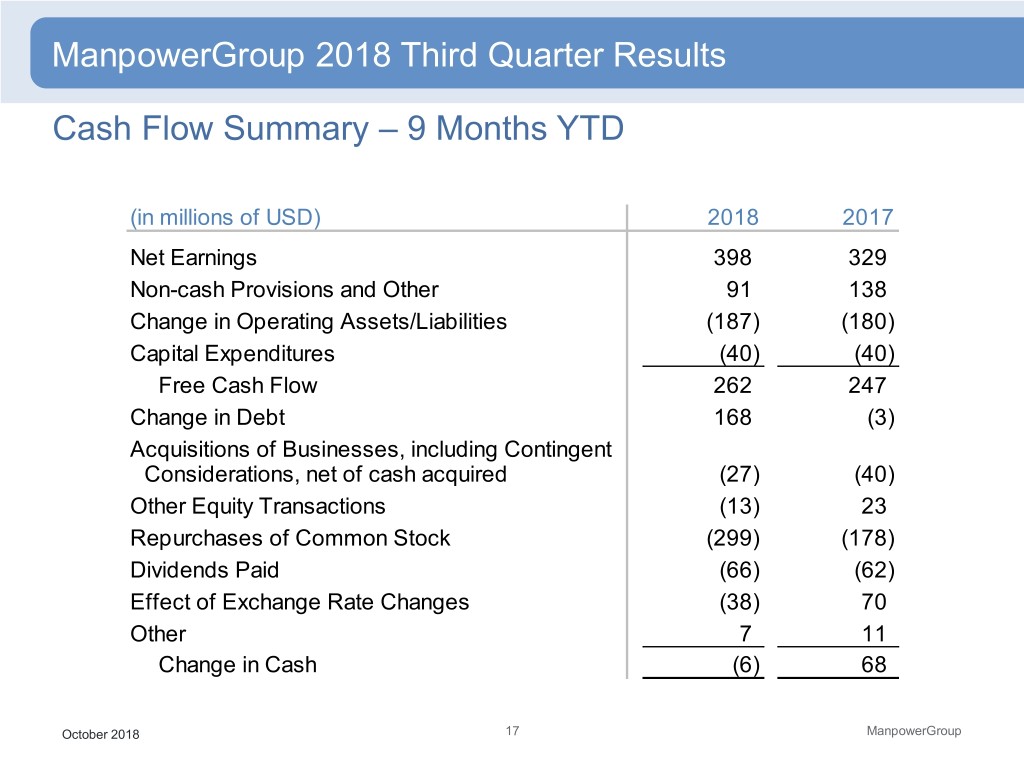

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Cash Flow Summary – 9 Months YTD (in millions of USD) 2018 2017 Net Earnings 398 329 Non-cash Provisions and Other 91 138 Change in Operating Assets/Liabilities (187) (180) Capital Expenditures (40) (40) Free Cash Flow 262 247 Change in Debt 168 (3) Acquisitions of Businesses, including Contingent Considerations, net of cash acquired (27) (40) Other Equity Transactions (13) 23 Repurchases of Common Stock (299) (178) Dividends Paid (66) (62) Effect of Exchange Rate Changes (38) 70 Other 7 11 Change in Cash (6) 68 October 2018 17 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Balance Sheet Highlights Total Debt (in millions of USD) 1,250 1,000 1,089 1,079 948 970 750 855 825 Total Debt 500 Net Debt (Cash) 468 250 418 396 227 259 321 0 -231 125 -250 2014 2015 2016 2017 Q1 Q2 Q3 2018 Total Debt to Total Capitalization 30% 28% 28% 25% 25% 25% 20% 24% 10% 14% 0% 2014 2015 2016 2017 Q1 Q2 Q3 2018 October 2018 18 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Debt and Credit Facilities – September 30, 2018 (in millions of USD) Interest Maturity Total Remaining Rate Date Outstanding Available Euro Notes - €500M 1.809% Jun 2026 575 - Euro Notes - €400M 1.913% Sep 2022 462 - (1) Revolving Credit Agreement 3.26% Jun 2023 - 599 (2) Uncommitted lines and Other Various Various 42 266 Total Debt 1,079 865 (1) The $600M agreement requires that we comply with a Leverage Ratio (net Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a net Debt-to-EBITDA ratio of 0.86 and a fixed charge coverage ratio of 5.31 as of Sept 30, 2018. As of Sept 30, 2018, there were $0.5M of standby letters of credit issued under the agreement. (2) Represents subsidiary uncommitted lines of credit & overdraft facilities, which total $307.5M. Total subsidiary borrowings are limited to $300M due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M. October 2018 19 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Fourth Quarter Outlook Revenue Total Down 2-4% (Down/Up 1% CC) Americas Down 1-3% (Up 1-3% CC) Southern Europe Flat/Down 2% (Flat/Up 2% CC) Northern Europe Down 5-7% (Down 3-5% CC) APME Flat/Up 2% (Up 3-5% CC) Right Management Down 8-10% (Down 6-8% CC) Gross Profit Margin 15.9 – 16.1% Operating Profit Margin 3.6 – 3.8% Tax Rate 27.5% EPS $2.15 – $2.23 (unfavorable $0.05 currency) October 2018 20 ManpowerGroup

ManpowerGroup 2018 2018 Third Second Quarter Quarter Results Results Global Recruiter Summit Key Take Aways Third quarter results reflect a softened market environment, particularly in Europe. Our global footprint and broad portfolio of services and solutions gives us the opportunity to pursue growth opportunities even when some markets become more challenging. We continue to implement leading technology tools throughout our businesses globally. Although we expect the environment to continue to be challenging in Europe during the fourth quarter, we will continue to execute on our strategic priorities while managing costs and productivity. October 2018 21 ManpowerGroup