Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Nuverra Environmental Solutions, Inc. | d636783dex991.htm |

| 8-K - 8-K - Nuverra Environmental Solutions, Inc. | d636783d8k.htm |

Nuverra Acquires Clearwater October 5, 2018 Exhibit 99.2

Cautionary Statements This presentation includes forward-looking information. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that the forward-looking information presented in this presentation is not a guarantee of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industries in which we operate may differ materially from those made in or suggested by the forward-looking information contained in this presentation. A number of important factors could cause actual results to differ materially from those contained in or implied by the forward-looking statements, in particular, the achievement of macroeconomic, financial and operational objectives, none of which we can guarantee. As a result, all forward looking financial and operational information included herein are not customary, not delivered in the ordinary course and are highly dependent on factors outside of our control and as a result, are purely indicative in nature. The forward looking financial and operation information presented herein should be considered in light of these factors. Any forward-looking information presented herein is made only as of the date of this presentation, and we do not undertake any obligation to update or revise any forward-looking information to reflect changes in assumptions, the occurrence of unanticipated events, changes in future operating results over time or otherwise. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data. In addition to disclosing financial results that are determined in accordance with U.S. generally accepted accounting principles (“GAAP”), the Company also disclosed in this presentation certain non-GAAP financial information including EBITDA and adjusted EBITDA. These financial measures are not recognized measures under GAAP, and are not intended to be and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Furthermore any transactions described herein are illustrative in nature and subject in all respects to, among other things, due diligence, analysis of tax effects and structure, and negotiation and execution of all necessary document and agreements. Any offer of securities in connection with these materials will only be made in compliance with all applicable securities laws and other laws. These materials shall not and do not constitute, nor shall it be deemed to constitute, a commitment to the illustrative transactions outlined herein and no party shall be obligated in any way by these materials or any of the terms and provisions hereof. These materials do not create and are not intended to create a duty to negotiate in good faith definitive agreements and may not be relied upon as the basis for a contract by estoppel or otherwise, and does not constitute an offer to sell or a solicitation of an offer to buy securities.

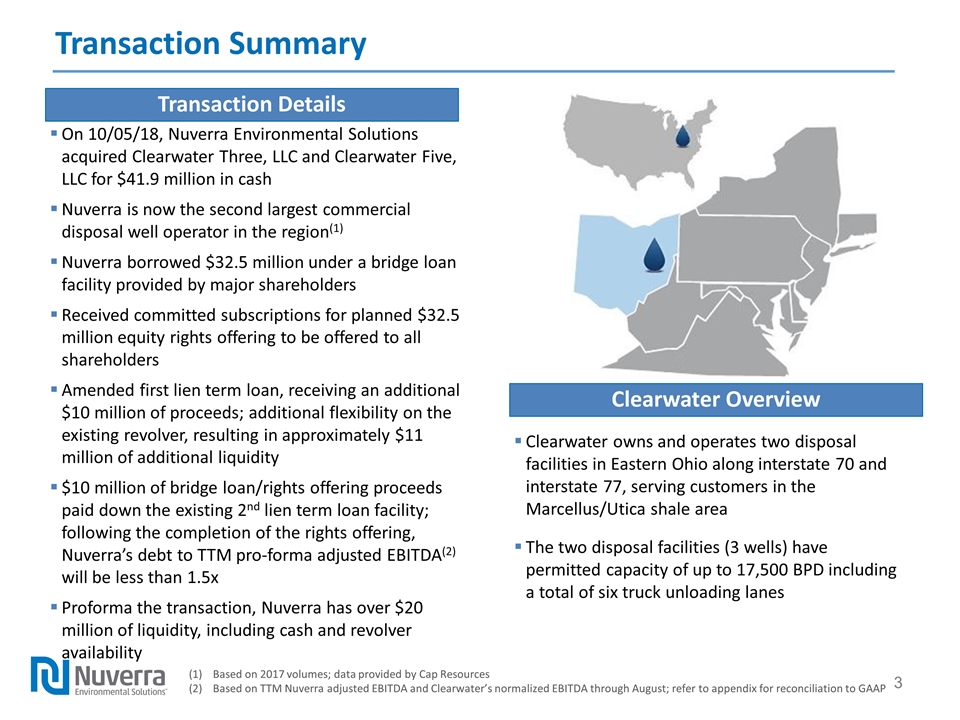

Transaction Summary On 10/05/18, Nuverra Environmental Solutions acquired Clearwater Three, LLC and Clearwater Five, LLC for $41.9 million in cash Nuverra is now the second largest commercial disposal well operator in the region(1) Nuverra borrowed $32.5 million under a bridge loan facility provided by major shareholders Received committed subscriptions for planned $32.5 million equity rights offering to be offered to all shareholders Amended first lien term loan, receiving an additional $10 million of proceeds; additional flexibility on the existing revolver, resulting in approximately $11 million of additional liquidity $10 million of bridge loan/rights offering proceeds paid down the existing 2nd lien term loan facility; following the completion of the rights offering, Nuverra’s debt to TTM pro-forma adjusted EBITDA(2) will be less than 1.5x Proforma the transaction, Nuverra has over $20 million of liquidity, including cash and revolver availability Transaction Details Clearwater Overview Clearwater owns and operates two disposal facilities in Eastern Ohio along interstate 70 and interstate 77, serving customers in the Marcellus/Utica shale area The two disposal facilities (3 wells) have permitted capacity of up to 17,500 BPD including a total of six truck unloading lanes Based on 2017 volumes; data provided by Cap Resources Based on TTM Nuverra adjusted EBITDA and Clearwater’s normalized EBITDA through August; refer to appendix for reconciliation to GAAP

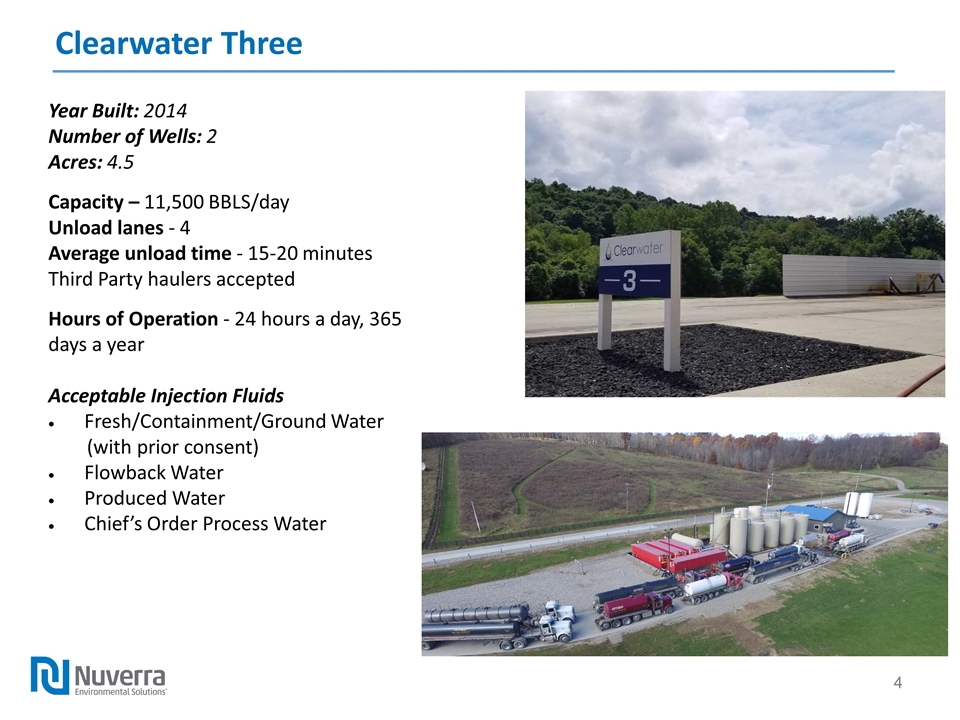

Clearwater Three Year Built: 2014 Number of Wells: 2 Acres: 4.5 Capacity – 11,500 BBLS/day Unload lanes - 4 Average unload time - 15-20 minutes Third Party haulers accepted Hours of Operation - 24 hours a day, 365 days a year Acceptable Injection Fluids Fresh/Containment/Ground Water (with prior consent) Flowback Water Produced Water Chief’s Order Process Water

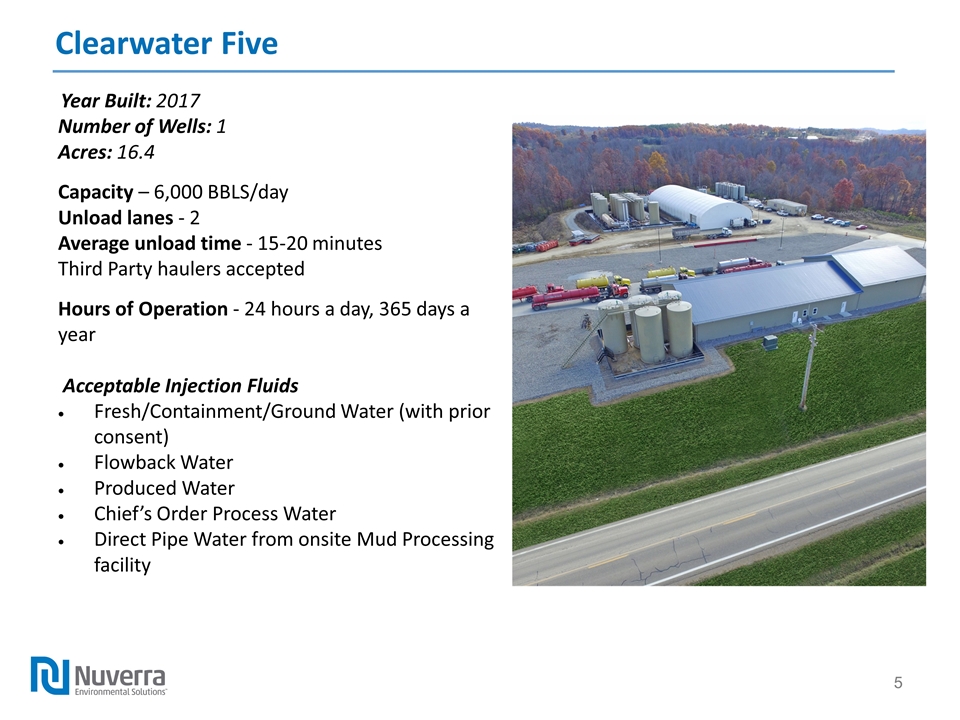

Clearwater Five Year Built: 2017 Number of Wells: 1 Acres: 16.4 Capacity – 6,000 BBLS/day Unload lanes - 2 Average unload time - 15-20 minutes Third Party haulers accepted Hours of Operation - 24 hours a day, 365 days a year Acceptable Injection Fluids Fresh/Containment/Ground Water (with prior consent) Flowback Water Produced Water Chief’s Order Process Water Direct Pipe Water from onsite Mud Processing facility

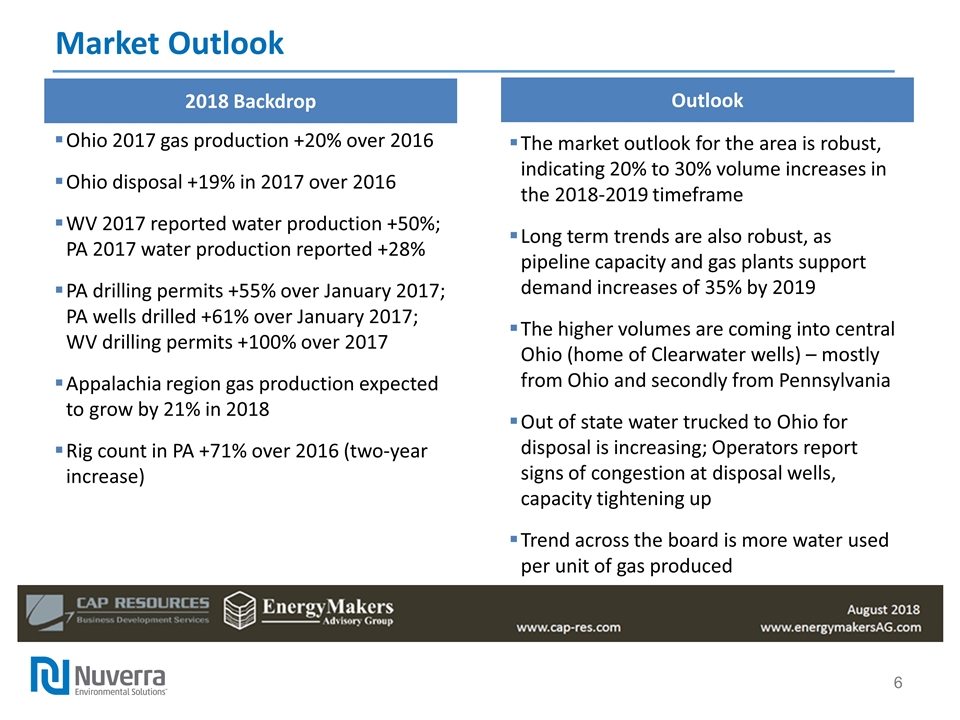

Market Outlook The market outlook for the area is robust, indicating 20% to 30% volume increases in the 2018-2019 timeframe Long term trends are also robust, as pipeline capacity and gas plants support demand increases of 35% by 2019 The higher volumes are coming into central Ohio (home of Clearwater wells) – mostly from Ohio and secondly from Pennsylvania Out of state water trucked to Ohio for disposal is increasing; Operators report signs of congestion at disposal wells, capacity tightening up Trend across the board is more water used per unit of gas produced 2018 Backdrop Ohio 2017 gas production +20% over 2016 Ohio disposal +19% in 2017 over 2016 WV 2017 reported water production +50%; PA 2017 water production reported +28% PA drilling permits +55% over January 2017; PA wells drilled +61% over January 2017; WV drilling permits +100% over 2017 Appalachia region gas production expected to grow by 21% in 2018 Rig count in PA +71% over 2016 (two-year increase) Outlook

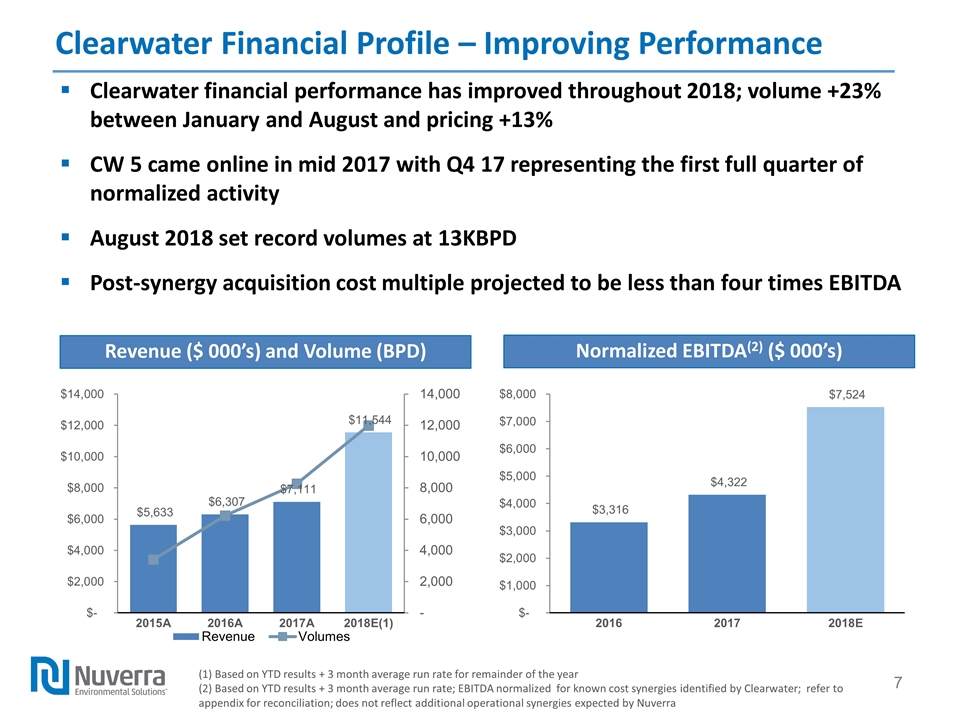

Clearwater Financial Profile – Improving Performance Normalized EBITDA(2) ($ 000’s) Revenue ($ 000’s) and Volume (BPD) Clearwater financial performance has improved throughout 2018; volume +23% between January and August and pricing +13% CW 5 came online in mid 2017 with Q4 17 representing the first full quarter of normalized activity August 2018 set record volumes at 13KBPD Post-synergy acquisition cost multiple projected to be less than four times EBITDA (1) Based on YTD results + 3 month average run rate for remainder of the year (2) Based on YTD results + 3 month average run rate; EBITDA normalized for known cost synergies identified by Clearwater; refer to appendix for reconciliation; does not reflect additional operational synergies expected by Nuverra

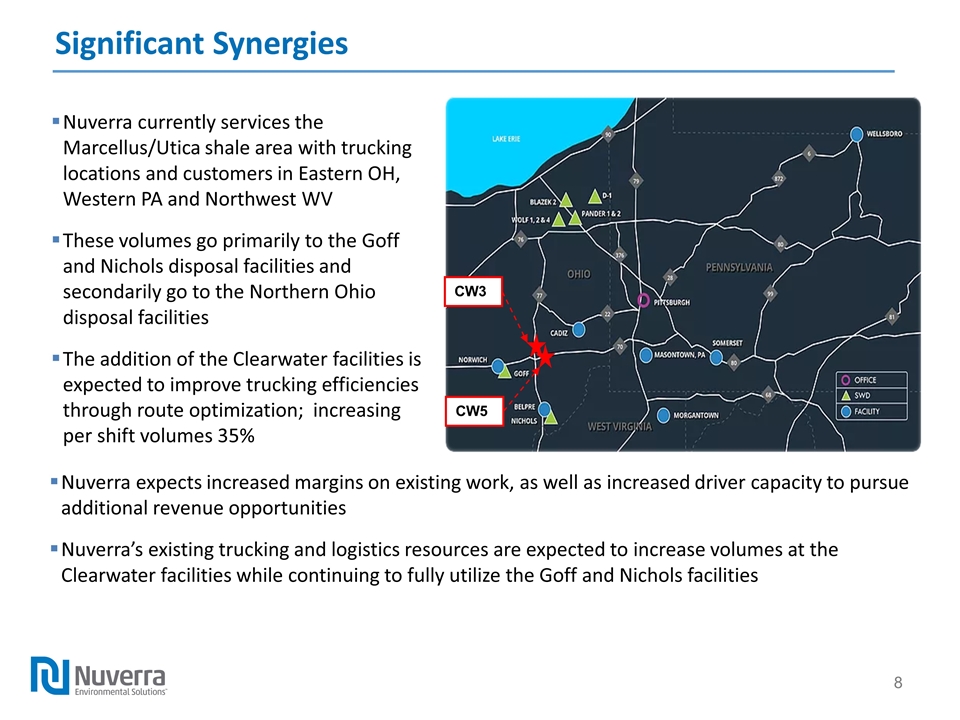

Significant Synergies Nuverra currently services the Marcellus/Utica shale area with trucking locations and customers in Eastern OH, Western PA and Northwest WV These volumes go primarily to the Goff and Nichols disposal facilities and secondarily go to the Northern Ohio disposal facilities The addition of the Clearwater facilities is expected to improve trucking efficiencies through route optimization; increasing per shift volumes 35% CW3 CW5 Nuverra expects increased margins on existing work, as well as increased driver capacity to pursue additional revenue opportunities Nuverra’s existing trucking and logistics resources are expected to increase volumes at the Clearwater facilities while continuing to fully utilize the Goff and Nichols facilities

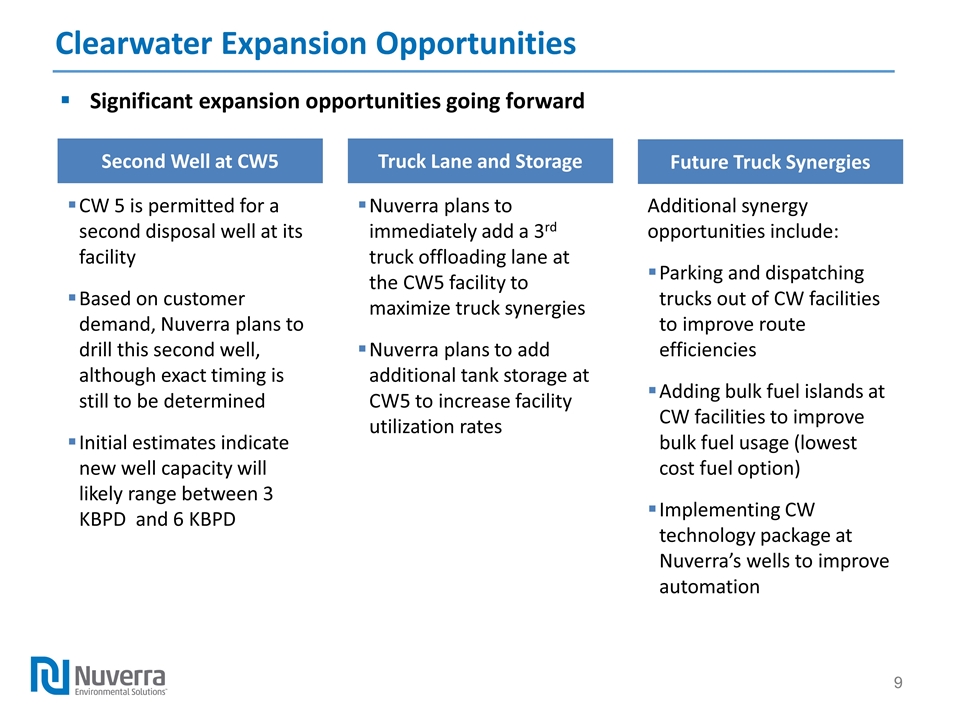

Clearwater Expansion Opportunities Second Well at CW5 Truck Lane and Storage CW 5 is permitted for a second disposal well at its facility Based on customer demand, Nuverra plans to drill this second well, although exact timing is still to be determined Initial estimates indicate new well capacity will likely range between 3 KBPD and 6 KBPD Future Truck Synergies Nuverra plans to immediately add a 3rd truck offloading lane at the CW5 facility to maximize truck synergies Nuverra plans to add additional tank storage at CW5 to increase facility utilization rates Additional synergy opportunities include: Parking and dispatching trucks out of CW facilities to improve route efficiencies Adding bulk fuel islands at CW facilities to improve bulk fuel usage (lowest cost fuel option) Implementing CW technology package at Nuverra’s wells to improve automation Significant expansion opportunities going forward

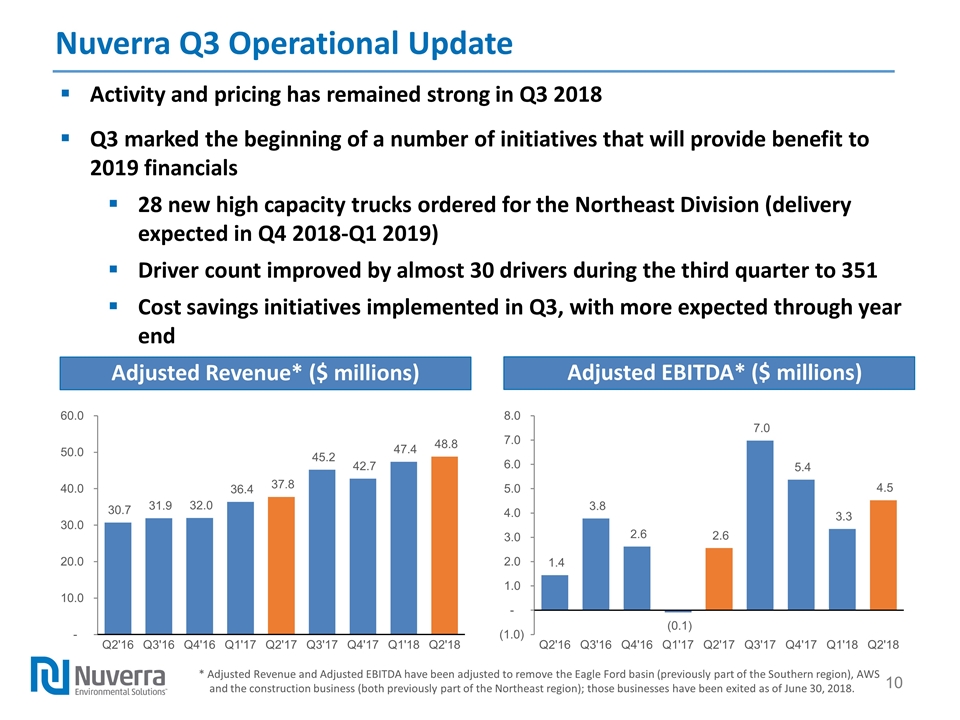

Nuverra Q3 Operational Update Adjusted EBITDA* ($ millions) Adjusted Revenue* ($ millions) Activity and pricing has remained strong in Q3 2018 Q3 marked the beginning of a number of initiatives that will provide benefit to 2019 financials 28 new high capacity trucks ordered for the Northeast Division (delivery expected in Q4 2018-Q1 2019) Driver count improved by almost 30 drivers during the third quarter to 351 Cost savings initiatives implemented in Q3, with more expected through year end * Adjusted Revenue and Adjusted EBITDA have been adjusted to remove the Eagle Ford basin (previously part of the Southern region), AWS and the construction business (both previously part of the Northeast region); those businesses have been exited as of June 30, 2018.

Appendix Reconciliation of Non-GAAP Financials

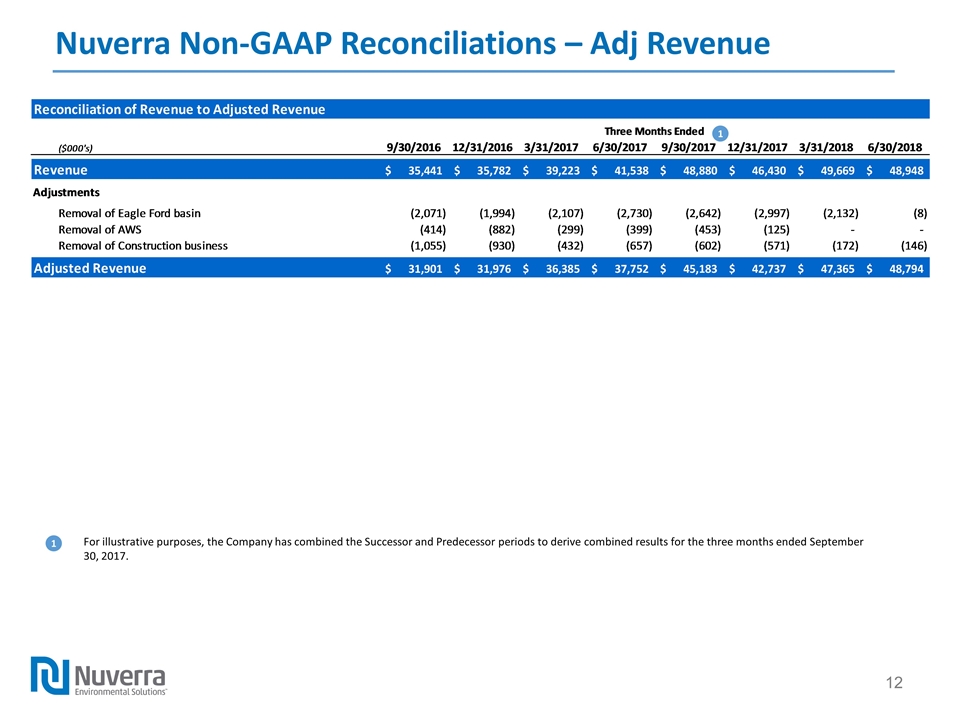

Nuverra Non-GAAP Reconciliations – Adj Revenue 1 For illustrative purposes, the Company has combined the Successor and Predecessor periods to derive combined results for the three months ended September 30, 2017. 1

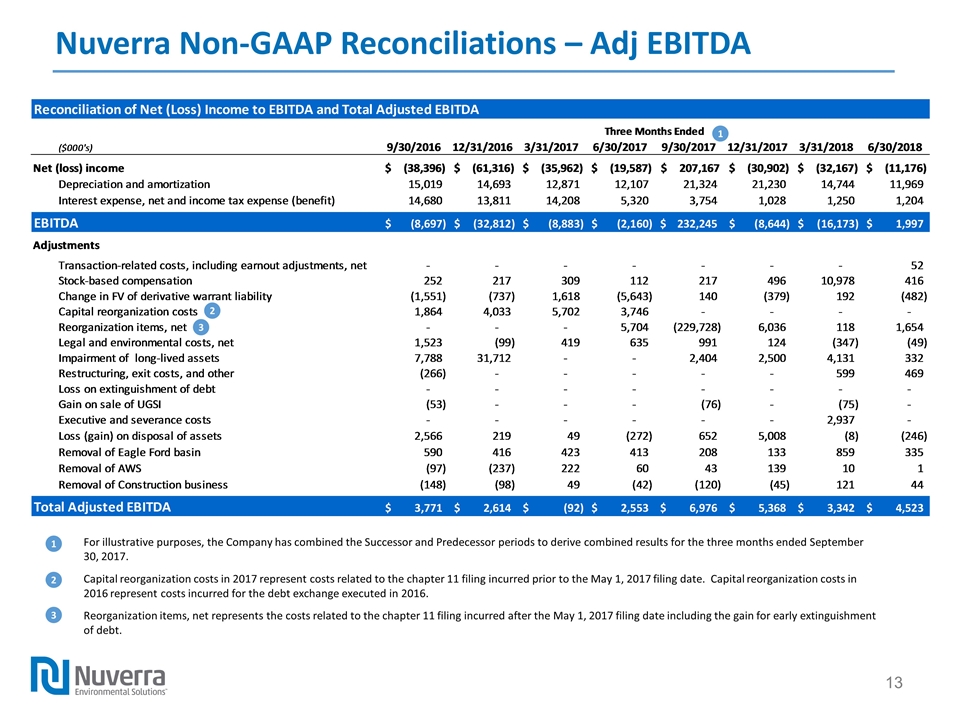

Nuverra Non-GAAP Reconciliations – Adj EBITDA 1 3 For illustrative purposes, the Company has combined the Successor and Predecessor periods to derive combined results for the three months ended September 30, 2017. Capital reorganization costs in 2017 represent costs related to the chapter 11 filing incurred prior to the May 1, 2017 filing date. Capital reorganization costs in 2016 represent costs incurred for the debt exchange executed in 2016. Reorganization items, net represents the costs related to the chapter 11 filing incurred after the May 1, 2017 filing date including the gain for early extinguishment of debt. 2 2 1 3

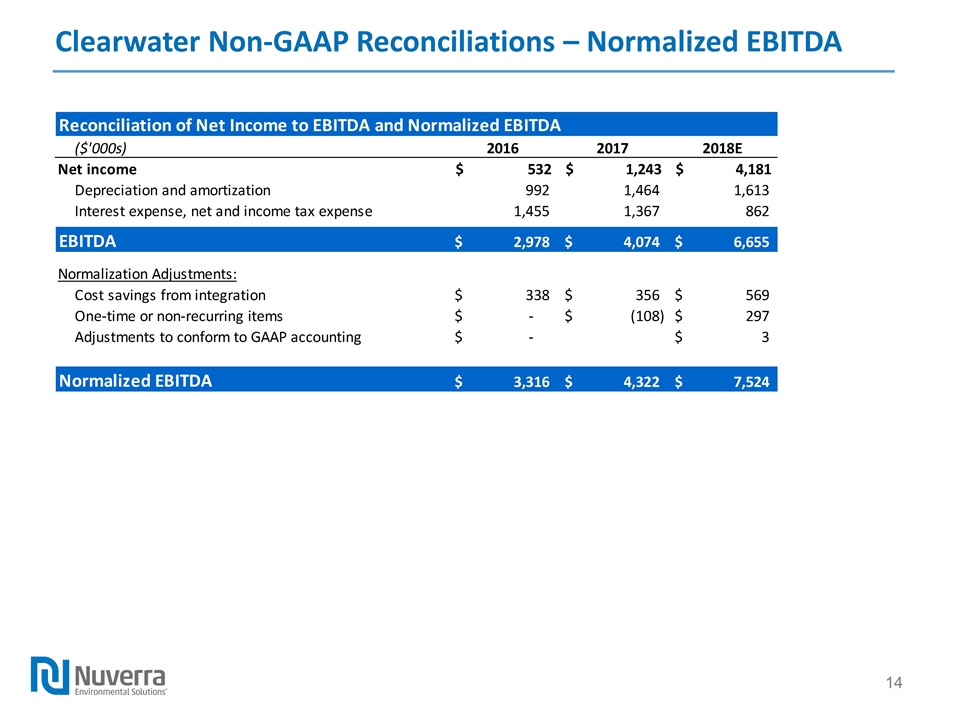

Clearwater Non-GAAP Reconciliations – Normalized EBITDA

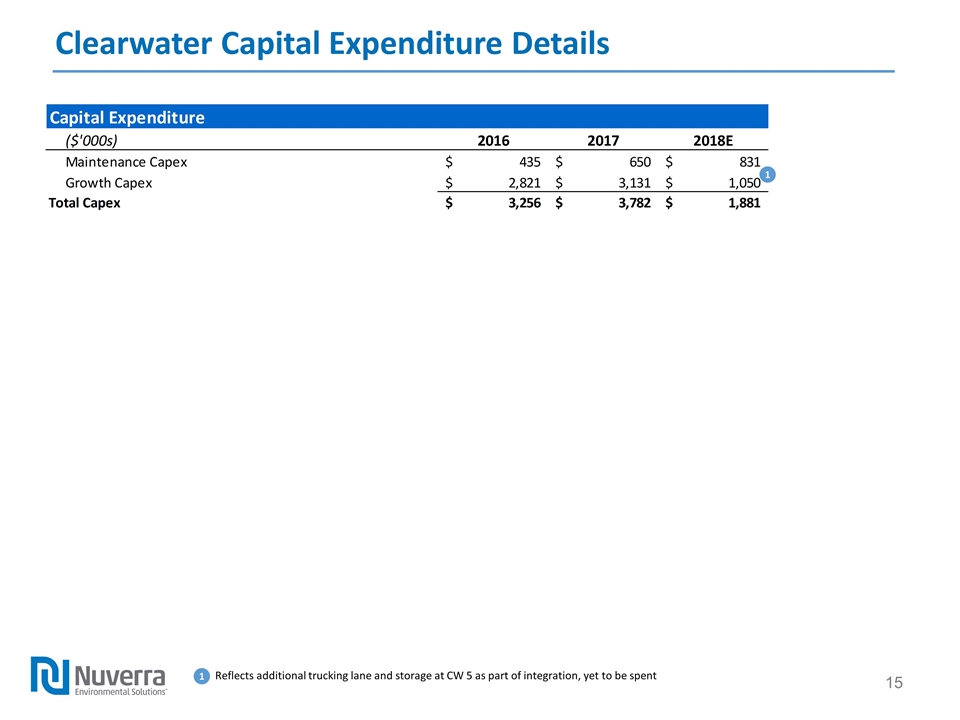

Clearwater Capital Expenditure Details Reflects additional trucking lane and storage at CW 5 as part of integration, yet to be spent 1 1