Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LILIS ENERGY, INC. | lilisenergyinc8k20180911.htm |

EXHIBIT 99.1 Corporate Presentation September 2018 NYSE American | LLEX

Disclaimer This presentation contains forward-looking statements. The use of words such as “believes”, “expects”, “anticipates”, “intends”, “plans”, “estimates”, “should”, “likely” or similar expressions, indicates a forward-looking statement. These statements and all the projections in this presentation are subject to risks and uncertainties and are based on the beliefs and assumptions of management, and information currently available to management. The actual results could differ materially from a conclusion, forecast or projection in the forward-looking information. The identification in this presentation of factors that may affect Lilis’ future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. These forward-looking statements are given only as of the date of this presentation. Except as required by law, we do not intend, and undertake no obligations to update any forward -looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. These forward-looking statements include, among other things, statements about Lilis’ expectations, beliefs, intentions or business strategies for the future, statements concerning Lilis’ outlook with regard to the timing and amount of future production of oil, natural gas liquids and natural gas, price realizations, the nature and timing of capital expenditures for exploration and development, plans for funding operations and drilling program capital expenditures, the timing and success of specific projects, operating costs and other expenses, proved oil and natural gas reserves, liquidity and capital resources, outcomes and effects of litigation, claims and disputes and derivative activities. Factors that could cause Lilis’ actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to: the success of Lilis’ exploration and development efforts; the price of oil, gas and other produced gases and liquids; the worldwide economic situation; changes in interest rates or inflation; the ability of Lilis to transport gas, oil and other products; the ability of Lilis to raise additional capital, as it may be affected by current conditions in the stock market and competition in the oil and gas industry for risk capital; Lilis’ capital costs, which may be affected by delays or cost overruns; cost of production; environmental and other regulations, as the same presently exist or may later be amended; Lilis’ ability to identify, finance and integrate any future acquisitions; and the volatility of Lilis’ stock price. See the risks discussed in Lilis’ Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. RESERVE/RESOURCE DISCLOSURE The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves that meet the SEC’s definitions of such terms. Reserve estimates that are intended to meet SEC guidelines are included in our periodic reports filed with the SEC. In this presentation, Lilis sometimes refers to broader, less precise terms when characterizing reserve estimates, such as “resource potential” and “estimated ultimate recovery”, or “EUR”, which the SEC does not permit to be disclosed in SEC filings and are not intended to conform to SEC filing requirements. These estimates are by their nature more speculative than those disclosed in Lilis’ SEC filings and thus are subject to substantially greater uncertainty of being realized. They are based on internal estimates, are not reviewed or reported upon by any independent third party and are subject to ongoing review. Actual quantities recovered will likely differ substantially from these estimates. Factors affecting ultimate recovery of reserves include t he scope of Lilis’ actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices (including prevailing oil and gas prices), availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, actual recoveries of oil and natural gas in place, length of horizontal laterals, actual drilling results, including geological and mechanical factors affecting recovery rates, and other factors. These estimates may change significantly as the development of properties provides additional data. Investors are urged to consider closely the oil and gas disclosures in Lilis’ 2017 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other public filings. No Liability. Recipients are urged to consult with their own independent legal and financial advisors with respect to any investment. This presentation should be independently verified. Neither Lilis nor any of its officers, directors, members, employees or consultants, accept and liability whatsoever for any direct or consequential loss arising from any use of information contain in this presentation. Investing in securities can be speculative and can carry a high degree of risk. Strictly Private and Confidential

Lilis Energy Overview Delaware Basin Position Corporate Overview Pure Play Delaware Basin Operator Lea • Core contiguous Delaware Basin asset position — Approximately 20,000 net acres currently and approaching 22,000 net acres in the core of the Northern Delaware — Recent acreage swaps increasing the Company’s working interest New Mexico and net revenue interest to ~100% in core New Mexico acreage Texas — Drilled several of the highest IP per 1,000 ft. wells in the Basin • Existing liquidity and contemplated revolver will provide sufficient capital to execute our business plan through 2019 Loving • Infrastructure for crude oil, gas, and water in place with FT for crude and Gulf Coast Pricing Winkler • Exit rate of 8,000 Boe/d for 2018 • Capex in 2H’18 and on a go forward basis is focused almost exclusively LLEX Profile(1) on longer 1.5 mile laterals • Approximately 700 locations able to accommodate longer (1.5 mile +) Recent Share Price $5.56 laterals and 1,200 total locations(3) • Approximately 99% operated with average working interest of 73% and Shares Outstanding 64 million growing Geographical and geological delineation in 2018 (4) Market Cap $356 million • Recent well results from the Prizhog 2H, Wildhog 2H, Howell 1H and Antelope 1H continue to prove the delineation and de-risking $641 million Enterprise Value objectives Upcoming wells include: Operations • Flowback (2) 69 million PF Diluted Shares Outstanding — AG Hill #2H: 2nd Bone Spring – 1 mile lateral (Eastern Well) — Axis #1H: Wolfcamp B – 1 ½ mile lateral Adjusted Market Cap $383 million Drilling and Drilling Completion Completion — East Axis #2H: Wolfcamp A – 1 ½ mile lateral Operations — Tiger #3H: 3rd Bone Spring – 1 ½ mile lateral 1. Based on closing price and shares outstanding on September 4, 2018 2. Assumes conversion of all in the money warrants and restricted stock units. Fully diluted share count, on a treasury stock method — NW Axis #1H: Wolfcamp A – 1 ½ mile lateral 3. Possible locations are calculated using required spacing as determined by observing results on wells, how they are being drilled within the play and analysis of Permeability and Porosity on well logs — Oso #1H: Wolfcamp XY – 1 ½ mile lateral 4. 2018 drilling plan subject to continued internal evaluation, including development targets and well locations. 3

Lilis Energy Financial & Operational Highlights Centennial / GMT Exploration* • Year-end target exit rate of 8,000 Boe/d • Second quarter production of 5,297 Boe/d(1) Concho Resources / RSP Permian* • Production increased by 210% year-over-year Concho Resources / Endurance* • Proved Reserves increased by 228% since December 31, 2017 Oasis Petroleum / Forge Energy* • Strong well results from the Company’s Wolfcamp A, B and XY and 3rd Bone Spring Diamondback Energy / Energen * • Infrastructure arrangements for crude oil, gas, and water fully in place: Carrizo / Devon (acreage)* – June 1, 2018 – February 28, 2019 – 100% of oil production via truck – March 1, 2019 – December 31, 2024 – 5,000 – 6,000 Bbl/d firm takeaway with Gulf Coast Pricing – Firm transportation for natural gas in place – January 1, 2019 – June 30, 2019 – 3,500 Bbl/d of Midland/Cushing basis hedges in place at an average price of ($7.39) • Executed acreage swaps increasing the Company’s working interest and net revenue interest, including increasing working interest to 100% in its New Mexico acreage, as well as increased PDP and PUD reserves • Owned acreage of 20,000 net acres currently and approaching 22,000 acres • Liquidity increased by $55 million (without dilution) through executing crude gathering and water gathering and disposal contracts ($20 million to be received after 6/30/18) • Capex in second half of 2018 is focused exclusively on 1.5 mile laterals with higher IRRs – Capex for 2018 remains at approximately $100 million(2) 1) Production is reported as 4,805 Boe/d in the 10Q due to one time transitory working interest adjustment in the first quarter 2018. Pro forma production for 2’Q18 is 5,297 Boe/d plus adjustments of (i) 590 Boe/d of curtailment due to upgrades and maintenance shut-ins 2) Approximately $22 million attributable to 2017 wells on GAAP basis Lilis Acreage * Select recent Delaware Basin acquisitions 4

Infrastructure – Agreements for Crude and Natural Gas Takeaway in Place Lilis Acreage Crude flow assurance and firm takeaway at Gulf Coast pricing • Secured cost-effective movement of Lilis’ oil production in Lea Texas and New Mexico, to Wink, Texas for transport via New long-haul pipeline(s) to the Gulf Coast Mexico • Executed five and a half-year agreement, commencing Texas second-half 2019, securing firm takeaway and Gulf Coast pricing Loving Winkler – Average Differential: Magellan East Houston (MEH) less approximately $5.50 Bbl/d over life of agreement – Firm, long-haul, transportation of 5,000-6,000 Bbl/d Mar. 2018 – Flexibility to expand capacity during the term of LLEX announces third- agreement party midstream Aug. 2018 solution to meet LLEX announces firm – 100% CAPEX borne by gatherer current and future gas takeaway to Gulf transportation needs Coast (MEH) with Salt Creek Midstream for Implemented 3,500 Bbl/d of Midland/Cushing basis hedges • Jul. 2018 crude starting July 2019 covering the first-half of 2019 LLEX announces Water Gathering and Disposal agreement with SCM Water 5

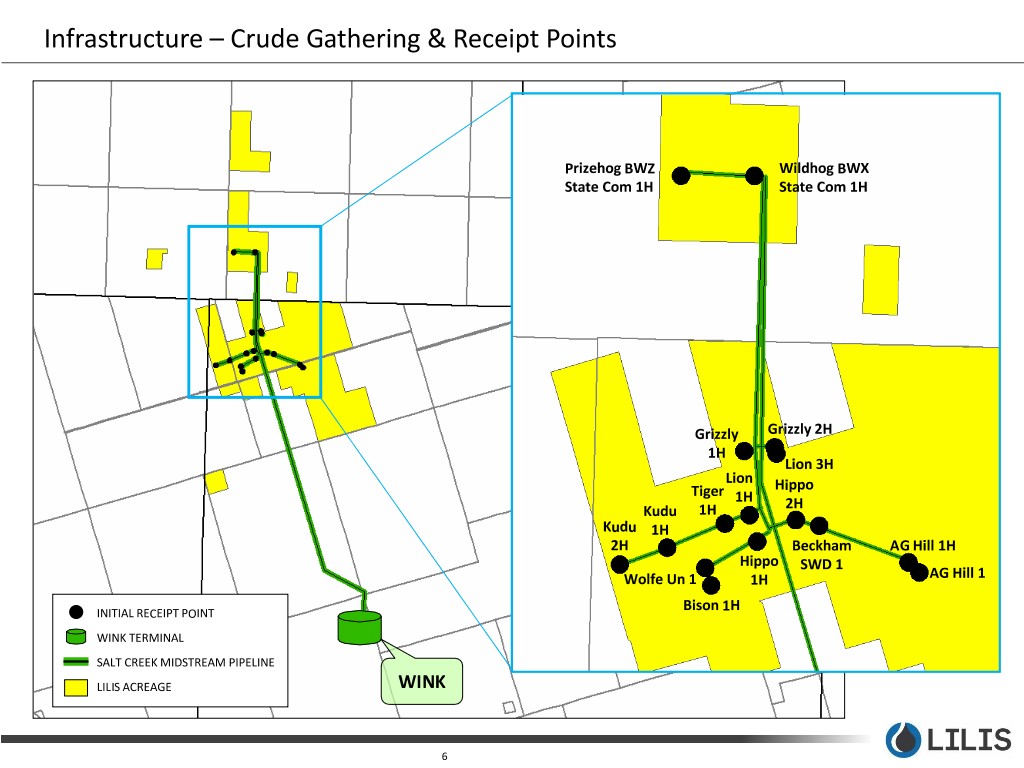

Infrastructure – Crude Gathering & Receipt Points Prizehog BWZ Wildhog BWX State Com 1H State Com 1H Grizzly Grizzly 2H 1H Lion 3H Lion Hippo Tiger 1H Kudu 1H 2H Kudu 1H 2H Beckham AG Hill 1H Hippo SWD 1 Wolfe Un 1 1H AG Hill 1 INITIAL RECEIPT POINT Bison 1H WINK TERMINAL SALT CREEK MIDSTREAM PIPELINE LILIS ACREAGE WINK 6

Infrastructure – Gas Gathering & Transportation System Firm Takeaway and Transportation • Gatherer has secured firm takeaway to handle 100% of Lilis’ gas and NGL production • Natural gas pricing at Waha • NGL pricing at Mont Belvieu 7

Infrastructure – Enhancing Shareholder Value Through Cost Optimization Securing crude oil gathering / transportation and water gathering / disposal agreements will significant savings over the life of the agreements. Pro-forma Savings: Existing Cost Basis Negotiated Cost Basis Crude Gathering $5.15 / Bbl trucking $0.75 / Bbl Gathering Fee on crude gathering system Water Gathering and ~$2.00-$4.00 / Bbl trucking; or, $0.485 / Bbl on Gathering and Disposal Fee on water Disposal $1.08 / Bbl via pipeline gathering and disposal system Crude Firm Transport 100% produced crude under sales Firm takeaway (5k Bbl/d from Mar/19 – June/19; 6k and Pricing agreement through Feb/19 applying Bbl/d from Jul/19 – Jun/20; 5k Bbl/d from Jul/20 – Mid-Cush differential to NYMEX WTI Dec/24) applying Magellan East Houston differential to NYMEX WTI and fixed transportation deduct ($5.85 / Bbl from Jul/19 – Jun/20; $5.54 / Bbl from Jul/20 – Dec/24) Savings of Savings of $8.5 million $8.0 million per year per year 1) Assumes oil of 5,000 Bbl/d and water of 15,000 Bbl/d; (using exit rate of 8,000 Boe/d, ~60% oil, and 3:1 water to oil ratio) 8

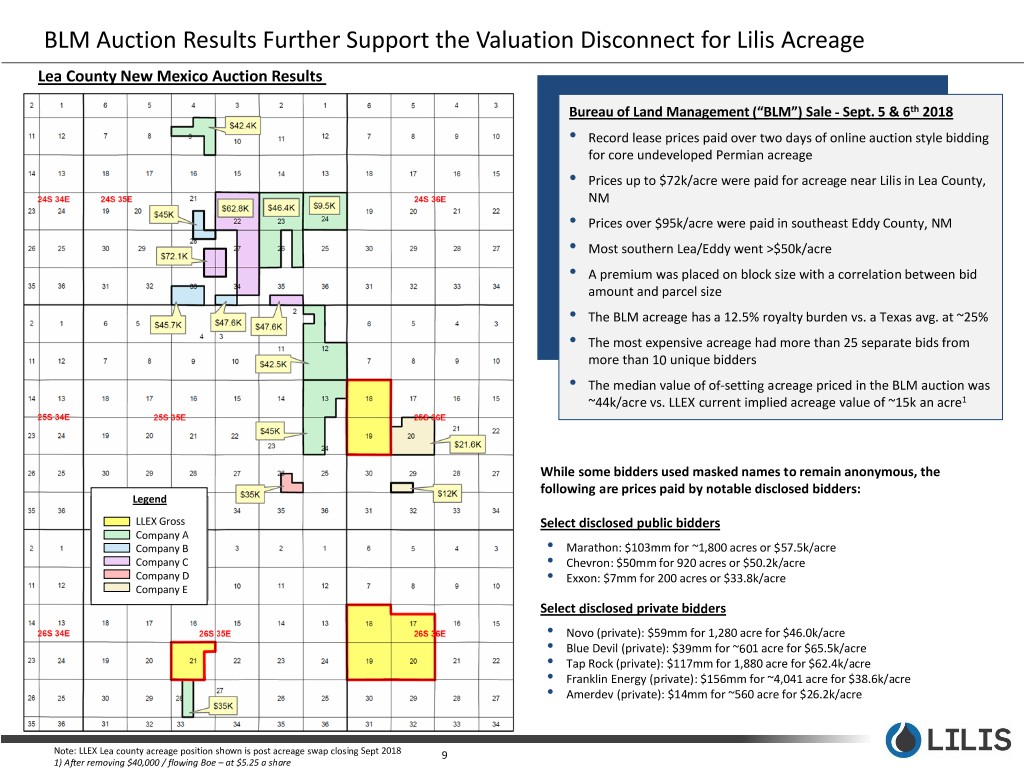

BLM Auction Results Further Support the Valuation Disconnect for Lilis Acreage Lea County New Mexico Auction Results Bureau of Land Management (“BLM”) Sale - Sept. 5 & 6th 2018 • Record lease prices paid over two days of online auction style bidding for core undeveloped Permian acreage • Prices up to $72k/acre were paid for acreage near Lilis in Lea County, NM • Prices over $95k/acre were paid in southeast Eddy County, NM • Most southern Lea/Eddy went >$50k/acre • A premium was placed on block size with a correlation between bid amount and parcel size • The BLM acreage has a 12.5% royalty burden vs. a Texas avg. at ~25% • The most expensive acreage had more than 25 separate bids from more than 10 unique bidders • The median value of of-setting acreage priced in the BLM auction was ~44k/acre vs. LLEX current implied acreage value of ~15k an acre1 While some bidders used masked names to remain anonymous, the following are prices paid by notable disclosed bidders: Legend LLEX Gross Select disclosed public bidders Company A Company B • Marathon: $103mm for ~1,800 acres or $57.5k/acre Company C • Chevron: $50mm for 920 acres or $50.2k/acre Company D • Exxon: $7mm for 200 acres or $33.8k/acre Company E Select disclosed private bidders • Novo (private): $59mm for 1,280 acre for $46.0k/acre • Blue Devil (private): $39mm for ~601 acre for $65.5k/acre • Tap Rock (private): $117mm for 1,880 acre for $62.4k/acre • Franklin Energy (private): $156mm for ~4,041 acre for $38.6k/acre • Amerdev (private): $14mm for ~560 acre for $26.2k/acre Note: LLEX Lea county acreage position shown is post acreage swap closing Sept 2018 9 1) After removing $40,000 / flowing Boe – at $5.25 a share

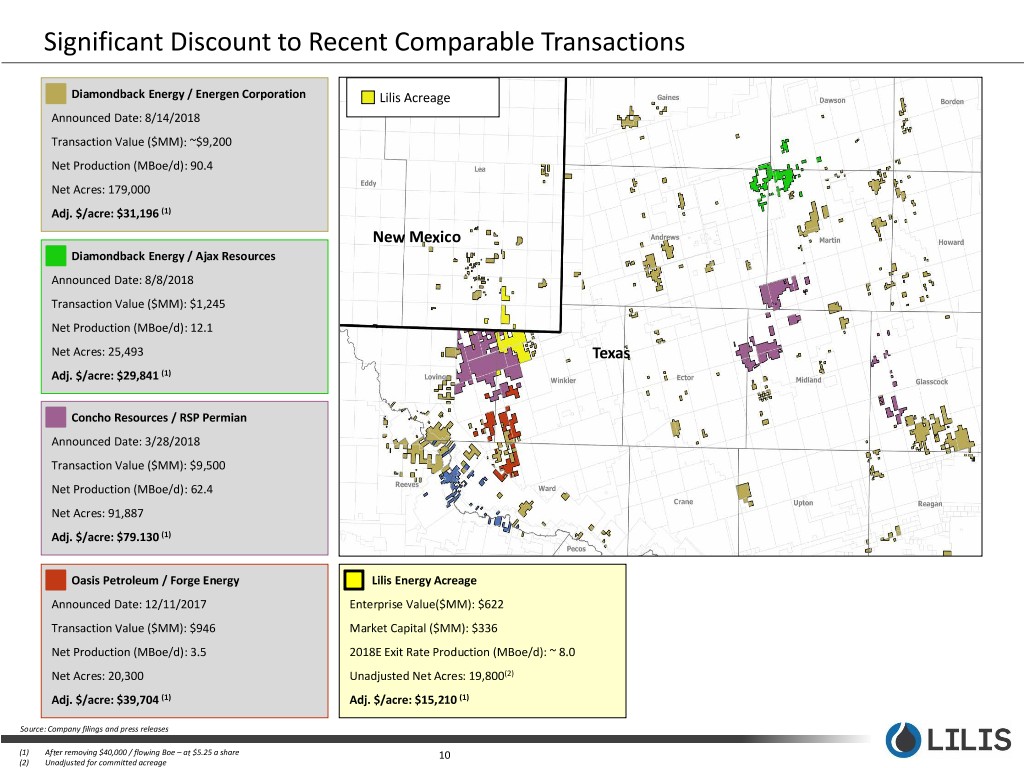

Significant Discount to Recent Comparable Transactions Diamondback Energy / Energen Corporation Lilis Acreage Announced Date: 8/14/2018 Transaction Value ($MM): ~$9,200 Net Production (MBoe/d): 90.4 Net Acres: 179,000 Adj. $/acre: $31,196 (1) New Mexico Diamondback Energy / Ajax Resources Announced Date: 8/8/2018 Transaction Value ($MM): $1,245 Net Production (MBoe/d): 12.1 Net Acres: 25,493 Texas Adj. $/acre: $29,841 (1) Concho Resources / RSP Permian Announced Date: 3/28/2018 Transaction Value ($MM): $9,500 Net Production (MBoe/d): 62.4 Net Acres: 91,887 Adj. $/acre: $79.130 (1) Oasis Petroleum / Forge Energy L Lilis Energy Acreage Announced Date: 12/11/2017 Enterprise Value($MM): $622 Transaction Value ($MM): $946 Market Capital ($MM): $336 Net Production (MBoe/d): 3.5 2018E Exit Rate Production (MBoe/d): ~ 8.0 Net Acres: 20,300 Unadjusted Net Acres: 19,800(2) Adj. $/acre: $39,704 (1) Adj. $/acre: $15,210 (1) Source: Company filings and press releases (1) After removing $40,000 / flowing Boe – at $5.25 a share 10 (2) Unadjusted for committed acreage

Strategic and Complementary Expansion in the Delaware Basin Acquisition Overview Acreage Map • On August 16, 2018, Lilis closed an acre-for-acre trade of approximately 1,500 net acres in the Delaware Basin ‒ Concentrates acreage in main operational area: Blocks C-23 & C-24 ‒ Increases Lilis-operated drilling units ‒ All acreage traded is non-operated • Trade increases Lilis’ GWI by 35% overall in its remaining Texas Delaware Asset ‒ 5 drilling units with >90% GWI each ‒ Average increase of over 21% GWI in multiple upcoming 2018/2019 wells • Adds 116 net operated locations1 targeting the Wolfcamp A, Wolfcamp B and Bone Spring, with further upside from additional benches • Pro-forma from the trade, Lilis projects increases in PDP and PUD Note: LLEX acreage position shown is post acreage swap closing Sept 2018 (1) Assumes 48 gross wells per unit 11

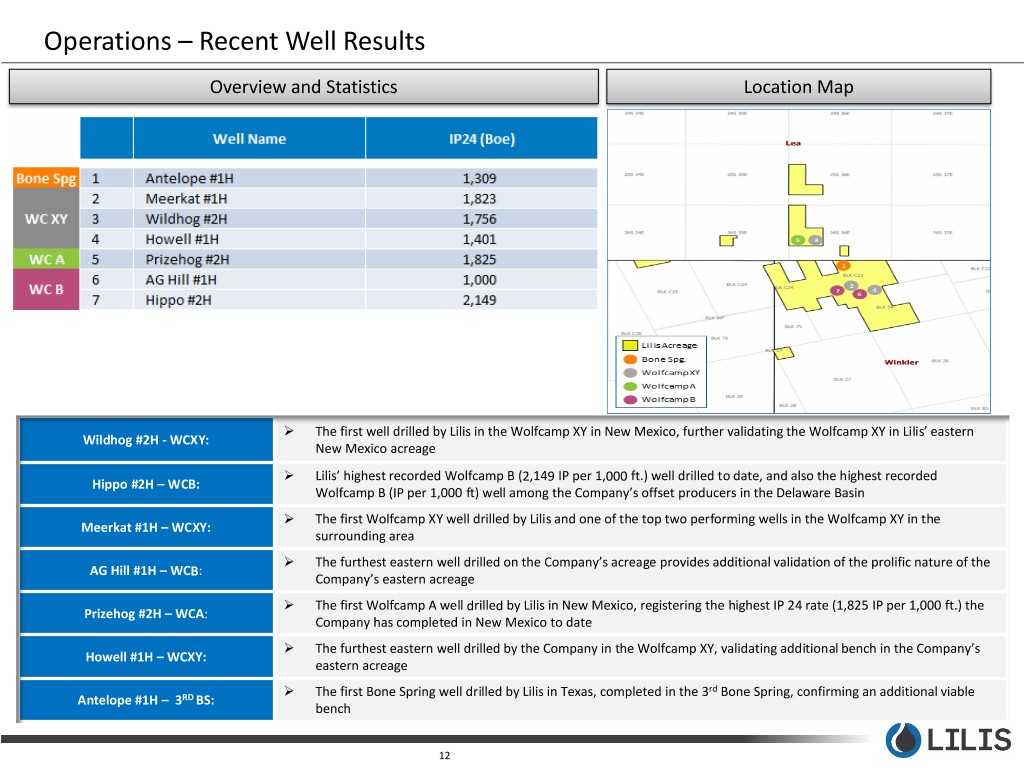

Operations – Recent Well Results Overview and Statistics Location Map The first well drilled by Lilis in the Wolfcamp XY in New Mexico, further validating the Wolfcamp XY in Lilis’ eastern Wildhog #2H - WCXY: New Mexico acreage Lilis’ highest recorded Wolfcamp B (2,149 IP per 1,000 ft.) well drilled to date, and also the highest recorded Hippo #2H – WCB: Wolfcamp B (IP per 1,000 ft) well among the Company’s offset producers in the Delaware Basin The first Wolfcamp XY well drilled by Lilis and one of the top two performing wells in the Wolfcamp XY in the Meerkat #1H – WCXY: surrounding area The furthest eastern well drilled on the Company’s acreage provides additional validation of the prolific nature of the AG Hill #1H – WCB: Company’s eastern acreage The first Wolfcamp A well drilled by Lilis in New Mexico, registering the highest IP 24 rate (1,825 IP per 1,000 ft.) the Prizehog #2H – WCA: Company has completed in New Mexico to date The furthest eastern well drilled by the Company in the Wolfcamp XY, validating additional bench in the Company’s Howell #1H – WCXY: eastern acreage The first Bone Spring well drilled by Lilis in Texas, completed in the 3rd Bone Spring, confirming an additional viable Antelope #1H – 3RD BS: bench 12

Operations – Well Status The Company’s 2018 development plan continues to focus on the delineation and de-risking of its acreage position. The Company has realized increased cost efficiencies through numerous infrastructural solutions. Well Status: Flowback • AG Hill #2H – 2nd Bone Spring (1 mile lateral - Eastern Well) Operations • Axis #1H – Wolfcamp B (1 ½ mile lateral) Completion • East Axis #2H – Wolfcamp A (1 ½ mile lateral) Operations • Tiger #3H – 3rd Bone Spring (1 ½ mile lateral) Drilling • North West Axis #1H – Wolfcamp A (1 ½ mile lateral) Operations • Oso #1H – Wolfcamp XY (1 ½ mile lateral) 13

Current Operations New Mexico Texas Loving Lea Wildhog 1H Prizehog 2H Drilling NW Axis 1H Oso 1H New Mexico Winkler Drilled Planned Texas Completing Brushy Canyon East Axis 2H Bonespring Tiger 3H Wolfcamp XY Wolfcamp A Wolfcamp B Flowback Target TBD AG Hill 2H SWD Axis 1H 14

Delaware Basin Structural Cross Section PRODUCING BENCHES A A’ Brushy Canyon (lower) Producing Wolfcamp A Wolfcamp B Testing- 2018 Wolfcamp XY rd 3 Bone Spring Future Test LBYCN TESTING BENCHES (2018) AVLN Wolfcamp XY 2nd Bone Spring Lm FBNSP 2nd Bone Spring Sd 3rd Bone Spring Lm FUTURE BENCHES 2nd LM Avalon 1st Bone Spring 2nd SD A 3rd LM 3rd SD WCXY WCA WCB A’ 15

Lilis Illustrative Wolfcamp Type Curve Type Curve Wolfcamp Lateral Length 1.5 Mile 2.0 Mile Oil Qi (PHD) 1,100 1,500 Oil Di 96.3 96.3 b factor 1.2 1.2 Dmin 8 8 GOR (SCF/BBL) 3,000 3,000 EUR Oil (MBO) 766 1,051 EUR Gas (MMCF) 2,298 3,153 6:1 MBOE 1,149 1,577 CAPEX (MM$) $ 9.50 $ 10.50 IRR WC 1.5 Miler WC 2.0 Miler $60 Oil / $3 Gas 60% 105% $70 Oil / $3 Gas 69% 121% Cum BOE Cum Days 16

Investment Highlights • Pure play Delaware Basin operator • Infrastructure solutions in place Pure Play Permian • Owned net acreage of approximately 20,000 approaching 22,000 net acres (99% operated) in the Permian’s Delaware basin Operator with Core • Exceptional drilling results Delaware Position • Year end 2018 exit rate of 8,000 Boe/d • Multi-year inventory of over 1,200 potential net horizontal locations with over 700 locations focusing on longer (1.5 mile +) laterals • 2018 D&C development plan(1) provides continued delineation of our acreage both geographically and geologically through High Growth Rate testing of eastern acreage and additional benches in upcoming wells with 2018 • Long-term gas gathering, processing and natural gas and NGL purchase agreement providing unconstrained field production Development • Long-term crude gathering and transportation agreement with Salt Creek Midstream, LLC, an ARM Energy Holdings’ affiliate Program • Water gathering and disposal agreement with Salt Creek Midstream, LLC – significantly cost savings and reduction in LOE • Drilling program in the second half of 2018 targets almost exclusively 1.5-mile laterals. • Existing liquidity and contemplated revolver will provide sufficient capital to execute our business plan through 2019 Strong Financial • The Company has entered into production hedging and basis hedging arrangements with third parties Position and Liquidity • The Company increased liquidity by $55 million, without dilution, through executing crude gathering and water gathering and disposal contracts Track Record of • Company net acre position assembled through multiple accretive lease acquisitions Delaware Acreage • Highly contiguous block with high WI, operatorship and HBP acreage Acquisition in Prime • Acquisition pipeline remains very active Area • Acreage valuation at substantial discount to recent Delaware Basin transactions (currently trading an implied ~$15k/net acre)2 Experienced and • Management and Board of Directors beneficially own ~25% of the company and are aligned with shareholder interests Aligned Management • Current management and operational teams with extensive industry expertise and experience Team 1. 2018 drilling plan subject to continued internal evaluation, including development targets and well locations 2. After removing $40,000 / flowing Boe – at $5.25 a share 17

Appendix

Recent Offset Delaware Transaction Summaries Buyer Seller Transaction Date 14-Aug-18 14-Aug-18 08-Aug-18 28-Mar-18 11-Dec-17 01-May-17 19-Nov-16 (1) (1) Transaction Value $9,200mm $215mm $1,245mm $9,500mm $946mm $350mm $430mm TRANSACTION MAP Simple Multiples Metric Multiple Metric Multiple Metric Multiple Metric Multiple Metric Multiple Metric Multiple Metric Multiple (2) Production ($/boe/d) 90,400 boe/d $101,770 2,500 boe/d $86,000 12,100 boe/d $102,871 55,500 boe/d $171,171 3,500 boe/d $270,286 2,100 boe/d $166,667 2,500 boe/d $172,000 Net Acreage ($/acre) 179,000 $51,397 9,600 $22,396 25,493 $48,827 92,000 $103,261 20,300 $46,601 11,860 $29,511 16,400 $26,220 (4) Total Net Locations ($/loc.) 3,901 $2.4mm 100 $2.2mm 362 $3.4mm 4,000 $2.4mm 507 $1.9mm 255 $1.4mm n.a. n.a. Undeveloped Multiples(3) PDP Mult. $40,000 PDP Mult. $40,000 PDP Mult. $40,000 PDP Mult. $40,000 PDP Mult. $40,000 PDP Mult. $40,000 PDP Mult. $40,000 Net Acreage ($/acre) 179,000 $31,196 9,600 $11,979 25,493 $29,841 92,000 / $79,130 20,300 $39,704 11,860 $22,428 16,400 $20,122 (4) Total Net Locations ($/loc.) 3,901 $1.4mm 100 $1.2mm 362 $2.1mm 4,000 $1.8mm 507 $1.6mm 255 $1.0mm n.a. n.a. TRANSACTION MAP LILIS IMPLIED VALUATION Lilis Implied Enterprise Value (5)(3) Net Acreage Total Net Locations ($mm) ($mm) / $938 $2,000 / $557 $1,760 / $911 $2,840 / $1,887 $2,480 / $1,106 $2,240 $764 $1,520 Source: Company disclosure, BMO transaction database / Note: Lilis multiples based on 8,000 boe/d production, 19,800 unadjusted net acres (includes committed acreage), and 1,200 net locations 1. Transaction value based on 2.58 million shares and 06-Aug-18 closing price of $133.62/share plus $900mm in cash $718 n.a. 2. Production excludes 7 mboe/d attributable to CBP / 3. Implied undeveloped multiples are less PDP value calculated as net production multiplied by $40,000/boe/d 4. Gross locations 5. Implied EV calculated using undeveloped transaction multiples plus PDP value at $40,000/boe/d 19

Lea County - Recent Well Results / Activity – Multiple Offset Benches Targeted Wildhog BWX State Com 1H 1 County Fair 1H 20 Coronado 35 Federal 1H 19 Wheatfield 16 State 701H 18 Coachman Fee Com – 4H 17 Lilis OneEnergy Endurance EOG Concho Target: Wolfcamp B Target: 3rd Bone Spring Target: 3rd Bone Spring Target: Wolfcamp A Target: 3rd Bone Spring IP24: 997 Boe/d IP24: 1,863 Boe/d IP30: 705 Boe/d IP24: 1,211 Boe/d IP24: 1,142 Boe/d 9 Prizehog BWX State Com #1H 2 Viking Helmet State Com – 2H 16 Lilis Lilis Acreage Concho Target: Wolfcamp B Target: Wolfcamp XY IP24: 1,127 Boe/d IP30: 2,064 Boe/d 7 8 Bone Spring Wolfcamp XY Prizehog #2H 3 Viking Helmet State Com – 1H 15 Lilis Wolfcamp A Concho Target: Wolfcamp A Target: Wolfcamp XY IP24: 1,825 Boe/d Wolfcamp B IP24: 3,444 Boe/d 16 4 15 Skull Cap Federal – 022H 4 10 5 20 Sioux 36 State 001H 14 Concho Caza Target: Lower Wolfcamp A Target: Lower Wolfcamp A IP24: 2,833 Boe/d 18 Peak IP: 1,200 Bo/d 11 19 17 Stove Pipe Federal – 2H 5 Talco 9 26 35 Fed – 3H 13 Concho Endurance Target: Wolfcamp XY Target: Lower Wolfcamp A IP24: 2,378 Boe/d IP24: 1,016 Boe/d 14 13 2 1 Wildhog #2H 6 3 6 Roja Arena Fed Unit 15H 12 Lilis Devon Target: Wolfcamp XY 12 Target: Wolfcamp XY IP24: 1,756 Boe/d IP30: 660 Boe/d Mad Dog 26 B30B 7 Beowulf 33 State Com 601H 8 Wicked 17 State Com – 301H 9 Fascinator Fee 2H 10 Duo Sonic Federal 29 4H 11 Mewbourne EOG EOG Concho Endurance Target: Wolfcamp XY Target: 3rd Bone Spring Target: 1st Bone Spring Target: 3rd Bone Spring Target: 2rd Bone Spring IP24: 1,077 Boe/d IP24: 2,765 Boe/d IP30: 2,730 Boe/d IP30: 2,200 Boe/d IP24: 1,880 Boe/d 20

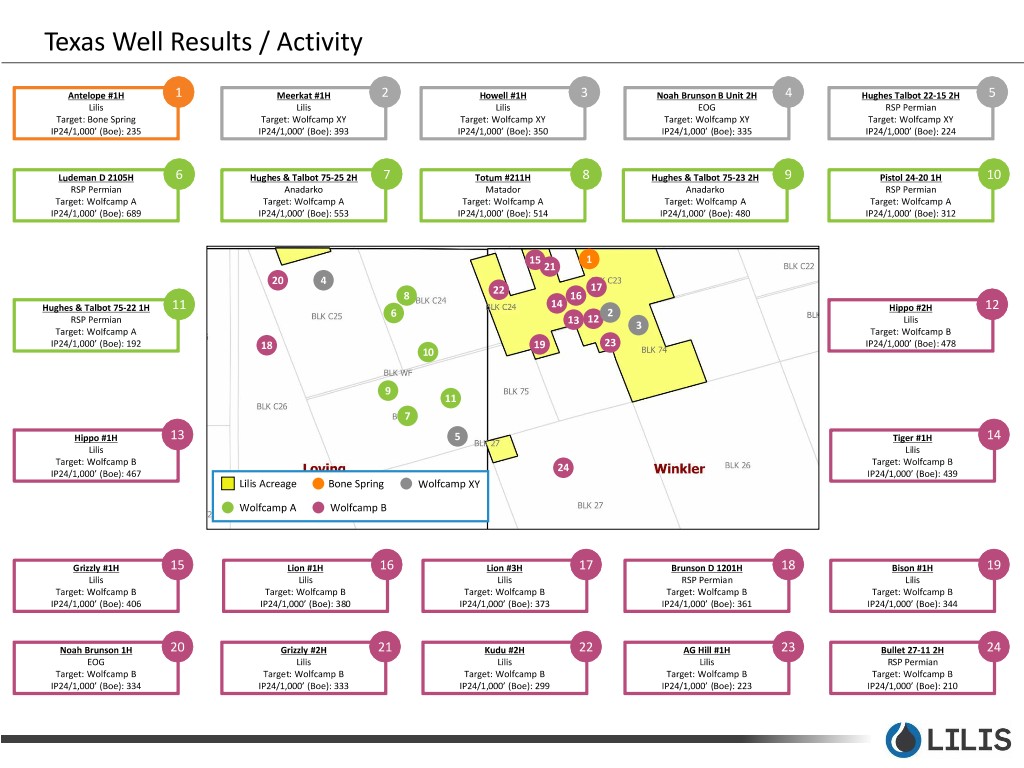

Texas Well Results / Activity Antelope #1H 1 Meerkat #1H 2 Howell #1H 3 Noah Brunson B Unit 2H 4 Hughes Talbot 22-15 2H 5 Lilis Lilis Lilis EOG RSP Permian Target: Bone Spring Target: Wolfcamp XY Target: Wolfcamp XY Target: Wolfcamp XY Target: Wolfcamp XY IP24/1,000’ (Boe): 235 IP24/1,000’ (Boe): 393 IP24/1,000’ (Boe): 350 IP24/1,000’ (Boe): 335 IP24/1,000’ (Boe): 224 Ludeman D 2105H 6 Hughes & Talbot 75-25 2H 7 Totum #211H 8 Hughes & Talbot 75-23 2H 9 Pistol 24-20 1H 10 RSP Permian Anadarko Matador Anadarko RSP Permian Target: Wolfcamp A Target: Wolfcamp A Target: Wolfcamp A Target: Wolfcamp A Target: Wolfcamp A IP24/1,000’ (Boe): 689 IP24/1,000’ (Boe): 553 IP24/1,000’ (Boe): 514 IP24/1,000’ (Boe): 480 IP24/1,000’ (Boe): 312 15 1 21 20 4 22 17 8 16 11 14 12 Hughes & Talbot 75-22 1H 6 2 Hippo #2H RSP Permian 13 12 Lilis Target: Wolfcamp A 3 Target: Wolfcamp B IP24/1,000’ (Boe): 192 18 19 23 IP24/1,000’ (Boe): 478 10 9 11 7 Hippo #1H 13 5 Tiger #1H 14 Lilis Lilis Target: Wolfcamp B Target: Wolfcamp B IP24/1,000’ (Boe): 467 24 IP24/1,000’ (Boe): 439 Lilis Acreage Bone Spring Wolfcamp XY Wolfcamp A Wolfcamp B Grizzly #1H 15 Lion #1H 16 Lion #3H 17 Brunson D 1201H 18 Bison #1H 19 Lilis Lilis Lilis RSP Permian Lilis Target: Wolfcamp B Target: Wolfcamp B Target: Wolfcamp B Target: Wolfcamp B Target: Wolfcamp B IP24/1,000’ (Boe): 406 IP24/1,000’ (Boe): 380 IP24/1,000’ (Boe): 373 IP24/1,000’ (Boe): 361 IP24/1,000’ (Boe): 344 Noah Brunson 1H 20 Grizzly #2H 21 Kudu #2H 22 AG Hill #1H 23 Bullet 27-11 2H 24 EOG Lilis Lilis Lilis RSP Permian Target: Wolfcamp B Target: Wolfcamp B Target: Wolfcamp B Target: Wolfcamp B Target: Wolfcamp B IP24/1,000’ (Boe): 334 IP24/1,000’ (Boe): 333 IP24/1,000’ (Boe): 299 IP24/1,000’ (Boe): 223 IP24/1,000’ (Boe): 210

Capitalization & Liquidity - Unaudited Pro forma liquidity at 6/30/18 was $44.9 million • Liquidity will be bolstered by the following in the third quarter: – $17.5 million cash payment from the recently announced water gathering and disposal agreement – Expected closing of a reserve based revolving credit facility in the third quarter of 2018 to add additional liquidity ($ in millions) Capitalization 6/30/2018 Δ(1) PF 6/30/18 Cash $ 27.4 $ 17.5 $ 44.9 Debt 1L Term Loan $ 50.0 $ - $ 50.0 2L Term Loan $ 162.9 $ - $ 162.9 Total Debt $ 212.9 $ - $ 212.9 Equity Existing Preferred $ 100.0 $ - $ 100.0 Other Equity $ (25.4) $ - $ (25.4) Total Equity $ 74.6 $ - $ 74.6 Total Capitalization $ 287.5 $ - $ 287.5 Debt to Cap 74% 74% Liquidity Cash $ 27.4 $ 17.5 $ 44.9 Total Liquidity $ 27.4 $ - $ 44.9 1) Includes $2.5 million of additional cash to be received from the water disposal agreement in the third quarter 22

Current Fully Diluted Share Count LLEX Diluted Share Count: Treasury Stock Method Options Actual Exercised Shares Exercised Pro Forma As % of Fully 6/30/18 under TSM under TSM 6/30/18 Diluted Shares Shares Outstanding Shares Outstanding 64,071,281 64,071,281 56.6% Dilutives Warrants ($1.30) - expire 9.17.18 1,272,727 (300,826) 971,901 0.9% Warrants ($2.50) - expire throughout 2019 2,648,267 (1,203,758) 1,444,509 1.3% Warrants ($3.50) - expire 1.8.20 144,642 (92,045) 52,597 0.0% Warrants ($4.50) - Pipe Offering - expire 3.6.22 2,579,420 (2,110,435) 468,985 0.4% Total Warrants 6,645,056 (3,707,064) 2,937,992 2.6% Options (avg. $3.68) 5,501,150 (3,680,769) 1,820,381 1.6% Total In-the-Money 5,501,150 (3,680,769) 1,820,381 1.6% Current Net In-the Money Shares 76,217,487 68,829,654 60.9% Dilutives 2L Conv. Note - Varde Partners 23,970,219 23,970,219 21.2% Preferred Equity - Varde Partners 20,312,607 20,312,607 18.0% Current Fully Diluted Shares 120,500,313 113,112,480 100.0% Notes: • Assumes $5.50 share price for treasury stock method • Dilutives exclude 65,000 out of the money warrants and 225,000 out of the money options 23

Current Hedging Schedule WTI Oil Hedges Sept - Dec 2018 Jan - Jun 2019 Jul - Dec 2019 Current Swap Volume (Bbl) 109,800 - - Average Daily Swap Volume (Bbl/d) 900 - - Average Price $57.68 - - Current Collar Volume Long Put (Bbl) 211,950 362,000 276,000 Average Daily Collar Volume (Bbl/d) 1,737 2,000 1,500 Average Price $58.36 $53.75 $55.00 Current Collar Volume Short Call (Bbl) 211,950 362,000 276,000 Average Daily Collar Volume (Bbl/d) 1,737 2,000 1,500 Average Price $69.97 $69.21 $70.47 Current Collar Volume Short Put (Bbl) - 181,000 276,000 Average Daily Collar Volume (Bbl/d) - 1,000 1,500 Average Price - $45.00 $45.00 Total Volume 321,750 362,000 276,000 Average Daily WTI Volume (Bbl/d) 2,637 2,000 1,500 Average Ceiling $65.77 $69.21 $70.47 Average Floor $58.13 $53.75 $55.00 Midland-Cushing WTI Basis Hedges (Bbl) 183,000 633,500 276,000 Average Daily Basis Hedge Volume (Bbl/d) 1,500 3,500 1,500 Average Price ($5.62) ($7.39) ($5.62) 24

LLEX Management Team Mr. Ormand brings more than 34 years of industry experience. Mr. Ormand has completed over $25 billion of capital markets and $10 billion of financial advisory transactions as both a principal and banker. Mr. Ormand was a co-founder and senior executive at Magnum Hunter Resources Ronald D. Ormand Corporation (NYSE: MHR). While with MHR, Mr. Ormand executed a strategy to grow MHR from sub-$30 million enterprise value to over $3.2 Chairman & CEO billion in 4 ½ years. Mr. Ormand has served as a member of numerous Board of Directors, most recently the Chairman of the Board of MLV & Co., where he oversaw and led the acquisition of MLV by FBR Capital Markets (NASDAQ:FBRC). Mr. Daches possesses more than 25 years of experience and expertise directing strategy and growth for small and mid-cap oil and gas companies. Mr. Daches has guided multiple E&P companies through financial strategies, capital raises, private and public offerings. He has also developed, negotiated and implemented various midstream and infrastructure solutions for multiple oil and gas companies. Prior to joining Lilis, Joseph C. Daches Mr. Daches held executive roles in multiple upstream and midstream companies. Mr. Daches joined Lilis on January 23, 2017, as Executive Vice President, CFO & President, Chief Financial Officer and Treasurer. Since joining the Company, Mr. Daches has been instrumental in securing over $300 million in Treasurer various forms of financing, negotiating and constructing a full infrastructure system across the Company’s properties and establishing significant capital market relationships to further enhance the Company’s strategic growth objectives. Mr. Daches holds a Bachelor of Science in Accounting from Wilkes University in Pennsylvania, and he is a certified public accountant in good standing with the Texas State Board of Public Accountancy. Mr. Denny brings more than 45 years of industry related experience. Prior to joining Lilis, Mr. Denny served as Vice President at Siltstone and as Magnum Hunter Resource Corporation’s Executive Vice President of Operations and as President of the Appalachian Division. Prior to joining James W. Denny III Magnum Hunter, Mr. Denny served as President and Chief Executive Officer of Gulf Energy Management Company, a wholly-owned subsidiary of Harken Energy Corporation. In his capacity as President and Chief Executive Officer of Gulf Energy Management, Mr. Denny was responsible EVP of Production & for all facets of Gulf Energy Management's North American operations. He is a registered Professional Engineer (Louisiana) and is a Certified Operations Earth Scientist. He is also a member of various industry associations, including the American Petroleum Institute, the National Society of Professional Engineers, the Society of Petroleum Engineers, and the Society of Petroleum Evaluation Engineers. He is a graduate of the University of Louisiana-Lafayette with a B. S. in Petroleum Engineering. Mr. Burgher brings more than 30 years of continuous experience in the oil and gas business with emphasis on leases, titles, negotiations and Brian Burgher legal areas. Mr. Burgher began in the Oil & Gas Business with Alcorn Exploration and George A. Alcorn, Sr. He served as Senior Vice President of Senior Land & Business Land for Sharon Resources and Magnum Hunter Resources and was also the land manager for the Eagle Ford Asset, which was assembled, Development Advisor developed and sold under his leadership. He further oversaw the acquisition and divestiture of, and due diligence on, more than $1 billion worth of leases and wells during his tenure at Magnum Hunter. 25

LLEX Management Team (cont’d) Mr. Placke is a registered professional engineer with 37 years of direct hands on engineering and management experience in all functions of the George Placke upstream petroleum production industry. Mr. Placke has held engineer positions with Risco La Sara, Tana Oil and Gas, and Exxon. Mr. Placke VP of Production & earned his B.S. in Mechanical Engineering from the University of Houston. He is a member of the Society of Petroleum Engineers and a Operations registered professional engineer. Prior to joining Lilis in April 2017, Mr. Placke worked as an engineering consultant primarily in South Texas, South Louisiana, the Permian Basin and the Eagleford. Mr. Rudderow joined Lilis Energy in February 2017 as Land Manager before his promotion to VP of Land & Business Development in April of Neal Rudderow 2018. Prior to joining Lilis Energy, Mr. Rudderow held various roles at Occidental Petroleum gaining extensive experience to all facets of the land VP of Land & Business discipline in various domestic unconventional oil and gas plays. Mr. Rudderow is a Registered Professional Landman with the American Development Association of Professional Landmen and holds a B.B.A. in Entrepreneurship from Baylor University and a M.B.A. in Energy and Finance from the University of Houston. Austin Brooks Mr. Brooks joined Lilis Energy as Vice President of Finance and Corporate Development in August 2018. Mr. Brooks has over 10 years of finance and investment banking experience, most recently working in the energy investment banking group at Capital One Securities in Houston. His VP of Finance and primary experience is in creative modeling, capital markets, and credit analysis. Mr. Brooks holds a BS in Finance from the University of Corporate Development Colorado. Wobbe Ploegsma Mr. Ploegsma has over 15 years of finance and energy investment banking related experience. Prior to joining Lilis Energy, Mr. Ploegsma held VP of Capital Markets & various positions with Growth Capital Partners, Tudor Pickering Holt & Co., MLV & Co. and FBR Capital Markets. Mr. Ploegsma received his Investor Relations undergraduate degree in Business Administration from Trinity University and his MBA from Rice University’s Jones School of Business. 26

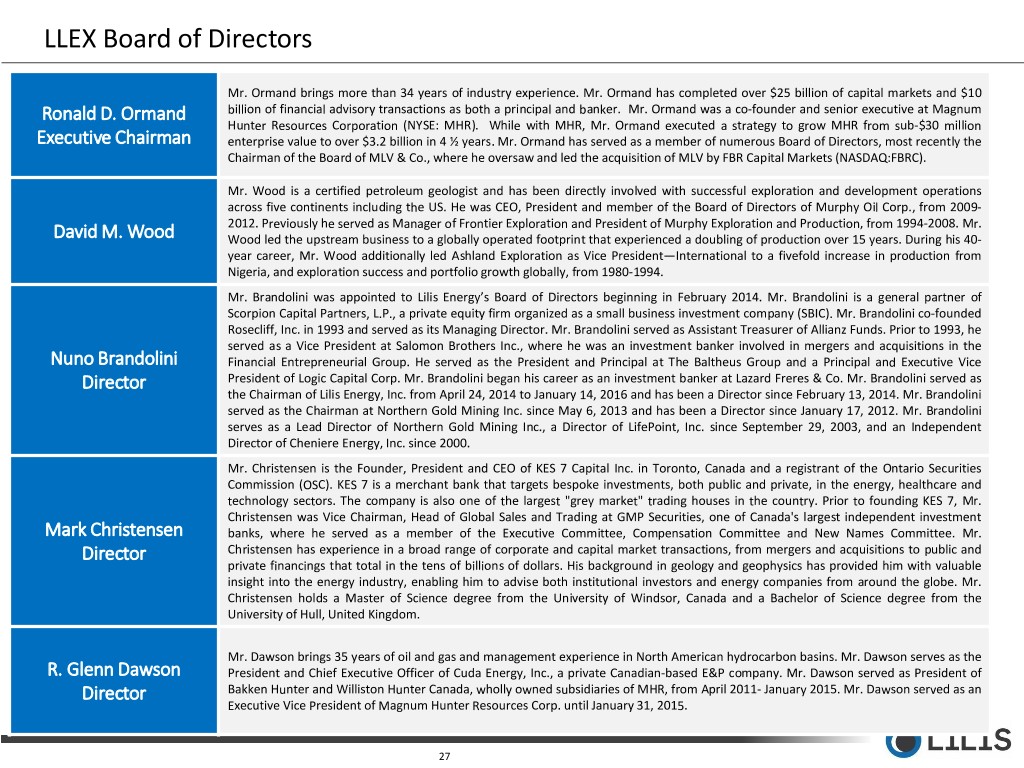

LLEX Board of Directors Mr. Ormand brings more than 34 years of industry experience. Mr. Ormand has completed over $25 billion of capital markets and $10 Ronald D. Ormand billion of financial advisory transactions as both a principal and banker. Mr. Ormand was a co-founder and senior executive at Magnum Hunter Resources Corporation (NYSE: MHR). While with MHR, Mr. Ormand executed a strategy to grow MHR from sub-$30 million Executive Chairman enterprise value to over $3.2 billion in 4 ½ years. Mr. Ormand has served as a member of numerous Board of Directors, most recently the Chairman of the Board of MLV & Co., where he oversaw and led the acquisition of MLV by FBR Capital Markets (NASDAQ:FBRC). Mr. Wood is a certified petroleum geologist and has been directly involved with successful exploration and development operations across five continents including the US. He was CEO, President and member of the Board of Directors of Murphy Oil Corp., from 2009- 2012. Previously he served as Manager of Frontier Exploration and President of Murphy Exploration and Production, from 1994-2008. Mr. David M. Wood Wood led the upstream business to a globally operated footprint that experienced a doubling of production over 15 years. During his 40- year career, Mr. Wood additionally led Ashland Exploration as Vice President—International to a fivefold increase in production from Nigeria, and exploration success and portfolio growth globally, from 1980-1994. Mr. Brandolini was appointed to Lilis Energy’s Board of Directors beginning in February 2014. Mr. Brandolini is a general partner of Scorpion Capital Partners, L.P., a private equity firm organized as a small business investment company (SBIC). Mr. Brandolini co-founded Rosecliff, Inc. in 1993 and served as its Managing Director. Mr. Brandolini served as Assistant Treasurer of Allianz Funds. Prior to 1993, he served as a Vice President at Salomon Brothers Inc., where he was an investment banker involved in mergers and acquisitions in the Nuno Brandolini Financial Entrepreneurial Group. He served as the President and Principal at The Baltheus Group and a Principal and Executive Vice Director President of Logic Capital Corp. Mr. Brandolini began his career as an investment banker at Lazard Freres & Co. Mr. Brandolini served as the Chairman of Lilis Energy, Inc. from April 24, 2014 to January 14, 2016 and has been a Director since February 13, 2014. Mr. Brandolini served as the Chairman at Northern Gold Mining Inc. since May 6, 2013 and has been a Director since January 17, 2012. Mr. Brandolini serves as a Lead Director of Northern Gold Mining Inc., a Director of LifePoint, Inc. since September 29, 2003, and an Independent Director of Cheniere Energy, Inc. since 2000. Mr. Christensen is the Founder, President and CEO of KES 7 Capital Inc. in Toronto, Canada and a registrant of the Ontario Securities Commission (OSC). KES 7 is a merchant bank that targets bespoke investments, both public and private, in the energy, healthcare and technology sectors. The company is also one of the largest "grey market" trading houses in the country. Prior to founding KES 7, Mr. Christensen was Vice Chairman, Head of Global Sales and Trading at GMP Securities, one of Canada's largest independent investment Mark Christensen banks, where he served as a member of the Executive Committee, Compensation Committee and New Names Committee. Mr. Director Christensen has experience in a broad range of corporate and capital market transactions, from mergers and acquisitions to public and private financings that total in the tens of billions of dollars. His background in geology and geophysics has provided him with valuable insight into the energy industry, enabling him to advise both institutional investors and energy companies from around the globe. Mr. Christensen holds a Master of Science degree from the University of Windsor, Canada and a Bachelor of Science degree from the University of Hull, United Kingdom. Mr. Dawson brings 35 years of oil and gas and management experience in North American hydrocarbon basins. Mr. Dawson serves as the R. Glenn Dawson President and Chief Executive Officer of Cuda Energy, Inc., a private Canadian-based E&P company. Mr. Dawson served as President of Director Bakken Hunter and Williston Hunter Canada, wholly owned subsidiaries of MHR, from April 2011- January 2015. Mr. Dawson served as an Executive Vice President of Magnum Hunter Resources Corp. until January 31, 2015. 27

LLEX Board of Directors John Johanning is the Technical Director of Värde’s energy business. Based in Houston, he joined the firm in 2017. Prior to joining Värde, John Johanning Mr. Johanning was a Vice President at Evercore in Houston, where he was influential in numerous A&D transactions and mergers totaling Director over $10 Billion in transaction value. Mr. Johanning began his career as a Reservoir Engineer at BP, where he developed oil and gas assets across several US Basins. Mr. Johanning graduated from The University of Texas at Austin with a B.S. in Petroleum Engineering. Mr. Long is an experienced financial executive with over 35 years of oil and gas related management, corporate finance, capital markets, risk management and strategic planning activities for both private and public oil and gas companies. Mr. Long is currently a member of Michael G. Long the Board of Directors of S&A Resources, a Denham Capital backed private equity upstream oil and gas start-up company focused on the Director Eagle Ford. Prior to joining the Board of Directors of S&A Resources, Mr. Long was the EVP and Chief Financial Officer for Sanchez Energy Corporation (NYSE:SN) and privately held Sanchez Oil and Gas Corporation and its affiliates. Mr. Long also held the positions of EVP and CFO of Edge Petroleum Corporation and Vice President of Finance for W&T Offshore. Markus Specks is a Managing Director of Värde Partners, Inc. and Head of the firm’s Houston office. Mr. Specks leads Värde’s energy Markus Specks business, and has experience managing credit, equity, and structured asset-level investments across the energy sector. He also serves on Värde’s Investment Committee, as well as several Boards of private energy companies. Prior to joining Värde in 2008, Mr. Specks worked Director in investment banking at Lazard, focusing on middle-market M&A advisory. Mr. Specks holds a B.A. in Government from Lawrence University in Wisconsin. Mr. Steinsberger is a petroleum engineer with 31 years of experience in oil and gas exploration and development. He began his career with Mitchell Energy and served as the Completion Manager for Mitchell from 1995 to 2002, where he piloted the Company’s fracking Nicholas Steinsberger technique and developed the slick water frac, pioneering the current oil and gas shale boom. Mr. Steinsberger then served as the Completion Manager for Devon Energy after Devon’s acquisition of Mitchell Energy. In 2005 he founded Steinsberger Tight Gas Director Consulting, where he has drilled and completed wells in the Barnett, Fayetteville, Woodford, Wolfcamp, Utica, Bakken and Marcellus Shales. Mr. Steinsberger is regarded as an expert in the field of unconventional well completion and is responsible for the drilling and completion of over 1,000 wells in his career. He holds a B.S. in Petroleum Engineering from the University of Texas. 28

Wobbe Ploegsma VP of Capital Markets & Investor Relations ir@lilisenergy.com 210.999.5400 NYSE American | LLEX