Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 2, 2018

Exceed World, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 000-55377 | 98-1339955 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

1-23-38-6F, Esakacho, Suita-shi, Osaka Japan |

564-0063 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +81-6-6339-4177

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

-1-

Throughout this Report on Form 8-K, the terms the “Company,” “we,” “us” “our” and “Exceed World” refer to Exceed World, Inc., and “our board of directors” refers to the board of directors of Exceed World, Inc.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Current Report on Form 8-K contains forward-looking statements regarding, among other things, our future operating results and financial position, our business strategy, and other objectives for our future operations. The words “anticipate,” “believe,” “intend,” “expect,” “may,” “estimate,” “predict,” “project,” “potential” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. There are a number of important risks and uncertainties that could cause our actual results to differ materially from those indicated by forward-looking statements including those set forth in the section of this Current Report entitled “Risk Factors.” We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments that we may make.

You should read this Current Report on Form 8-K and the documents that we have filed as exhibits to this Current Report on Form 8-K completely and with the understanding that our actual future results may be materially different from what we expect. The forward-looking statements contained in this Current Report on Form 8-K are made as of the date of this Current Report on Form 8-K, and we do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

-2-

-3-

Item 1.01 Entry into a Material Definitive Agreement.

On September 26, 2018, Force Internationale Limited, a Cayman Island limited company (“Force Internationale”) entered into a Share Purchase Agreement with its wholly-owned subsidiary, e-Learning Laboratory Co., Ltd., a Japan corporation (“e-Learning”) and 74.5% owner of the Company. Under this Share Purchase Agreement, e-Learning transferred its 74.5% interest in the Company to Force Internationale. As consideration for this transfer, Force Internationale paid $26,000.00 to e-Learning. Immediately subsequent, the Company entered into a Share Purchase Agreement with Force Internationale, to acquire 100% of Force International Holdings Limited, a Hong Kong limited company (“Force Holdings”) and 100% direct owner of e-Learning. In consideration of this agreement, the Company issued 12,700,000 common shares to Force Internationale. The result of these transaction is that Force Internationale is a 74.5% owner of the Company, the Company is a 100% owner of Force Holdings, and Force Holdings is a 100% owner of e-Learning. Prior to the Share Purchase Agreements, Force Internationale was an indirect owner of 74.5% of the Company and subsequent to the Share Purchase Agreements, Force Internationale is a direct owner of 74.5% of the Company. The Share Purchase Agreements were approved by the boards of directors of each of the Company, Force Internationale, Force Holdings, and e-Learning. Copies of the Share Purchase Agreements are included as Exhibit 2.1 and Exhibit 2.2 to this Current Report and is hereby incorporated by reference. All references to the Agreements and other exhibits to this Current Report are qualified, in their entirety, by the text of such exhibits.

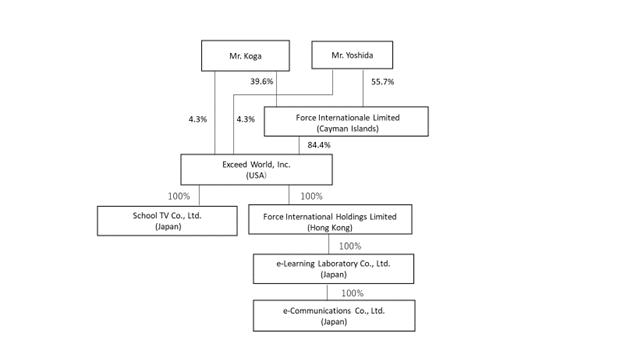

The following chart illustrates the structure of our consolidated affiliated entities prior to such restructuring:

The following chart illustrates the structure of our consolidated affiliated entities after such restructuring:

Force Internationale is owned and controlled by Mr. Tomoo Yoshida (“Mr. Yoshida”) and Mr. Keiichi Koga (“Mr. Koga”), who own 55.7% and 39.6%, respectively of Force Internationale, and who serve on the two-person Board of Directors of Force Internationale. Mr. Yoshida also serves as the sole director and Chief Executive Officer of the Company. Mr. Yoshida and Mr. Koga also serve as directors on the two-person board of directors of Force Holdings. The five-person board of directors for e-Learning is comprised of Mr. Yoshida, Mr. Koga, Kaname Mori, Koji Okada, and Naoharu Wada.

The information contained in Item 2.01 below relating to the Agreement and the transaction contemplated thereby is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

As described in item 1.01 above, and as incorporated herein by reference thereto, on September 26, 2018, the Company participated in two transactions pursuant to which: (1) 74.5% of the Company’s common stock is directly owned, rather than indirectly owned, by Force Internationale; and (2) the Company is the indirect 100% owner of e-Learning.

-4-

FORM 10 DISCLOSURE

Set forth below is the information required by Form 10 Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934.

The Company was incorporated under the laws of the State of Delaware on November 25, 2014. The address is 1-23-38-6F, Esakacho, Suita-shi, Osaka 564-0063 Japan. We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups (JOBS) Act.

History

The Company was originally incorporated with the name Brilliant Acquisition, Inc., under the laws of the State of Delaware on November 25, 2014, with an objective to acquire, or merge with, an operating business. On January 12, 2016, Thomas DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910, the sole shareholder of the Company, entered into a Share Purchase Agreement with e-Learning. Pursuant to the Agreement, Mr. DeNunzio transferred to e-Learning, 20,000,000 shares of our common stock which represents all of our issued and outstanding shares. Following the closing of the share purchase transaction, e-Learning gained a 100% interest in the issued and outstanding shares of our common stock and became the controlling shareholder of the Company.

On January 12, 2016, the Company changed its name to Exceed World, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment. On January 12, 2016, Mr. Thomas DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Also, on January 12, 2016, Mr. Tomoo Yoshida was appointed as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

On February 29, 2016, the Company entered into a Stock Purchase Agreement with Tomoo Yoshida, our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer. Pursuant to this Agreement, Tomoo Yoshida transferred to Exceed World, Inc., 10 shares of the common stock of E&F Co., Ltd., a Japan corporation (“E&F”), which represents all of its issued and outstanding shares in consideration of $4,835 (JPY 500,000). Following the effective date of the share purchase transaction on February 29, 2016, Exceed World, Inc. gained a 100% interest in the issued and outstanding shares of E&F’s common stock and E&F became a wholly owned subsidiary of Exceed World. On August 4, 2016, the E&F changed its name to School TV Co., Ltd (“School TV”) and filed with the Legal Affairs Bureau in Osaka, Japan.

On April 1, 2016, e-Learning entered into stock purchase agreements with 7 Japanese individuals. Pursuant to these agreements, e-Learning sold 140,000 shares of common stock in total to these individuals and received $270 as aggregate consideration. Each paid JPY0.215 per share. At the time of purchase the price paid per share by each was the equivalent of about $0.002. This sale of shares was exempt from registration in accordance with Regulation S of the Securities Act of 1933, as amended ("Regulation S") because the above sales of the stock were made to non-U.S. persons as defined under Rule 902 section (k)(2)(i) of Regulation S, pursuant to offshore transactions, and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates, or any person acting on behalf of any of the foregoing.

On August 1, 2016, the Company changed its fiscal year end from November 30 to September 30.

On August 9, 2016, e-Learning entered into stock purchase agreements with 33 Japanese individuals. Pursuant to these agreements, e-Learning sold 3,300 shares of common stock in total to these individuals and received $330 as aggregate consideration. Each paid JPY10 per share. At the time of purchase the price paid per share by each shareholder was the equivalent to about $0.1. These shares were sold pursuant to the Company’s effective S-1 Registration Statement deemed effective on July 20, 2016 at 4pm EST.

On October 28, 2016, the Company, with the approval of its board of directors and its majority shareholders by written consent in lieu of a meeting, authorized the cancellation of shares owned by e-Learning. e-Learning consented to the cancellation of shares. The total number of shares cancelled was 19,000,000 shares which was comprised of 16,500,000 restricted common shares and 2,500,000 free trading shares.

On October 28, 2016, every one (1) share of common stock, par value $.0001 per share, of the Company issued and outstanding was automatically reclassified and changed into twenty (20) shares fully paid and non-assessable shares of common stock of the Company, par value $.0001 per share. (“20-for-1 Forward Stock Split”) No fractional shares were issued. The authorized number of shares, and par value per share, of common stock are not affected by the 20-for-1 Forward Stock Split.

On October 28, 2016, we filed a Certificate of Amendment with the Delaware Secretary of State. The effective date of the 20-for-1 Forward Stock Split was upon the acceptance of the Certificate of Amendment with the Secretary of State of the State of Delaware. The Certificate of Amendment can be found as Exhibit 3.1 to Form 8-K filed November 1, 2016.

During July 2017 and August 2017, e-Learning entered into stock purchase agreements with 24 Japanese individuals. Pursuant to these agreements, e-Learning sold 2,240,000 shares of its common stock in total to these individuals and received $38,263 as aggregate consideration.

-5-

Existing Business

We operate three lines of business through our wholly owned subsidiary, School TV. These include:

- The sale and distribution of health related products;

- The promotion of third party consumer goods and services; and

- RE/MAX realtor business in Kanagawa, Okinawa, and Tokyo, Japan.

Nature of Business: Sale and Distribution of Health Related Products

*The chart above does not depict when we make direct sales to consumers.

As depicted in the diagram above School TV is our wholly owned subsidiary through whom we operate exclusively at this time. School TV sells primarily health related consumer goods to distributors and consumers alike. At this time, School TV primarily operates under the operational model of “drop shipping.” It should be noted however, that School TV does hold inventory and sells products directly to the consumer from time to time. For products sold through our drop shipping model, after a purchase order has been filled out by a consumer the product is shipped out by School TV’s suppliers, rather than School TV. School TV sends a portion of the proceeds from the sale of any our products directly to suppliers when sold through the drop shipping model. This accounts for Exceed World’s cost of the good and any other related expenses. Revenues generated from the sale of inventory held directly by School TV are retained entirely by School TV. School TV is responsible for shipping goods sold that come from its own supply of inventory.

School TV has acquired its physical inventory, which will be explained in further detail below, from suppliers, and has plans to acquire additional inventory from as of yet unidentified suppliers.

Currently, School TV has future intentions to create an online marketplace to sell goods through but at this time, has not yet begun pursuing development of such a marketplace or website. Plans and timeline of such also remain undetermined.

School TV currently has no storefront and there is no guarantee that it will ever obtain a storefront. At this time, School TV is not actively seeking to acquire a storefront and it relies exclusively on personal relationships of our Chief Executive Officer to sell its current inventory.

Health Related Products

We offer the below products for sale:

| PURE ESALA | POPOCA | Le jeune | Magic Soap in Bath | Becker | ||

| Supplement | Supplement | Supplement | Soap | Health Beauty Equipment | ||

|

|

|

|

|

| ||

| Benefit | Discharges excessive moisture and salt from the body; Relieves constipation. | Heats the body; Promotes metabolism. | Antioxidation from the body; Keeps moisture in the skin. | Free of additives; Positive for skin health | Activation of tissue by impulse waves | |

| Principal Ingredients | Potassium chloride, Essence of vitamin Hyaluronic acid | Piper longum extracts, Essential vitamins, Ginger and pepper | Placental extracts, Collagen peptide, Essence of melon | Olive oil, Palm oil, Clay called kaoline | N/A | |

| Supplier | Exceed Japan Co., Ltd. | Exceed Japan Co., Ltd. | Exceed Japan Co., Ltd. | Exceed Japan Co., Ltd. | Amoto Kyouiku Kenko Co., Ltd. | |

| Unit Price and Cost | Selling Price JPY | 4,000 | 4,000 | 9,800 | 2,400 | 58,320 |

| Selling Price USD | 38.10 | 38.10 | 93.33 | 22.86 | 555.43 | |

| Cost Price JPY | 1,920 | 1,920 | 5,220 | 600 | 37,800 | |

| Cost Price USD | 18.29 | 18.29 | 49.71 | 5.71 | 360.00 | |

| Markup % | 52% | 52% | 46.7% | 75% | 35.2% |

Inventory

As of June 30, 2018, we had $78,570 in inventory which primarily consists of a health beauty equipment. Any goods that are purchased from our supply of physical inventory are sent out to the purchaser. We are responsible for any shipping and or related costs.

On July 27, 2018, e-Learning, the beneficial owner of the Company, agreed to acquire significant majority of the remaining health beauty equipment, "Becker", at cost from the Company. The Company completed the delivery subsequently on July 31, 2018.

-6-

Process of Ordering, Delivery and Payment

Should a purchaser purchase a health related supplement or product directly from School TV, the Company provides the purchaser a “call sheet” or in other words a purchase order form which includes but is not limited to, basic information on the purchaser, the shipping address of the purchaser, and payment details of the purchaser. School TV offers standard methods of shipping for its products at the cost of the purchaser. School TV bills the purchaser directly as the purchase is from School TV’s own stock of inventory.

Purchasers may also decide to purchase products through particular ‘distributors’ or sales agents of School TV. In this case the distributors receive a commission decided upon by the Company on a case by case basis. Payments, billing, and shipping are still handled by School TV.

For products not available in School TV’s inventory, the Company utilizes the drop-shipping model described in the proceeding paragraphs. In this case School TV is responsible for collecting payment and shipping information from the purchaser and then provides this information to the supplier at which time the supplier bills the purchaser for the purchase of the product(s) and handles any shipping of the product(s) thereafter. A commission is then paid to School TV for facilitating the transaction. Commissions are on a case by case basis with no set commission.

Competition - Health, Food, and Related Goods

Our primary competition comes from other health food and supplement companies within Japan, but can also include global companies who offer their products within Japan. Some of our competitors have larger resources than we have, a longer operating history, and established connections throughout our target regions, which may make it difficult to penetrate into the market effectively. Even if we do manage to penetrate into the health food and or supplement market with our products there can be no guarantee that we will be able to continue to compete effectively with these established competitors.

Our competition includes, but is not limited to, MUSO Co., Ltd, Asahi Food & Healthcare Co., Ltd., Daiichi Sankyo Co., Ltd., Taisho Pharmaceutical Co., Ltd. and Takeda Pharmaceutical Co., Ltd.. Several of these competitors have an established track record in Japan and offer highly valued products throughout the country, which may serve to make it more difficult for our own products to gain attention as we begin operations.

Nature of Business: Promotion of Third Party Consumer Goods and Services

In addition to our retail and drop-shipping business described above we also provide promotional services for third party businesses and receive a commission upon the sale of such product(s) or service(s). Included below we have disclosed the name, and principal good or service, of each third party business to whom we presently offer promotional services.

Products and Services - Sales

| Products | Supplier of Product or Service |

| Internet provider service(s) | Next BB Co., Ltd. |

| Delivery service(s) of Goods | Real Web Co., Ltd. |

| Food product(s) | Morita Seicha |

| Food product(s) | TOMOTO Co., Ltd. |

Promotional activities are made through existing relationships of School TV.

Process of Ordering, Delivery and Payment

Any and all billing, fulfillment, and shipping (if applicable) related to this business is handled entirely by the supplier of each product or service exclusively. We receive a commission upon facilitating a sale of a service or product that varies on a case by case basis. We are not directly involved in the sale of any product or service in any way except for assisting with facilitating the sale via promotional services.

-7-

Nature of Business: RE/MAX Realtor Business in Kanagawa, Okinawa, and Tokyo, Japan

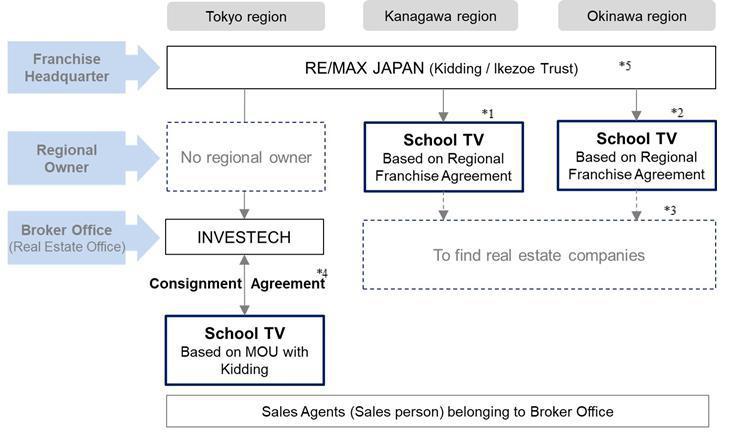

Basic structure

(description continued on next page)

Kanagawa region and Okinawa region

On July 7, 2017, our wholly owned subsidiary, School TV entered into a RE/MAX Regional Franchise Agreement with the master franchisor of RE/MAX Japan, Kidding Co., to lease the franchise rights to two Japanese Prefectures, Kanagawa and Okinawa, in consideration of JPY75,060,000 ($674,333) effective on July 7, 2017. Both lease terms are for a term of fifteen years and, after expiration of the lease term, School TV will need to pay to renew its rights to franchise RE/MAX should the Company decide to do so at that time. (*1, *2)

As depicted in the chart above, School TV has leased the rights to be regional franchisor owner of RE/MAX brokerage offices in two Prefectures (regions) of Japan from Kidding Co. Kidding Co. is the managing company for all of Japan’s RE/MAX operations. School TV is not engaged in any real estate activities and any brokerage offices opened up in these prefectures under School TV will be Japanese real estate companies with the proper licenses to carry out real estate sales and activities.

Currently, there is no brokerage office in either of these Prefectures and we have not yet generated any income relating to these activities. School TV is actively searching for real estate companies which will agree to open up, own and run RE/MAX broker offices for each region. However, any and all plans regarding the identification of an appropriate and interested real estate company remain speculative in nature and are still under development. (*3)

Tokyo region

*In relation to the below operations we have not yet generated any income.

On July 28, 2017, School TV entered into an Agreement with Investech Co. whereas it is agreed that School TV will provide monetary support to Investech Co., a Japanese Company, which operates a real estate brokerage office of RE/MAX Japan in the Tokyo region (the “Investech Agreement”). (*4)

On July 28, 2017, School TV entered into a Memorandum of Understanding with Kidding Co., pursuant to which Kidding Co. consents for School TV to provide monetary support to Investech Co., a Japanese Company, which operates a regional branch of RE/MAX Japan in the Tokyo region (further details can be found in the agreement titled “Kidding MOU”).

The Tokyo region has the largest real estate market in Japan. However, there is currently no regional owner in the Tokyo area. As such, Kidding Co. currently conducts management of the RE/MAX location in Tokyo, Japan.

School TV cannot, at this time, open and/or own a real estate brokerage office pursuant to Japanese regulations. However, they are not forbidden from providing monetary support to such brokerage offices in exchange for a percentage of profits from the brokerage offices. At present, School TV provides monetary support to Investech Co., the owner and operator of the RE/MAX brokerage office located in Tokyo. Currently, Investech Co. has three sales agents.

e-Learning intends to provide sales agents to Investech Co. in order to identify potential parties interested in purchasing real estate. Such sales agents will not be directly involved in the sale of any real estate, and their sole purpose is to identify a potential real estate purchaser for Investech to contact and pursue sales efforts. Pursuant to School TV’s relationship with Investech, Co., School TV receives a share of any profits generated from the RE/MAX profits in Tokyo through profit sharing. In the event that a sale is consummated resulting from the efforts of e-Learning’s sales agents, then 20% of Investech’s profits for the transaction go to the sales agent, and an additional 24% of the profits are paid to School TV. In any other scenario, that does not include a sales agent from e-Learning, in which Investech generates revenue from the operations of their RE/MAX location then School TV receives 5% of Investech’s profits.

Note: e-Learning and School TV do not have a formal agreement pursuant to their sales agents or profit sharing at this point in time.

From time to time Kidding Co., may pay fees to School TV to cover some or all of the monetary support given to Investech Co., by School TV.

(*5) Ikezoe Trust owns Kidding Co., referred to in the chart as “Kidding”.

Competition - RE/MAX Business

Our primary competition comes from established real estate companies within Japan, but can also include global companies who offer their products/services within Japan. Some of our competitors have larger resources than we have, a longer operating history, and established connections throughout our target regions, which may make it difficult to penetrate into the market effectively and find a real estate company to operate in Kanagawa or Okinawa. Even if we do manage to penetrate into the market there can be no guarantee that we will be able to continue to effectively compete with established competitors in an effective manner.

-8-

e-learning Business

With the completion of the Company’s acquisition of Force Holdings and its subsidiaries (Hereinafter, collectively referred to as the “Group”), we are now adding the business of providing education services to current business plan.

The Group is an education service provider in Japan and it offers a range of e-learning education programs as well as supporting services to complement such education programs through an internet platform named “Force Club” (“Force Club”), which was launched in 2007. The Group has offered e-learning programs through “Force Club”, all of which were procured from independent third-party software developers, including pre-school learning resources, learning resources supplementing elementary school, junior high school and senior high school curriculum, preparation courses for university entrance examinations and professional qualification examinations, and English learning, appealing to a diverse customer base from pre-school children to students and adult learners. A list of the Group’s e-learning programs, target customer group and release date are set out below. The e-learning programs of Force Club mainly serve as supplemental learning resources and self-learning tools for students and adult learners.

| No. | Content Name | Target | Compatible Devices | Release Date |

| 1 | ENGLISH MONSTERS | Primary school student | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | 2013 | |||

| 2 | Romantic English Conversation - London Ver. | Age 18 and over | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | 2013 | |||

| 3 | Romantic English Conversation - College Life Ver. | Age 18 and over | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | 2013 | |||

| 4 | ENGLISH MONSTERS AR | Primary school student | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | 2013 | |||

| 5 | The Blue Danube | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 6 | The Nutcracker | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 7 | Peter & the Wolf | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 8 | The Four Seasons | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 9 | The Carnival of the Animals | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 10 | Play A,B,C on the Keyboard | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 11 | Say Hello to English Words! | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 12 | Force Paint | Infants | iOS smartphone / tablet | 2012 |

| Android smartphone / tablet | 2014 | |||

| 13 | Force Musician | Infants | iOS smartphone / tablet | 2012 |

| 14 | Inheritance Diagnosis Consultant | Adult | iOS smartphone / tablet | 2013 |

| Android smartphone / tablet | 2013 | |||

| 15 | Sign Language Course | Adult | PC | 2014 |

| 16 | University Entrance Exam Preparation Course | High school student / Those who prepare for entrance exam |

PC | 2008 |

| Android smartphone / tablet | 2014 | |||

| 17 | LEARNING EYES | Adult | PC | 2012 |

| Android smartphone / tablet | 2014 | |||

| 18 | High School Student-oriented e-learning | High school student | PC | 2009 |

| Android smartphone / tablet | 2014 | |||

| 19 | Folstar | Adult | Feature Phone | 2008 |

| 20 | Qualification Attainment Strategies Course | Adult | iOS smartphone / tablet | 2015 |

| Android smartphone / tablet | ||||

| 21 | School TV | Primary school student / Middle school student | PC | 2015 |

| iOS smartphone / tablet | ||||

| Android smartphone / tablet | ||||

| 23 | English Monsters app | Main: High school student / College student (However, primary school student, middle school student, and adults are also included as targets.) |

iOS smartphone / tablet | 2015 |

| 23 | ForceMart | Force Club Members | PC | 2017 |

| iOS smartphone / tablet | ||||

| Android smartphone / tablet |

The Group’s e-learning programs are offered to its customers who have to be first registered as a member of Force Club. Since 2002, the Group began to offer its e-learning programs to its customers in CD-ROMs with pre-loaded learning content until 2007. Due to the popular trend for internet, starting from 2007, the Group has made its e-learning programs available on its website for its customers, and the customers need to pay a monthly fee in order to access and view the most up-to-date content on the website of the Group. At the advent of digital technology in recent years and in view of the increasing popularity of tablet devices, the Group has released its e-learning programs on smartphones and tablet devices for customer use since 2012 to cater for the popular demand of young learners and users in rural areas of Japan. The e-learning programs of Force Club are targeted at residents of Japan, and thus the e-learning programs are presented in Japanese only and no translated version is available. Since 2015, in addition to e-learning, the Group has started offline business which attracts public attentions such as Abacus School and Robot Programming School. Through these offline business, the Group has provided services to general users.

The Group regularly updates its e-learning materials and programs. In particular, the learning resources supplementing elementary school, junior high school and senior high school curriculum would be overhauled to correspond to any revision in school curriculum, which generally takes place once in a four-year period. In addition, most of preparation courses for the university entrance examinations and professional qualification examinations would be revised at one to two year intervals to cater for any changes to the examination syllabus. The website of the Group is updated from time to time to reflect the updates and changes to the learning materials and programs and for users with smartphones and tablet devices, these updates can also be downloaded from the website of the Group.

-9-

Business Model

Apart from using the conventional direct sales marketing strategy, the Group has also adopted multilevel marketing (“MLM”) in operating its businesses.

Since 2002, the Group has adopted a direct sale marketing strategy to market its e-learning programs. Since 2007, the Group gradually changed its marketing strategy from direct sale to MLM for the purposes of (i) establishing its brand name and penetrating into the rural areas of Japan; (ii) promoting its products to wider customer groups through premium members; and (iii) incentivizing premium members to recruit new members to join Force Club in order to increase the sales of its products and maximize profits for the Group. The Group adopted MLM since 2007 which is considered to be immediately effective, penetrative, and cost efficient as means of expanding its own educational business for the following reasons: (i) distance learning is a word-of-mouth business, and word-of-mouth has immediate impact; (ii) the Group relies on its premium members to help on product penetration into the suburban and rural areas of Japan; and (iii) marketing cost can be reduced. Currently, the Group has no retail shops or other point-of-sale for its products. Based on the consolidated accounts of the Group for each of the financial years from 2007 to 2017, the revenue generated by the Group after adopting MLM has increased from JPY634,950,892 in 2007 to JPY4,101,389,763 in 2017.

MLM was adopted by the Group in order to expand the sales of its e-learning programs through its Force Club members. Among Force Club members, premium members get a tablet device, which entitle the premium members a life-time access of all e-learning educational content and a right to introduce those content to other individuals. Since the Group’s e-learning education programs are distributed in the form of online downloads, it can be used for both online and offline and fully features a characteristic of e-learning: “whenever, wherever, and easy". Furthermore, the Group achieves high levels of customer satisfaction and maintains certain number of members providing various e-learning education programs for persons aged 0 to 100 years at an affordable price.

Force Club Membership

Force Club members are those who intend to use products and services the Group offers. Among Force Club members, members who wish to engage in recruiting new members are called premium members (“Premium Members”)

Premium Members can obtain rewards (special income or commissions) from their activities for recruitment of new Force Club members.

Premium Members are high-end users of the Group’s products. Premium Members have to join a premium plan under which members are given rights to use all products and services of the Group, and engage in activities to recruit new Force Club members and obtain rewards (special income or commissions) from such activities.

The Group generally enters into a contract (the “Premium Member Contract”) with each of its Premium Members, after confirming definitions, and terms and conditions of engaging in multilevel marketing activities and details of the commission scheme for recruitment of new members.

The salient terms of the Premium Member Contract are as follows:

Eligibility - the following individuals/corporations are eligible to register as the Group’s Premium Members:

(i) Individuals (other than students) who are 20 years old or above and are residents of Japan; and

(ii) Corporations established in Japan

Applicants are required to provide proof of identity, such as driver license, passport or resident card for individual members or a certified copy of the commercial registration for corporate members.

Payments – an applicant who wishes to be a Force Club Premium Member has to join the premium plan and pay an initial payment of JPY453,600, comprising:

(i) The one-off registration fee of JPY10,800;

(ii) The premium package fee of JPY421,200; and

(iii)An advanced payment of monthly membership fees for the initial two months amounting to JPY21,600.

Monthly membership fees payable from the third month onwards will be automatically transmitted from a Premium Member’s bank account until termination of membership.

Premium Members have to pay monthly membership fees of JPY10,800 commencing from the third month to maintain their premium membership. If a Premium Member does not pay the monthly membership fee before the prescribed due date, such Premium Member will be disqualified and will not be paid any commission with respect to his recruitment performance in the preceding month, and Force Club services for such Premium Member will be suspended in the following month. The commission and Force Club services for such Premium Member will be resumed in the subsequent month if the monthly membership fee is paid within three months from the due date. Otherwise, the Premium Member is deemed to have withdrawn from his membership if the monthly membership fee is not paid for three consecutive months after the payment due date.

Cooling-off period - An individual who has applied for registration as a Premium Member has a 20-day cooling-off period during which he may withdraw his Premium Member application provided that he would return a premium package. The Group will refund in full any payments made by such Premium Member upon receipt of the notification of the withdrawal of application and the premium package.

Cancellation of contract after the cooling-off period - after the 20-day cooling off period, Premium Members may cancel their contracts within 90 days from the receipt of premium package provided that the following conditions are met:

(i) Force Club services have not been used;

(ii) Such Premium Member has not started recruiting any new members; and

(iii) Such Premium Member has not intentionally or inadvertently lost or destroyed all or part of the premium package.

Upon cancellation of the contract, the Group will, if applicable, return part of the payment to such Premium Member. The amount of payment to be returned to a Premium Member in different scenarios, depending on when the contract is cancelled and whether the premium package is returned to the Group, is set out below:

| Cancellation in the first month after joining Force Club | Cancellation in the second/third month after joining Force Club | |

| If the premium package is returned to the Group | Refund JPY389,800 to a Premium Member | Refund JPY379,080 to a Premium Member |

| If the premium package is not returned to the Group | Refund JPY10,800 to a Premium Member | None. |

Membership withdrawal - Premium Members may withdraw their membership and terminate contracts by sending a withdrawal notification to the Group. The Group would not seek penalty charges or compensation from any Premium Member who withdraws and terminates his contract.

In addition, the Premium Member Contract sets out the rules of conduct required to be observed by Premium Members in recruiting new members to join Force Club. The Group is entitled to suspend a Premium Member’s business activities, suspend his commission, demand return of commission, remove his title, or terminate his membership if such Premium Member violates or infringes the rules of conduct or other related laws or regulations, and/or acts in a way that is offensive to public order and morals.

Upon registration as Force Club members, applicants will be given a user ID to gain access to the e-learning programs through Force Club platform. Force Club members will be given additional four user IDs after registration so that they can use total five user IDs for accessing e-learning content through Force Club platform.

Force Club members can gain access to e-learning programs through Force Club platform for their use of e-learning programs of the Group.

Since the launch of Force Club in 2007, the number of Force Club members had remained relatively stable. The number of Force Club members has increased from 3,989 as at September 30, 2008 to 6,558 as at September 30, 2017;

As of June 30, 2018, our subsidiaries, Force Holdings and its subsidiaries, had total assets of $19,907,774 and total liabilities of $7,161,131. Our consolidated assets as of June 30, 2018 were $19,933,774 and total liabilities were $7,161,131.

Employees

The number of the employees of the Group at June 30, 2018 was 42.

-10-

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this report before making a decision to invest in our common stock. If any of the following risks and uncertainties develop into actual events, our business, results of operations and financial condition could be adversely affected. In those cases, the trading price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Company

Since one of our products constitutes a significant portion of our net sales, significant decreases in consumer demand for this product or our failure to produce a suitable replacement should we cease offering it would harm our financial condition and operating results.

If consumer demand for this product decreases significantly or we cease offering this product without a suitable replacement, then our financial condition and operating results would be harmed.

If we lose the services of members of our senior management team, then our financial condition and operating results could be harmed.

We depend on the continued services of our Chief Executive Officer, Tomoo Yoshida, who also serves as our Chief Financial Officer, Director, President, Secretary, and Treasurer, and our senior management team as it works to create an environment of inspiration, motivation and entrepreneurial business success. Any significant leadership change or senior management transition involves inherent risk and any failure to ensure a smooth transition could hinder our strategic planning, execution and future performance. While we strive to mitigate the negative impact associated with changes to our senior management team, there may be uncertainty among investors, employees, Force Club and Premium Members and others concerning our future direction and performance. Any disruption in our operations or uncertainty could have a material adverse effect on our business, financial condition or results of operations.

Additionally, although we do not believe that any of our senior management team are planning to leave or retire in the near term, we cannot assure you that our senior managers will remain with us. The loss or departure of any member of our senior management team could adversely impact our Force Club and Premium Member relations and operating results. If any of these executives do not remain with us, our business could suffer. Also, our continued success will also be dependent on our ability to retain existing, and attract additional, qualified personnel to meet our needs. We currently do not maintain “key person” life insurance with respect to our senior management team.

Foreign-currency fluctuations and inflation in foreign markets could impact our financial position and results of operations.

In 2017, 100% of our sales occurred in Japan. In preparing our financial statements, we translate revenue and expenses in our markets outside the United States from their local currencies into U.S. dollars using weighted-average exchange rates. Foreign-currency fluctuations can also cause losses and gains resulting from translation of foreign-currency-denominated balances on our balance sheet. In addition, high levels of inflation and currency devaluations in any of our markets could negatively impact our balance sheet and results of operations. It is difficult to predict future fluctuations and the effect these fluctuations may have upon future reported results or our overall financial condition.

Difficult economic conditions could harm our business.

Global economic conditions continue to be challenging. Difficult economic conditions could adversely affect our business by causing a decline in demand for our products, particularly if the economic conditions are prolonged or worsen. In addition, such economic conditions may adversely impact access to capital for us and may otherwise adversely impact our operations and overall financial condition.

We may become involved in legal proceedings and other matters that, if adversely adjudicated or settled, could adversely affect our financial results.

We have been, and may again become in the future, party to litigation, investigations or other legal matters. In general, litigation claims could result in settlements or damages that could significantly affect financial results. It is not possible to predict the final resolution of any litigation to which we may become party, and the impact of these matters on our business, results of operations and financial condition could be material.

Government authorities may question our tax or customs positions or change their laws in a manner that could increase our effective tax rate or otherwise harm our business.

As a U.S. company doing business globally, we are subject to all applicable tax laws. We are subject to audit by tax authorities. If authorities challenge our tax positions, we may be subject to penalties, interest and payment of back taxes. The tax laws are continually changing and are further subject to interpretation by the local government agencies. Such situations may require that we defend our positions and/or adjust our operating procedures in response to such changes. Any or all of these potential risks may increase our effective tax rate, increase our overall tax costs or otherwise harm our business.

We may be held responsible for certain taxes or assessments relating to the activities of our Premium Members, which could harm our financial condition and operating results.

Our Premium Members are independent contractors and subject to taxation in their country of residency. In the event that our independent distributors are deemed as employees rather than independent distributors under local laws and regulations, or the interpretation of local laws and regulations, we may be held responsible for a variety of obligations that are imposed upon employers relating to their employees, including withholding and related taxes plus any related assessments and penalties, which could harm our financial condition and operating results. If our independent distributors were deemed to be employees rather than independent contractors, we would also face the risk of increased liability for their actions.

Market conditions and the strengths of competitors may harm our business.

Our results of operations may be harmed by market conditions and competition in the future. In addition, our business may be negatively impacted if we fail to adequately adapt to trends in consumer behavior and technologies.

-11-

The intellectual property we utilize may infringe on the rights of others, resulting in costly litigation.

Currently, the rights of 70% of our products are licensed from third party providers and the remaining 30% are owned by the Group. We expect that competition for developing new products will become more severe in the competitive education industry. Under such circumstances, if we depend on development of our own products, it would be time consuming and expensive. Rather, as our established sales system has proved effective, we plan to continue to use the products developed by other companies. We expect to increase the ratio of the products licensed by third parties.

In recent years, there has been significant litigation involving patents and other intellectual property rights. In particular, there has been an increase in the filing of suits alleging infringement of intellectual property rights, which pressure defendants into entering settlement arrangements quickly to dispose of such suits, regardless of their merit. Other companies or individuals may allege that we, or our members consumers, licensees or other parties indemnified by us infringe on their intellectual property rights. Even if we believe that such claims are without merit, defending such intellectual property litigation can be costly, distract management's attention and resources, and the outcome is inherently uncertain. Claims of intellectual property infringement also might require us to redesign affected products, enter into costly settlement or license agreements, pay costly damage awards, or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our products. Any of these results may adversely affect our financial condition.

If we are unable to protect our intellectual property rights, our ability to compete could be negatively impacted.

Many of our products rely on technologies developed or licensed by third parties, and we may not be able to obtain or continue to obtain licenses and technologies from these third parties on reasonable terms or at all. The market for our products depends to a significant extent upon the value associated with our product innovations and our brand equity. We rely upon patent, copyright, trademark and trade secret laws in Japan and similar laws in other markets, and non-disclosure, confidentiality and other types of agreements with our employees, members, consumers, suppliers and other parties, to establish, maintain and enforce our intellectual property rights. Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated, or such intellectual property rights may not be sufficient to permit us to provide competitive advantages, which could result in costly product redesign efforts, discontinuance of certain product offerings or other competitive harm. The costs required to protect our intellectual property may be substantial or even not practical.

To enforce and protect our intellectual property rights, we may initiate litigation against third parties. Any lawsuits that we initiate could be expensive, take significant time and divert management's attention from other business concerns, and we may ultimately fail to prevail or recover on any claim. Litigation also puts our intellectual property at risk of being invalidated or interpreted narrowly. Additionally, we may provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate and the damages or other remedies awarded, if any, may not be commercially valuable. The occurrence of any of these events may adversely affect our financial condition or diminish our investments in this area.

If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our products could be adversely affected.

We rely on our licenses, copyrights, trade secrets, processes and know-how. Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated. We generally seek to protect this information by confidentiality, non-disclosure and assignment of invention agreements with our employees, consultants, scientific advisors and third parties. Our employees may leave to work for competitors. Our distributors or sales leaders may seek other opportunities. These agreements may be breached, and we may not have adequate remedies for any such breach. In addition, our trade secrets may be disclosed to or otherwise become known or be independently developed by competitors. To the extent that our current or former employees, distributors, sales leaders, consultants or contractors use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions. If, for any of the above reasons, our intellectual property is disclosed or misappropriated, it would harm our ability to protect our rights and adversely affect our financial condition.

A failure of our internal controls over financial reporting or our compliance efforts could harm our stock price and our financial and operating results or could result in fines or penalties.

We have implemented internal controls to help ensure the accuracy and completeness of our financial reporting and have implemented compliance policies and programs to help ensure that our employees and members comply with applicable laws and regulations. Our internal audit team regularly audits our internal controls and various aspects of our business and compliance program, and we regularly assess the effectiveness of our internal controls. There can be no assurance, however, that our internal or external assessments and audits will identify all significant deficiencies or material weaknesses in our internal controls. If a material weakness results in a material misstatement of our financial results, we would be required to restate our financial statements.

Cyber security risks and the failure to maintain the integrity of company, employee, member data could expose us to data loss, litigation, liability and harm to our reputation.

We collect, store and transmit large volumes of company, employee and member data, including personally identifiable information, for business purposes, including for transactional and promotional purposes, and our various information technology systems enter, process, summarize and report such data. The integrity and protection of this data is critical to our business.

In addition, a penetrated or compromised data system or the intentional, inadvertent or negligent release, misuse or disclosure of data could result in theft, loss or fraudulent or unlawful use of company, employee or member data. Although we take measures to protect the security, integrity and confidentiality of our data systems, we experience cyber attacks of varying degrees and types on a regular basis, and our infrastructure may be vulnerable to these attacks. Our security measures may also be breached due to employee error or malfeasance, system errors or otherwise. Additionally, outside parties may attempt to fraudulently induce employees, users, or customers to disclose sensitive information to gain access to our data or our users' or customers' data. Any such breach or unauthorized access could result in the unauthorized disclosure, misuse or loss of sensitive information and lead to significant legal and financial exposure, regulatory inquiries or investigations, loss of confidence by our members, disruption of our operations and damage to our reputation. These risks are heightened as we work with third-party partners and as our members use social media, as the partners and social media platforms could be vulnerable to the same types of breaches.

We will need additional capital to expand our current operations or to enter into new fields of operations.

Currently, a significant portion of our revenue derives from sales of our premium package. We expect this revenue to continue to grow. While we will maintain and further increase the base for sale of this product, we also aim to expand our business by developing other services as well as entering into other promising market. We will need to seek additional financing either through borrowing, private offerings of our securities or through strategic partnerships and other arrangements with corporate partners. We cannot be assured that additional financing will be available to us, or if available, will be available to us on terms favorable to us. If adequate additional financing is not available on acceptable terms, we may not be able to implement our business development plan or expand our operations.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the expansion of our operations, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to hire additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

Relationships with our majority shareholder and its parent and affiliates may be on terms which are perceived by investors as more or less favorable than those that could be obtained from third parties.

Our majority shareholder, Force Internationale, presently owns 84.4% of our issued and outstanding common stock. While we anticipate that such percentage will be diluted over time, our majority shareholder, its parent and affiliates will be perceived as having influence over our management and operations, and any loans or other agreements which we may enter into with our majority shareholder and its parents and affiliates may be perceived by investors as being on terms that are less favorable than we could otherwise receive; such perception could adversely impact the price of our common stock. Similarly, such agreements could be perceived as being on terms more favorable than those that could be obtained from third parties, and any unwillingness by our majority shareholder and its parent and affiliates to engage with our common stock could discourage investors.

-12-

If we fail to further penetrate existing markets, then the growth in sales of our products, along with our operating results, could be negatively impacted.

We plan to expand business around Asia. Recently the number of foreigners visiting Japan for sightseeing and other purposes is increasing and there has been a growing interest in Japanese culture. We plan to start providing language education services which include Japanese language education to foreigners.

Our business could be materially and adversely affected as a result of natural disasters, other catastrophic events, acts of war or terrorism, or cyber-security incidents and other acts by third parties.

We depend on the ability of our business to run smoothly, including the ability of Premium Members to engage in their business building activities and the ability of our programs and products to be available to consumers. Any material disruption caused by natural disasters, including, but not limited to, fires, floods, hurricanes, volcanoes, and earthquakes; power loss or shortages; environmental disasters; telecommunications or business information systems failures; acts of war or terrorism and other similar disruptions, including those due to cyber-security incidents, ransomware, or other actions by third parties, could adversely affect our ability to conduct business.

We depend on the integrity and reliability of our information technology infrastructure, and any related inadequacies may result in substantial interruptions to our business.

Our ability to provide products and services to our Force Club and Premium Members depends on the performance and availability of our core transactional systems. While we continue to invest in our information technology infrastructure, there can be no assurance that there will not be any significant interruptions to such systems or that the systems will be adequate to meet all of our future business needs.

The most important aspect of our information technology infrastructure is the system through which we calculate, record and store Premium Member sales and other incentives. We have encountered, and may encounter in the future, errors in our software or our enterprise network, or inadequacies in the software and services supplied by our vendors, although to date none of these errors or inadequacies has had a meaningful adverse impact on our business. Any such errors or inadequacies that we may encounter in the future may result in substantial interruptions to our services and may damage our relationships with, or cause us to lose, our Force Club and Premium Members if the errors or inadequacies impair our ability to calculate sales and pay royalty overrides, bonuses and other incentives, which would harm our financial condition and operating results. Such errors may be expensive or difficult to correct in a timely manner, and we may have little or no control over whether any inadequacies in software or services supplied to us by third parties are corrected, if at all.

Anyone who is able to circumvent our security measures could misappropriate confidential or proprietary information, including that of third parties such as our Force Club and Premium Members, cause interruption in our operations, damage our computers or otherwise damage our reputation and business. We may need to expend significant resources to protect against security breaches or to address problems caused by such breaches. Any actual security breaches could damage our reputation and result in a violation of applicable privacy and other laws, legal and financial exposure, including litigation and other potential liability, and a loss of confidence in our security measures, which could have an adverse effect on our results of operations and our reputation as a brand, business partner or employer. In addition, employee error or malfeasance or other errors in the storage, use or transmission of any such information could result in a disclosure to third parties. If this should occur, we could incur significant expenses addressing such problems. Since we collect and store Force Club and Premium Member and vendor information, these risks are heightened.

Risks Relating to the Education Industry

It is expected that if the birthrate continues to be declining in Japan, the Japanese education industry will face severe competition and face reduced revenues over the medium and long terms. Taking such risk into consideration, we are planning to develop business in the emerging countries in Asia and establish education platform adding usability to provision of content. However, if the change in the market is faster than expected or conversion into new business is not promptly made, our revenue or financial condition may be adversely affected.

Risks Associated with Multi-Level Marketing

Our failure to establish and maintain Force Club and Premium Member relationships for any reason could negatively impact sales of our products and harm our financial condition and operating results.

We distribute our products exclusively to and through Force Club and Premium Members, and we depend upon them directly for substantially all of our sales. Our Force Club and Premium Members may voluntarily terminate their agreements with us at any time subject to the termination provisions. To increase our revenue, we must increase the number of, or the productivity of, our Force Club and Premium Members. Accordingly, our success depends in significant part upon our ability to recruit, retain and motivate a large base of Premium Members. The loss of a significant number of Force Club or Premium Members for any reason could negatively impact sales of our products and could impair our ability to attract new Force Club or Premium Members. Our operating results could be harmed if our existing and new business opportunities and products do not generate sufficient interest to retain existing, and attract new, Force Club and Premium Members.

Adverse publicity associated with our products, ingredients or network marketing program, or those of similar companies, could harm our financial condition and operating results.

The size of our Force Club and Premium Members and the results of our operations may be significantly affected by the public’s perception of the Company and similar companies. This perception is dependent upon opinions concerning:

| • | the quality of our products; |

| • | the quality of similar products distributed by other companies; |

| • | our Force Club and Premium Members; |

Adverse publicity concerning any actual or purported failure of our Company or our Force Club and Premium Members to comply with applicable laws and regulations could have an adverse effect on the goodwill of our Company and could negatively affect our ability to attract, motivate and retain Force Club and Premium Members, which would negatively impact our ability to generate revenue.

In addition, our Force Club and Premium Members’ and consumers’ perception of the quality of our products and as well as similar products distributed by other companies can be significantly influenced by media attention concerning our products or similar products distributed by other companies. Adverse publicity questions the benefits of our or similar products could lead to lawsuits or other legal challenges and could negatively impact our reputation, the market demand for our products, or our general business.

Inability of products to gain or maintain Force Club or Premium Membership could harm our business.

Our operating results could be adversely affected if our products, business opportunities, and other initiatives do not generate sufficient enthusiasm and economic benefit to retain our existing Force Club and Premium Members or to attract new Force Club or Premium Members. Potential factors affecting the attractiveness of our products, business opportunities, and other initiatives include, among other items, perceived product quality and value, product exclusivity or effectiveness, economic success in our business opportunity, adverse media attention, or regulatory restrictions.

Challenges to the form of our network marketing system could harm our business.

We may be subject to challenges by government regulators regarding the form of our network marketing system. Legal and regulatory requirements concerning the multi-level marketing industry generally do not include "bright line" rules and are inherently fact-based and subject to interpretation. As a result, regulators and courts have discretion in their application of these laws and regulations, and the enforcement or interpretation of these laws and regulations by government agencies or courts can change. We could also be subject to challenges by private parties in civil actions. All of these actions and any future scrutiny of us or our industry could generate negative publicity or further regulatory actions that could result in fines, restrict our ability to conduct our business in our various markets, enter into new markets, motivate our membership, and attract consumers.

Improper actions by our Members could harm our business.

Actions by our Members, sanctioned by our Company or not, could violate applicable laws or regulations could result in government or third-party actions against us, which could harm our business.

The direct selling industry in Japan continues to experience regulatory and media scrutiny, and other direct selling companies have been suspended from sponsoring activities in the past. Japan imposes strict requirements regarding how distributors approach prospective customers. As a result, we continually evaluate and enhance our distributor compliance, education and training efforts in Japan. However, we cannot be certain that our efforts will successfully prevent regulatory actions against us, including fines, suspensions or other sanctions, or that the company and the direct selling industry will not receive further negative media attention, all of which could harm our business.

The loss of key Premium Members could negatively impact our growth and our revenue.

Currently we have 20 key Premium Members. They are responsible for sales promotion to expand their group and provide support and compliance training to the members of their group. The loss of a key Premium Member, or a sales leader or a group of leading sales leaders, whether by their own choice or through disciplinary actions by us for violations of our policies and procedures, could negatively impact our growth and our revenue.

Laws and regulations may prohibit or severely restrict direct selling and cause our revenue and profitability to decline, and regulators could adopt new regulations that harm our business.

Laws and regulations in Japan are particularly stringent and subject to broad discretion in enforcement by regulators. These laws and regulations are generally intended to prevent fraudulent or deceptive schemes, often referred to as "pyramid schemes," that compensate participants primarily for recruiting additional participants without significant emphasis on product sales to consumers.

Complying with these rules and regulations can be difficult, time-consuming and expensive, and may require significant resources. The laws and regulations governing direct selling are modified from time to time, and, like other direct selling companies, we are subject from time to time to government inquiries and investigations related to our direct selling activities. In addition, markets where we currently do business could change their laws or regulations to prohibit direct selling. If we are unable to continue business in existing markets or commence operations in new markets because of these laws, our revenue and profitability may decline.

If we change sales compensation plans, such changes could be viewed negatively by some or all of our membership and could contribute to a failure to achieve desired long-term results and have a negative impact on revenue.

-13-

Risks Related To Our Common Stock

The shares of our common stock are currently not being traded and there can be no assurance that there will be an active market in the future.

Our shares of common stock are traded on the OTC Pink, which does not have the liquidity or corporate standards of the NYSE or NASDAQ and as such, the price per share quoted on the OTC Pink may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock in the future. As a result, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business.

It is possible that we will not establish an active market unless our stock is listed for trading on an exchange, and we cannot assure you that we will ever satisfy exchange listing requirements.

It is possible that a significant trading market for our shares will not develop unless the shares are listed for trading on a national exchange. Exchange listing would require us to satisfy a number of tests as to corporate governance, public float, shareholders, equity, assets, market makers and other matters, some of which we do not currently meet. We cannot assure you that we will ever satisfy listing requirements for a national exchange or that there ever will be significant liquidity in our shares.

If we issue additional shares of our common stock, you will experience dilution of your ownership interest.

We may issue shares of our authorized but unissued equity securities in the future. Such shares may be issued in connection with raising capital, acquiring assets or firing or retaining employees or consultants. If we issue such shares, your ownership will be diluted.

We do not intend to pay dividends in the foreseeable future, and investors should not purchase our stock expecting to receive dividends.

We have not paid any dividends on our common stock in the past, and we do not anticipate that we will pay dividends in the foreseeable future. Accordingly, some investors may decline to invest in our common stock, and this may reduce the liquidity of our stock.

The limitations on liability for officers, directors and employees under the laws of the State of Delaware and the existence of indemnification rights for our officers, directors and employees could result in substantial expenditures by the Company and could discourage lawsuits against our officers, directors and employees.

Our Articles of Incorporation contain a specific provision that eliminates the liability of our officers and directors for monetary damages to our company and shareholders. Further, we intend to provide indemnification to our officers and directors to the fullest extent permitted by the laws of the State of Delaware. We may also enter into employment and other agreements in the future pursuant to which we will have indemnification obligations. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against officers and directors. These obligations may discourage the filing of derivative litigation by our shareholders against our officers and directors even where such litigation may be perceived as beneficial by our shareholders.

Exceed World will incur increased costs and compliance risks as a result of becoming a public company.

As a public company, Exceed World will have additional legal, accounting and other expenses that Exceed World did not have prior to acquiring Force Holdings and its subsidiaries.

-14-

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in this Current Report on Form 8-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may”, “will”, “expect”, “believe”, “anticipate”, “estimate” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include by are not limited to economic conditions generally and in the industries in which we may participate; competition within our chosen industry, including competition from much larger competitors; technological advances and failure to successfully develop business relationships.

Results of Operations of Force International Holdings Limited and its subsidiaries (collectively referred to as the “Group”) for the Years Ended September 30, 2017, 2016 and 2015

| 2017 | 2016 | 2015 | |||

| US$ | US$ | US$ | |||

| Revenue | 36,860,282 | 22,599,405 | 42,608,256 | ||

| Cost of sales | (22,219,015) | (15,577,446) | (23,869,890) | ||

| Gross profit | 14,641,267 | 7,021,959 | 18,738,366 | ||

| Other income | 158,856 | 291,621 | 179,317 | ||

| Change in fair value of investment held for trading | 130,280 | 62,309 | (239,608) | ||

| Selling and distributions expenses | (1,120,970) | (2,292,856) | (2,372,227) | ||

| Administrative expenses | (9,720,466) | (9,994,759) | (8,083,885) | ||

| Finance costs | (2,801) | - | - | ||

| Profit (loss) before tax | 4,086,166 | (4,911,726) | 8,221,963 | ||

| Income tax (expense) credit | (533,439) | 48,888 | (3,049,426) | ||

| Profit (loss) for the year | 3,552,727 | (4,862,838) | 5,172,537 | ||

Revenue

Revenue was decreased from US$42,608,256 for the year ended September 30, 2015 to US$22,599,405 for the year ended September 30, 2016. This decrease in revenue is mainly due to the Group’s strategy to increase direct sales, which were substantially small compared to MLM sales in order to develop and expand new market for the Group. The Group again focus on MLM sales thereafter and revenue was increased to US$36,860, 282 for the year ended September 30, 2017.

Operating Expenses

Selling and distribution expenses was slightly decreased from US$2,372,227 for the year ended September 30, 2015 to US$2,292,856 for the year ended September 2016 and further significantly decreased to US$1,120,970 for the year ended September 30, 2017. The significantly decrease in selling and distributions expenses was primarily attributable to the Group’s efforts for cost cutting measures. The administrative expenses for the year ended September 30, 2015, 2016 and 2017 were US$8,083,885, US$9,994,759 and US$9,720,466 respectively.

Profit / Loss from Operations

The Group’s loss for the year ended September 30, 2016 was US$4,862,838 compared to profit of US$5,172,537 for the year ended September 30, 2015. This decrease is mainly attributable to significant decrease in revenue and increase in operating expenses due to the Group’s strategy to focus on direct sales. The Group recorded profit of US$3,552,727 for the year ended 30 September 2017 from loss position in 2016 due to increase in MLM sales.

Liquidity and Capital Resources

The Group’s total assets decreased from US$26,000,026 at September 30, 2015 to US$15,806,613 at September 30, 2016. The decrease in total assets was mainly attributable to decrease in bank balance and cash due to decrease in revenue for the year ended September 30, 2016. At September 30, 2017, the total assets was US$19,911,979, increased US$4,105,366 compared to the previous year. As total liabilities of the Group significantly decreased from US$12,154,552 at September 30, 2015 to US$4,751,288 at September 30, 2016, net assets at September 2016 was US$11,055,325 compared to US$13,845,474 at the end of the previous year. Net assets at September 30, 2017 was increased to US$13,489,981.

Results of Operations of Group for the Nine Months Ended June 30, 2018 and 2017

Revenue

Revenue for the nine months ended June 30, 2018 was US$19,795,079 as compared to US$29,820,580 for the nine months ended June 30, 2017. This decrease in revenue is mainly attributable to the timing of sales promotion period. We time to time run campaigns to promote sales. As the main campaign for the year ended September 30, 2017 was held during the first quarter of the year, the sales for the beginning of the year was increased. However, for the year ended September 30, 2018, such campaign has been running during the last quarter, therefore, the sales during the nine months ended June 30, 2018 was significantly decreased compared to that of the nine months ended June 30, 2017.

Operating Expenses