Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - MURPHY OIL CORP | mur-20181010xex99_1.htm |

| EX-10.1 - EX-10.1 - MURPHY OIL CORP | mur-20181010xex10_1.htm |

| 8-K - 8-K - MURPHY OIL CORP | mur-20181010x8k.htm |

ROGER W. JENKINS PRESIDENT & CHIEF EXECUTIVE OFFICER MURPHY ANNOUNCES STRATEGIC DEEP WATER, OIL-WEIGHTED GULF OF MEXICO JOINT VENTURE October 11, 2018 Murphy Oil Corporation 1

Cautionary Statement & Investor Relations Contacts Cautionary Note to U.S. Investors – The United States Securities and Exchange Commission (SEC) requires oil and natural gas companies, in their filings with the SEC, to disclose proved reserves that a company has demonstrated by actual production or conclusive formation tests to be economically and legally producible under existing economic and operating conditions. We may use certain terms in this presentation, such as “resource”, “gross resource”, “recoverable resource”, “net risked PMEAN resource”, “recoverable oil”, “resource base”, “EUR” or “estimated ultimate recovery” and similar terms that the SEC’s rules prohibit us from including in filings with the SEC. The SEC permits the optional disclosure of probable and possible reserves in our filings with the SEC. Investors are urged to consider closely the disclosures and risk factors in our most recent Annual Report on Form 10-K filed with the SEC and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K that we file, available from the SEC’s website. Forward-Looking Statements – This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified through the inclusion of words such as “aim”, “anticipate”, “believe”, “drive”, “estimate”, “expect”, “expressed confidence”, “forecast”, “future”, “goal”, “guidance”, “intend”, “may”, “objective”, “outlook”, “plan”, “position”, “potential”, “project”, “seek”, “should”, “strategy”, “target”, “will” or variations of such words and other similar expressions. These statements, which express management’s current views concerning future events or results, are subject to inherent risks and uncertainties. Factors that could cause one or more of these future events or results not to occur as implied by any forward-looking statement include, but are not limited to, increased volatility or deterioration in the level of crude oil and natural gas prices, deterioration in the success rate of our exploration programs or in our ability to maintain production rates and replace reserves, reduced customer demand for our products due to environmental, regulatory, technological or other reasons, adverse foreign exchange movements, political and regulatory instability in the markets where we do business, natural hazards impacting our operations, any other deterioration in our business, markets or prospects, any failure to obtain necessary regulatory approvals, any inability to service or refinance our outstanding debt or to access debt markets at acceptable prices, and adverse developments in the U.S. or global capital markets, credit markets or economies in general. For further discussion of factors that could cause one or more of these future events or results not to occur as implied by any forward-looking statement, see “Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K that we file, available from the SEC’s website. Murphy undertakes no duty to publicly update or revise any forward-looking statements. Investor Relations Contacts Kelly Whitley VP, Investor Relations & Communications 281-675-9107 Email: kelly_whitley@murphyoilcorp.com Emily McElroy Sr. Investor Relations Analyst 870-864-6324 Email: emily_mcelroy@murphyoilcorp.com Murphy Oil Corporation www.murphyoilcorp.com NYSE:MUR 2

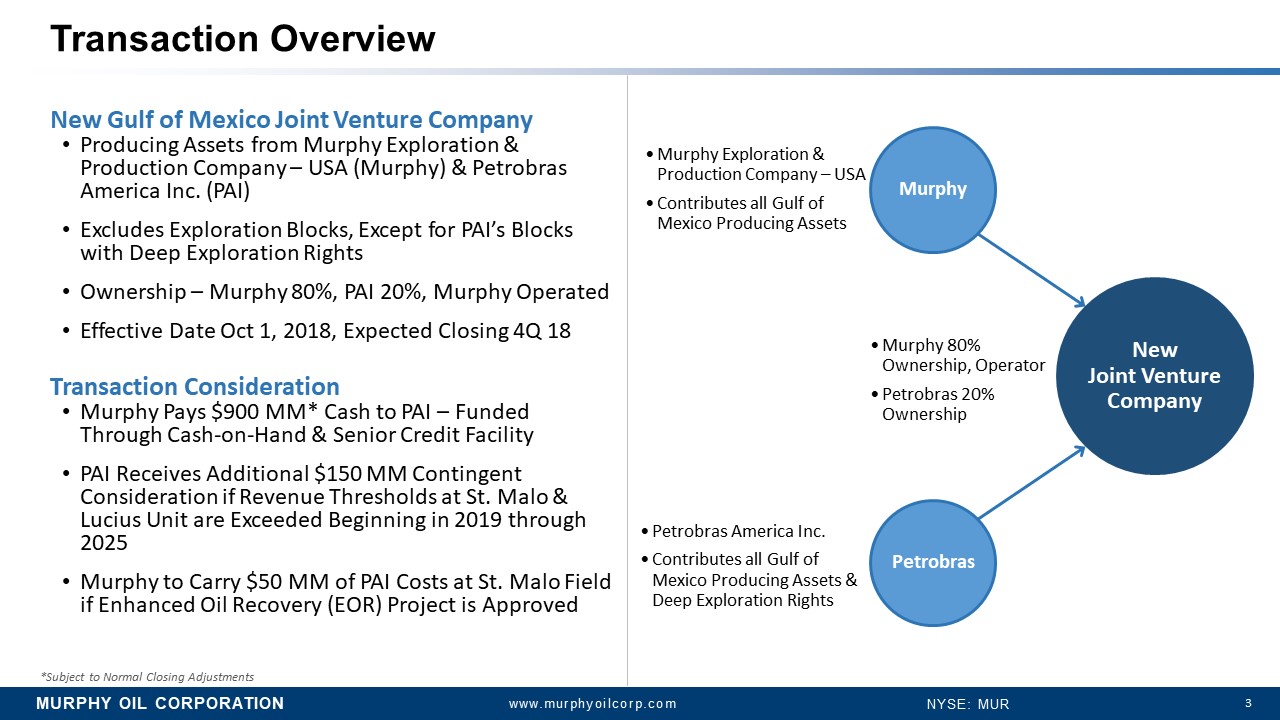

Transaction Overview New Gulf of Mexico Joint Venture Company •Producing Assets from Murphy Exploration & Production Company –USA (Murphy) & Petrobras America Inc. (PAI) •Excludes Exploration Blocks, Except for PAI’s Blocks with Deep Exploration Rights •Ownership –Murphy 80%, PAI 20%, Murphy Operated •Effective Date Oct 1, 2018, Expected Closing 4Q 18 Transaction Consideration •Murphy Pays $900 MM* Cash to PAI –Funded Through Cash-on-Hand & Senior Credit Facility •PAI Receives Additional $150 MM Contingent Consideration if Revenue Thresholds at St. Malo & Lucius Unit are Exceeded Beginning in 2019through 2025 •Murphy to Carry $50 MM of PAI Costs at St. Malo Field if Enhanced Oil Recovery (EOR) Project is Approved Murphy •Murphy Exploration & Production Company –USA •Contributes all Gulf of Mexico Producing Assets Petrobras •Petrobras America Inc. •Contributes all Gulf of Mexico Producing Assets & Deep Exploration Rights New Joint Venture Company •Murphy 80% Ownership, Operator •Petrobras 20% Ownership *Subject to Normal Closing Adjustments Murphy Oil Corporation www.murphyoilcorp.com NYSE:MUR 3

Executing on Our Strategy . Develop DIFFERENTIATED PERSPECTIVES In Underexplored Basins & Plays Growing Offshore Portfolio at Bottom of Cycle Continue to be a PREFERRED PARTNERto NOCs & Regional Independents .PETROBRAS & Murphy to Enter Long-Term Partnership .PETROBRAS Retaining Partial Ownership of Assets BALANCEour Offshore Business by Acquiring & Developing Advantaged Unconventional NA Onshore Plays .Increasing High-Margin Offshore Production .Increasing Oil-Weighted Production Mix DEVELOP & PRODUCE Fields in a Safe, Responsible, Timely & Cost Effective Manner .Long-Standing Reputation as Excellent Deep Water Operator in Gulf of Mexico .Outstanding Safety Track Record in the Gulf of Mexico ACHIEVE & MAINTAIN a Sustainable, Diverse & Price Advantaged Oil-Weighted Portfolio .Allocating Portion of Incremental Free Cash Flow to Oil-Weighted Eagle Ford Shale Asset .Gulf of Mexico Pricing .Increasing Oil Reserves Murphy Oil Corporation www.murphyoilcorp.com NYSE:MUR 4

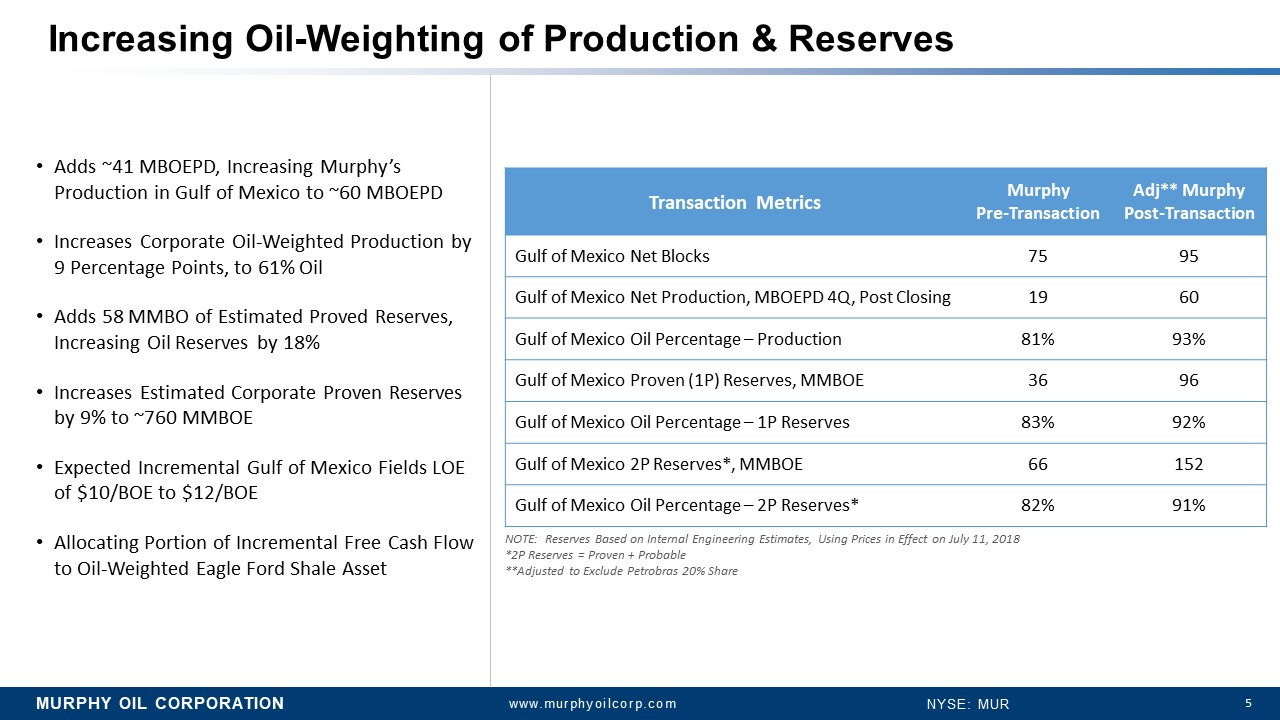

Increasing Oil-Weighting of Production & Reserves •Adds ~41 MBOEPD, Increasing Murphy’s Production in Gulf of Mexico to ~60 MBOEPD •Increases Corporate Oil-Weighted Production by 9 Percentage Points, to 61% Oil •Adds 58 MMBO of Estimated Proved Reserves, Increasing Oil Reserves by 18% •Increases Estimated Corporate Proven Reserves by 9% to ~760 MMBOE •Expected Incremental Gulf of Mexico Fields LOE of $10/BOE to $12/BOE •Allocating Portion of Incremental Free Cash Flow to Oil-Weighted Eagle Ford Shale Asset Transaction Metrics Murphy Pre-Transaction Murphy Post-Transaction Gulf of Mexico Net Blocks 75 95 Gulf of Mexico Net Production, MBOEPD 4Q, Post Closing 19 60 Gulf of Mexico Oil Percentage –Production 81% 93% Gulf of Mexico Proven (1P) Reserves, MMBOE 36 96 Gulf of Mexico Oil Percentage –1P Reserves 83% 92% Gulf of Mexico 2P Reserves*, MMBOE 66 152 Gulf of Mexico Oil Percentage –2P Reserves* 82% 91% NOTE: Reserves Based on Internal Engineering Estimates, Using Prices in Effect on July 11, 2018 *2P Reserves = Proven + Probable **Adjusted to Exclude Petrobras 20% Share Murphy Oil Corporation www.murphyoilcorp.com NYSE:MUR 5

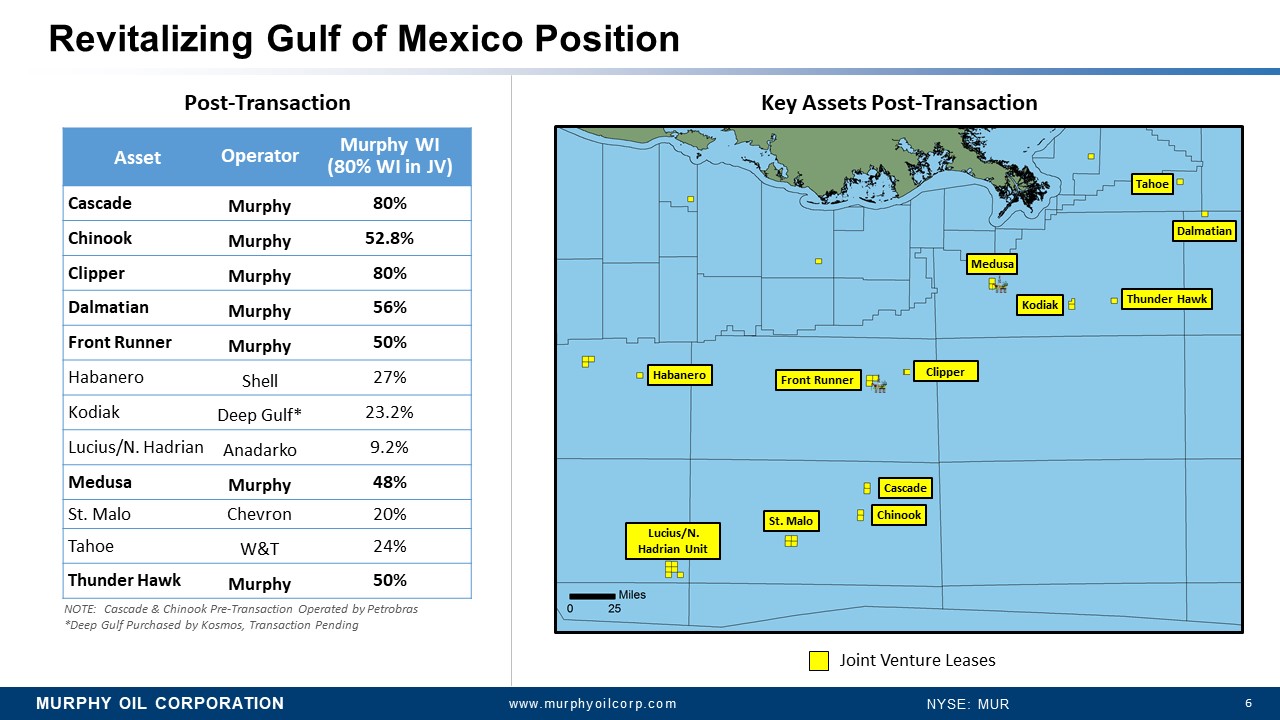

Revitalizing Gulf of Mexico Post-Transaction Position Asset Operator Murphy WI (80% WI in JV) Cascade Murphy 80% Chinook Murphy 52.8% Clipper Murphy 80% Dalmatian Murphy 56% Front Runner Murphy 50% Habanero Shell 27% Kodiak Deep Gulf* 23.2% Lucius/N. Hadrian Anadarko 9.2% Medusa Murphy 48% St. Malo Chevron 20% Tahoe W&T 24% Thunder Hawk Murphy 50% NOTE: Cascade & Chinook Pre-Transaction Operated by Petrobras *Deep Gulf Purchased by Kosmos, Transaction Pending Front Runner Medusa St. Malo Cascade Chinook Lucius/N. Hadrian Unit Dalmatian Tahoe Habanero Thunder Hawk Kodiak Joint Venture Leases Clipper Joint Venture Leases Key Assets Post-Transaction Murphy Oil Corporation www.murphyoilcorp.com NYSE:MUR 6

Creating Long-Term Value Creates Long-Term Partnership with Global Deep Water Leader Strengthens Portfolio with Quality Assets & Top-Tier Operators Increases Oil-Weighting of Production & Reserves Advantaged Gulf Coast-Priced Production with Low Operating Costs Generates Immediate Free Cash Flow Provides Capital Allocation Optionality Murphy Oil Corporation www.murphyoilcorp.com NYSE:MUR 7

MURPHY ANNOUNCES STRATEGIC DEEP WATER, OIL-WEIGHTED GULF OF MEXICO JOINT VENTURE October 11, 2018 ROGER W. JENKINS PRESIDENT & CHIEF EXECUTIVE OFFICER 8