Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FIRST FINANCIAL BANCORP /OH/ | a8k3q18earningsreleaseex991.htm |

| 8-K - 8-K - FIRST FINANCIAL BANCORP /OH/ | a8kearningsrelease3q18.htm |

Exhibit 99.2 Earnings Presentation Third Quarter 2018

Forward Looking Statement Disclosure Certain statements contained in this report which are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as ‘‘believes,’’ ‘‘anticipates,’’ “likely,” “expected,” “estimated,” ‘‘intends’’ and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Examples of forward-looking statements include, but are not limited to, statements we make about (i) our future operating or financial performance, including revenues, income or loss and earnings or loss per share, (ii) future common stock dividends, (iii) our capital structure, including future capital levels, (iv) our plans, objectives and strategies, and (v) the assumptions that underlie our forward-looking statements. As with any forecast or projection, forward-looking statements are subject to inherent uncertainties, risks and changes in circumstances that may cause actual results to differ materially from those set forth in the forward-looking statements. Forward-looking statements are not historical facts but instead express only management’s beliefs regarding future results or events, many of which, by their nature, are inherently uncertain and outside of management’s control. It is possible that actual results and outcomes may differ, possibly materially, from the anticipated results or outcomes indicated in these forward-looking statements. Important factors that could cause actual results to differ materially from those in our forward-looking statements include the following, without limitation: (i) economic, market, liquidity, credit, interest rate, operational and technological risks associated with the Company’s business; (ii) the effect of and changes in policies and laws or regulatory agencies, including the Dodd-Frank Wall Street Reform and Consumer Protection Act and other legislation and regulation relating to the banking industry; (iii) management’s ability to effectively execute its business plans; (iv) mergers and acquisitions, including costs or difficulties related to the integration of acquired companies; (v) the possibility that any of the anticipated benefits of the Company’s recent merger with MainSource Financial Group, Inc. will not be realized or will not be realized within the expected time period; (vi) the effect of changes in accounting policies and practices; (vii) changes in consumer spending, borrowing and saving and changes in unemployment; (viii) changes in customers’ performance and creditworthiness; and (ix) the costs and effects of litigation and of unexpected or adverse outcomes in such litigation. Additional factors that may cause our actual results to differ materially from those described in our forward- looking statements can be found in the Form 10-K for the year ended December 31, 2017, as well as its other filings with the SEC, which are available on the SEC website at www.sec.gov. All forward-looking statements included in this filing are made as of the date hereof and are based on information available at the time of the filing. Except as required by law, the Company does not assume any obligation to update any forward-looking statement. . 2

3Q 2018 Results 112th Consecutive Quarter of Profitability . Net income = $50.7 million or $0.51 per diluted share. Adjusted net income = $57.0 million or $0.58 per diluted share1,2 1 Profitability . Return on average assets = 1.45%. Adjusted return on average assets = 1.64% . Return on average shareholders’ equity = 9.94%. Adjusted return on average shareholders’ equity = 11.19%1 . Return on average tangible common equity = 18.52%1. Adjusted return on average tangible common equity = 20.83%1 . Net interest income = $123.5 million. . Net interest margin of 4.06% on a GAAP basis; 4.12% on a fully tax equivalent basis1. . Noninterest income = $28.7 million ; $29.3 million1 as adjusted for merger related items Income Statement . Noninterest expense = $85.4 million; $78.0 million1 as adjusted for merger related items. . Efficiency ratio = 56.13%. Adjusted efficiency ratio = 51.06%1 . Effective tax rate of 20.2%. Adjusted effective tax rate of 20.3%1 . Total assets decreased $77.5 million compared to the linked quarter to $13.8 billion. . EOP loans decreased $37.2 million compared to the linked quarter to $8.8 billion. Balance Sheet . EOP deposits decreased $351.1 million compared to the linked quarter to $9.8 billion. . EOP investment securities decreased $17.0 million compared to the linked quarter. . Provision expense = $3.2 million. Net charge offs = ($0.4) million. NCOs / Avg. Loans = (0.02)% annualized. Asset Quality . Nonperforming Loans / Total Loans = 0.71%. Nonperforming Assets / Total Assets = 0.47%. . ALLL / Nonaccrual Loans = 136.22%. ALLL / Total Loans = 0.65%. Classified Assets / Total Assets = 1.00%. . Credit mark of $30.8 million on acquired MainSource loans. . Total capital ratio = 13.77%. Capital . Tier 1 common equity ratio = 11.52%. . Tangible common equity ratio = 8.53%. . Tangible book value per share = $11.25. 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. 2 See Slide 5 for Adjusted Earnings detail. 3

3Q 2018 Highlights Strong quarterly earnings Adjusted1 earnings per share - $0.58 Adjusted1 return on assets – 1.64% Adjusted1 return on average tangible common equity – 20.83% Expansion in capital ratios Stable net interest margin Slight decline driven by lower loan fees and day count Higher asset yields offset by shifts in funding mix Adjusted1 noninterest income increased $0.7 million to $29.3 million compared to the linked quarter Adjusted1 noninterest expense decreased $0.8 million to $78.0 million compared to the linked quarter Slight decline in loan balances Increased fundings and commitments offset by lower than expected line utilization and elevated payoffs compared to the linked quarter Deposit outflows primarily related to decline in public funds and brokered CD’s Core deposit attrition rates began to normalize late in the third quarter Credit quality remains excellent 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. 4

Adjusted Net Income 1 The table below lists certain adjustments that we believe are significant to understanding our quarterly performance. 3Q 2018 2Q 2018 As Reported Adjusted As Reported Adjusted Net interest income $ 123,485 $ 123,485 $ 123,979 $ 123,979 Provision for loan and lease losses $ 3,238 $ 3,238 $ 3,735 $ 3,735 Noninterest income $ 28,684 $ 28,684 $ 28,256 $ 28,256 plus: bankcard interchange 340 A 341 A plus: losses on investment securities 279 A 30 A Total noninterest income $ 28,684 $ 29,303 $ 28,256 $ 28,627 Noninterest expense $ 85,415 $ 85,415 $ 102,755 $ 102,755 less: merger-related expenses 5,205 A 19,397 A less: severance expenses 2,200 A 4,546 A Total noninterest expense $ 85,415 $ 78,010 $ 102,755 $ 78,812 Income before income taxes $ 63,516 $ 71,540 $ 45,745 $ 70,059 Income tax expense $ 12,859 $ 12,859 $ 9,327 $ 9,327 plus: tax effect of adjustments (A) @ 21% statutory rate - 1,685 - 5,106 Total income tax expense $ 12,859 $ 14,544 $ 9,327 $ 14,433 Net income $ 50,657 $ 56,996 $ 36,418 $ 55,626 Net earnings per share - diluted $ 0.51 $ 0.58 $ 0.37 $ 0.57 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliations. All dollars shown in thousands, except per share amounts 5

Profitability Diluted EPS Return on Average Assets $0.57 $0.58 1.60% 1.64% $0.52 1.49% $0.45 1.26% $0.39 1.11% 1.45% $0.49 $0.51 1.40% $0.40 $0.40 1.13% 1.13% $0.37 1.05% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 1 DilutedEPS Adjusted EPS 1 ROA Adjusted ROA Return on Avg Tangible Common Equity Efficiency Ratio 88.19% 21.00% 20.83% 58.28% 67.50% 18.24% 56.38% 56.13% 15.47% 13.86% 18.5% 57.02% 57.99% 53.79% 17.2% 51.64% 51.06% 14.1% 13.9% 13.7% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 1 ROATCE Adjusted ROATCE 1 Adjusted Efficiency Ratio Efficiency Ratio 1 Non-GAAP financial measure which management believes facilitates a better understanding of the Company’s financial condition. See Appendix for Non-GAAP reconciliation. 6

Net Interest Margin Net Interest Margin (FTE) 3Q18 NIM (FTE) Progression 4.15% 4.12% 2Q18 4.15% Asset yields 0.09% 0.29% 0.29% 3.82% 3.84% Asset mix -0.01% 0.15% 0.15% 0.13% Loan fees -0.02% 0.24% 3.57% Funding costs -0.02% 0.14% Funding mix -0.05% 3.69% 3.71% 3.70% 3.58% Purchase accounting 0.00% 3.43% Day count -0.02% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q18 4.12% Basic Margin (FTE) Loan Fees Purchase accounting 7

Average Balance Sheet Average Loans Average Deposits 5.49% 5.53% 0.61% 0.60% 0.59% 5.05% 0.54% 0.57% 4.90% 4.71% $8,933 $8,849 $5,911 $5,960 $6,018 $10,383 $9,888 $6,680 $6,840 $6,903 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Gross Loans Loan Yield (Gross) Total Deposits Cost of Deposits Average Securities 3.16% 3.21% 3.04% 2.85% 2.90% $3,157 $3,168 $2,042 $2,020 $2,043 3Q17 4Q17 1Q18 2Q18 3Q18 Average Investment Securities Investment Securities Yield All dollars shown in millions 8

Loan Portfolio Loan LOB Mix (EOP) Net Loan Change-LOB (Linked Quarter) Total $8.8 billion ICRE $36.6 $1,074 Commercial -$13.1 12% $2,747 Small Business Banking -$75.2 $971 31% 11% Consumer -$19.8 $921 11% Mortgage $13.5 Commercial Finance $40.7 $1,360 $1,774 15% 20% 1 Other -$19.9 ICRE Commercial Small Business Banking Consumer Total growth/(decline): ($37.2) Mortgage Commercial Finance 1 Includes planned attrition related to syndications and loan marks All dollars shown in millions 9

Deposits Deposit Product Mix (Avg) 3Q18 Average Deposit Progression Total $9.9 billion Balance as of June 30 $ 10,382,635 $ 1,408 14% $ 2,389 Impact from: 24% $ 1,245 Branch divestiture (86,335) 13% $ 576 Brokered CD's (155,326) 6% $ 906 $ 1,058 9% Public funds (163,126) 11% $ 381 $ 1,925 Total (404,787) 4% 19% Organic growth/(decline) (89,760) Interest-bearing demand Public Funds Savings Money Markets Balance as of September 30 $ 9,888,088 Other Time Retail CDs Brokered CDs Noninterest-bearing Dollars shown in millions Dollars shown in thousands 10

Asset Quality Classified Assets / Total Assets Nonperforming Assets / Total Assets 1.08% 0.98% 0.98% 1.00% 1.00% 0.60% 0.50% 0.52% 0.46% 0.47% $139.3 $138.9 $64.2 $64.6 $52.9 $44.4 $46.3 $94.3 $87.3 $87.6 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Classified Assets Classified Assets / Total Assets NPAs NPAs / Total Assets Allowance / Total Loans Net Charge Offs & Provision Expense 0.22% 0.18% 0.91% 0.90% 0.89% 0.13% 0.65% 0.02% -0.02% 0.61% $4.0 $3.7 $3.3 $54.5 $54.0 $54.4 $54.1 $57.7 $3.0 $3.2 $2.3 $1.9 3Q17 4Q17 1Q18 2Q18 3Q18 $0.3 -$0.2 -$0.4 3Q17 4Q17 1Q18 2Q18 3Q18 Allowance for Loan Losses ALLL / Total Loans NCOs Provision Expense NCOs / Average Loans All dollars shown in millions 11

Capital Tangible Book Value Per Share Total Capital Ratio $11.75 $11.62 $11.36 $11.25 13.77% $11.01 13.36% 13.17% 12.50% 12.98% 13.07% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Tangible Book Value per Share Total Capital Ratio Target Tier 1 Common Equity Ratio Tangible Common Equity Ratio 11.52% 8.53% 10.50% 11.15% 8.30% 8.41% 8.30% 10.77% 8.25% 10.53% 10.63% 7.50% 3Q17 4Q17 1Q18 2Q18 3Q18 3Q17 4Q17 1Q18 2Q18 3Q18 Tier 1 Common Equity Ratio Target Tangible Common Equity Ratio Target All capital numbers are considered preliminary 12

Appendix: Non-GAAP Measures The Company’s earnings release and accompanying presentation contain certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States (GAAP). Such non-GAAP financial information should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. However, we believe that non-GAAP reporting provides meaningful information and therefore we use it to supplement our GAAP information. We have chosen to provide this supplemental information to investors, analysts and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments and to provide an additional measure of performance. We believe this information is helpful in understanding the results of operations separate and apart from items that may, or could, have a disproportional positive or negative impact in any given period. For a reconciliation of the differences between the non-GAAP financial measures and the most comparable GAAP measures, please refer to the following reconciliation tables. to GAAP Reconciliation 13

Appendix: Non-GAAP to GAAP Reconciliation Net interest income and net interest margin - fully tax equivalent Three months ended Sep. 30, June 30, Mar. 31, Dec. 31, Sep. 30, 2018 2018 2018 2017 2017 Net interest income $ 123,485 $ 123,979 $ 75,812 $ 75,614 $ 70,479 Tax equivalent adjustment 1,567 1,420 718 1,387 1,353 Net interest income - tax equivalent $ 125,052 $ 125,399 $ 76,530 $ 77,001 $ 71,832 Average earning assets $ 12,056,627 $ 12,120,000 $ 8,087,848 $ 8,005,100 $ 7,989,969 Net interest margin* 4.06 % 4.10 % 3.80 % 3.75 % 3.50 % Net interest margin (fully tax equivalent)* 4.12 % 4.15 % 3.84 % 3.82 % 3.57 % * Margins are calculated using net interest income annualized divided by average earning assets. The tax equivalent adjustment to net interest income recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 21% tax rate for 2018 and a 35% tax rate for 2017. Management believes that it is a standard practice in the banking industry to present net interest margin and net interest income on a fully tax equivalent basis. Therefore, management believes these measures provide useful information to investors by allowing them to make peer comparisons. Management also uses these measures to make peer comparisons. All dollars shown in thousands 14

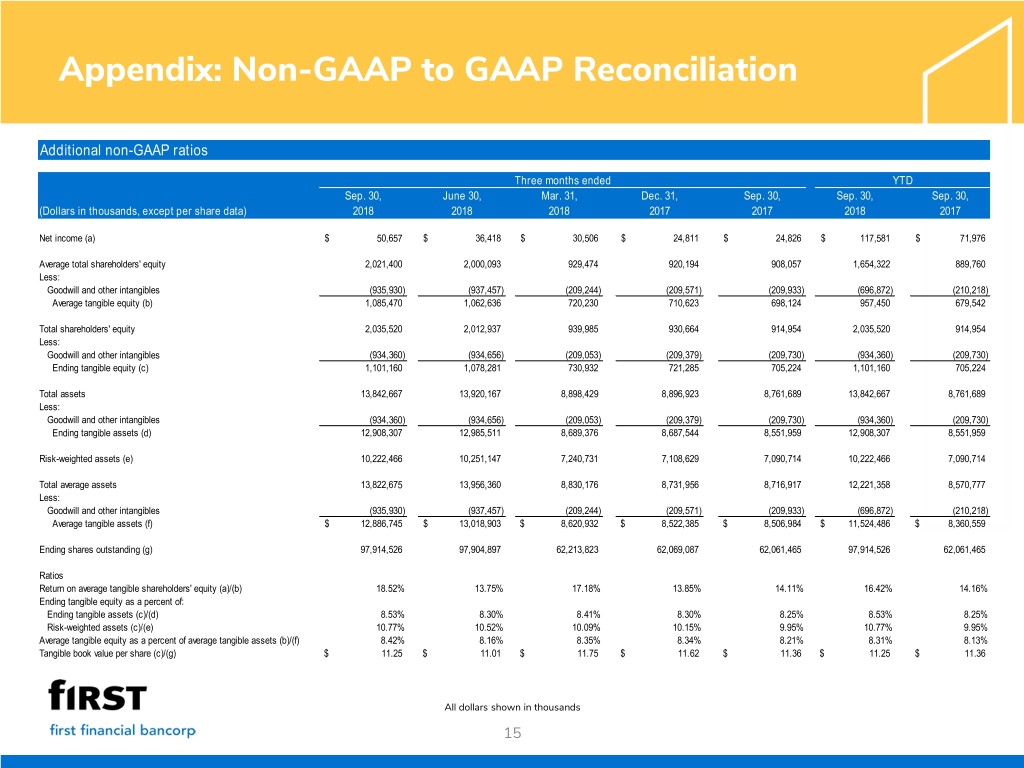

Appendix: Non-GAAP to GAAP Reconciliation Additional non-GAAP ratios Three months ended YTD Sep. 30, June 30, Mar. 31, Dec. 31, Sep. 30, Sep. 30, Sep. 30, (Dollars in thousands, except per share data) 2018 2018 2018 2017 2017 2018 2017 Net income (a) $ 50,657 $ 36,418 $ 30,506 $ 24,811 $ 24,826 $ 117,581 $ 71,976 Average total shareholders' equity 2,021,400 2,000,093 929,474 920,194 908,057 1,654,322 889,760 Less: Goodwill and other intangibles (935,930) (937,457) (209,244) (209,571) (209,933) (696,872) (210,218) Average tangible equity (b) 1,085,470 1,062,636 720,230 710,623 698,124 957,450 679,542 Total shareholders' equity 2,035,520 2,012,937 939,985 930,664 914,954 2,035,520 914,954 Less: Goodwill and other intangibles (934,360) (934,656) (209,053) (209,379) (209,730) (934,360) (209,730) Ending tangible equity (c) 1,101,160 1,078,281 730,932 721,285 705,224 1,101,160 705,224 Total assets 13,842,667 13,920,167 8,898,429 8,896,923 8,761,689 13,842,667 8,761,689 Less: Goodwill and other intangibles (934,360) (934,656) (209,053) (209,379) (209,730) (934,360) (209,730) Ending tangible assets (d) 12,908,307 12,985,511 8,689,376 8,687,544 8,551,959 12,908,307 8,551,959 Risk-weighted assets (e) 10,222,466 10,251,147 7,240,731 7,108,629 7,090,714 10,222,466 7,090,714 Total average assets 13,822,675 13,956,360 8,830,176 8,731,956 8,716,917 12,221,358 8,570,777 Less: Goodwill and other intangibles (935,930) (937,457) (209,244) (209,571) (209,933) (696,872) (210,218) Average tangible assets (f) $ 12,886,745 $ 13,018,903 $ 8,620,932 $ 8,522,385 $ 8,506,984 $ 11,524,486 $ 8,360,559 Ending shares outstanding (g) 97,914,526 97,904,897 62,213,823 62,069,087 62,061,465 97,914,526 62,061,465 Ratios Return on average tangible shareholders' equity (a)/(b) 18.52% 13.75% 17.18% 13.85% 14.11% 16.42% 14.16% Ending tangible equity as a percent of: Ending tangible assets (c)/(d) 8.53% 8.30% 8.41% 8.30% 8.25% 8.53% 8.25% Risk-weighted assets (c)/(e) 10.77% 10.52% 10.09% 10.15% 9.95% 10.77% 9.95% Average tangible equity as a percent of average tangible assets (b)/(f) 8.42% 8.16% 8.35% 8.34% 8.21% 8.31% 8.13% Tangible book value per share (c)/(g) $ 11.25 $ 11.01 $ 11.75 $ 11.62 $ 11.36 $ 11.25 $ 11.36 All dollars shown in thousands 15

Appendix: Non-GAAP to GAAP Reconciliation Additional non-GAAP measures 3Q18 2Q18 1Q18 4Q17 3Q17 (Dollars in thousands, except per share data) As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted As Reported Adjusted Net interest income (f) $ 123,485 $ 123,485 $ 123,979 $ 123,979 $ 75,812 $ 75,812 $ 75,614 $ 75,614 $ 70,479 $ 70,479 Provision for loan and lease losses 3,238 3,238 3,735 3,735 2,303 2,303 (205) (205) 2,953 2,953 plus: provision expense adjustment 799 Noninterest income 28,684 28,684 28,256 28,256 16,938 16,938 18,382 18,382 22,942 22,942 less: gains from the redemption of off balance sheet securitizations 5,764 plus: Bankcard interchange 340 341 plus: losses on sale of investment securities 279 30 (19) (275) Total noninterest income (g) 28,684 29,303 28,256 28,627 16,938 16,938 18,382 18,363 22,942 16,903 Noninterest expense 85,415 85,415 102,755 102,755 52,288 52,288 82,898 82,898 54,443 54,443 less: severance expense 2,200 4,546 3,818 less: historic tax credit investment write-down 11,328 less: merger-related expenses 5,205 19,397 1,985 8,444 800 less: indemnification asset impairment 1 527 5,055 less: charitable foundation contribution 3,000 less: other (113) 577 Total noninterest expense (e) 85,415 78,010 102,755 78,812 52,288 49,889 82,898 54,494 54,443 49,825 Income before income taxes (i) 63,516 71,540 45,745 70,059 38,159 40,558 11,303 39,688 36,025 35,403 Income tax expense 12,859 12,859 9,327 9,327 7,653 7,653 (13,508) (13,508) 11,199 11,199 plus: tax effect of adjustments 1,685 5,106 504 9,935 (178) plus: tax reform impact on DTLs & tax partnerships 8,191 plus: after-tax impact of historic tax credit write-down @ 35% - - - 7,363 - Total income tax expense (h) 12,859 14,544 9,327 14,433 7,653 8,157 (13,508) 11,981 11,199 11,021 Net income (a) $ 50,657 $ 56,996 $ 36,418 $ 55,626 $ 30,506 $ 32,401 $ 24,811 $ 27,707 $ 24,826 $ 24,382 Average diluted shares (b) 98,484 98,484 98,432 98,432 62,181 62,181 62,132 62,132 62,190 62,190 Average assets (c) 13,822,675 13,822,675 13,956,360 13,956,360 8,830,176 8,830,176 8,731,956 8,731,956 8,716,917 8,716,917 Average shareholders' equity 2,021,400 2,021,400 2,000,093 2,000,093 929,474 929,474 920,194 920,194 908,057 908,057 Less: Goodwill and other intangibles (935,930) (935,930) (937,457) (937,457) (209,244) (209,244) (209,571) (209,571) (209,933) (209,933) Average tangible equity (d) 1,085,470 1,085,470 1,062,636 1,062,636 720,230 720,230 710,623 710,623 698,124 698,124 1 - Impairment charge related to preliminary agreement to terminate FDIC loss sharing agreements. Ratios Net earnings per share - diluted (a)/(b) $ 0.51 $ 0.58 $ 0.37 $ 0.57 $ 0.49 $ 0.52 $ 0.40 $ 0.45 $ 0.40 $ 0.39 Return on average assets - (a)/(c) 1.45% 1.64% 1.05% 1.60% 1.40% 1.49% 1.13% 1.26% 1.13% 1.11% Return on average tangible shareholders' equity - (a)/(d) 18.52% 20.83% 13.75% 21.00% 17.18% 18.24% 13.85% 15.47% 14.11% 13.86% Efficiency ratio - (e)/((f)+(g)) 56.1% 51.1% 67.5% 51.6% 56.4% 53.8% 88.2% 58.0% 58.3% 57.0% Effective tax rate - (h)/(i) 20.2% 20.3% 20.4% 20.6% 20.1% 20.1% -119.5% 30.2% 31.1% 31.1% 16

Update -New colors 17