Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BAR HARBOR BANKSHARES | investorpresentation91918.htm |

Investor Presentation September 2018

Legal Disclaimer Forward Looking Statements This document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. There are several factors that could cause actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see the Company’s most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC’s website at www.sec.gov. The Company does not undertake any obligation to update forward-looking statements. Non -GAAP Financial Statements This document contains certain non-GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles (“GAAP”). These non-GAAP measures provide supplemental perspectives on operating results, performance trends, and financial condition . They are not a substitute for GAAP measures; they should be read and used in conjunction with the Company’s GAAP financial information. A reconciliation of non-GAAP financial measures to GAAP measures is included in the first quarter earnings release which can be found at www.bhbt.com. In all cases, it should be understood that non-GAAP per share measures do not depict amounts that accrue directly to the benefit of shareholders. The Company utilizes the non-GAAP measure of core earnings in evaluating operating trends, including components for core revenue and expense. These measures exclude items which the Company does not view as related to its normalized operations. These items include securities gains/losses, acquisition costs, restructuring costs, and systems conversion costs. Non-core adjustments are presented net of an adjustment for income tax expense. This adjustment is determined as the difference between the GAAP tax rate and the effective tax rate applicable to core income. The efficiency ratio is adjusted for non-core revenue and expense items and for tax preference items. The Company also calculates measures related to tangible equity, which adjust equity (and assets where applicable) to exclude intangible assets due to the importance of these measures to the investment community. 2

Company Overview (NYSE American: BHB) Financial Highlights1 Asset and Income Generation Market Data Total Assets (MM's) Stock Price $29.45 3,565 Market Cap (MM's) $456 Price / LTM Core EPS 13.21x 3,541 Price / Tangible Book Value 184% 3,511 Dividend Yield 2.72% 3,503 Balance Sheet ($Million) 3,476 Total Assets $3,541 Cash and Securities $810 Net Loans $2,472 Total Deposits $2,375 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 Total Equity $356 YTD Performance Ratios and Profitability Core Net Income (000's) Core Return on Average Assets 1.00% Core Return on Average Equity 9.86% 8,964 Net Interest Margin 2.91% 8,821 8,715 Efficiency Ratio 58.83% Core Net Income (000's) $8,715 Capital Ratios Tang. Common Equity / Tang. Assets 7.22% 8,091 8,066 Tier 1 Leverage Ratio 8.30% Common Equity Tier 1 Risk- Based Capital Ratio 11.48% Tier 1 Risk- Based Capital Ratio 12.38% Total Risk-Based Capital Ratio 13.92% 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 1) BHB common equity share price as of August 31, 2018. All other financial data as of June 30, 2018. 3

Second Quarter 2018 - Highlights & Initiatives A strong second quarter as BHB executed on our strategies and deliverables on financial performance. We diversified revenue streams, grew loans under a uniformed brand & banking franchise, and adhered to our strong credit culture. In addition to growing business and revenue, we continue to apply a disciplined approach to expense management. • 9% y-o-y increase in non-interest income • 8% y-o-y increase in core EPS • 13.6% commercial and industrial loan growth (annualized, YTD) • 1.00 % core ROA • 9.86% core ROE • 9% annualized growth in TBV /Share1 • Opened over 6,500 new deposit accounts YTD • Rolled out expanded customer derivatives platform 1) Excluding security adjustments Note: See appendix for GAAP reconciliation 4

Strategic Objectives We strive to be one of the most profitable banks in New England; to provide exceptional service to the people, businesses and communities we serve; and create a corporate culture that develops and rewards existing employees and attracts outside talent. To be one of the most profitable banks headquartered in New England Increase sources of fee income via Trust, Treasury Management and Mortgage Banking Focus on the core bank: core commercial banking business, core funding, core earnings Continued commitment to an exceptional risk management culture Strategically fill-in and expand our New England footprint Maintain a strong capital base that supports growth opportunities 5

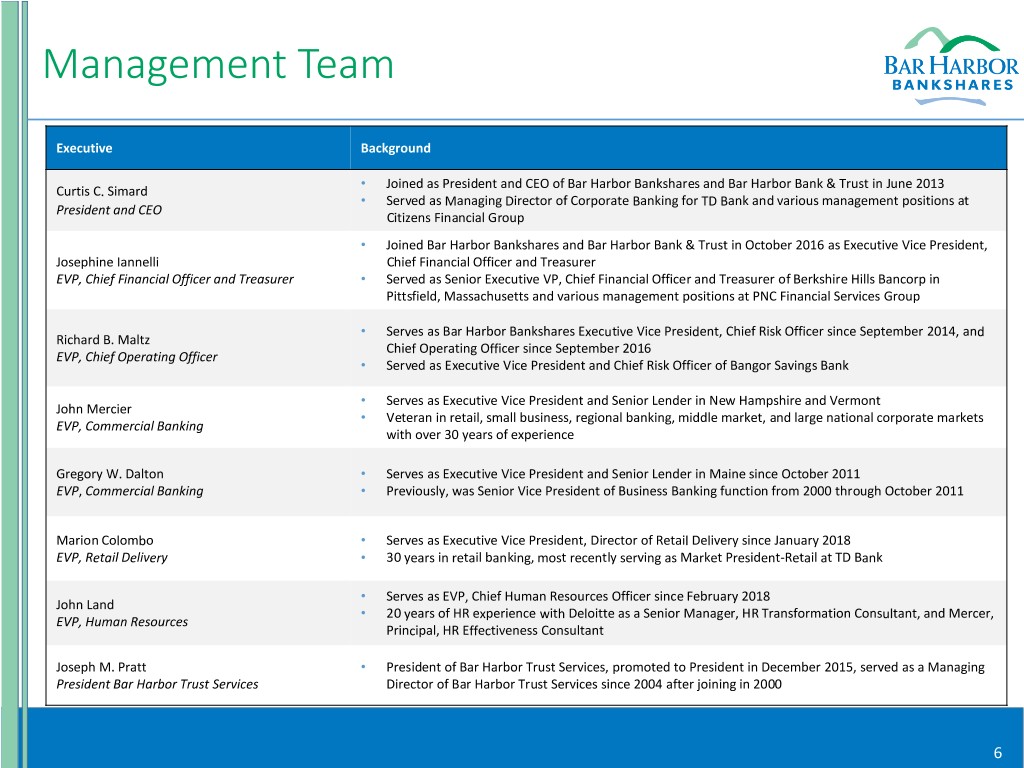

Management Team Executive Background • Joined as President and CEO of Bar Harbor Bankshares and Bar Harbor Bank & Trust in June 2013 Curtis C. Simard • Served as Managing Director of Corporate Banking for TD Bank and various management positions at President and CEO Citizens Financial Group • Joined Bar Harbor Bankshares and Bar Harbor Bank & Trust in October 2016 as Executive Vice President, Josephine Iannelli Chief Financial Officer and Treasurer EVP, Chief Financial Officer and Treasurer • Served as Senior Executive VP, Chief Financial Officer and Treasurer of Berkshire Hills Bancorp in Pittsfield, Massachusetts and various management positions at PNC Financial Services Group • Serves as Bar Harbor Bankshares Executive Vice President, Chief Risk Officer since September 2014, and Richard B. Maltz Chief Operating Officer since September 2016 EVP, Chief Operating Officer • Served as Executive Vice President and Chief Risk Officer of Bangor Savings Bank • Serves as Executive Vice President and Senior Lender in New Hampshire and Vermont John Mercier • Veteran in retail, small business, regional banking, middle market, and large national corporate markets EVP, Commercial Banking with over 30 years of experience Gregory W. Dalton • Serves as Executive Vice President and Senior Lender in Maine since October 2011 EVP, Commercial Banking • Previously, was Senior Vice President of Business Banking function from 2000 through October 2011 Marion Colombo • Serves as Executive Vice President, Director of Retail Delivery since January 2018 EVP, Retail Delivery • 30 years in retail banking, most recently serving as Market President-Retail at TD Bank • Serves as EVP, Chief Human Resources Officer since February 2018 John Land • 20 years of HR experience with Deloitte as a Senior Manager, HR Transformation Consultant, and Mercer, EVP, Human Resources Principal, HR Effectiveness Consultant Joseph M. Pratt • President of Bar Harbor Trust Services, promoted to President in December 2015, served as a Managing President Bar Harbor Trust Services Director of Bar Harbor Trust Services since 2004 after joining in 2000 6

Company History Ma ri on Colombo Acquisition of John Mercier hired as EVP, Bar Harbor Trust Rick Maltz hired Lake Sunapee hired to run Acquired Border Director of Retail Es tablished in Bar as Chief Operating Bank group – commercial Trust Company Del ivery Harbor, Maine Officer expansion into NH banking in NH and John Land hired as and VT markets VT EVP, HR 1887 1984 2012 2013 2014 2016 2017 2018 Es tablished Bar Announced Expansion of treasury Curtis Simard Jos ephine Iannelli Upgraded Further Harbor sale of management services hired as President hired as Chief core operating expansion into Bankshares as a ins urance and customer & CEO Financial Officer systems Southern NH holding company business derivatives platform 7

Markets We Serve: Demographics / Economy • Serving affluent and growing markets in the Maine, New Hampshire and Vermont • Strong employment evidenced by its major markets unemployment rates of 3.0% or less • Core markets have increasingly diversified into services industries while legacy manufacturing has dissipated • Agriculture, fishing and forestry remain strong economic drivers for this region of the country 2018 Median HH Income ($) Projected HH Income Change 2018-2023 (%) December 2018 Unemployment Rate (%) 11.2% $90,000 $80,246 12.0% 5.0% $75,742 9.6% 9.5% 4.1% $75,000 $67,764 10.0% 8.9% 8.8% 4.0% $61,045 $61,542 $55,679 3.0% $60,000 8.0% 2.8% 6.5% 3.0% 2.6% 2.4% $45,000 6.0% 2.2% 2.0% $30,000 4.0% $15,000 2.0% 1.0% $0 0.0% 0.0% USA Maine New Hampshire Vermont Manchester-Nashua MSA Portland-South Portland MSA Major Employers Source: S&P Global Market Intelligence 8

Markets We Serve: Deposit Market Share • Number 1 or 2 deposit market share position in 31 of the 42 communities we serve • Top 5 deposit market share position for 39 of the 42 communities we serve • 50 branch network provides strong geographical presence throughout our markets Maine Total Total Deposits Market Share Rank Company Name Branches ($000) (%) 1 Toronto-Dominion Bank 44 3,725,156 13.41 2 Camden National Corp. 61 2,956,560 10.64 3 Bangor Bancorp MHC 56 2,792,415 10.05 4 KeyCorp 49 2,542,925 9.15 5 Bank of America Corp. 16 1,951,295 7.02 8 Bar Harbor Bankshares 15 1,124,425 4.05 Market Total 478 27,785,129 100.00 New Hampshire Total Total Deposits Market Share Rank Company Name Branches ($000) (%) 1 Citizens Financial Group 67 7,683,114 23.50 2 Toronto-Dominion Bank 65 6,866,386 21.00 3 Bank of America Corp. 21 4,778,817 14.62 4 New Hampshire Mutual Bancorp 27 1,627,502 4.98 5 People's United Financial Inc. 26 1,619,740 4.95 9 Bar Harbor Bankshares 21 791,810 2.42 Market Total 415 32,692,701 100.00 Vermont Total Total Deposits Market Share Rank Company Name Branches ($000) (%) 1 People's United Financial Inc. 40 3,034,691 23.16 2 Toronto-Dominion Bank 29 2,645,418 20.19 3 Community Bank System Inc. 31 1,317,286 10.05 4 Citizens Financial Group Inc. 17 858,416 6.55 5 KeyCorp 11 799,557 6.10 12 Bar Harbor Bankshares 14 298,544 2.28 Market Total 237 13,104,491 100.00 Note: Deposit data as of June 30, 2017 Source: FDIC 9

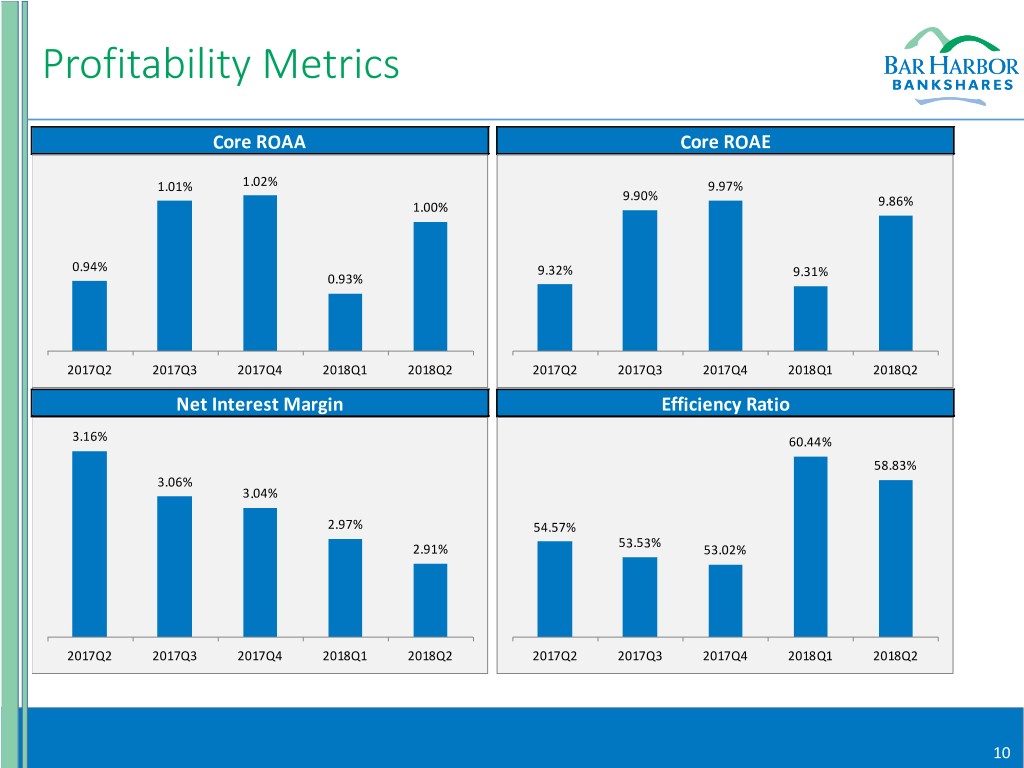

Profitability Metrics Core ROAA Core ROAE 1.01% 1.02% 9.97% 9.90% 1.00% 9.86% 0.94% 9.32% 9.31% 0.93% 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 Net Interest Margin Efficiency Ratio 3.16% 60.44% 58.83% 3.06% 3.04% 2.97% 54.57% 53.53% 2.91% 53.02% 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 10

Focus on Non-Interest Income Maximizing Existing Sources & Assets Under Management Developing New Initiatives $1,803 • Wealth Management and Financial Services $1,779 $1,754 $1,757 $1,759 ‒ Bar Harbor Financial Services ‒ Two wholly owned subsidiaries, Charter Trust and Bar Harbor Trust services offering trust management services • $1.8B AUM 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 ‒ Total Revenue of $3.1 million in 2Q18 ‒ Trust, investment management and Non-Interest Income / Operating Revenue¹ financial services represent 44% of total non-interest income (2Q18) ‒ Improving efficiencies by migrating both 23.65% Trust Companies to one operating platform 22.87% 21.60% 21.72% 21.22% • Additional Sources ‒ Mortgage Banking ‒ Cash Management ‒ Customer Derivatives Offerings 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 1) Excludes gain-on-sale of securities 11

Loan Portfolio Overview Portfolio Composition as of 6/30/18 Highlights Tax exempt Consumer and other 5% 3% • Net loans of $2.5 billion as of June 30, 2018 CRE 34% • Yield on loans of 4.25% for the quarter ended June 30, 2018 • Increase of 8.8 bps from 1Q18 Residential • Increase of 13.3 bps YTD 45% C&I 13% • 13.6% annualized commercial and industrial loan growth for the first half of 2018 Source: Company filings 12

Deposit Portfolio Overview Portfolio Composition as of 6/30/18 Highlights Demand Time deposits 14% 41% • Total deposits of $2.4 billion as of June 30, 2018 NOW 19% • Opened 6,500 new deposit accounts YTD • Cost of interest bearing deposits of Savings 0.90% 15% Money Market 11% • Loans / Deposits of 105% Source: Company filings 13

Asset Quality NPAs / Assets NCOs / Avg. Loans 0.50% 1.20% 1.00% 0.40% 0.80% 0.30% 0.59% 0.62% 0.60% 0.41% 0.20% 0.40% 0.20% 0.15% 0.07% 0.06% 0.10% 0.20% 0.03% 0.04% 0.01% 0.00% 0.00% 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 Reserves / Loans 1.20% 1.00% 0.80% 0.53% 0.48% 0.49% 0.50% 0.51% 0.60% 0.40% 0.20% 0.00% 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 Source: Company filings 14

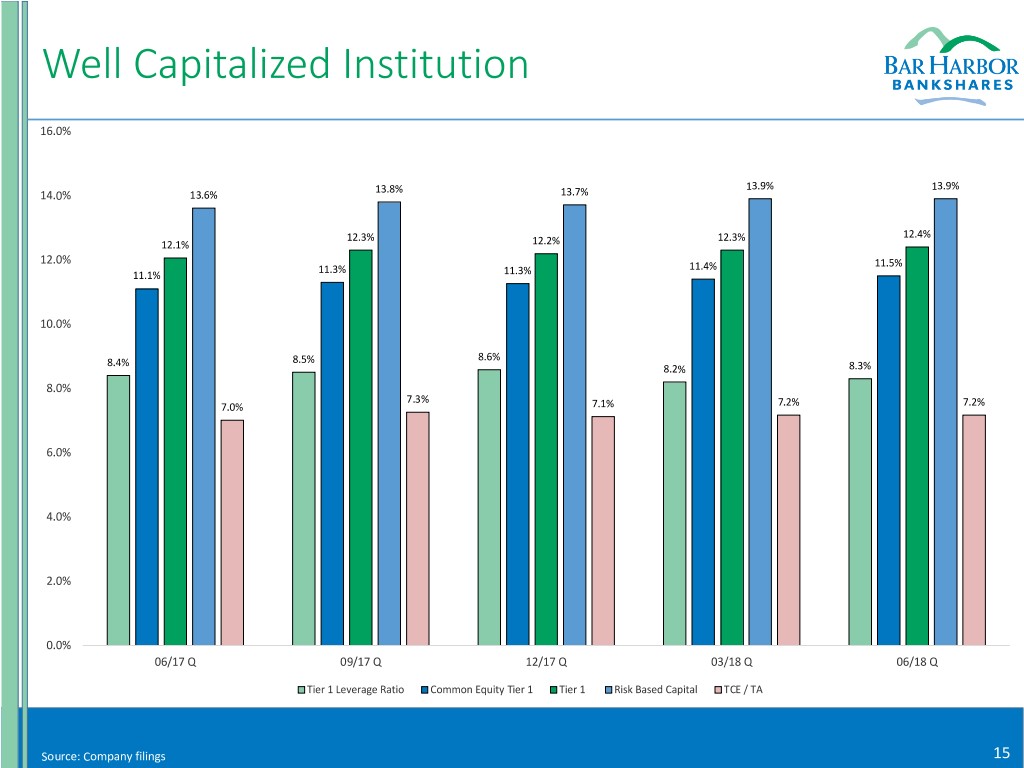

Well Capitalized Institution 16.0% 13.8% 13.9% 13.9% 14.0% 13.6% 13.7% 12.3% 12.3% 12.4% 12.1% 12.2% 12.0% 11.5% 11.3% 11.4% 11.1% 11.3% 10.0% 8.6% 8.4% 8.5% 8.2% 8.3% 8.0% 7.3% 7.0% 7.1% 7.2% 7.2% 6.0% 4.0% 2.0% 0.0% 06/17 Q 09/17 Q 12/17 Q 03/18 Q 06/18 Q Tier 1 Leverage Ratio Common Equity Tier 1 Tier 1 Risk Based Capital TCE / TA Source: Company filings 15

Investment Considerations • Focused on building franchise value • Deep and talented management team • Profitable and efficient business model • Clear vision to grow core loan/deposit business • Development and expansion of non-interest income revenue • Proven ability to grow organically and via acquisitions • Pristine credit quality and a conservative risk management culture • Team, platform and strategy in place to generate efficient growth • Consistent dividend payments to shareholders with an attractive yield 16

Appendix

Historical Financial Performance Dollar values in thousands, except per share For the Year Ended, For the Quarter Ended, amounts or otherwise noted 2014Y 2015Y 2016Y 2017Y 2017Q3 2017Q4 2018Q1 2018Q2 Balance Sheet Total Assets $1,459 $1,580 $1,755 $3,565 $3,476 $3,565 $3,511 $3,541 Net Loans 910 981 1,119 2,473 2,417 2,473 2,452 2,472 Total Deposits 858 943 1,050 2,352 2,275 2,352 2,341 2,375 Capital Total Equity $146 $154 $157 $355 $353 $355 $352 $356 Tang. Common Equity / Tang. Assets 9.68% 9.45% 8.65% 7.12% 7.26% 7.12% 7.17% 7.22% Tier 1 Leverage Ratio 9.30% 9.37% 8.94% 8.10% 8.50% 8.60% 8.16% 8.30% Total Risk-Based Capital Ratio 17.24% 17.12% 16.52% 13.73% 13.81% 13.70% 13.89% 13.92% Commercial Real Estate Loans / Total RBC 137.57% 127.36% 141.82% 193.76% 153.07% 193.76% 192.86% 193.02% Earnings & Profitability Net Income $14.6 $15.2 $14.9 $26.0 $8.6 $6.6 $7.8 $8.5 Core ROAA 1.01% 0.93% 0.83% 0.93% 1.01% 1.02% 0.93% 1.00% Core ROAE 10.51% 9.46% 8.57% 9.15% 9.90% 9.97% 9.31% 9.86% Net Interest Margin 3.33% 3.19% 2.96% 3.10% 3.06% 3.04% 2.97% 2.91% Efficiency Ratio 54.70% 56.60% 60.00% 55.50% 53.53% 53.02% 60.44% 58.83% Asset Quality NPLs / Loans 1.34% 0.71% 0.58% 0.58% 0.28% 0.58% 0.83% 0.88% NPAs / Assets 0.88% 0.46% 0.38% 0.41% 0.20% 0.41% 0.59% 0.62% Reserves / Loans 0.98% 0.95% 0.92% 0.50% 0.49% 0.50% 0.51% 0.53% NCOs / Average Loans 0.15% 0.14% (0.00%) 0.04% 0.01% 0.04% 0.07% 0.06% Yield and Cost Yield on Earning Assets 4.05% 3.89% 3.72% 3.86% 3.89% 3.87% 3.92% 3.99% Cost of Interest Bearing Deposits 0.74% 0.72% 0.75% 0.60% 0.66% 0.70% 0.82% 0.90% Cost of Total Interest Bearing Liabilities 0.82% 0.80% 0.86% 0.87% 0.96% 0.97% 1.11% 1.25% Market Information (8/31/2018) Current Stock Price $29.45 Price / BV 128% 52 Week High $32.33 Price / TBV 184% 52 Week Low $25.49 Price / LTM Core EPS 13.21x Market Capitalization $456.4 Dividend Yield 2.72% Source: Company filings 18

Non-GAAP to GAAP Reconciliations Dollar values in thousands, except per share 2017Q2 2017Q3 2017Q4 2018Q1 2018Q2 amounts or otherwise noted Net income 6,556 8,617 6,609 7,812 8,535 Adj: Security Gains - (19) - - - Adj: Loss on sale of fixed assets, net - (1) - - - Adj: Loss on OREO - - - - 23 Adj: Merger and acquisition expense 2,459 346 (2,615) 335 214 Adj: Income taxes (24.15% in 2018, 37.57% in 2017) (924) (122) 982 (81) (57) Adj: Tax reform charge - - 3,988 - - Total Core Income (A) $8,091 $8,821 $8,964 $8,066 $8,715 Net-interest income (B) 23,809 23,478 23,496 23,158 22,992 Plus: Non-interest income 6,558 6,960 6,518 6,238 7,121 Total Revenue $30,367 $30,438 $30,014 $29,396 $30,113 Adj: Net security gains - (19) - - - Total Core Revenue (C) $30,367 $30,419 $30,014 $29,396 $30,113 Total non-interest expense 20,046 17,586 14,263 18,852 18,685 Less: Loss on sale of fixed assets, net - (1) - - - Adj: Loss on OREO - - - - (23) Less: Acquisition Expenses (2,459) (346) 2,615 (335) (214) Core Non-Interest Expense (D) $17,587 $17,239 $16,878 $18,517 $18,448 Averages Total average earning assets (E) 3,139 3,157 3,187 3,233 3,235 Total average assets (F) 3,434 3,453 3,493 3,512 3,512 Total average shareholders equity (G) 347 354 357 351 355 Performance Ratios Performance ratios (2) GAAP return on assets 0.76% 0.99% 0.75% 0.90% 0.97% Core return on assets (A/F) 0.94% 1.01% 1.02% 0.93% 1.00% GAAP return on equity 7.55% 9.67% 7.35% 9.01% 9.65% Core return on equity (A/G) 9.32% 9.90% 9.97% 9.31% 9.86% Efficiency ratio (D-N-O)/(C+M) 54.57% 53.53% 53.02% 60.44% 58.83% Net interest margin (B+O)/E 3.16% 3.06% 3.04% 2.97% 2.91% Supplementary Data Taxable equivalent adjustment for efficiency ratio (M) $1,185 $1,107 $1,122 $645 $622 Franchise taxes included in non-interest expense (N) 158 154 161 152 159 Tax equivalent adjustment for net interest margin (O) 936 878 897 503 502 Intangible amortization (P) 211 212 209 207 207 19

Interest Rate Risk Analysis On a quarterly basis, the company measures and reports NII and EVE at risk to isolate the change in income and value related solely to interest-earning assets and interest-bearing liabilities. The analysis below shows the impact of instantaneous parallel shifts in the market yield curve for a period of one year while EVE shows a liquidation calculation over the same shifts in the curve. NII Impact EVE Impact 0.0% - 10.0% 50.0 -2.0% (2.0) 0.0% - -4.0% -10.0% (4.0) -6.0% -20.0% (50.0) (6.0) -8.0% -30.0% (100.0) (8.0) -10.0% -40.0% (150.0) -12.0% (10.0) -50.0% -14.0% (12.0) -60.0% (200.0) -100BP +100BP +200BP +300BP +400BP -100BP +100BP +200BP +300BP +400BP % Change NII $ Change NII % Change EVE $ Change EVE Interest Rate Risk to Earnings (NII) Interest Rate Risk to Capital (EVE) June 30, 2018 June 30, 2018 Change in % Change in $ Change % Interest Rates $ Change NII Change Interest Rates EVE Change (basis points) (millions) NII (basis points) (millions) EVE +400BP (11.1) -12.6% +400BP (157.6) -52.7% +300BP (7.4) -8.5% +300BP (119.0) -39.8% +200BP (4.1) -4.7% +200BP (78.3) -26.2% +100BP (1.9) -2.2% +100BP (36.0) -12.1% -100BP (0.6) -0.7% -100BP 19.2 6.4% 20