Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2009

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-33816

HECKMANN CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 26-0287117 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 75080 Frank Sinatra Drive | ||

| Palm Desert, CA | 92211 | |

| (Address of principal executive offices) | (Zip Code) | |

(760) 341-3606

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Units |

New York Stock Exchange | |

| Common Stock, $0.001 par value |

New York Stock Exchange | |

| Common Stock Purchase Warrants |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | |||

| Non-accelerated filer ¨ | (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of June 30, 2009, the aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was $377,503,624 based on the closing sale price on such date as reported on the New York Stock Exchange. Shares held by executive officers, directors and persons owning directly or indirectly more than 10% of the outstanding common stock have been excluded from the preceding number because such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares outstanding of the registrant’s common stock as of March 10, 2010 was 108,750,650.

Documents Incorporated by Reference

Portions of the registrant’s Proxy Statement for the 2010 Annual Meeting of Stockholders to be held on May 7, 2010 are incorporated by reference into Part III, Items 10-13 of this Annual Report on Form 10-K.

Table of Contents

TABLE OF CONTENTS

| Page | ||||

| Item 1. | 2 | |||

| Item 1A. | 9 | |||

| Item 1B. | 22 | |||

| Item 2. | 23 | |||

| Item 3. | 24 | |||

| Item 4. | 24 | |||

| Item 5. | 25 | |||

| Item 6. | 27 | |||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

28 | ||

| Item 7A. | 43 | |||

| Item 8. | 44 | |||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

44 | ||

| Item 9A. | 44 | |||

| Item 9B. | 49 | |||

| Item 10. | 50 | |||

| Item 11. | 50 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

50 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

50 | ||

| Item 14. | 50 | |||

| Item 15. | 51 | |||

| 52 | ||||

Table of Contents

Certain Terms

In this Annual Report on Form 10-K, unless the context indicates otherwise, the terms “the Company,” “we,” “us” and “our” refer to the combined company, which is Heckmann Corporation and its subsidiaries and operating entities.

Forward-Looking Statements

This Annual Report contains statements that are forward-looking and, as such, are not historical facts. Rather, these statements constitute projections, forecasts and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are not guarantees of performance. They involve known and unknown risks, uncertainties, assumptions and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by these statements. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements use words such as “believe,” “expect,” “should,” “strive,” “plan,” “intend,” “estimate,” “anticipate” or similar expressions. When the Company discusses its strategies or plans, it is making projections, forecasts or forward-looking statements. Actual results and stockholders’ value will be affected by a variety of risks and factors, including, without limitation, continuing fallout from the recent crisis in worldwide financial markets, international, national and local economic conditions, organic growth plans, merger, acquisition and business combination risks, financing risks, geo-political risks, and acts of terror or war. Many of the risks and factors that will determine these results and stockholder values are beyond the Company’s ability to control or predict. These statements are necessarily based upon various assumptions involving judgment with respect to the future. You should carefully read the risk factor disclosure contained in “Item 1A. Risk Factors” of this Annual Report, where many of the important factors currently known to management that could cause actual results to differ materially from those in our forward-looking statements are discussed.

All such forward-looking statements speak only as of the date of this Annual Report. The Company is under no obligation to, nor does it intend to, release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

Periodic Reporting and Financial Information

Our units, common stock and warrants are registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and each are listed and trade on the New York Stock Exchange (“NYSE”) under the symbols HEK.U, HEK, and HEK.WS, respectively. We have compliance and reporting obligations, including the requirement that we file annual and quarterly reports with the Securities and Exchange Commission (“SEC”), and comply with the NYSE’s listing policies and procedures. In accordance with the requirements of the Exchange Act, this Annual Report contains financial statements audited and reported on by our independent registered public accounting firm.

Where You Can Find Additional Information About Us

You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov. We also maintain an internet site at http://www.heckmanncorp.com where you can find our filings with the SEC in the Investor Relations area of the site.

1

Table of Contents

HECKMANN CORPORATION

| Item 1. | Business |

Heckmann Corporation (NYSE: HEK) is a holding company that was created to buy operating businesses, and our focus is on buying and building companies in the water sector. We have two operating segments, which, as of the date of this report, we refer to as domestic and international. Our domestic segment presently includes our water disposal, treatment, and pipeline transport facilities in Texas and Louisiana operated by our wholly-owned subsidiary Heckmann Water Resources Corporation (“HWR”); our joint venture with Energy Transfer Partners, L.P., to develop water pipeline infrastructure and treatment solutions for oil and gas producers in the Marcellus and Haynesville Shale fields, operated through our wholly-owned subsidiary HEK Water Solutions, LLC (“HWS”); and our minority interest investment in water infrastructure solutions and pipeline supplier Underground Solutions, Inc. (OTC: UGSI) (“UGSI’). Our international segment presently includes our bottled water business operated by our wholly-owned subsidiary China Water and Drinks, Inc., (“China Water”) and our minority investment in China Bottles, Inc., a bottling equipment manufacturer. As of December 31, 2009, we had approximately $250 million in invested cash and cash equivalents on our balance sheet. In 2010, we plan to continue building the businesses in our domestic and international segments, and we will also make additional acquisitions as we find attractive long-term opportunities for our stockholders.

Headquartered in Palm Desert, California, the Company was incorporated in Delaware on May 29, 2007. We began our corporate existence as a blank check development stage company. On November 16, 2007, we completed an initial public offering (“IPO”) of 54,116,800 units (each consisting of one share of common stock and one warrant exercisable for an additional share of common stock), including 4,116,800 units issued pursuant to the partial exercise of the underwriters’ over-allotment option, and received net proceeds of approximately $421 million. On the same date, we also completed a private placement of warrants to our founders at an aggregate purchase price of $7 million, or $1.00 per warrant.

On October 30, 2008, we completed our acquisition of China Water, subsequently consolidated its subsidiaries and affiliate entities, and now operate its eight bottled water facilities in the People’s Republic of China (“China”) with Coca-Cola and its subcontractors located in China, which we collectively refer to as “Coca-Cola China,” as our largest customer.

On July 1, 2009, we purchased all of the assets of Greer Exploration Corporation and the Silversword Partnerships, and all the membership interests of Charis Partners, LLC. The assets of these entities were consolidated into HWR together with the capital and operating resources necessary to build a pipeline and network of disposal wells and terminal facilities. HWR now operates a multi-modal water disposal, treatment and pipeline transportation business in Texas and Louisiana serving customers seeking to dispose of complex water flows including flowback water, frac fluids, and produced brine waters generated in their oil and gas operations. On January 30, 2010, we completed our 50-mile water transport pipeline. At full capacity, it is designed to treat and dispose up to 100,000 barrels of water per day and is supported by a network of deep injection disposal wells.

On February 9, 2010, we announced a joint venture with Energy Transfer Partners, L.P. (NYSE: ETP). The joint venture is a 50/50 partnership and will operate under the name Energy Transfer Water Solutions, JV, LLC, a joint venture of Heckmann Corporation and Energy Transfer. It will develop water pipeline infrastructure and treatment solutions for oil and gas producers in the Marcellus and Haynesville Shale fields, and potentially other areas within the states of New York, Pennsylvania, Ohio, West Virginia, Virginia, Tennessee, Kentucky, Texas, and Louisiana.

2

Table of Contents

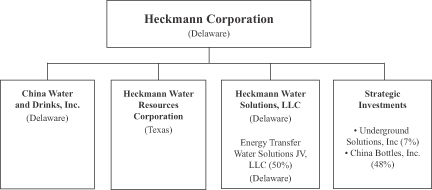

Our Corporate Structure

As of the date of this report, our organizational structure, excluding subsidiaries of China Water and HWR, is as follows:

We have two operating segments, which as of the date of this report, we refer to as domestic and international. Financial information regarding each segment and the geographic areas in which we do business is available in Note 13 to our consolidated financial statements included in this Annual Report on Form 10-K.

Our Domestic Segment

Our domestic segment presently includes the businesses of our subsidiaries HWR and HWS, and our strategic minority investment in UGSI.

Through HWR, we own and operate a network of water disposal, treatment, and pipeline transport facilities in Texas and Louisiana, including our recently completed 50-mile pipeline. HWR serves oil and natural gas exploration and production companies seeking to dispose of complex water flows including flowback water, frac fluids, and produced brine waters generated in their oil and gas operations. HWR does this in two ways. First, we directly connect customers from their field operations to our pipeline. Second, we provide terminal facilities where producers and independent truckers can deliver water to us for processing. All water is then treated and subsequently disposed of into our network of disposal wells.

Through HWS and our recently announced joint venture with Energy Transfer, L.P., we intend to develop water pipeline infrastructure and treatment solutions for oil and gas producers in the Marcellus and Haynesville Shale fields, and potentially other areas within the states of New York, Pennsylvania, Ohio, West Virginia, Virginia, Tennessee, Kentucky, Texas, and Louisiana. Our 50% interest in the joint venture is managed through HWS. The joint venture is designed to accomplish this by laying water transport pipelines alongside natural gas pipelines which may transport water in both directions—complex or fluid laden water from oil and natural gas drilling fields to treatment and disposal facilities, and fresh and/or remediated water to oil and natural gas drilling fields. Where applicable, our joint venture projects may also extend water transport and treatment services to mining companies and coal and electric utilities.

Our investment in UGSI is a strategic complement to HWR and HWS. Both are a potential customer of UGSI’s patented flexible fusion pipeline products and their fusion processes, technologies, and field know-how, which we believe are emerging as a leading product line for long-life pipeline installations.

The Convergence of Water and Energy, Market Opportunities & Competition

In North America, through HWR and HWS we are entering the water infrastructure and the oil and natural gas service sectors. Both are very large industry sectors comprised of competitors with longer industry tenure and

3

Table of Contents

greater resources than us. Our strategy is to participate in the newly emerging subsector that is experiencing a convergence of water and energy expertise and technologies that will provide the commercial solutions rapidly being demanded by oil and gas producers, mining companies, and utilities. Specifically, through HWR and HWS we are building products and service solutions for dealing with expanding complex water flows anticipated by increased exploration in unconventional shale gas fields. These large discoveries, known as Shale Plays (e.g. Marcellus Shale, Haynesville Shale, Barnett Shale, Eagle Ford Shale, Fayetteville Shale) refer to previously inaccessible or non-economical depth formations in the earth’s crust now being exploited by advances in drilling technology that utilize high water pressure methods (or hydraulic fracturing) combined with proppant fluids (sand grains or microscopic beads) to crack open and exploit new perforation depths and fissures to extract large quantities of natural gas, oil, and other hydrocarbon condensates. Complex water flows represent the largest waste stream from these methods of hydrocarbon exploration and production. The energy industry creates daily water production volumes 2.5 times greater than oil volumes, making it vital to deal effectively and efficiently with produced water volumes at the surface. The market for produced water management and handling is estimated at $9.8 billion dollars over the next five years, and the market for produced water treatment systems is estimated at $4.3 billion dollars over the same period, according to “The Produced Water Gamechanger Report 2010-2014,” an industry report of OTM Consulting and energy business analysts, Douglas-Westwood, as cited in a March 2010 article of Water Online Newsletter Magazine.

Our International Segment

Our international segment presently includes the business of our subsidiary China Water and its operating entities, and our minority investment in China Bottles, a bottling equipment manufacturer.

Through China Water, we produce bottled water products at facilities in the cities of X’ian (Shaanxi Province), Guangzhou (Guangdong Province), Changchun (Jilin Province), Feixian (Shandong Province), Nanning (Guangxi Province), Changsha (Hunan Province), and Harbin (Heilongjiang Province).

Our production plants have two types of production lines: one type produces hand-held sized (330 milliliters to 1.5 liters) bottled water (“Small Bottles”) and the other produces carboy-sized (11.4 to 18.9 liters, or 3 to 5 gallons) bottled water (“Carboy Bottles”). We produce a variety of bottled water products including natural mineral water, spring water, purified water, flavored water and oxygenated water.

We market our bottled water products in China using the brand names “Darcunk” (which translates to “Absolutely Pure”) and “Grand Canyon.” We also supply bottled water products to beverage companies and servicing companies, which we refer to as OEM customers, including Coca-Cola China, as well as Uni-President and Jian Li Bao. In addition, we provide private label bottled water products to companies in the service industry, such as hotels and casinos.

In 2009, we produced approximately 405 million Small Bottles and 3 million Carboy Bottles of bottled water products. We currently market and sell our bottled water products in multiple regions of China, including Beijing, Guangdong Province, Guangxi Province, Shandong Province, Heilongjiang Province, Jilin Province, Shanxi Province, Shaanxi Province, Gansu Province, Liaoning Province, Anhui Province, Sichuan Province, Hebei Province, Hunan Province and Macau.

The Bottled Water Industry in China

In China, consumption of bottled water has overtaken consumption of carbonated sweet drinks and China is one of the largest potential national markets for bottled water sales.

Although China is fast growing and represents one of the largest potential national markets for bottled water, consumption per person is still among the lowest in the world. According to Beverage Marketing Corporation, a consulting and market research firm, China’s bottled water consumption per capita represents less than one-half of the global per capita average, and only 11% of the per capita average of the top 20 national markets by volume.

4

Table of Contents

In China, the competitive landscape is shaped by two layers of companies: branding companies and production companies. The first layer consists of those companies that have marketing, distribution and branding capabilities. The second layer consists of those companies that actually produce bottled water. Although some branding companies also build plants themselves, we believe they still need production companies to address their production gaps and fill in the locations where their facilities do not cover. Because the China market is so large, we believe that no single branding company can cover all locations with their own plants.

In 2010, we believe that our water business in China will be influenced by the following factors:

| • | Growth and evolution of China’s bottled water industry. The bottled water industry in China is in a process of continuous growth, consolidation, and development. With the growth in demand and addition of new industry participants offering new and varied bottled water products, the Chinese bottled water industry is poised for continued growth and consolidation. |

| • | Health consciousness of Chinese individuals. We believe that Chinese citizens are becoming increasingly health conscious. Given concerns with the quality and hygiene standards of available drinking water in China, we believe that consumers will increasingly purchase and consume bottled drinking water, teas, and juices that have been purified and treated to afford consumers greater health benefits. |

| • | Growing middle class in China. According to research by McKinsey Global Institute, a market research firm, by 2011, the middle class in China will number more than 350 million people, representing more than 50% of the urban population. This group is likely to possess increased spending power and a desire and ability to consume products, including bottled water, teas, and juices. |

| • | Demand for greater product mix offerings. Consumers are demanding specialty bottled water, tea, and juice products, such as flavored waters and nutrient-enriched water products. We believe that bottled water producers that have the resources to offer to consumers a variety of specialty water products will prosper. |

Our Competitive Strengths in the Chinese Bottled Water Business

We believe that the following key competitive strengths enable us to compete effectively in China:

| • | Strong Long-Term Relationship with Well Known Global Brands. We have maintained stable and trusted long-term relationships with several globally recognized beverage companies and original equipment manufacturers involved in the bottled water production businesses in China, including Coca-Cola China, Uni-President and Jian Li Bao. We have expanded our own production capacity in order to leverage and capitalize upon Coca-Cola’s business plans in China. |

| • | Top Tier Production Capability and Quality Control. As a long-term supplier to Coca-Cola China and other well known beverage companies, we are required to comply with their production requirements and rigid quality control standards. We have implemented these high standards in all of our manufacturing facilities. Our plants are audited by independent assessors for compliance with our customers’ procedures, quality control requirements and hygiene standards. |

| • | Production Cost Advantages. The majority of our production processes are standardized and fully automated. We believe increased automation will increase production yields and efficiency as well as reduce labor costs and minimize the impact of any labor shortages. |

| • | Established Distribution Network. We sell our bottled water products through an extensive distribution network of local and regional distributors, which help us establish a presence in each regional market we serve. We have maintained a stable long-term relationship with the majority of our distributors. |

5

Table of Contents

Our International and Domestic Customers

For the year ended December 31, 2009, our total sales to our top five customers and distributors among both international and domestic segments is shown in the table below:

| Top Five Customers/Distributors |

Year Ended December 31, 2009 |

||

| Coca Cola China (OEM/Private Label) |

57 | % | |

| Bai Chuan (distributor) |

6 | % | |

| Tang Xia (distributor) |

2 | % | |

| El Paso |

2 | % | |

| Shi Pai (distributor) |

2 | % | |

| Percentage of total sales to top five customers/distributors |

69 | % | |

In the year ended December 31, 2009, approximately 63% of sales in China and 57% of our total sales were made to Coca-Cola China. Coca-Cola China resells our bottled water products. We believe that our relationship with Coca-Cola China provides consistent sales and credibility for us in our target markets. However, not all arrangements with Coca-Cola China impose minimum purchase commitments upon Coca-Cola China, nor are they all exclusive. If Coca-Cola China discontinues or reduces purchases and we are unable to generate replacement sales from new and existing customers, our revenue and net income would decline considerably. Also, because the margins on our sales to Coca-Cola China are generally lower than on our sales to other customers and through distributors, if sales to Coca-Cola China increase as a percentage of overall sales, then our margins would decline.

Our International Segment’s Sales Network of Distributors

In China, we market and sell our bottled water products to distributors that sell our bottled water products to end users under our own brands, and OEM and private label customers, which include major global drink and beverage companies such as Coca-Cola China, Uni-President and Jian Li Bao, which usually sell our bottled water products under their brand or brands. For the year ended December 31, approximately 21% of our revenue was derived from sales of our bottled water products to consumers directly under our own brands, and 79% of our revenue was derived from sales of our bottled water products to OEM and private label customers such as Coca-Cola China, which represented the largest customer for our OEM and private label sales.

Raw Materials and Principal Suppliers

The main raw materials for our international segment’s products are water, which is obtained from local municipal water systems and streams, lakes and wells, and PET (polyethylene terephthalate) bottling materials, such as PET plastic materials and containers, caps, oil byproducts and packaging materials. PET bottling materials account for a significant percentage of our product costs and are subject to a high degree of price volatility caused by the supply and demand, as well the price of oil. Our domestic segment does not have any material raw materials needs.

For the year ended December 31, 2009, our top five suppliers of raw materials are shown in the table below:

| Top Five Suppliers |

Raw Material Supplied | Year Ended December 31, 2009 |

|||

| Zhuhai Fuhongmao |

PET plastic material | 26 | % | ||

| Foshan Expanding Industry Trade |

PET plastic material | 22 | % | ||

| Shunde Yong Hui Plastic Products Co. Ltd. |

PET plastic material | 13 | % | ||

| Liao Yang Chemical |

PET plastic material | 7 | % | ||

| Zhongfu |

PET plastic material | 5 | % | ||

| Percentage of total purchases from top five suppliers |

73 | % | |||

6

Table of Contents

Competition

The bottled water industry in China is highly fragmented, consisting of several large Chinese and international competitors and a number of smaller local and regional manufacturers. We primarily compete with Chinese bottled water producers, including Hangzhou Wahaha Group, Nongfu Spring Company Ltd., and Guandong Robust Corp. In addition to local Chinese producers, we compete with global beverage companies and brands including Nestle S.A., the leading company in the global bottled water market, as well as Coca-Cola, C’est Bon, Danone, Tingyi Master Kong, and Uni-President. Many of these competitors have substantially greater resources in China than we have and pose significant competition to us. Nevertheless, we believe that we can compete effectively in our markets given the fragmentation of the market, the heavily regional aspect of bottled water in China, our strong brand recognition and established distributorships and customer relationships, and our strong balance sheet, which may allow us to seize on appropriately valued acquisition and new facilities manufacturing opportunities without accessing credit markets. We also believe that we can effectively compete based on price, quality and hygiene standards.

The water treatment and produced water handling industries, even if nascent in respect of competing for customers in the expanding oil and gas shale fields, are serviced by many large international and domestic competitors including GE Water, Siemens, Veolia, Schlumberger, Baker-Hughes, BJ Services, Key Energy Services, and Basic Energy Services. We believe we can compete effectively in the emerging subsector of water handling and closed loop treatment, recycling, and reuse as a result of our strong balance sheet, water industry experience, water transport pipeline experience, and industry alliances.

Seasonality and Commodity Fluctuations

Our sales in China are subject to seasonality factors. We typically experience higher sales of bottled water in the summer time in coastal cities while sales remain constant throughout the entire year in some inland cities. In general, our sales are higher in the second and third quarters of the year when the weather is hot and dry, and lower in the first and fourth quarters when the weather is cold and wet. Sales can also fluctuate throughout the year for a number of other reasons, including the timing of advertising and promotional campaigns, and unforeseen circumstances, such as production interruptions.

Our domestic water handling sales are subject to seasonality factors and the fluctuation of commodity futures. Extreme weather has historically reduced our total handling volumes because a portion of the water we receive is delivered via overland trucking, although we expect that, going forward, extreme weather will have less of an impact on our sales as we accept a greater portion of our total water deliveries directly into pipelines connected to the operational sites of customers. We are negatively leveraged to fluctuating natural gas prices in the sense that our customers could alter drilling and capital expense plans if long term futures turned down substantially. We are favorably leveraged to oil and diesel prices in the sense that our pipeline displaces water transport by trucks when diesel prices rise and fuel surcharges influence our customers to consider pipeline transport.

Government Regulation

Our China operations are heavily regulated. Like other bottled water manufacturers within China, we are subject to compliance with China’s food hygiene, tax, licensing, and environmental laws and regulations. Our domestic operations are subject to environmental laws and regulations.

Food and Hygiene Regulatory System of China. The Food Hygiene Law sets out the hygiene standards for the production of bottled water, water additives, water packaging and containers, and the prescribed contents of water packaging labels. It also stipulates hygiene requirements in respect of premises, facilities and equipment for the production, transport and sale of bottled water.

China’s Ministry of Health is responsible for the regulation and supervision of bottled water hygiene in China. The Food Hygiene Law requires all enterprises proposing to be involved in bottled water production and

7

Table of Contents

processing to obtain a hygiene license from the relevant local department of the Ministry of Health before they can register their enterprise with the relevant Local Administration for Industry and Commerce, which is responsible for issuing business licenses. Enterprises cannot begin bottled water production and processing activities without first obtaining a hygiene license.

Regulation of Production in China. China’s Administration of Production Licenses for Industrial Products requires us to maintain a production license for manufacturing bottled water products. Spot tests and product inspection, as well as periodic supervisory inspections are conducted. To date, we have passed spot tests and product inspections, but have yet to be selected for any supervisory inspections.

Environmental Protection Laws and Regulations. The environmental protection laws of the United States and China establish a basic legal framework for environmental protection. The environmental protection laws of the individual states where we operate pipelines and disposal wells also represent a regulatory framework requiring compliance. In Texas, we are also subject to rules and regulations promulgated by the Texas Railroad Commission and the Texas Commission on Environmental Quality, including those designed to protect the environment and monitor compliance with water quality.

Government authorities can impose various types of penalties on persons or enterprises who are in violation of environmental and water quality laws depending on the circumstances and extent of pollution or surface and subsurface impact. Penalties can include issuing a warning notice, imposing fines, setting a time limit for rectification, suspending production, ordering, reinstallation and operation of environmental protection facilities that have been dismantled or left unused, imposing administrative sanctions against management in charge, or ordering the termination and closure of enterprises or institutions conducting such operations.

We believe we are in material compliance with all applicable environmental protection laws and regulations in the United States and China. We have completed the required environmental assessments and, where applicable, our environmental assessment reports have been approved by the local environmental administration or authority. Also, we have installed the necessary environmental protection equipment, adopted advanced environmental protection technologies, established responsibility systems for environmental protection, and reported to and registered with the relevant local environmental protection departments.

Employees

As of December 31, 2009, we had 1,074 full-time employees, of which 358 were executive, managerial, sales, general administrative and accounting staff, and 716 were manufacturing and field workers. We also hire temporary manufacturing workers in China to supplement our manufacturing capabilities during periods of high demand. None of our employees are under collective bargaining agreements. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

8

Table of Contents

| Item 1A. | Risk Factors |

You should carefully consider the following risk factors, together with all of the other information included in this Annual Report. We are subject to a number of risks. The market price of our common stock and warrants could decline due to any of the risks discussed below, in which case you could lose all or part of your investment. In assessing these risks, you should also refer to the other information included in this Annual Report, including our financial statements and accompanying notes. We face risks common to newly acquired or newly built operations in the United States. Separately, because we operate in China, we are subject to legal and regulatory environments that differ in many respects from those of the United States. Our business, financial condition or results of operations could be affected materially and adversely by any of the risks discussed below.

Risks Related to Our Company

We are involved in litigation with Xu Hong Bin, China Water’s former president and chairman, related to our intended cancellation of approximately 5.3 million shares of our common stock held by Xu, the outcome of which cannot be predicted with certainty.

As more fully described in Part I, Item 3—Legal Proceedings, of this Annual Report, Xu Hong Bin has filed a lawsuit against us claiming that our intended cancellation of his shares is a breach of an escrow resolution and transition agreement that we entered into with him. We filed a vigorous countersuit expanding our claims against Xu and seeking recovery of not only the stock at issue, but also cash paid to Xu in connection with our acquisition of China Water and cash misappropriated by Xu. Although we believe that we will prevail in our countersuit, no assurance can be given that the outcome of the litigation will be in our favor or, in the event that it is, that a court will award us the full amount of damages that we are seeking. Also, we may determine that it is in the best interests of the Company to settle our claims against Xu for less than the amount of damages we are seeking in our countersuit. The resolution of this litigation could have a material effect on our financial condition.

A business strategy of making acquisitions subjects us to all of the risks inherent in identifying, acquiring and operating newly acquired businesses.

We face all the risks associated with such a strategy, including, but not limited to:

| • | the potential disruption of our existing businesses, including the diversion of management attention and the redeployment of resources; |

| • | entering new markets or industries in which we have limited prior experience; |

| • | failure to identify in due diligence key issues specific to the businesses we seek to acquire or the industries or other environments in which they operate, or, failure to protect against contingent liabilities arising from those issues; |

| • | difficulties in integrating, aligning and coordinating organizations which will likely be geographically separated and may involve diverse business operations and corporate cultures; |

| • | difficulties in integrating and retaining key management, sales, research and development, production and other personnel; |

| • | difficulties in incorporating the acquired business into our organization; |

| • | the potential loss of customers, distributors or suppliers; |

| • | difficulties in integrating or expanding information technology systems and other business processes to accommodate the acquired businesses; |

| • | risks associated with integrating financial reporting and internal control systems; |

| • | the potential for future impairments of goodwill if the acquired business does not perform as expected; |

9

Table of Contents

| • | the inability to obtain necessary government approvals for the acquisition, if any; and |

| • | successfully operating the acquired business. |

If we cannot overcome these challenges, we may not realize actual benefits from past and future acquisitions, which will impair our overall business results. If we complete an investment or acquisition, we may not realize the anticipated benefits from the transaction.

The process of targeting, selecting, acquiring, and operating newly acquired businesses is time consuming and potentially expensive. We may be unable to identify other suitable investment or acquisition candidates or may be unable to make these investments or acquisitions on commercially reasonable terms, if at all.

If we use stock as consideration, this would have a dilutive effect on existing stockholders. If we use cash, this would reduce our liquidity and impact our financial flexibility. We may seek debt financing for particular acquisitions, which may not be available on commercially reasonable terms, or at all.

Future charges due to possible impairments of acquired assets may have a material adverse effect on our financial condition and results of operations.

A portion of our assets is comprised of goodwill and other intangible assets, which may be subject to future impairment that would result in financial statement write-offs. Goodwill and other intangible assets represent approximately 10% of our total assets at December 31, 2009. If there is a material change in our business operations or prospects, the value of the intangible assets we have acquired or may acquire in the future could decrease significantly. On an ongoing basis and at least annually, we will evaluate, partially based on discounted expected future cash flows, whether the carrying value of such intangible assets may no longer be recoverable, in which case a charge to earnings may be necessary. Any future determination requiring the write-off of a significant portion of unamortized intangible assets, although not requiring any additional cash outlay, could have a material adverse effect on our financial condition, results of operations and stock price.

Fallout from the global financial crisis could have a negative impact on our results of operations.

Overall consumption was reduced following the global financial and credit crisis, and we expect continued cautious spending in 2010 relating to consumer consumption of bottled water products in China, and consumer and industrial consumption of natural gas in the United States. Our international operations could be impacted in 2010 as a result of cautious spending or if Chinese consumer consumption is flat or lower than estimated. Our domestic operations could be impacted if consumer and industrial consumption of natural gas is reduced to the point of causing our energy customers to reduce drilling and exploration expenditures and thereby reduce their demand for our water handling services. Separately, the global financial and credit crisis has negatively impacted returns on our cash and investments, and we expect this to continue through 2010.

We do not believe that the estimates provided to us by China Water in connection with our acquisition will be achieved in 2010.

During our due diligence investigation of China Water in connection with its acquisition by us, we were presented with estimated levels of pro forma annualized revenue and net income that China Water could achieve by the end of 2008 and forward. This forward-looking information pre-dated the worldwide crisis in financial and credit markets and was based on our review of internal financial projections prepared by China Water, general due diligence, and anticipated benefits from plant expansions and acquisitions. Also, after taking over, we discovered financial irregularities, misdirected funds, receivables overstatements, deposit overstatements, and operating and accounting deficiencies that caused us to take substantial impairment charges to goodwill, write downs of purported acquisition deposits, receivables reserve adjustments, and write offs of receivables. We expect that our revenues and net income for 2010 will be lower than we originally forecast. The consequences of this determination could include a decline in our stock price.

10

Table of Contents

We are subject to litigation risks, which may be costly to defend and the outcome of which is uncertain.

All industries, including those businesses in our domestic and international segments, are subject to legal claims. As a public company we are particularly susceptible to securities and derivative lawsuits. These claims may be costly to defend and divert the attention of our management and our resources in general. Defense and settlement costs can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, the resolution of any particular legal claim or proceeding could have a material effect on our business, financial condition, results of operations or cash flows.

Our ability to succeed will largely depend upon the efforts of our directors and officers, and in particular our chief executive officer, Mr. Richard J. Heckmann. The loss of Mr. Heckmann could affect our ability to operate.

Our ability to succeed is largely dependent upon the efforts of our officers and directors, especially Mr. Heckmann, our Chairman and Chief Executive Officer. Even though we believe that our success depends on the continued services of Mr. Heckmann, we have not entered into an employment agreement with Mr. Heckmann, nor obtained “key man” life insurance. Accordingly, we cannot be sure that Mr. Heckmann will remain with the company for the immediate or foreseeable future. In addition, though Mr. Heckmann has expressed a commitment of his full time to our success, he is not required to commit any specified amount of time to the company’s affairs and, as a result, he may have conflicts of interest in allocating management time among various business activities, including identifying more potential business acquisitions and monitoring the related due diligence and closing process. The loss of the services of Mr. Heckmann or any other of our other executive officers and directors could have a material adverse effect on our ability to successfully achieve our business objectives.

There are material weaknesses in our internal control over financial reporting that could cause investors to lose confidence in our reported financial information and thereby cause a decline in our stock price.

We inherited, and have undertaken to fix and remediate certain previously reported and currently reported weaknesses in China Water’s internal controls over financial reporting. See “Item 9A. Controls and Procedures.”

We continue efforts toward remediation of China Water’s control deficiencies. However, if we are unable to address these or other material weaknesses in our internal control over financial reporting, this might result in errors in our financial statements that could result in a restatement of our financial statements, cause us to fail to meet our reporting deadlines, and cause investors to lose confidence in our reported financial information, leading to a decline in our stock price.

The results of China Water during the 10 month pre-acquisition period ended October 30, 2008 have not been audited.

We have included in this report pro forma operating results of China Water for the ten months ended October 31, 2008, which is based in part on unaudited information of China Water for the year ended December 31, 2008. Changes could be required to this information if it were to be audited, and there can be no assurance those changes will not be material. Further, China Water’s actual operating results may differ, and those differences may be material, from the pro forma operating results.

Changes to the fair market or carrying value of our investments in China Bottles, Inc. and UGSI could affect the value of our investment and any potential recordable income from the investments, which could result in a substantial write down.

We own 48% of the outstanding equity of China Bottles, Inc. (“China Bottles”), a manufacturer of bottling equipment and provider of contract manufacturing and finished product services. At December 31, 2009, our investment in China Bottles totaled $4.0 million, and our ability to estimate the market value of our shares of

11

Table of Contents

China Bottles common stock is limited to management’s estimate only since China Bottles is no longer providing data to the Over-the-Counter Bulletin Board or similar system for observable market value.

We own 7% of UGSI, a supplier of water infrastructure pipeline products. In 2009, through two separate purchases, we acquired shares of their common and convertible preferred stock for a total investment of $7.2 million dollars. At December 31, 2009, the market value of our shares was approximately $12.4 million (based on the closing market price on the Over-the-Counter Bulletin Board).

China Bottles has a significant insider ownership, the observable market price of UGSI’s stock has been volatile, and there is no liquidity in either stock. Changes to the fair market or carrying value of our investment in China Bottles or UGSI could affect the value of our investments and any potential recordable income from the investments, which could result in a substantial write down.

Risks Related to our Domestic Segment’s Business Operations

We have operated our recently acquired water disposal and pipeline business for just two quarters, and we may not achieve all the benefits anticipated.

On July 1, 2009, we purchased the assets underlying the business of HWR. The purchase could subject us to a number of risks and uncertainties, including, but not limited to, geopolitical events affecting the expansion plans of our customers, domestic political issues affecting the energy industry generally such as energy and tax legislation unfavorable to our customers that directly influences their capital expenditure and exploration plans, fluctuations in commodity prices that impact our customers’ expansion plans, near term integration and management challenges typical to acquisitions, and unforeseen interruptions in our newly operational pipeline. We have operated HWR’s business for just two quarters and continue to evaluate and determine the risks to which it is subject and therefore we can offer no assurance that we will achieve all the benefits anticipated.

Our new pipeline operations and expansion plans could be delayed.

We recently constructed a new pipeline and we are expanding our existing disposal capacity in order to accommodate much greater volumes of disposed water. Construction of our new pipeline in the Haynesville Play was substantially completed on January 30, 2010. Successful consistent operation could be impacted by inclement weather, land use and right of way disputes, equipment breakdowns, delays common to start up of complex construction and engineering equipment and systems, pipe, and measurement devices, installation interruptions, and operational safety, testing and troubleshooting of interdependent systems. Although we believe we have allocated all the necessary resources to insure consistent operation, any unforeseen interruptions could delay or negatively impact the realization of our business plans and have a material impact on our anticipated new pipeline revenues.

Our initial anticipated revenue from new pipeline operations is currently from three principal customers.

HWR has pre-sold approximately 46% of our new pipeline capacity to three principal customers under multi-year contracts with guaranteed minimum volumes and guaranteed minimum prices that reflect early adoption rates. These customers (Exco Production Company, El Paso E&P Company, and Encana Oil & Gas USA Inc.) are large, well capitalized public companies that we anticipate doing business with for the full term of these contracts. Even so, any unforeseen reduction or interruption concerning the operations of these initial principal customers that results in reduced water volume deliveries to us, or their refusal to make the minimum contractually agreed payments, could have a material impact on our initial anticipated pipeline revenues. Separately, we intend to sell the remaining 54% of the pipeline capacity over time to a larger group of customers under a combination of short and long term volume guarantees and at differing prices. If we do not sell the remaining capacity as soon as it is available, or if we sell it at rates different than anticipated, there could be a material impact on our anticipated new pipeline revenues.

12

Table of Contents

A portion of our domestic business will be operated through a joint venture in which our rights to control business decisions are limited.

A portion of our domestic business going forward will be generated through Energy Transfer Water Solutions JV, LLC, our joint venture with Energy Transfer Partners, L.P. (“ETP”) in which we hold a 50% ownership interest. We have less control over business decisions affecting this joint venture than we have in our wholly-owned businesses. In particular, we generally cannot act on major business initiatives for Energy Transfer Water Solutions JV, LLC without the consent of ETP. As a result, for this joint venture to operate efficiently, we and ETP must be in agreement on strategic, operational, funding and other matters. There is a significant risk that, as a result of differing views and priorities, there will be occasions when we do not agree on various matters related to the operation of the joint venture which could result in delays or changes in operations that could materially harm our prospects or even lead to dissolution of the joint venture.

Our joint venture has not commenced operations.

On February 9, 2010, we announced a joint venture with ETP to develop water pipeline infrastructure and treatment solutions for oil and gas producers in the Marcellus and Haynesville Shale fields, and potentially other areas within the states of New York, Pennsylvania, Ohio, West Virginia, Virginia, Tennessee, Kentucky, Texas and Louisiana. The joint venture is designed to accomplish this by laying water transport pipelines alongside natural gas pipelines which may transport water in both directions—complex or fluid laden water from oil and natural gas drilling fields to treatment and disposal facilities, and fresh and/or remediated water to oil and natural gas drilling fields. Where applicable, our joint venture projects may also extend water transport and treatment services to mining companies and coal and electric utilities.

Our joint venture has not commenced operations and does not have any agreements with any customers. The process of identifying a new potential customer, negotiating and entering into a services agreement, and constructing related pipelines and treatment and disposal facilities will require a significant investment of time and capital. If we are unable to complete this process efficiently, we may not achieve our goals for our joint venture and the price of our stock could decline.

Any interruption in our services due to pipeline breakdowns or necessary maintenance could impair our financial performance and negatively affect our brand.

Our current and future water transport pipelines are susceptible to breakdown and require ongoing maintenance. We may experience difficulties in maintaining the operation of our pipelines, thereby causing downtime and delays. Any interruption in our services due to pipeline breakdowns or necessary maintenance could reduce sales revenues and earnings. If there are interruptions, even if only temporary, our business and reputation could be severely harmed.

Our domestic segment’s operations may fluctuate due to seasonality and commodity fluctuations.

Our domestic water handling sales are subject to seasonality factors and the fluctuation of commodity futures. Extreme weather has historically reduced our total handling volumes because a portion of the water we receive is delivered via overland trucking. Also, we are negatively leveraged to fluctuating natural gas prices in the sense that our customers could alter drilling and capital expense plans if long term futures turned down substantially.

Changes to the existing environmental laws and regulations governing the transport and disposal of produced water may cause us to incur additional costs that could have an adverse impact on our financial position, and we may not be able to comply with such laws and regulations.

Our domestic segment operations are subject to federal and state environmental laws and regulations. If we fail to comply with these laws and regulations, we could face substantial fines, suspension of operations and loss of necessary permits. There can be no assurance that we will be able to comply with such laws and regulations. There also can be no assurance that there will not be changes to existing laws or regulations, compliance with which may cause us to incur significant additional costs that we cannot pass on to customers through higher prices.

13

Table of Contents

Risks Related to Our International Segment’s Business Operations

We face risks associated with recent acquisitions by China Water and if we fail to successfully integrate these acquired businesses our operating results will be negatively affected.

Within the past three years, our China Water subsidiary acquired outright control or a controlling interest in several businesses through acquisition. The ongoing process of integrating these businesses is distracting, time consuming, expensive, and requires continuous optimization and allocation of resources. Geographic distance between business operations, the compatibility of the technologies and operations being integrated, and combining disparate corporate cultures also present significant challenges. The acquired businesses also have different standards, controls, contracts, procedures, and policies, making it difficult to implement and harmonize company-wide financial, accounting, billing, information, and other systems. Continuing the successful integration of the recently acquired companies will require us to integrate and retain key management and other personnel, incorporate the acquired products or capabilities into our product offerings from an engineering, sales and marketing perspective, coordinate research and development efforts, integrate and support pre-existing supplier, distribution and customer relationships, and combine or centralize back office accounting, order processing, purchasing, and support functions. China Water’s focus on integrating operations may also distract attention from China Water’s day-to-day business and may disrupt key research and development, marketing, or sales efforts. If China Water cannot overcome these challenges, we may not realize actual benefits from past and future acquisitions, which will impair our overall business results.

Part of our strategy for China Water involves the development of new products and if we fail to timely develop new products or incorrectly gauge the potential market for new products, our financial results may suffer.

We are developing new bottled water products, such as flavored water, juices, teas, oxygenated water and nutrient-enriched bottled water products that could become new sources of revenue for us in the future and help us to diversify our revenue base. Part of our future development efforts will be focused on expanding our product offerings. If we fail to timely develop new products or if we miscalculate market demand for new products in development, we may not be able to grow our sales revenue sufficiently to outpace our product development expenses.

The revenues of our China business are highly concentrated in a single customer, Coca-Cola China, and we would be harmed if Coca-Cola China reduces its orders.

In the year ended December 31, 2009, approximately 63% of sales in China and 57% of our total sales were made to Coca-Cola China. Coca-Cola China resells our bottled water products. We believe that our relationship with Coca-Cola China provides consistent sales and credibility for us in our target markets. However, the arrangements with Coca-Cola China do not impose minimum purchase commitments upon Coca-Cola China, and they are not exclusive. If Coca-Cola China discontinues or reduces purchases and we are unable to generate replacement sales from new and existing customers, our revenue and net income would decline considerably. Also, because the margins on our sales to Coca-Cola China are generally lower than on our sales to other customers and through distributors, if sales to Coca-Cola China increase as a percentage of overall sales, then our margins would decline.

We face increasing competition which may negatively impact our market share and profit margins.

The bottled water industry in China is highly competitive, and we anticipate it will become even more competitive in the future. We compete with domestic Chinese bottled water producers including Hangzhou Wahaha Group, Nongfu Spring Company Ltd., and Guangdong Robust Corp., and with global beverage companies and brands including Nestle S.A, Coca-Cola, C’est Bon, Danone, Tingyi Master Kong, and Uni-President. Some of our competitors have been in business longer, some have substantially greater financial and other resources, and some are better established in their markets. Some may also benefit from raw material sources or production facilities that are closer to their markets, thereby giving them a competitive advantage in terms of cost and proximity to consumers.

14

Table of Contents

Currently, there are several thousand water brands in China, including those offered by domestic and foreign-invested enterprises. Our ability to compete against these enterprises will depend on our continuing ability to leverage our brand recognition and to distinguish our products by providing quality products at reasonable prices that appeal to wide consumer tastes and preferences.

Some of our competitors may provide products comparable or superior to ours, or adapt more quickly to consumer trends or changing market requirements. Significant consolidation among our competitors is also possible. Increased competition may lead our competitors to substantially increase their advertising expenditures and promotional activities or to engage in irrational or predatory pricing behavior. Third parties may actively engage in activities, whether legal or illegal, designed to undermine our brand name and product quality or to influence consumer confidence in our products. These activities may result in price reductions, reduced margins, and loss of market share, any of which could have a material adverse effect on our profit margins. As a result, we may not be able to compete effectively against current and future competitors.

Any interruption in our production could impair our financial performance and negatively affect our brand.

We produce bottled water products at eight facilities in China. Our manufacturing operations are complicated and integrated, involving the coordination of sourcing of water and other raw materials from third parties, internal production processes, and external distribution processes. While these operations are modified on a regular basis in an effort to improve manufacturing and distribution efficiency and flexibility, we may experience difficulties in coordinating the various aspects of our manufacturing processes, thereby causing downtime and delays. We may encounter interruptions in our manufacturing processes due to events beyond our control, such as fires, explosions, labor disturbances or violent weather conditions. Any interruptions in production could reduce sales revenue and earnings. If there are interruptions at any of our production facilities, even if only temporary, or delays in delivery times to our customers, our business and reputation could be severely harmed. Any significant delays in deliveries to our distributors or customers could also lead to increased returns or cancellations and cause us to lose future sales.

Limitations on or the unavailability of natural resources or energy resources needed to operate our business in China would impair our profitability.

In order to produce our bottled water products in China, we need a readily available supply of water and electricity. We depend mainly on municipal water supplies to provide the water used in our products and on regulated electric companies to provide us with the electricity needed for our production facilities. In the year ended December 31, 2009 approximately 66% of our water was sourced from municipal water supplies and the remaining 34% was sourced from ground water. It is possible that municipal governments could put usage limits on these water resources in situations when water reserves for their cities are low or curtail electricity usage when the demand for energy resources is high relative to supply. Our business operations, income, and profits would be highly impaired if such limits are imposed.

Increases in raw material prices that we are unable to pass on to our customers would reduce profit margins.

The principal raw materials used in our production, including water, bottled water containers, caps and packaging materials, are subject to a high degree of price volatility caused by external conditions. In particular, the PET we use to manufacture our bottles is petroleum based, and therefore subject to significant price fluctuations. In the year ended December 31, 2009 PET accounted for approximately 52% of our cost of goods sold. Oil prices have fluctuated at record velocity in recent years and the prices we pay for oil products and other raw materials may escalate in the future. Price changes to our raw materials may result in unexpected increases in production, packaging, and distribution costs, and we may be unable to increase the prices of our products to offset these increased costs. If so, we would suffer a reduction in our profit margins.

15

Table of Contents

Any difficulties or delays in delivery or poor handling by distributors and third party transport operators may affect our sales and damage our reputation.

In China, we sell our own brands of bottled water through distributors. In the year ended December 31, 2009, our three largest distributors accounted for approximately 10% of total sales. The delivery of our products by distributors to retailers could be delayed or interrupted in the case of unforeseen events and disruptions that occur for various reasons beyond our control, including poor handling by distributors or third party transport operators, transportation bottlenecks, natural disasters, and labor strikes. Poor handling by distributors and third-party transport operators could also result in damage to our products. If our products are not delivered to retailers on time, or are delivered damaged, we could lose business and our reputation could be harmed.

We may ineffectively allocate and balance the supply of our bottled water products among our distribution channels.

We market and sell our bottled water products to distributors that sell them to end users under our own brands, to major global drink and beverage companies, and to other corporations, hotels, and casinos on a private label basis. Like any other manufacturer or producer of products, we have limited production capacity and there are times when we are resource and capacity constrained. As our production capacity reaches its limit, it becomes more difficult for us to produce, balance, and allocate our bottled water products for sales through our various distribution and sales channels.

If we fail to strike an appropriate balance in producing and delivering our products for sale through our network of sales and distribution channels, we may be unsuccessful in meeting the relative demands of our distributors and the consumer market, which would hurt our sales, reputation, and relationships with distributors and customers.

Our products may become subject to recall in the event of defects or other performance related issues.

Our bottled water products have never been the subject of an open recall. However, like many other bottled water producers in China, we are at risk for product recall costs if a product is recalled due to a known or suspected contamination or other health or performance related defect. Costs typically include the cost of the product being replaced, the cost of the recall borne by our distributors, and the cost of removing our products from the market. If a recall decision is made, we will need to estimate the cost of the recall and record a charge to earnings. In making this estimate, judgment is required as to the quantity or volume to be recalled, the total cost of the recall campaign, and the ultimate negotiated sharing of the cost between us and our customers. Excessive recall costs or our failure to adequately estimate these costs may negatively affect our operating results. Recalls could also create reputational damage that materially affects our business.

Our results of operations may fluctuate due to seasonality.

Our sales in China are subject to seasonality factors. We typically experience higher sales of bottled water in the summer time in coastal cities while sales remain constant throughout the entire year in some inland cities. In general, our sales are higher in the second and third quarters of the year when the weather is hot and dry, and lower in the first and fourth quarters when the weather is cold and wet.

Sales can fluctuate throughout the year for a number of other reasons, including the timing of advertising and promotional campaigns, and unforeseen circumstances, such as production interruptions.

Changes to the existing environmental and food and hygiene laws and regulations in China may cause us to incur additional costs that could have an adverse impact on our financial position, and we may not be able to comply with such laws and regulations.

As a China based bottled water producer, we are subject to the environmental and food and hygiene laws and regulations of China. If we fail to comply with these laws and regulations, we could face substantial fines,

16

Table of Contents

suspension of operations by China’s government, loss of necessary licenses and, in the case of serious noncompliance with China’s food and hygiene laws, we and our management may be subject to criminal proceedings. There can be no assurance that we will be able to comply with such laws or regulations. There can also be no assurance that the Chinese government will not change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant additional costs that we cannot pass on to customers through higher prices.

Risks Related to Doing Business in China

Adverse changes in political and economic policies of China’s government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct operations and generate a portion of our revenue in China. Accordingly, our business, financial condition, results of operations and prospects will be affected significantly by economic, political and legal developments in China. The Chinese economy differs from the economies of most developed countries in many respects, including:

| • | the higher level of government involvement in commercial activities; |

| • | the early stage of development of the market-oriented sector of the economy; |

| • | the rapid growth rate; |

| • | the higher level of control over foreign exchange; and |

| • | the allocation of resources. |

As China’s economy has been transitioning from a planned economy to a more market-oriented economy, China’s government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall Chinese economy, they may also have a negative effect on our China business.

Although China’s government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, China’s government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways. Any adverse change in the economic conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of investments and expenditures in China, which in turn could lead to a reduction in demand for China Water’s products and consequently have a material adverse effect on our business and prospects.

Uncertainties with respect to China’s legal system could limit the legal protections available to the Company and its stockholders.

We conduct business through China Water’s operating subsidiaries in China. China Water’s operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign-invested enterprises. China’s legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new Chinese laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since China’s legal system continues to evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to us and our stockholders. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention.

17

Table of Contents

China’s government exerts substantial influence over the manner in which we must conduct our business activities.

China’s government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in China’s laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that China Water’s bottled water production operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which China Water operates may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require the Company to divest itself of any interest it then holds in Chinese properties or joint ventures.

Past or future violations of complicated Chinese regulations governing merger and acquisition activity involving domestic Chinese companies could materially adversely affect our business.

Our past and any future acquisitions of Chinese operating companies are subject to complicated Chinese regulations governing merger and acquisition activity. On August 8, 2006, six Chinese regulatory agencies, including the China Securities Regulatory Commission, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, among other things, governs the approval process by which a Chinese company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the Chinese parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, business combination transactions in China became significantly more complicated, time consuming and expensive.

In October 2005, China’s State Administration of Foreign Exchange, or SAFE, issued the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, generally referred to as Circular 75. Circular 75 requires Chinese residents to register with an applicable branch of SAFE before establishing or acquiring control over an offshore special purpose company for the purpose of engaging in an equity financing outside of China that is supported by domestic Chinese assets originally held by those residents. Following the issuance of Circular 75, SAFE issued internal implementing guidelines for Circular 75 in June 2007. These implementing guidelines, known as Notice 106, effectively expanded the reach of Circular 75 by:

| • | purporting to regulate the establishment or acquisition of control by Chinese residents of offshore entities which merely acquire “control” over domestic companies or assets, even in the absence of legal ownership; |

| • | adding requirements relating to the source of the Chinese resident’s funds used to establish or acquire the offshore entity; |

| • | regulating the use of existing offshore entities for offshore financings; |

| • | purporting to regulate situations in which an offshore entity establishes a new subsidiary in China or acquires an unrelated company or unrelated assets in China; |

18

Table of Contents

| • | making the domestic affiliate of the offshore entity responsible for the accuracy of certain documents which must be filed in connection with any such registration, notably, the business plan which describes the overseas financing and the use of proceeds; and |

| • | requiring that the registrant establish that all foreign exchange transactions undertaken by the offshore entity and its affiliates were in compliance with applicable laws and regulations. |